Attached files

| file | filename |

|---|---|

| 10-K - 10-K - MVC CAPITAL, INC. | a15-20774_110k.htm |

| EX-31 - EX-31 - MVC CAPITAL, INC. | a15-20774_1ex31.htm |

| EX-32 - EX-32 - MVC CAPITAL, INC. | a15-20774_1ex32.htm |

| EX-10.7 - EX-10.7 - MVC CAPITAL, INC. | a15-20774_1ex10d7.htm |

| EX-21.1 - EX-21.1 - MVC CAPITAL, INC. | a15-20774_1ex21d1.htm |

| EX-10.10 - EX-10.10 - MVC CAPITAL, INC. | a15-20774_1ex10d10.htm |

| EX-10.27 - EX-10.27 - MVC CAPITAL, INC. | a15-20774_1ex10d27.htm |

| EX-10.26 - EX-10.26 - MVC CAPITAL, INC. | a15-20774_1ex10d26.htm |

| EX-10.28 - EX-10.28 - MVC CAPITAL, INC. | a15-20774_1ex10d28.htm |

| EX-10.30 - EX-10.30 - MVC CAPITAL, INC. | a15-20774_1ex10d30.htm |

| EX-10.18 - EX-10.18 - MVC CAPITAL, INC. | a15-20774_1ex10d18.htm |

| EX-10.29 - EX-10.29 - MVC CAPITAL, INC. | a15-20774_1ex10d29.htm |

| EX-10.15 - EX-10.15 - MVC CAPITAL, INC. | a15-20774_1ex10d15.htm |

Exhibit 21.2

MVC AUTOMOTIVE COMBINED GROUP

COMBINED BALANCE SHEET (US GAAP)

December 31, 2013

(in thousands of Euro)

Index

|

Independent Auditors’ Report |

|

|

|

|

|

Combined Balance Sheet as of December 31, 2013 |

I |

|

|

|

|

Notes to the Combined Balance Sheet |

II |

|

|

|

|

| |

|

| |

|

PwC Wirtschaftsprüfung GmbH | |

|

Erdbergstraβe 200 | |

|

1030 Vienna | |

|

Austria | |

|

Tel.: +43 1 501 88 - 0 | |

|

Fax: +43 1 501 88 - 601 | |

|

E-mail: office.wien@at.pwc.com | |

|

www.pwc.at |

To the management of

MVC Automotive Group GmbH

September 29, 2015

Independent Auditors’ Report

We have audited the accompanying combined balance sheet of MVC Automotive Austria GmbH, Vienna, MVC Motors GmbH, Vienna, MVC Immobilien GmbH, Vienna, Auto Motol Beni a.s., Prague, Czech Republic, BE & NI Group a.s., Prague, Czech Republic, Somotra N.V., Brussels, Belgium and Bromalease NV, Brussels, Belgium (collectively, here after the Company) as of December 31, 2013, expressed in EUR’ooo’, and the related notes.

Management’s Responsibility for the Combined balance sheet

Management is responsible for the preparation and fair presentation of the combined balance sheet in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of a combined balance sheet that is free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on the combined balance sheet based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the combined balance sheet is free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the combined balance sheet. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the combined balance sheet, whether due to fraud or error. In making those risks assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the combined balance sheet in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the combined balance sheet. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Managing Directors: WP/StB Mag. Friedrich Baumgartner, WP/StB Mag. Horst Bernegger, WP/StB Mag. Dr. Christine Catasta, StB Mag. Andrea Cerne-Stark, WP/StB Mag. Gerhard Helmreich, WP/StB Mag. Liane Hirner, WP/StB Mag. Karl Hofbauer, WP/StB Mag. Werner Krumm, WP/StB Mag. Dr. Aslan Milla, WP/StB Mag. Christian Neuherz, WP/StB Mag. Peter Pessenlehner, WP/StB Mag. Gerhard Prachner, WP/StB Dipl. Kfm. Univ. Dorotea-E. Rebmann, WP/StB Mag. Alexandra Rester, WP/StB Mag. Jürgen Schauer, WP/StB Mag. Johannes Schmidtbauer, WP/StB Mag. Helga M. Stangl, WP/StB Mag. Ute Unden-Schubert, WP/StB Mag. Kristina Weis, WP/StB Mag. Günter Wiltschek, WP/StB Mag. Felix Wirth Domicile: Vienna; Company Register: FN 88248 b, Commercial Court of Vienna; DVR: 0656071; VAT number: ATU 16124600; WT: 800834

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

Opinion

In our opinion, the accompanying combined balance sheet presents fairly, in all material respects, the financial position of MVC Automotive Austria GmbH, Vienna, MVC Motors GmbH, Vienna, MVC Immobilien GmbH, Vienna, Auto Motol Beni a.s., Prague, Czech Republic, BE & NI Group a.s., Prague, Czech Republic, Somotra N.V., Brussels, Belgium and Bromalease NV, Brussels, Belgium. as of December 31, 2013, in accordance with the accounting principles generally accepted in the United States of America.

Emphasis of a matter

We draw attention to Note 2 to the combined balance sheet, where it is indicated that management has prepared the combined balance sheet of one of the Company’s subsidiaries as of December 31, 2013 under the assumption of going concern. Such assumption is only justified as long as the subsidiary continues receiving the financial support from its shareholders to support its subsidiary or has access other financial means. The combined balance sheet as of December 31, 2013 has not been subject to adjustments that might become necessary should the Company no longer be able to continue as a going concern. Our audit opinion is not modified with respect to this matter.

|

/s/ Alexandra Rester |

|

|

Alexandra Rester |

|

|

|

|

|

PwC Wirtschaftsprüfung GmbH |

|

|

COMBINED FINANCIAL STATEMENT |

MVC AUTOMOTIVE GROUP |

December 31, 2013 |

I. COMBINED BALANCE SHEET

|

|

|

December 31, 2013 |

| |

|

|

|

in EUR thsd. |

| |

|

Assets |

|

|

| |

|

Cash and cash equivalents |

|

€ |

987 |

|

|

Trade accounts receivable, net |

|

€ |

9,111 |

|

|

Inventories |

|

€ |

32,197 |

|

|

Amounts due from related parties short-term |

|

€ |

5,057 |

|

|

Prepaid expenses and other assets |

|

€ |

5,488 |

|

|

Total current assets |

|

€ |

52,840 |

|

|

|

|

|

| |

|

Other intangible assets, net |

|

€ |

55 |

|

|

Property, plant and equipment, net |

|

€ |

28,518 |

|

|

Deferred tax assets |

|

€ |

655 |

|

|

Total non-current assets |

|

€ |

29,228 |

|

|

Total assets |

|

€ |

82,068 |

|

|

|

|

|

| |

|

Liabilities and shareholders’ equity |

|

|

| |

|

|

|

|

| |

|

Bank loans short-term |

|

€ |

9,471 |

|

|

Current portion of long-term financial liabilities |

|

€ |

941 |

|

|

Trade accounts payable |

|

€ |

4,364 |

|

|

Customer advances/prepayments |

|

€ |

2,112 |

|

|

Financial payables for acquisition of cars |

|

€ |

27,077 |

|

|

Amounts due to related parties short-term (trade) |

|

€ |

1,724 |

|

|

Financial liabilities due to related parties short-term |

|

€ |

727 |

|

|

Finance lease liabilities short-term |

|

€ |

313 |

|

|

Short-term personnel provisions |

|

€ |

106 |

|

|

Accrued expenses and other short term liabilities |

|

€ |

5,544 |

|

|

Income taxes payable |

|

€ |

24 |

|

|

Total current liabilities |

|

€ |

52,402 |

|

|

|

|

|

| |

|

Long-term personnel provisions |

|

€ |

2,628 |

|

|

Financial liabilities due to related parties |

|

€ |

380 |

|

|

Bank loans long-term |

|

€ |

13,018 |

|

|

Finance lease liabilities long- term |

|

€ |

2,425 |

|

|

Financial payables for acquisition of cars long-term |

|

€ |

418 |

|

|

Total non-current liabilities |

|

€ |

18,869 |

|

|

|

|

|

| |

|

Shareholders’ equity |

|

|

| |

|

Owner’s net investment |

|

€ |

11,214 |

|

|

Accumulated other comprehensive profit / (loss) |

|

€ |

(416 |

) |

|

Total shareholders’ equity |

|

€ |

10,798 |

|

|

Total liabilities and shareholders’ equity |

|

€ |

82,068 |

|

II. NOTES TO THE COMBINED BALANCE SHEET

NOTE 1 BACKGROUND AND COMPANIES INCLUDED

This Combined Balance Sheet (together “MVC Automotive Combined Group”) includes the accounts of

