Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NABORS INDUSTRIES LTD | a15-18060_38k.htm |

| EX-99.1 - EX-99.1 - NABORS INDUSTRIES LTD | a15-18060_3ex99d1.htm |

Exhibit 99.2

3Q15 Earnings Presentation October 28, 2015 Presenters: Anthony G. Petrello Chairman, President & Chief Executive Officer William J. Restrepo Chief Financial Officer

Forward-Looking Statements We often discuss expectations regarding our markets, demand for our products and services, and our future performance in our annual and quarterly reports, press releases, and other written and oral statements. Such statements, including statements in this document incorporated by reference that relate to matters that are not historical facts are “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the U.S. Securities Exchange Act of 1934. These “forward-looking statements” are based on our analysis of currently available competitive, financial and economic data and our operating plans. They are inherently uncertain, and investors must recognize that events and actual results could turn out to be significantly different from our expectations. Factors to consider when evaluating these forward-looking statements include, but are not limited to: • • • • • • • • fluctuations in worldwide prices and demand for natural gas and oil; fluctuations in levels of natural gas and oil exploration and development activities; fluctuations in the demand for our services; the existence of competitors, technological changes and developments in the oilfield services industry; our ability to complete, and realize the expected benefits of, any strategic transactions; the existence of operating risks inherent in the oilfield services industry; the possibility of changes in tax laws and other laws and regulations; the possibility of political or economic instability, civil disturbance, war or acts of terrorism in any of the countries in which we do business; and general economic conditions including the capital and credit markets. • Our businesses depend, to a large degree, on the level of spending by oil and gas companies for exploration, development and production activities. Therefore, a continued decrease in the price of natural gas or oil, which could have a material impact on exploration and production activities, could also materially affect our financial position, results of operations and cash flows. The above description of risks and uncertainties is by no means all inclusive, but is designed to highlight what we believe are important factors to consider. Statements made in this presentation include non-GAAP financial measures. The required reconciliation to the nearest comparable GAAP financial measures is included in the investor relations section of our website. 2

Recent Highlights 1111, NABORS 3

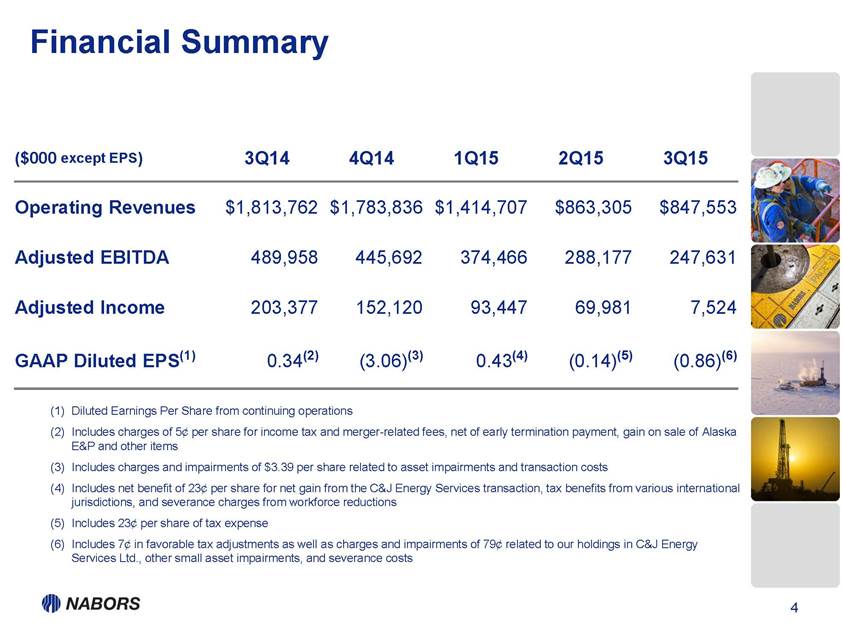

Financial Summary ($000 except EPS) 3Q14 4Q14 1Q15 2Q15 3Q15 Operating Revenues $1,813,762 $1,783,836 $1,414,707 $863,305 $847,553 Adjusted EBITDA 489,958 445,692 374,466 288,177 247,631 Adjusted Income 203,377 152,120 93,447 69,981 7,524 GAAP Diluted EPS(1) 0.34(2) (3.06)(3) 0.43(4) (0.14)(5) (0.86)(6) (1) (2) Diluted Earnings Per Share from continuing operations Includes charges of 5¢ per share for income tax and merger-related fees, net of early termination payment, gain on sale of Alaska E&P and other items Includes charges and impairments of $3.39 per share related to asset impairments and transaction costs Includes net benefit of 23¢ per share for net gain from the C&J Energy Services transaction, tax benefits from various international jurisdictions, and severance charges from workforce reductions Includes 23¢ per share of tax expense Includes 7¢ in favorable tax adjustments as well as charges and impairments of 79¢ related to our holdings in C&J Energy Services Ltd., other small asset impairments, and severance costs (3) (4) (5) (6) 4

