Attached files

| file | filename |

|---|---|

| 8-K - IMATION CORP. 8-K - GlassBridge Enterprises, Inc. | a51201397.htm |

Exhibit 99.1

Imation Announces Executive Appointments and Strategic Acquisition of Connected Data

Bob Fernander appointed Interim CEO

Acquires Connected Data, An Emerging Private Cloud Sync and Share Company

Geoff Barrall appointed Chief Technology Officer

Corporate restructuring expected to be completed in early 2016

OAKDALE, Minn--(BUSINESS WIRE)--October 14, 2015--Imation Corp. (NYSE:IMN) (“Imation” or the “Company”) today announced that Bob Fernander, an existing member of the Company’s Board of Directors (the “Board”), has been appointed as Interim CEO, effective immediately. Additionally, the Company announced it has acquired substantially all of the equity of Connected Data, Inc. (“Connected Data”), an emerging enterprise-class, private cloud sync and share company, in a transaction valued at approximately $7.5 million at closing. The Company intends to complete the acquisition of Connected Data through a short-form merger as soon as practicable. Connected Data’s founder, CEO and current member of Imation’s Board, Geoff Barrall, will join the Company’s executive leadership team as Chief Technology Officer. Separately, Interim President Barry Kasoff has assumed the role of Chief Restructuring Officer and will continue to work with Mr. Fernander to execute Imation’s restructuring plan.

“As an experienced professional with an established track record of building technology-based businesses, Bob is the right interim leader for Imation. He is deeply involved in the execution of the Company-wide restructuring plan and has the skill set necessary to maximize the value of our storage businesses, which includes Nexsan, IronKey and now Connected Data,” said Joseph A. De Perio, non-executive Chairman of the Board. “Connected Data puts the Company’s product roadmap on trend and boosts the enterprise value potential of all of Imation’s storage businesses. Geoff is an exceptional business builder, technologist and inventor, and Imation is fortunate to bring him on as an executive overseeing all of our storage strategies and development.”

Founded in 2012, Connected Data produces Transporter, an enterprise-class, private cloud sync and share line of appliances that offer a secure, on premise and cost efficient alternative to Dropbox. Connected Data’s patented technology creates a mobile data infrastructure that delivers public cloud features without the expense or security compromises of cloud services. Transporter solutions allow corporations to use existing storage infrastructure to achieve high performance cloud functionality. Transporter can be scaled and integrated with existing Imation product lines, and the acquisition augments Imation’s vision in delivering a comprehensive and secure storage, backup and collaboration ecosystem.

“Connected Data is a pioneering company and a significant acquisition for Imation that will place us at the forefront of the one of the fastest growing and most important sectors of technology. The Connected Data product line will be able to leverage the existing Nexsan sales infrastructure and channel relationships to boost sales and create a more comprehensive product offering,” said Mr. Fernander. “We are witnessing an increasing global demand for cost efficient, secure file synchronization to mobile devices, and Connected Data’s alignment with Imation’s SDMA (Secure Data Movement Architecture) will allow us to deliver industry leading private cloud solutions.”

Under the terms of the transaction, subject to certain adjustments, approximately $4.4 million of consideration will be paid in Imation common stock at an issue price of $2.75 per share, approximately $0.5 million will be paid in cash, and approximately $2.6 million in debt will be paid off by the Company. Up to $5 million in cash and shares in earn outs are possible based upon Connected Data’s performance through 2016 and the first half of 2017. Connected Data is projected to have over $7 million in standalone revenue in 2016, and the transaction will be immediately accretive to Imation.

Geoff Barrall, Chief Technology Officer, commented, “We are proud of what we have built at Connected Data. Our innovative product line represents a major disruption in the field of file sync and share as customers look for cost effectiveness and maximum security. Coming under the Imation umbrella is a logical extension of our evolution and will drive significant synergies and efficiencies across the organization.”

The transaction was approved by the Company’s Audit Committee pursuant to the Board’s Related Party Transaction Policy and by the disinterested directors, after receiving a fairness opinion that the transaction was fair, from a financial point of view, to the Company.

Imation’s Board and executive team will also continue to work closely with its advisors to drive change within the Company and explore strategic alternatives to maximize shareholder value, including, but not limited to, divestitures of its non-core and non-operating assets. To that end, the Strategic Alternatives Committee was formed in August 2015 to work with management and make recommendations to the Board. The Strategic Alternatives Committee has also been tasked with (i) examining opportunities to invest the Company’s excess cash and (ii) formulating strategies to maximize the value of the Company’s investments and assets, such as its owned common stock in Sphere3D Corporation. As of September 30, 2015, Imation’s total cash balance is expected to be at least $85 million, and the corporate-wide restructuring plan is expected to be mainly completed by January 1, 2016.

The Company has enclosed a brief slide presentation related to its current initiatives in the Form 8-K filed today with the SEC.

Webcast and Replay Information

A teleconference to discuss this release is scheduled for today October 14, 2015 at 4:00 PM Central Time and will be available on the Internet on a listen-only basis at www.ir.Imation.com or www.streetevents.com.

A taped replay of the teleconference will be available beginning at 8:00 PM Central Time on October 14, 2015, until 7:30 PM Central Time on October 20, 2015, by dialing 855-859-2056 or 404-537-3406 (conference ID 59169709). All remarks made during the teleconference will be current at the time of the teleconference, and the replay will not be updated to reflect any subsequent developments.

About Imation

Imation (NYSE: IMN) is a global data storage and information security company. Our products and solutions help organizations and individuals store, manage and protect digital content. Imation’s storage and security portfolio includes Nexsan high-density, archive and solid-state optimized unified hybrid storage solutions; IronKey™ mobile security solutions that address the needs of professionals for secure data transport and mobile workspaces; and consumer storage solutions, audio products and accessories sold under the Imation, Memorex and TDK Life on Record brands. Imation reaches customers in more than 100 countries through a powerful global distribution network. For more information, visit www.imation.com.

Risk and Uncertainties

Certain information contained in this press release which does not relate to historical financial information may be deemed to constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties that could cause our actual results in the future to differ materially from our historical results and those presently anticipated or projected. We wish to caution investors not to place undue reliance on any such forward-looking statements. Any forward-looking statements speak only as of the date on which such statements are made, and we undertake no obligation to update such statements to reflect events or circumstances arising after such date. Risk factors include various factors set forth from time to time in our filings with the Securities and Exchange Commission including the following: Our ability to successfully implement our strategy; our ability to grow our business in new products with profitable margins and the rate of revenue decline for certain existing products; our ability to meet future revenue growth, gross margin and earnings targets; the ability to quickly develop, source, introduce and deliver differentiated and innovative products; our potential dependence on third parties for new product introductions or technologies in order to introduce our own new products; our ability to successfully implement restructuring plans; foreign currency fluctuations; the ready availability and price of energy and key raw materials or critical components including the effects of natural disasters and our ability to pass along raw materials price increases to our customers; continuing uncertainty in global and regional economic conditions; our ability to identify, value, integrate and realize the expected benefits from any acquisition which has occurred or may occur in connection with our strategy; the possibility that our goodwill and intangible assets or any goodwill or intangible assets that we acquire may become impaired; the ability of our security products to withstand cyber-attacks; the loss of a major customer, partner or reseller; changes in European law or practice related to the imposition or collectability of optical levies; the seasonality and volatility of the markets in which we operate; significant changes in discount rates and other assumptions used in the valuation of our pension plans; changes in tax laws, regulations and results of inspections by various tax authorities; our ability to successfully defend our intellectual property rights and the ability or willingness of our suppliers to provide adequate protection against third party intellectual property or product liability claims; the outcome of any pending or future litigation and patent disputes; our ability to access financing to achieve strategic objectives and growth due to changes in the capital and credit markets; limitations in our operations that could arise from compliance with the debt covenants in our credit facilities; our ability to retain key employees; increased compliance with changing laws and regulations potentially affecting our operating results; failure to adequately protect our information systems from cyber-attacks; the effect of the announcement of our review of strategic alternatives; and the volatility of our stock price due to our results or market trends.

