Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - Health-Right Discoveries, Inc. | s102086_ex5-1.htm |

| EX-10.1 - EXHIBIT 10.1 - Health-Right Discoveries, Inc. | s102086_ex10-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Health-Right Discoveries, Inc. | s102086_ex23-1.htm |

As filed with the Securities and Exchange Commission on October 30, 2015

Registration No. 333-206839

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HEALTH-RIGHT DISCOVERIES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 2834 | 45-3588650 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

18851 NE 29th Avenue, Suite 700

Aventura, Florida 33180

(305) 705-3247

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive officer)

David Hopkins

President

18851 NE 29th Avenue, Suite 700

Aventura, Florida 33180

(305) 705-3247

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Dale S. Bergman, Esq.

Gutierrez Bergman Boulris, P.L.L.C.

100 Almeria Avenue, Suite 340

Coral Gables, Florida 33134

(305) 358-5100

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

|

(Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

Title of each class of Securities to be Registered(1) |

Amount to be Registered |

Proposed Maximum Offering Price Per Share(2)(3) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||||||||||

| Common stock, par value $0.001 per share | 5,309,152 | $ | 0.25 | $ | 1,327,288 | $ | 133.71 | (4) | ||||||||

(1) This registration statement covers the resale by our selling shareholders of up to 5,309,152 shares of common stock previously issued to such selling shareholders.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457. The proposed maximum offering price is based on the estimated high end of the range at which the common stock will initially be sold.

(3) The selling shareholders will offer their shares at $0.25 per share until the Company’s shares are quoted on the OTCQX or the OTCQB operated by OTC Markets Group and, assuming we secure this qualification, thereafter at prevailing market prices or privately negotiated prices.

(4) Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities nor may offers to buy these securities be accepted until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 30, 2015

PROSPECTUS

HEALTH-RIGHT DISCOVERIES, INC.

5,309,152 Shares of Common Stock

The selling shareholders named in this prospectus are offering up to 5,309,152 shares of common stock through this prospectus. We will not receive any proceeds from this offering and have not made any arrangements for the sale of these securities.

Our common stock is presently not traded on any market or securities exchange. Given the foregoing, the selling shareholders will offer their shares at $0.25 per share until the shares are quoted on the OTCQX or the OTCQB operated by OTC Markets Group. Although we intend to apply for quotation of our common stock on the OTCQX or the OTCQB operated by OTC Markets Group, we may not secure this qualification and even if we do an active public market for our common stock may never materialize. If we secure this qualification, the sale price to the public of the shares registered hereunder will be at prevailing market prices or privately negotiated prices.

The Company is an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (the “Jobs Act”) and as such, may elect to comply with certain reduced public company reporting requirements for future filings.

The purchase of the shares of common stock offered through this prospectus involves a high degree of risk. See the section of this prospectus entitled “Risk Factors” beginning at page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is ____________, 2015

TABLE OF CONTENTS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using the SEC’s registration rules for a delayed or continuous offering and sale of securities. Under the registration rules, using this prospectus and, if required, one or more prospectus supplements, the selling shareholders named herein may distribute the shares of common stock covered by this prospectus. This prospectus also covers any shares of common stock that may become issuable as a result of stock splits, stock dividends or similar transactions. A prospectus supplement may add, update or change information contained in this prospectus.

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless when the time of delivery of this prospectus or the sale of any common stock. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, our common stock in any jurisdiction in which the offer or sale is not permitted.

| 1 |

This summary provides an overview of all material information contained in this prospectus. It does not contain all the information you should consider before making a decision to purchase the shares our selling shareholders are offering. You should very carefully and thoroughly read the more detailed information in this prospectus and review our financial statements and all other information that is incorporated by reference in this prospectus.

Unless the context otherwise requires, references in this prospectus to “HRD,” “Health-Right,” “the Company,” “we,” “our” and “us” refers to Health-Right Discoveries, Inc. All share and per share information in this prospectus has been adjusted to give retroactive effect to a two-for-one stock split implemented in November 2014.

Overview

Health-Right is a natural biotech company that combines science and nutrition to develop branded ingredients, formulations and products that seek to provide a better quality of life for consumers who primarily suffer from stress-induced viruses and diseases. These formulations and products are developed naturally, by utilizing and scientifically combining various ingredients to help positively influence the interrelationship between stress and the immune system. The Company is planning to explore the application of its formulation platform to include cannabidiol (“CBD”) derived from industrial hemp. CBD, which is a cannabis-derived compound that may offer some of the benefits of medical marijuana without the side effects (i.e. the feeling of being “high” that comes from other cannabis compounds such as THC). The Company’s efforts in this regard will be dependent upon the U.S. Food and Drug Administration (“FDA”) clarifying its position with respect to the classification of hemp-derived CBD as a dietary supplement and an ingredient deemed to be Generally Described as Safe (“GRAS’), as opposed to cannabis-derived CBD, which is not so classified (the FDA has not as yet differentiated hemp-derived CBD from cannabis-derived CBD).

The Company believes the formulation platform it has developed in order to help address the negative nutritional interrelationship between stress, a weakened immune system and certain conditions and diseases is now in place. At the end of 2014, Health-Right completed initial test-marketing of Advanced H-Plex Defense Formula 11, its first product (“H-Plex Defense”), an all-natural dietary supplement whose formulation seeks to address less than optimal nutrition and nutritional deficiencies to aid persons afflicted with Herpes Simplex Virus 1 (“HSV-1”). Based on customer feedback, including a reorder rate exceeding industry norms, HRD believes that it has developed an alternative approach to help counteract and improve the causes/triggers of HSV-1, a virus that affects over an estimated 100 million people in the U.S. alone with symptoms including tingling, itching, blisters, sores and rashes with an estimated $5 billion marketplace for treatments by 2017, according to Global Industry Analysts, Inc.

