Attached files

| file | filename |

|---|---|

| EX-32.2 - CHIEF FINANCIAL OFFICER'S CERTIFICATE - AccuShares Trust I | e66867ex32-2.htm |

| EX-31.1 - CHIEF EXECUTIVE OFFICER'S CERTIFICATE - AccuShares Trust I | e66867ex31-1.htm |

| EX-31.2 - CHIEF FINANCIAL OFFICER'S CERTIFICATE - AccuShares Trust I | e66867ex31-2.htm |

| EX-32.1 - CHIEF EXECUTIVE OFFICER'S CERTIFICATE - AccuShares Trust I | e66867ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended September 30, 2015 |

| £ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number: 001-36890

AccuShares Trust I

Sponsored by AccuShares Investment Management, LLC

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 36-7629280 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

c/o AccuShares Investment Management, LLC

300 First Stamford Place, 4th Floor

Stamford, Connecticut 06920

(Address of Principal Executive Offices)

1-855-286-7866

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer £ | Accelerated filer £ |

| Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes £ No x

ACCUSHARES TRUST I

(formerly known as AccuShares Commodities Trust I)

Table of Contents

| Items | Page | ||

| Part I. FINANCIAL INFORMATION | |||

| Item 1. | Financial Statements. | 3 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 28 | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 35 | |

| Item 4. | Controls and Procedures. | 35 | |

| Part II. OTHER INFORMATION | |||

| Item 1. | Legal Proceedings. | 36 | |

| Item 1A. | Risk Factors. | 36 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 36 | |

| Item 3. | Defaults Upon Senior Securities. | 37 | |

| Item 4. | Mine Safety Disclosures. | 37 | |

| Item 5. | Other Information. | 37 | |

| Item 6. | Exhibits. | 37 | |

2

PART I – FINANCIAL INFORMATION

Index to Financial Statements

3

| AccuShares Spot CBOE VIX Fund | ||||||||||||

| Statements of Assets and Liabilities | ||||||||||||

| September 30, 2015 (Unaudited) | December 31, 2014 | |||||||

| Assets: | ||||||||

| Cash | $ | 2,319,505 | $ | 1,000 | ||||

| Total assets | $ | 2,319,505 | $ | 1,000 | ||||

| Liabilities: | ||||||||

| Management fees payable | $ | 2,101 | $ | — | ||||

| Total liabilities | 2,101 | — | ||||||

| Net assets: | ||||||||

| Paid-in capital | $ | 2,361,404 | $ | 1,000 | ||||

| Accumulated deficit | (44,000 | ) | — | |||||

| Total net assets | 2,317,404 | 1,000 | ||||||

| Total liabilities and net assets | $ | 2,319,505 | $ | 1,000 | ||||

| Up Shares: | ||||||||

| Net assets | $ | 1,233,157 | $ | 500 | ||||

| Shares outstanding^ | 35,000.00 | 0.80 | ||||||

| Net asset value per share^ | $ | 35.23 | $ | 625.00 | ||||

| Down Shares: | ||||||||

| Net assets | $ | 1,084,247 | $ | 500 | ||||

| Shares outstanding^ | 35,000.00 | 0.80 | ||||||

| Net asset value per share^ | $ | 30.98 | $ | 625.00 | ||||

| ^ | AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information. |

The accompanying notes are an integral part of these financial statements.

4

| AccuShares Spot CBOE VIX Fund | ||||||||||||||||||

| Statements of Operations (Unaudited) | ||||||||||||||||||

| For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||

| 2015 (1) | 2014 (2) | 2015 (1) | 2014 (2) | |||||||||||||

| Expenses: | ||||||||||||||||

| Management fees: | ||||||||||||||||

| Up Shares | $ | 12,367 | $ | — | $ | 22,231 | $ | — | ||||||||

| Down Shares | 11,915 | — | 21,769 | — | ||||||||||||

| Total expenses | $ | 24,282 | $ | — | $ | 44,000 | $ | — | ||||||||

| Net investment income (loss) | $ | (24,282 | ) | $ | — | $ | (44,000 | ) | $ | — | ||||||

| Net increase (decrease) in net assets resulting from operations | $ | (24,282 | ) | $ | — | $ | (44,000 | ) | $ | — | ||||||

| Per share data Up Shares:^ | ||||||||||||||||

| Earnings per share (basic and diluted): | $ | (0.51 | ) | $ | — | $ | (1.05 | ) | $ | — | ||||||

| Net investment loss per share (basic and diluted): | $ | (0.51 | ) | $ | — | $ | (1.05 | ) | $ | — | ||||||

| Average shares outstanding: | 24,043.00 | 0.80 | 21,244.00 | 0.80 | ||||||||||||

| Distributions declared per share: | $ | 704.30 | $ | — | $ | 913.03 | $ | — | ||||||||

| Per share data Down Shares:^ | ||||||||||||||||

| Earnings per share (basic and diluted): | $ | (0.50 | ) | $ | — | $ | (1.02 | ) | $ | — | ||||||

| Net investment loss per share (basic and diluted): | $ | (0.50 | ) | $ | — | $ | (1.02 | ) | $ | — | ||||||

| Average shares outstanding: | 24,043.00 | 0.80 | 21,244.00 | 0.80 | ||||||||||||

| Distributions declared per share: | $ | 268.10 | $ | — | $ | 268.10 | $ | — | ||||||||

| (1) | Commenced operations on May 19, 2015. | |

| (2) | For the period from June 17, 2014 (Inception) to September 30, 2014. | |

| ^ | AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information. |

The accompanying notes are an integral part of these financial statements.

5

| AccuShares Spot CBOE VIX Fund | |||||||||||

| Statements of Changes in Net Assets (Unaudited) | |||||||||||

| For the Nine Months Ended September 30, 2015 (1) | For the Nine Months Ended September 30, 2014 (2) | |||||||

| Increase (decrease) in net assets resulting from operations: | ||||||||

| Net investment income (loss) | $ | (44,000 | ) | $ | — | |||

| Net increase (decrease) in net assets resulting from operations | (44,000 | ) | — | |||||

| Distributions to shareholders from: | ||||||||

| Return of capital: | ||||||||

| Up Shares | (9,678,404 | ) | — | |||||

| Down Shares | (4,916,711 | ) | — | |||||

| Total distributions to shareholders | (14,595,115 | ) | — | |||||

| Capital transactions: | ||||||||

| Issuance of common stock: | ||||||||

| Up Shares | 15,107,463 | 500 | ||||||

| Down Shares | 13,172,485 | 500 | ||||||

| Redemption of common stock: | ||||||||

| Up Shares | (8,710,975 | ) | — | |||||

| Down Shares | (2,613,454 | ) | — | |||||

| Net increase (decrease) in net assets resulting from capital transactions | 16,955,519 | 1,000 | ||||||

| Total increase in net assets | 2,316,404 | 1,000 | ||||||

| Net assets at beginning of period | 1,000 | — | ||||||

| Net assets at end of period | $ | 2,317,404 | $ | 1,000 | ||||

| Changes in Shares:^ | ||||||||

| Up Shares: | ||||||||

| Issuance of common stock | 47,000.00 | 0.80 | ||||||

| Redemption of common stock | (12,000.80 | ) | — | |||||

| Net change in shares | 34,999.20 | 0.80 | ||||||

| Down Shares: | ||||||||

| Issuance of common stock | 47,000.00 | 0.80 | ||||||

| Redemption of common stock | (12,000.80 | ) | — | |||||

| Net change in shares | 34,999.20 | 0.80 | ||||||

| (1) | Commenced operations on May 19, 2015. | |

| (2) | For the period from June 17, 2014 (Inception) to September 30, 2014. | |

| ^ | AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information. |

The accompanying notes are an integral part of these financial statements.

