Attached files

| file | filename |

|---|---|

| EX-31 - EXHIBIT 31.2 - Algae Resource Holdings Inc. | ex312-111015ver.htm |

| EX-32 - EXHIBIT 32.2 - Algae Resource Holdings Inc. | ex322-111015ver.htm |

| EX-31 - EXHIBIT 31.1 - Algae Resource Holdings Inc. | ex311-111015ver.htm |

| EX-32 - EXHIBIT 32.1 - Algae Resource Holdings Inc. | ex321-111015ver.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No.333-199029

VERSHIRE CORPORATION

(Exact name of registrant as specified in its charter)

Nevada (State or Other Jurisdiction of Incorporation or Organization) |

8900 (Primary Standard Industrial Classification Number) |

98-1190597 (IRS Employer Identification Number) |

72-3b, Jln puteri 2/4, bdr puteri Puchong 47100, Selangor, Malaysia

Tel: +60122953206

Email: nubus2006@yahoo.com

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Copies of all communications to:

GRENFELL CAPITAL LIMITED

Suite 705, Siu On Centre

188 Lockhart Road, Wanchai, Hong Kong 00000

Telephone No.: +852 8120 7213 Fax: +1 323 843 1095

Email: corp@grenfellcaptial.com

Not Applicable

(Former Name, Former Address and Former

Fiscal Year if Changed Since Last Report)

Securities registered under Section 12(b) of the Act:

Title of each class registered -------------------------------------------- None |

Name

of each exchange on which registered: ----------------------------------------------------- None |

Securities registered under Section 12(g) of the Act:

Common

Stock, $0.001 Par Value

(Title of Class)

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| Yes [ ] No [ x ] |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

| Yes [ ] No [ x ] |

| Indicate by check whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| Yes [ x ] No [ ] |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |

| [ ] |

| Indicate by check whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "small reporting company" in Rule 12b-2 of the Exchange Act. (check one) |

| Large Accelerated Filer [ ] Accelerated Filer [ ] Non-Accelerated Filer [ ] Smaller Reporting Company [ x ] |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

| Yes [ x ] No [ ] |

| On October 15, 2015, the number of shares held by non-affiliates of the registrant was 8,000,000 shares of common stock. There is no calculation on the aggregate market value of the voting stock held by non-affiliates at the moment, as the Company's shares have not yet traded on the Over-the-counter Bulletin Board. |

| Solely for the purpose of this calculation, shares held by directors and officers of the registrant have been excluded. Such exclusion should not be deemed a determination or an admission by registrant that such individuals are, in fact, affiliates of the registrant. |

| There are 11,000,000 shares of Vershire Corporation of $0.001 par value common stock outstanding as of the date of this filing October 15, 2015 |

| At October 15, 2015, we had outstanding 11,000,000 shares of common stock. |

| DOCUMENTS INCORPORATED BY REFERENCE |

| Exhibits incorporated by reference are referred under Part IV. |

| VERSHIRE CORPORATION | ||

| June 30, 2015 | ||

| PART I | Page | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 4 |

| Item 1B. | Unresolved Staff Comments | 7 |

| Item 2. | Properties | 7 |

| Item 3. | Legal Proceedings | 7 |

| Item 4. | Mine Safety Disclosures | 7 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 7 |

| Item 6. | Selected Financial Data | 7 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 8 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 9 |

| Item 8. | Financial Statements and Supplementary Data | 9 |

| Item 9. | Changes in and Disagreements with Accountant on Accounting and Financial Disclosures | 9 |

| Item 9A. | Controls and Procedures | 9 |

| Item 9B. | Other Information | 9 |

| 9 | ||

| PART III | ||

| Item 10. | Directors, Executive Officers, And Corporate Governance | 10 |

| Item 11. | Executive Compensation | 11 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 13 |

| Item 13 | Certain Relationships and Related Transactions, and Director Independence | 14 |

| Item 14 | Principal Accounting Fees And Services. | 14 |

| PART IV | 15 | |

| Item 15. | Exhibits, Financial Statement Schedules | 15 |

| SIGNATURES | 16 | |

| PART I |

| Item 1. Business. |

| Business History |

| VERSHIRE CORPORATION (“VSC”, “we”, “the Company”) was incorporated in the State of Nevada on March 10, 2014 and established June 30 as its fiscal year end. We are a development-stage company that intended to provide online beauty tips services through our to-be-developed website. We planned on provide online beauty consultation and sale of organic beauty products. Originally, we focused on providing beauty tip and advises based on traditional beauty methods and theory practiced in Asia. Our business model was to build a membership base offering our member various membership plans of select hours of consultation. As our membership grows, we then offer to sell our own line of beauty products made from natural herbs and/or organic substances. We plan on providing online services through online website focusing on: |

| 1. | Traditional skin care knowledge and tips from head to toe, including face and body care by massage and face and body care by diet via using natural herbs. |

| 2. | DIY treatment for controlling weight, and overall health wellness. |

| At the very beginning stage, we also intended to provide live-person video call services center for proper care of body and face consultancy, control weight consultancy and personal health wellness tracking program. For those people who expect to have a regular and traditional beauty consultancy to solve face and body problems by using natural herbs, DIY treatments on weight control, or even a personal tailored health wellness program, they can get our consultants to make video calls at scheduled time to guide and monitor the treatments, or packages mentioned above. |

| We plan on generating revenue through monthly subscriptions fees. We expect to charge depending on the number of services needed. Our planned membership services packages and description would be: |

| Description | |

| Proper Face & Body Care | Basic Asian face care theory and knowledge.

|

| Face Care by Massage | Except the basic face care knowledge and tips, we intend to post on our to-be-developed website, face care massage classes to our paid membership on webcast or other internet tools.

|

| Face Care by Diet | For those clients who desire to prevent facial skin from early aging, we plan to give classes to paid members to teach them nutritional diet balance, having more food good for the skin and some Dos and Don’t in daily diet.

|

| Face & Body Care by Herbs | We plan to offer beauty tips and face and body care from the use of herbs for those who are particular interested in a natural way to maintain a beauty appearance without taking any medicine or using artificial skin care products. |

| Due to the nature of our services, we believed that we could offer our services throughout the Hong Kong and Asia area. We intended to focus our initial marketing campaign in Hong Kong and then extended our marketing campaign towards the other parts of Asia. |

| Business Overview |

| Vershire Corporation is a development stage company in the business of providing beauty and wellness tips through its website and intends to sell organic nature herb beauty products once we complete the product sourcing. The Company's activities to date have consisted primarily of organizational, developing the website and membership system, and doing research on defining our distinguished aspects on providing beauty and wellness tips, especially on offering face recognition system on our website as a share platform to provide beauty and wellness tips based on individual cases. The Company has not yet commenced its principal revenue driving activities. As of the date of this report, the Company has concentrated on conducting market research on the future trend and needs of the beauty industry in digital imagery and face recognition. |

| During the year, in January 2015, the Company sold 3,000,000 shares in the Company for a total of $45,000 under a registration statement registered with the SEC which became effective on December 17, 2014. The proceeds from this capital raise was used as working capital to further develop our business and our business plan as set out in our Form S-1 registered with the SEC on September 30, 2014. |