Notwithstanding the foregoing, the Company has not conducted formal clinical trials of H-Plex Defense. Subject to receipt of necessary funding, the Company intends to do so, utilizing the services of Miami Research Associates (“MRA”), one of the largest, multi-special clinical research centers in the United States. Management has had multiple meetings and discussion with MRA and has negotiated Protocol Development Agreement for clinical trials, the finalization and execution of which is subject to receipt of necessary funding.

We believe that Health-Right is uniquely positioned because its approach of not just responding to stress induced conditions and diseases, but proactively addressing stress-induced problems before they wreak havoc on multiple body systems. The Company’s research, formulation and nutritional theories offer wide ranging potential because we believe that our formulation platform has the potential to be successfully applied In the prescription nutritional/medical foods, OTC monograph drug and all-natural dietary supplement/nutraceutical arenas. HRD anticipates that it will be able to leverage the results of its planned clinical trials in order to market ingredients, branded ingredients, private label ingredients and finished products. We also believe that we will be positioned to license our formulations to strategic partners in order to expedite and achieve product commercialization and cross-promotion.

In addition to its initial product, the Company plans to focus its efforts on areas where it believes that HRD can commercialize and market products on an expedited basis. We believe that are other potential applications for our formulations that we have in the pipeline, including all-natural products designed to relieve symptoms associated with:

| · | compromised immune systems and related muscle and joint pain; |

| · | the common cold and flu viruses; and |

| · | constipation resulting from prescription medications. |

By adapting its formulation platform to applications such as these, the Company believes that it will be able to generate revenues in the short term in the following markets:

| · | the Over-the-Counter (“OTC”) monograph drug industry; |

| · | the prescription nutritional marketplace; and |

| · | the natural products space. |

| 2 |

The Company intends to use its contacts in the healthcare, medical foods and natural products industries to market and sell its proposed products either directly or through strategic partners and licensees.

To date, the Company has generated limited revenues and has operated with limited capital. The Company will require significant capital to implement its business plan. There can be no assurance that the Company can raise the necessary funds, on favorable terms or otherwise. Failure to obtain sufficient capital will substantially harm the Company’s prospects.

Corporate Information

The Company was incorporated in the state of Florida on October 11, 2011 under the name “Four Plex Partners, Inc.” and changed its name to “Health-Right Discoveries, Inc.” on March 22, 2012.

Our executive offices are located at 18851 NE 29th Avenue, Suite 700, Aventura, Florida 33180 and our telephone number is (305) 705-3247. Our corporate website is www.health-right.com. Information appearing on our corporate website is not part of this prospectus.

Selling Shareholders

The Company previously sold or issued an aggregate of 17,133,332 shares of common stock to its founders, investors in private transactions (the “Private Placements”) and service providers.

The Company issued an aggregate of 14,133,332 shares of common stock to its founders from inception to June 30, 2015 for capital contributions of $25,000 and for services rendered to the Company, including 6,766,666 shares to David Hopkins, 6,366,666 shares to James Pande and 1,000,000 shares to Michael Fabiano. Mr. Hopkins subsequently gifted 950,000 of the shares of common stock held by him to five non-affiliated parties in October and December 2013 and transferred 153,156 shares to one party in March 2015 a private transaction in satisfaction of obligations owed to it by Mr. Hopkins. The resale of 3,257,574 shares of common stock currently held by our founders and 551,578 of the 1,103,156 shares of common stock transferred by Mr. Hopkins to third parties is covered by this prospectus.

In the Private Placements which were conducted from December 2011 to September 2012, the Company sold an aggregate of 1,350,000 shares of common stock to seven investors from inception to June 30, 2015, which sales generated gross proceeds of $165,000. The resale of 675,000 of these shares is covered by this prospectus.

We have also issued an additional 1,650,000 shares of common stock to third party service providers for legal and other business services. The resale of 825,000 of these shares is covered by this prospectus.

The Offering

This prospectus relates to the resale from time to time by the selling shareholders identified in this prospectus of 5,309,152 shares of our common stock, par value $0.001 per share. No shares are being offered for sale by the Company.

| Common stock offered by selling shareholders: | 5,309,172 shares of common stock. |

| Common stock outstanding on October 30, 2015: | 17,133,332 shares of common stock (1). |

| Terms of the Offering: | The selling shareholders will determine when and how they will sell the shares of common stock offered in this prospectus. |

| Use of proceeds: | We will not receive any proceeds from the sale of the shares of common stock offered by the selling shareholders under this prospectus. |

| Risk factors: | The common stock offered hereby involves a high degree of risk and should not be purchase by investors who cannot afford the loss of their entire investment. |

(1) Does not include 3,000,000 shares of our common stock reserved for issuance under our 2015 Stock Incentive Plan.

| 3 |

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the Financial Statements and Notes thereto, included elsewhere in this prospectus.

| For the Years Ended December 31, | For the Six Months Ended June 30, | |||||||||||||||

| Statement Of Operations | 2014 | 2013 | 2015 | 2014 | ||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Revenues | $ | 59,811 | $ | 12,724 | $ | 13,581 | $ | 26,199 | ||||||||

| Cost of Sales | $ | 10,276 | $ | 11,424 | $ | 2,664 | $ | 4,380 | ||||||||

| Other Selling, General and Interest Expenses | $ | 241,114 | $ | 340,977 | $ | 38,740 | $ | 75,490 | ||||||||

| Net Loss | $ | (191,579 | ) | $ | (339,677 | ) | $ | (27,823 | ) | $ | (53,671 | ) | ||||

| As of | ||||||||

| December 31, 2014 | June 30, 2015 | |||||||

| Balance Sheet Data | (Unaudited) | |||||||

| Cash | $ | 609 | $ | 748 | ||||

| Total Assets | $ | 1,822 | $ | 5,413 | ||||

| Total Liabilities | $ | 201,133 | $ | 231,147 | ||||

| Total Stockholders’ Deficiency | $ | (199,311 | ) | $ | (226,134 | ) | ||

| 4 |

The shares of our common stock being offered for resale by the selling shareholders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risks described below and the other information in this process before investing in our common stock.

