Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - National Waste Management Holdings, Inc. | f8k111115_nationalwaste.htm |

Exhibit 99.1

National Waste Management Holdings, Inc. Investor Presentation – November 2015 OTC:NWMH

Safe Harbor This presentation may contain “forward - looking statements” that are made pursuant to the “safe harbor” provisions as defined within the Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by words including “anticipates,” “believes,” “intends,” “estimates,” and similar expressions. These statements are based upon management’s current expectations as of the date of this presentation. Such forward - looking statements may include statements regarding the Company’s future financial performance or results of operations, including expected revenue growth, cash flow growth, future expenses and other future or expected performances. The Company cautions readers there may be events in the future that the Company is not able to accurately predict or control and the information contained in the forward - looking statements is inherently uncertain and subject to a number of risks that could cause actual results to differ materially from those indicated in the forward - looking statements. Further information on these and other potential factors that could affect the Company’s financial results is included in the Company’s filings with the SEC under the “Risk Factors” sections and elsewhere in those filings. 2

Company Overview ▪ National Waste Management Holdings (“ NWMH”) is a growing solid waste management company, headquartered in central Florida ▪ Construction and demolition (C&D) landfill in Hernando, Florida servicing Citrus, Hernando, and Marion counties ▪ Comprehensive solutions for full waste diversion • Landfill, transfer stations, roll - off, mulch, recycling ▪ Long - term partnerships with municipal, institutional, commercial and industrial customers 3 Strategy to become a leading national solid waste company through organic growth and acquisitions

Market Overview ▪ Highly regulated industry • Company maintains high level of compliance and strong working relationship with Florida’s Department of Environmental Protection • The regulatory expertise, certifications, and high cost of capital needed to operate in the industry pose significant barriers to entry ▪ Attractive m acro t rends • National recycling mandate driving increase in construction and demolition debris disposal • U.S. new h ousing construction up significantly over past years and projected to increase further • State and local infrastructure spending is increasing 4

Industry Statistics ▪ 6.1 million tons of C&D was disposed in Florida’s 75 C&D disposal sites ▪ C&D constitutes 25% of Florida’s MSW waste stream or 8.2 million tons ▪ According to U.S. Census Bureau statistics, new construction in Florida from 2009 to 2013 increased by approximately 245% ▪ Currently only 27% or 2.1 million tons of Florida’s C&D is recycled ▪ In 2010, House Bill 7243 was passed by the Florida Legislature, which applied the statewide recycling goal of 75% by 2020 to all counties ▪ At least 12% of Florida’s 75% recycling mandate can be achieved by recycling C&D debris currently being disposed 5

Landfill Operations ▪ Operating landfill in Hernando, Florida • Servicing Citrus , Hernando , and Marion counties in Florida ▪ 54 acre landfill facility ▪ Average annual disposals of approximately 110,000 cubic yards of construction debris • Operating four roll - off trucks and 350 containers ▪ Received expansion permit and a 10 - year renewal permit for its landfill operations in September 2015 from Florida’s Department of Environmental Protection 6

Services ▪ Recycling • Permitted waste processing and disposal facility • Serves industrial and residential markets ▪ Transfer Station ▪ Roll - Off • Waste removal services in roll off/dumpsters ▪ Mulch • Manufacture mulch from reclaimed and recycled wood at National Waste’s landfills and transfer stations 7

Business Strategy: Three Prong Approach ▪ Acquire complementary businesses • Enhance geographic footprint: Exhaust local opportunities • Identify cash flow positive companies • Build shareholder value through accretive acquisition ▪ Expand national presence • New satellite offices to be customer - focused and operationally economical • Exhaust expansion into neighboring counties and states ▪ Increase operational efficiency of existing business and future acquisitions • Emphasis on shareholder value • Focus on redundancy of G&A 8

Expand National Footprint ▪ Currently covering Marion, Citrus , Hernando , Lake, Levy, and Sumter counties on Florida’s west coast ▪ Immediate expansion into New York and future expansion along the U.S. East coast 9

National W aste Roll Up Strategy ▪ Acquire and restructure existing “mom and pop type” facilities with emphasis on exit strategy ▪ Plan to add strategic capabilities in the area of recycling to meet DEP mandates ▪ Emphasis on accretive value/cash flow positive companies 10

Targeted Acquisition ▪ Purchase agreement signed to acquire key landfill site in neighboring county, expanding solid waste management plan • 80 acre site; permitted for yard trash, land clearing debris, recycling and landfill disposal site • 600,000 cubic yards of air space permitted on a 21.7 acre footprint • 300,000 cubic yards of sand on site for immediate use • 3 million cubic yards of air space for yard trash/land clearing disposal for future permitting • Future permissible use as storm debris disposal site 11

