Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Orion Group Holdings Inc | a8-kamendment.htm |

| EX-99.3 - EXHIBIT 99.3 - Orion Group Holdings Inc | exhibit9930615tasholding.htm |

| EX-99.1 - EXHIBIT 99.1 - Orion Group Holdings Inc | exhibit991auditorsconsen.htm |

| EX-99.5 - EXHIBIT 99.5 - Orion Group Holdings Inc | exhibit995notestounaudited.htm |

| EX-99.2 - EXHIBIT 99.2 - Orion Group Holdings Inc | exhibit992tasholdingsllc.htm |

UNAUDITED PRO FORMA COMBINED BALANCE SHEET EXHIBIT 99.4 June 30, 2015 Assets Current assets: ORION MARINE GROUP T.A.S COMBINED HISTORICAL PRO FORMA ADJUSTMENTS COMBINED PRO FORMA Cash and cash equivalents 20,735 7,628 28,363 (7,628) 20,735 Accounts receivable: Trade, net of allowance of 48,679 35,308 83,987 - 83,987 Retainage 14,003 17,156 31,159 - 31,159 Other 3,229 1,083 4,312 - 4,312 Taxes receivable 100 - 100 - 100 Inventory 7,108 71 7,179 - 7,179 Investment in subsidiary GLM - - - - - Deferred tax asset 1,733 - 1,733 - 1,733 Costs and estimated earnings in excess of billings on uncompleted contracts 45,152 1,769 46,921 - 46,921 Asset held for sale 375 - 375 - 375 Prepaid expenses and other 3,568 254 3,822 - 3,822 Total current assets 144,682 63,269 207,951 (7,628) (1) 200,323 Inventory - noncurrent 4,983 - 4,983 - 4,983 Property and equipment, net 158,642 9,361 168,003 8,977 (2) 176,980 Goodwill 33,798 14,690 48,488 21,041 (3) 69,529 Intangible assets, net of amortization 31 70 101 33,110 (4) 33,211 Other assets - 399 399 - 399 Total assets 342,136 87,789 429,925 55,500 485,425 Liabilities and Stockholders' Equity Current liabilities Current portion of long-term debt 29,123 5,070 34,193 (12,578) (5) 21,615 Accounts payable Trade 28,391 12,755 41,146 - 41,146 Retainage 1,484 - 1,484 - 1,484 Accrued liabilities 14,857 4,666 19,523 - 19,523 Taxes payable 266 - 266 - 266 Billings in excess of costs and estimated earnings on uncompleted contracts 11,552 9,643 21,195 - 21,195 Total current liabilities 85,673 32,134 117,807 (12,578) 105,229 Long-term debt, less current portion 3,348 12,702 16,050 110,335 (5) 126,385 Other long-term liabilities 565 696 1,261 - 1,261 Deferred income taxes 19,693 - 19,693 - 19,693 Deferred revenue - - - - - Total liabilities 109,279 45,532 154,811 97,757 252,568 Stockholders' equity: Common stock 279 - 279 - 279 Treasury stock (6,540) - (6,540) - (6,540) Additional paid in capital 167,776 42,257 210,033 (42,257) (6) 167,776 Retained earnings 71,342 - 71,342 - 71,342 Total stockholders' equity 232,857 42,257 275,114 (42,257) 232,857 Total liabilities and stockholders' equity 342,136$ 87,789$ 429,925$ 55,500$ 485,425$ ** See accompany notes to the Unaudited Pro Forma Combined Consolidated Financial Information (1) Reflects the decrease of cash as a result of the terms of the purchase agreement (2) Reflects the fair value adjustment to the acquired property and equipment. (3) Reflects the preliminary estimate of goodwill, which represents the excess of the purchase price over the fair value of the acquiree's assets acquired and liabilities assumed (4) Reflects the fair value adjustment for intangible assets (5) Reflects the term loan issued necessary to finance the acquisition less the debt extinguished under the previous credit facilities (6) Reflects the reduction of the acquiree's membership interests 10/22/2015Exhibit 99 4 TAS Pro Forma Combined Consolidated FS.xlsx

