Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - OPPENHEIMER HOLDINGS INC | opy8-ka110215.htm |

OPPENHEIMER HOLDINGS INC. NOVEMBER 2015 Presented by: Robert Lowenthal Senior Managing Director, Chairman of Management Committee Jeffrey Alfano Executive Vice President & Chief Financial Officer

SAFE HARBOR STATEMENT 2 This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. (the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “2014 Annual Report”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part II, “Item 7. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward-Looking Statements’” of our 2014 Annual Report. Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2014 Annual Report and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. The company does not undertake any obligation to publicly update or revise any forward-looking statements.

ABOUT US 3 Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. Private client services and asset management solutions tailored to individuals unique financial objectives Investment banking services and capital markets products for institutions and corporations Provides high quality service for the acquisition, refinance, rehabilitation and construction of multifamily and healthcare properties Wealth Management Capital Markets Commercial Mortgage Banking $79.6B Client Assets Under Administration 1,250+ Financial Advisors 91 offices in 24 states; 5 foreign jurisdictions $23.7B Client Assets Under Management +250 Institutional Sales Professionals 40 senior research analysts covering ~575 equity securities Note: Data as of September 30, 2015 Quick Facts

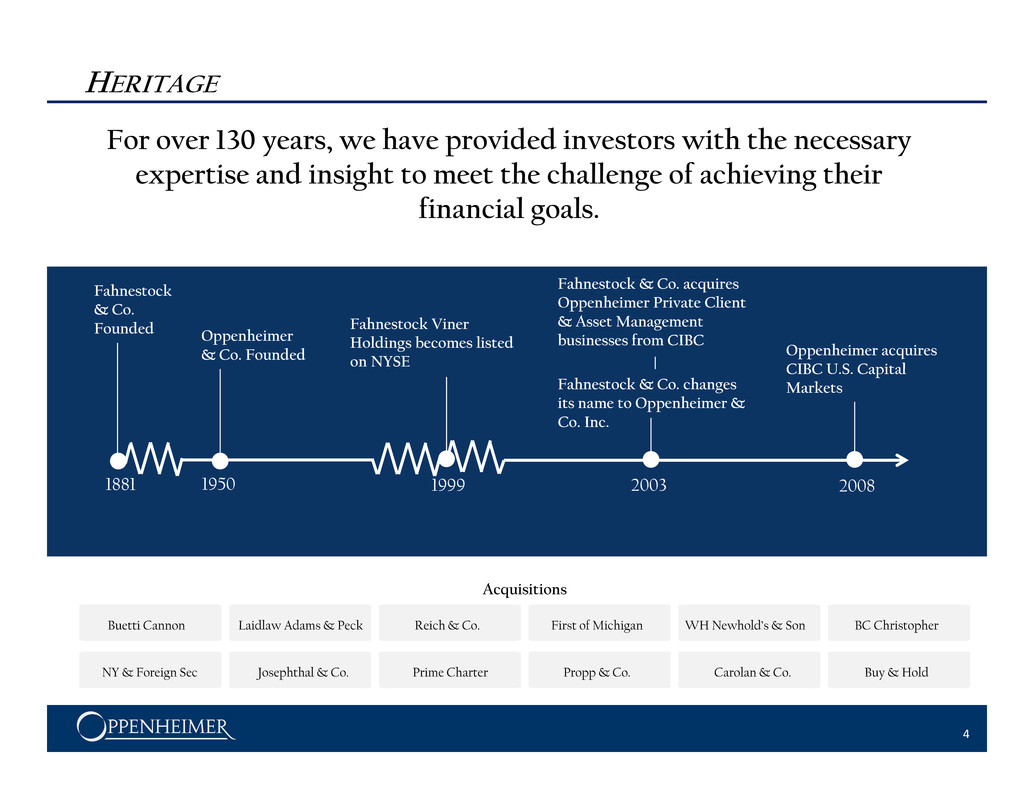

HERITAGE 4 For over 130 years, we have provided investors with the necessary expertise and insight to meet the challenge of achieving their financial goals. Buetti Cannon Laidlaw Adams & Peck Reich & Co. First of Michigan WH Newhold’s & Son BC Christopher NY & Foreign Sec Josephthal & Co. Prime Charter Propp & Co. Carolan & Co. Buy & Hold Acquisitions 1881 200820031950 1999 Fahnestock & Co. Founded Oppenheimer & Co. Founded Fahnestock Viner Holdings becomes listed on NYSE Fahnestock & Co. acquires Oppenheimer Private Client & Asset Management businesses from CIBC Fahnestock & Co. changes its name to Oppenheimer & Co. Inc. Oppenheimer acquires CIBC U.S. Capital Markets

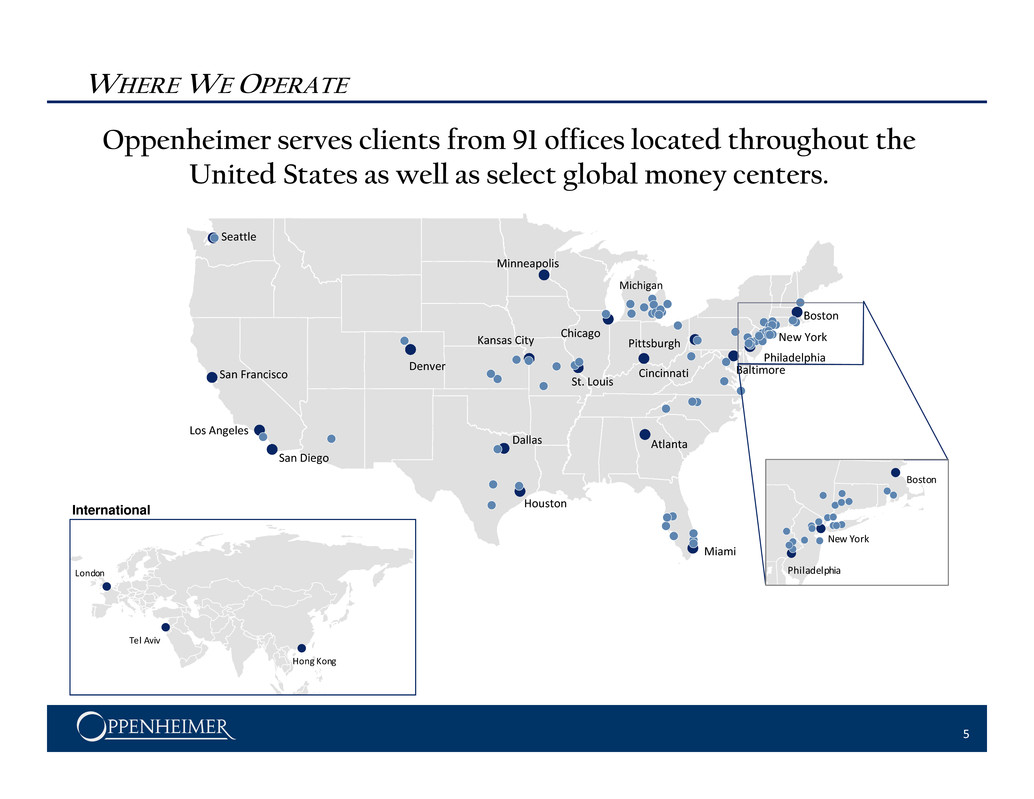

Los Angeles San Diego San Francisco Pittsburgh Chicago Cincinnati St. Louis Kansas City Denver AtlantaDallas Seattle Minneapolis Philadelphia Baltimore New York Boston Miami Houston WHERE WE OPERATE 5 Oppenheimer serves clients from 91 offices located throughout the United States as well as select global money centers. London Hong Kong Tel Aviv New York Philadelphia Boston Michigan International

OUR COMMITMENT 6 Our commitment to our clients' investment needs and our experienced and dedicated professionals empower us in our proud tradition to deliver effective and innovative solutions to our clients. Client Focus Trusted Reputation Tailored Advice Flexibility At Scale Open Architecture Heritage and Continuity Proven Expertise Entrepreneurial Mindset

7 Capital Markets Boutiques Bulge Bracket Investment Banks A d v i s o r y B o u t i q u e s Foreign M oney C enter Banks Full Service / Mid-Market Investment Banks OUR INDUSTRY

8 WHAT DIFFERENTIATES US Each of our business lines benefits from the dedicated, senior-level commitment of a boutique combined with the capabilities of a global, full-service investment bank. Full service capabilities Global distribution Diversified business, stable profile Experienced professionals lead customer engagement Top‐ranked research Traditional and alternative investment strategies

GROWTH STRATEGY 9 Refining operations and increasing productivity within our core businesses Developing new product offerings Adding the right resources – recruiting and retaining top talent Focusing resources on secular shift from transaction to fee-based accounts Seeking accretive acquisitions that fit our model Oppenheimer is pursuing a number of initiatives to grow our client base and revenue streams, while also leveraging our operations to improve profitability.

