Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vectrus, Inc. | vec-09252015x8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - Vectrus, Inc. | vec-09252015x8xk991.htm |

VECTRUS THIRD QUARTER 2015 EARNINGS PRESENTATION KEN HUNZEKER CHIEF EXECUTIVE OFFICER AND PRESIDENT MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER NOVEMBER 5, 2015

SAFE HARBOR STATEMENT Page 2 SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 (THE “ACT”): CERTAIN MATERIAL PRESENTED HEREIN INCLUDES FORWARD-LOOKING STATEMENTS INTENDED TO QUALIFY FOR THE SAFE HARBOR FROM LIABILITY ESTABLISHED BY THE ACT. THESE FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS ABOUT OUR SPIN-OFF FROM FORMER PARENT (“THE SEPARATION”), THE TERMS AND THE EFFECT OF THE SEPARATION AND RELATED MATTERS, FUTURE STRATEGIC PLANS AND OTHER STATEMENTS THAT DESCRIBE OUR BUSINESS STRATEGY, OUTLOOK, OBJECTIVES, PLANS, INTENTIONS OR GOALS, AND ANY DISCUSSION OF GUIDANCE OR FUTURE OPERATING OR FINANCIAL PERFORMANCE. WHENEVER USED, WORDS SUCH AS “MAY,” “WILL,” “LIKELY,” "ANTICIPATE,“ "ESTIMATE,“ "EXPECT,“ "PROJECT,“ "INTEND,“ "PLAN,“ "BELIEVE,“ "TARGET,“ “COULD,” “POTENTIAL,” “CONTINUE,” OR SIMILAR TERMINOLOGY. THESE STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE RESULTS CONTEMPLATED BY THE FORWARD- LOOKING STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM OUR HISTORICAL EXPERIENCE AND OUR PRESENT EXPECTATIONS OR PROJECTIONS. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO: RISKS AND UNCERTAINTIES RELATING TO THE SPIN-OFF, INCLUDING WHETHER THE SPIN- OFF AND THE RELATED TRANSACTIONS WILL RESULT IN ANY TAX LIABILITY, THE OPERATIONAL AND FINANCIAL PROFILE OR ANY OF OUR BUSINESSES AFTER GIVING EFFECT TO THE SPIN-OFF, AND OUR ABILITY TO OPERATE AS AN INDEPENDENT ENTITY; ECONOMIC, POLITICAL AND SOCIAL CONDITIONS IN THE COUNTRIES IN WHICH WE CONDUCT OUR BUSINESSES; CHANGES IN U.S. OR INTERNATIONAL GOVERNMENT DEFENSE BUDGETS; GOVERNMENT REGULATIONS AND COMPLIANCE THEREWITH, INCLUDING CHANGES TO THE DEPARTMENT OF DEFENSE PROCUREMENT PROCESS; PROTESTS OF NEW AWARDS; OUR ABILITY TO SUBMIT PROPOSALS FOR AND/OR WIN ALL POTENTIAL OPPORTUNITIES IN OUR PIPELINE, CHANGES IN TECHNOLOGY; INTELLECTUAL PROPERTY MATTERS; GOVERNMENTAL INVESTIGATIONS, REVIEWS, AUDITS AND COST ADJUSTMENTS; CONTINGENCIES RELATED TO ACTUAL OR ALLEGED ENVIRONMENTAL CONTAMINATION, CLAIMS AND CONCERNS; DELAYS IN COMPLETION OF THE U.S. GOVERNMENT’S BUDGET; OUR SUCCESS IN EXPANDING OUR GEOGRAPHIC FOOTPRINT OR BROADENING OUR CUSTOMER BASE; OUR ABILITY TO REALIZE THE FULL AMOUNTS REFLECTED IN OUR BACKLOG AND TO RETAIN AND RENEW OUR EXISTING CONTRACTS; IMPAIRMENT OF GOODWILL; MISCONDUCT OF OUR EMPLOYEES, SUBCONTRACTORS, AGENTS AND BUSINESS PARTNERS; OUR ABILITY TO CONTROL COSTS; OUR LEVEL OF INDEBTEDNESS; SUBCONTRACTOR PERFORMANCE; ECONOMIC AND CAPITAL MARKETS CONDITIONS; ABILITY TO RETAIN AND RECRUIT QUALIFIED PERSONNEL; SECURITY BREACHES AND OTHER DISRUPTIONS TO OUR INFORMATION TECHNOLOGY AND OPERATIONS; CHANGES IN OUR TAX PROVISIONS OR EXPOSURE TO ADDITIONAL INCOME TAX LIABILITIES; CHANGES IN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP); AND OTHER FACTORS SET FORTH IN PART I, ITEM 1A, “RISKS FACTORS,” AND ELSEWHERE IN OUR 2014 ANNUAL REPORT ON FORM 10-K AND DESCRIBED FROM TIME TO TIME IN OUR FUTURE REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (SEC). WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW.