CONTACT:

Imation Corp.

Scott Robinson, 651-704-4311

srobinson@imation.com

Shareholder Update Leadership Enhancements Acquisition of Connected Data Restructuring Update October 14, 2015

Imation Corporate Overview Bob Fernander named Interim CEO of Imation Imation has acquired Connected Data Emerging enterprise-class, private cloud sync and share company Flagship product, the Transporter, is a mobile data infrastructure device that exists as a secure enterprise alternative to Dropbox The acquisition of Connected Data enhances the corporate leadership and enterprise value potential of Imation’s Storage Businesses Corporate-wide restructuring plan is being executed and expected to be mainly complete by January 1, 2016, with a target completion by February 2016 Executive Summary

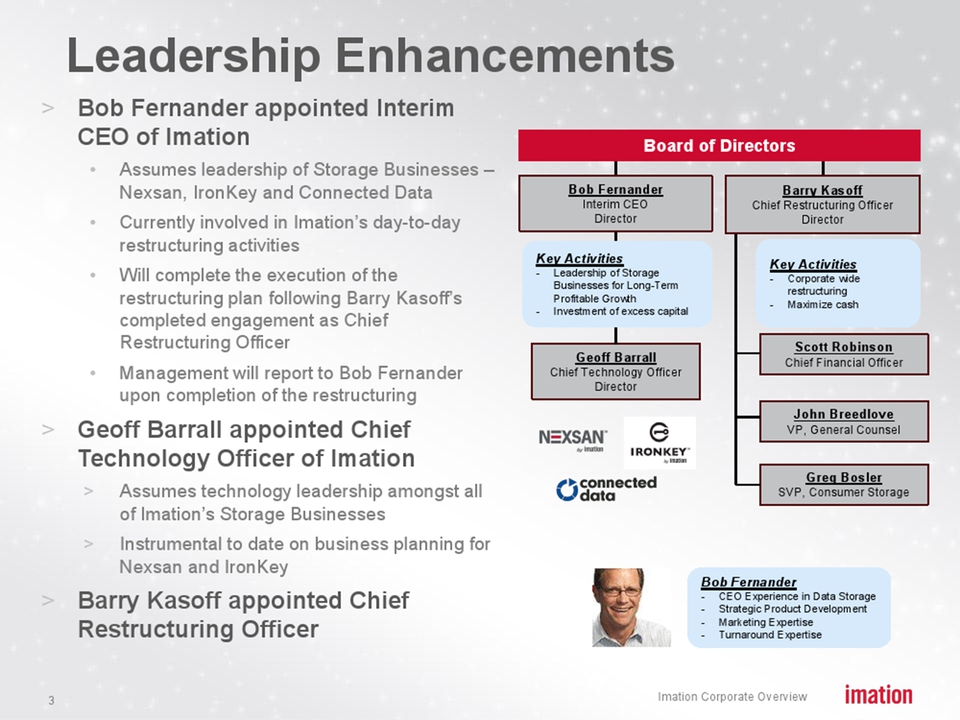

Imation Corporate Overview Bob Fernander appointed Interim CEO of Imation Assumes leadership of Storage Businesses Nexsan, IronKey and Connected Data Currently involved in Imation’s day-to-day restructuring activities Will complete the execution of the restructuring plan following Barry Kasoff’s completed engagement as Chief Restructuring Officer Management will report to Bob Fernander upon completion of the restructuring Geoff Barrall appointed Chief Technology Officer of Imation Assumes technology leadership amongst all of Imation’s Storage Businesses Instrumental to date on business planning for Nexsan and IronKey Barry Kasoff appointed Chief Restructuring Officer Leadership Enhancements Geoff Barrall Chief Technology Officer Director Scott Robinson Chief Financial Officer John Breedlove VP, General Counsel Greg Bosler SVP, Consumer Storage Bob Fernander CEO Experience in Data Storage Strategic Product Development Marketing Expertise Turnaround Expertise Board of Directors Barry Kasoff Chief Restructuring Officer Director Bob Fernander Interim CEO Director Key Activities Corporate wide restructuring Maximize cash Key Activities -Leadership of Storage Businesses for Long-Term Profitable Growth Investment of excess capital

Imation Corporate Overview Founded in 2012 by CEO Geoff Barrall, Connected Data produces the Transporter, an enterprise-class, private cloud sync and share appliance The Transporter is a mobile data infrastructure device that exists as a secure, on-premise, enterprise alternative to Dropbox Patented technology that comprises the method for delivering cloud services without the expense or security compromises of the cloud Connected Data projects $7 million in standalone revenues for 2016, and is accretive to Imation Introduction to Connected Data

