Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW YORK COMMUNITY BANCORP INC | d17588d8k.htm |

| EX-2.1 - EX-2.1 - NEW YORK COMMUNITY BANCORP INC | d17588dex21.htm |

| EX-99.1 - EX-99.1 - NEW YORK COMMUNITY BANCORP INC | d17588dex991.htm |

New York Community Bancorp and Astoria Financial Announce a Strategic In-Market Merger October 29, 2015 Conference Call Information New York Community and Astoria will conduct a conference call at 8:30 a.m. Eastern Daylight Time on October 29, 2015 to elaborate on the strategic and financial implications of the merger. Details about the conference call and the simultaneous webcast follow: Access Code for Dial-in and Replay:71565380 Dial-in:(Domestic):(866) 411-7391 (International):(704) 908-0380 Replay:October 29 (11:30 AM) – November 7 (Midnight) (Domestic):(855) 859-2056 (International):(404) 537-3406 The conference call will be webcast at www.myNYCB.com and archived at both www.myNYCB.com and www.astoria.com through 5:00 p.m. on November 25th. Exhibit 99.2

Cautionary Statements Cautionary Statements Regarding Forward-Looking Information The information presented herein, on the related conference call, in the related news release, and in other related communications, may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the expected completion date, financial benefits, and other effects of the proposed merger of New York Community and Astoria. Forward-looking statements can be identified by the use of the words “anticipate,” “expect,” “intend,” “estimate,” “target,” and words of similar import. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of the management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees, and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with New York Community’s and Astoria’s respective businesses, customers, borrowings, repayment, investment, and deposit practices, and general economic conditions, either nationally or in the market areas in which New York Community and Astoria operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks and important factors that could affect New York Community’s and Astoria’s future results are identified in their Annual Reports on Form 10-K for the year ended December 31, 2014 and other reports filed with the Securities and Exchange Commission (“SEC”). Forward-looking statements are made only as of the date of this presentation, and neither New York Community nor Astoria undertakes any obligation to update any forward-looking statements contained in this presentation to reflect events or conditions after the date hereof. Important Additional Information This communication is being made in respect of the proposed merger transaction involving New York Community and Astoria. New York Community intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of Astoria and New York Community and a prospectus of New York Community, and each party will file other documents regarding the proposed transaction with the SEC. A definitive joint proxy statement/ prospectus will also be sent to Astoria and New York Community stockholders seeking any required stockholder approvals. Before making any voting or investment decision, investors and security holders of Astoria and New York Community are urged to carefully read the entire registration statement and joint proxy statement/ prospectus, when they become available, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by New York Community and Astoria with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by New York Community may be obtained free of charge at its website at http://ir.mynycb.com/ and the documents filed by Astoria may be obtained free of charge at Astoria’s website at http://ir.astoriabank.com/. Alternatively, these documents, when available, can be obtained free of charge from New York Community upon written request to New York Community Bancorp, Inc., Attn: Corporate Secretary, 615 Merrick Avenue, Westbury, New York 11590 or by calling (516) 683-4420, or from Astoria upon written request to Astoria Financial Corporation, Attn: Monte N. Redman, President, One Astoria Bank Plaza, Lake Success, New York 11042 or by calling (516) 327-3000. New York Community, Astoria, their directors, executive officers, and certain other persons may be deemed to be participants in the solicitation of proxies from New York Community’s and Astoria’s stockholders in favor of the approval of the merger. Information about the directors and executive officers of New York Community and their ownership of its common stock is set forth in the proxy statement for New York Community’s 2015 annual meeting of stockholders, as previously filed with the SEC on April 24, 2015. Information about the directors and executive officers of Astoria and their ownership of its common stock is set forth in the proxy statement for Astoria’s 2015 annual meeting of stockholders, as previously filed with the SEC on April 17, 2015. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the proxy statement/prospectus when they become available. Our Use of Non-GAAP Financial Measures This presentation may contain certain non-GAAP financial measures which management believes to be useful to investors in understanding the Company’s performance and financial condition, and in comparing our performance and financial condition with those of other banks. Such non-GAAP financial measures are not to be considered in isolation or as a substitute for measures calculated in accordance with GAAP. Before considering an investment in New York Community, investors should read the prospectus in the registration statement and other documents New York Community has filed with the SEC for more complete information about the issuer and this offering. These documents are available without charge by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, a copy of the prospectus may be requested by calling New York Community at (516) 683-4420 or by contacting one of the following underwriters: Goldman Sachs at prospectus-ny@ny.email.gs.com or +1 (866) 471-2526; Credit Suisse at newyork.prospectus@credit-suisse.com or +1 (800) 221-1037; or Bank of America Merrill Lynch at dg.prospectus_requests@baml.com.

