Attached files

| file | filename |

|---|---|

| 8-K - UIL HOLDINGS CORPORATION 8-K 11-2-2015 - UIL HOLDINGS CORP | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UIL HOLDINGS CORP | ex99_1.htm |

Exhibit 99.2

3Q ‘15 Earnings PresentationNovember 3, 2015 Exhibit 99.2

Forward Looking Statements James TorgersonPresident and Chief Executive OfficerRichard NicholasExecutive Vice President and Chief Financial Officer Visit our website at www.UIL.com Certain statements contained in this presentation regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. In addition, risks and uncertainties related to our proposed merger with Iberdrola USA include, but are not limited to, the expected timing and likelihood of completion of the pending merger, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending merger that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that our shareowners may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed merger in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed merger, the risk that any announcements relating to the proposed merger could have adverse effects on the market price of UIL Holdings’ common stock, and the risk that the proposed transaction and its announcement could have an adverse effect on our ability to retain and hire key personnel and maintain relationships with our suppliers, and on our operating results and businesses generally. New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks, as well as other risks associated with the merger, are more fully discussed in UIL Holdings’ preliminary proxy statement/prospectus included in Iberdrola USA’s Registration Statement on Form S-4, as amended, which was filed with the Securities and Exchange Commission (SEC) in connection with the proposed merger. Additional risks and uncertainties are identified and discussed in our reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this presentation speak only as of the date of this presentation. We do not undertake any obligation to update our forward-looking statements to reflect events or circumstances after the date of this presentation. We believe that a breakdown presented on a net income and per share basis by line of business is useful in understanding the change in the results of operations of UIL Holdings’ lines of business from one reporting period to another and in evaluating the actual and projected financial performance and contribution of UIL Holdings’ lines of businesses. Earnings per share (EPS) by business is a non-GAAP (not determined using generally accepted accounting principles) measure that is calculated by taking the pre-tax amounts determined in accordance with GAAP of each line of business, and applying the effective statutory federal and state tax rate and then dividing the results by the average number of diluted shares of UIL Holdings’ common stock outstanding for the periods presented. Any such amounts provided are provided for informational purposes only and are not intended to be used to calculate "Pro-forma" amounts.We also believe presenting earnings excluding certain non-recurring items, including as presented in the net income discussion and in the earnings guidance section, is useful in understanding and evaluating actual and projected financial performance and contribution of UIL Holdings and to more fully compare and explain our results without including the impact of the non-recurring items. Non-GAAP financial measures should not be considered as alternatives to UIL Holdings’ consolidated net income or EPS determined in accordance with GAAP as indicators of UIL Holdings’ operating performance.

Important Information For Investors &Shareholders Important Information For Investors And ShareholdersThis communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed transaction between UIL Holdings and Iberdrola USA. In connection with the proposed merger between UIL Holdings and Iberdrola USA, Iberdrola USA has filed with the SEC a registration statement on Form S-4, as amended, containing a preliminary prospectus of Iberdrola USA and a preliminary proxy statement of UIL Holdings. UIL HOLDINGS AND IBERDROLA USA URGE INVESTORS AND SHAREHOLDERS TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE, AS WELL AS ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Iberdrola USA or UIL Holdings may file with the SEC or send to shareholders in connection with the proposed transaction. You may obtain copies of all documents filed with the SEC regarding the proposed transaction (when available), free of charge, at the SEC’s website (www.sec.gov). Copies of the documents filed with the SEC by UIL Holdings are also available free of charge on UIL Holdings’ website at www.uil.com or by contacting UIL Holdings’ Investor Relations Department at 203-499-2409. UIL Holdings will mail the definitive proxy statement/prospectus to its shareholders when it becomes available. Participants in Solicitation UIL Holdings and its directors and executive officers, and Iberdrola USA and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of UIL Holdings common stock in respect of the proposed transaction. Information about UIL Holdings’ executive officers and directors is set forth in UIL Holdings’ definitive proxy statement for its 2015 Annual Meeting of Shareholders, which was filed with the SEC on April 1, 2015. Other information regarding the interests of such individuals, as well as information regarding Iberdrola USA’s directors and executive officers, is set forth in the proxy statement/prospectus, which is included in Iberdrola USA’s registration on Form S-4, as amended, filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph. 3

