Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CITIZENS FINANCIAL GROUP INC/RI | d32959d8k.htm |

BancAnalysts Association of Boston Conference Eric Aboaf Chief Financial Officer November 5, 2015 Exhibit 99.1

Important Information and GAAP/Non-GAAP Information This document contains forward-looking statements within the Private Securities Litigation Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: negative economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense; the rate of growth in the economy and employment levels, as well as general business and economic conditions; our ability to implement our strategic plan, including the cost savings and efficiency components, and achieve our indicative performance targets; our ability to remedy regulatory deficiencies and meet supervisory requirements and expectations; liabilities and business restrictions resulting from litigation and regulatory investigations; our capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms; the effect of the current low interest rate environment or changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber attacks; management’s ability to identify and manage these and other risks; and any failure by us to successfully replicate or replace certain functions, systems and infrastructure provided by The Royal Bank of Scotland Group plc (RBS). In addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including requirements of our subsidiaries), and any other factors that our board of directors deems relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock, or as to the amount of any such dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the United States Securities and Exchange Commission on March 3, 2015. Note: Percentage changes, per share amounts, and ratios presented in this document are calculated using whole dollars. Non‐GAAP Financial Measures This document contains non-GAAP financial measures. The Appendix hereto presents reconciliations of certain non-GAAP financial measures to the most directly comparable GAAP measures. These non-GAAP measures include “core revenue”, “core noninterest income”, “core noninterest expense”, “core net income”, “total average deposits”, “interest-bearing deposits”, “core expense to core earning assets”, and “core net interest margin”. In addition, we present computations for "tangible book value per common share", “return on average tangible common equity”, “return on average total tangible assets”, “efficiency ratio”, “core return on average tangible common equity”, and “core efficiency ratio” as part of our non-GAAP measures. Additionally, "pro forma Basel III fully phased-in common equity tier 1 capital" computations for applicable periods are presented as part of our non-GAAP measures. We believe these non-GAAP measures provide useful information to investors because these are among the measures used by our management team to evaluate our operating performance and to make day-to-day operating decisions. We believe this presentation also increases comparability of period-to-period results. We also consider pro forma capital ratios defined by banking regulators but not effective at each period end to be non-GAAP financial measures. Since analysts and banking regulators may assess our capital adequacy using these pro forma ratios, we believe they are useful to provide investors the ability to assess our capital adequacy on the same basis. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar measures used by other companies. We caution investors not to place undue reliance on such non-GAAP measures, but instead to consider them with the most directly comparable GAAP measure. Non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation, or as a substitute for our results as reported under GAAP.

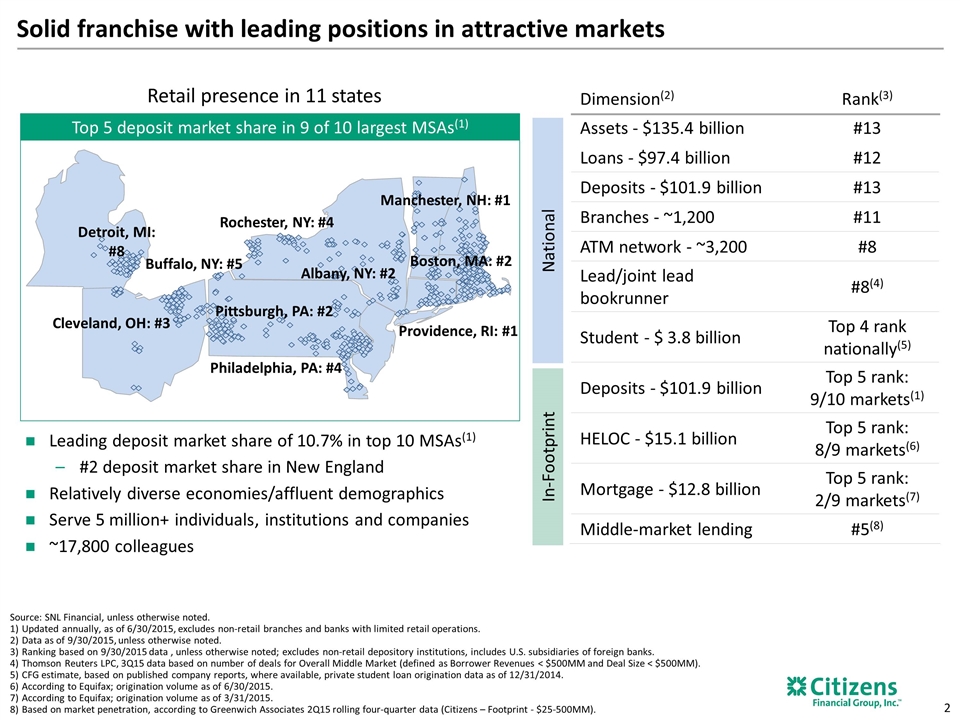

Dimension(2) Rank(3) Assets - $135.4 billion #13 Loans - $97.4 billion #12 Deposits - $101.9 billion #13 Branches - ~1,200 #11 ATM network - ~3,200 #8 Lead/joint lead bookrunner #8(4) Student - $ 3.8 billion Top 4 rank nationally(5) Deposits - $101.9 billion Top 5 rank: 9/10 markets(1) HELOC - $15.1 billion Top 5 rank: 8/9 markets(6) Mortgage - $12.8 billion Top 5 rank: 2/9 markets(7) Middle-market lending #5(8) National In-Footprint Source: SNL Financial, unless otherwise noted. Updated annually, as of 6/30/2015, excludes non-retail branches and banks with limited retail operations. Data as of 9/30/2015, unless otherwise noted. Ranking based on 9/30/2015 data , unless otherwise noted; excludes non-retail depository institutions, includes U.S. subsidiaries of foreign banks. Thomson Reuters LPC, 3Q15 data based on number of deals for Overall Middle Market (defined as Borrower Revenues < $500MM and Deal Size < $500MM). CFG estimate, based on published company reports, where available, private student loan origination data as of 12/31/2014. According to Equifax; origination volume as of 6/30/2015. According to Equifax; origination volume as of 3/31/2015. Based on market penetration, according to Greenwich Associates 2Q15 rolling four-quarter data (Citizens – Footprint - $25-500MM). Leading deposit market share of 10.7% in top 10 MSAs(1) #2 deposit market share in New England Relatively diverse economies/affluent demographics Serve 5 million+ individuals, institutions and companies ~17,800 colleagues Retail presence in 11 states Top 5 deposit market share in 9 of 10 largest MSAs(1) Buffalo, NY: #5 Albany, NY: #2 Pittsburgh, PA: #2 Cleveland, OH: #3 Manchester, NH: #1 Boston, MA: #2 Rochester, NY: #4 Philadelphia, PA: #4 Detroit, MI: #8 Providence, RI: #1 Solid franchise with leading positions in attractive markets