We are an early stage company with a limited operating history.

The Company was incorporated in 2011, is an early stage company and has generated only limited revenues to date, with its primary focus being applying its limited capital resources in large part to product development activities. It is subject to all the problems, expenses, difficulties, complications and delays encountered in establishing a new business. The Company does not know if it will become commercially viable and ever generate significant revenues or operate at a profit.

The Company will require additional financing to become commercially viable.

To date, the Company has funded its development activities primarily through the Private Placements, which have generated approximately $165,000 and from inception in 2011 through June 30, 2015, respectively, $25,000 in capital contributions from principal shareholders and additional loans from principal shareholders. The Company will require additional financing to complete development of, commercially launch and market its planned products. The Company incurred net losses of $191,579 and $339,677 for the years ended December 31, 2014 and 2013, respectively and $27,823 and $53,671 for the six months ended June 30, 2015 and 2014, respectively. Moreover, as of June 30, 2015, we had a total shareholders’ deficiency of $226,134. Our independent auditors report for the year ended December 31, 2014 includes an explanatory paragraph stating that our lack of revenues and working capital raise substantial doubt about our ability to continue as a growing concern. While we are seeking to raise additional financing through additional securities offerings, there can be no assurance that additional financing will be available to the Company when needed, on favorable terms or otherwise. Moreover, any such additional financing may dilute the interests of purchasers of the shares offered hereby. The absence of additional financing, when needed, could cause the Company to delay implementation of its business plan in whole or in part, curtail its business activities and seriously harm the Company and its prospects.

Our success will be dependent in part on our ability to successfully develop, commercialize and market a portfolio of products utilizing our formulation platform and market acceptance of our planned products.

To date, we have only developed and test marketed our initial product H-Plex Defense. Our ultimate success will be dependent in part on our ability to successfully develop, commercialize and market a portfolio of products utilizing our formulation platform. In addition, market acceptance by and demand for our planned products from consumers will also be key factors in our ability to succeed. If we are unable to develop, commercialize and market our portfolio of planned products or if they are not accepted by consumers, our business and financial condition could be seriously harmed.

We will be dependent on third parties to help formulate and manufacture our planned products.

We intend to enter into agreements with third parties to assist in the formulation of and manufacture our planned products, including furnishing the necessary ingredients. While Health-Right believes that there are multiple firms who can provide such services, we have not entered into formal agreements with any such third parties. Should we not be able to do so on commercially reasonable terms or if subsequent to doing so, a good relationship with our formulation and manufacturing partners is not maintained or the supply of ingredients is interrupted, our business may be significantly harmed.

We have not undertaken any significant marketing efforts and we have only limited marketing experience.

As we are in the development stage, we have not undertaken any significant marketing efforts for our planned products beyond our initial trial marketing of H-Plex Defense. Moreover, we have only limited marketing experience and will likely rely on third parties to assist with product marketing. Accordingly, there is no assurance that any marketing strategy we develop can be successfully implemented or if implemented, that it will result in significant sales of our planned portfolio of products.

| 5 |

As we develop and commercialize our planned product portfolio, we may be increasingly subject to government regulation.

Although we do not anticipate that our planned products will be subject to the lengthy and costly FDA application processes for new drug approvals, we will be subject to some degree of regulation depending on the intended applications and markets our planned products. For example, our ability to manufacture and market products containing hemp-derived CBD will be dependent upon the FDA clarifying its classification of CBD, so that hemp-derived CBD (as opposed to cannabis-derived CBD), is classified as a dietary supplement and deemed to be an ingredient which is GRAS by the FDA (the FDA has not as yet differentiated hemp-derived CBD from cannabis-derived CBD, which is not classified as GRAS). All of our products will need to be manufactured in facilities that comply with current Good Manufacturing Processes (“cGMP”) as promulgated by the FDA from time to time. In addition, even though are planned products are expected to contain ingredients which are deemed to be GRAS by the FDA; we may need to conduct clinical trials to support our claims of efficacy. Moreover, we will be subject to various labeling requirements and registration requirements, such as securing a National Drug Code (“NDC”) for products we develop which are intended to be eligible for insurance reimbursement, such as those for the prescription nutritional marketplace. There can also be no assurance that future regulatory changes will be implemented and if implemented that we will be able to comply with such future regulations, at commercially reasonable cost, if at all.

As we develop and commercialize our planned products, we may become subject to risks entailed in securing reimbursement from private and public insurance plans.

To the extent that we formulate and commercialize products that may be eligible for insurance reimbursement, such as products for the prescription nutritional marketplace, we will be subject to various requirements in order to obtain reimbursement from private insurance or public insurance, such as Medicare and Medicaid. There is no certainty that we will be able to secure and maintain these requirements for insurance reimbursement. If we do not do so, we may not be able to successfully market these products and generate revenues therefrom. Even if we do so, revenues generated from these products will be subject to potential delays in receiving reimbursement payments from insurers.

Our business plan depends on our intellectual property rights and if we are unable to protect them, our competitive position may suffer.

Our business plan is predicated on part on our intellectual property rights, including our proprietary formulation platform and individual product formulations. Accordingly, protecting our intellectual property rights is critical to our continued success and our ability to maintain our competitive position. We protect our proprietary rights through a combination of trade secret and copyright law, confidentiality agreements and technical measures. We generally enter into non-disclosure agreements with our consultants and limit access to our trade secrets. We cannot assure you that the steps we have taken will prevent misappropriation of our proprietary property. Misappropriation of our intellectual property would have an adverse effect on our competitive position. In addition, we may have to engage in litigation in the future to enforce or protect our intellectual property rights or to defend against claims of invalidity, and we may incur substantial costs and the diversion of management’s time and attention as a result.

If we are deemed to infringe on the proprietary rights of third parties, we could incur unanticipated expense and be prevented from providing our planned products.