6

| AccuShares Spot CBOE VIX Fund | |||||||||||

| Statements of Cash Flows (Unaudited) | |||||||||||

| For the Nine Months Ended September 30, 2015 (1) | For the Nine Months Ended September 30, 2014 (2) | |||||||

| Cash flows from operating activities | ||||||||

| Net increase (decrease) in net assets resulting from operations | $ | (44,000 | ) | $ | — | |||

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | ||||||||

| Increase in operating assets and liabilities: | ||||||||

| Increase in management fees payable | 2,101 | — | ||||||

| Net cash used in operating activities | (41,899 | ) | — | |||||

| Cash flows from financing activities | ||||||||

| Issuance of common stock | 28,279,948 | 1,000 | ||||||

| Redemption of common stock | (11,324,429 | ) | — | |||||

| Distributions paid | (14,595,115 | ) | — | |||||

| Net cash provided by financing activities | 2,360,404 | 1,000 | ||||||

| Net increase in cash | 2,318,505 | 1,000 | ||||||

| Cash, beginning of period | 1,000 | — | ||||||

| Cash, end of period | $ | 2,319,505 | $ | 1,000 | ||||

| (1) | Commenced operations on May 19, 2015. | |

| (2) | For the period from June 17, 2014 (Inception) to September 30, 2014. |

The accompanying notes are an integral part of these financial statements.

7

| AccuShares Spot CBOE VIX Fund | |||||||||

| Financial Highlights (Unaudited) | |||||||||

| Up Shares | |||||||||

| For the Period Ended September 30, 2015* | ||||

| Per Share Data:(1) | ||||

| Net asset value, beginning of period | $ | 625.00 | ||

| Net investment income (loss)(2) | (1.05 | ) | ||

| Net asset value after investment operations | 623.95 | |||

| Allocation between share classes | 324.31 | |||

| Distributions per share declared from: | ||||

| Return of capital | (913.03 | ) | ||

| Total distributions declared | (913.03 | ) | ||

| Net asset value, end of period | $ | 35.23 | ||

| Closing trading price, end of period | $ | 32.00 | ||

| Shares outstanding, end of period | 35,000 | |||

| Total return at net asset value(3)(4) | 58.36 | % | ||

| Total return at market value(3)(4) | 35.85 | % | ||

| Ratios/supplemental data: | ||||

| Net assets, end of period | $ | 1,233,157 | ||

| Ratio of total expenses to average net assets(5) | 0.95 | % | ||

| Ratio of net investment income to average net assets(5) | (0.95 | )% | ||

| * | Commenced operations on May 19, 2015. | |

| (1) | AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information. | |

| (2) | Per share amounts based on average shares outstanding during the period. | |

| (3) | Not annualized. | |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions, if any, reinvested. | |

| (5) | Annualized. |

The accompanying notes are an integral part of these financial statements.

8

| AccuShares Spot CBOE VIX Fund | |||||||||

| Financial Highlights (Unaudited) | |||||||||

| Down Shares | |||||||||

| For the Period Ended September 30, 2015* | ||||||||||||||||||||||||||||

| Per Share Data:(1) | ||||||||||||||||||||||||||||

| Net asset value, beginning of period | $ | 625.00 | ||||||||||||||||||||||||||

| Net investment income (loss)(2) | (1.02 | ) | ||||||||||||||||||||||||||

| Net asset value after investment operations | 623.98 | |||||||||||||||||||||||||||

| Allocation between share classes | (324.90 | ) | ||||||||||||||||||||||||||

| Distributions declared from: | ||||||||||||||||||||||||||||

| Return of capital | (268.10 | ) | ||||||||||||||||||||||||||

| Total distributions declared | (268.10 | ) | ||||||||||||||||||||||||||

| Net asset value, end of period | $ | 30.98 | ||||||||||||||||||||||||||

| Closing trading price, end of period | $ | 33.50 | ||||||||||||||||||||||||||

| Shares outstanding, end of period | 35,000 | |||||||||||||||||||||||||||

| Total return at net asset value(3)(4) | (62.42 | )% | ||||||||||||||||||||||||||

| Total return at market value(3)(4) | (74.43 | )% | ||||||||||||||||||||||||||

| Ratios/supplemental data: | ||||||||||||||||||||||||||||

| Net assets, end of period | $ | 1,084,247 | ||||||||||||||||||||||||||

| Ratio of total expenses to average net assets(5) | 0.95 | % | ||||||||||||||||||||||||||

| Ratio of net investment income to average net assets(5) | (0.95 | )% | ||||||||||||||||||||||||||

| * | Commenced operations on May 19, 2015. | |

| (1) | AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information. | |

| (2) | Per share amounts based on average shares outstanding during the period. | |

| (3) | Not annualized. | |

| (4) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions, if any, reinvested. | |

| (5) | Annualized. |

The accompanying notes are an integral part of these financial statements.

9

* The Consolidating Statements of Assets and Liabilities of AccuShares Trust I (formerly known as AccuShares Commodities Trust I) (the "Trust") are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have assets or liabilities separate from those of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

^ AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information.

The accompanying notes are an integral part of these financial statements.

10

| AccuShares Trust I * | ||||||||||||||||||||||||||||||||

| Consolidating Statements of Assets & Liabilities | ||||||||||||||||||||||||||||||||

| December 31, 2014 | ||||||||||||||||||||||||||||||||

| AccuShares S&P GSCI Spot Fund | AccuShares S&P GSCI Agriculture & Livestock Spot Fund | AccuShares S&P GSCI Industrial Metals Spot Fund | AccuShares S&P GSCI Crude Oil Excess Return Fund** | AccuShares S&P GSCI Brent Oil Spot Fund | AccuShares S&P GSCI Natural Gas Spot Fund | AccuShares Spot CBOE VIX Fund | Consolidating Total | |||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||

| Cash | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 7,000 | ||||||||||||||||

| Total assets | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 7,000 | ||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||||||||

| Management fees payable | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Total liabilities | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Net assets: | ||||||||||||||||||||||||||||||||

| Paid-in capital | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 7,000 | ||||||||||||||||

| Accumulated deficit | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Total net assets | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 7,000 | ||||||||||||||||||||||||

| Total liabilities and net assets | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 7,000 | ||||||||||||||||

| Up Shares: | ||||||||||||||||||||||||||||||||

| Net assets | $ | 500 | $ | 500 | $ | 500 | $ | 500 | $ | 500 | $ | 500 | $ | 500 | N/A | |||||||||||||||||

| Shares outstanding^ | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Net asset value per share^ | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 625.00 | N/A | |||||||||||||||||

| Down Shares: | ||||||||||||||||||||||||||||||||

| Net assets | $ | 500 | $ | 500 | $ | 500 | $ | 500 | $ | 500 | $ | 500 | $ | 500 | N/A | |||||||||||||||||

| Shares outstanding^ | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Net asset value per share^ | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 25.00 | $ | 625.00 | N/A | |||||||||||||||||

* The Consolidating Statements of Assets and Liabilities of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have assets or liabilities separate from those of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

^ AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information.

