Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | a2015q38k.htm |

| EX-99.1 - EARNINGS RELEASE - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | a2015q3pressrelease.htm |

November 5, 2015 Fannie Mae 2015 Third Quarter Credit Supplement Exhibit 99.2

This presentation includes information about Fannie Mae, including information contained in Fannie Mae’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, the “2015 Q3 Form 10-Q.” Some of the terms used in these materials are defined and discussed more fully in the 2015 Q3 Form 10-Q and in Fannie Mae’s Form 10-K for the year ended December 31, 2014, the “2014 Form 10-K.” These materials should be reviewed together with the 2015 Q3 Form 10-Q and the 2014 Form 10-K, copies of which are available on the “SEC Filings” page in the “Investor Relations” section of Fannie Mae’s web site at www.fanniemae.com. Some of the information in this presentation is based upon information that we received from third-party sources such as sellers and servicers of mortgage loans. Although we generally consider this information reliable, we do not independently verify all reported information. Due to rounding, amounts reported in this presentation may not add to totals indicated (or 100%). A dash indicates less than 0.05% or a null value. Unless otherwise indicated data labeled as “YTD 2015” is as of September 30, 2015 or for the first nine months of 2015.

2 Table of Contents Home Prices Home Price Growth/Decline Rates in the U.S. 3 One Year Home Price Change as of 2015 Q3 4 Home Price Change From 2006 Q3 Through 2015 Q3 5 Credit Profile of Fannie Mae Single-Family Loans Credit Characteristics of Single-Family Business Acquisitions 6 Credit Risk Profile Summary of Single-Family Business Acquisitions 7 Certain Credit Characteristics of Single-Family Business Acquisitions: 2004 - 2015 8 Single-Family Business Acquisitions by Loan Purpose 9 Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Origination Year 10 Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Certain Product Features 11 Geographic Credit Profile of Fannie Mae Single-Family Loans and Foreclosed Properties (REO) Credit Characteristics of Single-Family Conventional Guaranty Book of Business and Single-Family Real Estate Owned (REO) in Select States 12 Seriously Delinquent Loan and REO Ending Inventory Share by Select States 13 Single-Family Short Sales and REO Sales Prices to UPB of Mortgage Loans 14 Workouts of Fannie Mae Single-Family Loans Single-Family Loan Workouts 15 Re-performance Rates of Modified Single-Family Loans 16 Additional Credit Information for Fannie Mae Single-Family Loans Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business 17 Cumulative Default Rates of Single-Family Conventional Guaranty Book of Business by Origination Year 18 Credit Profile of Fannie Mae Multifamily Loans Multifamily Credit Profile by Loan Attributes 19 Multifamily Credit Profile by Acquisition Year 20 Multifamily Credit Profile 21 Multifamily YTD 2015 Credit Losses by State Through 2015 Q3 22

3 13.6% 13.5% 1.7% -5.4% -12.0% -3.8% -4.1% -3.9% 6.5% 10.7% 4.5% 4.3% 10.6% 11.3% 2.7% -3.6% -9.1% -4.8% -4.3% -3.5% 4.1% 7.9% 4.4% 5.4% -15% -10% -5% 0% 5% 10% 15% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Home Price Growth/Decline Rates in the U.S. Fannie Mae Home Price Index * Year-to-date as of Q3 2015. Estimate based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of September 2015. Including subsequent data may lead to materially different results **Year-to-date as of Q2 2015. As comparison, Fannie Mae’s index for the same period is 4.0%. Based on our home price index, we estimate that home prices on a national basis increased by 1.3% in the third quarter of 2015 and by 5.4% in the first nine months of 2015, following increases of 4.4% in 2014 and 7.9% in 2013. Despite the recent increases in home prices, we estimate that, through September 30, 2015, home prices on a national basis remained 5.6% below their peak in the third quarter of 2006. Our home price estimates are based on preliminary data and are subject to change as additional data become available. * S&P/Case-Shiller Index **

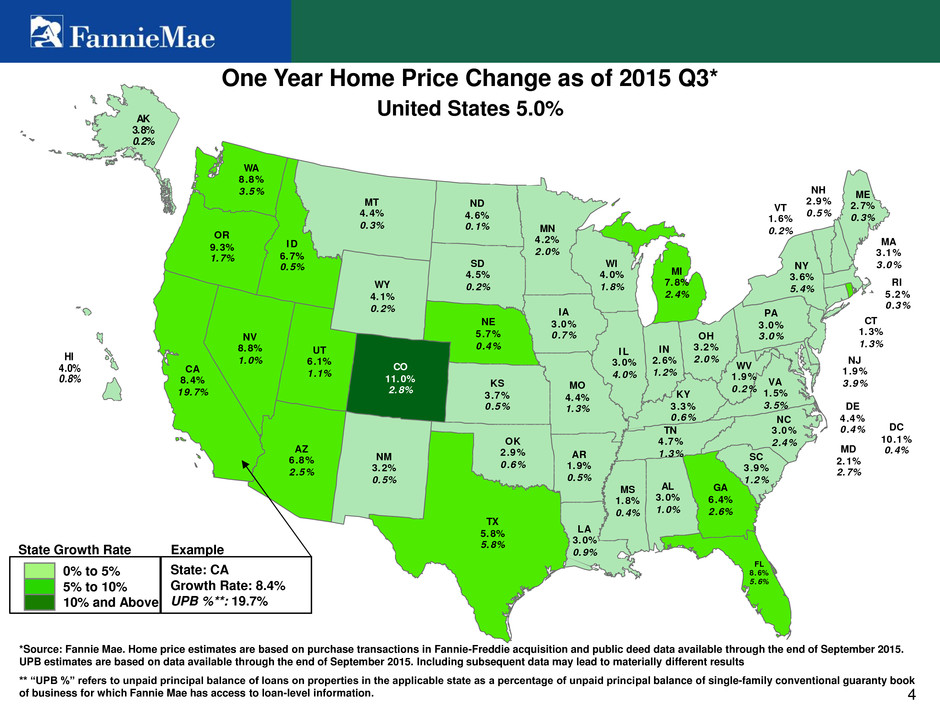

4 AK 3.8% 0.2% WA 8.8% 3.5% HI 4.0% 0.8% TX 5.8% 5.8% MT 4.4% 0.3% CA 8.4% 19.7% NM 3.2% 0.5% AZ 6.8% 2.5% NV 8.8% 1.0% WY 4.1% 0.2% OR 9.3% 1.7% UT 6.1% 1.1% MN 4.2% 2.0% CO 11.0% 2.8% ID 6.7% 0.5% KS 3.7% 0.5% NE 5.7% 0.4% SD 4.5% 0.2% ND 4.6% 0.1% OK 2.9% 0.6% MO 4.4% 1.3% WA 8.8% 3.5% GA 6.4% 2.6% I L 3.0% 4.0% IA 3.0% 0.7% WI 4.0% 1.8% AR 1.9% 0.5% AL 3.0% 1.0% NC 3.0% 2.4% MS 1.8% 0.4% NY 3.6% 5.4% PA 3.0% 3.0%OH 3.2% 2.0% IN 2.6% 1.2% FL 8. 6% 5. 6% LA 3.0% 0.9% TN 4.7% 1.3% MI 7.8% 2.4% KY 3.3% 0.6% VA 1.5% 3.5% ME 2.7% 0.3% SC 3.9% 1.2% WV 1.9% 0.2% MD 2.1% 2.7% VT 1.6% 0.2% NH 2.9% 0.5% MA 3.1% 3.0% NJ 1.9% 3.9% CT 1.3% 1.3% DE 4.4% 0.4% RI 5.2% 0.3% DC 10.1% 0.4% *Source: Fannie Mae. Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of September 2015. UPB estimates are based on data available through the end of September 2015. Including subsequent data may lead to materially different results ** “UPB %” refers to unpaid principal balance of loans on properties in the applicable state as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae has access to loan-level information. One Year Home Price Change as of 2015 Q3* United States 5.0% 0% to 5% 5% to 10% 10% and Above State Growth Rate State: CA Growth Rate: 8.4% UPB %**: 19.7% Example

5 AK 12.7% 0.2% WA -2.5% 3.5% TX 24.1% 5.8% MT 12.8% 0.3% CA -17.2% 19.7% NM -6.7% 0.5% UT 6.9% 1.1% CO 19.1% 2.8% KS 9.0% 0.5% OR -2.3% 1.7% AZ -27.6% 2.5% WY 16.1% 0.2% NV -33.8% 1.0% MN -6.3% 2.0% ID -7.2% 0.5% NE 13.0% 0.4% SD 19.2% 0.2% MO -0.5% 1.3% WA -2.5% 3.5% ND 52.4% 0.1% OK 13.5% 0.6% AR 2.1% 0.5% GA -8.3% 2.6% NC 0.1% 2.4% WI -3.2% 1.8% PA 2.5% 3.0% IA 10.8% 0.7% AL -0.8% 1.0% MS -1.3% 0.4% NY -3.4% 5.4% IN 4.3% 1.2% OH -4.0% 2.0% TN 4.0% 1.3% KY 6.3% 0.6% I L - 13.8% 4.0% FL -29. 6% 5. 6% LA 12.6% 0.9% MI -9.5% 2.4% VA -11.0% 3.5% ME -3.6% 0.3% SC -1.9% 1.2% WV 4.4% 0.2% VT -4.3% 0.2% MA -3.6% 3.0% MD -19.0% 2.7% NH -10.6% 0.5% NJ -19.1% 3.9% CT - 16.9% 1.3% DE -12.9% 0.4% RI -22.4% 0.3% DC 28.4% 0.4% HI -1.1% 0.8% United States -5.6% *Source: Fannie Mae. Home price estimates are based on purchase transactions in Fannie-Freddie acquisition and public deed data available through the end of September 2015. UPB estimates are based on data available through the end of September 2015. Including subsequent data may lead to materially different results. ** “UPB %” refers to unpaid principal balance of loans on properties in the applicable state as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae has access to loan-level information. Note: Home prices on a national basis reached a peak in the third quarter of 2006. Home Price Change From 2006 Q3 Through 2015 Q3* Below -30% -30% to -15% -15% to -5% -5% to 0% 0% to 5% 5% and Above State Growth Rate State: CA Growth Rate: -17.2% UPB %**: 19.7% Example

