Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Baxalta Inc | d39752dex991.htm |

| 8-K - 8-K - Baxalta Inc | d39752d8k.htm |

Baxalta Incorporated Third Quarter 2015 Financial Results & Business Performance Update October 29 th , 2015 Exhibit 99.2 |

Baxalta Performance Update | Q3 2015 | Page 2 Third Quarter

2015 Earnings Conference Call Agenda

Introduction

Mary Kay

Ladone

Opening Remarks

Ludwig Hantson, Ph.D.

Innovation Update

John Orloff, M.D.

Financial Performance

& Outlook

Robert Hombach

Questions

& Answers

Management Team

Robert Hombach

Executive Vice President,

CFO and COO

Ludwig Hantson, Ph.D.

Chief Executive Officer and

President

John Orloff, M.D.

Executive Vice President,

Head of R&D

Mary Kay Ladone

Senior Vice President,

Investor Relations |

| Baxalta Performance Update | Q3 2015 | Page 3

Forward-Looking Statements and

GAAP Reconciliation

“Safe Harbor” Statement under the Private Securities

Litigation Reform Act of 1995: This presentation includes forward-

looking statements concerning expectations, prospects, estimates

and other matters that are dependent upon future events or developments. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve

factors or circumstances that are beyond Baxalta's

control and which could cause actual results to differ materially from those in the forward-looking statements, including, but not limited to, the following: demand for and market acceptance

of risks for new and existing products; product

development risks; product quality or patient safety concerns; future actions of regulatory bodies and other governmental authorities, including the FDA and foreign counterparts; failures with respect to

compliance programs; future actions of

third-parties, including payers; U.S. healthcare reform and other global austerity measures; pricing, reimbursement, taxation and rebate policies of government agencies and private payers; the impact of

competitive products and pricing, including generic

competition, drug reimportation and disruptive technologies; global, trade and tax policies; accurate identification of and execution on business development and R&D opportunities and

realization of anticipated benefits; fluctuations

in supply and demand and the pricing of plasma-based therapies; the availability of acceptable raw materials and component supply; the inability to create timely production capacity or other

manufacturing or supply difficulties; the ability

to successfully achieve the intended results of the spin-off from Baxter International Inc.; the ability to enforce owned or in-licensed patents, or the patents of third parties preventing or

restricting manufacture, sale or use of affected

products or technology; the impact of global economic conditions; fluctuations in foreign exchange and interest rates; any changes in law concerning the taxation of income, including income earned outside the

United States; actions by tax authorities in

connection with ongoing tax audits; breaches or failures of Baxalta’s information technology systems; loss of key employees or inability to identify and recruit new employees; the outcome of pending or

future litigation; the adequacy of Baxalta’s

cash flows from operations to meet its ongoing cash obligations and fund its investment program; future actions that may be taken by Shire plc in furtherance of its unsolicited proposal; and other

risks identified in Baxalta’s registration

statement on Form 10 and other Securities and Exchange Commission filings, all of which are available on Baxalta’s website. This presentation reflects management’s views as of October 29, 2015. Except

to the extent required by applicable law, we

undertake no obligation to update or revise any forward-looking statement.

Non-GAAP Financial Measures:

The financial information included in this presentation includes financial measures that are not calculated in accordance with generally accepted accounting principles (GAAP). Reconciliations of the GAAP to

non-GAAP financial measures can be found on

slides 31-36. |

Ludwig Hantson, Ph.D. Delivering Shareholder Value By Executing Our Strategy |

Baxalta Performance Update | Q3 2015 | Page 5 Achieving ~20

new product launches by 2020 •

Advancing the pipeline with key milestone

achievements •

Driving enhanced value from new products with 2015 sales of

~$280 million •

Delivering risk-adjusted revenues of $2.8B by 2020 and $7.0B

by 2025 Generating positive momentum across the

portfolio •

Pro forma sales growth of 13% (constant currency)

• Adjusted EPS of $0.56 per diluted share Augmenting portfolio with disciplined M&A initiatives • Creating value with ONCASPAR leukemia portfolio acquisition

