Attached files

| file | filename |

|---|---|

| 8-K - TRUSTCO BANK CORP NY 8-K 11-10-2015 - TRUSTCO BANK CORP N Y | form8k.htm |

Exhibit 99(a)

Robert J. McCormick, President and Chief Executive OfficerRobert T. Cushing, Executive Vice President and Chief Operating OfficerMichael M. Ozimek, Senior Vice President and Chief Financial Officer November 11, 2015

Forward Looking Statements * Note: Data in this presentation was obtained from SNL Financial and from the Company’s SEC filings. All statements in this presentation that are not historical are forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our expectations for our performance during 2015 and for the growth of loans and deposits throughout our branch network, our ability to capitalize on economic changes in the areas in which we operate and the extent to which higher expenses to fulfill operating and regulatory requirements recur or diminish over time. Such forward-looking statements are subject to factors that could cause actual results to differ materially for TrustCo from those discussed. TrustCo wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The following important factors, among others, in some cases have affected and in the future could affect TrustCo’s actual results and could cause TrustCo’s actual financial performance to differ materially from that expressed in any forward-looking statement: our ability to continue to originate a significant volume of one-to-four family mortgage loans in our market areas; our ability to continue to maintain noninterest expense and other overhead costs at reasonable levels relative to income; our ability to comply with the supervisory agreement entered into with Trustco Bank’s regulator and potential regulatory actions if we fail to comply; restrictions or conditions imposed by our regulators on our operations that may make it more difficult for us to achieve our goals; the future earnings and capital levels of Trustco Bank and the continued ability of Trustco Bank under regulatory rules and the supervisory agreement to distribute capital to TrustCo, which could affect our ability to pay dividends; results of examinations of Trustco Bank and TrustCo by our respective regulators; our ability to make accurate assumptions and judgments regarding the credit risks associated with lending and investing activities; the effect of changes in financial services laws and regulations and the impact of other governmental initiatives affecting the financial services industry; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board, inflation, interest rates, market and monetary fluctuations; the perceived overall value of our products and services by users, including in comparison to competitors’ products and services and the willingness of current and prospective customers to substitute competitors’ products and services for our products and services; real estate and collateral values; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the FASB or PCAOB; changes in local market areas and general business and economic trends, as well as changes in consumer spending and saving habits; our success at managing the risks involved in the foregoing and managing our business; and other risks and uncertainties under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2014, as amended, and, if any, in our subsequent quarterly reports on Form 10-Q or other securities filings.

