Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MICROSEMI CORP | t1502393_ex99-1.htm |

| 8-K - FORM 8-K - MICROSEMI CORP | t1502393_8k.htm |

Exhibit 99.2

Acquisition of PMC October 19, 2015

Disclaimer Cautionary Note Concerning Forward-Looking Statements Statements in this presentation regarding Microsemi’s offer to acquire PMC-Sierra Inc. (“PMC”), the financing and expected timing of the proposed transaction, the potential benefits of the acquisition (including potentially accretive and synergistic benefits), Microsemi’s expected future performance (including expected results of operations and financial guidance), the combined company’s future financial condition, operating results, strategy and plans, and all other statements in this presentation other than the recitation of historical facts are forward-looking statements. These statements are based on current expectations or beliefs, as well as a number of assumptions about future events, and are subject to factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Potential risks and uncertainties include, but are not limited to, such factors as the ultimate outcome of any possible transaction between Microsemi and PMC, including the possibilities that Microsemi will not pursue a transaction with PMC or that PMC will reject a transaction with Microsemi; if a transaction between Microsemi and PMC were to occur, the ultimate outcome and results of integrating the operations of Microsemi and PMC, the ultimate outcome of Microsemi’s operating strategy applied to PMC and the ultimate ability to realize synergies; the effects of the business combination of Microsemi and PMC, including the combined company’s future financial condition, operating results, strategy and plans; negative or worsening worldwide economic conditions or market instability; downturns in the highly cyclical semiconductor industry; and difficulties in closing or disposing of operations or assets or transferring work, assets or inventory from one plant to another. In addition to these factors and any other factors mentioned elsewhere in this news release, the reader should refer as well to the factors, uncertainties or risks identified in Microsemi's most recent Form 10-K and any subsequent Form 10-Q reports filed by Microsemi with the SEC. Additional risk factors may be identified from time to time in Microsemi's future filings. The forward-looking statements included in this presentation speak only as of the date hereof, and Microsemi does not undertake any obligation to update these forward-looking statements to reflect subsequent events or circumstances.

MSCC + PMCS = A World Class Platform Pro Forma LTM (with synergies) (1) Revenue $1,220 $530 $1,750 Gross Margin 57% 70% ~60% Operating Margin 25% 17% ~30% EBITDA $335 $110 $602 1 Expands Microsemi’s portfolio of high-performance mixed-signal solutions 2 Complements optical and switching portfolios, and accelerates existing data center growth effort 3 Immediate opportunity to increase content with improved solution sell and go-to-market strategy 4 Increases Microsemi’s scale, EBITDA (>$600 million) and EPS (accretion greater than $0.60) ($MM) Note: Historical financials based on Company filings. LTM figures as of 6/30/15. Gross/operating margin and EBITDA based non-GAAP measures. Note: EBITDA calculated as non-GAAP operating income plus depreciation. (1) EBITDA pro forma for Vitesse synergies, PMC standalone July 2015 restructuring and $100 million of transaction-related synergies.