We could be subject to intellectual property infringement claims as the number of our competitors grows and our products overlap with competitive products. While we do not believe that we have infringed or are infringing on any proprietary rights of third parties, we cannot assure you that infringement claims will not be asserted against us or that those claims will be unsuccessful. We could incur substantial costs and diversion of management resources defending any infringement claims whether or not such claims are ultimately successful. Furthermore, a party making a claim against us could secure a judgment awarding substantial damages, as well as injunctive or other equitable relief that could effectively block our ability to provide products or services. In addition, we cannot assure you that licenses for any intellectual property of third parties that might be required for our products or services will be available on commercially reasonable terms, or at all.

The Company will face significant competition.

The markets for natural biotechnology products are and will continue to be highly competitive. The Company will face significant competition from other companies who are developing, commercializing and marketing competitive products, as well as those who may elect to do so in the future. Some of these competitors or potential competitors have greater experience, more extensive industry contacts and greater financial resources than the Company. There can be no assurance that the Company can effectively compete.

We currently rely on our President and his loss could have an adverse effect on the Company.

Until we build up our management infrastructure, our success depends upon our President, who is our sole executive officer. The loss of his services would currently have a material adverse effect on HRD. We are not party to an employment agreement with our President and do not anticipate having key man insurance in place on him in the foreseeable future.

| 6 |

The Company’s success will be dependent in part upon its ability to attract qualified personnel and consultants.

The Company’s success will be dependent in part upon its ability to attract qualified management, administrative, product development and marketing and sales personnel and consultants. The inability to do so on favorable terms may harm the Company’s proposed business.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934 that will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit.

Following the effective date of our registration statement of which this prospectus is a part, we will be required to file periodic reports with the SEC pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted at this time because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and will have a major effect on the amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Rule 13a-15(f) under the Exchange Act, internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| · | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| · | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| · | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. |

We will be required to include a report of management on the effectiveness of our internal control over financial reporting. We expect to incur additional expenses and diversion of management’s time as a result of performing the system and process evaluation, testing and remediation required in order to comply with the management certification requirements.

We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our testing, we may identify other deficiencies that we may not be able to timely remediate. In addition, if we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act (“Sarbanes-Oxley”). Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

| 7 |

The Jobs Act has reduced the information that the Company is required to disclose, which could adversely affect the price of the common stock.

Under the Jobs Act, the information that the Company will be required to disclose has been reduced in a number of ways.

Before the adoption of the Jobs Act, the Company was required to register the common stock under the Exchange Act within 120 days after the last day of the first fiscal year in which the Company had total assets exceeding $1,000,000 and 500 record holders of the common stock; the Jobs Act has changed this requirement such that the Company must register the common stock under the Exchange Act within 120 days after the last day of the first fiscal year in which the Company has total assets exceeding $10,000,000 and 2,000 record holders or 500 record holders who are not “accredited investors.” As a result, the Company is now required to register the Common Stock under the Exchange Act substantially later than previously.

As a company that had gross revenues of less than $1 billion during the Company’s last fiscal year, the Company is an “emerging growth company,” as defined in the Jobs Act (an “EGC”). The Company will retain that status until the earliest of (a) the last day of the fiscal year which the Company has total annual gross revenues of $1,000,000,000 (as indexed for inflation in the manner set forth in the Jobs Act) or more; (b) the last day of the fiscal year of following the fifth anniversary of the date of the first sale of the common stock pursuant to an effective registration statement under the Securities Act; (c) the date on which the Company has, during the previous three year period, issued more than $1,000,000,000 in non-convertible debt; or (d) the date on which the Company is deemed to be a “large accelerated filer,” as defined in Rule 12b-2 under the Exchange Act or any successor thereto. As an EGC, the Company is relieved from the following:

| • | The Company is excluded from Section 404(b) of Sarbanes-Oxley, which otherwise would have required the Company’s auditors to attest to and report on the Company’s internal control over financial reporting. The JOBS Act also amended Section 103(a)(3) of Sarbanes-Oxley to provide that (i) any new rules that may be adopted by the PCAOB requiring mandatory audit firm rotation or changes to the auditor’s report to include auditor discussion and analysis (each of which is currently under consideration by the PCAOB) shall not apply to an audit of an EGC; and (ii) any other future rules adopted by the PCAOB will not apply to the Company’s audits unless the SEC determines otherwise. |

| • | The Jobs Act amended Section 7(a) of the Securities Act to provide that the Company need not present more than two years of audited financial statements in an initial public offering registration statement and in any other registration statement, need not present selected financial data pursuant to Item 301 of Regulation S-K for any period prior to the earliest audited period presented in connection with such initial public offering. In addition, the Company is not required to comply with any new or revised financial accounting standard until such date as a private company (i.e., a company that is not an “issuer” as defined by Section 2(a) of Sarbanes-Oxley) is required to comply with such new or revised accounting standard. Corresponding changes have been made to the Exchange Act, which relates to periodic reporting requirements, which would be applicable if the Company were required to comply with them. |

| • | As long as the Company is an EGC, the Company may comply with Item 402 of Regulation S-K, which requires extensive quantitative and qualitative disclosure regarding executive compensation, by disclosing the more limited information required of a “smaller reporting company.” |

| • | In the event that the Company registers the common stock under the Exchange Act as it intends to do, the Jobs Act will also exempt the Company from the following additional compensation-related disclosure provisions that were imposed on U.S. public companies pursuant to the Dodd-Frank Act: (i) the advisory vote on executive compensation required by Section 14A(a) of the Exchange Act; (ii) the requirements of Section 14A(b) of the Exchange Act relating to shareholder advisory votes on “golden parachute” compensation; (iii) the requirements of Section 14(i) of the Exchange Act as to disclosure relating to the relationship between executive compensation and our financial performance; and (iv) the requirement of Section 953(b)(1)of the Dodd-Frank Act, which requires disclosure as to the relationship between the compensation of the Company’s chief executive officer and median employee pay. |

Since the Company is not required, among other things, to file reports under Section 13 of the Exchange Act or to comply with the proxy requirements of Section 14 of the Exchange Act until such registration occurs or to comply with certain provisions of Sarbanes-Oxley and the Dodd-Frank Act and certain provisions and reporting requirements of or under the Securities Act and the Exchange Act or to comply with new or revised financial accounting standards as long as the Company is an EGC, and the Company’s officers, directors and 10% shareholders are not required to file reports under Section 16(a) of the Exchange Act until such registration occurs, the Jobs Act has had the effect of reducing the amount of information that the Company and its officers, directors and 10% shareholders are required to provide for the foreseeable future.

