Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - JOHNSON CONTROLS INC | exh991-johnsonctrlsq4fy15.htm |

| 8-K - 8-K - JOHNSON CONTROLS INC | a8-kq4resultsfy15.htm |

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Quarterly update FY 2015 fourth quarter October 29, 2015 Exhibit 99.2

Johnson Controls, Inc. — 2 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Forward-Looking Statements Johnson Controls, Inc. has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Johnson Controls cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Johnson Controls’ control, that could cause Johnson Controls’ actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include required regulatory approvals that are material conditions for proposed transactions to close, currency exchange rates, strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, energy and commodity prices, availability of raw materials and component products, and cancellation of or changes to commercial contracts, as well as other factors discussed in Item 1A of Part I of Johnson Controls’ most recent Annual Report on Form 10-K for the year ended September 30, 2014 and Johnson Controls’ subsequent Quarterly Reports on Form 10-Q. Shareholders, potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward- looking statements included in this document are only made as of the date of this document, and Johnson Controls assumes no obligation, and disclaims any obligation, to update forward-looking statements to reflect events or circumstances occurring after the date of this document. October 29, 2015

Johnson Controls, Inc. — 3 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Agenda October 29, 2015 Fourth quarter highlights Alex Molinaroli, Chairman and Chief Executive Officer Introduction Glen Ponczak, Vice President, Global Investor Relations Business results Bruce McDonald, Vice Chairman and Executive Vice President Financial review Brian Stief, Executive Vice President and Chief Financial Officer Q&A 2 3 4 5 1

1/6 2/6 4/6 5/6 1/4 3/4 1/2 FY 2015* +120 bps Segment Margin $3.42 ▲ $3.00 Diluted EPS Growth $1.4B Shares Repurchased +18% Quarterly Dividend A record of excellence in transformation and execution * Excluding transaction / integration / separation costs and non-recurring items 4 Johnson Controls, Inc. - October 29, 2015

Johnson Controls, Inc. — 5 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Record FY15 earnings from continuing operations* - 4% +5% FY15 FY14 $37.2 B $38.7 B NET REVENUES FY15 FY14 $3.2 B $2.9 B SEGMENT INCOME +12% +14% DILUTED EPS FY15 FY14 $3.42 $3.00 +16% excluding FX October 29, 2015 +120 * Excluding transaction / integration / separation costs and non-recurring items SEGMENT MARGIN FY15FY14FY13FY12 8.6% 7.4% 6.5% 6.1% bps excluding FX and Interiors JV

1/6 2/6 4/6 5/6 1/4 3/4 1/2 FY2015 fourth quarter highlights* Executing well during significant portfolio changes Record fourth quarter earnings from continuing operations GWS, Interiors JV and Hitachi JV now closed Johnson Controls Operating System expanding and delivering increasing benefits Continued focus on cost structure in anticipation of AE spin-off Markets supporting continued growth China automotive production improving by the end of Q4 Building Efficiency core North American branch orders up more than 4% • North American bidding activity robust Hitachi JV provides significant VRF growth opportunity Battery volumes up in every region; strong AGM demand 6 Johnson Controls, Inc. - * Excluding transaction / integration / separation costs and non-recurring items October 29, 2015

