Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - EARNINGS RELEASE SUPPLEMENT - KAR Auction Services, Inc. | exhibit992-q32015earningsr.htm |

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE - KAR Auction Services, Inc. | exhibit991-q32015earningsr.htm |

| 8-K - FORM 8-K - Q3 2015 EARNINGS RELEASE, SUPPLEMENT AND SLIDES - KAR Auction Services, Inc. | form8-kxearningsreleasesup.htm |

KAR Auction Services, Inc. Q3 2015 Earnings Slides November 4, 2015

Forward-Looking Statements This presentation includes forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. Many of these risk factors are outside of the company’s control, and as such, they involve risks which are not currently known to the company that could cause actual results to differ materially from forecasted results. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The forward-looking statements in this document are made as of the date hereof and the company does not undertake to update its forward-looking statements. 2

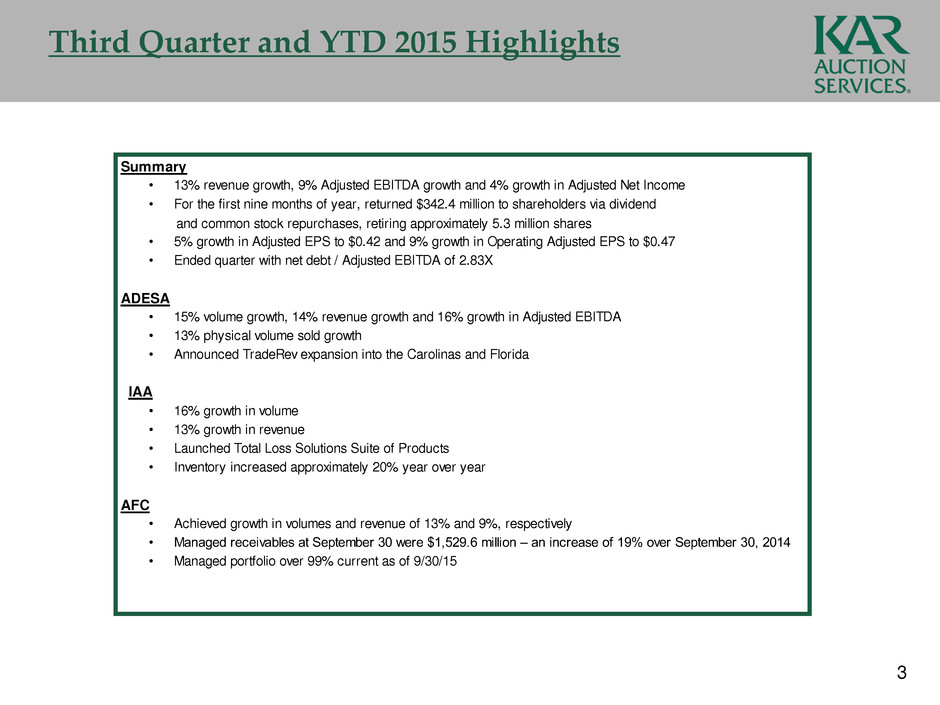

Third Quarter and YTD 2015 Highlights 3 Summary • 13% revenue growth, 9% Adjusted EBITDA growth and 4% growth in Adjusted Net Income • For the first nine months of year, returned $342.4 million to shareholders via dividend and common stock repurchases, retiring approximately 5.3 million shares • 5% growth in Adjusted EPS to $0.42 and 9% growth in Operating Adjusted EPS to $0.47 • Ended quarter with net debt / Adjusted EBITDA of 2.83X ADESA • 15% volume growth, 14% revenue growth and 16% growth in Adjusted EBITDA • 13% physical volume sold growth • Announced TradeRev expansion into the Carolinas and Florida IAA • 16% growth in volume • 13% growth in revenue • Launched Total Loss Solutions Suite of Products • Inventory increased approximately 20% year over year AFC • Achieved growth in volumes and revenue of 13% and 9%, respectively • Managed receivables at September 30 were $1,529.6 million – an increase of 19% over September 30, 2014 • Managed portfolio over 99% current as of 9/30/15

