Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TEAM HEALTH HOLDINGS INC. | d41748d8k.htm |

Exhibit 99.1

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

| I. | EXECUTIVE SUMMARY |

A. Introduction

TeamHealth, Inc. (“TeamHealth”, “TMH” or the “Company”) is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States, based upon revenues, patient visits, and number of clients. TeamHealth serves approximately 1,000 civilian and military hospitals in 47 states with a team of more than 14,000 affiliated healthcare professionals, including physicians, physician assistants, nurse practitioners and nurses. Since its inception in 1979, TeamHealth has focused primarily on providing outsourced services in emergency departments. The Company also provides comprehensive programs for anesthesiology, inpatient care (hospitalists comprising the specialties of internal medicine, orthopedic surgery, general surgery and OB/GYN), urgent care, pediatrics and other healthcare services, principally within hospitals and other healthcare facilities, enabling their management teams to outsource certain management, recruiting, hiring, payroll, billing and collection and benefits functions.

On August 4, 2015, TeamHealth entered into a definitive agreement to acquire IPC Healthcare, Inc., a leading national acute hospitalist and post-acute provider group practice in the United States, for total consideration of approximately $1.6 billion in cash (the “Acquisition”).

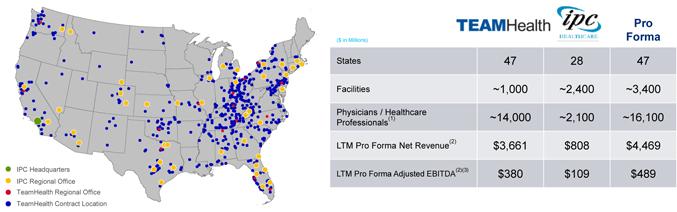

The Acquisition combines two physician-centric companies with leading market positions in their respective core service lines to create the nation’s leading physician services organization with a diversified, complementary business mix and significantly enhanced growth and cash flow profiles. The combined company will offer the leading emergency medicine and hospitalist services program and will possess an unmatched presence in the post-acute clinician services market, significantly enhancing each individual company’s positioning against an evolving healthcare landscape, including the migration to value based payment systems. The pro forma business will operate across 47 states in approximately 3,400 facilities. For the twelve months ended September 30, 2015, the combined company, after giving effect for full-year impact of previously closed acquisitions, had pro forma net revenue of approximately $4.5 billion and pro forma adjusted EBITDA (“EBITDA”) of $489 million.

1

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

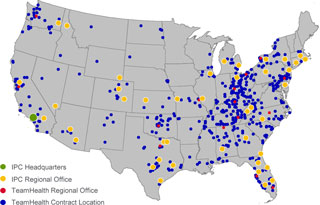

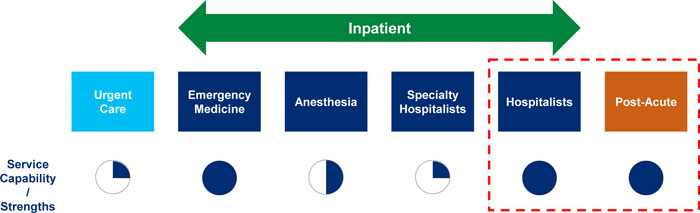

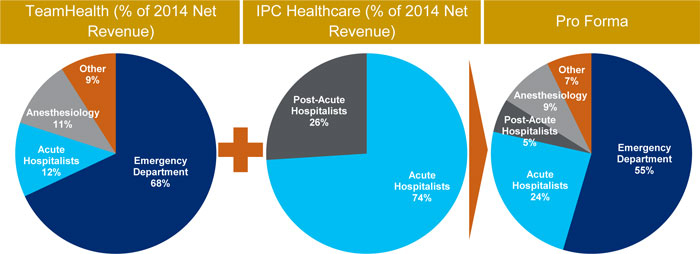

Figure 01 illustrates the percentage of net revenue for the year ended December 31, 2014 for each of TeamHealth, IPC Healthcare and the combined company by specialty / business line, demonstrating the enhanced diversification this combination creates.

Figure 01 – Combined Product Offering: ~3,400 Facilities and ~$4.5 billion in LTM Revenue

Source: Company filings, investor presentations and management analysis.

2

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

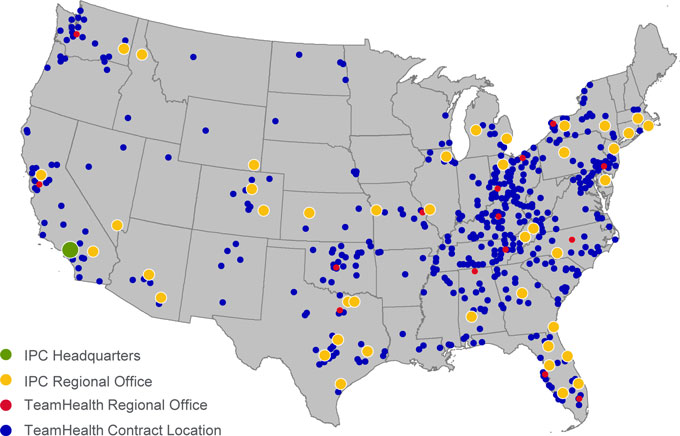

TeamHealth’s national footprint and high quality, long-standing relationships with its broad set of hospital and health system customers provides a significant opportunity to broaden IPC’s presence across the United States. TeamHealth’s current footprint in 47 states will extend IPC into 19 states in which it currently does not have operations today. Additionally, TeamHealth provides emergency medicine services in less than 20% of IPC’s roughly 375 acute-care sites of service, providing an attractive opportunity to grow TeamHealth’s core service lines by leveraging IPC’s high quality customer relationships. As illustrated in Figure 02, there is significant opportunity for TeamHealth to utilize its national presence to grow IPC’s current footprint in new markets and enhance bundled service options across the unique customer base of each company.

Figure 02 – Geographic Overlap

Source: TeamHealth management.

TeamHealth has identified a substantial synergy opportunity through its combination with IPC. TeamHealth’s management, which will be supplemented by key operational executives from IPC, believes it can achieve approximately $60 million of synergies within three years of closing the acquisition. This

3

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

estimated synergy opportunity is comprised of approximately $25 million in cost savings and identifiable revenue opportunities representing an approximately $35 million impact to EBITDA (primarily related to enhanced billing and collection processes and optimizing IPC’s managed care contracting efforts).

4

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

B. Sources and Uses

| Sources |

$ | % | Uses |

$ | % | |||||||||||||

| IPC Cash |

$ | 2 | 0.1 | % | Purchase IPCM Equity | $ | 1,485 | 88.4 | % | |||||||||

| Revolving Credit Facility Draw |

168 | 10.0 | Refinance IPCM Debt | 130 | 7.7 | |||||||||||||

| New Term Loan |

965 | 57.4 | Fees and Expenses | 65 | 3.9 | |||||||||||||

| New Unsecured Debt |

545 | 32.4 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Sources |

$ | 1,680 | 100.0 | % | Total Uses | $ | 1,680 | 100.0 | % | |||||||||

C. Pro Forma Capitalization

| ($ in millions) |

9/30/15 | Transaction Adjustment |

Pro Forma 9/30/15 |

|||||||||

| Cash |

$ | 18 | — | $ | 18 | |||||||

| Revolving Credit Facility |

$ | 170 | 168 | $ | 338 | |||||||

| Term Loan A |

585 | $ | 585 | |||||||||

| New Term Loan |

— | 965 | 965 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Senior Secured Debt |

$ | 755 | $ | 1,133 | $ | 1,888 | ||||||

| New Unsecured Debt |

— | 545 | 545 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Debt |

$ | 755 | $ | 1,678 | $ | 2,433 | ||||||

| Credit Statistics |

||||||||||||

| LTM PF Adj. EBITDA (09/30/15) |

$ | 380 | (1) | $ | 109 | (2) | $ | 489 | ||||

| Senior Secured Debt / LTM PF Adj. EBITDA |

2.0x | 3.9x | ||||||||||

| Total Debt / LTM PF Adj. EBITDA |

2.0 | 5.0 | ||||||||||

| Net Debt / LTM PF Adj. EBITDA |

1.9 | 4.9 | ||||||||||

|

|

|

|

|

|

|

|||||||

| TeamHealth Compliance Cert. PF Adj. EBITDA(3) |

$ | 414 | $ | 109 | $ | 523 | ||||||

| Senior Secured Debt / Compliance Cert. PF Adj. EBITDA |

1.8x | 3.6x | ||||||||||

| Total Debt / Compliance Cert. PF Adj. EBITDA |

1.8 | 4.7 | ||||||||||

| Net Debt / Compliance Cert. PF Adj. EBITDA |

1.8 | 4.6 | ||||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Includes full-year impact of previously closed acquisitions. See next section for details. |

| (2) | Includes $25mm of expected cost synergies related to IPC transaction as well as other adjustments detailed in next section. |

| (3) | Based on TMH current credit agreement definition of EBITDA for the trailing twelve month period ending 9/30/15, which includes add back for non-cash component of professional liability insurance expense. |

5

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

D. Pro Forma Adjusted EBITDA

| Twelve Months Ended September 30, 2015 | ||||||||||||||||

| ($ in Millions) |

TeamHealth | IPC | Adj. | Pro Forma | ||||||||||||

| Historical Financials |

$ | 3,408.3 | $ | 728.8 | — | $ | 4,137.1 | |||||||||

| Acquisitions Pro Forma Adjustment |

253.1 | (1) | 79.1 | (1) | — | 332.3 | ||||||||||

| Net Revenues |

$ | 3,661.4 | $ | 807.9 | — | $ | 4,469.4 | |||||||||

| EBIT |

$ | 200.8 | $ | 47.3 | — | $ | 248.1 | |||||||||

| Depreciation & Amortization |

105.5 | 5.9 | — | 111.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA |

$ | 306.4 | $ | 53.2 | $ | 359.6 | ||||||||||

| Equity Based Compensation |

16.7 | 8.4 | — | 25.1 | ||||||||||||

| Full Year Impact of Previous Acquisitions |

12.2 | (2) | 6.2 | (3) | — | 18.4 | ||||||||||

| Non-recurring Charges |

42.9 | (4) | 16.0 | (5) | — | 58.9 | ||||||||||

| Insurance Subsidiaries Interest Income |

2.1 | (4) | — | — | 2.1 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA Adjustments |

$ | 73.8 | $ | 30.6 | — | $ | 104.4 | |||||||||

| Expected Cost Synergies |

— | — | 25.0 | 25.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro Forma Adj. EBITDA |

$ | 380.2 | $ | 83.8 | $ | 25.0 | $ | 489.0 | ||||||||

| (1) | Includes full year impact of previously closed acquisitions. |

(2) (3) (4) (5) See tables below and sections VI A and B.

