Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | a8kcoverpage093015.htm |

| EX-99.3 - EXHIBIT 99.3 - STATE BANK FINANCIAL CORP | patriotpressrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - STATE BANK FINANCIAL CORP | pressrelease093015.htm |

State Bank Financial Corporation 3rd Quarter 2015 Earnings Presentation Joe Evans, Chairman and CEO Tom Wiley, Vice Chairman and President Sheila Ray, EVP and Chief Financial Officer David Black, EVP and Chief Credit Officer October 22, 2015

2 Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this presentation that are not statements of historical fact are forward-looking statements. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “will,” “expect,” “should,” “anticipate,” and “project,” as well as similar expressions. These forward-looking statements include statements related to the expected cost savings and the timing of such savings related to our efficiency initiatives (slides 3 and 8), the direct expense savings and loan recovery income from the early termination of loss share and our ability to recapture the tangible book value dilution (slide 3), the expected annual origination and yields from our equipment finance division (slide 5), our revenue trends and the anticipated results of our focus on efficiency. In the course of management’s discussion of this presentation, they may address other forward-looking topics, including expected cost savings related to our recent acquisitions, the sustainability of our core operating franchise, the strength of our credit metrics on our organic loans, the opportunity to use the mortgage and SBA platforms from our recent acquisitions, the growth of our payroll business, our projected growth, continued improvement in our deposit funding mix, our well-positioned franchise, our execution of strategic priorities, our anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to the anticipated effects on results of operations and financial condition from expected developments or events, including projections of future accretion on loans, anticipated internal growth, and plans to establish or acquire banks or the assets of failed banks. These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those anticipated in such statements. Potential risks and uncertainties include the following: • negative reactions to our recent acquisitions by the customers, employees and counterparties of the acquired banks, or difficulties related to the transition of services; • general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a reduction in demand for credit and a decline in real estate values; • a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results; • costs or difficulties related to the integration of the banks we have acquired or may acquire may be greater than expected; • restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • competitive pressures among depository and other financial institutions may increase significantly; • changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; • other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; • our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry; • adverse changes may occur in the bond and equity markets; • war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; • economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate; and • we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the SEC. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this report. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal year, for a description of some of the important factors that may affect actual outcomes.

