Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Apollo Residential Mortgage, Inc. | d33117dex991.htm |

| 8-K - FORM 8-K - Apollo Residential Mortgage, Inc. | d33117d8k.htm |

Information is as of September 30, 2015, except as otherwise noted. It should not be assumed that investments made in the future will be profitable or will equal the performance of investments in this document. Supplemental Financial Information Package – Q3 2015 November 6, 2015 Exhibit 99.2

Forward Looking Statements and Other Disclosures Certain statements contained in this presentation may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and Apollo Residential Mortgage, Inc. (“AMTG” or the “Company”) claims the protections of the safe harbor for forward looking statements contained in such sections. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond management’s control. These forward-looking statements include information about possible or assumed future results of Apollo Residential Mortgage, Inc.’s the Company’s business, financial condition, liquidity, results of operations, plans and objectives. When used in this presentation, the words “believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may”, or similar expressions are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in the Company’s industry, interest rates, real estate values, the debt securities markets, the U.S. housing market or the general economy or the demand for residential mortgage loans; the Company’s business and investment strategy; the Company’s operating results and potential asset performance; availability of opportunities to acquire Agency RMBS, non-Agency RMBS, residential mortgage loans and other residential mortgage assets or other real estate related assets; changes in the prepayment rates on the mortgage loans securing the Company’s RMBS; management’s assumptions regarding default rates on the mortgage loans securing the Company’s non-Agency RMBS; the Company’s ability to borrow to finance its assets and the terms, including the cost, maturity and other terms, of any such borrowing; the Company’s estimates regarding taxable income, the actual amount of which is dependent on a number of factors, including, but not limited to, changes in the amount of interest income and financing costs, the method elected by the Company to accrete the market discount on non-Agency RMBS, realized losses and changes in the composition of the Company’s Agency RMBS and non-Agency RMBS portfolios that may occur during the applicable tax period, including gain or loss on any RMBS disposals; expected leverage; general volatility of the securities markets in which the Company participates; the Company’s expected portfolio and scope of the Company’s target assets; the Company’s expected investment and underwriting process; interest rate mismatches between the Company’s target assets and any borrowings used to fund such assets; changes in interest rates and the market value of the Company’s target assets; rates of default or decreased recovery rates on the Company’s assets; the degree to which the Company’s hedging strategies may or may not protect the Company from interest rate volatility and the effects of hedging instruments on the Company’s assets; the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters affecting the Company’s business; the timing and amount of distributions to stockholders, which are declared and paid at the discretion of the Company’s board of directors and will depend on, among other things, the Company’s taxable income, the Company’s financial results and overall financial condition and liquidity; maintenance of the Company’s qualification as a real estate investment trust for U.S. Federal income tax purposes and such other factors as the Company’s board of directors deems relevant; the Company’s ability to maintain its exclusion from registration as an investment company under the Investment Company Act of 1940, as amended; availability of qualified personnel through ARM Manager, LLC; and the Company’s understanding of its competition. The forward-looking statements are based on management’s beliefs, assumptions and expectations of AMTG’s future performance, taking into account all information currently available to management. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to AMTG. Some of these factors are described in the Company's Annual Report on Form 10-K for the year ended December 31, 2014 and the Company’s other filings with the Securities and Exchange Commission (“SEC”). These and other risks, uncertainties and factors, including those described in the Company’s annual, quarterly and current reports filed with the SEC, could cause the Company’s actual results to differ materially from those included in any forward-looking statements the Company makes. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible for management to predict those events or how they may affect AMTG. Except as required by law, AMTG is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation contains information regarding the Company’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Operating Earnings and Operating Earnings per share. Please refer to page 3 for a definition of “Operating Earnings” and the reconciliation of “Operating Earnings” to the applicable GAAP financial measure set forth on pages 17 and 18. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. AMTG makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness or completeness of such information. Past performance is not indicative nor a guarantee of future returns. Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors (such as number and types of securities). Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special investment techniques such as leveraging or short selling. No such index is indicative of the future results of any investment by AMTG.

November 6, 2015 Michael A. Commaroto Chief Executive Officer Teresa D. Covello Chief Financial Officer Keith Rosenbloom Agency Portfolio Manager Paul Mangione Non-Agency Portfolio Manager Hilary Ginsberg Investor Relations Manager AMTG Q3 2015 Earnings Call

Third Quarter 2015 Summary Highlights Reported Operating Earnings of $17.4 million, or $0.54 per share of common stock for the third quarter of 2015(1) Declared a $0.48 per share of common stock quarterly dividend for stockholders of record as of September 30, 2015 Book value per share of common stock of $17.08 at September 30, 2015 Repurchased 360,800 shares of common stock at a weighted average per share price of $13.86 Residential Mortgage Backed Securities (“RMBS”) portfolio totaled $3.3 billion at September 30, 2015 RMBS, securitized mortgage loan portfolio and other credit investments had a 2.58% effective net interest spread at September 30, 2015(2) Had $12.4 million of advances outstanding on a warehouse line receivable, held $25.0 million of legal title to real estate subject to bond-for-title contracts (“BFT Contracts”) and $7.4 million of mortgage loans under Seller Financing Program(3) at September 30, 2015 Increased net position in Agency risk sharing securities, small-balance commercial mortgage backed securities (“SBC-MBS”) and Small Business Administration interest-only securities by $9.0 million, $1.0 million and $3.0 million, respectively (1) Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see pages 17 & 18 for a reconciliation of Operating Earnings and Operating Earnings per share of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share of common stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock. (2) Effective net interest spread is a non-GAAP financial measure, which include the cost of the Company’s Swaps as a component of its interest expense. Please see page 7. (3) The “Seller Financing Program” refers to the initiative whereby the Company provides funding through a warehouse line to a third-party to finance the acquisition and improvement of single-family homes. Once the homes are improved, they are marketed for sale, with the seller providing financing to the buyer in the form of a mortgage loan or a BFT Contract. The mortgage loans and BFT Contracts may be purchased by the Company or by an unrelated third party from the counterparty, at which time the associated balance on the warehouse line is repaid.