· MVC Automotive Austria GmbH Subgroup and its investments in

· MVC Immobilien GmbH (Vienna)

· MVC Motors GmbH (Vienna)

· Somotra N.V (Brussels),

· Bromalease N.V (Brussels),

· Auto Motol Beni A.S. (Prague), and

· BE & NI Group A.S. (Prague)

MVC Automotive Group GmbH is 100% owned by MVC Capital Inc.

Due to insolvency proceedings in regard to the Belgium subsidiary Cegeac S.A. (Note 12) MVC Automotive Combined Group’s ability to access accounting records are limited. It was not possible to obtain sufficient and reliable evidence about the amounts and disclosures in the annual accounts of Cegeac S.A. for the business year 2013.

Therefore a combined balance sheet including all subsidiaries of MVC Automotive Group GmbH, Austria, except Cegeac S.A. and the parent company MVC Automotive Group GmbH itself has been prepared.

MVC Automotive Group B.V. was established in September 2007, and thereupon acquired nine Ford dealerships in the capitals of Belgium, Netherlands and Austria. In 2008 also two dealerships in Prague were restructured under MVC Automotive Group B.V. MVC Automotive Group is wholly owned by MVC Capital Inc., USA. Today MVC Automotive Group represents 7 brands: Ford, Mazda, Volvo, Land Rover, Jaguar, Fiat and Alfa Romeo.

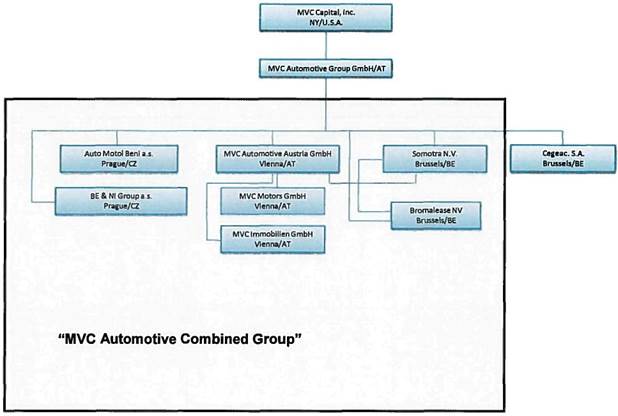

In 2013 the former Dutch holding company, MVC Automotive Group B.V. was merged into the newly established Austrian holding company, MVC Automotive Group GmbH. After the cross-border merger the MVC Automotive Group has the following current structure:

MVC Automotive Group

NOTE 2 BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying combined balance sheet has been prepared in accordance with accounting principles generally accepted in the United States of America (US-GAAP). MVC Automotive Combined Group has elected to use the EURO as its reporting currency. Management believes the assumptions underlying the combined balance sheet are reasonable. However, the combined balance sheet may not necessarily reflect MVC Automotive Combined Group’s combined financial position in the future or what its financial position would have been, had each of the entities included in MVC Automotive Combined Group been a stand-alone entity during the periods presented.

Intercompany transactions and balances between the companies included in the combined balance sheet have been eliminated.

As these combined balance sheet represents the combination of separate legal entities which are all wholly owned by MVC Capital Inc. (through an Austrian Holding Company “MVC Automotive Group GmbH, Vienna”), the net assets of all subsidiaries have been presented as MVC Capital Inc.’s net investment. The MVC Capital Inc.’s net investment in its subsidiaries is primarily composed of: (i) the initial investment to establish the net assets (and any subsequent adjustments thereto); (ii) the accumulated earnings; (iii) net transfers to or from the MVC Capital Inc.

The assets and liabilities of the companies are stated at historical costs and are included in the combined balance sheet of MVC Automotive Combined Group from the beginning of the earliest period presented as if they had always been part of the Combined Group.

GOING CONCERN

The combined balance sheet is prepared under the assumption that the Combined Group continues in operation for the foreseeable future. The going concern assumption is based on the measures described in Note 17 and a letter dated April 10, 2015 of financial support provided by MVC Capital Inc. New York, USA to the Board of Directors of Somotra N.V.

By this letter, MVC Capital Inc. has confirmed that:

· It will infuse up to EUR 2 million in equity or debt Capital in Somotra N.V. if additional cash is required by Somotra N.V., Drogenbos, Belgium to pay its debts as they mature and for general purpose.

· It will cause MVC Automotive Group GmbH, a wholly owned and controlled affiliate of MVC Capital Inc., to forgive or convert into equity to Somotra N.V., Drogenbos, Belgium up to EUR 1.5 million of intercompany loans.

The financial support letter is valid until the date of the shareholder’s meeting of Somotra N.V., Drogenbos, Belgium held to approve the statutory accounts as of December 31, 2015 of Somotra N.V.

BASIS OF COMBINATION

The combined balance sheet includes the consolidated accounts of MVC Automotive Austria GmbH Subgroup (Vienna), Somotra N.V. (Brussels), Bromalease N.V. (Brussels), Auto Motol Beni A.S. (Prague), and BE & NI Group A.S. (Prague).

The financial statements of MVC Automotive Austria GmbH Subgroup (Vienna) include the accounts of MVC Automotive Austria GmbH, Vienna, and its subsidiaries. Intercompany transactions and balances have been eliminated.

Subsidiaries are all entities over which MVC Automotive Group GmbH has the power to govern the financial and operating policies. Subsidiaries are included in the combined balance sheet from the date on which control is transferred to MVC Automotive Group GmbH and are taken out from the date on which MVC Automotive Group GmbH’s control ceases.

BUSINESS COMBINATIONS

ASC Topic 805 (“Business Combinations”) requires that companies record acquisitions under the purchase method of accounting. Accordingly, the purchase price is allocated to the tangible assets and liabilities and intangible assets acquired, based on their estimated fair values. The excess purchase price over the fair value is recorded as goodwill. Purchased intangibles with definite lives are amortized over their respective useful lives. When a bargain purchase incurs, which is the case when the fair value of the acquired business exceeds the purchase price, this surplus in fair value is recognized as a gain from bargain purchase.

On February 19, 2013 MVC Automotive Combined Group acquired the entire business of a car dealer close to Vienna in Brunn am Gebirge for a cash consideration of EUR 263 thsd and consolidated the entity under the acquisition method of accounting. The new location was consolidated into our results of operations starting on the acquisition date. The management of the acquired car dealer was fully integrated into the business activities of MVC Automotive Combined Group by this date.