As a result of such reduced disclosure, the price for the Common Stock may be adversely affected.

| 8 |

The costs of being a public company could result in us being unable to continue as a going concern.

As a public company, we will have to comply with numerous financial reporting and legal requirements, including those pertaining to audits and internal control. The costs of this compliance could be significant. If our revenues do not increase and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs in the normal course of business which would result in our being unable to continue as a going concern.

Our Articles of Incorporation and By Laws provide for indemnification of officers and directors at our expense and limit their liability that may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our Articles of Incorporation and Bylaws provide for the indemnification of our officers and directors. We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act of 1933 (the “Securities Act”) and is, therefore, unenforceable.

The offering price of the shares has been arbitrarily determined by the Company.

The offering price of the shares has been arbitrarily determined by the Company and bears no relationship to the Company’s assets, book value, potential earnings or any other recognized criterion of value.

Currently, there is no public market for our securities, and we cannot assure you that any public market will ever develop and it is likely to be subject to significant price fluctuations.

Currently, there is no public market for our common stock and our common stock may never be traded on any exchange, or, if traded, a public market may not materialize. Even if we are successful in developing a public market, there may not be enough liquidity in such market to enable shareholders to sell their stock.

Our common stock is unlikely to be followed by any market analysts, and there may be few or no institutions acting as market makers for the common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of the Company, and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

| 9 |

If a trading market should develop for our common stock, it is likely that it will initially be deemed to be a “penny stock.” Therefore, trading of our common stock may be restricted by the SEC’s penny stock regulations and FINRA’s sales practice requirements, which may limit a shareholder’s ability to buy and sell our common stock.

In addition to the “penny stock” rules promulgated by the SEC, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

The market for penny stocks has experienced numerous frauds and abuses that could adversely impact investors in our stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| · | Control of the market for the security by one or a few broker-dealers that are often related to a promoter or issuer; |

| · | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| · | “Boiler room” practices involving high pressure sales tactics and unrealistic price projections by sales persons; |

| · | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| · | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

Any trading market that may develop for our common stock may be restricted by virtue of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

There is currently no established public market for our common stock, and there can be no assurance that any established public market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities laws and regulations promulgated by various states and foreign jurisdictions, commonly referred to as “blue sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities being registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares, and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our common stock. We currently do not intend to and may not be able to qualify securities for resale in a number of states that do not offer manual exemptions and require shares to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be a limited one.

Our board of directors has the authority, without shareholder approval, to issue preferred stock with terms that may not be beneficial to common shareholders and with the ability to affect adversely shareholder voting power and perpetuate their control over us.

Our Amended and Restated Articles of Incorporation allows us to issue shares of preferred stock without any vote or further action by our shareholders. Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock.

The ability of our executive officers and directors, who are our principal shareholders, to control our business may limit or eliminate minority shareholders’ ability to influence corporate affairs.

Our executive officers and directors, who are our principal shareholders, own and assuming the sale of the shares registered by them hereunder as selling shareholders, will continue to own a majority of our issued and outstanding common stock. Accordingly, they will be able to effectively control the election of directors, as well as all other matters requiring shareholder approval. The interests of our principal shareholders may differ from the interests of other shareholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of other directors and other business decisions. The minority shareholders have no way of overriding decisions made by our principal shareholders. This level of control may also have an adverse impact on the market value of our shares because our principal shareholders may institute or undertake transactions, policies or programs that result in losses may not take any steps to increase our visibility in the financial community and / or may sell sufficient numbers of shares to significantly decrease our price per share.

| 10 |

We do not expect to pay cash dividends in the foreseeable future.

We have never paid cash dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our shareholders have limited protection against interested director transactions, conflicts of interest and similar matters.

Sarbanes-Oxley, as well as rule changes proposed and enacted by the SEC, the New York Stock Exchange/NYSE/AMEX and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with voluntary compliance, we have not yet adopted these measures.

We do not currently have independent audit or compensation committees. As a result, directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest, if any, and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations as a result thereof.

We intend to comply with all corporate governance measures relating to director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley enactment of Sarbanes-Oxley has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders. We have agreed to bear the expenses (other than any underwriting discounts or commissions or broker’s commissions) in connection with the registration of the common stock being offered hereby by the selling shareholders.

| 11 |

DETERMINATION OF OFFERING PRICE

All shares being offered will be sold by selling shareholders without our involvement, consequently the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

This prospectus covers the resale from time to time by the selling shareholders identified in the table below of up to 5,309,152 shares of our common stock, which were issued in various transactions exempt from registration under the Securities Act. We are registering the shares to permit the selling shareholders and any of their pledgees, donees, transferees, assignees and successors-in-interest to, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions when and as they deem appropriate in the manner described in “Plan of Distribution.” As of the date of this prospectus there are 17,133,332 shares of our common stock issued and outstanding.

The following table sets forth, as of the date of this prospectus, the name of each selling shareholder, the number and percentage of shares of our common stock beneficially owned by each selling shareholder prior to the offering for resale of the shares under this prospectus, the number of shares of our common stock beneficially owned by each selling shareholder that may be offered from time to time under this prospectus, and the number and percentage of shares of our common stock beneficially owned by the selling shareholder after the offering of the shares (assuming all of the offered shares are sold by the selling shareholder.

