Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Newtek Business Services Corp. | q32015investorpresentation.htm |

Strictly Confidentialwww.thesba.com Newtek Business Services Corp. “The Small Business Authority®” NASDAQ: NEWT Hosted by: Barry Sloane, President & CEO Jennifer Eddelson, EVP & CAO Investor Relations Public Relations Newtek Investor Relations Newtek Public Relations Jayne Cavuoto Director of Investor Relations jcavuoto@thesba.com (212) 273-8179 Simrita Singh Director of Marketing ssingh@thesba.com (212) 356-9566 Third Quarter 2015 Financial Results Conference Call November 4, 2015 8:30 am ET

www.thesba.com 1 Note Regarding Forward Looking Statements This presentation contains certain forward-looking statements. Words such as “plan,” “believes,” “expects,” “plans,” “anticipates,” “forecasts” and “future” or similar expressions are intended to identify forward-looking statements. All forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the plans, intentions and expectations reflected in or suggested by the forward-looking statements. Such risks and uncertainties include, among others, intensified competition, operating problems and their impact on revenues and profit margins, anticipated future business strategies and financial performance, anticipated future number of customers, business prospects, legislative developments and similar matters. Risk factors, cautionary statements and other conditions, which could cause Newtek’s actual results to differ from management’s current expectations, are contained in Newtek’s filings with the Securities and Exchange Commission and available through http://www.sec.gov/

www.thesba.com 2 Third Quarter & Other Financial Highlights Net asset value (“NAV”) equaled $174.7 million, or $16.88 per share, at September 30, 2015, compared with NAV of $166.4 million, or $16.31 per share, at December 31, 2014; an increase of approximately 5% On October 1, 2015, the Board adjusted the NAV to $135.6 million, or $13.10 per share, as a result of the declaration of the $34.0 million special dividend Adjusted net investment income* was $5.1 million, or $0.50 per share For the nine months ended September 30, 2015, Adjusted net investment income* was $15.4 million, or $1.50 per share Closed public offering of $8.2 million in aggregate principal amount of 7.5% notes due 2022 – The Notes trade on the Nasdaq Global Market under the trading symbol "NEWTZ" On October 15, 2015, the Company closed an underwritten offering of 2.3 million shares of common stock at a public offering price of $16.50 per share for total gross proceeds of approximately $38.0 million *See Slide 38 for definition of Adjusted net investment income

www.thesba.com 3 Newtek Small Business Finance Highlights Funded $64.2 million of SBA 7(a) loans in the third quarter of 2015; an increase of 32.0% over the third quarter of 2014 Fourth quarter has historically been the strongest quarter of the year, comprising approximately one-third of the annual loan fundings Reaffirm loan funding forecast of between $230 million and $270 million of SBA 7(a) loans in 2015, which represents an approximate 23.6% increase over 2014 In November of 2015 expect to fund first SBA 504 loan through our portfolio company CDS Business Services, Inc. Completed sixth securitization of $40.8 million of Standard and Poor's AA rated Unguaranteed SBA 7(a) Loan- Backed Notes, the Company’s largest securitization to date – The Notes were priced and sold to investors at a yield of 2.5%, which represents an approximate 100 basis point improvement in the overall yield since the Company's last securitization In October 2015, Newtek entered into an alliance partnership with LendingTree Historical Quarterly SBA 7 (a) Loan Originations ($ in thousands) Q1 Q2 Q3 Q4 Total 24,486$ 21,025$ 26,632$ 35,282$ 107,425$ Q1 Q2 Q3 Q4 Total 34,826$ 42,825$ 42,299$ 57,991$ 177,941$ Q1 Q2 Q3 Q4 Total 45,680$ 42,557$ 48,790$ 65,241$ 202,268$ 2012 2013 2014

www.thesba.com 4 Dividend Distributions November 3, 2015 paid third quarterly cash dividend of $0.50 per share Paid a total of $1.36 in cash dividends to date in 2015, which represents approximately 91% of the adjusted net investment income of $1.50 per share for the nine months ended September 30, 2015 October 15, 2015: increased annual dividend forecast to $20.9 million, or $1.82* per share (based on outstanding share count of 12.6 million; does not include the yet-to-be determined number of shares to be issued on December 31, 2015 in connection with the special dividend) an increase of $2.3 million in the anticipated full year 2015 dividend payments compared to the previously issued forecast of $18.6 million, or $1.82* per share (based on the 10.3 million shares outstanding at time of forecast) On October 1, 2015, the Board declared a special dividend of approximately $34.0 million, payable on December 31, 2015 to common shareholders of record as of November 18, 2015 – Equates to $2.69 per share based on the 12.6 million shares of common stock currently outstanding, (as adjusted for the October 15 closing of the 2.3 million share common stock offering) – The special dividend represents the distribution of our C-corp earnings and profits accumulated through December 31, 2014, prior to the effective date of our election to be treated as a regulated investment company (“RIC”) *Amount and timing of dividends, if any, remain subject to the discretion of the Company’s board of directors.

www.thesba.com 5 Senior Note Offering – Continued Ability to Access Capital Markets September 16, 2015: completed public offering of $8.3 million of 7.5% Notes due 2022 – Interest rate of 7.5% to be paid quarterly beginning December 31, 2015 May be redeemed all or in part beginning in three years from date of delivery Notes listed on Nasdaq Global Market under trading symbol “NEWTZ” This Note offering with a long-term fixed-rate coupon will facilitate the Company’s continued growth Newtek’s common stock transferred from the Nasdaq Capital Market to the Nasdaq Global Market; trading symbol for the Company’s common stock remains “NEWT”

www.thesba.com 6 Third Quarter Securitization Completed largest securitization to date of $40.8 million S&P AA rated Unguaranteed SBA 7(a) Loan- Backed Notes, which was accomplished as an amendment and supplement to the 2010-1 securitization The Notes were priced and sold to investors at a yield of 2.5%; an approximate 100 basis point improvement in the overall yield since the Company's last securitization – Original 2010-1 securitization was priced and sold to investors at 5.75% Collateral and securities are term match funded with the non-guaranteed portions of the SBA 7(a) loans bearing a current interest rate of Prime (3.25%) plus 2.75%, which equates to a 6% interest rate for the borrower Improvement in pricing is believed to be a result of historic credit performance, the size of the transaction and Newtek’s 12-year history as an SBA 7(a) loan originator Sandler O'Neill + Partners L.P. acted as the placement agent for the sale of the Notes Transaction was oversubscribed and we ultimately placed this issue with five institutional investors, three of whom were new to Newtek's securitization investment program

