Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SMART ABS Series 2015-3US Trust | d74702d8k.htm |

| EX-8.2 - EX-8.2 - SMART ABS Series 2015-3US Trust | d74702dex82.htm |

| EX-4.2 - EX-4.2 - SMART ABS Series 2015-3US Trust | d74702dex42.htm |

| EX-4.3 - EX-4.3 - SMART ABS Series 2015-3US Trust | d74702dex43.htm |

| EX-4.1 - EX-4.1 - SMART ABS Series 2015-3US Trust | d74702dex41.htm |

| EX-4.4 - EX-4.4 - SMART ABS Series 2015-3US Trust | d74702dex44.htm |

| EX-4.5 - EX-4.5 - SMART ABS Series 2015-3US Trust | d74702dex45.htm |

| EX-8.1 - EX-8.1 - SMART ABS Series 2015-3US Trust | d74702dex81.htm |

| EX-1.1 - EX-1.1 - SMART ABS Series 2015-3US Trust | d74702dex11.htm |

| EX-10.2 - EX-10.2 - SMART ABS Series 2015-3US Trust | d74702dex102.htm |

| EX-10.4 - EX-10.4 - SMART ABS Series 2015-3US Trust | d74702dex104.htm |

| EX-10.5 - EX-10.5 - SMART ABS Series 2015-3US Trust | d74702dex105.htm |

| EX-10.3 - EX-10.3 - SMART ABS Series 2015-3US Trust | d74702dex103.htm |

| EX-99.1 - EX-99.1 - SMART ABS Series 2015-3US Trust | d74702dex991.htm |

Exhibit 4.6

SMART ABS SERIES 2015-3US TRUST

SERIES SUPPLEMENT

MACQUARIE LEASING PTY LIMITED

ABN 38 002 674 982

MACQUARIE BANK LIMITED

ABN 46 008 583 542

MACQUARIE SECURITIES MANAGEMENT PTY LIMITED

ABN 26 003 435 443

PERPETUAL TRUSTEE COMPANY LIMITED

ABN 42 000 001 007

CONTENTS

| Clause |

Page |

|||||

| 1. |

Definitions and Interpretation |

1 | ||||

| 2. |

The Units |

34 | ||||

| 3. |

SMART Receivable Rights |

35 | ||||

| 4. |

The Notes |

35 | ||||

| 5. |

Conditions Precedent to Acceptance of Letter of Offer |

39 | ||||

| 6. |

Remuneration of Manager, Trustee and Security Trustee |

41 | ||||

| 7. |

Manager Default |

44 | ||||

| 8. |

Termination of a Fixed Rate Swap or a Currency Swap |

45 | ||||

| 9. |

Determination and Application of Total Principal Collections |

46 | ||||

| 10. |

Determination and Application of Available Income |

50 | ||||

| 11. |

Charge-Offs |

55 | ||||

| 12. |

Payment of Expenses, Principal and Interest to Noteholders and other distributions |

57 | ||||

| 13. |

Collections Account |

59 | ||||

| 14. |

Clean-Up and Extinguishment |

62 | ||||

| 15. |

Termination of the Series Trust |

65 | ||||

| 16. |

General |

69 | ||||

| 17. |

Trustee’s Limitation of Liability |

80 | ||||

| 18. |

National Credit Code |

82 | ||||

| 19. |

Notices |

84 | ||||

| 20. |

Miscellaneous |

87 | ||||

| Schedule

|

||||||

| 1. |

Eligibility Criteria |

90 | ||||

| 2. |

Form of Note Certificate for Class A-4 Notes, Class B Notes and Seller Notes |

92 | ||||

| 3. |

Form of Note Transfer |

94 | ||||

| 4. |

Pool Performance Data |

98 | ||||

| 5. |

Form of Noteholder Report |

100 | ||||

| 6. |

Form of Annual Certification |

106 | ||||

| 7. |

Form of Assessment of Compliance Report |

107 | ||||

| 8. |

Servicer’s Certificate of Compliance |

111 | ||||

THIS SERIES SUPPLEMENT is made at Sydney on 15 October 2015

PARTIES:

| (1) | MACQUARIE LEASING PTY LIMITED ABN 38 002 674 982 of Level 6, 50 Martin Place, Sydney, NSW 2000 (MLPL, the Seller and hereinafter included in the expression the Servicer). |

| (2) | MACQUARIE BANK LIMITED ABN 46 008 583 542 of Level 1, 50 Martin Place, Sydney, NSW 2000 (MBL). |

| (3) | MACQUARIE SECURITIES MANAGEMENT PTY LIMITED ABN 26 003 435 443 of Level 1, 50 Martin Place, Sydney, NSW 2000 (hereinafter included in the expression the Manager). |

| (4) | PERPETUAL TRUSTEE COMPANY LIMITED ABN 42 000 001 007 in its capacity as trustee of the Series Trust of Level 12, Angel Place, 123 Pitt Street, Sydney, NSW 2000 (hereinafter included in the expression the Trustee). |

BACKGROUND:

| (A) | This Deed relates to the SMART ABS Series 2015-3US Trust constituted pursuant to the Master Trust Deed and the Trust Creation Deed. |

| (B) | In accordance with the Master Trust Deed, this Deed includes, amongst other things, the terms upon which: |

| (a) | the Trustee may purchase SMART Receivable Rights from the Seller and/or from the Trustee as trustee of a Disposing Trust; and |

| (b) | the Trustee may issue Notes to fund such purchase. |

| (C) | The Trustee has agreed to act as trustee of the Series Trust and the Seller Trust on the terms and conditions of this Deed, the Trust Creation Deed and the Master Trust Deed. |

OPERATIVE PROVISIONS

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | Definitions |

In this Deed, unless the contrary intention appears:

A$ and Australian dollars means the lawful currency for the time being of the Commonwealth of Australia.

A$ Class A-1 Floating Amount in relation to a Distribution Date and the Interest Period ending on that Distribution Date means an amount calculated as follows:

| CA1FA = CAPA x CAR x |

N | |||

| 365 |

where:

| CA1FA |

= |

the A$ Class A-1 Floating Amount for the Interest Period; |

1

| CAPA |

= |

the A$ Equivalent of the aggregate Invested Amounts of the Class A-1 Notes at the close of business on the first day of the Interest Period (after any reductions in the Invested Amounts of the Class A-1 Notes on that day); | ||||

| CAR |

= |

the A$ Class A-1 Rate for the Interest Period; and | ||||

| N |

= |

the number of days in the Interest Period. | ||||

A$ Class A-1 Margin has the same meaning as the “Spread” specified in the Currency Swap in relation to the Class A-1 Notes for the purposes of calculating the A$ floating amounts payable by the Trustee under the Currency Swap in relation to the Class A-1 Notes.

A$ Class A-1 Principal in relation to a Distribution Date means the aggregate of the amounts allocated to the Class A-1 Notes pursuant to Clauses 9.2(a), 9.2(e), 9.3(a)(i)(A) and 9.3(a)(i)(E) on that Distribution Date.

A$ Class A-1 Rate in relation to an Interest Period means the aggregate of:

| (a) | the “Floating Rate Option” specified in the Currency Swap in relation to the Class A-1 Notes for the purposes of calculating A$ floating amounts payable by the Trustee on the Distribution Date at the end of that Interest Period; and |

| (b) | the A$ Class A-1 Margin. |

A$ Class A-2a Floating Amount in relation to a Distribution Date and the Interest Period ending on that Distribution Date means an amount calculated as follows:

where:

| CA2aFA |

= |

the A$ Class A-2a Floating Amount for the Interest Period; | ||||

| CA2aPA |

= |

the A$ Equivalent of the aggregate Invested Amounts of the Class A-2a Notes at the close of business on the first day of the Interest Period (after any reductions in the Invested Amounts of the Class A-2a Notes on that day); | ||||

| CA2aR |

= |

the A$ Class A-2a Rate for the Interest Period; and | ||||

| N |

= |

the number of days in the Interest Period. | ||||

A$ Class A-2a Margin has the same meaning as the “Spread” specified in the Currency Swap in relation to the Class A-2a Notes for the purposes of calculating the A$ floating amounts payable by the Trustee under the Currency Swap in relation to the Class A-2a Notes.

A$ Class A-2a Principal in relation to a Distribution Date means the aggregate of the amounts allocated to the Class A-2a Notes pursuant to Clauses 9.2(b)(i), 9.2(e), 9.3(a)(i)(B)I and 9.3(a)(i)(E) on that Distribution Date.