| Market Opportunity |

| The Company believes online beauty tip services are very important for personal use and will be an effective tool for building up a strong constitution, to achieve a goal of health enhancement, beautifulness preservation, and relieving pressure in order to improve the work efficiency. |

| There is a growing concern about plastic surgery and cosmetic products and their side effects including allergic reactions and beauty products dependence, which make people concern with these type of treatment. This creates the demand for improved beauty care methods, and the use of natural herbs and Asian beauty theory of using natural herb and folk recipes to adjust the internal balance to reach good condition of face and body appearance. |

| Stress is a natural part and an unavoidable consequence of life. As the pace of modern life continues to increase, we always feel the stress of non-stop action from morning till night. Our online beauty tips and organic products, will not only ameliorate people’s appearance but also to promote an environment for a peaceful mind. Moreover, useful online beauty tips will bring people more confidence and make daily life better. |

| People often spend a lot of money to go to a beauty salon for maintain healthy skin and body, which is very time and energy consuming. Sometimes it is difficult to make skin care appointment on the weekend, thus some people even have to sacrifice work or family time to adjust their schedule for a skin care appointment. We believe people with busy lives can also benefit from our live-person video call centre services. Instead of spending money at beauty salon, our business strategy is to make our service more convenient than the spas or beauty salons offered to the customer. We plan to offer our services at affordable prices in the existing markets to complete for the business sector and the unexplored market for regular daily personal use. |

1

| Competition |

| We believe that our services would be beneficial for a greater number of clients, ranging from the teenagers stay-at-home mother, university students, beauty lovers, overweight people, business people, most of people who care about their beauty and health condition. |

| Compared with the beauty salon, our strategy is to offer a brand new, flexible, effective and cheaper way to have beauty services, affordable to virtually anybody. We expect our costs will be lower than the beauty salon, and at a greater convenience to the time when people are available. |

| Marketing |

| Our services are planned to be based from our website, but we also intend to use our to-be-developed website (www.vershirecorp.com) as a marketing tool. We intend to advertise our services and website in health and beauty magazines, other websites and in the social media including Facebook, Twitter, Wechat and Weibo. |

| Our marketing campaign is planned to start after the successful launching of our services centre and website. We expect to start and run our initial marketing campaign around one month after we have raised enough funds to start implementing our Plan of Operations. |

| We have not yet contacted, researched or secured any kind of agreement and/or contract with any magazine or website. |

| We have not yet contacted or secured any kind of agreement and/or contract with any retailer or supplier. |

| Business Development |

| Management |

| Subsequent to the year end of June 30, 2015, in February 2015 the controlling shareholder of the Company was changed to Masterco International Limited which now holds and controls 72.73% equity interests of the Company. As a result of the shareholder change, on February 24, 2015, Ms. Xi Ying KOU, our then President, Treasurer, Chief Financial Officer and Director and Ms. Lu XIA, our then Company Secretary resigned from all their respective positions in the Company. And on the same date, Mr. Oon Leong WONG was appointed as the President, Chief Executive Officer and Director of the Company, Mr. Boon Thye WONG was appointed as the Treasurer, Chief Financial Officer and Director of the Company and Mr. Yoke Chong SIN was appointed as the Company Secretary of the Company. |

| Service Sharing Platform |

| For the year ended June 30, 2015, our focus was on identifying a unique technique to offer beauty and wellness tips through a service sharing platform (both our website and mobile app as the carrier) via face recognition technology. The service sharing platform promotes reciprocal strategies for users on beauty tips and organic cosmetic advertising, efficient time management, cash-free payment, potentially directs the target customers to the suitable cosmetic products and wellness beauty advisers, and links the online users to the offline cosmetic companies (O2O). |

| The platform will cover all inclusive beauty and wellness tips categories including facial, hair, nails, makeup, massage, and fitness, etc. as set out in our business plan in our Registration Statement Form S-1 and its related amendments. By embedding the face recognition system on the website and mobile app, it will allow the camera to scan the person by either computer camera or cellphone camera, rapidly capture essential face structure and health evaluation, and eventually provide facial, makeup or fitness advice. Once the user advice result comes out, the system will automatically generate a few suitable cosmetic products to the user, and a 10 years later picture of the user projecting an image of the user’s face with who has followed the recommended skin care, cosmetic products and beauty tips provided. |

| Face Recognition and Analysis System |

| The system is mainly consists of three key components. i) visual sensing: the component includes one camera and a control node (a workstation computer). The code will be programmed to control the end user’s camera either on computer or cellphone, so the camera is assigned and manipulated to detect and capture the body, face and expression; the control node will send the data stream to the platform backend node to analyze; ii) back end node control: the control node of the platform in the back end will analyze the visual inputs to estimate/recognize/reason users’ face, body and health information, such as age, gender, weight, height, face structure, health condition. It will select to play corresponding multimedia skin care and cosmetic contents, such as skin care ads for a middle age woman who has more fine lines and winkles on the face compared to the similar age women, based on the injected demographic face and body database. Users’ emotion states will be estimated through facial expressions which can infer the context of psychographic information, such as attitude and feelings. By capturing and analyzing the structure of a group of customers, the control node will extract contextual features of social settings that can infer the social status and living environment. The detected psychographic information will be transferred to the multimedia server to label the corresponding multimedia content; iii) multimedia management: this component is dominated by the multimedia server, which stores all the multimedia contents, online updates the demographic and psychographic information, and summarizes the statistics of ratings and generates surveys in real-time. It communicates with other system components to update system states. |

| Product Sourcing |

| Adhering to our nature and organic product philosophy, for the year ended June 30, 2015, we reviewed many cosmetic products and narrowed down to two brands of organic skin care and cosmetic products which share the same value with us, one is from Italian, the other brand is from France. We have reviewed these two product lines and determined that at this time we cannot include them in our product line. We will need to continue to source other brands to add to our product lineup to appeal to the needs of our customers. Therefore, we will continue to focus on sourcing products in the coming year. |

2

| Business Development |

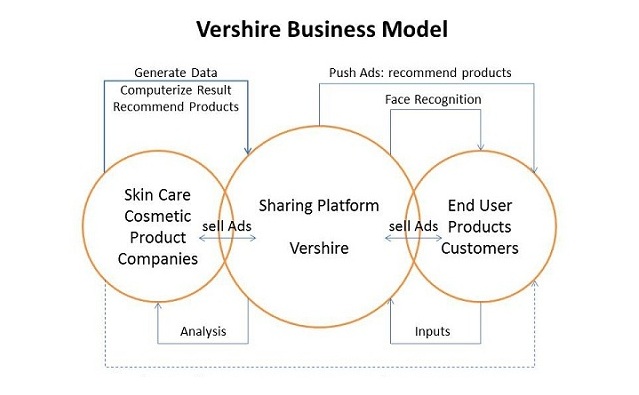

| Creating unique platform for sharing and providing beauty and wellness information, and linking up end user to the offline skin care and beauty cosmetic companies, will greatly stimulate more online transactions and activities. The below chart describes our business model: |