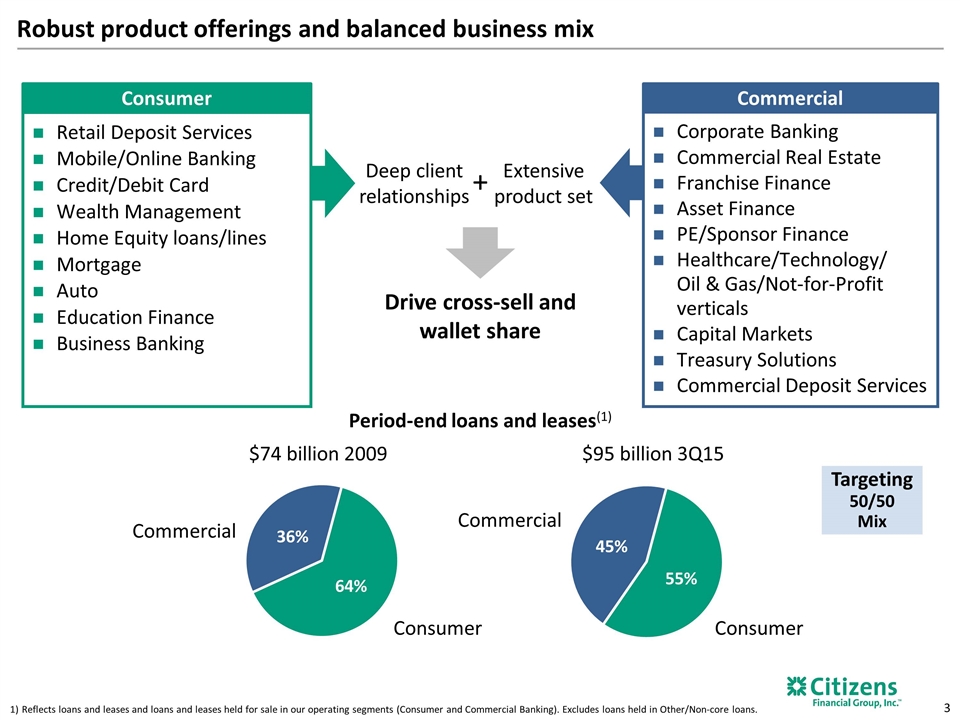

Corporate Banking Commercial Real Estate Franchise Finance Asset Finance PE/Sponsor Finance Healthcare/Technology/ Oil & Gas/Not-for-Profit verticals Capital Markets Treasury Solutions Commercial Deposit Services Retail Deposit Services Mobile/Online Banking Credit/Debit Card Wealth Management Home Equity loans/lines Mortgage Auto Education Finance Business Banking Consumer Commercial Deep client relationships + Extensive product set Robust product offerings and balanced business mix Targeting 50/50 Mix Period-end loans and leases(1) $95 billion 3Q15 $74 billion 2009 Drive cross-sell and wallet share Reflects loans and leases and loans and leases held for sale in our operating segments (Consumer and Commercial Banking). Excludes loans held in Other/Non-core loans.

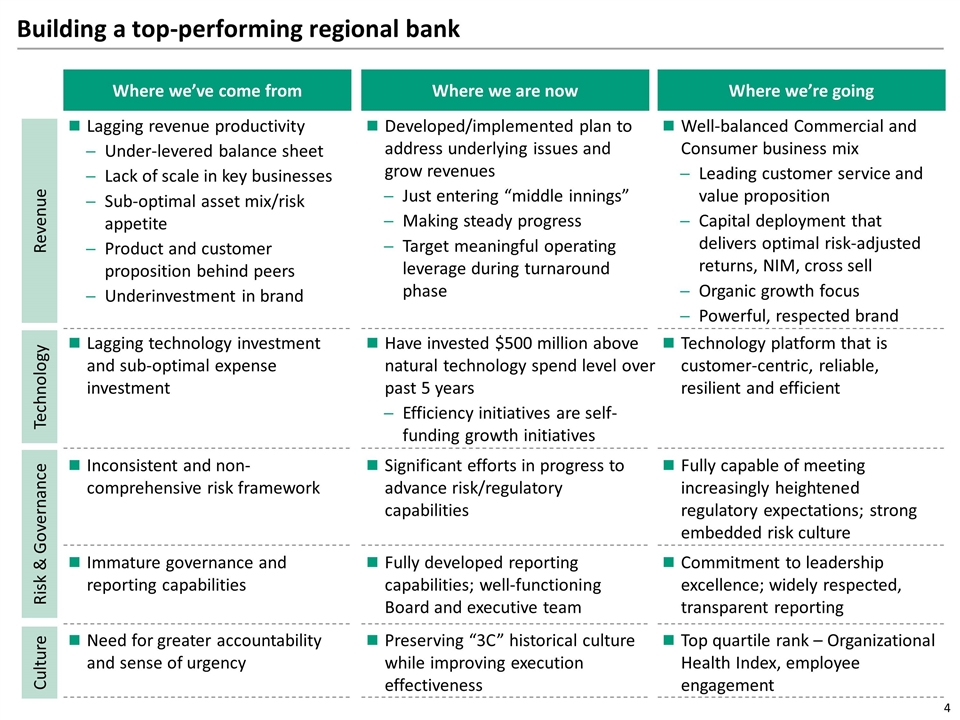

Building a top-performing regional bank Where we’ve come from Lagging revenue productivity Under-levered balance sheet Lack of scale in key businesses Sub-optimal asset mix/risk appetite Product and customer proposition behind peers Underinvestment in brand Where we are now Developed/implemented plan to address underlying issues and grow revenues Just entering “middle innings” Making steady progress Target meaningful operating leverage during turnaround phase Where we’re going Well-balanced Commercial and Consumer business mix Leading customer service and value proposition Capital deployment that delivers optimal risk-adjusted returns, NIM, cross sell Organic growth focus Powerful, respected brand Have invested $500 million above natural technology spend level over past 5 years Efficiency initiatives are self-funding growth initiatives Lagging technology investment and sub-optimal expense investment Technology platform that is customer-centric, reliable, resilient and efficient Inconsistent and non-comprehensive risk framework Significant efforts in progress to advance risk/regulatory capabilities Fully capable of meeting increasingly heightened regulatory expectations; strong embedded risk culture Immature governance and reporting capabilities Fully developed reporting capabilities; well-functioning Board and executive team Commitment to leadership excellence; widely respected, transparent reporting Need for greater accountability and sense of urgency Preserving “3C” historical culture while improving execution effectiveness Top quartile rank – Organizational Health Index, employee engagement Revenue Technology Risk & Governance Culture

