Attached files

| file | filename |

|---|---|

| EX-2.1 - STOCK PURCHASE AGREEMENT - EVIO, INC. | sgby_ex21.htm |

| EX-5.1 - OPINION LETTER OF AUSTIN LEGAL GROUP - EVIO, INC. | sgby_ex51.htm |

| EX-23.1 - CONSENT OF MALONEBAILEY, LLP - EVIO, INC. | sgby_ex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Signal Bay, Inc. |

(Exact name of registrant as specified in its charter) |

Colorado | 8372 | 47-1890509 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

9484 S. Eastern Ave #141, Las Vegas, NV 89123

(Address of principal executive offices) (zip code)

(702) 748-9944

(Registrant's telephone number, including area code)

(866) 820-1141

(Registrant's fax number, including area code)

Approximate date of commencement of proposed sale to the public: As soon as practical after the effective date of this registration statement and from time to time thereafter.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

Title of Each Class Of |

| Amount to be Registered |

|

| Proposed Maximum Aggregate Offering Price per share |

|

| Proposed Maximum Aggregate Offering Price |

|

| Amount of Registration Fee |

| ||||

Common Stock, $0.0001 par value per share |

|

| 93,000,000 |

|

| $ | 0.015 |

|

| $ | 1,395,000 |

|

| $ | 140.48 |

|

(1) | Consists of (i) up to 93,000,000 shares of common stock to be sold by Kodiak Capital Group, LLC ("Kodiak" or the "Selling Security Holder") pursuant to an Equity Purchase Agreement dated July 31, 2015 (the "Equity Purchase Agreement"). In accordance with Rule 416(a), this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. | |

(2) | Based on the average of the high and low transactions prices on October 27, 2015. The shares offered hereunder may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions, or a combination of these methods at market prices prevailing at the time of sale or at negotiated prices. | |

(3) | Calculated under Section 6(b) of the Securities Act of 1933 as the aggregate offering price multiplied by 0.0001007. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

2

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission ("SEC") is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED _________, 2015

SIGNAL BAY, INC.

93,000,000 SHARES OF COMMON STOCK

This offering is for the sale of up to 93,000,000 shares of our common stock by Kodiak Capital Group, LLC ("Kodiak" or the "Selling Security Holder") pursuant to this prospectus. The Selling Shareholder will acquire the shares via put options issued pursuant to an Equity Purchase Agreement dated July 31, 2015 (the "Equity Purchase Agreement") between the Company and Kodiak. If issued presently, the 93,000,000 shares of common stock registered for resale by Kodiak would represent 23.27% of our issued and outstanding shares of common stock as of October 27, 2015.

The Selling Security Holder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices, or at negotiated prices.

We will not receive any proceeds from the sale of the shares of our common stock by Kodiak. However, we will receive proceeds from our initial sale of shares to Kodiak pursuant to the Equity Purchase Agreement. We will sell shares to Kodiak at a price equal to 75% of the lowest closing bid price for our common stock during the five consecutive trading day period beginning on the date on which we deliver a put notice to Kodiak. We will pay for expenses of this offering, except that the selling stockholders will pay any broker discounts or commissions or equivalent expenses applicable to the sale of their shares.

Kodiak is an underwriter of the shares within the meaning of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may also be deemed to be "underwriters" in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933.

Our common stock is traded on OTC Markets under the symbol "SGBY". On October 27, 2015, the last reported sale price for our common stock was $0.015 per share.

Prior to this offering, there has been a very limited market for our securities. While our common stock is on the OTC Bulletin Board, there has been negligible trading volume. There is no guarantee that an active trading market will develop in our securities.

We qualify as an "emerging growth company" as defined in the Jumpstart our Business Startups Act ("JOBS Act").

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 7 to read about factors you should consider before purchasing any of the shares offered by this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is , 2015

3

TABLE OF CONTENTS

Prospectus Summary |

|

| 6 |

|

Business of Registrant |

|

| 6 |

|

Company Contact Information |

|

| 6 |

|

Company History |

|

| 6 |

|

Financing Requirements |

|

| 7 |

|

Emerging Growth Company Status |

|

| 7 |

|

Going Concern |

|

| 8 |

|

Kodiak Equity Purchase Agreement and Registration Rights Agreement |

|

| 8 |

|

Summary of This Offering |

|

| 9 |

|

Risk Factors |

|

| 10 |

|

Use of Proceeds |

|

| 17 |

|

Determination of Offering Price |

|

| 17 |

|

Dilution |

|

| 17 |

|

Selling Security Holders |

|

| 18 |

|

Plan of Distribution |

|

| 20 |

|

Description of Securities to be Registered |

|

| 21 |

|

Interests of Named Experts and Counsel |

|

| 23 |

|

Information with Respect to Registrant |

|

| 23 |

|

Business of Registrant |

|

| 23 |

|

Description of Property |

|

| 26 |

|

Involvement in Legal Proceedings |

|

| 26 |

|

Governmental Regulation |

|

| 26 |

|

Market Price and Dividends |

|

| 26 |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| 28 |

|

Revenue |

|

| 29 |

|

Operating Expenses |

|

| 29 |

|

Liquidity and Capital Resources |

|

| 30 |

|

Timing Needs for Funding |

|

| 30 |

|

Dividend Policy |

|

| 30 |

|

Going Concern |

|

| 30 |

|

Off Balance Sheet Arrangements |

|

| 30 |

|

Changes or Disagreements with Accountants |

|

| 32 |

|

Quantitative and Qualitative Disclosures about Market Risk |

|

| 32 |

|

Sale of Unregistered Securities |

|

| 32 |

|

Identification of Directors and Executive Officers |

|

| 34 |

|

Executive Compensation |

|

| 38 |

|

Transactions with Related Persons |

|

| 38 |

|

Security Ownership of Certain Beneficial Owners and Management |

|

| 39 |

|

Director Independence |

|

|

| |

Legal Proceedings |

|

|

| |

Material Changes |

|

| 40 |

|

Incorporation By Reference |

|

| 40 |

|

Commission's Position on Indemnification On Securities Act Violations |

|

| 40 |

|

Where You Can Find Additional Information |

|

| 40 |

|

Financial Statements |

|

| 41 |

|

| 4 |

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus is correct as of any time after its date.

