Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Armada Hoffler Properties, Inc. | d38529dex991.htm |

| 8-K - FORM 8-K - Armada Hoffler Properties, Inc. | d38529d8k.htm |

Exhibit 99.2

|

|

Small Cap Equity REIT Silver

|

|

Table of Contents

Forward Looking Statements 3 Corporate Profile 4 Highlights 5 2015 Outlook 6 Summary Information 7 Summary Balance Sheet 8 Summary Income Statement 9 FFO, Normalized FFO & Adjusted FFO 10 Outstanding Debt 11 Core Debt to Core EBITDA 12 Debt Information 13 Property Portfolio 14 Property Portfolio Footnotes 15 Development Pipeline 16 Acquisitions & Dispositions 17 Construction Business Summary 18 Same Store NOI by Segment 19 Top 10 Tenants by Annualized Base Rent 20 Office Lease Summary 21 Office Lease Expirations 22 Retail Lease Summary 23 Retail Lease Expirations 24 Net Asset Value Component Data 26 Appendix—Definitions & Reconciliations 27 Definitions 28 Reconciliation to Property Portfolio NOI 32 Reconciliation to GAAP Net Income 34

| 2 |

|

|

|

Forward Looking Statements

This Supplemental Information should be read in conjunction with our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, and the unaudited condensed consolidated financial statements appearing in our press release dated November 3, 2015, which has been furnished as Exhibit 99.1 to our Form 8-K filed on November 3, 2015. The Company makes statements in this Supplemental Information that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, all of our statements regarding anticipated growth in our funds from operations, normalized funds from operations, adjusted funds from operations, funds available for distribution and net operating income are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, estimates, data or methods, which may be incorrect or imprecise, and actual results may vary materially from those anticipated, estimated or projected. The Company does not guarantee that the transactions and events described will happen as described (or that they will happen at all). For further discussion of risk factors and other events that could impact our future results, please refer to the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”), and the documents subsequently filed by us from time to time with the SEC.

| 3 |

|

|

|

CORPORATE PROFILE

Armada Hoffler Properties, Inc. (NYSE: AHH) is a full service real estate company that develops, constructs and owns institutional grade office, retail and

multifamily properties in the Mid-Atlantic United States. The Company also provides general contracting and development services to third-party clients

throughout the Mid-Atlantic and Southeastern regions. Armada Hoffler Properties, Inc. was founded in 1979 and is headquartered in Virginia Beach, VA. The

Company has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

Board of Directors Corporate Officers

Daniel A. Hoffler Executive Chairman of the Board Louis S. Haddad President and Chief Executive Officer

A. Russell Kirk Vice Chairman of the Board Anthony P. Nero President of Development

Louis S. Haddad Director Shelly R. Hampton President of Asset Management

John W. Snow Lead Independent Director Eric E. Apperson President of Construction

George F. Allen Independent Director Michael P. O’Hara Chief Financial Officer and Treasurer

James A. Carroll Independent Director Eric L. Smith Chief Investment Officer and Corporate Secretary

James C. Cherry Independent Director

Eva S. Hardy Independent Director

Joseph W. Prueher Independent Director

Analyst Coverage

Janney, Montgomery, & Scott LLC Raymond James & Associates Robert W. Baird & Co. Stifel, Nicolaus & Company, Inc. Wunderlich Securities

Robert Stevenson Bill Crow David Rodgers John Guinee Craig Kucera

(646) 840-3217 (727) 567-2594 (216) 737-7341 (443) 224-1307 (540) 277-3366

robertstevenson@janney.com rj.milligan@raymondjames.com drodgers@rwbaird.com jwguinee@stifel.com ckucera@wundernet.com

Investor Relations Contact

Michael P. O’Hara

Chief Financial Officer and Treasurer

(757) 366-6684

mohara@armadahoffler.com

4

|

|

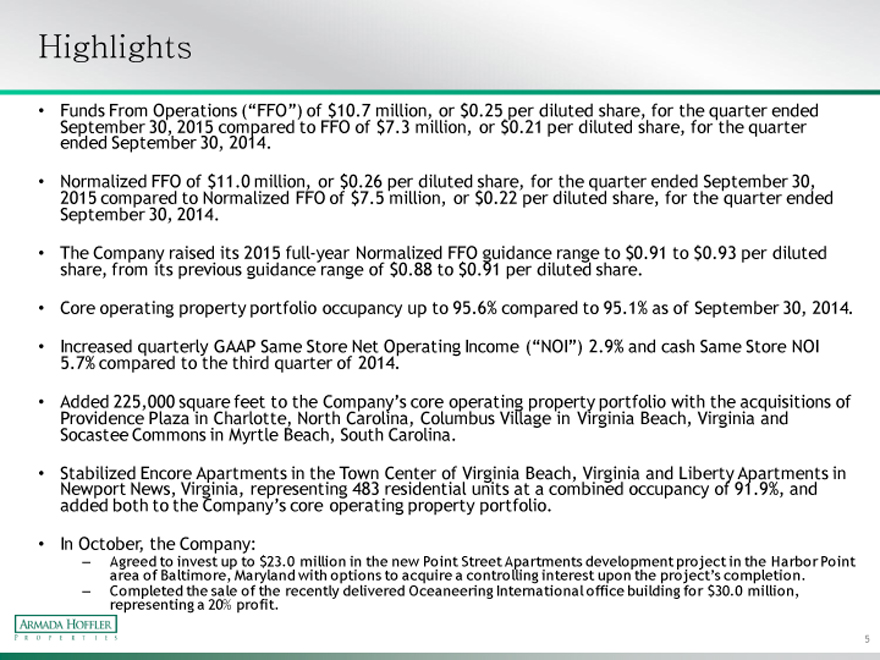

Highlights

• Funds September From 30, Operations 2015 compared (“FFO”) to of FFO $10.7 of million, $7.3 million, or $0.25 or $ per 0.21 diluted per diluted share, share, for the for quarter the quarter ended ended September 30, 2014.

• Normalized 2015 compared FFO to of Normalized $11.0 million, FFO or of $ 0.26 $7.5 per million, diluted or $ share, 0.22 per for diluted the quarter share, ended for the September quarter ended 30, September 30, 2014.

• The share, Company from its raised previous its 2015 guidance full-year range Normalized of $0.88 to FFO $0.91 guidance per diluted range share. to $0.91 to $0.93 per diluted

• Core operating property portfolio occupancy up to 95.6% compared to 95.1% as of September 30, 2014.

• Increased 5.7% compared quarterly to the GAAP third Same quarter Store of Net 2014. Operating Income (“NOI”) 2.9% and cash Same Store NOI

• Added Providence 225,000 Plaza square in Charlotte, feet to the North Company’s Carolina, core Columbus operating Village property in Virginia portfolio Beach, with Virginia the acquisitions and of

Socastee Commons in Myrtle Beach, South Carolina.

• Stabilized Encore Apartments in the Town Center of Virginia Beach, Virginia and Liberty Apartments in

Newport added both News, to the Virginia, Company’s representing core operating 483 residential property units portfolio. at a combined occupancy of 91.9%, and

• In October, the Company:

– Agreed area of to Baltimore, invest up Maryland to $23.0 with million options in the to new acquire Point a Street controlling Apartments interest development upon the project’s project completion. in the Harbor Point

– Completed representing the a 20% sale profit. of the recently delivered Oceaneering International office building for $30.0 million,

5

|

|

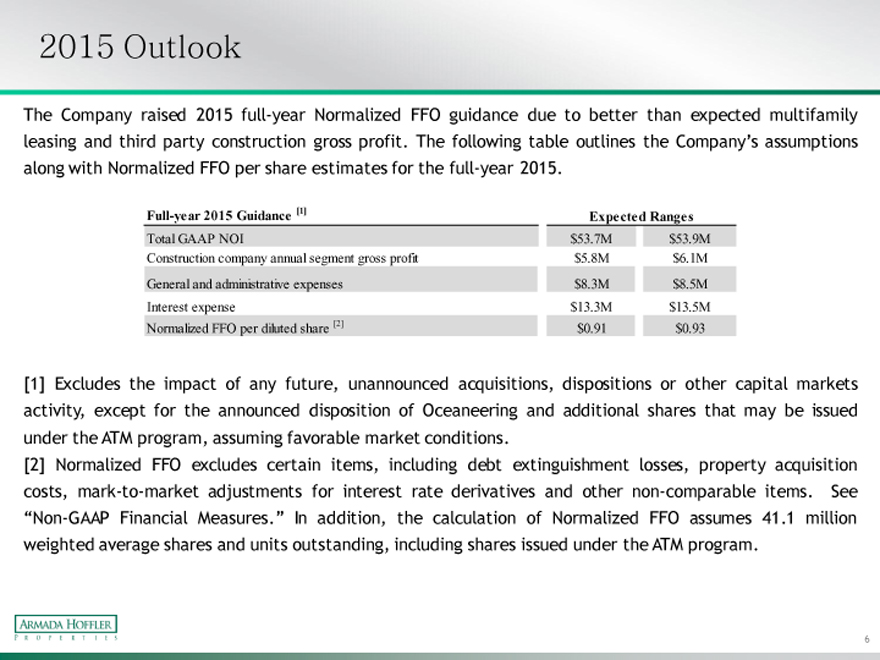

2015 Outlook

The Company raised 2015 full-year Normalized FFO guidance due to better than expected multifamily leasing and third party construction gross profit. The following table outlines the Company’s assumptions along with Normalized FFO per share estimates for the full-year 2015.

Full-year 2015 Guidance [1] Expected Ranges

Total GAAP NOI $53.7M $53.9M

Construction company annual segment gross profit $5.8M $6.1M

General and administrative expenses $8.3M $8.5M

Interest expense $13.3M $13.5M

Normalized FFO per diluted share [2] $0.91 $0.93

[1] Excludes the impact of any future, unannounced acquisitions, dispositions or other capital markets activity, except for the announced disposition of Oceaneering and additional shares that may be issued under the ATM program, assuming favorable market conditions.

[2] Normalized FFO excludes certain items, including debt extinguishment losses, property acquisition costs, mark-to-market adjustments for interest rate derivatives and other non-comparable items. See

“Non-GAAP Financial Measures.” In addition, the calculation of Normalized FFO assumes 41.1 million weighted average shares and units outstanding, including shares issued under the ATM program.

|

|

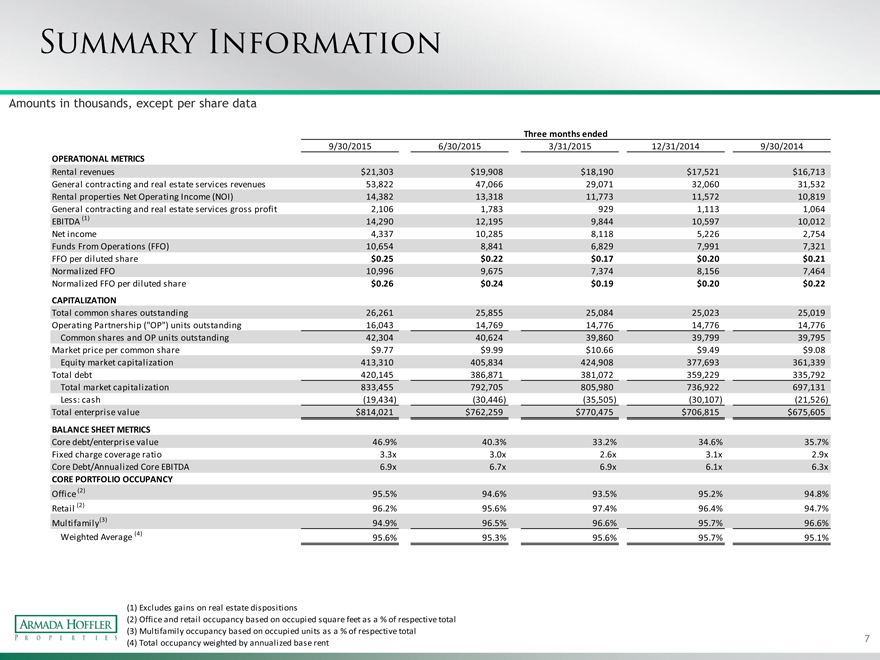

SUMMARY INFORMATION

Amounts in thousands, except per share data

Three months ended

9/30/2015 6/30/2015 3/31/2015 12/31/2014 9/30/2014

OPERATIONAL METRICS

Rental revenues $21,303 $19,908 $18,190 $17,521 $16,713

General contracting and real estate services revenues 53,822 47,066 29,071 32,060 31,532

Rental properties Net Operating Income (NOI) 14,382 13,318 11,773 11,572 10,819

General contracting and real estate services gross profit 2,106 1,783 929 1,113 1,064

EBITDA (1) 14,290 12,195 9,844 10,597 10,012

Net income 4,337 10,285 8,118 5,226 2,754

Funds From Operations (FFO) 10,654 8,841 6,829 7,991 7,321

FFO per diluted share $0.25 $0.22 $0.17 $0.20 $0.21

Normalized FFO 10,996 9,675 7,374 8,156 7,464

Normalized FFO per diluted share $0.26 $0.24 $0.19 $0.20 $0.22

CAPITALIZATION

Total common shares outstanding 26,261 25,855 25,084 25,023 25,019

Operating Partnership (“OP”) units outstanding 16,043 14,769 14,776 14,776 14,776