| Vershire sharing platform is the link chain to bridge the end user/customers with the skin care/cosmetic product companies. Vershire sharing platform is in a role of providing push advertisement of recommend products based on the computerized result from capturing the end user/customer face and body image via face recognition technology. End user/customer will have a sense the outcome of continue applying the recommend products, and through a picture of himself/herself after 10 years. |

| This is the just the first part of our business model. We have an updated business model once we have fully develop the face recognition system and then we will contact the named brands of nature and organic cosmetic companies to offer the face recognition system and Vershire platform into their retail shops inside the department stores. The system will capture the face and body image, analyze the data and recommend the in store products to the customer and will show a picture of the customer using the products for 10 years and to provide a comparison picture of the customer’s image without using any skin care products for 10 years. Currently we are still developing our business model. |

| Employment |

| As of June 30, 2015, we have three part time employees namely our officers of the Company. Subject to financing, in the next twelve months, the Company plans to hire consultants to undertake and implement the operational plans. |

| Intellectual Property |

| We intend, in due course, subject to legal advice, to apply for trademark protection and/or copyright protection of our future intellectual property and our to-be-developed services in the Hong Kong and Asia. |

| We intend to aggressively assert our right trademark and copyright laws to protect our future intellectual property, including concepts and recognized trademarks. These rights are protected through the acquisition of trademark registrations, the maintenance of copyrights, and, where appropriate, litigation against those who are, in our opinion, infringing these rights. |

| While there can be no assurance that registered trademarks and copyrights will protect our proprietary information, we intend to assert our future intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our Company, we believe that the protection of our future intellectual property rights is a key component of our operating strategy. |

| Regulatory Matters |

| We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations of the beauty consultancy services industry. However, we still need to verify certifications and possible government approvals needed to execute our business. We are subject to the laws and regulations of those jurisdictions in which we plan to sell our services, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our business is not subject to special regulatory and/or supervisory requirements. |

3

| Item 1A. Risk Factors |

| An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below before making a decision to invest in our Common Stock. Our business, operating results, financial condition or prospects could be materially and adversely affected by any of these risks and uncertainties. In that case, the trading price of our Common Stock could decline and you might lose all or part of your investment. In addition, the risks and uncertainties discussed below are not the only ones we face. Our business, operating results, financial performance or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. In assessing the risks and uncertainties described below, you should also refer to the other information contained in this Report before making a decision to invest in our Common Stock. |

| Risks Associated with Our Financial Condition |

| OUR AUDITORS HAVE ISSUED A GOING CONCERN OPINION AND ALTHOUGH OUR PRESIDENT HAS AGREED TO CONTRIBUTE MONEY TO US, WE MAY NOT BE ABLE TO ACHIEVE OUR OBJECTIVES SINCE WE DO NOT HAVE ADEQUATE CAPITAL AND MAY HAVE TO SUSPEND OR CEASE OUR ACTIVITY |

| Our auditors have issued a going concern opinion. This means that there is doubt that we can continue as an ongoing business for the next twelve months. Despite the fact our President Mr. Oon Leong WONG, our CFO Mr. Boon Thye WONG, and Company Secretary Mr. Yoke Chong SIN are willing to contribute or advance capital to the Company to finance 12 months of operating expenses, we would not be able to implement our operating plans without raising additional capital through the issuance of common shares. In the event we are unable to raise additional capital we may have to cease operations and go out of business. |

| SINCE THE COMPANY ANTICIPATES OPERATING EXPENSES WILL INCREASE PRIOR TO EARNING REVENUE, WE MAY NEVER ACHIEVE PROFITABILITY |

| The Company anticipates increases in its operating expenses, without realizing any revenues from its business activities. Within the next 12 months, the Company will have costs related to (i) maintaining our report status, (ii) hiring third party services for web development, (iii) marketing, and (vi) administrative expenses. |

| There is no history upon which to base any assumption as to the likelihood that the Company will prove successful. We cannot provide investors with any assurance that our services will attract customers; generate any operating revenue or ever achieve profitable operations. If we are unable to address these risks, there is a high probability that our business can fail, which will result in the loss of your entire investment. |

| IF WE DO NOT RAISE ENOUGH CAPITAL TO RUN OUR BUSINESS, WE WILL HAVE TO DELAY THE LAUNCH OF OUR BUSINESS ACTIVITIES OR GO OUT OF BUSINESS, WHICH WILL RESULT IN THE LOSS OF YOUR INVESTMENT |

| There is no assurance that can be given that the Company would gain access to capital markets or obtain acceptable financing to continue operations for twelve months. If we are not successful in providing additional financing to sustain operations it may have adverse effect upon the results of its operations and upon its financial conditions. You may be investing in a company that may not have the funds necessary to conduct any business due to our inability to raise additional capital. If that occurs we will have to delay or cease our business activities and go out of business which will result in the loss of your investment. |

| Risks Related to Our Stocks |

| OUR COMMON STOCK IS SUBJECT TO RISKS ARISING FROM RESTRICITON ON RELIANCE ON RULE 144 BY SHELL COMPANIES OR FORMER SHELL COMPANIES. |

Under a regulation of the SEC known as "Rule 144," a person who has beneficially owned restricted securities of an issuer and who is not an affiliate of that issuer may sell them without registration under the Securities Act provided that certain conditions have been met. One of these conditions is that such person has held the restricted securities for a prescribed period, which will be 6 months or 1 year, depending on various factors. The holding period for our common stock would be 1 year if our common stock could be sold under Rule 144. However, Rule 144 is unavailable for the resale of securities issued by an issuer that is a shell company (other than a business combination related shell company) or that has been at any time previously a shell company. The SEC defines a shell company as a company that has (a) no or nominal operations and (b) either (i) no or nominal assets, (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets.

The SEC has provided an exception to this unavailability if and for as long as the following conditions are met: |

| - | We will have to be sponsored by a participating market maker who will file a Form 211 on our behalf since we will not have direct access to the NASD personnel and; |

| - | The issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| - | The issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and |

| - | At least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company known as “Form 10 Information.” |

| THE COMPANY’S MANAGEMENT COULD ISSUE ADDITIONAL SHARES, SINCE THE COMPANY HAS 75,000,000 AUTHORIZED SHARES, DILLUTING THE CURRENT SHARE HOLDERS’ EQUITY |

| The Company has 75,000,000 authorized shares, of which 11,000,000 are issued and outstanding as of June 30, 2015. The Company’s management could, without the consent of the existing shareholders, issue substantially more shares, causing a large dilution in the equity position of the Company’s current shareholders. Additionally, large share issuances would generally have a negative impact on the Company’s share price. It is possible that, due to additional share issuance, you could lose a substantial amount, or all, of your investment. |