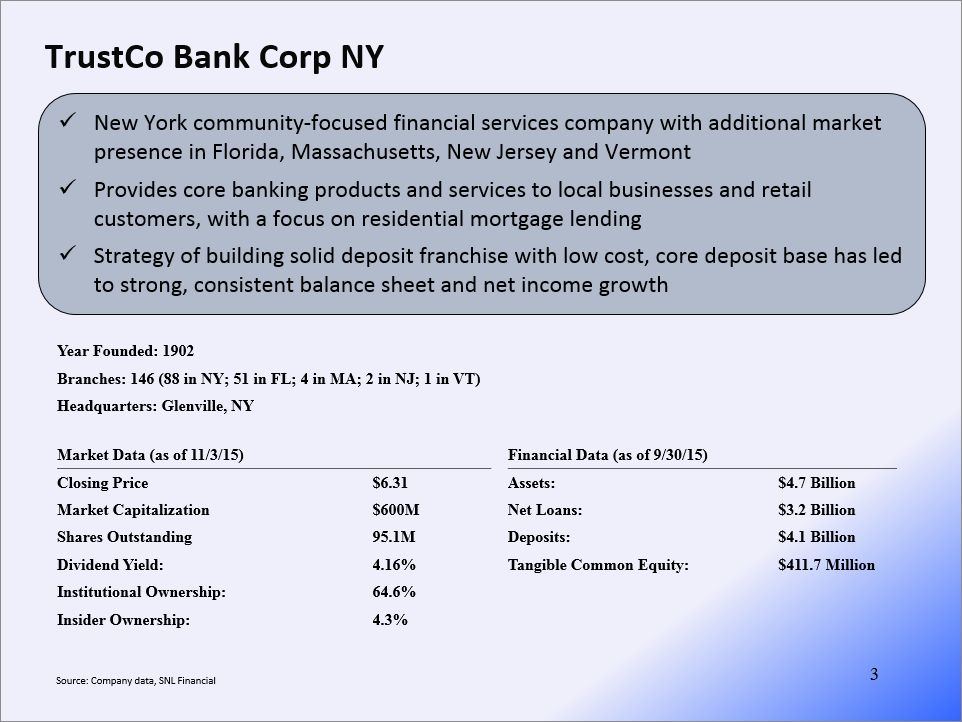

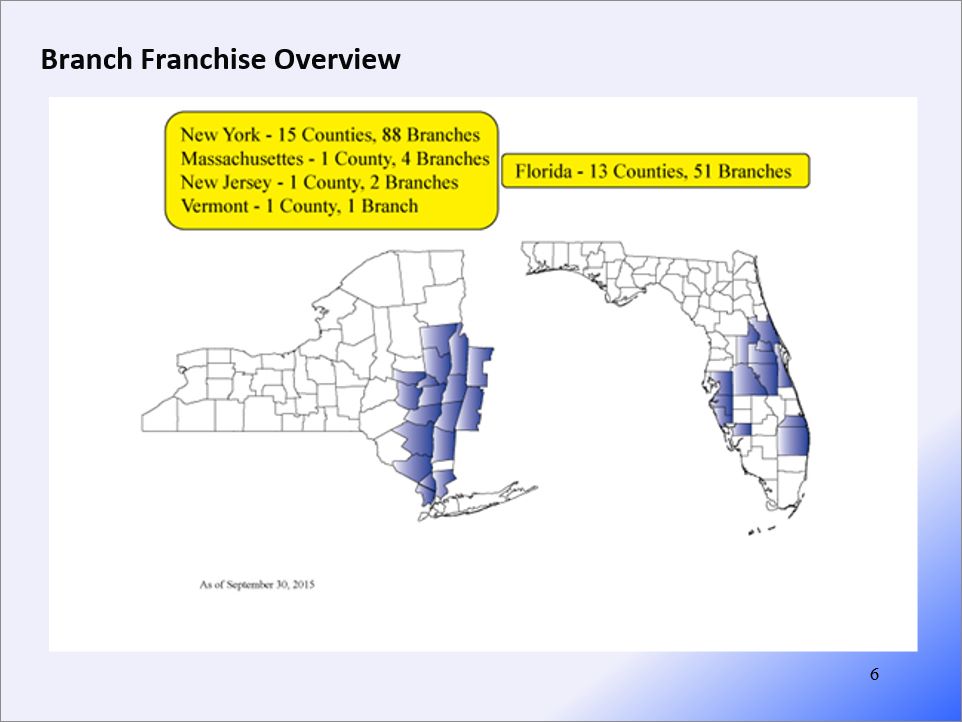

* TrustCo Bank Corp NY New York community-focused financial services company with additional market presence in Florida, Massachusetts, New Jersey and VermontProvides core banking products and services to local businesses and retail customers, with a focus on residential mortgage lendingStrategy of building solid deposit franchise with low cost, core deposit base has led to strong, consistent balance sheet and net income growth Source: Company data, SNL Financial Year Founded: 1902 Branches: 146 (88 in NY; 51 in FL; 4 in MA; 2 in NJ; 1 in VT) Branches: 146 (88 in NY; 51 in FL; 4 in MA; 2 in NJ; 1 in VT) Branches: 146 (88 in NY; 51 in FL; 4 in MA; 2 in NJ; 1 in VT) Branches: 146 (88 in NY; 51 in FL; 4 in MA; 2 in NJ; 1 in VT) Headquarters: Glenville, NY Market Data (as of 11/3/15) Financial Data (as of 9/30/15) Closing Price $6.31 Assets: $4.7 Billion Market Capitalization $600M Net Loans: $3.2 Billion Shares Outstanding 95.1M Deposits: $4.1 Billion Dividend Yield: 4.16% Tangible Common Equity: $411.7 Million Institutional Ownership: 64.6% Insider Ownership: 4.3%