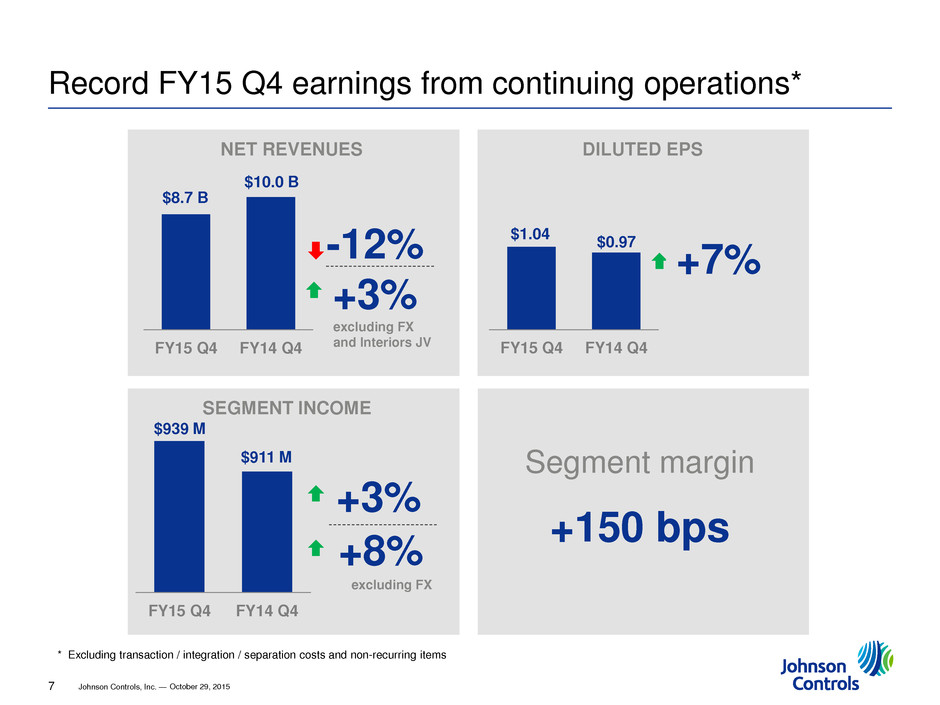

Johnson Controls, Inc. — 7 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Record FY15 Q4 earnings from continuing operations* -12% +3% FY15 Q4 FY14 Q4 $8.7 B $10.0 B NET REVENUES FY15 Q4 FY14 Q4 $939 M $911 M SEGMENT INCOME +3% +7% DILUTED EPS FY15 Q4 FY14 Q4 $1.04 $0.97 * Excluding transaction / integration / separation costs and non-recurring items +8% excluding FX Segment margin October 29, 2015 +150 bps excluding FX and Interiors JV