Q3 2015 HIGHLIGHTS Page 3 • Completed first full year as a publicly-traded pure-play government services provider • Core business revenue (1) increased 17%(1) compared to the prior year period • Army Corps of Engineers Information Technology (ACE-IT) contract fully operational • Solid third quarter results o Revenue of $299.1 million o Operating margin of 2.8%, adjusted operating margin (1) of 3.9% o Diluted earnings per share (EPS) of $1.29, adjusted EPS(1) of $0.65 o Year-to-date net cash provided by operating activities of $10.0 million; free cash flow(1) of $9.3 million Incremental free cash flow(2) $10.2 million during the quarter • Strong free cash flow enabled voluntary debt payment of $3 million in Q3; $9 million year-to-date • Favorable settlements of uncertain tax positions (1) See Appendix for definitions and reconciliation. (2) Incremental free cash flow of $10.2 million is the change in free cash flow from Q2 2015 to Q3 2015; ($0.9M) Q2 2015 vs. $9.3M Q3 2015.

VECTRUS UPDATE Page 4 (1) Indefinite Delivery Indefinite Quantity (IDIQ) contracts carry no value in the pipeline of potential proposals to be submitted until a specific task order is identified. • Appointed Vice President for IT & Network Communication Services • Contract updates o Recompetes: K-BOSSS, APS-5, Maxwell o Thule Base Maintenance • Orders and pipeline o Strong funded orders of $444 million in the quarter o Seeing task orders emerge from newly won IDIQ contracts o Approx. $1 billion of proposals submitted and pending potential award(1), 100% for new business; approx. $6 billion in potential new business opportunities identified over the next 12 months • Afghanistan & macro environment o In October, the President announced his decision to maintain the force posture of 9,800 troops in Afghanistan through most of next year o Vectrus supporting Operation Inherent Resolve from Incirlik Air Base in Turkey

Q3 2015 FINANCIAL RESULTS Page 5 (1) For periods ended September 27, 2014 (date of the Spin-off) and prior, basic and diluted earnings per share are computed using the number of shares of Vectrus common stock outstanding on September 27, 2014, the date on which the Vectrus common stock was distributed to the shareholders of Exelis Inc. (2) See Appendix for definitions and reconciliation. Adjusted Q3 2015 Financial Results(2) (In millions, except Operating Margin and Diluted Earnings Per Share) Q3 2015 Q3 2014 vs. 2014 Funded Orders 443.8$ 715.6$ (271.8)$ Revenue 299.1$ 300.7$ (1.6)$ Operating Income 8.5$ 3.3$ 5.2$ Operating Margin 2.8% 1.1% 170 bps Diluted Earnings Per Share (1) 1.29$ 0.20$ 1.09$ Third Quarter 2015 (In millions, except Operating Margin and Diluted Earnings Per Share) Q3 2015 Q3 2014 vs. 2014 Funded Orders 443.8$ 703.0$ (259.2)$ Revenue 299.1$ 288.1$ 11.0$ Operating Income 11.8$ 9.5$ 2.3$ Operating Margin 3.9% 3.3% 60 bps Diluted Earnings Per Share (1) 0.65$ 0.59$ 0.06$ Thir Qua ter 2015