www.thesba.com 7 Equity Offering – Continued Ability to Access Capital Markets October 15, 2015: closed an underwritten offering of 2.3 million shares of common stock at a public offering price of $16.50 – The 2.3 million shares included the underwriters' exercise of their option to purchase an additional 300,000 shares – The current outstanding share count at the close of this offering is approximately 12.6 million shares. Keefe, Bruyette & Woods, Inc., Raymond James & Associates, Inc. and JMP Securities LLC acted as joint bookrunners for this offering, and Ladenburg Thalmann & Co. Inc. and Compass Point Research & Trading, LLC acted as co-managers Added new institutional investors as shareholders; currently Newtek’s top institutional shareholders include: -Wellington Management Company -Perritt Capital Management -Bard & Associates -Northpointe -Zelman Capital -Royce & Associates -Bridgeway Capital Management -West Family Investments Compass Point Research & Trading, LLC and Raymond James and Associates, Inc. initiated research coverage on Newtek, which now has five analysts covering the Company, compared to one research analyst covering the Company one year ago

www.thesba.com 8 Use of Proceeds Plan to continue to invest in the SBA 7(a) loan business and continue to grow our loan origination volume – As of September 26, 2015 the SBA has approved $23.1 billion in gross SBA 7(a) loans, which gives Newtek significant potential for further penetration of this market Continue to explore acquisition opportunities and further expand our business services footprint similar to the recent Premier Payments acquisition – Plan to acquire companies at between 4-8x EBITDA multiple Continue to build portfolio company SBA 504 loan funding platform

www.thesba.com 9 Acquisition Pipeline Target Software development company – 10 years in business – Stable cash flow – Valued at 4-5x EBITDA – Synergy with Newtek Technology Services

www.thesba.com 10 Comparable Company Statistics Live Oak Bancshares, Inc. (NASDAQ: LOB) – Online platform for small business lending – $551 million market capitalization – Raised $81.6 million in IPO on 7/23/15 – Transaction priced at 4.8x tangible book value On Deck Capital (NYSE: ONDK) – Operates an online platform for small business lending – Raised $200 million in IPO on 12/17/14 – $1.3 billion market valuation Lending Club (NYSE: LC) – Operates as an online marketplace that facilitates loans to consumers and businesses in the U.S. – Raised over $1.0 billion in IPO 12/11/14 – $5.56 billion market valuation BankUnited, Inc. (NYSE: BKU) – Acquired Certus’ Small Business Finance Unit in an asset purchase transaction – Certus’ loan portfolio totaled approximately $203 million as of January 31, 2015 – Purchase price for the transaction was a $20 million premium to the tangible NAV

www.thesba.com 11 Newtek Small Business Finance Currently the largest non-bank institution licensed by the U.S. Small Business Administration (SBA) under the federal Section 7(a) loan program based on annual origination volume (national PLP status) One of 14 Non-Bank SBA Government-Guaranteed Lender Licenses (these licenses are presently no longer being issued) 9th largest SBA 7(a) lender including banks(1) ROI in SBA 7(a) lending in excess of 30% National SBA 7(a) lender to small business since 2003; 12-year history of loan default frequency and severity statistics Issued 6 S&P Rated AA & A Securitizations since 2010 Small balance, industry and geographically diversified portfolio of 897 loans – Average loan size is $173K of average Newtek uninsured retained loan balance Floating rate at Prime plus 2.75% with no caps; equivalent to 6% cost to borrower No origination fees with 7- to 25-year amortization schedules and are receiving high-quality loan product Secondary market established for SBA 7(a) government-guaranteed lending for over 61 years and Newtek establishes liquidity for unguaranteed portions through securitizations After securitization of unguaranteed portion and sale of government insured portion, principal in the loan is returned (1) As of September 30, 2015

www.thesba.com 12 Newtek Rated Best Performing BDC* Newtek stock price has outperformed all BDCs as well as the Russell 2000 and S&P 500 both year to date and over trailing 12 months as of October 12, 2015 *According to the BDC Valuation Report by Ladenburg Thalmann dated October 12, 2015 Year-to-Date Stock Performance as of October 12, 2015 Trailing 12-Month Stock Performance as of October 12, 2015 Newtek Common Stock (Nasdaq: NEWT) 15% 28% Mean of BDC Universe -8% -7% Median of BDC Universe -12% -10% S&P 500 Index -2% 6% Russell 2000 Index -3% 11% Over the last 12 months, as of November 2, 2015, including dividends and appreciation, NEWT has realized an approximate 29% return

www.thesba.com 13 Current SBA 7(a) Loan Pipeline; A Year-Over-Year Comparison Loans in pipeline totaled approximately $368.6 million at September 30, 2015 compared to $342.2 million at September 30, 2014 Expect to fund between $230 million and $270 million of SBA 7 (a) loans in 2015, which represents an approximate 24% increase over 2014 SBA 7(a) Loan Pipeline September 30, 2015 September 30, 2014 Prequalified Loans $45,737,125 69,657,529 Loans In Underwriting $56,451,199 35,755,297 Approved Pending Closing $42,376,700 28.646,450 Open Referrals $224,051,561 208,146,227 Total Loan Pipeline $368,616,585 342,205,503

