Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - XO GROUP INC. | v423639_ex99-1.htm |

| 8-K - 8-K - XO GROUP INC. | v423639_8k.htm |

Exhibit 99.2

Investor Presentation | November 2015

2 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. This presentation may contain projections or other forward - looking statements regarding future events or our future financial performance or estimates regarding third parties . These statements are only estimates or predictions and reflect our current beliefs and expectations . Actual events or results may differ materially from those contained in the estimates, projections or forward - looking statements . It is routine for internal projections and expectations to change as the quarter progresses, and therefore it should be clearly understood that the internal projections and beliefs upon which we base our expectations may change prior to the end of the quarter . Although these expectations may change, we will not necessarily inform you if they do . Our policy is to provide expectations not more than once per quarter, and not to update that information until the next quarter . Some of the factors that could cause actual results to differ materially from the forward - looking statements contained herein include, without limitation, (i) our online wedding - related and other websites, mobile and other digital properties may fail to generate sufficient revenue to survive over the long term, (ii) we incurred losses for many years following our inception and may incur losses in the future, (iii) we may be unable to adjust spending quickly enough to offset any unexpected revenue shortfall, (iv) efforts to launch new or upgrading existing technology and features may not generate significant new revenue or may reduce revenue from existing services, (v) we may be unable to develop solutions that generate revenue from advertising and other services delivered to mobile phones and wireless devices, (vi) the significant fluctuation to which our quarterly revenue and operating results are subject, (vii) the seasonality of the wedding industry, (viii) our operations are dependent on Internet search engine rankings, and our ability to influence those rankings is limited, (ix) the dependence of our registry and commerce services business on third parties, (x) increased competition in our markets could reduce our market share, and (xi) other factors detailed in documents we file from time to time with the Securities and Exchange Commission . Forward - looking statements in this release are made pursuant to the safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995 . This presentation includes certain "Non - GAAP financial information." A reconciliation of such information to the most directly comparable GAAP data can be found at the end of this presentation. Safe Harbor

3 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Leader in Attractive Market • #1 online wedding property; growing baby property • Replenishing audience in an attractive demographic • Strong multi - platform brand built over 18 years Solid Financial Foundation • Diversified revenue streams • Healthy margin capability • Balanced approach to capital allocation Strategic Transformation Underway • Evolving our wedding vendor marketplace • Investing in our business and invigorating our product road map • Improving performance with rigorous examination and decisive action • Experienced, focused management team Investment Opportunity

4 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. XO Group at a Glance Our mission is to help people navigate and truly enjoy life’s biggest moments, together. Our family of multi - platform brands guide couples through transformative life stages, from getting married, to moving in together and having a baby. *Bump total revenue for the year ended December 31, 2014 **Number of employees as of 9/30/15 $143.7M $24.6M 630 #1 $53.8M 85.2% 18 years 9% of revenue 2014 Revenue (+7% Y/Y) 2014 Adjusted EBITDA Employees** Online Wedding Property with Growing Visitors Free cash flow generated over last 3 years 2014 Gross Margin Growing Baby Property* Founded in 1996

5 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Business Overview * As of 9/30/15; avg revenue/vendor and retention rate calculated on a trailing 12 month basis **Ijie revenue included as part of The Knot 2014 Revenue by Business Line 2014 Revenue by Brand** 2014 Revenue $143.7M +7.4% Y/Y Local Online Delivering qualified leads to local vendors; foundation for our wedding vendor marketplace • ~25,000 vendors*, ~$2,500 avg * revenue/vendor, ~75% retention* National Online Brand advertising to endemic and non - endemic advertisers • The Bump national online revenue up 57% year - over - year 2014 Publishing Other Delivering award winning content & ads in local & national markets • The Knot National magazine, regional magazines & The Bump magazine; books Registry Service and Commerce Affiliate partnerships with top online wedding registries • Registry revenue growth 20%+ year - over - year 2014 Merchandise Connecting our audience to goods and services through our commerce affiliate partners • Exited merchandise fulfilment operations during Q1 2015

6 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. The Knot: #1 in Weddings 9 months ended September 30, 2015 Unique Visitors Monthly Average (in millions) with Year - Over - Year % Growth *United States Census Bureau American Community Survey and The 2014 Knot Market Intelligence’s Annual Real Weddings Survey Does not meet minimum reporting requirements Unique Visitor Source: comScore Multi Platform • ~2 million marriages/yr • 11 month average planning cycle • National avg. wedding spend continues to grow: $31,213 for 2014* • $70+ B spent annually Wedding * Includes engagement ring but does not include honeymoon 0.7 0.6 1.9 2.3 4.3

7 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. • ~4 million births/year • $60+ B spend annually on newborns Baby* Growing mobile user - base dramatically expands editorial and advertisers’ reach The Bump: Growing Baby Platform +20% Y/Y 3.6M 9 month as of September 30, 2015 Avg. Monthly Unique Visitors • 2014 Development team focused on mobile apps (not included by comScore) • New responsive site launched February 2015 Unique Visitor Source: comScore Multi Platform; *NCHS National Vital Health Statistics Reports and USDA report - expenditures o n children

