Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Adynxx, Inc. | v424469_8k.htm |

Exhibit 99.1

Investor Presentation November 2015 Nasdaq: ALQA

This presentation contains forward - looking statements . Forward - looking statements are generally identifiable by the use of words like "may," "will," "should," "could," "expect," "anticipate," "estimate," "believe," "intend," or "project" or the negative of these words or other variations on these words or comparable terminology . Such statements are based on management's good faith expectations and are subject to numerous factors, risks and uncertainties that may cause actual results, the outcome of events, timing and performance to differ materially from those expressed or implied by such statements . These factors, risks and uncertainties include, but are not limited to, the adequacy of the Company’s liquidity to pursue its complete business objectives ; inadequate capital ; the Company’s ability to obtain and retain sufficient reimbursement from third party payers for its products ; loss or retirement of key executives ; adverse economic conditions or intense competition ; loss of a key customer or supplier ; entry of new competitors and products ; adverse federal, state and local government regulation ; technological obsolescence of the Company’s products ; technical problems with the Company’s research and products ; the Company’s ability to expand its business through strategic acquisitions ; the Company’s ability to integrate acquisitions and related businesses ; price increases for supplies and components ; and the inability to carry out research, development and commercialization plans . In addition, other factors that could cause actual results to differ materially are discussed in our filings with the SEC, including our Annual Report on Form 10 - K and our Quarterly Reports on Form 10 - Q . Investors and security holders are urge d to read these documents free of charge on the SEC's web site at www . sec . gov . We undertake no obligation to publicly update or revise our forward - looking statements as a result of new information, future events or otherwise . Forward - Looking Statement Disclaimer

3 Corporate Vision To build a suite of differentiated, clinically efficacious, advanced wound care solutions that will enable surgeons, clinicians & wound care practitioners to address the entire spectrum of challenges presented by chronic and acute wounds

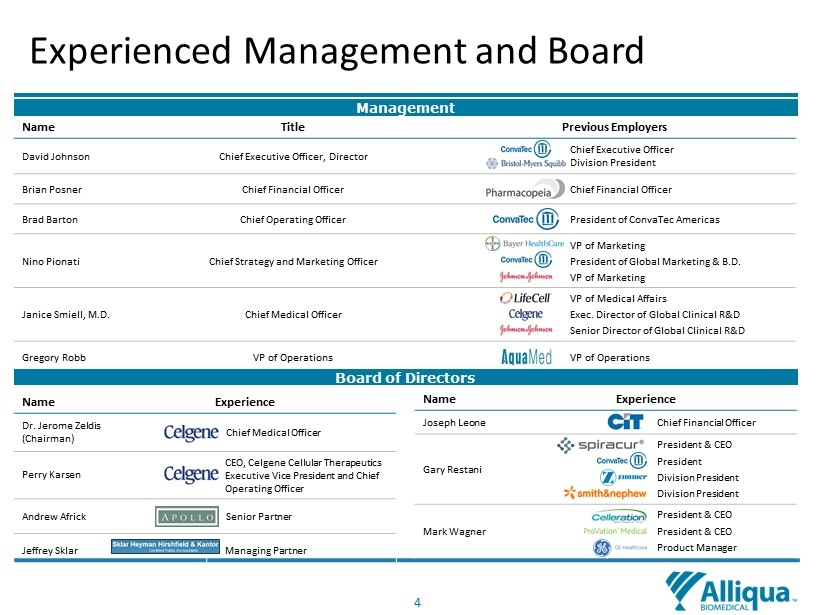

4 Experienced Management and Board Name Title Previous Employers David Johnson Chief Executive Officer, Director Chief Executive Officer Division President Brian Posner Chief Financial Officer Chief Financial Officer Brad Barton Chief Operating Officer President of ConvaTec Americas Nino Pionati Chief Strategy and Marketing Officer VP of Marketing President of Global Marketing & B.D. VP of Marketing Janice Smiell, M.D. Chief Medical Officer VP of Medical Affairs Exec. Director of Global Clinical R&D Senior Director of Global Clinical R&D Gregory Robb VP of Operations VP of Operations Management Board of Directors Name Experience Dr. Jerome Zeldis (Chairman) Chief Medical Officer Perry Karsen CEO, Celgene Cellular Therapeutics Executive Vice President and Chief Operating Officer Andrew Africk Senior Partner Jeffrey Sklar Managing Partner Name Experience Joseph Leone Chief Financial Officer Gary Restani President & CEO President Division President Division President Mark Wagner President & CEO President & CEO Product Manager