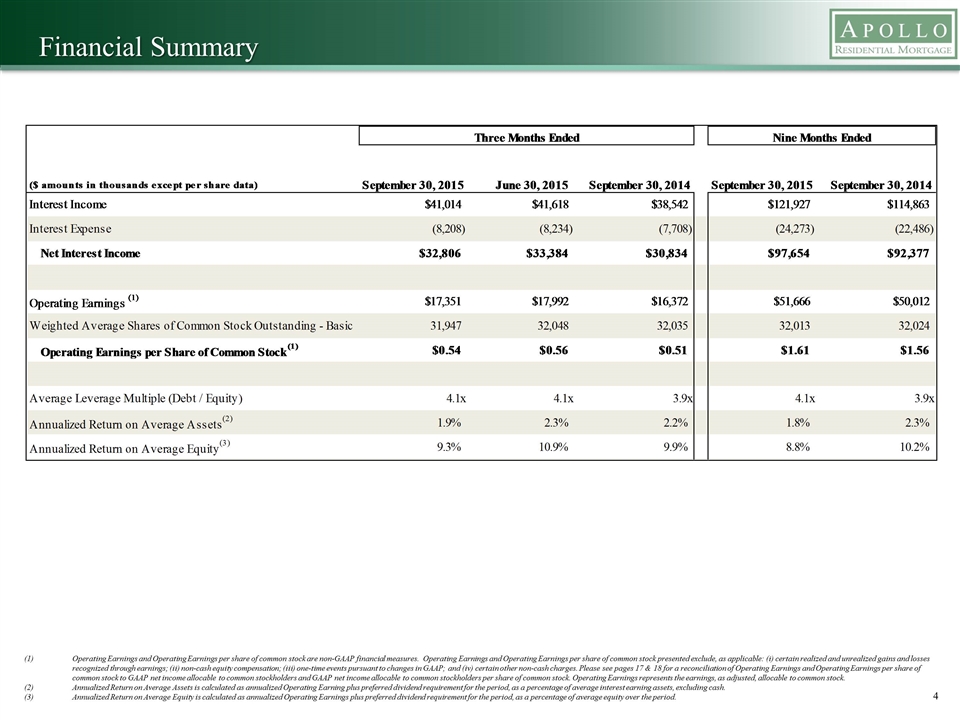

Financial Summary Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see pages 17 & 18 for a reconciliation of Operating Earnings and Operating Earnings per share of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share of common stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock. Annualized Return on Average Assets is calculated as annualized Operating Earning plus preferred dividend requirement for the period, as a percentage of average interest earning assets, excluding cash. Annualized Return on Average Equity is calculated as annualized Operating Earnings plus preferred dividend requirement for the period, as a percentage of average equity over the period.

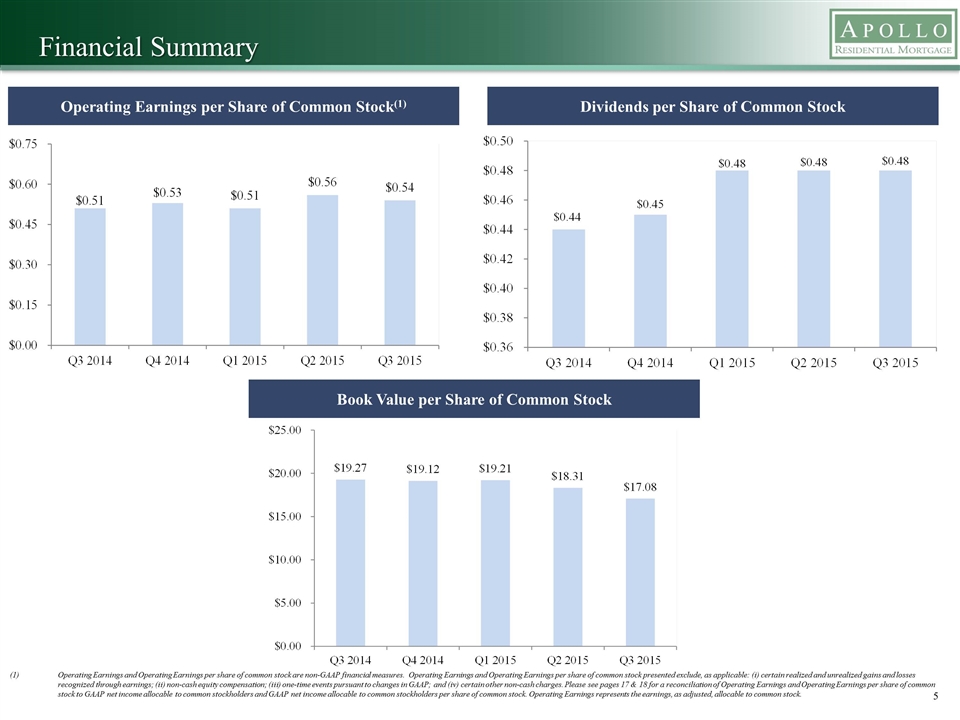

Financial Summary Operating Earnings per Share of Common Stock(1) Dividends per Share of Common Stock Book Value per Share of Common Stock Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see pages 17 & 18 for a reconciliation of Operating Earnings and Operating Earnings per share of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share of common stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock.