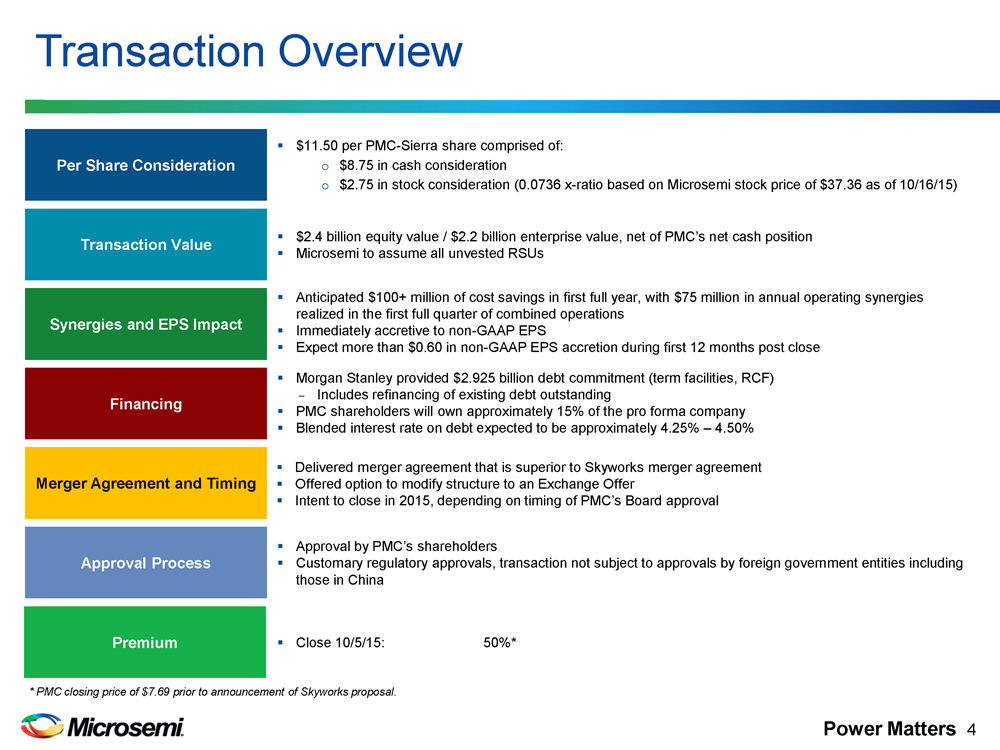

Transaction Overview $11.50 per PMC-Sierra share comprised of: Per Share Consideration o $8.75 in cash consideration o $2.75 in stock consideration (0.0736 x-ratio based on Microsemi stock price of $37.36 as of 10/16/15) $2.4 billion equity value / $2.2 billion enterprise value, net of PMC’s net cash position Transaction Value Microsemi to assume all unvested RSUs Anticipated $100+ million of cost savings in first full year, with $75 million in annual operating synergies realized in the first full quarter of combined operations Synergies and EPS Impact Immediately accretive to non-GAAP EPS Expect more than $0.60 in non-GAAP EPS accretion during first 12 months post close Morgan Stanley provided $2.925 billion debt commitment (term facilities, RCF) Includes refinancing of existing debt outstanding Financing PMC shareholders will own approximately 15% of the pro forma company Blended interest rate on debt expected to be approximately 4.25% 4.50% Delivered merger agreement that is superior to Skyworks merger agreement Merger Agreement and Timing Offered option to modify structure to an Exchange Offer Intent to close in 2015, depending on timing of PMC’s Board approval Approval by PMC’s shareholders Approval Process Customary regulatory approvals, transaction not subject to approvals by foreign government entities including those in China Premium Close 10/5/15:50%* * PMC closing price of $7.69 prior to announcement of Skyworks proposal.

Superior Proposal for PMC Shareholders Meaningful premium to currently proposed offer Cash consideration provides significant liquidity with incremental upside from Microsemi stock Microsemi proposal has no conditions, with ability to close as early as late December 2015, and not subject to approvals by foreign government entities including China Extensive understanding of PMC’s products and end markets Morgan Stanley agreement to provide committed financing Term and conditions superior to Skyworks merger agreement, modified for stock component

PMC Snapshot Quick Facts What PMC Does PMC Revenue by Market (LTM) Founded: 1984 PMC provides innovative semiconductor and software solutions that connect, move and store Big Data IPO Date: 1991 Storage Status: Public NASDAQ: PMCS LTM Revenue: $380mm CY14 SAM: $1.3B Storage CY17 SAM: $1.9B (13% CAGR) Headquarters: Sunnyvale, CA 72% Optical Other Locations: Canada, Italy, Israel, LTM Revenue: $94mm CY14 SAM: $410mm China, India, Malaysia CY17 SAM: $565mm (11% CAGR) 10% 18% Employees: ~1,200 Optical Wireless Infrastructure Wireless LTM Revenue: $56mm Infrastructure CY14 SAM: $550mm IP: 688 granted U.S. patents and CY17 SAM: $560mm (1% CAGR) 128 pending U.S. patents PMC’s Customers are the Largest in the Storage and Comms Markets: Storage Customers Communications Customers Note: LTM financial figures as of 6/27/15. *10% customer in 1H 2015.