KAR Q3 2015 Highlights 4 (in millions, except per share amounts) KAR Q3 2015 Q3 2014 Highlights* Total operating revenues 666.7$ 589.1$ -$15.2M CAD currency Gross profit** 288.6$ 261.1$ SG&A $ 128.5 $ 116.5 +$3.8M acquired SG&A, +1.4M professional fees, -$2.4M CAD currency EBITDA 160.3$ 145.0$ -$6M CAD currency Adjusted EBITDA 163.1$ 149.1$ -$6M CAD currency Net income 52.3$ 47.5$ -$3M CAD currency Net income per share - diluted 0.37$ 0.33$ -$0.02 per share CAD currency Weighted average diluted shares 141.8 142.3 Dividends declared per common share 0.27$ 0.25$ Effective tax rate 36.1% 37.4% Capital expenditures 92.3$ 70.3$ Cash flow from operating activities 315.4$ 327.7$ * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended September 30, 2015. ** Exclusive of depreciation and amortization

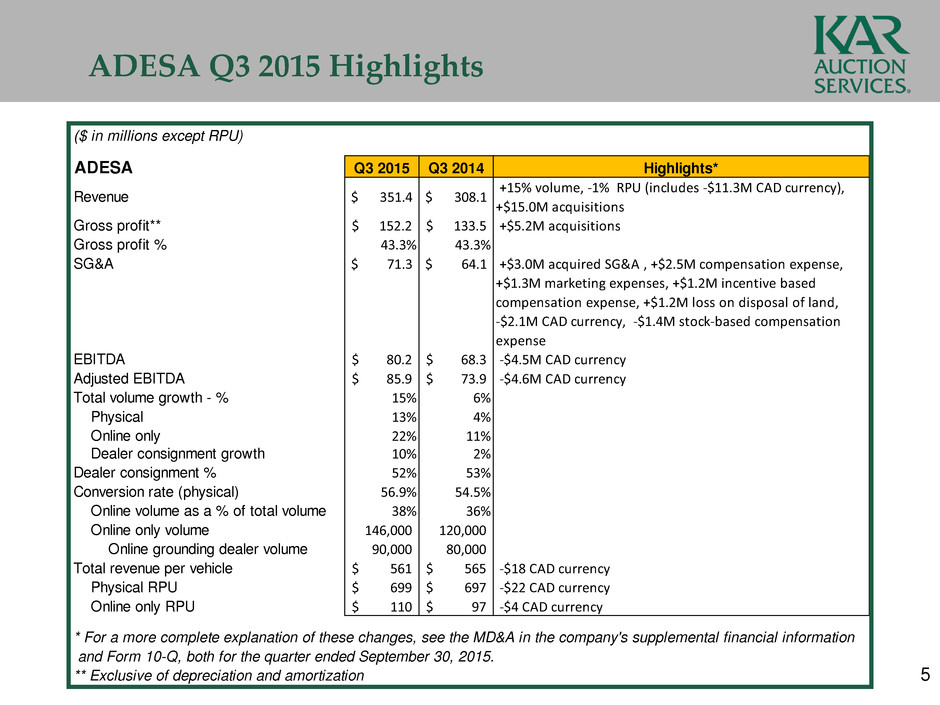

ADESA Q3 2015 Highlights 5 ($ in millions except RPU) ADESA Q3 2015 Q3 2014 Highlights* Revenue $ 351.4 $ 308.1 +15% volume, -1% RPU (includes -$11.3M CAD currency), +$15.0M acquisitions Gross profit** 152.2$ 133.5$ +$5.2M acquisitions Gross profit % 43.3% 43.3% SG&A $ 71.3 $ 64.1 +$3.0M acquired SG&A , +$2.5M compensation expense, +$1.3M marketing expenses, +$1.2M incentive based compensation expense, +$1.2M loss on disposal of land, -$2.1M CAD currency, -$1.4M stock-based compensation expense EBITDA 80.2$ 68.3$ -$4.5M CAD currency Adjusted EBITDA 85.9$ 73.9$ -$4.6M CAD currency Total volume growth - % 15% 6% Physical 13% 4% Online only 22% 11% Dealer consignment growth 10% 2% Dealer consignment % 52% 53% Conversion rate (physical) 56.9% 54.5% Online volume as a % of total volume 38% 36% Online only volume 146,000 120,000 Online grounding dealer volume 90,000 80,000 Total revenue per vehicle 561$ 565$ -$18 CAD currency Physical RPU 699$ 697$ -$22 CAD currency Online only RPU 110$ 97$ -$4 CAD currency * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended September 30, 2015. ** Exclusive of depreciation and amortization