2

A$ Class A-2a Rate in relation to an Interest Period means the aggregate of:

| (a) | the “Floating Rate Option” specified in the Currency Swap in relation to the Class A-2a Notes for the purposes of calculating A$ floating amounts payable by the Trustee on the Distribution Date at the end of that Interest Period; and |

| (b) | the A$ Class A-2a Margin. |

A$ Class A-2b Floating Amount in relation to a Distribution Date and the Interest Period ending on that Distribution Date means an amount calculated as follows:

where:

| CA2bFA |

= |

the A$ Class A-2b Floating Amount for the Interest Period; | ||||

| CA2bPA |

= |

the A$ Equivalent of the aggregate Invested Amounts of the Class A-2b Notes at the close of business on the first day of the Interest Period (after any reductions in the Invested Amounts of the Class A-2b Notes on that day); | ||||

| CA2bR |

= |

the A$ Class A-2b Rate for the Interest Period; and | ||||

| N |

= |

the number of days in the Interest Period. | ||||

A$ Class A-2b Margin has the same meaning as the “Spread” specified in the Currency Swap in relation to the Class A-2b Notes for the purposes of calculating the A$ floating amounts payable by the Trustee under the Currency Swap in relation to the Class A-2b Notes.

A$ Class A-2b Principal in relation to a Distribution Date means the aggregate of the amounts allocated to the Class A-2b Notes pursuant to Clauses 9.2(b)(ii), 9.2(e), 9.3(a)(i)(B)II and 9.3(a)(i)(E) on that Distribution Date.

A$ Class A-2b Rate in relation to an Interest Period means the aggregate of:

| (a) | the “Floating Rate Option” specified in the Currency Swap in relation to the Class A-2b Notes for the purposes of calculating A$ floating amounts payable by the Trustee on the Distribution Date at the end of that Interest Period; and |

| (b) | the A$ Class A-2b Margin. |

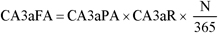

A$ Class A-3a Floating Amount in relation to a Distribution Date and the Interest Period ending on that Distribution Date means an amount calculated as follows:

where:

| CA3aFA |

= |

the A$ Class A-3a Floating Amount for the Interest Period; |

3

| CA3aPA |

= | the A$ Equivalent of the aggregate Invested Amounts of the Class A-3a Notes at the close of business on the first day of the Interest Period (after any reductions in the Invested Amounts of the Class A-3a Notes on that day); | ||

| CA3aR |

= | the A$ Class A-3a Rate for the Interest Period; and | ||

| N |

= | the number of days in the Interest Period. | ||

A$ Class A-3a Margin has the same meaning as the “Spread” specified in the Currency Swap in relation to the Class A-3a Notes for the purposes of calculating the A$ floating amounts payable by the Trustee under the Currency Swap in relation to the Class A-3a Notes.

A$ Class A-3a Principal in relation to a Distribution Date means the aggregate of the amounts allocated to the Class A-3a Notes pursuant to Clauses 9.2(c)(i), 9.2(e), 9.3(a)(i)(C)I and 9.3(a)(i)(E) on that Distribution Date.

A$ Class A-3a Rate in relation to an Interest Period means the aggregate of:

| (a) | the “Floating Rate Option” specified in the Currency Swap in relation to the Class A-3a Notes for the purposes of calculating A$ floating amounts payable by the Trustee on the Distribution Date at the end of that Interest Period; and |

| (b) | the A$ Class A-3a Margin. |

A$ Class A-3b Floating Amount in relation to a Distribution Date and the Interest Period ending on that Distribution Date means an amount calculated as follows:

| CA3bFA = CA3bPA ´ CA3bR ´

|

N | |||

| 365 |

| where: |

||||

| CA3bFA |

= | the A$ Class A-3b Floating Amount for the Interest Period; | ||

| CA3bPA |

= | the A$ Equivalent of the aggregate Invested Amounts of the Class A-3b Notes at the close of business on the first day of the Interest Period (after any reductions in the Invested Amounts of the Class A-3b Notes on that day); | ||

| CA3bR |

= | the A$ Class A-3b Rate for the Interest Period; and | ||

| N |

= | the number of days in the Interest Period. | ||

A$ Class A-3b Margin has the same meaning as the “Spread” specified in the Currency Swap in relation to the Class A-3b Notes for the purposes of calculating the A$ floating amounts payable by the Trustee under the Currency Swap in relation to the Class A-3b Notes.

A$ Class A-3b Principal in relation to a Distribution Date means the aggregate of the amounts allocated to the Class A-3b Notes pursuant to Clauses 9.2(c)(ii), 9.2(e), 9.3(a)(i)(C)II and 9.3(a)(i)(E) on that Distribution Date.

4

A$ Class A-3b Rate in relation to an Interest Period means the aggregate of:

| (a) | the “Floating Rate Option” specified in the Currency Swap in relation to the Class A-3b Notes for the purposes of calculating A$ floating amounts payable by the Trustee on the Distribution Date at the end of that Interest Period; and |

| (b) | the A$ Class A-3b Margin. |

A$ Equivalent means in relation to an amount which is calculated, determined or expressed in a Foreign Currency or which includes a component determined or expressed in a Foreign Currency, that Foreign Currency amount or Foreign Currency component (as the case may be) multiplied by the relevant A$ Exchange Rate.

A$ Exchange Rate in relation to the Class A-1 Notes, the Class A-2a Notes, the Class A-2b Notes, the Class A-3a Notes or the Class A-3b Notes, means the “A$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to that Sub-Class of Notes.

A$ Invested Amount means at any time:

| (a) | in relation to an A$ Note, the Invested Amount of that A$ Note at that time; and |

| (b) | in relation to a US$ Note, the Initial Adjusted Invested Amount of that US$ Note less the aggregate of all Australian dollar denominated payments previously made on account of principal in respect of that US$ Note pursuant to Clauses 9.2 and 9.3. |

A$ Note means a Note issued as a registered debt security denominated in A$ in accordance with Clause 4 of this Deed and includes the Class A-4 Notes, the Class B Notes and the Seller Notes.

A$ Noteholder means a Noteholder of an A$ Note.

A$ Note Interest Rate in relation to an A$ Note and an Interest Period in relation to that A$ Note means the aggregate of:

| (a) | BBSW for that Interest Period; and |

| (b) | the Margin for that A$ Note. |

Adjusted Collateralised Amount in relation to:

| (a) | the Class A-1 Notes or a Class A-1 Note means, at any given time, the A$ Equivalent of the Collateralised Amount of those Class A-1 Notes or that Class A-1 Note at that time; |

| (b) | the Class A-2 Notes, a Sub-Class of the Class A-2 Notes or a Class A-2 Note means, at any given time, the A$ Equivalent of the Collateralised Amount of those Class A-2 Notes, that Sub-Class of Class A-2 Notes or that Class A-2 Note at that time; and |

| (c) | the Class A-3 Notes, a Sub-Class of the Class A-3 Notes or a Class A-3 Note means, at any given time, the A$ Equivalent of the Collateralised Amount of those Class A-3 Notes, that Sub-Class of Class A-3 Notes or that Class A-3 Note at that time. |

Adjusted Invested Amount in relation to:

| (a) | the Class A-1 Notes or a Class A-1 Note means, at any given time: |

5

| (i) | while a Currency Swap is in place for the Class A-1 Notes and a Currency Swap Provider Payment Default is not subsisting in respect of that Currency Swap, the A$ Equivalent of the Invested Amount of those Class A-1 Notes or that Class A-1 Note at that time; or |

| (ii) | while a Currency Swap is not in place for the Class A-1 Notes or while a Currency Swap is in place for the Class A-1 Notes but a Currency Swap Provider Payment Default is subsisting in respect of that Currency Swap, such amount in Australian dollars as is required to be exchanged in the spot exchange market in order to obtain US$ in an amount equal to the Invested Amount of those Class A-1 Notes or that Class A-1 Note at that time; |

| (b) | the Class A-2 Notes, a Sub-Class of the Class A-2 Notes or a Class A-2 Note means, at any given time: |

| (i) | while a Currency Swap is in place for the relevant Sub-Class of Class A-2 Notes and a Currency Swap Provider Payment Default is not subsisting in respect of that Currency Swap, the A$ Equivalent of the Invested Amount of those Class A-2 Notes, that Sub-Class of Class A-2 Notes or that Class A-2 Note at that time; or |

| (ii) | while a Currency Swap is not in place for the relevant Sub-Class of Class A-2 Notes or while a Currency Swap is in place for the relevant Sub-Class of Class A-2 Notes but a Currency Swap Provider Payment Default is subsisting in respect of that Currency Swap, such amount in Australian dollars as is required to be exchanged in the spot exchange market in order to obtain US$ in an amount equal to the Invested Amount of those Class A-2 Notes, that Sub-Class of Class A-2 Notes or that Class A-2 Note at that time; and |

| (c) | the Class A-3 Notes, a Sub-Class of the Class A-3 Notes or a Class A-3 Note means, at any given time: |

| (i) | while a Currency Swap is in place for the relevant Sub-Class of Class A-3 Notes and a Currency Swap Provider Payment Default is not subsisting in respect of that Currency Swap, the A$ Equivalent of the Invested Amount of those Class A-3 Notes, that Sub-Class of Class A-3 Notes or that Class A-3 Note at that time; or |

| (ii) | while a Currency Swap is not in place for the relevant Sub-Class of Class A-3 Notes or while a Currency Swap is in place for the relevant Sub-Class of Class A-3 Notes but a Currency Swap Provider Payment Default is subsisting in respect of that Currency Swap, such amount in Australian dollars as is required to be exchanged in the spot exchange market in order to obtain US$ in an amount equal to the Invested Amount of those Class A-3 Notes, that Sub Class of Class A-3 Notes or that Class A-3 Note at that time. |

Adverse Effect means an event which materially and adversely affects the amount of any payment to be made to any Investor (to the extent that it affects any Investor other than the Seller and any Related Body Corporate of the Seller) or materially and adversely affects the timing of such payment.