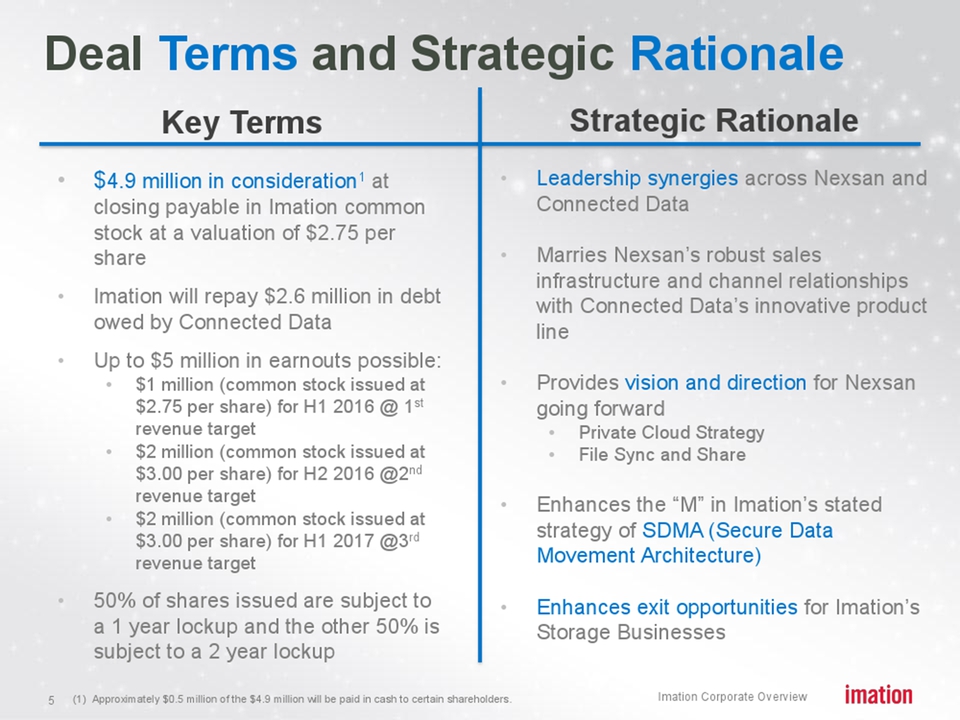

Imation Corporate Overview Deal Terms and Strategic Rationale Key Terms $4.9 million in consideration1 at closing payable in Imation common stock at a valuation of $2.75 per share Imation will repay $2.6 million in debt owed by Connected Data Up to $5 million in earnouts possible: $1 million (common stock issued at $2.75 per share) for H1 2016 @ 1st revenue target $2 million (common stock issued at $3.00 per share) for H2 2016 @2nd revenue target $2 million (common stock issued at $3.00 per share) for H1 2017 @3rd revenue target 50% of shares issued are subject to a 1 year lockup and the other 50% is subject to a 2 year lockup Strategic Rationale Leadership synergies across Nexsan and Connected Data Marries Nexsan’s robust sales infrastructure and channel relationships with Connected Data’s innovative product line Provides vision and direction for Nexsan going forward Private Cloud Strategy File Sync and Share Enhances the “M” in Imation’s stated strategy of SDMA (Secure Data Movement Architecture) Enhances exit opportunities for Imation’s Storage Businesses (1) Approximately $0.5 million of the $4.9 million will be paid in cash to certain shareholders.

Imation Corporate Overview The Connected Data Leadership Team Geoff Barrall Chief Executive Officer Mark Herbert VP of Engineering Gene Spies Chief Financial Officer Russ Johnson Chief Operating Officer Doug O’Shaughnessy VP of Customer Service Geraldine Osman VP of Marketing

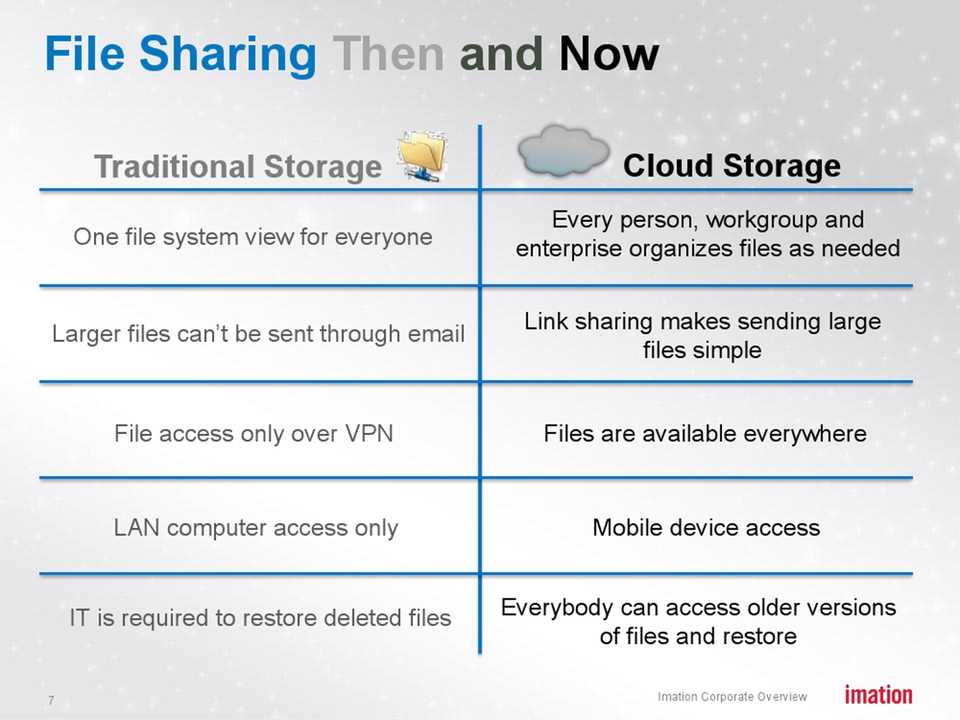

Imation Corporate Overview One file system view for everyone File Sharing Then and Now Every person, workgroup and enterprise organizes files as needed Traditional Storage Cloud Storage Larger files can’t be sent through email File access only over VPN IT is required to restore deleted files LAN computer access only Mobile device access Everybody can access older versions of files and restore Files are available everywhere Link sharing makes sending large files simple

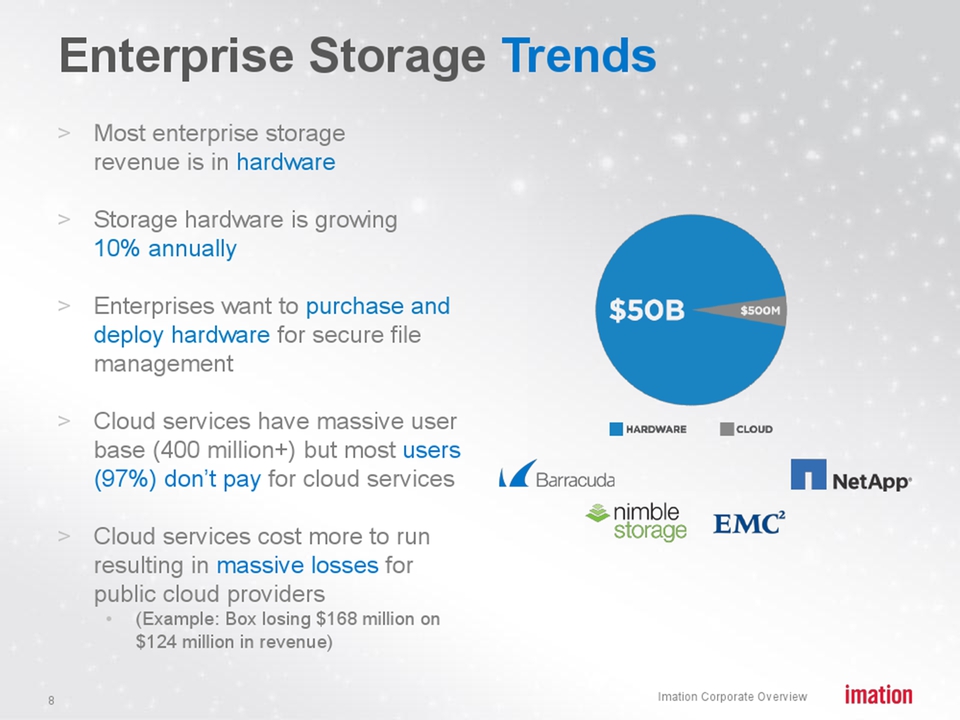

Imation Corporate Overview Enterprise Storage Trends Most enterprise storage revenue is in hardware Storage hardware is growing 10% annually Enterprises want to purchase and deploy hardware for secure file management Cloud services have massive user base (400 million+) but most users (97%) don’t pay for cloud services Cloud services cost more to run resulting in massive losses for public cloud providers (Example: Box losing $168 million on $124 million in revenue)