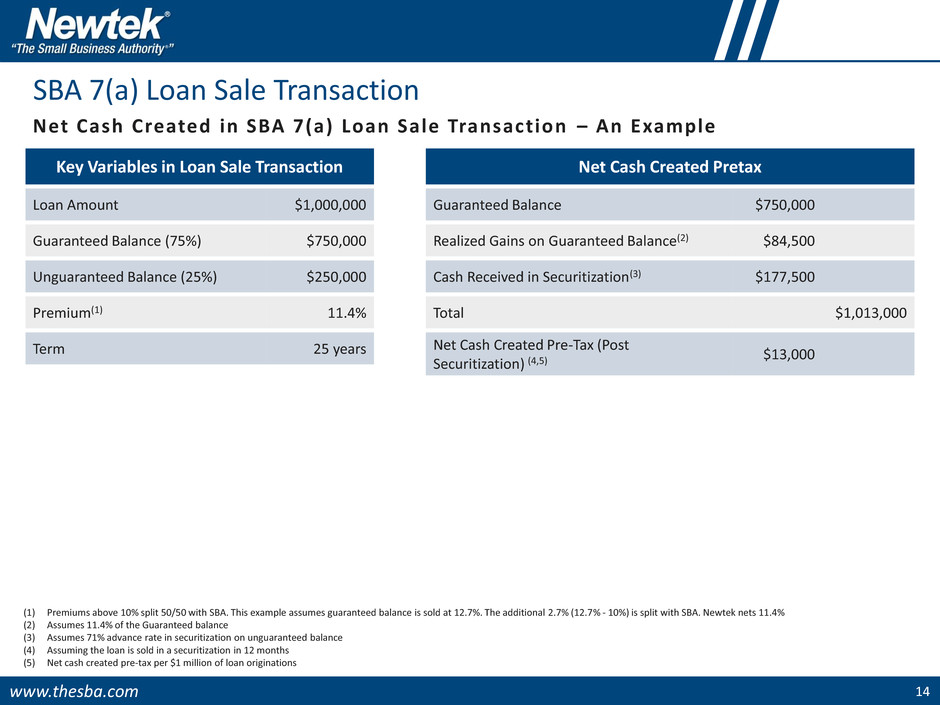

www.thesba.com 14 SBA 7(a) Loan Sale Transaction (1) Premiums above 10% split 50/50 with SBA. This example assumes guaranteed balance is sold at 12.7%. The additional 2.7% (12.7% - 10%) is split with SBA. Newtek nets 11.4% (2) Assumes 11.4% of the Guaranteed balance (3) Assumes 71% advance rate in securitization on unguaranteed balance (4) Assuming the loan is sold in a securitization in 12 months (5) Net cash created pre-tax per $1 million of loan originations Net Cash Created in SBA 7(a) Loan Sale Transaction – An Example Key Variables in Loan Sale Transaction Loan Amount $1,000,000 Guaranteed Balance (75%) $750,000 Unguaranteed Balance (25%) $250,000 Premium(1) 11.4% Term 25 years Net Cash Created Pretax Guaranteed Balance $750,000 Realized Gains on Guaranteed Balance(2) $84,500 Cash Received in Securitization(3) $177,500 Total $1,013,000 Net Cash Created Pre-Tax (Post Securitization) (4,5) $13,000

www.thesba.com 15 SBA 7(a) Loan Sale Transaction (1) Premiums above 10% split 50/50 with SBA. This example assumes guaranteed balance is sold at 12.7%. The additional 2.7% (12.7% - 10%) is split with SBA. Newtek nets 11.4% (2) Assumes 11.4% of the Guaranteed balance (3) Value determined by GAAP servicing value; a present value of future servicing income (4) Net risk-adjusted profit recognized per $1 million of loan originations (5) Unguaranteed piece gets immediately written down at origination to reflect cumulative estimate of default frequency and severity Direct Revenue / Expense of an SBA 7(a) Loan Sale Transaction – An Example Key Variables in Loan Sale Transaction Loan Amount $1,000,000 Guaranteed Balance (75%) $750,000 Unguaranteed Balance (25%) $250,000 Premium(1) 11.4% Term 25 years Resulting Revenue (Expense) Associated Premium (2) $85,500 Servicing Asset (3) $18,630 Total Realized Gain $104,130 Packaging Fee Income $2,500 FV Non-Cash Adjustment on Uninsured Loan Participations $(12,500) Referral Fees Paid to Alliance Partners $(7,500) Total Direct Expenses $(20,000) Net Risk-Adjusted Profit Recognized (4,5) $86,630 In Q3 2015, referral fees paid to alliance partners decreased to 50 basis points from our historical average of 75 basis points

www.thesba.com 16 Sale of Unguaranteed Portion of SBA 7(a) loans Currently Newtek retains on its balance sheet 25% of the unguaranteed balance of the SBA 7(a) loans it originates Beginning in 2016, the Company expects to explore the option to sell a portion of the 25% unguaranteed balance in the market at par or premium to par As a result, the Company expects to be able to immediately access additional capital from the sale of a portion of the 25% of unguaranteed balance, therefore increasing the Company’s liquidity

www.thesba.com 17 Guaranteed Loan Pricing* Comparison *The above prices are solely indicative of the SBA government-guaranteed participation certificates that have historically been bought and sold in the secondary market. Other factors include loan seasoning, loan size, weighted average maturity and collateral securing the loan. All Loans 10-Year Term Loans 25-Year Term Loans Qtr Weighted Average Sale Price Weighted Average Net Price to NSBF Weighted Average Loan Term (Yrs) Weighted Average Sale Price Weighted Average Net Price to NSBF Weighted Average Sale Price Weighted Average Net Price to NSBF Q1 2014 114.49 112.24 15.95 112.19 111.10 118.49 114.25 Q2 2014 115.15 112.57 18.60 112.47 111.23 117.33 113.66 Q3 2014 116.37 113.19 22.32 113.66 111.83 116.89 113.45 Q4 2014 113.62 111.73 17.87 111.40 110.54 115.62 112.81 YTD 2014 115.01 112.49 18.79 112.25 111.09 117.05 113.53 All Loans 10-Year Term Loans 25-Year Term Loans Qtr Weighted Average Sale Price Weighted Average Net Price to NSBF Weighted Average Loan Term (Yrs) Weighted Average Sale Price Weighted Average Net Price to NSBF Weighted Average Sale Price Weighted Average Net Price to NSBF Q1 2015 114.87 112.44 18.82 112.73 111.37 114.87 113.18 Q2 2015 114.91 112.46 17.13 113.45 111.73 114.91 113.59 Q3 2015 112.93 111.34 18.84 111.04 110.26 116.07 113.04 YTD 2015 114.26 112.09 18.26 112.72 111.31 116.62 113.31

www.thesba.com 18 Gain-on-Sale Premium Trend Loan Sale Premium Income Trend $ in thousands 2010 2011 2012 2013 2014 9 Months Ended 9/30/2015 $2,428 $12,468 $12,367 $19,456 $19,493 $22,287* *Realized gains on non-affiliate investments. Prior to conversion to a BDC in November 2014, amounts were recorded as Premium Income in the consolidated statements of operations.