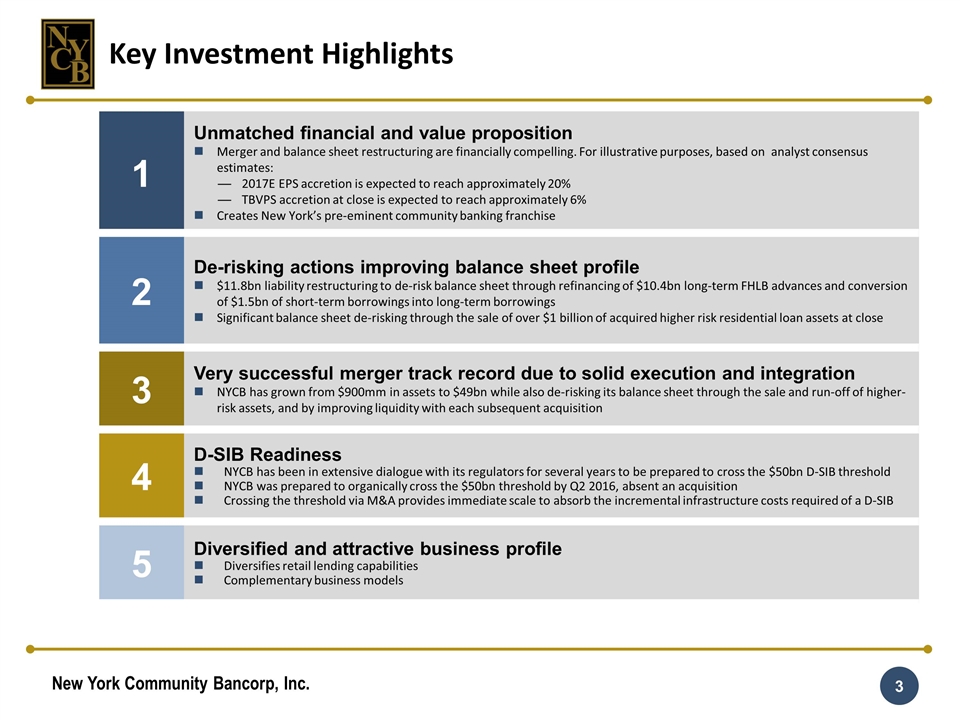

Key Investment Highlights 1 Unmatched financial and value proposition Merger and balance sheet restructuring are financially compelling. For illustrative purposes, based on analyst consensus estimates: 2017E EPS accretion is expected to reach approximately 20% TBVPS accretion at close is expected to reach approximately 6% Creates New York’s pre-eminent community banking franchise 2 De-risking actions improving balance sheet profile $11.8bn liability restructuring to de-risk balance sheet through refinancing of $10.4bn long-term FHLB advances and conversion of $1.5bn of short-term borrowings into long-term borrowings Significant balance sheet de-risking through the sale of over $1 billion of acquired higher risk residential loan assets at close 3 Very successful merger track record due to solid execution and integration NYCB has grown from $900mm in assets to $49bn while also de-risking its balance sheet through the sale and run-off of higher-risk assets, and by improving liquidity with each subsequent acquisition 4 D-SIB Readiness NYCB has been in extensive dialogue with its regulators for several years to be prepared to cross the $50bn D-SIB threshold NYCB was prepared to organically cross the $50bn threshold by Q2 2016, absent an acquisition Crossing the threshold via M&A provides immediate scale to absorb the incremental infrastructure costs required of a D-SIB 5 Diversified and attractive business profile Diversifies retail lending capabilities Complementary business models

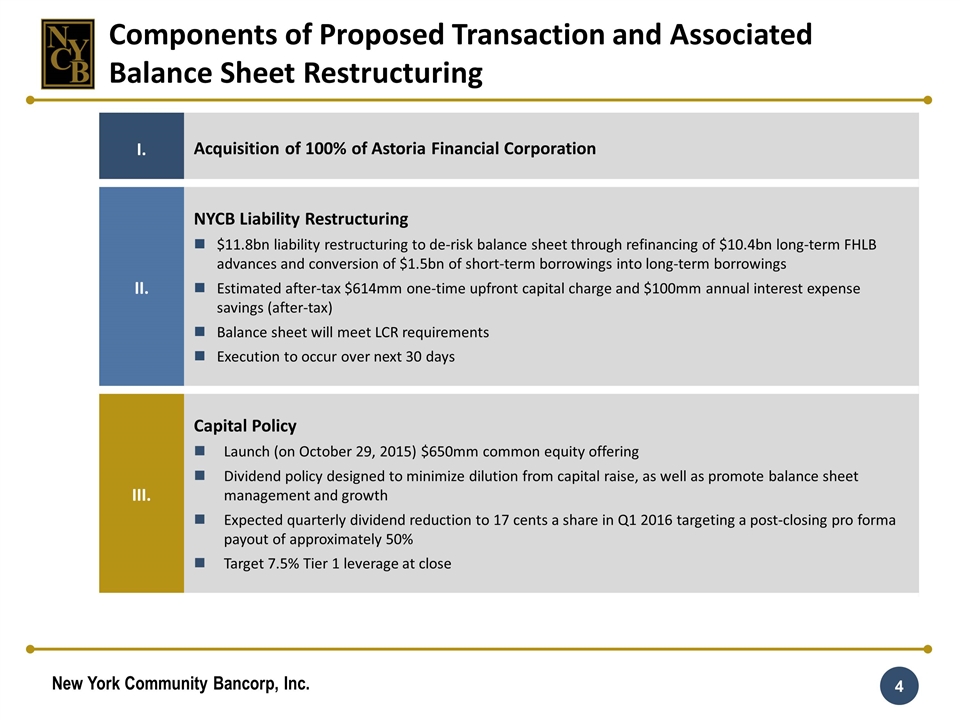

I. Acquisition of 100% of Astoria Financial Corporation II. NYCB Liability Restructuring $11.8bn liability restructuring to de-risk balance sheet through refinancing of $10.4bn long-term FHLB advances and conversion of $1.5bn of short-term borrowings into long-term borrowings Estimated after-tax $614mm one-time upfront capital charge and $100mm annual interest expense savings (after-tax) Balance sheet will meet LCR requirements Execution to occur over next 30 days III. Capital Policy Launch (on October 29, 2015) $650mm common equity offering Dividend policy designed to minimize dilution from capital raise, as well as promote balance sheet management and growth Expected quarterly dividend reduction to 17 cents a share in Q1 2016 targeting a post-closing pro forma payout of approximately 50% Target 7.5% Tier 1 leverage at close Components of Proposed Transaction and Associated Balance Sheet Restructuring