4

| WITHOUT A PUBLIC MARKET THERE IS NO LIQUIDITY FOR OUR SHARES AND OUR SHAREHOLDERS MAY NEVER BE ABLE TO SELL THEIR SHARES WHICH WOULD RESULT IN A TOTAL LOSS OF THEIR INVESTMENT |

| Our Common Stock are not listed on any exchange or quotation system. There is no market for our shares. Consequently, our shareholders will not be able to sell their shares in an organized market place unless they sell their shares privately. If this happens, our shareholders might not receive a price per share which they might have received had there been a public market for our shares. It is our intention to apply for a quotation on the OTCBB whereby: |

| - | We will have to be sponsored by a participating market maker who will file a Form 211 on our behalf since we will not have direct access to the NASD personnel and, |

| - | We will not be quoted on the OTCBB unless we are current in our periodic reports filed with the SEC. |

| As of June 30, 2015, we estimate that it could take us between twelve to twenty weeks to be approved for a quotation on the OTCBB. However, we cannot be sure we will be able to obtain a participating market maker or be approved for a quotation on the OTCBB, in which case, there will be no liquidity for the shares of our shareholders. |

| BECAUSE WE WILL BE SUBJECT TO THE "PENNY STOCK" RULES, THE LEVEL OF TRADING ACTIVITY IN OUR STOCK MAY BE REDUCED. |

| Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on NASDAQ). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares. |

| WE HAVE NOT PAID, AND DO NOT INTEND TO PAY CASH DIVIDENDS IN THE FORESEEABLE FUTURE |

| We have not paid any cash dividends on our Common Stock and do not intend to pay cash dividends in the foreseeable future. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business. Dividend payments in the future may also be limited by other loan agreements or covenants contained in other securities that we may issue. Any future determination to pay cash dividends will be at the discretion of our Board of Directors and depend on our financial condition, results of operations, capital and legal requirements and such other factors as our Board of Directors deems relevant. |

| Risks Associated with Management and Control Persons |

| OUR OFFICERS AND DIRECTOR HAVE OTHER OUTSIDE BUSINESS ACTIVITIES AND MAY NOT BE IN A POSITION TO DEVOTE A MAJORITY OF THEIRTIME TO OUR BUSINESS ACTIVITY, WHICH MAY RESULT IN PERIODIC INTERRUPTIONS AND BUSINESS FAILINGS |

| Our President and Director, Mr. Oon Leong WONG, and CFO, Mr. Boon Thye WONG, are currently devoting about 15 hours per week each to our business. Our Company Secretary Mr. Yoke Chong SIN is dedicating about 5 hours per weeks to our business. Nevertheless, as a consequence of the limited devotion of time to the affairs of the Company expected from management, our business may suffer. Additionally, we do not have any full or part-time employees. If the demands of our business require the full business time of our management, it is possible that both our Officers and Directors may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail. |

| BECAUSE OUR OFFICERS AND DIRECTOR DO NOT HAVE TECHNICAL TRAINING OR EXPERIENCE WITH STARTING, AND OPERATING AN ONLINE BEAUTY SERVICE COMPANY NOR WITH MANAGING A PUBLIC COMPANY, WE WILL HAVE TO HIRE QUALIFIED PERSONNEL TO FULFILL THESE FUNCTIONS. IF WE LACK FUNDS TO RETAIN SUCH PERSONNEL, OR CANNOT LOCATE QUALIFIED PERSONNEL, WE MAY HAVE TO SUSPEND OR CEASE DEVELOPMENT ACTIVITY OR CEASE OPERATIONS WHICH WILL RESULT IN THE LOSS OF YOUR INVESTMENT |

| Our President Mr. Oon Leong WONG, CFO Mr. Boon Thye WONG, and Company Secretary Mr. Yoke Chong SIN have certain experience in financing and managing private companies. However, they do not have experience starting and operating an online beauty tips services company. As a result their decisions and choices may not take into account, all the factors in managing and running an online beauty business. Consequently our ultimate financial success could suffer irreparable harm due to certain of lack of experience. Additionally, our Officers and Directors have no direct training or experience in managing and fulfilling the regulatory reporting obligations of a public company. We will have to hire professionals to undertake these filing requirements and this will increase the overall cost of operations. As a result we may have to suspend or cease operations, which will result in the loss of your investment. |

5

| Risks Related to the Company’s Market and Strategy |

| WE HAVE NOT YET DEVELOPED OUR SERVICES, THERE IS NO GUARANTEES THAT WE WILL BE ABLE TO DEVELOP OUR SERVICES |

| The development of our business is dependent on the successful development of our services and our capability to attract customers. In order to develop our services, we would need to raise enough funds, and even if we have the required funds, there is no guarantee that we would be able to successfully develop our services. If we cannot develop our services and/or attract clients, our business will fail. |

| BECAUSE WE HAVE NOT STARTED OUR BUSINESS, WE DO NOT KNOW IF OUR SERVICES WILL BE ACCEPTED |

| The success of our business depends on public acceptance. We do not know if our services will be accepted by business persons and/or by the general public. If we cannot attract clients, our business will fail. |

| WE HAVE LIMITED RESOURCES FOR MARKETING AND PROMOTING OUR SERVICES AND WE MAY NOT BE ABLE TO DEVELOP A SALES AND MARKETING TEAM THAT CAN MEET OUR CUSTOMER NEEDS |

| We have limited marketing and promotion experience. Our future sales will depend in large part on our ability to develop and expand the Company’s services in the market. We may not be able to attract and retain personnel or be able to build an efficient and effective sales and marketing team, which could negatively impact sales of our services, and reduce our revenues and profitability. |

| COMPANY’S ABILITY TO IMPLEMENT THE BUSINESS STRATEGY |

| The implementation of the Company’s marketing strategy will depend on a number of factors. These include our ability to establish a significant customer base and maintain favorable relationships with customers and partners, obtain adequate financing on favorable terms in order to fund our business, maintain appropriate procedures, policies and systems; hire, train and retain skilled employees and to continue to operate within an environment of increasing competition. The inability of our Company to manage any or all of these factors could impair our ability to implement our business strategy successfully, which could have a material adverse effect on the results of its operations and its financial condition. |

| WE MAY BE UNABLE TO GAIN ANY SIGNIFICANT MARKET ACCEPTANCE FOR OUR SERVICES OR ESTABLISH A SIGNIFICANT MARKET PRESENCE |

| The Company’s growth strategy is substantially dependent upon its ability to market its services successfully to prospective clients. However, its services may not achieve significant acceptance. Such acceptance, if achieved, may not be sustained for any significant period of time. Failure of the Company’s services to achieve or sustain market acceptance could have a material adverse effect on our business, financial conditions and the results of our operations. |

| Risks Associated with Our Business Model |

| OUR OPERATING RESULTS MAY PROVE UNPREDICTABLE |

| Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control. Factors that may cause our operating results to fluctuate significantly include: the level of commercial acceptance by the public of our services; fluctuations in the demand; the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, infrastructure and general economic conditions. |

| If realized, any of these risks could have a material adverse effect on our business, financial condition and operating results. |

| BECAUSE WE ARE SMALL AND DO NOT HAVE MUCH CAPITAL, OUR MARKETING CAMPAIGN MAY NOT BE ENOUGH TO ATTRACT SUFFICIENT CLIENTS TO OPERATE PROFITABLY. IF WE DO NOT MAKE A PROFIT, WE MAY HAVE TO SUSPEND OR CEASE OPERATIONS |

| Due to the fact that we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations. |