Until (insert date), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as "may," "shall," "could," "expect," "estimate," "anticipate," "predict," "probable," "possible," "should," "continue," or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. These forward-looking statements are based on current information and expectation, and we assume no obligation to update any such forward-looking statements.

5

Item 3: Summary Information and Risk Factors.

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the "risk factors" section, the financial statements and the notes to the financial statements.

Our Company

Business of Registrant

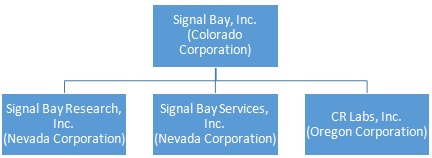

Signal Bay, Inc., a Colorado corporation and its subsidiaries ("Signal Bay", the "Company", the "Registrant", "we", "our", or "us") provide advisory, management and analytical testing services to the emerging legalized cannabis industry. Our three business units are described below:

Signal Bay Research provides industry research, business and market intelligence, and consulting services. We provide advisory and consulting services to cannabis companies including license application support, regulatory compliance, market forecasts, and operational insights. We also publish industry information via online media, research reports, and publications. Our media properties include CANNAiQ.com, a business to business information portal and MarijuanaMath.com a general interest informational website for the cannabis industry. Signal Bay is also the home of the Cannabis Consultant Marketplace (CCM). The CCM is an outsourcing freelancing matching platform enabling cannabis companies to post projects and hire consultants.

Signal Bay Services provides operating services for licensed cannabis businesses. Signal Bay Services has been engaged in Management Services Agreement with Libra Wellness Center, LLC, a licensed cannabis production and processing establishment, to operate their marijuana processing facility in North Las Vegas, Nevada. We will provide the staff and operational support to Libra Wellness to produce processed cannabis and infused products for licensed dispensaries throughout Southern Nevada.

CR Labs d.b.a. CannAlytical Research is the analytical laboratory division of Signal Bay. Signal Bay owns 80% of the issued and outstanding shares in CR Labs. CR Labs provides compliance testing services in accordance with the Oregon Health Authority. Tests include residual solvent analysis, pesticide screening, microbiological screening, terpene analysis, and cannabinoid potency profiling of cannabis and cannabis infused products. CR Labs also provides consulting services CR Labs is located in Bend Oregon, and tests cannabis for both medicinal and adult use. We are currently evaluating additional legal cannabis markets to provide our analytical testing services.

Where You Can Find Us

Our executive offices are located at 9484 S. Eastern Ave #141, Las Vegas, CA 89123 and our telephone number is (702) 748-9944.

Company History

Signal Bay, Inc. was originally incorporated in the State of New York, December 12, 1977 under the name 3171 Holding Corporation. On February 22, 1979 the name was changed to Electronomic Industries Corp. and on February 23, 1983 the name was changed to Quantech Electronics Corp. The Company was reincorporated in the State of Colorado on December 15, 2003. On August 29, 2014, the Company completed a reverse merger with Signal Bay Research, Inc., a Nevada Corporation, and took over its operations. In September 2014, the Company changed its name from Quantech Electronics Corp. to Signal Bay, Inc. The Company has selected September 30 as its fiscal year end. Signal Bay, Inc. is domiciled in the State of Colorado, and its corporate headquarters are located in Las Vegas, Nevada.

6

As a part of and prior to the consummation of the reverse merger, William Waldrop and Lori Glauser, principals of Signal Bay Research, Inc., purchased 28,811,933 shares of the Company (80% of the issued and outstanding common stock) from WB Partners. The merger between the Company and Signal Bay Research was finalized and closed contemporaneously with the share purchase. As part of this share purchase, Mr. Waldrop and Ms. Glauser became the officers and directors of the Company. Signal Bay Research was acquired through the issuance of 254,188,067 shares of common stock and 5,000,000 shares of Series B Preferred Stock to Mr. Waldrop and Ms. Glauser, pro rata. After the reverse merger, William Waldrop and Lori Glauser individually each own 127,500,000 shares of common stock and 2,500,000 shares of Series B Preferred stock in the Company. Immediately prior to the reverse merger, neither William Waldrop nor Lori Glauser had any interest in the Company. Immediately after to the reverse, WB Partners owned less than 5% of the common stock. After the reverse merger, Signal Bay Research, Inc. continues to operate as a wholly owned subsidiary capturing the research and advisory services for Signal Bay, Inc.

Signal Bay Services was formed on January 25, 2015, as the management services division of Signal Bay. Currently, Signal Bay Services has one contract with Libra Wellness Services, LLC with anticipated engagement commencing in April 2016.

On September 17, 2015, Signal Bay entered into a share exchange agreement with CR Labs, Inc., an Oregon Corporation, pursuant to which the company issued 40,000,000 shares of the Company's Common Stock in exchange for 80% of the outstanding common stock of CR Labs, Inc.