6 Credit Characteristics of Single-Family Business Acquisitions (1) Single-Family Acquisitions Excl. Refi Plus (2) Single-Family Acquisitions Excl. Refi Plus (2) Single-Family Acquisitions Excl. Refi Plus (2) Single-Family Acquisitions Excl. Refi Plus (2) Single-Family Acquisitions Excl. Refi Plus (2) Single-Family Acquisitions Excl. Refi Plus (2) Unpaid Principal Balance (billions) $124.5 $117.6 $128.1 $118.9 $113.2 $104.9 $369.8 $324.8 $106.0 $97.0 $102.3 $92.2 Weighted Average Origination Note Rate 4.05% 4.04% 3.87% 3.86% 3.98% 3.97% 4.31% 4.28% 4.22% 4.20% 4.28% 4.26% Origination Loan-to-Value (LTV) Ratio <= 60% 17.1% 16.6% 19.6% 18.8% 18.5% 17.8% 15.9% 15.1% 16.5% 15.8% 14.7% 13.9% 60.01% to 70% 12.6% 12.5% 14.4% 14.3% 14.6% 14.6% 12.2% 12.1% 12.7% 12.6% 11.7% 11.5% 70.01% to 80% 40.1% 41.3% 39.7% 41.2% 40.4% 42.0% 40.4% 43.5% 40.8% 42.7% 41.0% 43.5% 80.01% to 90% 12.8% 12.7% 11.8% 11.6% 12.4% 12.2% 13.1% 12.7% 13.3% 13.1% 13.8% 13.6% 90.01% to 100% 16.6% 16.9% 13.8% 14.1% 13.2% 13.4% 16.2% 16.5% 15.6% 15.9% 17.1% 17.5% > 100% 0.7% 0.8% 0.9% 2.2% 1.2% 1.7% Weighted Average Origination LTV Ratio 75.6% 75.7% 74.0% 74.0% 74.2% 74.2% 76.6% 76.1% 75.8% 75.7% 77.1% 76.8% FICO Credit Scores (3) < 620 0.6% 0.0% 0.6% 0.7% 1.2% 0.9% 1.1% 620 to < 660 5.0% 4.5% 4.3% 3.7% 4.6% 4.0% 5.4% 4.4% 5.4% 4.7% 5.4% 4.6% 660 to < 700 12.6% 12.2% 11.1% 10.6% 11.8% 11.4% 13.4% 12.6% 13.2% 12.7% 13.4% 12.7% 700 to < 740 20.7% 20.8% 19.7% 19.8% 20.1% 20.3% 21.0% 21.2% 20.8% 21.0% 21.1% 21.3% >=740 61.1% 62.4% 64.3% 65.8% 62.7% 64.3% 58.9% 61.7% 59.8% 61.6% 59.0% 61.4% Weighted Average FICO Credit Score 747 749 750 753 748 751 744 748 745 748 744 748 Certain Characteristics Fixed-rate 97.5% 97.4% 98.1% 98.0% 97.2% 97.1% 95.3% 94.9% 96.1% 95.9% 95.2% 94.9% Adjustable-rate 2.5% 2.6% 1.9% 2.0% 2.8% 2.9% 4.7% 5.1% 3.9% 4.1% 4.8% 5.1% Alt-A (4) 0.3% 0.4% 0.5% 0.9% 0.6% 0.8% Interest Only Investor 7.7% 7.2% 7.7% 7.0% 8.4% 7.7% 9.0% 7.7% 8.2% 7.4% 8.1% 7.1% Condo/Co-op 10.0% 10.1% 10.3% 10.4% 9.6% 9.6% 10.3% 10.3% 9.9% 10.0% 10.1% 10.1% Refinance 46.1% 42.9% 59.7% 56.6% 63.2% 60.2% 48.3% 41.1% 50.3% 45.7% 43.4% 37.2% Loan Purpose Purchase 53.9% 57.1% 40.3% 43.4% 36.8% 39.8% 51.7% 58.9% 49.7% 54.3% 56.6% 62.8% Cash-out refinance 18.2% 19.3% 18.1% 19.5% 18.8% 20.3% 16.1% 18.3% 18.1% 19.8% 14.9% 16.5% Other refinance 27.9% 23.6% 41.6% 37.0% 44.4% 40.0% 32.2% 22.8% 32.2% 25.9% 28.5% 20.6% Top 3 Geographic Concentration California 20.6% California 24.8% California 25.6% California 21.2% California 22.1% California 20.5% Texas 8.0% Texas 6.9% Texas 6.7% Texas 7.7% Texas 7.5% Texas 8.0% Florida 5.2% Florida 4.9% Florida 4.7% Florida 5.3% Florida 5.1% Florida 5.2% Single-Family Acquisitions Acquisition Period Full Year 2014 Q4 2014 Q3 2014Q1 2015Q2 2015Q3 2015 Single-Family Acquisitions Single-Family Acquisitions Single-Family Acquisitions Single-Family Acquisitions Single-Family Acquisitions (1) Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization transactions. (2) Single-family business acquisitions for the applicable period excluding loans acquired under our Refi PlusTM initiative, which includes the Home Affordable Refinance Program® (“HARP®”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borrowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%. (3) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. (4) Newly originated Alt-A loans for the applicable periods consist of the refinance of existing loans under our Refi Plus initiative. For a description of our Alt-A loan classification criteria, refer to Fannie Mae’s 2015 Q3 Form 10-Q.

7 <= 60% 60.01% to 80% 80.01% to 95% > 95% Total >= 740 10.1% 34.8% 16.5% 0.4% 61.8% 660 to < 740 4.1% 18.3% 11.0% 0.5% 33.8% 620 to < 660 0.7% 2.6% 0.9% 4.3% Total 14.9% 55.7% 28.5% 0.9% 100.0%FIC O C red it S cor e (2 ) For the Nine Months Ended September 30, 2014 Origination Loan-to-Value (LTV) Ratio <= 60% 60.01% to 80% 80.01% to 95% > 95% Total >= 740 12.8% 35.5% 15.2% 0.7% 64.2% 660 to < 740 4.3% 17.2% 9.4% 0.8% 31.7% 620 to < 660 0.7% 2.4% 0.9% 0.1% 4.1% Total 17.7% 55.2% 2 .5% 1.5% 10 0FIC O C red it S cor e (2 ) For the Nine Months Ended September 30, 2015 Origination Loan-to-V lue ( TV) Ratio <= 60% 60.01% to 80% 80.01% to 100% > 100% Total >= 740 10.1% 31.6% 16.1% 0.9% 58.6% 660 to < 740 4.5% 17.4% 11.6% 1.1% 34.5% 620 to < 660 0.9% 2.8% 1.4% 0.4% 5.4% < 620 0.2% 0.4% 0.4% 0.3% 1.4% Total 15.7% 52.2 29.5 2.6% 100.0%FIC O C red it S cor e (2 ) For the Nine Months Ended September 30, 2014 Origination Loan-to-Value (LTV) Ratio <= 60% 60.01% to 80% 80.01% to 100% > 100% Total >= 740 12.9% 34.2% 15.4% 0.3% 62.8% 660 to < 740 4.6% 16.9% 10.2% 0.3% 32.0% 620 to < 660 0.8% 2.5% 1.1% 0.1% 4.6% < 620 0.1% 0.2% 0.2% 0.1% 0.6% Total 18.4% 53.9 26.9 0.8% 100 0FIC O C red it S cor e (2 ) For the Nine Months Ended September 30, 2015 Origination Loan-to-V lue ( TV) Ratio <= 60% 60.01% to 80% 80.01% to 95% > 95% Total >= 740 2.7% 0.8% -1.3% 0.2% 2.4% 660 to < 740 0.2% -1.0% -1.6% 0.3% -2.1% 62 to < 660 -0.2% -0.1% -0.2% Total 2.8% -0.5% -3.0% .6% FIC O C red it S cor e (2 ) Change in Acquisitions Profile Origination Loan-to-Value (LTV) Ratio <= 60% 6 .01% to 80% 80.01% to 100% > 100% Total >= 740 2.8% 2.6% -0.6% -0.6% 4.2% 6 0 to < 740 0.1% -0.4% -1.4% -0.8% -2.5% 62 to < 660 -0.1% -0.2% -0.3% -0.3% -0.9% < 6 0 -0.1% -0.2% -0.3% -0.2% -0.8% Total .7% 1.7% -2.6% -1.8% Change in Acquisitions Profile Origination Loan-to-Value (LTV) Ratio FIC O C red it S cor e (2 )Credit Risk Profile Summary of Single-Family Business Acquisitions (1) Credit Profile for Single-Family Acquisitions (1) Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization transactions. (2) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. FICO credit scores below 620 primarily consist of the refinance of existing loans under our Refi Plus initiative, which includes the Home Affordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borrowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%. (3) Single-family business acquisitions for the applicable period excluding loans acquired under our Refi Plus initiative, which includes HARP. Credit Profile for Singl -Family Acquisitions (Excluding Refi Plus) (3)

8 0% 20% 40% 60% 80% 100% 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015* Share of Single-Family Business Acquisitions: Loan Purpose - Purchase 0% 20% 40% 60% 80% 100% 2004 2005 2006 20 7 20 8 2009 201 2011 2012 2013 2014 2015* Share of Single-Family Business Acquisitions: Fixed Rate Product 0% 5% 10% 15% 20% 660 680 700 720 740 760 780 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015* Weighted Average FICO Credit Score (Left Axis) FICO Credit Score < 620 (Right Axis) Certain Credit Characteristics of Single-Family Business Acquisitions: 2004 – 2015(1) (1) Percentage calculated based on unpaid principal balance of loans at time of acquisition. Single-family business acquisitions refer to single-family mortgage loans we acquire through purchase or securitization transactions. (2) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. Loans acquired after 2009 with FICO credit scores below 620 primarily consist of the refinance of existing loans under our Refi Plus initiative, which includes HARP. FICO Credit Score (2) Origination Loan-to-Value Ratio Product Feature * Year-to-date through September 30, 2015.