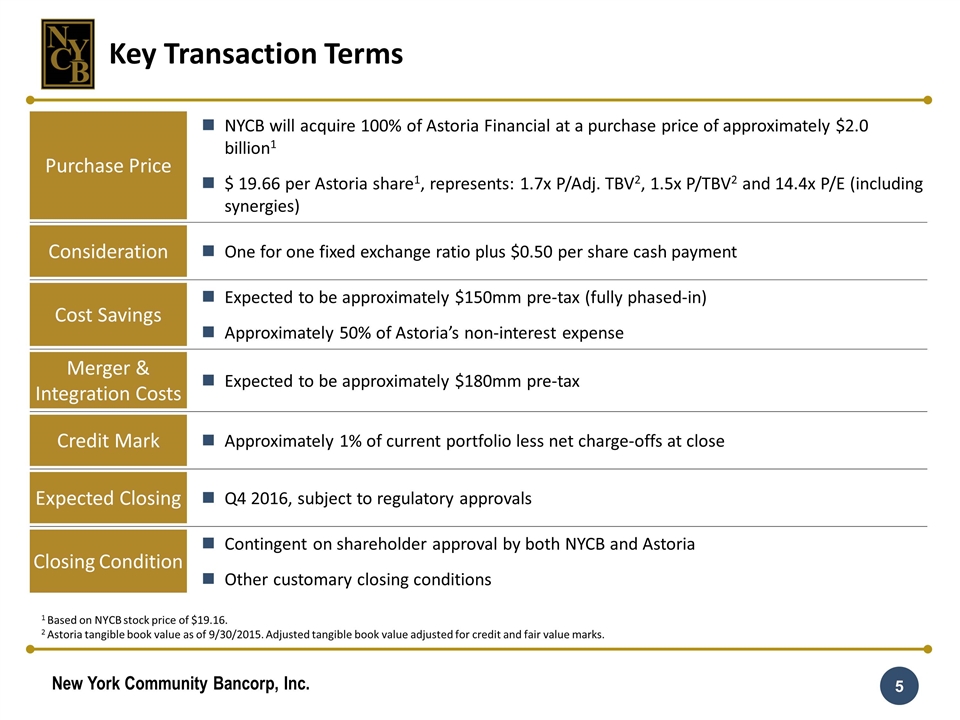

Purchase Price NYCB will acquire 100% of Astoria Financial at a purchase price of approximately $2.0 billion1 $ 19.66 per Astoria share1, represents: 1.7x P/Adj. TBV2, 1.5x P/TBV2 and 14.4x P/E (including synergies) Consideration One for one fixed exchange ratio plus $0.50 per share cash payment Cost Savings Expected to be approximately $150mm pre-tax (fully phased-in) Approximately 50% of Astoria’s non-interest expense Merger & Integration Costs Expected to be approximately $180mm pre-tax Credit Mark Approximately 1% of current portfolio less net charge-offs at close Expected Closing Q4 2016, subject to regulatory approvals Closing Condition Contingent on shareholder approval by both NYCB and Astoria Other customary closing conditions Key Transaction Terms 1 Based on NYCB stock price of $19.16. 2 Astoria tangible book value as of 9/30/2015. Adjusted tangible book value adjusted for credit and fair value marks.