Agency Agreement means the Agency Agreement dated on or after the date of this Deed between the Trustee, the Manager, the US$ Note Trustee, the Principal Paying Agent, the US$ Note Registrar and the Agent Bank.

Agent has the same meaning as in the Agency Agreement.

6

Agent Bank means the Bank of New York Mellon, or any replacement Agent Bank appointed under the Agency Agreement.

Approved External Dispute Resolution Scheme means an external dispute resolution scheme approved under and in accordance with section 47(1)(i) of the National Credit Code and Regulation 10(3) of the Regulations.

Arranger means Citigroup Global Markets Inc.

Arrears Days in relation to a SMART Receivable means the number of days that the SMART Receivable is in arrears (if any) calculated in accordance with the Operations Manual.

ASX Listing Rules means the Australian Securities Exchange Listing Rules as updated from time to time.

Australian Credit Licence has the meaning given to that term in the National Credit Code.

Authorised Short-Term Investments means:

| (a) | bonds, debentures or treasury bills issued by or notes or other securities issued by the Commonwealth of Australia or the government of any State or Territory of the Commonwealth of Australia; |

| (b) | deposits with, or certificates of deposit issued by, a bank; |

| (c) | bills of exchange, which at the time of acquisition have a maturity date of not more than 200 days and which have been accepted, drawn on or endorsed by a bank and provide a right of recourse against that bank by a holder in due course who purchases them for value; or |

| (d) | debentures of any public statutory body constituted under the laws of the Commonwealth of Australia or any State of the Commonwealth where the repayment of the principal secured and the interest payable on that principal is guaranteed by the Commonwealth or the State, |

in each case held at or through an Eligible Depository, in the name of the Trustee or its nominee and denominated in Australian dollars.

Available Income in relation to a Monthly Period means the aggregate of:

| (a) | the Income Collections in relation to that Monthly Period; |

| (b) | the Principal Draw in relation to the Determination Date immediately following the end of that Monthly Period; |

| (c) | the Liquidity Reserve Draw in relation to the Determination Date immediately following the end of that Monthly Period; and |

| (d) | the Liquidity Reserve Balance Excess (if any) in relation to the Distribution Date immediately following the end of that Monthly Period. |

BBSW in relation to an Interest Period for a Class of A$ Notes means the rate determined by the Calculation Agent (as defined in the Fixed Rate Swap Agreement) to be the AUD-BBR-BBSW applicable under the Fixed Rate Swap to the Calculation Period (as defined in the Fixed Rate Swap Agreement) corresponding to that Interest Period.

7

Business Day means (except where expressly provided otherwise) any day on which banks are open for business in Sydney, Melbourne, New York City and London, other than a Saturday, a Sunday or a public holiday in Sydney, Melbourne, New York City or London.

Capital Unit has the same meaning as in the Trust Creation Deed.

Capital Unitholder has the same meaning as in the Trust Creation Deed.

Charge-Off means a US$ Note Charge-Off, a Class A-4 Charge-Off, a Class B Charge-Off or a Seller Charge-Off.

Class means depending upon the context the Class A Notes, the Class B Notes and/or the Seller Notes.

Class A Charge-Off in relation to the Class A Notes, a Sub-Class of the Class A Notes or a Class A Note means all amounts charged off against the Collateralised Amount of the Class A-1 Notes, the Class A-2 Notes, the Class A-3 Notes or the Class A-4 Notes pursuant to Clause 11.1(c).

Class A Note means a Note forming part of the Class of Notes described in Clause 4.2 as a Class A Note and issued pursuant to Clause 4.1.

Class A Noteholder means a Class A-1 Noteholder, a Class A-2 Noteholder, a Class A-3 Noteholder and a Class A-4 Noteholder.

Class A-1 Note means a Note forming part of the Sub-Class of Notes described in Clause 4.2 as a Class A-1 Note and issued pursuant to Clause 4.1.

Class A-1 Noteholder has the same meaning as in the US$ Note Trust Deed.

Class A-2 Note means a Note forming part of the Sub-Class of Notes described in Clause 4.2 as a Class A-2 Note and issued pursuant to Clause 4.1.

Class A-2 Noteholder has the same meaning as in the US$ Note Trust Deed.

Class A-3 Note means a Note forming part of the Sub-Class of Notes described in Clause 4.2 as a Class A-3 Note and issued pursuant to Clause 4.1.

Class A-3 Noteholder has the same meaning as in the US$ Note Trust Deed.

Class A-4 Charge-Off in relation to the Class A-4 Notes or a Class A-4 Note means all amounts charged off against the Collateralised Amount of the Class A-4 Notes or that Class A-4 Note, as the case may be, pursuant to Clause 11.1(c)(ii).

Class A-4 Interest in relation to a Distribution Date means the aggregate of the interest payments to be made in respect of the Class A-4 Notes on that Distribution Date in accordance with Clause 4.4 (exclusive of any Unpaid Class A-4 Interest Amount).

Class A-4 Note means a Note forming part of the Sub-Class of Notes described in Clause 4.2 as a Class A-4 Note and issued pursuant to Clause 4.1.

Class A-4 Noteholder means a Noteholder of a Class A-4 Note.

8

Class B Charge-Off in relation to the Class B Notes or a Class B Note means all amounts charged off against the Collateralised Amount of the Class B Notes or that Class B Note, as the case may be, pursuant to Clause 11.1(b).

Class B Interest in relation to a Distribution Date means the aggregate of the interest payments to be made in respect of the Class B Notes on that Distribution Date in accordance with Clause 4.4.

Class B Note means a Note forming part of the Class of Notes described in Clause 4.2 as a Class B Note and issued pursuant to Clause 4.1.

Class B Noteholder means a Noteholder of a Class B Note.

Clean-Up Offer means the offer by the Trustee to extinguish in favour of the Seller its entire right, title and interest in the SMART Receivables in return for the payment by the Seller of the Clean-Up Settlement Price in accordance with Clause 14.

Clean-Up Percentage means 10%.

Clean-Up Settlement Date means the Distribution Date nominated by the Seller pursuant to Clause 14.3.

Clean-Up Settlement Price means the amount calculated in accordance with Clause 14.4.

Closing Date means in relation to a Letter of Offer (if any) in the form of:

| (a) | Schedule 1 of the Master Sale and Servicing Deed, the date specified in that Letter of Offer to be the Closing Date; or |

| (b) | a Transfer Proposal, the date specified in that Letter of Offer to be the Assignment Date, |

or in each case such other date as the Manager may notify the Trustee, the Seller and Arranger (if applicable) in accordance with that Letter of Offer.

Collateral Security means in respect of a SMART Receivable:

| (a) | any: |

| (i) | Security Interest; or |

| (ii) | guarantee, indemnity or other assurance, |

which secures or otherwise provides for the repayment or payment of that SMART Receivable but does not include a Mortgage relating to that SMART Receivable; and

| (b) | any Insurance Policy (both present and future) in respect of any Mortgage, Collateral Security or Retained Title Rights in relation to that SMART Receivable. |

A Collateral Security referred to in paragraph (a) may be given under the same document that evidences the SMART Receivable to which that Collateral Security relates.

Collateralised Amount means:

| (a) | in relation to a Note, Class of Notes or Sub-Class of Notes at any given time which is not on a Determination Date, the then aggregate Invested Amount for that Note, Class of Notes or |

9

| Sub-Class of Notes (as the case may be) less the aggregate amount of Charge-Offs in respect of that Note, Class of Notes or Sub-Class of Notes (as the case may be and, in relation to the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes, the US$ Equivalent of the amount of such Charge-Off) pursuant to this Deed or, in relation to the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes, the US$ Note Conditions, made on prior Distribution Dates and remaining unreimbursed; and |

| (b) | in relation to a Note, Class of Notes or Sub-Class of Notes (as the case may be) on a Determination Date, the amount calculated below: |

SA = A + B - C

Where:

SA = the Collateralised Amount of that Note, Class of Notes or Sub-Class of Notes (as the case may be) on that Determination Date;

A = the amount calculated pursuant to paragraph (a) in respect of that Note, Class of Notes or Sub-Class of Notes (assuming the reference to “which is not a Determination Date” does not apply);

B = the amount determined by the Manager on that Determination Date to be allocated from Available Income in accordance with Clauses 10.1(i) and (m) and Clauses 10.2(c) and (d) on the next following Distribution Date to reimburse any unreimbursed Charge-Offs in respect of that Note, Class of Notes or Sub-Class of Notes (and, in relation to the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes, the US$ Equivalent of such amounts); and

C = the amount determined by the Manager on that Determination Date to be charged-off in respect of that Note, Class of Notes or Sub-Class of Notes in accordance with Clause 11.1 on the next following Distribution Date (and, in relation to the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes, the US$ Equivalent of such amounts).