3Q ’15 consolidated net income was $15.6M, or $0.27 per diluted share, compared to $12.5M, or $0.22 per diluted share, in the 3Q ’14YTD ’15 consolidated net income was $89.1M, or $1.55 per diluted share, compared to $77.3M, or $1.35 per diluted share, YTD ‘14Consolidated earnings for the 3Q & YTD ’15 and the 3Q & YTD ‘14 include certain non-recurring items, as follows:Merger-related expenses associated with the pending merger of UIL & Iberdrola USA, Inc. Acquisition-related expenses associated with the now-terminated proposed acquisition of Philadelphia Gas WorksTransmission return on equity (ROE) reserves related to the ROE proceedings pending at the FERCExcluding non-recurring items, consolidated earnings for the 3Q & YTD September 30 were: 3Q & YTD ‘15 Earnings Summary

Iberdrola USA/UIL Merger

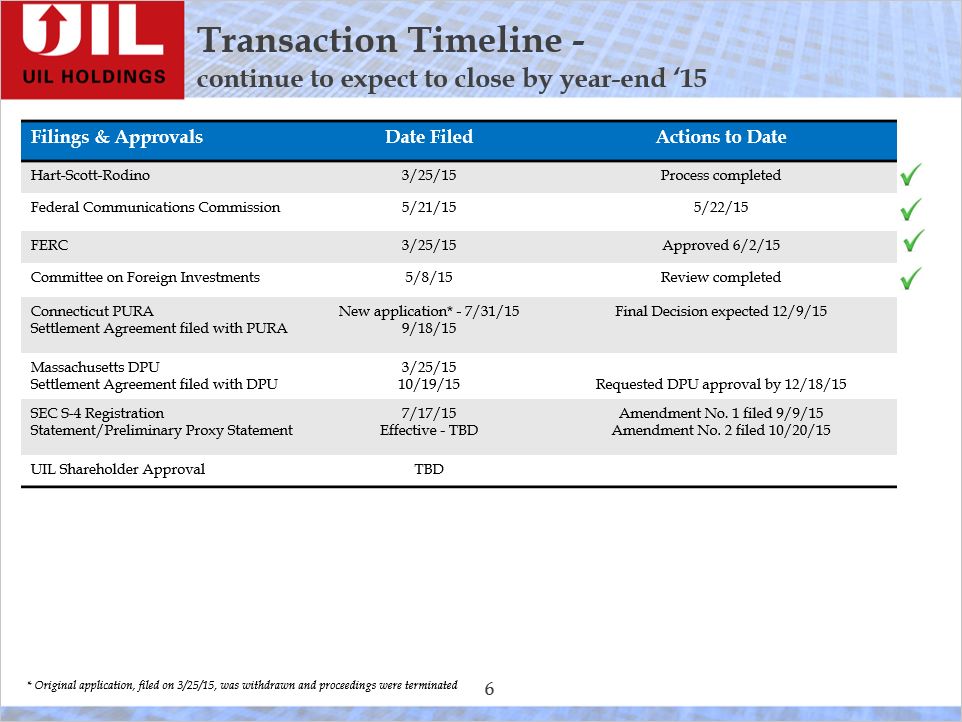

Transaction Timeline - continue to expect to close by year-end ‘15 Filings & Approvals Date Filed Actions to Date Hart-Scott-Rodino 3/25/15 Process completed Federal Communications Commission 5/21/15 5/22/15 FERC 3/25/15 Approved 6/2/15 Committee on Foreign Investments 5/8/15 Review completed Connecticut PURASettlement Agreement filed with PURA New application* - 7/31/159/18/15 Final Decision expected 12/9/15 Massachusetts DPUSettlement Agreement filed with DPU 3/25/1510/19/15 Requested DPU approval by 12/18/15 SEC S-4 Registration Statement/Preliminary Proxy Statement 7/17/15Effective - TBD Amendment No. 1 filed 9/9/15Amendment No. 2 filed 10/20/15 UIL Shareholder Approval TBD * Original application, filed on 3/25/15, was withdrawn and proceedings were terminated