8 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Strategic Transformation to Accelerate Growth

9 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. The Knot Wedding Vendor Marketplace Match Connect * Vendor count as of 9/30/15; Vendor engagement Q3 2014 vs Q3 2015 • New apps: generating high bride/vendor engagement • Relaunched TheKnot.com for mobile first • 5M+ Real Wedding photos tagged to 90,000 local vendors • Robust reviews • Comprehensive user data enables personalization efforts • ~25,000 paying vendors with extensive profiles • Couple/vendor engagement up 3X • Grew to 250,000+ vendors by adding unpaid listings • Detailed vendor analytics, helps vendors connect with couples Assets & Initiatives Engage

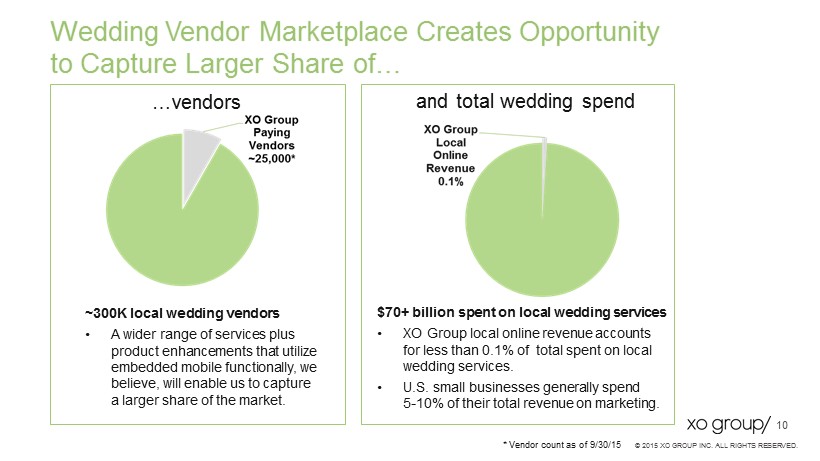

10 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. …vendors and total wedding spend ~300K local wedding vendors • A wider range of services plus product enhancements that utilize embedded mobile functionally, we believe, will enable us to capture a larger share of the market. Wedding Vendor Marketplace Creates Opportunity to Capture Larger Share of… * Vendor count as of 9/30/15 $70+ billion spent on local wedding services • XO Group local online revenue accounts for less than 0.1% of total spent on local wedding services. • U.S. small businesses generally spend 5 - 10% of their total revenue on marketing.

11 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Focused on assets with high performance and potential • Local online – transition to local wedding vendor marketplace • The Bump online • Registry and commerce Invest in Growth • National online (wedding) • Publishing Sustain Positive Momentum • Ijie - Disposed of in December 2014 • E - Commerce - exited merchandise operations during Q1 2015 Decisive Action Taken to Address Under - Performing/Non - Core Assets Our Business Strategy

12 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Invigorated Products The Bump App Wedding Lookbook App Personalized experience Mobile first Match & connect with relevant wedding professionals Tailored to her pregnancy stage and/or child’s age Mobile first Seamless integration between web and apps

13 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. • Joined XO in September 2015 • VP of Product Management at Udacity (October 2013 – April 2015) • Product Leader at Chegg, WebMD, ClassPass and Mint.com • Venture Capitalist at Shasta Ventures Brent Tworetzky | EVP, Product Nic Di Iorio | Chief Technology Officer • Chief Technology Officer since February 2008 • Cofounder and CEO of City24/7 LLC from (2006 - 2008), where he remains a member of the Advisory Board • Chief Technology Officer of Interpublic Group of Companies (IPG) • Joined XO Group July 2005; EVP of Local Enterprise (2010 - May 2015) • Executive Director of Bridal & Gift Registry at Linens ’n Things (1999 - 2005) Kristin Savilia | President, Local Marketplace Leadership Team Mike Steib | Chief Executive Officer • Appointed CEO of XO Group March 2014; joined July 2013 • CEO at Vente - Privee USA (2011 - 2013) • Managing Director Emerging Platforms; Google Inc. (2007 - 2011) • General Manager at NBC Universal Gillian Munson | Chief Financial Officer • Joined XO Group Nov. 2013 • MD at Allen & Co (2007 - 2013) • VP Business Development at Symbol Technologies (2003 - 2007) • Executive Director and Senior Equity Analyst at Morgan Stanley Kathy Wu Brady | EVP, E - Commerce & Registry • Joined XO in March 2014 • CEO of Vente - Privee USA, where sales doubled in 2013 under her management • Held senior - level positions at AOL in strategy & operations, and at NBC Universal Dhanusha Sivajee | EVP, Marketing • Joined XO in August 2014 • CMO, AOL Brand Group (June 2013 - July 2014) • VP, Marketing of Bloomberg Mobile (Feb. 2011 – June 2013) • Director, Affiliate & Advanced Product Marketing of HBO including HBO GO (June 2004 - Feb 2011) Jennifer Garrett | EVP, National Enterprise • Joined XO Group in February 2014 • Spent 12 years at Viacom Inc., in senior sales roles at Nickelodeon and MTV Networks International

