Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ashford Inc. | aincinvestorpresentation8-.htm |

Investor & Analyst Day – October 2015

2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, the degree and nature of our competition, and the satisfaction of the conditions to the completion of the proposed combination of Ashford Inc. with Remington Holdings L.P. These and other risk factors are more fully discussed in each company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc., Ashford Hospitality Prime, Inc., Ashford Inc., or any of their respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Safe Harbor

3 Management Team Attending Monty J. Bennett Chairman & Chief Executive Officer Ashford/Predecessor Experience: 26 yrs Douglas A. Kessler President Ashford/Predecessor Experience: 13 yrs Jeremy J. Welter EVP – Asset Management Ashford/Remington Experience: 10 yrs David A. Brooks Chief Operating Officer & General Counsel Ashford/Predecessor Experience: 23 yrs Deric S. Eubanks Chief Financial Officer Ashford Experience: 12 yrs J. Robison Hays III Chief Strategy Officer Ashford Experience: 10 yrs

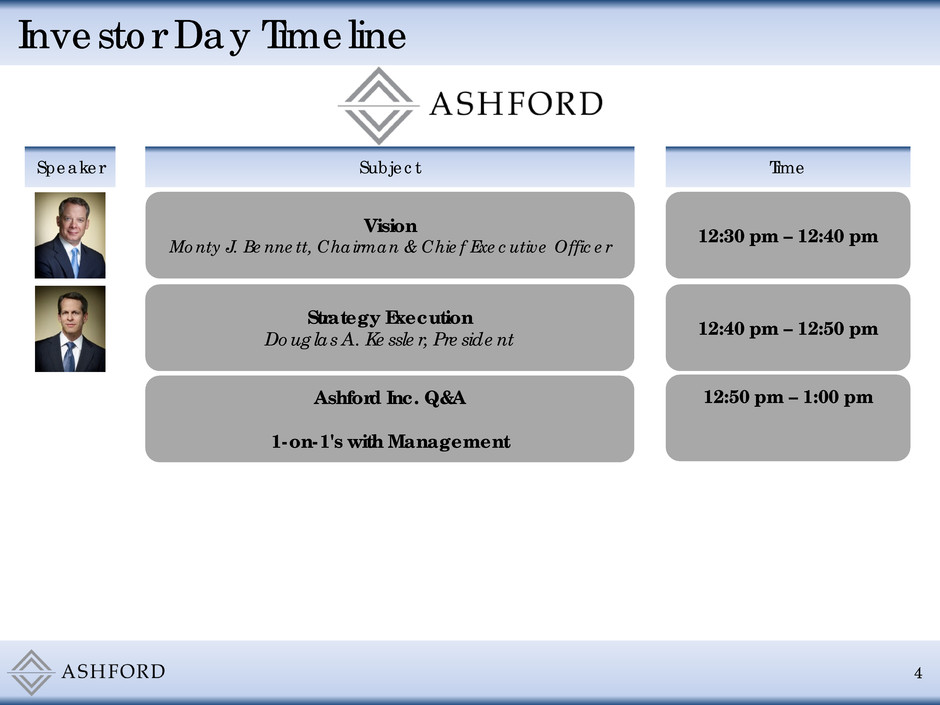

4 Investor Day Timeline Speaker Subject Time 12:30 pm – 12:40 pm 12:50 pm – 1:00 pm Ashford Inc. Q&A 1-on-1's with Management Vision Monty J. Bennett, Chairman & Chief Executive Officer Strategy Execution Douglas A. Kessler, President 12:40 pm – 12:50 pm

5 Ashford on Mobile & Social Media Follow Chairman and Chief Executive Officer, Monty J. Bennett, on Twitter at www.twitter.com/MBennettAshford or @MBennettAshford The Ashford App is now available for free download at Apple's App Store and Google Play Store by searching "Ashford”

Ashford, Inc. Vision – Monty Bennett, Chairman & CEO Marriott Plano Legacy Plano, TX