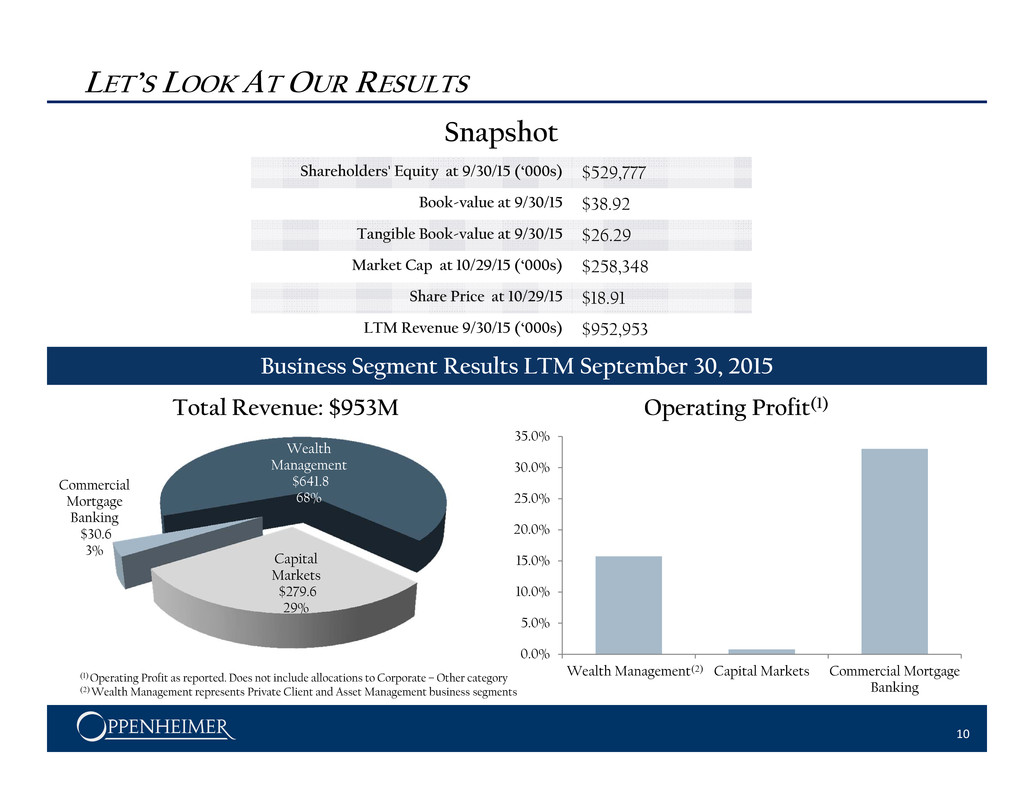

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Wealth Management Capital Markets Commercial Mortgage Banking Wealth Management $641.8 68% Capital Markets $279.6 29% Commercial Mortgage Banking $30.6 3% LET’S LOOK AT OUR RESULTS 10 Business Segment Results LTM September 30, 2015 Shareholders' Equity at 9/30/15 (‘000s) $529,777 Book-value at 9/30/15 $38.92 Tangible Book-value at 9/30/15 $26.29 Market Cap at 10/29/15 (‘000s) $258,348 Share Price at 10/29/15 $18.91 LTM Revenue 9/30/15 (‘000s) $952,953 Total Revenue: $953M Operating Profit(1) (1) Operating Profit as reported. Does not include allocations to Corporate – Other category (2) Wealth Management represents Private Client and Asset Management business segments Snapshot (2)

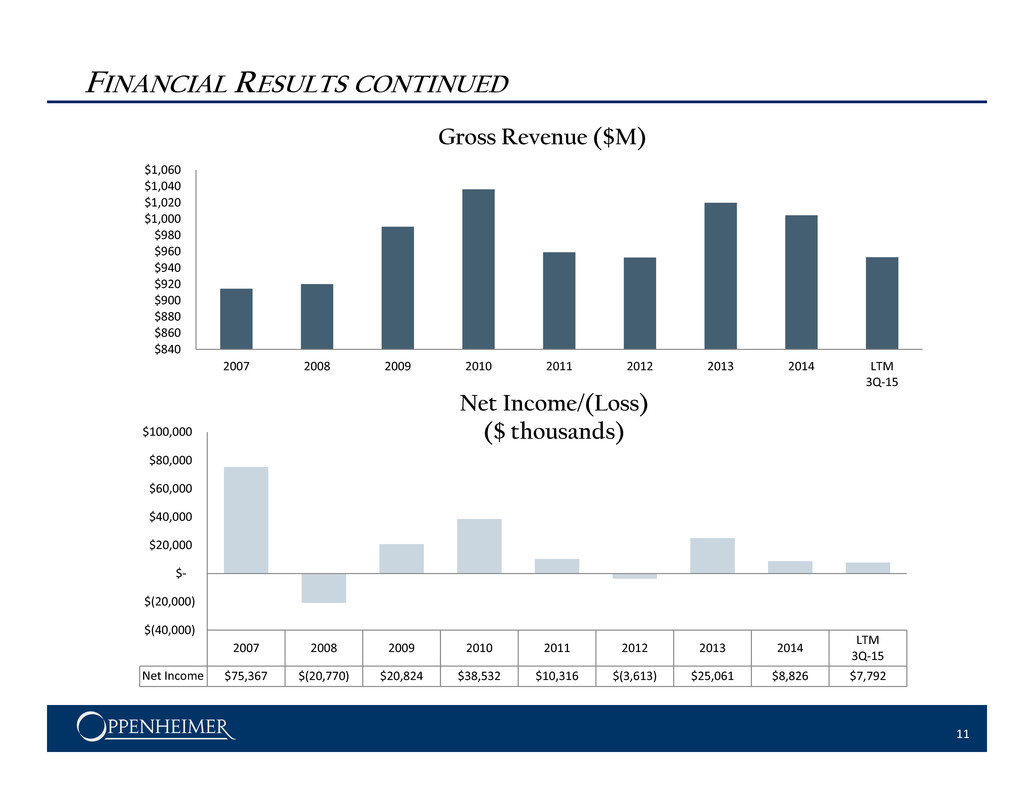

FINANCIAL RESULTS CONTINUED 11 Gross Revenue ($M) Net Income/(Loss) ($ thousands) $840 $860 $880 $900 $920 $940 $960 $980 $1,000 $1,020 $1,040 $1,060 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q‐15 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q‐15 Net Income $75,367 $(20,770) $20,824 $38,532 $10,316 $(3,613) $25,061 $8,826 $7,792 $(40,000) $(20,000) $‐ $20,000 $40,000 $60,000 $80,000 $100,000

