Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HAWAIIAN ELECTRIC INDUSTRIES INC | heiform8-k10x08x15.htm |

HEI Exhibit 4

AMENDMENT NO. 1

Dated as of October 8, 2015

to

LOAN AGREEMENT

Dated as of May 2, 2014

THIS AMENDMENT NO. 1 (this “Amendment”) is made as of October 8, 2015 by and among Hawaiian Electric Industries, Inc., a Hawaii corporation (the “Borrower”), the financial institutions listed on the signature pages hereof and The Bank of Tokyo-Mitsubishi UFJ, Ltd., as administrative agent (the “Administrative Agent”), under that certain Loan Agreement dated as of May 2, 2014 by and among the Borrower, the Lenders and the Administrative Agent (as amended, restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Loan Agreement”). Capitalized terms used herein and not otherwise defined herein shall have the respective meanings given to them in the Loan Agreement.

WHEREAS, the Borrower has requested that the Lenders and the Administrative Agent agree to certain amendments to the Loan Agreement;

WHEREAS, the Borrower, the Lenders and the Administrative Agent have so agreed on the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the premises set forth above, the terms and conditions contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Borrower, the Lenders party hereto and the Administrative Agent hereby agree to enter into this Amendment.

1.Amendments to the Loan Agreement. Effective as of October 8, 2015 (the “Amendment No. 1 Effective Date”), including with respect to Eurodollar Loans for the Interest Period beginning on that date, but subject to the satisfaction of the conditions precedent set forth in Section 2 below, the parties hereto agree that the Loan Agreement is hereby amended as follows:

(a)Royal Bank of Canada is hereby removed as Syndication Agent and RBC Capital Markets is hereby removed as a Joint Lead Arranger and Joint Book Runner in respect of the credit facility evidenced by the Loan Agreement as amended hereby. Accordingly, the cover page of the Loan Agreement is hereby amended to delete the reference to Royal Bank of Canada as Syndication Agent and modify the reference to Joint Lead Arrangers and Joint Book Runners to read as follows: “THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., as Lead Arranger and Book Runner”.

(b)Section 1.01 of the Loan Agreement is hereby amended to insert or amend and restate, as applicable, the following definitions in their entirety in the appropriate alphabetical order to read as follows:

“Applicable Margin” means with respect to: (a) any Eurodollar Borrowing, 0.75% and (b) any ABR Borrowing, 0%.

“Capitalization” means, at any date of determination with respect to the Borrower on a non-consolidated basis, the sum of (a) Funded Debt, (b) preferred stock and (c) Common Stock Equity. The Borrower’s Capitalization as of December 31, 2014 is annexed hereto as Schedule 1.01 (Capitalization); for the avoidance of doubt, such Schedule is attached hereto for illustrative purposes only and is not intended to be a calculation of Capitalization on or for any subsequent date of determination.

“Current SEC Reports” means (a) the Annual Report of the Borrower to the SEC on Form 10K for the fiscal year ended December 31, 2014, (b) the Quarterly Reports of the Borrower to the SEC on Form 10-Q for the fiscal quarters ended March 31, 2015 and June 30, 2015 and (c) any current reports of the Borrower to the SEC on Form 8K filed prior to the Effective Date.

“Disclosed Matters” means the matters (a) disclosed in the current, periodic and annual reports and other publicly-available filings including exhibits filed by the Borrower or Significant Subsidiaries from time to time with the SEC pursuant to the requirements of the Securities Exchange Act of 1934 and the rules and regulations promulgated thereunder, including, without limitation, the NextEra Merger, the provisions of the NextEra Merger Agreement for replacement Indebtedness under Section 5.01(a)(x) thereof and for Repayment Debt under Sections 6.06 and 9.03 thereof and the spin-off of ASB Hawaii, Inc. contemplated by the NextEra Merger Agreement, or (b) disclosed by the Borrower to the Lenders (either directly or indirectly through the Administrative Agent) in writing.