There are no agreements between the Company and any selling shareholder pursuant to which the shares subject to this registration statement were issued. Other than James Pande, a founder and director, David Hopkins, a founder, officer and director and Michael Fabiano, a founder, none of the selling shareholders ever been an officer or director of the Company and other than rendering services in the ordinary course of business, has had a material relationship with us at any time within the past three years.

Beneficial ownership is determined in accordance with the rules of the SEC, and includes any shares of common stock as to which a person has sole or shared voting power or investment power and any shares of common stock which the person has the right to acquire within sixty (60) days through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement.

| 12 |

| Name of Selling Shareholder | Total Shares Owned by Selling Shareholder |

Total Shares to be Registered Pursuant to this Offering |

Percentage of Common Stock Before Offering |

Number of Shares Owned by Selling Shareholder After Offering |

||||||||||||

| James Pande | 6,366,666 | 1,591,696 | 37.2% | 4,774,970 | ||||||||||||

| David Hopkins | 5,663,510 | 1,415,878 | 33.1% | 4,247,632 | ||||||||||||

| Michael Fabiano | 1,000,000 | 250,000 | 5.8% | 750,000 | ||||||||||||

| Zach Hollman(1) | 500,000 | 250,000 | 2.9% | 250,000 | ||||||||||||

| Dale S. Bergman(2) | 400,000 | 200,000 | 2.3% | 200,000 | ||||||||||||

| John W. Koelle | 400,000 | 200,000 | 2.3% | 200,000 | ||||||||||||

| Charlie Bird(3) | 290,000 | 145,000 | 1.7% | 145,000 | ||||||||||||

| Dominic Joseph Lewis(4) | 500,000 | 250,000 | 2.9% | 250,000 | ||||||||||||

| Douglas B. Porter (5) | 250,000 | 125,000 | 1.4% | 125,000 | ||||||||||||

| Trenton Pande | 200,000 | 100,000 | 1.2% | 100,000 | ||||||||||||

| Timothy and Kyle Crotty | 200,000 | 100,000 | 1.2% | 100,000 | ||||||||||||

| David Petoskey | 200,000 | 100,000 | 1.2% | 100,000 | ||||||||||||

| Julian Cameron(6) | 200,000 | 100,000 | 1.2% | 100,000 | ||||||||||||

| Viviana Hammons | 150,000 | 75,000 | * | 75,000 | ||||||||||||

| Robert Brenner | 150,000 | 75,000 | * | 75,000 | ||||||||||||

| Jay Carr | 150,000 | 75,000 | * | 75,000 | ||||||||||||

| Preston J. Fields | 100,000 | 50,000 | * | 50,000 | ||||||||||||

| Brian K. Linstrand | 100,000 | 50,000 | * | 50,000 | ||||||||||||

| Kevin Henderson | 100,000 | 50,000 | * | 50,000 | ||||||||||||

| Joel Mayersohn | 50,000 | 25,000 | * | 25,000 | ||||||||||||

| Mark Purvis | 10,000 | 5,000 | * | 5,000 | ||||||||||||

| Blaine Heckaman(7) | 153,156 | 76,578 | * | 76,578 | ||||||||||||

*Less than 1%.

| (1) | Represents shares held of record by NE1 Design Studios, LLC, of which firm Mr. Holman is a managing member. |

| (2) | Represents shares held of record by Almeria Group Holdings, LLC, an affiliate of the Company’s legal counsel, of which firm Mr. Bergman is a managing member. |

| (3) | Represents shares held of record by The Better Image Company, of which firm Mr. Bird is President. |

| (4) | Includes 50,000 shares purchased by Dr. Lewis for the benefit of his daughter. |

| (5) | Includes 200,000 shares held of record by William B. Porter Group, of which firm Mr. Porter is President. |

| (6) | Represents shares held of record by the JA Cameron Revocable Trust, of which trust Mr. Cameron is Trustee. |

| (7) | Represents shares held of record by Kaufman, Rossin & Company, P.A., of which firm Mr. Heckaman is Managing Principal. |

The selling shareholders and any of their pledgees, donees, transferees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. As there is currently no trading market for our shares, the selling shareholders will offer their shares at $0.25 per share until the Company’s shares are quoted on the OTCQX or the OTCQB operated by the OTC Markets Group. Assuming we secure this qualification, thereafter the shares may be sold these at fixed or negotiated prices. The selling shareholders may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits investors; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| 13 |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | to cover short sales made after the date that this registration statement is declared effective by the SEC; |

| · | broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share; |

| · | through the distribution of common stock by any selling shareholder to its partners, members or shareholders; |

| · | any other method permitted pursuant to applicable law; and |

| · | a combination of any such methods of sale. |

Broker-dealers engaged by the selling shareholders may arrange for broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The selling shareholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved.

The selling shareholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell shares of common stock from time to time under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus.

Upon a selling shareholder’s notification to us that any material arrangement has been entered into with a broker-dealer for the sale of such shareholder’s common stock through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, a supplement to this prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act disclosing (i) the name of each such selling shareholder and of the participating broker-dealer(s), (ii) the number of shares involved, (iii) the price at which such shares of common stock were sold, (iv) the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable, (v) that such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus, and (vi) other facts material to the transaction. In addition, upon our being notified in writing by a selling shareholder that a donee or pledgee intends to sell more than 500 shares of common stock, a supplement to this prospectus will be filed if then required in accordance with applicable securities law.

The selling shareholders also may transfer the shares of common stock in other circumstances, in which case the donees, assignees, transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus and may sell the shares of common stock from time to time under this prospectus after we have filed any necessary supplements to this prospectus under Rule 424(b), or other applicable provisions of the Securities Act supplementing or amending the list of selling shareholders to include such donee, assignee, transferee, pledgee, or other successor-in-interest as a selling shareholder under this prospectus.