The following table summarizes the total purchase consideration and the identified assets and liabilities that were separately recognized in the finalized purchase price allocation.

|

|

|

Carrying Value of |

|

|

|

|

|

|

|

|

Net Assets |

|

Purchase Price |

|

|

|

|

|

|

acquired * |

|

Allocation |

|

Fair Value |

|

|

Inventories |

|

82 |

|

370 |

|

370 |

|

|

Trade and other receivables |

|

54 |

|

54 |

|

54 |

|

|

CURRENT ASSETS |

|

136 |

|

424 |

|

424 |

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment |

|

15 |

|

15 |

|

15 |

|

|

NON-CURRENT ASSETS |

|

15 |

|

15 |

|

15 |

|

|

TOTAL ASSETS |

|

151 |

|

439 |

|

439 |

|

|

|

|

|

|

|

|

|

|

|

Deferred tax liabilities |

|

0 |

|

72 |

|

72 |

|

|

CURRENT LIABILITIES |

|

0 |

|

72 |

|

72 |

|

|

TOTAL LIABILITIES |

|

0 |

|

72 |

|

72 |

|

|

|

|

|

|

|

|

|

|

|

IDENTIFIED NET ASSETS |

|

151 |

|

367 |

|

367 |

|

|

Cash acquired |

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

367 |

|

|

Total consideration |

|

|

|

|

|

(263 |

) |

|

BARGAIN PURCHASE GAIN |

|

|

|

|

|

104 |

|

* excluding acquired cash

The purchase price allocation resulted in the valuation of acquired equipment and vehicles. Acquisition related costs have been excluded from the cost of acquisition and recognized as an expense in the year when incurred as within the “general and administrative expenses” line item in the combined statement of operations.

The gain from a bargain purchase of EUR 104 thsd was recognized upon completion of the acquisition in 2013.

The gain from a bargain purchase on acquisition was mainly attributable to depressed market value of the acquired business due to bankruptcy of the seller.

USE OF ESTIMATES

The preparation of the combined balance sheet in conformity with US-GAAP requires management to make estimates, judgments and assumptions that affect the reported amounts of revenues and expenses during the reporting period. Significant items subject to such estimates and assumptions include, but are not limited to long-lived asset and indefinite-lived intangible asset impairment analyses, asset retirement obligations, warranty obligations, restructuring accruals, valuation of deferred taxes, obligations related to income taxes, obligations related to employee benefits and the useful lives of property and equipment.

Actual results could differ from those estimates. Future changes in economic conditions may have a significant effect on such estimates made by management. Management believes the following significant accounting policies affect its more significant estimates, judgments and assumptions used in the preparation of our combined balance sheet.

RECENT ACCOUNTING PRONOUNCEMENTS

In July 2015 the FASB issued an amendment to the accounting standards to align the measurement of inventory according to US GAAP more closely to the measurement of inventory in IFRS. The amendment is effective for fiscal years beginning after December 15, 2016 and we expect no impact on our combined financial statement once adopted.

In April 2015 the FASB issued updated guidance in relation to debt issuance costs. The amendments in this update require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying value. This guidance is effective for annual periods beginning after December 15, 2015, and we are currently evaluating its impact.

In January 2015 the FASB issued updated guidance in relation to extraordinary items to simplify income statement presentation. The update eliminates the concept of extraordinary items. This guidance is effective for annual periods beginning after December 15, 2015, and we are currently evaluating its impact.

In November 2014 the FASB issued an amendment to the accounting standards related to business combinations that provide an acquired entity with an option to apply pushdown accounting in its separate financial statements. The amendments are effective on November 18, 2014 and we expect no impact on our combined financial statement once adopted.

In August 2014 the FASB issued updated guidance in relation to going concern disclosure requirements. The amendments provide guidance about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern. This guidance is effective for annual periods ending after December 15, 2016, and we are currently evaluating its impact.

In May 2014 the FASB issued a new standard related to revenue recognition. Under the new standard, recognition of revenue occurs when a customer obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The new standard will be effective for annual reporting periods beginning after December 15, 2017 and early adoption is permitted, but only for periods beginning after December 15, 2016. We anticipate this standard will have impact on our combined financial statement, and we are currently evaluating its impact.

In April 2014 the FASB issued an updated Accounting Standard on “reporting discontinued operations and disclosures of disposals of components on an entity” that raises the threshold for a disposal to qualify as a discontinued operation and requires new disclosures. This guidance is effective for fiscal periods beginning after December 15, 2014. We do not expect the impact of the adoption of the standard to be material to our combined financial statement.

In July 2013, the Financial Accounting Standards Board (FASB) issued updated guidance requiring that certain unrecognized tax benefits be recognized as offsets against the corresponding deferred tax asset for a net operating loss carryforward, a similar tax loss or a tax credit carryforward, unless the deferred tax asset is not available or not intended to be used at the reporting date. This guidance is effective for fiscal periods beginning after December 15, 2013, and is to be applied prospectively to unrecognized tax benefits that exist at the effective date. We will comply with this guidance as of January, 2014, and it will not have a material impact on our combined financial statement.

In March 2013, the FASB issued updated guidance to clarify a parent company’s accounting for the release of the cumulative translation adjustment into income upon derecognition of certain subsidiaries or groups of assets within a foreign entity or of an investment in a foreign entity. This guidance is effective for fiscal periods beginning after December 15, 2013, and is to be applied prospectively to derecognition events occurring

after the effective date. We will comply with this guidance as of January, 2014, and it will not have a material impact on our combined financial statement.

In February 2013, the FASB issued updated guidance in relation to the recognition, measurement and disclosure of obligations resulting from joint and several liability arrangements for which the total amount of the obligation is fixed at the reporting date. This guidance is effective for fiscal periods beginning after December 15, 2013, and is to be applied prospectively for all periods presented for those obligations resulting from joint and several liability arrangements that exist at the beginning of the fiscal year of adoption. We will comply with this guidance as of January, 2014, and it will not have a material impact on our combined financial statement.

In February 2013, the FASB issued updated guidance that amends the reporting of amounts reclassified out of accumulated other comprehensive income (loss) (AOCI). These amendments do not change the current requirements for reporting net income or other comprehensive income in the financial statements. However, the guidance requires an entity to provide information about the amounts reclassified out of accumulated other comprehensive income by component, either on the face of the financial statement where net income is presented or in the notes to the financial statements. This guidance is effective for fiscal periods beginning after December 15, 2013. We expect no material impact on our combined financial statement once adopted.

SIGNIFICANT ACCOUNTING POLICIES

REVENUE RECOGNITION

Revenue for sales of vehicles and service parts is recognized when persuasive evidence of an agreement exists, the risks and rewards of ownership have transferred to the customer, delivery has occurred or services have been rendered, the price of the transaction is fixed and determinable and collectability is reasonably assured. For vehicles, this is generally when the vehicle is released to the customer. Revenues are recognized net of discounts, including but not limited to, cash sales incentives, customer bonuses and rebates granted. Shipping and handling costs are recorded as cost of sales in the period incurred.

We use price discounts to adjust vehicle pricing in response to a number of market and product factors, including: pricing actions and incentives offered by competitors, economic conditions, sales incentive programs received, the intensity of market competition, consumer demand for the product.

We offer customers the opportunity to purchase separately-priced extended warranty and service contracts. In addition, from time to time we sell certain vehicles with a service contract included in the sales price of the vehicle. The service contract and vehicle qualified as separate units of accounting in accordance with the accounting guidance for multiple-element arrangements. The revenue from these contracts, as well as our separately-priced extended warranty and service contracts, is recorded as a component of Deferred Revenue in the accompanying Combined Balance Sheets at the inception of the contract and is recognized as revenue over the contract period in proportion to the costs expected to be incurred based on historical information. A Loss on these contracts is recognized if the sum of the expected costs for services under the contract exceeds unearned revenue.