YEAR TO DATE 2015 FINANCIAL RESULTS Page 6 (1) For periods ended September 27, 2014 (date of the Spin-off), and prior, basic and diluted earnings per share are computed using the number of shares of Vectrus common stock outstanding on September 27, 2014, the date on which the Vectrus common stock was distributed to the shareholders of Exelis Inc. (2) See Appendix for definitions and reconciliation. Adjusted YTD 2015 Financial Results(2) (In millions, except Operating Margin and Diluted Earnings Per Share) 2015 2014 vs. 2014 Funded Orders 919.8$ 1,192.9$ (273.1)$ Revenue 869.5$ 917.5$ (48.0)$ Operating Income 28.7$ 30.3$ (1.6)$ Operating Margin 3.3% 3.3% 0 bps YTD Net Cash Provided by Operating Activities 10.0$ 40.2$ (30.2)$ Diluted Earnings Per Share (1) 2.31$ 1.86$ 0.45$ Year-to-date September 2015 (In millio s, xcept Operating Margin and Diluted Earnings Per Share) 2015 2014 vs. 2014 Funded Orders 919 8 1,168 0 (248 2 Revenue 869.5$ 886.2$ (16.7)$ Operating Income 32 1 1 4 (9 3 Operating Mar in 3 7% 4 7% (100) bps TD Free Cash Flow 9.3$ 38.1$ (28.8)$ Diluted Earnings Per Share (1) 1.69$ 2.54$ (0.85)$ Year-to-date September 2015

BACKLOG (1) Page 7 (1) Total backlog represents firm orders and potential options on multi-year contracts, excluding potential orders under Indefinite-Delivery/Indefinite-Quantity (IDIQ) contracts. • As of Q3 2015, total backlog of $2.4 billion o Funded backlog $0.9 billion o Unfunded backlog $1.5 billion $0.7 $0.7 $0.9 $1.9 $1.8 $1.5 $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 Q1 2015 Q2 2015 Q3 2015 Unfunded Funded $2.6 $2.5 $2.4