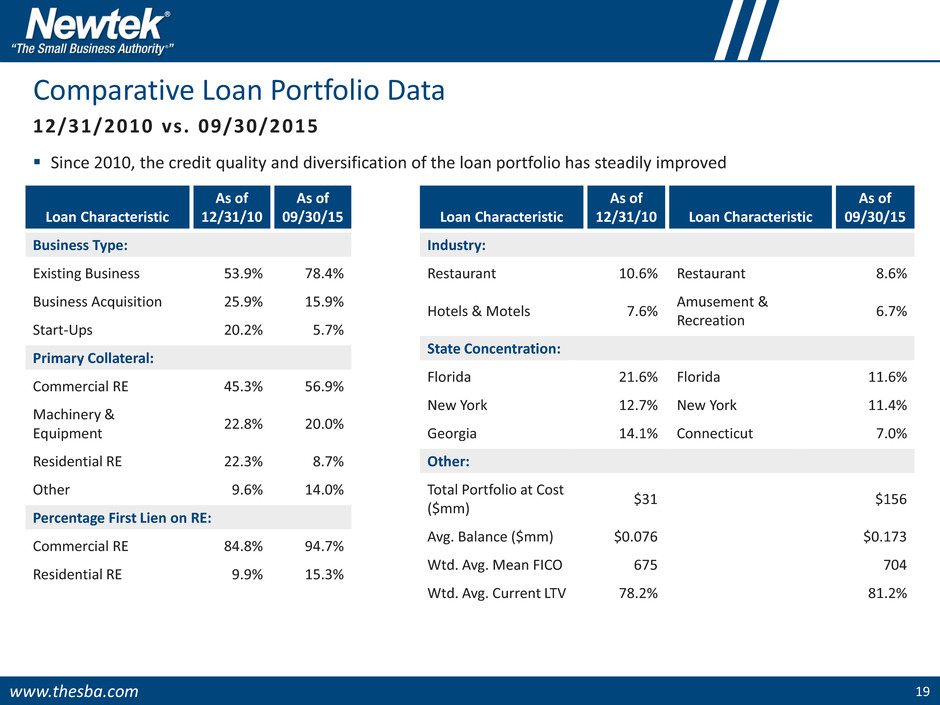

www.thesba.com 19 Comparative Loan Portfolio Data 12/31/2010 vs. 09/30/2015 Since 2010, the credit quality and diversification of the loan portfolio has steadily improved Loan Characteristic As of 12/31/10 As of 09/30/15 Business Type: Existing Business 53.9% 78.4% Business Acquisition 25.9% 15.9% Start-Ups 20.2% 5.7% Primary Collateral: Commercial RE 45.3% 56.9% Machinery & Equipment 22.8% 20.0% Residential RE 22.3% 8.7% Other 9.6% 14.0% Percentage First Lien on RE: Commercial RE 84.8% 94.7% Residential RE 9.9% 15.3% Loan Characteristic As of 12/31/10 Loan Characteristic As of 09/30/15 Industry: Restaurant 10.6% Restaurant 8.6% Hotels & Motels 7.6% Amusement & Recreation 6.7% State Concentration: Florida 21.6% Florida 11.6% New York 12.7% New York 11.4% Georgia 14.1% Connecticut 7.0% Other: Total Portfolio at Cost ($mm) $31 $156 Avg. Balance ($mm) $0.076 $0.173 Wtd. Avg. Mean FICO 675 704 Wtd. Avg. Current LTV 78.2% 81.2%

www.thesba.com 20 SBA 504 Loans: A New Focus for Newtek’s Portfolio Company Portfolio company expected to fund first SBA 504 loan in November 2015 Provide financing for major fixed assets such as equipment or real estate Loans cannot be used for working capital or purchasing inventory (allowed uses under the 7(a) program) The Certified Development Company (“CDC”)/504 Loan Program is a long-term financing tool that provides growing businesses with fixed-rate financing to acquire assets such as land, buildings, and sizeable purchases of equipment Loan-to-value (“LTV”) ratio for the borrower of 90%; borrowers contribute 10% equity Portfolio company has exposure on only 50% of the LTV U.S. Government has exposure on 40% of the LTV Portfolio company will sell the senior loan participation at an anticipated 3-5 point premium SBA 504 loans give borrowers a fixed-rate alternative

www.thesba.com 21 Sample SBA 504 Loan Structure An example of a typical SBA 504 loan structure is detailed below Real Estate Acquisition Loan $ Amount $ Amount Percent of Total Purchase Price $800,000 1st Mortgage Originated by Newtek $500,000 50% Renovations $150,000 Bridge Loan Originally Funded by Newtek* $400,000 40% Soft & Closing Costs $50,000 Borrower Equity Injection $100,000 10% Total $1,000,000 Total $1,000,000 100% *Taken out by CDC funded second mortgage of $400,000 within 60-90 days of funding Up to 50% first mortgage Up to 40% second mortgage provided by CDC ($250,000 to $4.0 million) At least 10% equity contribution

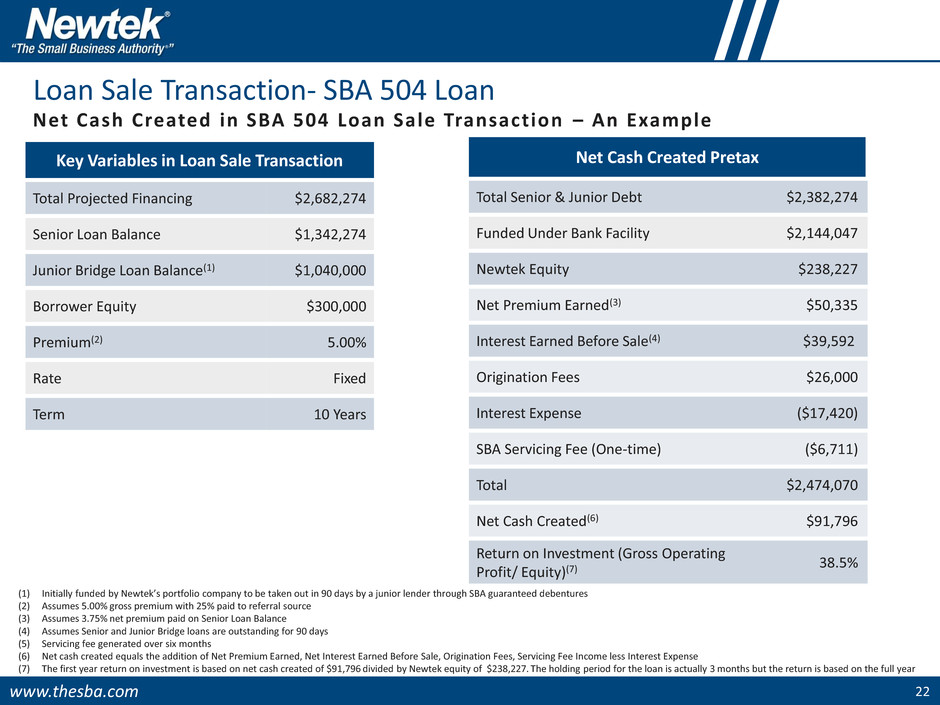

www.thesba.com 22 Loan Sale Transaction- SBA 504 Loan Net Cash Created in SBA 504 Loan Sale Transaction – An Example Key Variables in Loan Sale Transaction Total Projected Financing $2,682,274 Senior Loan Balance $1,342,274 Junior Bridge Loan Balance(1) $1,040,000 Borrower Equity $300,000 Premium(2) 5.00% Rate Fixed Term 10 Years Net Cash Created Pretax Total Senior & Junior Debt $2,382,274 Funded Under Bank Facility $2,144,047 Newtek Equity $238,227 Net Premium Earned(3) $50,335 Interest Earned Before Sale(4) $39,592 Origination Fees $26,000 Interest Expense ($17,420) SBA Servicing Fee (One-time) ($6,711) Total $2,474,070 Net Cash Created(6) $91,796 Return on Investment (Gross Operating Profit/ Equity)(7) 38.5% (1) Initially funded by Newtek’s portfolio company to be taken out in 90 days by a junior lender through SBA guaranteed debentures (2) Assumes 5.00% gross premium with 25% paid to referral source (3) Assumes 3.75% net premium paid on Senior Loan Balance (4) Assumes Senior and Junior Bridge loans are outstanding for 90 days (5) Servicing fee generated over six months (6) Net cash created equals the addition of Net Premium Earned, Net Interest Earned Before Sale, Origination Fees, Servicing Fee Income less Interest Expense (7) The first year return on investment is based on net cash created of $91,796 divided by Newtek equity of $238,227. The holding period for the loan is actually 3 months but the return is based on the full year