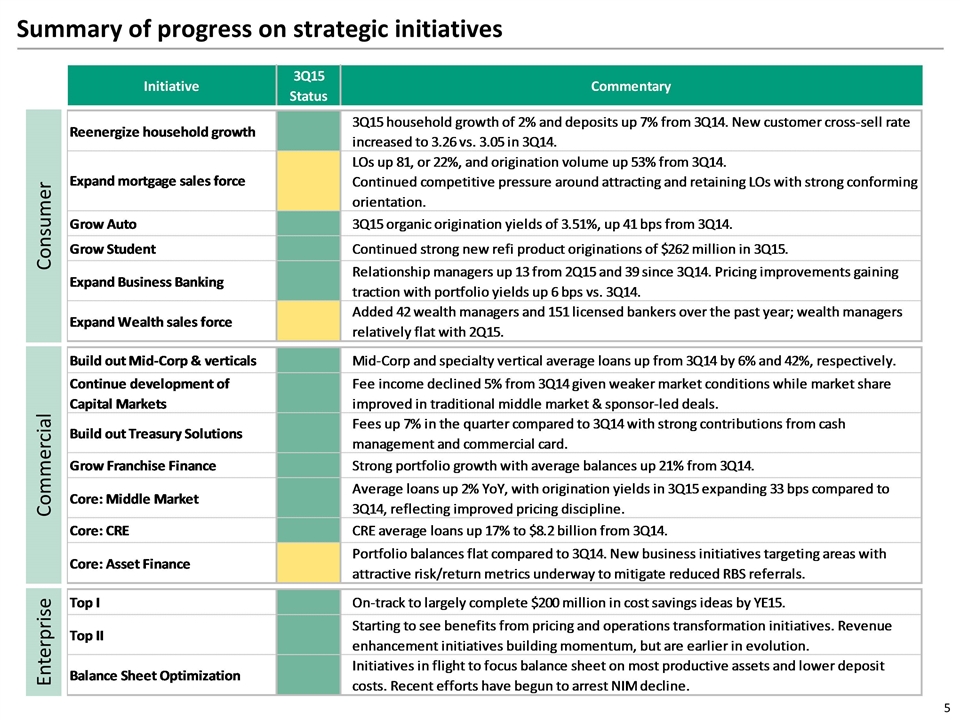

Summary of progress on strategic initiatives Consumer Commercial Enterprise

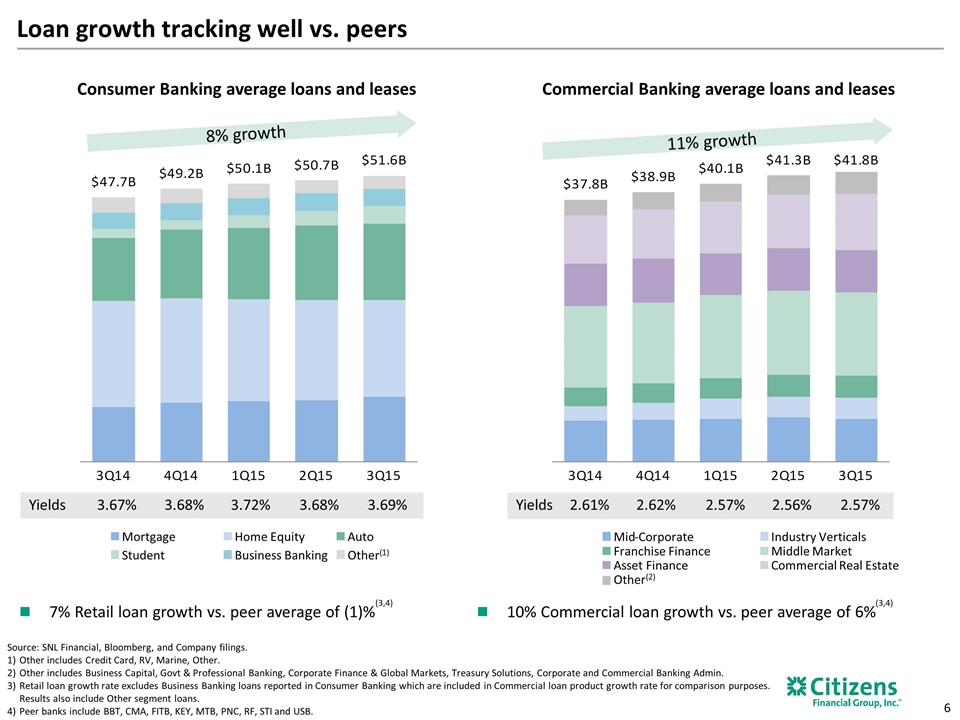

Loan growth tracking well vs. peers Commercial Banking average loans and leases 7% Retail loan growth vs. peer average of (1)% 10% Commercial loan growth vs. peer average of 6% (3,4) Source: SNL Financial, Bloomberg, and Company filings. Other includes Credit Card, RV, Marine, Other. Other includes Business Capital, Govt & Professional Banking, Corporate Finance & Global Markets, Treasury Solutions, Corporate and Commercial Banking Admin. Retail loan growth rate excludes Business Banking loans reported in Consumer Banking which are included in Commercial loan product growth rate for comparison purposes. Results also include Other segment loans. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. (3,4) Consumer Banking average loans and leases Yields 3.67% 3.68% 3.72% 3.68% 3.69% Mid - Corporate Industry Verticals Franchise Finance Middle Market Asset Finance Commercial Real Estate Other(2) Yields 2.61% 2.62% 2.57% 2.56% 2.57% Mortgage Home Equity Auto Student Business Banking Other(1) 8% growth 11% growth

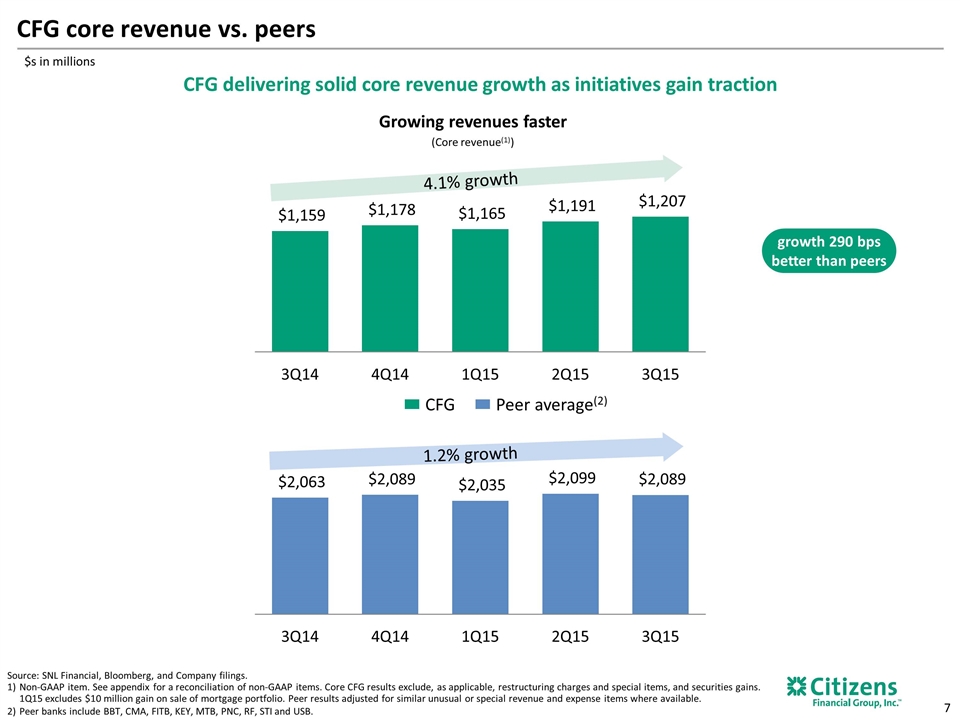

CFG core revenue vs. peers Growing revenues faster (Core revenue(1)) $s in millions growth 290 bps better than peers CFG delivering solid core revenue growth as initiatives gain traction CFG Peer average(2) 1.2% growth 4.1% growth Source: SNL Financial, Bloomberg, and Company filings. Non-GAAP item. See appendix for a reconciliation of non-GAAP items. Core CFG results exclude, as applicable, restructuring charges and special items, and securities gains. 1Q15 excludes $10 million gain on sale of mortgage portfolio. Peer results adjusted for similar unusual or special revenue and expense items where available. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB.

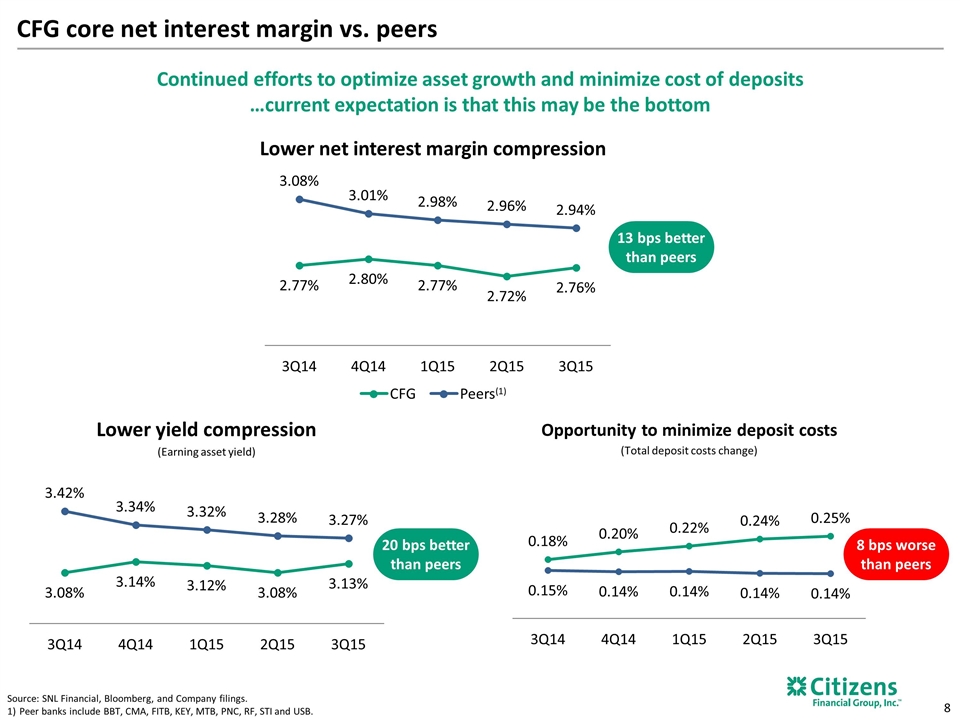

CFG core net interest margin vs. peers 13 bps better than peers Continued efforts to optimize asset growth and minimize cost of deposits …current expectation is that this may be the bottom 20 bps better than peers CFG Peers(1) Source: SNL Financial, Bloomberg, and Company filings. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. Lower net interest margin compression Lower yield compression (Earning asset yield) 8 bps worse than peers Opportunity to minimize deposit costs (Total deposit costs change)