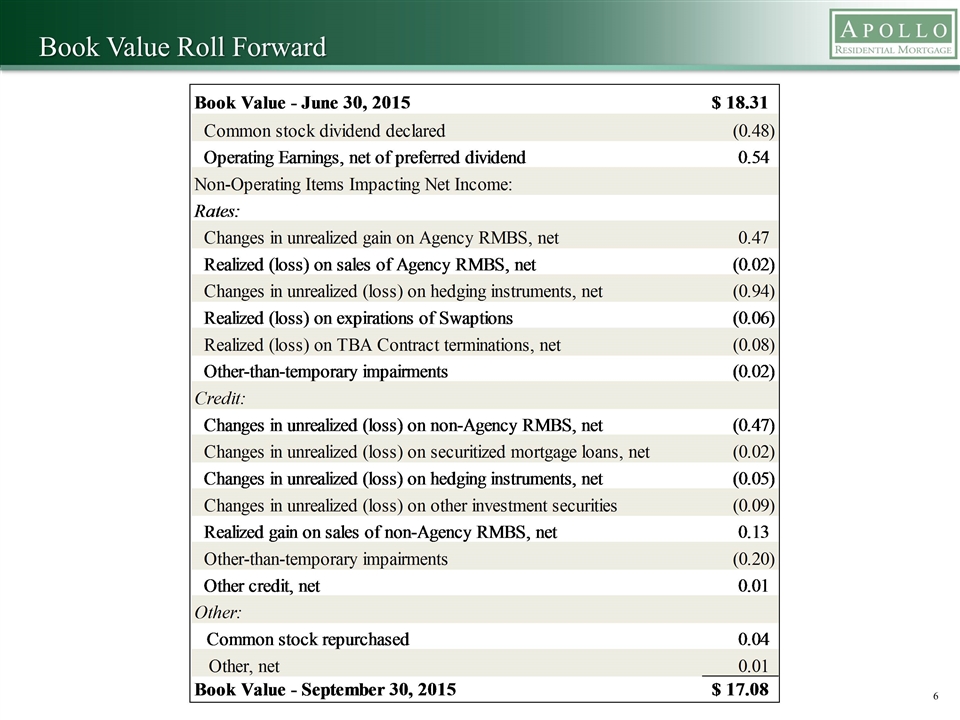

Book Value Roll Forward

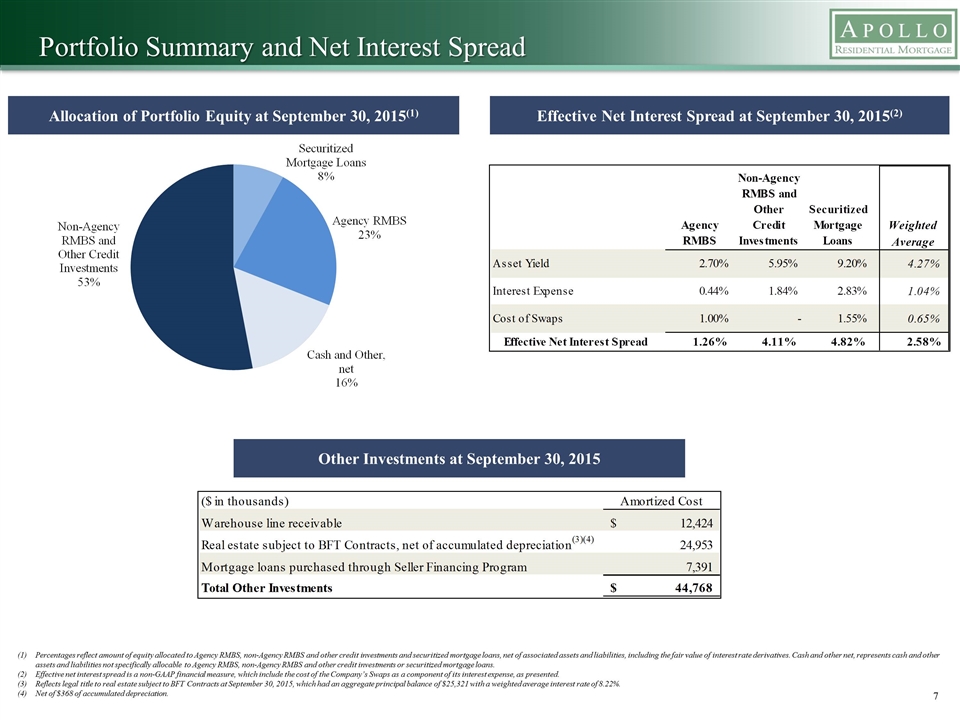

Portfolio Summary and Net Interest Spread Allocation of Portfolio Equity at September 30, 2015(1) Effective Net Interest Spread at September 30, 2015(2) Percentages reflect amount of equity allocated to Agency RMBS, non-Agency RMBS and other credit investments and securitized mortgage loans, net of associated assets and liabilities, including the fair value of interest rate derivatives. Cash and other net, represents cash and other assets and liabilities not specifically allocable to Agency RMBS, non-Agency RMBS and other credit investments or securitized mortgage loans. Effective net interest spread is a non-GAAP financial measure, which include the cost of the Company’s Swaps as a component of its interest expense, as presented. Reflects legal title to real estate subject to BFT Contracts at September 30, 2015, which had an aggregate principal balance of $25,321 with a weighted average interest rate of 8.22%. Net of $368 of accumulated depreciation. Other Investments at September 30, 2015