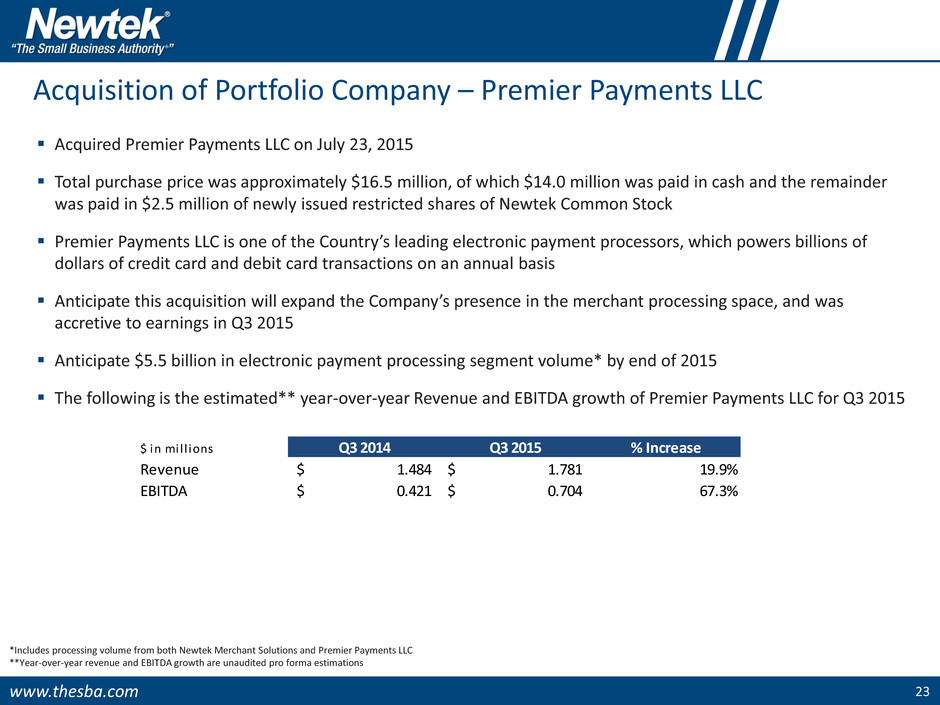

www.thesba.com 23 Acquisition of Portfolio Company – Premier Payments LLC *Includes processing volume from both Newtek Merchant Solutions and Premier Payments LLC **Year-over-year revenue and EBITDA growth are unaudited pro forma estimations Acquired Premier Payments LLC on July 23, 2015 Total purchase price was approximately $16.5 million, of which $14.0 million was paid in cash and the remainder was paid in $2.5 million of newly issued restricted shares of Newtek Common Stock Premier Payments LLC is one of the Country’s leading electronic payment processors, which powers billions of dollars of credit card and debit card transactions on an annual basis Anticipate this acquisition will expand the Company’s presence in the merchant processing space, and was accretive to earnings in Q3 2015 Anticipate $5.5 billion in electronic payment processing segment volume* by end of 2015 The following is the estimated** year-over-year Revenue and EBITDA growth of Premier Payments LLC for Q3 2015 $ in mi l l ions Q3 2014 Q3 2015 % Increase Revenue 1.484$ 1.781$ 19.9% EBITDA 0. 21 0. 04 67.3

www.thesba.com 24 Portfolio Company – Newtek Merchant Solutions (1) Estimates via Bloomberg *See page 38 for definition of Adjusted EBITDA. Publicly Traded Comparable Companies Name (Symbol) Enterprise Value / 2015E EBITDA (1) Heartland Payment Systems (HPY) 9.10x Vantiv, Inc. (VNTV) 10.24x Enterprise Valuation & Financial Performance Valued at 5.3x EBITDA Valued at $50 million Electronic payment processing business, which we have wholly owned and managed for 10+ years Over 13,000 business accounts; over $4.6 billion in electronic payment processing volume in 2014 For the nine months ended September 30, 2015 vs. nine months ended September 30, 2014: – Revenue was $73.1 million; an increase of 8.3% over $67.5 million – Adjusted EBITDA was $6.2 million; a slight decrease over $6.3 million – Flat growth was attributable, in part, to additional legal expenses of approximately $1.3 million for the nine month period New public comparable company: First Data Resources, LLC (NYSE: FDC) – Provides credit and bank card processing – Raised $2.6 billion in IPO on October 14, 2015; $14 billion market valuation – Enterprise Value/ Trailing 12 Months EBITDA: 16x 2015 Forecast Revenue: $97.7 million Adjusted EBITDA: $9.1 million

www.thesba.com 25 Opportunities in Payment Processing Additional alliance partners American Express OptBlue Tablet and mobile-based cloud computing Europay, MasterCard and Visa (“EMV”) compliance solutions

www.thesba.com 26 Portfolio Company - Newtek Technology Services (1) Estimates via Bloomberg. *See page 38 for definition of Adjusted EBITDA. Managed technology & cloud computing business, which we have wholly owned and managed for 10+ years Host and manage SMBs computer hardware, software and their technology solutions in our Level-4, 5,000 square foot data center in Phoenix, Arizona; additional space in the U.K., New Jersey and Phoenix, Arizona Over 106,000 business accounts and over 77,000 domain names This segment is being transformed to take advantage of shift to cloud-based business trends including eCommerce, Payroll and Insurance; additional cloud offerings in the pipeline Restructured IO data center lease, which we anticipate will allow us to save between $200K - $250K per year Revenue of $3.8 million; unchanged over $3.8 million in Q3 2014 Q3 2015 Adjusted EBITDA of $940 thousand; a decrease of 14.5% from $1.1 million in Q3 2014 Publicly Traded Comparable Companies Name (Symbol) Enterprise Value / 2015E EBITDA (1) Endurance (EIGI) 12.07x Rackspace Holdings, Inc. (RAX) 7.12x Enterprise Valuation & Financial Performance Valued at 1.4x revenue Valued at $21 million 2015 Forecast Revenue: $14.7 million Adjusted EBITDA: $3.6 million

www.thesba.com 27 Opportunities in Cloud Computing Dedicated server migration to the Cloud 24-7 outsourced managed service solutions Hot back-up and live redundancy globally HIPAA-compliant solutions under the Affordable Healthcare Act

www.thesba.com 28 Forecasted Full Year 2015 Adjusted EBITDA Breakdown* 36% of forecasted 2015 EBITDA emanates from business service portfolio companies 64% of forecasted 2015 EBITDA emanates from the lending business $9.1 $3.6 $2.8$28.0 Forecasted 2015 Adjusted EBITDA Breakdown Newtek Merchant Solutions Newtek Technology Services Premier Payments Newtek Small Business Finance $ in millions *Slide is for discussion only. Does not represent BDC consolidated results.