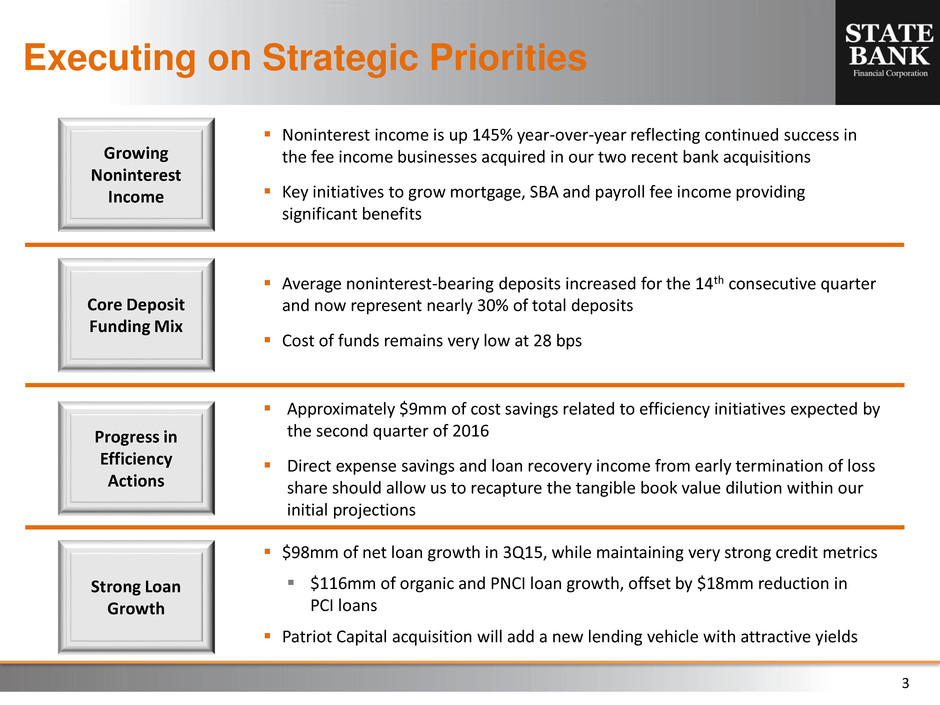

3 Executing on Strategic Priorities Growing Noninterest Income Core Deposit Funding Mix Progress in Efficiency Actions Noninterest income is up 145% year-over-year reflecting continued success in the fee income businesses acquired in our two recent bank acquisitions Key initiatives to grow mortgage, SBA and payroll fee income providing significant benefits Average noninterest-bearing deposits increased for the 14th consecutive quarter and now represent nearly 30% of total deposits Cost of funds remains very low at 28 bps Approximately $9mm of cost savings related to efficiency initiatives expected by the second quarter of 2016 Direct expense savings and loan recovery income from early termination of loss share should allow us to recapture the tangible book value dilution within our initial projections Strong Loan Growth $98mm of net loan growth in 3Q15, while maintaining very strong credit metrics $116mm of organic and PNCI loan growth, offset by $18mm reduction in PCI loans Patriot Capital acquisition will add a new lending vehicle with attractive yields