The accompanying notes are an integral part of these financial statements.

11

* The Consolidating Statements of Operations of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have income or expenses separate from those of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) Commenced operations on May 19, 2015.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

^ AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information.

The accompanying notes are an integral part of these financial statements.

12

| AccuShares Trust I * | ||||||||||||||||||||||||||||||||

| Consolidating Statements of Operations (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Three Months Ended September 30, 2014(1) | ||||||||||||||||||||||||||||||||

| AccuShares S&P GSCI Spot Fund | AccuShares S&P GSCI Agriculture & Livestock Spot Fund | AccuShares S&P GSCI Industrial Metals Spot Fund | AccuShares S&P GSCI Crude Oil Excess Return Fund** | AccuShares S&P GSCI Brent Oil Spot Fund | AccuShares S&P GSCI Natural Gas Spot Fund | AccuShares Spot CBOE VIX Fund | Consolidating Total | |||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||

| Management fees: | ||||||||||||||||||||||||||||||||

| Up Shares | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Down Shares | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Total expenses | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Net investment income (loss) | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Net increase (decrease) in net assets resulting from operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Per share data Up Shares:^ | ||||||||||||||||||||||||||||||||

| Earnings per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Net investment loss per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Average shares outstanding: | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Distributions declared per share: | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Per share data Down Shares:^ | ||||||||||||||||||||||||||||||||

| Earnings per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Net investment loss per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Average shares outstanding: | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Distributions declared per share: | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

* The Consolidating Statements of Operations of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have income or expenses separate from those of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) For the period from June 17, 2014 (Inception) to September 30, 2014.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

The accompanying notes are an integral part of these financial statements.

13

| AccuShares Trust I * | ||||||||||||||||||||||||||||||||

| Consolidating Statements of Operations (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2015 | ||||||||||||||||||||||||||||||||

| AccuShares S&P GSCI Spot Fund | AccuShares S&P GSCI Agriculture & Livestock Spot Fund | AccuShares S&P GSCI Industrial Metals Spot Fund | AccuShares S&P GSCI Crude Oil Excess Return Fund** | AccuShares S&P GSCI Brent Oil Spot Fund | AccuShares S&P GSCI Natural Gas Spot Fund | AccuShares Spot CBOE VIX Fund(1) | Consolidating Total | |||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||

| Management fees: | ||||||||||||||||||||||||||||||||

| Up Shares | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 22,231 | $ | 22,231 | ||||||||||||||||

| Down Shares | - | - | - | - | - | - | 21,769 | 21,769 | ||||||||||||||||||||||||

| Total expenses | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 44,000 | $ | 44,000 | ||||||||||||||||

| Net investment income (loss) | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | (44,000 | ) | $ | (44,000 | ) | ||||||||||||||

| Net increase (decrease) in net assets resulting from operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | (44,000 | ) | $ | (44,000 | ) | ||||||||||||||

| Per share data Up Shares:^ | ||||||||||||||||||||||||||||||||

| Earnings per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | (1.05 | ) | N/A | ||||||||||||||||

| Net investment loss per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | (1.05 | ) | N/A | ||||||||||||||||

| Average shares outstanding: | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 21,244.00 | N/A | ||||||||||||||||||||||||

| Distributions declared per share: | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 913.03 | N/A | |||||||||||||||||

| Per share data Down Shares:^ | ||||||||||||||||||||||||||||||||

| Earnings per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | (1.02 | ) | N/A | ||||||||||||||||

| Net investment loss per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | (1.02 | ) | N/A | ||||||||||||||||

| Average shares outstanding: | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 21,244.00 | N/A | ||||||||||||||||||||||||

| Distributions declared per share: | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 268.10 | N/A | |||||||||||||||||

* The Consolidating Statements of Operations of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have income or expenses separate from those of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) Commenced operations on May 19, 2015.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

The accompanying notes are an integral part of these financial statements.

14

| AccuShares Trust I * | ||||||||||||||||||||||||||||||||

| Consolidating Statements of Operations (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2014(1) | ||||||||||||||||||||||||||||||||

| AccuShares S&P GSCI Spot Fund | AccuShares S&P GSCI Agriculture & Livestock Spot Fund | AccuShares S&P GSCI Industrial Metals Spot Fund | AccuShares S&P GSCI Crude Oil Excess Return Fund** | AccuShares S&P GSCI Brent Oil Spot Fund | AccuShares S&P GSCI Natural Gas Spot Fund | AccuShares Spot CBOE VIX Fund | Consolidating Total | |||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||

| Management fees: | ||||||||||||||||||||||||||||||||

| Up Shares | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Down Shares | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Total expenses | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Net investment income (loss) | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Net increase (decrease) in net assets resulting from operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Per share data Up Shares:^ | ||||||||||||||||||||||||||||||||

| Earnings per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Net investment loss per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Average shares outstanding: | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Distributions declared per share: | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Per share data Down Shares:^ | ||||||||||||||||||||||||||||||||

| Earnings per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Net investment loss per share (basic and diluted): | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

| Average shares outstanding: | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Distributions declared per share: | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | N/A | |||||||||||||||||

* The Consolidating Statements of Operations of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have income or expenses separate from those of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) For the period from June 17, 2014 (Inception) to September 30, 2014.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

The accompanying notes are an integral part of these financial statements.

15

* The Consolidating Statements of Changes in Net Assets of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have capital separate from that of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) Commenced operations on May 19, 2015.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

^ AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information.

The accompanying notes are an integral part of these financial statements.

16

| AccuShares Trust I * | ||||||||||||||||||||||||||||||||

| Consolidating Statements of Changes in Net Assets (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2014(1) | ||||||||||||||||||||||||||||||||

| AccuShares S&P GSCI Spot Fund | AccuShares S&P GSCI Agriculture & Livestock Spot Fund | AccuShares S&P GSCI Industrial Metals Spot Fund | AccuShares S&P GSCI Crude Oil Excess Return Fund** | AccuShares S&P GSCI Brent Oil Spot Fund | AccuShares S&P GSCI Natural Gas Spot Fund | AccuShares Spot CBOE VIX Fund | Consolidating Total | |||||||||||||||||||||||||

| Increase (decrease) in net assets resulting from operations: | ||||||||||||||||||||||||||||||||

| Net investment income (loss) | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Net increase (decrease) in net assets resulting from operations | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Distributions to shareholders from: | ||||||||||||||||||||||||||||||||

| Return of capital: | ||||||||||||||||||||||||||||||||

| Up Shares | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Down Shares | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Total distributions to shareholders | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Capital share transactions: | ||||||||||||||||||||||||||||||||

| Issuance of common stock: | ||||||||||||||||||||||||||||||||

| Up Shares | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 3,500 | ||||||||||||||||||||||||

| Down Shares | 500 | 500 | 500 | 500 | 500 | 500 | 500 | 3,500 | ||||||||||||||||||||||||

| Redemption of common stock: | ||||||||||||||||||||||||||||||||

| Up Shares | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Down Shares | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Net increase (decrease) in net assets resulting from capital share transactions | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 7,000 | ||||||||||||||||||||||||

| Total increase (decrease) in net assets | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 7,000 | ||||||||||||||||||||||||

| Net assets at beginning of period | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Net assets at end of period | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 7,000 | ||||||||||||||||

| Changes in shares:^ | ||||||||||||||||||||||||||||||||

| Up Shares: | ||||||||||||||||||||||||||||||||

| Issuance of common stock | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Redemption of common stock | - | - | - | - | - | - | - | N/A | ||||||||||||||||||||||||

| Net change in shares | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Down Shares: | ||||||||||||||||||||||||||||||||

| Issuance of common stock | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

| Redemption of common stock | - | - | - | - | - | - | - | N/A | ||||||||||||||||||||||||

| Net change in shares | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 20.00 | 0.80 | N/A | ||||||||||||||||||||||||