(2) Full-Year Impact of Previous Acquisitions – TeamHealth

| ($ in Millions) | ||||||

| Adjustment |

Amount | Detail | ||||

| Q4 2014 Acquisitions |

$ | 1.4 | Acquisition of 1 hospitalist, 1 emergency department, 1 scribe and 1 anesthesia practice with operations in California, Ohio, Texas and Washington D.C., respectively | |||

| Q1 2015 Acquisitions |

$ | 2.5 | Acquisition of 2 emergency department and 1 emergency department / hospitalist practice with operations in New York, Nevada and Texas, respectively | |||

| Q2 2015 Acquisitions |

$ | 5.6 | Acquisition of 1 anesthesia and 1 emergency department practice with operations in Ohio and New Jersey, respectively | |||

| Q3 2015 Acquisitions |

$ | 2.7 | Acquisition of 1 anesthesia practice in New York | |||

6

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

(3) Full-Year Impact of Previous Acquisitions – IPC

| ($ in Millions) | ||||||

| Adjustment |

Amount | Detail | ||||

| Q4 2014 Acquisitions |

$ | 0.3 | Acquisition of 7 hospitalist practices with operations in Ohio, Pennsylvania, Southeast Florida, West Michigan, Jacksonville, Southwest Florida, North Carolina, South Carolina and Virginia | |||

| Q1 2015 Acquisitions |

$ | 1.0 | Acquisition of 6 hospitalist practices with operations in Jacksonville, New York, Maryland, Tennessee and New Mexico | |||

| Q2 2015 Acquisitions |

$ | 2.3 | Acquisition of 7 hospitalist practices with operations in Georgia, Alabama, Houston, New York, North Carolina, South Carolina and Virginia | |||

| Q3 2015 Acquisitions |

$ | 2.6 | Acquisition of 7 hospitalist practices with operations in California, Tucson, Virginia, North Carolina, Tennessee, Ocala and Tampa | |||

7

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

(4) Other TeamHealth PF Adj. EBITDA Adjustments

| ($ in Millions) | ||||||

| Adjustment |

Amount | Description | ||||

| Other (Income) Expenses, Net |

($ | 1.3 | ) | Represents gains and losses related to the sale of certain assets and equity stakes as well as violation adjustments on SERP assets | ||

| Contingent Purchase & Other Acquisition Expense |

$ | 20.4 | Reflects expense recognized for historical and estimated future contingent payments and other compensation expense activity associated with acquisitions | |||

| Transaction Costs |

$ | 8.6 | Reflects expenses associated with accounting, legal, due diligence and other transaction fees related to acquisition activities | |||

| Severance & Other Charges |

$ | 11.6 | Severance costs related to acquisitions and management changes | |||

| Debt Refinancing Costs |

$ | 3.6 | Reflects the write-off of deferred financing costs from the previous term loan as well as certain fees and expenses associated with the debt amendment | |||

|

|

|

|||||

| Non-Recurring Charges Subtotal |

$ | 42.9 | ||||

| Insurance Subsidiaries Interest Income |

$ | 2.1 | Interest income from investments of captive insurance subsidiary | |||

(5) Other IPC PF Adj. EBITDA Adjustments

| ($ in Millions) | ||||||

| Adjustment |

Amount | Description | ||||

| Net Changes in Fair Value of Contingent Consideration |

$ | 6.5 | Adjustment to fair value of contingent consideration liability related to acquisitions updated quarterly for the actual performance of acquired practices | |||

| Costs Related to the False Claims Act Litigation |

$ | 1.7 | Legal expenses related False Claims Act litigation with the U.S. government | |||

| TeamHealth Transaction Expenses |

$ | 5.3 | Transaction costs incurred that related to the pending merger with TeamHealth | |||

| Transaction Expenses and CID Related Legal Expenses |

$ | 1.8 | Legal expenses related to transactions and defending against federal lawsuits | |||

| BPCI Overhead |

$ | 0.8 | One time expenses related to the preparation for BPCI program launch in mid 2015 | |||

8

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

E. Pro Forma Corporate Structure

Please refer to Debtdomain for detailed information about the pro forma corporate structure.

F. Description of the Term Loan

Please refer to Debtdomain for detailed information about the proposed facilities.

G. Business Description

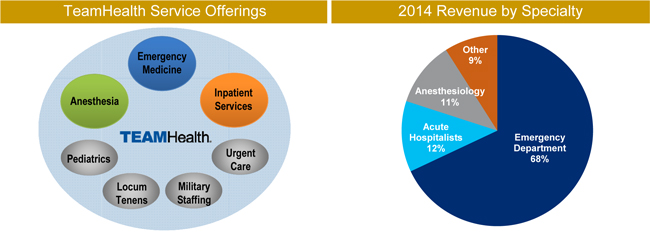

TeamHealth Overview

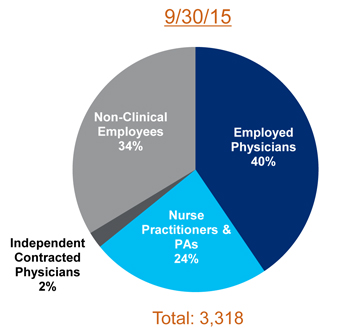

TeamHealth is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States, based upon revenues, patient visits, and number of clients. As of September 2015, the Company serves approximately 1,000 civilian and military hospitals, clinics and physician groups in 47 states with a team of more than 14,000 affiliated healthcare professionals, including physicians, physician assistants, nurse practitioners, and nurses. The Company recruits and contracts with healthcare professionals who then provide professional services within third-party healthcare facilities.

TeamHealth is a physician-founded organization with physician leadership throughout all levels of its organization. Since the Company’s inception in 1979, TeamHealth has provided outsourced services in emergency departments, or EDs. The Company also provides comprehensive programs for anesthesiology, inpatient services (hospitalists comprising the specialties of internal medicine, orthopedic surgery, general surgery and OB/GYN), urgent care, pediatrics and other healthcare services, by providing permanent staffing that enables the management teams of hospitals and other healthcare facilities to outsource certain management, recruiting, hiring, payroll, billing and collection and benefits functions. For the LTM period September 30, 2015, TeamHealth, after giving effect for full-year impact of previously closed acquisitions, generated net revenues of $3.7 billion and Adjusted EBITDA of $380 million (excluding the impact of the contemplated acquisition of IPC).

9

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

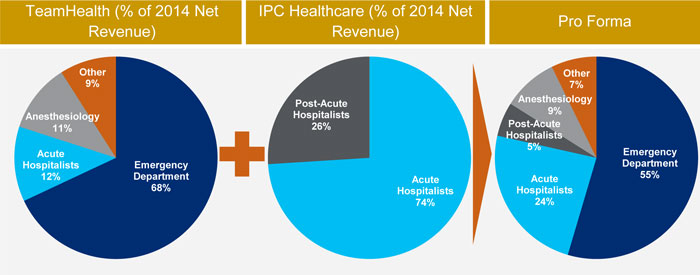

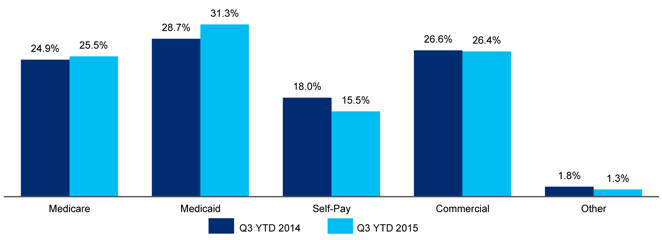

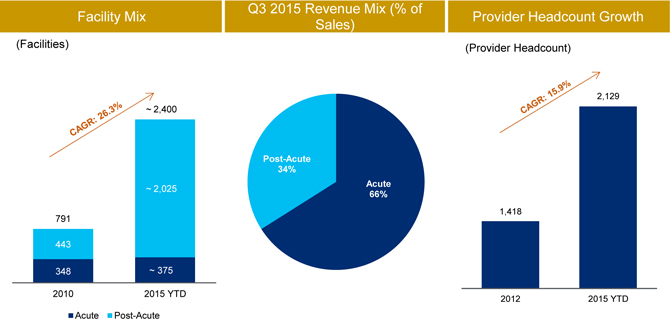

Figure 03 – TeamHealth Revenue Mix

Source: TeamHealth 2014 10-K and Q3 2015 earnings presentation.