9 4.1% 9.8% 9.9% 15.6% 13.7% 5.8% 2.5% 6.5% 13.6% 14.4% 8.9% 8.8% 6.4% 4.2% 69.4% 54.0% 52.2% 55.0% 47.7% 36.1% 49.5% 20.1% 22.6% 23.5% 20.6% 29.8% 51.7% 43.9% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 2009 2010 2011 2012 2013 2014 2015* % o f Si ngl e-Fa mil y B usi ness Acq uis itio ns HARP Acquisitions Refi Plus Acquisitions (Excluding HARP) Refinance Acquisitions (Excluding Refi Plus) Purchase Acquisitions HARP (1) Refi Plus (Excluding HARP) (1) HARP (1) Refi Plus (Excluding HARP) (1) HARP (1) Refi Plus (Excluding HARP) (1) HARP (1) Refi Plus (Excluding HARP) (1) HARP (1) Refi Plus (Excluding HARP) (1) HARP (1) Refi Plus (Excluding HARP) (1) HARP (1) Refi Plus (Excluding HARP) (1) Unpaid Principal Balance (billions) $27.9 $44.7 $59.0 $80.5 $55.6 $81.2 $129.9 $73.8 $99.5 $64.4 $21.5 $23.5 $9.0 $15.5 Weighted Average Origination Note Rate 5.05% 4.85% 5.00% 4.68% 4.78% 4.44% 4.14% 3.89% 4.04% 3.80% 4.62% 4.39% 4.23% 4.08% Origination Loan-to-Value Ratio: <=80% 100% 100% 100% 100% 100% 100% 100% 80.01 to 105% 99.1% 94.4% 88.1% 57.2% 58.4% 73.3% 78.2% 105.01% to 125% 0.9% 5.6% 11.9% 22.1% 21.5% 16.9% 14.8% >125% 20.7 20.1 9.9% 7.1% Weighted Average Origination Loan-to-Value Ratio 90.7% 63.3% 92.2% 62.3% 94.3% 60.2% 111.0% 61.1% 109.8% 60.2% 101.5% 61.3% 98.5% 60.3% FICO Credit Scores (2) < 620 1.2% 0.8% 2.0% 1.4% 2.1% 1.7% 3.7% 2.9% 6.7% 5.3% 10.6% 9.3% 9.5% 8.4% 620 to < 660 2.5 1.7 3.6 2.4 3.8 2.8 6.0 4.2 9.5 6.9 14.5 11.2% 14.3% 10.1% 660 to < 740 31.9% 23.0% 33.1% 23.9% 32.6% 25.6% 33.8% 26.0% 38.7% 31.9% 41.0% 36.5 40.6 33.9 >=740 64.4 74.5 61.2 72.3 61.5 70.0 56.6 66.9 45.1 55.8 33.9 43.0% 35.6% 47.6% Weighted Average FICO Credit Score 749 762 746 760 746 758 738 753 722 737 704 717 707 724 2015*2013 2014 Acquisition Year 2009 2010 2011 2012 Single-Family Business Acquisitions by Loan Purpose (1) Our Refi Plus initiative, which started in April 2009, includes the Home Affordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borrowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%. (2) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. * Year-to-date through September 30, 2015.

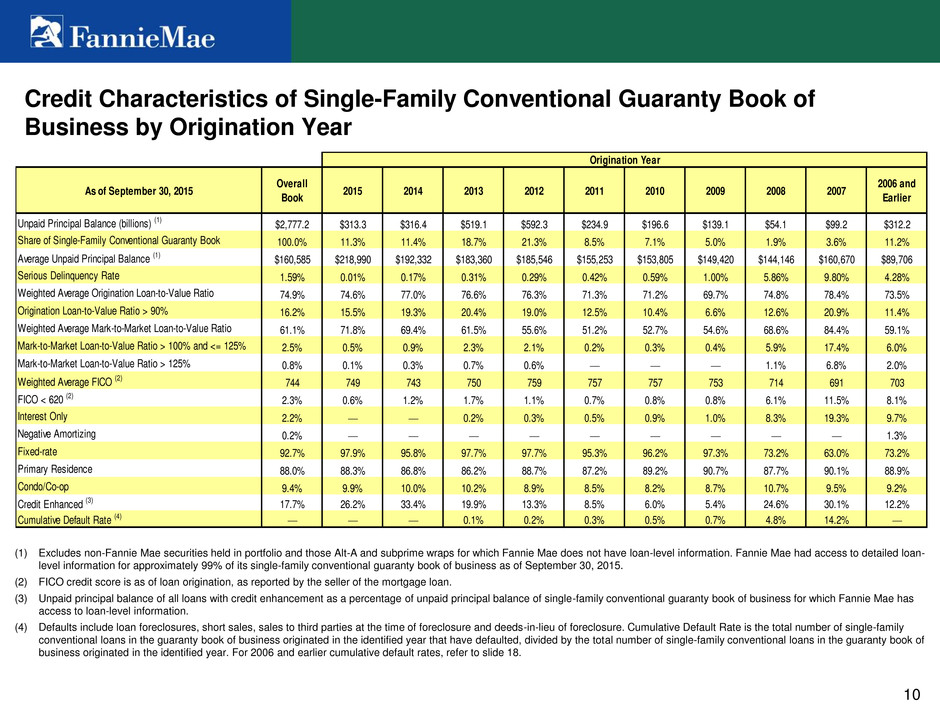

10 As of September 30, 2015 Overall Book 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 and Earlier Unpaid Principal Balance (billions) (1) $2,777.2 $313.3 $316.4 $519.1 $592.3 $234.9 $196.6 $139.1 $54.1 $99.2 $312.2 Share of Single-Family Conventional Guaranty Book 100.0% 11.3% 11.4% 18.7% 21.3% 8.5% 7.1% 5.0% 1.9% 3.6% 11.2% Average Unpaid Principal Balance (1) $160,585 $218,990 $192,332 $183,360 $185,546 $155,253 $153,805 $149,420 $144,146 $160,670 $89,706 Serious Delinquency Rate 1.59% 0.01% 0.17% 0.31% 0.29% 0.42% 0.59% 1.00% 5.86% 9.80% 4.28% Weighted Average Origination Loan-to-Value Ratio 74.9% 74.6% 77.0% 76.6% 76.3% 71.3% 71.2% 69.7% 74.8% 78.4% 73.5% Origination Loan-to-Value Ratio > 90% 16.2% 15.5% 19.3% 20.4% 19.0% 12.5% 10.4% 6.6% 12.6% 20.9% 11.4% Weighted Average Mark-to-Market Loan-to-Value Ratio 61.1% 71.8% 69.4% 61.5% 55.6% 51.2% 52.7% 54.6% 68.6% 84.4% 59.1% Mark-to-Market Loan-to-Value Ratio > 100% and <= 125% 2.5% 0.5% 0.9% 2.3% 2.1% 0.2% 0.3% 0.4% 5.9% 17.4% 6.0% Mark-to-Market Loan-to-Value Ratio > 125% 0.8% 0.1% 0.3% 0.7% 0.6% 1.1% 6.8% 2.0% Weighted Average FICO (2) 744 749 743 750 759 757 757 753 714 691 703 FICO < 620 (2) 2.3% 0.6% 1.2% 1.7% 1.1% 0.7% 0.8% 0.8% 6.1% 11.5% 8.1% Interest Only 2.2% 0.2% 0.3% 0.5% 0.9% 1.0% 8.3% 19.3% 9.7% Negative Amortizing 0.2% 1.3% Fixed-rate 92.7% 97.9% 95.8% 97.7% 97.7% 95.3% 96.2% 97.3% 73.2% 63.0% 73.2% Primary Residence 88.0% 88.3% 86.8% 86.2% 88.7% 87.2% 89.2% 90.7% 87.7% 90.1% 88.9% Condo/Co-op 9.4% 9.9% 10.0% 10.2% 8.9% 8.5% 8.2% 8.7% 10.7% 9.5% 9.2% Credit Enhanced (3) 17.7% 26.2% 33.4% 19.9% 13.3% 8.5% 6.0% 5.4% 24.6% 30.1% 12.2% Cumulative Default Rate (4) 0.1% 0.2% 0.3% 0.5% 0.7% 4.8% 14.2% Origination Year Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Origination Year (1) Excludes non-Fannie Mae securities held in portfolio and those Alt-A and subprime wraps for which Fannie Mae does not have loan-level information. Fannie Mae had access to detailed loan- level information for approximately 99% of its single-family conventional guaranty book of business as of September 30, 2015. (2) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. (3) Unpaid principal balance of all loans with credit enhancement as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae has access to loan-level information. (4) Defaults include loan foreclosures, short sales, sales to third parties at the time of foreclosure and deeds-in-lieu of foreclosure. Cumulative Default Rate is the total number of single-family conventional loans in the guaranty book of business originated in the identified year that have defaulted, divided by the total number of single-family conventional loans in the guaranty book of business originated in the identified year. For 2006 and earlier cumulative default rates, refer to slide 18.