Common shares and OP units outstanding 42,304 40,624 39,860 39,799 39,795

Market price per common share $9.77 $9.99 $10.66 $9.49 $9.08

Equity market capitalization 413,310 405,834 424,908 377,693 361,339

Total debt 420,145 386,871 381,072 359,229 335,792

Total market capitalization 833,455 792,705 805,980 736,922 697,131

Less: cash (19,434) (30,446) (35,505) (30,107) (21,526)

Total enterprise value $814,021 $762,259 $770,475 $706,815 $675,605

BALANCE SHEET METRICS

Core debt/enterprise value 46.9% 40.3% 33.2% 34.6% 35.7%

Fixed charge coverage ratio 3.3x 3.0x 2.6x 3.1x 2.9x

Core Debt/Annualized Core EBITDA 6.9x 6.7x 6.9x 6.1x 6.3x

CORE PORTFOLIO OCCUPANCY

Office (2) 95.5% 94.6% 93.5% 95.2% 94.8%

Retail (2) 96.2% 95.6% 97.4% 96.4% 94.7%

Multifamily(3) 94.9% 96.5% 96.6% 95.7% 96.6%

Weighted Average (4) 95.6% 95.3% 95.6% 95.7% 95.1%

| (1) |

|

Excludes gains on real estate dispositions |

| (2) |

|

Office and retail occupancy based on occupied square feet as a % of respective total |

| (3) |

|

Multifamily occupancy based on occupied units as a % of respective total |

| (4) |

|

Total occupancy weighted by annualized base rent |

| 7 |

|

|

|

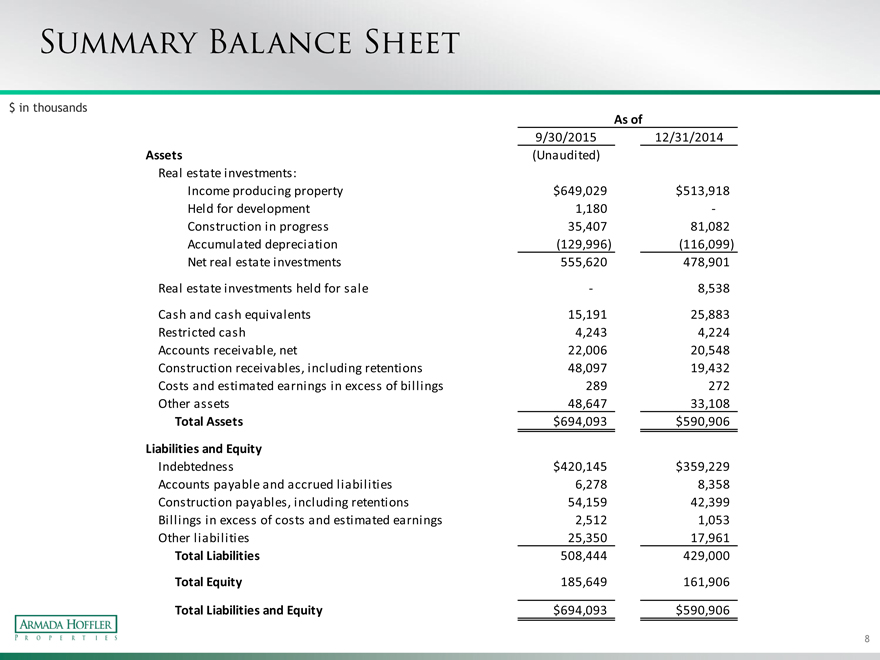

SUMMARY BALANCE SHEET

$ in thousands

As of

9/30/2015 12/31/2014

Assets (Unaudited)

Real estate investments:

Income producing property $649,029 $513,918

Held for development 1,180 -

Construction in progress 35,407 81,082

Accumulated depreciation (129,996) (116,099)

Net real estate investments 555,620 478,901

Real estate investments held for sale — 8,538

Cash and cash equivalents 15,191 25,883

Restricted cash 4,243 4,224

Accounts receivable, net 22,006 20,548

Construction receivables, including retentions 48,097 19,432

Costs and estimated earnings in excess of billings 289 272

Other assets 48,647 33,108

Total Assets $694,093 $590,906

Liabilities and Equity

Indebtedness $420,145 $359,229

Accounts payable and accrued liabilities 6,278 8,358

Construction payables, including retentions 54,159 42,399

Billings in excess of costs and estimated earnings 2,512 1,053

Other liabilities 25,350 17,961

Total Liabilities 508,444 429,000

Total Equity 185,649 161,906

Total Liabilities and Equity $694,093 $590,906

| 8 |

|

|

|

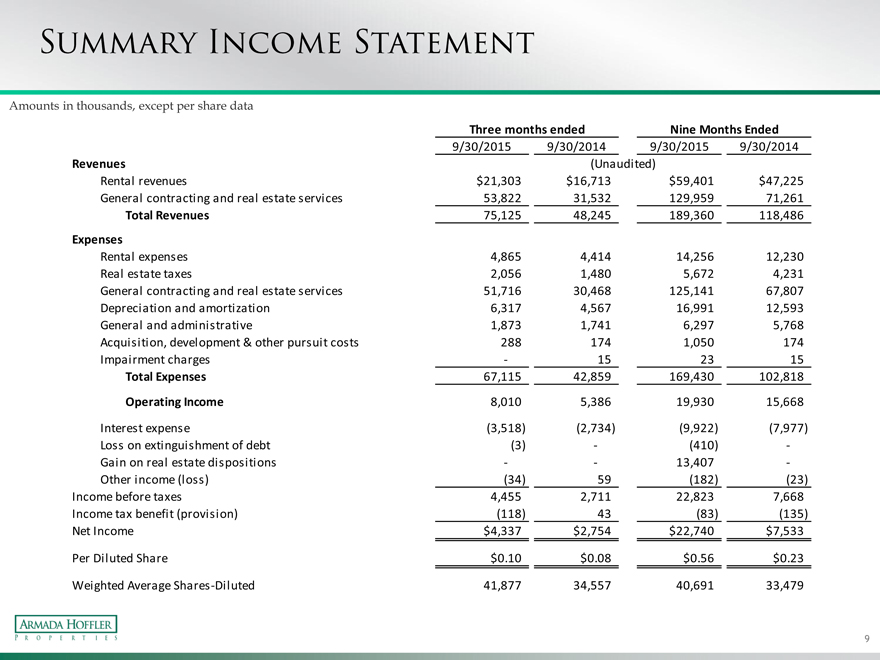

SUMMARY INCOME STATEMENT

Amounts in thousands, except per share data

Three months ended Nine Months Ended

9/30/2015 9/30/2014 9/30/2015 9/30/2014

Revenues (Unaudited)

Rental revenues $21,303 $16,713 $59,401 $47,225

General contracting and real estate services 53,822 31,532 129,959 71,261

Total Revenues 75,125 48,245 189,360 118,486

Expenses

Rental expenses 4,865 4,414 14,256 12,230

Real estate taxes 2,056 1,480 5,672 4,231

General contracting and real estate services 51,716 30,468 125,141 67,807

Depreciation and amortization 6,317 4,567 16,991 12,593

General and administrative 1,873 1,741 6,297 5,768

Acquisition, development & other pursuit costs 288 174 1,050 174

Impairment charges — 15 23 15

Total Expenses 67,115 42,859 169,430 102,818

Operating Income 8,010 5,386 19,930 15,668

Interest expense (3,518) (2,734) (9,922) (7,977)

Loss on extinguishment of debt (3) — (410) -

Gain on real estate dispositions —— 13,407 -

Other income (loss) (34) 59 (182) (23)

Income before taxes 4,455 2,711 22,823 7,668

Income tax benefit (provision) (118) 43 (83) (135)

Net Income $4,337 $2,754 $22,740 $7,533

Per Diluted Share $0.10 $0.08 $0.56 $0.23

Weighted Average Shares -Diluted 41,877 34,557 40,691 33,479

9

|

|

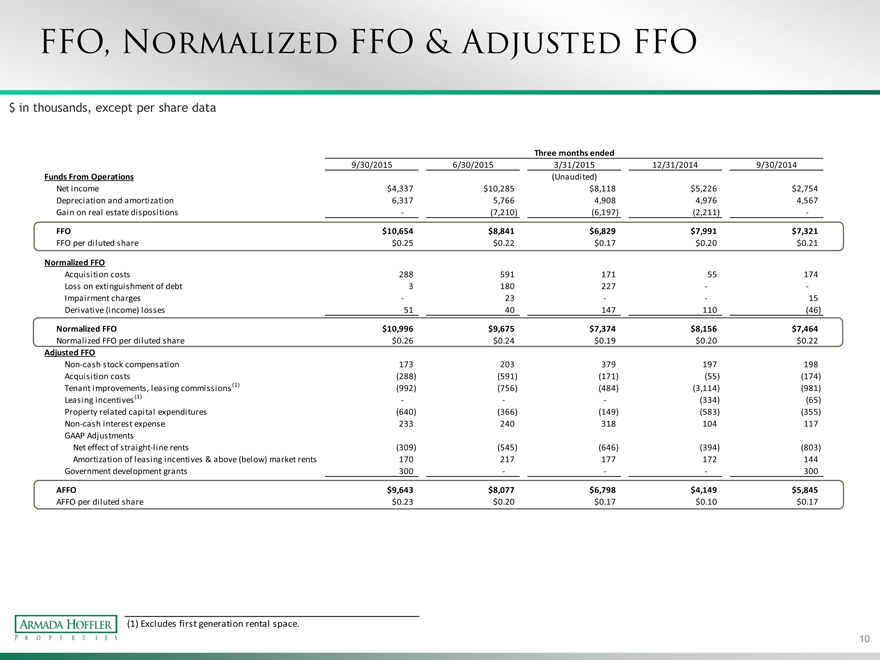

FFO, NORMALIZED FFO & ADJUSTED FFO

$ in thousands, except per share data

Three months ended

9/30/2015 6/30/2015 3/31/2015 12/31/2014 9/30/2014

Funds From Operations (Unaudited)

Net income $4,337 $10,285 $8,118 $5,226 $2,754

Depreciation and amortization 6,317 5,766 4,908 4,976 4,567

Gain on real estate dispositions — (7,210) (6,197) (2,211) -

FFO $10,654 $8,841 $6,829 $7,991 $7,321

FFO per diluted share $0.25 $0.22 $0.17 $0.20 $0.21

Normalized FFO

Acquisition costs 288 591 171 55 174

Loss on extinguishment of debt 3 180 227 — -

Impairment charges — 23 —— 15

Derivative (income) losses 51 40 147 110 (46)

Normalized FFO $10,996 $9,675 $7,374 $8,156 $7,464

Normalized FFO per diluted share $0.26 $0.24 $0.19 $0.20 $0.22

Adjusted FFO

Non-cash stock compensation 173 203 379 197 198

Acquisition costs (288) (591) (171) (55) (174)

Tenant improvements, leasing commissions (1) (992) (756) (484) (3,114) (981)

Leasing incentives (1) ——— (334) (65)

Property related capital expenditures (640) (366) (149) (583) (355)

Non-cash interest expense 233 240 318 104 117

GAAP Adjustments

Net effect of straight-line rents (309) (545) (646) (394) (803)

Amortization of leasing incentives & above (below) market rents 170 217 177 172 144

Government development grants 300 ——— 300

AFFO $9,643 $8,077 $6,798 $4,149 $5,845

AFFO per diluted share $0.23 $0.20 $0.17 $0.10 $0.17

| (1) |

|

Excludes first generation rental space. |

10

|

|

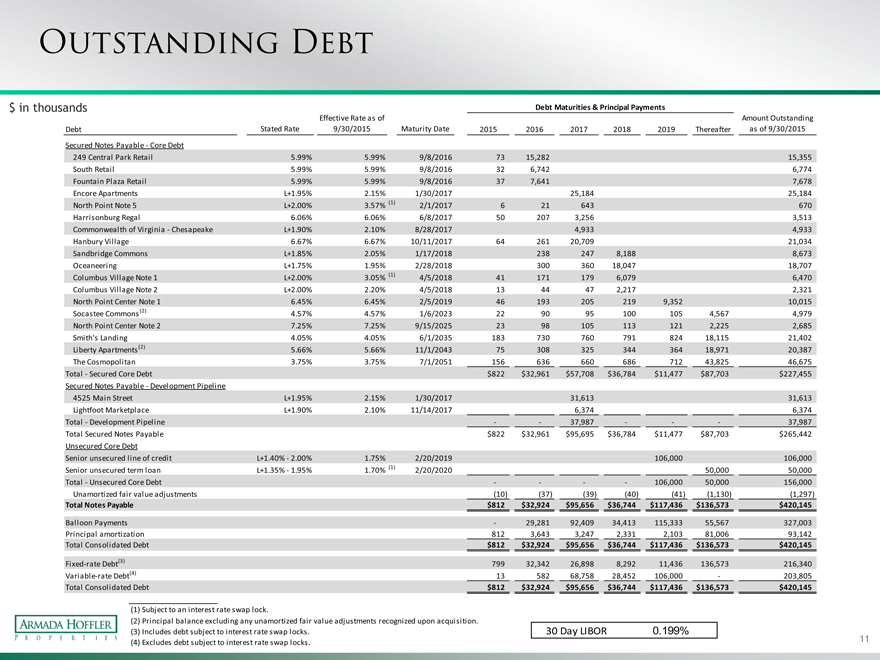

OUTSTANDING DEBT

$ in thousands Debt Maturities & Principal Payments

Effective Rate as of Amount Outstanding

Debt Stated Rate 9/30/2015 Maturity Date 2015 2016 2017 2018 2019 Thereafter as of 9/30/2015

