Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CIFC Corp. | a15-21052_18k.htm |

Exhibit 99.1

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this offering memorandum and in the information incorporated by reference herein are forward-looking statements within the meanings of the Securities Act, the Exchange Act, and the Private Securities Litigation Reform Act of 1995. These include, but are not limited to, statements regarding future results or expectations. Forward-looking statements can be identified by forward-looking language, including words such as “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “plans,” “projects,” “will,” “should,” “would,” “could,” “hope” and similar expressions, or the negative of these words. Such forward-looking statements are based on facts and conditions as they exist at the time such statements are made and various operating assumptions and predictions as to future facts and conditions, each of which may be difficult to accurately make and involve the assessment of events beyond our control, and are subject to inherent risks and uncertainties. Caution must be exercised in relying on forward-looking statements. Our actual results may differ materially from the forward-looking statements contained or incorporated by reference in this offering memorandum. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in this offering memorandum. These factors should not be construed as exhaustive and should be read with the other cautionary statements contained in and incorporated by reference into this offering memorandum.

Among the factors that may cause actual results to differ from anticipated results and expectations expressed in such forward-looking statements are the following:

· adverse market, economic or other industry conditions;

· changes in collateralized loan obligation spreads, management fees and/or other compensation arrangements;

· a failure to grow our assets under management;

· an inability to replicate historical results in new product lines;

· a reduction in the amount or value of assets under management and a corresponding reduction in the fees that we earn;

· the restrictions our outstanding recourse indebtedness places on our business and our ability to access the capital markets;

· limitations on the amount that can be collected under the guarantees;

· an inability to attract or retain qualified personnel, including members of the senior management team and key investment professionals;

· our incentive-based revenue structure, which may incentivize us to pursue speculative investments;

· our use of leverage;

· the incurrence of additional debt;

· risks associated with our entry into warehouse agreements;

· volatility in our quarterly and annual results;

· our use of estimates in valuing our assets and liabilities;

· an inability to maintain an effective system of internal control over financial reporting;

· loss of our exemption from registration under the Investment Company Act of 1940, as amended (the “1940 Act”);

· the complexity of the accounting rules applicable to our business, including the use of judgments and assumptions of our management under such rules;

· a failure to develop effective business continuity plans;

· the significant influence that our largest stockholder, DFR Holdings, LLC, exercises over our business and the election of our directors;

· the occurrence of a change of control;

· any impairment of our goodwill or other intangible assets;

· future litigation;

· extensive regulation of our business creates the potential for significant liabilities and penalties, and changes to the legislative or regulatory scheme applicable to us could result in additional burdens;

· European legal investment considerations, including with respect to risk retention;

· governmental and central bank action with respect to the financial industry;

· changes to tax laws;

· the volatility of our cash flows as a result of the incentive-based revenue payable to our asset management subsidiaries or their affiliates;

· unanticipated terminations of our investment or collateral management agreements;

· inadequate liquidity;

· impact of U.S. federal rules and regulations and those of other jurisdictions, including with respect to risk retention;

· defaults, downgrades or depressed market values of the collateral underlying the collateral loan obligations we manage or have invested in;

· the potential suspension of most of the restrictive covenants and corresponding events of default contained in the indenture;

· the triggering of structural protections built into certain of the collateral loan obligations we manage;

· the failure of our asset management subsidiaries to comply with investment guidelines set by their respective clients or other agreements to which they are a party;

· trading errors by our asset management subsidiaries;

· our asset management subsidiaries’ reliance on third-party distribution marketing channels;

· the riskiness of certain of our investments, including subordinated and mezzanine notes of collateralized loan obligations; and

· our status as a “controlled company” within the meaning of NASDAQ rules.

The forward-looking statements contained in this offering memorandum are made as of the date hereof and the forward-looking statements incorporated by reference herein are made as of the date of such statements, and we do not undertake any obligation to update any forward-looking statement to reflect subsequent events, new information or circumstances arising after the date of any such statement. All future written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referenced above. In addition, it is our policy generally not to make any specific projections as to future earnings, and we do not endorse any projections regarding future performance that may be made by third parties.

OFFERING MEMORANDUM SUMMARY

The following is a brief summary of our business and this offering, but it is not complete and does not contain all of the information that you should consider before making your investment decision. You should read this offering memorandum and the information incorporated by reference herein completely, including our consolidated financial statements and the related notes included in our Annual Report for the year ended December 31, 2014 (the “2014 Form 10-K”) and our Quarterly Report for the period ended June 30, 2015 (the “Second Quarter Form 10-Q”), and the “Risk Factors” included elsewhere in this offering memorandum. For a more detailed description of the notes, see the section entitled “Description of the Notes.” Unless the context otherwise requires, we refer to CIFC Corp. as “CIFC” and to CIFC and its subsidiaries, including the Guarantors, as “we,” “us,” “our,” “our company” or “the Company.” All capitalized terms used in this section and not otherwise defined in this Offering Memorandum Summary have the meanings given to them to in “Description of the Notes.”

Our Company

Overview

CIFC is a Delaware corporation headquartered in New York City. We are a fundamentals-based, relative value, alternative credit manager. Our primary business is to provide investment management services for investment products. We manage assets for various types of investors, including pension funds, hedge funds, other asset management firms, banks, insurance companies and other types of institutional investors around the world. According to Moody’s Investor Service, we were the second largest U.S. CLO manager as measured by AUM as of June 30, 2015.

Fee earning assets under management (“Fee Earning AUM” or “AUM”) refers to principal balance, net asset value or value of assets managed by us on which we earn management and/or incentive-based revenue. Our AUM primarily comprises collateralized loan obligations (“CLOs”). In addition, we manage credit funds, separately managed accounts (“SMAs”), and other-loan based products (together, with credit funds and SMAs, “Non-CLO products,” and together with CLOs, “Funds”). We manage these credit products through opportunistic investment strategies where we seek to generate both current income and capital appreciation, primarily through senior secured corporate loan investments (“SSCLs”) and, to a lesser extent, other investments. We also manage collateralized debt obligations (“CDOs”) which we do not expect to manage in the future. We have four primary asset management subsidiaries: CIFC Asset Management LLC, Columbus Nova Credit Investments Management, LLC, CypressTree Investment Management, LLC and Deerfield Capital Management LLC (“DCM”), as well as certain other relying advisers (collectively, the “Advisers”).

We have three primary sources of revenue: management fees, incentive-based revenue and investment income. Management fees are generally based on a percentage of a Fund’s AUM. Incentive-based revenue is earned based on the performance of the Funds and for certain Funds includes performance-based or preferred allocation of income and gains from such Fund, or “carried interest.” Investment income represents interest income, as well as realized and unrealized gains and losses on investments in Funds sponsored by us and those sponsored by third parties.

Each of the Guarantors will unconditionally guarantee the performance of all obligations of CIFC under the indenture and the notes on an unsecured basis. As described below, the PTP Parent will be a Guarantor of the notes. The obligations of each Guarantor in respect of its guarantee will be limited as necessary to purport to prevent the guarantees from constituting a fraudulent conveyance, fraudulent transfer or similar illegal transfer under applicable law.

Core Asset Management Activities

We establish and manage investment products for various types of investors, including pension funds, hedge funds, other asset management firms, banks, insurance companies and other types of institutional investors located around the world. We earn management fees and incentive-based revenue from our investment products as follows:

CLOs — The management fees and, in certain cases, incentive-based revenue paid to us by these investment products are our primary sources of revenue. Management fees on CLOs are generally paid on a quarterly basis for as long as we manage the products and typically consist of senior and subordinated management fees based on the principal balance or value of the assets held in the investment product. In certain cases, CLOs also provide that incentive-based revenue be paid to us based on the returns generated for certain investors.