Financing Requirements

The following financing requirements are based on estimates made by our management team. The working capital requirements and the projected milestones are approximations and are subject to adjustments.

Phase 1: 0-4 Months: $350,000. The Company needs $350,000 to acquire additional testing equipment, hire additional laboratory technicians, develop and execute a marketing plan.

Phase 2: 5-12 Months: $650,000. The Company needs $650,000 to commence stage 1 roll-out into the California Market.

Phase 3: 13-36 Months: $12,500,000. The Company needs $12,500,000 to complete its California expansion, and target Hawaii, Maryland, and Washington DC.

Emerging Growth Company Status

We are an "emerging growth company," as defined in the JOBS Act. For as long as we are an "emerging growth company," we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies," including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding advisory "say-on-pay" votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an "emerging growth company" until the earliest of:

| · | the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; |

| ||

| · | the last day of the fiscal year following the fifth anniversary of the effective date of this registration statement; |

| ||

| · | the date on which we have, during the previous three-year period, issued more than $1 billion in non- convertible debt; and |

| ||

| · | the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934, or the Exchange Act. |

We will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months. The value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter.

The Section 107 of the JOBS Act provides that we may elect to utilize the extended transition period for complying with new or revised accounting standards and such election is irrevocable if made. As such, we have made the election to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. Please refer to a discussion on page 13 under "Risk Factors" of the effect on our financial statements of such election.

7

Going Concern

Our auditor has expressed substantial doubt about our ability to continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses and has experienced negative cash flows from operations, which raises substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to those matters are also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Kodiak Equity Purchase Agreement and Registration Rights Agreement

This prospectus includes the resale of up to 93,000,000 shares of our common stock by Kodiak. Kodiak will obtain our common stock pursuant to the Equity Purchase Agreement entered into by Kodiak and us, dated July 31, 2015 (the "Equity Purchase Agreement"). Pursuant to the Equity Purchase Agreement, the Company can require Kodiak to purchase up to $1,000,000 of common stock from the Company ("Put Shares") during the term of the Equity Purchase Agreement. Kodiaks obligations to purchase shares under the Equity Purchase Agreement terminate December 31, 2016.

The purchase price of the common stock will be set at seventy-five percent (75%) of the lowest closing bid price of the common stock during the pricing period. The pricing period will be the five consecutive trading days immediately after the put notice date. On the put notice date, we are required to deliver Put Shares to Kodiak in an amount (the "Estimated Put Shares") determined by dividing the closing bid price on the trading day immediately preceding the Put Notice date multiplied by 75%. At the end of the pricing period when the purchase price is established and the number of Put Shares for a particular Put is definitely determined, Kodiak must return to us any excess Put Shares provided as Estimated Put Shares or alternatively, we must deliver to Kodiak any additional Put Shares required to cover the shortfall between the amount of Estimated Put Shares and the amount of Put Shares. At the end of the pricing period we must also return to Kodiak any excess related to the investment amount previously delivered to us.

Kodiak is not permitted to engage in short sales involving our common stock during the commitment period ending December 31, 2016. In accordance with Regulation SHO, however, sales of our common stock by Kodiak after delivery of a Put Notice of such number of shares reasonably expected to be purchased by Kodiak under a Put will not be deemed a short sale.

In addition, we must deliver the other documents, instruments and writings required by the Equity Purchase Agreement. Kodiak is not required to purchase the Put Shares unless:

● | Our registration statement with respect to the resale of the shares of common stock delivered in connection with the applicable Put shall have been declared effective. | |

● | We shall have obtained all material permits and qualifications required by any applicable state for the offer and sale of the registrable securities. | |

● | We shall in a timely manner have filed with the SEC all reports, notices, and other documents required. |

We believe that we will be able to meet all of the above obligations mandated in the Equity Purchase Agreement set forth above.

Also pursuant to the Equity Purchase Agreement, in July, 2015 (i) Kodiak received a one-time issuance of 3,500,000 shares of our common stock, and (ii) we executed a Registration Rights Agreement whereby we agreed to register the shares issued to Kodiak pursuant to the Equity Purchase Agreement and to indemnify Kodiak for certain legal claims that may arise as a result of such registration. We are currently in breach of the Registration Rights Agreement for failure to timely complete this registration statement; however, Kodiak has currently waived such breach.

8

Summary of the Offering

Common Stock Offered by the Selling Security Holder |

| 93,000,000 shares of common stock. |

| ||

Common Stock Outstanding Before the Offering |

| 399,042,345 as of October 27, 2015 |

| ||

Common Stock Outstanding After the Offering |

| 488,542,345 shares, assuming the sale of all of the shares being registered in this Registration Statement. |

| ||

Terms of the Offering |

| The Selling Security Holder will determine when and how it will sell the common stock offered in this prospectus. The Selling Security Holder should be considered an "underwriter" under the Securities Act. |

| ||

Termination of the Offering |

| This offering is being made on a continuous basis pursuant to Rule 415 under the Securities Act and will expire two years from the date on which the registration statement related to this prospectus becomes effective, unless earlier terminated or extended by our Company by the filing of a post-effective amendment. Our premature termination of this registration statement could result in the breach of our agreements with the Selling Security Holder. |

| ||

Use of Proceeds |

| We will not receive any proceeds from the sale of the shares of common stock offered by the Selling Security Holder. However, we will receive up to $1,000,000 from the sale of our common stock to Kodiak under the Equity Purchase Agreement, which proceeds we intend to deploy as working capital. |

| ||

Risk Factors |

| The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See "Risk Factors" beginning on page 10. |

| ||

OTC Markets Symbol |

| SGBY |

| 9 |

RISK FACTORS

An investment in our common stock is highly speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below together with all of the other information included in this prospectus. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the value of our common stock could decline, and an investor in our securities may lose all or part of their investment.