Strategic and Financially Compelling Transaction Strategically Compelling Accelerates data center penetration and adds exposure to cloud storage and hyperscale computing Transformative to communications business; solidifies position in networking, routing and switching and newly acquired Ethernet and storage assets Differentiated technology portfolio with significant barriers to entry and defensible margin structure Significant Value Creation Immediately and significantly accretive to non-GAAP EPS (greater than $0.60) Augments industry leading profitability profile Anticipated $100+ million in total cost synergies in first full year, with $75 million in annual operating savings realized in the first full quarter of combined operations

Complementary Business Platforms RF, Controllers & OTN Mobile Power Timing Microwave & FPGA Switches Processors Processors MM Wave Optimized Systems Aerospace & Defense Industrial Communications Storage

Acquisition Diversifies End Market Exposure LTM Revenue: $1,220mm LTM Revenue: $1,750mm Defense & Security Industrial 15% Aerospace 15% Comms 36% Comms 34% Industrial 22% Storage 22% Industrial 15% Aerospace & Defense & 29% Defense Security 27% Note: LTM as of 6/30/15. Note: Pro forma Comms includes PMC Optical and Mobile Infrastructure revenues.

Top 10 Analog / Mixed-Signal Company CY 2015E Revenue $15.5 $12.8 $10.8 $7.0 $3.6 $3.4 $2.7 $2.3 $2.3 $1.8 $1.7 $1.4 $1.3 $1.2 $0.9 $0.7 $0.7 $0.6 $0.5 $0.5 $0.5 $0.4 $0.4 $0.3 $0.3 $0.3 $0.2 $0.2 $0.1 CY 2015E EBITDA Margin 49% 40% 40% 40% 39% 38% 34% 32% 31% 30% 28% 28% 27% 27% 26% 25% 24% 23% 23% 23% 22% 22% 20% 19% 19% 17% 16% 15% ($ in billions) Source: Company filings, Company press releases, Capital IQ and FactSet estimates as of 10/16/15. * Avago financials pro forma for acquisition of Broadcom and include $750M announced synergies; NXP financials pro forma for acquisition of Freescale and include $200M announced synergies; Dialog financials pro forma for acquisition of Atmel and include $150M announced synergies; Microchip financials pro forma for acquisition of Micrel; M/A-COM financials pro forma for divestiture of automotive business. MaxLinear financials pro forma for acquisition of Entropic. Note: PMC and Intersil projected EBITDA calculated as non-GAAP operating income plus depreciation. Combined EBITDA includes synergies from both PMC and Vitesse.

Successful M&A Track Record $453 $518 $836 $1,013 $976 $1,138 $1,245 $1,351 $95 $130 $241 $263 $249 $285 $341 $410 $0 $300 $600 $900 $1,200 $1,500 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 Revenue Adjusted EBITDA Microsemi Acquisitions (1) Communications, Timing & Synchronization Defense Systems Business Power Products Business (1) Based on FactSet estimates as of 10/16/15.

Scale-Derived Synergy Opportunities Sales & Marketing Research & Development (+) Consolidated global efforts and solution sell capability (+) Realigned resources and elimination of redundant spend (+) Enhanced visibility into customer needs (+) Expanded and complementary IP portfolio delivery (+) Increased relevance to distribution partners of innovative solutions with minimal incremental costs (+) Enhanced technological know-how $100M+ of Synergies ($75M in First Full Combined Quarter) General & Administrative Supply Chain (+) Eliminate duplicative G&A costs, including public (+) Optimized procurement costs due to higher volumes company expenses (+) Reduced assembly / test costs (+) Consolidation of overlapping facilities (+) Consolidated wafer / backend processes (+) Sophisticated and streamlined business processes

Transaction Financing $2,575 million term loan facilities Credit Facility $350 million revolving credit facility Weighted-average interest rate of approximately 4.25% 4.50% Expected at closing ($100M+ 12 Month 18 Month ($B) Synergies) Target Target Pro Forma Capitalization Gross Debt $2.7 4.5x 3.5x 3.0x Statistics Cash $0.2 0.3x Net Debt $2.5 4.2x