IPC Healthcare Overview

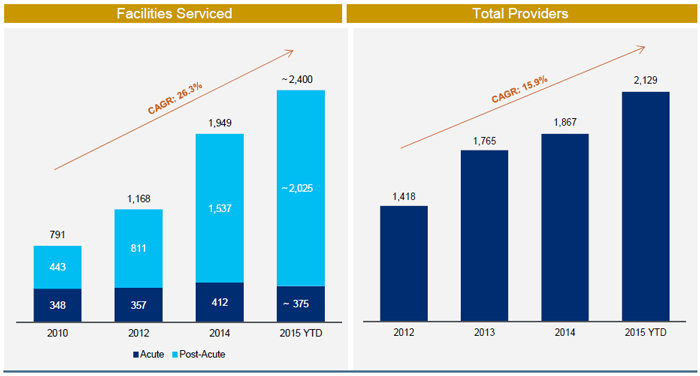

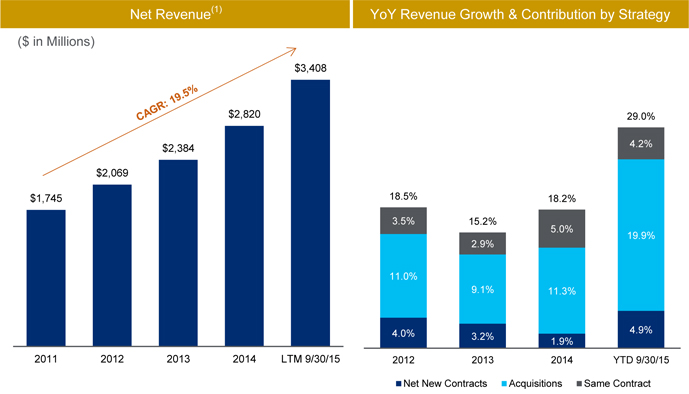

IPC is a leading national acute hospitalist and post-acute provider group practice in the United States. Hospitalist medicine is organized around inpatient care, delivered primarily in acute care hospitals, and post-acute medicine is delivered primarily in skilled nursing facilities. IPC’s clinical services are focused on providing, managing and coordinating the entire episode of care of inpatients. IPC believes it is the largest dedicated hospitalist and post-acute provider in the United States based on revenues, patient encounters and number of affiliated clinicians. As of September 30, 2015, IPC’s approximately 2,100 affiliated clinicians, including physicians, nurse practitioners and physician assistants (collectively “affiliated clinicians”) practice in 375 hospitals and 2,025 other inpatient and post-acute care facilities primarily in 28 states. IPC has had approximately 24 million patient encounters since the beginning of 2012. Collectively, IPC’s affiliated clinicians work with more than 48,000 referring physicians and 3,500 health plans. IPC’s early entry into the emerging hospitalist industry has permitted it to establish a reputation and leadership position that IPC believes is closely identified with the success of hospitalist medicine.

10

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

IPC began operating its first hospitalist practice in 1998 and in recent years has also become a leading provider in the post-acute arena. Since that time, IPC has increased the number of practice groups to over 360 as of September 31, 2015. IPC’s affiliated clinicians are primarily full-time employees of wholly-owned subsidiaries or affiliated professional organizations.

IPC assists hospitals, post-acute care facilities and payors in improving quality of care, increasing operating efficiencies and reducing costs. Through IPC’s affiliated clinicians, IPC provides, manages and coordinates the care of hospitalized patients and serves as the inpatient partner of primary care physicians and specialists, allowing them to focus their time and resources on their office based practices or specialties. IPC provides its affiliated clinicians with the infrastructure, information management systems, specialized training programs and administrative support necessary to perform these services. These administrative services help reduce the burden associated with managing a physician practice, making IPC an attractive employer for hospitalists and post-acute clinicians whether practicing individually or in groups.

For the LTM period September 30, 2015, IPC, after giving effect for full-year impact of previously closed acquisitions, generated revenues of $808 million and Adjusted EBITDA of $84 million.

11

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Figure 04 – IPC Healthcare Facility and Physician Overview

Source: Public filings.

H. Transaction Rationale

TeamHealth’s acquisition of IPC Healthcare creates a leading physician services organization spanning multiple specialties in the hospital based and post-acute settings. The combined company expects to realize several benefits from the Acquisition, including the following:

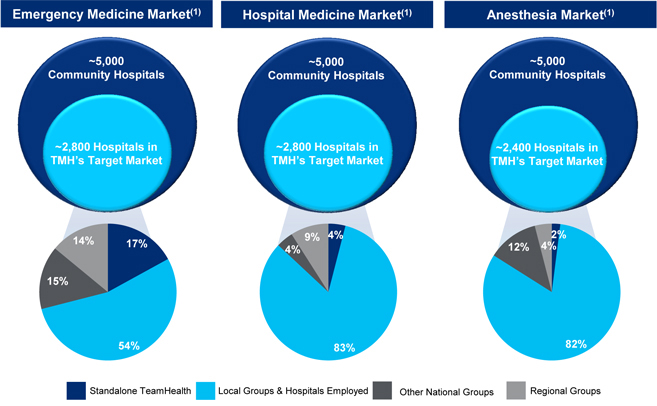

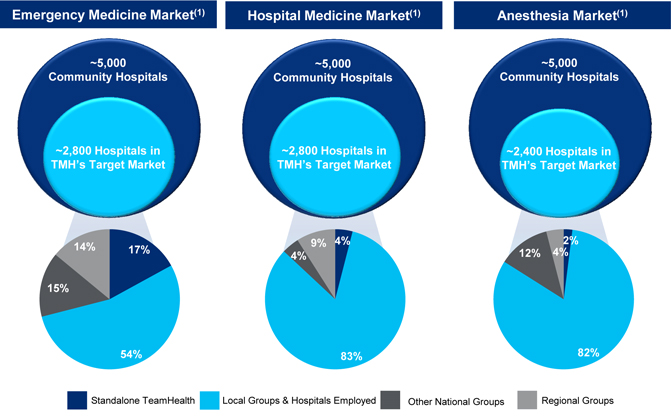

Diversifying and Highly Strategic Transaction Combines Two Physician-Centric Companies Creating the Nation’s Leading Physician Services Organization. TeamHealth is the market leader in emergency medicine (ED), servicing 17% of the 2,800 hospitals comprising TeamHealth’s target market and serving 12 million patients in 2014. The Company also enjoys a strong position in the hospital medicine and anesthesia markets, servicing 4% and 2%, respectively, of the hospitals comprising TeamHealth’s target market. IPC is a leading provider of physician outsourcing services and the largest pure-play hospitalist player. With approximately 2,100 affiliated providers serving approximately 2,400 facilities in 28 states, IPC is the largest dedicated hospitalist and post-acute provider in the United States based on revenues, patient encounters and number of affiliated clinicians. The addition of IPC’s service network will increase TeamHealth’s national presence in the acute

12

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

and post-acute markets, creating the leading physician outsourcing organization in multiple specialties. With >16,000 healthcare professionals nationwide, the combined company will have a powerful capability to manage patient care and influence outcomes while lowering costs across the continuum of care.

Combination Substantially Enhances Business Diversity, Scale and National Footprint. After consummation of the acquisition, TeamHealth expects to be one of the largest providers of multi-specialty outsourced healthcare services in the United States. The combined company’s >16,000 physicians and health-care professionals will operate in approximately 3,400 facilities across 47 states generating over $4.5bn in pro forma net revenue and approximately $490mm in pro forma adjusted EBITDA. TeamHealth believes its geographic diversification will provide it with a strong competitive position within the highly fragmented industries that the combined company will serve. The Company also believes its national scale and position as a large, public company operator has made and will continue to make it an attractive partner for physicians and service provider for clients. TeamHealth’s scalable national infrastructure drives value for customers and is a significant competitive advantage.

Figure 05 – Combination Enhances Scale

Source: TeamHealth management and public filings. See sections VI A and B for PF Adjusted EBITDA detail.

| (1) | TeamHealth physician / healthcare professionals count includes relationships with ~4,000 independent contractors. |

| (2) | Includes full year impact of previously closed acquisitions. |

| (3) | IPC Adjusted EBITDA includes $25mm of expected cost synergies. |

13

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Establishes a Leadership Position in the Large and Increasingly Strategic Post-Acute Setting. The post-acute setting represents one of the most impactable, yet expensive parts of healthcare delivery. Driven in part by trends towards value-based reimbursement models, TeamHealth’s health system customer base has increasingly expressed interest in post-acute coordination. IPC healthcare has the leading national post-acute platform, providing services in approximately 2,000 post-acute facilities across 28 states. IPC has demonstrated significant momentum in the buildout of its post-acute business, increasing the number of facilities it services from under 450 in 2010 to today’s level, representing a CAGR of 38% over the last ~5 years. TeamHealth believes there are no other competitors of scale in the post-acute space, a healthcare segment characterized as a highly fragmented and unpenetrated market comprised of approximately 15,000 facilities. Even as the clear leader in the market with significant growth in the platform over the last five years, IPC provides services in only roughly 13% of total post-acute facilities in the United States. The combined company’s expanded presence in the post-acute setting will provide TeamHealth with the powerful capability to manage patient care throughout the care continuum (from ED to post-acute) and to improve patient outcomes while lowering costs.

Enhances TeamHealth’s Positioning Relative to Key Trends Impacting the Healthcare Industry. The combined company, with its market leading service offerings in emergency medicine, hospitalist medicine, anesthesia and post-acute physician services, will be uniquely positioned to provide a differentiated suite of services to a variety of providers across the healthcare continuum. Additionally, the Acquisition enhances the positioning of the pro forma business relative to key trends impacting healthcare, including:

| • | Migration to value based reimbursement models (e.g., BPCI) |

| • | Growing importance of post-acute management |

| • | Continued outsourcing of critical hospital based physician services to large national and regional providers |

| • | Ongoing consolidation of commercial payors |

Annual Cost and Revenue Synergy Opportunity of Approximately $60 Million Within Three Years. Through its comprehensive diligence effort, TeamHealth identified a significant synergy opportunity related to the Acquisition and believes it can achieve identified annual synergies of approximately $60 million within three years of closing the transaction. The synergy opportunity is comprised of a combination of cost and revenue synergies, the realization of which will be based on an integration and synergy realization strategy that TeamHealth has successfully employed in dozens of previous acquisitions. Specifically, TeamHealth expects to achieve approximately $25 million of cost synergies as part of the IPC acquisition. This amount represents approximately 10% of the roughly $250 million of IPC corporate and combined hospital medicine regional overhead of the two companies. TeamHealth also expects to achieve EBITDA contribution of approximately $35 million related to revenue synergies as part of the IPC acquisition. The overwhelming majority of the revenue synergy opportunity is expected to be driven by leveraging TeamHealth’s robust managed care contracting and collections infrastructure (key components of the integration strategy TeamHealth has successfully employed in nearly all of its historical acquisitions).