Management fees and incentive-based revenue paid for the management of CLOs, in general, consist of the following (before fee sharing arrangements, if any):

· Senior management fees (payable before the interest payable on the debt securities issued by such CLOs) that generally range from 15 to 20 basis points annually on the principal balance of the underlying collateral of such CLOs.

· Subordinated management fees (payable after the interest payable on the debt securities issued by such CLOs and certain other expenses) that generally range from 20 to 35 basis points annually on the principal balance of the underlying collateral of such CLOs.

· Incentive-based revenue varies based on the terms of each CLO and is generally paid after certain investors’ returns exceed an internal rate of return hurdle. Upon achievement of this hurdle (generally 12%), the manager is paid a percentage (generally 20%) of residual cash flows in excess of the hurdle.

Non-CLO products — We also earn management fees based on AUM and, in certain cases, incentive-based revenue on our credit funds and SMAs, which may differ from product to product.

Legacy CDOs — Management fees on the CDOs we manage also differ from product to product, but in general consist of a senior management fee (payable before the interest payable on the debt securities issued by such CDOs) that ranges from 5 to 25 basis points annually of the principal balance of the underlying collateral of such CDOs, and a subordinated management fee (payable after the interest payable on the debt securities issued by such CDOs and certain other expenses) that ranges from 5 to 35 basis points annually of the principal balance of the underlying collateral of such CDOs. Only a limited number of the CDOs we manage pay subordinated management fees. We do not expect to manage additional CDOs in the future.

Investment Approach

Our investment processes are overseen by our Investment Research and Portfolio Management & Trading teams. Under our analytical framework, each new investment opportunity for one of our investment products is first screened and, if it passes initial review, subsequent to any additional analysis and due diligence requested at the initial screening, is then voted on by our Investment Committee. Our investment team includes over 30 professionals with an average 12 years of credit experience. Our investment team is led by Co-President, Steve Vaccaro, who has 37 years of relevant credit experience and has been with us since our inception. Our top three senior credit analysts average 19 years of relevant experience, and our Head of Investment Research and Head of Special Situations average 26 years of credit experience. When evaluating the suitability of an investment opportunity, subject to an account’s individual investment objectives and parameters, our evaluation process typically includes:

· employing underwriting discipline based on (i) fundamental credit analysis, which assesses each

borrower’s debt servicing capability, (ii) fundamental value, (iii) loan to value and (iv) identifying and selecting investment candidates whose enterprise value is robust and durable;

· utilizing internally developed risk ratings and risk assessment models based on individual obligor assessment, without undue reliance on credit rating agencies;

· diversifying investment portfolios by avoiding concentration imbalances, through on-going active portfolio management and with the utilization of proprietary credit analytic tools; and

· continuously re-assessing and adjusting these portfolios by identifying relative value differentials, market inefficiencies and technical imbalances.

When any weakness is identified in an existing portfolio investment, we evaluate whether to sell or hold such investments to maximize our recovery. Our Portfolio Management & Trading team works closely with our Investment Research team from the date an investment is made until the time it is exited in an effort to ensure that performance of each investment is closely monitored and our clients’ investment objectives are met.

Competitive Advantages

Seasoned Management Team; Consistent Returns

We have a seasoned investment team of over 30 professionals averaging 12 years of credit experience. Our 10-member investment committee averages 24 years of experience through multiple credit cycles. Our disciplined investment and risk management philosophy and processes have delivered consistent returns to both pre- and post-crisis investors. Our Funds currently are invested in approximately 500 borrowers across various industries and sectors. The breadth and depth of the Funds’ collective investment portfolios provides valuable insight to the investment team as they assess potential new investments and actively manage their existing exposures.

Active Trading Strategy

We employ an active trading strategy to manage risk and to optimize relative value in the Funds’ investment portfolios.

Access to New Issue Allocations

Our dedicated coverage of sell-side banks and private equity sponsors, together with our size and reputation in the market, drives strong new issue allocations as well as the opportunity, in some instances, to provide feedback on deal structures before general syndication.

Scalable Business Model

We believe that we have a scalable business model built on a robust and highly customized technology platform. We expect the infrastructure and systems we have in place to facilitate our ability to grow AUM through the issuance of new CLOs and other investment vehicles. We have issued four new CLOs so far in 2015 for a total of approximately $2.1 billion of new AUM. According to Moody’s Investor Service, we were the second largest U.S. CLO manager as measured by AUM as of June 30, 2015.

Technology-Driven Efficiencies

The pervasive use of technology throughout our investment, trading and risk management teams delivers real-time information to the entire investment and trading teams, promotes information sharing across the entire organization and facilitates consistent implementation of processes.

Business Strategy

Continued Issuance of New CLOs

U.S. CLO issuance has been steadily increasing since the financial crisis and is now above pre-crisis levels. We believe that demand for CLOs will continue with an expected rise in interest rates that will favor floating rate bonds over fixed rate bonds. Market participants expect 2015 CLO issuance to be below 2014 levels. While we expect our CLO issuance levels for 2015 to be below 2014 levels, we expect our issuance levels to be substantially similar to our 2013 levels and that we will issue the same number of new CLOs in 2015 as we issued in 2014. As mentioned above, we have issued four new CLOs so far in 2015 for a total of approximately $2.1 billion of new AUM. We have appointed underwriters, opened warehouses and initiated asset aggregation for two additional CLOs that we expect to close in the fourth fiscal quarter of 2015 and the first fiscal quarter of 2016, respectively. We have also completed the refinancing of two of our CLOs in 2015.

We are focused on maintaining our strong level of post-financial crisis CLO issuance that continues to more than replace our pre-crisis CLO AUM. We believe that the advent of risk retention in the U.S. (i.e., the requirement that CLO managers hold, throughout the life of each CLO they manage, a 5% exposure to the risk of that CLO, either directly or through a consolidated affiliate) will lead to compression in the number of managers able to issue new CLOs, resulting in tighter spreads on CLO bonds and greater “arbitrage,” and that managers like CIFC with strong balance sheets, track records and market reputations will benefit.

Grow Our Non-CLO Business

Our other principal focus is growing our non-CLO AUM. To date we have launched two Funds that pursue a total return strategy. The first of these will reach its three year anniversary before the end of 2015 and we expect to be able to significantly broaden the target investor base for that vehicle thereafter. Performance for both vehicles year to date has substantially exceeded certain relevant benchmark indices.

Expand Structured Product Fund Offerings

We have also launched two structured product Funds that are nearly fully invested. We believe that there remains additional market opportunity to pursue the strategies undertaken by these Funds.

Broaden Credit Product Offerings

We continue to examine additional avenues to further utilize our existing platform to broaden our U.S. credit product offering, such as middle market lending and corporate debt trading strategies. These strategies, if implemented, may be pursued through private funds or permanent capital vehicles.

Expand Outside the U.S.

We also continue to monitor developments outside the U.S. for attractive long-term investment and business-building opportunities. Among the opportunities that we are considering is a CLO business in Europe.