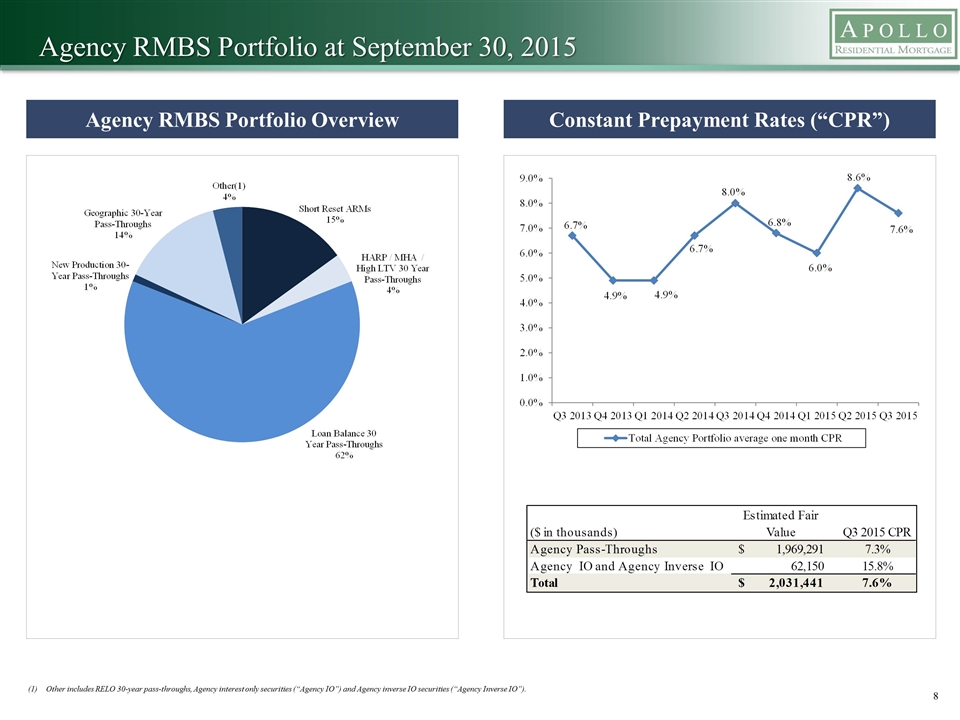

Agency RMBS Portfolio at September 30, 2015 Agency RMBS Portfolio Overview Constant Prepayment Rates (“CPR”) Other includes RELO 30-year pass-throughs, Agency interest only securities (“Agency IO”) and Agency inverse IO securities (“Agency Inverse IO”).

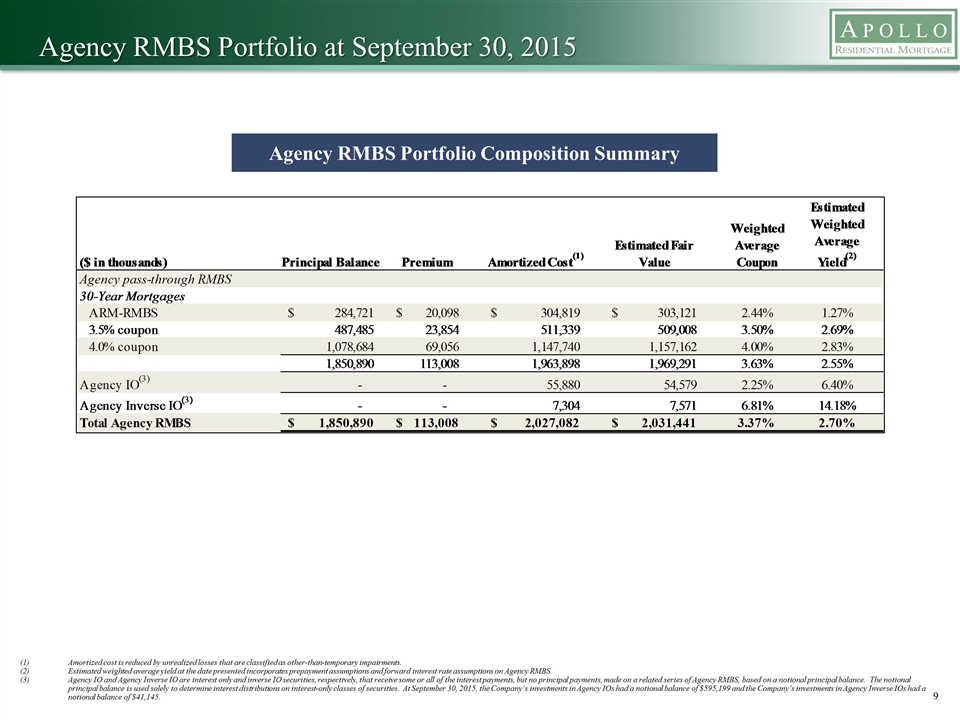

Agency RMBS Portfolio at September 30, 2015 Agency RMBS Portfolio Composition Summary Amortized cost is reduced by unrealized losses that are classified as other-than-temporary impairments. Estimated weighted average yield at the date presented incorporates prepayment assumptions and forward interest rate assumptions on Agency RMBS. Agency IO and Agency Inverse IO are interest only and inverse IO securities, respectively, that receive some or all of the interest payments, but no principal payments, made on a related series of Agency RMBS, based on a notional principal balance. The notional principal balance is used solely to determine interest distributions on interest-only classes of securities. At September 30, 2015, the Company’s investments in Agency IOs had a notional balance of $595,199 and the Company’s investments in Agency Inverse IOs had a notional balance of $41,145.