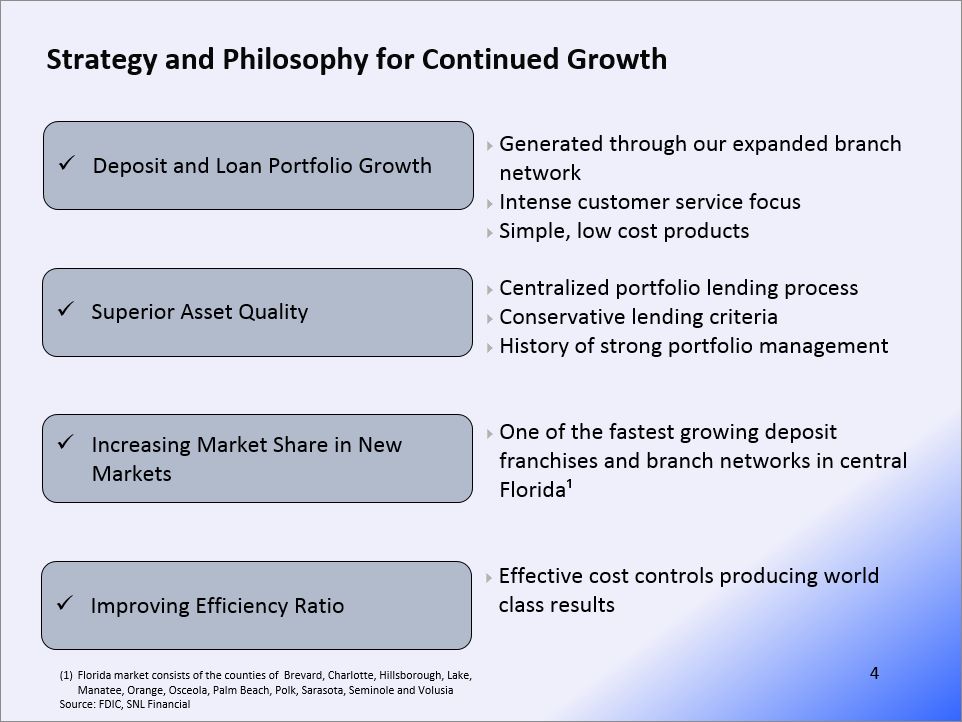

* Strategy and Philosophy for Continued Growth Deposit and Loan Portfolio Growth Superior Asset Quality Increasing Market Share in New Markets Generated through our expanded branch networkIntense customer service focusSimple, low cost products Centralized portfolio lending processConservative lending criteriaHistory of strong portfolio management One of the fastest growing deposit franchises and branch networks in central Florida¹ Improving Efficiency Ratio Effective cost controls producing world class results Florida market consists of the counties of Brevard, Charlotte, Hillsborough, Lake, Manatee, Orange, Osceola, Palm Beach, Polk, Sarasota, Seminole and VolusiaSource: FDIC, SNL Financial

* Formal Agreement Formal Agreement (FA) signed with OCC on July, 21, 2015Primary Issues CoveredComplianceGovernanceInternal AuditStrategic PlanCapital PlanLoan ReviewTimingCostStatusBenefits Source: SEC Filings; Company Documents