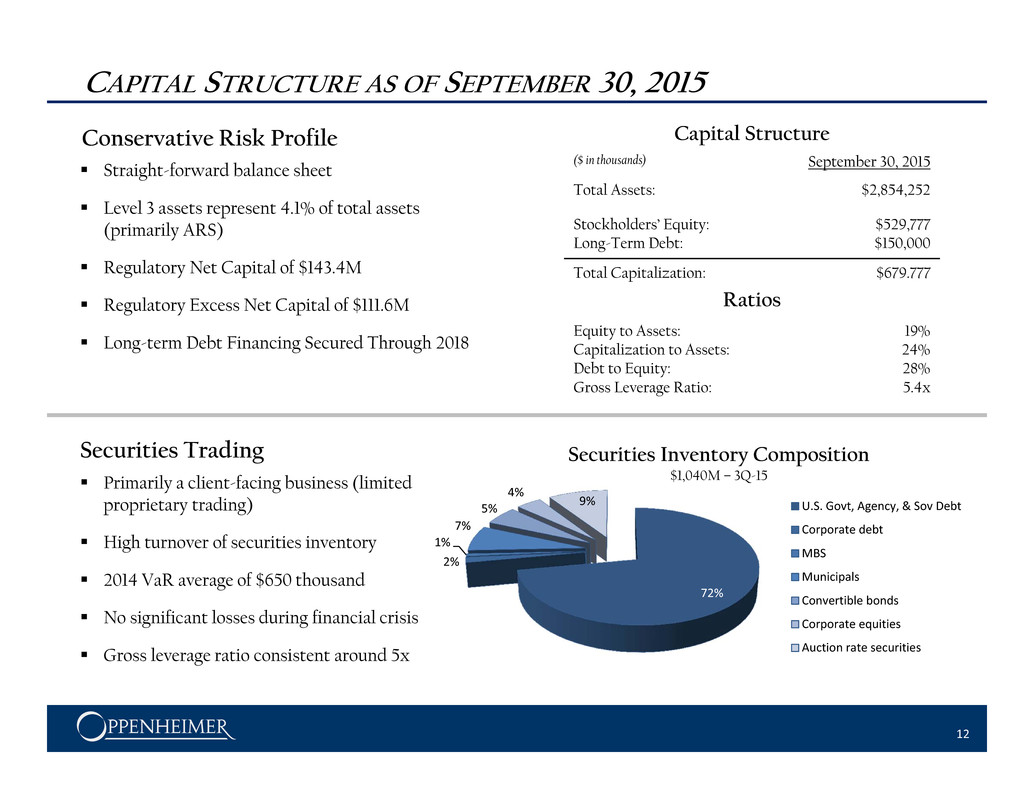

72% 2% 1% 7% 5% 4% 9% U.S. Govt, Agency, & Sov Debt Corporate debt MBS Municipals Convertible bonds Corporate equities Auction rate securities CAPITAL STRUCTURE AS OF SEPTEMBER 30, 2015 12 Conservative Risk Profile Ratios Equity to Assets: Capitalization to Assets: Debt to Equity: Gross Leverage Ratio: 19% 24% 28% 5.4x ($ in thousands) September 30, 2015 Total Assets: $2,854,252 Stockholders’ Equity: Long-Term Debt: $529,777 $150,000 Total Capitalization: $679.777 Capital Structure Straight-forward balance sheet Level 3 assets represent 4.1% of total assets (primarily ARS) Regulatory Net Capital of $143.4M Regulatory Excess Net Capital of $111.6M Long-term Debt Financing Secured Through 2018 Securities Inventory Composition $1,040M – 3Q-15 Securities Trading Primarily a client-facing business (limited proprietary trading) High turnover of securities inventory 2014 VaR average of $650 thousand No significant losses during financial crisis Gross leverage ratio consistent around 5x

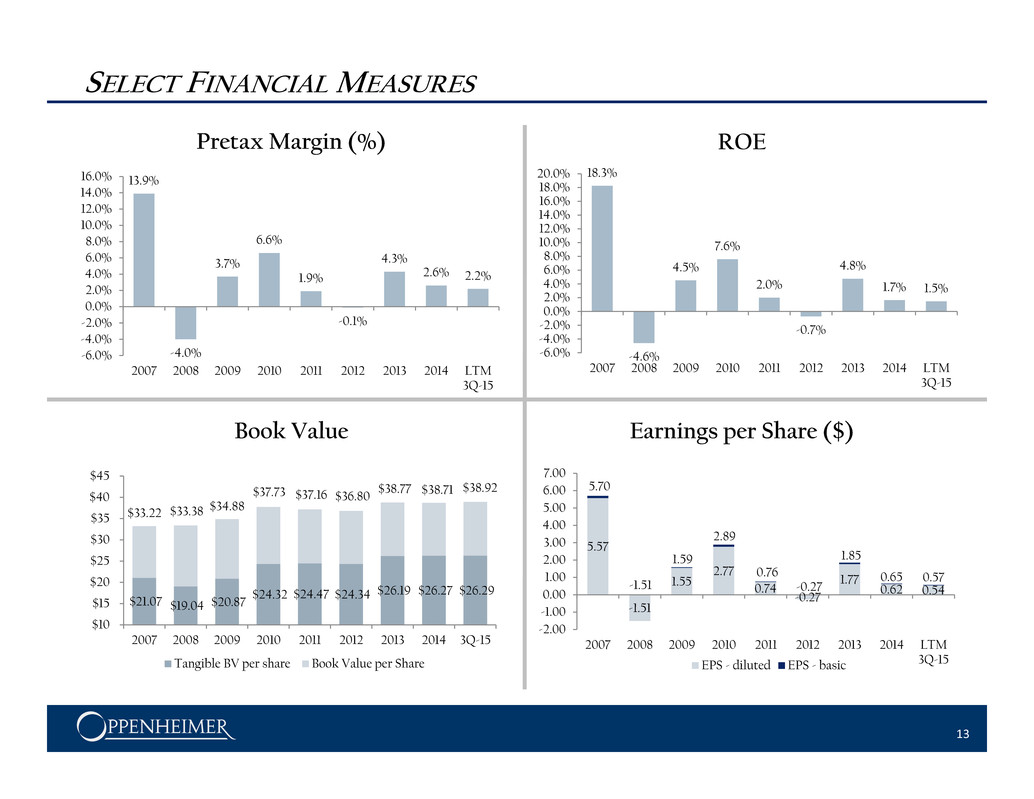

$21.07 $19.04 $20.87 $24.32 $24.47 $24.34 $26.19 $26.27 $26.29 $33.22 $33.38 $34.88 $37.73 $37.16 $36.80 $38.77 $38.71 $38.92 $10 $15 $20 $25 $30 $35 $40 $45 2007 2008 2009 2010 2011 2012 2013 2014 3Q-15 Tangible BV per share Book Value per Share 13.9% -4.0% 3.7% 6.6% 1.9% -0.1% 4.3% 2.6% 2.2% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15 18.3% -4.6% 4.5% 7.6% 2.0% -0.7% 4.8% 1.7% 1.5% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15 5.57 -1.51 1.55 2.77 0.74 -0.27 1.77 0.62 0.54 5.70 -1.51 1.59 2.89 0.76 -0.27 1.85 0.65 0.57 -2.00 -1.00 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15EPS - diluted EPS - basic 13 SELECT FINANCIAL MEASURES Book Value ROE Earnings per Share ($) Pretax Margin (%)