14

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

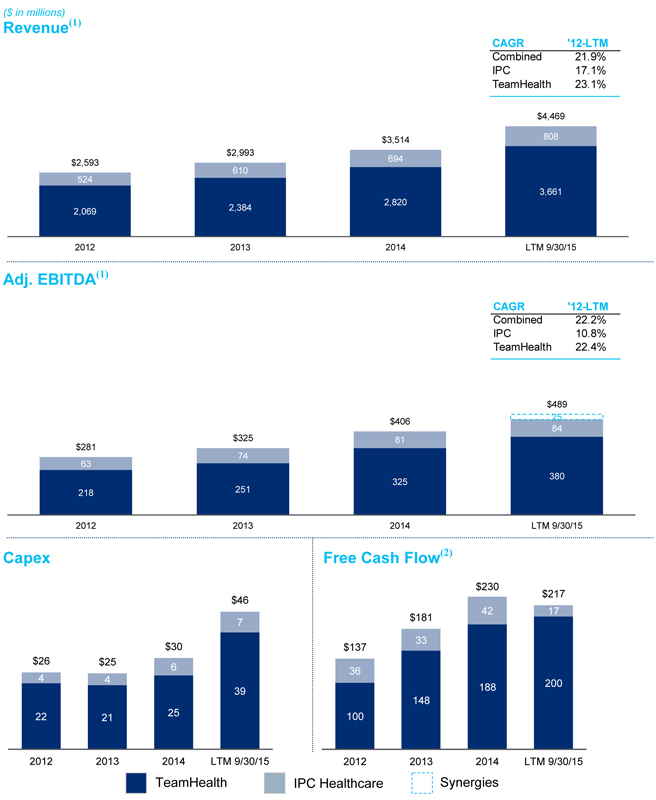

Enhances TeamHealth’s Already Attractive Financial Profile. The acquisition of IPC materially enhances TeamHealth’s already highly attractive financial profile and robust free cash flow generation, creating a pro forma company with the potential to delever quickly.

TeamHealth believes its experience and expertise in managing the complexities of high-volume EDs (a core component of its customer base) are competitive advantages and enable its hospital customers to provide higher quality and more efficient patient care. These competitive advantages, coupled with TeamHealth’s long history of demonstrated expertise, commitment to clinical excellence, superior customer service and focus on physician satisfaction, have enabled the Company to maintain long-standing relationships with many of its customers. IPC’s business model, which does not exclusively rely on contract-based revenues, will complement TeamHealth’s current business model. Additionally, TeamHealth expects the combined company to benefit from an accelerated, differentiated and diversified growth profile. While TeamHealth’s organic growth has been approximately 6% and 7% in 2013 and 2014, respectively, IPC has been able to deliver over 9% same-market revenue in each of the last three years. The Company expects IPC to continue its established track record of organic growth, which it believes to be immediately accretive to TeamHealth’s own organic growth profile.

Given the scale of each of TeamHealth’s and IPC’s businesses, and the ability to leverage administrative and support infrastructure, both companies have been able to demonstrate consistent and favorable Adjusted EBITDA margins of 10% to 12% over the last three years. Strong revenue growth coupled with stable margins and relatively low capital expenditures (roughly 1% of net revenue on a pro forma basis) and working capital requirements have resulted in strong and growing cash flows from operations. The combined company’s robust cash flow profile is expected to drive deleveraging, with a target of mid-to-low 4x leverage by the end of 2016, and to create significant capacity to continue to grow the business through a disciplined acquisition strategy.

Experienced TeamHealth Leadership Team Supplemented with Core IPC Executive Team. Upon completion of the merger, TeamHealth’s senior management team will be supplemented by members of the IPC executive team who have played a crucial role in growing IPC into the leading national acute hospitalist and post-acute provider. The new TeamHealth management team has extensive healthcare experience as well as a proven track record of successfully identifying, diligencing, executing and integrating acquisitions of physician practice groups. Jeff Taylor, IPC President and Chief Operating Officer, along with other key IPC executives, will join the combined company and will assist with the integration and the continuity of IPC’s operational plan. The combined executive team will have an average of twenty-nine years of relevant experience.

15

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

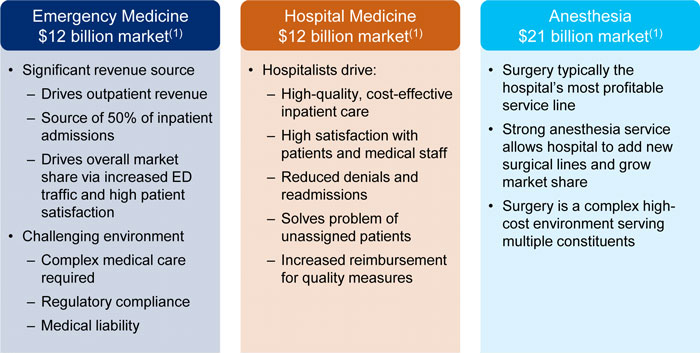

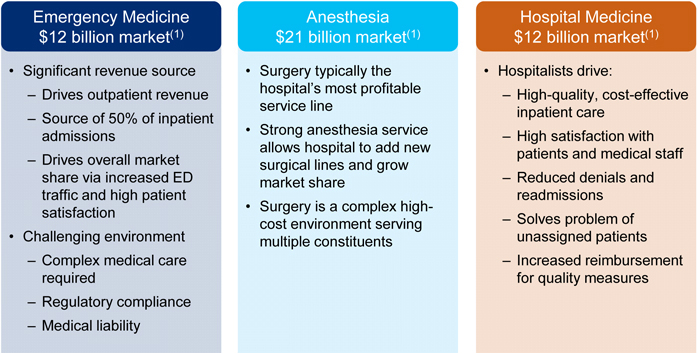

I. Industry Overview

TeamHealth estimates the size of the domestic outsourced healthcare professional staffing market for emergency medicine, hospital medicine and anesthesia to be approximately $50 billion. Over the last decade, healthcare facilities have experienced increased pressure from government and private payors both to improve the quality and to reduce the cost of care. With the increasing complexity of clinical, regulatory, managed care and reimbursement matters in today’s healthcare environment, healthcare facilities have increasingly outsourced the staffing and management of key clinical areas to companies such as TeamHealth and IPC that possess specialized skills, standardized models and information technology to improve service, increase the overall quality of care and reduce administrative costs.

TeamHealth and IPC target certain clinical areas within healthcare facilities, including emergency medicine (ED), hospital medicine, and anesthesiology. TeamHealth estimates the annual size of these markets in the United States to be approximately $12 billion, $12 billion and $21 billion, respectively.

16

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Figure 06 – The Total Addressable Market Opportunity

| (1) | Based on TeamHealth estimates. |

Each of these clinical areas currently faces severe physician shortages, and many healthcare facilities lack the resources necessary to identify and attract specialized, career-oriented physicians. Moreover, the market for outsourced services in each of these areas is highly fragmented and predominately served by small practice groups. TeamHealth believes these market conditions present attractive opportunities for future growth through continued consolidation and the ability to leverage its national platform and infrastructure to win new contracts.

17

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

J. Summary of Historical Financials

18

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Source: Public filings and TeamHealth Q3 2015 investor presentation. See sections VI A and B for PF Adj. EBITDA detail.

| (1) | LTM 9/30/15 includes full year impact of previously closed acquisitions. |

| (2) | Free cash flow represents operating cash flow plus contingent purchase payments, less capital expenditures, less net change in investments at insurance subsidiary. Figures represent actual historical financials for each company on a standalone basis and does not include pro forma adjustments for the contemplated acquisition. |

19

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

| II. | INVESTMENT HIGHLIGHTS |

A. Diversifying and Highly Strategic Transaction Combines Two Physician-Centric Companies to Create the Nation’s Leading Physician Services Organization

TeamHealth and IPC are physician-centric companies with leadership positions in their respective core service areas with vast networks of employed and affiliated physicians. The acquisition creates a leading, more diversified physician outsourcing company with complementary business mixes and cultures as well as significantly enhanced growth and free cash flow profiles. The combined company, with its service lines extending from urgent care to the post-acute setting will be even better positioned in an evolving healthcare landscape and to address the challenges facing physicians, health systems, payors and communities.

Figure 07 – Physician / Clinician Organization Spanning the Care Continuum

With presence in approximately 1,000 civilian and military hospitals in 47 states and affiliations with more than 14,000 healthcare professionals, TeamHealth is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States. TeamHealth is a market leader in emergency medicine (ED), servicing 17% of the 2,800 hospitals comprising TeamHealth’s target market and serving 12 million patients in 2014. The Company also enjoys a strong position in the hospital medicine and anesthesia markets, servicing 4% and 2%, respectively, of the hospitals comprising TeamHealth’s target market. IPC is a leading provider of physician outsourcing services and the largest pure-play hospitalist player. With more than 2,100 affiliated providers serving approximately 2,400 facilities in 28 states, IPC is the largest dedicated hospitalist and post-acute provider in the United States based on revenues, patient encounters and number of affiliated clinicians.

The addition of IPC’s service network will increase TeamHealth’s national presence in the acute and post-acute markets, creating the leading physician outsourcing organization in multiple specialties. With >16,000 healthcare professionals nationwide, the combined company will have a powerful capability to manage patient care and influence outcomes while lowering costs across the continuum of care.

20

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

B. Combination Substantially Enhances Scale, Business Diversity, and National Footprint

The acquisition creates a combined company with significant business diversity and scale.