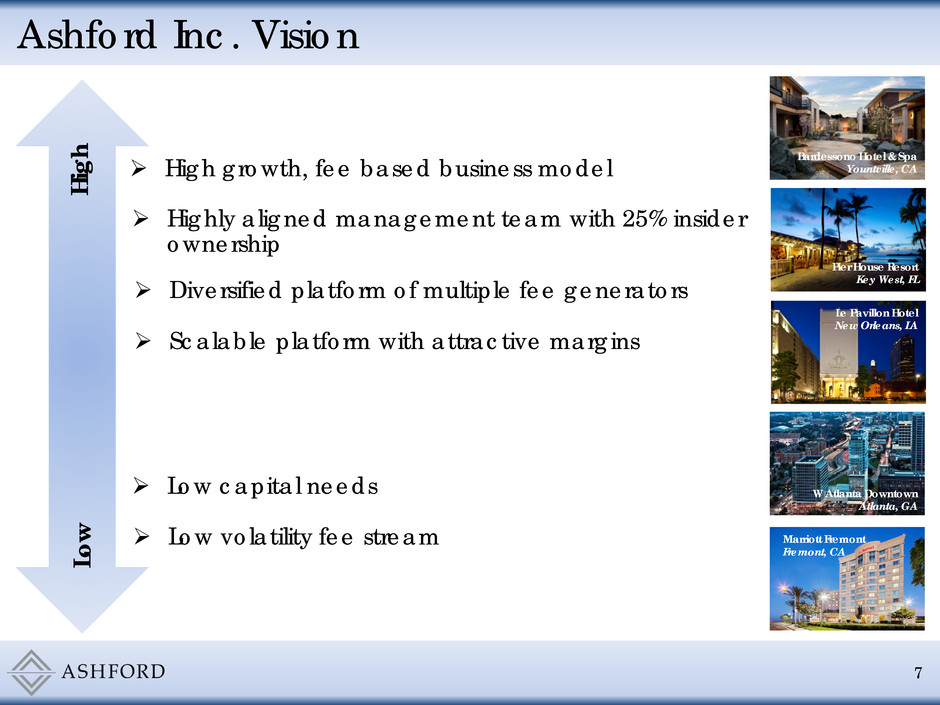

Ashford Inc. Vision 7 Bardessono Hotel & Spa Yountville, CA Pier House Resort Key West, FL Hig h Lo w High growth, fee based business model Highly aligned management team with 25% insider ownership Low capital needs Low volatility fee stream Scalable platform with attractive margins Diversified platform of multiple fee generators W Atlanta Downtown Atlanta, GA Marriott Fremont Fremont, CA Le Pavillon Hotel New Orleans, LA