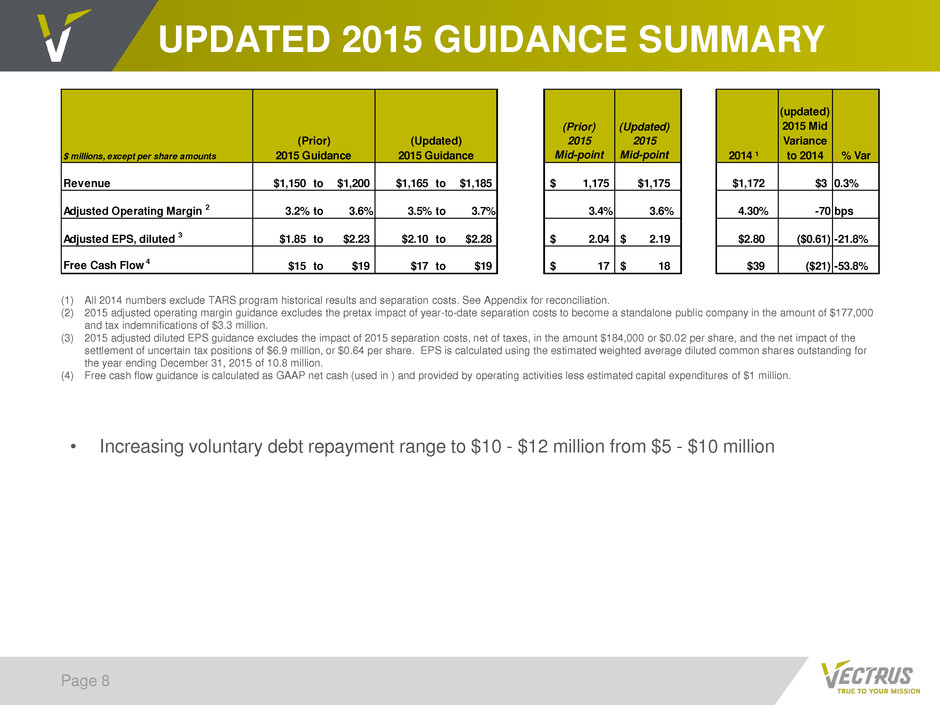

UPDATED 2015 GUIDANCE SUMMARY Page 8 (1) All 2014 numbers exclude TARS program historical results and separation costs. See Appendix for reconciliation. (2) 2015 adjusted operating margin guidance excludes the pretax impact of year-to-date separation costs to become a standalone public company in the amount of $177,000 and tax indemnifications of $3.3 million. (3) 2015 adjusted diluted EPS guidance excludes the impact of 2015 separation costs, net of taxes, in the amount $184,000 or $0.02 per share, and the net impact of the settlement of uncertain tax positions of $6.9 million, or $0.64 per share. EPS is calculated using the estimated weighted average diluted common shares outstanding for the year ending December 31, 2015 of 10.8 million. (4) Free cash flow guidance is calculated as GAAP net cash (used in ) and provided by operating activities less estimated capital expenditures of $1 million. • Increasing voluntary debt repayment range to $10 - $12 million from $5 - $10 million $ millions, except per share amounts (Prior) 2015 Mid-point (Updated) 2015 Mid-point 2014 ¹ (updated) 2015 Mid Variance to 2014 % Var Revenue $1,150 to $1,200 $1,165 to $1,185 1,175$ $1,175 $1,172 $3 0.3% Adjusted Operating Margin 2 3.2% to 3.6% 3.5% to 3.7% 3.4% 3.6% 4.30% -70 bps Adjusted EPS, diluted 3 $1.85 to $2.23 $2.10 to $2.28 2.04$ 2.19$ $2.80 ($0.61) -21.8% Free Cash Flow 4 $15 to $19 $17 to $19 17$ 18$ $39 ($21) -53.8% (Prior) 2015 Guidance (Updated) 2015 Guidance

VECTRUS THIRD QUARTER 2015 EARNINGS PRESENTATION KEN HUNZEKER CHIEF EXECUTIVE OFFICER AND PRESIDENT MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER NOVEMBER 5, 2015

APPENDIX

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Page 11 The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. In addition, we consider adjusted revenue, adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, and free cash flow to be useful to management and investors in evaluating our operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. Adjusted revenue, adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, free cash flow and adjusted funded orders, however, are not measures of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for revenue, operating income, net income, diluted earnings per share or net cash provided by operating activities as determined in accordance with GAAP. Reconciliations of adjusted revenue, adjusted operating income and free cash flow are provided below. “Adjusted revenue” is defined as revenue adjusted to exclude historical results relating to the Tethered Aerostat Radar System (TARS) program which was retained by former parent in connection with the spin-off. “Adjusted operating income” is defined as net income, adjusted to exclude income tax expense (benefit), interest income (expense), TARS program operating income (loss), pretax impact of separation costs incurred to become a public company, and tax indemnifications. “Adjusted operating margin” is defined as net income, adjusted to exclude income tax expense (benefit), interest income (expense), TARS program operating income (loss), pretax impact of separation costs incurred to become a public company, and tax indemnifications divided by adjusted revenue. “Adjusted net income” is defined as net income, adjusted to exclude TARS program operating income (loss), separation costs incurred to become a public company, and net settlement of uncertain tax positions, net of taxes. “Adjusted diluted earnings per share” is defined as net income, adjusted to exclude TARS program operating income (loss), separation costs incurred to become a public company, and net settlement of uncertain tax positions, net of taxes, divided by the weighted average diluted common shares outstanding. “Free cash flow” is defined as GAAP net cash (used in) and provided by operating activities less capital expenditures. “Adjusted funded orders” is defined as funded orders adjusted to exclude the TARS program orders. “Core business revenue” is defined as total adjusted revenue less revenue from Afghanistan programs. (I th usands) Adjusted R venue (Non-GAAP Measure) September 25, 2015 September 26, 2014 September 25, 2015 September 26, 2014 R venue 299,061$ 300,651$ 869,490$ 917,504$ TARS revenue ¹ — (12,578) — (31,315) Adjusted revenue 299,061$ 288,073$ 869,490$ 886,189$ Three Months Ended Nine Months Ended ¹ TARS program historical revenue, which has been retained by former parent.