www.thesba.com 29 Internally Managed vs. Externally Managed BDCs Newtek is an internally managed BDC, and is currently trading at 0.99x* the NAV as of September 30, 20151 The following Internally managed BDC public comparables currently trade at a median price to NAV of approximately 1.08x** – Hercules Technology Growth Capital (NASDAQ: HTGC) – KCAP Financial (NASDAQ: KCAP) – Main Street Capital (NASDAQ: MAIN) – Triangle Capital (NASDAQ: TCAP) 1On October 1, 2015, the Board adjusted the NAV to $135.6 million, or $13.10 per share, as a result of the declaration of the $34.0 million special dividend * As of November 2, 2015 closing price of $16.86 **As of November 2, 2015. Internally Managed BDCs Externally Managed BDCs No base or incentive fees paid to an external manager Pay expense and incentive fees to a management company Generally a greater percent of revenue becomes dividend income for the shareholder Not required to provide shareholders with compensation information Lower operating expense ratios than externally managed Higher operating expense ratios than internally managed BDCs Typically trade at a premium to NAV/share Typically trade at a discount to NAV/share

www.thesba.com 30 New Location: Lake Success, NY Newtek Small Business Finance, LLC, signed a lease for approximately 34,000 square feet of office space in Lake Success, New York (Long Island), which will commence in early 2016 Signifies the anticipated further expansion of lending business, growth of our other portfolio companies and potential future acquisitions Furthers the goal of housing all service offerings in a central location in order to sell and cross-market products and services in a more efficient and effective manner Central location will allow Newtek to more easily recruit talent from the five Boroughs, Long Island and parts of Westchester, and offers proximity to New York City, which is easily accessible via both public and private transportation Three additional buildings contiguous to this address that offer additional 1.0 million square feet of space, which further enhances the attractiveness of expanding Newtek’s business in this particular location

www.thesba.com 31 Expanding Portfolio Company Senior Management Team John C. Traynor President & Chief Operating Officer, Newtek Merchant Solutions Mr. Traynor has over 35 years of extensive experience in leading and building global and regional transaction banking businesses Brings a broad range of experience including P&L responsibility for payments, liquidity, trade services, supply chain financing, commercial cards and factoring Has managed various functions including sales, product management, implementation, customer service and information technology Most recently, Mr. Traynor was the Head of Group Transaction Banking at Erst Group Bank AG, Vienna, with €197 billion in assets, where he built transaction banking capabilities in seven Central and Eastern European countries as well as developed and executed strategies to grow trade services, payments and cash management, and factoring businesses Prior to that, Mr. Traynor was the Head of Transaction Banking at Alfa Bank, Moscow, the largest private bank in Russia with $49 billion in assets, where he built a transaction banking business as well as created a financial institutions business in Russia and the Commonwealth of Independent States Mr. Traynor was also the Head of International Cash Management at Barclays Bank PLC, London, where he created and grew a new global transactions business Throughout his career, Mr Traynor held several senior positions at institutions such as Key Bank, Cleveland; Fifth Third bank, Cincinnati; ABN Amro, Chicago and Amsterdam and Citibank, New York He began his career, and spent over 15 years, at Citibank, New York in Vice President positions in Citibank’s global transaction services division as well as Citicorp Mortgage and CitiCards Mr. Traynor is a graduate of Rochester Institute of Technology with a Bachelor of Science Degree and received his Master of Business Administration from Fordham University

www.thesba.com 32 Expanding Portfolio Company Senior Management Team John Raven President & Chief Operating Officer, Newtek Technology Services Over 20 years of experience in information technology space Brings a broad array of expertise in areas of cloud technology, information technology and, security and data center and storage solutions as well as sales and marketing, and product development Mr. Raven is an operations executive offering deep expertise and proven performance in leading, developing, managing and delivering complex solutions in support of a company’s objectives Most recently, Mr. Raven offered Chief Technology Officer and Chief Operating Officer consulting services to Looksmart, LTD. and Clickable Prior to that, he served as a Chief Technology Officer and Chief Operating Officer consultant for IBM Global Services and its elite IBM Export Blue Team where he provided information technology architect services Prior to that, Mr. Raven was the President, Chief Technology Officer and Chief Operating Officer for YP.com & LiveDeal, Inc., where he analyzed priority strategic challenges, delivered concepts and recommendations for course of action to CEO and Board Throughout his career he has held various senior positions at technology companies including Perot Systems, Read-Rite Corporation, Southern Texas PCS (T-Mobile) and Viacom, Inc. Mr. Raven is a graduate of the California Institute of Technology with a B.S. in Computer Science Mr. Raven spent 12 active years and 10 reserve years with the United States Army, serving as a soldier and combat veteran in the Infantry and Special Operations Mr. Raven worked for NASA Jet Propulsion Laboratory for 3 years as a System and Network Engineer for the 1996 Mission to Mars, Mars Pathfinder He is an ISC2 Certified Information Systems Security Professional (C.I.S.S.P) and Project Management Institute Project Management Professional (P.M.P) Has experience with Hypervisor platforms, SQL database environments, network and telecom environments, datacenter operations, information security systems, storage systems, compliance standards, leadership and management methodologies, Internet search systems, Internet marketing, carrier operations and manufacturing systems Mr. Raven will be based in Newtek Technology Services’ Phoenix, Arizona office