COST OF SALES

Our income statement classifies our Automotive total costs and expenses into two categories: (i) cost of sales, and (ii) selling, administrative, and other expenses. We include within cost of sales those costs related to the purchase and distribution of our vehicles, parts, and services. Specifically, we include in cost of sales each of the following: purchase costs of new and used vehicles; service parts; freight costs; warranty; labor and other costs related to the purchase of our products and services rendered; depreciation and amortization and other associated costs. We include within selling, administrative, and other expenses labor and other costs not directly related to

the purchase of our products and services rendered, including such expenses as advertising and sales promotion costs. Advertising, sales promotion and other product-related costs are also expensed as incurred.

We record the revenues of incentive programs offered by the manufacturer as a reduction to cost of sales at the time of the purchase from the manufacturer.

We establish reserves for product warranty obligations, including the estimated cost of these services, when the related sale is recognized. The estimated future costs of these actions are principally based on assumptions, as well as historical claims experience for our vehicles.

Costs associated with these actions are recorded in Cost of Sales.

RESTRUCTURING ACTIONS — EXIT AND DISPOSAL ACTIVITIES

We account for employee separation, exit and disposal activities in accordance with the relevant accounting guidance on these topics. Actions associated with restructuring plans include, but are not limited to, workforce reductions, capacity adjustments.

Costs associated with these actions may include, but are not limited to, employee severance, accelerated post-employment benefits, relocations, contract terminations, and legal claims.

Post-employment benefits accrued for workforce reductions related to restructuring activities are recorded in the period when it is probable that employees will be terminated.

Other associated costs such as relocations, contract terminations are recorded when the costs are incurred. Costs associated with actions that will exceed one year are reflected on a discounted basis.

INCOME TAXES

MVC Automotive Austria GmbH is a group parent for corporate income tax purposes for MVC Immobilien GmbH and MVC Motors GmbH. Under group taxation provisions in Austria, the profits and losses of group members are offset, reducing the basis for calculating corporate income tax. Therefore MVC Automotive Austria GmbH is the only entity recognized for corporate income tax purposes for group taxation.

Our other subsidiaries are classified as separate entities for income tax purposes. Our subsidiaries’ income or loss is included in the income tax returns of their respective countries.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for net operating loss and tax credit carryforwards and the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and the respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in the rates is recognized in income in the period that includes the enactment date. Valuation allowances on deferred tax assets are recognized if it is more likely than not that the benefit from the deferred tax asset will not be realized. In addition, current income taxes include adjustments to accruals or uncertain tax positions and related interest expense or income.

There were no provisions recorded on temporary differences for foreign withholding taxes because these differences are permanent in duration. This amount may become taxable upon a repatriation of assets from the subsidiaries or a sale or liquidation of the subsidiaries. There are no plans to repatriate the retained earnings from these subsidiaries, as the earnings are permanently reinvested. Quantification of the deferred tax liability, if any, associated with permanently reinvested earnings is not practicable.

CASH AND CASH EQUIVALENTS

Highly liquid investments with original maturities of three months or less at the date of purchase are classified as cash equivalents.

ACCOUNTS RECEIVABLE

Accounts receivable are stated at nominal value less an allowance for doubtful accounts.

A significant percentage of our accounts receivable is derived from sales of new and used vehicles to customers. In order to monitor potential credit losses, we perform ongoing credit evaluations of our customers’ financial conditions.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

We maintain an allowance for doubtful accounts as a contra asset to our accounts receivable balances. A provision for probable losses is charged against selling, administrative and other expenses to maintain the allowance for doubtful accounts at an amount management believes represents the best estimate of potential losses related to specifically identified receivables, as well as probable losses inherent in all other receivables as of the balance sheet date. Management periodically and systematically evaluates the adequacy of the allowance for doubtful accounts by reviewing historical loss experience, delinquency statistics and other factors in the economy that are expected to have an impact on the losses incurred, in addition to specifically identified probable losses. As of December 31, 2013 the allowance for doubtful debts amounts of EUR 88 thsd. As of December 31, 2013 the amount of past due receivables without allowance recorded is insignificant.

INVENTORIES

Inventories are stated at acquisition cost, subject to the lower of cost or market. Cost includes net prices paid for vehicles and spare parts purchased, charges for freight and overhead related to the purchase of inventories. MVC regularly reviews inventory quantities on hand, stock turn ratios, future purchase commitments with our suppliers, and the estimated utility of our inventory. These reviews include analysis of demand forecasts, current sales levels, pricing strategy, and cost trends. Used cars shall be reviewed monthly based on Eurotax-valuation. If our review indicates a reduction in utility below carrying value, we reduce our inventory to a new cost basis through a charge to cost of sales. The determination of market value and the estimated volume of demand used in the lower of cost or market analysis require significant judgment. The costing methodology for the cost of inventory within the MVC Automotive Combined Group is at average cost.

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is generally provided using the straight-line method over the estimated useful lives of the assets.

Capital leased assets are recorded at the present value of future lease obligations. Depreciation is calculated using the straight-line method over the estimated useful lives. Leasehold improvements are depreciated over the lesser of the estimated useful life of

the leasehold improvement or the term of the underlying lease. Maintenance is expensed during the financial period in which they incurred.

Estimated useful lives of the assets are as follows:

|

Asset |

|

Useful life |

|

|

Buildings |

|

10-30 years |

|

|

Technical plants and equipment |

|

5-10 years |

|

|

Other machinery and plants |

|

3-5 years |

|

|

Prepayments and assets under construction |

|

— |

|

IMPAIRMENT OF LONG-LIVED ASSETS

Long-lived assets held and used (such as property, plant and equipment) are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be recoverable. Recoverability of an asset or asset group to be held and used is measured by a comparison of the carrying amount of an asset or asset group to the estimated undiscounted future cash flows expected to be generated by the asset or group of assets. If the carrying amount of an asset or asset group exceeds its estimated undiscounted future cash flows, an impairment charge is recognized for the amount by which the carrying amount of the asset or group of assets exceeds the fair value of the asset or group of assets. As of December 31, 2013 useful lives of long-lived assets were reconsidered which leads to an additional depreciation of EUR 303 thsd (see also Note 5).

OTHER INTANGIBLE ASSETS

Intangible assets that have a definite useful life are generally amortized over their respective estimated useful lives, on a straight-line basis. The estimated useful lives of the intangible assets are reviewed by management each reporting period and whenever changes in circumstances indicate that the carrying value of the assets may not be recoverable.

FOREIGN CURRENCY

The functional currency of the companies included in this combined balance sheet is the respective entity’s local currency. The assets and liabilities of our foreign operations, where the functional currency is the respective entity’s local currency, are translated into EUR using the exchange rate in effect as of the balance sheet date. Income statement

amounts are translated at the average exchange rate prevailing during the period. The resulting translation adjustments are recorded as a component of accumulated other comprehensive income (AOCI).

Foreign currency exchange gains and losses arising from fluctuations in currency exchange rates on transactions and the effects of remeasurement of monetary balances denominated in currencies other than the functional currency are recorded in earnings as incurred and are included in other income.

FAIR VALUE MEASUREMENTS

The measurement of fair value is based on a three-tier hierarchy, which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The three levels of the fair value hierarchy are as follows:

Level 1 — Quoted prices are available in active markets for identical assets or liabilities as of the balance sheet date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2 — Pricing inputs are other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the balance sheet date. Level 2 includes those financial instruments that are valued using models or other valuation methodologies. These models are primarily industry-standard models that consider various assumptions, including quoted forward prices for commodities, time value, volatility factors and current market and contractual prices for the underlying instruments, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace throughout the full term of the instrument and can be derived from observable data.