* Branch Franchise Overview

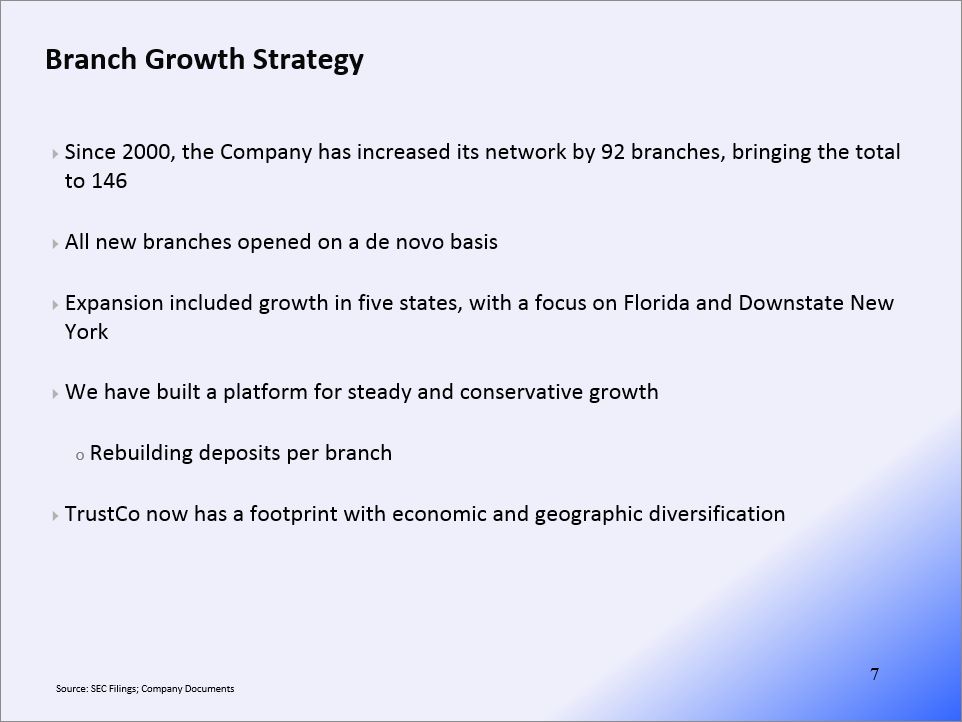

* Branch Growth Strategy Since 2000, the Company has increased its network by 92 branches, bringing the total to 146All new branches opened on a de novo basisExpansion included growth in five states, with a focus on Florida and Downstate New YorkWe have built a platform for steady and conservative growthRebuilding deposits per branch TrustCo now has a footprint with economic and geographic diversification Source: SEC Filings; Company Documents