Highlights of Settlement Agreement with CT OCC Customer Rate Credits – $20M in the aggregate to customers of UI, CNG & SCGAdditional Ratepayer Benefits for CNG - $12.5M in rate credits over a 10-year periodAdditional Ratepayer Benefits for SCG $7.5M in rate credits over a 10-year periodIncreased bare steel/cast iron replacements over a 3-year period with delayed recovery (customer benefit of $1.6M)Base Rate Freezes – distribution base rate freezes for UI until 1/1/17 and for CNG & SCG until 1/1/18Storm Resiliency – UI customer benefit of $5M associated with limited recovery for 1st $50M of UI spending on PURA-approved distribution resiliency projectsHirings – commitment to hire 150 people in CT over a 3-year periodClean Energy - $2M annual contribution over a 3-year period to stimulate investmentDisaster Relief - $1M in funding for CT residentsCustomer Service Quality BenefitsImprove certain customer service metrics by 5% over a 3-year periodApplicants will maintain high levels of safety & reliability 7

Highlights of Settlement Agreement with CT OCC – cont. English Station – proposed partial consent order that would, upon approval by the CT DEEP and closing of the merger transaction, require UI to investigate & remediate certain environmental conditions on-siteLitigation – resolution of appeals and issuesUI will withdraw appeals related to the FMCC/GSC semi-annual reconciliation and ‘13 standard offer reconciliation of CTA & SBC docketsSettlement resolves all issues related to the ‘10 change of control docket for CNG & SCGOCC will withdraw all appeals related to the CNG ‘13 rate caseMaintaining Local Management No involuntary employee terminations in CT for at least 3 years (other than for cause or performance)Long-term commitment to maintain headquarters and operations of the UIL utilities in CTRing-fencing – implement comprehensive measures designed to protect UIL and the UIL utilities over the long-term from potential changes in the financial circumstances of IUSA or its affiliates, including creating a special purpose entity to protect UIL and the UIL utilities against bankruptcy proceedings of IUSA or its affiliates 8

Highlights of Settlement Agreement with MA AG &MA Department of Energy Resources 9 Customer Rate Credits – $4M in the aggregate to customers of Berkshire (BGC)Additional Ratepayer Benefits for BGC - $1M allocated for jobs, economic development, alternative heating programs or for customers impacted by the moratorium in the BGC service territoryBase Rate Freeze – distribution base rate freeze for BGC until 6/1/18Charitable Contributions - $50K-$75K annual contribution for at least a 4-year periodAdditional $80K in the 1st year following the merger closingMaintaining Local Management No involuntary employee terminations in MA for at least 3 years (other than for cause or performance)BGC collective bargaining agreement will be honored Commitment to maintain BGC headquarters in MARing-fencing – similar to the provisions in the CT settlement

UIL Holdings Stand-alone

‘15 target is to convert at least 12,000 households & businessesConverted 6,754 households & businesses as of 9/30/15Natural gas remains more cost effective than home heating oil and the benefits of natural gas remain advantageous for our customers* Acquisition Nov. ‘10 Gas Heating Customers # of Conversions 12,000