| ANY PROLONGED BUSINESS INTERRUPTION AT OUR SERVICES COULD HARM OUR EARNINGS AND NEGATIVELY AFFECT OUR BUSINESS |

| Our services are intended to be available first in Hong Kong, then expand to other locations in Asia after the development and acceptance of our services and products. An interruption in our services as a result of equipment failure could result in reducing our sales and earnings for the current and following periods, thereafter. Any significant delay in our services could lead to increased returns or cancellations and cause us to lose future sales. |

| OUR SERVICE MAY NOT BE ABLE TO DISTINGUISH ITSELF IN THE MARKET |

| Because we are a brand-new company with new services and we have not conducted advertising, there is little or no recognition of our name. There are a wide range of online beauty tips services that offer similar services. If we are unable to demonstrate clearly our practical services and cost effective benefits, we may be unable to attract enough clients. |

| IF THERE ARE EVENTS OR CIRCUMSTANCES AFFECTING THE RELIABILITY AND SECURITY OF THE INTERNET, ACCESS TO OUR SITE AND/OR THE ABILITY TO SAFEGUARD CONFIDENTIAL INFORMATION COULD BE IMPAIRED CAUSING A NEGATIVE EFFECT ON THE FINANCIAL RESULTS OF OUR BUSINESS OPERATIONS |

| Despite the implementation of security measures, our website infrastructure may be vulnerable to computer viruses, hacking or similar disruptive problems caused by members, other Internet users, other connected Internet sites, and the interconnecting telecommunications networks. Such problems caused by third-parties could lead to interruptions, delays or cessation of service to our customers. Inappropriate use of the Internet by third-parties could also potentially jeopardize the security of confidential information stored in our computer system, which may deter individuals from becoming customers. Such inappropriate use of the Internet includes attempting to gain unauthorized access to information or systems, which is commonly known as “cracking” or “hacking.” Although we intend to implement security measures, such measures have been circumvented in the past, and there can be no assurance that any measures we implement would not be circumvented in future. Dealing with problems caused by computer viruses or other inappropriate uses or security breaches may require interruptions, delays or cessation of service to our customers, which could have a material adverse effect on our business, financial condition and results of operations. |

6

| Item 1B. Unresolved Staff Comments |

| None. |

| Item 2. Properties. |

| As at June 30, 2015, Vershire Corporation uses its 200 square feet office from its Officers rent free. |

| Item 3. Legal Proceedings. |

| There are no legal proceedings pending or threatened against us. |

| Item 4. Mine Safety Disclosures |

| Not applicable. |

| PART II |

| Item 5. Market Price For Common Equity And Related Stockholder Matters And Small Business Issuer Purchases Of Equity Securities. |

| Market Information |

| A registrant that qualifies as a smaller reporting company is not required to provide the performance graph required in paragraph (e) of Item 201. |

| We have one class of securities, Common Voting Equity Shares ("Common Stock"). Our Common Stock is quoted on the Over The Counter Bulletin Board. |

| Issuer's Repurchase Of Equity Securities |

| None. |

| Holders |

| On October 15, 2015, the Company had 3 holders of record of our Common Stock. |

| Dividends |

| We have not declared or paid dividends on our Common Stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends. |

| Stock Options |

| Currently, there are no stock options outstanding. |

| Item 6. Selected Financial Data |

| A registrant that qualifies, as a smaller reporting company is not required to provide the information required by this item. |

7

| Item 7. Management's Discussion And Analysis Of Financial Condition And Results Of Operations. |

| The following discussion of our financial condition and our subsidiaries and our results of operations should be read together with the consolidated financial statements and related notes that are included later in this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under Risk Factors or in other parts of this Annual Report on Form 10-K. |

| Twelve Months Operating Plan |

Over the next twelve months, our operating plan will be continually focused on three segments, including service sharing platform, face recognition & analysis system and product sourcing.

For service platform, concentration is on identifying a unique technique to offer beauty and wellness tips through a service sharing platform (both our website and mobile app as the carrier) via face recognition technology. The service sharing platform promotes reciprocal strategies for users on beauty tips and organic cosmetic advertising, efficient time management, cash-free payment, potentially directs the target customers to the suitable cosmetic products and wellness beauty advisers, and links the online users to the offline cosmetic companies (O2O).

For the face recognition & analysis system segment, we will develop the three major components including visual sensing, back end node control and multimedia management.

On product sourcing, we will keep seeking the suitable skin care and cosmetic products brands. |

| Our financial plan is to obtain sufficient funding for the business development and marketing services for online platform services. We will seek to raise development and operation funds for the next twelve months by equity offering to support these plans. In addition, management is seeking strategic investors and partners to support our business. |

| Research and Development |

| Since incorporation, the Company has not embarked on any research and development program and has not incurred or is expecting to incur any such costs. |

| Costs and Effects of Compliance with Environmental Laws |

| We have not incurred and do not anticipate incurring any expenses in our current plan of operation associated with environmental laws. |

| Employees |

| As of June 30, 2015, we have three part time employees namely our directors and officers. Subject to financing, in the next twelve months, the Company plans to hire consultants to undertake and implement the operational plans. |

| Results of Operations |

| FOR THE YEAR ENDED JUNE 30, 2015 AND PERIOD FROM MARCH 10, 2014 (INCEPTION) TO JUNE 30, 2014 |

| REVENUES |

| For the years ended June 30, 2015 and period from March 10, 2014 (inception) to June 30, 2014, the Company has realized no revenue in both periods. The Company had not incurred any costs of revenue either in 2015 or 2014 since all the costs related to services which are set out in the general and administrative expenses. For both years, the Company was still in the process of identifying the business model and had not commenced operations. |

| OPERATING EXPENSES |

| For the year ended June 30, 2015, the Company had earned no gross profit and our total operating expenses was $79,522 which was all general and administrative expenses. Our net loss to our shareholders for the year ended June 30, 2015 was $79,522. For the year ended June 30, 2014, we had no gross profit and our operating expense was $8,703 which was all general and administrative expenses. Our net loss to our shareholders for the year ended June 30, 2014 was $8,703. |

| Liquidity and Capital Resources |

| We do not have sufficient resources to accomplish our business plans. As of June 30, 2015, we had cash of $1,000. |

| We will have to raise funds to pay for our expenses and to accomplish our business plans. We may have to borrow money from shareholders or issue debt or equity or enter into a strategic arrangement with a third party. There can be no assurance that additional capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans or lines of credit. Our inability to raise funds for our operations will have a severe negative impact on our ability to remain a viable company. |

| Going Concern Consideration |

| The Company had no revenue and incurred a net loss of $79,522 for the year ended June 30, 2015 and an accumulated net loss of $88,225 as at June 30, 2015. These factors raise substantial doubt about the Company's ability to continue as a going concern. The Company's ability to continue as a going concern must be considered in light of the problems, expenses and complications frequently encountered in emerging markets and the competitive environment in which the Company operates. The Company is pursuing financing for its operations. Failure to secure such financing, to raise additional equity capital and to earn revenue may result in the Company depleting its available funds and not being able to pay its obligations. These consolidated financial statements do not include any adjustment to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern. |