Secured Notes Payable—Core Debt

249 Central Park Retail 5.99% 5.99% 9/8/2016 73 15,282 15,355

South Retail 5.99% 5.99% 9/8/2016 32 6,742 6,774

Fountain Plaza Retail 5.99% 5.99% 9/8/2016 37 7,641 7,678

Encore Apartments L+1.95% 2.15% 1/30/2017 25,184 25,184

North Point Note 5 L+2.00% 3.57% (1) 2/1/2017 6 21 643 670

Harrisonburg Regal 6.06% 6.06% 6/8/2017 50 207 3,256 3,513

Commonwealth of Virginia—Chesapeake L+1.90% 2.10% 8/28/2017 4,933 4,933

Hanbury Village 6.67% 6.67% 10/11/2017 64 261 20,709 21,034

Sandbridge Commons L+1.85% 2.05% 1/17/2018 238 247 8,188 8,673

Oceaneering L+1.75% 1.95% 2/28/2018 300 360 18,047 18,707

Columbus Village Note 1 L+2.00% 3.05% (1) 4/5/2018 41 171 179 6,079 6,470

Columbus Village Note 2 L+2.00% 2.20% 4/5/2018 13 44 47 2,217 2,321

North Point Center Note 1 6.45% 6.45% 2/5/2019 46 193 205 219 9,352 10,015

Socastee Commons(2) 4.57% 4.57% 1/6/2023 22 90 95 100 105 4,567 4,979

North Point Center Note 2 7.25% 7.25% 9/15/2025 23 98 105 113 121 2,225 2,685

Smith’s Landing 4.05% 4.05% 6/1/2035 183 730 760 791 824 18,115 21,402

Liberty Apartments(2) 5.66% 5.66% 11/1/2043 75 308 325 344 364 18,971 20,387

The Cosmopolitan 3.75% 3.75% 7/1/2051 156 636 660 686 712 43,825 46,675

Total—Secured Core Debt $ 822 $32,961 $57,708 $36,784 $11,477 $87,703 $ 227,455

Secured Notes Payable—Development Pipeline

4525 Main Street L+1.95% 2.15% 1/30/2017 31,613 31,613

Lightfoot Marketplace L+1.90% 2.10% 11/14/2017 6,374 6,374

Total—Development Pipeline —— 37,987 ——— 37,987

Total Secured Notes Payable $ 822 $32,961 $95,695 $36,784 $11,477 $87,703 $ 265,442

Unsecured Core Debt

Senior unsecured line of credit L+1.40%—2.00% 1.75% 2/20/2019 106,000 106,000

Senior unsecured term loan L+1.35%—1.95% 1.70% (1) 2/20/2020 50,000 50,000

Total—Unsecured Core Debt ———— 106,000 50,000 156,000

Unamortized fair value adjustments (10) (37) (39) (40) (41) (1,130) (1,297)

Total Notes Payable $ 812 $32,924 $95,656 $36,744 $117,436 $136,573 $ 420,145

Balloon Payments — 29,281 92,409 34,413 115,333 55,567 327,003

Principal amortization 812 3,643 3,247 2,331 2,103 81,006 93,142

Total Consolidated Debt $ 812 $32,924 $95,656 $36,744 $117,436 $136,573 $ 420,145

Fixed-rate Debt(3) 799 32,342 26,898 8,292 11,436 136,573 216,340

Variable-rate Debt(4) 13 582 68,758 28,452 106,000 — 203,805

Total Consolidated Debt $ 812 $32,924 $95,656 $36,744 $117,436 $136,573 $ 420,145

| (1) |

|

Subject to an interest rate swap lock. |

| (2) |

|

Principal balance excluding any unamortized fair value adjustments recognized upon acquisition. |

| (3) |

|

Includes debt subject to interest rate swap locks. 30 Day LIBOR 0.199% |

| (4) |

|

Excludes debt subject to interest rate swap locks. |

11

|

|

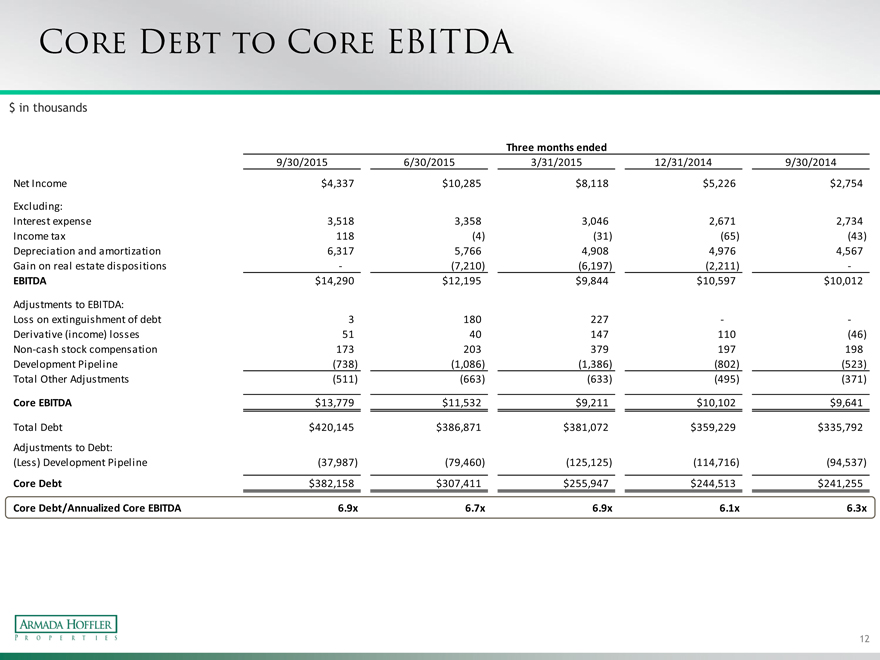

CORE DEBT TO CORE EBITDA

$ in thousands

Three months ended

9/30/2015 6/30/2015 3/31/2015 12/31/2014 9/30/2014

Net Income $4,337 $10,285 $8,118 $5,226 $2,754

Excluding:

Interest expense 3,518 3,358 3,046 2,671 2,734

Income tax 118 (4) (31) (65) (43)

Depreciation and amortization 6,317 5,766 4,908 4,976 4,567

Gain on real estate dispositions — (7,210) (6,197) (2,211) -

EBITDA $14,290 $12,195 $9,844 $10,597 $10,012

Adjustments to EBITDA:

Loss on extinguishment of debt 3 180 227 — -

Derivative (income) losses 51 40 147 110 (46)

Non-cash stock compensation 173 203 379 197 198

Development Pipeline (738) (1,086) (1,386) (802) (523)

Total Other Adjustments (511) (663) (633) (495) (371)

Core EBITDA $13,779 $11,532 $9,211 $10,102 $9,641

Total Debt $420,145 $386,871 $381,072 $359,229 $335,792

Adjustments to Debt:

(Less) Development Pipeline (37,987) (79,460) (125,125) (114,716) (94,537)

Core Debt $382,158 $307,411 $255,947 $244,513 $241,255

Core Debt/Annualized Core EBITDA 6.9x 6.7x 6.9x 6.1x 6.3x

12

|

|

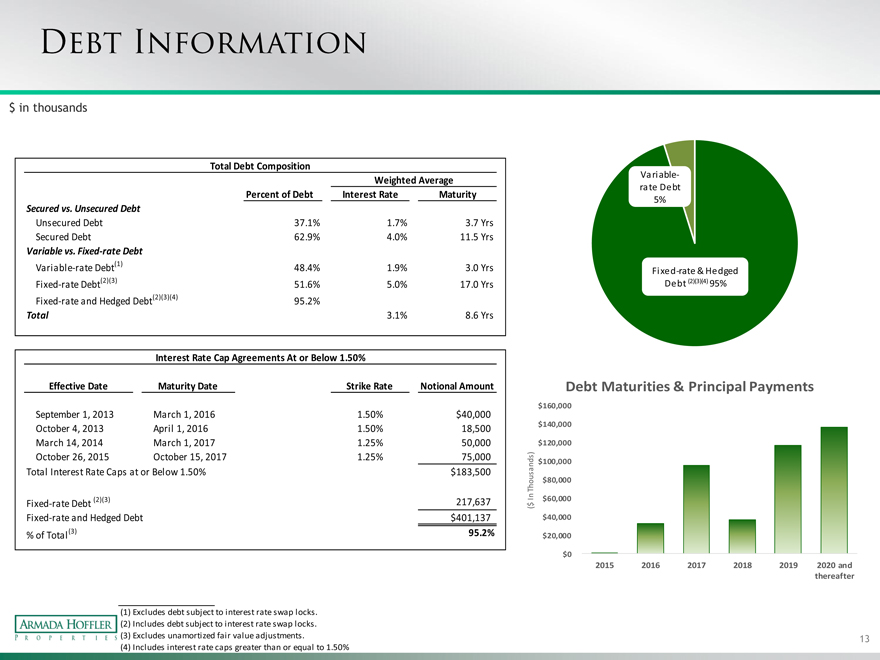

DEBT INFORMATION

$ in thousands

Total Debt Composition

Weighted Average Variable-rate Debt 5%

Percent of Debt Interest Rate Maturity

Secured vs. Unsecured Debt

Unsecured Debt 37.1% 1.7% 3.7 Yrs

Secured Debt 62.9% 4.0% 11.5 Yrs

Variable vs. Fixed-rate Debt

Variable-rate Debt(1) 48.4% 1.9% 3.0 Yrs

Fixed-rate & Hedged Debt (2)(3)(4) 95%

Fixed-rate Debt(2)(3) 51.6% 5.0% 17.0 Yrs

Fixed-rate and Hedged Debt(2)(3)(4) 95.2%

Total 3.1% 8.6 Yrs

Interest Rate Cap Agreements At or Below 1.50%

Effective Date Maturity Date Strike Rate Notional Amount Debt Maturities & Principal Payments

| Debt |

|

Maturities & Principal Payments |

($ In Thousands)

$160,000

$140,000

$120,000

$100,000

$80,000

$60,000

$40,000

$20,000

$0

2015 2016 2017 2018 2019 2020 and thereafter

| (1) |

|

Excludes debt subject to interest rate swap locks. |

| (2) |

|

Includes debt subject to interest rate swap locks. |

| (3) |

|

Excludes unamortized fair value adjustments. |

| (4) |

|

Includes interest rate caps greater than or equal to 1.50% |

13

|

|

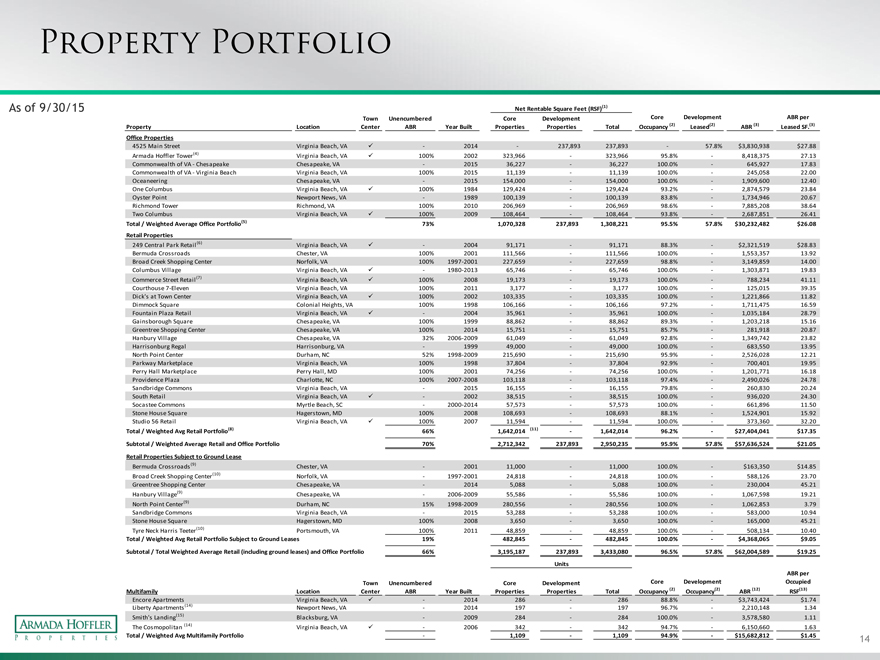

PROPERTY PORTFOLIO

As of 9/30/15 Net Rentable Square Feet (RSF)(1)

Town Unencumbered Core Development Core Development ABR per

Property Location Center ABR Year Built Properties Properties Total Occupancy (2) Leased(2) ABR (3) Leased SF.(3)

Office Properties

4525 Main Street Virginia Beach, VA — 2014 — 237,893 237,893 — 57.8% $3,830,938 $27.88

Armada Hoffler Tower(4) Virginia Beach, VA 100% 2002 323,966 — 323,966 95.8% — 8,418,375 27.13

Commonwealth of VA—Chesapeake Chesapeake, VA — 2015 36,227 — 36,227 100.0% — 645,927 17.83

Commonwealth of VA—Virginia Beach Virginia Beach, VA 100% 2015 11,139 — 11,139 100.0% — 245,058 22.00

Oceaneering Chesapeake, VA — 2015 154,000 — 154,000 100.0% — 1,909,600 12.40

One Columbus Virginia Beach, VA 100% 1984 129,424 — 129,424 93.2% — 2,874,579 23.84