Level 3 — Pricing inputs include significant inputs that are generally less observable from objective sources. These inputs may be used with internally developed methodologies that result in management’s best estimate of fair value. Assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of assets and liabilities and their placement within the fair value hierarchy.

At each balance sheet date, we perform an analysis of all instruments potentially subject to fair value measurement and include in Level 3 all of those whose fair value is based on significant unobservable inputs.

As of December 31, 2013 MVC Automotive Combined Group’s financial instruments measured at fair value primarily consists of Level 1 financial instruments such as cash and cash equivalents.

We measure debt at fair value for purposes of disclosure (see Note 10) using quoted prices from similar public debt with approximately the same remaining maturities, where possible. Where quoted prices are not available, we estimate fair value using discounted cash flows and market-based expectations for interest rates, credit risk, and the contractual terms of the debt instruments. For certain short-term debt with an original maturity date of one year or less, we assume that book value is a reasonable approximation of the debt’s fair value. The fair value of debt is categorized within Level 2 of the hierarchy.

NOTE 3 ACCUMULATED OTHER COMPREHENSIVE LOSS

The components of AOCI as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

Actuarial |

|

|

|

|

|

|

|

|

gains |

|

Translation |

|

|

|

|

|

|

(losses) |

|

adjustments |

|

Total |

|

|

Total gain (loss) recorded in OCI |

|

(404 |

) |

(113 |

) |

(516 |

) |

|

Tax effect |

|

101 |

|

0 |

|

101 |

|

|

Balance at December 31, 2013 |

|

(303 |

) |

(113 |

) |

(416 |

) |

NOTE 4 INVENTORIES

The components of inventories as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

2013 |

|

|

Raw materials and supplies |

|

4,441 |

|

|

New cars |

|

20,536 |

|

|

Used cars |

|

7,221 |

|

|

Total |

|

32,197 |

|

As of December 31, 2013 an inventory valuation allowance of EUR 326 thsd was recorded. Thereof an amount of EUR 293 thsd is based on applying the lower-cost-or-market rule to new cars.

NOTE 5 PROPERTY, PLANT AND EQUIPMENT, NET

The components of property, plant and equipment as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

Useful Lives |

|

|

|

|

|

|

(years) |

|

2013 |

|

|

Land and buildings |

|

10-30 |

|

34,124 |

|

|

Machinery, equipment and others |

|

3-10 |

|

8,817 |

|

|

Assets under construction |

|

|

|

4 |

|

|

|

|

|

|

42,945 |

|

|

Accumulated depreciation |

|

|

|

(14,427 |

) |

|

Total |

|

|

|

28,518 |

|

As of December 31, 2013 useful lives of long-lived assets were reconsidered which leads to an additional depreciation of EUR 303 thsd.

NOTE 6 OTHER INTANGIBLE ASSETS, NET

The components of other intangible assets, net as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

Range of |

|

|

|

|

|

|

Useful Lives |

|

2013 |

|

|

Concessions, Licenses and similar rights |

|

3-5 |

|

1,097 |

|

|

|

|

|

|

1,097 |

|

|

Accumulated amortization |

|

|

|

(1,042 |

) |

|

Total |

|

|

|

55 |

|

The expected amortization for intangible assets for the next five years is insignificant.

NOTE 7 TRADE ACCOUNTS RECEIVABLE, NET

The components of trade accounts receivable, net as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

2013 |

|

|

|

|

Total |

|

|

Trade accounts receivables |

|

9,199 |

|

|

Allowance for doubtful accounts |

|

(88 |

) |

|

Trade accounts receivables, net |

|

9,111 |

|

NOTE 8 PREPAID EXPENSES AND OTHER ASSETS

The components of prepaid expenses and other assets as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

2013 |

|

|

|

|

Total |

|

|

Sales and marketing incentives |

|

2,195 |

|

|

Short-term tax receivables |

|

1,869 |

|

|

Prepaid expenses |

|

257 |

|

|

Other |

|

1,167 |

|

|

Total |

|

5,488 |

|

NOTE 9 ACCRUED EXPENSES AND OTHER SHORT-TERM LIABILITIES

The components of accrued expenses and other short-term liabilities as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

2013 |

|

|

|

|

Total |

|

|

Product warranty costs |

|

125 |

|

|

Personnel costs |

|

2,363 |

|

|

Taxes other than income taxes |

|

811 |

|

|

Deferred income |

|

224 |

|

|

Credit balances customers |

|

654 |

|

|

Other |

|

1,367 |

|

|

Total |

|

5,544 |

|

NOTE 10 FINANCIAL LIABILITIES

The components of financial liabilities as of December 31, 2013 were as follows (in EUR thsd):