Collections in relation to a given period means the aggregate of the following amounts (without double counting) in respect of the SMART Receivables then forming part of the Assets of the Series Trust:

| (a) | A less the sum of (B + C) where: |

| A = |

the sum of amounts for which a credit entry is made during the period to the accounts established in the Servicer’s records for those SMART Receivables (but excluding any Adjustment Advances to be paid to a Disposing Trust on the Closing Date); | |

| B = |

amounts for which a credit entry is made to the accounts established in the Servicer’s records for those SMART Receivables which relates to any Defaulted Amount on those SMART Receivables during the period; and | |

| C = |

reversals made during the period to the accounts established in the Servicer’s records in respect of those SMART Receivables where the original credit entry (or part thereof) was made in error or was made but subsequently reversed due to funds not being cleared; | |

| (b) | any Recoveries received by the Servicer in relation to those SMART Receivables during the period (less any reversals made during the period in respect of Recoveries where the original |

10

| credit entry (or part thereof) was in error or was made but subsequently reversed due to funds not being cleared); |

| (c) | any amounts received by the Trustee pursuant to clause 6.6 of the Master Sale and Servicing Deed in respect of the period; |

| (d) | any amounts reasonably expected by the Manager to be received by the Trustee pursuant to Clause 14.5 on the Distribution Date immediately following that period; |

| (e) | any amounts received by the Trustee pursuant to clauses 3.10(b), 3.16(b) or 6.10 of the Master Sale and Servicing Deed in respect of the period; |

| (f) | any damages received by the Trustee in the period other than as described in paragraphs (c) and (e) above; |

| (g) | any amounts received by the Trustee in the period pursuant to Clause 15.9(c); |

| (h) | in respect of the first Monthly Period only, the A$ Equivalent of any note proceeds in respect of the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes and any note proceeds in relation to the A$ Notes received by the Trustee during the period which are not used on the Closing Date to acquire SMART Receivable Rights; |

| (i) | any insurance proceeds received during the period by the Servicer or the Trustee in accordance with any Insurance Policy; |

| (j) | any Transfer Amount (or part thereof) received by the Trustee pursuant to clause 16 of the Master Sale and Servicing Deed and Clause 14.10 of this Deed where the Series Trust is a Disposing Trust; and |

| (k) | any other amount received by the Trustee in the period (excluding any Collections referred to in the preceding paragraphs, any amount drawn from the Liquidity Reserve Balance pursuant to Clause 10.4(e), any collateral or prepayment under any Fixed Rate Swap Agreement or Currency Swap Agreement, any US$ amount received by the Trustee from the Currency Swap Provider under a Currency Swap where such amount has been or is to be paid directly by the Currency Swap Provider to the Principal Paying Agent for the US$ Notes, any Currency Swap Termination Proceeds and any US$ amount received by the Trustee pursuant to an exchange of Australian dollars for US$ in the spot exchange market as contemplated by Clause 9.4(g) or Clause 10.1(d)), |

less any amount debited during the period to the accounts established in the Servicer’s records for those SMART Receivables representing fees or charges imposed by any Governmental Agency, bank accounts debits tax or similar tax or duty imposed by any Governmental Agency (including any tax or duty in respect of payments or receipts to or from bank or other accounts), insurance premiums paid by the Servicer or any Obligor Taxes.

Collections Account means:

| (a) | the account established and maintained pursuant to Clause 13.1 or any new account established as the Collections Account under Clause 13.3; and |

| (b) | any other account opened by the Trustee pursuant to Clause 13.7. |

Credit Support Percentage in relation to a Class of Notes on any date means the proportion of the aggregate Collateralised Amount of all Classes of Notes which rank below that Class of Notes

11

(determined by reference to the order of priority of enforcement as set out in the General Security Deed) to the Total Collateralised Amount of the Notes as at that date, expressed as a percentage.

Currency Swap means the currency swap entered into:

| (a) | in relation to the Class A-1 Notes, the Class A-2a Notes and the Class A-3a Notes, substantially on the terms of Annexure 1 of the Currency Swap Agreement (within the meaning of paragraph (a) of the definition of that term); and |

| (b) | in relation to the Class A-2b Notes and the Class A-3b Notes, substantially on the terms of Annexure 2 of the Currency Swap Agreement (within the meaning of paragraph (a) of the definition of that term), |

or, in relation to any US$ Note, on the terms of any other Currency Swap Agreement (within the meaning of paragraph (b) of the definition of that term) provided the Manager has issued a Rating Notification in relation to the entering into of that other Currency Swap Agreement.

Currency Swap Agreement means:

| (a) | the ISDA Master Agreement dated on or about the date of this Deed to which the Trustee, the Manager and Australia and New Zealand Banking Group Limited ABN 11 005 357 522 are a party and which sets out the terms and conditions for each Currency Swap, as amended and supplemented from time to time; and/or |

| (b) | any agreement in the form (with agreed amendments) of an ISDA Master Agreement to which the Trustee and the Manager are a party where such agreement is in substitution (in whole or part) of an existing Currency Swap Agreement, |

which, in each case, is satisfactory to the Manager and to the Trustee and where, in relation to the entering into of the agreement referred to in paragraph (b), the Manager has issued a Rating Notification.

Currency Swap Provider at any time means the person specified as “Party A” under the Currency Swaps at that time which will, initially, be Australia and New Zealand Banking Group Limited ABN 11 005 357 522.

Currency Swap Provider Event of Default means an Event of Default or a Termination Event (in either case, as defined in the relevant Currency Swap Agreement) in relation to the Currency Swap Provider under a Currency Swap Agreement.

Currency Swap Provider Payment Default means, in respect of a Currency Swap, an “Event of Default” in relation to the Currency Swap Provider under section 5(a)(i) of the Currency Swap Agreement for that Currency Swap.

Currency Swap Termination Proceeds has the meaning given to that term in the General Security Deed.

Custodian Fee means the fee agreed by MLPL, the Manager and the Trustee in accordance with Clause 6.5.

Deed of Assumption means the Deed of Assumption dated 27 February 2007 between Macquarie Securities Management Pty Limited ABN 26 003 435 443 and Perpetual Trustee Company Limited ACN 000 001 007.

12

Defaulted Amount in relation to a Monthly Period means the aggregate amount of any SMART Receivables which have been written off by the Servicer as uncollectible in accordance with clause 3.12 of the Master Sale and Servicing Deed during that Monthly Period.

Defaulted Amount Insufficiency has the meaning ascribed to it in Clause 11.1.

Determination Date means the day which is three Business Days before each Distribution Date.

Distribution Date means the 14th day of each month (or if such a day is not a Business Day, the next Business Day). The first Distribution Date is 14 December 2015 (or if that is not a Business Day, the next Business Day).

DTC means The Depository Trust Company.

Eligibility Criteria has the meaning set out in Schedule 1.

Eligible Depository means:

| (a) | for the purposes of determining the entity with which the Collections Account may be established and maintained under Clause 13, a financial institution which has assigned to it: |

| (i) | a short term credit rating equal to or higher than F1 by Fitch Ratings; |

| (ii) | a short term deposit rating equal to or higher than P-1 by Moody’s; and |

| (iii) | a long term credit rating equal to or higher than A by Fitch Ratings |

and includes MBL to the extent that it is rated in this manner; and

| (b) | otherwise, a financial institution which has assigned to it: |

| (i) | a short term credit rating equal to or higher than F1 by Fitch Ratings; |

| (ii) | a short term counterparty risk assessment of P-1(cr) by Moody’s or, if a short term counterparty risk assessment is not available for that financial institution, a short term deposit rating equal to or higher than P-1 by Moody’s; and |

| (iii) | a long term credit rating equal to or higher than A by Fitch Ratings, |

and includes MBL to the extent that it is rated in this manner.

Exchange Act means the Securities Exchange Act of 1934 of the United States of America, as amended.

Extraordinary Expenses in relation to a Monthly Period means any out-of-pocket expenses incurred by the Trustee in respect of that Monthly Period which are not Required Payment Amounts for that Monthly Period.