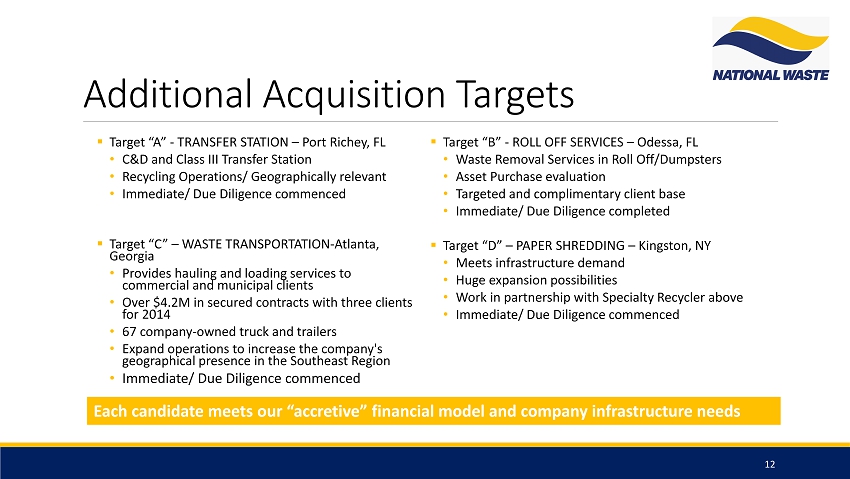

Additional Acquisition Targets ▪ Target “A” - TRANSFER STATION – Port Richey, FL • C&D and Class III Transfer Station • Recycling Operations/ Geographically relevant • Immediate/ Due Diligence commenced ▪ Target “C” – WASTE TRANSPORTATION - Atlanta, Georgia • Provides hauling and loading services to commercial and municipal clients • Over $4.2M in secured contracts with three clients for 2014 • 67 company - owned truck and trailers • Expand operations to increase the company's geographical presence in the Southeast Region • Immediate/ Due Diligence commenced ▪ Target “B” - ROLL OFF SERVICES – Odessa, FL • Waste Removal Services in Roll Off/Dumpsters • Asset Purchase evaluation • Targeted and complimentary client base • Immediate/ Due Diligence completed ▪ Target “D” – PAPER SHREDDING – Kingston, NY • Meets infrastructure demand • Huge expansion possibilities • Work in partnership with Specialty Recycler above • Immediate/ Due Diligence commenced 12 Each candidate meets our “accretive” financial model and company infrastructure needs

Completed Acquisition ▪ Waste Recovery Enterprises, LLC - Bainbridge, New York • Acquired for $250,000 and 2.75 million restricted shares • Permitted waste processing and disposal facility • C&D and Class III recycling ability • Expected to generate revenue for National Waste in excess of $1,500,000 annually with gross profit margins of approximately 45 % 13

Experienced Management & Board ▪ Louis Paveglio , Chief Executive Officer. With almost 40 years of operations management and more than 20 years experience in the sanitation industry, Louis’ expertise and industry connections are unsurpassable. Louis has continued to grow Sandland since he took over operations in 2002. ▪ Jeffrey Chartier, President. Over 30 years of experience in the financial industry. Former positions include: Senior Vice President at Morgan Stanley, President of Green EnviroTech Holdings Corp., an innovative environmental recycling company, founder of Chartier Financial, a full - service retail brokerage firm, and public markets consultant. ▪ Charles W. Teelon, Chairman. From mid 1970’s to the late 90’s Charlie had grown Ulster Sanitation into a multi - million dollar organization, acquiring more than 60 small businesses along the way. Ulster Sanitation included more than 100 trash trucks and coupled the trash collection business with paper shredding, landfills, interstate trucking, roll - off service, transfer stations, and recycling facilities. Ulster Sanitation was valued at over $70,000,000 when sold. 14