Figure 08 – Combination Enhances Scale

Source: TeamHealth management and public filings. See sections VI A and B for PF Adjusted EBITDA detail.

| (1) | TeamHealth physician / healthcare professionals count includes relationships with ~4,000 independent contractors. |

| (2) | Includes full year impact of previously closed acquisitions. |

| (3) | IPC Adjusted EBITDA includes $25mm of expected cost synergies. |

Market Leading, National Scale Provider of Critical Outsourced Physician Services. After consummation of the acquisition, TeamHealth expects to be one of the largest providers of multi-specialty outsourced healthcare services in the United States. The combined company’s >16,000 physicians and health-care professionals will operate in 3,400 facilities across 47 states generating over $4.5bn in pro forma net revenue and approximately $489mm in pro forma adjusted EBITDA. TeamHealth believes its

21

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

geographic diversification will provide it with a strong competitive position within the highly fragmented industries that the combined company will serve. The Company also believes its national scale and position as a large, public company operator has made and will continue to make it an attractive partner for physicians and service provider for clients. TeamHealth’s scalable national infrastructure drives value for customers and is a significant competitive advantage.

| • | 21 regional offices throughout the United States allow for local client facing support and market knowledge |

| • | Four billing centers offer national managed care contracting that works in tandem with regional operators and processes approximately fourteen million patient claims per year across a single IT platform |

| • | Centralized risk & claims management and professional liability insurance support an aggressive claims management process and captive professional liability insurance program |

| • | A centralized and well-funded administrative unit supports accounting, payroll, human resources, legal and compliance needs |

Diversifies Business and Establishes a Leadership Position in the Large and Increasingly Strategic Post-Acute Setting. After giving effect to the acquisition, TeamHealth will operate a diversified set of critical care physician services businesses with leading positions in service lines vital to the operations of acute care providers. Pro forma for the acquisition of IPC, TeamHealth’s concentration in emergency medicine will decline from 68% of 2014 net revenue to approximately 55% of pro forma 2014 net revenue. Despite acquiring the leading hospitalist medicine platform, hospitalist medicine will approximately comprise only 24% of pro forma 2014 net revenue.

Figure 09 – Combined PF Product Offering: ~3,400 facilities and LTM Revenue of ~$4.5bn

Source: TeamHealth 2014 10-K and Q3 2015 earnings presentation.

22

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

The post-acute setting represents one of the most impactable, yet expensive parts of healthcare delivery. Driven in part by trends towards value-based reimbursement models. TeamHealth’s health system customer base has increasingly expressed interest in post-acute coordination. IPC healthcare has the leading national post-acute platform, providing services in approximately 2,000 post-acute facilities across 28 states. IPC has demonstrated significant momentum in the buildout of its post-acute business, increasing the number of facilities it services from under 450 in 2010 to today’s level, representing a CAGR of 38% over the last ~5 years. TeamHealth believes IPC is the leader in the post-acute space, a healthcare segment characterized as a highly fragmented and unpenetrated market comprised of approximately 15,000 facilities. Even as the clear leader in the market, with significant growth in the platform over the last five years, IPC provides services in only roughly 13% of total post-acute facilities in the United States. The combined company’s expanded presence in the post-acute setting will provide TeamHealth with the powerful capability to manage patient care throughout the care continuum (from ED to post-acute) and to improve patient outcomes while lowering costs.

C. Enhances TeamHealth’s Positioning Relative to Key Trends Impacting the Healthcare Industry

The combined company, with its market leading service offerings in emergency medicine, hospitalist medicine, anesthesia and post-acute physician services, will be uniquely positioned to provide a differentiated suite of services to a variety of providers across the healthcare continuum. Additionally, the Acquisition enhances the positioning of the pro forma business relative to key trends impacting healthcare, including:

| • | Migration to value based reimbursement models (e.g., CMS value-based reimbursement initiatives such as Bundled Payments for Care Improvement (BPCI)) |

| • | Growing importance of post-acute management |

| • | Continued outsourcing of critical hospital based physician services to large national and regional providers |

| • | Ongoing consolidation of commercial payors |

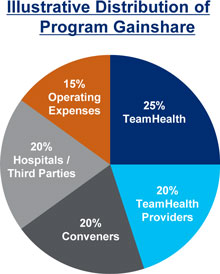

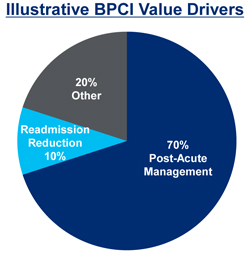

Migration to Value Based Reimbursement Models and the BPCI Opportunity. Both commercial and government payors have articulated plans to increase the percentage of annual reimbursement paid through value-based programs in the coming years. In a January 26, 2015 press release, the Centers for Medicare and Medicaid Services (CMS) announced a goal of increasing the reimbursement of Medicare spending that flows through alternative payment models to 50% from today’s level of 20% by the end of 2018.

One such alternative payment program is the Bundled Payments for Care Improvement (“BPCI”) initiative, which illustrates the growing opportunity for providers who can efficiently and effectively coordinate patient care both within and beyond the hospital setting. Under this program, Medicare consolidates all payments for a hospitalization episode and pays a flat fee, including post-discharge care of up to 90 days, as opposed to the current system where Medicare pays on a procedure-by-procedure basis to every party involved. The BPCI program intends to consolidate payments to a single provider entity (such as a physician or hospital) with the goal of improving care coordination to ultimately drive better outcomes for patients and lower costs for

23

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Medicare. Savings are based on retrospective bundled payment arrangements, with actual expenditures reconciled against a target price for an episode of care. Providers will be incentivized under the program through a gain sharing construct whereby the provider will be entitled to a portion of total savings generated for specific patient encounters. Participating providers can select in which clinical conditions to participate and receive payment through an organization known as a “convener”. The convener enters into an agreement with CMS whereby it receives the difference between Medicare’s predetermined target price for a given clinical condition and the actual fee-for-service payment upon reconciliation of the patient episode. Successfully managing the episode of care for a lower cost than the Medicare assigned bundled payment rate results in program savings. The savings, after operating expenses and CMS’ retention of the first 2% of savings, is then distributed among the various entities involved. These entities can include physicians and other providers, hospitals, potential third-parties, the convener and TeamHealth or IPC.

Figure 10 depicts an illustrative distribution of the program gainshare to the combined company and its partners.

Figure 10 –Significant BPCI Opportunity

Source: TeamHealth management estimates.

This program represents a unique opportunity for the combined company given its strong pro forma presence across the continuum of care in the ED, hospital and post-acute settings. TeamHealth believes expertise across these key services will differentiate the Company’s ability to coordinate entire episodes of care for a large portion of eligible patient encounters. Select TeamHealth and IPC Healthcare provider groups began participation in phase II of the BPCI program effective July 1, 2015, leveraging state-of-the-art proprietary technology and infrastructure as well as post-acute expertise to manage a combined $2 billion of Medicare spend. While TeamHealth believes the BPCI program represents an attractive and potentially substantial opportunity, the Company has conservatively not included any revenue from BPCI in its identified synergy expectation.

24

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

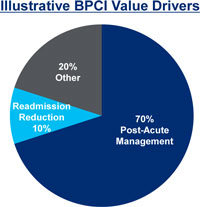

Growing Importance of Post-Acute Management. Estimated at a market size greater than $300 billion, the post-acute setting represents the most impactable and expensive part of healthcare delivery (CMS). With ~44% of Medicare patients discharged from acute care facilities to post-acute settings, a substantial portion of overall Medicare spend is generated in post-acute facilities today (MedPAC). That spend is expected to continue to grow as the number of Americans aged 65 and over (who represent the highest utilizers of acute care services) will increase approximately 36% to approximately 65 million by 2025 (U.S. Census Bureau). As Figure 11 demonstrates, TeamHealth anticipates the primary driver of savings for the BPCI program is post-acute management. These savings are expected to be achieved by a combination of care coordination initiatives, including procedural containment efforts, focus on clinically appropriate discharge timing and locations, reduction in average length of stay in post-acute facilities and a focus on reduction in readmit rates.

Figure 11 –Increasing Strategic Importance of Post-Acute Services

Source: TeamHealth management estimates.

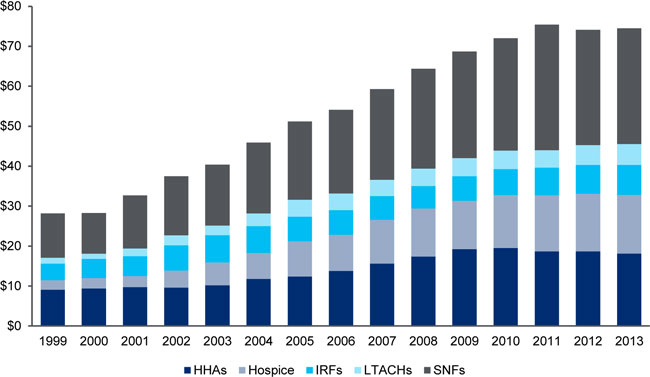

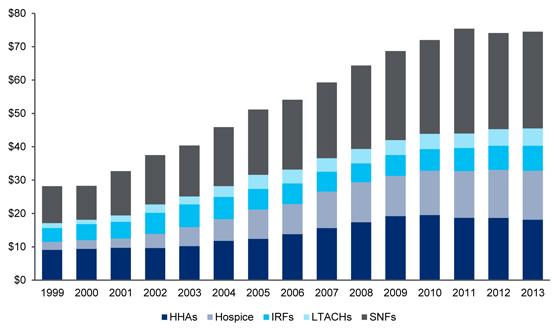

Figure 12 illustrates post-acute Medicare spending has grown over 6% annually from 1999 to 2013.

25

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Figure 12 – Growth in Medicare Spending from 1999 – 2013

Source: CMS, MedPAC.

Shift towards national providers of physician outsourcing. Hospitals and other healthcare facilities are increasingly utilizing national providers of outsourced healthcare professionals for a variety of reasons. Third-party outsourcing services assist healthcare facilities in reducing operating expenses and in achieving targeted physician coverage levels, including addressing difficulties associated with hiring and retaining physicians. Additionally, companies such as TeamHealth and IPC are impactful to a variety of operational challenges faced by hospital administrators, including increasing operational efficiency, improving patient flow, reducing wait times, coordinating care, shortening lengths of stay and reducing readmission rates. Such improvements not only reduce the cost of care, but also improve patient outcomes, the overall quality of care and patient satisfaction. Hospitals and other healthcare providers continue to experience pressure from managed care companies and other payers to reduce costs while maintaining or improving their quality of service. Additionally, providers in general are increasingly faced with challenges related to the evolving healthcare environment, including increased administrative burdens driven by regulatory initiatives and the introduction of new reimbursement models (including bundled payments and at-risk models).