* The Consolidating Statements of Changes in Net Assets of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have capital separate from that of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) For the period from June 17, 2014 (Inception) to September 30, 2014.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

^ AccuShares Spot CBOE VIX Fund made corrective distributions on September 22, 2015 and October 22, 2015. Additionally, a 1 for 10 reverse stock split occurred on September 25, 2015 and October 23, 2015. The corrective distributions and reverse stock splits have been retroactively applied to the per share data shown above. See Note 7 for further information.

The accompanying notes are an integral part of these financial statements.

17

* The Consolidating Statements of Cash Flows of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have cash separate from that of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) Commenced operations on May 19, 2015.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

The accompanying notes are an integral part of these financial statements.

18

| AccuShares Trust I* | ||||||||||||||||||||||||||||||||

| Consolidating Statements of Cash Flows (Unaudited) | ||||||||||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2014(1) | ||||||||||||||||||||||||||||||||

| AccuShares S&P GSCI Spot Fund | AccuShares S&P GSCI Agriculture & Livestock Spot Fund | AccuShares S&P GSCI Industrial Metals Spot Fund | AccuShares S&P GSCI Crude Oil Excess Return Fund** | AccuShares S&P GSCI Brent Oil Spot Fund | AccuShares S&P GSCI Natural Gas Spot Fund | AccuShares Spot CBOE VIX Fund | Consolidating Total | |||||||||||||||||||||||||

| Cash flows from operating activities: | ||||||||||||||||||||||||||||||||

| Net increase (decrease) in net assets resulting from operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash used in operating activities: | ||||||||||||||||||||||||||||||||

| Increase (decrease) in operating assets and liabilities: | ||||||||||||||||||||||||||||||||

| Increase (decrease) in management fees payable | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Net cash provided by (used for) operating activities | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Cash flows from financing activities: | ||||||||||||||||||||||||||||||||

| Issuance of common stock | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 7,000 | ||||||||||||||||||||||||

| Redemption of common stock | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Distributions paid | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Net cash provided by financing activities | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 7,000 | ||||||||||||||||||||||||

| Net increase (decrease) in cash | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 7,000 | ||||||||||||||||||||||||

| Cash, beginning of period | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Cash, end of period | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 1,000 | $ | 7,000 | ||||||||||||||||

* The Consolidating Statements of Cash Flows of the Trust are being provided solely to meet Securities and Exchange Commission regulatory requirements. The Trust does not have cash separate from that of its seven fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole.

(1) For the period from June 17, 2014 (Inception) to September 30, 2014.

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

The accompanying notes are an integral part of these financial statements.

19

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

1. Organization

AccuShares Trust I (formerly known as AccuShares Commodities Trust I) (the "Trust") is a Delaware statutory trust organized on June 28, 2013 and is currently organized into eight separate series (each, a “Fund” and collectively, the “Funds”). The AccuShares Spot CBOE VIX Fund (the “VIX Fund”), one of the Trust’s series, issues shares that represent beneficial interests in, and ownership of, the assets of the VIX Fund only. The VIX Fund offers its shares on a continuous basis and is listed on the NASDAQ OMX (the “Exchange”).

The VIX Fund commenced operations as of May 19, 2015. As of September 30, 2015, no other Fund has commenced operations.

The Trust may offer shares of an additional fund series. The term of the Trust and the Funds is perpetual unless terminated earlier by the Trust’s sponsor, AccuShares Investment Management, LLC (the “Sponsor”).

The shares of the Funds are designed for investors who want a cost-effective, targeted and transparent exposure to changes in such Fund’s referenced financial index (an “Underlying Index”). The CBOE® Volatility Index® (the “VIX Index”) is the Underlying Index of the VIX Fund.

Each Fund seeks to track its Underlying Index’s changes, without the need to hold any securities, futures or other financial instruments relating to its Underlying Index or the assets referenced by the Underlying Index. Instead, the Funds are expressly limited to holding only: cash; bills, bonds and notes issued and guaranteed by the United States Treasury with remaining maturities of 90 calendar days or less (“Eligible Treasuries”); and overnight repurchase agreements collateralized by United States Treasury securities (“Eligible Repos”, together with cash and Eligible Treasuries, “Eligible Assets”). A Fund’s Eligible Assets are not managed to track performance of such Fund’s Underlying Index. A Fund will invest its assets so as to preserve capital while, at the same time, earning an investment return that is consistent with such preservation of capital.

A Fund will issue its shares in offsetting pairs of share classes, where one constituent of the pair is positively linked to such Fund’s Underlying Index (“Up Shares”) and the other constituent is negatively linked to such Fund’s Underlying Index (“Down Shares”). Therefore, a Fund will only issue, distribute, maintain and redeem equal quantities of Up and Down Shares at all times. Once issued, and before any redemption, the Up Shares and Down Shares of a Fund are expected to trade separately without restriction on the Exchange.

The Funds’ custodian will determine daily each Fund’s liquidation value attributable to each of its classes (“Class Value”), which liquidation value is based on the value of such Fund’s Eligible Assets attributable to such class, (a) plus any accrued income or gains or losses on such assets attributable to such class (“Investment Income”), (b) less all fees, expenses and taxes attributable to such class not otherwise assumed by the Sponsor, where such income and gains after deduction of such fees, expenses and taxes is referred to as the class’ “Net Investment Income.” Investment Income with respect to a class will be adjusted during any creation or redemption order settlement period for any increases or decreases in value of the Fund’s assets attributable to such class resulting from such order. The Net Investment Income and Investment Income can be positive or negative.

The Sponsor initially capitalized each of its seven initial Funds with $1,000 in exchange for 20 shares of the Fund’s Up Shares and 20 shares of its Down Shares. On October 5, 2015, AccuShares Trust I filed a registration statement on Form S-1 for the AccuShares S&P 500 VIX Front-Month Futures Index Fund which is the eighth series of the Trust. The AccuShares S&P 500 Front-Month Futures Index Fund was not capitalized as of September 30, 2015 and, as a result, is not reflected in the financial statements enclosed herewith.

20

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Funds and the Trust in preparation of these financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

The accompanying financial statements have been prepared on the accrual basis of accounting in conformity with GAAP. In the opinion of management, the unaudited interim financial results included herein contain all adjustments and reclassifications that are necessary for the fair presentation of financial statements for the periods included herein.