“Financial Officer” means the Executive Vice President and Chief Financial Officer of the Borrower, the Treasurer of the Borrower and persons performing similar responsibilities regardless of title. As of the date of this Agreement, the Executive Vice President and Chief Financial Officer of the Borrower is James A. Ajello and the Interim Treasurer of the Borrower is Clifford H. Chen, and replacement or additional Financial Officers may be identified to the Administrative Agent from time to time in a writing signed by the President and Secretary of the Borrower.

“First Amendment Effective Date” means October 8, 2015.

“Lead Arranger” means The Bank of Tokyo-Mitsubishi UFJ, Ltd. in its capacity as lead arranger and book runner for the credit facility evidenced by this Agreement.

“Maturity Date” means October 6, 2017.

“NextEra” means NextEra Energy, Inc., a Florida corporation.

“NextEra Merger” means, collectively, the merger of NEE Acquisition Sub II, Inc. with and into the Borrower, with the Borrower being the surviving corporation, followed by the merger of the Borrower with and into NEE Acquisition Sub I, LLC, with NEE Acquisition Sub I, LLC being the surviving limited liability company, as provided for in the NextEra Merger Agreement.

“NextEra Merger Agreement” means the Agreement and Plan of Merger dated as of December 3, 2014, by and among NextEra, NEE Acquisition Sub I, LLC, a Delaware limited liability company, NEE acquisition Sub II, Inc., a Delaware corporation, and the Borrower as in effect on the First Amendment Effective Date.

2#

“Permitted Investments” means, at any time, investments as allowed in accordance with the HEI Cash Management Investment Guidelines dated May 5, 2015, as disclosed to the Administrative Agent prior to the Effective Date and as the same may be amended from time to time with the written consent of the Administrative Agent, such written consent not to be unreasonably delayed or withheld.

“Significant Subsidiary” means each of Hawaiian Electric, American Savings Bank, F.S.B., ASB Hawaii, Inc. and any other Subsidiary having 15% or more of the total assets, or 15% or more of the total operating income, of the Borrower and its Subsidiaries on a consolidated basis, in either case as the consolidated total assets and consolidated total operating income of the Borrower and its Subsidiaries are reflected in the most recent annual or quarterly report filed by the Borrower with the SEC.

(c)Section 1.02 of the Loan Agreement is hereby amended to (i) delete the word “and” immediately prior to clause (f) and (ii) to add a new clauses (g) and (h) immediately after the end of clause (f) thereof to read as follows:

, (g) the words “convert” or “conversion” when used with reference to a Loan mean a conversion of a Loan from one Type to another Type and (h) the words “continue” or “continuation” when used with reference to a Loan mean a continuation of any Eurodollar Loan as a Eurodollar Loan with the same or a different Interest Period.

(d)Section 2.07(c) of the Loan Agreement is hereby amended to add the following at the end of first sentence thereof:

, or in the case of each of clauses (i) and (ii), such later time as the Administrative Agent shall reasonably determine.

(e)Section 3.02(e) of the Loan Agreement is hereby amended and restated in its entirety to read as follows:

(e) If the Borrower fails to deliver a timely Interest Election Request prior to the end of the Interest Period applicable to a Eurodollar Borrowing, then, unless such Borrowing is repaid as provided herein, at the end of such Interest Period, such Borrowing shall be continued as a Eurodollar Borrowing with an Interest Period of one month’s duration. Notwithstanding any contrary provision hereof, if an Event of Default has occurred and is continuing and the Administrative Agent, at the request of the Required Lenders, so notifies the Borrower, then, so long as an Event of Default is continuing, (i) no outstanding Borrowing may be converted to or continued beyond the current Interest Period as a Eurodollar Borrowing, and (ii) unless repaid, each Eurodollar Borrowing shall be converted to an ABR Borrowing at the end of the Interest Period applicable thereto.

(f)Section 4.04 of the Loan Agreement is hereby amended to (i) replace the references in clause (a) thereof to “2013” with “2014” and (ii) amend and restate clause (b) thereof in its entirety to read as follows:

(b) As of the First Amendment Effective Date, except as set forth in the Disclosed Matters, since December 31, 2014, there has been no change or development that has had or would reasonably be expected to have a Material Adverse Effect.