|

|

|

|

|

2013 |

| ||

|

|

|

|

|

|

|

Carrying |

|

|

Financial liabilities < 1 year |

|

Interest Rate |

|

Fair Value |

|

Value |

|

|

Financial liabilities due to related parties short-term |

|

|

|

|

|

|

|

|

MVC Automotive Group GmbH, Austria |

|

0% |

|

120 |

|

120 |

|

|

Cegeac S.A., Belgium |

|

0% |

|

607 |

|

607 |

|

|

Total financial liabilities due to related parties short-term |

|

|

|

727 |

|

727 |

|

|

|

|

|

|

|

|

|

|

|

Financial payables for acquisition of cars short-term |

|

|

|

|

|

|

|

|

Car Financing Austria |

|

variable 2.8 - 7.0% |

|

17,897 |

|

17,897 |

|

|

Car Financing Czech Republic |

|

variable 6.7 - 8.8% |

|

4,278 |

|

4,278 |

|

|

Car Financing Belgium |

|

variable 5.4 - 9.4% |

|

4,902 |

|

4,902 |

|

|

Total financial payables for acquisition of cars short-term |

|

|

|

27,077 |

|

27,077 |

|

|

|

|

|

|

|

|

|

|

|

Bank loans short-term |

|

|

|

|

|

|

|

|

Revolving facilities Austria |

|

variable 2.13 - 2.78% |

|

8,377 |

|

8,377 |

|

|

Short-term loan Belgium |

|

variable 3.5% |

|

1,000 |

|

1,000 |

|

|

Other current accounts |

|

floating |

|

94 |

|

94 |

|

|

Total bank loans short-term |

|

|

|

9,471 |

|

9,471 |

|

|

|

|

|

|

|

|

|

|

|

Finance lease liabilities short-term |

|

|

|

|

|

|

|

|

Finance lease Beligum |

|

variable 4% |

|

117 |

|

117 |

|

|

Finance lease Austria |

|

variable 3.6% |

|

196 |

|

196 |

|

|

Total finance lease liabilities short-term |

|

|

|

313 |

|

313 |

|

|

|

|

|

|

2013 |

| ||

|

|

|

|

|

|

|

Carrying |

|

|

Financial liabilities > 1 year |

|

Interest Rate |

|

Fair Value |

|

Value |

|

|

|

|

|

|

|

|

|

|

|

Financial liabilities due to related parties long-term |

|

|

|

|

|

|

|

|

MVC Automotive Group GmbH, Austria |

|

0% |

|

342 |

|

380 |

|

|

Total financial liabilities due to related parties long-term |

|

|

|

342 |

|

380 |

|

|

|

|

|

|

|

|

|

|

|

Financial payables for acquisition of cars long-term |

|

|

|

|

|

|

|

|

Car Financing Czech Republic |

|

variable 6.7 - 8.8% |

|

418 |

|

418 |

|

|

Total financial payables for acquisition of cars long-term |

|

|

|

418 |

|

418 |

|

|

|

|

|

|

|

|

|

|

|

Bank loans long-term |

|

|

|

|

|

|

|

|

Loan BE & Nl |

|

fixed 6% |

|

3,383 |

|

3,383 |

|

|

Loan Somotra |

|

fixed 5.71% |

|

1,568 |

|

1,665 |

|

|

Loans Somotra |

|

variable 1.6% - 1.9% |

|

307 |

|

307 |

|

|

Loan MVC Immo, Austria |

|

variable 1.83% |

|

8,604 |

|

8,604 |

|

|

Total bank loans long-term |

|

|

|

13,862 |

|

13,959 |

|

|

thereof current portion long-term debt |

|

|

|

941 |

|

941 |

|

|

thereof bank loans long-term |

|

|

|

12,921 |

|

13,018 |

|

|

|

|

|

|

|

|

|

|

|

Finance lease liabilities long-term |

|

|

|

|

|

|

|

|

Finance lease Beligum |

|

variable 4% |

|

20 |

|

20 |

|

|

Finance lease Austria |

|

variable 2.27 - 3.60% |

|

2,405 |

|

2,405 |

|

|

Total finance lease liabilities long-term |

|

|

|

2,425 |

|

2,425 |

|

MVC Automotive Combined Group and its subsidiaries borrow under separate short-term lines of credit with banks in the countries where they are located. The lines contain general provisions concerning renewal and continuance at the option of the banks.

Short-term lines of credit amounted to EUR 23,575 thsd as of December 31, 2013. The outstanding amount as of December 31, 2013 was EUR 20,696 thsd. For a credit facility of EUR 7.6 million with Erste Bank der oesterreichischen Sparkassen AG, Vienna, Austria, the financing bank obtained a letter of comfort from MVC Capital Inc.

As of December 31, 2013 outstanding credit lines of EUR 15 million are secured by a mortgage on real estate. Thereof EUR 8.6 million are related to a loan of MVC Immobilien GmbH, Vienna, with Bawag PSK AG, Vienna, Austria. EUR 3.4 million are related to a loan of BE/NI Group a.s., Prague, Czech Republic, for the acquisition of the new property in Orech, Czech Republic. Loans of Somotra N.V. Drogenbos, Belgium of EUR 3 millon with ING bank are secured by mortgage of real estate.

Outstanding credit lines of EUR 27.5 million for car financing are secured by reservation of title of the financed cars. In Austria the outstanding credit lines as of December 31, 2013 are with Santander Consumer Bank GmbH, Vienna, EUR 4.9 million, Autobank GmbH, Vienna, EUR 1.1 million and Ford Bank Austria, Vienna, EUR 11.9 million.

In Belgium (Somotra N.V.) outstanding short term credit lines of EUR 4.9 million used for car financing for Jaguar Land Rover brands with FGA Capital Belgium SA are secured by reservation of title of the financed cars.

Regarding future financing capacity, we refer to the letter of comfort Somotra N.V. received from MVC Capital Inc., USA, in Note 2 and Note 17. The table below summarizes the maturities and conditions of all financial liabilities, including the financing of cars acquired for business purposes (in EUR thsd):

|

Debt maturities |

|

|

|

|

|

Expected |

|

|

as of December 31, 2013 |

|

Carrying Value |

|

Interests |

|

Payments |

|

|

2014 |

|

38,949 |

|

2,327 |

|

41,275 |

|

|

2015 |

|

1,446 |

|

485 |

|

1,931 |

|

|

2016 |

|

4,108 |

|

350 |

|

4,458 |

|

|

2017 |

|

888 |

|

221 |

|

1,109 |

|

|

2018 |

|

800 |

|

189 |

|

989 |

|

|

thereafter |

|

8,580 |

|

408 |

|

8,988 |

|

|

Total |

|

54,771 |

|

3,980 |

|

58,750 |

|

NOTE 11 INCOME TAXES

VALUATION OF DEFERRED TAX ASSETS AND LIABILITIES

Deferred tax assets and liabilities are recognized based on the future tax consequences attributable to temporary differences that exist between the financial statement carrying value of assets and liabilities and their respective tax bases, and operating loss and tax credit carryforwards on a taxing jurisdiction basis. We measure deferred tax assets and liabilities using enacted tax rates that will apply in the years in which we expect the temporary differences to be recovered or paid.

Our accounting for deferred tax consequences represents our best estimate of the likely future tax consequences of events that have been recognized on our financial statements or tax returns and their future probability. In assessing the need for a valuation allowance, we consider both positive and negative evidence related to the likelihood of realization of the deferred tax assets. If, based on the weight of available evidence, it is more likely than not that the deferred tax assets will not be realized, we record a valuation allowance.

Unrecognized tax benefits amount of EUR 19,790 thsd. as of December 31, 2013.

Operating losses carried forward for tax purposes were EUR 19.8 million at December 31, 2013, resulting in a deferred tax asset of EUR 4.9 million. Tax losses of EUR 1.2 million expire within four years. There is no expiration date for tax losses of EUR 18.6 million. Tax benefits of operating loss and tax credit carryforwards are evaluated on an ongoing basis, including a review of historical and projected future operating results, the eligible carryforward period, and other circumstances.

At December 31, 2013, in the absence of enough evidence of future profits, management decided to impair the deferred tax asset on, resulting in a valuation allowance of EUR 5.1 million primarily for deferred tax assets related to tax losses carried forward.

Deferred tax assets and liabilities result from differences between assets and liabilities measured for financial reporting purposes and those measured for income tax return purposes. The table below summarizes the significant components of deferred tax assets and liabilities as of December 31, 2013 (in EUR thsd):

|

Deferred Tax Assets |

|

2013 |

|

|

Property, plant and equipment |

|

476 |

|

|

Pension liabilities and other assets |

|

683 |

|

|

Tax credit carryforwards |

|

4,595 |

|

|

Other |

|

98 |

|

|

Total Gross Deferred Tax Assets |

|

5,852 |

|

|

Less: Valuation Allowance |

|

(5,113 |

) |

|

Total Net Deferred Tax Assets |

|

739 |

|

|

|

|

|

|

|

Deferred Tax Liabilities |

|

2013 |

|

|

Property, plant and equipment |

|

(8 |

) |

|

Inventory (Note 2, Purchase Price Allocation) |

|

(72 |

) |

|

Other |

|

(4 |

) |

|

Total Deferred Tax Liabilities |

|

(84 |

) |

|

|

|

|

|

|

Net Deferred Tax Assets |

|

655 |

|

NOTE 12 COMMITMENTS, CONTINGENCIES AND CONCENTRATIONS

LITIGATION

As of December 31, 2013 no material claims and proceedings are pending.

Reserves have been established for matters in which we believe that losses are probable and can be reasonably estimated.

CEGEAC

After balance sheet date, on March 11, 2014 the Belgium subsidiary Cegeac S.A. declared bankruptcy. From the date of the bankruptcy order the company (and therefore, the directors) lost the right to manage its assets. All payments, acts or transactions carried out by the company and all payments made to the company after the declaration of bankruptcy are void. The trustee in bankruptcy represents the company took over the running of the business. The trustee in bankruptcy has wide discretionary powers including a power to sell the assets of the company and to distribute the proceeds to creditors.

These restrictions due to the bankruptcy proceedings and other restrictions limit MVC Automotive Combined Group’s ability to benefit from the investment and maintain a

controlling interest in the Belgium subsidiary. Therefore the investment in Cegeac S.A. is stated “at cost” and fully impaired as of December 31, 2013.