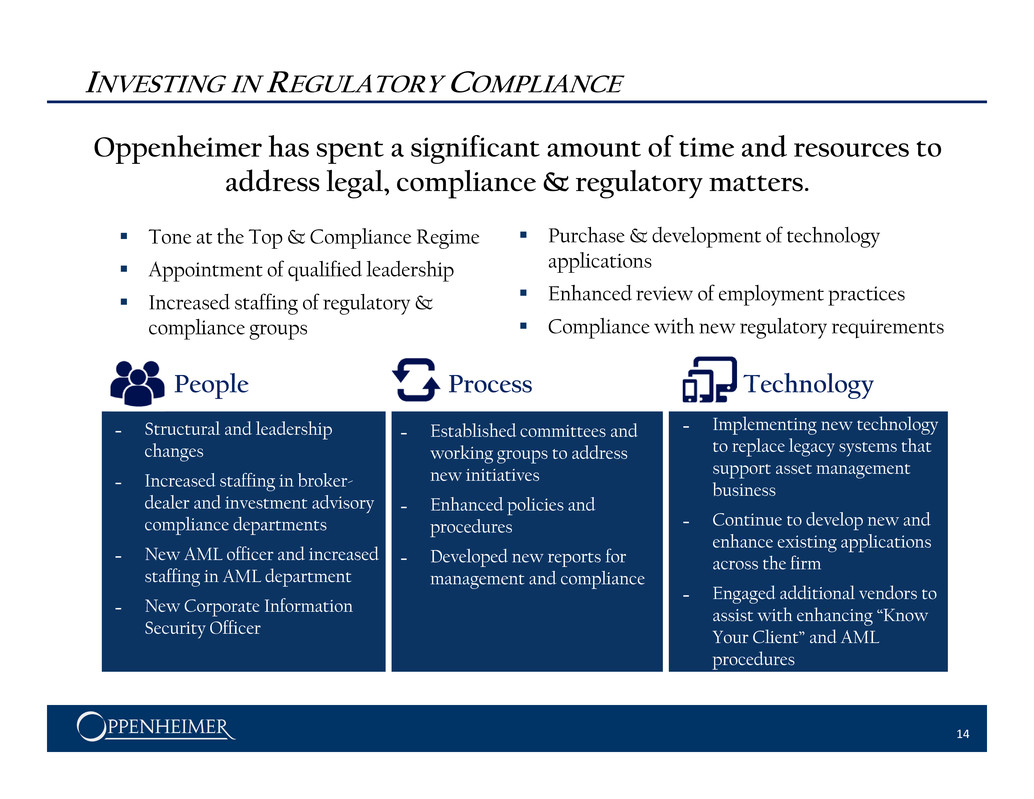

INVESTING IN REGULATORY COMPLIANCE 14 Oppenheimer has spent a significant amount of time and resources to address legal, compliance & regulatory matters. ˗ Structural and leadership changes ˗ Increased staffing in broker- dealer and investment advisory compliance departments ˗ New AML officer and increased staffing in AML department ˗ New Corporate Information Security Officer People Process Technology ˗ Established committees and working groups to address new initiatives ˗ Enhanced policies and procedures ˗ Developed new reports for management and compliance ˗ Implementing new technology to replace legacy systems that support asset management business ˗ Continue to develop new and enhance existing applications across the firm ˗ Engaged additional vendors to assist with enhancing “Know Your Client” and AML procedures Purchase & development of technology applications Enhanced review of employment practices Compliance with new regulatory requirements Tone at the Top & Compliance Regime Appointment of qualified leadership Increased staffing of regulatory & compliance groups

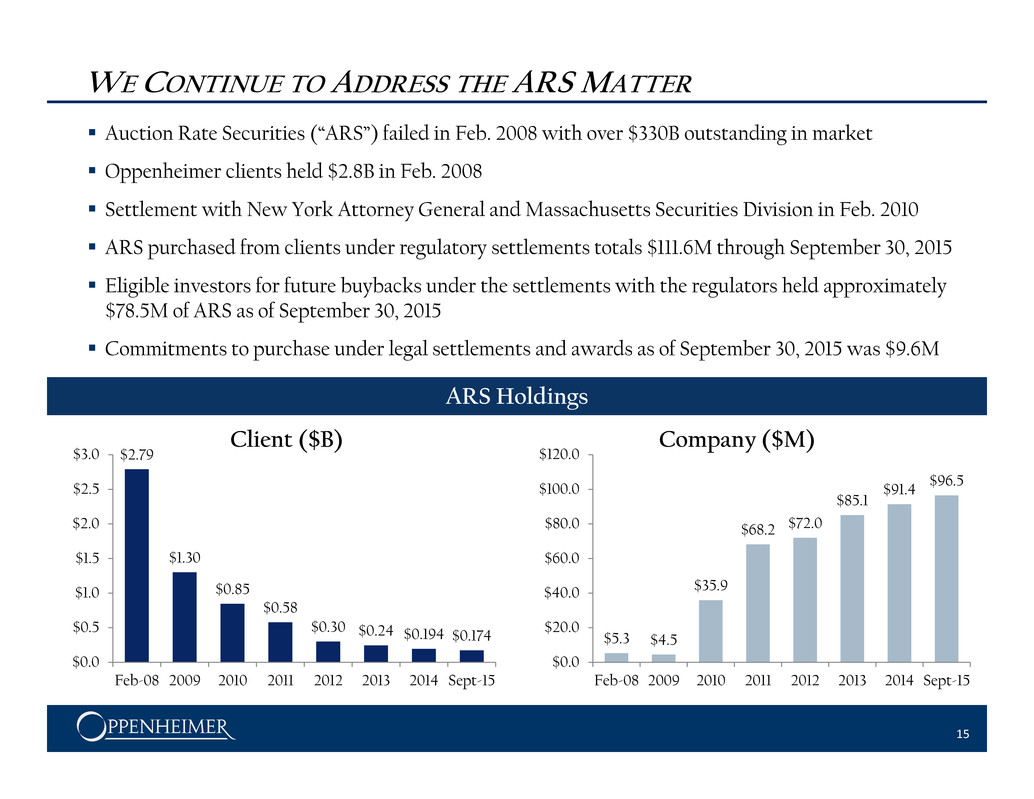

$2.79 $1.30 $0.85 $0.58 $0.30 $0.24 $0.194 $0.174 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 Feb-08 2009 2010 2011 2012 2013 2014 Sept-15 WE CONTINUE TO ADDRESS THE ARS MATTER 15 Auction Rate Securities (“ARS”) failed in Feb. 2008 with over $330B outstanding in market Oppenheimer clients held $2.8B in Feb. 2008 Settlement with New York Attorney General and Massachusetts Securities Division in Feb. 2010 ARS purchased from clients under regulatory settlements totals $111.6M through September 30, 2015 Eligible investors for future buybacks under the settlements with the regulators held approximately $78.5M of ARS as of September 30, 2015 Commitments to purchase under legal settlements and awards as of September 30, 2015 was $9.6M Company ($M)Client ($B) ARS Holdings $5.3 $4.5 $35.9 $68.2 $72.0 $85.1 $91.4 $96.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 Feb-08 2009 2010 2011 2012 2013 2014 Sept-15