Recent Events

Proposed PTP Conversion

On July 28, 2015, CIFC announced that its board of directors (the “Board”) approved a reorganization plan (the “Proposed PTP Conversion”) to convert CIFC’s top-level form of organization from a corporation to a limited liability company that would be taxed as a partnership for U.S. federal income tax purposes. The Proposed PTP Conversion is intended to bring the operations and structure of CIFC in line with other publicly traded alternative asset managers and allow CIFC to operate in a more tax-efficient manner compared to its current structure. The Proposed PTP Conversion remains subject to final approval by the Board, the approval of CIFC’s stockholders and other customary conditions. Stockholders of CIFC holding at least a simple majority of CIFC’s outstanding shares must vote in favor of the Proposed PTP Conversion in order to satisfy the requisite stockholder approval. DFR Holdings, LLC (“DFR”), which held approximately 74% of the outstanding shares of CIFC’s common stock as of September 25, 2015 (excluding shares that may be purchased upon the exercise of warrants held by DFR), has indicated that it currently intends to vote its shares in favor of approving the Proposed PTP Conversion. See “—Proposed PTP Conversion.”

Company Information

Our principal executive offices are located at 250 Park Avenue, 4th Floor, New York, New York 10177 and our telephone number is (212) 624-1200.

PROPOSED PTP CONVERSION

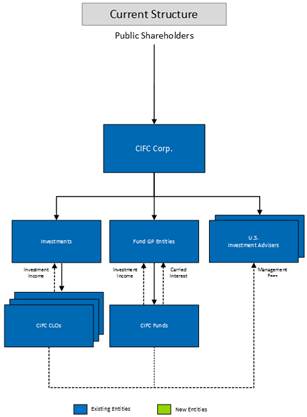

As of the date of this offering memorandum, CIFC is incorporated as a Delaware corporation and its common stock trades on NASDAQ under the trading symbol “CIFC.” We currently operate our business through our asset management, investment and other subsidiaries, and the consolidated financial statements of CIFC included and incorporated by reference herein include the financial statements of our wholly owned subsidiaries, the entities in which we have a controlling interest (“Consolidated Funds”) and variable interest entities (“VIEs” or “Consolidated VIEs”) for which we are deemed to be the primary beneficiary, which include certain CLOs and warehouse vehicles that we manage (collectively, the “Consolidated Entities”). The diagram below (which omits certain intermediate holding companies) depicts our current simplified organizational structure:

By December 31, 2015, we expect to complete the Proposed PTP Conversion pursuant to which, through a series of transactions, we will convert our top-level form of organization from a corporation to a limited liability company intending to operate so that it will qualify to be treated as a partnership for U.S. federal income tax purposes. The Proposed PTP Conversion has been approved by the Board, but remains subject to final approval by the Board, the approval of the common stockholders of CIFC and other customary conditions. Stockholders of CIFC holding at least a simple majority of CIFC’s outstanding shares must vote in favor of the Proposed PTP Conversion in order to satisfy the requisite stockholder approval. DFR Holdings, LLC, which held approximately 74% of the outstanding shares of CIFC’s common stock as of September 25, 2015 (excluding shares that may be purchased upon the exercise of warrants held by DFR), has indicated that it currently intends to vote its shares in favor of approving the Proposed PTP Conversion.

The Proposed PTP Conversion will be implemented through a series of steps including, among other things, CIFC entering into an agreement and plan of merger (the “PTP Merger Agreement”) with (i) CIFC LLC, a newly formed Delaware limited liability company (the “PTP Parent”) which, prior to the merger (the “PTP Merger”), will be a direct, wholly owned subsidiary of CIFC, and (ii) CIFC Merger Corp., a newly formed Delaware corporation (“PTP Merger Sub”) which, prior to the PTP Merger will be an indirect, wholly owned subsidiary of CIFC and a direct, wholly owned subsidiary of the PTP Parent. Pursuant to the PTP Merger Agreement, CIFC would be merged with and into PTP Merger Sub with CIFC

continuing as the surviving entity, and as a direct, wholly owned subsidiary of the PTP Parent. Upon consummation of the Proposed PTP Conversion, shares of common stock (and other securities convertible into common stock) of CIFC will be converted into the right to receive an equal number of common shares (and similar convertible securities) representing limited liability company interests in the PTP Parent, and the PTP Parent’s common shares will be listed on the NASDAQ Stock Market under the ticker symbol “CIFC.”

Following the Proposed PTP Conversion, the PTP Parent intends to operate so that it will qualify to be treated as a partnership for U.S. federal income tax purposes and will hold the equity interests of CIFC and certain existing holding entities (collectively, the “PTP HoldCos”). In addition, CIFC will distribute ownership of one or more subsidiary entities that hold investments in CLOs and other Consolidated Entities to the PTP Parent. Accordingly, the PTP Parent will operate and control all of the material business and affairs of CIFC and the PTP HoldCos, and will consolidate the financial results of CIFC, the PTP HoldCos and the Consolidated Entities. The diagram below (which may omit certain intermediate holding companies) depicts our anticipated simplified organizational structure following the Proposed PTP Conversion, including the PTP Merger:

Following the Proposed PTP Conversion, we expect that CIFC, which will become an indirect, wholly owned subsidiary of PTP Parent as a result of the Proposed PTP Conversion, will continue to hold the equity interests of our domestic asset management subsidiaries and that one or more PTP HoldCos will hold the equity interests of our domestic investment subsidiaries. One or more newly formed PTP HoldCos not reflected in the diagram above would be formed to hold and conduct any non-U.S. investment advisers, and other non-U.S. fee-generating business that we may own or acquire in the future, if any, and to hold non-U.S. investments.

As further described in “Description of the Notes,” following the Proposed PTP Conversion:

· CIFC will continue to be the primary obligor in respect of the notes and the PTP Parent will continue to be a Guarantor of the notes;

· CIFC may designate any Restricted Entity other than the PTP Parent as a Non-Guarantor Entity if the Consolidated Total Assets of such Restricted Entity, together with the Consolidated Total Assets of all then-existing Non-Guarantor Entities designated pursuant to the Indenture on a combined and Consolidated basis, would not represent 10% or more of the PTP Parent’s Consolidated Total Assets as of the end of the most recently completed fiscal quarter;

· the financial metrics for the incurrence of Indebtedness and ability to make Restricted Payments under the Indenture will be measured with reference to the PTP Parent, CIFC and the other Restricted Entities, in lieu of CIFC and its Restricted Subsidiaries;

· the PTP Parent will become the reporting entity for purposes of the informational reporting requirements contained in the Indenture;

· any action required to be taken by the Board of Directors or any officer of CIFC may be taken by the Board of Directors or any officer of the PTP Parent; and

· the applicable Change of Control Triggering Events will be tested at the PTP Parent level, rather than at the CIFC level.

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents our summary historical consolidated financial data as of and for the periods presented. This information should only be read in conjunction with the “Use of Proceeds” ; and “Capitalization,” contained elsewhere in this offering memorandum, and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Second Quarter Form 10-Q and 2014 Form 10-K, each of which is incorporated by reference into this offering memorandum, as well as our consolidated financial statements and the notes related thereto which are filed as a part of the Second Quarter Form 10-Q and the 2014 Form 10-K. The summary historical financial data for the years ended December 31, 2014 and 2013 have been derived from our audited consolidated financial statements, which are incorporated by reference from the 2014 Form 10-K. The summary financial data for the six months ended June 30, 2015 and 2014 were derived from our unaudited consolidated financial statements, which are incorporated by reference from the Second Quarter Form 10-Q. The consolidated financial data for the year ended December 31, 2012 was derived from our audited consolidated financial statements that are not included, or incorporated by reference, in this offering memorandum. Our consolidated financial statements include the financial statements of the Consolidated Entities.