In course of the bankruptcy proceedings various legal actions, governmental investigations, claims and proceedings are pending including matters arising out of employment-related matters; dealer, supplier and other contractual relationships.

With regard to the bankruptcy litigation matters discussed in the previous paragraph Cegeac is not included in this combined balance sheet. Potential reserves for litigations and claims associated with bankruptcy of Cegeac are therefore not recorded in this combined balance sheet. The matters include claims from current and former employees related to alleged unpaid wage, benefit, severance and other compensation matters.

As of December 31, 2013, investments and amounts due from the Belgium subsidiary Cegeac were not material. At December 31, 2013, the combined balance sheet includes payables to Cegeac related to purchases of goods and services of EUR 1.6 million in 2013, and a short term loan of EUR 607 thsd. (Note 15).

We believe that appropriate accruals have been established for related party transactions based on information currently available. Reserves for litigation losses are not to be recorded at combined balance sheet level. Bankruptcy proceeding and litigation are inherently unpredictable however; and unfavorable resolutions could occur. Accordingly it is possible that an adverse outcome from such proceedings could also have negative impact on companies included in the combined balance sheet (Note 17).

GUARANTEES AND INDEMNIFICATIONS

Guarantees and indemnifications are recorded at fair value at their inception. We regularly review our performance risk under these arrangements, and in the event it becomes probable we will be required to perform under the guarantee or indemnification, the amount of probable payment is recorded.

As of December 31, 2013 the maximum potential payments and the carrying value of recorded liabilities related to guarantees and limited indemnities are insignificant.

ARRANGEMENTS WITH KEY SUPPLIERS

From time to time, in the ordinary course of our business, we enter into various arrangements with key suppliers in order to establish strategic and technological advantages. These arrangements do not contain unconditional purchase obligations to purchase a fixed or minimum quantity of goods and/or services with fixed and determinable price provisions.

LONG-TERM WARRANTY AND SERVICE CONTRACTS

We offer customers the opportunity to purchase separately-priced extended warranty and service contracts. In addition, from time to time we sell certain vehicles with a service contract included in the sales price of the vehicle. The revenue from these contracts, as well as our separately-priced extended warranty and service contracts, is recorded as a component of deferred revenue at the inception of the contract and is recognized as revenue over the contract period in proportion to the costs expected to be incurred based on historical information. A Loss on these contracts is recognized if the sum of the expected costs for services under the contract exceeds unearned revenue. The total amount of revenues and expenses related to these contracts is not material.

CONDITIONAL ASSET RETIREMENT OBLIGATIONS

In connection with certain agreements, we have entered into agreements indemnifying certain lessors and other parties with respect to environmental conditions and other closure costs pertaining to real property we leased (owned).

It is not possible to estimate our maximum exposure under these indemnifications or guarantees due to the conditional nature of these obligations. Immaterial amounts have been recorded for such obligations as the majority of them are not probable or estimable at this time and the fair value of the guarantees at issuance was insignificant.

Asset retirement obligations relate to legal obligations associated with retirement of tangible long-lived assets that result from acquisition, construction, development or normal operation of a long-lived asset. An analysis is performed of such obligations associated with all real property owned or leased, including facilities, warehouses and offices. Estimates of conditional asset retirement obligations relate, in the case of owned properties, to costs estimated to be necessary for the legally required removal or

remediation of various regulated materials. For leased properties such obligations relate to the estimated cost of contractually required property restoration. At December 31, 2013 accruals for asset retirement obligations were not material.

NON CANCELABLE OPERATING LEASES AND FINANCE LEASES

The following table summarizes our minimum commitments under non cancelable operating leases and Finance leases having initial terms in excess of one year, primarily for property.

The majority of our lease payments are for operating leases. As of December 31, 2013, the future minimum rental commitments under operating and finance leases with non-cancelable lease terms in excess of one year were as follows (in EUR thsd):

|

|

|

Minimum |

|

|

|

|

|

|

|

Operating Leases |

|

commitments |

|

|

|

|

|

|

|

2014 |

|

1,959 |

|

|

|

|

|

|

|

2015 |

|

1,751 |

|

|

|

|

|

|

|

2016 |

|

708 |

|

|

|

|

|

|

|

2017 |

|

708 |

|

|

|

|

|

|

|

2018 |

|

498 |

|

|

|

|

|

|

|

Thereafter |

|

1,774 |

|

|

|

|

|

|

|

Total |

|

7,398 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum |

|

|

Interest |

|

Principal |

|

|

Finance Leases |

|

commitments |

|

|

Payments |

|

Payments |

|

|

2014 |

|

381 |

|

|

68 |

|

313 |

|

|

2015 |

|

268 |

|

|

57 |

|

211 |

|

|

2016 |

|

263 |

|

|

50 |

|

213 |

|

|

2017 |

|

263 |

|

|

44 |

|

219 |

|

|

2018 |

|

169 |

|

|

37 |

|

132 |

|

|

Thereafter |

|

1,931 |

|

|

281 |

|

1,650 |

|

|

Total |

|

3,275 |

|

|

537 |

|

2,738 |

|

Finance leases included in property, plant and equipment are as follows (in EUR thsd):

|

Finance Leases - Assets |

|

|

|

|

2013 |

|

|

|

|

|

Land and Buildings |

|

|

|

|

1,970 |

|

|

|

|

|

Machinery and equipment |

|

|

|

|

1,531 |

|

|

|

|

|

|

|

|

|

|

3,501 |

|

|

|

|

|

Less accumulated depreciation |

|

|

|

|

(830 |

) |

|

|

|

|

Total |

|

|

|

|

2,671 |

|

|

|

|

In February 2013 MVC Immobilien GmbH (lessor) and Hypo Tirol Leasing Wiener Betriebsansiedlungen GmbH signed a long term lease agreement in regard to business premises in Brunn am Gebirge. The contract was concluded based on a purchase price for land & buildings of EUR 4.6 million and a no cancelable lease term of 15 years. Because of the purchase obligation for MVC Immobilien GmbH to acquire the premises at the end of the lease term this contract was classified a finance lease.

RENTAL CONTRACTS BUILDINGS

|

|

|

|

|

EUR thsd |

|

|

Lessor, Site |

|

End of Contract |

|

Annual rent |

|

|

Fomoco, Vienna |

|

December 2015 |

|

370 |

|

|

CPB Immobilien, Vienna |

|

December 2021 |

|

380 |

|

|

Vohryzka, Vienna |

|

October 2015 |

|

516 |

|

|

Melchart, Vienna |

|

indefinite |

|

51 |

|

|

Wr. Stadtwerke, Vienna |

|

indefinite |

|

25 |

|

|

Moring, Vienna |

|

indefinite |

|

131 |

|

|

Ursula Deutsch, Vienna |

|

December 2017 |

|

110 |

|

|

Doris Haller-Deutsch, Vienna |

|

December 2017 |

|

100 |

|

|

ÖBB, Vienna |

|

indefinite |

|

18 |

|

|

Hypo Tirol Leasing, Brunn am Gebirge |

|

February 2028 |

|

62 |

|

|

Strakoniská & Plzenská, Prague and Orech |

|

indefinite |

|

234 |

|

|

Total annual rent |

|

|

|

1,997 |

|

NOTE 13 FAIR VALUE MEASUREMENTS

The following summarizes our financial assets and liabilities measured at fair value for disclosure purposes on a recurring basis as of December 31, 2013 (in EUR thsd):

|

|

|

2013 |

| ||

|

|

|

Carrying |

|

|

|

|

|

|

Amount |

|

Fair Value |

|

|

Cash and cash equivalents |

|

987 |

|

987 |

|

|

Financial Assets |

|

0 |

|

0 |

|

|

Financial Liabilities |

|

54,771 |

|

54,636 |

|

The estimated fair values have been determined by using available market information and valuation methodologies as described below. Considerable judgment is required in interpreting market data to develop the estimates of fair value.