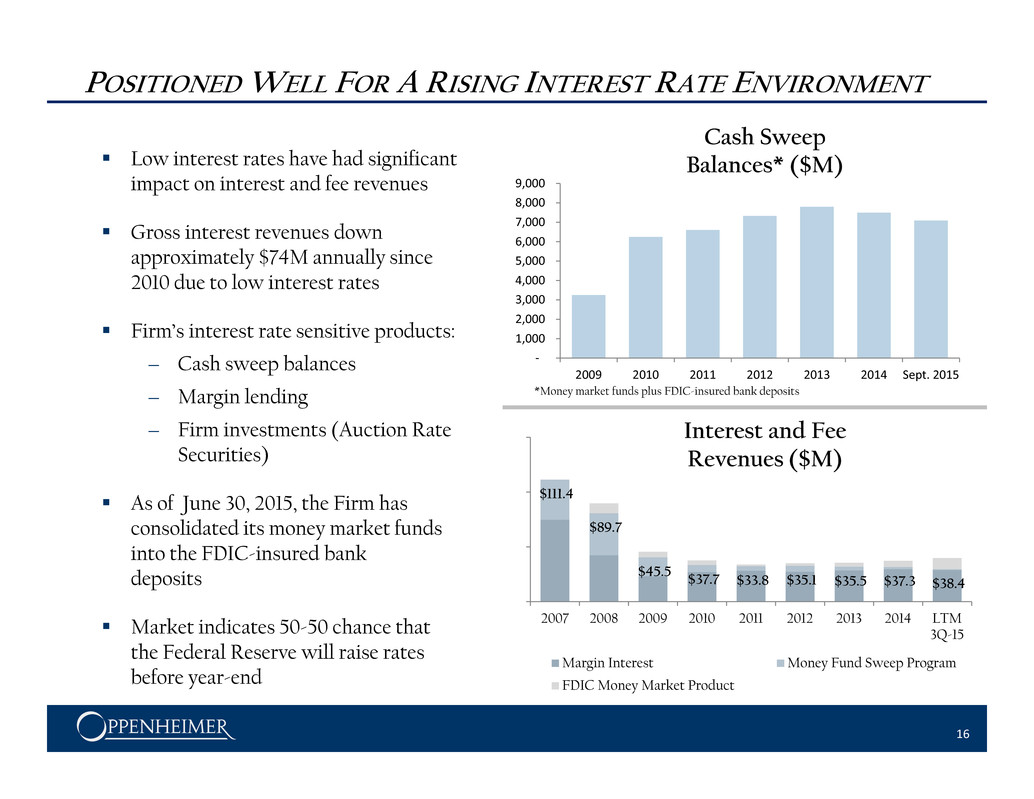

$111.4 $89.7 $45.5 $37.7 $33.8 $35.1 $35.5 $37.3 $38.4 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15 Margin Interest Money Fund Sweep Program FDIC Money Market Product 16 POSITIONED WELL FOR A RISING INTEREST RATE ENVIRONMENT Low interest rates have had significant impact on interest and fee revenues Gross interest revenues down approximately $74M annually since 2010 due to low interest rates Firm’s interest rate sensitive products: – Cash sweep balances – Margin lending – Firm investments (Auction Rate Securities) As of June 30, 2015, the Firm has consolidated its money market funds into the FDIC-insured bank deposits Market indicates 50-50 chance that the Federal Reserve will raise rates before year-end Interest and Fee Revenues ($M) Cash Sweep Balances* ($M) *Money market funds plus FDIC-insured bank deposits ‐ 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2009 2010 2011 2012 2013 2014 Sept. 2015

WHY OPPENHEIMER 17 Oppenheimer has a strong history The firm has navigated through a difficult environment Our client assets are near all time highs Our business model is low risk and well diversified We are poised to benefit from a rising interest rate environment We are investing in our future and well-positioned for growth

APPENDIX

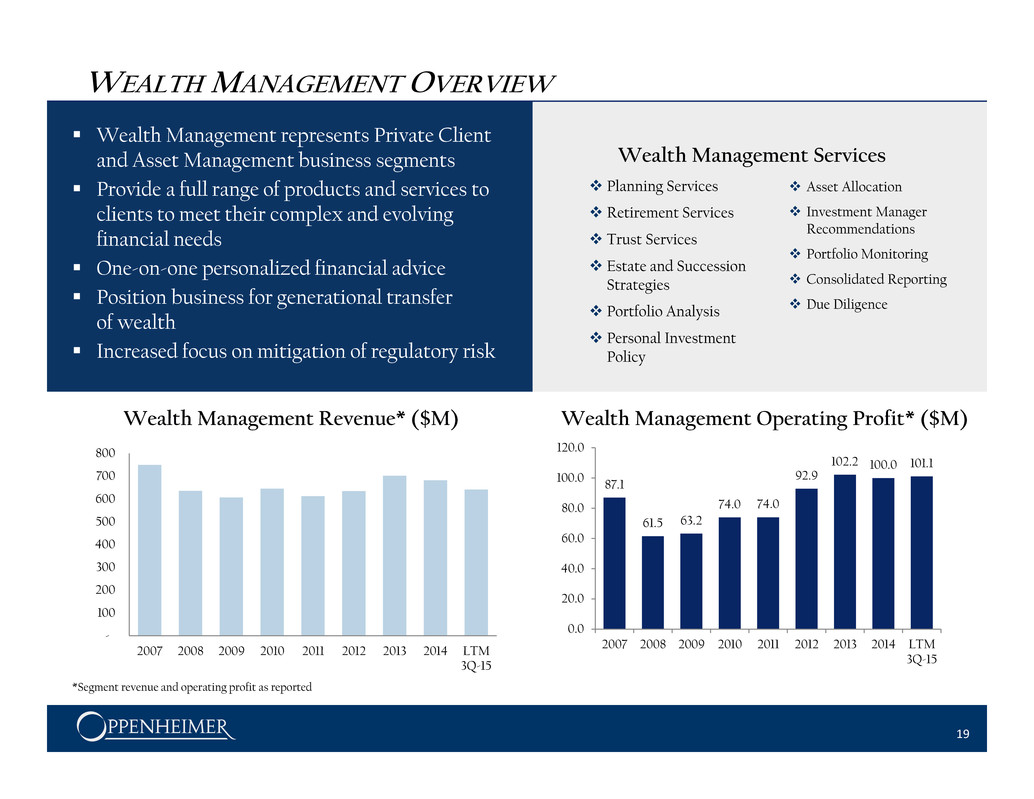

- 100 200 300 400 500 600 700 800 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15 87.1 61.5 63.2 74.0 74.0 92.9 102.2 100.0 101.1 0.0 20.0 40.0 60.0 80.0 100.0 120.0 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15 WEALTH MANAGEMENT OVERVIEW 19 Wealth Management Services Wealth Management represents Private Client and Asset Management business segments Provide a full range of products and services to clients to meet their complex and evolving financial needs One-on-one personalized financial advice Position business for generational transfer of wealth Increased focus on mitigation of regulatory risk Wealth Management Revenue* ($M) Wealth Management Operating Profit* ($M) *Segment revenue and operating profit as reported Asset Allocation Investment Manager Recommendations Portfolio Monitoring Consolidated Reporting Due Diligence Planning Services Retirement Services Trust Services Estate and Succession Strategies Portfolio Analysis Personal Investment Policy