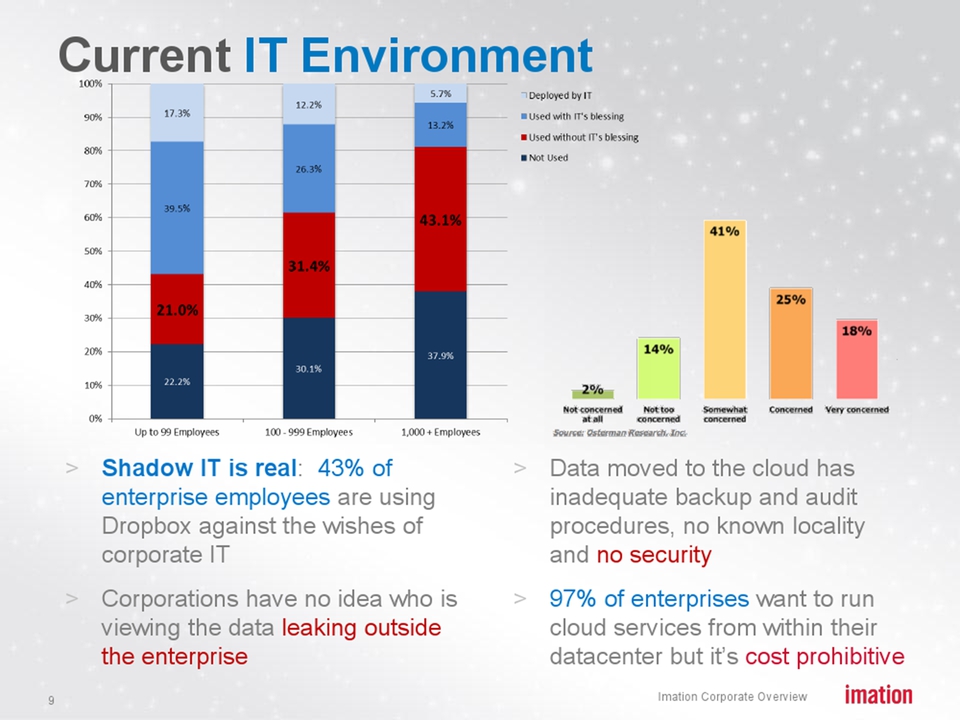

Imation Corporate Overview Current IT Environment Shadow IT is real: 43% of enterprise employees are using Dropbox against the wishes of corporate IT Corporations have no idea who is viewing the data leaking outside the enterprise Data moved to the cloud has inadequate backup and audit procedures, no known locality and no security 97% of enterprises want to run cloud services from within their datacenter but it’s cost prohibitive 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Up to 99 Employees 100 – 999 Employees 1,000 + Employees Deployed by IT Used with IT’s blessing Used without IT’s blessing Not Used 17.3% 39.5% 21.0% 22.2% 12.2% 26.3% 31.4% 30.1% 5.7% 13.2% 43.1% 37.9% 2% 14% 41% 25% 18% Not concerned at all Not too concerned Somewhat concerned Concerned Very concerned

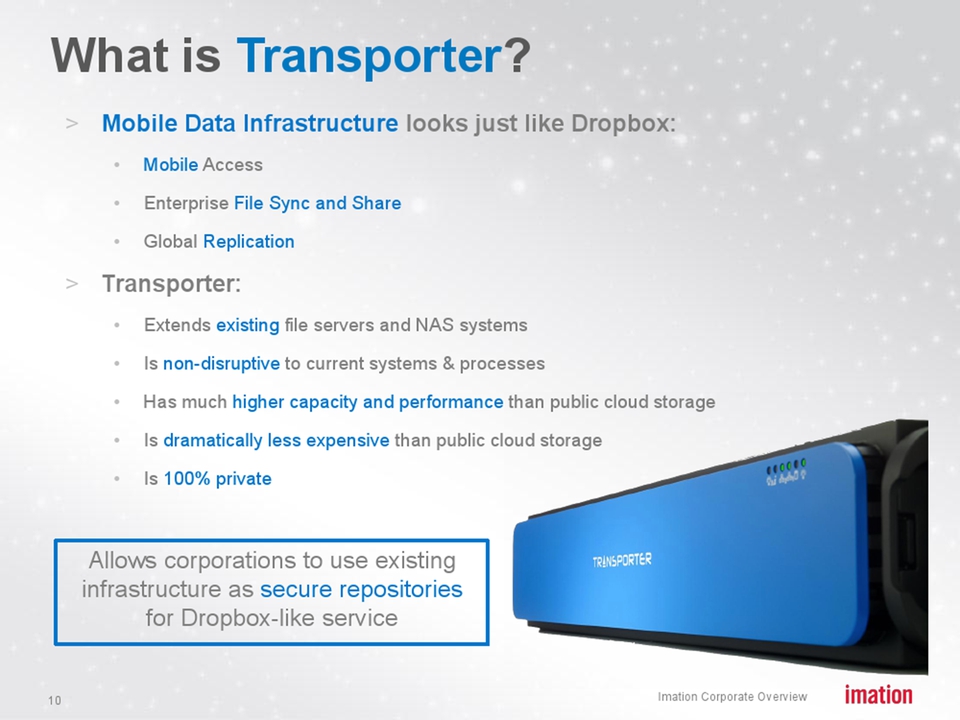

Imation Corporate Overview What is Transporter? Mobile Data Infrastructure looks just like Dropbox: Mobile Access Enterprise File Sync and Share Global Replication Transporter: Extends existing file servers and NAS systems Is non-disruptive to current systems & processes Has much higher capacity and performance than public cloud storage Is dramatically less expensive than public cloud storage Is 100% private Allows corporations to use existing infrastructure as secure repositories for Dropbox-like service

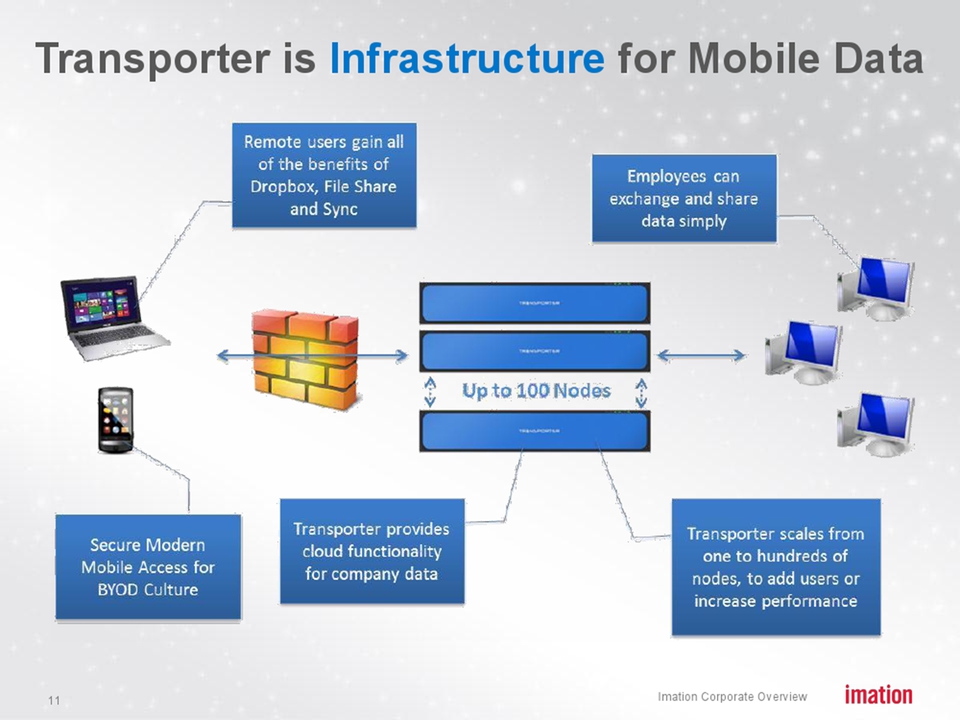

Imation Corporate Overview Transporter is Infrastructure for Mobile Data Remote users gain all of the benefits of Dropbox, File Share and Sync Employees can exchange and share date simply Up to 100 Nodes Secure Modern Mobile Access for BYOD Culture Transporter provides cloud functionality for company data Transporter scales from one to hundreds of nodes, to add users or increase performance