Fair Market Value in relation to a SMART Receivable means the fair market price for the purchase of that SMART Receivable as agreed between the Manager and the Seller (or, in the absence of agreement, determined by the Seller’s external auditors) and which reflects the performance status, underlying nature and franchise value of that SMART Receivable. If the price offered to the Trustee in respect of a SMART Receivable is equal to, or more than, the principal balance plus accrued

13

interest in respect of that SMART Receivable, the Trustee is entitled to assume that this price represents the Fair Market Value in respect of that SMART Receivable.

Finance Charges in relation to a given period means the aggregate of the following amounts (without double counting) in respect of the SMART Receivables then forming part of the Assets of the Series Trust:

| (a) | the aggregate of: |

| (i) | all debit entries representing interest (or in the case of a SMART Receivable which is a Hire Purchase Contract or a Lease Contract, interest and any amount of rent which the Servicer determines is in the nature of interest) or other charges or fees (which the Servicer has determined are in the nature of income) that have been charged during that period to the accounts established in the Servicer’s records for those SMART Receivables (but excluding any Adjustment Advances to be paid to a Disposing Trust on the Closing Date); |

| (ii) | subject to paragraph (iii), any Prepayment Break Costs charged in relation to those SMART Receivables during that or a prior period and received by the Servicer during that period; and |

| (iii) | any amounts received by the Servicer during that period from the enforcement of any Mortgage in relation to those SMART Receivables, where such amounts: |

| (A) | exceed the aggregate of the costs of enforcement of any such Mortgage and the interest and principal then outstanding on those SMART Receivables in respect of which the amounts are received; and |

| (B) | represent part or all of the Prepayment Break Costs charged during that or a prior period on those SMART Receivables in respect of which the amounts are received, |

less the aggregate of any reversals made during that period in respect of interest or other charges in relation to any of the accounts established in the Servicer’s records for those SMART Receivables where the original debit entry (or part thereof) was in error;

| (b) | any Recoveries received by the Servicer in relation to those SMART Receivables during that period (less any reversals made during the period in respect of Recoveries where the original debit entry (or part thereof) was in error); |

| (c) | any amounts reasonably expected by the Manager to be received by the Trustee pursuant to Clause 14.5 on the Distribution Date immediately following that period which represent amounts in respect of accrued but unpaid interest on those SMART Receivables in respect of that period; |

| (d) | any amounts received by the Trustee in that period where those amounts are to be treated as Finance Charges in accordance with Clause 16.6; |

| (e) | the amount of any Finance Charges corresponding to any amounts received by the Trustee in that period pursuant to Clause 15.9(c), as determined by the Manager in accordance with that Clause; |

14

| (f) | any Collections received by the Trustee or the Servicer during any period in which the aggregate of the Invested Amount of all Notes has been reduced to zero; and |

| (g) | any Adjustment Advance (or part thereof) received by the Trustee pursuant to clause 16.8 of the Master Sale and Servicing Deed where the Series Trust is a Disposing Trust, |

less any amount debited during that period to the accounts established in the Servicer’s records for those SMART Receivables representing fees or charges imposed by any Governmental Agency, bank accounts debits tax or similar tax or duty imposed by any Governmental Agency (including tax or duty in respect of payments or receipts to or from bank or other accounts), insurance premiums paid by the Servicer or any Obligor Taxes.

Financial Year has the meaning ascribed to it in Clause 12.2(d).

Fitch Ratings means Fitch Australia Pty Limited ABN 93 081 339 184.

Fixed Rate Swap means any fixed rate swap entered into:

| (a) | on the terms of the Fixed Rate Swap Agreement and which is dated on or after the date of this Deed and on or prior to the Closing Date between the Trustee, the Manager and Macquarie Bank Limited ABN 46 008 583 542; or |

| (b) | on the terms of any other Fixed Rate Swap Agreement that replaces that Fixed Rate Swap Agreement provided the Manager has issued a Rating Notification in relation to the entering into of that other Fixed Rate Swap Agreement. |

Fixed Rate Swap Agreement means:

| (a) | the ISDA Master Agreement dated on or about the date of this Deed to which the Trustee, the Manager and Macquarie Bank Limited ABN 46 008 583 542 as a Fixed Rate Swap Provider are a party and which sets out the terms and conditions for any Fixed Rate Swap; or |

| (b) | any agreement in the form (with agreed amendments) of an ISDA Master Agreement to which the Trustee and the Manager are a party where such agreement is in substitution (in whole or part) of an existing Fixed Rate Swap Agreement, |

which, in each case, is satisfactory to the Manager and to the Trustee and where, in relation to the entering into of the agreement referred to in paragraph (b), the Manager has issued a Rating Notification.

Fixed Rate Swap Provider at any time means the party which is “Party A” under the Fixed Rate Swap Agreement for the Fixed Rate Swap at that time.

Fixed Rate Swap Provider Event of Default means an Event of Default or a Termination Event (in either case, as defined in the relevant Fixed Rate Swap Agreement) in relation to the Fixed Rate Swap Provider under a Fixed Rate Swap Agreement.

Foreign Currency means the currency for the time being of any country other than Australia.

General Security Deed means the General Security Deed dated 14 October 2015 between the Trustee, the Manager, the US$ Note Trustee and the Security Trustee.

GST means the goods and services tax imposed pursuant to the GST Legislation.

15

GST Legislation means A New Tax System (Goods and Services Tax) Act 1999 (Cth) and any other related legislation or regulations.

GST Tax Change has the same meaning as in Clause 6.7(a).

Income Collections in relation to a Monthly Period and the Determination Date immediately following the end of that Monthly Period means the aggregate of the following (without double counting):

| (a) | the lesser of: |

| (i) | Collections for that Monthly Period; and |

| (ii) | Finance Charges for that Monthly Period; |

| (b) | all income received in that Monthly Period in respect of Authorised Short-Term Investments; |

| (c) | the net amount (if any) receivable by the Trustee under any Currency Swap or Fixed Rate Swap in respect of the Interest Period ending on the Distribution Date immediately following the end of that Monthly Period (excluding any US$ amount receivable by the Trustee from the Currency Swap Provider where such amount has been or is to be paid directly by the Currency Swap Provider to the Principal Paying Agent for the US$ Notes); |

| (d) | any interest income (or amounts in the nature of interest income) credited to the Collections Account during that Monthly Period or amounts in the nature of interest otherwise paid by the Servicer or the Manager in respect of Collections held by it; |

| (e) | any amount of input tax credits (as defined in the GST Legislation) received by the Trustee in that Monthly Period in respect of the Series Trust; |

| (f) | any amounts received by the Trustee in that period pursuant to Clause 15.9(c) and determined by the Manager to be received on account of Income Collections in accordance with that Clause; and |

| (g) | any other amount received by the Trustee in that Monthly Period (excluding any Income Collections referred to in the preceding paragraphs, any amount drawn from the Liquidity Reserve Balance pursuant to Clause 10.4(e), any collateral or prepayment under any Fixed Rate Swap Agreement or Currency Swap Agreement, any US$ amount received by the Trustee from the Currency Swap Provider under a Currency Swap where such amount has been or is to be paid directly by the Currency Swap Provider to the Principal Paying Agent for the US$ Notes and any US$ amount received by the Trustee pursuant to an exchange of Australian dollars for US$ in the spot exchange market as contemplated by Clause 9.4(g) or Clause 10.1(d)) which the Manager determines is in the nature of income. |

Income Unit has the same meaning as in the Trust Creation Deed.

Income Unit Amount means the amount available for payment to the Income Unitholder pursuant to Clauses 10.1(a) and 10.1(o).

Income Unitholder has the same meaning as in the Trust Creation Deed.

Initial Adjusted Invested Amount in relation to:

16

| (a) | the Class A-1 Notes or a Class A-1 Note means, at any given time, the Initial Invested Amount of those Class A-1 Notes or that Class A-1 Note multiplied by the “A$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to the Class A-1 Notes which was in place at the date of issue of the Class A-1 Notes; |

| (b) | the Class A-2a Notes or a Class A-2a Note means, at any given time, the Initial Invested Amount of those Class A-2a Notes or that Class A-2a Note multiplied by the “A$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to the Class A-2a Notes which was in place at the date of issue of the Class A-2a Notes; |

| (c) | the Class A-2b Notes or a Class A-2b Note means, at any given time, the Initial Invested Amount of those Class A-2b Notes or that Class A-2b Note multiplied by the “A$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to the Class A-2b Notes which was in place at the date of issue of the Class A-2b Notes; |

| (d) | the Class A-3a Notes or a Class A-3a Note means, at any given time, the Initial Invested Amount of those Class A-3a Notes or that Class A-3a Note multiplied by the “A$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to the Class A-3a Notes which was in place at the date of issue of the Class A-3a Notes; and |

| (e) | the Class A-3b Notes or a Class A-3b Note means, at any given time, the Initial Invested Amount of those Class A-3b Notes or that Class A-3b Note multiplied by the “A$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to the Class A-3b Notes which was in place at the date of issue of the Class A-3b Notes. |

Initial Invested Amount in relation to:

| (a) | a Class A-1 Note, a Class A-2 Note and a Class A-3 Note means US$1,000, or such other integral multiple thereof as set out in the US$ Note Conditions; |

| (b) | a Class A-4 Note means A$1,000, or such other amount as the Manager determines; |

| (c) | a Class B Note or a Seller Note, means A$1,000 or such other amount as the Manager determines; and |

| (d) | a Class of Notes or Sub-Class of Notes means the aggregate initial principal amount of all Notes in that Class of Notes or Sub-Class of Notes (as the case may be) upon the issue of those Notes. |

Inappropriate Person has the meaning given to that term in the Regulations.