• Leveraging capabilities as an attractive BD and licensing partner

Creating value with compelling financial profile

• Raising sales and EPS guidance for 2H 2015 • Providing enhanced outlook for 2016; heightened conviction in

aspiration of double-digits earnings growth beyond

2016 Strong Execution Validates

Baxalta’s Commitment To Driving Shareholder

Value |

Baxalta Performance Update | Q3 2015 | Page 6 Driving Strong Q3

2015 Financial Results Adjusted Sales

Growth* % Sales Growth At Constant

Currency 8%-10%

13%

0.0%

5.0%

10.0%

15.0%

Q3 2015

Expectation

Q3 2015

Actual

Adjusted EPS**

$ Per Diluted Share

$0.56

$0.45

$0.50

$0.55

$0.60

Q3 2015

Expectation

Q3 2015

Actual

Positive Momentum Continues Across Broad And Differentiated

Portfolio $0.48-$0.50

*Growth rates are at constant currency and compare to 2014 pro

forma sales **Financial results and guidance exclude

special items and are presented on an adjusted basis;

refer to slides 31-36 for information regarding non-GAAP

measures used throughout the presentation |

Baxalta Performance Update | Q3 2015 | Page 7 Building Three

Sustainable Businesses Q3 Growth* =

10% Q3 Growth* = 13%

Q3 Sales = $34M

Treating unmet medical needs and orphan diseases

Innovating in a focused, targeted manner

Leveraging patient centricity and high touch models

Ensuring sustainable, high quality supply

Enhancing access

and standards

of care

Capitalizing

on differentiated

brands

Accelerating

innovation &

launch excellence

Augmenting

portfolio with BD

Hematology

Immunology

Oncology

Exceeding Sales Expectations Across All Key Product

Categories *Growth rates are at constant currency

and compare to 2014 pro forma sales |

Baxalta Performance Update | Q3 2015 | Page 8 Advancing

Portfolio With Significant Regulatory

Success 7

Regulatory

Approvals

4

Products

Under Review

ADYNOVATE

(U.S.)

VONVENDI

(U.S.)

20% IGSC

(U.S./EU)

nal-IRI

(EU) |

Baxalta Performance Update | Q3 2015 | Page 9 New Product

Sales (Risk-Adjusted)

Meaningful Revenue

Contribution Beyond 2020

$0

$2

$4

$6

$8

2015

Expectation

2016

Expectation

2020

Outlook

2025

Outlook

Risk Adjusted

0%

20%

40%

60%

80%

100%

2015

Expectation

2016

Expectation

2020

Outlook

2025

Outlook

New Product Sales

Total BXLT Sales

~30%

~$2.8B

~$7.0B

~$280M

50%+

New Product Sales

(Risk-Adjusted % of Total)

~$750M

10%+ |

Baxalta Performance Update | Q3 2015 | Page 10 Substantial

Revenues From Late-Stage Assets

Hematology

Hematology

Immunology

Immunology

Oncology

Oncology

2020 New Product Sales

2020 New Product Sales

~90% of Revenues

from products that

are approved,

under regulatory

review, or have

positive phase III

data

Non Risk-Adjusted

Risk-Adjusted

~$2.8 Billion

(including ONCASPAR)

$4.0+ Billion

(including ONCASPAR) |

Baxalta Performance Update | Q3 2015 | Page 11 Multiple R&D

Programs With Revenue Potential Of $500+

Million Oncology

Immunology

Hematology

Early-Stage Assets

Recent Product Launches/

Late-Stage Assets

HYQVIA

20% IGSC

ADYNOVATE

VONVENDI

Pacritinib

nal-IRI

ONCASPAR

BAX 826

Gene Therapy

SuppreMol

Biosimilars

IMALUMAB |

Baxalta Performance Update | Q3 2015 | Page 12

Acquisitions

Partnerships

Advancing External Innovation |

Baxalta Performance Update | Q3 2015 | Page 13 Enhancing Growth

With M&A Initiatives M&A Strategic

Principles •

Focusing on value-creation

• Evaluating opportunities with strong strategic fit across core therapeutic orphan disease areas: Hematology Immunology Oncology • Enhancing integration success by leveraging existing capabilities • Applying disciplined financial criteria Cash Flow Reinvestment Dividends M&A / Buyback 0% 100% Disciplined Capital Allocation Framework Executing Transactions With Disciplined Approach Focused On