In accordance with ASU 2013-08, the Sponsor has determined the Trust is classified as an investment company for financial reporting purposes, and accordingly, the Trust follows the accounting guidance in ASC 946. However, the Trust is not registered as an investment company under the Investment Company Act of 1940, as amended, and is not required to register under such act.

Revenue Recognition

The Funds will record investment transactions on each trade date. Realized gains and losses are based on the specific identification method.

Interest income, adjusted for amortization of premium and accretion of discount, will be recorded on an accrual basis. Discount and premiums to par value on investments purchased will be accreted and amortized, respectively, into interest income over the life of the respective investment using the effective interest method. Original issue discount and market discounts or premiums will be capitalized and amortized into interest income using the effective interest method or straight-line method, as applicable.

Use of Estimates and Indemnifications

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these financial statements. Actual results could differ from those estimates.

In the normal course of business, the Trust on behalf of a Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Trust’s maximum exposure, under these arrangements, cannot be known; however, the Sponsor expects any risk of loss to be remote.

21

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

Fair Value Measurements

The Funds follow ASC 820 for measuring the fair value of portfolio investments. Fair value is the price that would be received in the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation models involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity. A Fund’s fair value analysis includes an analysis of the value of any unfunded loan commitments. Financial investments recorded at fair value in the financial statements are categorized for disclosure purposes based upon the level of judgment associated with the inputs used to measure their value. The valuation hierarchical levels are based upon the transparency of the inputs to the valuation of the investment as of the measurement date. The three levels are defined as follows:

· Level 1 — Valuations based on quoted prices in active markets for identical assets or liabilities at the measurement date.

· Level 2 — Valuations based on inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable at the measurement date. This category includes quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in non-active markets including actionable bids from third parties for privately held assets or liabilities, and observable inputs other than quoted prices such as yield curves and forward currency rates that are entered directly into valuation models to determine the value of derivatives or other assets or liabilities.

· Level 3 — Valuations based on inputs that are unobservable and where there is little, if any, market activity at the measurement date. The inputs for the determination of fair value may require significant management judgment or estimation and is based upon management’s assessment of the assumptions that market participants would use in pricing the assets or liabilities.

As of September 30, 2015, the Funds hold no investments.

Cash and Cash Equivalents

Any date on which there is cash on deposit in a Fund’s custody account that is not required to make payments or to make distributions to shareholders all such cash will be either held as cash or invested by the investment advisor (the “Investment Advisor”) to the Fund, acting in accordance with Non-Custody Investment Advisory Agreement among the Trust, on behalf of the Funds, the Sponsor and the Investment Advisor (the “Investment Advisory Agreement”) in:

| · | cash bank deposits, |

| · | bills, notes and bonds issued and backed by the full faith and credit of the government of the United States of America, which qualify as Eligible Treasuries because they have residual maturities less than or equal to 90 calendar days, or |

| · | agreements for the sale and repurchase of, and collateralized by, bills, notes and bonds issued and backed by the full faith and credit of the government of the United States of America, which qualify as Eligible Repos. |

The Second Amended and Restated Trust Agreement of the Trust between the Sponsor and the trustee of the Trust (“Trustee”), as amended by an instrument of amendment dated June 5, 2015 and by an instrument of amendment dated September 29, 2015, and as may be further amended and restated from time to time (the “Trust Agreement”) limits, and the Investment Advisory Agreement directs the Investment Advisor to limit, the Funds’ holdings of Eligible Repos to 40% of its Eligible Assets.

22

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

Investments

The Funds will hold only cash, short-dated U.S. Treasuries or collateralized U.S. Treasury repurchases. The Funds will not invest in equity securities, futures, swaps, or other assets that may track their respective Underlying Indices.

Distributions

Unlike other exchange traded products, and for the protection of investors in the Funds, the Funds have an additional set of protective features built in to ensure that the shares track their intended Underlying Index.

These protective features include:

| · | Regular Distributions; |

| · | Special Distributions; and |

| · | Corrective Distributions. |

In addition, notice of Net Income Distributions for the classes of the Funds, if any, will also be included in the notifications of Regular, Special and Corrective Distributions.

Reverse share splits will be declared to maintain a positive Class Value per Share for either the Up Shares or the Down Shares should the Class Value per Share of either class approach zero. Reverse share splits are expected to occur in the context of Special Distributions and are expected to be triggered after Class Value per Share declines below $4.00. No other share splits are expected to occur, although the Sponsor will have the right to declare in its sole discretion a share split, either forward or reverse, pursuant to the Second Amended and Restated Trust Agreement of the Trust, as may be further amended and restated from time to time (the “Trust Agreement”).

Income Taxes

For U.S. federal and applicable state and local income tax purposes, the Trust intends to treat (i) each Fund as a separate taxable corporation, (ii) the shares of each Fund as stock therein and (iii) each investor in a Fund as a shareholder in such Fund. Accordingly, each taxable year each Fund will be subject to federal and applicable state and local income taxation at applicable corporate income tax rates on its net taxable income, if any.

23

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

3. Agreements

Management Fee

The classes of the Funds pay the Sponsor a management fee (the “Management Fee”) in consideration of the Sponsor’s management and administrative services and the other services provided to the Funds for which the Sponsor pays directly. The Management Fee is paid by the classes of the Funds, monthly in arrears, in an amount equal to the percentage of its average daily Class Value at the rates indicated in the following table, calculated on the basis of a 365-day year:

| Management Fee for Up Shares | Management Fee for Down Shares | |||||

| AccuShares Spot CBOE VIX Fund | 95 basis points | 95 basis points | ||||

| AccuShares S&P GSCI Spot Fund | 75 basis points | 75 basis points | ||||

| AccuShares S&P GSCI Agriculture and Livestock Spot Fund | 75 basis points | 75 basis points | ||||

| AccuShares S&P GSCI Industrial Metals Spot Fund | 75 basis points | 75 basis points | ||||

| AccuShares S&P GSCI Crude Oil Excess Return Fund** | 45 basis points | 45 basis points | ||||

| AccuShares S&P GSCI Brent Oil Spot Fund | 45 basis points | 45 basis points | ||||

| AccuShares S&P GSCI Natural Gas Spot Fund | 60 basis points | 60 basis points | ||||

| AccuShares S&P 500 VIX Front-Month Futures Index Fund | 95 basis points | 95 basis points | ||||

** On September 29, 2015, the name of the AccuShares S&P GSCI Crude Oil Fund was changed to the AccuShares S&P GSCI Crude Oil Excess Return Fund.

The Sponsor receives the Management Fee and otherwise bears all the routine ordinary expenses of the Funds, including the fees and reimbursable expenses of the Trustee, the Investment Advisor, the custodian, the administrator, the transfer agent, S&P Dow Jones Indices LLC (the “Index Provider”) and the marketing agent. The Funds bear all their tax liabilities, which are accrued daily, and their extraordinary, non-recurring expenses that are not assumed by the Sponsor under the Trust Agreement. Expenses, fees and taxes shall be accrued in advance for all non-business days at the end of the immediately preceding business day.

No other fee is paid by the Funds. The Management Fee is paid in consideration of the Sponsor’s management and administrative services and the other services provided to the Funds for which the Sponsor pays directly.

Under the Trust Agreement, the Sponsor has exclusive management and control of all aspects of the business of the Funds. Specifically, the Sponsor:

· Selects the Funds’ service providers;

· Negotiates various fees and agreements; and

· Performs such other services as the Sponsor believes that the Trust may require from time to time.

