Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - METLIFE INC | d28934d8k.htm |

| EX-99.1 - EX-99.1 - METLIFE INC | d28934dex991.htm |

| EX-99.2 - EX-99.2 - METLIFE INC | d28934dex992.htm |

Exhibit 99.3

Description of Video Third Quarter 2015 Financial Update

From Chief Financial Officer John Hele

This exhibit (video transcript and slides) contains forward-looking statements. Forward-looking statements give expectations or forecasts of future events and use words such as “anticipate,” “estimate,” “expect,” “project” and other terms of similar meaning, or that are tied to future periods. Any or all forward-looking statements may turn out to be wrong, and actual results could differ materially from those expressed or implied in the forward-looking statements. Predictions of future performance are inherently difficult and are subject to numerous risks and uncertainties, including those identified in the “Risk Factors” section of MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission. The company is not required to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

This exhibit (video transcript and slides) also contains measures that are not calculated based on accounting principles generally accepted in the United States of America, also known as GAAP. Information regarding those non-GAAP financial measures and the reconciliations of the non-GAAP financial measures to the most directly comparable GAAP measures is provided in the company’s third quarter 2015 Financial Supplement, and/or the company’s earnings news release dated November 4, 2015 for the three months ended September 30, 2015. Each of the Financial Supplement, the news release, and this exhibit (video transcript and slides) accompany one another as they are each exhibits to the company’s Current Report on Form 8-K, dated November 4, 2015.

Video Transcript and Description:

[Shows slide 1 below]

[MetLife Executive Vice President & CFO John Hele speaks from a studio at MetLife’s corporate headquarters in New York City]

Hello, I’m John Hele and I’m joining you from MetLife’s global headquarters in New York City. MetLife’s financial results for the third quarter of 2015 had several notable items that negatively impacted earnings, and macroeconomic factors were unfavorable relative to the prior year period. While earnings were down this quarter, our nine month operating earnings per share were up 3 percent adjusting for these notable items.

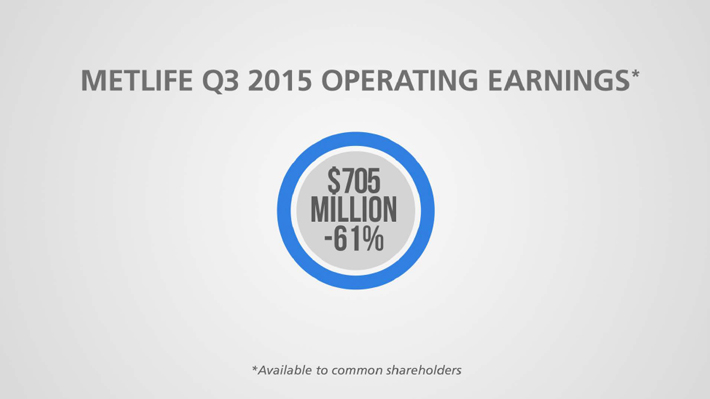

Taking a look at the third quarter of 2015, MetLife reported operating earnings of $705 million, down 61 percent from the prior year period. [Shows slide 2 below]

As we disclosed in our third quarter Financial Supplement and news release, this quarter we had some significant notable items that negatively impacted our results by $828 million. The largest item was the previously announced non-cash, tax-related charge of $792 million, or $0.70 per share after tax.

Other factors negatively impacting results include our annual actuarial assumption review and other insurance adjustments, which decreased operating earnings by $92 million, or $0.08 per share after tax. As part of our review, we have extended the timeframe to reach our long-term interest rate assumptions.

Adjusting for all notable items, operating earnings were $1.5 billion for the third quarter of 2015.

Operating earnings on a per share basis were $0.62, also down 61 percent from the prior year period. Adjusted for all notable items, operating earnings per share were $1.36, which compares to $1.51 on the same basis in the prior year period. Foreign currency weakness, equity market declines and low interest rates explain all the movement year over year.

Our net income was $1.2 billion in the quarter, or $1.06 per share. Net income includes $315 million after tax in net derivative gains, reflecting changes in interest rates and foreign currencies.

In the Americas, operating earnings were $1.3 billion, down 18 percent, or 11 percent when adjusted for all notable items. [Shows slide 3 below]

On a constant currency basis, operating earnings were down 16 percent, or 9 percent when adjusted for all notable items. [Shows slide 4 below]

The decrease in operating earnings was due to lower investment margins and equity markets, as well as the annual actuarial assumption review. In addition, unfavorable underwriting was offset by a favorable tax item in Latin America.

In Asia, operating earnings for the third quarter were $338 million, up 9 percent, or 6 percent when adjusted for all notable items. [Shows slide 5 below]

On a constant currency basis, operating earnings were up 26 percent, or 22 percent when adjusted for all notable items. [Shows slide 6 below]

The increase in operating earnings was driven by business growth, one-time investment income and favorable non-recurring tax items.

And in EMEA, operating earnings were $66 million, down 15 percent, or 12 percent when adjusted for all notable items. [Shows slide 7 below]

On a constant currency basis, operating earnings were up 14 percent, or 25 percent when adjusted for all notable items. [Shows slide 8 below]

Operating earnings were positively impacted by business growth, expense discipline and favorable tax items.

Finally, book value per share was $51.11, up 3 percent year-over-year. [Shows slide 9 below]

In summary, third quarter earnings were mainly impacted by macroeconomic factors, as well as some significant notable items. Despite a challenging quarter, we continue to focus on cash, returning approximately $2.3 billion in share repurchases and dividends to shareholders in the first nine months of 2015.

Thank you for watching. [Shows slide 10 below]

Slide 1

Slide 2

Slide 3

Slide 4

Slide 5

Slide 6

Slide 7

Slide 8

Slide 9

Slide 10