3Q & YTD ‘15 Financial Results by Segment

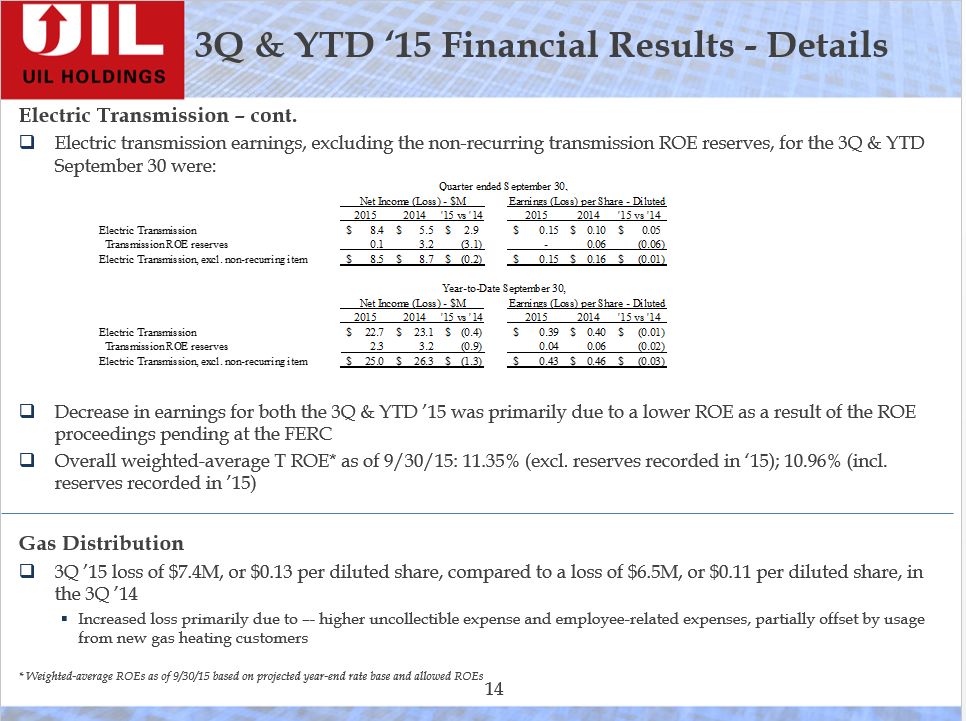

Electric Distribution3Q ’15 earnings of $18.1M, or $0.31 per diluted share, compared to earnings of $17.9M, or $0.31 per diluted share, in the 3Q ’14YTD ’15 earnings of $39.9M, or $0.70 per diluted share, compared to earnings of $43.1M, or $0.75 per diluted share, YTD ‘14Decrease in earnings primarily due to –- higher employee-related expenses, depreciation and amortization expenses as well as adjustments associated with the completion of the IRS’s examination of income tax years ’09-’12GenConn contributed pre-tax earnings of $3.4M & $10.3M in the 3Q & YTD ’15, compared to $3.5M & $10.4M in the 3Q & YTD ‘1412-month average D ROE as of 9/30/15: 8.60%Electric Transmission3Q ’15 earnings of $8.4M, or $0.15 per diluted share, compared to earnings of $5.5M, or $0.10 per diluted share, in the 3Q ’14YTD ’15 earnings of $22.7M, or $0.39 per diluted share, compared to earnings of $23.1M, or $0.40 per diluted share, YTD ‘14 3Q & YTD ‘15 Financial Results - Details

Electric Transmission – cont.Electric transmission earnings, excluding the non-recurring transmission ROE reserves, for the 3Q & YTD September 30 were:Decrease in earnings for both the 3Q & YTD ’15 was primarily due to a lower ROE as a result of the ROE proceedings pending at the FERC Overall weighted-average T ROE* as of 9/30/15: 11.35% (excl. reserves recorded in ‘15); 10.96% (incl. reserves recorded in ’15)Gas Distribution3Q ’15 loss of $7.4M, or $0.13 per diluted share, compared to a loss of $6.5M, or $0.11 per diluted share, in the 3Q ’14Increased loss primarily due to –- higher uncollectible expense and employee-related expenses, partially offset by usage from new gas heating customers* Weighted-average ROEs as of 9/30/15 based on projected year-end rate base and allowed ROEs 3Q & YTD ‘15 Financial Results - Details