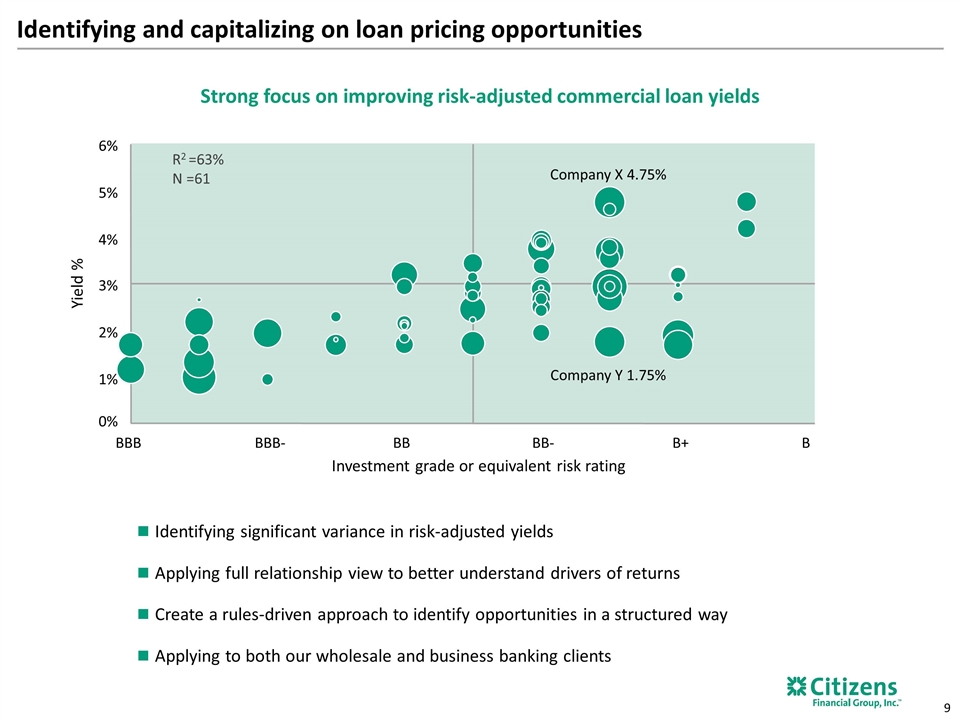

Identifying and capitalizing on loan pricing opportunities Identifying significant variance in risk-adjusted yields Applying full relationship view to better understand drivers of returns Create a rules-driven approach to identify opportunities in a structured way Applying to both our wholesale and business banking clients Strong focus on improving risk-adjusted commercial loan yields 1% 2% 3% 4% 5% 6% Company X 4.75% Company Y 1.75% 0% BBB BBB- BB BB- B+ B Investment grade or equivalent risk rating Yield % R2 =63% N =61

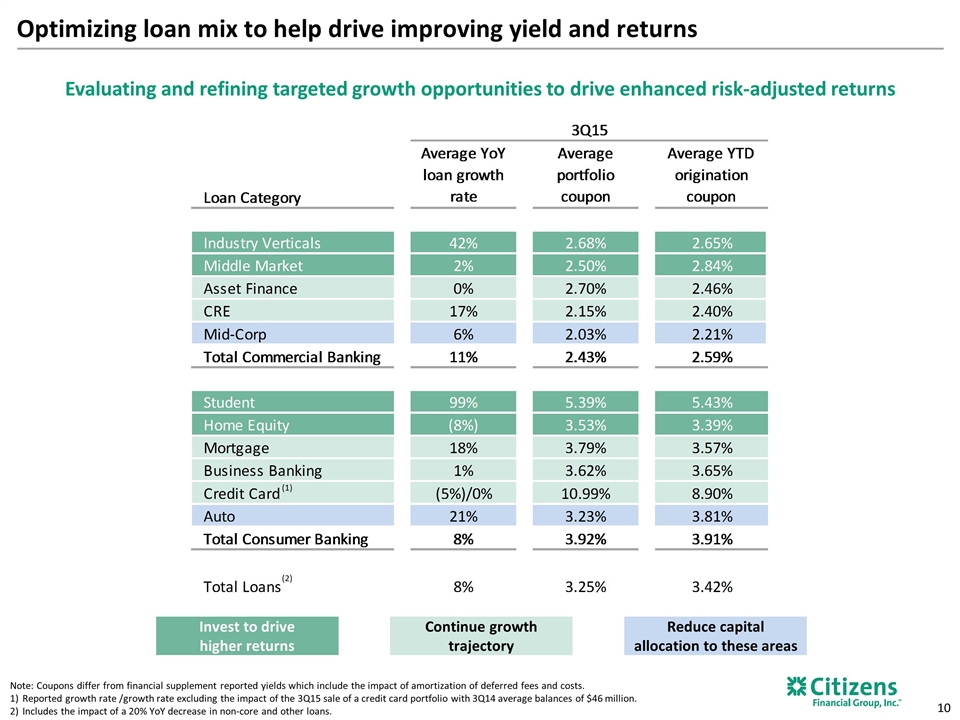

Optimizing loan mix to help drive improving yield and returns Note: Coupons differ from financial supplement reported yields which include the impact of amortization of deferred fees and costs. Reported growth rate /growth rate excluding the impact of the 3Q15 sale of a credit card portfolio with 3Q14 average balances of $46 million. Includes the impact of a 20% YoY decrease in non-core and other loans. Evaluating and refining targeted growth opportunities to drive enhanced risk-adjusted returns Invest to drive higher returns Reduce capital allocation to these areas Continue growth trajectory (2) (1)

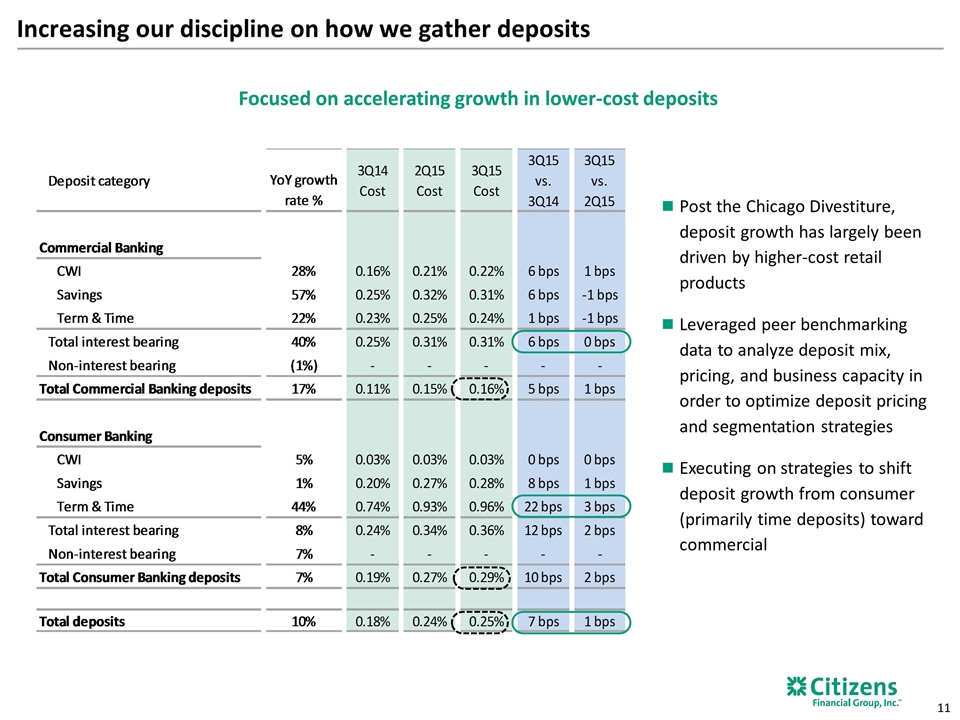

Increasing our discipline on how we gather deposits Post the Chicago Divestiture, deposit growth has largely been driven by higher-cost retail products Leveraged peer benchmarking data to analyze deposit mix, pricing, and business capacity in order to optimize deposit pricing and segmentation strategies Executing on strategies to shift deposit growth from consumer (primarily time deposits) toward commercial Focused on accelerating growth in lower-cost deposits