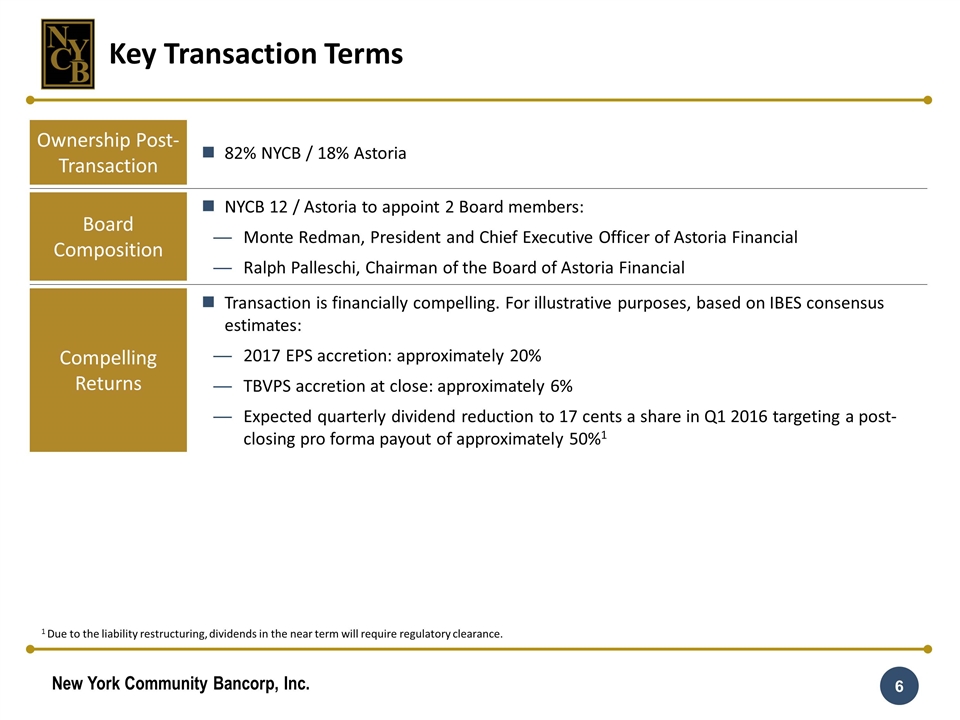

Ownership Post-Transaction 82% NYCB / 18% Astoria Board Composition NYCB 12 / Astoria to appoint 2 Board members: Monte Redman, President and Chief Executive Officer of Astoria Financial Ralph Palleschi, Chairman of the Board of Astoria Financial Compelling Returns Transaction is financially compelling. For illustrative purposes, based on IBES consensus estimates: 2017 EPS accretion: approximately 20% TBVPS accretion at close: approximately 6% Expected quarterly dividend reduction to 17 cents a share in Q1 2016 targeting a post-closing pro forma payout of approximately 50%1 Key Transaction Terms 1 Due to the liability restructuring, dividends in the near term will require regulatory clearance.

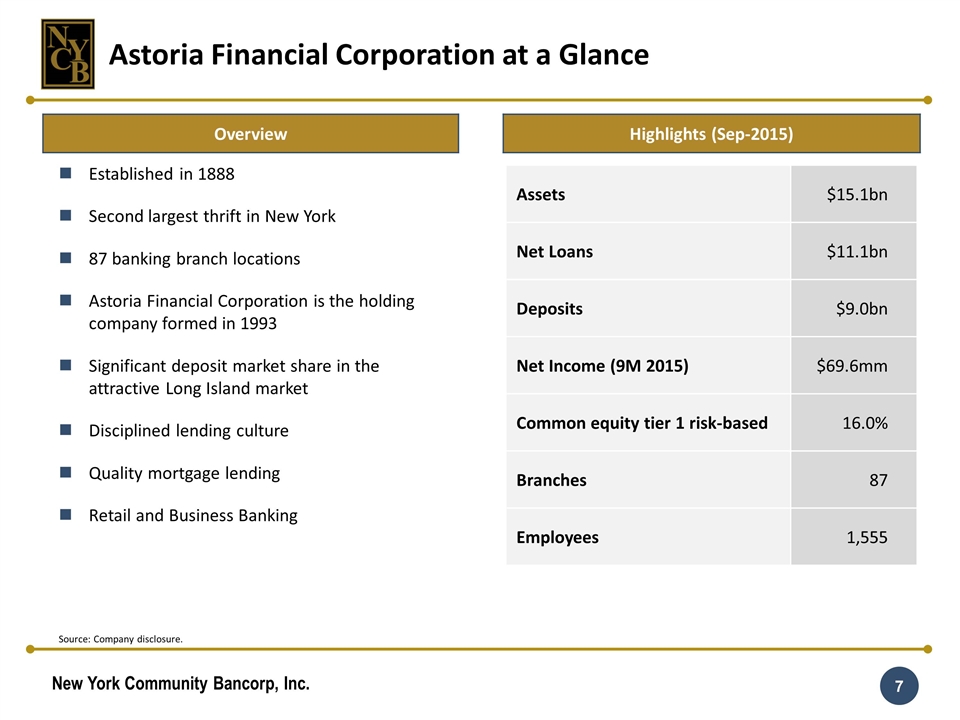

Overview Highlights (Sep-2015) Astoria Financial Corporation at a Glance Assets $15.1bn Net Loans $11.1bn Deposits $9.0bn Net Income (9M 2015) $69.6mm Common equity tier 1 risk-based 16.0% Branches 87 Employees 1,555 Established in 1888 Second largest thrift in New York 87 banking branch locations Astoria Financial Corporation is the holding company formed in 1993 Significant deposit market share in the attractive Long Island market Disciplined lending culture Quality mortgage lending Retail and Business Banking Source: Company disclosure.