IAA Q3 2015 Highlights 6 ($ in millions) IAA Q3 2015 Q3 2014 Highlights* Revenue $ 246.2 $ 217.5 +16% volume, -3% RPU (includes -$3.1M CAD currency) +$9.8M HBC Gross profit** 87.3$ 82.1$ +$0.7M HBC Gross profit % 35.5% 37.7% SG&A $ 25.6 $ 23.5 +$1.0M telecom expenses, +$0.9M compensation expense, +$0.8M acquired SG&A, -$0.8M stock-based compensation expense EBITDA 60.8$ 58.6$ -$1M CAD currency Adjusted EBITDA 61.9$ 59.3$ -$1M CAD currency % Volume growth 16% 7% % Purchased contract vehicles 7% 6% +1% HBC volume * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended September 30, 2015. ** Exclusive of depreciation and amortization

AFC Q3 2015 Highlights 7 AFC Q3 2015 Q3 2014 Highlights* Revenue 69.1$ 63.5$ +13% LTUs, +6% in "Other service revenue", -3% revenue per LTU ( includes -$0.8M CAD currency) Other service revenue 7.1$ 6.7$ Provision for credit losses (2.7)$ (3.3)$ Gross profit** 49.1$ 45.5$ Gross profit % 71.1% 71.7% SG&A 7.0$ 6.8$ EBITDA 42.1$ 38.7$ -$0.6M CAD currency Adjusted EBITDA 37.9$ 36.3$ -$0.5M CAD currency Loan transactions 405,116 358,800 % Volume growth 13% 5% Revenue per loan transaction unit (LTU)*** 153$ 158$ -$2 CAD currency Managed receivables 1,529.6$ 1,285.3$ Obligations collateralized by finance receivables 1,122.9$ 858.8$ * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the quarter ended September 30, 2015. ** Exclusive of depreciation and amortization *** Excludes "Other service revenue" ($ in millions except for revenue per loan transaction)

ADESA Incremental Operating Profit Margin Analysis 8 ($ in millions) Reported Impact of Acquisitions ADESA Excluding Acquisitions Q3 2015 Revenue 351.4$ 15.0$ 336.4$ Operating Profit 58.6$ 0.5$ 58.1$ Operating Profit % 16.7% 3.3% 17.3% Q3 2014 Revenue 308.1$ Operating Profit 49.7$ Operating Profit % 16.1% Q3 2015 Reported Growth Reported Revenue Growth 43.3$ Reported Operating Profit Growth 8.9$ Incremental Operating Margin 20.6% Q3 2015 Excluding Acquisitions Revenue Growth 28.3$ Operating Profit Growth 8.4$ Incremental Operating Margin 29.7%

Appendix 9

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. EBITDA and Adjusted EBITDA have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies. Non-GAAP Financial Measures 10