|

|

|

For the Six Months |

|

For the Year Ended December 31, |

| |||||||||||

|

|

|

(in thousands, except per share amounts) |

| |||||||||||||

|

|

|

2015 |

|

2014(1) |

|

2014(1) |

|

2013(1) |

|

2012(1) |

| |||||

|

Management and incentive fees |

|

$ |

3,299 |

|

$ |

2,990 |

|

$ |

4,868 |

|

$ |

8,400 |

|

$ |

10,696 |

|

|

Net interest income from investments |

|

2,364 |

|

194 |

|

790 |

|

333 |

|

226 |

| |||||

|

Total net revenues |

|

5,663 |

|

3,184 |

|

5,658 |

|

8,733 |

|

10,922 |

| |||||

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Employee compensation and benefits |

|

16,034 |

|

14,544 |

|

28,805 |

|

23,002 |

|

18,938 |

| |||||

|

Stock-based compensation |

|

2,668 |

|

881 |

|

2,692 |

|

7,487 |

|

4,157 |

| |||||

|

Professional services |

|

3,722 |

|

1,752 |

|

7,259 |

|

5,277 |

|

6,221 |

| |||||

|

General and administrative expenses |

|

4,813 |

|

4,434 |

|

10,686 |

|

7,557 |

|

5,946 |

| |||||

|

Depreciation and amortization |

|

4,490 |

|

6,015 |

|

11,421 |

|

15,541 |

|

17,931 |

| |||||

|

Impairment of intangible assets |

|

742 |

|

— |

|

— |

|

3,106 |

|

1,771 |

| |||||

|

Restructuring charges |

|

— |

|

— |

|

— |

|

— |

|

5,877 |

| |||||

|

Total expenses |

|

32,469 |

|

27,626 |

|

60,863 |

|

61,970 |

|

60,841 |

| |||||

|

Other Income (Expense) and Gain (Loss) |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net gain (loss) on investments |

|

2,225 |

|

2,527 |

|

2,474 |

|

1,822 |

|

2,308 |

| |||||

|

Net gain (loss) on contingent liabilities |

|

(1,290 |

) |

(1,758 |

) |

(2,932 |

) |

1,644 |

|

(11,452 |

) | |||||

|

Corporate interest expense |

|

(1,294 |

) |

(2,953 |

) |

(4,236 |

) |

(5,865 |

) |

(5,912 |

) | |||||

|

Net gain on the sale of management contract |

|

— |

|

228 |

|

229 |

|

1,386 |

|

5,772 |

| |||||

|

Strategic transactions expenses |

|

— |

|

— |

|

— |

|

— |

|

(657 |

) | |||||

|

Other, net |

|

— |

|

— |

|

— |

|

(2 |

) |

(421 |

) | |||||

|

Net other income (expense) and gain (loss) |

|

(359 |

) |

(1,956 |

) |

(4,465 |

) |

(1,015 |

) |

(10,362 |

) | |||||

|

Operating income (loss) |

|

(27,165 |

) |

(26,398 |

) |

(59,670 |

) |

(54,252 |

) |

(60,281 |

) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net results of Consolidated Entities |

|

49,426 |

|

86,128 |

|

69,505 |

|

169,869 |

|

(168,380 |

) | |||||

|

Income (loss) before income taxes |

|

22,261 |

|

59,730 |

|

9,835 |

|

115,617 |

|

(228,661 |

) | |||||

|

Income tax (expense) benefit |

|

(12,915 |

) |

(19,241 |

) |

(22,158 |

) |

(18,782 |

) |

(10,750 |

) | |||||

|

Net income (loss) |

|

9,346 |

|

40,489 |

|

(12,323 |

) |

96,835 |

|

(239,411 |

) | |||||

|

Net (income) loss attributable to non-controlling interest in Consolidated Entities |

|

(2,815 |

) |

(33,810 |

) |

20,704 |

|

(73,464 |

) |

230,712 |

| |||||

|

Net income (loss) attributable to CIFC |

|

$ |

6,531 |

|

$ |

6,679 |

|

$ |

8,381 |

|

$ |

23,371 |

|

$ |

(8,699 |

) |

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic |

|

$ |

0.26 |

|

$ |

0.32 |

|

$ |

0.37 |

|

$ |

1.12 |

|

$ |

(0.43 |

) |

|

Diluted |

|

$ |

0.25 |

|

$ |

0.29 |

|

$ |

0.35 |

|

$ |

0.98 |

|

$ |

(0.43 |

) |

|

Weighted-average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic |

|

25,291 |

|

20,906 |

|

22,909 |

|

20,801 |

|

20,356 |

| |||||

|

Diluted |

|

26,504 |

|

26,141 |

|

24,168 |

|

25,737 |

|

20,356 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dividends per Share |

|

$ |

0.20 |

|

$ |

0.20 |

|

$ |

0.40 |

|

$ |

0.20 |

|

— |

| |

(1) The statement of operations for the years ended December 31, 2014, 2013 and 2012 and the six months ended June 30, 2014 have been reclassified to conform to the presentation of the six months ended June 30, 2015.

|

|

|

As of June 30, |

|

As of December 31, |

| |||||||||||

|

|

|

($ in thousands) |

| |||||||||||||

|

|

|

2015 |

|

2014 |

|

2014 |

|

2013 |

|

2012 |

| |||||

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Cash and cash equivalents |

|

$ |

28,369 |

|

$ |

22,046 |

|

$ |

59,290 |

|

$ |

25,497 |

|

$ |

47,692 |

|

|

Total assets, including Consolidated Entities |

|

$ |

13,705,878 |

|

$ |

12,785,375 |

|

$ |

13,148,135 |

|

$ |

11,600,188 |

|

$ |

10,508,280 |

|

|

Total liabilities, including non-recourse liabilities of Consolidated Entities |

|

$ |

13,112,411 |

|

$ |

12,264,867 |

|

$ |

12,626,233 |

|

$ |

11,292,435 |

|

$ |

10,305,563 |

|

|

Total CIFC stockholders’ equity |

|

$ |

180,302 |

|

$ |

155,273 |

|

$ |

176,320 |

|

$ |

151,260 |

|

$ |

124,688 |

|

|

|

|

As of June 30, |

|

As of December 31, |

| |||||||||||

|

|

|

($ in thousands) |

| |||||||||||||

|

|

|

2015 |

|

2014 |

|

2014 |

|

2013 |

|

2012 |

| |||||

|

Operating Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total Fee Earning AUM (1) |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Post-2011 CLOs |

|

$ |

8,457,581 |

|

$ |

5,539,964 |

|

$ |

7,402,986 |

|

$ |

4,127,951 |

|

$ |

1,579,558 |

|

|

Legacy CLOs (2) |

|

4,016,596 |

|

5,819,791 |

|

4,960,877 |

|

6,811,382 |

|

9,599,220 |

| |||||

|

Total CLOs |

|

12,474,177 |

|

11,359,755 |

|

12,363,863 |

|

10,939,333 |

|

11,178,778 |

| |||||

|

Credit Funds & SMAs (3) |

|

884,713 |

|

495,465 |

|

593,456 |

|

406,857 |

|

60,961 |

| |||||

|

Other Loan-Based Products (3) |

|

648,449 |

|

716,442 |

|

719,170 |

|

699,669 |

|

605,159 |

| |||||

|

Total Non-CLOs (3) |

|

1,533,162 |

|

1,211,907 |

|

1,312,626 |

|

1,106,526 |

|

666,120 |

| |||||

|

Total Loan-Based AUM |

|

14,007,339 |

|

12,571,662 |

|

13,676,489 |

|

12,045,859 |

|

11,844,898 |

| |||||

|

ABS and Corporate Bond CDOs (4) |

|

643,303 |

|

737,769 |

|

687,555 |

|

802,821 |

|

2,469,141 |

| |||||

|

Total Fee Earning AUM |

|

$ |

14,650,642 |

|

$ |

13,309,431 |

|

$ |

14,364,044 |

|

$ |

12,848,680 |

|

$ |

14,314,039 |

|

(1) Fee Earning AUM is based on latest available monthly report issued by the trustee or fund administrator prior to the end of the period, and may not tie back to consolidated GAAP financial statements.