The Company has limited capitalization and lack of working capital and as a result is dependent on raising funds to grow and expand its business.

Our management has concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company will endeavor to finance its need for additional working capital through debt or equity financing. Additional debt financing would be sought only in the event that equity financing failed to provide the Company necessary working capital. Debt financing may require the Company to mortgage, pledge or hypothecate its assets, and would reduce cash flow otherwise available to pay operating expenses and acquire additional assets. Debt financing would likely take the form of short-term financing provided by officers and directors of the Company, to be repaid from future equity financing. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. However, there are no current agreements or understandings with regard to the form, time or amount of such financing and there is no assurance that any of this financing can be obtained or that the Company can continue as a going concern.

We are an "emerging growth company," and any decision on our part to comply only with certain reduced disclosure requirements applicable to "emerging growth companies" could make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the JOBS Act, and, for as long as we continue to be an "emerging growth company," we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to "emerging growth companies," including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards.

The Company has limited revenue and limited operating history which make it difficult to evaluate the Company which could restrict your ability to sell your shares.

The Company has only a limited operating history and limited revenues. Activities to date have been limited to organizational efforts and obtaining initial financing. The Company must be considered in the developmental stage. Prospective investors should be aware of the difficulties encountered by such enterprises, as the Company faces all the risks inherent in any new business, including the absence of any prior operating history, need for working capital and intense competition. The likelihood of success of the Company must be considered in light of such problems, expenses and delays frequently encountered in connection with the operation of a new business and the competitive environment in which the Company will be operating.

10

The Company is dependent on key personnel and loss of the services of any of these individuals could adversely affect the conduct of the company's business.

Initially, success of the Company is entirely dependent upon the management efforts and expertise of Mr. Waldrop and Ms. Glauser. A loss of the services of Mr. Waldrop or Ms. Glauser could adversely affect the conduct of the Company's business. In such event, the Company would be required to obtain other personnel to manage and operate the Company, and there can be no assurance that the Company would be able to employ a suitable replacement for either of such individuals, or that a replacement could be hired on terms which are favorable to the Company. The Company does not currently maintain key man insurance on the lives of any of its officers or directors. The Company currently has not entered into any employment agreements with our officers or key personal. The Company expects to enter into employment agreements in 2015.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the sole discretion of our Board of Directors after considering whether we have generated sufficient revenues, our financial condition, operating results, cash needs, growth plans and other factors. Accordingly, investors that are seeking cash dividends should not purchase our common stock.

Our shares may be subject to the "penny stock" rules that might subject you to restrictions on marketability and you may not be able to sell your shares.

Broker-dealer practices in connection with transactions in "Penny Stocks" are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risk associated with the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker- dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker- dealer must make a written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. If the Company's securities become subject to the penny stock rules, investors in this offering may find it more difficult to sell their securities.

Due to the control by management of 84.6% of the total voting power our non-management shareholders will have no power to choose management or impact operations.

Management currently maintains a voting power of 84.6%. Consequently, management has the ability to influence control of our operations and, acting together, will have the ability to influence or control substantially all matters submitted to stockholders for approval, including:

| ● | Election of the Board of Directors; |

| ● | Removal of directors; and |

| ● | Amendment to the our certificate of incorporation or bylaws. |

These stockholders will thus have substantial influence over our management and affairs and other stockholders possess no practical ability to remove management or effect the operations of our business. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the common stock.

We may need additional financing which we may not be able to obtain on acceptable terms. If we are unable to raise additional capital, as needed, the future growth of our business and operations would be severely limited.

A limiting factor on our growth, and is our limited capitalization which could impact our ability execute on our divisions business plans. If we raise additional capital through the issuance of debt, this will result in increased interest expense. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our common stock. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (for example, negative operating covenants). There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business, fund expansion, develop or enhance products or respond to competitive pressures, could suffer if we are unable to raise the additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues or possibly attain profitable operations in the future.

11

We cannot guarantee that an active trading market will develop for our common stock, which may restrict your ability to sell your shares.

The Company's stock trades on the OTC under the ticker SGBY. However, there is no active public market for our common stock and there can be no assurance that a regular trading market for our common stock will ever develop or that, if developed, it will be sustained. Therefore, purchasers of our common stock should have a long-term investment intent and should recognize that it may be difficult to sell the shares, notwithstanding the fact that they are not restricted securities. There has not been a market for our common stock. We cannot predict the extent to which a trading market will develop or how liquid a market might become.

Compliance and continued monitoring in connection with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure may create uncertainty regarding compliance matters. New or changed laws, regulations and standards are subject to varying interpretations in many cases. As a result, their application in practice may evolve over time. We are committed to maintaining high standards of corporate governance and public disclosure. Complying with evolving interpretations of new or changed legal requirements may cause us to incur higher costs as we revise current practices, policies and procedures, and may divert management time and attention from the achievement of revenue generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to uncertainties related to practice, our reputation might be harmed which would could have a significant impact on our stock price and our business. In addition, the ongoing maintenance of these procedures to be in compliance with these laws, regulations and standards could result in significant increase in costs.

You could be diluted from the issuance of additional common stock.