Generating Strong Returns On Invested Capital

|

Baxalta Performance Update | Q3 2015 | Page 14 Baxalta: A

Compelling & Unique Investment

Opportunity Leadership

• Established $6 billion global biopharmaceutical leader focused on orphan diseases

• Well positioned in attractive and growing markets with differentiated therapies • Strong global channels and patient relationships and potential to broaden access in

emerging markets

Capabilities

• Leader in creating dynamic business models to improve patient access

• Attractive business development and licensing partner • Best-in-class global biologic manufacturing network with proprietary technology

platforms, such as gene therapy

Value

• Robust and balanced late-stage pipeline spanning core therapeutic disease areas

• Driving acceleration in sales and profitability with ~20 new products by 2020

• Attractive financial profile with compelling cash flow generation and disciplined

capital allocation approach

|

John Orloff, M.D. Innovation Update |

Baxalta Performance Update | Q3 2015 | Page 16 Achieving Key

Milestones ADYNOVATE

U.S. regulatory approval pending; favorable FDA late-cycle

review VONVENDI

U.S. regulatory approval pending; favorable FDA late-cycle

review OBIZUR

Received

Canadian

approval

and

positive

opinion

from

EMA

Gene

Therapy

FIX

Progressed Phase I/II open-label study (7 patients

dosed) 20% IGSC

Submitted for U.S. and European regulatory approval for PI

BAX 923

Initiated Phase III trial in patients with chronic plaque

psoriasis Sanquin

Submitted European application for approval of contract

manufacturing site ONCASPAR

Completed acquisition; extracting meaningful value

nal-IRI

Submitted

European

MAA;

FDA

approval

granted

to

Merrimack

Pacritinib

Disclosed accelerated U.S. filing (Q4 2015); requesting priority

FDA review Oncology

Immunology

Hematology |

Baxalta Performance Update | Q3 2015 | Page 17 ~20 New Product

Launches By 2020 RIXUBIS

[EU]

2015

2016

2017

nal-IRI

1

st

line metastatic

Pancreatic Cancer

[EU]

ADYNOVATE

(BAX 855)

[U.S.]

nal-IRI

Pancreatic Cancer

Post-gemcitabine

[EU]

Etanercept

(BAX 2200)

[EU]

Adalimumab

(BAX 923)

[U.S. & EU]

Imalumab

(BAX 069)

Malignant Ascites

[U.S.]

VONVENDI

(BAX 111)

[U.S.]

FEIBA

Recon Reduction

[U.S.]

OBIZUR CHAWI

Surgery

[U.S.]

nal-IRI

1

st

line Gastric

Cancer

[EU]

IG 10% HYQVIA

CIDP

[U.S.]

rFVIIa

(BAX 817)

[U.S.]

rADAMTS13

hTTP

(BAX 930)

[U.S.]

GT FIX

(BAX 335)

[U.S.]

SM101

IgA N

[U.S.]

3

rd

line metastatic

Colorectal

[U.S.]

ONCASPAR

Lyophilized

ALL

[EU]

ALL

[U.S.]

20% IGSC

[U.S. & EU]

OBIZUR

[EU]

Pacritinib

MF

[EU]

Pacritinib

New Indication

[U.S. & EU]

ADYNOVATE

(BAX 855)

[Japan]

ADYNOVATE

(BAX 855)

[EU]

ONCASPAR

ALL

[Japan]

Pacritinib

MF

[Japan]

nal-IRI

Pancreatic Cancer

Post-gemcitabine

[Japan]

2018

-

2020

ONCASPAR

ALL

[EU]

Pacritinib

MF

[U.S.]

(BAX 826)

[U.S.]

Oncology

Immunology

Hematology

ADYNOVATE and Oncology geographic expansion included; excludes

additional externally-sourced assets; pending portfolio funding decisions; New assets, line extension, geographic expansion ONCASPAR Lyophilized ALL [U.S.] EHL rFVIII PSA

Calaspargase

pegol

Imalumab

(BAX 069) |

Bob Hombach Financial Performance |

Baxalta Performance Update | Q3 2015 | Page 19 Q3 2015

Revenues Worldwide Revenues*

$ In Billions

5%

6%

8%

13%

8%

7%

13%

0%

5%

10%

15%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Quarterly Revenue Growth*

% Sales Growth At Constant Currency

*2015 growth rates compare to 2014 pro forma sales; 2014 constant

currency growth rates do not include pro forma

adjustments $1.6B

+13% cc

U.S.