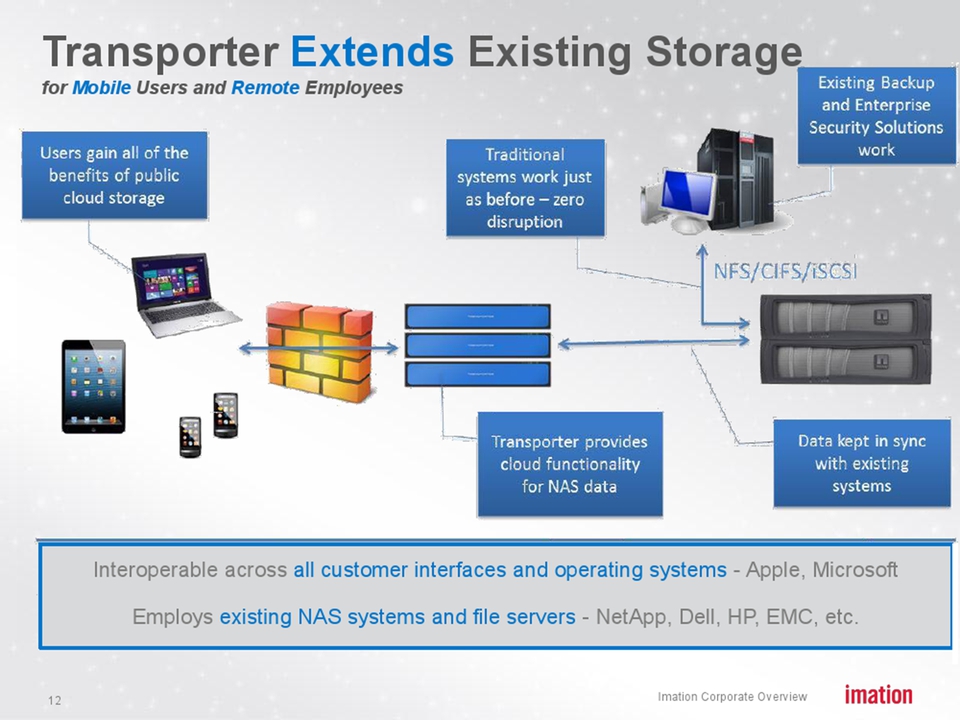

Imation Corporate Overview Transporter Extends Existing Storage for Mobile Users and Remote Employees Interoperable across all customer interfaces and operating systems - Apple, Microsoft Employs existing NAS systems and file servers - NetApp, Dell, HP, EMC, etc. Users gain all of the benefits of public cloud storage Traditional systems work just as before – zero disruption Existing Backup and Enterprise Security Solutions work Transporter provides cloud functionality for NAS data Data kept in sync with existing systems

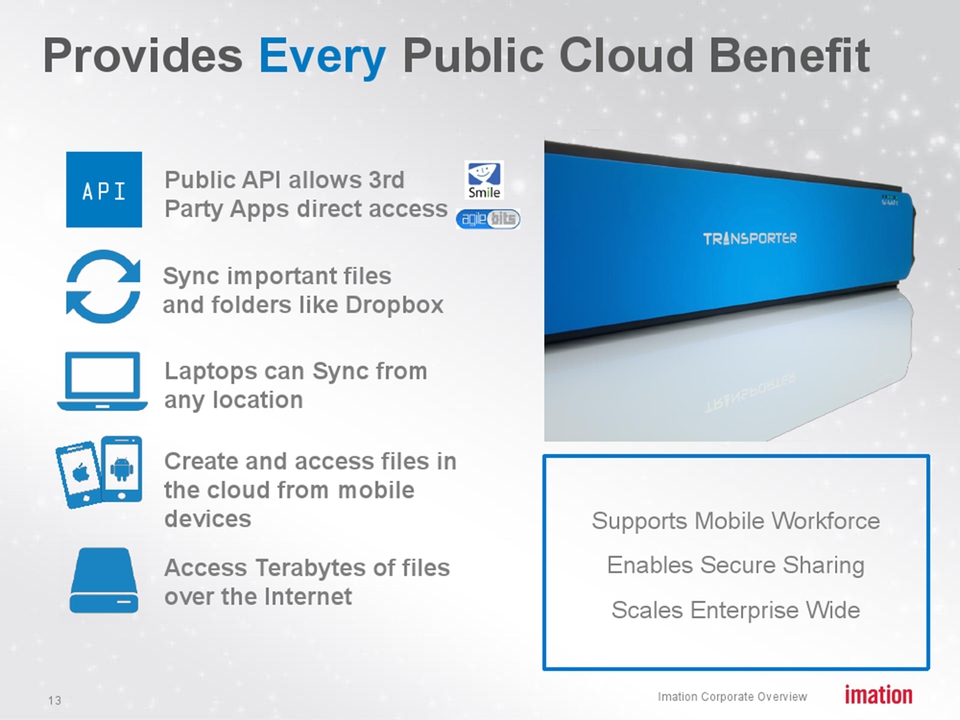

Imation Corporate Overview Provides Every Public Cloud Benefit Public API allows 3rd Party Apps direct access API Sync important files and folders like Dropbox Laptops can Sync from any location Create and access files in the cloud from mobile devices Access Terabytes of files over the Internet Supports Mobile Workforce Enables Secure Sharing Scales Enterprise Wide Imation Corporate Overview