11 As of September 30, 2015 Interest Only Loans Loans with FICO < 620 (2) Loans with FICO ≥ 620 and < 660 (2) Loans with Origination LTV Ratio > 90% Loans with FICO < 620 and Origination LTV Ratio > 90% Alt-A Loans (3) Refi Plus Including HARP (4) Subtotal of Certain Product Features (1) Unpaid Principal Balance (billions) (5) $61.0 $65.0 $152.1 $450.0 $19.4 $105.9 $499.6 $975.2 Share of Single-Family Conventional Guaranty Book 2.2% 2.3% 5.5% 16.2% 0.7% 3.8% 18.0% 35.1% Average Unpaid Principal Balance (5) $230,157 $118,263 $133,561 $171,574 $133,231 $148,117 $155,135 $152,486 Serious Delinquency Rate 8.19% 7.88% 5.13% 2.36% 8.87% 6.75% 0.74% 2.87% Acquisition Years 2005 - 2008 81.8% 41.8% 31.5% 10.0% 31.4% 60.0% 17.9% Weighted Average Origination Loan-to-Value Ratio 74.2% 81.6% 79.3% 104.0% 108.1% 78.3% 86.7% 85.5% Origination Loan-to-Value Ratio > 90% 8.0% 29.9% 23.2% 100.0% 100.0% 15.5% 39.7% 46.1% Weighted Average Mark-to-Market Loan-to-Value Ratio 81.3% 72.2% 69.6% 85.6% 93.0% 74.2% 66.7% 71.5% Mark-to-Market Loan-to-Value Ratio > 100% and <= 125% 16.8% 9.9% 7.2% 9.6% 21.4% 12.5% 6.0% 6.2% Mark-to-Market Loan-to-Value Ratio > 125% 6.1% 3.8% 2.6% 3.3% 9.3% 4.6% 1.7% 2.0% Weighted Average FICO (2) 722 583 642 729 583 712 735 719 FICO < 620 (2) 1.6% 100.0% 4.3% 100.0% 2.7% 4.9% 6.7% Fixed-rate 23.6% 83.3% 86.2% 95.7% 88.2% 65.2% 98.9% 89.5% Primary Residence 85.6% 94.5% 93.1% 92.0% 94.2% 76.9% 84.6% 89.3% Condo/Co-op 14.7% 4.7% 6.1% 9.9% 5.9% 9.8% 9.4% 8.9% Credit Enhanced (6) 13.5% 22.9% 21.5% 62.1% 54.9% 10.5% 12.4% 31.5% Categories Not Mutually Exclusive (1) (1) Loans with multiple product features are included in all applicable categories. The subtotal is calculated by counting a loan only once even if it is included in multiple categories. (2) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. (3) For a description of our Alt-A loan classification criteria, refer to Fannie Mae’s 2015 Q3 Form 10-Q. (4) Our Refi Plus initiative, which started in April 2009, includes the Home Affordable Refinance Program (“HARP”). Our Refi Plus initiative provides expanded refinance opportunities for eligible Fannie Mae borrowers, and may involve the refinance of existing Fannie Mae loans with high loan-to-value ratios, including loans with loan-to-value ratios in excess of 100%. (5) Excludes non-Fannie Mae securities held in portfolio and those Alt-A and subprime wraps for which Fannie Mae does not have loan-level information. Fannie Mae had access to detailed loan-level information for approximately 99% of its single-family conventional guaranty book of business as of September 30, 2015. (6) Unpaid principal balance of all loans with credit enhancement as a percentage of unpaid principal balance of single-family conventional guaranty book of business for which Fannie Mae had access to loan-level information. Credit Characteristics of Single-Family Conventional Guaranty Book of Business by Certain Product Features

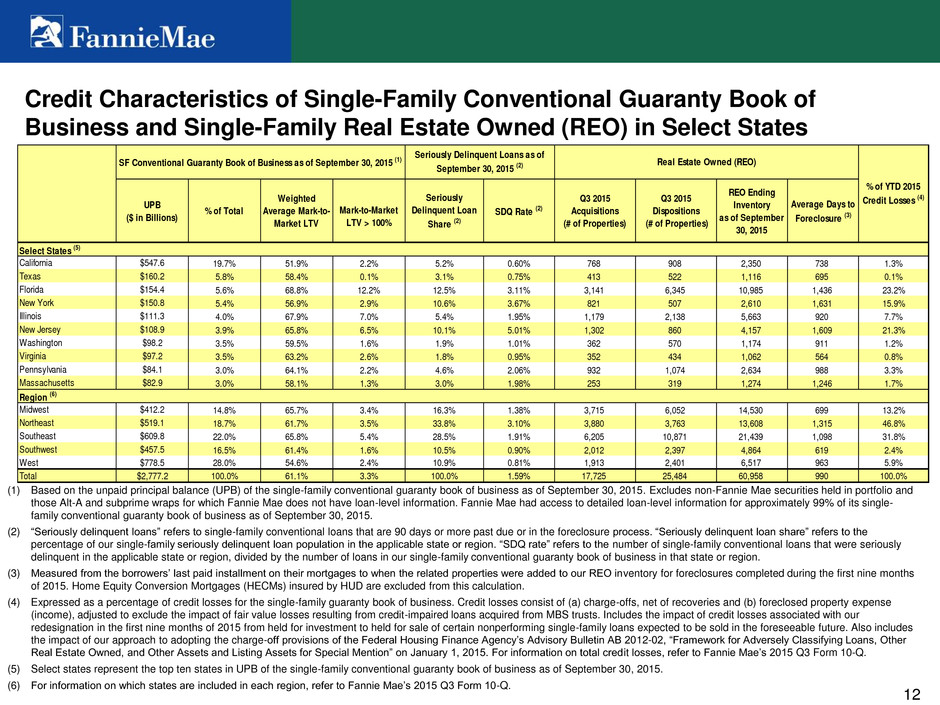

12 UPB ($ in Billions) % of Total Weighted Average Mark-to- Market LTV Mark-to-Market LTV > 100% Seriously Delinquent Loan Share (2) SDQ Rate (2) Q3 2015 Acquisitions (# of Properties) Q3 2015 Dispositions (# of Properties) REO Ending Inventory as of September 30, 2015 Average Days to Foreclosure (3) Select States (5) California $547.6 19.7% 51.9% 2.2% 5.2% 0.60% 768 908 2,350 738 1.3% Texas $160.2 5.8% 58.4% 0.1% 3.1% 0.75% 413 522 1,116 695 0.1% Florida $154.4 5.6% 68.8% 12.2% 12.5% 3.11% 3,141 6,345 10,985 1,436 23.2% New York $150.8 5.4% 56.9% 2.9% 10.6% 3.67% 821 507 2,610 1,631 15.9% Illinois $111.3 4.0% 67.9% 7.0% 5.4% 1.95% 1,179 2,138 5,663 920 7.7% New Jersey $108.9 3.9% 65.8% 6.5% 10.1% 5.01% 1,302 860 4,157 1,609 21.3% Washington $98.2 3.5% 59.5% 1.6% 1.9% 1.01% 362 570 1,174 911 1.2% Virginia $97.2 3.5% 63.2% 2.6% 1.8% 0.95% 352 434 1,062 564 0.8% Pennsylvania $84.1 3.0% 64.1% 2.2% 4.6% 2.06% 932 1,074 2,634 988 3.3% Massachusetts $82.9 3.0% 58.1% 1.3% 3.0% 1.98% 253 319 1,274 1,246 1.7% Region (6) Midwest $412.2 14.8% 65.7% 3.4% 16.3% 1.38% 3,715 6,052 14,530 699 13.2% Northeast $519.1 18.7% 61.7% 3.5% 33.8% 3.10% 3,880 3,763 13,608 1,315 46.8% Southeast $609.8 22.0% 65.8% 5.4% 28.5% 1.91% 6,205 10,871 21,439 1,098 31.8% Southwest $457.5 16.5% 61.4% 1.6% 10.5% 0.90% 2,012 2,397 4,864 619 2.4% West $778.5 28.0% 54.6% 2.4% 10.9% 0.81% 1,913 2,401 6,517 963 5.9% Total $2,777.2 100.0% 61.1% 3.3% 100.0% 1.59% 17,725 25,484 60,958 990 100.0% SF Conventional Guaranty Book of Business as of September 30, 2015 (1) Seriously Delinquent Loans as of September 30, 2015 (2) Real Estate Owned (REO) % of YTD 2015 Credit Losses (4) Credit Characteristics of Single-Family Conventional Guaranty Book of Business and Single-Family Real Estate Owned (REO) in Select States (1) Based on the unpaid principal balance (UPB) of the single-family conventional guaranty book of business as of September 30, 2015. Excludes non-Fannie Mae securities held in portfolio and those Alt-A and subprime wraps for which Fannie Mae does not have loan-level information. Fannie Mae had access to detailed loan-level information for approximately 99% of its single- family conventional guaranty book of business as of September 30, 2015. (2) “Seriously delinquent loans” refers to single-family conventional loans that are 90 days or more past due or in the foreclosure process. “Seriously delinquent loan share” refers to the percentage of our single-family seriously delinquent loan population in the applicable state or region. “SDQ rate” refers to the number of single-family conventional loans that were seriously delinquent in the applicable state or region, divided by the number of loans in our single-family conventional guaranty book of business in that state or region. (3) Measured from the borrowers’ last paid installment on their mortgages to when the related properties were added to our REO inventory for foreclosures completed during the first nine months of 2015. Home Equity Conversion Mortgages (HECMs) insured by HUD are excluded from this calculation. (4) Expressed as a percentage of credit losses for the single-family guaranty book of business. Credit losses consist of (a) charge-offs, net of recoveries and (b) foreclosed property expense (income), adjusted to exclude the impact of fair value losses resulting from credit-impaired loans acquired from MBS trusts. Includes the impact of credit losses associated with our redesignation in the first nine months of 2015 from held for investment to held for sale of certain nonperforming single-family loans expected to be sold in the foreseeable future. Also includes the impact of our approach to adopting the charge-off provisions of the Federal Housing Finance Agency’s Advisory Bulletin AB 2012-02, “Framework for Adversely Classifying Loans, Other Real Estate Owned, and Other Assets and Listing Assets for Special Mention” on January 1, 2015. For information on total credit losses, refer to Fannie Mae’s 2015 Q3 Form 10-Q. (5) Select states represent the top ten states in UPB of the single-family conventional guaranty book of business as of September 30, 2015. (6) For information on which states are included in each region, refer to Fannie Mae’s 2015 Q3 Form 10-Q.