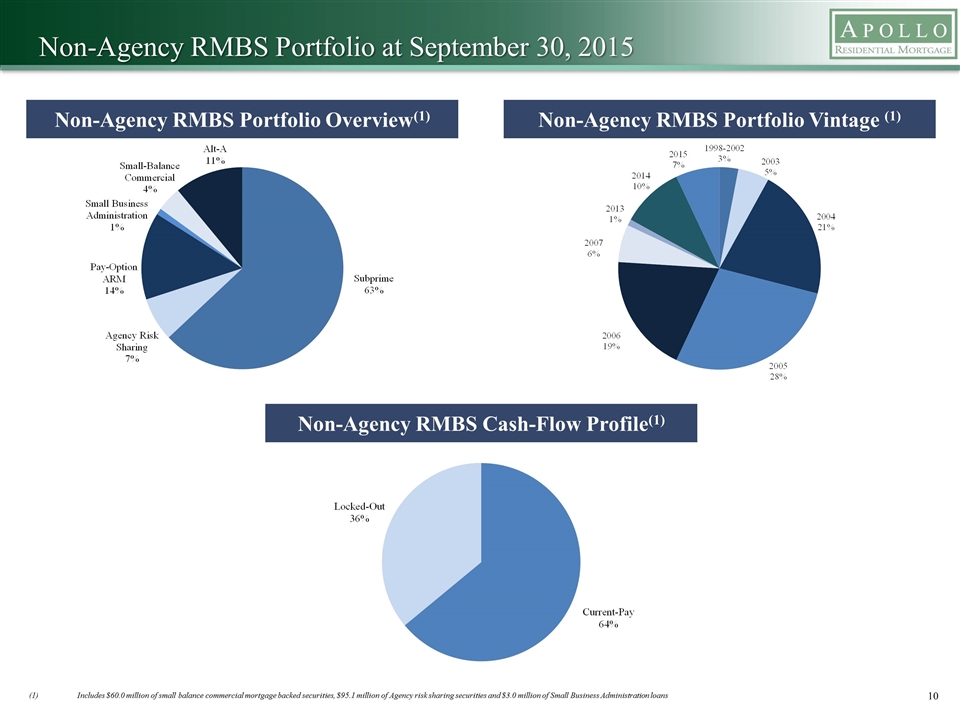

Non-Agency RMBS Portfolio at September 30, 2015 Non-Agency RMBS Portfolio Overview(1) Non-Agency RMBS Portfolio Vintage (1) Non-Agency RMBS Cash-Flow Profile(1) Includes $60.0 million of small balance commercial mortgage backed securities, $95.1 million of Agency risk sharing securities and $3.0 million of Small Business Administration loans

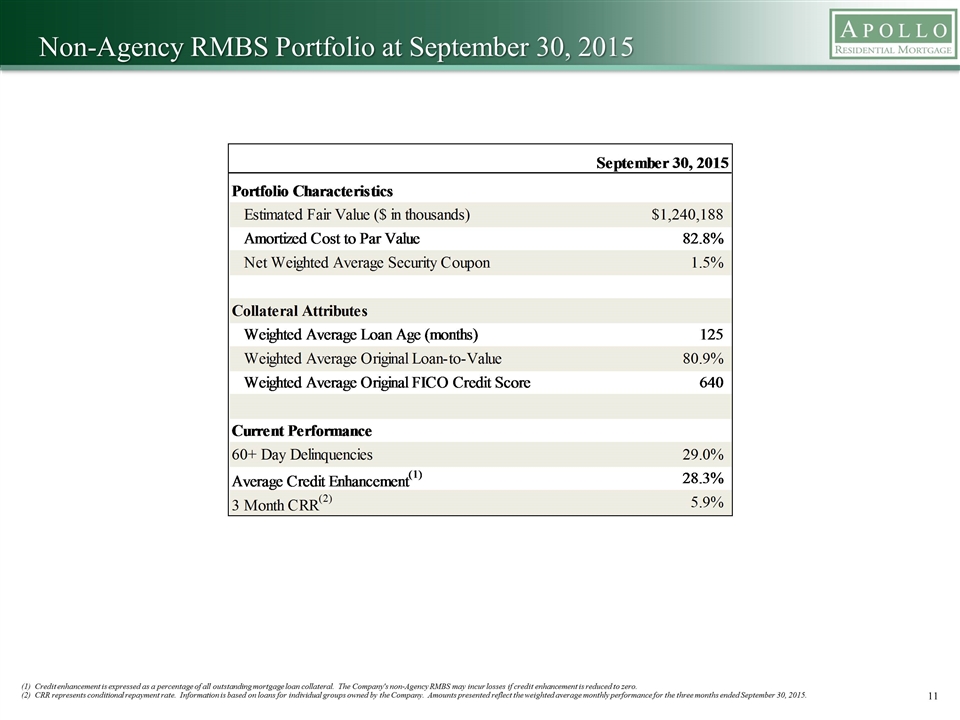

Non-Agency RMBS Portfolio at September 30, 2015 (1) Credit enhancement is expressed as a percentage of all outstanding mortgage loan collateral. The Company's non-Agency RMBS may incur losses if credit enhancement is reduced to zero. (2) CRR represents conditional repayment rate. Information is based on loans for individual groups owned by the Company. Amounts presented reflect the weighted average monthly performance for the three months ended September 30, 2015.

