Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PERICOM SEMICONDUCTOR CORP | d55787d8k.htm |

| EX-99.2 - EX-99.2 - PERICOM SEMICONDUCTOR CORP | d55787dex992.htm |

Investor Presentation – Follow-up Presentation November 2015 Pericom Semiconductor Enabling High-Speed Serial Connectivity Exhibit 99.1 Copyright Pericom Semiconductor Corp 2015

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including, but not limited to, the ability of the parties to consummate the proposed transaction; satisfaction of closing conditions to the consummation of the proposed transaction; the impact of the announcement of the proposed transaction on Pericom’s relationships with its employees, existing customers or potential future customers; and such other risks and uncertainties pertaining to Pericom’s business as detailed in its filings with the SEC on Forms 10-K and 10-Q, which are available on the SEC’s website at www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. Pericom assumes no obligation to update any forward-looking statement contained in this document. Forward Looking Statements Copyright Pericom Semiconductor Corp 2015

Pericom has filed a definitive proxy statement and relevant documents in connection with the special meeting of the shareholders of Pericom at which the Pericom shareholders will consider certain proposals regarding the potential acquisition of Pericom by Diodes Incorporated (the “Special Meeting Proposals”). Pericom and its directors and executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from Pericom’s shareholders in connection with the Special Meeting Proposals. SHAREHOLDERS OF PERICOM ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. The definitive proxy statement and other relevant documents filed with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders will be able to obtain free copies of the definitive proxy statement from Pericom by contacting Pericom’s Investor Relations by telephone at (408) 232-9100, or by mail Pericom Semiconductor Corporation, 1545 Barber Lane, Milpitas, California 95035 or by going to Pericom’s Investor Relations page on its corporate website at www.pericom.com. Additional Information and Where to Find It Copyright Pericom Semiconductor Corp 2015