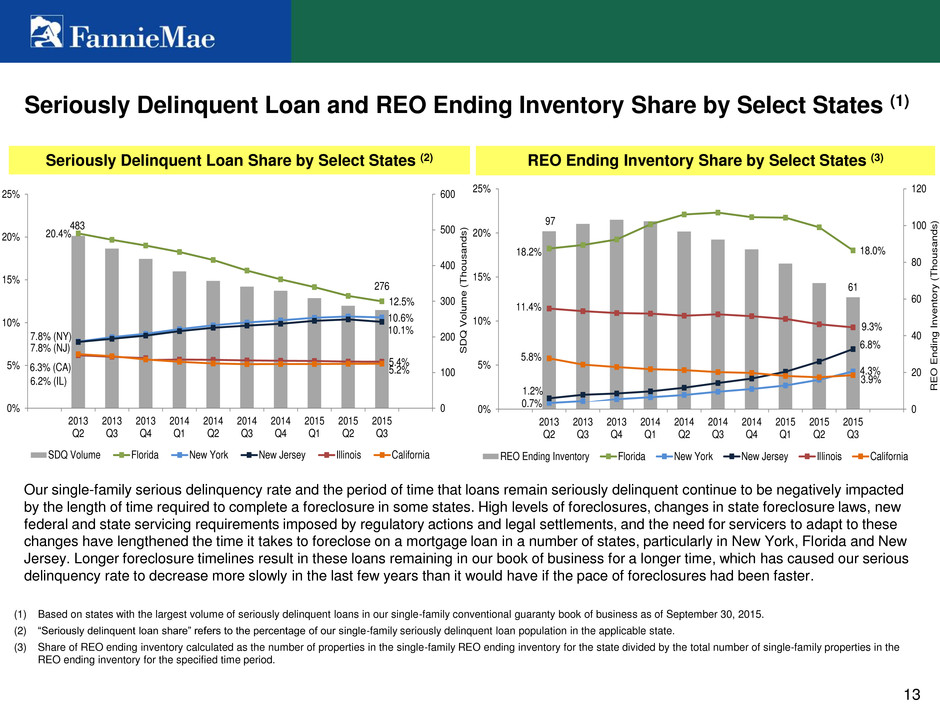

13 97 61 18.2% 18.0% 0.7% 4.3% 1.2% 6.8% 11.4% 9.3% 5.8% 3.9% 0 20 40 60 80 100 120 0% 5% 10% 15% 20% 25% 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 RE O En din g In ve nt or y ( Th ous an ds ) REO Ending Inventory Florida New York New Jersey Illinois California 483 276 20.4% 12.5% 7.8% (NJ) 10.6% 7.8% (NY) 10.1% 6.2% (IL) 5.4%6.3% (CA) 5.2% 0 100 200 300 400 500 600 0% 5% 10% 15% 20% 25% 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 SD Q Vo lume (T ho us an ds ) SDQ Volume Florida New York New Jersey Illinois California Seriously Delinquent Loan and REO Ending Inventory Share by Select States (1) Seriously Delinquent Loan Share by Select States (2) REO Ending Inventory Share by Select States (3) Our single-family serious delinquency rate and the period of time that loans remain seriously delinquent continue to be negatively impacted by the length of time required to complete a foreclosure in some states. High levels of foreclosures, changes in state foreclosure laws, new federal and state servicing requirements imposed by regulatory actions and legal settlements, and the need for servicers to adapt to these changes have lengthened the time it takes to foreclose on a mortgage loan in a number of states, particularly in New York, Florida and New Jersey. Longer foreclosure timelines result in these loans remaining in our book of business for a longer time, which has caused our serious delinquency rate to decrease more slowly in the last few years than it would have if the pace of foreclosures had been faster. (1) Based on states with the largest volume of seriously delinquent loans in our single-family conventional guaranty book of business as of September 30, 2015. (2) “Seriously delinquent loan share” refers to the percentage of our single-family seriously delinquent loan population in the applicable state. (3) Share of REO ending inventory calculated as the number of properties in the single-family REO ending inventory for the state divided by the total number of single-family properties in the REO ending inventory for the specified time period.

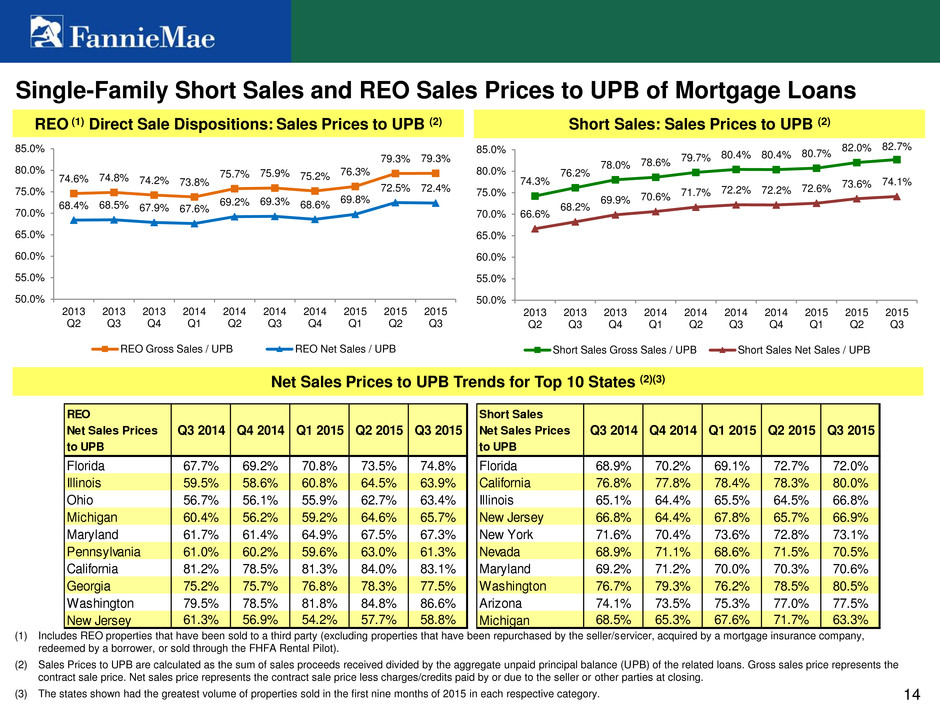

14 74.3% 76.2% 78.0% 78.6% 79.7% 80.4% 80.4% 80.7% 82.0% 82.7% 66.6% 68.2% 69.9% 70.6% 71.7% 72.2% 72.2% 72.6% 73.6% 74.1% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 Short Sales Gross Sales / UPB Short Sales Net Sales / UPB Short Sales Net Sales Prices to UPB Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Florida 68.9% 70.2% 69.1% 72.7% 7 .0% California 76.8% 77.8% 78.4% 78.3% 80.0% Illinois 65.1% 64.4% 65.5% 64.5% 66.8% New Jersey 66.8% 64.4% 67.8% 65.7% 66.9% New York 71.6% 70.4% 73.6% 72.8% 73.1% Nevada 68.9% 71.1% 68.6% 71.5% 70.5% Maryland 69.2% 71.2% 70.0% 70.3% 70.6% Washington 76.7% 79.3% 76.2% 78.5% 80.5% Arizona 74.1% 73.5% 75.3% 77.0% 77.5% Michigan 68.5% 65.3% 67.6% 71.7% 63.3% Single-Family Short Sales and REO Sales Prices to UPB of Mortgage Loans REO (1) Direct Sale Dispositions: Sales Prices to UPB (2) Short Sales: Sales Prices to UPB (2) Net Sales Prices to UPB Trends for Top 10 States (2)(3) 74.6% 74.8% 74.2% 73.8% 75.7% 75.9% 75.2% 76.3% 79.3% 79.3% 68.4% 68.5% 67.9% 67. % 69.2% 69.3% 68.6% 69.8% 72.5% 72.4% 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 REO Gross Sales / UPB REO Net Sales / UPB (1) Includes REO properties that have been sold to a third party (excluding properties that have been repurchased by the seller/servicer, acquired by a mortgage insurance company, redeemed by a borrower, or sold through the FHFA Rental Pilot). (2) Sales Prices to UPB are calculated as the sum of sales proceeds received divided by the aggregate unpaid principal balance (UPB) of the related loans. Gross sales price represents the contract sale price. Net sales price represents the contract sale price less charges/credits paid by or due to the seller or other parties at closing. (3) The states shown had the greatest volume of properties sold in the first nine months of 2015 in each respective category. REO Net Sales Prices to UPB Q3 2014 Q4 2014 Q 2015 Q2 2015 Q3 2015 Florida 67.7% 69.2% 7 .8% 73.5% 74.8% Illinois 59.5% 58.6% 60.8% 64.5% 63.9% Ohio 56.7% 56.1% 55.9% 62.7% 63.4% Michigan 60.4% 56.2% 59.2% 64.6% 65.7% Maryland 61.7% 61.4% 64.9% 67.5% 67.3% Pennsylvania 61.0% 60.2% 59.6% 63.0% 61.3% California 81.2% 78.5% 81.3% 84.0% 83.1% Georgia 75.2% 75.7% 76.8% 78.3% 77.5% Washington 79.5% 78.5% 81.8% 84.8% 86.6% New Jersey 61.3% 56.9% 54.2% 57.7% 58.8%