Oyster Point Newport News, VA — 1989 100,139 — 100,139 83.8% — 1,734,946 20.67

Richmond Tower Richmond, VA 100% 2010 206,969 — 206,969 98.6% — 7,885,208 38.64

Two Columbus Virginia Beach, VA 100% 2009 108,464 — 108,464 93.8% — 2,687,851 26.41

Total / Weighted Average Office Portfolio(5) 73% 1,070,328 237,893 1,308,221 95.5% 57.8% $30,232,482 $26.08

Retail Properties

249 Central Park Retail(6) Virginia Beach, VA — 2004 91,171 — 91,171 88.3% — $2,321,519 $28.83

Bermuda Crossroads Chester, VA 100% 2001 111,566 — 111,566 100.0% — 1,553,357 13.92

Broad Creek Shopping Center Norfolk, VA 100% 1997-2001 227,659 — 227,659 98.8% — 3,149,859 14.00

Columbus Village Virginia Beach, VA — 1980-2013 65,746 — 65,746 100.0% — 1,303,871 19.83

Commerce Street Retail(7) Virginia Beach, VA 100% 2008 19,173 — 19,173 100.0% — 788,234 41.11

Courthouse 7-Eleven Virginia Beach, VA 100% 2011 3,177 — 3,177 100.0% — 125,015 39.35

Dick’s at Town Center Virginia Beach, VA 100% 2002 103,335 — 103,335 100.0% — 1,221,866 11.82

Dimmock Square Colonial Heights, VA 100% 1998 106,166 — 106,166 97.2% — 1,711,475 16.59

Fountain Plaza Retail Virginia Beach, VA — 2004 35,961 — 35,961 100.0% — 1,035,184 28.79

Gainsborough Square Chesapeake, VA 100% 1999 88,862 — 88,862 89.3% — 1,203,218 15.16

Greentree Shopping Center Chesapeake, VA 100% 2014 15,751 — 15,751 85.7% — 281,918 20.87

Hanbury Village Chesapeake, VA 32% 2006-2009 61,049 — 61,049 92.8% — 1,349,742 23.82

Harrisonburg Regal Harrisonburg, VA — 1999 49,000 — 49,000 100.0% — 683,550 13.95

North Point Center Durham, NC 52% 1998-2009 215,690 — 215,690 95.9% — 2,526,028 12.21

Parkway Marketplace Virginia Beach, VA 100% 1998 37,804 — 37,804 92.9% — 700,401 19.95

Perry Hall Marketplace Perry Hall, MD 100% 2001 74,256 — 74,256 100.0% — 1,201,771 16.18

Providence Plaza Charlotte, NC 100% 2007-2008 103,118 — 103,118 97.4% — 2,490,026 24.78

Sandbridge Commons Virginia Beach, VA — 2015 16,155 — 16,155 79.8% — 260,830 20.24

South Retail Virginia Beach, VA — 2002 38,515 — 38,515 100.0% — 936,020 24.30

Socastee Commons Myrtle Beach, SC — 2000-2014 57,573 — 57,573 100.0% — 661,896 11.50

Stone House Square Hagerstown, MD 100% 2008 108,693 — 108,693 88.1% — 1,524,901 15.92

Studio 56 Retail Virginia Beach, VA 100% 2007 11,594 — 11,594 100.0% — 373,360 32.20

Total / Weighted Avg Retail Portfolio(8) 66% 1,642,014 (11) — 1,642,014 96.2% — $27,404,041 $17.35

Subtotal / Weighted Average Retail and Office Portfolio 70% 2,712,342 237,893 2,950,235 95.9% 57.8% $57,636,524 $21.05

Retail Properties Subject to Ground Lease

Bermuda Crossroads(9) Chester, VA — 2001 11,000 — 11,000 100.0% — $163,350 $14.85

Broad Creek Shopping Center(10) Norfolk, VA — 1997-2001 24,818 — 24,818 100.0% — 588,126 23.70

Greentree Shopping Center Chesapeake, VA — 2014 5,088 — 5,088 100.0% — 230,004 45.21

Hanbury Village(9) Chesapeake, VA — 2006-2009 55,586 — 55,586 100.0% — 1,067,598 19.21

North Point Center(9) Durham, NC 15% 1998-2009 280,556 — 280,556 100.0% — 1,062,853 3.79

Sandbridge Commons Virginia Beach, VA — 2015 53,288 — 53,288 100.0% — 583,000 10.94

Stone House Square Hagerstown, MD 100% 2008 3,650 — 3,650 100.0% — 165,000 45.21

Tyre Neck Harris Teeter(10) Portsmouth, VA 100% 2011 48,859 — 48,859 100.0% — 508,134 10.40

Total / Weighted Avg Retail Portfolio Subject to Ground Leases 19% 482,845 — 482,845 100.0% — $4,368,065 $9.05

Subtotal / Total Weighted Average Retail (including ground leases) and Office Portfolio 66% 3,195,187 237,893 3,433,080 96.5% 57.8% $62,004,589 $19.25

Units

ABR per

Town Unencumbered Core Development Core Development Occupied

Multifamily Location Center ABR Year Built Properties Properties Total Occupancy (2) Occupancy(2) ABR (12) RSF(13)

Encore Apartments Virginia Beach, VA — 2014 286 — 286 88.8% — $3,743,424 $1.74

Liberty Apartments(14) Newport News, VA — 2014 197 — 197 96.7% — 2,210,148 1.34

Smith’s Landing(15) Blacksburg, VA — 2009 284 — 284 100.0% — 3,578,580 1.11

The Cosmopolitan (14) Virginia Beach, VA — 2006 342 — 342 94.7% — 6,150,660 1.63

Total / Weighted Avg Multifamily Portfolio — 1,109 — 1,109 94.9% — $15,682,812 $1.45

14

|

|

PROPERTY PORTFOLIO FOOTNOTES

1)The net rentable square footage for each of our office properties is the sum of (a) the square footage of existing leases, plus (b) for available space, management’s estimate of net rentable square footage based, in part, on past leases. The net rentable square footage included in office leases is generally consistent with the Building Owners and Managers Association, or BOMA, 1996 measurement guidelines. The net rentable square footage for each of our retail properties is the sum of (a) the square footage of existing leases, plus (b) for available space, the field verified square footage. 2)Occupancy for each of our office and retail properties is calculated as (a) square footage under executed leases as of September 30, 2015, divided by (b) net rentable square feet, expressed as a percentage. Occupancy for our multifamily properties is calculated as (a) total units occupied as of September 30, 2015, divided by (b) total units available, expressed as a percentage.

3)For the properties in our office and retail portfolios, annualized base rent, or ABR, is calculated by multiplying (a) base rental payments for executed leases as of September 30, 2015 (defined as cash base rents (before abatements) excluding tenant reimbursements for expenses paid by the landlord), by (b) 12. ABR per leased square foot is calculated by dividing (a) ABR, by (b) square footage under executed leases as of September 30, 2015. In the case of triple net or modified gross leases, ABR does not include tenant reimbursements for real estate taxes, insurance, common area or other operating expenses.

4)As of September 30,2015, the Company occupied 18,984 square feet at this property at an ABR of $413,753 or $21.79 per leased square foot, which amounts are reflected in this table. The rent paid by us is eliminated in accordance with GAAP. In addition, effective March 1, 2013, the Company subleases approximately 5,000 square feet of space from a tenant at this property.

5)Includes square footage and ABR pursuant to leases for space occupied by the Company.

6)As of September 30, 2015, the Company occupied 8,995 square feet at this property at an ABR of $295,900, or $32.90 per leased square foot, which amounts are reflected in this table. The rent paid by us is eliminated in accordance with GAAP.

7)Includes $32,760 of ABR pursuant to a rooftop lease.

8)Reflects square footage and ABR pursuant to leases for space occupied by the Company.

9)Pursuant to this ground lease, the Company owns the land and the tenant owns the improvements thereto. The Company will succeed to the ownership of the improvements to the land upon the termination of the ground lease.

10)The Company leases the land underlying this property and re-leases it to our tenant under a ground lease pursuant to which our tenant owns the improvements on the land.

11)Excludes the square footage of land subject to ground leases.

12)For the properties in our multifamily portfolio, annualized base rent, or ABR, is calculated by multiplying (a) base rental payments for the month ended September 30, 2015 by (b) 12.

13)ABR per occupied rentable square foot is calculated by dividing (a) ABR, by (b) net rentable square footage of occupied units as of September 30, 2015.

14)The ABR for Liberty and Cosmopolitan excludes $205,000 and $918,000 from ground floor retail leases, concurrently. 15)The Company leases the land underlying this property pursuant to a ground lease.

15

|

|

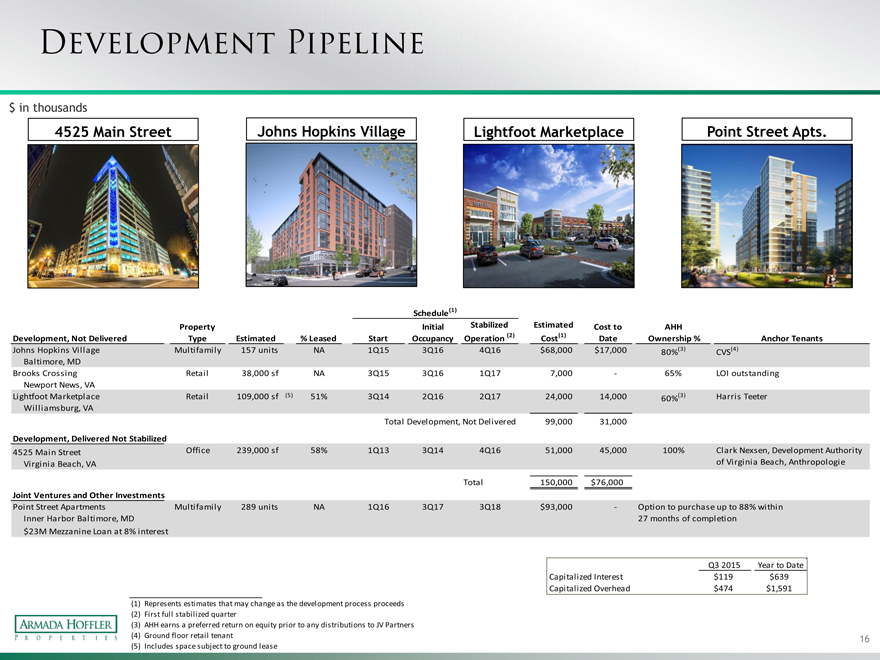

DEVELOPMENT PIPELINE

$ in thousands

4525 Main Street Johns Hopkins Village Lightfoot Marketplace Point Street Apts.

Schedule(1)

Development, Not Delivered Property Type % Leased Start Initial Occupancy Stabilized Operation (2) Estimated Estimated Cost(1) Cost to Date AHH Ownership % Anchor Tenants

Johns Hopkins Village Multifamily 157 units NA 1Q15 3Q16 4Q16 $68,000 $17,000 80%(3) CVS(4) Baltimore, MD

Brooks Crossing Retail 38,000 sf NA 3Q15 3Q16 1Q17 7,000 —65% LOI outstanding Newport News, VA

Lightfoot Marketplace Retail 109,000 sf (5) 51% 3Q14 2Q16 2Q17 24,000 14,000 60%(3) Harris Teeter Williamsburg, VA

Total Development, Not Delivered 99,000 31,000

Development, Delivered Not Stabilized

4525 Main Street Office 239,000 sf 58% 1Q13 3Q14 4Q16 51,000 45,000 100% Clark Nexsen, Development Authority Virginia Beach, VA of Virginia Beach, Anthropologie

Total 150,000 $76,000

Joint Ventures and Other Investments

Point Street Apartments Multifamily 289 units NA 1Q16 3Q17 3Q18 $93,000 —Option to purchase up to 88% within Inner Harbor Baltimore, MD 27 months of completion $23M Mezzanine Loan at 8% interest

Q3 2015 Year to Date Capitalized Interest $119 $639 Capitalized Overhead $474 $1,591

(1) Represents estimates that may change as the development process proceeds (2) First full stabilized quarter (3) AHH earns a preferred return on equity prior to any distributions to JV Partners

| (4) |

|

Ground floor retail tenant (5) Includes space subject to ground lease |

16

|

|

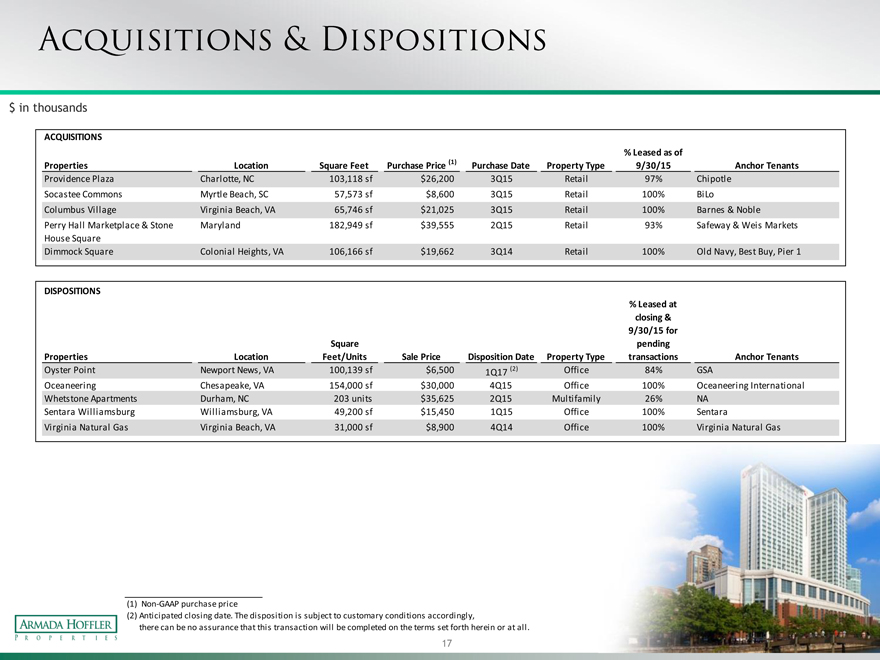

ACQUISITIONS & DISPOSITIONS

$ in thousands

ACQUISITIONS

% Leased as of

Properties Location Square Feet Purchase Price (1) Purchase Date Property Type 9/30/15 Anchor Tenants