As of October 27, 2015, we had 399,604,845 shares of common stock outstanding and 6,840,000 shares of preferred stock outstanding. We are authorized to issue up to 750,000,000 shares of common stock and 10,000,000 shares of preferred stock. To the extent of such authorization, our Board of Directors will have the ability, without seeking stockholder approval, to issue additional shares of common stock or preferred stock in the future for such consideration as the Board of Directors may consider sufficient. The issuance of additional common stock or preferred stock in the future may reduce your proportionate ownership and voting power.

The market price of our common stock is highly volatile.

The market price of our common stock has been and is expected to continue to be highly volatile. Factors, including announcements of technological innovations by us or other companies, regulatory matters, new or existing products or procedures, concerns about our financial position, operating results, litigation, government regulation, developments or disputes relating to agreements, patents or proprietary rights, may have a significant impact on the market price of our stock. In addition, potential dilutive effects of future sales of shares of common stock by shareholders and by the Company, and subsequent sales of common stock by the holders of warrants and options could have an adverse effect on the market price of our shares.

Our by-laws provide for indemnification of our officers and directors at our expense and limit their liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our bylaws require that we indemnify and hold harmless our officers and directors, to the fullest extent permitted by law, from certain claims, liabilities and expenses under certain circumstances and subject to certain limitations and the provisions of Colorado law. Under Colorado law a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, officer, employee or agent of the corporation, against expenses, attorneys' fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by him in connection with an action, suit or proceeding if the person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation.

12

The Company's auditors have issued a going concern opinion that the Company's may not be able to continue without raising additional capital.

Our auditors and management have concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company needs to raise additional capital to continue its operations and to implement its plan of operations. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. However, there are no current agreements or understandings with regard to the form, time or amount of such financing and there is no assurance that any of this financing can be obtained or that the Company can continue as a going concern.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

Management identified the following control deficiencies that represent material weaknesses as of June 30, 2015:

(1) | Lack of an independent audit committee. The Company does not have an audit committee. We may establish an audit committee comprised solely of independent directors when we have sufficient capital resources and working capital to attract qualified independent directors and to maintain such a committee. |

(2) | Inadequate staffing and supervision within our bookkeeping operations. The relatively small number of people who are responsible for bookkeeping functions prevents us from segregating duties within our internal control system. The inadequate segregation of duties is a weakness because it could lead to the ultimate identification and resolution of accounting and disclosure matters or could lead to a failure to perform timely and effective reviews which may result in a failure to detect errors in spreadsheets, calculations, or assumptions used to compile the financial statements and related disclosures as filed with the Securities and Exchange Commission. |

(3) | Insufficient number of independent directors. At the present time, our Board of Directors does not consist of a majority of independent directors, a factor that is counter to corporate governance practices as set forth by the rules of various stock exchanges. |

Our management determined that these deficiencies constituted material weaknesses. Due to a lack of financial and personnel resources, we are not able to, and do not intend to, immediately take any action to remediate these material weaknesses. We will not be able to do so until we acquire sufficient financing and staff to do so.

Economic conditions, regulatory changes, and other factors beyond our control could cause a decline in demand for our products.

Our primary business relates to providing services to cannabis-related companies, including cannabis test labs. Therefore business is highly dependent on state laws pertaining to the cannabis industry. As of October 1, 2015, more than twenty states allow its citizens to use legal cannabis for medical purposes. Four states allow its adult citizens to use legal cannabis for any purpose. Our business depends on the continued regulation and legalization of medical and recreational cannabis. Further progress in the cannabis industry, while encouraging, is not assured.

13

Despite the development of a cannabis industry legal under state laws, state laws legalizing medicinal and adult cannabis use are in conflict with the Federal Controlled Substances Act, which classifies cannabis as a Schedule 1 controlled substance and makes cannabis use and possession illegal on a national level. The United States Supreme Court has ruled that it is the Federal government that has the right to regulate and criminalize cannabis, even for medical purposes, and thus Federal law criminalizing the use of cannabis preempts state laws that legalize its use. However, the Obama Administration has effectively stated that it is not an efficient use of resources to direct Federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical and recreational cannabis. Yet, there is no guarantee that the Obama Administration will not change its stated policy regarding the low-priority enforcement of Federal laws in states where cannabis has been legalized. Additionally, we face another presidential election cycle in 2016, and a new administration could introduce a less favorable policy or decide to enforce the Federal laws strongly. Any such change in the Federal government's enforcement of Federal laws could cause significant financial damage to us and our shareholders.

Local, state and federal cannabis laws and regulations are constantly changing and they are subject to evolving interpretations. This may be very beneficial for our business, which in part involves us providing services to businesses to help them come into compliance with the laws and regulations. However, it could also require us to incur substantial costs associated with compliance or to alter one or more of our service offerings. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our revenues, profitability, and financial condition.

It is possible that additional Federal or state legislation could be enacted in the future that would prohibit our customers from selling cannabis, and if such legislation were enacted, such customers may discontinue the use of our services, our potential source of customers would be reduced, causing revenues to decline. We cannot predict the nature of any future laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our business.

It is also possible that well established large consulting firms and or traditional established environmental laboratories expand into the cannabis sector. This could hurt the growth of our business and cause our revenues to be lower than we expect.

Our performance may be impacted by general economic conditions and an economic downturn.

Recessionary pressures from an overall decline in U.S. economic activity could adversely impact our results of operations. Economic uncertainty may reduce consumer spending and could result in increased pressure from competitors or customers to reduce the prices of our products and/or limit our ability to increase or maintain prices, which could lower revenues and profitability. Instability in the financial markets may impact our ability or increase the cost to enter into new credit agreements in the future. Additionally, it may weaken the ability of customers, suppliers, distributors, banks, insurance companies and other business partners to perform in the normal course of business, which could expose us to losses or disrupt supply of inputs used to conduct our business. If one or more key business partners fail to perform as expected or contracted, our operating results could be negatively impacted.