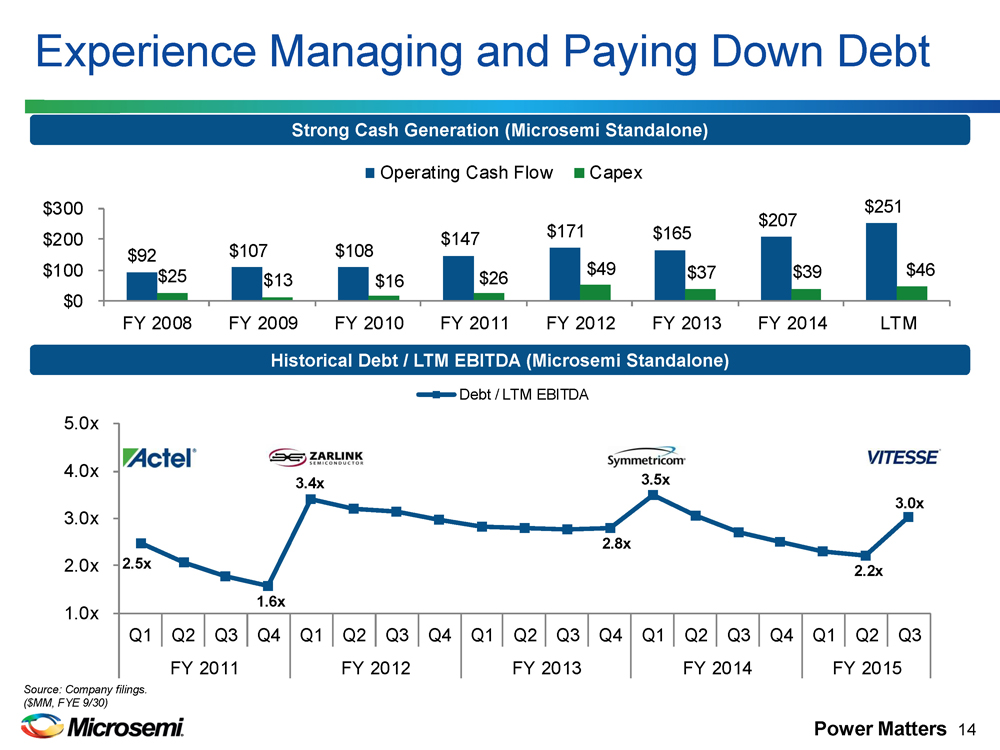

Experience Managing and Paying Down Debt Strong Cash Generation (Microsemi Standalone) 2014LTMOperating Cash FlowCapex $300 $200 $100 $0 $92 $107 $108 $147 $171 $165 $207 $251 $25 $13 $16 $26 $49 $37 $39 $46 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 LTM Historical Debt / LTM EBITDA (Microsemi Standalone) Debt / LTM EBITDA 5.0x 4.0x 3.0x 2.0x 1.0x Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Source: Company filings. ($MM, FYE 9/30)

Transaction Summary Creates industry leading profitability model (60%+ GM and 30%+ OM) Provides strong combined cash flow generation ($600M+ of pro forma EBITDA) Adds significant EPS accretion (>$0.60 in first year) Adds strong technology, product and IP portfolio (PMC maintains storage and comms leadership) Expands SAM in high growth markets (PMC adds $3B of incremental SAM by 2017) Accelerates existing data center growth effort (Complements growing optical and switching portfolios)

Additional Legal Disclaimers Additional Information and Where to Find It This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal which Microsemi Corporation (“Microsemi”) has made for a business combination transaction with PMC-Sierra Inc. (“PMC”). In furtherance of this proposal and subject to future developments, Microsemi (and, if a negotiated transaction is agreed to, PMC) may file one or more registration statements, prospectuses, proxy statements or other documents with the U.S. Securities and Exchange Commission (“SEC”). This communication is not a substitute for any registration statement, prospectus, proxy statement or other document Microsemi and/or PMC may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF MICROSEMI AND PMC ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS, PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement (if and when available) will be mailed to stockholders of PMC. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Microsemi through the web site maintained by the SEC at http://www.sec.gov. Certain Information Regarding Participants Microsemi and certain of its directors and executive officers may be deemed to be participants in any solicitation with respect to the proposed transaction under the rules of the SEC. Security holders may obtain information regarding the names and interests of Microsemi’s directors and executive officers Microsemi’s Annual Report on Form 10-K for the year ended September 28, 2014, which was filed with the SEC on November 13, 2014, and Microsemi’s proxy statement for the 2015 Annual Meeting of Shareholders, which was filed with the SEC on December 19, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC if and when they become available.