Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TWO HARBORS INVESTMENT CORP. | a8kmortgageloanconduitands.htm |

N ove mb er 4 , 2 015 Mortgage Loan Conduit & Securitization

Safe Harbor F O R W A R D - L O O K I N G S T A T E M EN T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward- looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2014, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the concentration of credit risks we are exposed to; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to successfully implement new strategies and to diversify our business into new asset classes; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage loans and successfully securitize the mortgage loans we acquire; our ability to acquire mortgage servicing rights (MSR) and successfully operate our seller-servicer subsidiary and oversee our subservicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; the state of commercial real estate markets and our ability to acquire or originate commercial real estate loans or related assets; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. 2

Two Harbors Overview

Mission-Based Strategy O U R M I S S I O N I S TO BE R E C O G N I Z E D A S T H E I N D U STRY - LE ADING M O RTG AG E R E I T: • Largest hybrid mortgage REIT investing in mortgage assets • Market capitalization of approximately $3.2 billion(1) • Provider of permanent capital to the U.S. mortgage market • Thought leader in the U.S. housing market BE N E F I T O F O U R H Y BR I D M O D E L : • Flexibility to take advantage of opportunities the residential and commercial mortgage markets, including: ― Residential mortgage-backed securities (RMBS) ― Residential mortgage loans ― Mortgage servicing rights (MSR) ― Commercial real estate assets ― Other financial assets I M P E R AT IV E S : • Rigorous risk management system • Strong administrative infrastructure • Best practice disclosure and corporate governance • Logically diversify portfolio for benefit of stockholders 4 (1) Source: Bloomberg as of September 30, 2015.

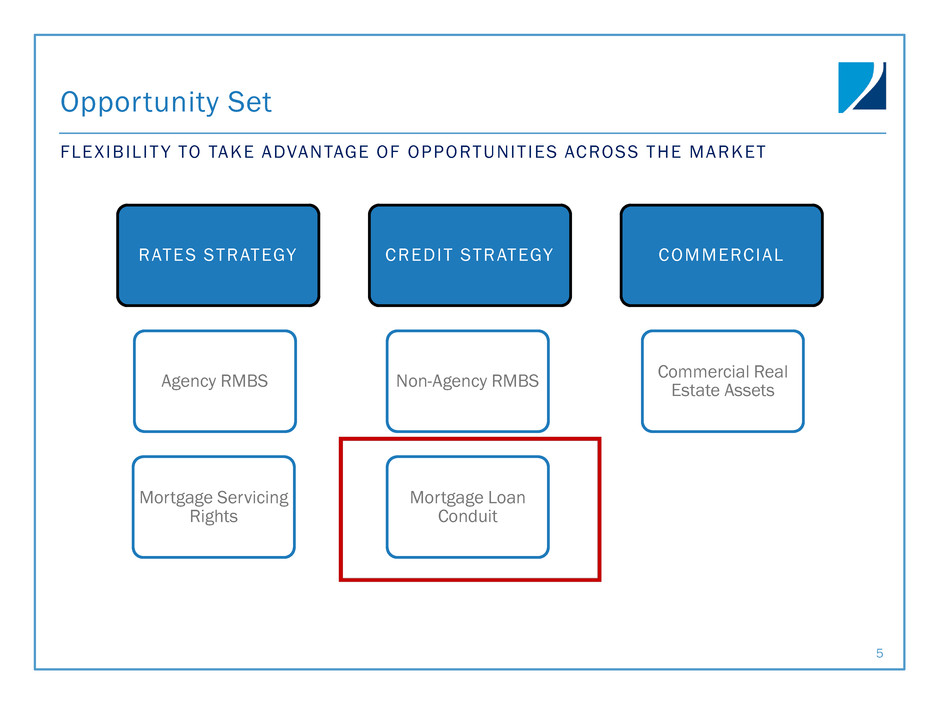

Opportunity Set 5 FLEXIB IL IT Y TO TAKE ADVANTAGE OF OPPORTUNITIES ACROSS THE MARKET RATES STRATEGY Agency RMBS Mortgage Servicing Rights CREDIT STRATEGY Non-Agency RMBS Mortgage Loan Conduit COMMERCIAL Commercial Real Estate Assets