(2) Legacy CLOs represent all managed CLOs issued prior to 2011, including CLOs acquired since 2011 but issued prior to 2011.

(3) Management fees for Non-CLO products vary by fund and may not be similar to a CLO.

(4) We do not expect to manage new CDOs in the future. Fee Earning AUM on Legacy CDOs is expected to continue to decline as these funds run-off per their contractual terms.

|

|

|

For the Six Months Ended |

|

For the Year Ended December 31, |

| |||||||||||

|

|

|

(in thousands, except ratios) |

| |||||||||||||

|

|

|

2015 |

|

2014 |

|

2014 |

|

2013 |

|

2012 |

| |||||

|

Other GAAP Financial Data |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Depreciation and amortization |

|

$ |

4,490 |

|

$ |

6,015 |

|

$ |

11,421 |

|

$ |

15,541 |

|

$ |

17,931 |

|

|

Corporate debt (1)(2) |

|

$ |

120,000 |

|

$ |

145,000 |

|

$ |

120,000 |

|

$ |

145,000 |

|

$ |

145,000 |

|

|

Corporate interest expense (1) |

|

$ |

(1,294 |

) |

$ |

(2,953 |

) |

$ |

(4,236 |

) |

$ |

(5,865 |

) |

$ |

(5,912 |

) |

|

Net cash provided by (used in) |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Operating activities |

|

$ |

59,127 |

|

$ |

(576,469 |

) |

$ |

(1,268,972 |

) |

$ |

(1,049,984 |

) |

$ |

(400,196 |

) |

|

Investing activities |

|

$ |

(214,187 |

) |

$ |

(114,461 |

) |

$ |

(223,191 |

) |

$ |

350,081 |

|

$ |

(495,135 |

) |

|

Financing activities |

|

$ |

124,139 |

|

$ |

687,479 |

|

$ |

1,525,956 |

|

$ |

677,705 |

|

$ |

907,047 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Other Non-GAAP Financial Data |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Economic Net Income (ENI) |

|

$ |

22,601 |

|

$ |

28,401 |

|

$ |

36,095 |

|

$ |

41,920 |

|

$ |

22,184 |

|

|

ENI EBITDA |

|

$ |

24,577 |

|

$ |

31,852 |

|

$ |

41,603 |

|

$ |

48,519 |

|

$ |

28,585 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Adjusted Consolidated ENI (3) |

|

$ |

18,607 |

|

$ |

16,258 |

|

$ |

20,448 |

|

$ |

24,067 |

|

$ |

19,750 |

|

|

Adjusted Consolidated ENI EBITDA (4) |

|

$ |

27,205 |

|

$ |

32,591 |

|

$ |

44,182 |

|

$ |

53,209 |

|

$ |

30,607 |

|

|

Consolidated Fixed Charge Coverage Ratio (5) (6) |

|

5.5 |

x(7) |

n/m |

|

6.2 |

x |

n/m |

|

n/m |

| |||||

|

Total Consolidated Senior Indebtedness to Adjusted Consolidated ENI EBITDA Ratio (8) |

|

1.0 |

x(7) |

n/m |

|

0.9 |

x |

n/m |

|

n/m |

| |||||

(1) In July 2014, CIFC’s $25.0 million par value convertible notes were converted into 4.1 million shares of CIFC’s common stock.

(2) Amounts are based on par value of debt.

(3) For the definition of Adjusted Consolidated ENI, see “—Description of the Notes—Certain Definitions.”

(4) For the definition of Adjusted Consolidated ENI EBITDA, see “—Description of the Notes—Certain Definitions.”

(5) Ratio presented is pro forma giving effect to the offering. For definition of Consolidated Fixed Charge Coverage Ratio, see “—Description of the Notes—Certain Definitions.”

(6) Pro forma interest assumes (a) interest on senior notes at three month Libor of 0.28% with a weighted average interest rate of 2.77% on $120.0 million par of junior subordinated notes and (b) interest on $40.0 million par value of senior notes at 8.50%.

(7) Ratio based upon Adjusted Consolidated ENI EBITDA for the last twelve months as of June 30, 2015 of $38,796.

(8) Total senior indebtedness includes the pro forma effect of the offering, or $40.0 million in senior notes.

We disclose financial measures that are calculated and presented on a basis of methodology other than in accordance with GAAP as follows:

Economic Net Income (“ENI”) is a non-GAAP financial measure of profitability which management uses in addition to GAAP net income attributable to CIFC Corp. to measure the performance of our core business (excluding non-core products). We believe ENI reflects the nature and substance of the business, the economic results driven by management fee revenues from the management of client funds and earnings on our investments. ENI represents net income (loss) attributable to CIFC Corp. excluding (i) income taxes, (ii) merger and acquisition related items including fee-sharing arrangements, amortization and impairments of intangible assets and gain (loss) on contingent consideration for earn-outs, (iii) non-cash compensation related to profits interests granted by CIFC Parent LLC in June 2011, (iv) revenues attributable to non-core investment products, (v) advances for fund organization expenses and (vi) certain other items as detailed.

ENI EBITDA is also a non-GAAP financial measure that management considers, in addition to net income (loss) attributable to CIFC, to evaluate our core performance. ENI EBITDA represents ENI before corporate interest expense and depreciation of fixed assets, a non-cash item.

These non-GAAP measures may not be comparable to similar measures presented by other companies, as they are not based on a comprehensive set of accounting rules or principles and therefore may be defined differently by other companies. In addition, these non-GAAP measures should be considered as an addition to, and not as a substitute for, or superior to, financial measures determined in accordance with GAAP.

ENI and ENI EBITDA are reconciled from net income (loss) attributable to CIFC as determined under GAAP as follows:

|

|

|

Trailing |

|

For the Six Months |

|

For the Year Ended December 31, |

| ||||||||||||

|

|

|

|

|

($ in thousands) |

| ||||||||||||||

|

|

|

2015 |

|

2015 |

|

2014 |

|

2014 |

|

2013 |

|

2012 |

| ||||||

|

GAAP Net Income (Loss) attributable to CIFC |

|

$ |

8,233 |

|

$ |

6,531 |

|

$ |

6,679 |

|

$ |

8,381 |

|

$ |

23,371 |

|

$ |

(8,699 |

) |

|

Management fee sharing arrangements (1) |

|

(7,117 |

) |

(3,466 |

) |

(5,066 |

) |

(8,716 |

) |

(15,744 |

) |

(10,193 |

) | ||||||

|

Management fees attributable to non-core funds (2) |

|

(711 |

) |

(340 |

) |

(442 |

) |

(814 |

) |

(3,139 |

) |

(3,168 |

) | ||||||

|

Employee compensation costs (3) |

|

1,272 |

|

603 |

|

942 |

|

1,610 |

|

3,767 |

|

2,135 |

| ||||||

|

Amortization and impairment of intangibles |

|

9,181 |

|

4,550 |

|

5,517 |

|

10,149 |

|

17,913 |

|

19,213 |

| ||||||

|

Net (gain)/loss on contingent liabilities and other (4) |

|

2,463 |

|

1,290 |

|

1,758 |

|

2,932 |

|

(1,644 |

) |

12,041 |

| ||||||

|

Income tax expense (benefit) |

|

15,832 |

|

12,915 |

|

19,241 |

|

22,158 |

|

18,782 |

|

10,750 |

| ||||||

|

Strategic transactions expenses (5) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

