Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8k09-30x15.htm |

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh990109-30x2015.htm |

Third Quarter 2015 Earnings Conference Call November 4, 2015

Safe Harbor Statement This presentation includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and technologies Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant The size of our construction program and our ability to complete construction on budget Potential delays in our construction schedule due to legal challenges or other reasons Costs at Palo Verde Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Possible physical or cyber attacks, intrusions or other catastrophic events Other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE’s filings are available from the Securities and Exchange Commission or may be obtained through EE’s website, http://www.epelectric.com 2

3rd Quarter Results Set a new native peak record of 1,794 MW on August 6, 2015 Set a new all-time MWh sales record during the quarter Paid a quarterly cash dividend of $0.295 per share on September 30, 2015 to shareholders of record as of September 16, 2015 3rd Quarter 2015 net income of $56.7 million or $1.40 per share, compared to 3rd Quarter 2014 net income of $52.5 million or $1.30 per share 3

A A 4 3rd Quarter Key Earnings Drivers Basic EPS Description September 30, 2014 1.30$ Changes In: Retail non-fuel base revenues 0.23 Increased revenues primarily due to hotter than normal summer weather Investment and interest income 0.07 Investment gains recorded due to the further diversification of the Company's Palo Verde decommissioning trust fund portfolio Allowance for funds used during construction (AFUDC) (0.06) Decreased due to lower construction work in progress balances primarily due to Montana Power Station (MPS) Units 1 & 2 and the Eastside Operations Center (EOC) being placed in service during the first quarter of 2015 and the reduction of the AFUDC accrual rate Interest on long-term debt (0.03) Increased due to interest accrued on the $150 million senior notes issued in December 2014 Depreciation and amortization (0.03) Increased primarily due to MPS Units 1 & 2 and the EOC being placed in service during the first quarter of 2015 Palo Verde operations and maintenance (0.03) Increased Palo Verde operation and maintenance expenses in the third quarter of 2015 Deregulated Palo Verde Unit 3 (0.02) Decreased due to a 20% decrease in proxy market prices reflecting a decline in natural gas prices Transmission and distribution O&M (0.01) Increased due to system support and improvements and preventive maintenance expense Other (0.02) September 30, 2015 1.40$

Historical Weather Summary 1,223 1,504 1,147 1,601 1,603 1,787 1,497 1,444 1,415 1,732* 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 3rd Quarter CDD’s 10-Yr CDD Average – 1,495 5 * August 2015 CDD’s were the second highest level recorded in the last 20 years and September 2015 CDD’s were the most on record since 1943 **Chart illustrates CDD’s for El Paso, Texas as reported by NOAA