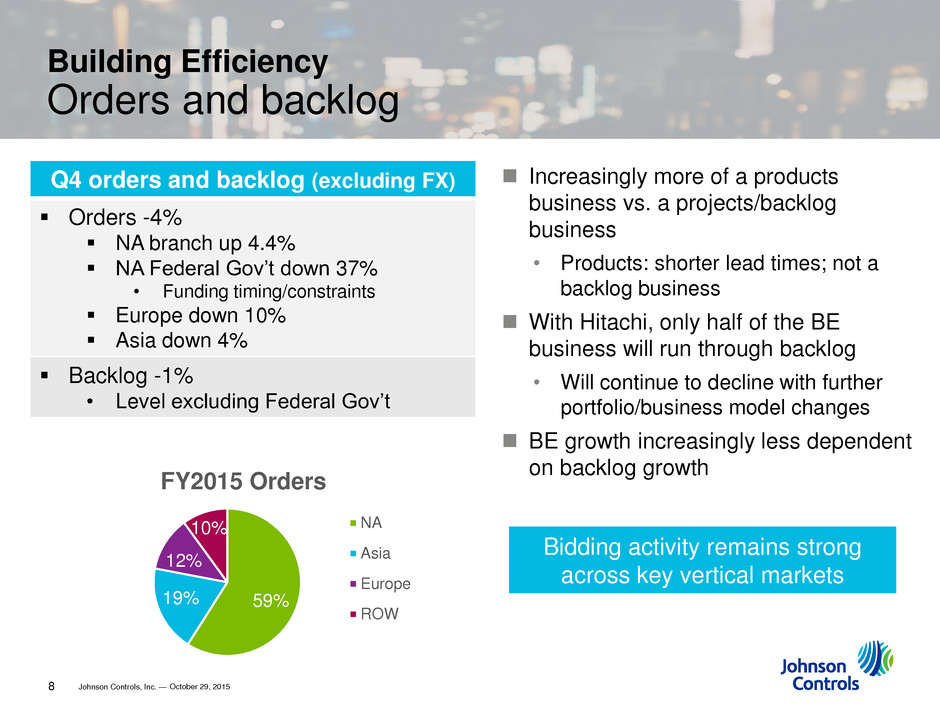

Johnson Controls, Inc. — 8 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Increasingly more of a products business vs. a projects/backlog business • Products: shorter lead times; not a backlog business With Hitachi, only half of the BE business will run through backlog • Will continue to decline with further portfolio/business model changes BE growth increasingly less dependent on backlog growth Building Efficiency Orders and backlog October 29, 2015 Q4 orders and backlog (excluding FX) Orders -4% NA branch up 4.4% NA Federal Gov’t down 37% • Funding timing/constraints Europe down 10% Asia down 4% Backlog -1% • Level excluding Federal Gov’t 59% 19% 12% 10% FY2015 Orders NA Asia Europe ROW Bidding activity remains strong across key vertical markets

1/6 2/6 4/6 5/6 1/4 3/4 1/2 9 Johnson Controls, Inc. - October 29, 2015 Investing in Growth – BE and PS Building Efficiency: supporting product-centric strategies Launched Champion LX Series packaged units Launched Hitachi VRF in North America; opened VRF training center Unveiled P2000 enhanced security management system Won Innovative Power Technology of the Year award Launched on-line order system for residential HVAC equipment Power Solutions: adding capacity and new products Building new plant in Shenyang with 6 million unit capacity by 2018 Debuted new dual battery system for advanced start-stop vehicles (12-volt lithium ion with 12-volt AGM) Signed MOU for sales and manufacturing JVs with BAIC New product offerings for lithium ion distributed energy storage market

1/6 2/6 4/6 5/6 1/4 3/4 1/2 10 Johnson Controls, Inc. - October 29, 2015 Automotive Experience: building global technology leadership Introduced new personalization options for car seat trim covers Successful seating system launch for the BMW 7-Series in Czech Republic Commercialization of core product portfolio mechanism families (T/L 3000 Recliner, HA3000 Height Adjuster) Unveiled new seat and interior technology for autonomous mobility Investing in Growth - AE Image of new interior seating and technology for autonomous vehicles