Interest Period means all of the following periods:

| (a) | the first Interest Period commences on (and includes) the Closing Date and ends on (but excludes) the first Distribution Date; |

| (b) | subject to paragraph (c), each subsequent Interest Period commences on (and includes) a Distribution Date and ends on (but excludes) the next Distribution Date; and |

| (c) | the final Interest Period ends on (but excludes) the date on which interest ceases to accrue on the Notes pursuant to Clause 4.4(a). |

Invested Amount in relation to a Note at any given time means the Initial Invested Amount for that Note less the aggregate amounts of payments previously made on account of principal to the

17

Noteholders of that Note in accordance with this Deed and, in relation to a Class A-1 Note, a Class A-2 Note and a Class A-3 Note, the US$ Note Conditions.

ISDA Master Agreement means the Multicurrency Cross-Border version of the 1992 ISDA Master Agreement published by the International Swap and Derivatives Association, Inc.

Letter of Offer means a notice from the Seller to the Trustee in or substantially in the form of Schedule 1 of the Master Sale and Servicing Deed and/or, except in relation to Clause 5.3, a Transfer Proposal.

Licensee means a holder of an Australian Credit Licence.

Liquidity Reserve Account means the account with an Eligible Depository established by the Trustee pursuant to Clause 10.4(a) or any replacement Liquidity Reserve Account established pursuant to Clause 10.4(b).

Liquidity Reserve Balance means the amount determined by the Manager in accordance with Clause 10.4(d).

Liquidity Reserve Balance Excess means:

| (a) | on any Determination Date other than the Determination Date immediately preceding the Distribution Date upon which the Notes are redeemed in accordance with Clauses 4.7 or 4.8, the amount (if any) by which the Liquidity Reserve Balance exceeds the Required Liquidity Reserve Balance, after taking into account any Liquidity Reserve Draw calculated on that Determination Date; and |

| (b) | on the Determination Date immediately preceding the Distribution Date upon which the Notes are redeemed in accordance with Clauses 4.7 or 4.8, the Liquidity Reserve Balance after the deduction of any Liquidity Reserve Draw with respect to that Determination Date or after any allocation to the Liquidity Reserve Balance under Clause 10.1(e) on that Distribution Date. |

Liquidity Reserve Draw means in relation to a Determination Date an amount equal to the lesser of:

| (a) | the Liquidity Shortfall in relation to that Determination Date (or zero if there is no Liquidity Shortfall in relation to that Determination Date); and |

| (b) | the Liquidity Reserve Balance as at that Determination Date. |

Liquidity Shortfall in relation to a Determination Date means the amount (if any) by which the Income Collections for the Monthly Period just ended are insufficient to meet the Required Payment Amounts in relation to that Monthly Period.

Management Fee means the fee payable to the Manager on each Distribution Date calculated in accordance with Clause 6.1.

Manager means Macquarie Securities Management Pty Limited ABN 26 003 435 443, or if Macquarie Securities Management Pty Limited ABN 26 003 435 443 retires or is removed as Manager of the Series Trusts (as defined in the Master Trust Deed), any then Substitute Manager and includes the Trustee when acting as the Manager of the Series Trusts in accordance with the terms of the Master Trust Deed.

18

Margin means in relation to:

| (a) | a Class A-2b Note or a Class A-3b Note, the “Margin” in relation to that Note specified in the US$ Note Conditions; |

| (b) | a Class A-4 Note, a Class B Note or a Seller Note, the percentage per annum specified by the Manager in accordance with Clause 4.3(c) provided that, if in relation to any Class of A$ Note no percentage per annum is so specified, the Margin in respect of that Class of A$ Note will be 0.00% per annum. |

Master Sale and Servicing Deed means the Master Sale and Servicing Deed dated 27 February 2007 between the Trustee, the Manager and the Seller, as amended and supplemented from time to time.

Master Security Trust Deed means the Master Security Trust Deed dated 27 February 2007 between the Trustee, the Manager and the Security Trustee, as amended and supplemented from time to time.

Master Trust Deed means the Master Trust Deed dated 11 March 2002 between the Manager and Permanent Custodians Limited ACN 001 426 384, the rights and obligations of which were assumed by Perpetual Trustee Company Limited ACN 000 001 007 pursuant to the Deed of Assumption, as amended and supplemented from time to time.

Maturity Date means in relation to the Class A-4 Notes, Class B Notes and the Seller Notes, the Distribution Date occurring in October 2023.

Monthly Period means each of the following periods:

| (a) | the first Monthly Period commences on (and includes) the Cut-Off Date and ends on (and includes) the last day of the calendar month prior to the calendar month in which the first Distribution Date occurs; |

| (b) | subject to paragraph (c), each subsequent Monthly Period commences on (and includes) the first day after the last day of the preceding Monthly Period and ends on (and includes) the last day of the calendar month following the calendar month in which the previous Monthly Period ended; and |

| (c) | the final Monthly Period ends on (but excludes) the Termination Payment Date for the Series Trust. |

Moody’s means Moody’s Investors Service Pty Ltd ABN 61 003 399 657.

National Credit Code means each of:

| (a) | the National Consumer Credit Protection Act 2009 (Cth), including the National Credit Code that comprises Schedule 1 to that Act; |

| (b) | the National Consumer Credit Protection (Fees) Act 2009 (Cth); |

| (c) | the National Consumer Credit Protection (Transitional and Consequential Provisions) Act 2009 (Cth); |

19

| (d) | any acts or other legislation enacted as an amendment to, or in connection with, any of the acts set out in paragraphs (a) to (c) (inclusive) and any regulations made under any of the acts set out in paragraphs (a) to (c) (inclusive); and |

| (e) | Division 2 of Part 2 of the Australian Securities and Investments Commission Act 2001, in so far as it relates to the obligations of any of the Trust Manager, the Servicer, the Seller or the Trustee in respect of an Australian Credit Licence issued under the National Consumer Credit Protection Act or registration as a registered person under the National Consumer Credit Protection (Transitional and Consequential Provisions) Act. |

Net Collections in relation to a Monthly Period means the Collections for that Monthly Period less the Principal Draw (if any) in relation to the Determination Date immediately following the end of that Monthly Period.

Net Trust Income in relation to any Financial Year means the amount determined by the Manager under Clause 12.2(a) for that Financial Year.

Note means a Note issued or to be issued, as the context requires, by the Trustee as trustee of the Series Trust as contemplated by Clause 4.

Note Factor in relation to a Class of Notes or Sub-Class of Notes at a given time means a percentage (rounded to the nearest 7 decimal places) calculated as follows:

|

NF=

|

A |

|||

| B |

| where: | ||||

| NF |

= | the Note Factor in relation to that Class of Notes or Sub-Class of Notes; | ||

| A |

= | the Collateralised Amount of that Class of Notes or Sub-Class of Notes on the last day of the just ended Monthly Period; and | ||

| B |

= | the Collateralised Amount of that Class of Notes or Sub-Class of Notes at the Closing Date. | ||

Noteholder Report means a report produced by the Manager substantially in the form of Schedule 5 in accordance with Clause 16.3(c)(i), containing, amongst other things, the Pool Performance Data.

Note Transfer means the Note Transfer as described in Clause 16.8(b).

Obligor in relation to a SMART Receivable means the person or persons obliged to make payments under that SMART Receivable and includes, where the context requires, the grantor of the Security Interest in relation to that SMART Receivable.

Obligor Taxes means any amounts received by the Seller or the Servicer from an Obligor in respect of any stamp or other duty or any GST in relation to a SMART Receivable.

Paying Agent has the same meaning as in the Agency Agreement.

Pool Performance Data has the meaning given to that term in Schedule 4.