We may incur significant future expenses due to the implementation of our business strategy.

We strive to achieve our long-term vision of being a leading marketing researching firm. Such action is subject to the substantial risks, expenses and difficulties frequently encountered in the implementation of a business strategy. If we are unsuccessful in developing, acquiring and/or licensing new products, and increasing sales volume of our existing products, our operating results could be negatively impacted. Even if we are successful, this business strategy may require us to incur substantial additional expenses, including advertising and promotional costs, and integration costs of any future acquisitions. We also may be unsuccessful at integrating any future acquisitions.

As an issuer of "penny stock," the protection provided by the federal securities laws relating to forward looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company's failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

Summary

We believe it is important to communicate our expectations to investors. There may be events in the future, however, that we are unable to predict accurately or over which we have no control. The risk factors listed on the previous pages as well as any cautionary language in this registration statement, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward looking statements. The occurrence of the events our business described in the previous risk factors and elsewhere in this registration statement could negatively impact our business, cash flows, results of operation, prospects, financial condition and stock price.

14

Risks Related to this Offering

Kodiak will pay less than the then-prevailing market price for our common stock.

The common stock to be issued to Kodiak pursuant to the Equity Purchase Agreement will be purchased at a 25% discount to the lowest closing price of the common stock during the five consecutive trading days immediately following the date of our put notice to Kodiak of our election to put shares pursuant to the Equity Purchase Agreement. Kodiak has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Kodiak sells the shares, the price of our common stock could decrease.

If our stock price decreases, Kodiak may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

Your ownership interest may be diluted and the value of our common stock may decline by exercise of the put right pursuant to our Equity Purchase agreement.

Effective July 31, 2015, we entered into a $1,000,000 Equity Purchase Agreement with Kodiak. Pursuant to the Equity Purchase Agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to Kodiak at a price equal to seventy-five percent (75%) of the lowest price of the Company's common stock for the five trading days immediately following the date our put notice is delivered. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We are registering an aggregate of 93,000,000 shares of common stock to be issued under the Equity Purchase Agreement. the sale of such shares could depress the market price of our common stock.

We are registering an aggregate of 93,000,000 Put Shares of common stock under the registration statement of which this prospectus forms a part for issuance pursuant to the Equity Purchase Agreement. Notwithstanding Kodiak's ownership limitation, the 93,000,000 Put Shares would represent approximately 23.27% of our shares of common stock outstanding immediately after our exercise of the put right under the Equity Purchase Agreement, presuming all 93,000,000 are issued at once and that there are no other changes to our issued and outstanding shares. The sale of these Put Shares into the public market by Kodiak could depress the market price of our common stock. At the assumed put price of $0.015 per share, we will be able to receive up to $1,000,000 in gross proceeds pursuant to the Equity Purchase Agreement. In the event that we put the entire 93,000,000 Put Shares to Kodiak and fail to receive $1,000,000 in gross proceeds, we would be required to register additional shares to obtain the balance of $1,000,000 under the Equity Purchase Agreement at the assumed put price of $0.015. Due to the floating put price, we are not able to determine the exact number of shares that we will issue under the Equity Purchase Agreement.

The Company may not have access to the full amount available under the equity agreement.

We have not drawn down funds and have not issued shares of our common stock under the Equity Purchase Agreement with Kodiak. Our ability to draw down funds and sell shares under the Equity Purchase Agreement requires that the registration statement, of which this prospectus is a part, be declared effective by the SEC, and that this registration statement continue to be effective. In addition, the registration statement of which this prospectus is a part registers 93,000,000 shares issuable under the Equity Purchase Agreement, and our ability to access the Equity Purchase Agreement to sell any remaining shares issuable under the Equity Purchase Agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These subsequent registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these subsequent registration statements cannot be assured. The effectiveness of these subsequent registration statements is a condition precedent to our ability to sell the shares of common stock to Kodiak. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the Equity Purchase Agreement to be declared effective by the SEC in a timely manner, we will not be able to sell shares under the Equity Purchase Agreement unless certain other conditions are met. Accordingly, because our ability to draw down amounts under the Equity Purchase Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the $1,000,000 available to us under the Equity Purchase Agreement.

15

Certain restrictions on the extent of puts and the delivery of put notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with the Equity Purchase Agreement, and as such, Kodiak may sell a large number of shares, resulting in substantial dilution to the value of shares held by existing shareholders.

Kodiak has agreed, subject to certain exceptions listed in the Equity Purchase Agreement, to refrain from holding an amount of shares which would result in Kodiak or its affiliates owning more than 9.99% of the then-outstanding shares of the Company's common stock at any one time. These restrictions, however, do not prevent Kodiak from selling shares of common stock received in connection with a put, and then receiving additional shares of common stock in connection with a subsequent put. In this way, Kodiak could sell more than 9.99% of the outstanding common stock in a relatively short time frame while never holding more than 9.99% at one time.

Assuming we utilize the maximum amount available under the equity line of credit, existing shareholders could experience substantial dilution upon the issuance of common stock.

Our Equity Purchase Agreement with Kodiak contemplates the potential future issuance and sale of up to $1,000,000 of our common stock to Kodiak subject to certain restrictions and obligations. The following table is an example of the number of shares that could be issued at various prices assuming we utilize the maximum amount remaining available under the Equity Purchase Agreement. These examples assume issuances at a market price of $0.015 per share and at 10%, 25%, 50%, and 75% below $0.01125 per share, taking into account Kodiak's 25% discount.