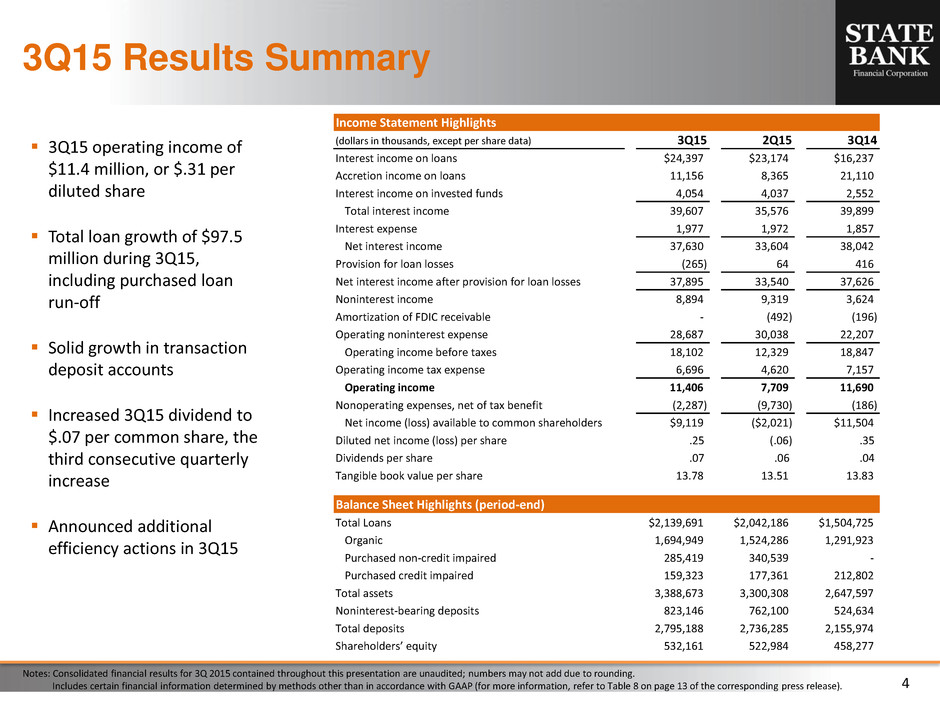

4 Notes: Consolidated financial results for 3Q 2015 contained throughout this presentation are unaudited; numbers may not add due to rounding. Includes certain financial information determined by methods other than in accordance with GAAP (for more information, refer to Table 8 on page 13 of the corresponding press release). 3Q15 Results Summary 3Q15 operating income of $11.4 million, or $.31 per diluted share Total loan growth of $97.5 million during 3Q15, including purchased loan run-off Solid growth in transaction deposit accounts Increased 3Q15 dividend to $.07 per common share, the third consecutive quarterly increase Announced additional efficiency actions in 3Q15 Income Statement Highlights (dollars in thousands, except per share data) 3Q15 2Q15 3Q14 Interest income on loans $24,397 $23,174 $16,237 Accretion income on loans 11,156 8,365 21,110 Interest income on invested funds 4,054 4,037 2,552 Total interest income 39,607 35,576 39,899 Interest expense 1,977 1,972 1,857 Net interest income 37,630 33,604 38,042 Provision for loan losses (265) 64 416 Net interest income after provision for loan losses 37,895 33,540 37,626 Noninterest income 8,894 9,319 3,624 Amortization of FDIC receivable - (492) (196) Operating noninterest expense 28,687 30,038 22,207 Operating income before taxes 18,102 12,329 18,847 Operating income tax expense 6,696 4,620 7,157 Operating income 11,406 7,709 11,690 Nonoperating expenses, net of tax benefit (2,287) (9,730) (186) Net income (loss) available to common shareholders $9,119 ($2,021) $11,504 Diluted net income (loss) per share .25 (.06) .35 Dividends per share .07 .06 .04 Tangible book value per share 13.78 13.51 13.83 Balance Sheet Highlights (period-end) Total Loans $2,139,691 $2,042,186 $1,504,725 Organic 1,694,949 1,524,286 1,291,923 Purchased non-credit impaired 285,419 340,539 - Purchased credit impaired 159,323 177,361 212,802 Total assets 3,388,673 3,300,308 2,647,597 Noninterest-bearing deposits 823,146 762,100 524,634 Total deposits 2,795,188 2,736,285 2,155,974 Shareholders’ equity 532,161 522,984 458,277

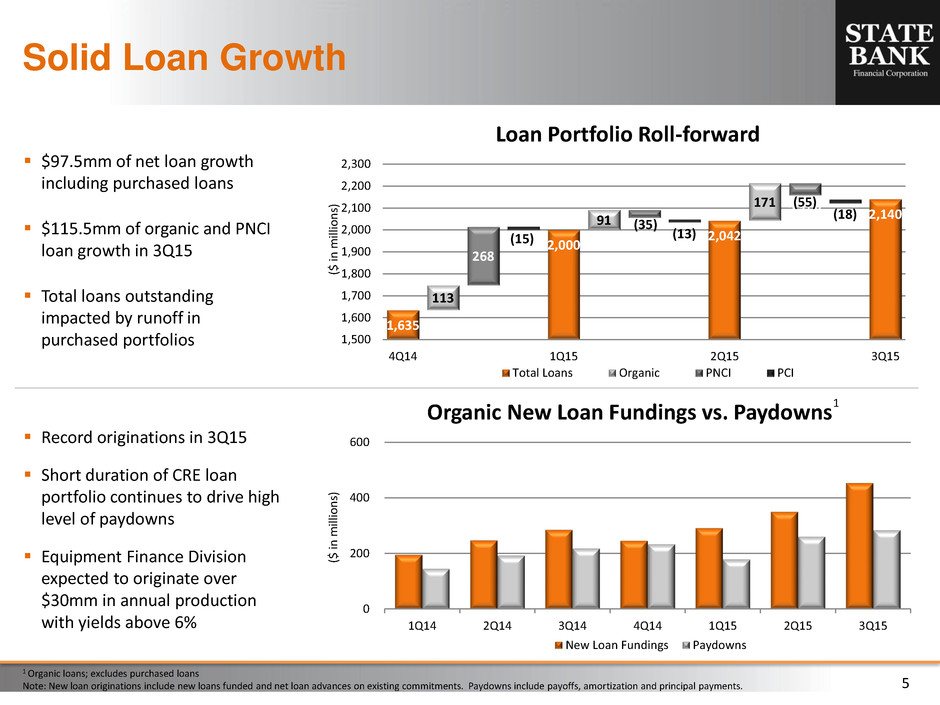

5 Solid Loan Growth ($ i n mi llio n s) ($ i n mi llio n s) 1 Organic loans; excludes purchased loans Note: New loan originations include new loans funded and net loan advances on existing commitments. Paydowns include payoffs, amortization and principal payments. $97.5mm of net loan growth including purchased loans $115.5mm of organic and PNCI loan growth in 3Q15 Total loans outstanding impacted by runoff in purchased portfolios Record originations in 3Q15 Short duration of CRE loan portfolio continues to drive high level of paydowns Equipment Finance Division expected to originate over $30mm in annual production with yields above 6% 1,635 2,000 2,042 2,158 2,121 2,140 113 91 171 268 (35) (55) (15) (13) (18) 1,500 1,600 1,700 1,800 1,900 2,000 2,100 2,200 2,300 4Q14 1Q15 2Q15 3Q15 Loan Portfolio Roll-forward Total Loans Organic PNCI PCI 0 200 400 600 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Organic New Loan Fundings vs. Paydowns 1 New Loan Fundings Paydowns