International |

Baxalta Performance Update | Q3 2015 | Page 20

Hematology

Hemophilia

• Enhancing access and elevating standards of care globally • Global ADVATE growth in double-digits: - Continued rFVIII conversion in Brazil - U.S. sales growth in mid single digits - Cumulative U.S. patient share loss of 2-3 points; pace of losses slowing Inhibitor Therapies • FEIBA growth driven by: - Robust demand and conversion to prophylaxis - Modest price improvements - Timing of tender sales in developing markets • Contribution of OBIZUR for acquired hemophilia A Q3 2015 Sales % Growth | At Actual % Growth | At Constant $ In Millions U.S. Int. Total U.S. Int. Total U.S. Int. Total Hemophilia $337 $390 $727 +6% -11% -4% +6% +7% +7% Inhibitor Therapies $78 $130 $208 +42% -2% +11% +42% +14% +22% Hematology $415 $520 $935 +11% -9% -1% +11% +9% +10% |

Baxalta Performance Update | Q3 2015 | Page 21 9%

7%

9%

8%

2%

4%

7%

0%

5%

10%

15%

20%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Hematology Sales Growth

Hemophilia

% Sales Growth At Constant Currency

9%

2%

17%

33%

18%

12%

22%

0%

10%

20%

30%

40%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Inhibitor Therapies

% Sales Growth At Constant Currency

|

Baxalta Performance Update | Q3 2015 | Page 22

Immunology*

Immunoglobulin Therapies

• Enhancing penetration in under- treated diseases • Capitalizing on broad and differentiated portfolio - Higher demand in Primary Immunodeficiency segment - Improved supply - Favorable reception and uptake of HYQVIA BioTherapeutics • Strong sales of specialty biotherapeutics - Albumin sales in U.S. and China - Alpha-1 therapies - Contract-manufacturing revenues Q3 2015 Sales % Growth | At Actual % Growth | At Constant $ In Millions U.S. Int. Total U.S. Int. Total U.S. Int. Total Immunoglobulin Therapies $334 $101 $435 +10% -1% +7% +10% +19% +12% BioTherapeutics $64 $127 $191 +7% +5% +6% +7% +18% +14% Immunology $398 $228 $626 +9% +2% +6% +9% +18% +13% *Growth rates compare to 2014 pro forma sales |

Baxalta Performance Update | Q3 2015 | Page 23 2%

3%

-2%

13%

9%

13%

12%

-5%

0%

5%

10%

15%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Immunology Sales Growth

Immunoglobulin Therapies

% Sales Growth At Constant Currency

-11%

15%

21%

19%

24%

4%

14%

-15%

-5%

5%

15%

25%

35%

Q1 14

Q2 14

Q3 14

Q4 14

Q1 15

Q2 15

Q3 15

Pro Forma BioTherapeutics*

% Sales Growth At Constant Currency

*2014 constant currency growth rates do not include pro forma

adjustments |

Baxalta Performance Update | Q3 2015 | Page 24

Oncology

Leveraging expertise in orphan diseases, high touch, service

intensive therapies Focusing on targeted

populations with limited treatment options

Capitalizing on attractive and growing market

Partnering with leading R&D companies on transformational

science Developing a portfolio of effective,

personalized, differentiated treatments Oncaspar

Portfolio Acquisition •

Q3 2015 sales of $34

million; annual sales trending at $200 million • Accelerates Baxalta’s rapid entry into Oncology • Leverages global presence • Strengthens Baxalta’s robust pipeline • Complements current partnerships $0 $1 $2 2015 Expectation 2020 Outlook 2025 Outlook $0.7B+ ~$1.5B ~$80M Oncology Sales* *Includes Oncology pipeline sales |

Baxalta Performance Update | Q3 2015 | Page 25 Q3 2015

Financial Results* Q3 2015

Sales ($ in

Millions) $1,595

Gross Margin

61.9%

Operating Margin

31.2%

EBITDA Margin

34.4%

Tax Rate

22.1%

Diluted EPS

$0.56

*Financial results exclude special items and are presented on an

adjusted basis; refer to slides 31-36 for

information regarding non-GAAP measures used throughout the presentation |

Bob Hombach Financial Outlook |

Baxalta Performance Update | Q3 2015 | Page 27 2015 Full Year

Sales Growth Expectations % Growth At Constant

Currency FY 2015

Original*

(Q1 Conference Call)