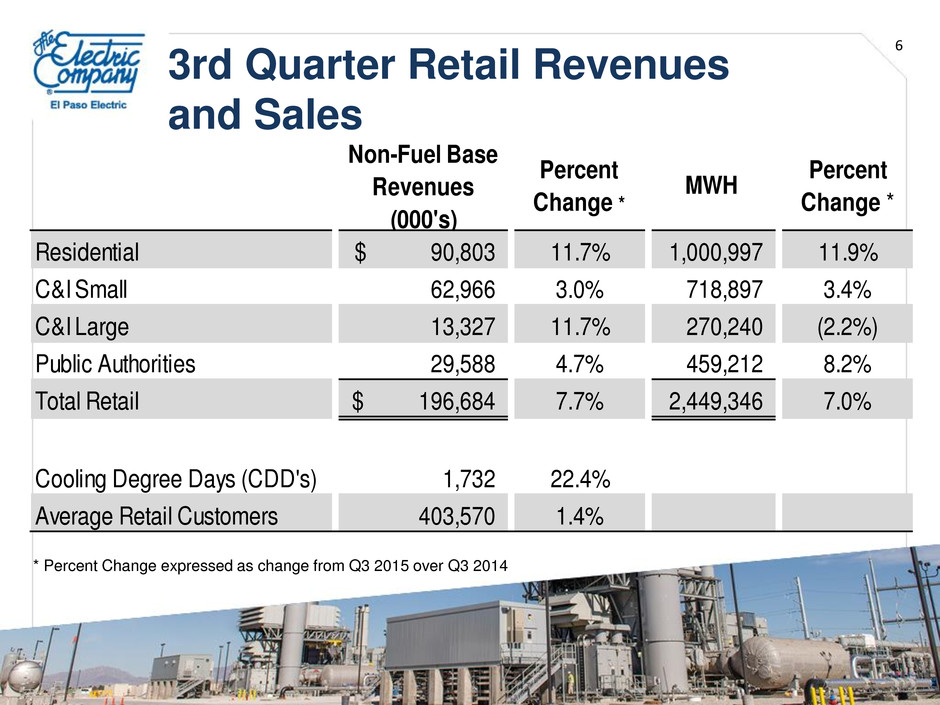

Non-Fuel Base Revenues (000's) Percent Change * MWH Percent Change * Residential 90,803$ 11.7% 1,000,997 11.9% C&I Small 62,966 3.0% 718,897 3.4% C&I Large 13,327 11.7% 270,240 (2.2%) Public Authorities 29,588 4.7% 459,212 8.2% Total Retail 196,684$ 7.7% 2,449,346 7.0% Cooling Degree Days (CDD's) 1,732 22.4% Average Retail Customers 403,570 1.4% * Percent Change expressed as change from Q3 2015 over Q3 2014 3rd Quarter Retail Revenues and Sales 6

Capital Requirements & Liquidity Expended $211.5mm for additions to utility plant for the nine months ended September 30, 2015 EE made $35.1mm in dividend payments for the nine months ended September 30, 2015 At September 30, 2015, EE had liquidity of $193.5mm including a cash balance of $12.6mm and unused capacity under the revolving credit facility Capital expenditures for utility plant in 2015 are anticipated to be approximately $279mm May issue long-term debt in early 2016 7

8 2015 Earnings Guidance We are adjusting and narrowing our earnings guidance range for 2015 to $1.95 - $2.10 per share from $1.75 - $2.05

A A a Rate Case Updates New Mexico Rate Case Intervenor testimony submitted September 30, 2015 NMPRC ruled against EE’s request to create a separate class with a different rate for residential roof-top solar customers EE retains the option to request a rider for residential roof-top solar customers in a separate proceeding Hearings on the merits of the general rate case set to begin on November 16, 2015 Anticipate new rates to become effective early 2nd quarter 2016 Texas Rate Case Intervenor testimony must be filed by December 11, 2015 Hearings on the merits set to begin on January 26, 2016 Anticipate new rates to become effective early 2nd quarter 2016 9

Expected Timeline - Current Rate Cases 10 (1) NM Rate Case filing used a historical test year end of December 2014 and via a “post test year adjustment” included MPS units 1 & 2 in requested rate base. (2) House Bill 1535 allows for rates to relate back to the 155th day after a rate case is filed. New Mexico Texas Dec Feb 2015 Apr Jun Aug Oct Dec Feb 2016 Apr Jun 2016 Final Order Early 2Q 2016 Final Order Early 2Q 2016 Hearing Begins Jan 26 Effective Date of Rates(2) Jan 12 Hearing Begins Nov 16 Intervention Deadline Sep 25 File Rate Case Aug 10 Intervention Deadline Aug 3 File Rate Case (1) May 11 Historical Test Year End Mar 31 Historical Test Year End Dec 31 2014

Potential Timeline - Next Rate Cases 11 (1) NM Rate Case filing would use a historical test year end of September 2016 and via a “post test year adjustment” include MPS units 3 & 4 in requested rate base. (2) TX House Bill 1535 allows for the TX Rate Case filing to reflect a historical test year ended September 2016 and include MPS units 3 & 4 in requested rate base. (3) TX House Bill 1535 allows for rates to relate back to the 155th day after a rate case is filed. New Mexico Texas 2016 May Jul Sep Nov Jan 2017 Mar May Jul Sep Nov Jan 2018 2018 Final Order Q1 2018 Final Order 4Q 2017 Effective Date of Rates(3) 3Q 2017 File Rate Case(1) 1Q 2017 File Rate Case 1Q 2017 MPS Unit 4 In-Service Dec 2016 MPS Unit 4 In-Service Dec 2016 Historical Test Year End Sep 2016 Historical Test Year End(2) Sep 2016 MPS Unit 3 In-Service May 2016 MPS Unit 3 In-Service May 2016

Q & A 12