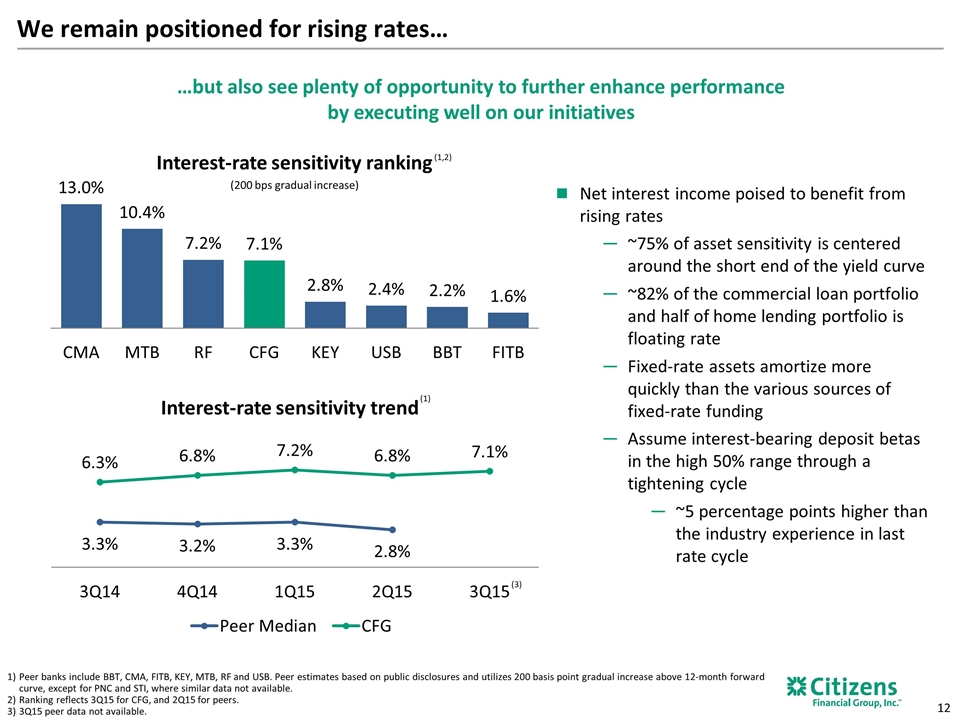

We remain positioned for rising rates… …but also see plenty of opportunity to further enhance performance by executing well on our initiatives Interest-rate sensitivity trend Peer banks include BBT, CMA, FITB, KEY, MTB, RF and USB. Peer estimates based on public disclosures and utilizes 200 basis point gradual increase above 12-month forward curve, except for PNC and STI, where similar data not available. Ranking reflects 3Q15 for CFG, and 2Q15 for peers. 3Q15 peer data not available. Net interest income poised to benefit from rising rates ~75% of asset sensitivity is centered around the short end of the yield curve ~82% of the commercial loan portfolio and half of home lending portfolio is floating rate Fixed-rate assets amortize more quickly than the various sources of fixed-rate funding Assume interest-bearing deposit betas in the high 50% range through a tightening cycle ~5 percentage points higher than the industry experience in last rate cycle (1) Interest-rate sensitivity ranking (200 bps gradual increase) (1,2) (3)

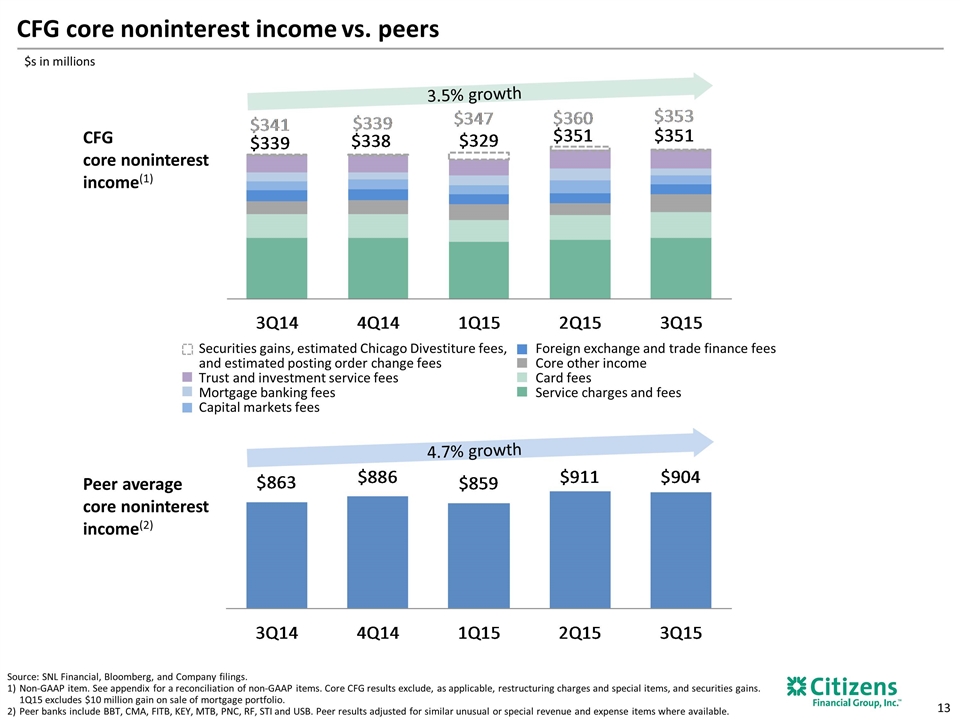

CFG core noninterest income vs. peers 3.5% growth 4.7% growth Securities gains, estimated Chicago Divestiture fees, and estimated posting order change fees Trust and investment service fees Mortgage banking fees Capital markets fees Foreign exchange and trade finance fees Core other income Card fees Service charges and fees Peer average core noninterest income(2) CFG core noninterest income(1) $s in millions Source: SNL Financial, Bloomberg, and Company filings. Non-GAAP item. See appendix for a reconciliation of non-GAAP items. Core CFG results exclude, as applicable, restructuring charges and special items, and securities gains. 1Q15 excludes $10 million gain on sale of mortgage portfolio. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. Peer results adjusted for similar unusual or special revenue and expense items where available.

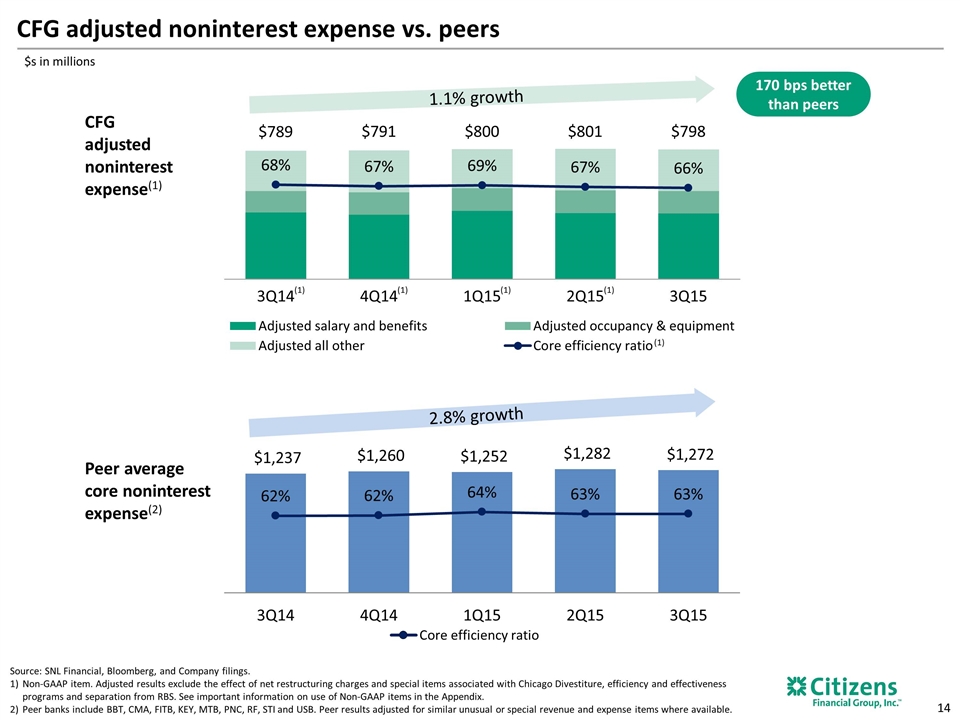

CFG adjusted noninterest expense vs. peers Source: SNL Financial, Bloomberg, and Company filings. Non-GAAP item. Adjusted results exclude the effect of net restructuring charges and special items associated with Chicago Divestiture, efficiency and effectiveness programs and separation from RBS. See important information on use of Non-GAAP items in the Appendix. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. Peer results adjusted for similar unusual or special revenue and expense items where available. (1) (1) (1) (1) (1) 1.1% growth 2.8% growth Peer average core noninterest expense(2) CFG adjusted noninterest expense(1) $s in millions Core efficiency ratio 170 bps better than peers