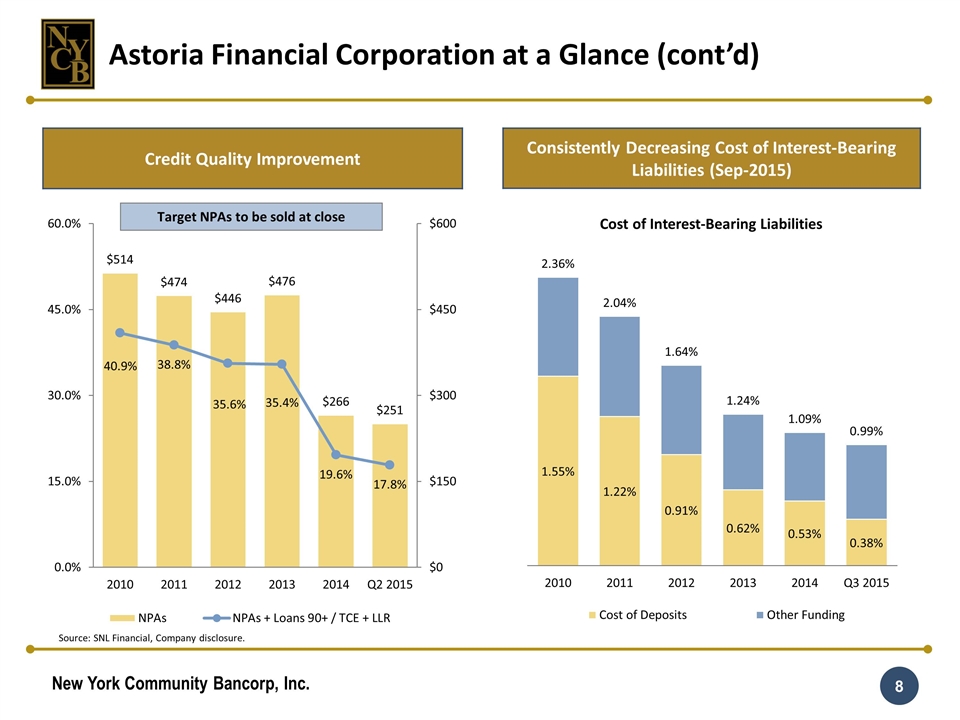

Astoria Financial Corporation at a Glance (cont’d) Credit Quality Improvement Consistently Decreasing Cost of Interest-Bearing Liabilities (Sep-2015) Source: SNL Financial, Company disclosure. Target NPAs to be sold at close Cost of Interest-Bearing Liabilities

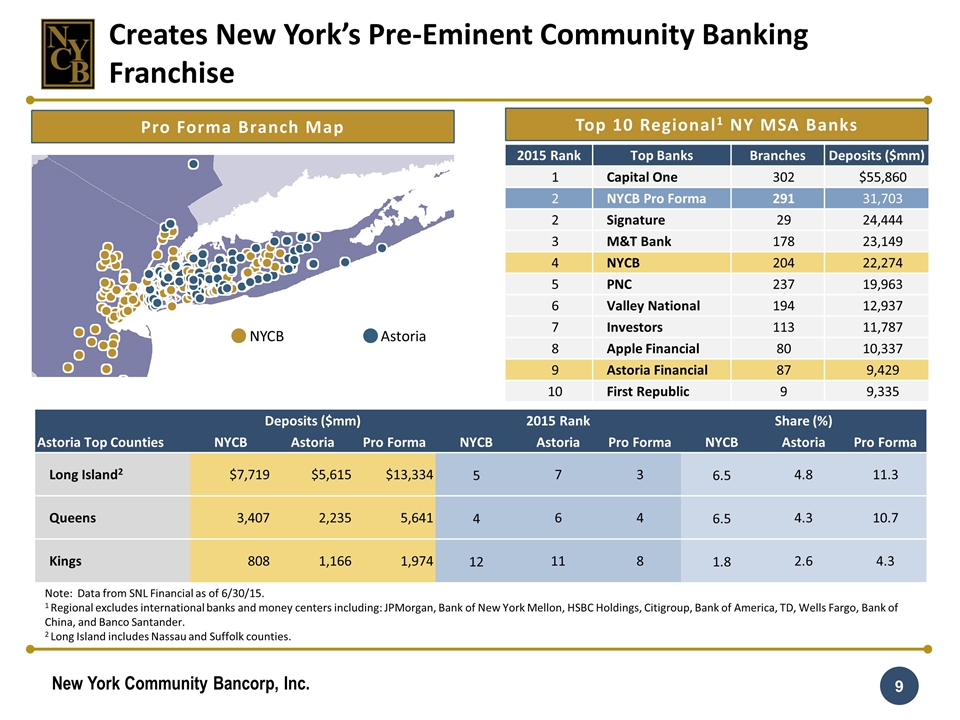

Creates New York’s Pre-Eminent Community Banking Franchise Pro Forma Branch Map Top 10 Regional1 NY MSA Banks NYCB Astoria 2015 Rank Top Banks Branches Deposits ($mm) 1 Capital One 302 $55,860 2 NYCB Pro Forma 291 31,703 2 Signature 29 24,444 3 M&T Bank 178 23,149 4 NYCB 204 22,274 5 PNC 237 19,963 6 Valley National 194 12,937 7 Investors 113 11,787 8 Apple Financial 80 10,337 9 Astoria Financial 87 9,429 10 First Republic 9 9,335 Note: Data from SNL Financial as of 6/30/15. 1 Regional excludes international banks and money centers including: JPMorgan, Bank of New York Mellon, HSBC Holdings, Citigroup, Bank of America, TD, Wells Fargo, Bank of China, and Banco Santander. 2 Long Island includes Nassau and Suffolk counties. Astoria Top Counties Deposits ($mm) 2015 Rank Share (%) NYCB Astoria Pro Forma NYCB Astoria Pro Forma NYCB Astoria Pro Forma Long Island2 $7,719 $5,615 $13,334 5 7 3 6.5 4.8 11.3 Queens 3,407 2,235 5,641 4 6 4 6.5 4.3 10.7 Kings 808 1,166 1,974 12 11 8 1.8 2.6 4.3