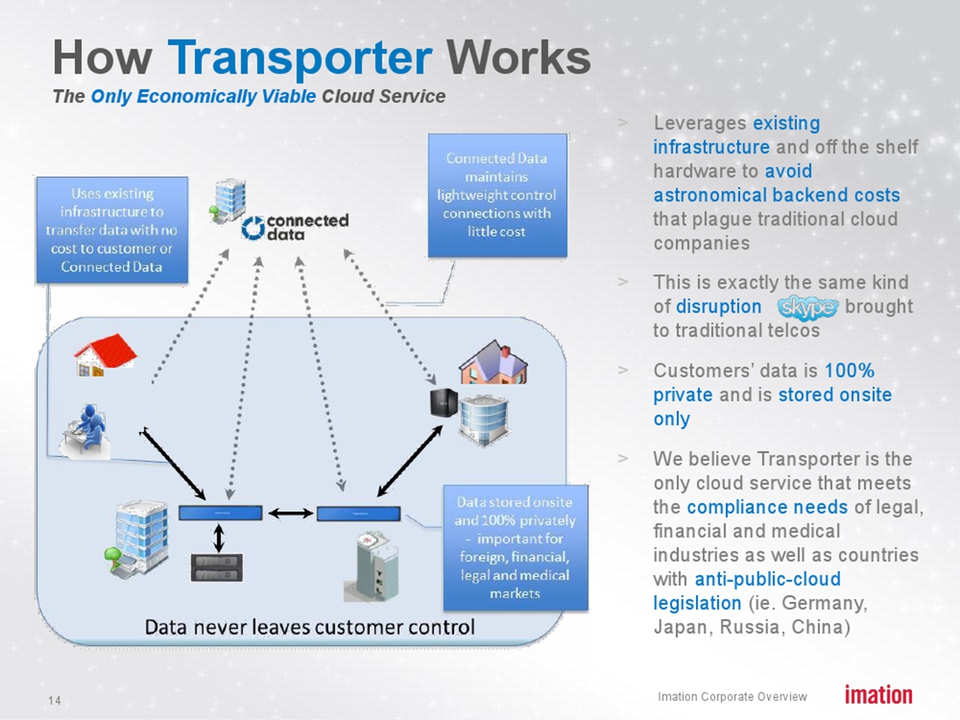

How Transporter Works The Only Economically Viable Cloud Service Leverages existing infrastructure and off the shelf hardware to avoid astronomical backend costs that plague traditional cloud companies This is exactly the same kind of disruption brought to traditional telcos Customers’ data is 100% private and is stored onsite only We believe Transporter is the only cloud service that meets the compliance needs of legal, financial and medical industries as well as countries with anti-public-cloud legislation (ie. Germany, Japan, Russia, China) Uses existing infrastructure to transfer data with no cost to customer or Connected Data connected data Connected Data maintains lightweight control connections with little cost Data never leaves customer control Data stored onsite and 100% privately – important for foreign, financial, legal and medical markets Skype

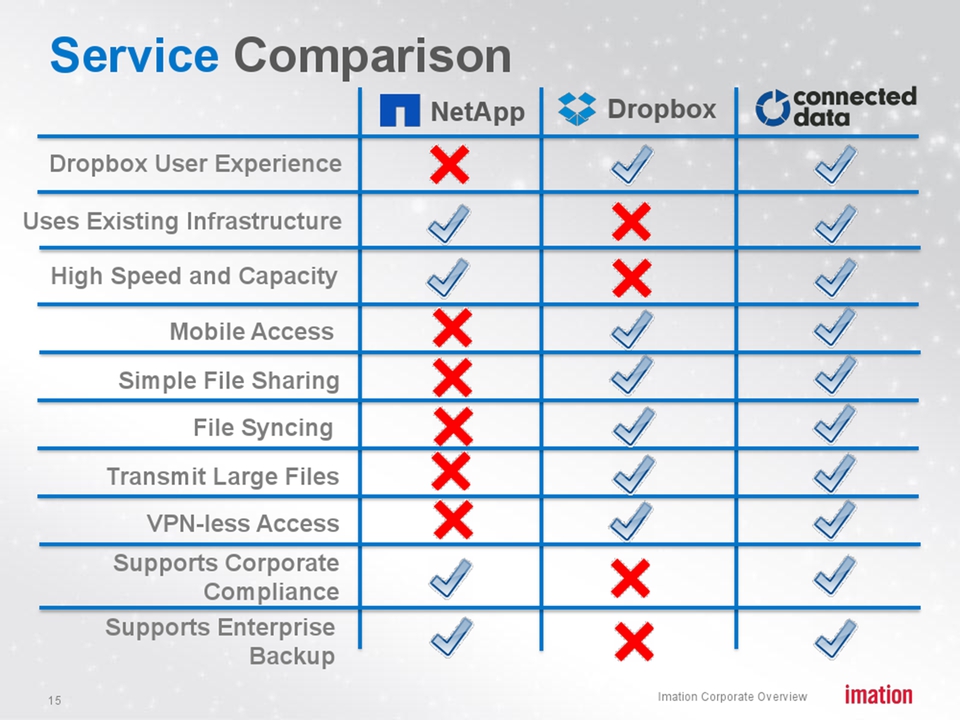

Imation Corporate Overview Service Comparison Dropbox NetApp Mobile Access Uses Existing Infrastructure High Speed and Capacity File Syncing Simple File Sharing Transmit Large Files Supports Corporate Compliance Supports Enterprise Backup Dropbox User Experience VPN-less Access

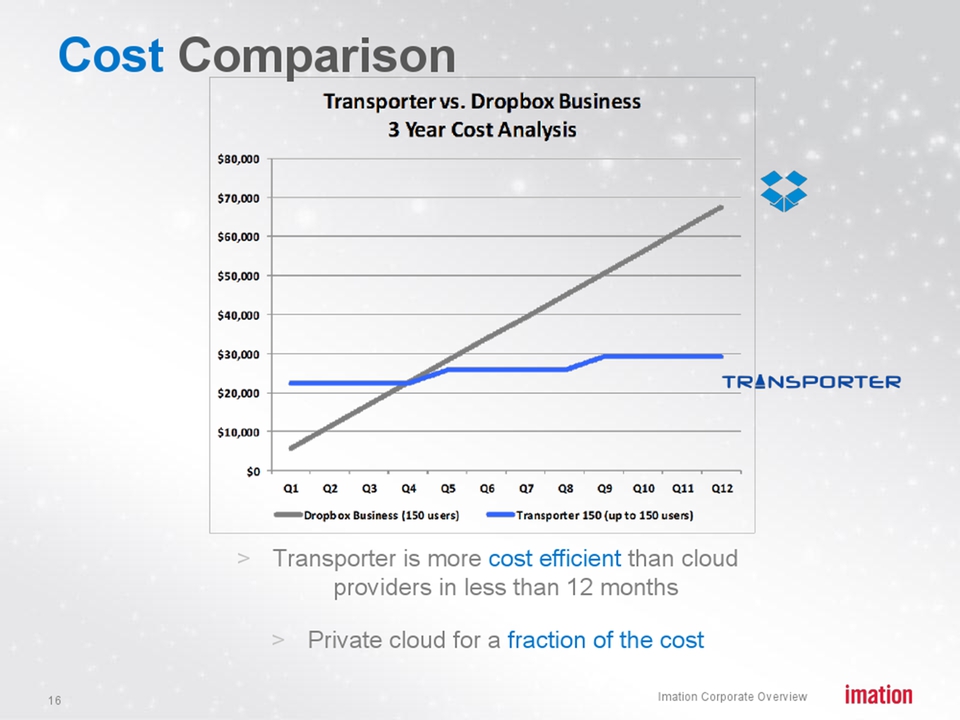

Imation Corporate Overview Cost Comparison Transporter is more cost efficient than cloud providers in less than 12 months Private cloud for a fraction of the cost Transporter vs. Dropbox Business 3 Year Cost Analysis $80,000 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 40 Q1 Q2 Q3 Q4 Q5 Q6 Q7 Q8 Q9 Q10 Q11 Q12 Dropbox Business (150 users) Transporter 150 (up to 150 users)