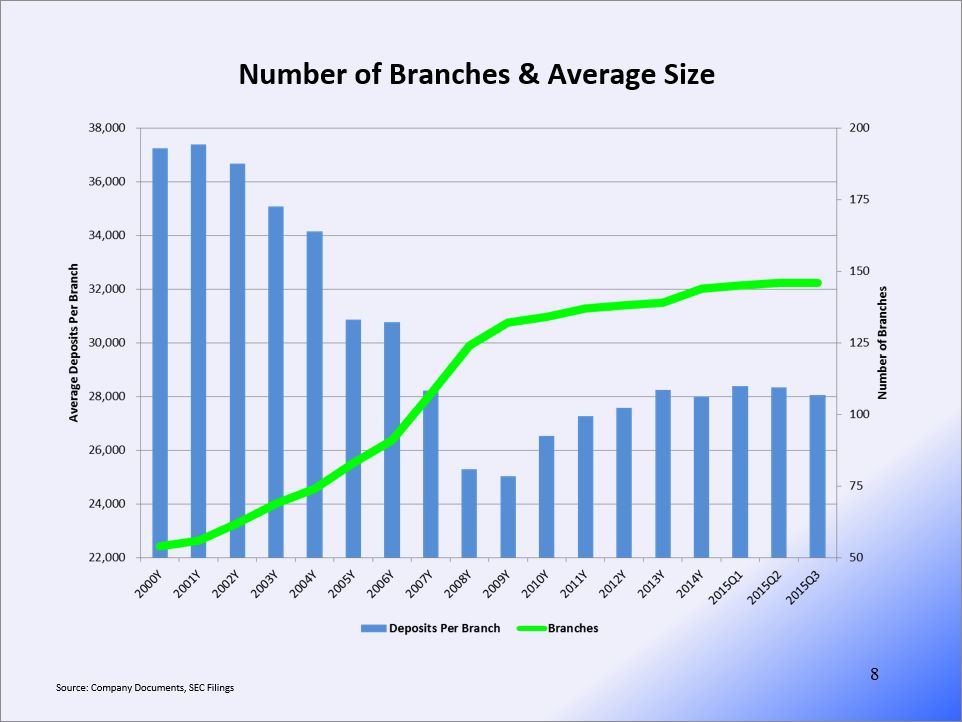

* Number of Branches & Average Size Source: Company Documents, SEC Filings

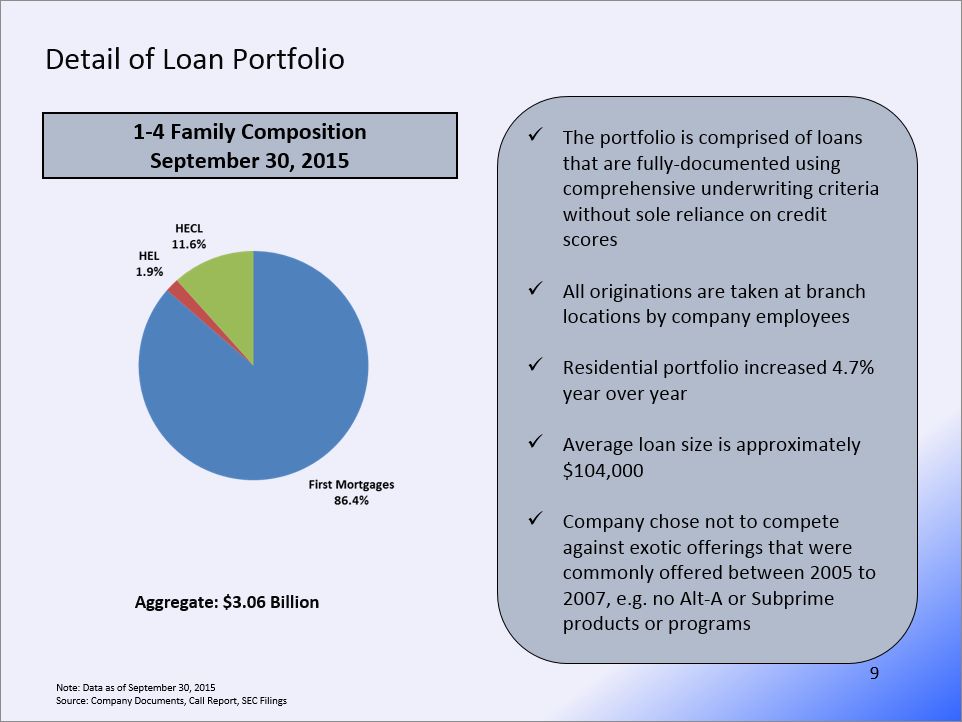

* Detail of Loan Portfolio 1-4 Family CompositionSeptember 30, 2015 The portfolio is comprised of loans that are fully-documented using comprehensive underwriting criteria without sole reliance on credit scoresAll originations are taken at branch locations by company employeesResidential portfolio increased 4.7% year over yearAverage loan size is approximately $104,000Company chose not to compete against exotic offerings that were commonly offered between 2005 to 2007, e.g. no Alt-A or Subprime products or programs Aggregate: $3.06 Billion Note: Data as of September 30, 2015Source: Company Documents, Call Report, SEC Filings