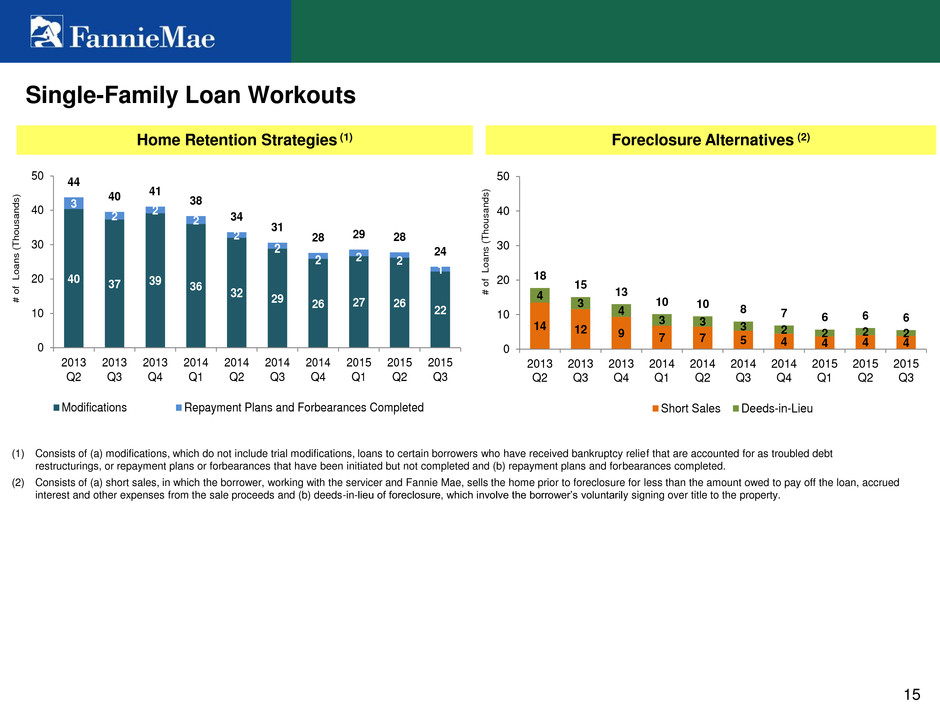

15 40 37 39 36 32 29 26 27 26 22 3 2 2 2 2 2 2 2 2 1 44 40 41 38 34 31 28 29 28 24 0 10 20 30 40 50 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 # o f L oa ns (Th ou sa nd s) Modifications Repayment Plans and Forbearances Completed 14 12 9 7 7 5 4 4 4 4 4 3 4 3 3 3 2 2 2 2 18 15 13 10 10 8 7 6 6 6 0 10 20 30 40 50 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 # o f L oa ns (Th ou sa nd s) Short Sales D eds-in-Lieu Single-Family Loan Workouts Foreclosure Alternatives (2) Home Retention Strategies (1) (1) Consists of (a) modifications, which do not include trial modifications, loans to certain borrowers who have received bankruptcy relief that are accounted for as troubled debt restructurings, or repayment plans or forbearances that have been initiated but not completed and (b) repayment plans and forbearances completed. (2) Consists of (a) short sales, in which the borrower, working with the servicer and Fannie Mae, sells the home prior to foreclosure for less than the amount owed to pay off the loan, accrued interest and other expenses from the sale proceeds and (b) deeds-in-lieu of foreclosure, which involve the borrower’s voluntarily signing over title to the property.

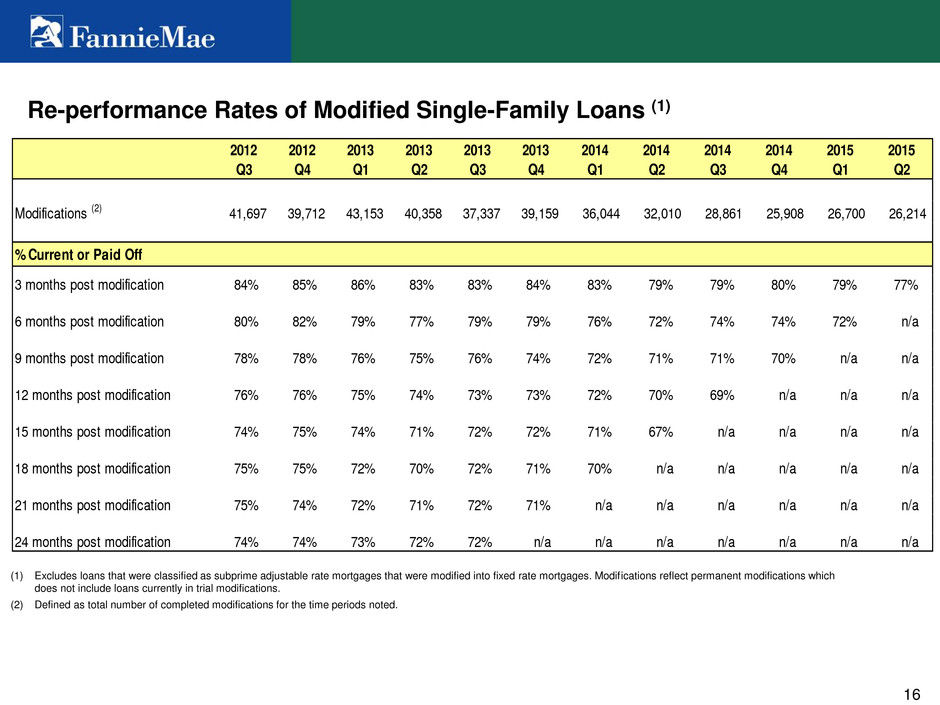

16 2012 Q3 2012 Q4 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 2015 Q1 2015 Q2 Modifications (2) 41,697 39,712 43,153 40,358 37,337 39,159 36,044 32,010 28,861 25,908 26,700 26,214 % Current or Paid Off 3 months post modification 84% 85% 86% 83% 83% 84% 83% 79% 79% 80% 79% 77% 6 months post modification 80% 82% 79% 77% 79% 79% 76% 72% 74% 74% 72% n/a 9 months post modification 78% 78% 76% 75% 76% 74% 72% 71% 71% 70% n/a n/a 12 months post modification 76% 76% 75% 74% 73% 73% 72% 70% 69% n/a n/a n/a 15 months post modification 74% 75% 74% 71% 72% 72% 71% 67% n/a n/a n/a n/a 18 months post modification 75% 75% 72% 70% 72% 71% 70% n/a n/a n/a n/a n/a 21 months post modification 75% 74% 72% 71% 72% 71% n/a n/a n/a n/a n/a n/a 24 months post modification 74% 74% 73% 72% 72% n/a n/a n/a n/a n/a n/a n/a Re-performance Rates of Modified Single-Family Loans (1) (1) Excludes loans that were classified as subprime adjustable rate mortgages that were modified into fixed rate mortgages. Modifications reflect permanent modifications which does not include loans currently in trial modifications. (2) Defined as total number of completed modifications for the time periods noted.