(g)Section 4.06(a) of the Loan Agreement is hereby amended and restated in its

3#

entirety to read as follows:

(a) Except for Disclosed Matters, as of the First Amendment Effective Date there are no suits or proceedings pending, or to the knowledge of the Borrower threatened, against or affecting the Borrower or any of its Significant Subsidiaries which have had or could reasonably be expected to have a Material Adverse Effect.

(h)Section 4.11 of the Loan Agreement is hereby amended to amend and restate the last sentence thereof in its entirety to read as follows:

As of the First Amendment Effective Date, there is no fact known to the Borrower which has had or would reasonably be expected to have a Material Adverse Effect which has not been disclosed herein or in the Disclosed Matters.

(i)Section 4.16 of the Loan Agreement is hereby amended to amend and restate the fourth sentence thereof in its entirety to read as follows:

The Borrower and its Subsidiaries have implemented, or caused to be implemented, reasonable additional measures designed to ensure compliance by the Borrower, its Subsidiaries and their officers and employees with applicable U.S. Department of State Sanctions in all material respects.

(j)Section 6.07 of the Loan Agreement is hereby amended to delete the last sentence thereof in its entirety.

(k)Section 7.02 of the Loan Agreement is hereby amended to amend and restate clause (d) thereof in its entirety to read as follows:

(d) sell, assign, transfer, or otherwise dispose of the common stock of or other ownership interests ordinarily entitled to vote in the election of directors of any Significant Subsidiary, other than directors’ qualifying shares, provided. that after written notice to the Administrative Agent by the Borrower (which notice shall certify, that since the First Amendment Effective Date, the Borrower shall not, nor shall any other Significant Subsidiary, have sold, contributed or otherwise transferred any material assets to ASB Hawaii in anticipation of such distribution), all issued and outstanding shares of common stock of ASB Hawaii, Inc. may be distributed to Borrower’s shareholders up to thirty days prior to the date the NextEra Merger is expected to become effective as set forth in the NextEra Merger Agreement.

