Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Aevi Genomic Medicine, Inc. | v422536_ex99-1.htm |

| 8-K - 8-K - Aevi Genomic Medicine, Inc. | v422536_8k.htm |

Exhibit 99.2

Q3 2015 Results October 22, 2015

Forward Looking Statement This presentation includes certain estimates and other forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, including statements with respect to anticipated operating and financial performance, clinical results, potential partnerships, licensing opportunities and other statements of expectation . Words such as “ expects, ” “ anticipates, ” “ intends, ” “ plans, ” “ believes, ” “ assumes, ” “ seeks, ” “ estimates, ” “ should ” and variations of these words and similar expressions, are intended to identify these forward - looking statements . While we believe these statements are accurate, forward - looking statements are inherently uncertain and we cannot assure you that these expectations will occur and our actual results may be significantly different . These statements by the Company and its management are based on estimates, projections, beliefs and assumptions of management and are not guarantees of future performance . Important factors that could cause actual results to differ from those in the forward - looking statements include the factors described in the Company ’ s filings with the U . S . Securities and Exchange Commission . The Company disclaims any obligation to update or revise any forward - looking statement based on the occurrence of future events, the receipt of new information, or otherwise . 2

Agenda 3 • Q3 Operational Update • Q3 Financial Update • 2015 Milestones

Business Model Evolution: Gene Therapy to Genomic Medicine 4 Diverse Limited Medgenics capabilities Ex vivo Gene Therapy • TARGT EPO • TARGT GLP - 2 Time Genomic Medicine • C ommercial capabilities • Further pipeline diversification Genomic Drug Development • World - class biobank and analytics • G enetically defined pediatric biosamples MDGN growth and diversification enhanced by CAG collaboration TM

Q3 Operational Update 5 • Acquired neuroFix , providing access to a Phase 2 - ready program, NFC - 1 – First program to be announced from ongoing collaboration with Center for Applied Genomics (CAG ) at The Children’s Hospital of Philadelphia (CHOP) – Breakthrough discovery: mGluR mutations cause ~20% of ADHD – Data to be presented at AACAP meeting in San Antonio, TX (October 31, 2015) • Completed successful equity offering for $46M in gross proceeds – Provides cash runway through at least mid - 2017 – Funds proof - of - concept data for NFC - 1 in mGluR+ ADHD and 22Q Deletion Syndrome

NFC - 1 Summary • First program from the collaboration – Phase 2 ready program via neuroFix acquisition • P rogram in mGluR + ADHD is highly de - risked – Extensive safety database – Compelling Phase 1b efficacy signal in mGluR+ ADHD • Potential rapid path to approval in 22q11.2 DS – Potentially large orphan indication – Compelling genetic hypothesis and positive signal in one patient – Potential for rapid development path with single pivotal trial • Opportunity in additional mGluR+ CNS/psych diseases 6

NFC - 1 GREAT Study Summary • Strong efficacy signal detected in several validated ADHD scales • Improvement in multiple symptoms noted by caregivers – I nattention, hyperactivity, anxiety, mood disorders • Treatment effect more robust over time & higher doses • Genetic biomarker predictive of response to NFC - 1 (Tier 1 & 2) • Confirmation of PK profile – C omparable to previous PK study; BID dosing • W ell tolerated, no treatment related serious adverse events • 20 of the 30 patients chose to continue in a long - term safety trial – Study began August 2015 7

Next Steps: mGluR+ ADHD Phase 2/3 trial in Tier 1/2 mGluR + ADHD • Objective: Identify optimal dose and confirm enhanced response in mGluR network mutation positive patients – Primary endpoints: ADHD RS, CGI - I – Powered to serve as pivotal trial – Top - line data anticipated H216 • Additional study for approval: – Confirmatory Phase 3 trial in target population (ages 6 – 19) 8

Next Steps: 22q11.2 Deletion Syndrome • Phase 1/2 indication & dose finding study – File IND 4Q15 – Explore major neuropsychiatric disorders: ADHD, Anxiety, Mood – Initial data expected mid - 2016 – Transition to pivotal trial in one or more disorders – Rapid path to approval based on potential of Orphan Designation 9