In the event that the selling shareholders are deemed to be “underwriters,” any broker-dealers or agents that are involved in selling the shares will be deemed to be “underwriters” within the meaning of the Securities Act, in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, that can be attributed to the sale of the shares of common stock will be paid by the selling shareholder and/or the purchasers. Each selling shareholder has represented and warranted to us that it acquired the securities subject to this registration statement for his/her own account for investment and not for the benefit of any other person and not with a view to distribute or sell in violation of the Securities Act or any state securities laws or rules and regulations promulgated thereunder.

| 14 |

If a selling shareholder uses this prospectus for any sale of the common stock, it will be subject to the prospectus delivery requirements of the Securities Act. The selling shareholders will be responsible to comply with the applicable provisions of the Securities Act and the Exchange Act and the rules and regulations thereunder promulgated, including, without limitation, Regulation M, as applicable to such selling shareholders in connection with resales of their respective shares under this registration statement.

We are required to pay all fees and expenses incident to the registration of the shares, but we will not receive any proceeds from the sale of the common stock.

| 15 |

Overview

Health-Right is a natural biotech company that combines science and nutrition to develop branded ingredients, formulations and products that seek to provide a better quality of life for consumers who primarily suffer from stress-induced viruses and diseases. These formulations and products are developed naturally, by utilizing and scientifically combining various ingredients to help positively influence the interrelationship between stress and the immune system. The Company is planning to explore the application of its formulation platform to include CBD derived from industrial hemp. CBD, which is a cannabis-derived compound that may offer some of the benefits of medical marijuana without the side effects (i.e. the feeling of being “high” that comes from other cannabis compounds such as THC). The Company’s efforts in this regard will be dependent upon the FDA clarifying its position with respect to the classification of hemp-derived CBD as a dietary supplement and an ingredient deemed to be GRAS, which is not so classified (the FDA has not as yet differentiated hemp-derived CBD from cannabis-derived CBD).

The Company believes the formulation platform it has developed in order to help address the negative nutritional inter-relationship between stress, a weakened immune system and certain conditions and diseases is now in place. At the end of 2014, Health-Right completed initial test marketing of H-Plex Defense, its first product, an all-natural dietary supplement whose formulation seeks to address less than optimal nutrition and nutritional deficiencies to aid persons afflicted with HSV-1. Based on customer feedback, including a reorder rate exceeding industry norms, HRD believes that it has developed an alternative approach to help counteract and improve the causes/triggers of HSV-1, a virus that affects over an estimated 100 million people in the U.S. alone with symptoms including tingling, itching, blisters, sores and rashes with an estimated $5 billion marketplace for treatments by 2017, according to Global Industry Analysts, Inc.

Notwithstanding the foregoing, the Company has not conducted formal clinical trials of H-Plex Defense. Subject to receipt of necessary funding, the Company intends to do so, utilizing the services of MRA, one of the largest, multi-special clinical research centers in the United States. Management has had multiple meetings and discussion with MRA and has negotiated Protocol Development Agreement for clinical trials, the finalization and execution of which is subject to receipt of necessary funding.

We believe that Health-Right is uniquely positioned because its approach of not just responding to stress induced conditions and diseases, but proactively addressing stress-induced problems before they wreak havoc on multiple body systems. The Company’s research, formulation and nutritional theories offer wide ranging potential because we believe that our formulation platform has the potential to be successfully applied In the prescription nutritional/medical foods, OTC monograph drug and all-natural dietary supplement/nutraceutical arenas. HRD anticipates that it will be able to leverage the results of its planned clinical trials in order to market ingredients, branded ingredients, private label ingredients and finished products. We also believe that we will be positioned to license our formulations to strategic partners in order to expedite and achieve product commercialization and cross-promotion.

In addition to its initial product, the Company plans to focus its efforts on areas where it believes that HRD can commercialize and market products on an expedited basis. We believe that are other potential applications for our formulations that we have in the pipeline, including all-natural products designed to relieve symptoms associated with:

| · | compromised immune systems and related muscle and joint pain; |

| · | the common cold and flu viruses; and |

| · | constipation resulting from prescription medications. |

By adapting its formulation platform to applications such as these, the Company believes that it will be able to generate revenues in the short term in the following markets:

| · | the OTC monograph drug industry; |

| · | the prescription nutritional marketplace; and |

| · | the natural products space. |

The Company intends to use its contacts in the healthcare, medical foods and natural products industries to market and sell its proposed products either directly or through strategic partners and licensees.

To date, the Company has generated limited revenues and has operated with limited capital. The Company will require significant capital to implement its business plan. There can be no assurance that the Company can raise the necessary funds, on favorable terms or otherwise. Failure to obtain sufficient capital will substantially harm the Company’s prospects.

| 16 |

The Problem – Stress Contributing to Disease

Introduction

Stress may come to be seen as the primary contributing cause of most disease in the future. Today’s research continues to link stress to more and more symptoms and diseases, both acute and chronic.

So what exactly is stress? Stress is our reaction to our external environment as well as our inner thoughts and feelings. Simply put, stress is our body’s natural response to dangers, the “fight or flight” mechanisms—the body’s preparedness to do battle with or flee from danger. This response involves a complex biochemical-hormonal process that can offer different results for each individual.

Stress can generate a number of symptoms and diseases caused by changes in the immune system function, hormonal response and biochemical reactions. When this happens, it then can influence body functions in our digestive tract as well as our cardiovascular, neurological or musculoskeletal systems.

Types of Stress

Physical Stress—exercise, hard labor or even giving birth.

Mental Stress—high responsibility, long hours or fatigue, anxiety and worrying

Emotional Stress—anger, fear, sadness, frustration, betrayal or bereavement

Traumatic Stress—infection, injury, surgery or burns and extreme temperatures

Nutritional Stress—vitamin and mineral deficiencies, protein or fat excesses or deficiencies, even food allergies

Chemical Stress—environmental pollution such as exposure to pesticides and cleaning solvents, and the personal use of chemicals such as drugs, alcohol, caffeine and nicotine

Psycho-spiritual Stress—financial or career pressures, relationships, life goals, spiritual alignment and the general state of happiness.