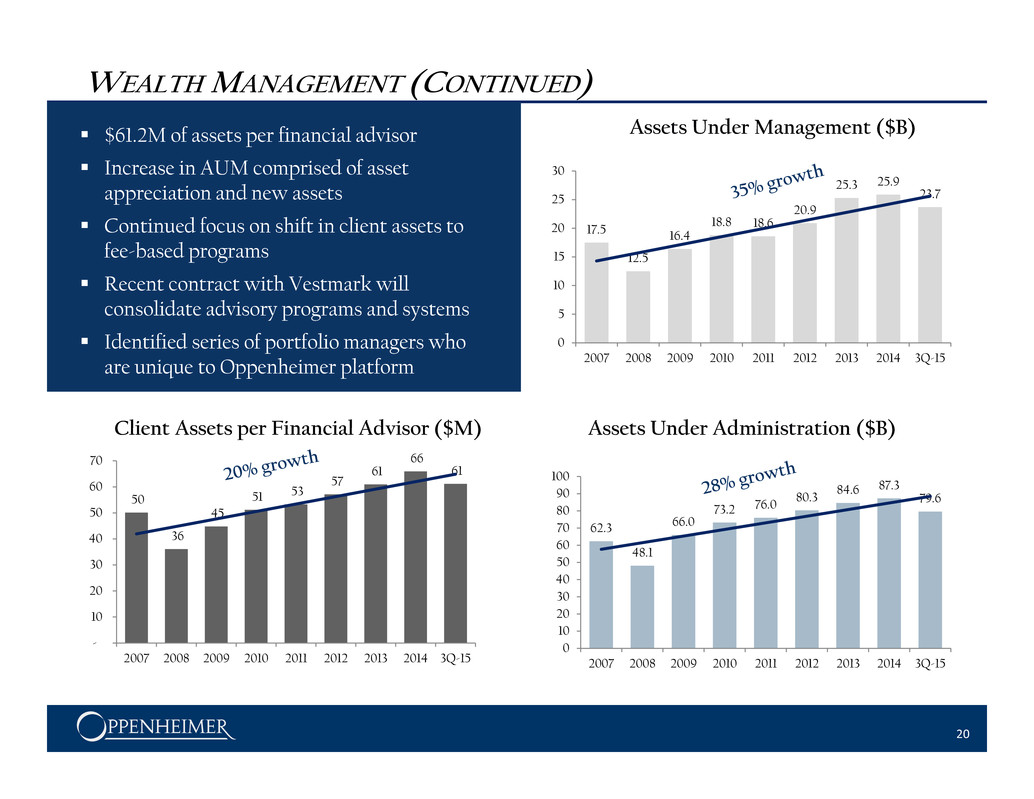

62.3 48.1 66.0 73.2 76.0 80.3 84.6 87.3 79.6 0 10 20 30 40 50 60 70 80 90 100 2007 2008 2009 2010 2011 2012 2013 2014 3Q-15 17.5 12.5 16.4 18.8 18.6 20.9 25.3 25.9 23.7 0 5 10 15 20 25 30 2007 2008 2009 2010 2011 2012 2013 2014 3Q-15 50 36 45 51 53 57 61 66 61 - 10 20 30 40 50 60 70 2007 2008 2009 2010 2011 2012 2013 2014 3Q-15 WEALTH MANAGEMENT (CONTINUED) 20 $61.2M of assets per financial advisor Increase in AUM comprised of asset appreciation and new assets Continued focus on shift in client assets to fee-based programs Recent contract with Vestmark will consolidate advisory programs and systems Identified series of portfolio managers who are unique to Oppenheimer platform Assets Under Administration ($B) Assets Under Management ($B) Client Assets per Financial Advisor ($M)

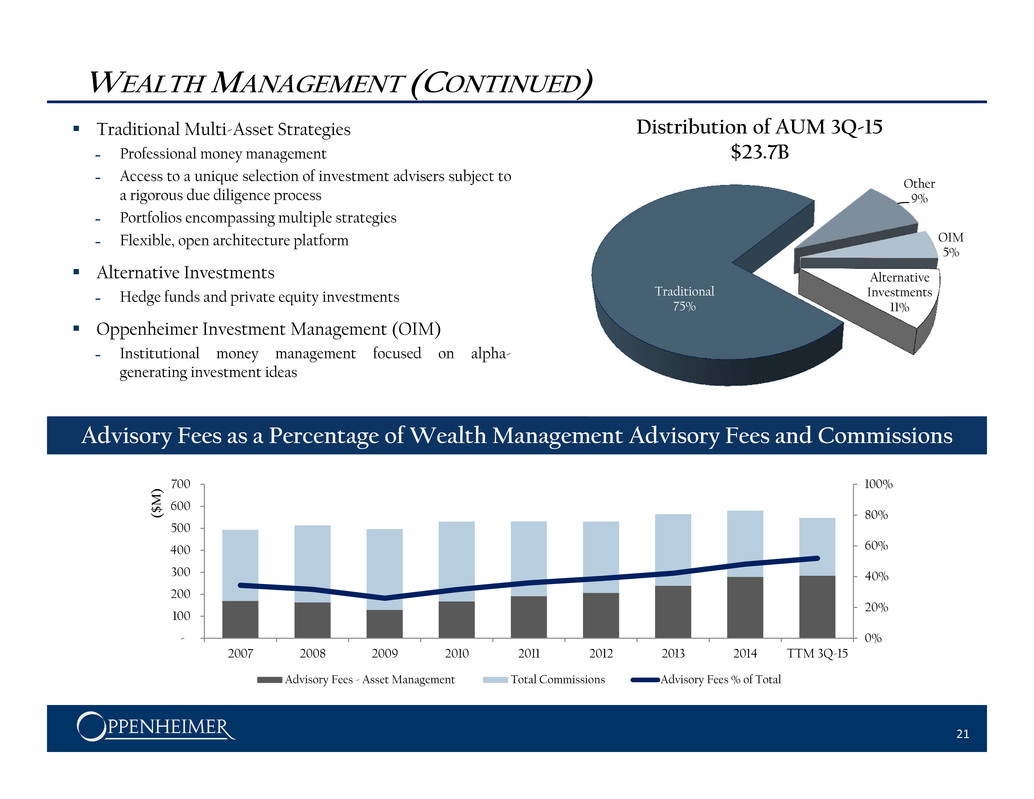

0% 20% 40% 60% 80% 100% - 100 200 300 400 500 600 700 2007 2008 2009 2010 2011 2012 2013 2014 TTM 3Q-15 ( $ M ) Advisory Fees - Asset Management Total Commissions Advisory Fees % of Total WEALTH MANAGEMENT (CONTINUED) 21 Traditional Multi-Asset Strategies ˗ Professional money management ˗ Access to a unique selection of investment advisers subject to a rigorous due diligence process ˗ Portfolios encompassing multiple strategies ˗ Flexible, open architecture platform Alternative Investments ˗ Hedge funds and private equity investments Oppenheimer Investment Management (OIM) ˗ Institutional money management focused on alpha- generating investment ideas Distribution of AUM 3Q-15 $23.7B Advisory Fees as a Percentage of Wealth Management Advisory Fees and Commissions Traditional 75% Other 9% OIM 5% Alternative Investments 11%

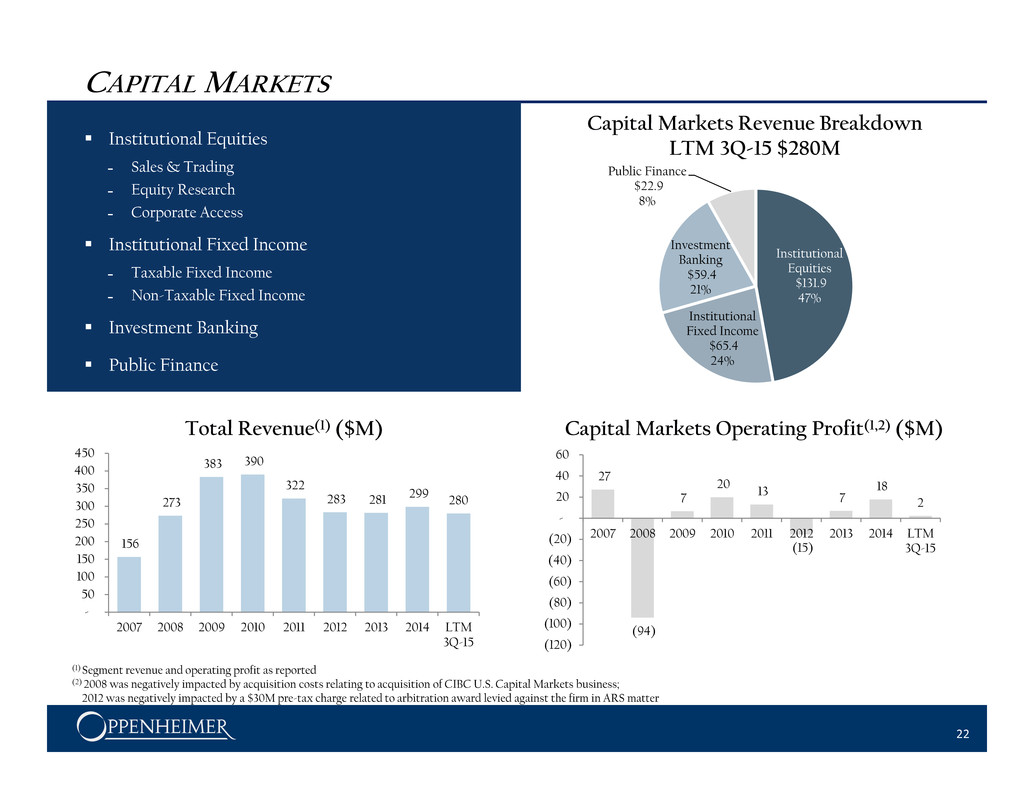

27 (94) 7 20 13 (15) 7 18 2 (120) (100) (80) (60) (40) (20) - 20 40 60 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15156 273 383 390 322 283 281 299 280 - 50 100 150 200 250 300 350 400 450 2007 2008 2009 2010 2011 2012 2013 2014 LTM 3Q-15 Institutional Equities $131.9 47% Institutional Fixed Income $65.4 24% Investment Banking $59.4 21% Public Finance $22.9 8% Total Revenue(1) ($M) CAPITAL MARKETS 22 Institutional Equities ˗ Sales & Trading ˗ Equity Research ˗ Corporate Access Institutional Fixed Income ˗ Taxable Fixed Income ˗ Non-Taxable Fixed Income Investment Banking Public Finance Capital Markets Operating Profit(1,2) ($M) Capital Markets Revenue Breakdown LTM 3Q-15 $280M (1) Segment revenue and operating profit as reported (2) 2008 was negatively impacted by acquisition costs relating to acquisition of CIBC U.S. Capital Markets business; 2012 was negatively impacted by a $30M pre-tax charge related to arbitration award levied against the firm in ARS matter