FY

2015

Guidance**

(Q2 Conference Call)

FY 2015

Guidance**

(Revised)

Hemophilia

0%

-

2%

~2%

~3%

Inhibitor

Therapies

8%+

13% -

14%

10% -

11%

Hematology

2% -

3%

~4%

~5%

Immunoglobulin

Therapies

6% -

8%

~8%

~9%

BioTherapeutics

2%

-

4%

~8%

~10%

Immunology

5% -

7%

~8%

~9%

Oncology

N/A

$50M+

~$80M

Baxalta

~4%

6% -

7%

~8%

*FY 2015 original guidance does not include pro forma

adjustments **Growth compares to 2014 pro forma

sales; H1 2015 results include pro forma adjustments |

Baxalta Performance Update | Q3 2015 | Page 28 2H 2015

Financial Outlook* Q3 2015

Actual Results

Q4 2015

Guidance

2H 2015

Guidance

(Revised)

Sales Growth**

13%

3% -

5%

8% -

9%

Diluted EPS

$0.56

$0.55 -

$0.57

$1.11 -

$1.13

*Financial results and guidance presented on an adjusted

basis; refer to slides 31-36 for additional information **Growth rates are at constant currency and compare to 2014 pro forma sales |

Baxalta Performance Update | Q3 2015 | Page 29 Raising 2H 2015

Financial Guidance* 2H 2015

Guidance

(Investor Conference)

2H 2015

Guidance

(Q2 Conference Call)

2H 2015

Guidance

(Revised)

Sales Growth**

2% -

3%

5% -

6%

8% -

9%

Gross Margin

58%

-

59%

59%

-

60%

~62%

Operating Margin

~29%

30%

-

31%

~31%

EBITDA Margin

~33%

~34%

~35%

Tax Rate

23% -

24%

23% -

24%

~23%

Diluted EPS

N/A

$1.02 -

$1.04

$1.11 -

$1.13

*Financial guidance presented on an adjusted basis; refer

to slides 31-36 for additional information

**Growth rates are at constant currency and compare to 2014 pro

forma sales |

Baxalta Performance Update | Q3 2015 | Page 30 Preliminary Full

Year 2016 Financial Guidance*

FY 2016

Guidance

(Investor Conference)

FY 2016

Guidance

(Revised)

Sales Growth**

Mid-Single Digits

8% -

9%

Gross Margin

~59%

~62%

Operating Margin

~29%

~31%

EBITDA Margin

33% -

34%

~35%

Tax Rate

23% -

24%

~23%

Diluted EPS

N/A

$2.15 -

$2.25

*Financial guidance presented on an adjusted basis; refer

to slides 31-36 for additional information

**Growth rates are at constant currency and compare to 2015 pro

forma sales |

GAAP to Pro Forma Non-GAAP Reconciliations |

| Baxalta Performance Update | Q3 2015 | Page 32 Notice To

Investors Non-GAAP Financial Measures: The financial information included in these schedules includes financial measures that are not calculated in accordance with generally accepted accounting principles (GAAP). Reconciliations of the GAAP to

non-GAAP financial measures can be found on

pages 33-36. The non-GAAP financial measures include “adjusted gross margin”, “adjusted operating income,” “adjusted EBITDA,” and “adjusted diluted earnings per

share”. Non-GAAP financial measures may

provide a more complete understanding of the Company’s operations and may facilitate a fuller analysis of the Company’s results of operations, particularly in evaluating performance from one period to another. The

Company has presented “adjusted operating

income,” which excludes interest and other expense and intangible asset amortization; and “adjusted EBITDA” which, in addition to the previous adjustments, also excludes depreciation

expense. Additionally, the non-GAAP

financial measures presented exclude the impact of certain special items, which are excluded because they are highly variable, difficult to predict, and of a size that may substantially impact the

Company’s operations and can facilitate a

fuller analysis of the Company’s results of operations, particularly in evaluating performance from one period to another. Upfront and milestone payments related to collaborative arrangements that

have been expensed as research and development

(R&D) are uncertain and often result in a different payment and expense recognition pattern than internal R&D activities and therefore are typically excluded as special items.