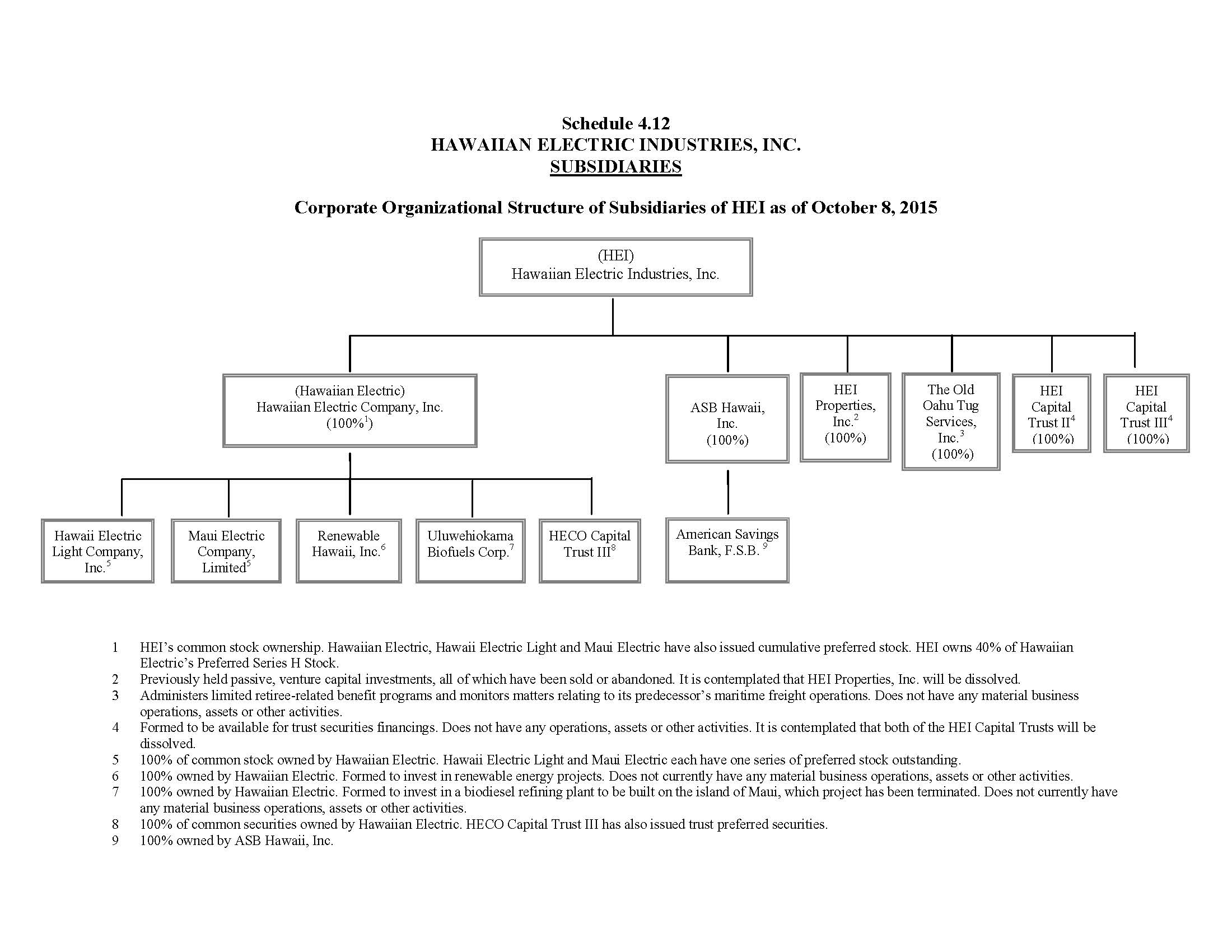

(l)Schedules 1.01, 2.01, 4.12 and 7.03 to the Loan Agreement are hereby replaced in their entirety with Schedules 1.01, 2.01, 4.12 and 7.03 attached hereto.

2.Conditions of Effectiveness. The effectiveness of this Amendment on the Amendment No. 1 Effective Date is subject to the conditions precedent that the Administrative Agent shall have received (i) counterparts of this Amendment duly executed by the Borrower, the Lenders and the Administrative Agent, (ii) payment and/or reimbursement of the Administrative Agent’s reasonable and documented out-of-pocket expenses (including, to the extent invoiced, the reasonable fees and expenses of counsel for the Administrative Agent) in connection with this Amendment, (iii) favorable written opinions (addressed to the Credit Parties and dated the Amendment No. 1 Effective Date) from (x) Goodsill Anderson Quinn & Stifel LLP and (y) Chester A. Richardson, Esq., Executive Vice President, General Counsel, Secretary and Chief Administrative Officer of the Borrower, (iv) a certificate of the

4#

secretary of Borrower certifying (a) that there have been no changes in the articles of incorporation or bylaws of Borrower since May 2, 2014 (or if changes have occurred, attaching the current articles of incorporation or bylaws), (b) resolutions of its board of directors authorizing the execution, delivery and performance of the Amendment, (c) to the extent modified from the incumbency and specimen signatures delivered to the Administrative Agent as of May 2, 2014, the incumbency and specimen signature of each of its officers authorized to sign this Amendment and (d) a certificate of good standing for the Borrower, dated on or immediately prior to the Amendment No. 1 Effective Date from the Director of the Department of Commerce and Consumer Affairs of the State of Hawaii and (v) such other documents, instruments and agreements as the Administrative Agent may reasonably request.

3.Representations and Warranties of the Borrower. The Borrower hereby represents and warrants as follows:

(a)This Amendment and the Loan Agreement as amended hereby constitute legal, valid and binding obligations of the Borrower, enforceable against the Borrower in accordance with their terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

(b)As of the date hereof and after giving effect to the terms of this Amendment, (i) no Default or Event of Default has occurred and is continuing and (ii) each of the representations and warranties contained in the Loan Agreement as amended hereby and the other Loan Documents is true, correct and complete.

4.Reference to and Effect on the Loan Agreement.

(a)Upon the effectiveness hereof, each reference in the Loan Agreement (including any reference to “this Agreement,” “hereunder,” “herein” or words of like import referring thereto) or in any other Loan Document shall mean and be a reference to the Loan Agreement as amended hereby.