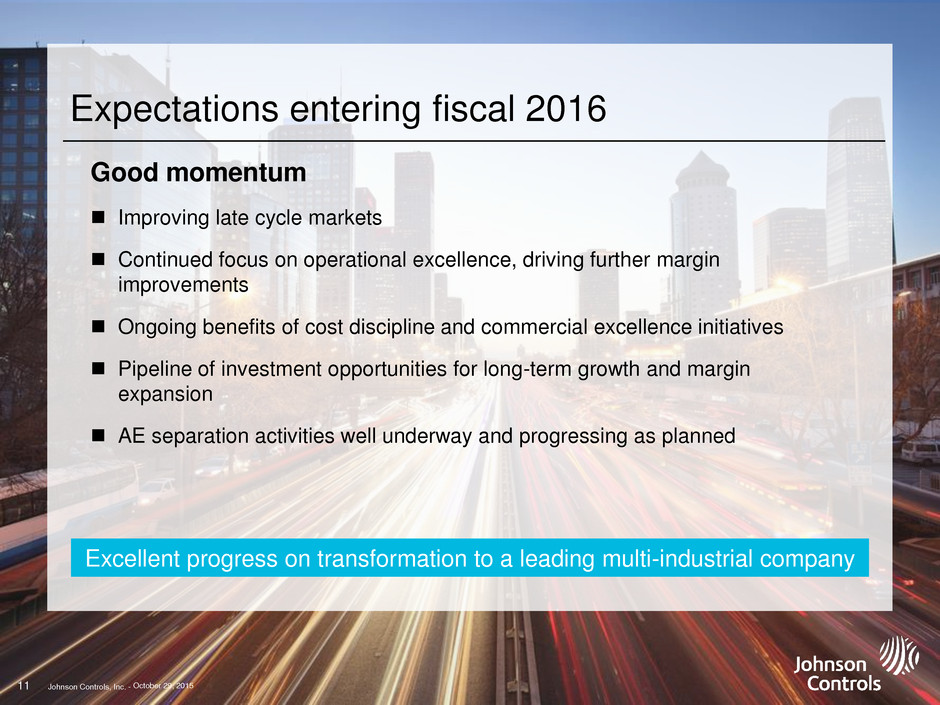

Johnson Controls, Inc. — 11 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Excellent progress on transformation to a leading multi-industrial company Good momentum Improving late cycle markets Continued focus on operational excellence, driving further margin improvements Ongoing benefits of cost discipline and commercial excellence initiatives Pipeline of investment opportunities for long-term growth and margin expansion AE separation activities well underway and progressing as planned Expectations entering fiscal 2016 11 Johnson Co tr ls, Inc. - October 29, 2015

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Building Efficiency* Improved profitability and margin expansion Sales level • North America up 5% (up 6% ex. FX) • Asia down 7% (level ex. FX) • Middle East strength offset by weakness in Europe Segment margin Higher volumes and favorable price/mix Improved margins in North America, Europe and the Middle East partially offset by lower margins in Asia ADT performance in-line with expectations Full year segment margins Level +5% FY15 Q4 FY14 Q4 $2.9 B $2.9 B NET REVENUES excluding FX +5% FY15 Q4 FY14 Q4 $351 M $335 M SEGMENT INCOME +8% excluding FX 12 Johnson Controls, Inc. - October 29, 2015 +60 bps * Excluding transaction / integration / separation costs and non-recurring items +70 bps

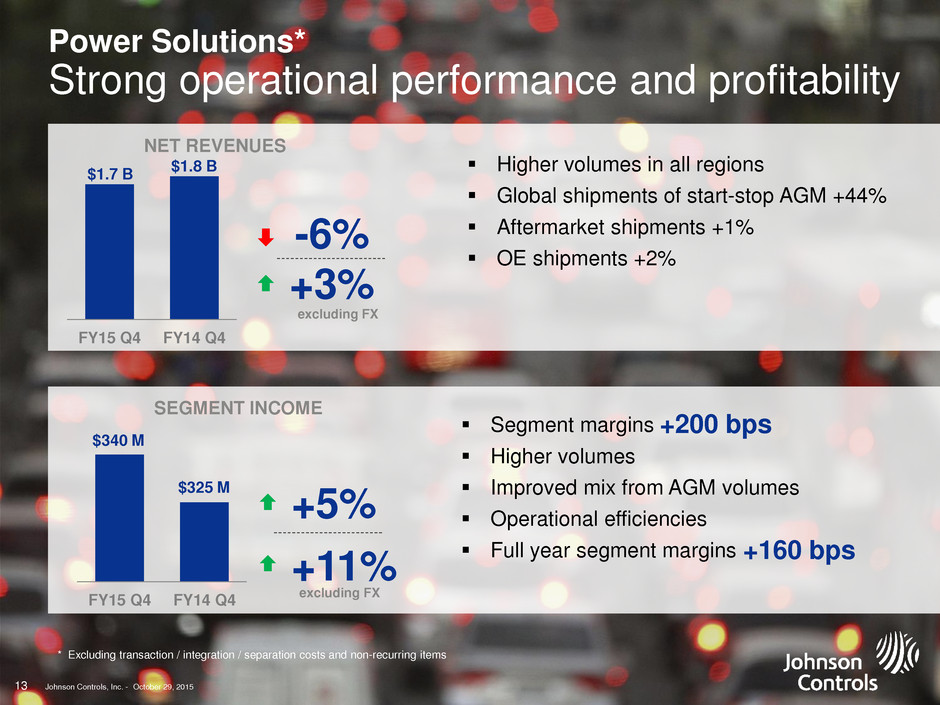

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Power Solutions* Strong operational performance and profitability Segment margins Higher volumes Improved mix from AGM volumes Operational efficiencies Full year segment margins -6% +3% FY15 Q4 FY14 Q4 $1.7 B $1.8 B NET REVENUES excluding FX +5% FY15 Q4 FY14 Q4 $340 M $325 M SEGMENT INCOME +11% excluding FX 13 Johnson Controls, Inc. - +200 bps October 29, 2015 Higher volumes in all regions Global shipments of start-stop AGM +44% Aftermarket shipments +1% OE shipments +2% +160 bps * Excluding transaction / integration / separation costs and non-recurring items