657 |

| ||||||

|

Restructuring charges |

|

— |

|

— |

|

— |

|

— |

|

— |

|

5,877 |

| ||||||

|

Insurance settlement received |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(657 |

) | ||||||

|

Other (6) |

|

1,142 |

|

518 |

|

(228 |

) |

395 |

|

(1,386 |

) |

(5,772 |

) | ||||||

|

Total reconciling and non-recurring items |

|

22,062 |

|

16,070 |

|

21,722 |

|

27,714 |

|

18,549 |

|

30,883 |

| ||||||

|

ENI |

|

$ |

30,295 |

|

22,601 |

|

28,401 |

|

36,095 |

|

41,920 |

|

22,184 |

| |||||

|

Corporate interest expense |

|

2,577 |

|

1,294 |

|

2,953 |

|

4,236 |

|

5,865 |

|

5,912 |

| ||||||

|

Depreciation on fixed assets |

|

1,456 |

|

682 |

|

498 |

|

1,272 |

|

734 |

|

489 |

| ||||||

|

ENI EBITDA |

|

34,328 |

|

$ |

24,577 |

|

$ |

31,852 |

|

$ |

41,603 |

|

$ |

48,519 |

|

$ |

28,585 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

ENI |

|

30,295 |

|

$ |

22,601 |

|

$ |

28,401 |

|

$ |

36,095 |

|

$ |

41,920 |

|

$ |

22,184 |

| |

|

Add: Stock-based compensation |

|

4,468 |

|

2,628 |

|

739 |

|

2,579 |

|

4,690 |

|

2,022 |

| ||||||

|

Less: Income taxes (7) |

|

11,966 |

|

6,622 |

|

12,882 |

|

18,226 |

|

22,543 |

|

4,456 |

| ||||||

|

Adjusted Consolidated ENI |

|

22,797 |

|

$ |

18,607 |

|

$ |

16,258 |

|

$ |

20,448 |

|

$ |

24,067 |

|

$ |

19,750 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

ENI EBITDA |

|

34,328 |

|

$ |

24,577 |

|

$ |

31,852 |

|

$ |

41,603 |

|

$ |

48,519 |

|

$ |

28,585 |

| |

|

Add: Stock-based compensation |

|

4,468 |

|

2,628 |

|

739 |

|

2,579 |

|

4,690 |

|

2,022 |

| ||||||

|

Adjusted Consolidated ENI EBITDA |

|

38,796 |

|

$ |

27,205 |

|

$ |

32,591 |

|

$ |

44,182 |

|

$ |

53,209 |

|

$ |

30,607 |

| |

(1) CIFC Corp. shares management fees on certain of the acquired CLOs it manages with the party that sold the funds to CIFC Corp. or an affiliate thereof. Management fees are presented on a gross basis for GAAP and on a net basis for non-GAAP ENI.

(2) For fiscal year 2012, the calculation of ENI has been adjusted to include a reduction attributable to non-core advisory fees. This conforms to the presentation for all other periods presented.

(3) Employee compensation has been adjusted for non-cash compensation related to profits interests granted to CIFC employees by CIFC Parent LLC and the sharing of incentive-based revenue with certain former employees established in connection with our acquisition of certain CLOs from Columbus Nova Credit Investments Management, LLC.

(4) Adjustments primarily include the elimination of gains (losses) on contingent liabilities during the respective periods.

(5) These expenses relate to a transaction to enter into a strategic relationship with an affiliate of General Electric Capital Corporation.

(6) In January 2012, we recognized $5.8 million of gains from the sale of our right to manage Gillespie CLO PLC. We recognized additional gains of $0.2 million, $1.4 million and $0.2 million, from contingent payments collected for the years ended December 31, 2014 and 2013 and for the six months ended June 30, 2014. In addition, (i) for the six months ended June 30, 2015, other included litigation expenses and certain professional fees and (ii) for the year ended December 31, 2014, other included litigation expense.

(7) Income taxes are based on current year GAAP taxes for the periods presented.

UNAUDITED PRO FORMA FINANCIAL DATA

Under GAAP, we expect that the Proposed PTP Conversion will be accounted for on a historical cost basis whereby the consolidated assets and liabilities of CIFC LLC will be recorded at the historical cost of CIFC Corp. as reflected on CIFC Corp.’s consolidated financial statements. Accordingly, the consolidated financial statements of CIFC LLC immediately following the Proposed PTP Conversion will be substantially similar to the consolidated financial statements of CIFC Corp. immediately prior to the Proposed PTP Conversion. Since the consolidated financial statements of CIFC LLC are substantially similar to those of CIFC Corp., full pro forma and comparative financial information regarding CIFC LLC and its consolidated subsidiaries giving effect to the Proposed PTP Conversion have not been included herein. Below we have included certain limited unaudited pro forma consolidated condensed balance sheet information that highlights those balance sheet accounts that will be adjusted due to the transactions noted above.

Unaudited Pro Forma Condensed Consolidated Balance Sheet and Statement of Operations

The unaudited pro forma condensed consolidated balance sheet of CIFC Corp. is presented as if the Proposed PTP Conversion had occurred on June 30, 2015. The presentation of unaudited pro forma non-GAAP operating net income and pro forma GAAP net income is presented as if the Proposed PTP Conversion had occurred on January 1, 2014.

Our pro forma financial information is subject to a number of estimates, assumptions and uncertainties and does not purport to reflect the financial condition that would have existed or occurred had such transactions taken place on the date indicated nor does it purport to reflect the financial condition or results of operations that will exist or occur in the future.

You should read this table together with the information under Summary—Summary Historical Consolidated Financial Data included elsewhere in this offering memorandum and the financial statements which are incorporated by reference into this offering memorandum.

Unaudited Pro Forma Condensed Consolidated Balance Sheet

As of June 30, 2015

($ in thousands)

|

|

|

As of June 30, 2015 |

| |||||||

|

|

|

Historical |

|

Proposed PTP |

|

Pro Forma(1) |

| |||

|

Assets |

|

|

|

|

|

|

| |||

|

Deferred tax assets, net |

|

$ |

48,050 |

|

$ |

(2,792 |

)(2) |

$ |

45,258 |

|

|

Other assets |

|

178,840 |

|

— |

|

178,840 |

| |||

|

Total assets of Consolidated Entities |

|

13,478,988 |

|

— |

|

13,478,988 |

| |||

|

Total assets |

|

$ |

13,705,878 |

|

$ |

(2,792 |

) |

$ |

13,703,086 |

|

|

Liabilities and Equity |

|

|

|

|

|

|

| |||

|

Liabilities |

|

|

|

|

|

|

| |||

|

Deferred tax liability |

|

$ |

— |

|

$ |

— |

(2) |

$ |

— |

|

|

Other liabilities |

|

154,901 |

|

— |

|

154,901 |

| |||

|

Total liabilities of Consolidated Entities |

|

12,957,510 |

|

— |

|

12,957,510 |

| |||

|

Total liabilities |

|

13,112,411 |

|

— |

|

13,112,411 |

| |||

|

Equity |

|

|

|

|

|

|

| |||

|

Stockholders’ Equity |

|

180,302 |

|

(2,792 |

)(2) |

177,510 |

| |||

|

Non-controlling interests of Consolidated Funds and |

|

|

|

|

|

|

| |||

|

Appropriated Earnings (deficit) of Consolidated VIEs |

|

413,165 |

|

— |

|

413,165 |

| |||

|

Total equity |

|

593,467 |

|

(2,792 |

) |

590,675 |

| |||

|

Total liabilities and equity |

|

$ |

13,705,878 |

|

$ |

(2,792 |

) |

$ |

13,703,086 |

|

(1) The pro forma condensed consolidated balance sheet does not include the impact of transaction costs or the realization of gains or losses, for tax purposes, related to the Proposed PTP Conversion.