(b)Except as specifically amended above, each Loan Document and all other documents, instruments and agreements executed and/or delivered in connection therewith shall remain in full force and effect and are hereby ratified and confirmed.

(c)The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or the Lenders, nor constitute a waiver of any provision of the Loan Agreement, any other Loan Document or any other documents, instruments and agreements executed and/or delivered in connection therewith.

(d)This Amendment is a “Loan Document” under (and as defined in) the Loan Agreement.

5.Governing Law. This Amendment shall be construed in accordance with and governed by the laws of the State of New York.

6.Headings. Section headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other purpose.

5#

7.Counterparts. This Amendment may be executed by one or more of the parties hereto on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Signatures delivered by facsimile or PDF shall have the same force and effect as manual signatures delivered in person.

[Signature Pages Follow]

6#

IN WITNESS WHEREOF, this Amendment has been duly executed as of the day and year first above written.

HAWAIIAN ELECTRIC INDUSTRIES, INC., as the Borrower

By:__/s/ James A. Ajello____________________

Name: James A. Ajello

Title: Executive Vice President and Chief Financial Officer

By:_/s/ Clifford H. Chen____________________

Name: Clifford H. Chen

Title: Interim Treasurer

Signature Page to Amendment No. 1 to

Loan Agreement

THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., as Administrative Agent and as a Lender

By:_/s/ Viet-Linh Fujitaki_____________________

Name: Viet-Linh Fujitaki

Title: Vice President

Signature Page to Amendment No. 1 to

Loan Agreement

U.S. BANK, NATIONAL ASSOCIATION, as a Lender

By:_/s/ Eric J. Cosgrove___________________

Name: Eric J. Cosgrove

Title: Vice President

Signature Page to Amendment No. 1 to

Loan Agreement

SCHEDULE 1.01

HAWAIIAN ELECTRIC INDUSTRIES, INC.

Funded Debt and Capitalization

(in thousands)

December 31, 2014 | Unconsolidated | Consolidated | |||||

Funded Debt: | |||||||

Notes payable to subsidiaries | $ | 7,857 | $ | — | |||

Short-term borrowings-other than bank | 118,972 | 118,972 | |||||

Long-term debt, net-other than bank | 300,000 | 1,506,546 | |||||

Total Funded Debt * | $ | 426,829 | $ | 1,625,518 | |||

Capitalization: | |||||||

Funded Debt | $ | 426,829 | $ | 1,625,518 | |||

Noncontrolling interest: Cumulative preferred stock of subsidiaries-not subject to mandatory redemption | — | 34,293 | |||||

Common stock equity ** | 1,818,806 | 1,818,806 | |||||

Total capitalization | $ | 2,245,635 | $ | 3,478,617 | |||

* | Excludes deposit liabilities, securities sold under agreements to repurchase and advances from Federal Home Loan Bank of Seattle. |

** Excludes accumulated other comprehensive loss of $27,378K.

Schedule 2.01

(HEI Loan Agreement)

Lender | Commitment | |

The Bank of Tokyo-Mitsubishi UFJ, Ltd. | $62,500,000 | |

U.S. Bank, National Association | $62,500,000 | |

Total | $125,000,000.00 | |

Schedule 7.03

HAWAIIAN ELECTRIC INDUSTRIES, INC.

EXISTING RESTRICTIONS

Pursuant to Section 7.03 of the Credit Agreement, the following restrictions and conditions exist on October 8, 2015:

1. | Hawaiian Electric Company, Inc. (“Hawaiian Electric”), Maui Electric Company, Ltd. (“Maui Electric”) and Hawaii Electric Light Company, Inc. (“Hawaii Electric Light”) are subject to restrictive covenants in connection with the offer and sale in March 2004 of Cumulative Quarterly Income Preferred Securities, as disclosed in the Registration Statements on Form S-3, Regis. Nos. 333-111073, 333-111073-01, 333-111073-02 and 333-111073-03 filed with the Securities and Exchange Commission (“SEC”), which descriptions are incorporated herein by reference. |