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Page 12 (In thousands) Adjusted Operating Income (Non-GAAP Measure) September 25, 2015 September 26, 2014 September 25, 2015 September 26, 2014 Net income 14,028$ 2,114$ 25,012$ 19,482$ Income tax (benefit) expense (7,140) 1,155 (958) 10,815 Interest (expense) income, net (1 583) (22) (4 616) 28 Operating income 8,471 3,291 28,670 30,269 Operating margin 2.8 % 1.1 % 3.3 % 3.3 % TARS operating income (loss) 1 (pretax) — (931) — (1,541) Separation costs ² (pretax) — 7,148 177 12,681 Tax Indemnifications 3 3,300$ —$ 3,300$ —$ Adjusted operating income 11 771$ 9 508$ 32 147$ 41 409$ Adjusted operating margin 3.9 % 3 3 % 3.7 % 4.7 % (In thousands, except for per share data) Adjusted Diluted Earnings Per Share September 25, 2015 September 26, 2014 September 25, 2015 September 26, 2014 Net income 14,028$ 2,114$ 25,012$ 19,482$ TARS operating income (loss) ¹ (pretax) — (931) — (1,541) Separation costs ² (pretax) — 7,148 177 12,681 Tax impact of adjustments — (2,195) 7 (3,977) Net settlement of uncertain tax positions 3 (6,949)$ —$ (6,949)$ —$ Adjusted net income 7,079$ 6,136$ 18,247$ 26,645$ GAAP EPS - diluted 1.29$ 0.20$ 2.31$ 1 86$ Adjusted EPS - diluted 0.65$ 0.59$ 1.69$ 2 54$ Weighted average common shares outstanding - diluted 10,848 10,474 10,808 10,474 Three Months Ended Nine Months Ended ¹ TARS program historical operating income (loss), which has been retained by former parent. ² Costs incurred to become a stand-alone public company. 3 Tax Indemnifications in connection with the spin-off (see NOTE 3 to the financial statements "Tax Indemnifications"). Three Months Ended Nine Months Ended ¹ TARS program historical operating income (loss), which has been retained by former parent. ² Costs incurred to become a stand-alone public company. 3 Net settlement of uncertain tax positions due to resolution of examinations of tax returns of our former parent (see NOTE 3 to the financial statements "Uncertain Tax Positions")

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Page 13 (In thousands) Free Cash Flow (Non-GAAP Measure) September 25, 2015 September 26, 2014 Net cash provided by operating activities 10,044$ 40,180$ Subtract: Capital expenditures (769) (2 049) Free cash flow 9,275$ 38,131$ (In millions) Adjusted Funded Orders (Non-GAAP Measure) September 25, 2015 September 26, 2014 September 25, 2015 September 26, 2014 Orders 443.8$ 715.6$ 919.8$ 1,192.9$ TARS Orders ¹ —$ (12.6)$ —$ (24.9)$ Adjusted Orders 443.8$ 703.0$ 919.8$ 1,168.0$ (In thousands) Adjusted Revenue and Core Business Revenue (Non- GAAP Measure) September 25, 2015 September 26, 2014 $ Change % Change Revenue 299,061$ 300,651$ TARS revenue ¹ — (12,578) Adjusted revenue 299,061$ 288,073$ Less Afghanistan Program Revenue (38,951)$ (65,190)$ Core business revenue 260 110$ 222 883$ 37 227$ 17 % (In thousands) Adjusted Revenue and Core Business Revenue (Non- GAAP Measure) September 25, 2015 September 26, 2014 $ Change % Change Revenue 869,490$ 917,504$ TARS revenue ¹ —$ (31,315)$ Adjusted revenue 869,490$ 886,189$ Less Afghanistan Program Revenue (128,498)$ (219,026)$ Core business revenue 740 992$ 667 163$ 73 829$ 11 % Nine Months Ended ¹ TARS program historical revenue, which has been retained by former parent. Three Months Ended Nine Months Ended ¹ TARS program historical orders, which has been retained by former parent. Nine Months Ended Three Months Ended