Intangible asset amortization is excluded to

facilitate an evaluation of current and past operating performance, particularly in terms of cash returns, and is similar to how management internally assesses performance.

The Company’s management uses non-GAAP financial

measures to evaluate the Company’s performance and provides them to investors as a supplement to the Company’s reported results, as they believe this information provides

additional insight into the Company’s

operating performance by disregarding certain nonrecurring items. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to,

similarly titled measures used by other companies.

In addition, these non-GAAP financial measures should not be considered in isolation, as a substitute for, or as superior to, financial measures calculated in accordance with GAAP,

and the Company’s financial results calculated

in accordance with GAAP and reconciliations to those financial statements should be carefully evaluated. |

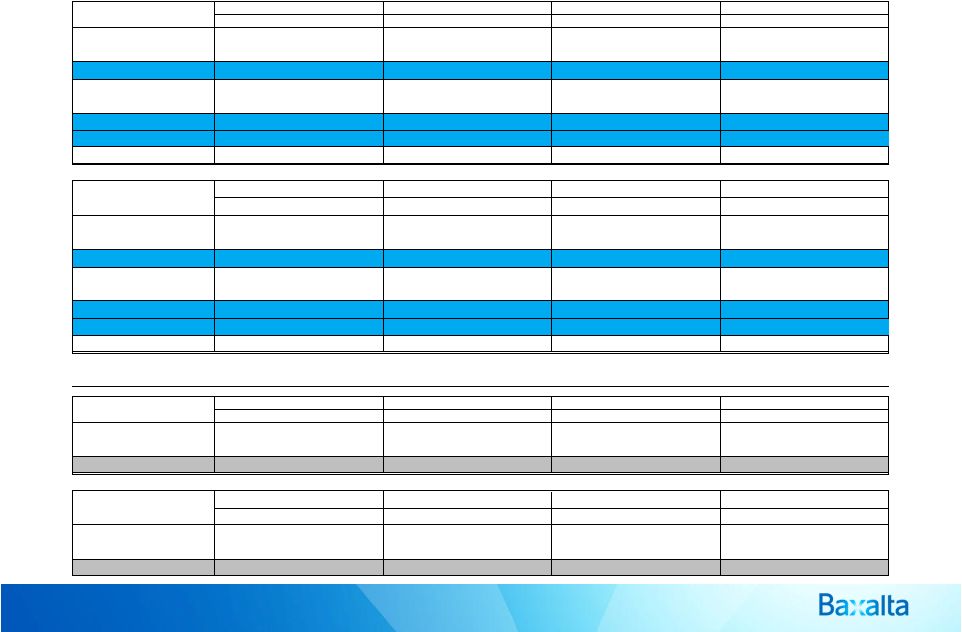

Baxalta Performance Update | Q3 2015 | Page 33 Pro Forma Sales

Reconciliation % Growth @ Actual Rates

% Growth @ Constant Rates

U.S. International Total U.S. International Total U.S. International Total U.S. International Total Hemophilia $337 $390 $727 $318 $437 $755 6% (11%) (4%) 6% 7% 7% Inhibitor Therapies 78 130 208 55 132 187 42% (2%) 11% 42% 14% 22% Hematology $415 $520 $935 $373 $569 $942 11% (9%) (1%) 11% 9% 10% Immunoglobulin Therapies 334 101 435 305 102 407 10% (1%) 7% 10% 19% 12% Pro Forma BioTherapeutics 64 127 191 60 121 181 7% 5% 6% 7% 18% 14% Pro Forma Immunology $398 $228 $626 $365 $223 $588 9% 2% 6% 9% 18% 13% Oncology $28 $6 $34 $ - $ - $ - N/M N/M N/M N/M N/M N/M Pro Forma Total Baxalta $841 $754 $1,595 $738 $792 $1,530 14% (5%) 4% 14% 12% 13% % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total Hemophilia $964 $1,076 $2,040 $938 $1,212 $2,150 3% (11%) (5%) 3% 5% 4% Inhibitor Therapies 210 347 557 151 372 523 39% (7%) 7% 39% 9% 17% Hematology $1,174 $1,423 $2,597 $1,089 $1,584 $2,673 8% (10%) (3%) 8% 6% 7% Immunoglobulin Therapies 980 297 1,277 906 292 1,198 8% 2% 7% 8% 21% 11% Pro Forma BioTherapeutics 189 370 559 182 339 521 4% 9% 7% 4% 18% 13% Pro Forma Immunology $1,169 $667 $1,836 $1,088 $631 $1,719 7% 6% 7% 7% 19% 12% Oncology $28 $6 $34 $ - $ - $ - N/M N/M N/M N/M N/M N/M Pro Forma Total Baxalta $2,371 $2,096 $4,467 $2,177 $2,215 $4,392 9% (5%) 2% 9% 10% 10% Pro Forma Net Sales Reconciliations % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total BioTherapeutics $64 $127 $191 $60 $79 $139 7% 61% 37% 7% 81% 49% Pro forma MSA revenue - - - - 42 42 Pro Forma BioTherapeutics $64 $127 $191 $60 $121 $181 7% 5% 6% 7% 18% 14% % Growth @ Actual Rates % Growth @ Constant Rates U.S. International Total U.S. International Total U.S. International Total U.S. International Total BioTherapeutics $189 $288 $477 $182 $216 $398 4% 33% 20% 4% 48% 28% Pro forma MSA revenue - 82 82 - 123 123 Pro Forma BioTherapeutics $189 $370 $559 $182 $339 $521 4% 9% 7% 4% 18% 13% Q3 2015 Q3 2014 YTD 2015 YTD 2014 Q3 2015 Q3 2014 YTD 2015 YTD 2014 |

