Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Q3 2015 EARNINGS CALL TRANSCRIPT - MOSAIC CO | exhibit991earningscalltran.htm |

| 8-K - 8-K - Q3 2015 EARNINGS CALL TRANSCRIPT AND SLIDES - MOSAIC CO | a8-kcy15xq3earningscalltra.htm |

The Mosaic Company Earnings Conference Call – Third Quarter 2015 November 3, 2015 Joc O’Rourke, President and Chief Executive Officer Rich Mack, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations

Safe Harbor Statement This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the long term ammonia supply agreements with CF, including the risk that the cost savings from the agreements may not be fully realized or that the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of these agreements becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for Mosaic’s products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. 2

Inherent Seasonality and Cyclicality Mosaic’s Actions: Controlling costs and executing well Effectively allocating capital Maintaining leadership and discipline Macro Environment: Challenges across geographies FX headwinds Import tariffs Cyclicality presents opportunities Positive Secular Trend Underpins Long-Term Demand Growth 3

Visible Strategic Progress $0.56 $0.62 $0.03 $0.02 $0.02 $0.03 $0.04 $0.35 $0.40 $0.45 $0.50 $0.55 $0.60 $0.65 $0.70 2014 Q3 Adjusted EPS K Costs International Distribution SG&A Share Count All Other 2015 Q3 Adjusted EPS Q3 2014 vs. Q3 2015 Adjusted EPS Benefit of Mosaic’s Strategic Initiatives: $0.10/share • Adjusted EPS Reconciliation in the Appendix. • All other includes impact of lower potash sales volumes and prices, lower tax rate and excludes the impact of disclosed notable items 4

Financial Results Review

Phosphates Segment Highlights Key Drivers: • The year-over-year decrease in net sales is driven by lower sales volumes and lower average selling prices. • The year-over-year decrease in operating earnings reflects lower finished product selling prices and lower operating rates, partially offset by lower ammonia costs. $ In millions, except DAP price Q3 2015 Q2 2015 Q3 2014 Net sales $1,032 $1,385 $1,133 Gross margin $199 $296 $236 Percent of net sales 19% 21% 21% Operating earnings $157 $259 $188 Sales volumes 2.1 2.8 2.2 NA production volume(a) 2.4 2.5 2.5 Finished product operating rate 83% 86% 85% Avg DAP selling price $451 $450 $463 (a) Includes crop nutrient dry concentrates and animal feed ingredients 0 50 100 150 200 250 300 Q3 2014 OE Sales price Sales volumes Raw materials Other Q3 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 6