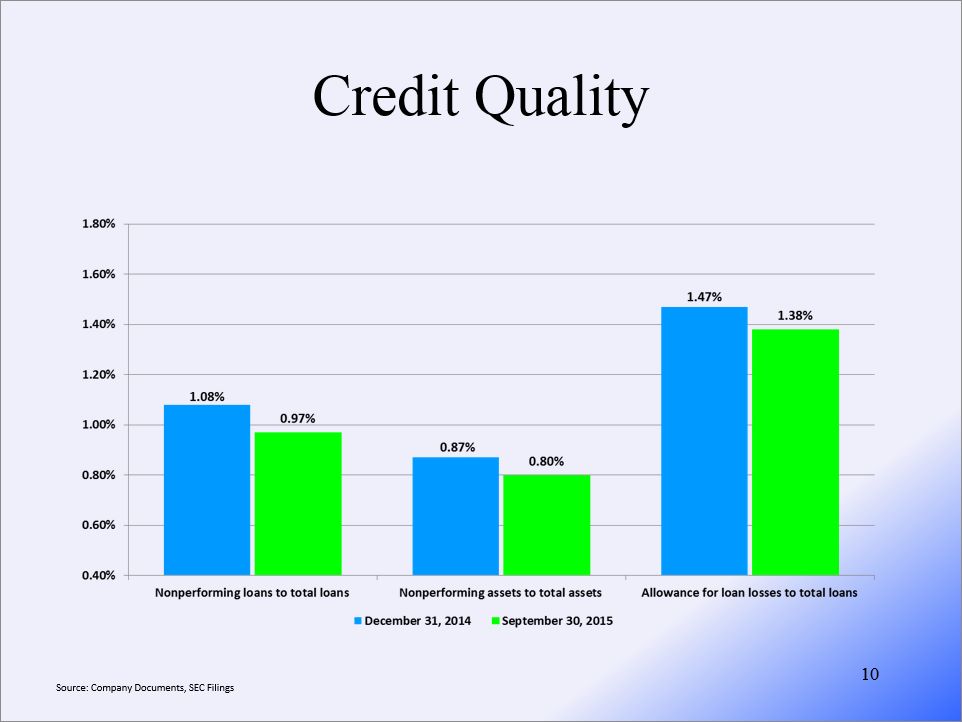

Credit Quality * Source: Company Documents, SEC Filings

* Investment Portfolio and Interest Rate Risk Strive to achieve a 60/40 split on loans to investmentsInvestment SecuritiesHigh level of liquidity well in excess of $1 billion (including cash)Vast majority of securities are available for saleHigh credit quality portfolioNo derivatives, trust preferred or exotic instrumentsInterest Rate RiskLoans are funded through core depositsNo borrowingsDeposit lives exceed asset livesSuccessfully navigated many interest rate environments