2. | Hawaiian Electric, Maui Electric and Hawaii Electric Light are subject to restrictive covenants in connection with their cumulative preferred stock financings to the effect that, until dividends have been paid or declared or set apart for payment on all shares of the respective company’s cumulative preferred stock, (a) no distributions on the respective company’s common stock or any future class of stock except cumulative preferred stock shall be made and (b) the respective company shall not purchase or otherwise acquire any of the respective company’s common stock or any future class of stock except cumulative preferred stock. In the event of liquidation, dissolution, receivership, bankruptcy, disincorporation or winding up of the affairs of the respective company, cumulative preferred stockholders are entitled to the par value of their shares and accrued and unpaid dividends, before any distribution is made to holders of the respective company’s common stock or any future class of stock except cumulative preferred stock. |

3. | Hawaiian Electric is subject to restrictive covenants in connection with its cumulative preferred stock financings to the effect that, as long as any shares of the respective series of cumulative preferred stock are outstanding, Hawaiian Electric shall not effect the merger or consolidation of Hawaiian Electric, or sell, lease or exchange all or substantially all of the property and assets of Hawaiian Electric without first obtaining the consent in writing of the holders of at least 75% of each of the respective outstanding series of cumulative preferred stock, provided that said consent shall not be required to make a mortgage, pledge, assignment or transfer of all or any part of its assets as security for any obligation or liability of any kind or nature. |

4. Hawaiian Electric, Maui Electric and Hawaii Electric Light are subject to restrictive covenants in connection with their special purpose revenue bonds which contain provisions to the effect that Hawaiian Electric, Maui Electric and Hawaii Electric Light shall not dissolve or otherwise dispose of all or substantially all of the respective company’s assets, and will not consolidate with or merge into another entity or permit other entities to consolidate with or merge into the respective company, unless certain specific requirements are met.

5. | Hawaiian Electric, Maui Electric and Hawaii Electric Light are subject to restrictive covenants in connection with their note purchase agreements dated as of April 19, 2012 and October 3, 2013 and Hawaiian Electric’s note purchase agreement dated as of September 13, 2012 (together the “Note Agreements”), pursuant to which several series of unsecured notes were issued in private placements. The Note Agreements contain a negative covenant that Hawaiian Electric will not permit the ratio of any Significant Subsidiaries’ Consolidated Subsidiary Funded Debt to Capitalization exceed a specified level, which restriction could operate indirectly to restrict the ability of Significant Subsidiaries to make Restricted Payments (as defined in Section 1.01 of the Credit Agreement) to Hawaiian Electric. Hawaiian Electric also entered into two similar note purchase agreements on each of the same April 19, 2013 and October 3, 2013 dates under which it is a “Guarantor” of Maui Electric (in two such agreements) and a Guarantor of Hawaii Electric Light (in two other such agreements). Each of these agreements contains similar negative covenants relating to the respective Consolidated Subsidiary Funded Debt to Capitalization ratios of Maui Electric and Hawaii Electric Light (as well as Hawaiian Electric) and their respective Significant Subsidiaries. The affirmative and negative restrictions are disclosed in the Current Reports on Form 8-K filed with the SEC on April 23, 2012, September 14, 2012 and October 7, 2013 and in the Quarterly Report on Form 10-Q filed with the SEC on November 7, 2013, which descriptions are incorporated herein by reference. |

6. | The NextEra Merger Agreement includes a negative covenant restricting the payment of dividends or the making of distributions by subsidiaries of the Company (including repurchases or redemptions of shares of such subsidiaries) other than (a) to any such subsidiary’s direct parent with declaration, record and payment dates in accordance with such subsidiary’s past practice, (b) regular quarterly cash dividends by the direct and indirect electric utility subsidiaries of the Company in respect of each such subsidiary’s shares of preferred stock and (c) the distribution of the shares of ASB Hawaii, Inc. that will comprise the spin‑off of ASB Hawaii, Inc. contemplated by the NextEra Merger Agreement. Following the spin‑off of ASB Hawaii, Inc., no further dividends will be payable to the Company directly by ASB Hawaii, Inc. or indirectly (through ASB Hawaii, Inc.) by American Savings Bank, F.S.B. |