Providence Plaza Charlotte, NC 103,118 sf $26,200 3Q15 Retail 97% Chipotle

Socastee Commons Myrtle Beach, SC 57,573 sf $8,600 3Q15 Retail 100% BiLo

Columbus Village Virginia Beach, VA 65,746 sf $21,025 3Q15 Retail 100% Barnes & Noble

Perry Hall Marketplace & Stone Maryland 182,949 sf $39,555 2Q15 Retail 93% Safeway & Weis Markets

House Square

Dimmock Square Colonial Heights, VA 106,166 sf $19,662 3Q14 Retail 100% Old Navy, Best Buy, Pier 1

DISPOSITIONS

% Leased at

closing &

9/30/15 for

Square pending

Properties Location Feet/Units Sale Price Disposition Date Property Type transactions Anchor Tenants

Oyster Point Newport News, VA 100,139 sf $6,500 1Q17 (2) Office 84% GSA

Oceaneering Chesapeake, VA 154,000 sf $30,000 4Q15 Office 100% Oceaneering International

Whetstone Apartments Durham, NC 203 units $35,625 2Q15 Multifamily 26% NA

Sentara Williamsburg Williamsburg, VA 49,200 sf $15,450 1Q15 Office 100% Sentara

Virginia Natural Gas Virginia Beach, VA 31,000 sf $8,900 4Q14 Office 100% Virginia Natural Gas

(1) Non-GAAP purchase price

(2) Anticipated closing date. The disposition is subject to customary conditions accordingly, there can be no Aassurance that this transaction will be completed on the terms set forth herein or at all.

17

|

|

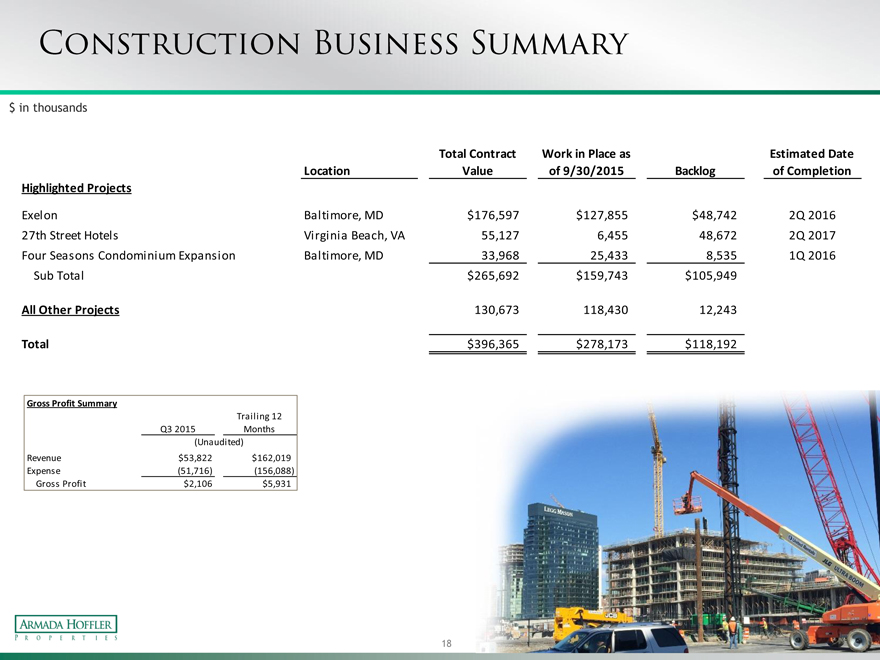

CONSTRUCTION BUSINESS SUMMARY

$ in thousands

Location Total Contract Value Work in Place as of 9/30/2015 Backlog Estimated Date of Completion

Highlighted Projects

Exelon Baltimore, MD $ 176,597 $ 127,855 $48,742 2Q 2016

27th Street Hotels Virginia Beach, VA 55,127 6,455 48,672 2Q 2017

Four Seasons Condominium Expansion Baltimore, MD 33,968 25,433 8,535 1Q 2016

Sub Total $ 265,692 $ 159,743 $105,949

All Other Projects 130,673 118,430 12,243

Total $ 396,365 $ 278,173 $118,192

Gross Profit Summary

Q3 2015 Trailing 12 Months

(Unaudited)

Revenue $53,822 $162,019

Expense (51,716) (156,088)

Gross Profit $2,106 $5,931

18

|

|

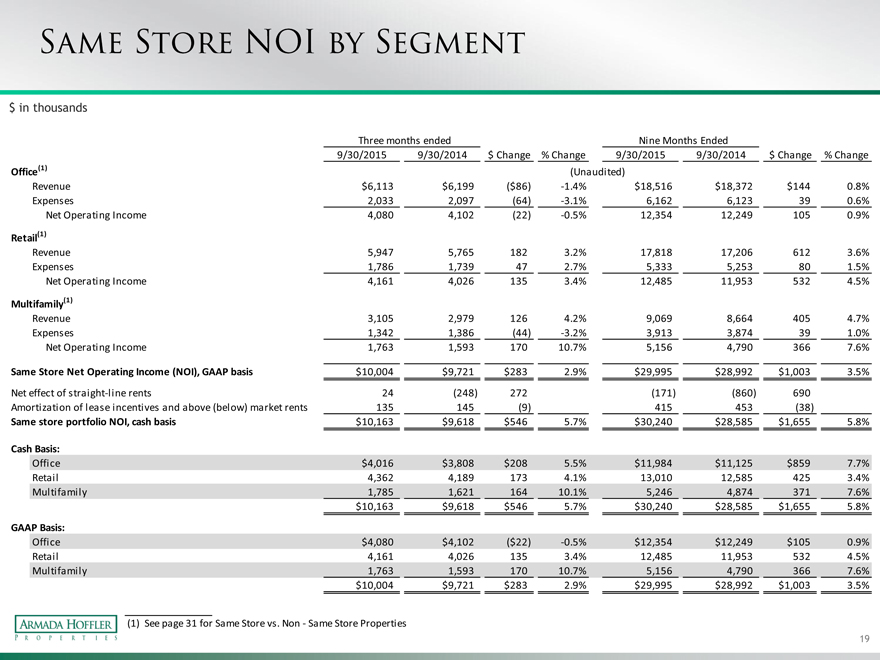

SAME STORE NOI BY SEGMENT

$ in thousands

Three months ended Nine Months Ended

9/30/2015 9/30/2014 $ Change % Change 9/30/2015 9/30/2014 $ Change % Change Office(1) (Unaudited) Revenue $6,113 $6,199 ($86) -1.4% $18,516 $18,372 $144 0.8% Expenses 2,033 2,097 (64) -3.1% 6,162 6,123 39 0.6% Net Operating Income 4,080 4,102 (22) -0.5% 12,354 12,249 105 0.9%

Retail(1)

Revenue 5,947 5,765 182 3.2% 17,818 17,206 612 3.6% Expenses 1,786 1,739 47 2.7% 5,333 5,253 80 1.5% Net Operating Income 4,161 4,026 135 3.4% 12,485 11,953 532 4.5%

Multifamily(1)

Revenue 3,105 2,979 126 4.2% 9,069 8,664 405 4.7% Expenses 1,342 1,386 (44) -3.2% 3,913 3,874 39 1.0% Net Operating Income 1,763 1,593 170 10.7% 5,156 4,790 366 7.6%

Same Store Net Operating Income (NOI), GAAP basis $10,004 $9,721 $283 2.9% $29,995 $28,992 $1,003 3.5%

Net effect of straight-line rents 24 (248) 272 (171) (860) 690 Amortization of lease incentives and above (below) market rents 135 145 (9) 415 453 (38)

Same store portfolio NOI, cash basis $10,163 $9,618 $546 5.7% $30,240 $28,585 $1,655 5.8%

Cash Basis:

Office $4,016 $3,808 $208 5.5% $11,984 $11,125 $859 7.7% Retail 4,362 4,189 173 4.1% 13,010 12,585 425 3.4% Multifamily 1,785 1,621 164 10.1% 5,246 4,874 371 7.6% $10,163 $9,618 $546 5.7% $30,240 $28,585 $1,655 5.8%

GAAP Basis:

Office $4,080 $4,102 ($22) -0.5% $12,354 $12,249 $105 0.9% Retail 4,161 4,026 135 3.4% 12,485 11,953 532 4.5% Multifamily 1,763 1,593 170 10.7% 5,156 4,790 366 7.6% $10,004 $9,721 $283 2.9% $29,995 $28,992 $1,003 3.5%

| (1) |

|

See page 31 for Same Store vs. Non—Same Store Properties |

19

|

|

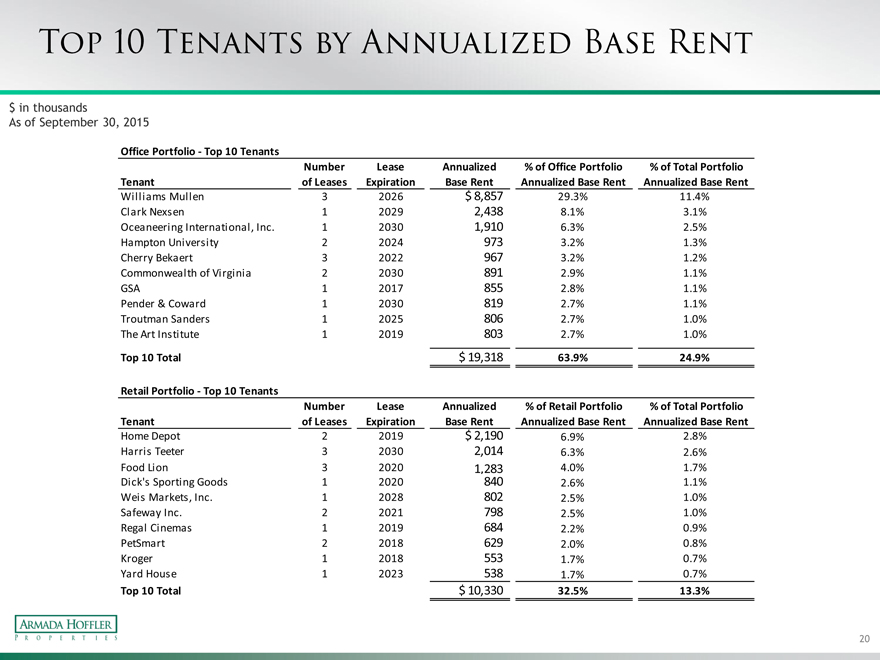

TOP 10 TENANTS BY ANNUALIZED BASE RENT

$ in thousands

As of September 30, 2015

Office Portfolio—Top 10 Tenants

Number Lease Annualized % of Office Portfolio % of Total Portfolio Tenant of Leases Expiration Base Rent Annualized Base Rent Annualized Base Rent

Williams Mullen 3 2026 $ 8,857 29.3% 11.4% Clark Nexsen 1 2029 2,438 8.1% 3.1% Oceaneering International, Inc. 1 2030 1,910 6.3% 2.5% Hampton University 2 2024 973 3.2% 1.3% Cherry Bekaert 3 2022 967 3.2% 1.2% Commonwealth of Virginia 2 2030 891 2.9% 1.1% GSA 1 2017 855 2.8% 1.1% Pender & Coward 1 2030 819 2.7% 1.1% Troutman Sanders 1 2025 806 2.7% 1.0% The Art Institute 1 2019 803 2.7% 1.0%

Top 10 Total $ 19,318 63.9% 24.9%

Retail Portfolio—Top 10 Tenants

Number Lease Annualized % of Retail Portfolio % of Total Portfolio Tenant of Leases Expiration Base Rent Annualized Base Rent Annualized Base Rent

Home Depot 2 2019 $ 2,190 6.9% 2.8% Harris Teeter 3 2030 2,014 6.3% 2.6% Food Lion 3 2020 1,283 4.0% 1.7% Dick’s Sporting Goods 1 2020 840 2.6% 1.1% Weis Markets, Inc. 1 2028 802 2.5% 1.0% Safeway Inc. 2 2021 798 2.5% 1.0% Regal Cinemas 1 2019 684 2.2% 0.9% PetSmart 2 2018 629 2.0% 0.8% Kroger 1 2018 553 1.7% 0.7% Yard House 1 2023 538 1.7% 0.7%