5 Why Advanced Wound Care? Large & Growing Global Market – U.S. represents more than one - third of the global market – U.S. market highly fragmented among private and micro - cap companies as well as large diversified companies *Source: 2012 Kalorama Information Wound Care Markets 2012 and Alliqua BioMedical management estimates CHRONIC WOUNDS (9.0 MILLION) Diabetic Foot Ulcers (5 – 15% of all diabetics = ~4.0M) Pressure Ulcers (~2.5M in acute care facilities alone ) Venous Leg Ulcers (2.5 million) Arterial Ulcers (~10% of all leg ulcers) ACUTE WOUNDS (450,000+) Burn Wounds (~450K out - patient) Trauma Wounds (~2.3M trauma hospital admissions per year) Surgical Wounds (~29M surgical procedures per year) U.S. Annual Wound Incidence – Growth in wound incidence expected due to demographic trends in diabetes and obesity Large and growing patient population Global Advanced Wound Care Market Estimated at $8+ Billion *

6 Why Advanced Wound Care? Clinical Need & Compelling Market Dynamics • Clear clinical need for advanced wound care therapies • Shift from conventional to sophisticated wound care products – “Skin & skin substitutes” sub - segment underpenetrated • Better/faster wound healing = Lower overall treatment costs – Reduced hospitalization times, incidence of HAIs, retreatment rates and risk of amputation • Multi - clinician user base – S urgeons, nurses and wound care specialists • Multi - channel customer base – H ospitals, ASCs, burn centers, wound care centers and trauma centers Venous leg ulcer Pressure ulcers Diabetic foot ulcer

7 Building the Portfolio Create an Integrated Portfolio of Wound Care Technologies ▪ Unique – differentiated ▪ Risk Adjusted – regulatory & reimbursement ▪ Clinically efficacious ▪ Economic value p roposition ▪ Strong margin p rofile The Criteria ▪ Wound bed p reparation ▪ Exudate management ▪ Anti - microbial t echnologies ▪ Regenerative medicine Targeting

8 Building the Portfolio (Cont.) Create an Integrated P ortfolio of Wound C are T echnologies COMMERCIAL PARTNERSHIPS LICENSING AGREEMENTS TARGETED ACQUISITIONS November, 2013 May, 2014 September, 2013 Licensing, marketing, development and supply agreement with “CCT,” the placental tissue & stem cell R&D division of Celgene Acquired wound care portfolio, technology platform, and sales and marketing team Long - term, exclusive agreement to commercialize sorbion® - branded products in the Americas Connective Tissue Matrix BIOVANCE® sorbion® Sana sorbion Sachet ®S TheraBond® 3D Acquired new reimbursed technology platform, and sales and reimbursement resources May, 2015 MIST Therapy ® UltraMIST ®

9 A Strong, Comprehensive and Unique Portfolio

10 Celleration Acquisition: MIST Therapy ® • Use low frequency ultrasound waves to stimulate the cells below the wound bed surface, a region that was previously inaccessible to wound care practitioners – Accelerates healing and wound closure – Reduces wound inflammation and bacteria/ bioburden – Increases blood flow to the afflicted area • FDA 510(k ) cleared; CE Mark – The only known noncontact, low - frequency, medical devices cleared by the FDA with an indication “to promote wound healing ” • Reimbursed by CMS – Covered in 6 of 8 Medicare administrative contractors representing 46 states – HOPD payment supports compelling value proposition • Strong clinical support – 8 randomized controlled trials, 10 other prospective, retrospective or observational studies, 25 case series and 1 meta - analysis with nearly 450 subjects • Commercial traction – $ 8.7 million of sales in fiscal year 2014 – FY’15 guidance: $6.3 million to $6.5 million (7 - months post - close of acquisition); updated from original range of $5.3 to $5.8 million UltraMIST ® System UltraMIST ® Applicator