| Off-Balance Sheet Arrangement |

| Vershire Corporation does not have any off-balance sheet arrangements. |

8

| Item 7A. Quantitative And Qualitative Disclosures About Market Risk |

| A smaller reporting company is not required to provide the information required by this Item. |

| Item 8. Financial Statements And Supplementary Data |

| Consolidated Financial Statements |

| Please see page F-1 through F-8 of this Form 10-K. |

| Item 9. Changes In And Disagreements With Accountants On Accounting And Financial Disclosure. |

| There are no such reportable events. |

| Item 9A. Controls And Procedures. |

| Disclosure Controls and Procedures |

| Under the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer, we evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) of the Exchange Act as of a date (the "Evaluation Date") within ninety (90) days prior to the filing of our June 30, 2015 Form 10-K. |

| Based upon that evaluation, our management has concluded that, as of June 30, 2015, our disclosure controls and procedures were not effective in timely alerting management to the material information relating to us (or our consolidated subsidiaries) required to be included in our periodic filings with the SEC. |

| Internal Control over Financial Reporting |

| (a)Management's Annual Report on Internal Control Over Financial Reporting |

| Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. |

| A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the registrant's annual or interim financial statements will not be prevented or detected on a timely basis. |

| Our management, with the participation of its President, assessed the effectiveness of our internal control over financial reporting as of June 30, 2015. In making this assessment, we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework. Based on that assessment under such criteria, management concluded that our internal controls over financial reporting were not effective as of June 30, 2015 due to control deficiencies that constituted material weaknesses. A material weakness is a control deficiency, or combination of control deficiencies, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. |

| In the course of making our assessment of the effectiveness of internal controls over financial reporting, we identified material weaknesses in our internal control over financial reporting. The material weaknesses consisted of inadequate staffing within the accounting operations of our Company. The small number of employees who are responsible for accounting functions (more specifically, one) prevents us from segregating duties within our internal control system. The inadequate segregation of duties is a weakness because it could lead to the untimely identification and resolution of accounting and disclosure matters or could lead to a failure to perform timely and effective reviews. The limited personnel also does not allow for multiple levels of supervision and review. |

| Management has identified specific remedial actions to address the material weaknesses described above: |

| * | Improve the effectiveness of the accounting group by continuing to augment our existing resources with additional consultants or employees to improve segregation procedures and to assist in the analysis and recording of complex accounting transactions and preparation of tax disclosures. We plan to mitigate the segregation of duties issues by hiring additional personnel in the accounting department once we have achieved positive cash flow from operations, and/or have raised significant additional working capital. |

| * | Improve segregation procedures by strengthening cross approval of various functions including cash disbursements and quarterly internal audit procedures where appropriate. |

| Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. |

| Changes in Controls and Procedures |

| There were no significant changes made in our internal controls over financial reporting during the year ended June 30, 2015 that have materially affected or are reasonably likely to materially affect these controls. Thus, no corrective actions with regard to significant deficiencies or material weaknesses were necessary. |

| Attestation Report of the Registered Public Accounting Firm |

| This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. We were not required to have, nor have we, engaged our independent registered public accounting firm to perform an audit of internal control over financial reporting pursuant to the rules of the Commission that permit us to provide only management's report in this annual report. |

| Item 9B. Other Information. |

| None. |

9

| PART III |

| Item 10. Directors, Executive Officers, And Corporate Governance. |

| The name, address, age and position of our present Officers and Director as at June 30, 2015 and to the date of this report are set forth below: |

| Name | Age | Position(s) |

| Oon Leong WONG | 39 | President, Chief Executive Officer and Director. |

| Boon Thye WONG | 45 | Treasurer, Chief Financial Officer and Director. |

| Yoke Chong SIN | 49 | Company Secretary. |

| Xi Ying KOU | 39 | President, Treasurer, Chief Executive Officer and Director (1). |

| Lu XIA | 30 | Company Secretary (2). |

(1) Ms. KOU was appointed President, Treasurer, Chief Executive Officer and Director on April 2, 2014 and resigned all her positions on February 25, 2015.

(2) Ms. XIA was appointed Company Secretary on September 12, 2014 and resigned all her positions on February 24, 2015.

Mr. Oon Leong WONG

Mr. OL Wong, age 39, was appointed as the President, Chief Executive Officer and Director of the Company on February 25, 2015. Currently, Mr. OL Wong is the Business Development Director in a Malaysia based Media Software company named Mediasoft Entertainment Sdn. Bhd., specialized in mobile game development. Previously, Mr. OL Wong was the President and Director of a Malaysia technology development infrastructure company for over 12 years managing 25 programmers. This company made tremendous achievement on e-commerce systems, games and mobile apps. Mr. OL Wong graduated with a Postgraduate Degree in Business Administration from University of Wolverhampton in United Kingdom in 1999. |

Mr. Boon Thye WONG

Mr. BT Wong, age 45, was appointed as the Treasurer, Chief Financial Officer and Director of Vershire Corporation on February 25, 2015. Mr. BT Wong is currently the Managing Director of Macro Infinite Sdn. Bhd. in Malaysia. With diverse experience in improving business and e-commerce operations, finance and product development, Mr. BT Wong manages the local popular e-commercial website www.yikmall.com to be one of the leading social media commerce and mobile commerce platform in Malaysia. Besides, Mr. BT Wong has been the Real Estate Investment International Marketing Director of a local company named Duta Venture PLT since 2013. Mr. Wong obtained his Bachelor Degree in the major of Business Administration from Hawaii Pacific University in United States. |

Mr. Yoke Chong SIN

Mr. Sin, age 49, was appointed as the Company Secretary on February 24, 2015. Mr. Sin is an experienced Financial Advisor with more than 20 years of cross border business in Hong Kong, China, Singapore and Malaysia markets particularly in financial management, capital market, fund management, trust & foundation and cross border tax planning structures. Mr. Sin has been the Managing Director of a Labuan trust company for the recent 5 years. |

Ms. Xi Ying KOU

Ms. Kou, age 39, was appointed as the President, Chief Executive Officer, Treasurer, Chief Financial Officer and Director on April 2, 2014, the inception of the Company. Ms. Kou resigned all her position from the Company on February 25, 2015.

Ms. Kou was the former controlling shareholder of the Company and was our President, Treasurer, and Director during the period from April 2, 2014 to February 25, 2015. For the recent five years, Ms. Kou has involved in share investment and operated and managed her own beauty salon. During this time, she was been involved in all aspects of the operation including marketing, sales, and financial control of the beauty salon. Ms. Kou has over 13 years of experiences in the beauty industry. Ms. Kou graduated from Dalian University of Foreign Language with a major in Hotel Management. |

| Ms. Lu XIA |

Ms. Xia, age 30, was appointed as the Company Secretary on September 12, 2014, the inception of the Company. Ms. Xia resigned all her position from the Company on February 24, 2015.