Top 10 Total $ 10,330 32.5% 13.3%

20

|

|

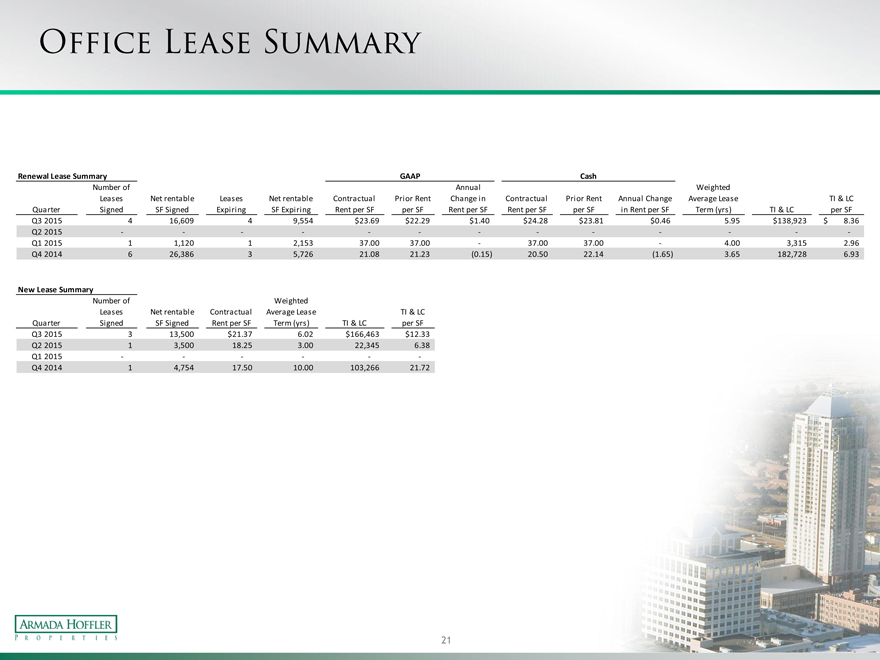

OFFICE LEASE SUMMARY

Renewal Lease Summary GAAP Cash

Number of Annual Weighted

Leases Net rentable Leases Net rentable Contractual Prior Rent Change in Contractual Prior Rent Annual Change Average Lease TI & LC Quarter Signed SF Signed Expiring SF Expiring Rent per SF per SF Rent per SF Rent per SF per SF in Rent per SF Term (yrs) TI & LC per SF Q3 2015 4 16,609 4 9,554 $23.69 $22.29 $1.40 $24.28 $23.81 $0.46 5.95 $138,923 $ 8.36 Q2 2015 — — — — — — — — — — — — -Q1 2015 1 1,120 1 2,153 37.00 37.00 — 37.00 37.00 — 4.00 3,315 2.96 Q4 2014 6 26,386 3 5,726 21.08 21.23 (0.15) 20.50 22.14 (1.65) 3.65 182,728 6.93

New Lease Summary

Number of Weighted

Leases Net rentable Contractual Average Lease TI & LC Quarter Signed SF Signed Rent per SF Term (yrs) TI & LC per SF Q3 2015 3 13,500 $21.37 6.02 $166,463 $12.33 Q2 2015 1 3,500 18.25 3.00 22,345 6.38 Q1 2015 — — — — — -Q4 2014 1 4,754 17.50 10.00 103,266 21.72

21

|

|

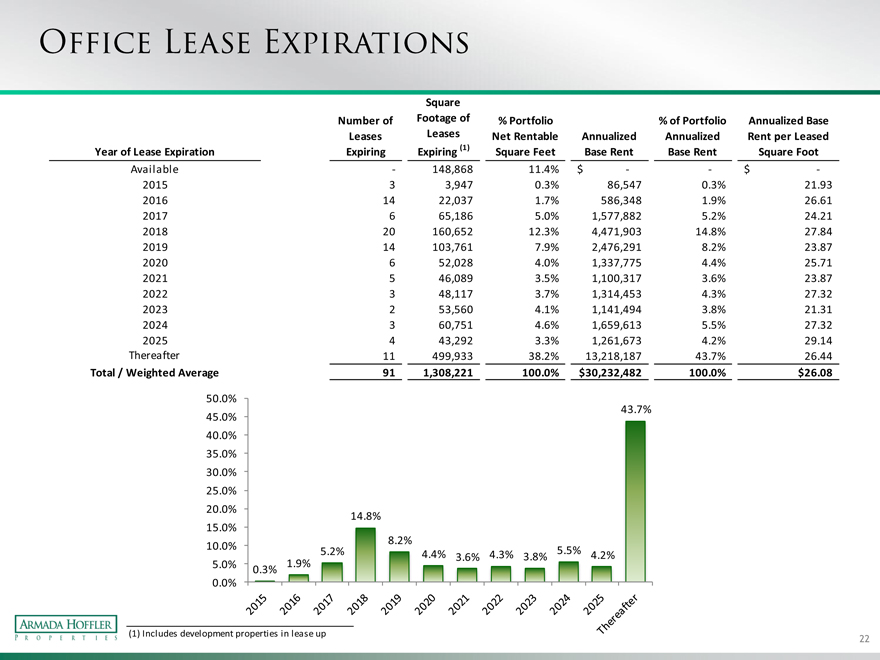

Square

Number of Footage of % Portfolio % of Portfolio Annualized Base Leases Leases Net Rentable Annualized Annualized Rent per Leased Year of Lease Expiration Expiring Expiring (1) Square Feet Base Rent Base Rent Square Foot

Available—148,868 11.4% $ — $ -2015 3 3,947 0.3% 86,547 0.3% 21.93 2016 14 22,037 1.7% 586,348 1.9% 26.61 2017 6 65,186 5.0% 1,577,882 5.2% 24.21 2018 20 160,652 12.3% 4,471,903 14.8% 27.84 2019 14 103,761 7.9% 2,476,291 8.2% 23.87 2020 6 52,028 4.0% 1,337,775 4.4% 25.71 2021 5 46,089 3.5% 1,100,317 3.6% 23.87 2022 3 48,117 3.7% 1,314,453 4.3% 27.32 2023 2 53,560 4.1% 1,141,494 3.8% 21.31 2024 3 60,751 4.6% 1,659,613 5.5% 27.32 2025 4 43,292 3.3% 1,261,673 4.2% 29.14 Thereafter 11 499,933 38.2% 13,218,187 43.7% 26.44

Total / Weighted Average 91 1,308,221 100.0% $ 30,232,482 100.0% $26.08

50.0%

43.7%

45.0%

40.0%

35.0%

30.0%

25.0%

20.0%

14.8%

15.0%

8.2%

10.0% 5.2% 4.4% 3.6% 4.3% 3.8% 5.5% 4.2%

5.0% 1.9%

0.3%

0.0%

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Thereafter

(1) Includes development properties in lease up

22

|

|

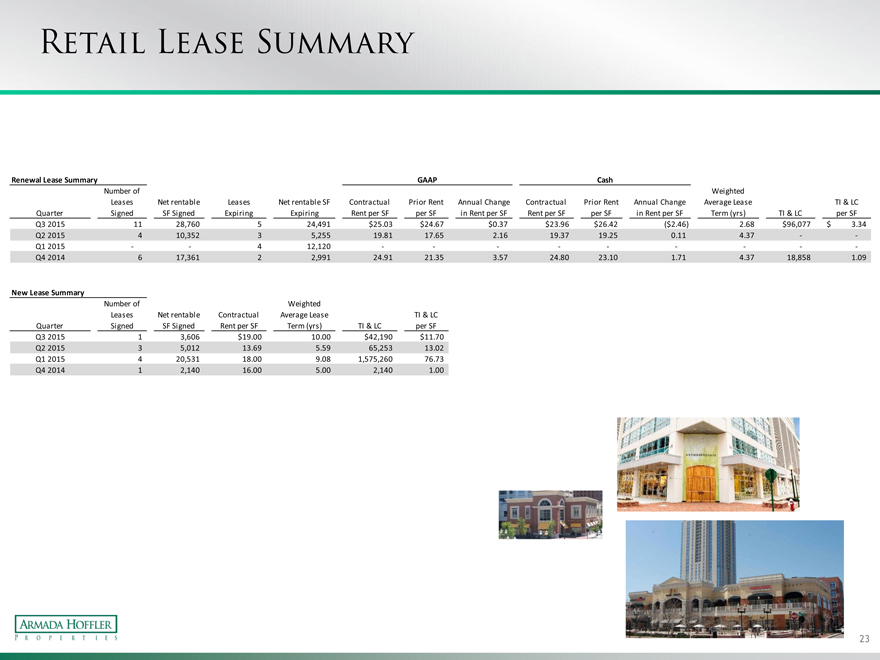

RETAIL LEASE SUMMARY

Renewal Lease Summary GAAP Cash

Number of Weighted

Leases Net rentable Leases Net rentable SF Contractual Prior Rent Annual Change Contractual Prior Rent Annual Change Average Lease TI & LC Quarter Signed SF Signed Expiring Expiring Rent per SF per SF in Rent per SF Rent per SF per SF in Rent per SF Term (yrs) TI & LC per SF Q3 2015 11 28,760 5 24,491 $25.03 $24.67 $0.37 $23.96 $26.42 ($2.46) 2.68 $96,077 $ 3.34 Q2 2015 4 10,352 3 5,255 19.81 17.65 2.16 19.37 19.25 0.11 4.37 — -Q1 2015 — — 4 12,120 — — — — — — — — -Q4 2014 6 17,361 2 2,991 24.91 21.35 3.57 24.80 23.10 1.71 4.37 18,858 1.09

New Lease Summary

Number of Weighted

Leases Net rentable Contractual Average Lease TI & LC Quarter Signed SF Signed Rent per SF Term (yrs) TI & LC per SF Q3 2015 1 3,606 $19.00 10.00 $42,190 $11.70 Q2 2015 3 5,012 13.69 5.59 65,253 13.02 Q1 2015 4 20,531 18.00 9.08 1,575,260 76.73 Q4 2014 1 2,140 16.00 5.00 2,140 1.00

23

|

|

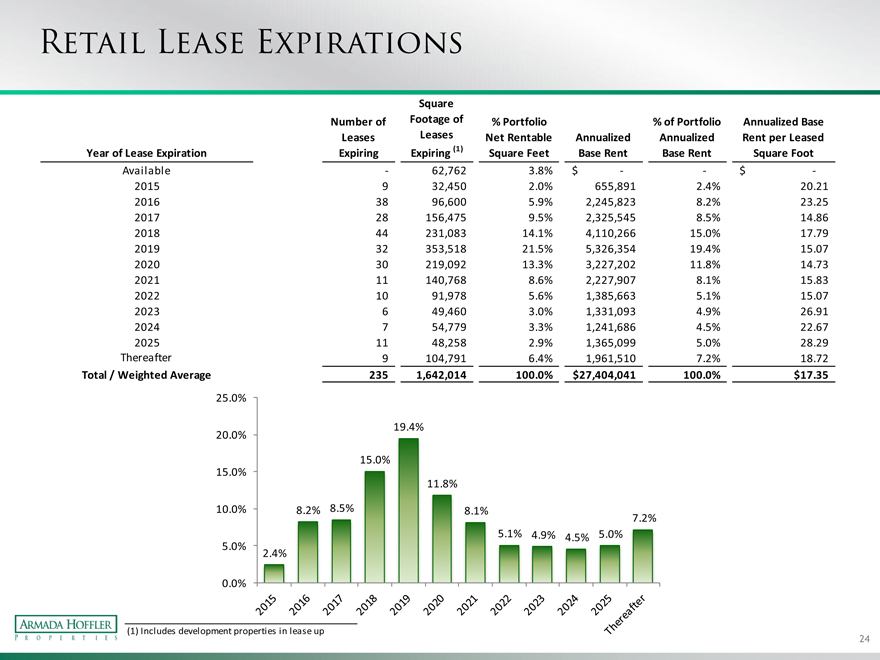

RETAIL LEASE EXPIRATIONS

Year of Lease Expiration Number of Leases Expiring Square Footage of Leases Expiring (1) % Portfolio Net Rentable Square Feet Annualized Base Rent % of Portfolio Annualized Base Rent Annualized Base Rent per Leased Square Foot