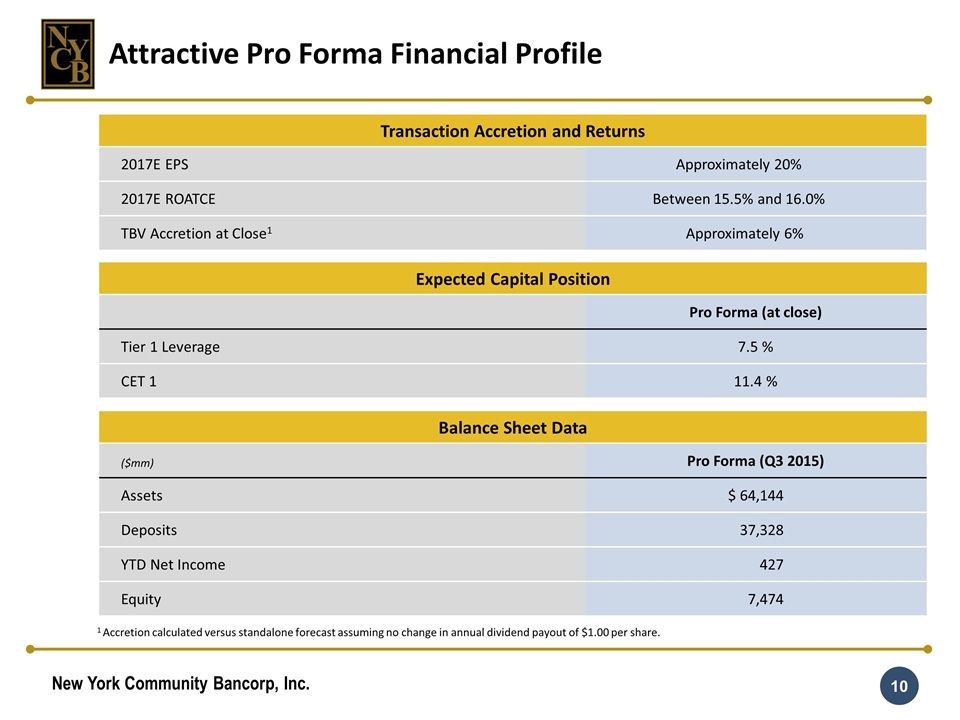

Attractive Pro Forma Financial Profile Expected Capital Position Pro Forma (at close) Tier 1 Leverage 7.5 % CET 1 11.4 % Balance Sheet Data ($mm) Pro Forma (Q3 2015) Assets $ 64,144 Deposits 37,328 YTD Net Income 427 Equity 7,474 1 Accretion calculated versus standalone forecast assuming no change in annual dividend payout of $1.00 per share. Transaction Accretion and Returns 2017E EPS Approximately 20% 2017E ROATCE Between 15.5% and 16.0% TBV Accretion at Close1 Approximately 6%

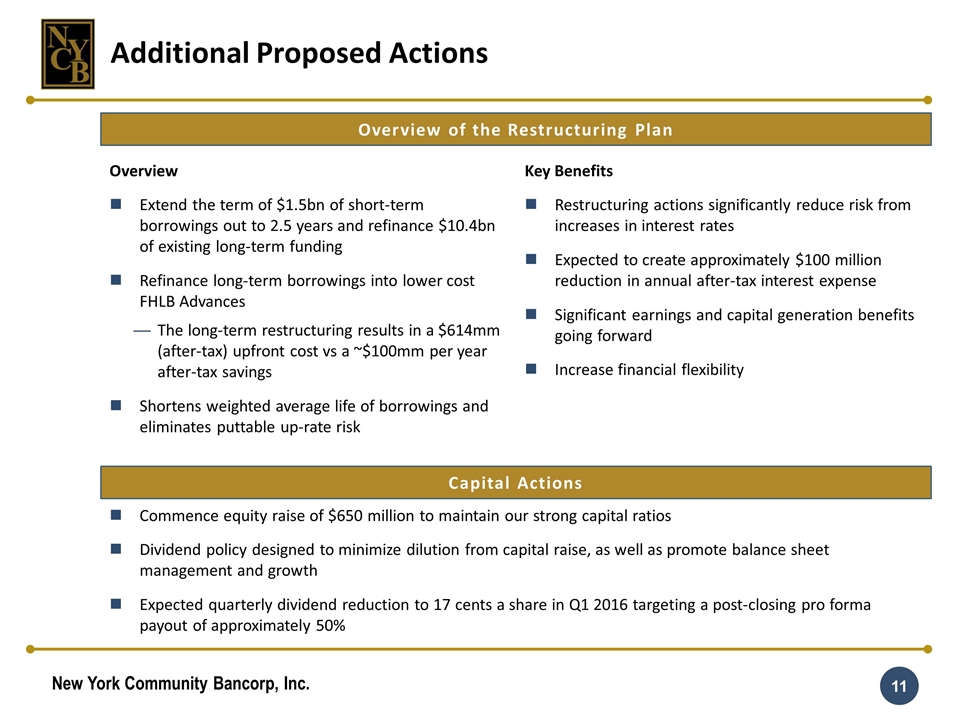

Overview Extend the term of $1.5bn of short-term borrowings out to 2.5 years and refinance $10.4bn of existing long-term funding Refinance long-term borrowings into lower cost FHLB Advances The long-term restructuring results in a $614mm (after-tax) upfront cost vs a ~$100mm per year after-tax savings Shortens weighted average life of borrowings and eliminates puttable up-rate risk Additional Proposed Actions Overview of the Restructuring Plan Capital Actions Key Benefits Restructuring actions significantly reduce risk from increases in interest rates Expected to create approximately $100 million reduction in annual after-tax interest expense Significant earnings and capital generation benefits going forward Increase financial flexibility Commence equity raise of $650 million to maintain our strong capital ratios Dividend policy designed to minimize dilution from capital raise, as well as promote balance sheet management and growth Expected quarterly dividend reduction to 17 cents a share in Q1 2016 targeting a post-closing pro forma payout of approximately 50%