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Automotive Experience* Strong global volumes and profitability Q4 industry production • North America up 5% • Europe up 5% • China down 5% China sales (mostly non-consolidated) up 27%; down 3% excluding Interiors JV Interiors JV closed July 2, 2015 (equity accounting) Segment margins Higher global seating volumes Full year segment margins -21% +3% FY15 Q4 FY14 Q4 $4.2 B $5.3 B NET REVENUES excluding FX and Interiors JV -1% FY15 Q4 FY14 Q4 $248 M $251 M SEGMENT INCOME +4% excluding FX 14 Johnson Controls, Inc. - +120 bps October 29, 2015 * Excluding transaction / integration / separation costs and non-recurring items +100 bps

Johnson Controls, Inc. — 15 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Gross margin Improvement of 160 bps includes improved product mix and JCOS benefits SG&A Reduction primarily due to Interiors deconsolidation and foreign exchange Equity income Interiors JV income and prior year equity interest gain Operating margin Improvement of 150 bps reflects operational execution and cost management Fourth quarter FY2015 i highlights i 1 Excluding Q4 2015 and 2014 items, refer to Appendix. (in millions) 2015 1 2014 1 % Change 2015 (reported) 2014 (revised) Sales $8,749 $9,952 -12% $8,749 $9,952 Gross profit % of sales 1,715 19.6% 1,790 18.0% -4% 1,559 17.8% 1,747 17.6% SG&A expenses 881 1,001 -12% 1,031 1,229 Equity income 105 122 -14% 100 122 Operating income $939 $911 +3% $628 $640 10.7% 9.2% October 29, 2015