Available - 62,762 3.8% $ - - $ -

2015 9 32,450 2.0% 655,891 2.4% 20.21

2016 38 96,600 5.9% 2,245,823 8.2% 23.25

2017 28 156,475 9.5% 2,325,545 8.5% 14.86

2018 44 231,083 14.1% 4,110,266 15.0% 17.79

2019 32 353,518 21.5% 5,326,354 19.4% 15.07

2020 30 219,092 13.3% 3,227,202 11.8% 14.73

2021 11 140,768 8.6% 2,227,907 8.1% 15.83

2022 10 91,978 5.6% 1,385,663 5.1% 15.07

2023 6 49,460 3.0% 1,331,093 4.9% 26.91

2024 7 54,779 3.3% 1,241,686 4.5% 22.67

2025 11 48,258 2.9% 1,365,099 5.0% 28.29

Thereafter 9 104,791 6.4% 1,961,510 7.2% 18.72

Total / Weighted Average 235 1,642,014 100.0% $27,404,041 100.0% $17.35

25.0%

19.4%

20.0%

15.0%

15.0%

11.8%

10.0% 8.2% 8.5% 8.1%

7.2%

5.1% 4.9% 4.5% 5.0%

5.0%

2.4%

0.0%

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Thereafter

| (1) |

|

Includes development properties in lease up |

24

|

|

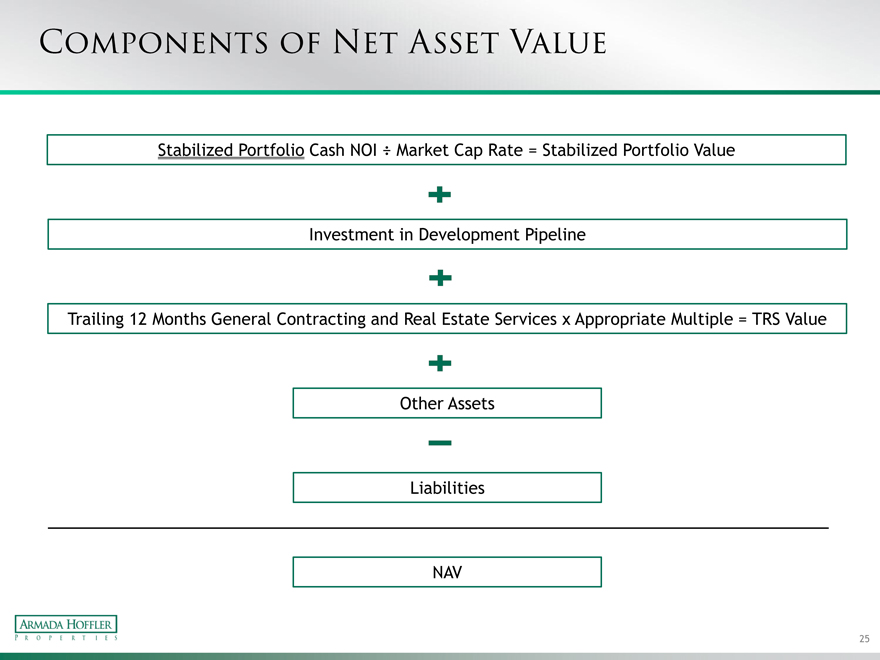

COMPONENTS OF NET ASSET VALUE

Stabilized Portfolio Cash NOI ÷ Market Cap Rate = Stabilized Portfolio Value

Investment in Development Pipeline

Trailing 12 Months General Contracting and Real Estate Services x Appropriate Multiple = TRS Value

Other Assets

Liabilities

NAV

25

|

|

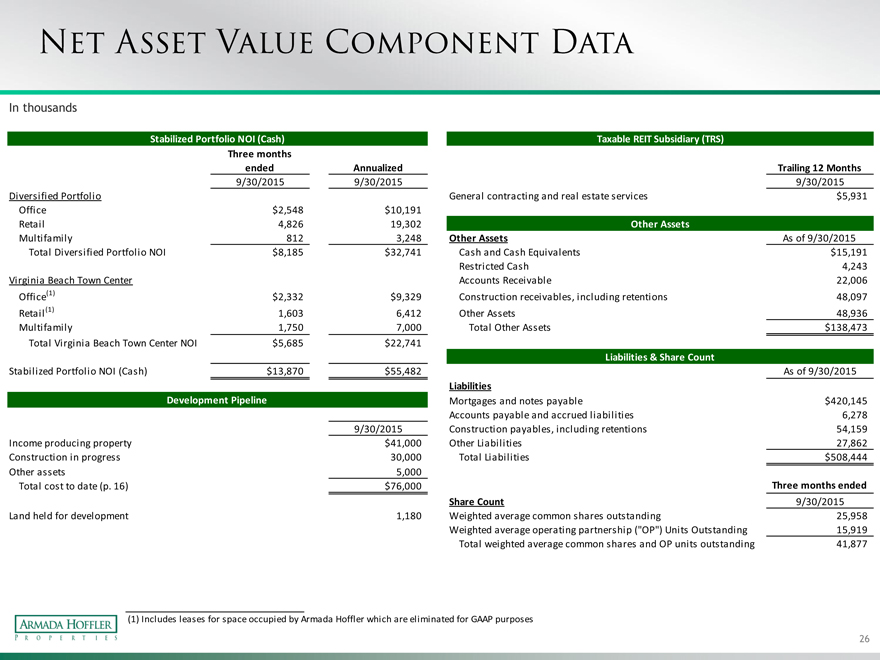

NET ASSET VALUE COMONENT DATA

In thousands

Stabilized Portfolio NOI (Cash) Taxable REIT Subsidiary (TRS) Three months ended Annualized Trailing 12 Months

9/30/2015 9/30/2015 9/30/2015 Diversified Portfolio General contracting and real estate services $5,931 Office $2,548 $10,191 Retail 4,826 19,302 Other Assets Multifamily 812 3,248 Other Assets As of 9/30/2015 Total Diversified Portfolio NOI $8,185 $32,741 Cash and Cash Equivalents $15,191 Restricted Cash 4,243 Virginia Beach Town Center Accounts Receivable 22,006 Office(1) $2,332 $9,329 Construction receivables, including retentions 48,097 Retail(1) 1,603 6,412 Other Assets 48,936 Multifamily 1,750 7,000 Total Other Assets $138,473 Total Virginia Beach Town Center NOI $5,685 $22,741

Liabilities & Share Count

Stabilized Portfolio NOI (Cash) $13,870 $55,482 As of 9/30/2015

Liabilities

Development Pipeline Mortgages and notes payable $420,145 Accounts payable and accrued liabilities 6,278 9/30/2015 Construction payables, including retentions 54,159 Income producing property $41,000 Other Liabilities 27,862 Construction in progress 30,000 Total Liabilities $508,444 Other assets 5,000 Total cost to date (p. 16) $76,000 Three months ended Share Count 9/30/2015 Land held for development 1,180 Weighted average common shares outstanding 25,958 Weighted average operating partnership (“OP”) Units Outstanding 15,919 Total weighted average common shares and OP units outstanding 41,877

| (1) |

|

Includes leases for space occupied by Armada Hoffler which are eliminated for GAAP purposes |

26

|

|

APPENDIX-DEFINITIONS & RECONCILIATIONS

|

|

DEFINITIONS

Net Operating Income:

We calculate Net Operating Income (“NOI”) as property revenues (base rent, expense reimbursements and other revenue) less property expenses (rental expenses and real estate taxes). Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to such other REITs’ NOI. NOI is not a measure of operating income or cash flows from operating activities as measured by GAAP and is not indicative of cash available to fund cash needs. As a result, NOI should not be considered an alternative to cash flows as a measure of liquidity. We consider NOI to be an appropriate supplemental measure to net income because it assists both investors and management in understanding the core operations of our real estate business.

Funds From Operations:

We calculate Funds From Operations (“FFO”) in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income (loss) (calculated in accordance with accounting principles generally accepted in the United States (“GAAP”)), excluding gains (or losses) from sales of depreciable operating property, real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures.

FFO is a supplemental non-GAAP financial measure. Management uses FFO as a supplemental performance measure because it believes that FFO is beneficial to investors as a starting point in measuring our operational performance. Specifically, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, which do not relate to or are not indicative of operating performance, FFO provides a performance measure that, when compared period-over-period, captures trends in occupancy rates, rental rates and operating costs. Other equity REITs may not calculate FFO in accordance with the NAREIT definition as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO.

28

|

|

DEFINITIONS

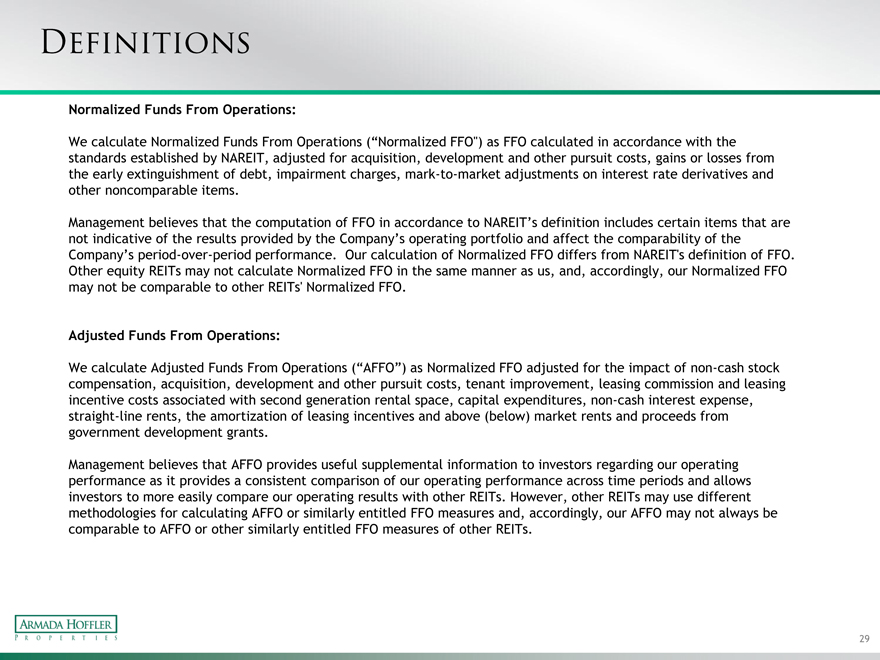

Normalized Funds From Operations:

We calculate Normalized Funds From Operations (“Normalized FFO”) as FFO calculated in accordance with the standards established by NAREIT, adjusted for acquisition, development and other pursuit costs, gains or losses from the early extinguishment of debt, impairment charges, mark-to-market adjustments on interest rate derivatives and other noncomparable items.

Management believes that the computation of FFO in accordance to NAREIT’s definition includes certain items that are not indicative of the results provided by the Company’s operating portfolio and affect the comparability of the Company’s period-over-period performance. Our calculation of Normalized FFO differs from NAREIT’s definition of FFO. Other equity REITs may not calculate Normalized FFO in the same manner as us, and, accordingly, our Normalized FFO may not be comparable to other REITs’ Normalized FFO.

Adjusted Funds From Operations:

We calculate Adjusted Funds From Operations (“AFFO”) as Normalized FFO adjusted for the impact of non-cash stock compensation, acquisition, development and other pursuit costs, tenant improvement, leasing commission and leasing incentive costs associated with second generation rental space, capital expenditures, non-cash interest expense, straight-line rents, the amortization of leasing incentives and above (below) market rents and proceeds from government development grants.

Management believes that AFFO provides useful supplemental information to investors regarding our operating performance as it provides a consistent comparison of our operating performance across time periods and allows investors to more easily compare our operating results with other REITs. However, other REITs may use different methodologies for calculating AFFO or similarly entitled FFO measures and, accordingly, our AFFO may not always be comparable to AFFO or other similarly entitled FFO measures of other REITs.

29

|

|

DEFINITIONS

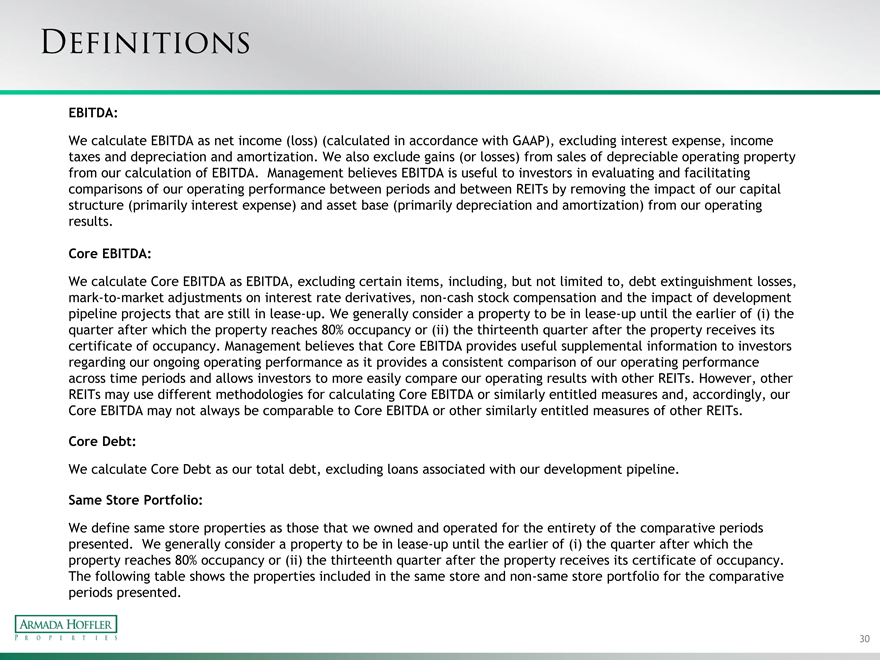

EBITDA:

We calculate EBITDA as net income (loss) (calculated in accordance with GAAP), excluding interest expense, income taxes and depreciation and amortization. We also exclude gains (or losses) from sales of depreciable operating property from our calculation of EBITDA. Management believes EBITDA is useful to investors in evaluating and facilitating comparisons of our operating performance between periods and between REITs by removing the impact of our capital structure (primarily interest expense) and asset base (primarily depreciation and amortization) from our operating results.

Core EBITDA:

We calculate Core EBITDA as EBITDA, excluding certain items, including, but not limited to, debt extinguishment losses, mark-to-market adjustments on interest rate derivatives, non-cash stock compensation and the impact of development pipeline projects that are still in lease-up. We generally consider a property to be in lease-up until the earlier of (i) the quarter after which the property reaches 80% occupancy or (ii) the thirteenth quarter after the property receives its certificate of occupancy. Management believes that Core EBITDA provides useful supplemental information to investors regarding our ongoing operating performance as it provides a consistent comparison of our operating performance across time periods and allows investors to more easily compare our operating results with other REITs. However, other REITs may use different methodologies for calculating Core EBITDA or similarly entitled measures and, accordingly, our Core EBITDA may not always be comparable to Core EBITDA or other similarly entitled measures of other REITs.