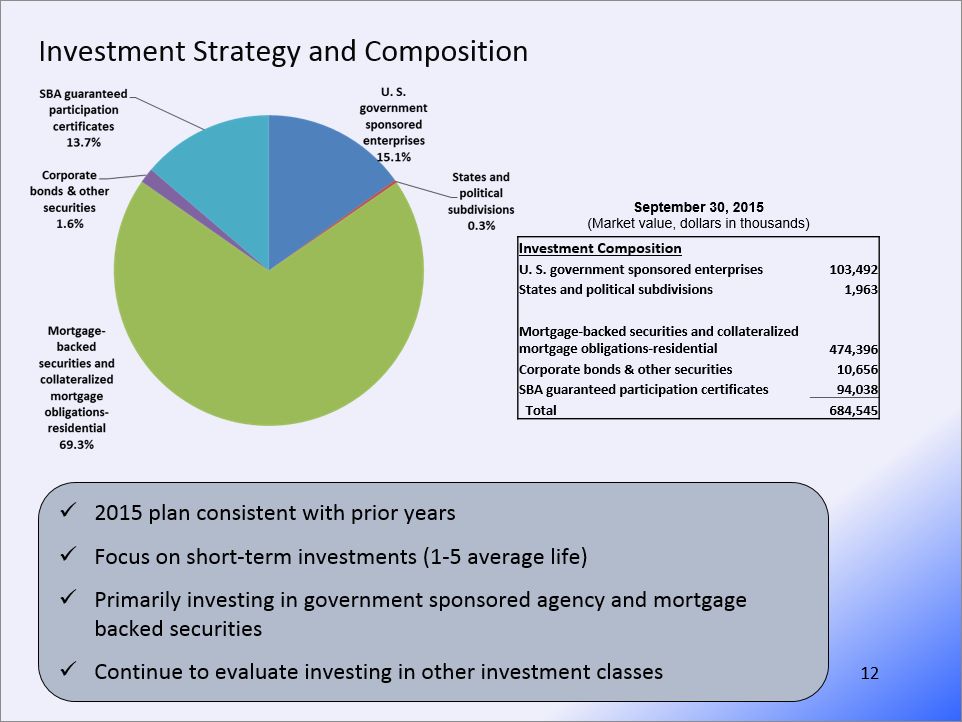

* Investment Strategy and Composition 2015 plan consistent with prior yearsFocus on short-term investments (1-5 average life)Primarily investing in government sponsored agency and mortgage backed securities Continue to evaluate investing in other investment classes September 30, 2015(Market value, dollars in thousands) Investment Composition U. S. government sponsored enterprises 103,492 States and political subdivisions 1,963 Mortgage-backed securities and collateralized mortgage obligations-residential 474,396 Corporate bonds & other securities 10,656 SBA guaranteed participation certificates 94,038 Total 684,545

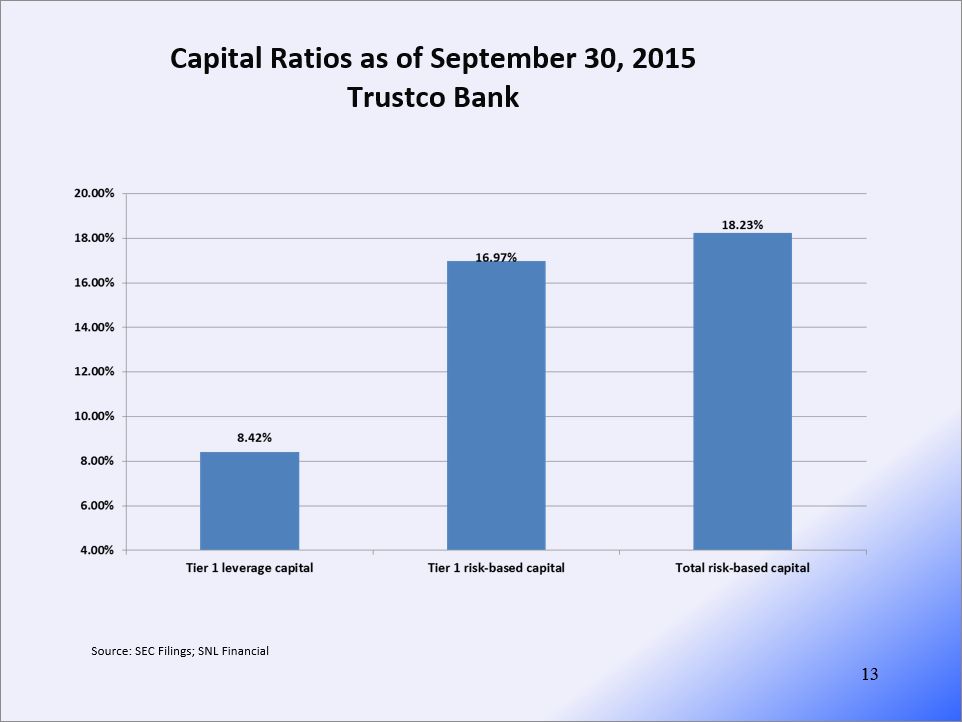

* Capital Ratios as of September 30, 2015Trustco Bank Source: SEC Filings; SNL Financial