Webinar Objectives

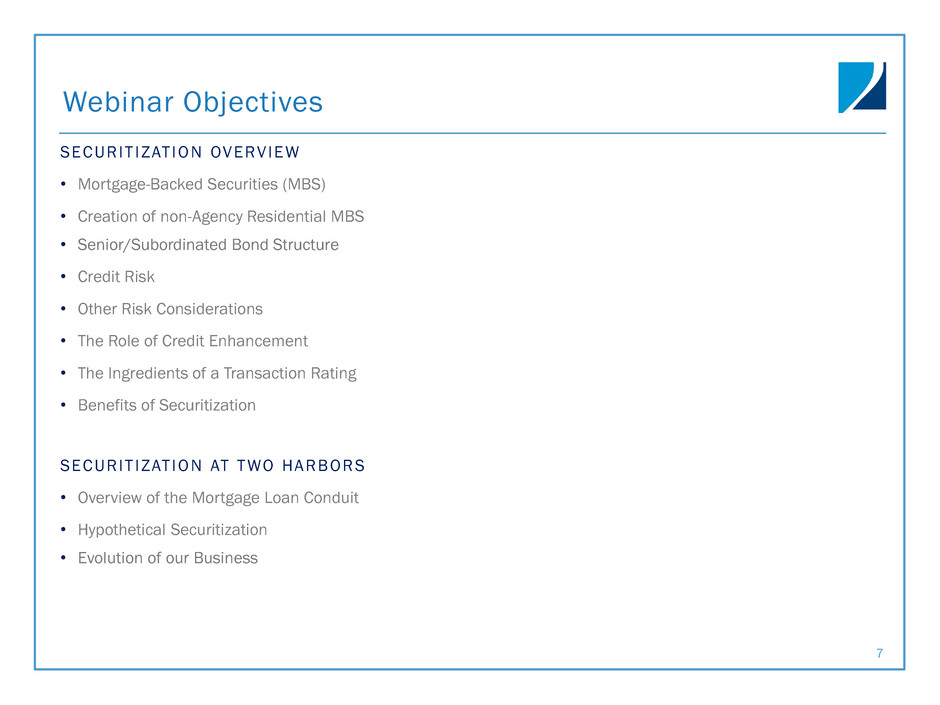

7 Webinar Objectives SECURIT IZATION OVERVIEW • Mortgage-Backed Securities (MBS) • Creation of non-Agency Residential MBS • Senior/Subordinated Bond Structure • Credit Risk • Other Risk Considerations • The Role of Credit Enhancement • The Ingredients of a Transaction Rating • Benefits of Securitization SECURIT IZATION AT T WO HARBORS • Overview of the Mortgage Loan Conduit • Hypothetical Securitization • Evolution of our Business