As these and other challenges continue to impact providers, TeamHealth believes hospitals and other contracting parties will increasingly turn to a single source with an established track record of success for outsourced physician staffing and administrative services. Further, partners such as TeamHealth and IPC are uniquely positioned to benefit customers through their operating models designed to provide localized presence with the benefits of scale in centralized administrative and other back office functions that accrue to larger, national companies. In 2012, approximately 65% of hospitals outsourced their emergency services and

26

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

approximately 50% of hospitals outsourced their anesthesiology services primarily to small local provider groups. However, hospitals and health systems are increasingly turning to national outsourced physician groups to meet their increasingly complex needs. The combined company is even better positioned to be a direct beneficiary of this continuing shift from smaller local groups to larger national provider organizations.

Payor Consolidation. With multiple large, pending mergers in the managed care sector, the potential exists for increased pressure on provider reimbursement from larger, more powerful commercial payors across numerous markets. Increasing scale and market relevance are amongst the key strategies for providers to employ to best counteract the potential impact of the wave of consolidation currently contemplated by the largest health insurers in the United States. The Merger not only enhances the scale and breadth of services of each of TeamHealth and IPC, but also positions the combined company to broaden its relevance in key markets through the expansion of service offerings, providing the Company with a stronger position from which to negotiate fair compensation for its high quality services. In addition, the complimentary nature of the leading emergency medicine and hospitalist medicine programs, particularly when coupled with post-acute expertise, has the potential to significantly impact cost of care while maintaining superior clinical outcomes. This dynamic should make TeamHealth a potentially powerful partner to payors seeking to steer patients towards providers with expertise across those critical clinical areas of service.

D. Strong, Stable Pro Forma Growth Profile Coupled with Robust Free Cash Flow Generation

TeamHealth and IPC represent two of the strongest and most stable high growth companies in the healthcare services sector. The acquisition of IPC enhances TeamHealth’s already attractive financial profile and robust free cash flow generation, creating a pro forma company with the potential to delever quickly.

Diversified and Recurring Revenue Stream. Both companies have a demonstrated track record of consistent growth driven by operational excellence, strong fundamentals and competitive differentiation. These characteristics are supported by market leading reputations in each of their respective core service lines as evidenced by long term customer relationships.

TeamHealth believes its experience and expertise in managing the complexities of high-volume EDs (a core component of its customer base) are competitive advantages and enable its hospital customers to provide higher quality and more efficient patient care. These competitive advantages, coupled with TeamHealth’s long history of demonstrated expertise, commitment to clinical excellence, superior customer service and focus on physician satisfaction, have enabled the Company to maintain long-standing relationships with many of its customers. The average ED contract length of TeamHealth’s top 50 customers by net revenue is approximately 13 years with many spanning over 25 years. TeamHealth’s contract stability is further demonstrated by the Company’s industry leading contract renewal rate (approximately 98% as of LTM September 30, 2015). TeamHealth has also built a diversified customer base, with no single individual staffing location accounting for more than 2% of total net revenue as of September 30, 2015.

27

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

IPC’s limited reliance on contract-based revenues will complement TeamHealth’s current business model. While hospitalist medicine contracts are in place for approximately 50% (based on revenue) of the acute care facilities in which IPC provides services, those contracts only provide IPC with access to patients admitted through the emergency department who do not have a primary care physician. IPC estimates inpatient admissions through the emergency department account for approximately only 30% of total inpatients at an average hospital, and are often patients with limited or no health insurance coverage. The remaining roughly 70% of inpatients are primarily admitted via referral by primary care or specialty physicians. These patients represent an important population of inpatients who could benefit from the oversight and care coordination IPC’s physicians provide through its market leading hospitalist medicine program. IPC is able to provide care to these patients by referral from the patient’s primary care or specialist physician. IPC relies on its well diversified referral network of over 48,000 primary and specialty care physicians as well as numerous payor relationships to provide service to this large population of patients. Importantly, IPC affiliated clinicians are able to provide hospitalist medicine services to any inpatient facility where they have credentials regardless of whether IPC has a contract with the facility. Thus, even if IPC loses a contract with a hospital, it can still provide service to patients admitted via its numerous referral sources. IPC’s patient volume at any given facility is often significantly weighted towards patients treated via referral rather than through patients seen due to contracts with the facility.

Enhancing to TeamHealth’s Already Attractive Total and Organic Growth Potential. TeamHealth expects the combined company to benefit from an accelerated, differentiated and diversified growth profile. While TeamHealth’s organic growth has been approximately 6% and 7% in 2013 and 2014, respectively, IPC has been able to deliver over 9% same-market growth in each of the last three years. The Company expects IPC to continue its established track record of organic growth, which it believes to be immediately accretive to TeamHealth’s own organic growth profile. To support its longer-term growth plan, IPC has made significant investment in growth driving functions and in re-engineering its physician retention efforts over the last year. Accordingly, IPC grew organic hires by 13% year-over-year in 2014, and year-to-date has increased new hires while lowering its physician turnover rates.

While IPC has been successful growing its business organically on a standalone basis, TeamHealth expects the combination has the potential to accelerate new contract growth. TeamHealth intends to utilize its broad geographic footprint in 47 states to expand IPC’s current presence into 20 new states and introduce IPC’s acute and post-acute services to a broad set of new potential clients leveraging TeamHealth’s long-standing customer relationships. IPC’s unique customer base also provides an attractive opportunity to expand TeamHealth’s portfolio of contracts across its suite of services. With TeamHealth providing emergency medicine services to only approximately 20% of the roughly 375 acute care facilities IPC services, a significant opportunity exists to enhance TeamHealth’s new organic contract pipeline. TeamHealth also expects industry fundamentals to drive continued tailwinds in the physician outsourcing space in both the acute and post-acute setting.

28

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

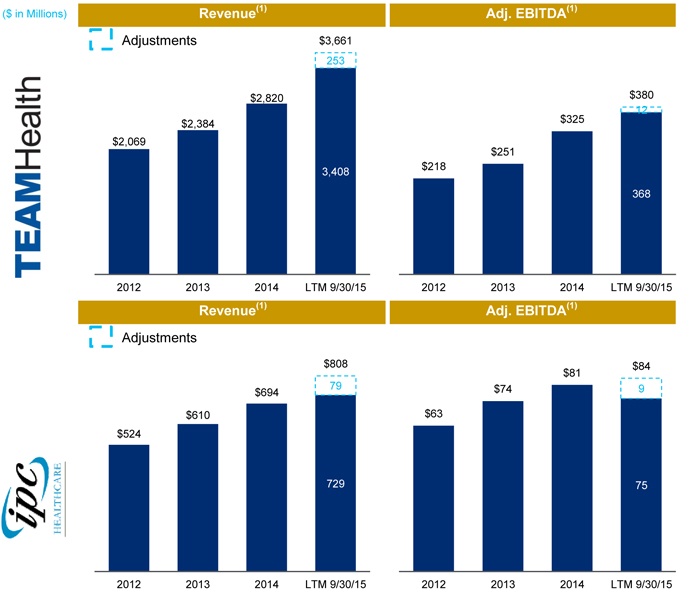

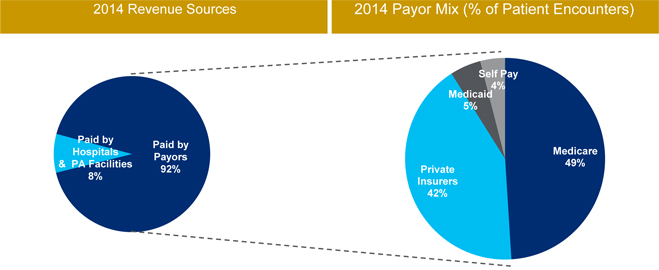

Figure 13 – Combines Two Stable and Fast Growing Providers

Source: Public filings and TeamHealth Q3 2015 investor presentation. See sections VI A and B for PF Adj. EBITDA detail.

| (1) | LTM 9/30/15 includes full year impact of previously closed acquisitions. |

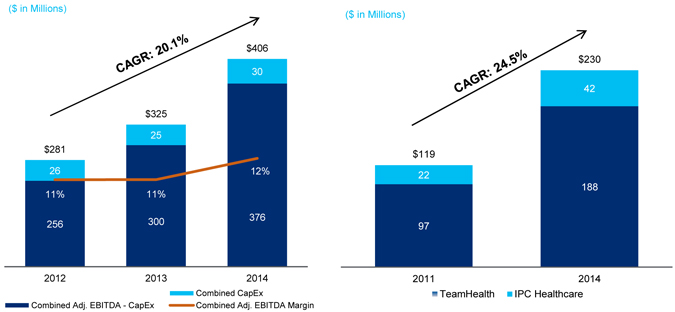

Robust Cash Flow and Delevering Profile. Given the scale of each of TeamHealth’s and IPC’s businesses, and the ability to leverage administrative and support infrastructure, both companies have been able to demonstrate consistent and favorable Adjusted EBITDA margins of 10% to 12% over the last three years.

29

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Strong revenue growth coupled with stable margins and relatively low capital expenditures (roughly 1% of net revenue on a pro forma basis) and working capital requirements have resulted in strong and growing cash flows from operations. The combined company’s robust cash flow profile is expected to drive deleveraging, with a target of mid-to-low 4x leverage by the end of 2016, and to create significant capacity to continue to grow the business through a disciplined acquisition strategy.

Source: Public filings and TeamHealth investor presentations.

| (1) | Represent historical financials and does not include adjustments for combining companies. |

| (2) | Free cash flow represents operating cash flow plus contingent purchase payments, less capital expenditures, less net change in investments at insurance subsidiary. Figures represent actual historical financials for each company on a standalone basis and do not include pro forma adjustments for the contemplated acquisition. |

Continued Execution of Disciplined Capital Efficient M&A Opportunities. As illustrated in Figure 16, the Company’s total addressable market is characterized by significant fragmentation and comprised of a majority of local and regional competitors. Small practices and physician groups are increasingly under significant financial pressure driven in large part by growing administrative burdens due to a confluence of factors including costly and evolving regulation. As a result, these smaller physician practices are increasingly seeking to align with larger, financially stable organizations. The combined company’s broad national presence, robust infrastructure, financial resources and market leading positions in ED, hospital medicine and anesthesia, will make it an increasingly attractive partner for local and regional practice groups in those service lines.