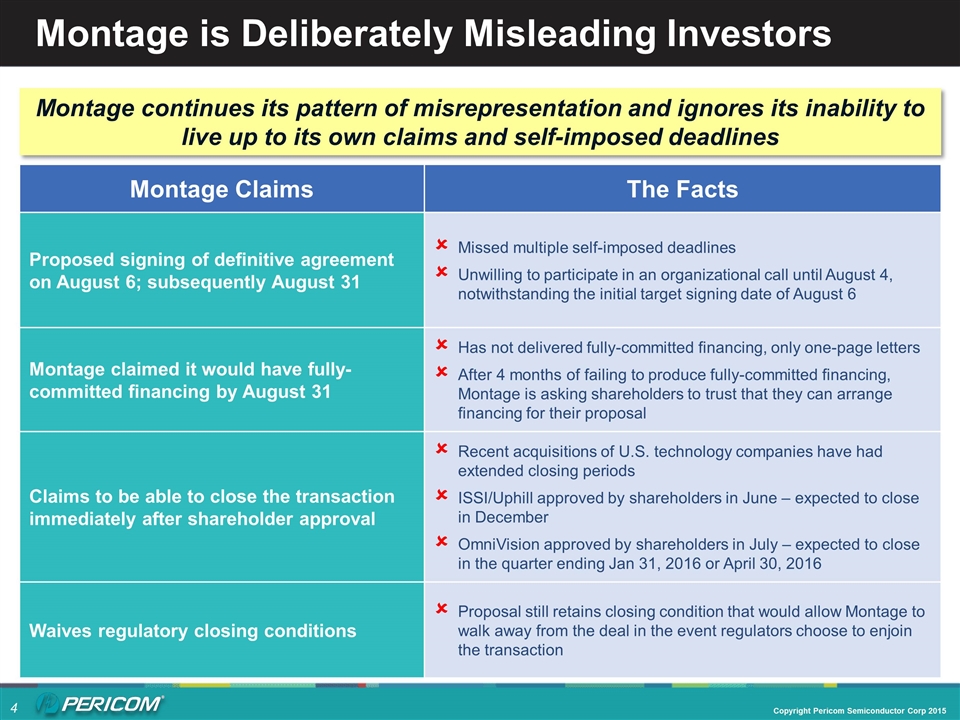

Montage is Deliberately Misleading Investors Montage continues its pattern of misrepresentation and ignores its inability to live up to its own claims and self-imposed deadlines Montage Claims The Facts Proposed signing of definitive agreement on August 6; subsequently August 31 Missed multiple self-imposed deadlines Unwilling to participate in an organizational call until August 4, notwithstanding the initial target signing date of August 6 Montage claimed it would have fully-committed financing by August 31 Has not delivered fully-committed financing, only one-page letters After 4 months of failing to produce fully-committed financing, Montage is asking shareholders to trust that they can arrange financing for their proposal Claims to be able to close the transaction immediately after shareholder approval Recent acquisitions of U.S. technology companies have had extended closing periods ISSI/Uphill approved by shareholders in June – expected to close in December OmniVision approved by shareholders in July – expected to close in the quarter ending Jan 31, 2016 or April 30, 2016 Waives regulatory closing conditions Proposal still retains closing condition that would allow Montage to walk away from the deal in the event regulators choose to enjoin the transaction Copyright Pericom Semiconductor Corp 2015