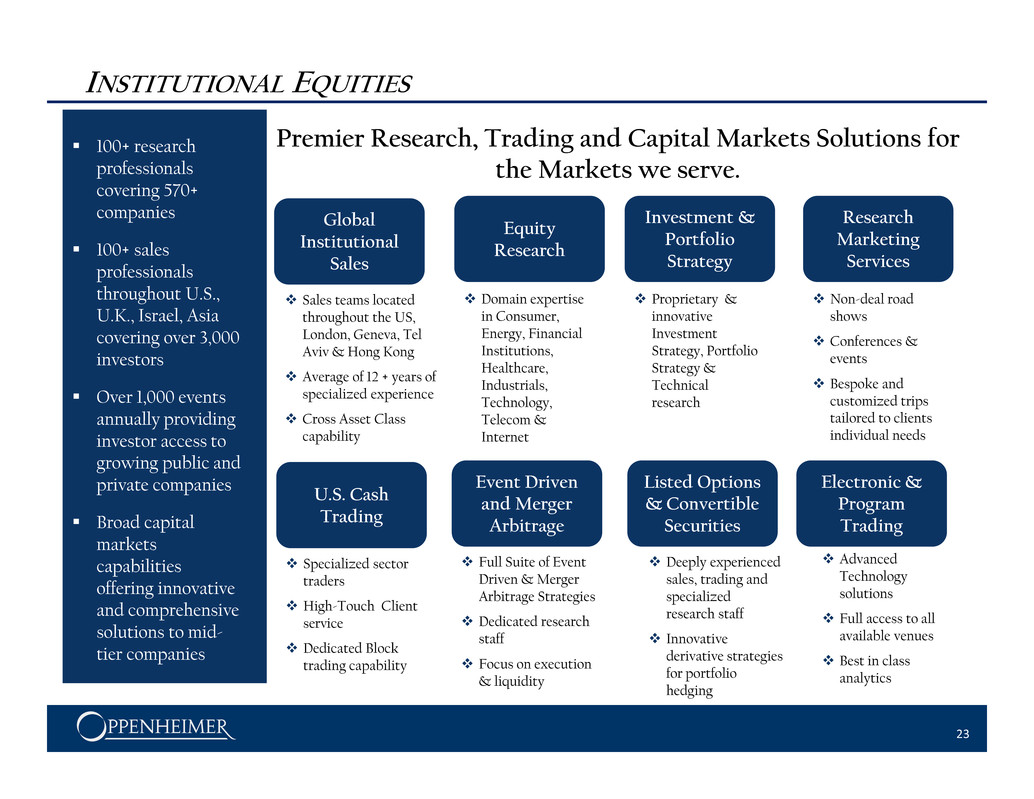

23 INSTITUTIONAL EQUITIES 100+ research professionals covering 570+ companies 100+ sales professionals throughout U.S., U.K., Israel, Asia covering over 3,000 investors Over 1,000 events annually providing investor access to growing public and private companies Broad capital markets capabilities offering innovative and comprehensive solutions to mid- tier companies Premier Research, Trading and Capital Markets Solutions for the Markets we serve. Global Institutional Sales Investment & Portfolio Strategy Proprietary & innovative Investment Strategy, Portfolio Strategy & Technical research Research Marketing Services Non-deal road shows Conferences & events Bespoke and customized trips tailored to clients individual needs Equity Research Domain expertise in Consumer, Energy, Financial Institutions, Healthcare, Industrials, Technology, Telecom & Internet U.S. Cash Trading Specialized sector traders High-Touch Client service Dedicated Block trading capability Event Driven and Merger Arbitrage Full Suite of Event Driven & Merger Arbitrage Strategies Dedicated research staff Focus on execution & liquidity Listed Options & Convertible Securities Deeply experienced sales, trading and specialized research staff Innovative derivative strategies for portfolio hedging Electronic & Program Trading Advanced Technology solutions Full access to all available venues Best in class analytics Sales teams located throughout the US, London, Geneva, Tel Aviv & Hong Kong Average of 12 + years of specialized experience Cross Asset Class capability

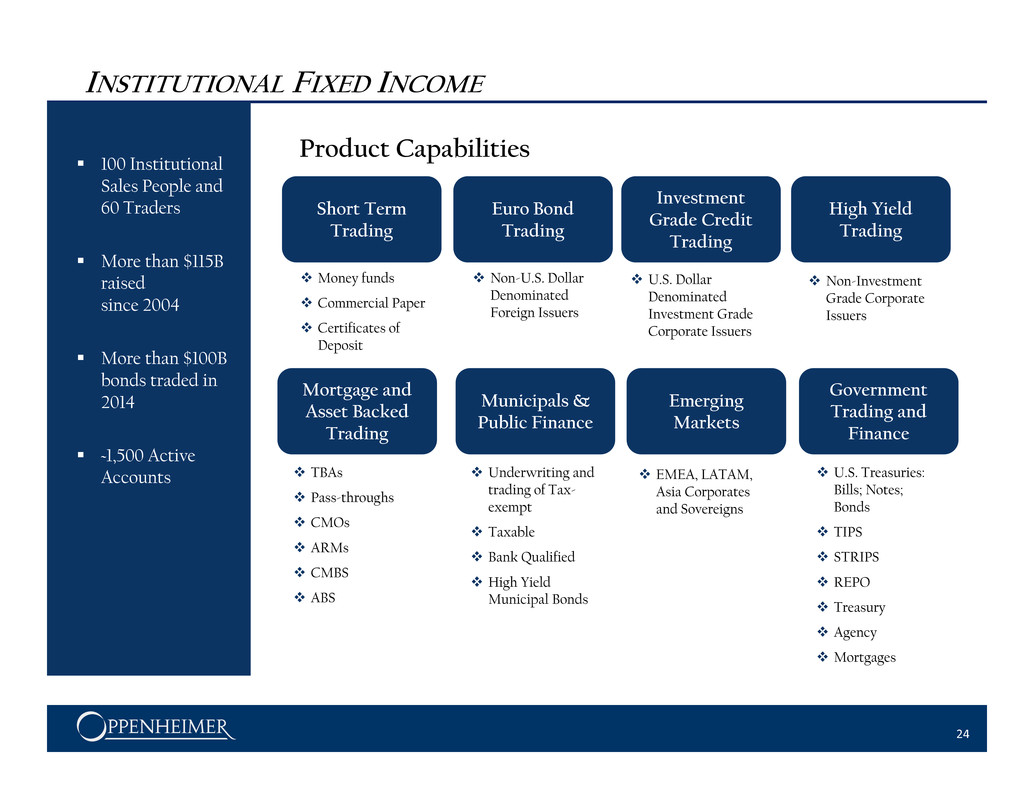

INSTITUTIONAL FIXED INCOME 24 100 Institutional Sales People and 60 Traders More than $115B raised since 2004 More than $100B bonds traded in 2014 ~1,500 Active Accounts Short Term Trading Money funds Commercial Paper Certificates of Deposit Government Trading and Finance U.S. Treasuries: Bills; Notes; Bonds TIPS STRIPS REPO Treasury Agency Mortgages Euro Bond Trading Non-U.S. Dollar Denominated Foreign Issuers Investment Grade Credit Trading U.S. Dollar Denominated Investment Grade Corporate Issuers Mortgage and Asset Backed Trading TBAs Pass-throughs CMOs ARMs CMBS ABS Municipals & Public Finance Underwriting and trading of Tax- exempt Taxable Bank Qualified High Yield Municipal Bonds Emerging Markets EMEA, LATAM, Asia Corporates and Sovereigns High Yield Trading Non-Investment Grade Corporate Issuers Product Capabilities