Ms. Lu Xia was appointed as the Company Secretary on September 12, 2014. Ms. Xia has 7 years of experiences in business development and corporate finance. Ms. Lu Xia graduated from Northeastern University in a Master of Science Degree in 2009. She also received her Bachelor Degree in 2007 from Shenzhen University. |

Each of Mr. Oon Leong Wong, Mr. Boon Thye Wong, and Mr. Yoke Chong Sin is not an officer of any other United States reporting company.

Save that Mr. Oon Leong Wong and Mr. Boon Thye Wong are sibling, there are no other family relationships amongst the directors and officers of the Company. |

| Auditors; Code of Ethics; Financial Expert |

| Our principal independent accountant is HKCMCPA Company Limited, Certified Public Accountants, located at Unit 602, 6/F Hoseinee House, 69 Wyndham Street, Central, Hong Kong. |

| We do not currently have a Code of Ethics because we have limited business operations and only three Officers/Directors on the Board. As at today, we do not have a "financial expert" on the board or an audit committee. |

| Potential Conflicts of Interest |

| At the present time, the Company does not foresee any direct conflict between the Officers and Directors other business interests and their involvement in Vershire Corporation. |

10

| Item 11. Executive Compensation. |

| Summary Compensation |

| Vershire Corporation has made no provisions for paying cash or non-cash compensation to its Officers and Directors. No salaries are being paid at the present time, and none will be paid unless and until our operations generate sufficient cash flows. |

| The table below summarizes all compensation awarded to, earned by, or paid to our named executive officers for all services rendered in all capacities to us for the period from March 10, 2014 (Inception) through June 30, 2015. |

| SUMMARY COMPENSATION TABLE | |||||||||

Name and Principal Position |

Year | Salary ($) | Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Xi Ying KOU(1) | 2014 | - | - | - | - | - | - | - | - |

| 2015 | - | - | - | - | - | - | - | - | |

| Lu XIA (2) | 2014 | - | - | - | - | - | - | - | - |

| 2015 | - | - | - | - | - | - | - | - | |

Oon Leong WONG(3) |

2015 | - | - | - | - | - | - | - | - |

| Boon Thye WONG(4) | 2015 | - | - | - | - | - | - | - | - |

| Yoke Chong SIN(5) | 2015 | - | - | - | - | - | - | - | - |

| (1) | Ms. Xi Ying KOU tendered her resignation of the positions as President, Director, Treasurer, Chief Executive Officer and Chief Financial Officer of the Company on February 25, 2015. |

| (2) | Ms. Lu XIA resigned from the position of Company Secretary on February 24, 2015. |

| (3) | Mr. Oon Leong WONG was appointed as the President, Chief Executive Officer and Director of the Company on February 25, 2015. |

| (4) | Mr. Boon Thye WONG was appointed as the Treasurer, Chief Financial Officer and Director of the Company on February 25, 2015. |

| (5) | Mr. Yoke Chong SIN was appointed as the Company Secretary of the Company on February 24, 2015. |

| There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our Officers and Director other than as described herein. |

| Outstanding Equity Awards at Fiscal Year-End |

| The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named Executive Officer as of June 30, 2015. |

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |||||||||

| OPTION AWARDS | STOCK AWARDS | ||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units of Stock That Have Not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Xi Ying KOU(1) |

- | - | - | - | - | - | - | - | - |

| Lu XIA(2) | - | - | - | - | - | - | - | - | - |

| Oon Leong WONG(3) | - | - | - | - | - | - | - | - | - |

| Boon Thye WONG(4) | - | - | - | - | - | - | - | - | - |

| Yoke Chong SIN(5) | - | - | - | - | - | - | - | - | - |

11

| (1) | Ms. Xi Ying KOU tendered her resignation of the positions as President, Director, Treasurer, Chief Executive Officer and Chief Financial Officer of the Company on February 25, 2015. |

| (2) | Ms. Lu XIA resigned from the position of Company Secretary on February 24, 2015. |

| (3) | Mr. Oon Leong WONG was appointed as the President, Chief Executive Officer and Director of the Company on February 25, 2015. |

| (4) | Mr. Boon Thye WONG was appointed as the Treasurer, Chief Financial Officer and Director of the Company on February 25, 2015. |

| (5) | Mr. Yoke Chong SIN was appointed as the Company Secretary of the Company on February 24, 2015. |

| There were no grants of stock options since inception to the date of this annual report. |

| We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance. |

| Stock Plan |

| The Company has not adopted a Stock Awards Plan, but may do so in the future. The terms of any such plan have not been determined. |

| Director Compensation |

| The table below summarizes all compensation awarded to, earned by, or paid to our Director and Officers for all services rendered in all capacities to us for the period from March 10, 2014 (inception) through June 30, 2015. |

| DIRECTOR COMPENSATION | |||||||

Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Non-Qualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Xi Ying KOU(1) | - | - | - | - | - | - | - |

| Lu XIA (2) | - | - | - | - | - | - | - |

| Oon Leong WONG (3) | - | - | - | - | - | - | - |

| Boon Thye WONG(4) | - | - | - | - | - | - | - |

| Yoke Chong SIN (5) | - | - | - | - | - | - | - |

| (1) | Ms. Xi Ying KOU tendered her resignation of the positions as President, Director, Treasurer, Chief Executive Officer and Chief Financial Officer of the Company on February 25, 2015. |

| (2) | Ms. Lu XIA resigned from the position of Company Secretary on February 24, 2015. |

| (3) | Mr. Oon Leong WONG was appointed as the President, Chief Executive Officer and Director of the Company on February 25, 2015. |

| (4) | Mr. Boon Thye WONG was appointed as the Treasurer, Chief Financial Officer and Director of the Company on February 25, 2015. |

| (5) | Mr. Yoke Chong SIN was appointed as the Company Secretary on February 24, 2015. |

| There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our Officers and Director other than as described herein. |

12

| Item 12. Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters. |

| The following table sets forth, as of June 30, 2015, the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group. Except as otherwise indicated, all shares are owned directly and the percentage shown is based on 11,000,000 shares of common stock issued and outstanding on June 30, 2015. |

| The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as otherwise indicated below and under applicable common share property laws, we believe that the beneficial owners of our common stock listed below have sole voting and investment power with respect to the shares shown. |

| Name and Address of Beneficial Owner | Title of Class | Total Shares Owned | Percentage(1) |

Oon Leong WONG (2)(3)(4) A0705, Zen Residences, Jalan Bunga Tanjung, Batu 14, 47100, Puchong Selangor, Malaysia |

Common | - | - |

Boon Thye WONG(2)(4)(5) A13-10, Block A, Jalan 1/125G, Desa Sri Puteri B, No. 6, 57100, Kuala Lumpur, Malaysia |

Common | - | - |

Yoke Chong SIN(6)(7) 15, Jalan BSJ 5, Taman Bukit Segar Jaya 2, 43200 Cheras, Selangor, Malaysia |

Common | 1,500,000 | 13.64% |

| All Executive Officers and Directors as a group [3 persons] | Common | 1,500,000 | 13.64% |

Masterco International Limited (8) OMC Chambers, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands |

Common | 8,000,000 | 72.73% |

Yok Kim CHEW DG 03, Pangsapuri Sri Mekar, JalanTempua 3, Bandar Puchong Jaya, 47100 Puchong, Selangor, Malaysia |