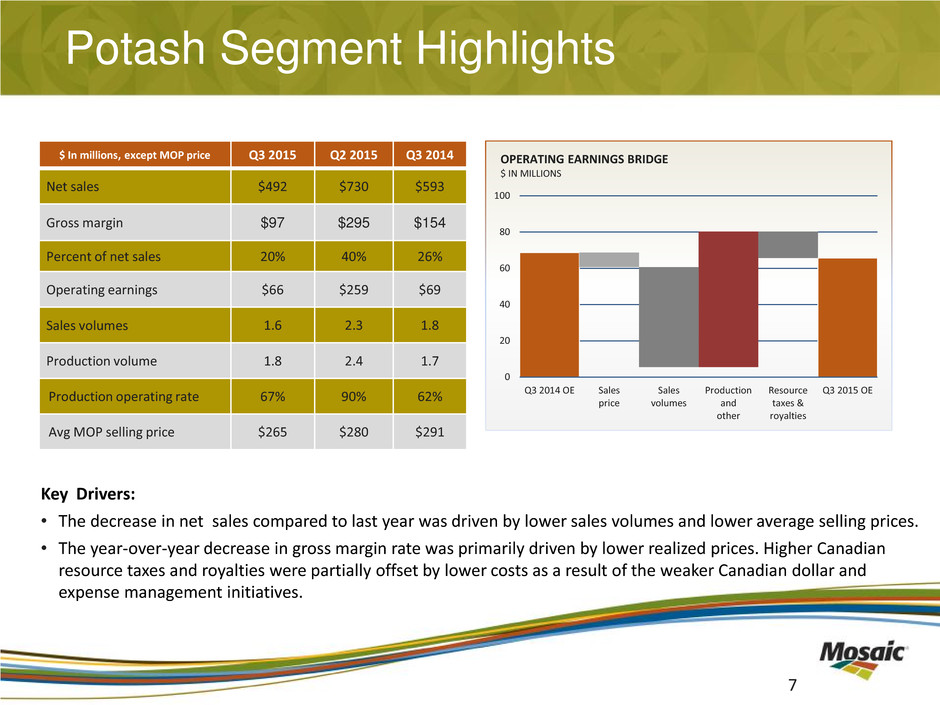

Potash Segment Highlights $ In millions, except MOP price Q3 2015 Q2 2015 Q3 2014 Net sales $492 $730 $593 Gross margin $97 $295 $154 Percent of net sales 20% 40% 26% Operating earnings $66 $259 $69 Sales volumes 1.6 2.3 1.8 Production volume 1.8 2.4 1.7 Production operating rate 67% 90% 62% Avg MOP selling price $265 $280 $291 0 20 40 60 80 100 Q3 2014 OE Sales price Sales volumes Production and other Resource taxes & royalties Q3 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS Key Drivers: • The decrease in net sales compared to last year was driven by lower sales volumes and lower average selling prices. • The year-over-year decrease in gross margin rate was primarily driven by lower realized prices. Higher Canadian resource taxes and royalties were partially offset by lower costs as a result of the weaker Canadian dollar and expense management initiatives. 7

International Distribution Segment Highlights $ In millions, except Blends price Q3 2015 Q2 2015 Q3 2014 Net sales $825 $637 $684 Gross margin $61 $29 $51 Percent of net sales 7% 4% 7% Operating earnings $44 $8 $30 Sales volumes 2.0 1.5 1.4 Margin per tonne $30 $19 $36 Average realized price (FOB destination) $400 $427 $481 0 50 100 150 200 250 Q3 2014 OE Sales volumes & mix Product cost Sales price Other Q3 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS Key Drivers: • The increase in net sales was driven by higher sales volumes, partially offset by lower average realized prices. • Operating earnings were $15 million higher than last year, reflecting a larger business footprint in Latin America. 8

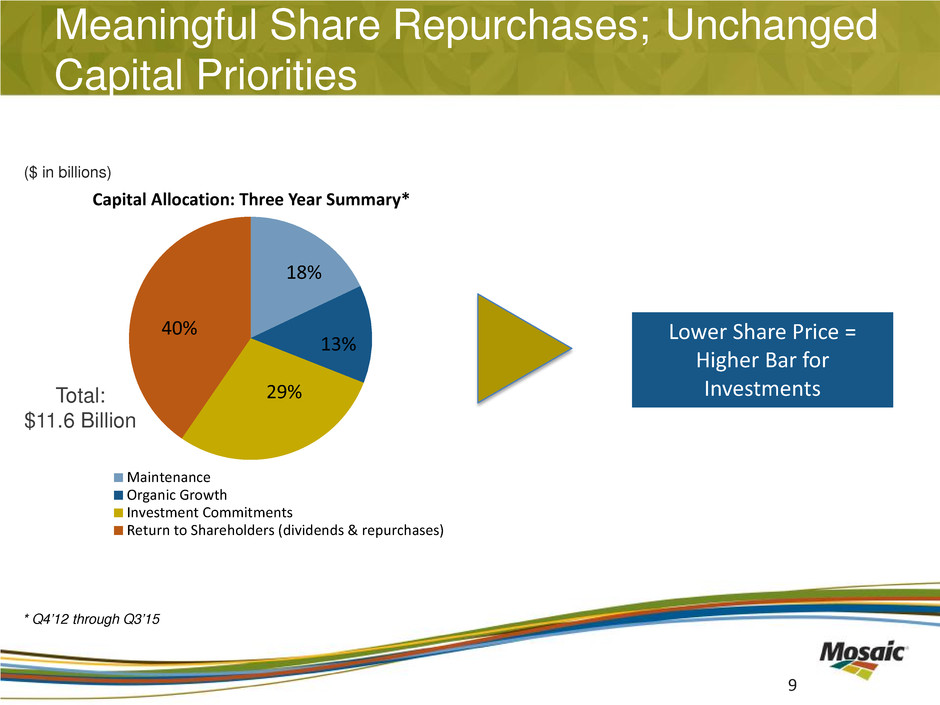

Meaningful Share Repurchases; Unchanged Capital Priorities Lower Share Price = Higher Bar for Investments * Q4’12 through Q3’15 ($ in billions) 18% 13% 29% 40% Capital Allocation: Three Year Summary* Maintenance Organic Growth Investment Commitments Return to Shareholders (dividends & repurchases) Total: $11.6 Billion 9

Financial Guidance Summary Phosphates 2015 Q4 Sales volumes 1.9 to 2.2 million tonnes Q4 DAP selling price $410 to $440 per tonne Q4 Gross margin rate High Teens Q4 Operating rate Around 80 percent International Distribution 2015 Q4 Sales volumes 1.3 to 1.6 million tonnes Q4 Gross margin per tonne $23 to $28 per tonne 10