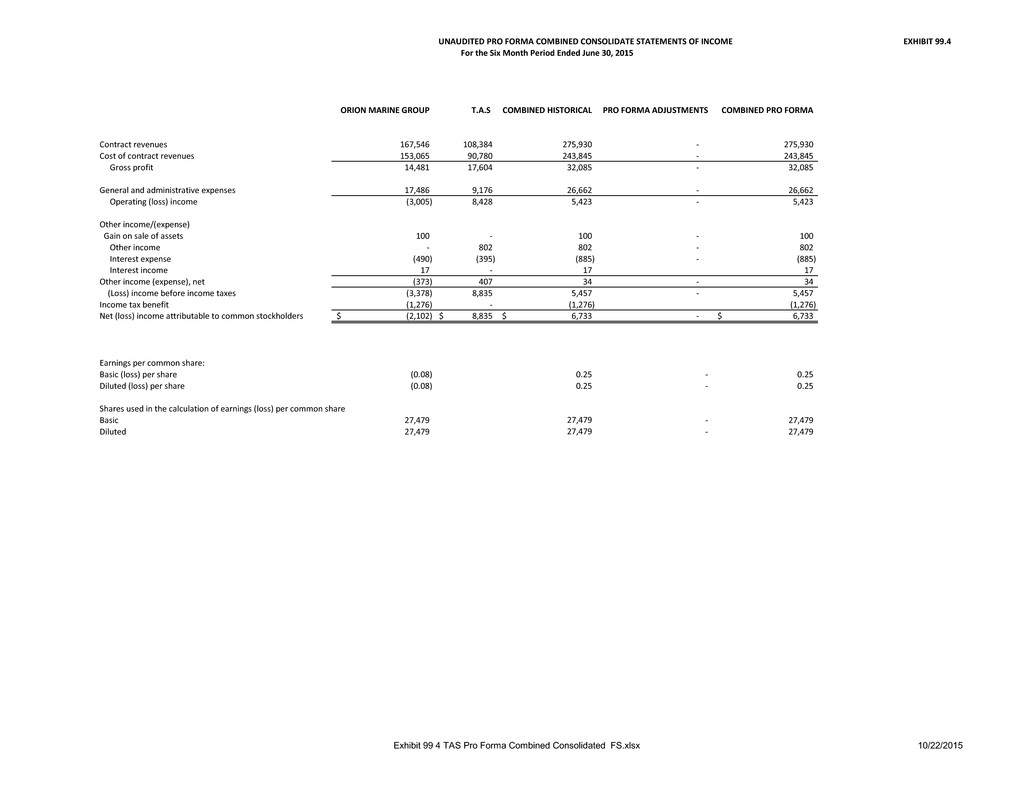

UNAUDITED PRO FORMA COMBINED CONSOLIDATE STATEMENTS OF INCOME EXHIBIT 99.4 For the Six Month Period Ended June 30, 2015 ORION MARINE GROUP T.A.S COMBINED HISTORICAL PRO FORMA ADJUSTMENTS COMBINED PRO FORMA Contract revenues 167,546 108,384 275,930 - 275,930 Cost of contract revenues 153,065 90,780 243,845 - 243,845 Gross profit 14,481 17,604 32,085 - 32,085 General and administrative expenses 17,486 9,176 26,662 - 26,662 Operating (loss) income (3,005) 8,428 5,423 - 5,423 Other income/(expense) Gain on sale of assets 100 - 100 - 100 Other income - 802 802 - 802 Interest expense (490) (395) (885) - (885) Interest income 17 - 17 17 Other income (expense), net (373) 407 34 - 34 (Loss) income before income taxes (3,378) 8,835 5,457 - 5,457 Income tax benefit (1,276) - (1,276) (1,276) Net (loss) income attributable to common stockholders (2,102)$ 8,835$ 6,733$ - 6,733$ Earnings per common share: Basic (loss) per share (0.08) 0.25 - 0.25 Diluted (loss) per share (0.08) 0.25 - 0.25 Shares used in the calculation of earnings (loss) per common share Basic 27,479 27,479 - 27,479 Diluted 27,479 27,479 - 27,479 10/22/2015Exhibit 99 4 TAS Pro Forma Combined Consolidated FS.xlsx

UNAUDITED PRO FORMA COMBINED CONSOLIDATED STATEMENTS OF INCOME EXHIBIT 99.4 For the Year Ended December 31, 2014 ORION MARINE GROUP T.A.S COMBINED HISTORICAL PRO FORMA ADJUSTMENTS COMBINED PRO FORMA Contract revenues 385,818 236,245 622,063 - 622,063 Cost of contract revenues 341,224 199,160 540,384 - 540,384 Gross profit 44,594 37,085 81,679 - 81,679 General and administrative expenses 34,691 16,185 50,876 - 50,876 Operating income 9,903 20,900 30,803 - 30,803 Other income/(expense) Gain on sale of assets 359 - 359 - 359 Other income 467 1,402 1,869 - 1,869 Interest expense (694) (1,121) (1,815) - (1,815) Interest income 17 - 17 17 Other income, net 149 281 430 - 430 Income before income taxes 10,052 21,181 31,233 - 31,233 Income tax expense 3,175 - 3,175 3,175 Net income attributable to common stockholders 6,877$ 21,181$ 28,058$ -$ 28,058$ Earnings per common share: Basic 0.25 1.02 - 1.02 Diluted 0.25 1.01 - 1.01 Shares used in the calculation of earnings per common share Basic 27,421 27,421 - 27,421 Diluted 27,788 27,788 - 27,788 See accompany notes to the Unaudited Pro Forma Combined Consolidated Financial Information 10/22/2015Exhibit 99 4 TAS Pro Forma Combined Consolidated FS.xlsx