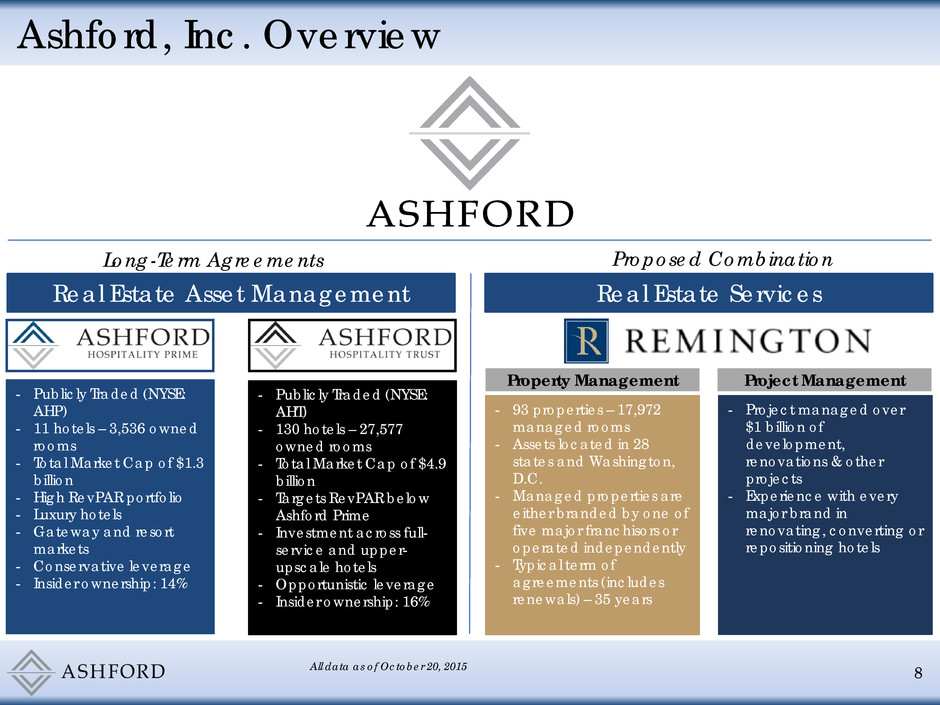

Ashford, Inc. Overview 8 - Publicly Traded (NYSE: AHP) - 11 hotels – 3,536 owned rooms - Total Market Cap of $1.3 billion - High RevPAR portfolio - Luxury hotels - Gateway and resort markets - Conservative leverage - Insider ownership: 14% - Publicly Traded (NYSE: AHT) - 130 hotels – 27,577 owned rooms - Total Market Cap of $4.9 billion - Targets RevPAR below Ashford Prime - Investment across full- service and upper- upscale hotels - Opportunistic leverage - Insider ownership: 16% - 93 properties – 17,972 managed rooms - Assets located in 28 states and Washington, D.C. - Managed properties are either branded by one of five major franchisors or operated independently - Typical term of agreements (includes renewals) – 35 years - Project managed over $1 billion of development, renovations & other projects - Experience with every major brand in renovating, converting or repositioning hotels Real Estate Asset Management Real Estate Services Property Management Project Management Proposed Combination Long-Term Agreements All data as of October 20, 2015

Base Fee/Minimum Fee Base Fee: 0.70% x Total Market Capitalization Minimum Fee: Greater of 90% of the Base Fee paid in the same quarter of the prior year OR the Peer G&A Ratio x Total Market Capitalization Payable quarterly Incentive Fee 5% of the TSR outperformance (compared to defined peer set) times Equity Market Capitalization – fee is subject to a 25% outperformance cap Incentive Fee Payment Fee is determined annually and paid over 3 years in equal annual installments - up to 50% can be paid in stock at AHT/AHP election Other Payments/Fees Reimbursement for internal audit and other overhead costs Long-Term Advisory Agreement 9

Douglas Kessler, President The Silversmith Chicago, IL

Remington Combination Overview AINC has entered into an agreement to combine with Remington(1) for total transaction value of $299.5 million 916,500 subsidiary nonvoting common shares issued at $100 per share (current market value of $59.5 million) $230 million in subsidiary convertible preferred stock • 6.625% yield • $120 conversion price (85% premium)(2) $10 million cash consideration(3) Remington sellers retain 20% of Remington through limited partner interests AINC to create new subsidiary (“NewCo”) & contribute all assets to NewCo Securities issued to sellers will be NewCo securities, but are intended to be economically equivalent to AINC securities NewCo stock will be issued to sellers at 54% premium to pre-announcement market price of AINC stock(2) Sellers only taking 3% of the consideration in cash signifying strong belief in future prospects for AINC & Remington 11 (1) Remington Holdings LP and its affiliates. A 20% interest in Remington Holdings will be retained by the current owners. (2) Based on closing stock price of AINC as of September 17, 2015. (3) Paid out quarterly over 4 years

Remington Combination Overview (cont.) Attractive valuation relative to the intrinsic value of the business and recent comparable transactions Expected to increase AINC’s normalized Adjusted EBITDA by approximately $32 million (approximately 250% increase) based on Remington 2016 EBITDA forecast, giving it significantly greater scale Expected to be immediately accretive to AINC's normalized Adjusted Net Income Per Share Subsidiary common shares issued at $100 per share, a 54% premium to current market price of AINC(1) Subsidiary as-converted shares issued at 85% premium to current market price of AINC(1) Very little cash consideration for large transformational combination signifying strong belief by the sellers in the future growth prospects for AINC and Remington 12 (1) Based on closing stock price of AINC as of September 17, 2015. Financial Benefits Strategic Benefits Adds incremental incentive fees which are tied to property performance, not strictly shareholder returns, as is currently the case for AINC Adds talented executives to help lead AINC’s growing platform Enhances strong alignment of sellers through issuance of non-voting common equity and convertible preferred equity Combination creates the only public, pure-play provider of asset and property management services to the lodging industry