(2) Deferred tax balances reflect the transfer of investment income generating assets as part of the contemplated Proposed PTP Conversion.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the Six Months Ended June 30, 2015 and For the Year Ended December 31, 2014

($ in thousands, except per share)

|

|

|

For the Six Months Ended June 30, 2015 |

| |||||||

|

|

|

Historical |

|

Proposed PTP |

|

Pro Forma |

| |||

|

Income (loss) before income taxes |

|

$ |

22,261 |

|

(250 |

)(1) |

$ |

22,011 |

| |

|

Income tax (expense) benefit |

|

(12,915 |

) |

3,548 |

(2) |

(9,367 |

) | |||

|

Net income (loss) |

|

9,346 |

|

3,298 |

|

12,644 |

| |||

|

Net (income) loss attributable to noncontrolling interest in Consolidated Entities |

|

(2,815 |

) |

— |

|

(2,815 |

) | |||

|

Net income (loss) attributable to CIFC Corp./CIFC LLC(3) |

|

$ |

6,531 |

|

$ |

3,298 |

|

$ |

9,829 |

|

|

|

|

|

|

|

|

|

| |||

|

Earnings (loss) per share— |

|

|

|

|

|

|

| |||

|

Basic |

|

$ |

0.26 |

|

$ |

0.13 |

|

$ |

0.39 |

|

|

Diluted |

|

$ |

0.25 |

|

$ |

0.12 |

|

$ |

0.37 |

|

|

Weighted-average number of shares outstanding— |

|

|

|

|

|

|

| |||

|

Basic |

|

25,291 |

|

— |

|

25,291 |

| |||

|

Diluted |

|

26,504 |

|

— |

|

26,504 |

| |||

|

Outstanding Shares |

|

25,372 |

|

— |

|

25,372 |

| |||

|

Book value per share |

|

$ |

7.11 |

|

$ |

(0.11 |

) |

$ |

7.00 |

|

|

|

|

For the Year Ended December 31, 2014 |

| |||||||

|

|

|

|

|

Proposed PTP |

|

|

| |||

|

|

|

Historical |

|

Conversion |

|

Pro Forma |

| |||

|

Income (loss) before income taxes |

|

$ |

9,835 |

|

(500 |

)(1) |

$ |

9,335 |

| |

|

Income tax (expense) benefit |

|

(22,158 |

) |

6,986 |

(2) |

(15,172 |

) | |||

|

Net income (loss) |

|

(12,323 |

) |

6,486 |

|

(5,837 |

) | |||

|

Net (income) loss attributable to noncontrolling interest in Consolidated Entities |

|

20,704 |

|

— |

|

20,704 |

| |||

|

Net income (loss) attributable to CIFC Corp./CIFC LLC(3) |

|

$ |

8,381 |

|

$ |

6,486 |

|

$ |

14,867 |

|

|

|

|

|

|

|

|

|

| |||

|

Earnings (loss) per share— |

|

|

|

|

|

|

| |||

|

Basic |

|

$ |

0.37 |

|

$ |

0.28 |

|

$ |

0.65 |

|

|

Diluted |

|

$ |

0.35 |

|

$ |

0.27 |

|

$ |

0.62 |

|

|

Weighted-average number of shares outstanding— |

|

|

|

|

|

|

| |||

|

Basic |

|

22,909 |

|

— |

|

22,909 |

| |||

|

Diluted |

|

24,168 |

|

— |

|

24,168 |

| |||

(1) Represents additional cost of administration and compliance.

(2) Estimated tax benefit to reflect the Proposed PTP Conversion, with the Company’s top-level form of organization converted from a corporation to a limited liability company as of January 1, 2014.

(3) CIFC LLC would be formed for the purpose of effecting the Proposed PTP Conversion.

Non-GAAP Financial Measures

The unaudited pro forma reconciliation of GAAP net income (loss) attributable to CIFC Corp. to ENI and ENI EBITDA are presented as if the Proposed PTP Conversion had occurred on January 1, 2014. Our pro forma financial information is subject to a number of estimates, assumptions and uncertainties and does not purport to reflect the financial condition that would have existed or occurred had such transactions taken place on the date indicated nor does it purport to reflect the financial condition or results of operations that will exist or occur in the future. Reconciliation is as follows ($ in thousands):

|

|

|

For the Six Months Ended June 30, 2015 |

| |||||||

|

|

|

|

|

Proposed PTP |

|

|

| |||

|

|

|

Historical |

|

Conversion |

|

Pro Forma |

| |||

|

GAAP Net income (loss) attributable to CIFC Corp. |

|

$ |

6,531 |

|

$ |

3,298 |

|

$ |

9,829 |

|

|

Income tax expense (benefit) |

|

12,915 |

|

(3,548 |

) |

9,367 |

| |||

|

Amortization and impairment of intangibles |

|

4,550 |

|

— |

|

4,550 |

| |||

|

Management fee sharing arrangement(1) |

|

(3,466 |

) |

— |

|

(3,466 |

) | |||

|

Net (gain)/loss on contingent liabilities and other |

|

1,290 |

|

— |

|

1,290 |

| |||

|

Employee compensation costs(2) |

|

603 |

|

— |

|

603 |

| |||

|

Management fees attributable to non-core funds |

|

(340 |

) |

— |

|

(340 |

) | |||

|

Other(3) |

|

518 |

|

— |

|

518 |

| |||

|

Total reconciling and non-recurring items |

|

16,070 |

|

(3,548 |

) |

12,522 |

| |||

|

ENI |

|

$ |

22,601 |

|

$ |

(250 |

) |

$ |

22,351 |

|

|

Add: Corporate interest expense |

|

1,294 |

|

|

|

1,294 |

| |||

|

Add: Depreciation of fixed assets |

|

682 |

|

|

|

682 |

| |||

|

ENI EBITDA |

|

$ |

24,577 |

|

$ |

(250 |

) |

$ |

24,327 |

|

|

|

|

For the Year Ended December 31, 2014 |

| |||||||

|

|

|

|

|

Proposed PTP |

|

|

| |||

|

|

|

Historical |

|

Conversion |

|

Pro Forma |

| |||

|

GAAP Net income (loss) attributable to CIFC Corp. |

|

$ |

8,381 |

|

$ |

6,486 |

|

$ |

14,867 |

|

|

Income tax expense (benefit) |

|

22,158 |

|

(6,986 |

) |

15,172 |

| |||

|

Amortization and impairment of intangibles |

|

10,149 |

|

— |

|

10,149 |

| |||

|

Management fee sharing arrangement(1) |

|

(8,716 |

) |

— |

|

(8,716 |

) | |||

|

Net (gain)/loss on contingent liabilities and other |

|

2,932 |

|

— |

|

2,932 |

| |||

|

Employee compensation costs(2) |

|

1,610 |

|

— |

|

1,610 |

| |||

|

Management fees attributable to non-core funds |

|

(814 |

) |

— |

|

(814 |

) | |||

|

Other(3) |

|

395 |

|

— |

|

395 |

| |||

|

Total reconciling and non-recurring items |

|

27,714 |

|

(6,986 |

) |

20,728 |

| |||

|

ENI |

|

$ |

36,095 |

|

$ |

(500 |

) |

$ |

35,595 |

|

|

Add: Corporate interest expense |

|

4,236 |

|

— |

|

4,236 |

| |||

|

Add: Depreciation of fixed assets |

|

1,272 |

|

— |

|

1,272 |

| |||

|

ENI EBITDA |

|

$ |

41,603 |

|

$ |

(500 |

) |

$ |

41,103 |

|

(1) CIFC Corp. shares management fees on certain of the acquired CLOs it manages (shared with the party that sold the funds to CIFC Corp. or an affiliate thereof). Management fees are presented on a gross basis for GAAP and on a net basis for Non-GAAP ENI.