Imation Corporate Overview Progress So Far Over 130 enterprise systems installed AEC, Financial, Legal and Medical are largest verticals 12,500 total Transporters worldwide Over 20 global channel partners with active trials in progress Partners contributing 2-3 opportunities weekly Over 300 Qualified Opportunities being developed

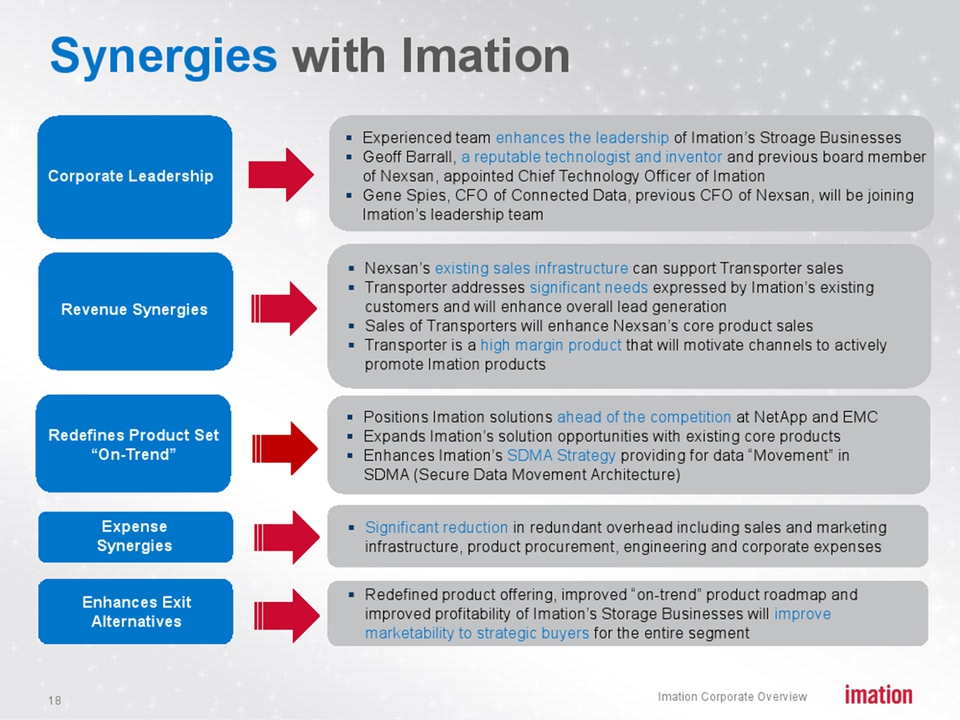

Imation Corporate Overview Synergies with Imation Corporate Leadership Revenue Synergies Redefines Product Set “On-Trend” Enhances Exit Alternatives Experienced team enhances the leadership of Imation’s Stroage Businesses Geoff Barrall, a reputable technologist and inventor and previous board member of Nexsan, appointed Chief Technology Officer of Imation Gene Spies, CFO of Connected Data, previous CFO of Nexsan, will be joining Imation’s leadership team Nexsan’s existing sales infrastructure can support Transporter sales Transporter addresses significant needs expressed by Imation’s existing customers and will enhance overall lead generation Sales of Transporters will enhance Nexsan’s core product sales Transporter is a high margin product that will motivate channels to actively promote Imation products Positions Imation solutions ahead of the competition at NetApp and EMC Expands Imation’s solution opportunities with existing core products Enhances Imation’s SDMA Strategy providing for data “Movement” in SDMA (Secure Data Movement Architecture) Redefined product offering, improved “on-trend” product roadmap and improved profitability of Imation’s Storage Businesses will improve marketability to strategic buyers for the entire segment Expense Synergies Significant reduction in redundant overhead including sales and marketing infrastructure, product procurement, engineering and corporate expenses

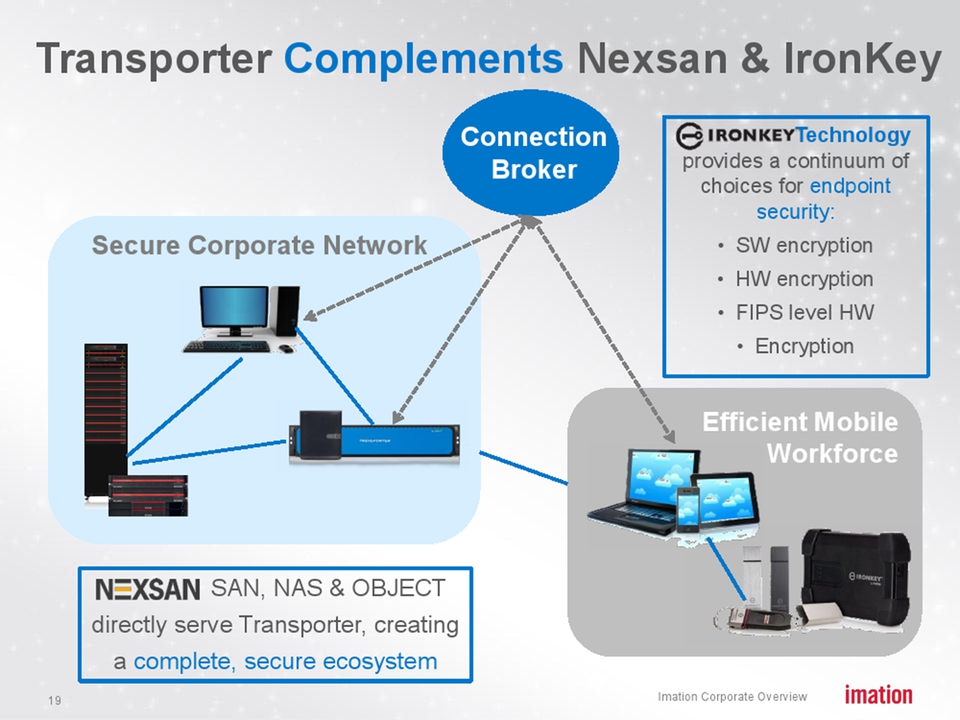

Imation Corporate Overview Transporter Complements Nexsan & IronKey SAN, NAS & OBJECT directly serve Transporter, creating a complete, secure ecosystem Technology provides a continuum of choices for endpoint security: SW encryption HW encryption FIPS level HW Encryption Secure Corporate Network Efficient Mobile Workforce Connection Broker