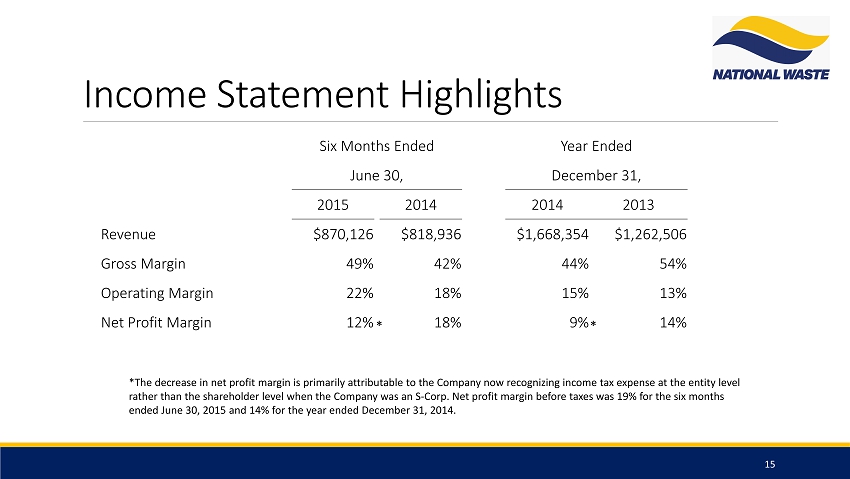

Income Statement Highlights 15 Six Months Ended Year Ended June 30, December 31, 2015 2014 2014 2013 Revenue $870,126 $818,936 $1,668,354 $1,262,506 Gross Margin 49% 42% 44% 54% Operating Margin 22% 18% 15% 13% Net Profit Margin 12% 18% 9% 14% * *The decrease in net profit margin is primarily attributable to the Company now recognizing income tax expense at the entity lev el rather than the shareholder level when the Company was an S - Corp. Net profit margin before taxes was 19% for the six months ended June 30, 2015 and 14% for the year ended December 31, 2014. *

Target ProForma Model 16 12 - 18 Months Years 2 - 3 Years 3 - 5 # of Acquisitions 3 - 5* 4 - 6 5 - 7 Revenue** $10M $30 - 35M $40 - 65M Gross Margin 48% 48% 48% EBITDA 25% 25% 25% *Three acquisitions already identified ** Acquisitions are accretive

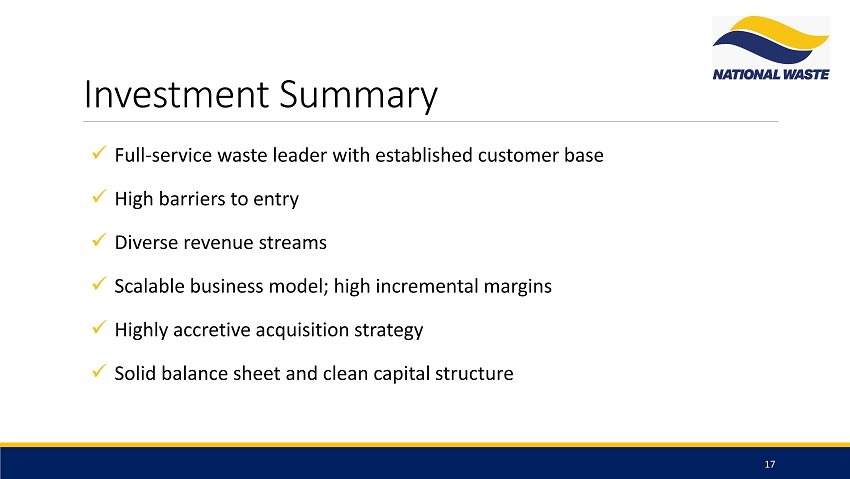

Investment Summary 17 x Full - service waste leader with established customer base x High barriers to entry x Diverse revenue streams x Scalable business model; high incremental margins x Highly accretive acquisition strategy x Solid balance sheet and clean capital structure

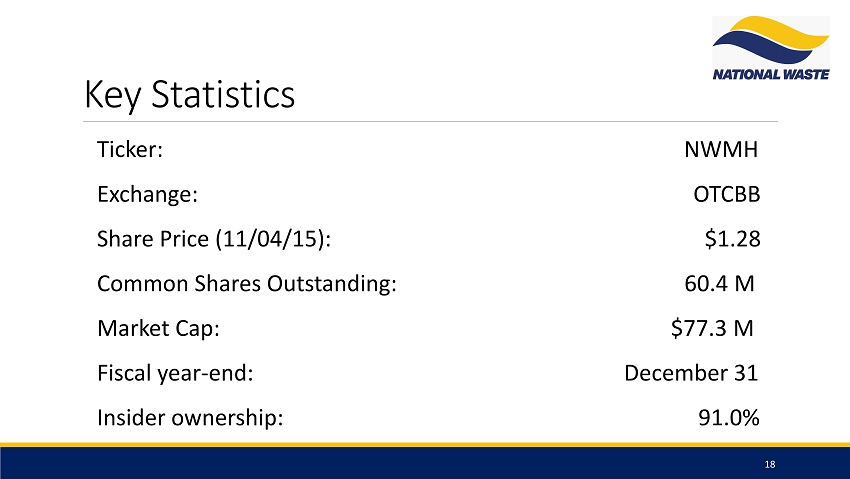

Key Statistics 18 Ticker: NWMH Exchange: OTCBB Share Price (11/04/15): $1.28 Common Shares Outstanding: 60.4 M Market Cap: $77.3 M Fiscal year - end: December 31 Insider ownership: 91.0%

Thank You. Company Contact: Investor Relations Contact: Jeff Chartier, President Natalya Rudman National Waste Management Holdings Inc. Crescendo Communications, LLC 917 - 414 - 6648 ( 212) 671 - 1020, Ext:304 jeff@nationalwastemgmt.com nwmh@crescendo - ir.com