30

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Figure 16 – Significant M&A Opportunity in Highly Fragmented Markets

| (1) | Management Estimates |

Both TeamHealth and IPC have a long track record of successfully acquiring and integrating practices of various sizes and achieving synergies. Since 2010, TeamHealth and IPC have successfully acquired 45 and 105 practices, respectively. Both companies have demonstrated an ability to source opportunities with attractive pro forma purchase multiple profiles achieved through execution on proven synergy realization strategies. Further, IPC’s leading position in the highly fragmented post-acute physician services segment provides TeamHealth with a substantial consolidation opportunity in a market largely comprised of smaller physician practices where acquisition opportunities are typically less competitive than TeamHealth’s core service lines.

31

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Figure 17 – IPC’s Track Record of Accretive M&A

Source: IPC management.

E. Annual Cost and Revenue Synergy Opportunity of Approximately $60 Million Within Three Years

Through its comprehensive diligence effort, TeamHealth identified a significant synergy opportunity related to the Acquisition and believes it can achieve identified annual synergies of approximately $60 million within three years of closing the transaction. The synergy opportunity is comprised of a combination of cost and revenue synergies, the realization of which will be based on an integration and synergy realization strategy TeamHealth has successfully employed in dozens of previous acquisitions.

Cost Synergies. TeamHealth expects to achieve approximately $25 million of cost synergies as part of the IPC acquisition. This amount represents approximately 10% of the roughly $250 million of IPC corporate and combined hospital medicine regional overhead of the two companies. Specifically, synergies are expected to be realized through numerous initiatives including eliminating duplicative public company and corporate function costs, streamlining regional operating costs, moving to a centralized billing system and leveraging the purchasing power of the combined company to drive savings related to supply purchasing. Moreover, TeamHealth expects additional synergies will be realized through leveraging IPC-Link (IPC’s leading proprietary technology system that improves the operating efficiency of hospital medicine practice groups) in TeamHealth’s own hospitalist programs.

Revenue Synergies. TeamHealth expects to achieve EBITDA contribution of approximately $35 million related to revenue synergies as part of the IPC acquisition. The overwhelming majority of the revenue synergy opportunity is expected to be driven by leveraging TeamHealth’s robust managed care contracting and collections infrastructure (key components of the integration strategy TeamHealth has successfully employed in nearly all of its historical acquisitions). TeamHealth’s experience successfully executing on this component of the revenue synergy opportunity via its formulaic approach underpins management’s high degree of confidence around not only the total opportunity and ultimate achievability of this portion of the synergy target, but also in the ability to achieve a significant portion relatively quickly post-closing.

32

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Beyond the identified revenue synergy opportunities noted above, TeamHealth also believes additional revenue synergy opportunities exist in the form of an enhanced ED/Hospitalist medicine bundled physician services offering for acute care customers. The introduction of post-acute services to a broad array of TeamHealth’s current health system customers is also expected to contribute to the revenue synergy opportunity.

While TeamHealth only provides emergency medicine services in less than 20% of the roughly 375 acute care facilities IPC services, TeamHealth has not included any revenue from cross-selling TeamHealth and IPC core services into the unique customer bases of each individual company. Additionally, potential revenue generated from the BPCI initiative is not included in the identified revenue synergy range. Nevertheless, the BPCI opportunity potentially represents potential upside for the combined company.

F. Experienced TeamHealth Leadership Team Supplemented with Core IPC Executive Team

An integral component of TeamHealth’s integration plan for the acquisition of IPC is maintaining the continuity of IPC’s operational plan and key management. As part of the acquisition, Jeffrey Taylor, President and Chief Operating Officer of IPC, as well as other key operational leaders of IPC will join TeamHealth to supplement the executive team. These key IPC executives will continue to maintain responsibility for the execution of the IPC growth strategy and have been instrumental building, cultivating and maintaining IPCs broad physician and customer relationships over the course of IPC’s history.

TeamHealth’s senior management team, and the senior management team of IPC who will join TeamHealth upon completion of the acquisition, have extensive healthcare industry experience. The combined executive team will have an average of twenty-nine years of relevant experience.

Methodical and Well-Formulated Integration Strategy. With over 45 acquisitions successfully executed since 2010, physician group integration is a core competency of TeamHealth. While IPC represents the largest acquisition TeamHealth has made to date, many of the key integration initiatives mirror those of the numerous successful physician group practice acquisitions the Company has made throughout its history. TeamHealth and IPC executives are fully utilizing the time between signing and closing to progress integration while experienced team leaders have been identified and detailed execution plans have been developed for integration of key functional areas. To supplement management’s efforts, TeamHealth has engaged a premier management consulting group to help management coordinate key aspects of the integration.

33

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

| III. | OVERVIEW OF TEAMHEALTH |

A. Company Overview

TeamHealth is one of the largest suppliers of outsourced healthcare professional staffing and administrative services to hospitals and other healthcare providers in the United States, based upon revenues, patient visits, and number of clients. As of September 2015, the Company serves approximately 1,000 civilian and military hospitals, clinics and physician groups in 47 states with a team of more than 14,000 affiliated healthcare professionals, including physicians, physician assistants, nurse practitioners, and nurses. The Company recruits and contracts with healthcare professionals, who then provide professional services within third-party healthcare facilities.

TeamHealth is a physician-founded organization with physician leadership throughout all levels of its organization. Since the Company’s inception in 1979, TeamHealth has provided outsourced services in emergency departments, or EDs. The Company also provides comprehensive programs for anesthesiology, inpatient services (hospitalists comprising the specialties of internal medicine, orthopedic surgery, general surgery and OB/GYN), urgent care, pediatrics and other healthcare services, by providing permanent staffing that enables the management teams of hospitals and other healthcare facilities to outsource certain management, recruiting, hiring, payroll, billing and collection and benefits functions. For the LTM period September 30, 2015, TeamHealth, after giving effect for full-year impact of previously closed acquisitions, generated net revenues of $3.7 billion and Adjusted EBITDA of $380 million (excluding the impact of the contemplated acquisition of IPC).

Figure 18 – Diverse Service Offering with Particular Strength in the Emergency Department

Source: TeamHealth 2014 10-K and TeamHealth investor presentations.

TeamHealth focuses on providing high-performance outsourced physician staffing solutions to hospitals. Under its business model, the Company signs exclusive contracts with hospitals that retain it to provide clinical staffing services. Once a relationship with a hospital has been formed, TeamHealth assigns affiliated physicians from its network of high-quality local physician groups to work with the hospital staff and to provide patient care. In addition,

34

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

TeamHealth works to recruit and maintain a network of top-notch local physician groups across the country. The range of physician and non-physician staffing and administrative services that TeamHealth provides to its clients include the following:

| • | Recruiting, schedule and credential coordination for clinical and non-clinical medical professionals |

| • | Coding, billing and collection of fees for services provided by medical professionals |

| • | Provision of experienced medical directors |

| • | Administrative support services, such as payroll, professional liability insurance coverage, continuing medical education services and management training |

| • | Claims and risk management services |

| • | Standardized procedures and operational consulting |

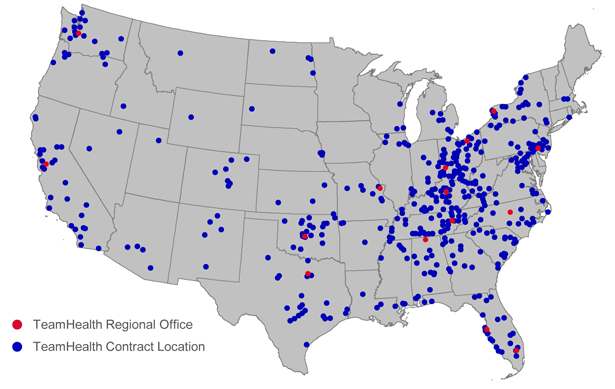

TeamHealth provides physicians and hospitals a compelling value proposition, demonstrated by a 93% physician retention rate and a 98% contract retention rate with affiliated hospitals (calculated on a preceding 12 month basis as of September 30, 2015 for ED operations). With respect to physicians, TeamHealth eases the administrative burdens associated with practice management while also providing physicians stable practice opportunities in well-regarded hospitals with competitive compensation. Furthermore, TeamHealth has demonstrated its commitment to building a strong physician-centric culture by employing physician leaders throughout all levels of its organization and by providing its physicians with continuing medical education and other opportunities for career advancement. For hospitals, TeamHealth delivers mission critical results via a robust operating platform. Supported by the resources of a national organization and 21 regional client service teams, the Company’s physicians offer hospitals customizable patient care and the option to “bundle” services.

TeamHealth is a national company delivering services through its regional operating units located in key geographic markets. This operating model enables the Company to provide a localized presence combined with the benefits of scale in centralized administrative and other back office functions that accrue to a larger, national company. The teams in TeamHealth’s regional offices are responsible for managing client relationships and for providing healthcare administrative services.

35

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

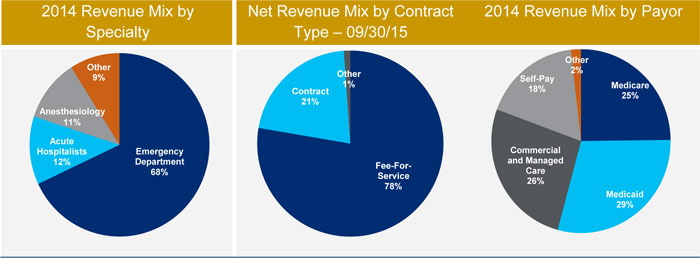

Figure 19 – TeamHealth’s National Presence

Source: TeamHealth management.