For the VIX Fund, for the three and nine months ended September 30, 2015, Management Fees charged amounted to $12,367 and $22,231, for the Up Shares, respectively and $11,915 and $21,769, for the Down Shares, respectively. As of September 30, 2015, $2,101 remained payable. For the VIX Fund, for the three and nine months ended September 30, 2014, there were no Management Fees charged.

24

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

Brokerage Commissions and Fees

Each Fund will pay its respective brokerage commissions, including applicable exchange fees, if any.

The Administrator, Transfer Agent and Custodian

The Sponsor and the Trust, on behalf of itself and on behalf of the Funds, have appointed State Street Bank and Trust Company as the administrator of the Funds and State Street Bank and Trust Company has entered into the administration agreement which sets forth the terms of the services provided by the administrator (the “Administration Agreement”) in connection therewith. In addition, State Street Bank and Trust Company serves as transfer agent and custodian of the Funds. The administrator’s fees are paid on behalf of the Funds by the Sponsor out of the Management Fee.

Pursuant to the terms of the Administration Agreement and under the supervision and direction of the Sponsor, the administrator performs or supervises the performance of services necessary for the operation and administration of the Funds (other than making investment decisions or providing services provided by other service providers), including accounting and other fund administrative services.

Routine Operational, Administrative and Other Ordinary Expenses

The Sponsor will pay all of the routine operational, administrative, and other ordinary expenses of the Funds, including, but not limited to, computer services expenses, the fees and expenses of the Trustee, the Investment Advisor, the custodian, the administrator, the transfer agent, the Index Provider, the marketing agent and any other service providers of the Funds, legal and accounting fees and expenses, filing fees, and printing, mailing and duplication costs.

Non-Recurring Fees and Expenses

All extraordinary, non-recurring expenses (referred to as extraordinary fees and expenses in the Trust Agreement), if any, will be borne by the affected Fund(s). Extraordinary fees and expenses affecting the Trust as a whole will be prorated to a Fund according to its respective aggregate Class Values. Extraordinary, non-recurring expenses include, without limitation, legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such fees and expenses, by their nature, are unpredictable with respect to timing and amount.

4. Offering Costs

Normal and expected expenses incurred in connection with the continuous offering of shares of the Funds will be paid by the Sponsor.

25

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

5. Creation and Redemption of Creation Units

A Fund will issue and redeem shares from time to time, but only in one or more blocks of both 25,000 Up Shares and 25,000 Down Shares of the Funds (“Creation Units”). Creation Units may be created or redeemed only by an entity that is (1) a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) a direct participant in The Depository Trust Company, and (3) a party to an Authorized Participant Agreement with the Sponsor, as sponsor of the Trust, on behalf of a Fund setting forth the procedures for the creation and redemption of Creation Units in the Funds (“Authorized Participant”). Authorized Participants may sell the shares included in the Creation Units they purchase from the Funds to other investors in the secondary market.

Except when aggregated in Creation Units, the shares are not redeemable securities. Retail investors, therefore, generally will not be able to purchase or redeem shares directly from or with a Fund. Rather, most retail investors will purchase or sell shares in the secondary market with the assistance of a broker.

Authorized Participants will pay a transaction fee of $600 per order plus 0.005% of the aggregate order value to the custodian in connection with the order for the creation or redemption of VIX Fund Creation Units. The transaction fee is intended to defray the transfer agent’s cost for processing the creation and redemption orders and the Sponsor’s Trust offering registration fee expense.

The transaction fee may be reduced, increased or otherwise changed by the Sponsor at its sole discretion.

6. Tax Information

As of September 30, 2015, the VIX Fund’s deferred tax asset was due to U.S. net operating losses (“NOL”). We believe it is more likely than not that the benefit from the NOL carryforwards will not be realized. In recognition of this risk, management has provided a full valuation allowance on the deferred tax asset. Management will continue to monitor deferred taxes and deferred tax allowances.

7. Distributions

On July 22, 2015, the AccuShares Spot CBOE VIX Down Class Shares (“Down Shares”) paid a cash distribution of $7.71 per each outstanding Down Share.

On August 24, 2015, the Down Shares paid a cash distribution of $2.21 per each outstanding Down Share.

On August 28, 2015, the AccuShares Spot VIX Up Class Shares (“Up Shares”) paid a cash distribution of $28.17 per each outstanding Up Share.

On September 22, 2015, the Down Shares paid a cash distribution of $0.80 per outstanding Down Share. Also on September 22, 2015 a Corrective Distribution was paid for both the Up Shares and Down Shares in which each outstanding Up Shares received one Down Share and each outstanding Down Share received one Up Share.

On September 25, 2015, a 1-for-10 Reverse Stock Split was effective for both the Up Shares and Down Shares. The effect of the transaction was to divide the number of outstanding shares of the Up Shares and Down Shares by 10, resulting in a corresponding increase in the net asset value per share. The share transactions presented in the statement of changes in net assets and the per share data in the financial highlights as of September 30, 2015 have been adjusted retroactively to reflect these reverse stock splits. There were no changes in nets assets, results of operations or total return as a result of these transactions.

26

AccuShares Spot CBOE VIX Fund

and AccuShares Trust I

Notes to the Financial Statements

September 30, 2015 (Unaudited)

8. Subsequent Events

Management has evaluated the possibility of subsequent events existing in the VIX Fund and Trust’s financial statement through the date the financial statements were issued.

On October 22, 2015, the Down Shares paid a cash distribution of $4.39 per outstanding Down Share. Also on October 22, 2015, a Corrective Distribution was paid for both the Up Shares and Down Shares in which each outstanding Up Shares received one Down Share and each outstanding Down Share received one Up Share.

On October 23, 2015, a 1-for-10 Reverse Stock Split was effective for both the Up Shares and Down Shares. The effect of the transaction was to divide the number of outstanding shares of the Up Shares and Down Shares by 4, resulting in a corresponding increase in the net asset value per share. The share transactions presented in the statement of changes in net assets and the per share data in the financial highlights as of September 30, 2015 have been adjusted retroactively to reflect these reverse stock splits. There were no changes in nets assets, results of operations or total return as a result of these transactions.

Management has determined that there are no other material events that would require disclosure in the VIX Fund and Trust’s financial statements through this date.

27

Item 2. Management’s discussion and analysis of financial condition and results of operations.

The following discussion and analysis should be read in conjunction with the financial statements and accompanying notes included in Item 1 of Part I of this Form 10-Q. The discussion and analysis that follows may contain forward-looking statements with respect to the financial conditions, operations, future performance and business of the AccuShares Spot CBOE VIX Fund (the “VIX Fund”) or AccuShares Trust I (formerly known as AccuShares Commodities Trust I) (the “Trust”). These statements can be identified by the use of the words “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or similar words and phrases. These statements are based upon certain assumptions and analyses AccuShares Investment Management, LLC, as sponsor of the Trust (the “Sponsor”) has made based on its perception of historical trends, current conditions and expected future developments. Neither the Trust nor the Sponsor is under a duty to update any of the forward-looking statements, to conform such statements to actual results or to reflect a change in management’s expectations or predictions.