Securitization Overview

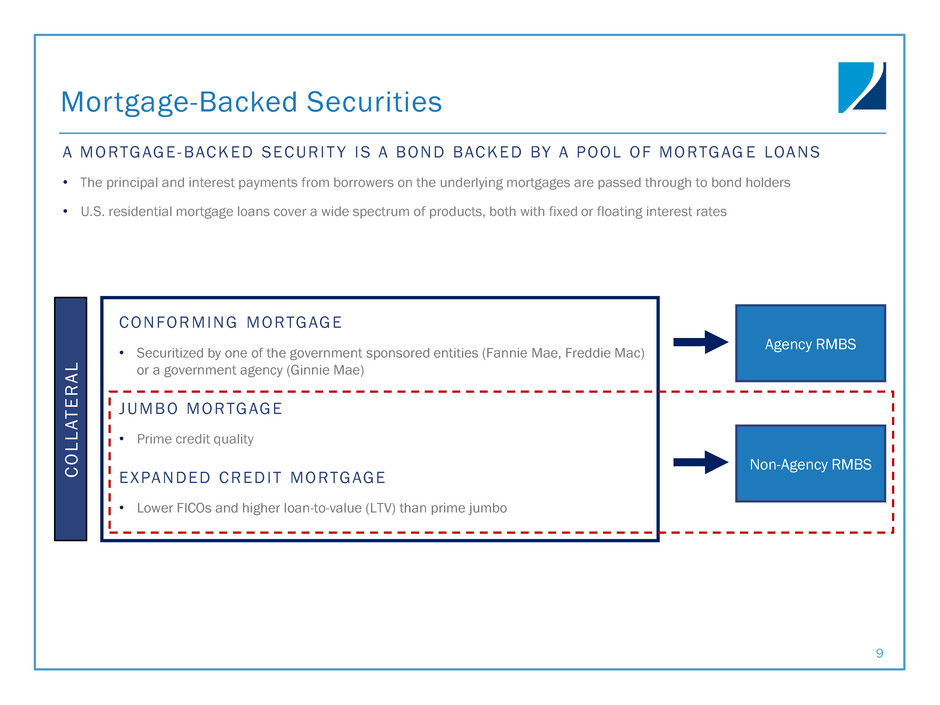

9 A MORTGAGE -BACKED SECURIT Y IS A BOND BACKED BY A POOL OF MORTGAG E LOANS • The principal and interest payments from borrowers on the underlying mortgages are passed through to bond holders • U.S. residential mortgage loans cover a wide spectrum of products, both with fixed or floating interest rates Mortgage-Backed Securities CONFORMING MORTGAGE • Securitized by one of the government sponsored entities (Fannie Mae, Freddie Mac) or a government agency (Ginnie Mae) JUMBO MORTGAGE • Prime credit quality EXPANDED CREDIT MORTGAGE • Lower FICOs and higher loan-to-value (LTV) than prime jumbo Non-Agency RMBS C O L L A T E R A L Agency RMBS

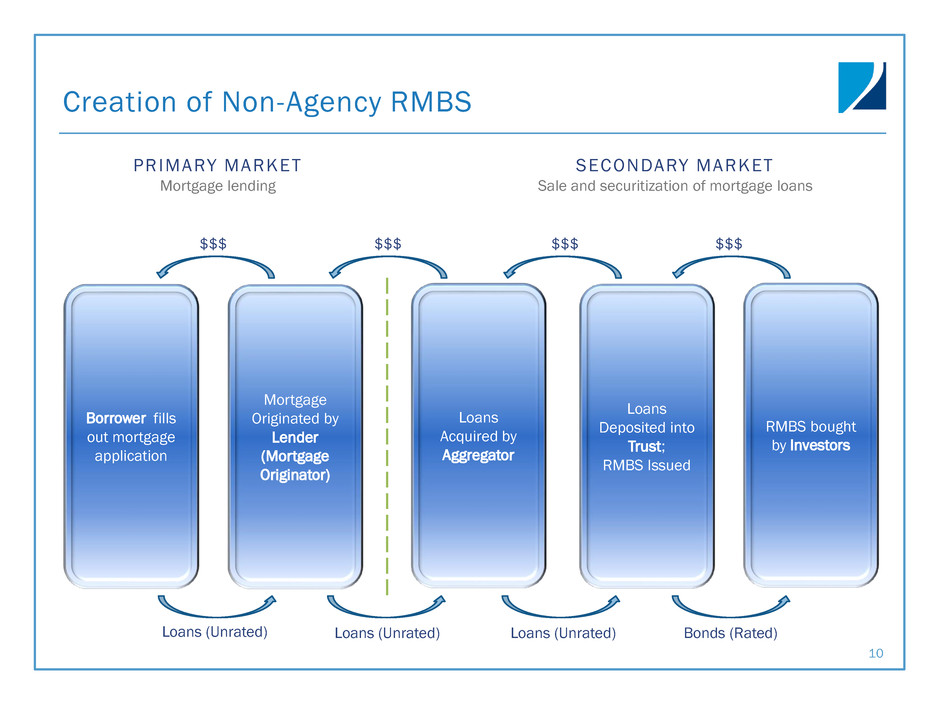

10 Creation of Non-Agency RMBS PRIMARY MARKET Mortgage lending Loans (Unrated) SECONDARY MARKET Sale and securitization of mortgage loans Borrower fills out mortgage application Mortgage Originated by Lender (Mortgage Originator) RMBS bought by Investors Loans Deposited into Trust; RMBS Issued Loans Acquired by Aggregator Loans (Unrated) Loans (Unrated) Bonds (Rated) $$$ $$$ $$$ $$$