The following table should be read in conjunction with the footnotes immediately following the table.

Percent below | Price per | Number of | Shares | Percent of | |||||||||||||

10 | % | $ | 0.010125 | 98,765,432 | 498,370,277 | 20 | % | ||||||||||

25 | % | $ | 0.008438 | 118,518,519 | 518,123,364 | 23 | % | ||||||||||

50 | % | $ | 0.005625 | 177,777,778 | 577,382,623 | 31 | % | ||||||||||

75 | % | $ | 0.002812 | 355,555,556 | 755,160,401 | 47 | % | ||||||||||

_______________

| (1) | Represents purchase prices equal to 75% of $0.045 and potential reductions thereof of 10%, 25%, 50% and 75%. | |

| (2) | Represents the number of shares issuable if the entire $1,000,000 under the Equity Purchase Agreement were drawn down at the indicated purchase prices. Our Articles of Incorporation currently authorizes 750,000,000 shares of common stock. | |

| (3) | Based on 399,042,345 shares of common stock outstanding at October 27, 2015. Our Articles of Incorporation currently authorizes 750,000,000 shares of common stock. We may in the future need to amend our Articles of Incorporation in order to increase our authorized shares of common stock. | |

| (4) | Percentage of the total outstanding shares of common stock after the issuance of the shares indicated, without considering any contractual restriction on the number of shares the Selling Security Holder may own at any point in time or other restrictions on the number of shares we may issue. | |

| (5) | We have agreed to indemnify certain of Kodiak, or their transferees or assignees, against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments the selling stockholder or their respective pledgees, donees, transferees or other successors in interest, may be required to make in respect of such liabilities |

| 16 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information included or incorporated by reference in this prospectus may contain forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words "may," "should," "expect," "anticipate," "estimate," "believe," "intend" or "project" or the negative of these words or other variations on these words or comparable terminology. The forward-looking statements contained in this report are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties' control) or other assumptions.

Item 4. Use of Proceeds

USE OF PROCEEDS

The Selling Security Holder is selling all of the shares of our common stock covered by this prospectus for its own account. Accordingly, we will not receive any proceeds from the resale of our common stock. However, we will receive proceeds from any sale of the common stock to Kodiak under the Equity Purchase Agreement, up to $1,000,000. We intend to use the net proceeds for the following $450K for analytical testing equipment, $200K to relocate to new laboratory, $185K for sales and marketing, and $165K for office and administration

The allocation of the use of proceeds from the sale of shares to Kodiak represents management's best estimates based on the current status of the Company's proposed operations, plans, investment objectives, capital requirements, and financial conditions. Future events, including changes in economic or competitive conditions of our business plan or the completion of less than the total Offering, may cause the Company to modify the above-described allocation of proceeds. The Company's use of proceeds may vary significantly in the event any of the Company's assumptions prove inaccurate. We reserve the right to change the allocation of net proceeds from the offering as unanticipated events or opportunities arise.

Item 5. Determination of Offering Price

DETERMINATION OF OFFERING PRICE

Our common stock currently trades on the OTC Markets under the symbol "SGBY". The proposed offering price of the Shares is $0.015 and has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c) of the Securities Act of 1933, on the basis of the average of the high and low transaction prices of the common stock of the Company as reported on the OTC Markets on October 27, 2015. The Selling Security Holder shall offer shares through the open market or at privately negotiated prices.

Item 6. Dilution

DILUTION

We are not offering any shares in this registration statement. All shares are being registered on behalf of the Selling Security Holder.However, because we must issue new Put Shares to Kodiak in order for it to sell them pursuant to the registration statement of which this prospectus is a part, if you invest in our securities, your interest may nonetheless be immediately and substantially diluted to the extent of the difference between the public offering price per share of our common stock and the pro forma net tangible book value per share of our common stock after giving effect to this offering.

17

Our net tangible book value as of June 30, 2015 was $60,952, or approximately $0.00015275 per share. Net tangible book value per share represents our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding. Net tangible book value dilution per share of common stock to new investors represents the difference between the amount per share paid by purchasers in this offering and the as adjusted net tangible book value per share of common stock immediately after completion of this offering. After giving effect to our sale the maximum of 93,000,000 shares of common stock to the Selling Security Holder pursuant to the Equity Purchase Agreement, and after estimated offering expenses, our as-adjusted net tangible book value as of June 30, 2015 would have been $1,050,952, or $0.00215120 per share. This represents an immediate increase in net tangible book value of $0.00199845 per share to existing stockholders and an immediate dilution in net tangible book value of $0.0128488 per share to investors of this offering, assuming an offering price to the public of $0.015 per share, as illustrated in the following table:

Public offering price per share |

| $ | 0.015 |

|

Net tangible book value per share as of June 30, 2015 |

| $ | 0.00015275 |

|

Increase in net tangible book value per share attributable to Kodiak investment |

| $ | 0.00199845 |

|

Adjusted net tangible book value per share as of June 30, 2015 |

| $ | 0.00215120 |

|

Dilution per share to new investors in the offering |

| $ | 0.0128488 |

|

Item 7. Selling Security Holders

SELLING SECURITY HOLDER

Pursuant to the Equity Purchase Agreement, we may cause the Selling Security Holder to purchase up to $1,000,000 worth of our common stock, calculated at a purchase price equal to seventy-five percent (75%) of the lowest closing price of the Company's common stock for the five trading days immediately following the date on which the Company is deemed to have provided a put notice under the Equity Purchase Agreement.