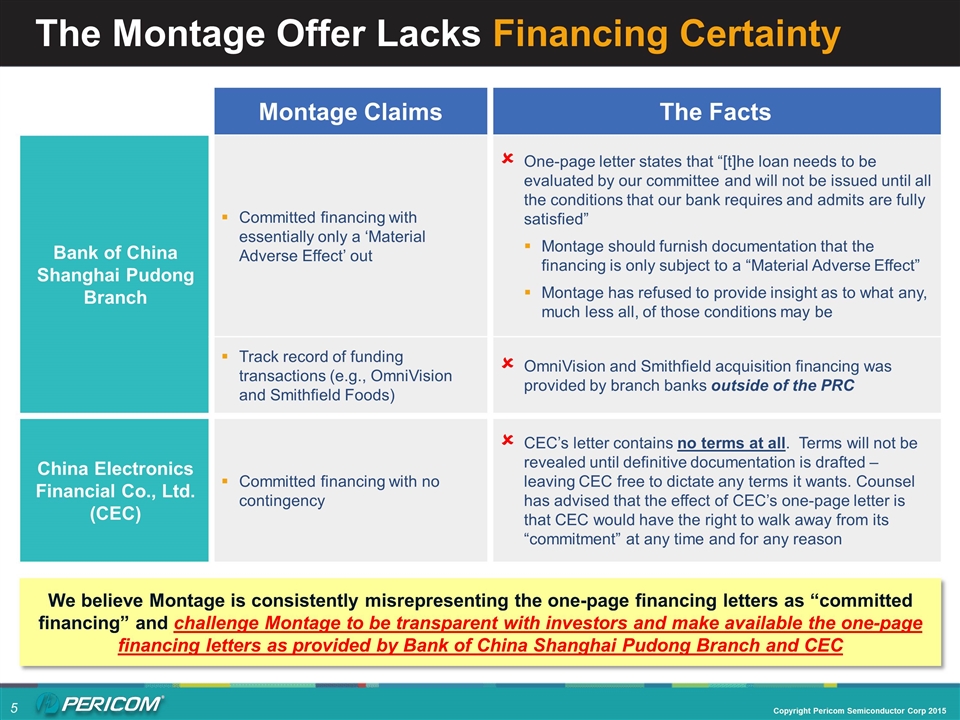

The Montage Offer Lacks Financing Certainty Montage Claims The Facts Bank of China Shanghai Pudong Branch Committed financing with essentially only a ‘Material Adverse Effect’ out One-page letter states that “[t]he loan needs to be evaluated by our committee and will not be issued until all the conditions that our bank requires and admits are fully satisfied” Montage should furnish documentation that the financing is only subject to a “Material Adverse Effect” Montage has refused to provide insight as to what any, much less all, of those conditions may be Track record of funding transactions (e.g., OmniVision and Smithfield Foods) OmniVision and Smithfield acquisition financing was provided by branch banks outside of the PRC China Electronics Financial Co., Ltd. (CEC) Committed financing with no contingency CEC’s letter contains no terms at all. Terms will not be revealed until definitive documentation is drafted – leaving CEC free to dictate any terms it wants. Counsel has advised that the effect of CEC’s one-page letter is that CEC would have the right to walk away from its “commitment” at any time and for any reason We believe Montage is consistently misrepresenting the one-page financing letters as “committed financing” and challenge Montage to be transparent with investors and make available the one-page financing letters as provided by Bank of China Shanghai Pudong Branch and CEC Copyright Pericom Semiconductor Corp 2015

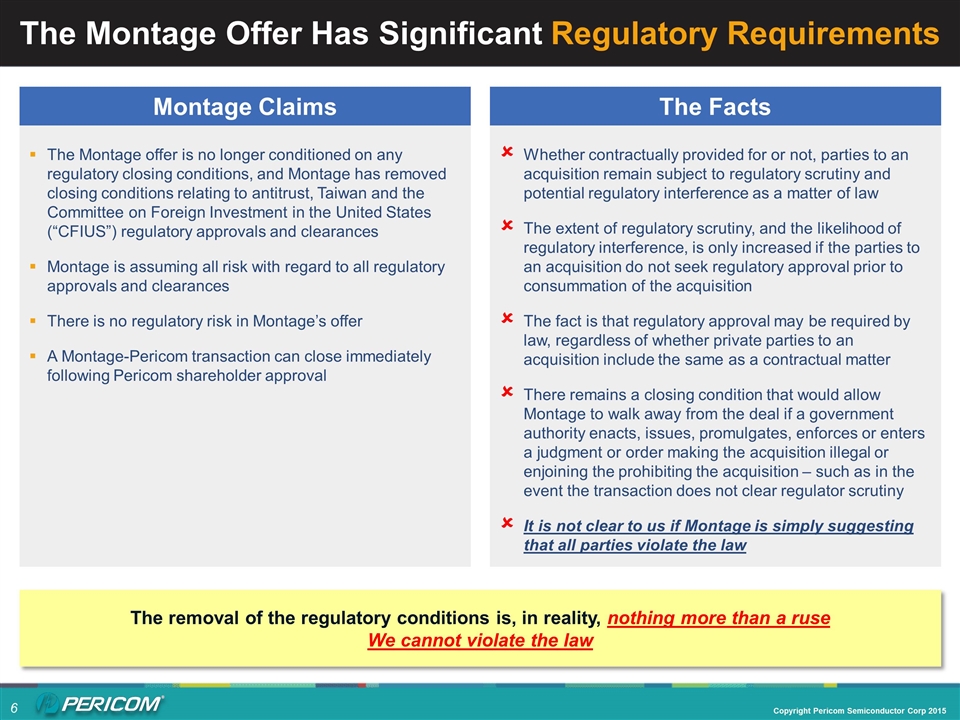

The Montage offer is no longer conditioned on any regulatory closing conditions, and Montage has removed closing conditions relating to antitrust, Taiwan and the Committee on Foreign Investment in the United States (“CFIUS”) regulatory approvals and clearances Montage is assuming all risk with regard to all regulatory approvals and clearances There is no regulatory risk in Montage’s offer A Montage-Pericom transaction can close immediately following Pericom shareholder approval Montage Claims Whether contractually provided for or not, parties to an acquisition remain subject to regulatory scrutiny and potential regulatory interference as a matter of law The extent of regulatory scrutiny, and the likelihood of regulatory interference, is only increased if the parties to an acquisition do not seek regulatory approval prior to consummation of the acquisition The fact is that regulatory approval may be required by law, regardless of whether private parties to an acquisition include the same as a contractual matter There remains a closing condition that would allow Montage to walk away from the deal if a government authority enacts, issues, promulgates, enforces or enters a judgment or order making the acquisition illegal or enjoining the prohibiting the acquisition – such as in the event the transaction does not clear regulator scrutiny It is not clear to us if Montage is simply suggesting that all parties violate the law The Facts The removal of the regulatory conditions is, in reality, nothing more than a ruse We cannot violate the law The Montage Offer Has Significant Regulatory Requirements Copyright Pericom Semiconductor Corp 2015