Common | 1,500,000 | 13.64% |

Yok Chin CHEE (8) 11A, Jalan Patin 2A/1, Desa Patin Ulu Yam Lama, 44300 Batang Kali Selangor, Malaysia |

Common | 8,000,000 | 72.73% |

Notes:

| (1) | For purposes of computing the percentage of outstanding Common Stocks held by each person or group of persons named above, any shares that such person or group has the right to acquire within 60 days are deemed outstanding but are not deemed to be outstanding for purposes of computing the percentage ownership of any other person or group. As of the date of the table above, there were 11,000,000 outstanding shares of our common stock and there was no options, warrants, and convertible notes outstanding entitling the holders to purchase any shares of our Common Stock owned by Officers and/or Directors of the Company. |

| (2) | A Director of Company as of June 30, 2015. |

| (3) | Mr. Oon Leong WONG was appointed as the President, Chief Executive Officer and Director of the Company on February 25, 2015. |

| (4) | Mr. Oon Leong WONG and Mr. Boon Thye Wong are sibling. |

| (5) | Mr. Boon Thye WONG was appointed as the Treasurer, Chief Financial Officer and Director of the Company on February 25, 2015. |

| (6) | An Officer of Company as of June 30, 2015 |

| (7) | Mr. Yoke Chong SIN was appointed as the Company Secretary on February 24, 2015. |

| (8) | Ms. Chee Yok CHIN holds 100% equity interests in Masterco International Limited, a company incorporated in British Virgin Islands. |

13

| Item 13. Certain Relationships And Related Transactions, And Director Independence. |

| Except as set forth below, none of our Directors or Executive officers, nor any proposed nominee for election as a director, nor any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to all of our outstanding shares, nor any members of the immediate family (including spouse, parents, children, siblings, and in-laws) of any of the foregoing persons has any material interest, direct or indirect, in any transaction since our incorporation or in any presently proposed transaction which, in either case, has or will materially affect us. |

| 1. | In the prior year, the Company paid a shareholder, Grenfell Capital Limited, $1,100 for rental service which were prepaid rental of service office for 12 months and $3,000 for corporate services. |

| Item 14. Principal Accounting Fees And Services. |

| AUDIT FEES. The aggregate fees billed in each of the fiscal years ended June 30, 2015 and 2014 for professional services rendered by the principal accountant for the audit of our annual financial statements and review of the financial statements included in our Form 10-K or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements as well as registration statement filings for those fiscal years were $9,000 and $4,500, respectively. |

| AUDIT-RELATED FEES. The aggregate fees billed for services reasonably related to the performance of the audit or review of the financial statements outside of those fees disclosed above under "Audit Fees" for fiscal years 2015 and 2014 was nil. |

| TAX FEES. For the fiscal years ended June 30, 2015 and 2014, our principal accountants did not render any services for tax compliance, tax advice, and tax planning work. |

| ALL OTHER FEES. None |

PRE-APPROVAL POLICIES AND PROCEDURES. Prior to engaging its accountants to perform a particular service, our Board of Directors obtains an estimate for the service to be performed. All of the services described above were approved by the Board of Directors in accordance with its procedures.

14

|

| PART IV |

| Item 15. Exhibits, Financial Statement Schedules. |

| (a) Index to Financial Statements and Financial Statement Schedules |

| Table of Contents |

| Report of Independent Registered Public Accounting Firm - HKCMCPA Company Limited. |

| Financial Statements: |

| Balance Sheets as of June 30, 2015 and 2014. |

| Statements of Operations and Comprehensive Income for the years ended June 30, 2015 and 2014. |

| Statements of Stockholders' Deficit for the years ended June 30, 2015 and 2014. |

| Statements of Cash Flows for the years ended June 30, 2015 and 2014 |

| Notes to Financial Statements |

| (c) Exhibits. |

Exhibit

| No. | Description of Exhibit | |

| 3.1 | Articles of Incorporation of Vershire Corporation dated March 10, 2014(1) | |

| 3.2 | Amended Articles of Incorporation of Vershire Corporation approved and adopted on March 24, 2014(1) | |

| 3.3 | Amended By-laws of Vershire Corporation approved and adopted on March 24, 2014(1) | |

| EXHIBIT 31.1 * | Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| EXHIBIT 31.2* | Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| EXHIBIT 32.1* | Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| EXHIBIT 32.2* | Certification of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101 * | Interactive Data Files for Vershire Corporation Form 10-K for the Year Ended June 30, 2015 |

| 101.INS* | XBRL Instance Document |

| 101.SCH* | XBRL Taxonomy Extension Schema |

| 101.CAL* | XBRL Taxonomy Extension Calculation |

| 101.DEF* | XBRL Taxonomy Extension Definition |

| 101.LAB* | XBRL Taxonomy Extension Label |

| 101.PRE* | XBRL Taxonomy Extension Presentation |

| 1 | Incorporated by reference to our Registration Statement on Form S-1 as filed with the SEC on September 30, 2014 |

| * | Filed hereof |

| 15 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: November 10, 2015

| VERSHIRE CORPORATION | |

| By: /s/ Oon Leong WONG | |

| --------------------------------- | |

| Oon Leong WONG | |

| President, Chief Executive Officer and Director | |

| Principal Executive Officer | |

| By: /s/ Boon Thye WONG | |

| --------------------------------- | |

| Boon Thye WONG | |

| Treasurer, Chief Financial Officer and Director | |

| By: /s/ Yoke Chong SIN | |

| --------------------------------- | |

| Yoke Chong SIN | |

| Company Secretary |

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Dated: November 10, 2015

| VERSHIRE CORPORATION | |

| By: /s/ Oon Leong WONG | |

| --------------------------------- | |

| Oon Leong WONG | |

| President, Chief Executive Officer and Director | |

| Principal Executive Officer | |

| By: /s/ Boon Thye WONG | |

| --------------------------------- | |

| Boon Thye WONG | |

| Treasurer, Chief Financial Officer and Director | |

| By: /s/ Yoke Chong SIN | |

| --------------------------------- | |

| Yoke Chong SIN | |

| Company Secretary |

| 16 |

| Index to Financial Statements |

| Table of Contents | Page |

| (1) Audited Financial Statements for the Fiscal Years Ended June 30, 2015 and 2014 | |

| Report of Independent Registered Public Accounting Firm | F-2 |

| Balance Sheets as of June 30, 2015 and 2014 | F-3 |

| Statement of Operations for the Years Ended June 30, 2015 and 2014 | F-4 |

| Statement of Stockholders' Deficit for the Years Ended June 30, 2015 and 2014 | F-5 |

| Statement of Cash Flows for the Years Ended June 30, 2015 and 2014 | F-6 |

| Notes to Financial Statements | F-7-8 |

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Stockholders and Board of Directors |

| Vershire Corporation |

We have audited the accompanying balance sheets of Vershire Corporation (the "Company") as of June 30, 2015 and 2014, and the related statements of operations, stockholders' deficits and cash flows for the year ended June 30, 2015 and the period from March 10, 2014 (inception) to June 30, 2014. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. |