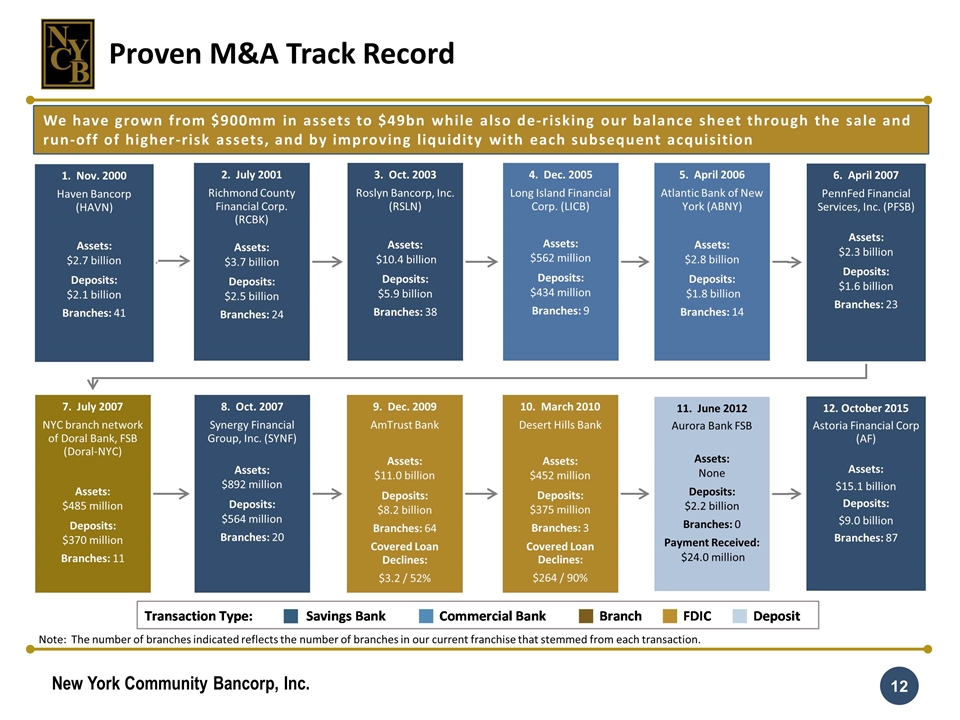

Note: The number of branches indicated reflects the number of branches in our current franchise that stemmed from each transaction. We have grown from $900mm in assets to $49bn while also de-risking our balance sheet through the sale and run-off of higher-risk assets, and by improving liquidity with each subsequent acquisition Proven M&A Track Record 1. Nov. 2000 Haven Bancorp (HAVN) Assets: $2.7 billion Deposits: $2.1 billion Branches: 41 3. Oct. 2003 Roslyn Bancorp, Inc. (RSLN) Assets: $10.4 billion Deposits: $5.9 billion Branches: 38 4. Dec. 2005 Long Island Financial Corp. (LICB) Assets: $562 million Deposits: $434 million Branches: 9 2. July 2001 Richmond County Financial Corp. (RCBK) Assets: $3.7 billion Deposits: $2.5 billion Branches: 24 5. April 2006 Atlantic Bank of New York (ABNY) Assets: $2.8 billion Deposits: $1.8 billion Branches: 14 6. April 2007 PennFed Financial Services, Inc. (PFSB) Assets: $2.3 billion Deposits: $1.6 billion Branches: 23 7. July 2007 NYC branch network of Doral Bank, FSB (Doral-NYC) Assets: $485 million Deposits: $370 million Branches: 11 8. Oct. 2007 Synergy Financial Group, Inc. (SYNF) Assets: $892 million Deposits: $564 million Branches: 20 9. Dec. 2009 AmTrust Bank Assets: $11.0 billion Deposits: $8.2 billion Branches: 64 Covered Loan Declines: $3.2 / 52% 10. March 2010 Desert Hills Bank Assets: $452 million Deposits: $375 million Branches: 3 Covered Loan Declines: $264 / 90% 11. June 2012 Aurora Bank FSB Assets: None Deposits: $2.2 billion Branches: 0 Payment Received: $24.0 million 12. October 2015 Astoria Financial Corp (AF) Assets: $15.1 billion Deposits: $9.0 billion Branches: 87

Straightforward Business Model Simplifies Integration Low Integration Risk Enhances Risk Positioning Focused business model streamlines integration Proven track record of thrift and bank conversions Established presence & experience in Astoria markets Diversifies retail lending capabilities Shared risk culture with strong historical underwriting performance Anticipated sale of non-performing and higher risk loans to create a more stable pro forma balance sheet