Financial Update 10

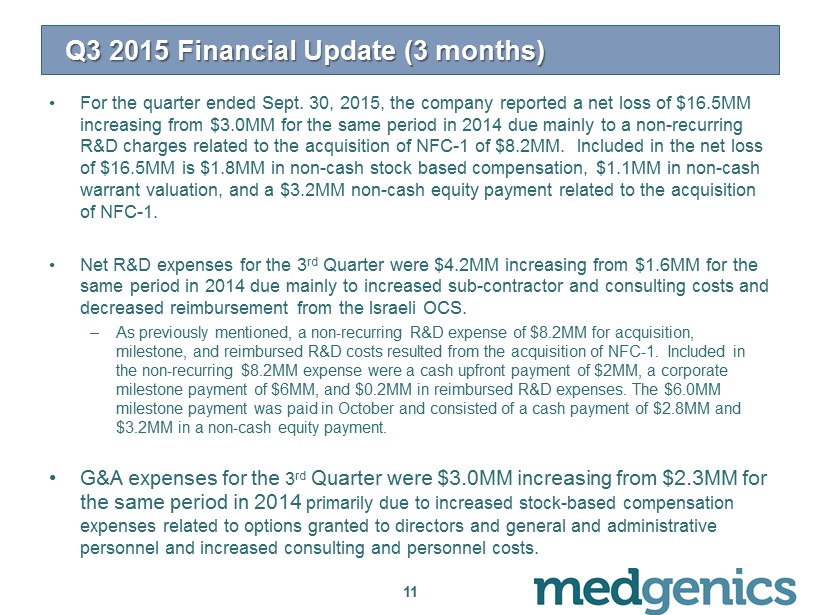

Q3 2015 Financial Update (3 months) • For the quarter ended Sept. 30, 2015, the company reported a net loss of $16.5MM increasing from $3.0MM for the same period in 2014 due mainly to a non - recurring R&D charges related to the acquisition of NFC - 1 of $8.2MM. Included in the net loss of $16.5MM is $1.8MM in non - cash stock based compensation, $1.1MM in non - cash warrant valuation, and a $3.2MM non - cash equity payment related to the acquisition of NFC - 1. • Net R&D expenses for the 3 rd Quarter were $4.2MM increasing from $1.6MM for the same period in 2014 due mainly to increased sub - contractor and consulting costs and decreased reimbursement from the Israeli OCS. – As previously mentioned, a non - recurring R&D expense of $8.2MM for acquisition, milestone, and reimbursed R&D costs resulted from the acquisition of NFC - 1. Included in the non - recurring $8.2MM expense were a cash upfront payment of $2MM, a corporate milestone payment of $ 6MM, and $0.2MM in reimbursed R&D expenses . The $ 6.0MM milestone payment was paid in October and consisted of a cash payment of $ 2.8MM and $ 3.2MM in a non - cash equity payment. • G&A expenses for the 3 rd Quarter were $3.0MM increasing from $2.3MM for the same period in 2014 primarily due to increased stock - based compensation expenses related to options granted to directors and general and administrative personnel and increased consulting and personnel costs. 11

Q3 2015 Financial Update (9 months) • For the first nine months of 2015, the company reported a net loss of $31.5MM increasing from $12.2MM for the same period in 2014 due mainly to a non - recurring R&D charges related to the acquisition of NFC - 1 of $8.2MM. Included in the net loss of $31.5MM is $7.6MM in non - cash stock based compensation,$1.4MM in non - cash warrant valuation, and a $3.2MM non - cash equity payment related to the acquisition of NFC - 1. • Net R&D expenses for the first nine months of 2015 were $11.1MM increasing from $4.5MM for the same period in 2014 due mainly to increased sub - contractor and consulting costs and increased stock based compensation expenses for options granted to R&D personnel. – As previously mentioned, a non - recurring R&D expense of $8.2MM for acquisition, milestone, and reimbursed R&D costs resulted from the acquisition of NFC - 1. Included in the non - recurring $8.2MM expense were a cash upfront payment of $2MM, a corporate milestone payment of $6MM, and $0.2MM in reimbursed R&D expenses . The $ 6.0MM milestone payment was paid in October and consisted of a cash payment of $ 2.8MM and $ 3.2MM in a non - cash equity payment. • G&A expenses for the first nine months of 2015 were $10.8MM increasing from $8.3MM for the same period in 2014 primarily due to increased stock - based compensation expenses related to options granted to directors and general and administrative personnel and increased consulting and personnel costs offset in part by a decrease in professional fees. 12

Q3 2015 Financial Update (Cash Balance) • Company’s cash balance as of Sept. 30, 2015 was $17.7MM • Subsequent to the end of the quarter the company completed a registered public offering of 7,078,250 shares at $6.50/share • Net proceeds from the transaction were $42.9MM • Current cash balance of >$60MM 13

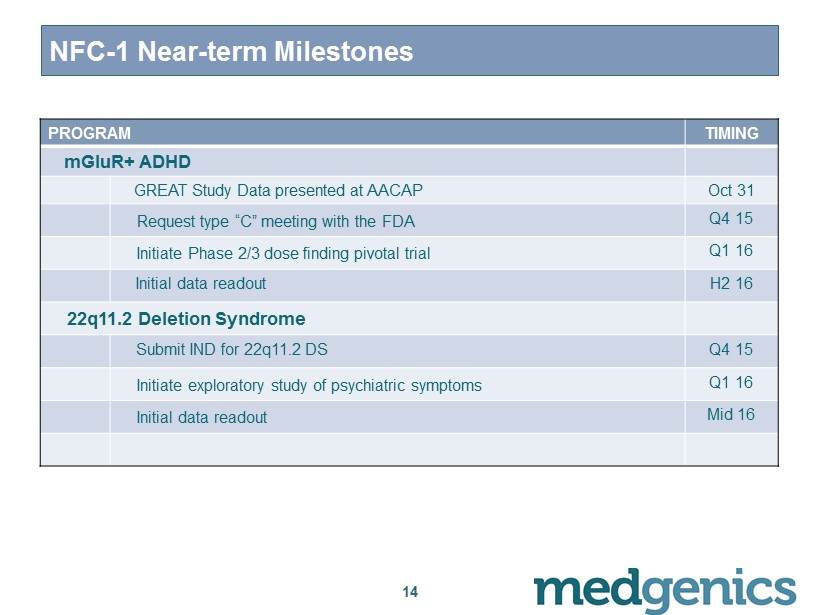

NFC - 1 Near - term Milestones 14 PROGRAM TIMING mGluR + ADHD GREAT Study Data presented at AACAP Oct 31 Request type “C” meeting with the FDA Q4 15 Initiate Phase 2/3 dose finding pivotal trial Q1 16 Initial data readout H2 16 22q11.2 Deletion Syndrome Submit IND for 22q11.2 DS Q4 15 Initiate exploratory study of psychiatric symptoms Q1 16 Initial data readout Mid 16

Summary • Transformative quarter for the Company – Acquisition of NFC - 1 program – Successful equity offering • Accelerates the Company’s transition to genomic m edicine approach to drug development • NFC - 1 acquisition is the first of multiple potential deals from Medgenics/CHOP collaboration 15