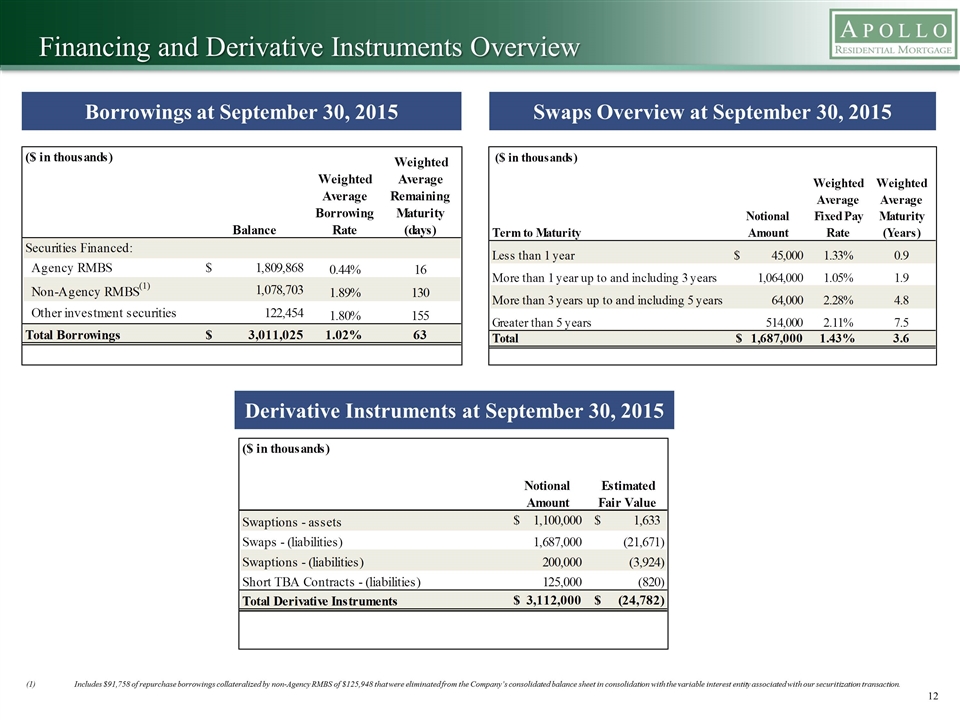

Financing and Derivative Instruments Overview Borrowings at September 30, 2015 Derivative Instruments at September 30, 2015 Swaps Overview at September 30, 2015 Includes $91,758 of repurchase borrowings collateralized by non-Agency RMBS of $125,948 that were eliminated from the Company’s consolidated balance sheet in consolidation with the variable interest entity associated with our securitization transaction.

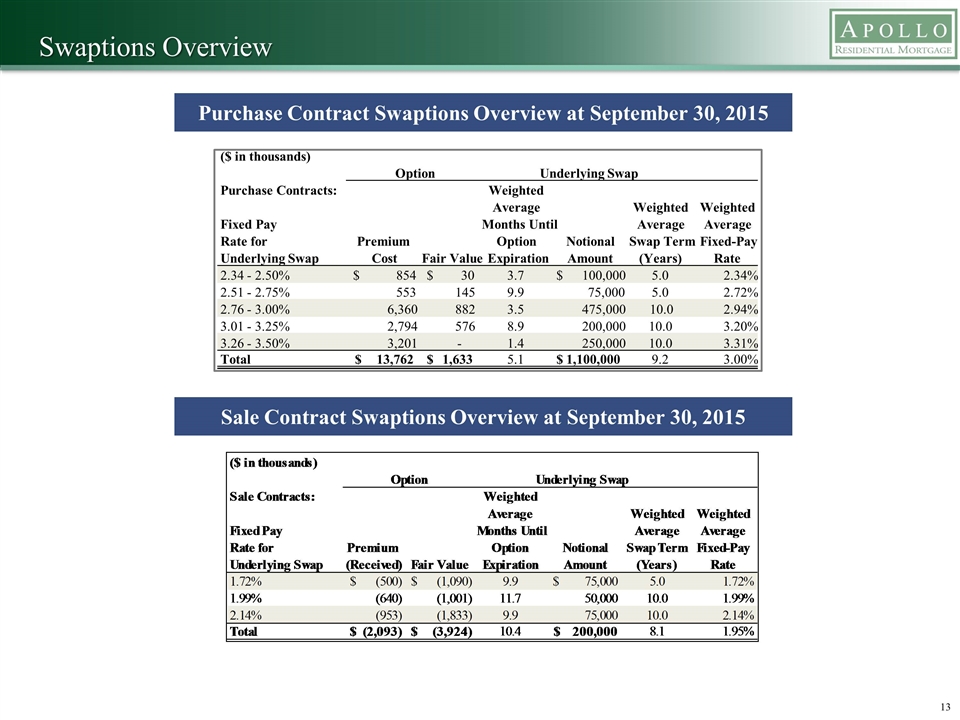

Swaptions Overview Purchase Contract Swaptions Overview at September 30, 2015 Sale Contract Swaptions Overview at September 30, 2015 ($ in thousands) Purchase Contracts: Weighted Average Weighted Weighted Fixed Pay Months Until Average Average Rate for Premium Option Notional Swap Term Fixed-Pay Underlying Swap Cost Fair Value Expiration Amount (Years) Rate 2.34 - 2.50% 854 $ 30 $ 3.7 100,000 $ 5.0 2.34% 2.51 - 2.75% 553 145 9.9 75,000 5.0 2.72% 2.76 - 3.00% 6,360 882 3.5 475,000 10.0 2.94% 3.01 - 3.25% 2,794 576 8.9 200,000 10.0 3.20% 3.26 - 3.50% 3,201 - 1.4 250,000 10.0 3.31% Total 13,762 $ 1,633 $ 5.1 1,100,000 $ 9.2 3.00% Option Underlying Swap