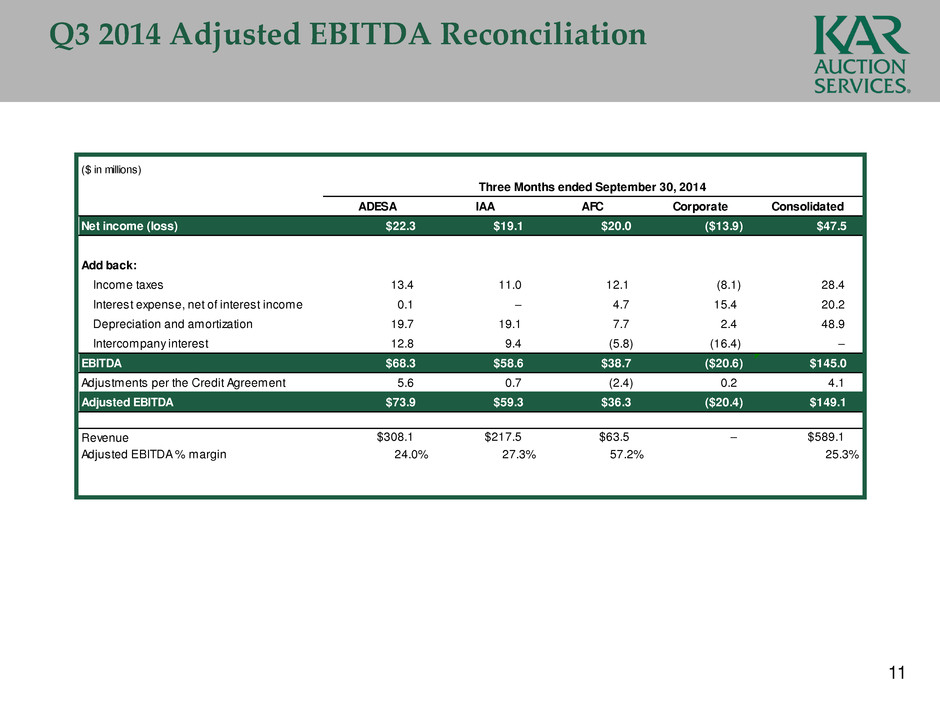

Q3 2014 Adjusted EBITDA Reconciliation 11 ($ in millions) Three Months ended September 30, 2014 ADESA IAA AFC Corporate Consolidated Net income (loss) $22.3 $19.1 $20.0 ($13.9) $47.5 Add back: Income taxes 13.4 11.0 12.1 (8.1) 28.4 Interest expense, net of interest income 0.1 – 4.7 15.4 20.2 Depreciation and amortization 19.7 19.1 7.7 2.4 48.9 Intercompany interest 12.8 9.4 (5.8) (16.4) – EBITDA $68.3 $58.6 $38.7 ($20.6) $145.0 Adjustments per the Credit Agreement 5.6 0.7 (2.4) 0.2 4.1 Adjusted EBITDA $73.9 $59.3 $36.3 ($20.4) $149.1 Revenue $308.1 $217.5 $63.5 – $589.1 Adjusted EBITDA % margin 24.0% 27.3% 57.2% 25.3%

12 Q3 2015 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended September 30, 2015 ADESA IAA AFC Corporate Consolidated Net income (loss) $29.6 $19.9 $22.1 ($19.3) $52.3 Add back: Income taxes 16.0 11.4 13.6 (11.4) 29.6 Interest expense, net of interest income 0.1 – 6.6 17.6 24.3 Depreciation and amortization 22.3 20.1 7.7 4.0 54.1 Intercompany interest 12.2 9.4 (7.9) (13.7) – EBITDA $80.2 $60.8 $42.1 ($22.8) $160.3 Adjustments per the Credit Agreement 5.7 1.1 (4.2) 0.2 2.8 Adjusted EBITDA $85.9 $61.9 $37.9 ($22.6) $163.1 Revenue $351.4 $246.2 $69.1 – $666.7 Adjusted EBITDA % margin 24.4% 25.1% 54.8% 24.5%