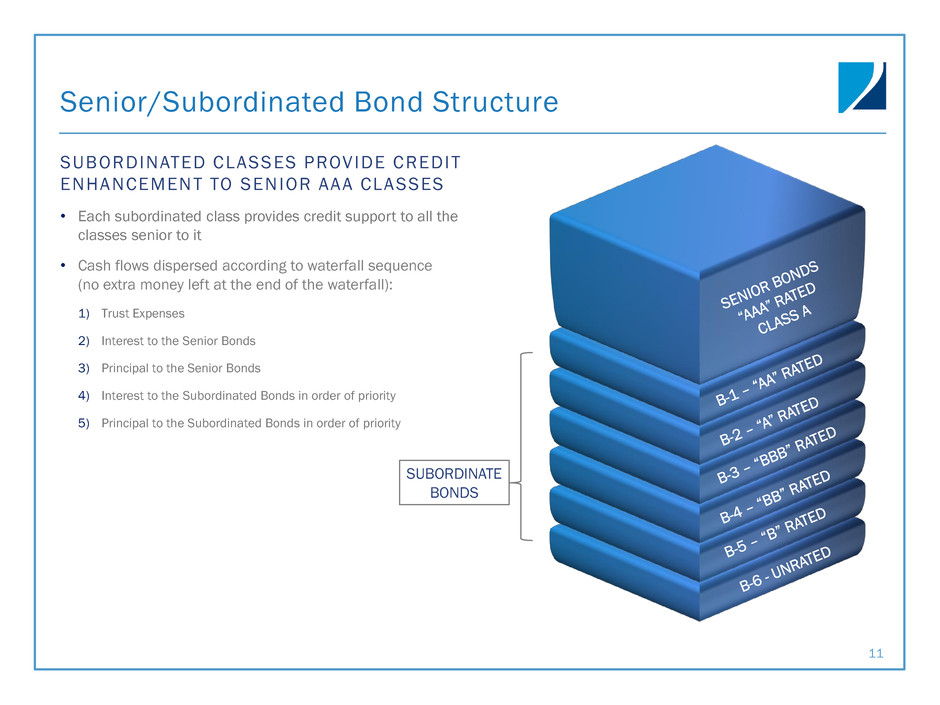

11 SUBORDINATED CLASSES PROVIDE CREDIT ENHANCEMENT TO SENIOR AAA CLASSES • Each subordinated class provides credit support to all the classes senior to it • Cash flows dispersed according to waterfall sequence (no extra money left at the end of the waterfall): 1) Trust Expenses 2) Interest to the Senior Bonds 3) Principal to the Senior Bonds 4) Interest to the Subordinated Bonds in order of priority 5) Principal to the Subordinated Bonds in order of priority Senior/Subordinated Bond Structure SUBORDINATE BONDS

12 CREDIT RISK IS THE POTENTIAL FOR PRINCIPAL LOSSES DUE TO DEFAULTS ON THE UNDERLY ING MORTGAGES • Defaults result from the borrower missing several scheduled monthly payments • Servicer may ultimately liquidate the loan to attempt to recover the principal and interest due ― Liquidation may be carried out through legal proceedings (foreclosure) or negotiation (short sale) • Frequency of default can be influenced by the following factors: ― Changes in home prices ― Credit score ― Product type ― Loan-to-value (LTV) ratio ― Owner occupancy ― Life events • Severity of default is the net loss resulting from a default divided by the current principal balance • Aggregate losses on RMBS are driven by default frequency and default severity Credit Risk

13 PREPAYMENTS: Actual yield on investment can differ from anticipated yield due to higher/lower prepayment rates • Housing turnover • Rate/term refinance (falling interest rates) • Cash-out refinance (increasing equity) • Partial prepayments (curtailments) LIQUIDIT Y : Ability or ease with which assets can be traded • Change in rating of security • Widening spreads • Servicer under-performance or adverse development • Collateral under-performance • Interest rate changes • Limited investor universe BANKRUPTCY: Securitized assets could be clawed back if aggregator goes bankrupt • Typically addressed by bankruptcy remote structure/special purpose entities (SPE) Other Risk Considerations and Drivers

14 CREDIT ENHANCEMENT DETERMINED BY RATING AGENCIES BASED ON EXPECT ED PORTFOLIO PERFORMANCE UNDER A WORST-CASE SCENARIO • Objective of credit enhancement is to protect investor principal against credit losses • A portfolio of mortgages cannot be AAA rated on a stand-alone basis – Credit needs to be enhanced by structure • The type of credit enhancement is generally decided by the Issuer – A function of investor preferences • Minimum size of the credit enhancement is determined by the rating agencies – Can be increased at the option of the issuer – Criteria among rating agencies may differ; general approach is based on a perceived worst case scenario • Under this scenario, credit enhancement should be sufficient to allow for the timely payment of interest and ultimate payment of principal before a specified date The Role of Credit Enhancement

15 ELEMENTS EXAMINED BY RATING AGENCIES • Legal Structure • Collateral Review – Historical losses, projected prepayments, delinquencies and recoveries (i.e. historical experience with this type of collateral) – Geographic concentration – LTV, debt-to-income (DTI), FICO score – Estimates of frequency and severity of default – Review of loan level diligence reports provided by third party review firms • Due Diligence on Originators, Servicer or Aggregator – Origination strategy, approval process, acquisition standards – If originator > 15% of pool, rating agency review typically required • Cash-Flow and Structural Features – Strength of representations and warranties – Enforcement mechanisms The Ingredients of a Transaction Rating