Financials

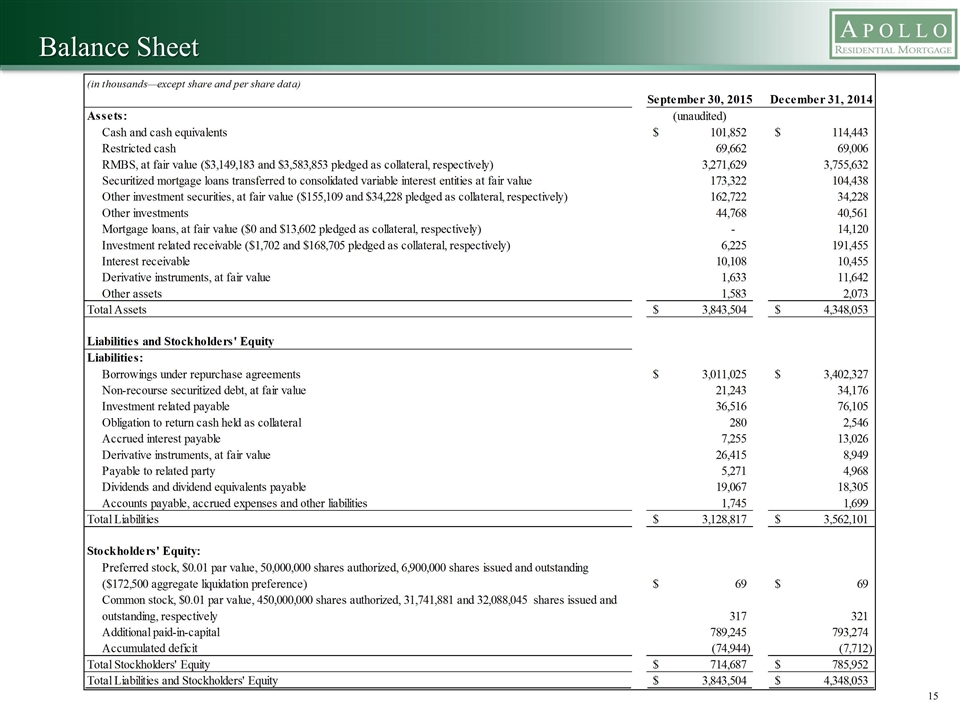

Balance Sheet

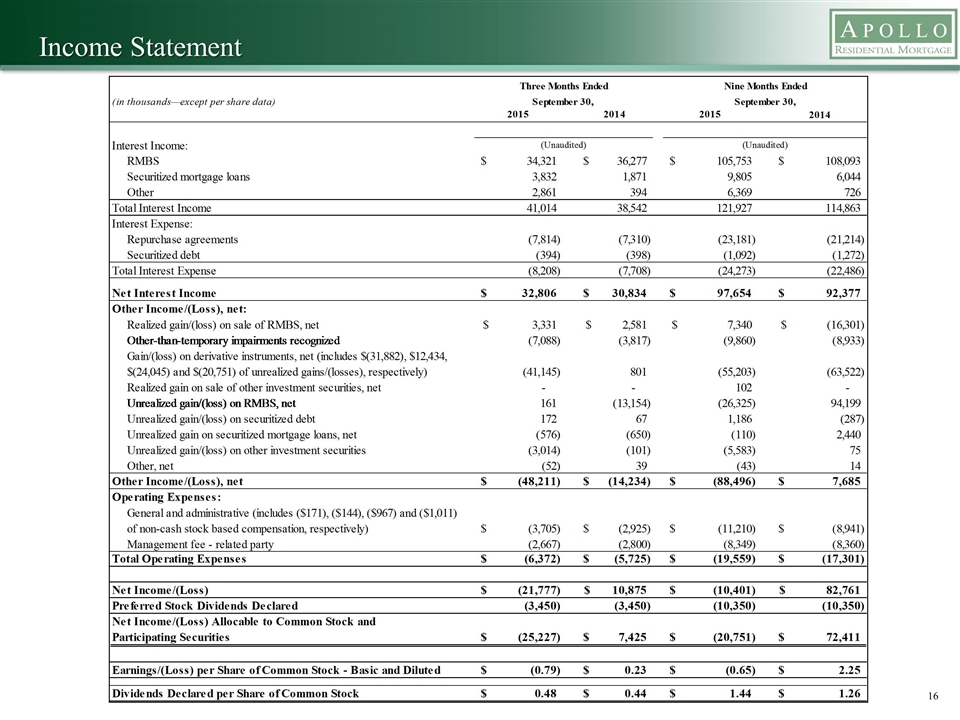

Income Statement

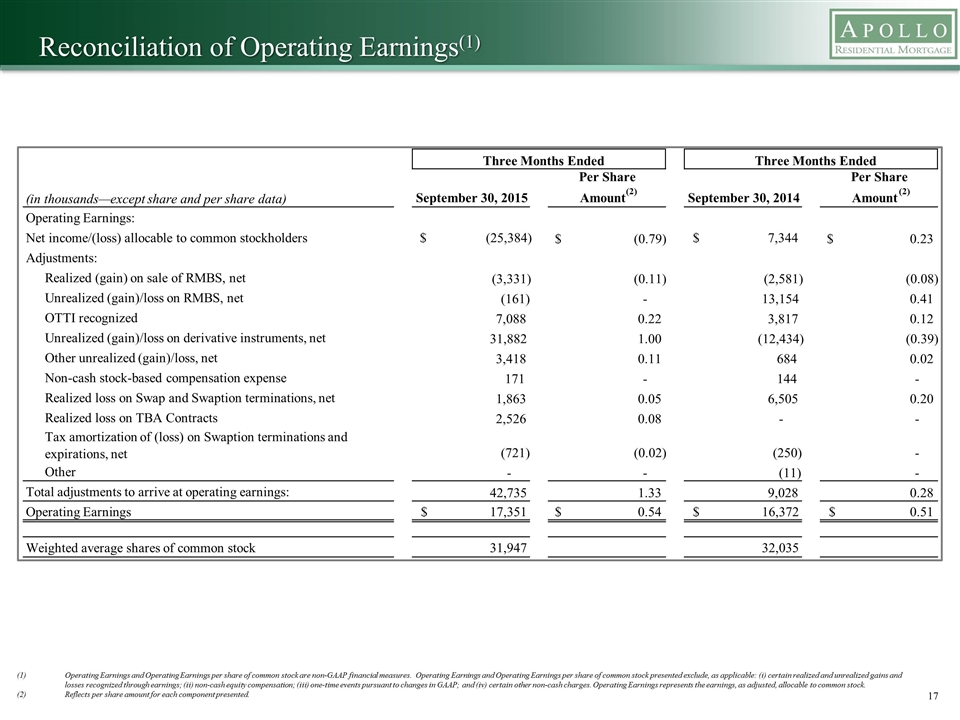

Reconciliation of Operating Earnings(1) Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Operating Earnings represents the earnings, as adjusted, allocable to common stock. Reflects per share amount for each component presented. (in thousands—except share and per share data) September 30, 2015 Per Share Amount (2) September 30, 2014 Per Share Amount (2) Operating Earnings: Net income/(loss) allocable to common stockholders (25,384) $ (0.79) $ 7,344 $ 0.23 $ Adjustments: Realized (gain) on sale of RMBS, net (3,331) (0.11) (2,581) (0.08) Unrealized (gain)/loss on RMBS, net (161) - 13,154 0.41 OTTI recognized 7,088 0.22 3,817 0.12 Unrealized (gain)/loss on derivative instruments, net 31,882 1.00 (12,434) (0.39) Other unrealized (gain)/loss, net 3,418 0.11 