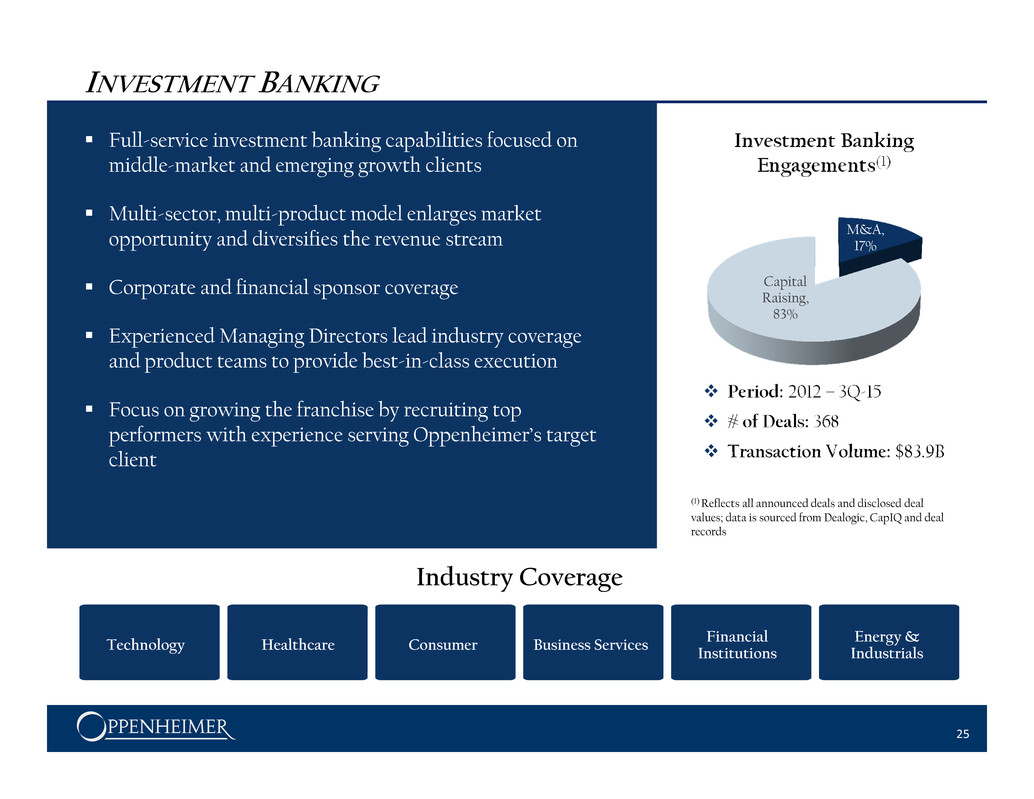

INVESTMENT BANKING 25 Full-service investment banking capabilities focused on middle-market and emerging growth clients Multi-sector, multi-product model enlarges market opportunity and diversifies the revenue stream Corporate and financial sponsor coverage Experienced Managing Directors lead industry coverage and product teams to provide best-in-class execution Focus on growing the franchise by recruiting top performers with experience serving Oppenheimer’s target client Investment Banking Engagements(1) Technology Healthcare Consumer Business Services Financial Institutions Energy & Industrials Industry Coverage Period: 2012 – 3Q-15 # of Deals: 368 Transaction Volume: $83.9B (1) Reflects all announced deals and disclosed deal values; data is sourced from Dealogic, CapIQ and deal records M&A, 17% Capital Raising, 83%

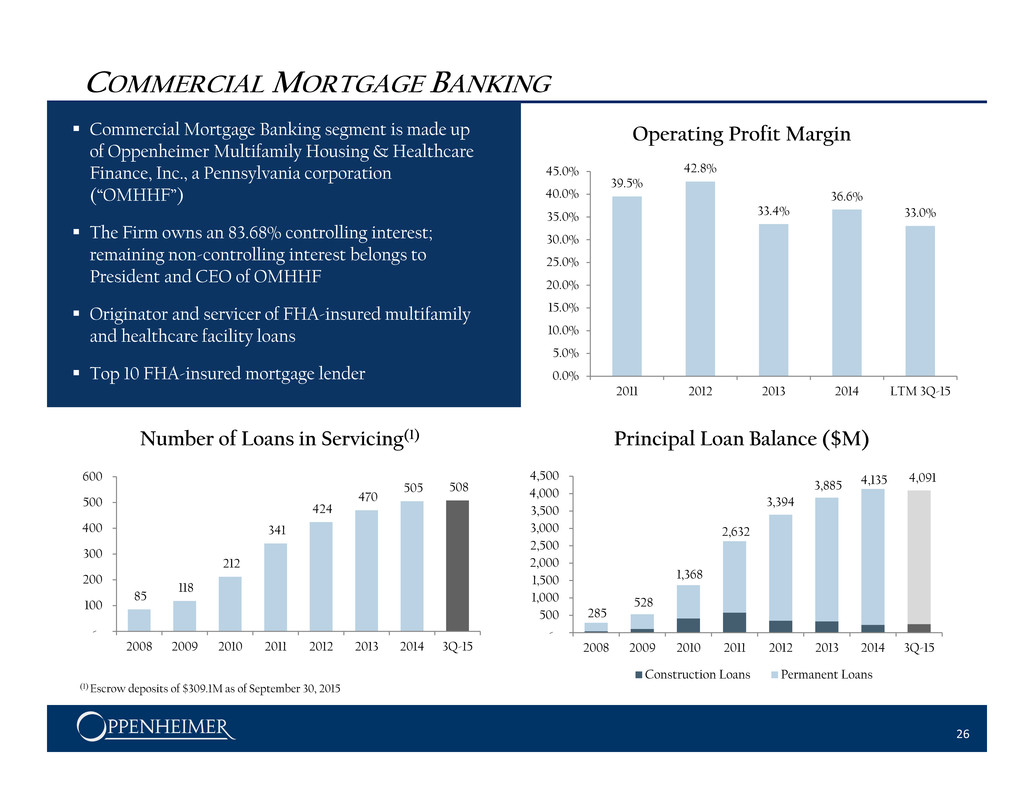

39.5% 42.8% 33.4% 36.6% 33.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 2011 2012 2013 2014 LTM 3Q-15 285 528 1,368 2,632 3,394 3,885 4,135 4,091 - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2008 2009 2010 2011 2012 2013 2014 3Q-15 Construction Loans Permanent Loans 85 118 212 341 424 470 505 508 - 100 200 300 400 500 600 2008 2009 2010 2011 2012 2013 2014 3Q-15 COMMERCIAL MORTGAGE BANKING 26 Operating Profit Margin Principal Loan Balance ($M)Number of Loans in Servicing(1) Commercial Mortgage Banking segment is made up of Oppenheimer Multifamily Housing & Healthcare Finance, Inc., a Pennsylvania corporation (“OMHHF”) The Firm owns an 83.68% controlling interest; remaining non-controlling interest belongs to President and CEO of OMHHF Originator and servicer of FHA-insured multifamily and healthcare facility loans Top 10 FHA-insured mortgage lender (1) Escrow deposits of $309.1M as of September 30, 2015

THANK YOU FOR YOUR TIME