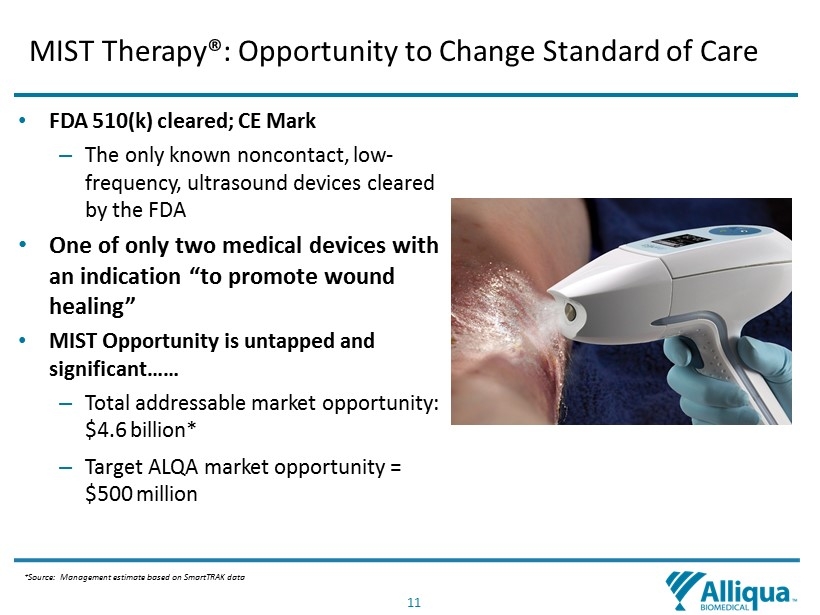

11 MIST Therapy ®: Opportunity to Change Standard of Care • FDA 510(k ) cleared; CE Mark – The only known noncontact, low - frequency, ultrasound devices cleared by the FDA • One of only two medical devices with an indication “to promote wound healing” • MIST Opportunity is untapped and significant …… – Total addressable market opportunity: $4.6 billion* – Target ALQA market opportunity = $500 million *Source: Management estimate based on SmartTRAK data

12 Introducing Biovance : Tissue Reborn Focused on the Rapidly Expanding Market for Skin Substitutes • November 2013, entered into license, marketing and development agreement with Celgene Cellular Therapeutics (“CCT”), an affiliate of Celgene Corporation • Biovance was the first commercialized product; future product pipeline includes: – Connective Tissue Matrix Product (CTM) • Targeting commercialization in mid - 2016 • Celgene is the largest shareholder of ALQA as of 6/30/15 filings – Participated in each of ALQA’s last three financing rounds (~$14m invested) • Skin substitutes represent a ~$600M opportunity* – Growing at +20% per year – Will be a >$1B market in 2018 *Source: SmartTRAK data