Financial Guidance Summary Potash 2015 Q4 Sales volumes 1.8 to 2.1 million tonnes Q4 MOP selling price $235 to $255 per tonne Q4 Gross margin rate Mid 20 percent range Q4 Operating rate Around 70 percent Full year Canadian Resources Taxes and Royalties $265 to $295 million Full year brine management costs $170 to $180 million Consolidated Full Year 2015 Total SG&A $350 to $370 million Capital Expenditures and Equity Investments $1.1 to $1.2 billion Effective Tax Rate Mid to high teens 11

Manageable Outlook for Potash; Compelling Phosphates Dynamics 12 59.1 61-63 25 30 35 40 45 50 55 60 65 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Global Potash Shipments Mil Tonnes KCl Source: CRU and Mosaic 65.5 66-68 30 35 40 45 50 55 60 65 70 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Global Phosphate Shipments MMT Product DAP/MAP/NPS/TSP Source: CRU and Mosaic

Closing Commentary

Compelling Free Cash Flow Growth Even at Today’s Nutrient Prices 14 Free cash flow* positive even at current low prices Benefits of investments expected to drive meaningful growth in 2017 Significant upside leverage to higher prices • Free cash flow reconciliation in the appendix.

Thank You The Mosaic Company Earnings Conference Call – Third Quarter 2015 November 3, 2015

Appendix

Q3 2015 Percent Ammonia ($/tonnes) Realized in COGS $418 Average Purchase Price $448 Sulfur ($/ton) Realized in COGS $151 Average Purchase Price $152 Phosphate rock (realized in COGS) ('000 tonnes) U.S. mined rock 3,427 95% Purchased Miski Mayo Rock 154 4% Other Purchased Rock 23 1% Total 3,604 100% Average cost / tonne consumed rock $61 Raw Material Cost Detail 17

(a) These factors do not change in isolation; actual results could vary from the above estimates (b) Assumes no change to KMAG pricing 2015 Q3 Actual Change 2015 Q3 Margin % Actual % Impact on Segment Margin Pre-Tax Impact EPS Impact Marketing MOP Price ($/tonne)(b) $265 $50 20% 15% $74 $0.17 Potash Volume (thousand tonnes) 1,626 500 20% 14% $71 $0.17 DAP Price ($/tonne) $451 $50 19% 10% $102 $0.24 Phosphate Volume (thousand tonnes) 2,049 500 19% 7% $72 $0.17 Raw Materials Sulfur ($/lt) $151 $50 19% 4% $45 $0.11 Ammonia ($/tonne) $418 $50 19% 2% $24 $0.06 Earnings Sensitivity to Key Drivers(a) 18

0 100 200 300 400 500 600 700 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015F Realized Costs Market Prices 0 25 50 75 100 125 150 175 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015F Realized Costs Market Prices Phosphate Raw Material Trends Ammonia Sulfur ($/tonne) ($/tonne) 1. Market ammonia prices are average prices based upon Tampa C&F as reported by Fertecon 2. Market sulfur prices are average prices based upon Tampa C&F as reported by Green Markets 3. Realized raw material costs include: ~$20/tonne of transportation, transformation and storage costs for sulfur ~$30/tonne of transportation and storage costs for ammonia 19

Reconciliation: Adjusted EPS and Free Cash Flow In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company has presented adjusted earnings per share and free cash flow, each of which is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a supplemental numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Neither adjusted diluted earnings per share nor free cash flow is a measure of financial performance under GAAP. Because not all companies use identical calculations, investors should consider that Mosaic’s calculations may not be comparable to other similarly titled measures presented by other companies. Adjusted diluted earnings per share and free cash flow should not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP. Management believes that adjusted diluted earnings per share provides securities analysts, investors and others, in addition to management, with useful supplemental information regarding our performance by excluding certain items that may not be indicative of or are unrelated to our core operating results. Management utilizes adjusted diluted earnings per share in analyzing and assessing the Company’s overall performance, for financial and operating decision-making, and to forecast and plan for future periods. Adjusted diluted earnings per share also assists our management in comparing our and our competitors’ operating results. Free cash flow provides a metric that the Company believes is helpful to investors in evaluating the Company’s ability to generate cash. Free cash flow should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Adjusted Diluted Earnings Per Share 2015 2014 Diluted earnings per share, as reported $0.45 $0.54 Items included in EPS: Foreign currency transaction (gain) loss 0.12 (0.06) Unrealized (gain) loss on derivatives 0.05 0.04 Discrete tax items (0.01) - Write-off of fixed assets 0.02 - Consumption tax refund (0.01) - Share repurchase - (0.01) Severance - 0.01 Adjustments to Argentine assets held for sale - (0.03) Gain on sale of Hersey - (0.03) Carlsbad restructuring expense - 0.10 Diluted earnings per share, as adjusted $0.62 $0.56 Three months ended September 30, Free Cash Flow Nine months ended September 30, US$ Million 2015 Net cash provided by operating activities $ 1,521 Less: Capital expenditures (702) Free cash flow $ 819 20