Introduction

The VIX Fund, a series of the Trust, is the only operational series of the Trust. The VIX Fund commenced operations on May 19, 2015. Additionally, the Trust does not have assets, liabilities, income, expenses, capital or cash separate from that of its eight fund series. An investor in a series of the Trust has an entitlement to the assets of that series only and not to the assets of any other series or the Trust as a whole. Consequently this management’s discussion and analysis of financial condition and results of operations relates solely to the VIX Fund. The consolidating financial statements of the Trust included in this report are being provided solely to meet Securities and Exchange Commission regulatory requirements.

The VIX Fund continuously offers and redeems its shares only in blocks of 50,000 shares that are comprised of 25,000 shares of each of its two classes (“Creation Units”). Only an entity that is (1) a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) a direct participant in The Depository Trust Company, and (3) a party to an Authorized Participant Agreement with the Sponsor, as sponsor of the Trust, on behalf of the VIX Fund setting forth the procedures for the creation and redemption of Creation Units in the VIX Fund (“Authorized Participant”) may purchase and redeem Creation Units for cash. Once issued, and before any redemption, each class of the VIX Fund’s shares trade separately without restriction on the NASDAQ OMX (the “Exchange”).

Investment Objectives, Class Value and Class Value per Share

The VIX Fund is designed to track the changes in the CBOE Volatility Index (the “Underlying Index”) occurring from the prior distribution declaration date (each, a “Distribution Date”), or the date of inception of the VIX Fund’s operations in the case of the first Distribution Date of the VIX Fund (in either case, the “prior Distribution Date”), to the next Distribution Date (the “Measuring Period”). The VIX Fund issues its shares in offsetting pairs, where one constituent of the pair, or class, is positively linked to the VIX Fund’s Underlying Index (“Up Shares”) and the other constituent is negatively linked to the VIX Fund’s Underlying Index (“Down Shares”). At the inception of operations of the VIX Fund the Sponsor established the initial fixed linear relationship of each of the VIX Fund’s classes (each class’ “Share Index Factor”), which is positive in the case of the Up Shares and negative in the case of the Down Shares, of the liquidation value of the VIX Fund attributable to each of its classes (“Class Value”) to the VIX Fund’s Underlying Index. Each class’ Share Index Factor determines the class’ level of participation in the VIX Fund’s Underlying Index, and is reset following certain types of distributions as described below.

Following the inception of the VIX Fund’s operations, the custodian has daily allocated among the VIX Fund’s Up Shares and Down Shares their respective Class Values where the Class Value for each class of the VIX Fund is shared equally among the outstanding shares of such class. This daily allocation of Class Values results in the “Class Value per Share” for each Up Share and each Down Share of the VIX Fund. The Class Value of each class is daily allocated by the custodian based on changes in the level of the Underlying Index from the previous calculation date. In certain circumstances an additional daily amount of Class Value per Share is both subtracted from the Up Shares’ Class Value per Share and added to the Down Shares’ Class Value per Share (the “Daily Amount”). Consequently, the Class Value per Share of a class of the VIX Fund is such class’ allocation per share of the VIX Fund’s liquidation value reflecting changes in the VIX Fund’s Underlying Index in accordance with the linkage – positive or negative – such class has to the Underlying Index, and the Daily Amount.

For any single Measuring Period in which the VIX Fund’s Underlying Index rises or falls by more than 90%, Class Value per Share will be calculated based on a rise or fall, as applicable, of 90% and not the actual rise or fall of the Underlying Index (the “Class Value per Share Limitation”). Therefore the Class Value per Share of the VIX Fund’s Down Shares will not decline, and the Class Value per Share of its Up Shares will not increase, by more than 90% in a single Measuring Period when the VIX Fund’s Underlying Index is rapidly rising. Conversely, the Class Value per Share Limitation is designed to preclude the Class Value per Share of the VIX Fund’s

28

Up Shares from declining, and the Class Value per Share of its Down Shares from increasing, by more than 90% in a single Measuring Period when the VIX Fund’s Underlying Index is rapidly falling.

The VIX Fund seeks to track its Underlying Index’s changes without the need to hold any securities, futures or other financial instruments relating to its Underlying Index or the assets referenced by the Underlying Index. Instead, the VIX Fund is expressly limited to holding only: cash; bills, bonds and notes issued and guaranteed by the United States Treasury with remaining maturities of 90 calendar days or less (“Eligible Treasuries”); and over-night repurchase agreements collateralized by United States Treasury securities (“Eligible Repos,” together with cash and Eligible Treasuries, “Eligible Assets”). Consequently the Class Value of each class is based on the value of the VIX Fund’s Eligible Assets attributable to such class, plus any accrued income or gains or losses on such assets attributable to such class (“Investment Income”), less all fees, expenses and taxes attributable to such class not otherwise assumed by the Sponsor, where such income and gains after deduction of such fees, expenses and taxes is referred to as the class’ “Net Investment Income.” Each class’ Net Investment Income and Investment Income can be positive or negative.

Up Shares of the VIX Fund seek to provide investment results, before adjustment for the class’ Net Investment Income and the Daily Amount, which results correspond to the performance of the Underlying Index over a Measuring Period, whether favorable or adverse (subject to the Class Value per Share Limitation). Down Shares of the VIX Fund seek to provide investment results, before adjustment for the class’ Net Investment Income and the Daily Amount, which results correspond to the inverse of the performance (negative one times) of its Underlying Index over a Measuring Period, whether favorable or adverse (subject to the Class Value per Share Limitation).

Distributions

The VIX Fund is expected to engage in four types of distributions. The first type of distribution occurs at regular monthly intervals for the VIX Fund (“Regular Distribution”). Regular Distributions will generally occur as long as there has been a change in the level of the Underlying Index and the Daily Amount as of the Distribution Date since the prior Distribution Date. Secondly, the VIX Fund expects to declare cash distributions on each Distribution Date to the shareholders of any class of the VIX Fund whose class Net Investment Income is positive as of such Distribution Date.

The other two types of distributions are not expected to regularly occur and are mechanisms intended to protect the interests of investors by providing them with the expected value of their shares upon specified events. Thus, the third type of distribution (“Special Distribution”) occurs when the level or value of the VIX Fund’s Underlying Index, as measured at the close, changes by more than 75% since the prior Distribution Date but before the next Regular Distribution Date. The fourth type of distribution (“Corrective Distribution”) occurs only if the trading price of the shares of the VIX Fund on the Exchange deviate from their Class Value per Share by ten percent or more over three consecutive business days. The VIX Fund began measuring for Corrective Distributions effective July 16, 2015.

Following each Regular Distribution or Special Distribution, the Share Index Factors will be reset. This resetting of the Share Index Factors causes Class Values per Share to be equal following each such distribution, where the Class Values per Share will be equal to the lowest Class Value per Share of either class calculated in determining the distribution.

Arbitrage

Similar to other exchange traded products, the VIX Fund relies primarily between Distribution Dates on the share creation and redemption process to reduce any premium or discount that may occur in the VIX Fund’s share trading prices on the Exchange relative to that share’s Class Value per Share. The creation/redemption process is important for the VIX Fund in providing Authorized Participants with an arbitrage mechanism through which they may keep share trading prices in line with the VIX Fund’s Class Values per Share.