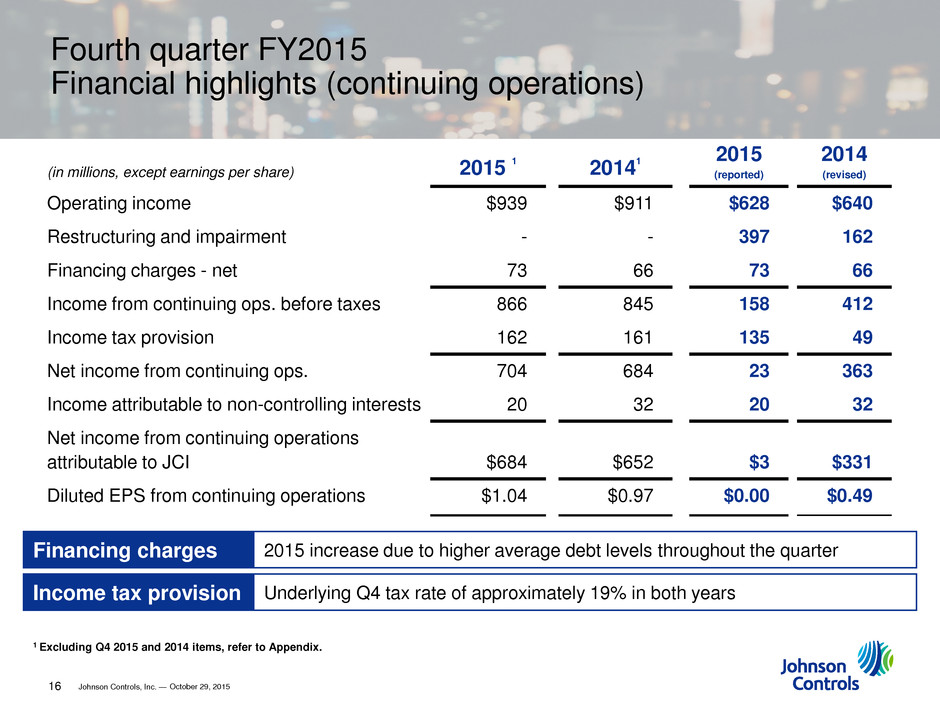

Johnson Controls, Inc. — 16 1/6 2/6 4/6 5/6 1/4 3/4 1/2 (in millions, except earnings per share) 2015 1 2014 1 2015 (reported) 2014 (revised) Operating income $939 $911 $628 $640 Restructuring and impairment - - 397 162 Financing charges - net 73 66 73 66 Income from continuing ops. before taxes 866 845 158 412 Income tax provision 162 161 135 49 Net income from continuing ops. 704 684 23 363 Income attributable to non-controlling interests 20 32 20 32 Net income from continuing operations attributable to JCI $684 $652 $3 $331 Diluted EPS from continuing operations $1.04 $0.97 $0.00 $0.49 Second Quarter 2015 Financial Highlights (continuing operations) Fourth quarter FY2015 i highlights i Financing charges 2015 increase due to higher average debt levels throughout the quarter Income tax provision Underlying Q4 tax rate of approximately 19% in both years October 29, 2015 1 Excluding Q4 2015 and 2014 items, refer to Appendix.

Johnson Controls, Inc. — 17 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Balance Sheet, Cash Flow and Guidance FY15 share repurchases of $1.4B; dividends of $0.7B GWS divestiture proceeds of $1.4B on 9/1/15 Discretionary tax audit settlements and pension contributions of $0.8B Strong balance sheet; net debt to capitalization of 36.7% at 9/30/15 Net debt of $6.0B at 9/30/15; Q4 net debt reduction of $1.3B Pension/OPEB 85% funded FY15 capex lower than expected by $0.2B FY16 Q1 FY16 Full Year Diluted EPS $0.80 - $0.83* +8% - +12% To be provided at 12/1/15 analyst day in NYC *Excludes transaction / integration / separation costs and non-recurring items FY16 Guidance October 29, 2015

1/6 2/6 4/6 5/6 1/4 3/4 1/2 Appendix

Johnson Controls, Inc. — 19 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) Q4 Non-Recurring Items – Continuing Operations Income (Expense) Tax (Expense) Benefit After-tax Income (Expense) EPS Impact Transaction, Integration & Separation Costs ($34) $6 ($28) ($0.04) Pension / OPEB MTM (422) 165 (257) ($0.39) Net Gain on Business Divestitures 145 (107) 38 $0.06 Restructuring and Impairment Costs (397) 87 (310) ($0.47) Income Taxes - (124) (124) ($0.19) Total* ($708) $27 ($681) ($1.04) Pre-Tax Income (Expense) Tax (Expense) Benefit After-tax Income (Expense) EPS Impact Transaction, Integration & Separation Costs ($19) $4 ($15) ($0.02) Pension / OPEB MTM (252) 64 ( 88) ($ .28) Restructuring and Impairment costs (162) 27 (135) ($0.20) Income Taxes - 17 17 $0.03 Total* ($433) $112 ($321) ($0.48) 2015 2014 October 29, 2015 (in millions, except earnings per share) *May not sum due to rounding.

Johnson Controls, Inc. — 20 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) 2015 Q4 Restructuring and Impairment Costs October 29, 2015 Severance and Other Cash Costs Corporate $28 Automotive Experience 154 Building Efficiency 21 Power Solutions 11 Total Severance and Other Cash Costs 214 Asset Impairment (Non-Cash) 183 Total Restructuring and Impairment Costs $397 $M’s

Johnson Controls, Inc. — 21 1/6 2/6 4/6 5/6 1/4 3/4 1/2 Second Quarter 2015 Financial Highlights (continuing operations) 2015 free cash flow Actual free cash flow as reported $ 0.5 B Tax audit settlements 0.4 Pension contributions 0.4 Net unfavorable impact of Interiors JV 0.1 Transaction/integration/separation costs 0.1 Transaction related tax payments 0.1 Favorable capital expenditures (0.2) Adjusted free cash flow $ 1.4 B October 29, 2015

1/6 2/6 4/6 5/6 1/4 3/4 1/2 johnsoncontrols.com/investors @JCI_IR