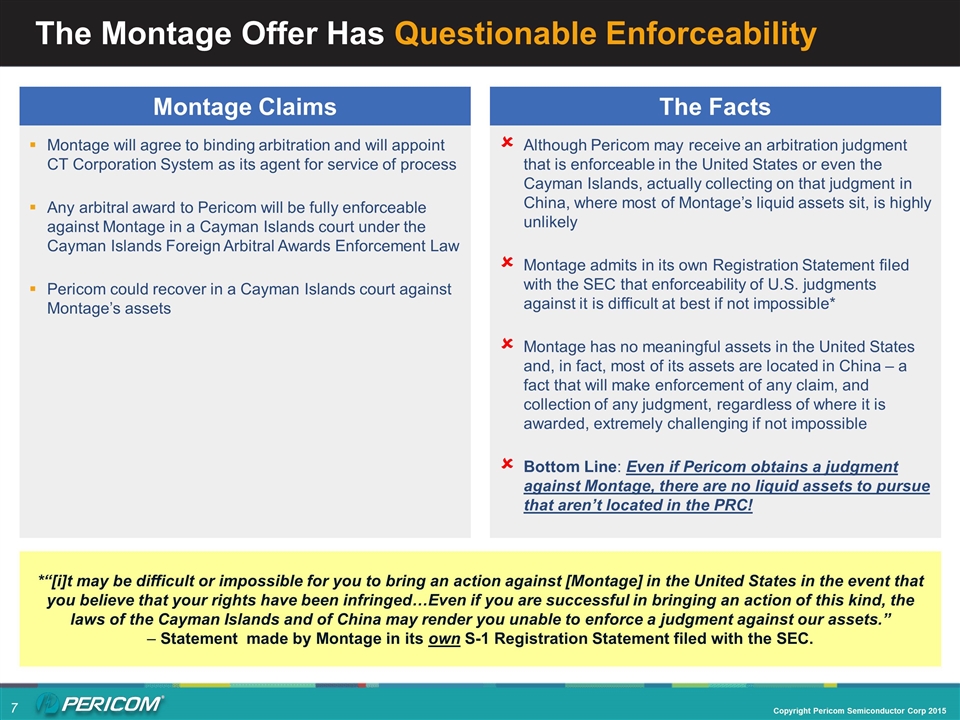

Montage will agree to binding arbitration and will appoint CT Corporation System as its agent for service of process Any arbitral award to Pericom will be fully enforceable against Montage in a Cayman Islands court under the Cayman Islands Foreign Arbitral Awards Enforcement Law Pericom could recover in a Cayman Islands court against Montage’s assets Although Pericom may receive an arbitration judgment that is enforceable in the United States or even the Cayman Islands, actually collecting on that judgment in China, where most of Montage’s liquid assets sit, is highly unlikely Montage admits in its own Registration Statement filed with the SEC that enforceability of U.S. judgments against it is difficult at best if not impossible* Montage has no meaningful assets in the United States and, in fact, most of its assets are located in China – a fact that will make enforcement of any claim, and collection of any judgment, regardless of where it is awarded, extremely challenging if not impossible Bottom Line: Even if Pericom obtains a judgment against Montage, there are no liquid assets to pursue that aren’t located in the PRC! The Montage Offer Has Questionable Enforceability Montage Claims The Facts *“[i]t may be difficult or impossible for you to bring an action against [Montage] in the United States in the event that you believe that your rights have been infringed…Even if you are successful in bringing an action of this kind, the laws of the Cayman Islands and of China may render you unable to enforce a judgment against our assets.” – Statement made by Montage in its own S-1 Registration Statement filed with the SEC. Copyright Pericom Semiconductor Corp 2015