As the VIX Fund’s shares trade intraday on the Exchange, their market prices will fluctuate due to simple supply and demand. The following scenarios describe the conditions surrounding a creation/redemption:

| · | If the market price of a share of the VIX Fund exceeds its Class Value per Share, an Authorized Participant can purchase shares through a cash payment as part of a Creation Unit from the VIX Fund, and then sell the new shares on the market at a profit, taking into account the value of both classes of shares. This process of increasing the supply of shares is expected to bring the trading price of a share back to its Class Value per Share. |

29

| · | If the Class Value per Share exceeds the market price of a share of the VIX Fund, an Authorized Participant can purchase shares on the market in an amount equal to a Creation Unit and redeem them for cash at their Class Values per Share at a profit, taking into account the value of both classes of shares. This process of increasing the demand for shares on the Exchange through decreasing supply is expected to raise the trading price of a share to meet its Class Value per Share. |

These processes are referred to as the arbitrage mechanism. The arbitrage mechanism helps to minimize the difference between the trading price of a share of the VIX Fund and its Class Value per Share.

The Underlying Index

The Underlying Index is a key measure of market expectations of near-term volatility conveyed by the S&P 500 total return stock index (the “S&P 500 Index”) option prices. Since its introduction in 1993, the Underlying Index has been considered by many to be the world’s premier barometer of investor sentiment and market volatility. The Underlying Index is an up-to-the-minute market estimate of expected volatility that is calculated by using real-time S&P 500 Index option (ticker: “SPX”) bid/ask quotes. The Underlying Index uses near-term and next-term SPX options with more than 23 days and less than 37 days to expiration, and then weights them to yield a constant, 30-day measure of the expected volatility of the S&P 500 Index. These include SPX options with “standard” third Friday expiration dates and “weekly” SPX options that expire every Friday, except the third Friday of each month. Using SPX options with more than 23 days and less than 37 days to expiration ensures that the VIX Index will always reflect an interpolation of two points along the S&P 500 Index volatility term structure.

Daily Underlying Index and Class Value per Share Reporting

The Chicago Board Options Exchange, Incorporated makes the official calculations of the value of the Underlying Index. At present, these calculations are performed continuously and are reported under the Reuters symbol “.VIX.” These calculations are updated during business hours on each day on which the Underlying Index is calculated. S&P Dow Jones Indices LLC (the “Index Provider”) has undertaken to include the value of the Underlying Index on its data feed that is disseminated to one or more financial data distribution platforms, such as those services offered by Thomson Reuters, and/or publish the Underlying Index values on its own website, on a continuous basis during regular trading hours for the VIX Fund’s shares for so long as any VIX Fund shares remain listed for trading.

The Class Value per Share of the Up Shares and the Down Shares is posted on each business day on the VIX Fund’s website at www.AccuShares.com. Additionally, an indicator of the value of the Class Value per Share of the Up Shares and the Down Shares (the “IOPVs”) is calculated and disseminated every 15 seconds throughout the business day. The Index Provider has undertaken to provide the IOPVs to certain third party vendors and to use commercially reasonable efforts to ensure that the IOPVs are further disseminated to and published on Thomson Reuters.

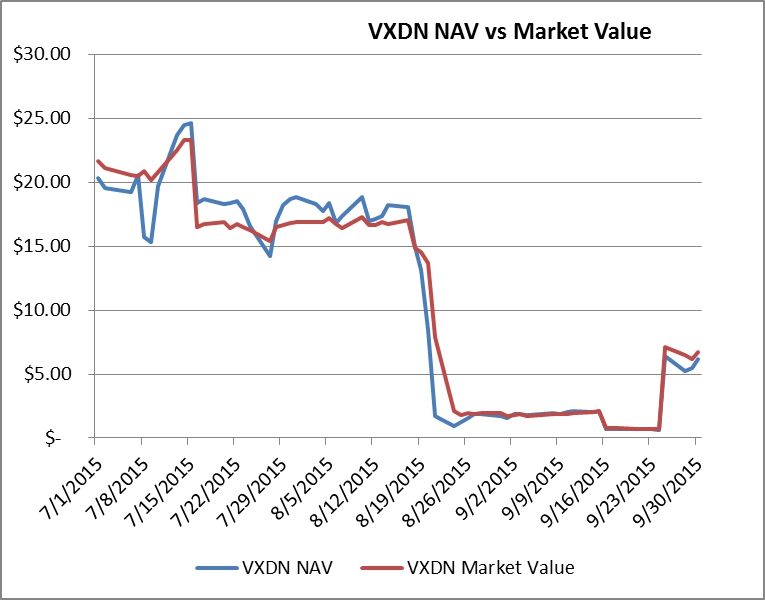

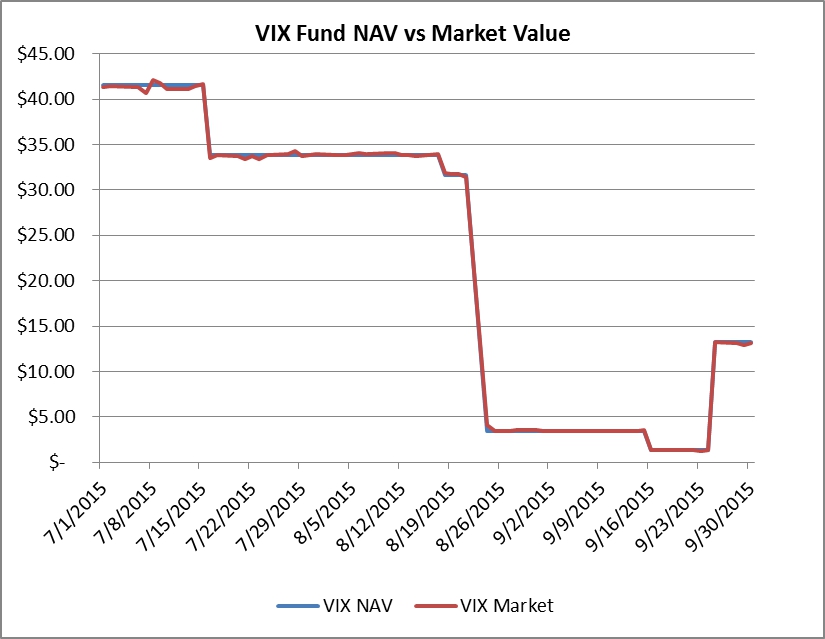

Underlying Index Tracking

The charts provided below show the daily Class Values per Share of the Up Shares and the Down Shares as compared to their respective daily closing trading prices on the Exchange for the three months ended September 30, 2015. The Up Shares and the Down Shares each experienced deviations between their respective closing trading prices during the reporting period.

30

31

Results of Operations for the Three and Nine Months Ended September 30, 2015

The VIX Fund commenced operations on May 19, 2015. The Sponsor, acting as initial purchaser of the VIX Fund, purchased 100,000 Up Shares and 100,000 Down Shares upon commencement of the VIX Fund’s operations for $25 per share.

For the three months ended September 30, 2015, the VIX Fund had issued 650,000 Up Shares and 650,000 Down Shares with aggregate Class Value of $1,556,500. For the nine months ended September 30, 2015 the VIX Fund had issued 1,075,000 Up Shares and 1,0750,000 Down Shares with an aggregate Class Value of approximately $23,280,000.