The Compromised Immune System

Weaker immune systems can leave people more vulnerable to stress-related conditions, infections and diseases. Some common causes that may weaken the immune system are:

| Causes of Physical and Emotional Stress | |

| Pain and inflammation | Lack of sleep |

| Viral infections | Internal toxins |

| Poor dietary choices | Chemicals |

| Worrying | Excessive alcohol consumption |

| Sunburn | Surgery |

| Allergic Reactions | Fatigue |

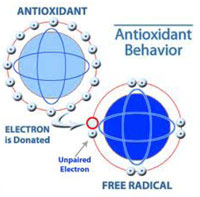

Our immune system becomes weaker when a free radical is attacking our body. This free radical is an atom or group of atoms that contains at least one unpaired electron. Free radicals have the ability to join easily with other compounds, which can create dramatic, negative changes in the body. Each free radical may only exist for a tiny fraction of a second, but the damage it leaves behind can be irreversible; particularly damage to heart muscle cells, nerve cells and certain immune system sensor cells. The formation of a large number of free radicals stimulates the formation of more free radicals, leading to even greater cellular damage and immune system impairment.

|

|

People are routinely advised to “minimize negative stress” in an effort to improve their state of physical and emotional wellness. As most of us know, not all stress is negative. However, for the majority of people, the constant daily stress we endure damages our bodies and weakens immunity, thereby dramatically increasing our susceptibility to illness and disease. It is generally accepted in the medical community that stress contributes or exacerbates a wide spectrum of illnesses. Simply not getting enough quality, daily sleep can dramatically increase a person’s stress.

| 17 |

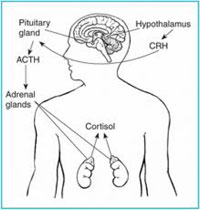

Almost all body functions and organs react to stress. During stressful events, which can be mental/emotional and/or physical, the pituitary gland increases its production of adrenocorticotropic hormone (ACTH), which in turn stimulates the release of the hormones Cortisone and Cortisol. These two hormones have the effect of inhibiting the functioning of disease-fighting white blood cells and suppressing the immune response. A stressful event actually triggers a state of physical changes in the body, and this is called the “fight or flight” response, which is primarily designed to prepare a person to face or flee from immediate/eminent danger. The increased production of adrenal hormones like Cortisol is what is believed to be responsible for most of the symptoms associated with stress. This “fight or flight” response causes the body to step up its metabolism of proteins, fats and carbohydrates to quickly produce energy for the body. The response also causes the body to excrete amino acids, potassium and phosphorus, deplete magnesium stored in the muscle tissue and decreases calcium. Stress also promotes the formation of free radicals that can become oxidized and damage body tissues, especially cell membranes.

During a stress response, our bodies begin excreting potassium, magnesium and calcium. Although these essential minerals are essential to good health and wellness, poor dietary and lifestyle choices rob our bodies of these vital minerals. In terms of micro-nutrients, minerals can be even more important than vitamins. Potassium and magnesium are some of the more helpful minerals for rebalancing the electrical properties of our cells, in addition to helping balance calcium.

The Health-Right Solution

Introduction

Health-Right believes that through solid research, it has developed a formulation platform to address the less than optimal nutrition and the nutritional deficiencies resulting from a stress-induced state. Pending clinical research, the Company believes that there are a number of applications for our products that can be rolled out in three different areas:

| · | the OTC monograph drug business; |

| · | the niche prescription nutritionals/medical foods arena; and |

| · | the natural markets for consumers who insist on natural alternatives. |

OTC Monograph Drug Business

HRD has identified two monographs, which, subject to receipt of required funding, HRD believes should allow it to access the OTC monograph drug business mass marketplace in 2016 with oral and topical formulations of H-Plex Defense. Once funding is in place, Health-Right will complete any formulation adjustments and, if necessary, file a New Drug Application (“NDA”) with the FDA. As it is basing its products on monograph drugs for the OTC marketplace, the Company anticipates that the FDA approval process will be fairly rapid. Once approved, we believe that by utilizing existing relationships, we can gain access to the food and drug mass merchant distribution channel. If we are able to successfully market our initial product in this manner, we intend to apply its H-Plex Defense formulation platform to other monograph drugs in order to develop additional products for distribution in the OTC marketplace.

Prescription Nutritional/Medical Foods Market

As defined by the Orphan Drug Act (1988 Amendment), a prescription nutritional or a medical food is “a food which is formulated to be consumed or administered enterally (orally) under the supervision of a physician, and which is intended for specific dietary management of a disease or condition for which distinctive nutritional requirements, based on recognized scientific principles, are established by medical evaluation.”

Prescription nutritionals or medical foods must be shown by medical evaluation to meet the distinctive nutritional needs of a specific, diseased patient population being targeted, prior to marketing. In contrast, dietary supplements are intended for normal, healthy adults and require no pre-market efficacy tests. Furthermore, as indicated by their nomenclature, prescription nutritionals or medical foods require physician supervision and a prescription. Simply put, prescription nutritionals or medical foods are medical products for a specific nutritional purpose while dietary supplements are a consumer product to supplement the diet and maintain good health and regular function.

Subject to receipt of necessary funding, HRD intends to conduct clinical trials to demonstrate the benefits of its formulation platform. HRD believes that its formulation platform could be applicable to the development of various products designed specifically for the dietary management of disease. HRD has identified at least three potential applications for its formulation platform in the prescription nutritional/medical foods marketplace.

We would anticipate that our prescription nutritional products, when and if successfully developed, would be marketed through one or more strategic partners with experience and relationships in this marketplace, whom we intend to ally with.

| 18 |

Natural Market