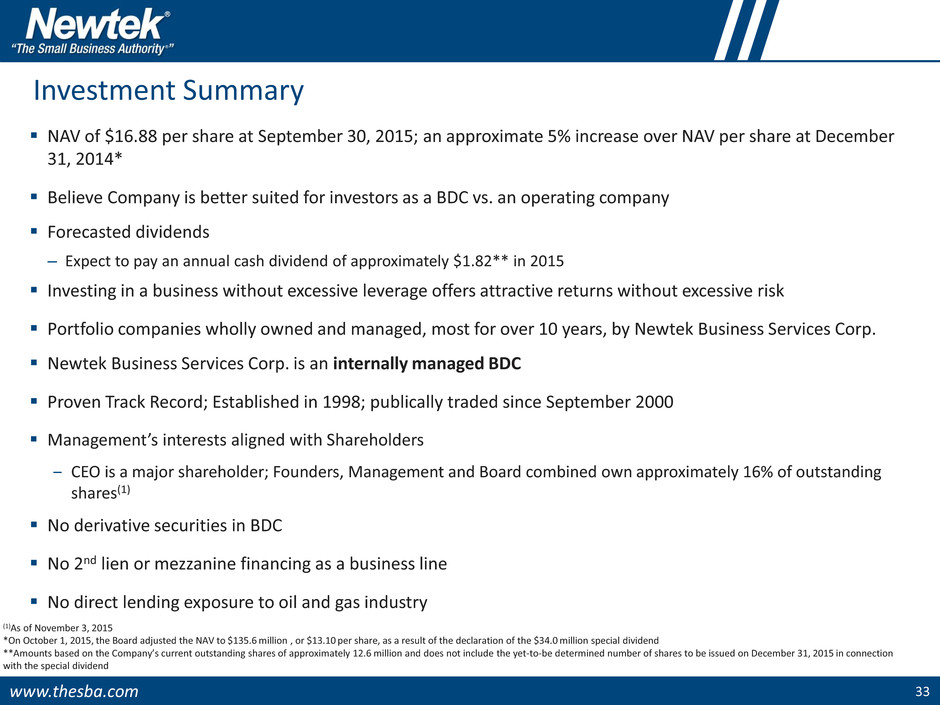

www.thesba.com 33 Investment Summary NAV of $16.88 per share at September 30, 2015; an approximate 5% increase over NAV per share at December 31, 2014* Believe Company is better suited for investors as a BDC vs. an operating company Forecasted dividends – Expect to pay an annual cash dividend of approximately $1.82** in 2015 Investing in a business without excessive leverage offers attractive returns without excessive risk Portfolio companies wholly owned and managed, most for over 10 years, by Newtek Business Services Corp. Newtek Business Services Corp. is an internally managed BDC Proven Track Record; Established in 1998; publically traded since September 2000 Management’s interests aligned with Shareholders ‒ CEO is a major shareholder; Founders, Management and Board combined own approximately 16% of outstanding shares(1) No derivative securities in BDC No 2nd lien or mezzanine financing as a business line No direct lending exposure to oil and gas industry (1)As of November 3, 2015 *On October 1, 2015, the Board adjusted the NAV to $135.6 million , or $13.10 per share, as a result of the declaration of the $34.0 million special dividend **Amounts based on the Company’s current outstanding shares of approximately 12.6 million and does not include the yet-to-be determined number of shares to be issued on December 31, 2015 in connection with the special dividend

www.thesba.com Financial Review – Jennifer C. Eddelson, Chief Accounting Officer

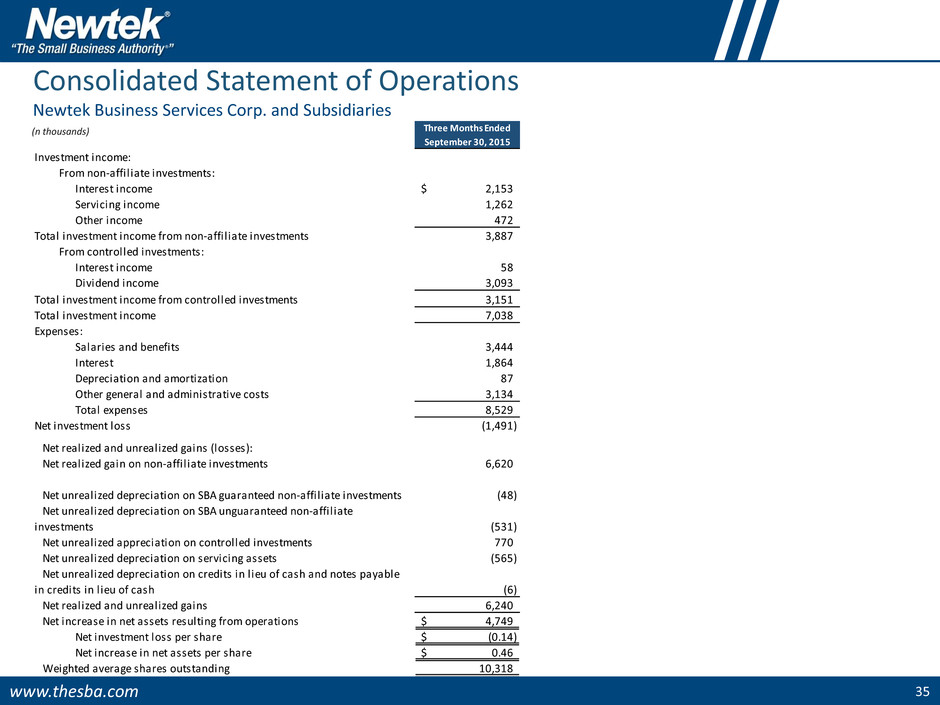

www.thesba.com 35 Consolidated Statement of Operations Newtek Business Services Corp. and Subsidiaries Three Months Ended September 30, 2015 Investment income: From non-affil iate investments: Interest income 2,153$ Servicing income 1,262 Other income 472 Total investment income from non-affil iate investments 3,887 From controlled investments: Interest income 58 Dividend income 3,093 Total investment income from controlled investments 3,151 Total investment income 7,038 Expenses: Salaries and benefits 3,444 Interest 1,864 Depreciation and amortization 87 Other general and administrative costs 3,134 Total expenses 8,529 Net investment loss (1,491) Net realized and unrealized gains (losses): Net realized gain on non-affil iate investments 6,620 Net unrealized depreciation on SBA guaranteed non-affil iate investments (48) Net unrealized depreciation on SBA unguaranteed non-affil iate investments (531) Net unrealized appreciation on controlled investments 770 Net unrealized depreciation on servicing assets (565) Net unrealized depreciation on credits in l ieu of cash and notes payable in credits in l ieu of cash (6) Net realized and unrealized gains 6,240 Net increase in net assets resulting from operations 4,749$ Net investment loss per share (0.14)$ Net increase in net assets per share 0.46$ Weighted average shares outstanding 10,318 (n thousands)

www.thesba.com 36 Change in Net Asset Value (1) Adjusted Net investment income is defined as Net investment income plus Net realized gains. * Amounts may not foot due to rounding. ** Based on 10.3 million shares outstanding on October 1, 2015. (in thousands, except per share data) NAV NAV/Share* NAV % Change NAV at December 31, 2014 166,418$ 16.31$ - Changes in NAV and NAV per share for the nine months ended September 30, 2015: Net investment income (loss) (6,262) (0.61) -3.7% Net realized gains - non-affiliate investments 21,659 2.12 13.0% Net unrealized depreciation - non-affiliate investments (4,877) (0.47) -2.9% Net unrealized appreciation - Controlled portfolio companies 10,289 1.00 6.2% Net unrealized depreciation - Servicing assets (1,177) (0.11) -0.7% Net unrealized depreciation on credits in lieu of cash and notes payable in credits in lieu of cash (4) (0.00) 0.0% Net increase in net assets from operations 19,628 1.93 11.8% Dividends declared (8,787) (0.86) -5.3% Net increase in net assets after dividend 10,841 1.07 6.6% NAV after dividend 177,259 17.38 Opening balance adjustment to Deferred tax asset (2,870) (0.28) -1.7% Adjustment to 2014 offering costs 17 0.00 0.0% Consolidation of Texas Whitestone Group and CCC Real Estate (33) (0.00) 0.0% Exponential of New York, LLC distribution to members (2,414) (0.22) -1.4% Issuance of common stock under DRIP 87 - 0.0% Issuance of common stock in connection with acquisition of Premier 2,472 - 0.0% Issuance of common stock in connection with legal settlement 215 - 0.0% NAV at September 30, 2015 174,733$ 16.88$ 3.5% Declaration of special dividend on October 1, 2015 ** (34,035) (3.29) -20.2% Declaration of third quarter 2015 dividend on October 1, 2015 ** (5,174) (0.50) -3.1% NAV at October 1, 2015 135,524$ 13.10$ -19.7% Total common shares outstanding: 10,353 Adjusted Net investment income 1 15,397$ Adjusted Net investment income 1 per share 1.50$ NAV per share on September 30, 2015 16.88$ NAV per share on October 1, 2015 ** 13.10$ As of September 30, 2015 and October 1, 2015 Newtek Business Services Corp. and Subsidiaries