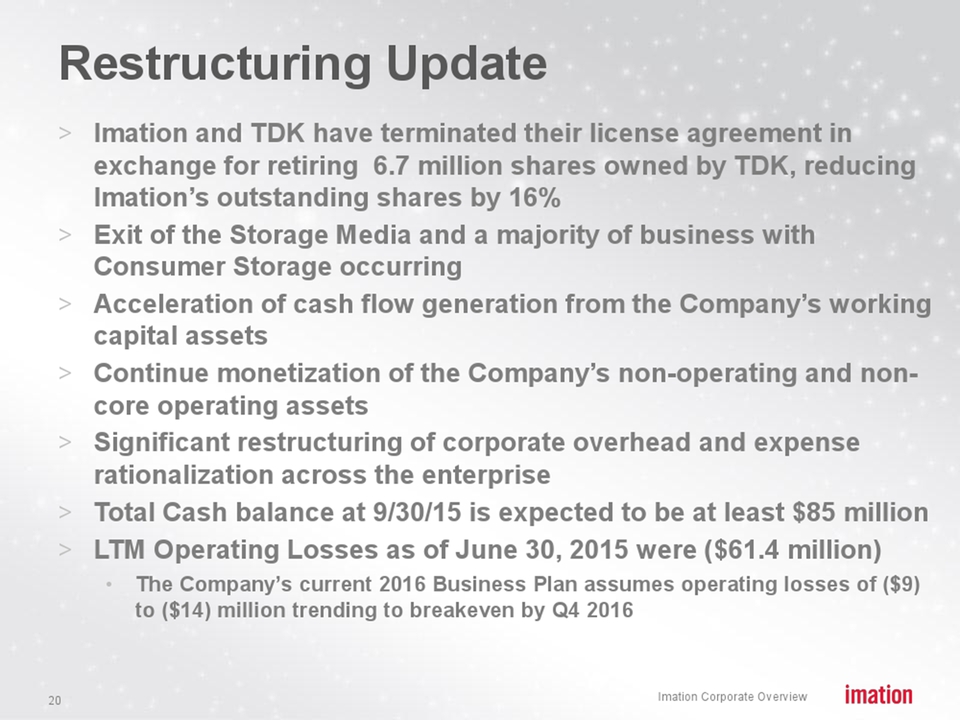

Imation Corporate Overview Imation and TDK have terminated their license agreement in exchange for retiring 6.7 million shares owned by TDK, reducing Imation’s outstanding shares by 16% Exit of the Storage Media and a majority of business with Consumer Storage occurring Acceleration of cash flow generation from the Company’s working capital assets Continue monetization of the Company’s non-operating and non-core operating assets Significant restructuring of corporate overhead and expense rationalization across the enterprise Total Cash balance at 9/30/15 is expected to be at least $85 million LTM Operating Losses as of June 30, 2015 were ($61.4 million) The Company’s current 2016 Business Plan assumes operating losses of ($9) to ($14) million trending to breakeven by Q4 2016 Restructuring Update

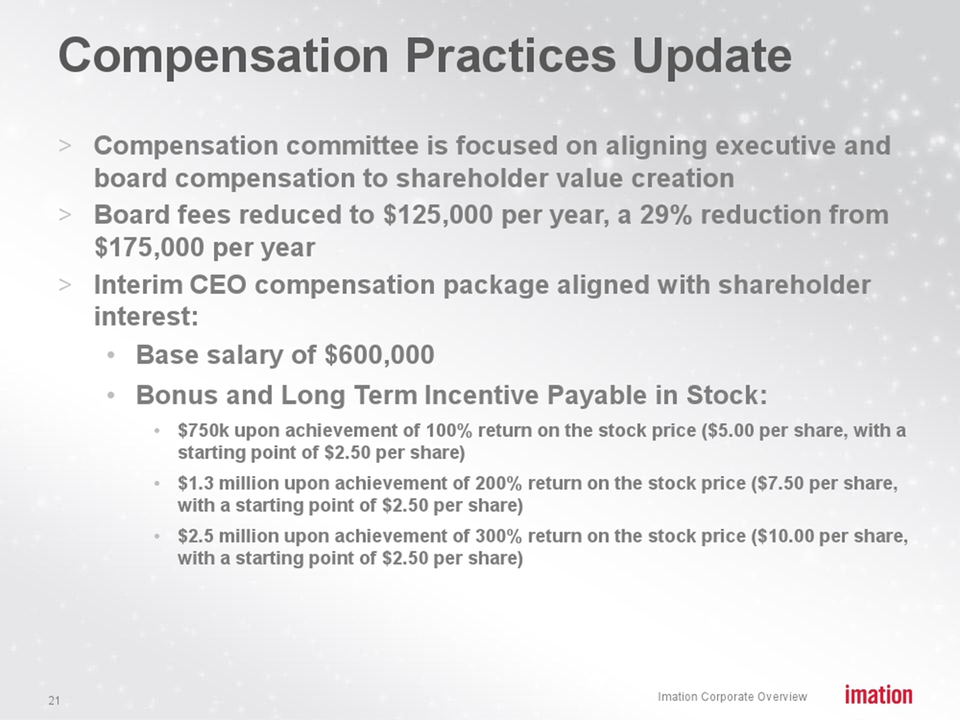

Imation Corporate Overview Compensation committee is focused on aligning executive and board compensation to shareholder value creation Board fees reduced to $125,000 per year, a 29% reduction from $175,000 per year Interim CEO compensation package aligned with shareholder interest: Base salary of $600,000 Bonus and Long Term Incentive Payable in Stock: $750k upon achievement of 100% return on the stock price ($5.00 per share, with a starting point of $2.50 per share) $1.3 million upon achievement of 200% return on the stock price ($7.50 per share, with a starting point of $2.50 per share) $2.5 million upon achievement of 300% return on the stock price ($10.00 per share, with a starting point of $2.50 per share) Compensation Practices Update

Imation Corporate Overview Certain information contained in this press release which does not relate to historical financial information may be deemed to constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties that could cause our actual results in the future to differ materially from our historical results and those presently anticipated or projected. We wish to caution investors not to place undue reliance on any such forward-looking statements. Any forward-looking statements speak only as of the date on which such statements are made, and we undertake no obligation to update such statements to reflect events or circumstances arising after such date. Risk factors include various factors set forth from time to time in our filings with the Securities and Exchange Commission including the following: Our ability to successfully implement our strategy; our ability to grow our business in new products with profitable margins and the rate of revenue decline for certain existing products; our ability to meet future revenue growth, gross margin and earnings targets; the ability to quickly develop, source, introduce and deliver differentiated and innovative products; our potential dependence on third parties for new product introductions or technologies in order to introduce our own new products; our ability to successfully implement restructuring plans; foreign currency fluctuations; the ready availability and price of energy and key raw materials or critical components including the effects of natural disasters and our ability to pass along raw materials price increases to our customers; continuing uncertainty in global and regional economic conditions; our ability to identify, value, integrate and realize the expected benefits from any acquisition which has occurred or may occur in connection with our strategy; the possibility that our goodwill and intangible assets or any goodwill or intangible assets that we acquire may become impaired; the ability of our security products to withstand cyber-attacks; the loss of a major customer, partner or reseller; changes in European law or practice related to the imposition or collectability of optical levies; the seasonality and volatility of the markets in which we operate; significant changes in discount rates and other assumptions used in the valuation of our pension plans; changes in tax laws, regulations and results of inspections by various tax authorities; our ability to successfully defend our intellectual property rights and the ability or willingness of our suppliers to provide adequate protection against third party intellectual property or product liability claims; the outcome of any pending or future litigation and patent disputes; our ability to access financing to achieve strategic objectives and growth due to changes in the capital and credit markets; limitations in our operations that could arise from compliance with the debt covenants in our credit facilities; our ability to retain key employees; increased compliance with changing laws and regulations potentially affecting our operating results; failure to adequately protect our information systems from cyber-attacks; the effect of the announcement of our review of strategic alternatives; the effect of the transition of our Board of Directors; and the volatility of our stock price due to our results or market trends. Risks and Uncertainties