Core Debt:

We calculate Core Debt as our total debt, excluding loans associated with our development pipeline.

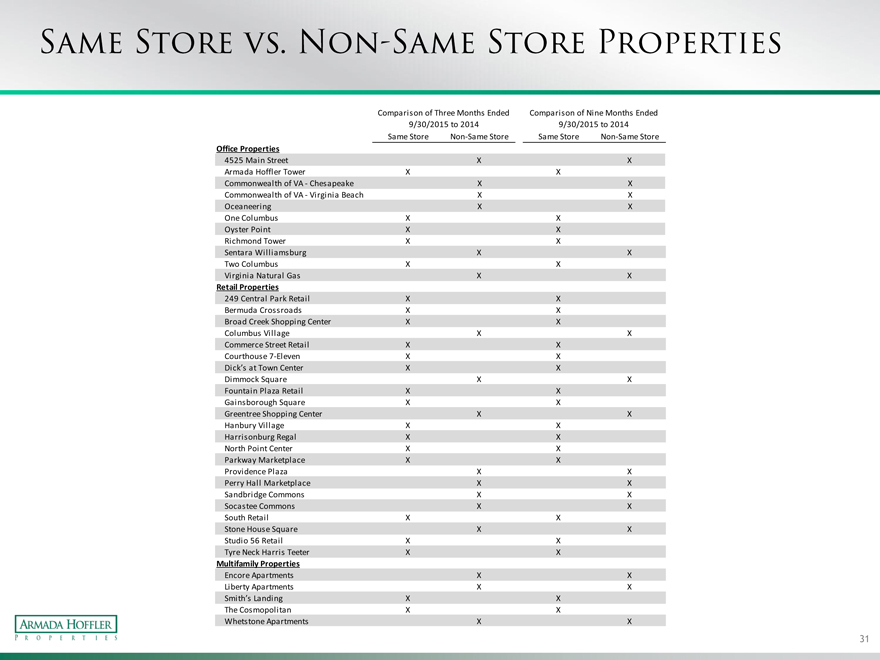

Same Store Portfolio:

We define same store properties as those that we owned and operated for the entirety of the comparative periods presented. We generally consider a property to be in lease-up until the earlier of (i) the quarter after which the property reaches 80% occupancy or (ii) the thirteenth quarter after the property receives its certificate of occupancy. The following table shows the properties included in the same store and non-same store portfolio for the comparative periods presented.

30

|

|

SAME STORE VS. NON-SAME STORE PROPERTIES

Comparison of Three Months Ended Comparison of Nine Months Ended 9/30/2015 to 2014 9/30/2015 to 2014 Same Store Non-Same Store Same Store Non-Same Store

Office Properties

4525 Main Street X X Armada Hoffler Tower X X

Commonwealth of VA—Chesapeake X X Commonwealth of VA—Virginia Beach X X Oceaneering X X One Columbus X X

Oyster Point X X Richmond Tower X X

Sentara Williamsburg X X Two Columbus X X

Virginia Natural Gas X X

Retail Properties

249 Central Park Retail X X Bermuda Crossroads X X Broad Creek Shopping Center X X

Columbus Village X X Commerce Street Retail X X

Courthouse 7-Eleven X X

Dick’s at Town Center X X

Dimmock Square X X Fountain Plaza Retail X X

Gainsborough Square X X

Greentree Shopping Center X X Hanbury Village X X

Harrisonburg Regal X X North Point Center X X Parkway Marketplace X X

Providence Plaza X X Perry Hall Marketplace X X Sandbridge Commons X X Socastee Commons X X South Retail X X

Stone House Square X X Studio 56 Retail X X

Tyre Neck Harris Teeter X X

Multifamily Properties

Encore Apartments X X Liberty Apartments X X

Smith’s Landing X X The Cosmopolitan X X

Whetstone Apartments X X

31

|

|

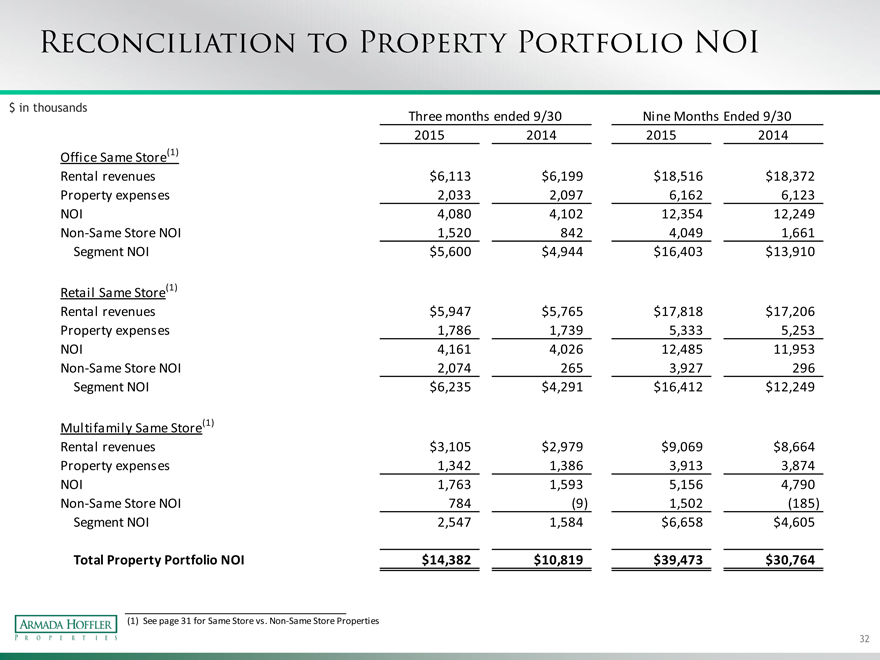

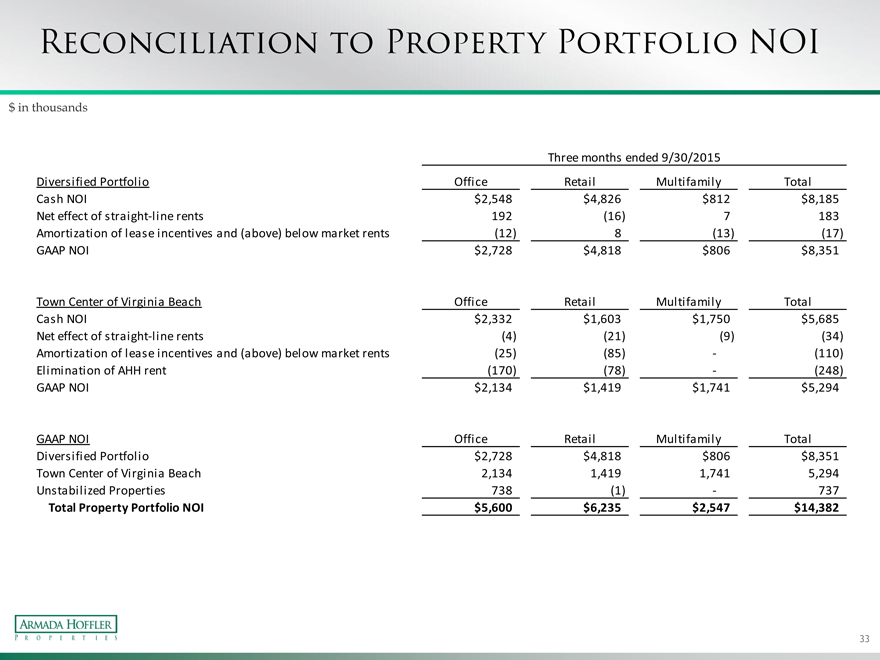

RECONCILIATION TO PROPERTY PORTFOLIO NOI

$ in thousands

Three months ended 9/30 Nine Months Ended 9/30 2015 2014 2015 2014 Office Same Store(1) Rental revenues $6,113 $6,199 $18,516 $18,372 Property expenses 2,033 2,097 6,162 6,123 NOI 4,080 4,102 12,354 12,249 Non-Same Store NOI 1,520 842 4,049 1,661 Segment NOI $5,600 $4,944 $16,403 $13,910

Retail Same Store(1)

Rental revenues $5,947 $5,765 $17,818 $17,206 Property expenses 1,786 1,739 5,333 5,253 NOI 4,161 4,026 12,485 11,953 Non-Same Store NOI 2,074 265 3,927 296 Segment NOI $6,235 $4,291 $16,412 $12,249

Multifamily Same Store(1)

Rental revenues $3,105 $2,979 $9,069 $8,664 Property expenses 1,342 1,386 3,913 3,874 NOI 1,763 1,593 5,156 4,790 Non-Same Store NOI 784 (9) 1,502 (185) Segment NOI 2,547 1,584 $6,658 $4,605

Total Property Portfolio NOI $14,382 $10,819 $39,473 $30,764

| (1) |

|

See page 31 for Same Store vs. Non-Same Store Properties |

32

|

|

RECONCILIATION TO PROPERTY PORTFOLIO NOI

$ in thousands

Three months ended 9/30/2015

Diversified Portfolio Office Retail Multifamily Total Cash NOI $2,548 $4,826 $812 $8,185 Net effect of straight-line rents 192 (16) 7 183 Amortization of lease incentives and (above) below market rents (12) 8 (13) (17) GAAP NOI $2,728 $4,818 $806 $8,351

Town Center of Virginia Beach Office Retail Multifamily Total Cash NOI $2,332 $1,603 $1,750 $5,685 Net effect of straight-line rents (4) (21) (9) (34) Amortization of lease incentives and (above) below market rents (25) (85) — (110) Elimination of AHH rent (170) (78) — (248) GAAP NOI $2,134 $1,419 $1,741 $5,294

GAAP NOI Office Retail Multifamily Total Diversified Portfolio $2,728 $4,818 $806 $8,351 Town Center of Virginia Beach 2,134 1,419 1,741 5,294 Unstabilized Properties 738 (1) — 737

Total Property Portfolio NOI $5,600 $6,235 $2,547 $14,382

33

|

|

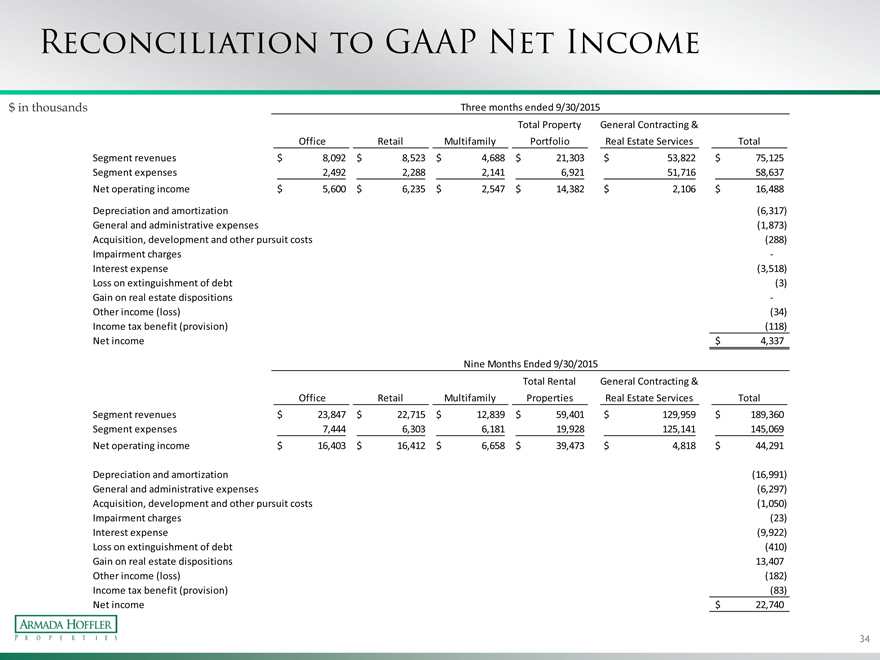

RECONCILIATION TO GAAP NET INCOME

$ in thousands Three months ended 9/30/2015

Total Property General Contracting &

Office Retail Multifamily Portfolio Real Estate Services Total Segment revenues $ 8,092 $ 8,523 $ 4,688 $ 21,303 $ 53,822 $ 75,125 Segment expenses 2,492 2,288 2,141 6,921 51,716 58,637 Net operating income $ 5,600 $ 6,235 $ 2,547 $ 14,382 $ 2,106 $ 16,488

Depreciation and amortization (6,317) General and administrative expenses (1,873) Acquisition, development and other pursuit costs (288) Impairment charges -Interest expense (3,518) Loss on extinguishment of debt (3) Gain on real estate dispositions -Other income (loss) (34) Income tax benefit (provision) (118) Net income $ 4,337

Nine Months Ended 9/30/2015

Total Rental General Contracting &

Office Retail Multifamily Properties Real Estate Services Total Segment revenues $ 23,847 $ 22,715 $ 12,839 $ 59,401 $ 129,959 $ 189,360 Segment expenses 7,444 6,303 6,181 19,928 125,141 145,069 Net operating income $ 16,403 $ 16,412 $ 6,658 $ 39,473 $ 4,818 $ 44,291

Depreciation and amortization (16,991) General and administrative expenses (6,297) Acquisition, development and other pursuit costs (1,050) Impairment charges (23) Interest expense (9,922) Loss on extinguishment of debt (410) Gain on real estate dispositions 13,407 Other income (loss) (182) Income tax benefit (provision) (83) Net income $ 22,740

34