Principal Collections in relation to a Monthly Period means the amount which is either:

20

| (a) | zero, where the Finance Charges for that Monthly Period exceed the Net Collections for that Monthly Period; or |

| (b) | in all other cases, the Net Collections for that Monthly Period less the Finance Charges for that Monthly Period. |

Principal Draw in relation to a Determination Date means an amount equal to the lesser of:

| (a) | the Liquidity Shortfall in relation to that Determination Date less the Liquidity Reserve Draw in relation to that Determination Date (or zero if there is no Liquidity Shortfall in relation to that Determination Date); and |

| (b) | where the Collections for the Monthly Period just ended exceed the Finance Charges for that Monthly Period, the amount of such excess or, where the Finance Charges for the Monthly Period just ended equal or exceed the Collections for that Monthly Period, zero. |

Principal Paying Agent has the same meaning as in the Agency Agreement.

Privacy Act means the Privacy Act 1988 (Commonwealth).

The Pro Rata Paydown Test is satisfied at any time on a Distribution Date if:

| (a) | the Subordination Percentage at that time (after any application of Total Principal Collections prior to that Distribution Date and prior to that time on that Distribution Date) is greater than or equal to 18.9%; and |

| (b) | the Total Collateralised Amount on the immediately preceding Determination Date when expressed as a percentage of the aggregate of the Initial Invested Amount of the A$ Notes and the A$ Equivalent of the Initial Invested Amount of the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes is greater than 10%. |

Otherwise the Pro Rata Paydown Test is not satisfied at that time.

Rating Agencies means Fitch Ratings and Moody’s.

Recoveries in relation to a SMART Receivable means all amounts recovered in respect of the principal of that SMART Receivable that was part (or the whole) of a Defaulted Amount.

Redirected Liquidity Reserve Balance Excess means on any Distribution Date the aggregate of all Liquidity Reserve Balance Excess previously applied in accordance with Clause 10.2 less the aggregate of any amounts previously paid to MBL pursuant to Clause 10.1(n) or Clause 10.2(e) (including any such amounts to be paid to MBL pursuant to Clause 10.2(e) on that Distribution Date).

Regulation AB means Subpart 229.1100 – Asset Backed Securities (Regulation AB), 17 C.F.R. Sections 229.1100-229.1124, as such regulation may be amended from time to time, and subject to such clarification and interpretation as have been provided by the SEC in the adopting release (Asset-Backed Securities, Securities Act Release No. 33-8518, 70 Fed. Reg. 1,506 (Jan. 7, 2005)), or in the amending release (Asset-Backed Securities Disclosure and Regulation, Securities Act Release No. 33-9638, 79 Fed. Reg. 57,184 (Sept. 24, 2014)) or by the staff of the SEC, or as may be provided by the SEC or its staff from time to time.

21

Regulation AB Compliance Agreement means the Regulation AB Compliance Agreement dated on or about the date of this Deed between, amongst others, the Trustee, the US$ Note Trustee, the Manager, MLPL, the Currency Swap Provider and the Fixed Rate Swap Provider.

Regulations means the National Consumer Credit Protection Regulations 2010 and the National Consumer Credit Protection (Transitional and Consequential Provisions) Regulations 2010.

Relevant Parties means each of the Manager, the Seller, the Servicer, each Currency Swap Provider, each Fixed Rate Swap Provider, the Standby Guarantor (if any), the Agent Bank, each Paying Agent, the US$ Note Registrar and the US$ Note Trustee.

Required Credit Rating has the meaning set out in Clause 16.1(a).

Required Liquidity Reserve Balance means on the Closing Date or any Determination Date:

| (a) | unless paragraph (b) applies, the greater of: |

| (i) | 1% of the aggregate of the A$ Equivalent of the Invested Amount of the US$ Notes and the Invested Amount of the A$ Notes on that day (as determined following application of Total Principal Collections, other than any Liquidity Reserve Balance Excess which is to be applied as Total Principal Collections, on the next Distribution Date); or |

| (ii) | A$300,000; or |

| (b) | if the Notes have been redeemed in accordance with Clauses 4.7 or 4.8, zero. |

Required Payment Amounts means, on any Determination Date in respect of a Monthly Period:

| (a) | if: |

| (i) | the Invested Amount of the Class B Notes as at the preceding Distribution Date was greater than zero (after taking into account any reduction in the Invested Amount of the Class B Notes made on that Distribution Date); and |

| (ii) | there are no unreimbursed Class B Charge-Offs, |

| the aggregate of the amounts referred to in Clauses 10.1(b) to (f) (inclusive) for that Monthly Period; |

| (b) | if paragraph (a) does not apply, and: |

| (i) | the Invested Amount of the Class A Notes as at the preceding Distribution Date was greater than zero (after taking into account any reduction in the Invested Amount of the Class A Notes made on that Distribution Date); and |

| (ii) | there are no unreimbursed Class A Charge-Offs, |

| the aggregate of the amounts referred to in Clauses 10.1(b) to (e) (inclusive) for that Monthly Period; and |

| (c) | if none of paragraphs (a) to (b) (inclusive) apply, the aggregate of the amounts referred to in Clauses 10.1(b) and (c) for that Monthly Period. |

22

SEC means the Securities and Exchange Commission of the United States of America, as from time to time constituted, created under the United States Securities Exchange Act of 1934, as amended.

Secured Creditor has the same meaning as in the General Security Deed.

Securities Act means the Securities Act of 1933 of the United States of America, as amended.

Security Trust Deed in relation to the Series Trust has the meaning given to it in Clause 1.8.

Security Trustee means the person for the time being who is security trustee under the Master Security Trust Deed.

Security Trustee Costs means the fees, costs and expenses payable to the Security Trustee on each Distribution Date calculated in accordance with Clause 6.3.

Seller Charge-Off in relation to the Seller Notes or a Seller Note means all amounts charged off against the Collateralised Amounts of the Seller Notes or that Seller Note, as the case may be, pursuant to Clause 11.1(a).

Seller Interest in relation to a Distribution Date means the aggregate of the interest payments to be made in respect of the Seller Notes on that Distribution Date in accordance with Clause 4.4.

Seller Note means a Note forming part of the Class of Notes described in Clause 4.2 as a Seller Note and issued pursuant to Clause 4.1.

Seller Noteholder means a Noteholder of a Seller Note.

Series Trust means the trust known as the SMART ABS Series 2015-3US Trust established pursuant to the Master Trust Deed and the Trust Creation Deed.

Series Trust Expenses in relation to a Monthly Period means:

| (a) | first, on a pari passu and rateable basis, all Taxes payable in relation to the Series Trust; |

| (b) | second, on a pari passu and rateable basis, all indemnities and reimbursements payable by the Trustee pursuant to the Transaction Documents; |

| (c) | third, on a pari passu and rateable basis, all Penalty Payments (to the extent that the Trustee is liable for such payments); |

| (d) | fourth, on a pari passu and rateable basis, all other amounts relating to the Series Trust referred to in (or incorporated by Clause 16.7 into) clause 16.11 of the Master Trust Deed in respect of that Monthly Period other than any liabilities specifically referred to in Clauses 10.1(a), 10.1(c) to 10.1(o), 10.2, 9.2 or 9.3 (each inclusive) or any liability of the Trustee to repay all or part of the any collateral or prepayment lodged with, or paid to, the Trustee under the terms of any Fixed Rate Swap Agreement or Currency Swap Agreement or any other amount referred to in paragraphs (e) to (i) (inclusive) below; |

| (e) | fifth, on a pari passu and rateable basis, the Trustee Fee and any fees, costs and expenses payable to the US$ Note Trustee under the US$ Note Trust Deed or the Agency Agreement or to an Agent under the Agency Agreement; |

| (f) | sixth, the Security Trustee Costs; |

23

| (g) | seventh, the Management Fee; |

| (h) | eighth, the Servicing Fee; and |

| (i) | ninth, the Custodian Fee. |

Servicing Criteria means the “servicing criteria” set forth in Item 1122(d) of Regulation AB.

Servicing Fee means the fee to be paid by the Trustee to the Servicer in accordance with Clause 6.4.

Settlement Statement means the statement prepared on each Determination Date by the Manager pursuant to Clause 16.2(a) in the form from time to time agreed between the Manager and the Trustee.

Shared Security means any Security Interest, guarantee, indemnity or other form of assurance that by its terms secures the payment or repayment of any SMART Receivable forming or to form part of the Assets of the Series Trust and also any other loan, credit contract or other financial accommodation of whatever nature forming or to form part of the Seller Trust Assets.

SMART Receivables means the receivables arising under or pursuant to a Lease Contract, a Loan Contract or a Hire Purchase Contract which are assigned or to be assigned (as the case may be) to the Trustee (as trustee of the Series Trust) and referred to in a Letter of Offer or a Transfer Proposal (as the case may be).

Standby Guarantee means at any given time, the standby guarantee (if any), or any replacement of it, provided by an Eligible Depository (within the meaning of paragraph (b) of the definition of that term) in favour of the Trustee (in its capacity as trustee of the Series Trust) to support the Servicer’s obligations to credit to, and to repay from, in accordance with normal banking practice, moneys deposited and to be deposited in the Collections Account under this Deed and which is in a form satisfactory to each Rating Agency to maintain the credit rating then assigned by each Rating Agency to the Notes.