Current Debt and Liquidity Liquidity(4) (at September 30, 2015) • Cash & Available Capacity: $2,481 Investment in Affiliate (at September 30, 2015) • C&J Energy Services shares: $ 220 (1) (2) (3) (4) Capitalization defined as Net Debt plus Shareholders’ Equity Coverage defined as TTM Adjusted EBITDA / TTM Interest Expense Leverage defined as Total Debt / TTM Adjusted EBITDA Includes the proceeds from the term loan in September 2015 Note: Subtotals may not foot due to rounding 5 High 2Q15 3Q15 Change Change ($MM's) 3/31/12 6/30/15 9/30/15 2Q15 to 3Q15 3Q15 from High Total Debt Cash and ST Investments Net Debt Shareholder’s Equity Net Debt to Capitalization(1) Coverage(2) Leverage(3) $4,773 $3,758 $3,747 ($11) ($1,026) 494 470 277 (193) (217) $4,279 $3,288 $3,470 182 ($809) 5,811 4,932 4,502 (430) (1,309) 42.4% 40.0% 44.0% 4.0% 1.6% 7.8x 9.0x 7.6x (1.4x) (0.2x) 2.5x 2.4x 2.8x 0.4x 0.3x

Drilling & Rig Services 1111, NABORS 6

3Q15 Rig Utilization & Availability 3Q15 Rig Average Rig Fleet(1) Years Utilization U.S. Lower 48 AC Legacy U.S. Lower 48 Total U.S. Offshore Alaska 172 85 257 17 19 79 10 89 7 7 46% 12% 35% 41% 37% 63 17 27% Canada International 180 121 67% Subtotal PACE®-X Construction(2) Intl. Newbuilds & Upgrades(2) U.S. & Intl. Offshore Newbuilds(2) 536 3 1 1 242 45% Total Fleet 541 (1) As of 9/30/15 (2) Includes announced newbuild commitments and rigs to be completed in 2015 Numbers may not calculate due to rounding 7

3Q15 U.S. Rig Utilization Power Type and Pad Capability % As of 9/30/15 8 Walking Skidding Pad Capable Not Pad Capable Total Rigs Total AC Legacy Grand Total Working Total 64 120 17 Util. 53% 14% Working Total 4 18 5 13 Util. 22% 38% Total 49% 30% WorkingTotal 6 34 5 65 Util. 18% 8% 172 85 Util. 43% 13% 65 127 51% 9 31 29% 47% 11 99 11% 257 33%

PACE®-X Rig Deployments & Rig Years 50 ---------------------------------------------------------------------45 +-----------------------------------------------------------------40 +-----------------------------------------------------------35 +-----------------------------------------------------30 +----------------------------------------------25 +----------------------------------------20 +---------------------------15 +---------------------10 +---------------------5 +--------------0 +---------- 1013 2013 3013 4013 1014 2014 3014 4014 1015 2015 3015 Lower 48 Deployments - lnt'l Deployments - cumulative Deployments - Cumulative Rig Years 1111, NABORS As of 9/30/15 9

3Q15 International Working Rigs As of 9/30/15 10 Total 119 PNG1 Russia5 Saudi44 Venezuela5 Kurdistan2 Kuwait2 Malaysia1 Mexico5 Oman4 Ecuador3 India3 Iraq1 Italy1 Kazakhstan2 Algeria10 Angola0 Argentina20 Colombia9 Congo1

Outlook and Summary 1111, NABORS 11

Strategic Focus Capitalize on the existing asset base > Differentiate the rig and service offerings > Enhance operational excellence > Improve financial flexibility > 12

Appendix 1111, NABORS 13

Rig Margins & Activity (1) Margin = gross margin per rig per day for the period. Gross margin is computed by subtracting direct costs from operating revenues for the period. 14 Drilling 4Q14 1Q15 2Q15 3Q15 Margin (1) Rig Yrs Margin (1) Rig Yrs Margin (1) Rig Yrs Margin (1) Rig Yrs U.S. Drilling$11,525212.2 Canada9,88936.9 International17,803121.2 $13,487167.6 9,92725.6 18,865130.1 $13,739119.5 7,7719.7 17,263127.1 $11,177103.0 6,34917.2 18,613121.3