684 0.02 Non-cash stock-based compensation expense 171 - 144 - Realized loss on Swap and Swaption terminations, net 1,863 0.05 6,505 0.20 Realized loss on TBA Contracts 2,526 0.08 - - Tax amortization of (loss) on Swaption terminations and expirations, net (721) (0.02) (250) - Other - - (11) - Total adjustments to arrive at operating earnings: 42,735 1.33 9,028 0.28 Operating Earnings 17,351 $ 0.54 $ 16,372 $ 0.51 $ Weighted average shares of common stock 31,947 32,035 Three Months Ended Three Months Ended

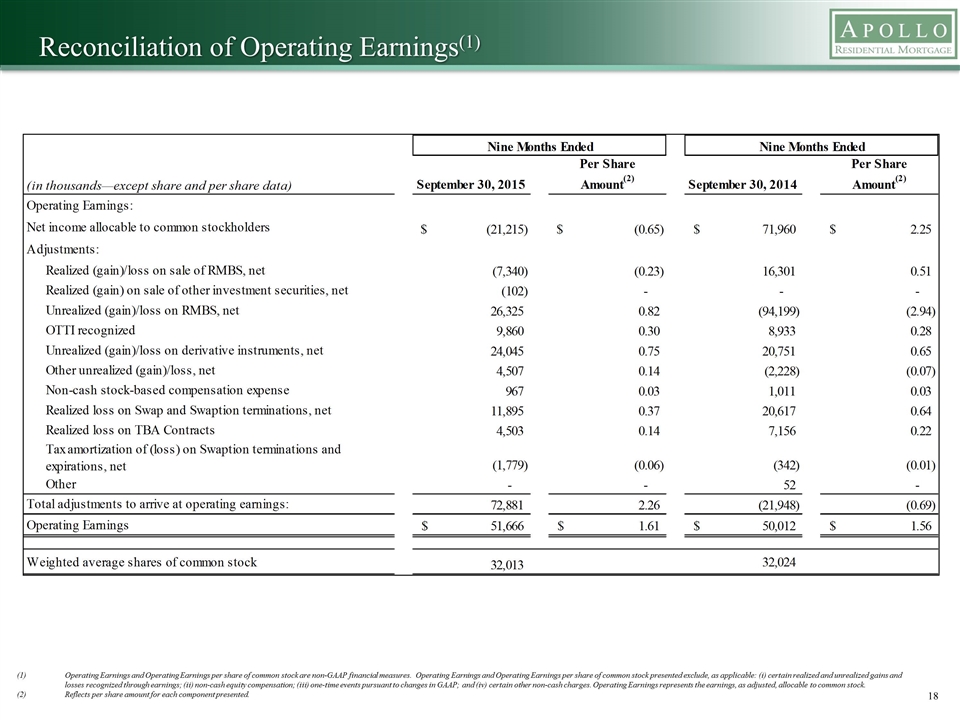

Reconciliation of Operating Earnings(1) Operating Earnings and Operating Earnings per share of common stock are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Operating Earnings represents the earnings, as adjusted, allocable to common stock. Reflects per share amount for each component presented.

Contact Information Hilary Ginsberg Investor Relations Manager 212-822-0767