We may draw on the facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Equity Purchase Agreement.

Selling Security Holder Pursuant to the Equity Purchase Agreement

The 93,000,000 Shares offered in this prospectus are based on the Equity Purchase Agreement between Selling Shareholder and us. Kodiak may from time to time offer and sell any or all of the Shares that are registered under this prospectus.

We are unable to determine the exact number of Shares that will actually be sold by Kodiak according to this prospectus due to:

● | the ability of Kodiak to determine when and whether it will sell any of the Shares under this prospectus; and | |

● | the uncertainty as to the number of Shares that will be issued upon exercise of our put options through the delivery of a put notice under the Equity Purchase Agreement. |

The following information contains a description of how Kodiak acquired (or shall acquire) the shares to be sold in this offering. Kodiak has not held a position or office, or had any other material relationship with us in the past three years, except as follows.

Kodiak is a limited liability company organized and existing under the laws of the Cayman Islands. Kodiak acquired, or will acquire, all shares being registered in this offering pursuant to the Equity Purchase Agreement with us.

18

Kodiak intends to initially sell up to 93,000,000 Shares of our common stock acquired pursuant to the Equity Purchase Agreement under this prospectus. On July 31, 2015, the Company and Kodiak entered into the Equity Purchase Agreement pursuant to which we have the option, until December 31, 2016, to sell shares of our common stock to Kodiak for a total price of $1,000,000. For each share of our common stock purchased under the Equity Purchase Agreement, Kodiak will pay seventy-five percent (75%) of the lowest closing price of the Company's common stock for the five trading days immediately following the date on which the Company is deemed to provide a put notice of a sale of common stock under the Equity Purchase Agreement.

We have relied and will rely on exemptions from the registration requirements of the Securities Act and "blue sky" laws to issue shares to Kodiak. Kodiak is an "accredited investor" and/or qualified institutional buyer and Kodiak has access to information about the Company and its investment.

At an assumed purchase price under the Equity Purchase Agreement of $0.01125 (equal to 75% of the closing bid price of our common stock of $0.015 on October 27, 2015), if we raise the entire $1,000,000 in gross proceeds from the sale of Put Shares to Kodiak, we will have issued Kodiak 88,888,889 shares. This is in addition to its initial 3,500,000 shares already issued pursuant to the Equity Purchase Agreement, for a total of 92,388,889 shares. We are registering a total of 93,000,000 shares to account for potential future issuances required as a result of a declining stock price. In the event that we sell the entire 89,500,000 shares registered hereby but not currently held by Kodiak and fail to receive $1,000,000 in gross proceeds, we would be required to register additional shares to obtain the balance of the $1,000,000 committed under the Equity Purchase Agreement. Pursuant to the Equity Purchase Agreement, the Company may not put shares to Kodiak if such issuance would result in Kodiak or its affiliates owning more than 9.99% of the then-outstanding shares of the Company's common stock at any one time.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the Equity Purchase Agreement. These risks include dilution of stockholders' interests and significant decline in our stock price.

Kodiak will periodically purchase shares of our common stock under the Equity Purchase Agreement and will, in turn, sell such shares to investors in the market at the prevailing market price. This may cause our stock price to decline, which will require us to issue increasing numbers of shares to Kodiak to raise the same amount of funds, as our stock price declines.

Kodiak and any participating broker-dealers are "underwriters" within the meaning of the Securities Act. All expenses incurred with respect to the registration of the common stock will be borne by us, but we will not be obligated to pay any underwriting fees, discounts, commission or other expenses incurred by the Selling Security Holder in connection with the sale of such shares.

The following table sets forth the name of the Selling Security Holder, the number of shares of common stock beneficially owned by the Selling Security Holder as of the date hereof and the number of share of common stock being offered by the Selling Security Holder. The shares being offered hereby are being registered to permit public secondary trading, and the Selling Security Holder may offer all or part of the shares for resale from time to time. However, the Selling Security Holder is under no obligation to sell all or any portion of such shares nor is the Selling Security Holder obligated to sell any shares immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the Selling Security Holder. The column entitled "Amount Beneficially Owned After the Offering" assumes the sale of all shares offered. The 89,500,000 shares of the 93,000,000 shares we are registering are not currently owned by Kodiak but are being included in the calculation of beneficial ownership for the Selling Security Holder since Kodiak could acquire all such shares within the next 60 days (not accounting for the 9.99% stock ownership limitations contained in the Equity Purchase Agreement).

Name |

| Shares Beneficially Owned Prior |

|

| Shares to be |

|

| Amount Beneficially Owned After Offering |

|

| Percent Beneficially Owned After Offering |

| ||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Kodiak Capital Group, LLC |

|

| 93,000,000 |

|

|

| 93,000,000 |

|

|

| 0 |

|

|

| 0 | % |

| 19 |

Item 8. Plan of Distribution

PLAN OF DISTRIBUTION

This prospectus relates to the resale of up to 93,000,000 Shares issued or to be issued to the Selling Security Holder pursuant to the Equity Purchase Agreement.

The Selling Security Holder may, from time to time, sell any or all of their shares of our common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. The Selling Security Holder may use any one or more of the following methods when selling shares:

● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

● | block trades in which the broker-dealer will sell the shares as agent; | |

● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

● | privately negotiated transactions; | |

● | broker-dealers may agree with the Selling Security Holder to sell a specified number of such shares at a stipulated price per share; | |

● | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

● | any other method permitted pursuant to applicable law, or | |

● | a combination of any such methods of sale. |