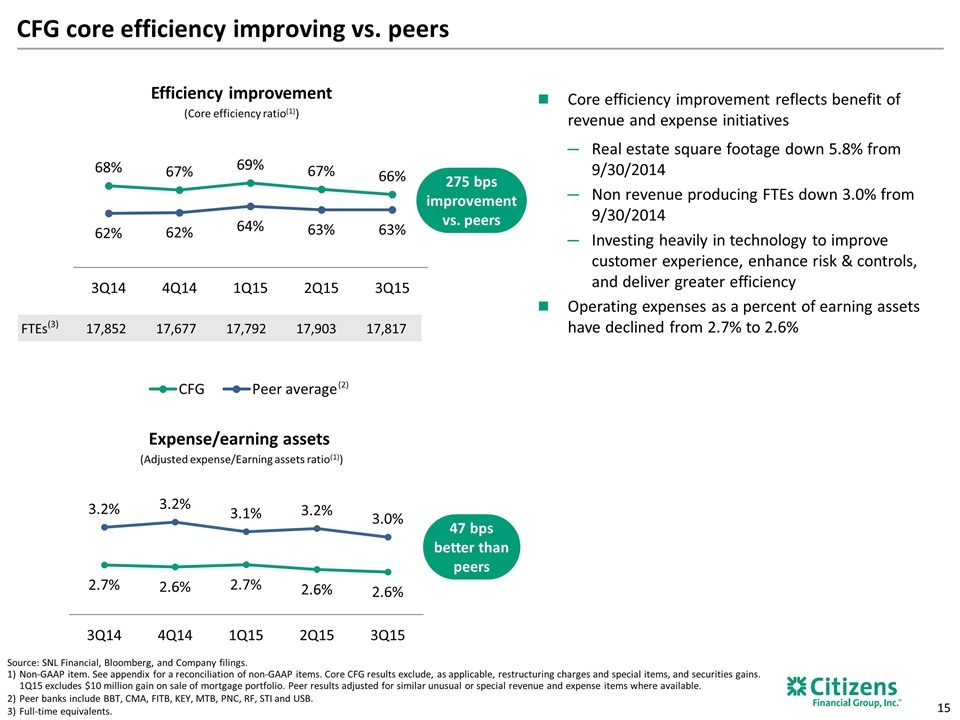

Expense/earning assets (Adjusted expense/Earning assets ratio(1)) 275 bps improvement vs. peers Core efficiency improvement reflects benefit of revenue and expense initiatives Real estate square footage down 5.8% from 9/30/2014 Non revenue producing FTEs down 3.0% from 9/30/2014 Investing heavily in technology to improve customer experience, enhance risk & controls, and deliver greater efficiency Operating expenses as a percent of earning assets have declined from 2.7% to 2.6% CFG core efficiency improving vs. peers 47 bps better than peers (2) Efficiency improvement (Core efficiency ratio(1)) FTEs(3) 17,852 17,677 17,792 17,903 17,817 Source: SNL Financial, Bloomberg, and Company filings. Non-GAAP item. See appendix for a reconciliation of non-GAAP items. Core CFG results exclude, as applicable, restructuring charges and special items, and securities gains. 1Q15 excludes $10 million gain on sale of mortgage portfolio. Peer results adjusted for similar unusual or special revenue and expense items where available. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. Full-time equivalents.

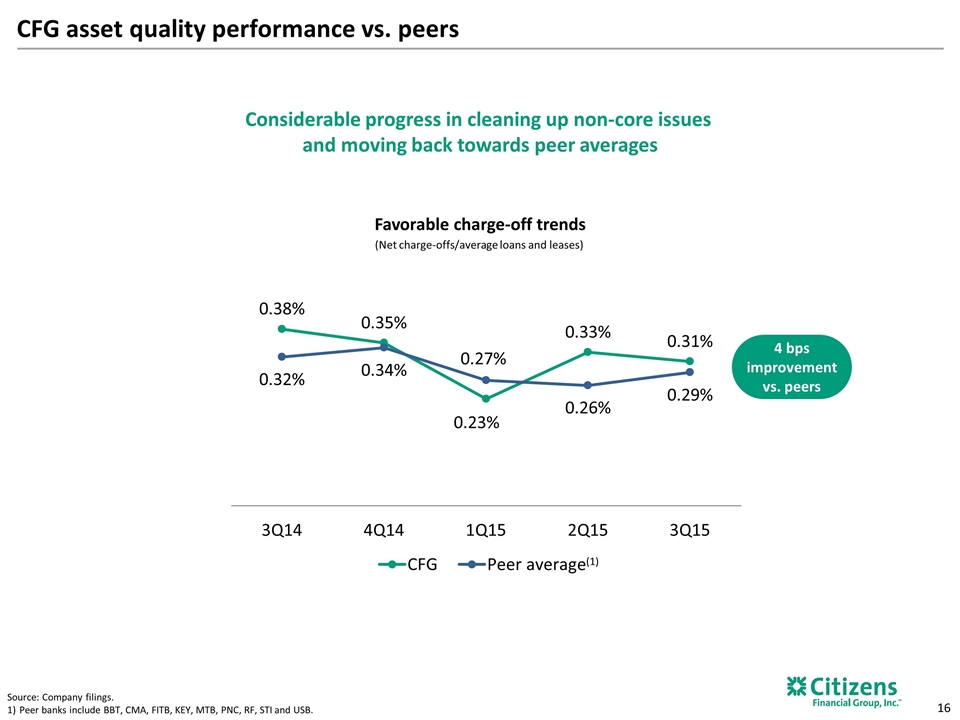

CFG asset quality performance vs. peers Considerable progress in cleaning up non-core issues and moving back towards peer averages Source: Company filings. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. Favorable charge-off trends (Net charge-offs/average loans and leases) 4 bps improvement vs. peers (1)

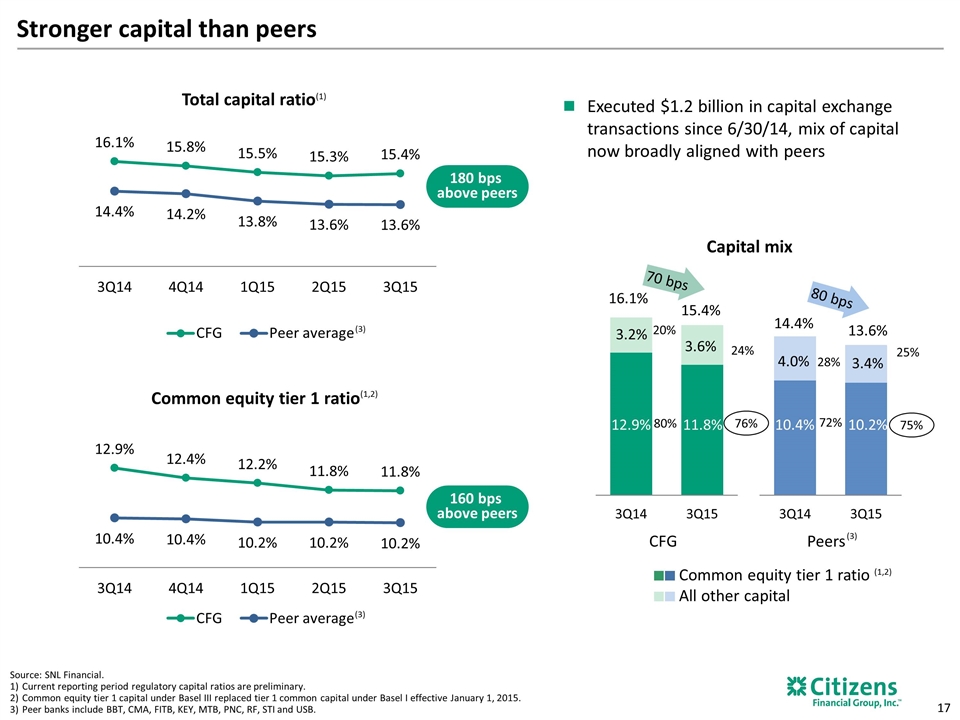

Stronger capital than peers Executed $1.2 billion in capital exchange transactions since 6/30/14, mix of capital now broadly aligned with peers Common equity tier 1 ratio Total capital ratio 160 bps above peers CFG Peers Common equity tier 1 ratio All other capital 16.1% 15.4% 3.2% 3.6% 12.9% 11.8% 14.4% 13.6% 4.0% 3.4% 10.4% 10.2% 70 bps 80 bps Capital mix (3) 76% 75% 24% 25% 20% 80% 28% 72% Source: SNL Financial. Current reporting period regulatory capital ratios are preliminary. Common equity tier 1 capital under Basel III replaced tier 1 common capital under Basel I effective January 1, 2015. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB. (1,2) (1,2) (3) (3) (1) 180 bps above peers