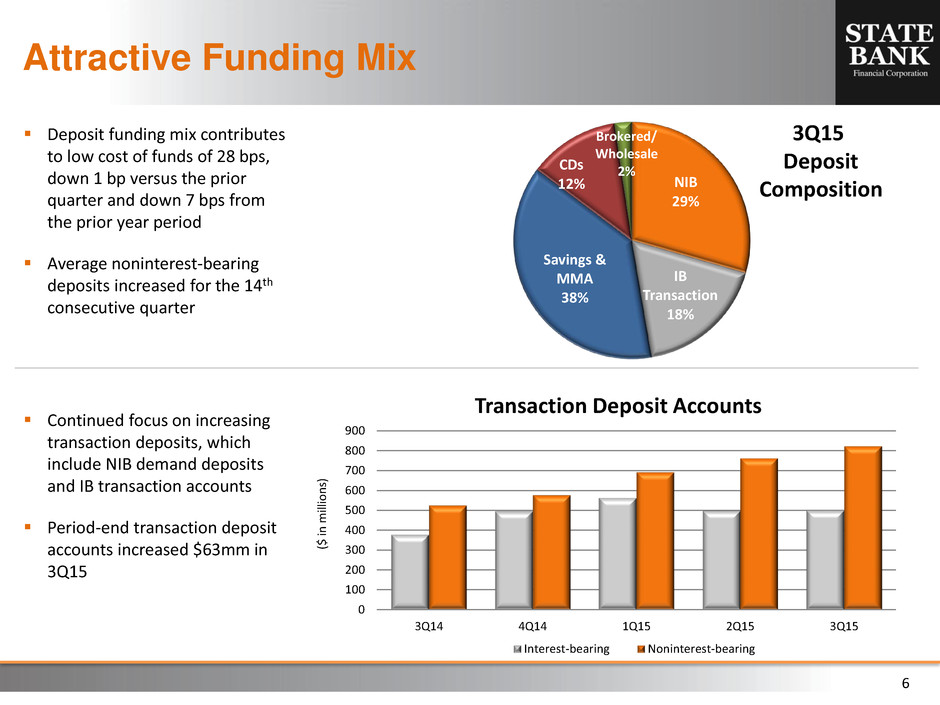

6 Attractive Funding Mix Continued focus on increasing transaction deposits, which include NIB demand deposits and IB transaction accounts Period-end transaction deposit accounts increased $63mm in 3Q15 ($ i n mi llio n s) 0 100 200 300 400 500 600 700 800 900 3Q14 4Q14 1Q15 2Q15 3Q15 Transaction Deposit Accounts Interest-bearing Noninterest-bearing NIB 29% IB Transaction 18% Savings & MMA 38% CDs 12% Brokered/ Wholesale 2% Deposit funding mix contributes to low cost of funds of 28 bps, down 1 bp versus the prior quarter and down 7 bps from the prior year period Average noninterest-bearing deposits increased for the 14th consecutive quarter 3Q15 Deposit Composition

7 1 Excludes accretion income on loans 2 Excludes (amortization)/accretion of FDIC receivable; other noninterest income excludes gain on securities Continue to replace accretion with interest income from organic and purchased non- credit impaired portfolios Total interest income of $28.3mm, excluding accretion, is up $9.6mm, or 51%, from 3Q14 ($ i n t h o u sa n d s) ($ i n t h o u sa n d s) Significant year-over-year progress as noninterest income of $8.9mm in 3Q15 is up 145% from 3Q14 Mortgage production of $146mm in the third quarter, leading to $3.1mm in fee income SBA team production of $17.8mm in 3Q15, leading to total SBA income of $1.7mm Payroll fee income increased 15% year-over-year Strong Revenue Trends 0 2,000 4,000 6,000 8,000 10,000 3Q14 4Q14 1Q15 2Q15 3Q15 Noninterest Income 2 Other NII Mortgage SBA Payroll 10,000 15,000 20,000 25,000 30,000 3Q14 4Q14 1Q15 2Q15 3Q15 Interest Income 1