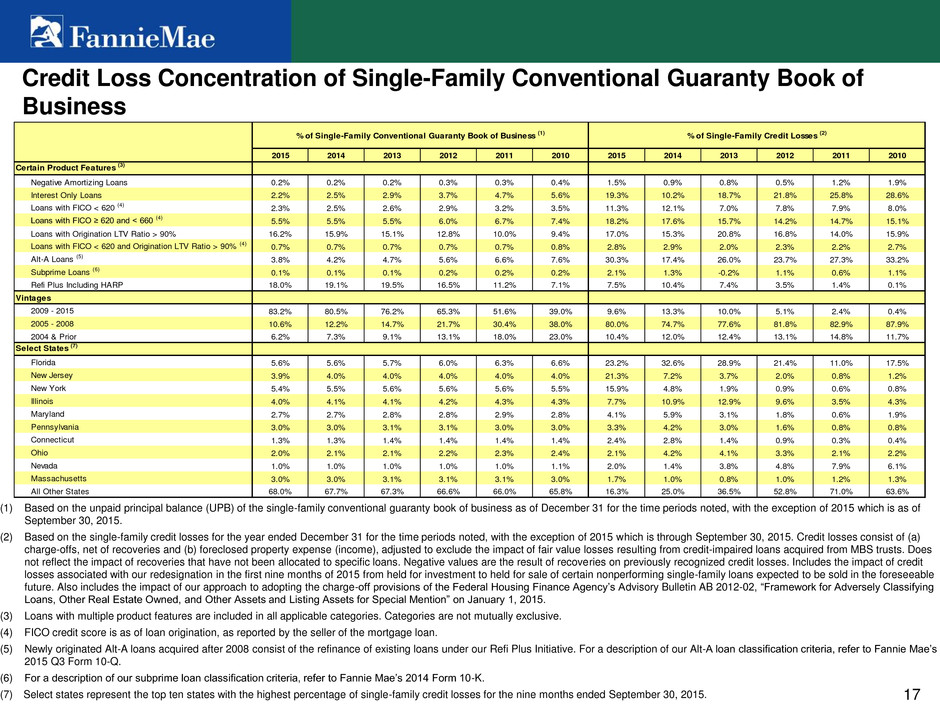

17 2015 2014 2013 2012 2011 2010 2015 2014 2013 2012 2011 2010 Certain Product Features (3) Negative Amortizing Loans 0.2% 0.2% 0.2% 0.3% 0.3% 0.4% 1.5% 0.9% 0.8% 0.5% 1.2% 1.9% Interest Only Loans 2.2% 2.5% 2.9% 3.7% 4.7% 5.6% 19.3% 10.2% 18.7% 21.8% 25.8% 28.6% Loans with FICO < 620 (4) 2.3% 2.5% 2.6% 2.9% 3.2% 3.5% 11.3% 12.1% 7.0% 7.8% 7.9% 8.0% Loans with FICO ≥ 620 and < 660 (4) 5.5% 5.5% 5.5% 6.0% 6.7% 7.4% 18.2% 17.6% 15.7% 14.2% 14.7% 15.1% Loans with Origination LTV Ratio > 90% 16.2% 15.9% 15.1% 12.8% 10.0% 9.4% 17.0% 15.3% 20.8% 16.8% 14.0% 15.9% Loans with FICO < 620 and Origination LTV Ratio > 90% (4) 0.7% 0.7% 0.7% 0.7% 0.7% 0.8% 2.8% 2.9% 2.0% 2.3% 2.2% 2.7% Alt-A Loans (5) 3.8% 4.2% 4.7% 5.6% 6.6% 7.6% 30.3% 17.4% 26.0% 23.7% 27.3% 33.2% Subprime Loans (6) 0.1% 0.1% 0.1% 0.2% 0.2% 0.2% 2.1% 1.3% -0.2% 1.1% 0.6% 1.1% Refi Plus Including HARP 18.0% 19.1% 19.5% 16.5% 11.2% 7.1% 7.5% 10.4% 7.4% 3.5% 1.4% 0.1% Vintages 2009 - 2015 83.2% 80.5% 76.2% 65.3% 51.6% 39.0% 9.6% 13.3% 10.0% 5.1% 2.4% 0.4% 2005 - 2008 10.6% 12.2% 14.7% 21.7% 30.4% 38.0% 80.0% 74.7% 77.6% 81.8% 82.9% 87.9% 2004 & Prior 6.2% 7.3% 9.1% 13.1% 18.0% 23.0% 10.4% 12.0% 12.4% 13.1% 14.8% 11.7% Select States (7) Florida 5.6% 5.6% 5.7% 6.0% 6.3% 6.6% 23.2% 32.6% 28.9% 21.4% 11.0% 17.5% New Jersey 3.9% 4.0% 4.0% 4.0% 4.0% 4.0% 21.3% 7.2% 3.7% 2.0% 0.8% 1.2% New York 5.4% 5.5% 5.6% 5.6% 5.6% 5.5% 15.9% 4.8% 1.9% 0.9% 0.6% 0.8% Illinois 4.0% 4.1% 4.1% 4.2% 4.3% 4.3% 7.7% 10.9% 12.9% 9.6% 3.5% 4.3% Maryland 2.7% 2.7% 2.8% 2.8% 2.9% 2.8% 4.1% 5.9% 3.1% 1.8% 0.6% 1.9% Pennsylvania 3.0% 3.0% 3.1% 3.1% 3.0% 3.0% 3.3% 4.2% 3.0% 1.6% 0.8% 0.8% Connecticut 1.3% 1.3% 1.4% 1.4% 1.4% 1.4% 2.4% 2.8% 1.4% 0.9% 0.3% 0.4% Ohio 2.0% 2.1% 2.1% 2.2% 2.3% 2.4% 2.1% 4.2% 4.1% 3.3% 2.1% 2.2% Nevada 1.0% 1.0% 1.0% 1.0% 1.0% 1.1% 2.0% 1.4% 3.8% 4.8% 7.9% 6.1% Massachusetts 3.0% 3.0% 3.1% 3.1% 3.1% 3.0% 1.7% 1.0% 0.8% 1.0% 1.2% 1.3% All Other States 68.0% 67.7% 67.3% 66.6% 66.0% 65.8% 16.3% 25.0% 36.5% 52.8% 71.0% 63.6% % of Single-Family Credit Losses (2)% of Single-Family Conventional Guaranty Book of Business (1) Credit Loss Concentration of Single-Family Conventional Guaranty Book of Business (1) Based on the unpaid principal balance (UPB) of the single-family conventional guaranty book of business as of December 31 for the time periods noted, with the exception of 2015 which is as of September 30, 2015. (2) Based on the single-family credit losses for the year ended December 31 for the time periods noted, with the exception of 2015 which is through September 30, 2015. Credit losses consist of (a) charge-offs, net of recoveries and (b) foreclosed property expense (income), adjusted to exclude the impact of fair value losses resulting from credit-impaired loans acquired from MBS trusts. Does not reflect the impact of recoveries that have not been allocated to specific loans. Negative values are the result of recoveries on previously recognized credit losses. Includes the impact of credit losses associated with our redesignation in the first nine months of 2015 from held for investment to held for sale of certain nonperforming single-family loans expected to be sold in the foreseeable future. Also includes the impact of our approach to adopting the charge-off provisions of the Federal Housing Finance Agency’s Advisory Bulletin AB 2012-02, “Framework for Adversely Classifying Loans, Other Real Estate Owned, and Other Assets and Listing Assets for Special Mention” on January 1, 2015. (3) Loans with multiple product features are included in all applicable categories. Categories are not mutually exclusive. (4) FICO credit score is as of loan origination, as reported by the seller of the mortgage loan. (5) Newly originated Alt-A loans acquired after 2008 consist of the refinance of existing loans under our Refi Plus Initiative. For a description of our Alt-A loan classification criteria, refer to Fannie Mae’s 2015 Q3 Form 10-Q. (6) For a description of our subprime loan classification criteria, refer to Fannie Mae’s 2014 Form 10-K. (7) Select states represent the top ten states with the highest percentage of single-family credit losses for the nine months ended September 30, 2015.

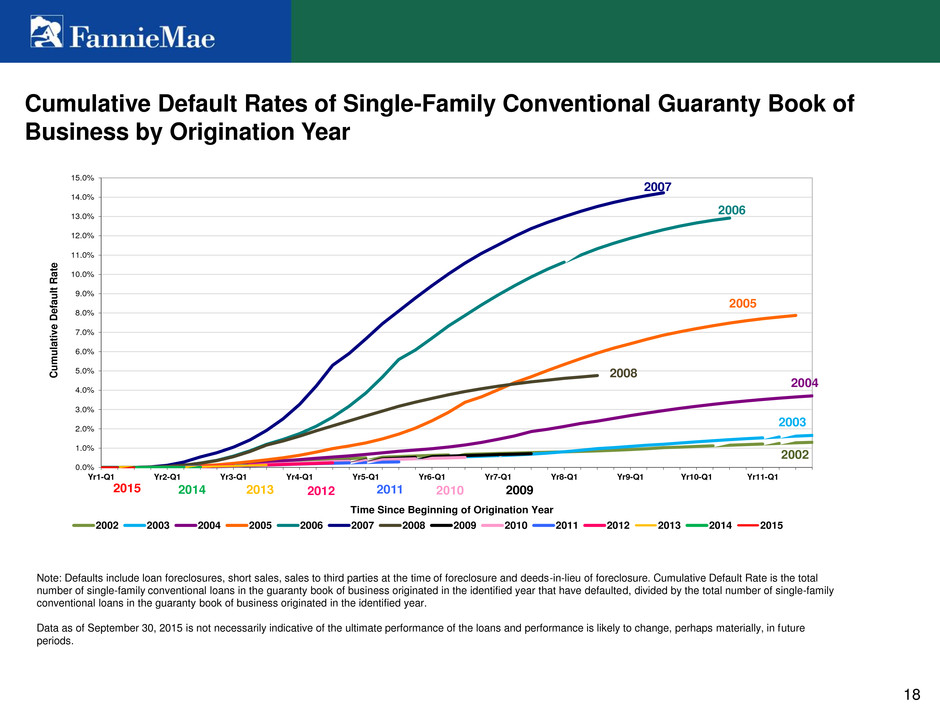

18 2002 2003 2004 2005 2006 2007 2008 20092010201120122014 20132015 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% Yr1-Q1 Yr2-Q1 Yr3-Q1 Yr4-Q1 Yr5-Q1 Yr6-Q1 Yr7-Q1 Yr8-Q1 Yr9-Q1 Yr10-Q1 Yr11-Q1 Cu mu lati ve D efaul t Ra te Time Since Beginning of Origination Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Cumulative Default Rates of Single-Family Conventional Guaranty Book of Business by Origination Year Note: Defaults include loan foreclosures, short sales, sales to third parties at the time of foreclosure and deeds-in-lieu of foreclosure. Cumulative Default Rate is the total number of single-family conventional loans in the guaranty book of business originated in the identified year that have defaulted, divided by the total number of single-family conventional loans in the guaranty book of business originated in the identified year. Data as of September 30, 2015 is not necessarily indicative of the ultimate performance of the loans and performance is likely to change, perhaps materially, in future periods.