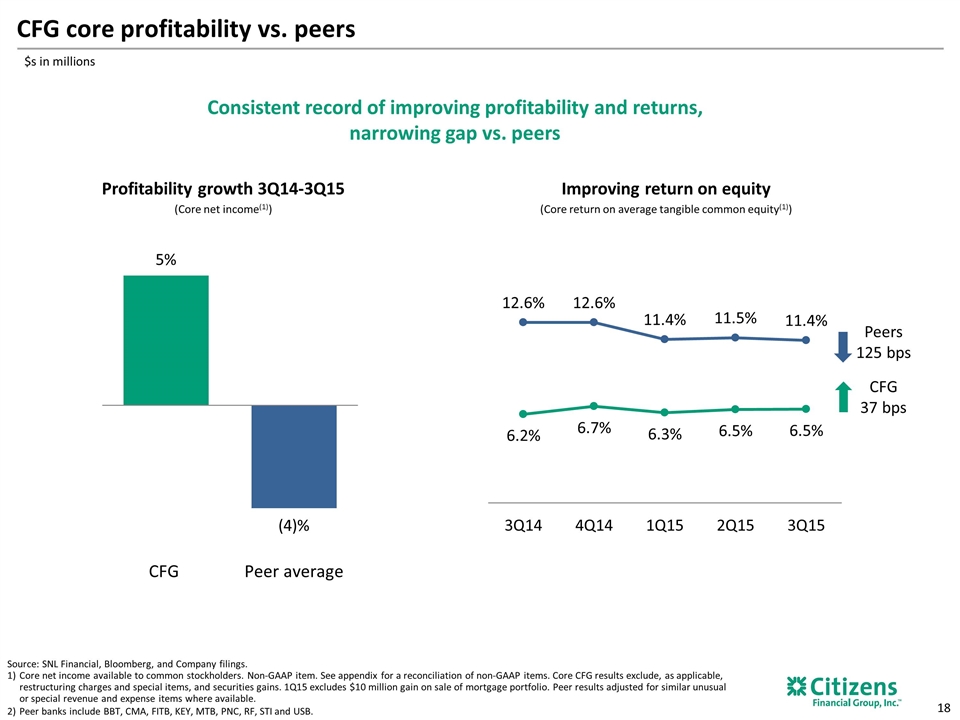

$s in millions Profitability growth 3Q14-3Q15 (Core net income(1)) Improving return on equity (Core return on average tangible common equity(1)) CFG core profitability vs. peers Peers 125 bps CFG 37 bps Consistent record of improving profitability and returns, narrowing gap vs. peers Source: SNL Financial, Bloomberg, and Company filings. Core net income available to common stockholders. Non-GAAP item. See appendix for a reconciliation of non-GAAP items. Core CFG results exclude, as applicable, restructuring charges and special items, and securities gains. 1Q15 excludes $10 million gain on sale of mortgage portfolio. Peer results adjusted for similar unusual or special revenue and expense items where available. Peer banks include BBT, CMA, FITB, KEY, MTB, PNC, RF, STI and USB.

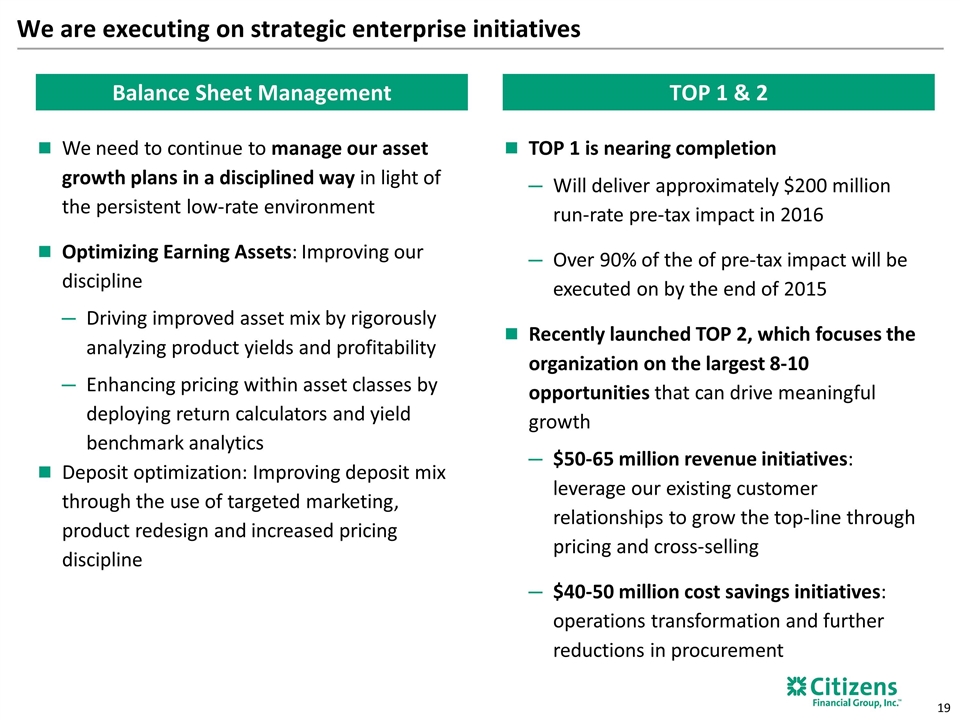

We are executing on strategic enterprise initiatives Balance Sheet Management We need to continue to manage our asset growth plans in a disciplined way in light of the persistent low-rate environment Optimizing Earning Assets: Improving our discipline Driving improved asset mix by rigorously analyzing product yields and profitability Enhancing pricing within asset classes by deploying return calculators and yield benchmark analytics Deposit optimization: Improving deposit mix through the use of targeted marketing, product redesign and increased pricing discipline TOP 1 & 2 TOP 1 is nearing completion Will deliver approximately $200 million run-rate pre-tax impact in 2016 Over 90% of the of pre-tax impact will be executed on by the end of 2015 Recently launched TOP 2, which focuses the organization on the largest 8-10 opportunities that can drive meaningful growth $50-65 million revenue initiatives: leverage our existing customer relationships to grow the top-line through pricing and cross-selling $40-50 million cost savings initiatives: operations transformation and further reductions in procurement

Key messages We are executing well against our agenda; delivering near-term financial progress towards ambitious medium-term goals We have the foundation for a great franchise, though much to do to tap full potential Our turnaround plan addresses gaps/weaknesses on both a tactical and strategic level While an increase in short-term rates will be beneficial, we can continue to drive business and financial progress by executing well To date, our performance gap with peers is steadily closing

Appendix

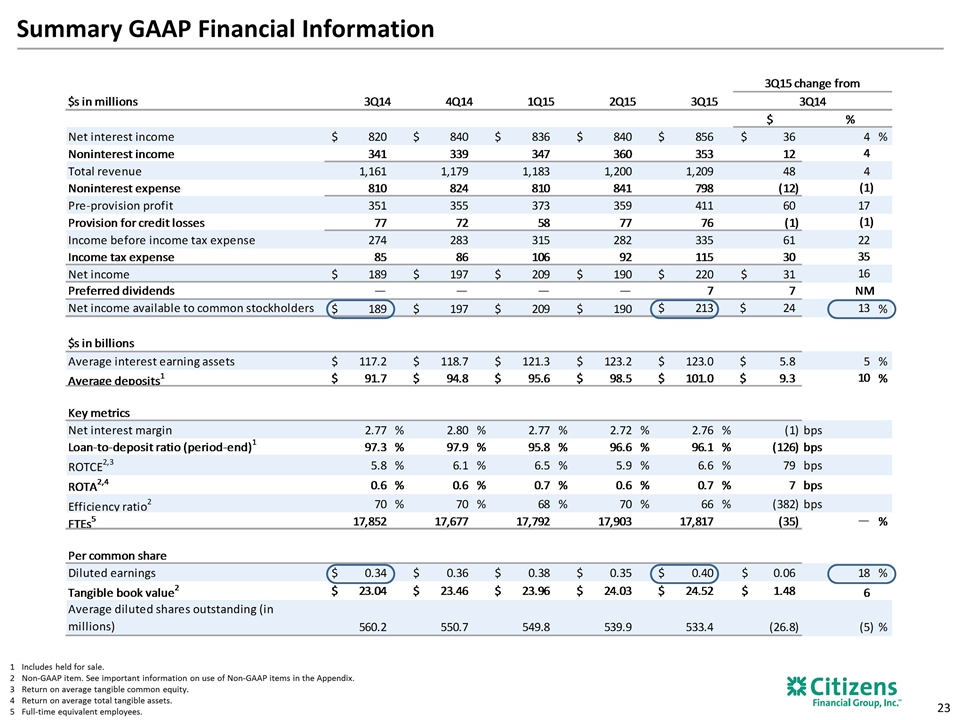

Summary GAAP Financial Information Includes held for sale. Non-GAAP item. See important information on use of Non-GAAP items in the Appendix. Return on average tangible common equity. Return on average total tangible assets. Full-time equivalent employees.