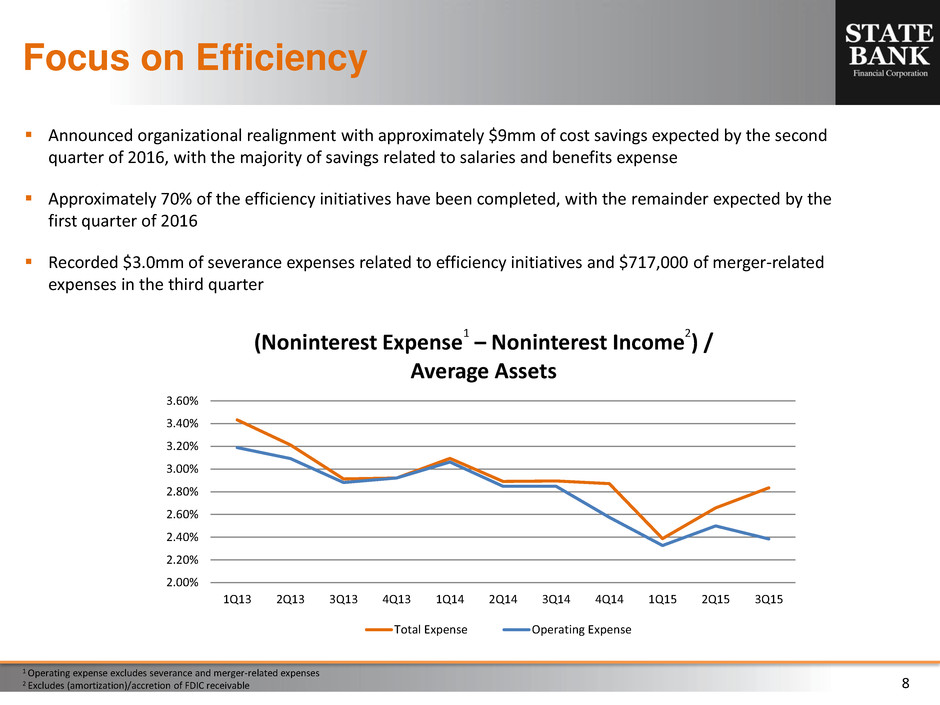

8 Focus on Efficiency Announced organizational realignment with approximately $9mm of cost savings expected by the second quarter of 2016, with the majority of savings related to salaries and benefits expense Approximately 70% of the efficiency initiatives have been completed, with the remainder expected by the first quarter of 2016 Recorded $3.0mm of severance expenses related to efficiency initiatives and $717,000 of merger-related expenses in the third quarter 1 Operating expense excludes severance and merger-related expenses 2 Excludes (amortization)/accretion of FDIC receivable 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 3.20% 3.40% 3.60% 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 (Noninterest Expense 1 – Noninterest Income 2 ) / Average Assets Total Expense Operating Expense

9 ($ i n t h o u sa n d s) Maintaining Solid Asset Quality Strong performance of organic and purchased non-credit impaired portfolios Organic metrics Past due loans: .08% NPAs: .33% Average NCOs: .01% Allowance: 1.19% (covers NPAs by 3.6x) N PA s / Orga n ic L o an s + OR EO ($ i n t h o u sa n d s) 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 0 2,000 4,000 6,000 8,000 10,000 3Q14 4Q14 1Q15 2Q15 3Q15 Organic Nonperforming Assets NPLs OREO NPAs / Organic Loans + OREO 0 50,000 100,000 150,000 200,000 250,000 3Q14 4Q14 1Q15 2Q15 3Q15 PCI Loans & OREO PCI Loans OREO Decreasing exposure to distressed assets as purchased credit impaired loans are down 25% year-over-year PCI loans: $159mm, a 32% discount to unpaid principal balance of $234mm OREO: $11mm, down 25% year-over- year