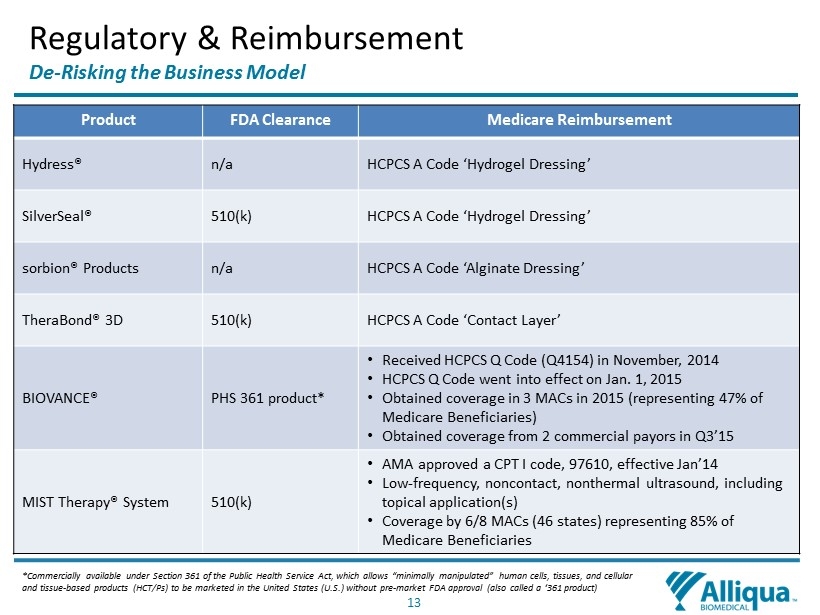

13 Regulatory & Reimbursement De - Risking the Business Model Product FDA Clearance Medicare Reimbursement Hydress® n/a HCPCS A Code ‘Hydrogel Dressing’ SilverSeal ® 510(k) HCPCS A Code ‘Hydrogel Dressing’ sorbion® Products n/a HCPCS A Code ‘Alginate Dressing’ TheraBond® 3D 510(k) HCPCS A Code ‘Contact Layer’ BIOVANCE® PHS 361 product* • Received HCPCS Q Code (Q4154) in November, 2014 • HCPCS Q Code went into effect on Jan. 1, 2015 • Obtained coverage in 3 MACs in 2015 (representing 47% of Medicare Beneficiaries) • Obtained coverage from 2 commercial payors in Q3’15 MIST Therapy ® System 510(k) • AMA approved a CPT I code, 97610, effective Jan’14 • Low - frequency, noncontact, nonthermal ultrasound, including topical application(s) • Coverage by 6/8 MACs (46 states) representing 85% of Medicare Beneficiaries * C ommercially available under Section 361 of the Public Health Service Act, which allows “minimally manipulated” human cells, tissues, and cel lular and tissue - based products (HCT/Ps) to be marketed in the United States (U.S.) without pre - market FDA approval (also called a ‘36 1 product )

14 Commercial Infrastructure World Class Sales & Marketing Product Supply Group Purchasing Agreements (GPO Contracts) Awarded August 2014 Awarded December 2014 44 Direct reps 23 Independent reps 29 DISTRIBUTION PARTNERS

15 $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 2013 2014 2015 Pro-Forma 2015 Contract Manufacturing Proprietary Products Mid - Point of 2015 Guidance (2) Revenue Growth Trends Improving (1) FY’14 proprietary products revenue includes contributions from the Choice Therapeutics acquisition of approximately $1.59 mi llion (2) Mid - point of FY’15 total revenue guidance ($15.5 million) includes approx. $7.1 million of proprietary products revenue, $2. 0 million of contract manufacturing revenue and $6.4 million from the Celleration acquisition, (assumes 7 - mo. contribution post May 29 close) (3) Mid - Point of FY’15 total revenue guidance on a pro - forma basis, assumes 12 - months of Celleration , ($6.4M*12/7 months), or approximately $11 million in revenue 2014 Drivers Mar Established Direct Sales Force Apr BIOVANCE Launch May Choice Therapeutics Acquisition Nov Q-Code for BIOVANCE 2015 Drivers Apr 1st MAC coverage for BIOVANCE May Celleration Acquisition & 2nd MAC coverage for BIOVANCE Sept. 3rd MAC coverage for BIOVANCE (1) (2) (3) Proprietary product margins over 70%

16 Financial Summary ($, 000s) Q3’15 (9/30/15) 9 Months ’15 (9/30/15) Products Revenue: $4,506 (+354% y/y (1) ) $8,637 (+422% y/y (1) ) Contract Manufacturing Revenue: $508 (1.5% y/y) $1,627 (+11% y/y) Total Revenue: $5,014 (+236% y/y (1) ) $10,264 (+229% y/y (1) ) Gross Margin: 67% (39% Q2’14) 59% (24% 9 mo. ’14) Cash: $30,732 Gross Debt: $15,500 Basic Shares O/S: 27,668 Fully Diluted Shares O/S: 37,341 Mkt Cap – (Basic shares): ~80 Million (2) Avg. Daily Volume – LTM (Shares): 71,500 Revenue Guidance $15.0 million - $16.0 million (3) (1) Q3’15 organic product revenue was +78% y/y; organic total revenue growth was +52%. 9mo’15 organic product revenue was +58% y/y; organic total revenue growth was +67%. (2) Market Capitalization based on closing price on 11/6/15 (3) Mid - Point of FY’15 total revenue guidance on a pro - forma basis, assumes 12 - months of Celleration , ($ 6.4M*12/7 months), or approximately $11 million in revenue

17 □ Salesforce expansion & productivity • Celleration integration – 19 new selling resources • Revenue / Rep increase – 2016 • Expand partnerships in non - core areas – 2015 / 2016 □ Expand and leverage reimbursement coverage • BIOVANCE® and MIST Therapy® ultrasound products □ Expand product portfolio – 2 new products in 2016 • New product development • Opportunistically utilize business development Growth Strategy

Nasdaq: ALQA Alliqua BioMedical, Inc. AlliquaBiomedical@westwicke.com 2150 Cabot Blvd West Langhorne, PA 19047 (215) 702 - 8550