16 A HEALTHY SECURITIZATION MARKET PROVIDES CAPITAL TO BORROWERS AN D L IQUIDIT Y TO THE HOUSING MARKET Benefits of Securitization CONSUMERS ISSUERS INVESTORS • Lowers cost of credit • Increases credit availability • Expands the variety of credit available to meet consumer needs • Encourages competition among lenders in the marketplace • Contributes to economic vitality by ensuring consumer access to credit • Securitization is an alternative to unsecured borrowing ― May provide cheaper financing than other sources and a more efficient, cost-effective and stable source of funding than unsecured market • Allows issuers to obtain cash from the sale of assets (loans) • Diversification of risk - pool of diverse mortgages versus unsecured corporate debt • More predictable performance • Greater liquidity compared to owning loans • Flexibility and choice in desired level of risk and return • Ratings stability • High transparency and disclosure

Securitization at Two Harbors

Two Harbors’ Conduit 18 EFFIC IENT AND SCALABLE PROGRAM ALLOWS QUICK RESPONSE TO BROAD ARRAY OF OPPORTUNITIES • Transaction management team oversees: ― Due diligence ― Contract management ― Seller-servicer onboarding and implementation ― Core technology infrastructure and oversight groups provide active surveillance and performance management of our sub-servicing and originator partners • Intensive counterparty management process maximizes investment returns while minimizing risk • Mortgage Compliance team provides legal and mortgage compliance guidance to mortgage servicing oversight and new loan product development teams • Staffed by seasoned operators with an average experience of 16+ years

Illustrative Securitization Economics 19 Note: The above scenario is intended to be illustrative. The numbers used in the scenarios are not projections of Two Harbors’ results. The above scenarios are provided for illustration purposes only and may not represent all assumptions used. Actual results of a portfolio may differ materially. (1) Illustration excludes estimated deal costs of $4.4 million. Due to accounting elections, deal costs are required to be immediately recognized in the income statement resulting in incremental ROE of 0.2% over the life of the securities. Securitization Pricing (1) Class Rating Price Market Value ($m) Yield A’s AAA 101.14% $940.6 3.5% B-1 AA 100.30% 26.1 3.7% B-2 A 98.85% 17.3 3.9% B-3 BBB 95.40% 12.4 4.3% B-4 BB 63.45% 3.5 6.1% B-5 B 45.00% 3.6 6.8% MSR 1.09% 10.9 7.9% IO 1.09% 10.2 6.7% Total Stack 102.46% $1,024.6 3.5% Market Value of Retained Bonds ($m) $40.6 Equity Invested ($m) $20.3 Unlevered ROE 6-8% Levered ROE 12-16% GOAL IS TO CREATE ATTRACTIVE CREDIT ASSETS FOR THE T WO HARBORS PORTFOLIO • Hypothetical $1 billion loan portfolio of 30-year, 4.0% coupon residential mortgage loans • Structured with 3.5% pass through and 25 basis points for MSR and IO • Source loans at 102.46% • Sell AAA, AA and A rated tranches; roughly $40 million in assets remain • Retain MSR, IO and subordinate bonds • Apply 1x debt-to-equity to $40 million of assets ― Financing at approximately LIBOR +125 • Results in capital deployment of approximately $20 million and levered ROE of 12-16%

$22 $222 $694 $438 $579 $646 $680 $642 $356 $575 $493 $606 $3,105 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $0 $500 $1,000 $1,500 Q1-2014 Q2-2014 Q3-2014 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Securitized 2013 - Q3-2015 Settled Securitized • Completed eleven Agate Bay Mortgage Trust securitizations since 2013(1) – Retained subordinates and IOs – Achieved stated goal of completing 6-10 securitizations in 2015 • Robust pipeline (interest rate locks and prime jumbo residential mortgage loan holdings); approximately $1.2 billion UPB at September 30, 2015 • Expanded Credit targets borrowers with lower FICOs and higher loan-to-value (LTV) ratios than prime jumbo program Evolution of Conduit at Two Harbors 20 SETTLED AND SECURITIZED LOANS (1) As of October 31, 2015. (2) Includes only securitizations sponsored under the Agate Bay Mortgage Trust issuer program. (2)

Closing Remarks 21 CONTACT INFORMATION Investor Relations 612-629-2500 investors@twoharborsinvestment.com