14 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Financials

15 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Solid Financial Foundation Adj. EBITDA ($MM) 2013 and 2014 FCF y/y decrease driven by an increase in capital expenditures and a lower cash flow from operations – Funding product transformation Free Cash Flow (FCF) ($MM)

16 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Long - Term Target Financial Model $MM 2008 - 2013 FY 2014 Target Model Net revenue y/y growth 5% CAGR 7% Double digit growth Gross Margin % 81.0 % avg. 85.2% 90 - 95% Adj. EBITDA Margin % 17.5% avg. 17 % At least 20%

17 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Q3 Update • text Summary Income Statement ($M) 3 months ended 9/30/15 3 months ended 9/30/14 Revenue $34.7 $35.9 Gross Profit $32.7 $31.0 Margin 94.1% 86.4% *Adjusted EBITDA $7.3 $7.1 Net Income $2.9 $2.1 Earnings per Diluted Share $0.11 $0.08 • Transactional businesses, Registry and Commence, revenue increased 40% y/y • Total revenue excluding merchandise operations increased 10.6% y/y • Gross margin 94% • Adjusted EBITDA increased 2.9% y/y • Earnings per diluted share rose $0.03 or 38% year over year to $ 0.11 • $86.3 million in cash • Used $2.5 million during the third quarter to make investments in Jetaport , Inc. and a vendor services company * Non - GAAP, please see reconciliation at the end of this presentation Summary Balance Sheet ($M) 9/30/15 12/31/14 Cash and cash equivalents $86.3 $90.0 Other current assets 26.9 23.5 Total Assets 193.1 193.6 Debt --- --- Current Liabilities 26.9 28.7 Total Liabilities 32.8 35.7 Total Liabilities and Stockholders’ Equity $193.1 $193.6

18 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Capital Allocation Priorities Capital Allocation Areas • Internal investments - In the midst of investment cycle: operating expenses to grow at rates larger than revenue growth rates • Strategic acquisitions and investments - Assets that accelerate marketplace transformation • Opportunistic stock buybacks - $20 million authorization; repurchased $1.6 million during 2014 - Repurchased $8.8 million year - to - date through September 30, 2015

19 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Leader in Attractive Market • #1 online wedding property; growing baby property • Replenishing audience in an attractive demographic • Strong multi - platform brand built over 18 years Solid Financial Foundation • Diversified revenue streams • Healthy margin capability • Balanced approach to capital allocation Strategic Transformation Underway • Evolving our wedding vendor marketplace • Investing in our business and invigorating our product road map • Improving performance with rigorous examination and decisive action • Experienced, focused management team Investment Opportunity

20 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Questions? Contact ir@xogrp.com

21 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Quarterly Revenue Break Out, Including Historical Registry and Commerce XO GROUP INC. 2014 - Q3 2015 Quarterly Revenue (Amounts in Thousands) (Unaudited) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 National online advertising $6,910 $7,541 $7,326 $8,679 $30,456 $7,999 $8,505 $8,669 Local online advertising 14,439 14,510 14,796 15,348 59,093 15,917 16,220 16,369 Total Online advertising 21,349 22,051 22,122 24,027 89,549 23,916 24,725 25,038 Registry and commerce 1,886 3,072 3,430 1,983 10,370 2,294 4,163 4,809 Merchandise 3,653 4,775 4,473 3,006 15,908 878 --- --- Publishing and other 5,532 8,432 5,833 8,040 27,837 5,514 7,302 4,859 Total net revenue $32,420 $ 38,330 $ 35,858 $37,056 $ 143,664 $32,602 $36,190 $34,706

22 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Supplemental Data (Unaudited) – Local Advertising Metrics (excluding Two Bright Lights) Q3 2015 Q2 2015 Q1 2015 Q4 2014 Q3 2014 Storefronts (a) 31,705 32,812 33,308 33,414 32,602 Vendor Count 25,034 24,619 25,182 24,764 24,304 Retention Rate (b) 74.9% 76.4% 78.9% 78.3% 77.2% Avg. Revenue/Vendor (c) $2,582 $2,547 $2,519 $2,527 $2,517 (a) Previously disclosed as Profile Count (b) Calculated on a trailing twelve - month basis. Previously disclosed as churn rate. Retention rate calculated as one less churn rate. (c) Calculated on a trailing twelve - month basis.

23 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Reconciliation of GAAP to NON - GAAP Financial Measures: Q3 2015 & YTD 9/30/2015

24 © 2015 XO GROUP INC. ALL RIGHTS RESERVED. Reconciliation of GAAP to NON - GAAP Financial Measures: 2012 - 2014