(2) Employee compensation and benefits has been adjusted for non-cash compensation related to profits interests granted to CIFC Corp. employees by CIFC Parent Holdings LLC and sharing of incentive fees with certain former employees established in connection with the Company’s acquisition of certain CLOs from Columbus Nova Credit Investments Management, LLC.

(3) For the six months ended June 30, 2015, Other includes litigation expenses and certain professional fees. For the year ended December 31, 2014, Other includes litigation expenses of $0.6 million, which was partially offset by additional gains from contingent payments collected on the 2012 sale of the Company’s rights to manage Gillespie CLO PLC of $0.2 million.

RISK FACTORS

An investment in the notes involves a high degree of risk. You should consider carefully the following risks involved in investing in the notes, as well as the other information contained or incorporated by reference in this offering memorandum, before deciding whether to purchase the notes. In particular, you should carefully consider, among other things, the matters discussed below and under “Risk Factors” in our 2014 Form 10-K and our Second Quarter Form 10-Q. The actual occurrence of any of these risks could materially adversely affect our business, financial condition and results of operations. In that case, the value of the notes could decline substantially, and you may lose part or all of your investment. This offering memorandum also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this offering memorandum and the documents incorporated by reference herein. See “Disclosure Regarding Forward-Looking Statements.”

Risks Related to the Notes

Our business operations may not generate the cash needed to service our indebtedness, including the notes.

Our ability to make payments on our indebtedness, including the notes, and to fund planned capital expenditures will depend on our ability to generate cash in the future. There can be no assurance that our business will generate sufficient cash flow from operations or that future borrowings will be available to us in an amount sufficient to enable us to pay interest on and principal of our indebtedness, including the notes, or to fund our other liquidity needs, or at all.

The indenture governing the notes imposes significant operating and financial restrictions on us, which may prevent us from capitalizing on business opportunities and, if we fail to comply with such restrictions, could result in an event of default under the indenture.

The indenture governing the notes imposes significant operating and financial restrictions on us. These restrictions, subject to certain exceptions, limit our ability to, among other things:

· pay dividends or make other distributions on, or redeem or repurchase, capital stock;

· make certain investments;

· incur certain liens or certain debt;

· transfer or sell certain assets and subsidiary capital stock;

· enter into transactions with affiliates;

· alter the business that we conduct;

· designate our subsidiaries as unrestricted subsidiaries; and

· enter into mergers, consolidations and sales of substantially all of our or our subsidiaries’ assets.

As a result of these restrictions, we are limited as to how we conduct our business and we may be unable to finance our future operations or capital needs or engage in other business activities that may be in our interest. The terms of any future indebtedness we may incur could include more restrictive covenants. Our ability to comply with these covenants may be affected by events beyond our control. There can be no assurance that we will be able to maintain compliance with these covenants in the future

and, if we fail to do so, that we will be able to obtain waivers and/or amend the covenants in order to avoid an event of default.

Our failure to comply with the agreements relating to our outstanding indebtedness, including as a result of events beyond our control, could result in an event of default that could materially and adversely affect our results of operations and our financial condition.

We have outstanding subordinated notes issued under two junior subordinated indentures (the “Junior Subordinated Notes”), each of which contain certain provisions relating to events of default. If there was an event of default under any of the agreements relating to our outstanding indebtedness, the holders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately. There can be no assurance that our assets or cash flows would be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default. If we are forced to refinance these borrowings on less favorable terms or cannot refinance these borrowings, our results of operations and financial condition could be adversely affected. Furthermore, if we are unable to repay, refinance or restructure any future secured indebtedness, the holders of such debt could proceed against the collateral securing that indebtedness, and we could be forced into bankruptcy or liquidation. In addition, any event of default or declaration of acceleration under one debt instrument could also result in a cross-default under one or more of our other debt instruments.

Redemption may adversely affect your return on the notes.

We have the right to redeem some or all of the notes prior to maturity, as described under “Description of the Notes—Optional Redemption.” CIFC may redeem prior to , 2020, at our option, all or part of the notes upon not less than 10 nor more than 60 days’ prior notice (with a copy to the trustee) at a redemption price equal to the sum of (i) 100% of the principal amount of the notes to be redeemed, plus (ii) the Applicable Premium (as defined in “Description of the Notes—Optional Redemption”) as of the date of redemption, plus (iii) accrued and unpaid interest to, but not including, the date of redemption (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date).

On or after , 2020, we may redeem, at our option, all or part of the notes upon not less than 10 nor more than 60 days’ prior notice (with a copy to the trustee) at certain redemption prices, expressed as percentages of the outstanding principal amount thereof, together with any accrued and unpaid interest to the date of redemption (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date), at the redemption price applicable to the corresponding twelve-month period set forth under “Description of the Notes—Optional Redemption.” We may redeem the notes at times when the prevailing interest rates may be relatively low.

In addition, until , 2020, CIFC may, at its option, on one or more occasions, redeem up to 35% of the aggregate principal amount of the notes with the proceeds from one or more public equity offerings at a redemption price equal to % of the aggregate principal amount of the notes to be redeemed (such percentage to be equal to 100% plus the annual coupon on the notes), plus accrued and unpaid interest to the date of redemption (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date); provided that at least 65% of the original aggregate principal amount of notes issued under the indenture remains outstanding immediately after the occurrence of each such redemption, and provided further that each such redemption occurs within 90 days of the date of closing of each such equity offering.

Accordingly, you may not be able to reinvest the proceeds of any such redemption in a comparable security at an effective interest rate as high as that of the notes.

The notes and related guarantees are unsecured and are effectively subordinated to our secured indebtedness.

The notes and related guarantees are not secured by any of our assets and therefore are

effectively subordinated to the claims of any secured debt holders to the extent of the value of the assets securing our secured indebtedness. The indenture governing the notes will permit us to incur additional senior secured indebtedness, the holders of which will be entitled to the remedies available to a secured lender. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization, or other bankruptcy proceeding, there can be no assurance that there will be sufficient assets to pay amounts due on the notes. As a result, holders of the notes may receive less, ratably, than holders of secured indebtedness.

Despite our current indebtedness level, we may still be able to incur substantially more debt, which could exacerbate the risks associated with our substantial indebtedness.

As of June 30, 2015, CIFC had $120.0 million of unsecured indebtedness outstanding under its Junior Subordinated Notes. The terms of the indenture governing the notes permit us to incur substantial additional indebtedness in the future, including secured indebtedness. If we incur any additional indebtedness that ranks equal to the notes, the holders of that debt will be entitled to share ratably with the holders of the notes in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding up of us. In particular, the terms of the indenture allow us to incur a substantial amount of incremental debt which ranks equal to the notes, including various amounts of debt permitted under the definition of “Permitted Indebtedness” in the Description of the Notes. If new debt is added to our or our subsidiaries’ current debt levels, the related risks that we now face could intensify.

The notes and related guarantees are structurally subordinated to all liabilities of our non-guarantor subsidiaries.