Baxalta Performance Update | Q3 2015 | Page 34

GAAP-to-Non-GAAP Reconciliation: Gross

Margin

$ in millions

Q3 2015

Gross Margin

962

Gross Margin Percentage

60.3%

Adjustments for special items

25 Adjusted Gross Margin 987

Adjusted Gross Margin Percentage

61.9%

Baxalta has also presented guidance for H2 2015 and 2016 using

the non-GAAP measure of Adjusted Gross

Margin. Baxalta projects that GAAP Gross Margin would be lower than Adjusted Gross Margin by approximately 1% for each period presented, with

reconciling items of intangible asset amortization expense and

other Q3 2015 special items for H2

2015. |

Baxalta Performance Update | Q3 2015 | Page 35

GAAP-to-Non-GAAP Reconciliation:

Operating Income and EBITDA

$ in millions

Q3 2015

Pre-tax Income

354

Pre-tax Income Margin

22.2%

Adjustments for special items

140 Adjusted Pre-tax Income 494

Adjusted Pre-tax Income Margin

31.0%

Remove: Net interest expense

23 Remove: Other income, net

(19) Adjusted Operating Income

498

Adjusted Operating Income Margin

31.2%

Remove: Depreciation

50 Adjusted EBITDA 548

Adjsuted EBITDA Margin

34.4%

Baxalta has also presented guidance for H2 2015 and 2016 using

non-GAAP measures of Adjusted Operating Income

Margin and Adjusted EBITDA Margin. Baxalta projects that GAAP Pre-tax Income Margin would be lower than Adjusted Operating Income

Margin by approximately 6% for H2 2015 and approximately 3% for

2016, with reconciling items of interest expense,

other income and intangible asset amortization

expense, as well as Q3 2015 special items for H2 2015

guidance. GAAP Pre-tax Income Margin

would be lower than Adjusted EBITDA Margin by an approximate additional 4% in both H2 2015 and 2016 related to depreciation expense. |

Baxalta Performance Update | Q3 2015 | Page 36

GAAP-to-Non-GAAP Reconciliation:

Diluted EPS

Q3 2015

Diluted EPS

$0.45

Adjustments for special items

0.11 Adjusted Diluted EPS $0.56 Baxalta has also presented guidance for Q4 2015, H2 2015 and 2016 using the non-

GAAP measure of Adjusted Diluted EPS. Baxalta projects that

GAAP Diluted EPS would be lower than Adjusted

Diluted EPS by approximately $0.02 per diluted share for Q4 2015, approximately $0.13 per diluted share for H2 2015 and approximately $0.08 per

diluted share in 2016, with reconciling items of intangible asset

amortization expense and other Q3 2015 special

items for H2 2015 guidance. |