Gas Distribution – cont.YTD ’15 earnings of $35.2M, or $0.61 per diluted share, compared to earnings of $30.3M, or $0.53 per diluted share, YTD ’14Increase in earnings primarily due to –- colder weather, usage from new gas heating customers and lower uncollectible expense (even though uncollectible expense was higher for the quarter), partially offset by higher employee-related expensesGross Margin impact of weather, NUPC and customer growth: 3Q & YTD ‘15 compared to the same periods in ’14Preliminary 12-month average ROEs* as of 9/30/15: SCG 9.51-9.71%, CNG 8.54-8.74% Preliminary 12-month average weather normalized ROEs* as of 9/30/15: SCG 8.71-8.91%, CNG 8.54-8.74% 3Q & YTD ‘15 Financial Results - Details * Including impact of 338(h)(10)

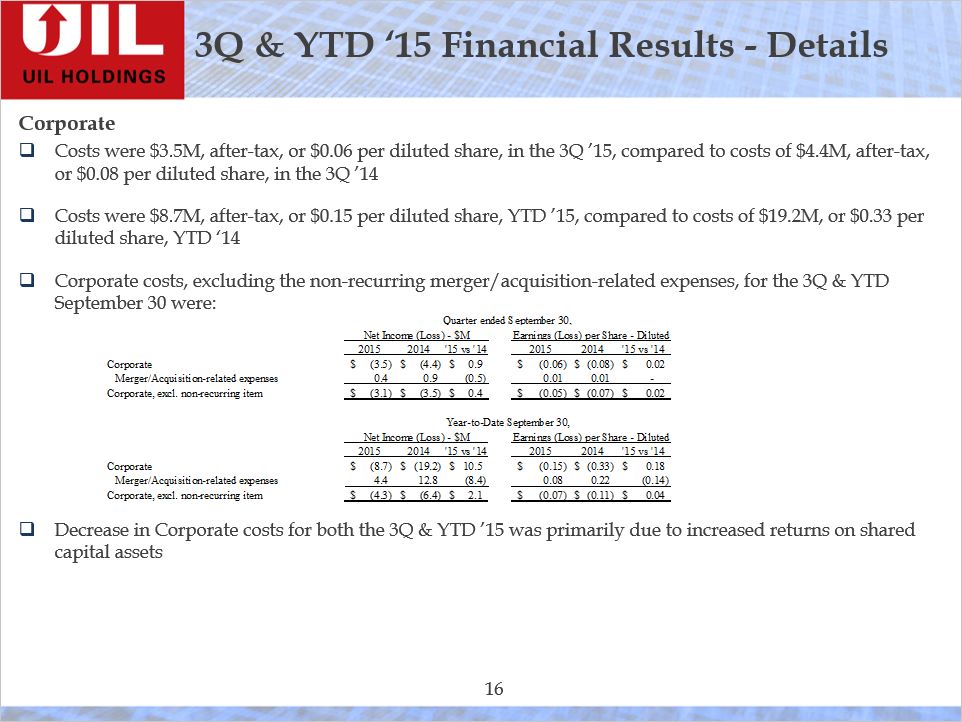

CorporateCosts were $3.5M, after-tax, or $0.06 per diluted share, in the 3Q ’15, compared to costs of $4.4M, after-tax, or $0.08 per diluted share, in the 3Q ’14Costs were $8.7M, after-tax, or $0.15 per diluted share, YTD ’15, compared to costs of $19.2M, or $0.33 per diluted share, YTD ‘14Corporate costs, excluding the non-recurring merger/acquisition-related expenses, for the 3Q & YTD September 30 were:Decrease in Corporate costs for both the 3Q & YTD ’15 was primarily due to increased returns on shared capital assets 3Q & YTD ‘15 Financial Results - Details

Affirming ‘15 Earnings Guidance

Questions