36

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

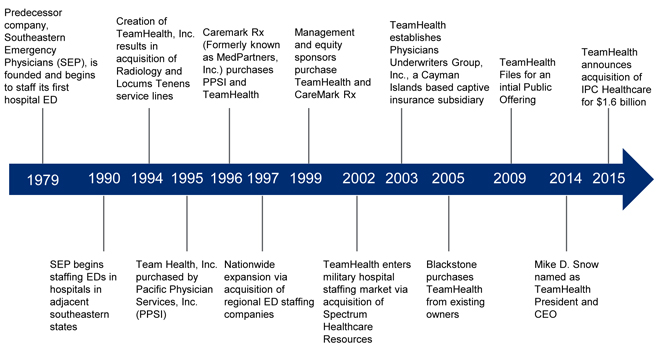

Figure 20 – Company History

Service Lines

TeamHealth provides a full range of outsourced physician staffing and administrative services in emergency medicine, anesthesiology, inpatient services (hospitalists comprising the specialties of internal medicine, critical care, orthopedic surgery, general surgery, and OB/GYN), scribes, urgent care, pediatrics and other hospital-based functions. The Company also provides a full range of healthcare management services to military treatment and government facilities. In addition to physician-related services within a military treatment facility setting, TeamHealth also provides non-physician staffing services, including such services as para-professional providers, nursing, specialty technicians and administrative staffing to military and government facilities.

Emergency Department. TeamHealth is one of the largest providers of outsourced clinical staffing and administrative services for EDs in the United States, based upon revenues and patient visits. EDs are a significant source of hospital inpatient admissions with a majority of admissions for key medical service lines starting in EDs, making successful management of this department critical to a hospital’s patient satisfaction rates and overall success. This dynamic, combined with the challenges involved in billing and collections and physician recruiting and retention, is a primary driver for hospitals to outsource their clinical staffing and management services to companies such as TeamHealth. For the year ended December 31, 2014, the Company’s clinicians provided services to over 12 million patients within the Company’s EDs. Net revenues from ED contracts increased by approximately 72% from the beginning of 2010 through 2014, or at a compound annual growth rate of approximately 14.6%. As of December 31, 2014, TeamHealth independently contracted with or employed approximately 4,200 hospital-based emergency physicians. Net revenues derived from the ED service line were 69%, 67% and 68% of consolidated net revenues in 2012, 2013 and 2014, respectively.

37

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

TeamHealth contracts with hospitals to provide qualified emergency physicians, physician assistants and nurse practitioners for their EDs. In addition to the core services of contract management, recruiting, credentials coordination, staffing and scheduling, the Company provides client hospitals with enhanced services designed to improve the efficiency and effectiveness of their EDs. The Company has specific programs that apply proven process improvement methodologies to departmental operations. By providing these enhanced services, TeamHealth believes it increases the value of services provided to clients and improves client relations. Additionally, the Company differentiates itself from its competitors in sales situations and improves its chances of being selected in a competitive bidding process.

The EDs that TeamHealth staffs are generally located in mid-sized to larger hospitals. The Company believes that its experience and expertise in managing the complexities of these high-volume EDs enables its hospital clients to provide higher quality and more efficient physician and administrative services. In this type of setting, TeamHealth can establish stable long-term relationships, recruit and retain high quality physicians and other providers and staff, and obtain attractive payor mixes and reasonable margins. The Company has long-term relationships with customers under exclusive ED contracts with an approximate 98% renewal rate and a 93% physician retention rate as of September 30, 2015 (calculated on a preceding 12 months basis).

Anesthesiology. TeamHealth provides outsourced anesthesiology and pain management solutions to hospitals and ambulatory surgery centers on a ‘turn-key’ basis. The services provided by anesthesiologists, certified registered nurse anesthetists (CRNAs), and anesthesiologist assistants include anesthesia for the full range of surgical subspecialties, including cardiac, pediatric, trauma, ambulatory, orthopedic, obstetrical, general and ear, nose and throat, as well as interventional pain management. The Company also provides comprehensive administrative oversight and business management of these services, including processes designed to improve the efficiency and effectiveness of the anesthesiology department and the hospital’s surgical services. This, along with TeamHealth’s industry reputation and focus on high levels of customer service, provide the Company with key market differentiation. As of December 31, 2014, the Company independently contracted with or employed approximately 400 anesthesiologists. Net revenues derived from the anesthesiology service line were 8%, 10% and 11% of consolidated net revenues in 2012, 2013 and 2014, respectively.

Inpatient Services (Hospitalists Comprising the Specialties of Internal Medicine, Critical Care, Orthopedic Surgery, General Surgery and OB/GYN). TeamHealth provides physician staffing and administrative functions for inpatient services, which include hospital medicine, intensivist and house coverage services. Inpatient contracts with hospitals are generally on a cost-plus or flat rate basis. The Company also contracts directly with health plans. As of December 31, 2014, the Company independently contracted with or employed approximately 1,000 inpatient physicians. Net revenues derived from inpatient services operations were 11% of consolidated net revenues in 2012, 12% in 2013 and 12% in 2014.

38

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

Other. In addition, TeamHealth operates the following business lines:

Military Staffing Services. TeamHealth provides physician and other non-physician staffing services, including such services as nursing, specialty technician and administrative staffing, primarily in military treatment and outpatient clinical facilities within the United States. These services are generally provided on an hourly contract basis. Net revenues derived from military staffing services line were 5%, of consolidated net revenues in 2012, and 2013 and 4% in 2014.

Temporary Staffing. TeamHealth provides temporary staffing (locum tenens) of physicians and advanced practice clinicians to hospitals and other healthcare organizations through a subsidiary, Daniel and Yeager, Inc., or D&Y. Temporary staffing specialties placed through D&Y include anesthesiology, hospitalists, primary care, radiology, psychiatry and emergency medicine, among others. Revenues from these services are generally derived from a standard contract rate based upon the type of service provided. Customers include hospitals, military treatment facilities and medical groups.

Pediatrics. TeamHealth provides outsourced pediatric physician staffing and administrative services for general and pediatric hospitals on a fee for service basis. These services include pediatric emergency medicine, neonatal intensive care, pediatric intensive care, urgent care centers, primary care centers, observation units and inpatient services. The Company also operates after-hours pediatric urgent care centers in Florida.

Scribes. Through its newly acquired medical scribes company, PhysAssist, TeamHealth provides documentation services to physicians and other medical personnel in a variety of healthcare environments.

Urgent Care and Occupational Medicine. TeamHealth provides cost-effective, high quality primary care physician staffing and administrative services in stand-alone urgent care clinics and in clinics located on the work-site of industrial clients. Urgent care is an emerging area that is an important part of the continuum of care and not only serves as a portal on the initial or front end of care but also as a site for the delivery of follow up post discharge care to patients.

Medical Call Center Services. Through a subsidiary, TeamHealth Medical Call Center, the Company provides medical call center services to hospitals, physician groups and managed care organizations. The 24-hour medical call center is staffed by registered nurses and specially trained telephone representatives with consultation available from practicing physicians. The services provided by TeamHealth Medical Call Center include: physician after-hours call coverage, community nurse lines, ED advice calls, physician referral, class scheduling, appointment scheduling, and web response

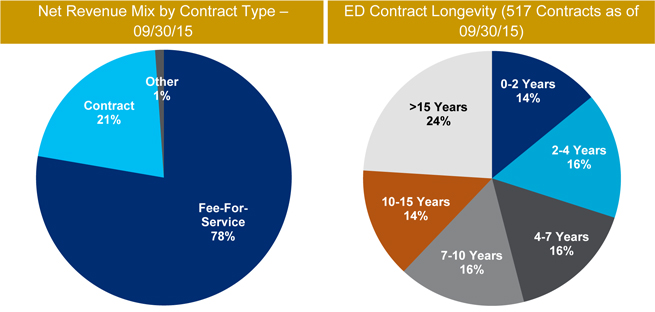

Contractual Arrangements

Revenues are earned from both fee for service arrangements and from flat-rate or hourly contracts. Neither form of contract requires any significant financial outlay, investment obligation or equipment purchase other than the professional expenses and administrative support costs associated with obtaining and staffing the contracts and the associated cost of working capital for such investments.

39

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |

The Company’s contracts with hospitals generally have terms of three years. Present contracts with military treatment and government facilities are generally for one year. Both types of contracts often include automatic renewal options under similar terms and conditions unless either party gives notice to the other of an intent not to renew. Despite the fact that most contracts are terminable by either party upon notice of as little as 90 days, the average tenure of existing ED contracts is approximately eleven years. The termination of a contract is usually due to either an award of the contract to another staffing provider as a result of a competitive bidding process or the termination of the contract by the Company due to a lack of an acceptable profit margin on fee for service patient volumes coupled with inadequate contract subsidies. Contracts may also be terminated as a result of a hospital facility closing due to facility mergers or a hospital attempting to insource the services.

Figure 21 – Long-Term Relationships Generating Recurring Contractual Revenue

Source: TeamHealth Q3 2015 investor presentation.

Hospitals. TeamHealth provides outsourced physician staffing and administrative services to hospitals under fee for service contracts, flat-rate contracts and cost-plus contracts. Hospitals entering into fee for service contracts agree, in exchange for granting exclusivity to the Company for such services, to authorize the Company to bill and collect the professional component of the charges for such professional services. Under the fee for service arrangements, the Company bills patients and third-party payors for services rendered. Depending on the underlying economics of the services provided to the hospital, including its payor mix, TeamHealth may also receive supplemental revenue from the hospital. In a fee for service arrangement, TeamHealth accepts responsibility for billing and collections.

Under flat-rate contracts, the hospital usually performs the billing and collection services of the professional component and assumes the risk of collectibility. In return for providing the physician staffing and administrative services, the hospital pays the Company a contractually negotiated fee, often on an hourly basis. Under cost-plus contracts, the hospital typically reimburses the Company the amount of its total costs incurred in providing physicians and mid-level practitioners to perform the professional services, plus an agreed upon administrative management fee, less billings and collections of the professional component of the charges for such professional services.

40

| CONFIDENTIAL INFORMATION MEMORANDUM | NOVEMBER 2015 |