Standby Guarantor means the financial institution providing the Standby Guarantee.

Sub-Class in relation to the Notes means each sub-class of Class A Notes referred to in Clause 4.2.

Subordination Percentage means on any Determination Date the aggregate Collateralised Amount of the Class B Notes and the Seller Notes on that date when expressed as a percentage of the aggregate Invested Amount of all A$ Notes and the A$ Equivalent of the Invested Amount of all US$ Notes on that date.

Subscription Agreement means the SMART ABS Series 2015-3US Trust Subscription Agreement dated on or after the date of this Deed between the Trustee, MLPL, the Manager and Australia and New Zealand Banking Group Limited.

Subscription Amount in relation to the Income Unit at any time means the aggregate of the amounts, if any, previously paid by the Income Unitholder to, or at the direction of, the Trustee pursuant to Clause 2.6 less the aggregate of all amounts previously applied towards the reduction of the Subscription Amount.

Taxes has the same meaning as in the Master Trust Deed as modified by Clause 6.6(b) of this Deed.

Termination Event Date means the earliest of the following dates to occur:

24

| (a) | if the Notes have been issued by the Trustee, the date appointed by the Manager as the Termination Event Date by notice in writing to the Trustee (which must not be a date earlier than: |

| (i) | the date that the Collateralised Amount of the Notes has been reduced to zero; or |

| (ii) | if an Event of Default (as defined in the Master Security Trust Deed) has occurred, the date of the final distribution by the Security Trustee under the Master Security Trust Deed); |

| (b) | if the Notes have not been issued by the Trustee, the date appointed by the Manager as the Termination Event Date by notice in writing to the Trustee; |

| (c) | the date which is 80 years after the date of the constitution of the Series Trust in accordance with this Deed or the Trust Creation Deed (as applicable) and the Master Trust Deed; and |

| (d) | the date on which the Series Trust terminates by operation of statute or by the application of general principles of law, including as a result of any change in any statute or law. |

Termination Payment Date means the Distribution Date declared by the Trustee to be the Termination Payment Date of the Series Trust pursuant to Clause 15.2 (subject to any substitution of another Distribution Date as the Termination Payment Date in accordance with that Clause).

TIA means the Trust Indenture Act of 1939 of the United States of America, as amended.

Total Collateralised Amount at any given time means the aggregate of the then Collateralised Amounts in respect of the A$ Notes and the then Adjusted Collateralised Amounts of the Class A-1 Notes, the Class A-2 Notes and the Class A-3 Notes.

Total Principal Collections in relation to a Monthly Period means the aggregate of:

| (a) | the Principal Collections in relation to that Monthly Period; |

| (b) | any amount allocated to Total Principal Collections pursuant to Clauses 10.1(g), 10.1(h), 10.1(i), |

| (c) | all other amounts received by the Trustee in the nature of repayments of principal on the SMART Receivables. |

Transfer Date means the day which is one Business Day prior to each Distribution Date.

Trust Creation Deed means the Trust Creation Deed dated 8 October 2015 executed by Perpetual Trustee Company Limited in accordance with the Master Trust Deed.

Trustee means Perpetual Trustee Company Limited ABN 42 000 001 007 or if Perpetual Trustee Company Limited ABN 42 000 001 007 retires or is removed as trustee of the Series Trusts (as defined in the Master Trust Deed) and the Seller Trust, any then Substitute Trustee.

Trustee Fee means the fee payable to the Trustee on each Distribution Date calculated in accordance with Clause 6.2.

Underwriting Agreement means the US$ Underwriting Agreement relating to the Series Trust, dated on or about 22 October 2015 made between the Trustee, MLPL, the Manager and the underwriters under that agreement.

25

Unpaid Class A-4 Interest Amount has the meaning given to that term in Clause 4.4(a).

Unreimbursed Principal Draw in relation to a Determination Date means the aggregate amount of all Principal Draws in relation to prior Determination Dates less the aggregate of all amounts allocated to Total Principal Collections in accordance with Clauses 10.1(g) or 10.2(a) on prior Distribution Dates.

US Dollars or US$ means the lawful currency for the time being of the United States of America.

US$ Equivalent in relation to an amount which is calculated, determined or expressed in A$ or which includes a component determined or expressed in A$ means the A$ amount or A$ component (as the case may be) multiplied by the relevant US$ Exchange Rate.

US$ Exchange Rate in relation to the Class A-1 Notes, the Class A-2a Notes, the Class A-2b Notes, the Class A-3a Notes or the Class A-3b Notes, means the “US$ Exchange Rate” specified in the confirmation for the Currency Swap in relation to that Sub-Class of Notes.

US$ Fixed Rate Interest Amount has the meaning given to that term in the US$ Note Conditions.

US$ Floating Rate Interest Amount has the meaning given to that term in the US$ Note Conditions.

US$ Note has the meaning given to that term in the US$ Note Trust Deed.

US$ Note Charge-Off in relation to the US$ Notes, a Sub-Class of the US$ Notes or a US$ Note means all amounts charged off against the Collateralised Amount of the US$ Notes, the relevant Sub-Class of US$ Notes or that US$ Note, as the case may be, pursuant to Clause 11.1(c)(i).

US$ Note Conditions means the terms and conditions in relation to the Class A-1 Notes, the Class A-2a Notes, the Class A-2b Notes, the Class A-3a Notes and the Class A-3b Notes substantially in the form of Schedule 4 of the US$ Note Trust Deed.

US$ Note Registrar has the meaning given to that term in the Agency Agreement.

US$ Note Trust Deed means the deed entered into on or about the date of this Deed between the US$ Note Trustee, the Trustee, MLPL and the Manager.

US$ Note Trustee has the meaning set out in the US$ Note Trust Deed.

US$ Noteholder has the meaning set out in the US$ Note Trust Deed.

Voting Secured Creditors has the same meaning as in the General Security Deed.

| 1.2 | Interpretation |

In this Deed, unless the contrary intention appears:

| (a) | a reference to this Deed includes the Background and Schedules; |

| (b) | a reference to a statute, ordinance, code or other law includes regulations and other instruments under it and consolidations, amendments, re-enactments or replacements of any of them; |

26

| (c) | a reference to a section of a statute, ordinance, code or other law includes any consolidation, amendment, re-enactment or replacement of that section; |

| (d) | the singular includes the plural and vice versa and words denoting a gender include all other genders; |

| (e) | the word person includes an individual, a body politic, a corporation and a statutory or other authority or association (incorporated or unincorporated); |

| (f) | a reference to a person includes a reference to the person’s executors, administrators, successors, substitutes (including persons taking by novation) and assigns; |

| (g) | the word corporation means any body corporate wherever formed or incorporated including, without limiting the generality of the foregoing, any public authority or any instrumentality of the Crown; |

| (h) | the expression owing includes amounts that are owing whether such amounts are liquidated or not or are contingent or presently accrued due and includes all rights sounding in damages only; |

| (i) | where a word or phrase has a defined meaning any other part of speech or grammatical form in respect of such word or phrase has a corresponding meaning; |

| (j) | a reference to any thing (including any amount) is a reference to the whole or any part of it and a reference to a group of persons is a reference to any one or more of them; |

| (k) | if an act prescribed under this Deed to be done by a party on or by a given day is done after 5.30 p.m. on that day, it is to be taken to be done on the following day; |

| (l) | where any day on which a payment is due to be made or a thing is due to be done is not a Business Day, that payment must be made or that thing must be done on the immediately succeeding Business Day; |

| (m) | references to time are to Sydney time; |

| (n) | the expression certified means, in respect of a person, certified in writing by 2 Authorised Officers of that person or by legal counsel for that person and certify and like expressions will be construed accordingly; |

| (o) | a reference to extinguish includes a reference to rights and interests being surrendered and released; |

| (p) | a reference to a month is to a calendar month; |

| (q) | a reference to wilful default in relation to the Trustee or the Manager means, subject to Clause 1.2(r), any wilful failure to comply with, or wilful breach by, the Trustee or the Manager (as the case may be) of any of its obligations under any Transaction Document, other than a failure or breach which: |

(i) (A) arises as a result of a breach of a Transaction Document by a person other than:

I. the Trustee or the Manager (as the case may be); or

27

II. any other person referred to in Clause 1.2(r) in relation to the Trustee or the

Manager (as the case may be); and

| (B) | the performance of the action (the non-performance of which gave rise to such breach) is a precondition to the Trustee or the Manager (as the case may be) performing the said obligation; |

| (ii) | is in accordance with a lawful court order or direction or required by law; or |

| (iii) | is in accordance with a proper instruction or direction of: |

| (A) | the Secured Creditors given at a meeting of Secured Creditors convened pursuant to the Master Security Trust Deed; or |

| (B) | the Investors given at a meeting convened under the Master Trust Deed; |