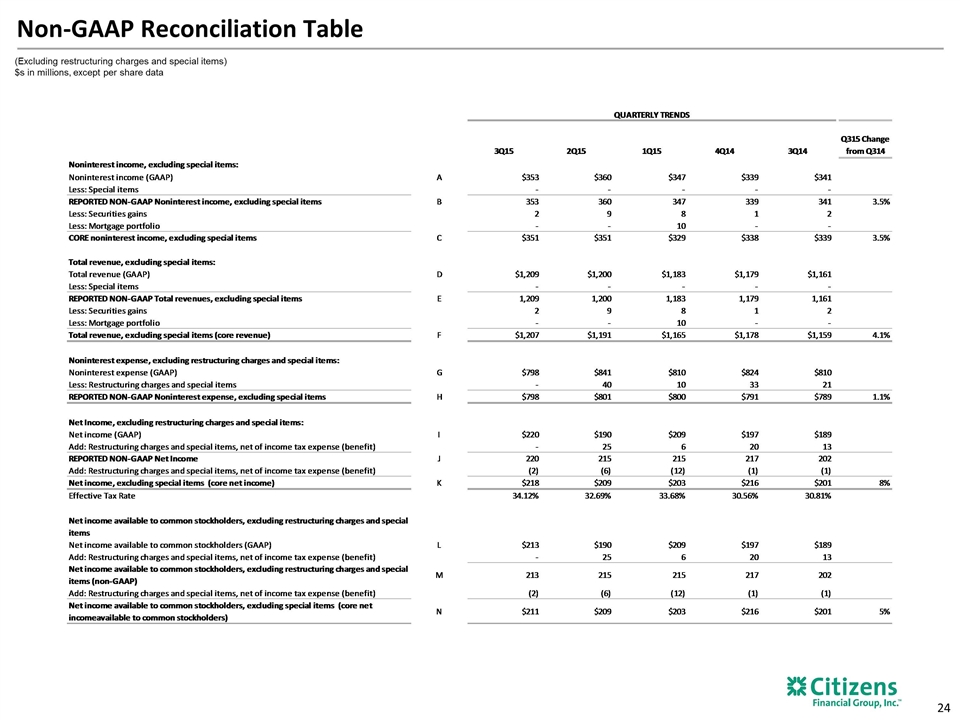

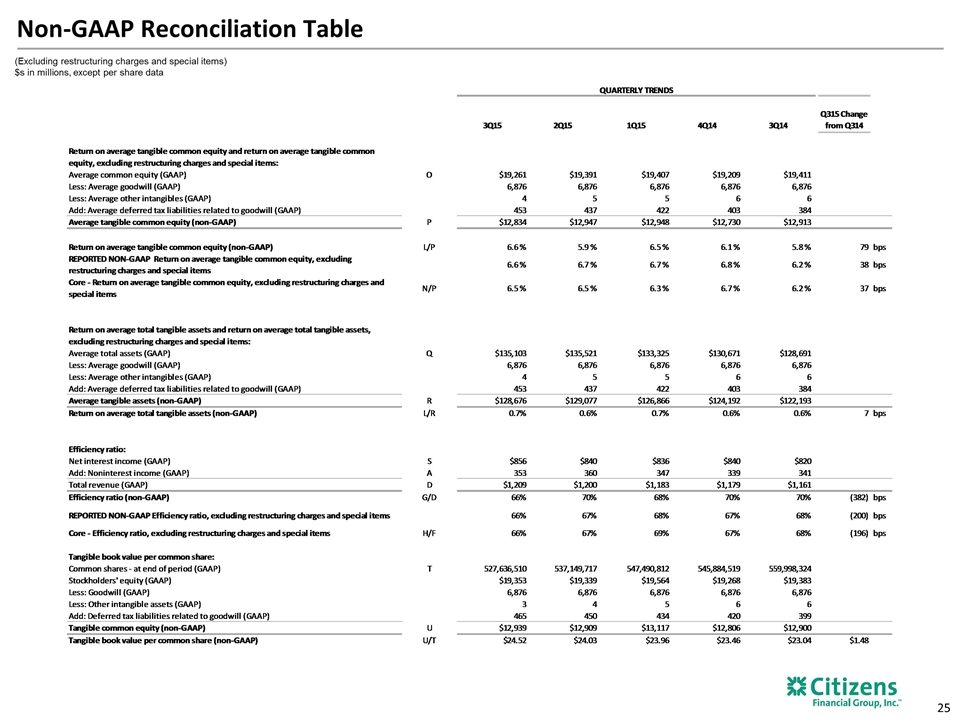

Non-GAAP Reconciliation Table (Excluding restructuring charges and special items) $s in millions, except per share data

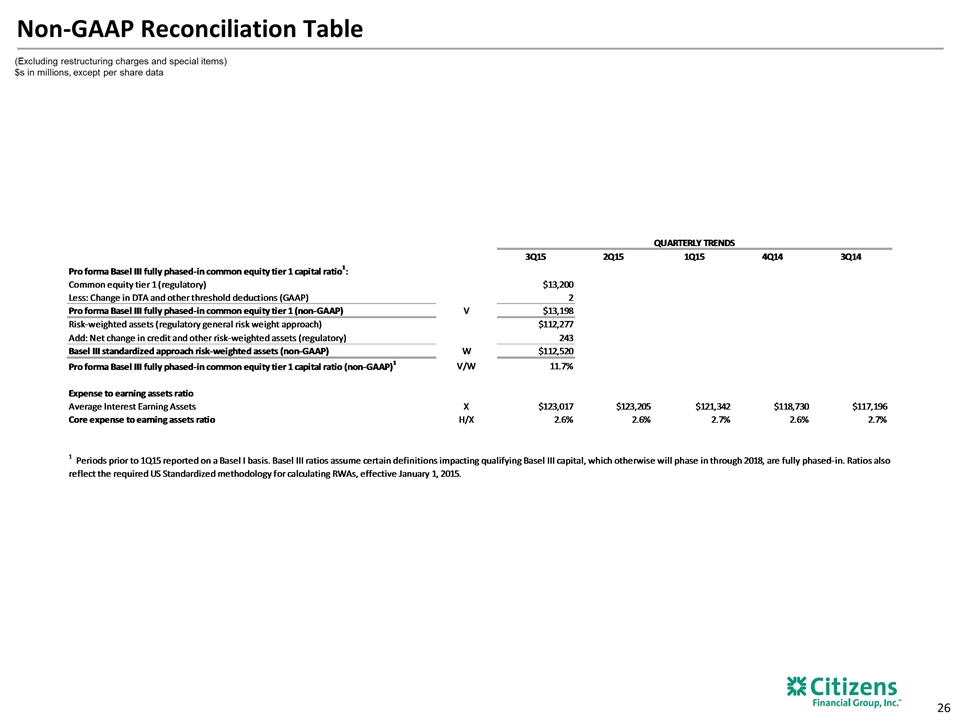

Non-GAAP Reconciliation Table (Excluding restructuring charges and special items) $s in millions, except per share data

Non-GAAP Reconciliation Table (Excluding restructuring charges and special items) $s in millions, except per share data