www.thesba.com 37 In thousands, except per share data Adjusted Net Investment Income Reconciliation For the three months ended September 30, 2015 Per share For the nine months ended September 30, 2015 Per share Net investment loss (1,491)$ (0.14)$ (6,262)$ (0.61)$ Net realized gain on non-affiliate investments 6,620 0.64 21,659 2.11 Adjusted net investment income 5,129$ 0.50$ 15,397$ 1.50$ Adjusted Net Investment Income (ANII)

www.thesba.com 38 Non-GAAP Financial Measures In evaluating its business, Newtek considers and uses adjusted net investment income as a measure of its operating performance. Adjusted net investment income includes short-term capital gains from the sale of the guaranteed portions of SBA 7(a) loans, which is a reoccurring event. The Company defines Adjusted net investment income (loss) as Net investment income (loss) plus Net realized gains. The Company defines Adjusted EBITDA as earnings before, interest expense, taxes, depreciation and amortization, corporate overhead allocation, unrealized gains and losses and stock compensation expense. Newtek uses Adjusted EBITDA as a supplemental measure to review and assess the operating performance of its portfolio companies. The Company also presents the Adjusted EBITDA of its portfolio companies because it believes it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance. The terms Adjusted net investment income and Adjusted EBITDA, are not defined under U.S. generally accepted accounting principles, or U.S. GAAP, and are not a measure of operating income, operating performance or liquidity presented in accordance with U.S. GAAP. Adjusted net investment income and Adjusted EBITDA, have limitations as analytical tools and, when assessing the Company’s operating performance, and that of its portfolio companies, investors should not consider Adjusted net investment income and Adjusted EBITDA in isolation, or as a substitute for net investment income (loss), or other consolidated income statement data prepared in accordance with U.S. GAAP. Among other things, Adjusted net investment income and Adjusted EBITDA do not reflect the Company’s, or its portfolio companies, actual cash expenditures. Other companies may calculate similar measures differently than Newtek, limiting their usefulness as comparative tools. The Company compensates for these limitations by relying primarily on its GAAP results supplemented by Adjusted net investment income and Adjusted EBITDA.

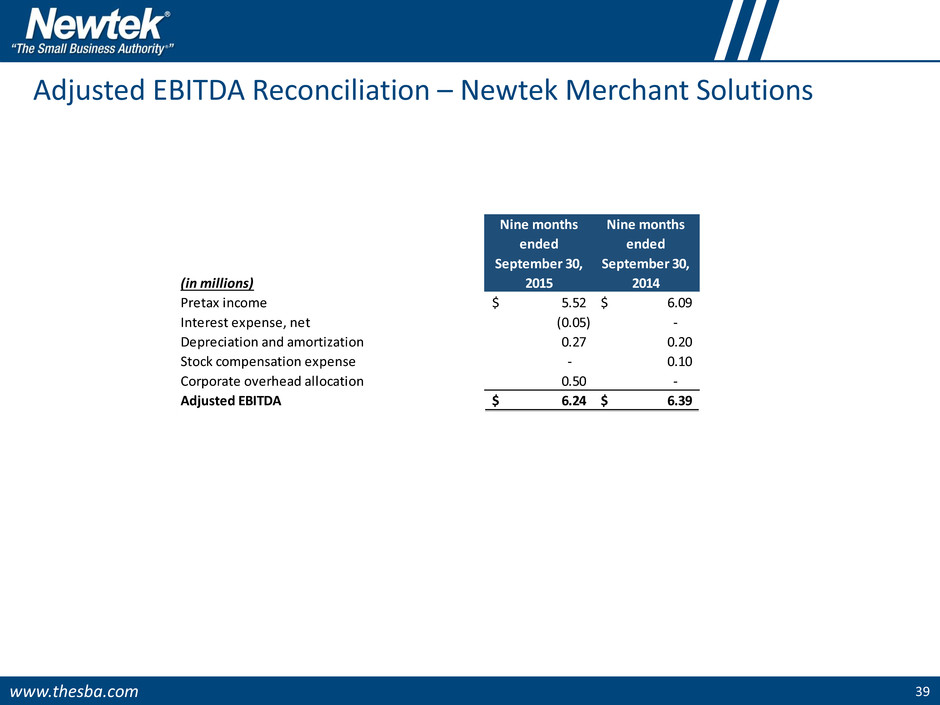

www.thesba.com 39 Adjusted EBITDA Reconciliation – Newtek Merchant Solutions (in millions) Nine months ended September 30, 2015 Nine months ended September 30, 2014 Pretax income 5.52$ 6.09$ Interest expense, net (0.05) - Depreciation and amortization 0.27 0.20 Stock compensation expense - 0.10 Corporate overhead allocation 0.50 - Adjusted EBITDA 6.24$ 6.39$

www.thesba.com 40 Adjusted EBITDA Reconciliation – Newtek Technology Services (in millions) Three months ended September 30, 2015 Three months ended September 30, 2014 Pretax income 0.47$ 0.80$ Interest expense, net 0.01 0.01 Depreciation and amortization 0.33 0.34 Stock compensation expense - - Corporate overhead allocation 0.13 - Adjusted EBITDA 0.94$ 1.15$

www.thesba.com 41 Forecasted Full Year 2015 Adjusted EBITDA Reconciliation Newtek Merchant Solutions Newtek Technology Services Premier Payments Newtek Small Business Finance (in millions) Pretax income 7.81$ 1.64$ 1.29$ 12.86$ Interest expense, net 0.26 0.13 - 7.77 Depreciation and amortization 0.40 1.34 1.46 0.07 Unrealized gains/(losses) - - - 7.34 Corporate overhead allocation 0.63 0.50 - - Adjusted EBITDA 9.10$ 3.61$ 2.75$ 28.04$