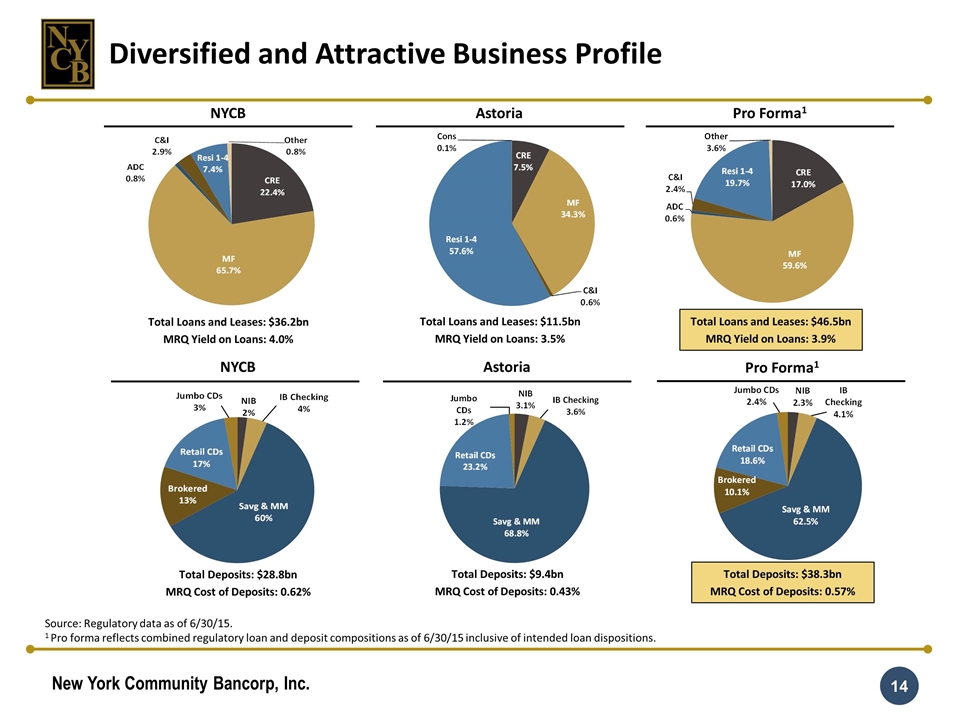

Source: Regulatory data as of 6/30/15. 1 Pro forma reflects combined regulatory loan and deposit compositions as of 6/30/15 inclusive of intended loan dispositions. Diversified and Attractive Business Profile NYCB Astoria Pro Forma1 Total Loans and Leases: $36.2bn MRQ Yield on Loans: 4.0% Total Loans and Leases: $11.5bn MRQ Yield on Loans: 3.5% Total Loans and Leases: $46.5bn MRQ Yield on Loans: 3.9% Pro Forma1 NYCB Astoria Total Deposits: $28.8bn MRQ Cost of Deposits: 0.62% Total Deposits: $9.4bn MRQ Cost of Deposits: 0.43% Total Deposits: $38.3bn MRQ Cost of Deposits: 0.57%

Visit our website: ir.myNYCB.com E-mail requests to: ir@myNYCB.com Call Investor Relations at: (516) 683-4420 Write to: Investor Relations New York Community Bancorp, Inc. 615 Merrick Avenue Westbury, NY 11590 For More Information

Appendix

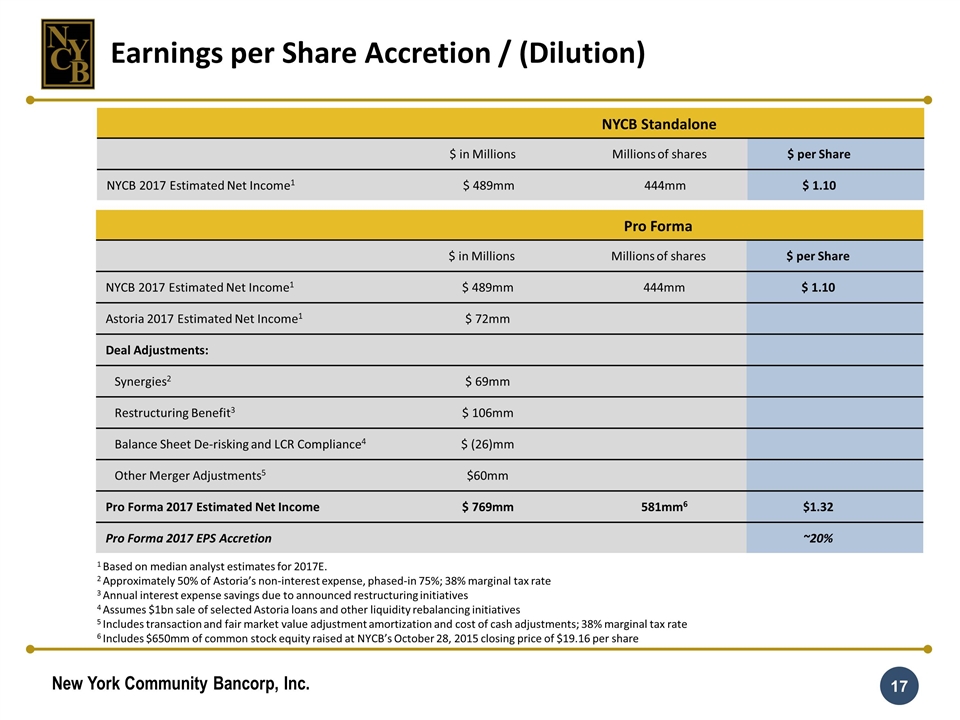

Earnings per Share Accretion / (Dilution) NYCB Standalone $ in Millions Millions of shares $ per Share NYCB 2017 Estimated Net Income1 $ 489mm 444mm $ 1.10 Pro Forma $ in Millions Millions of shares $ per Share NYCB 2017 Estimated Net Income1 $ 489mm 444mm $ 1.10 Astoria 2017 Estimated Net Income1 $ 72mm Deal Adjustments: Synergies2 $ 69mm Restructuring Benefit3 $ 106mm Balance Sheet De-risking and LCR Compliance4 $ (26)mm Other Merger Adjustments5 $60mm Pro Forma 2017 Estimated Net Income $ 769mm 581mm6 $1.32 Pro Forma 2017 EPS Accretion ~20% 1 Based on median analyst estimates for 2017E. 2 Approximately 50% of Astoria’s non-interest expense, phased-in 75%; 38% marginal tax rate 3 Annual interest expense savings due to announced restructuring initiatives 4 Assumes $1bn sale of selected Astoria loans and other liquidity rebalancing initiatives 5 Includes transaction and fair market value adjustment amortization and cost of cash adjustments; 38% marginal tax rate 6 Includes $650mm of common stock equity raised at NYCB’s October 28, 2015 closing price of $19.16 per share