19 Total Multifamily Guaranty Book of Business 30,584 $210.5 100% 0.05% $6 $(46) $52 $257 Credit Enhanced Loans: Credit Enhanced 28,076 $197.3 94% 0.05% $14 $(35) $0 $189 Non-Credit Enhanced 2,508 $13.2 6% 0.10% $(8) $(11) $52 $68 Origination loan-to-value ratio: (4) Less than or equal to 70% 19,286 $114.0 54% 0.03% $(13) $(11) $24 $37 Greater than 70% and less than or equal to 80% 9,535 $90.8 43% 0.09% $3 $(38) $18 $182 Greater than 80% 1,763 $5.6 3% 0.03% $16 $3 $10 $38 Delegated Underwriting and Servicing (DUS ®) Loans: (5) DUS ® - Small Balance Loans (6) 8,134 $15.2 7% 0.24% $3 $11 $3 $19 DUS ® - Non Small Balance Loans 13,336 $184.8 88% 0.03% $(6) $(67) $29 $182 DUS ® - Total 21,470 $200.0 95% 0.05% $(3) $(57) $32 $201 Non-DUS - Small Balance Loans (6) 8,746 $5.7 3% 0.36% $3 $11 $23 $41 Non-DUS - Non Small Balance Loans 368 $4.8 2% $6 $0 $(3) $15 Non-DUS - Total 9,114 $10.5 5% 0.20% $8 $11 $20 $56 Maturity Dates: Loans maturing in 2015 194 $1.0 0% 1.20% $(6) $(3) $(1) $20 Loans maturing in 2016 1,552 $7.4 4% 0.06% $(1) $8 $17 $30 Loans maturing in 2017 2,815 $13.6 6% 0.19% $(7) $(19) $42 $84 Loans maturing in 2018 2,530 $14.6 7% 0.07% $12 $(4) $0 $35 Loans maturing in 2019 2,455 $18.9 9% 0.06% $(2) $1 $(3) $21 Other maturities 21,038 $155.0 74% 0.03% $10 $(29) $(4) $68 Loan Size Distribution: Less than or equal to $750K 6,413 $1.7 1% 0.21% $1 $5 $7 $13 Greater than $750K and less than or equal to $3M 9,685 $14.9 7% 0.24% $7 $19 $33 $45 Greater than $3M and less than or equal to $5M 4,162 $15.2 7% 0.24% $11 $(9) $2 $31 Greater than $5M and less than or equal to $25M 8,570 $90.4 43% 0.04% $(10) $(53) $(18) $141 Greater than $25M 1,754 $88.3 42% $(3) $(9) $29 $28 2012 Multifamily Credit Losses ($ in Millions) (3) As of September 30, 2015 Loan Counts Unpaid Principal Balance ($ in Billions) % of Multifamily Guaranty Book of Business (UPB) % Seriously Delinquent (1) 2013 Multifamily Credit Losses ($ in Millions) (2)(3) 2014 Multifamily Credit Losses ($ in Millions) (2)(3) YTD 2015 Multifamily Credit Losses ($ in Millions) (2)(3) (1) We classify multifamily loans as seriously delinquent when payment is 60 days or more past due. (2) Negative values are the result of recoveries on previously recognized credit losses. (3) Dollar amount of multifamily credit-related losses/(income) for the applicable period and category. Total credit losses for each period will not tie to sum of all categories due to rounding. The 2013 multifamily credit losses for DUS and Non-DUS loans have been corrected from the amounts previously reported. (4) Weighted average origination loan-to-value ratio is 66% as of September 30, 2015. (5) Under the Delegated Underwriting and Servicing, or DUS ®, product line, Fannie Mae acquires individual, newly originated mortgages from specially approved DUS lenders using DUS underwriting standards and/or DUS loan documents. Because DUS lenders generally share the risk of loss with Fannie Mae, they are able to originate, underwrite, close and service most loans without our pre-review. (6) Multifamily loans with an original unpaid balance of up to $3 million nationwide or up to $5 million in high cost markets. Multifamily Credit Profile by Loan Attributes

20 As of September 30, 2015 Unpaid Principal Balance ($ in Billions) % of Multifamily Guaranty Book of Business (UPB) % Seriously Delinquent (1) # of Seriously Delinquent loans (1) YTD 2015 Multifamily Credit Losses ($ in Millions) (2)(3) 2014 Multifamily Credit Losses ($ in Millions) (2)(3) 2013 Multifamily Credit Losses ($ in Millions) (2)(3) 2012 Multifamily Credit Losses ($ in Millions) (3) Total Multifamily Guaranty Book of Business $210.5 100% 0.05% 50 $6 $(46) $52 $257 By Acquisition Year: 2015 $32.3 15% 2014 $28.4 13% 0.00% 1 2013 $26.0 12% 0.02% 2 $0 2012 $28.1 13% 0.02% 4 $0 $0 $0 2011 $19.5 9% 0.11% 6 $2 $0 $(1) $0 2010 $13.7 6% 0.06% 3 $0 $2 $7 $1 2009 $13.1 6% 0.10% 2 $4 $(3) $(14) $17 2008 $11.3 5% 0.12% 7 $(9) $(4) $(6) $60 2007 $14.2 7% 0.23% 18 $(5) $(17) $50 $123 Prior to 2007 $23.9 11% 0.07% 7 $14 $(25) $17 $57 (1) We classify multifamily loans as seriously delinquent when payment is 60 days or more past due. (2) Negative values are the result of recoveries on previously recognized credit losses. (3) Dollar amount of multifamily credit-related losses/(income) for the applicable period and category. Total credit losses for each period will not tie to sum of all categories due to rounding. Multifamily Credit Profile by Acquisition Year Multifamily SDQ Rate by Acquisition Year Cumulative Defaults by Acquisition Year

21 Total Multifamily Guaranty Book of Business $210.5 100% 0.05% $6 $(46) $52 $257 Region: (4) Midwest $18.9 9% 0.11% $10 $(3) $(20) $40 Northeast $36.3 17% 0.09% $5 $4 $(4) $25 Southeast $48.2 23% 0.09% $3 $(22) $6 $138 Southwest $43.7 21% 0.02% $(1) $(21) $(16) $19 West $63.5 30% 0.02% $(12) $(4) $87 $35 Top Five States by UPB: California $48.1 23% 0.01% $0 $(2) $4 $4 Texas $23.3 11% $(1) $(33) $(8) $6 New York $20.6 10% 0.08% $2 $2 $1 $7 Florida $12.4 6% $(3) $(8) $11 $92 Washington $7.9 4% 0.04% $1 $0 $1 $0 Asset Class: (5) Conventional/Co-op $187.4 89% 0.06% $4 $(37) $52 $242 Seniors Housing $13.0 6% $9 $(3) Manufactured Housing $5.6 3% $0 $(2) $0 $7 Student Housing $4.5 2% $(7) $(4) $1 $7 Targeted Affordable Segment: Privately Owned with Subsidy (6) $29.7 14% 0.07% $18 $(4) $(8) $9 DUS & Non-DUS Lenders/Servicers: DUS: Bank (Direct, Owned Entity, or Subsidiary) $82.9 39% 0.03% $(3) $(28) $6 $55 DUS: Non-Bank Financial Institution $122.5 58% 0.07% $5 $(25) $39 $180 Non-DUS: Bank (Direct, Owned Entity, or Subsidiary) $4.6 2% 0.14% $1 $2 $2 $17 Non-DUS: Non-Bank Financial Institution $0.3 0% $3 $6 $5 $6 Non-DUS: Public Agency/Non Profit $0.1 0% $0 $0 $0 As of September 30, 2015 Unpaid Principal Balance ($ in Billions) % of Multifamily Guaranty Book of Business (UPB) % Seriously Delinquent (1) 2013 Multifamily Credit Losses ($ in Millions) (2)(3) 2012 Multifamily Credit Losses ($ in Millions) (3) 2014 Multifamily Credit Losses ($ in Millions) (2)(3) YTD 2015 Multifamily Credit Losses ($ in Millions) (2)(3) (1) We classify multifamily loans as seriously delinquent when payment is 60 days or more past due. (2) Negative values are the result of recoveries on previously recognized credit losses. (3) Dollar amount of multifamily credit-related losses/(income) for the applicable period and category. Total credit losses for each period will not tie to sum of all categories due to rounding. (4) For information on which states are included in each region, refer to Fannie Mae’s 2014 Form 10-K. (5) Conventional Multifamily/Cooperative Housing/Affordable Housing: Conventional Multifamily is a loan secured by a residential property comprised of five or more dwellings which offers market rental rates (i.e., not subsidized or subject to rent restrictions). Cooperative Housing is a multifamily loan made to a cooperative housing corporation and secured by a first or subordinated lien on a cooperative multifamily housing project that contains five or more units. Affordable Housing is a multifamily loan on a mortgaged property encumbered by a regulatory agreement or recorded restriction that limits rents, imposes income restrictions on tenants or places other restrictions on the use of the property. Manufactured Housing Communities: A multifamily loan secured by a residential development that consists of sites for manufactured homes and includes utilities, roads and other infrastructure. In some cases, landscaping and various other amenities such as a clubhouse, swimming pool, and tennis and/or sports courts are also included. Seniors Housing: A multifamily loan secured by a mortgaged property that is intended to be used for residents for whom the owner or operator provides special services that are typically associated with either “independent living” or “assisted living.” Some Alzheimer’s and skilled nursing capabilities are permitted. Dedicated Student Housing: Multifamily loans secured by residential properties in which college or graduate students make up at least 80% of the tenants. Dormitories are not included. (6) The Multifamily Affordable Business Channel focuses on financing properties that are under a regulatory agreement that provides long-term affordability, such as properties with rent subsidies or income restrictions. Multifamily Credit Profile

22 Multifamily YTD 2015 Credit Losses by State Through 2015 Q3 ($ Millions) (1) Numbers: Represent YTD 2015 credit-related losses/(income) for each state which totaled $6M in losses for the nine months ended September 30, 2015. States with no numbers had less than $500K in credit losses or less than $500K in credit-related income in YTD 2015. Shading: Represent Unpaid Principal Balance (UPB) for each state which totaled $210.5B as of September 30, 2015. Portfolio UPB Concentration by State as of 9/30/2015 (1) Total state credit losses will not tie to total YTD 2015 credit losses due to rounding. Negative values are the result of recoveries on previously recognized credit losses. Example: UPB in PA is $5B and YTD 2015 Credit Losses are $2M