CASH AND CASH EQUIVALENTS

The carrying value of cash and cash equivalents approximates fair value due to the short maturity of these instruments and consists primarily of cash, marketable securities and time deposits.

FINANCIAL LIABILITIES

We estimate the fair values of our financial liabilities using quoted market prices where available. Where market prices are not available, we estimate fair value by discounting future cash flows using market interest rates, adjusted for non-performance risk over the remaining term of the financial liability.

For certain short-term debt with an original maturity date of one year or less, we assume that book value is a reasonable approximation of the debt’s fair value.

NOTE 14 EMPLOYEE RETIREMENT AND OTHER BENEFITS

We sponsor both noncontributory and contributory defined other post employment benefit obligations plans.

We have defined other post employment benefit obligations plans (OPEB), primarily severance and jubilee benefits, in Austria, Belgium and other locations covering hourly and salaried employees. The largest portion of our worldwide obligation is associated with Austrian statutory severance payments obligations. Our OPEB plans are unfunded and the benefits are paid from general Company cash.

Employees of MVC Automotive Combined Group which joined the Austrian subsidiaries after 2002 are members of state managed retirement benefit schemes operated by the relevant governments. MVC Automotive Combined Group is required to contribute a certain percentage of payroll costs to these schemes to fund the benefits. The only obligation of MVC Automotive Combined Group with respect to these schemes is to make the specified contributions. The assets of the schemes are held separately from those of MVC Automotive Combined Group in funds under the control of trustees.

Defined benefit pension and OPEB plan obligations are measured based on the present value of projected future benefit payments for all participants for services rendered to date. The measurement of projected future benefits is dependent on the provisions of each specific plan, demographics of the group covered by the plan, and other key measurement assumptions. For plans that provide benefits dependent on salary assumptions, we include a projection of salary growth in our measurements. No assumption is made regarding any potential changes to benefit provisions beyond those to which we are presently committed (e.g., in existing labor contracts).

The net periodic benefit costs associated with the Company’s defined benefit pension and OPEB plans are determined using assumptions regarding the benefit obligation as of the beginning of each year. Net periodic benefit costs are recorded in Automotive cost of sales and Selling, administrative, and other expenses. The benefit obligations are determined using assumptions as of the end of each year. The impact of plan amendments and actuarial gains and losses are recorded in Accumulated other comprehensive income/ (loss), and generally are amortized as a component of net periodic cost over the remaining service period of our active employees. Unamortized gains and losses are amortized only to the extent they exceed 10% of the market-related value of the benefit obligation of the respective plan (i.e., outside of corridor).

Curtailment gains or losses are recorded when an event occurs that significantly reduces the expected years of future service or eliminates the accrual of defined benefits for the future services of a significant number of employees. Upon a settlement, we recognize the proportionate amount of the unamortized gains and losses if the cost of all settlements during the year exceeds the interest component of net periodic cost for the affected plan. Expense from curtailments and settlements is recorded in Automotive cost of sales and Selling, administrative, and other expenses.

BENEFIT OBLIGATIONS

BENEFIT COSTS AND BENEFIT OBLIGATIONS RECOGNIZED INAOCI

The components of benefit obligations were as follows (in EUR thsd):

|

|

|

Severance |

|

Jubilee |

|

Total |

|

|

Defined benefit obligations December 31, 2013 |

|

(2,330 |

) |

(405 |

) |

(2,734 |

) |

ASSUMPTIONS

Assumptions used to determine the benefit obligation and expense were as follows:

|

|

|

2013 |

| ||

|

|

|

Severance |

|

Jubilee |

|

|

Weighted-Average Assumptions used to determine Benefit Obligations |

|

|

|

|

|

|

|

|

|

|

|

|

|

Discount rate —ongoing benefits |

|

3.70 |

% |

3.70 |

% |

|

Rate of compensation increase |

|

3.00 |

% |

3.00 |

% |

ESTIMATED FUTURE BENEFIT PAYMENTS AND AMORTIZATION

The following table presents estimated future gross benefit payments (in EUR thsd):

|

|

|

Gross Benefit Payments |

| ||||

|

|

|

Severance |

|

Jubilee |

|

Total |

|

|

2014 |

|

74 |

|

32 |

|

106 |

|

|

2015 |

|

65 |

|

23 |

|

88 |

|

|

2016 |

|

80 |

|

63 |

|

143 |

|

|

2017 |

|

78 |

|

29 |

|

107 |

|

|

2018 |

|

188 |

|

0 |

|

188 |

|

|

2019 - 2024 |

|

987 |

|

164 |

|

1,151 |

|

|

Total |

|

1,472 |

|

311 |

|

1,783 |

|

NOTE 15 TRANSACTIONS WITH RELATED PARTIES

The Company is and was engaged in transactions with the US ultimate parent company, MVC Capital Inc., with Tekers Holdings, Latvia, 100% owned by MVC Capital Inc. and with the former (until December 2013) Belgian subsidiary, Cégéac S.A. Belgium, on commercial terms in their respective markets, considering the characteristics of the goods or services involved.

MVC INC.

As of December 31, 2013, the MVC Capital Inc. had a 100 percent beneficial ownership interest in the Company.

In course of the cross border merger in 2013 MVC Capital Inc. made a capital contribution of USD 5 million (EUR 3.7 million) to MVC Automotive Group GmbH. Additionally the outstanding bridge loan (principal plus interest) of USD 1.8 million (EUR 1.3 million) was converted into further contribution. The total Contribution of Capital recorded in combined equity of MVC Automotive Group GmbH was EUR 5 million.

MVC AUTOMOTIVE GROUP GMBH

MVC Automotive Group GmbH performs only holding functions for MVC Automotive Group.

In 2012 Auto Motol Beni a.s (lender) and MVC Automotive Group GmbH (borrower) signed a revolving loan agreement up to an amount of EUR 5 million; repayment date is December 31, 2013 and the applicable interest rate 4% per annum. The loan and the related interests amount to EUR 4,095 thsd as of December 31, 2013.

In 2013 MVC Automotive Group GmbH granted a non interest bearing loan of EUR 500 thsd to Somotra N.V. which, for information purposes, was converted into a capital contribution to Somotra N.V. in May 2014. Additional loans and capital contributions were granted in 2014. We also refer to Note 17 and Note 2.

The following table presents the balance sheet of MVC Automotive Group GmbH as of December 31, 2013 for information purposes (in EUR thsd):

MVC Automotive Group GmbH - Single Balance Sheet as of Dec 31, 2013

|

Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

2,525 |

|

|

Amounts due from related parties trade |

|

165 |

|

|

Loan Somotra SA |

|

500 |

|

|

Allowance loan Somotra SA |

|

(500 |

) |

|

Prepaid expenses and other assets |

|

2 |

|

|

Total current assets |

|

2,692 |

|

|

Investment MVC Automotive Austria Subgroup |

|

8,100 |

|

|

Investment Auto Motol Beni a.s. |

|

3,855 |

|

|

Investment BE & NI Group a.s. |

|

0 |

|

|

Investment Cegeac SA |

|

0 |

|

|

Investment Somotra SA |

|

0 |

|

|

Total non-current assets |

|

11,955 |

|

|

Total assets |

|

14,647 |

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

Loan Auto Motol Beni a.s. |

|

4,272 |

|

|

Loan MVC Motors GmbH |

|

125 |

|

|

Amounts due to Cegeac SA |

|

930 |