Remington Combination Overview (cont.) 13 Ashford Inc.: $ in thousands Adjusted EBITDA (Normalized)(1) 13,042 Less: Assumed taxes at full tax rate of 35% (4,565) Adjusted Net Income (Normalized) 8,477 Common shares 2,273 Adjusted Net Income Per Share (Normalized) 3.73 Combined Companies: AINC Adjusted EBITDA (Normalized) 13,042 80% Share of Remington's 2016E EBITDA 32,000 Combined Pro Forma Adjusted EBITDA 45,042 Less: Assumed taxes at full tax rate of 35% (15,765) Combined Pro Forma Adjusted Net Income Before Minority Interest 29,277 Less: Minority Interest(2) (19,366) Combined Pro Forma Adjusted Net Income 9,912 Common shares 2,273 Combined Pro Forma Adjusted Net Income Per Share 4.36 Accretion - $ per share 0.63 Accretion - % 16.9% Combined Companies ("As-Converted"): Combined Pro Forma Adjusted Net Income 9,912 Plus: Minority Interest(2) 19,366 Combined Pro Forma Adjusted Net Income Before Minority Interest 29,277 Common shares(3) 5,106 Combined Pro Forma Adjusted Net Income Per Share 5.73 Accretion - $ per share 2.00 Accretion - % 53.7% Immediately accretive to AINC Normalized Adjusted Net Income Per Share: (1) 2Q 2015 YTD Annualized (2) Includes 30% interest in NewCo and 70% of convertible preferred dividend (3) Assumes all NewCo common stock and NewCo convertible preferred stock is converted into AINC common stock, which can occur only in limited circumstances as provided in the Investor Rights Agreement.

Balance Sheet 14 As of June 30, 2015 LIABILITIES AND EQUITY Accounts Payable, net & Accrued Expenses $10.2 Due to Affiliates 0.5 Liabilities Associated with Investments 26.7 Deferred Compensation Plan 0.1 Other Liabilities 7.4 Total Current Liabilities $44.9 Deferred Compensation Plan $18.4 Total Liabilities $63.2 Redeemable Noncrontrolling Interest $0.4 Equity $131.9 Total Liabilities and Equity $195.6 Figures in millions ASSETS Cash & Cash Equivalents $21.1 Restricted Cash 7.3 Investments in Securities 138.0 Accounts Receivable, net 0.3 Prepaid Expenses 1.9 Due from Ashford Trust OP 9.3 Due from Ashford Prime OP 2.4 Deferred Tax Assets 1.7 Total Current Assets $182.0 Investments in Unconsolidated Affiliates $4.4 Furniture, Fixtures and Equipment, net 4.4 Deferred Tax Assets 0.7 Other Assets 4.0 Total Assets $195.6 Asset light business model Cash available for investments Currently no debt

Growth Opportunities Organic growth of current Ashford Trust platform Maximize shareholder value and outperform peers 15 Organic growth of current Ashford Prime platform Maximize shareholder value and outperform peers Incremental incentive fees tied to property performance Increased cash flow and earnings of AINC Expands AINCs high growth, fee based business Maintains high alignment of management team

Key Takeaways High growth, fee based business model 16 Asset light with very low capital requirements Diversified fee generators Strong management team with a long track record of creating shareholder value Highly-aligned platform through high insider ownership

Ashford, Inc. Q&A The Ritz-Carlton Atlanta Atlanta, GA

18 In connection with the Remington transaction, Ashford Inc. will file a proxy statement with the Securities and Exchange Commission (the “SEC”). SHAREHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT WHEN IT IS AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain a free copy of the proxy statement when available and other relevant documents filed with the SEC from the SEC’s website at www.sec.gov, or by directing a request by mail to Ashford Inc., 14185 Dallas Parkway, Suite 1100, Dallas, TX, 75254 or from Ashford Inc.’s website at www.ashfordinc.com. Ashford Inc. and certain of its directors and officers may, under the rules of the SEC, be deemed to be “participants” in the solicitation of proxies from its shareholders that will occur in connection with the Remington transaction. Information concerning the interests of the persons who may be considered “participants” in the solicitation is set forth in Ashford Inc.’s proxy statements and its Annual Report on Form 10-K previously filed with the SEC, and will be set forth in the proxy statement relating to the Remington transaction when the proxy statement becomes available. Copies of these documents can be obtained, without charge, at the SEC’s website at www.sec.gov, by directing a request to Ashford Inc. at the address above, or at www.ashfordinc.com. Additional Information and Where to Find it

Investor & Analyst Day – October 2015