Attached files

Exhibit 3.1

AMENDED AND RESTATED

ARTICLES OF INCORPORATION OF

EQUITY BANCSHARES, INC.

The original Articles of Incorporation of Equity Bancshares, Inc. were filed with the Secretary of the State of Kansas on August 23, 2002 and are hereby amended and restated to read in their entirety as follows:

ARTICLE I

NAME CF CORPORATION

The name of the corporation is Equity Bancshares, Inc. (the “Corporation”).

ARTICLE II

REGISTERED OFFICE AND AGENT

The address of the Corporation’s registered office in the State of Kansas is 120 W. Kansas, City of McPherson, McPherson County, Kansas 67460. The name of its registered agent at such address is Brett A. Reber.

ARTICLE III

GENERAL NATURE OF BUSINESS

The purpose of the Corporation is to engage in any lawful conduct or activity for which corporations maybe organized under the Kansas General Corporation Code.

ARTICLE IV

DURATION

The duration of the Corporation shall be perpetual.

ARTICLE V

CAPITAL STOCK

AUTHORIZED SHARES

1. The total number of shares of stock the Corporation has authority to issue shall be 20,000,000 shares, of which 10,000,000 shares shall be designated Preferred Stock (the “Preferred Stock”) and 10,000,000 shares shall be designated Common Stock, par value $0.01 per share (the “Common Stock”).

2. The relative rights, voting power, preferences and restrictions of the shares of each class of stock that arc fixed by these Amended and Restated Articles of Incorporation, and the express grant of authority to the Board of Directors of the Corporation to fix by resolution or resolutions certain rights, voting power, preferences and restrictions, arc as follows:

PREFERRED STOCK

3. Shares of Preferred Stock may be issued in one or more series at such time or times and for such consideration as the Board of Directors may determine- Each such series shall be given a distinguishing designation. All shares of any one series shall have preferences* limitations and relative rights identical with those of other shares of the same series and, except to the extent otherwise provided in the description of such series, with those of other shares of Preferred Stock.

4. The authority of the Board of Directors with respect to each series of Preferred Stock shall include, but not be limited to, determination of the following:

(a) The distinguishing designation and number of shares constituting that series, which number may (except where otherwise provided by the Board of Directors in creating such series) be increased or decreased from time to time by action of the Board of Directors;

1

(b) The dividend rate, if any, on the shares of that series, whether dividends shall be cumulative, and, if so, from, which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series over shares of any other series or over the Common Stock;

(c) The voting rights, if any, the shares of that series shall have, and the terms of such voting rights;

(d) Whether the shares of that series shall be convertible into or exchangeable for cash, shares of stock of any other class or any other series, indebtedness or other property or rights, including securities of another corporation or other entity, and, if so, the terms and conditions of such exchange or conversion, including the rate or rates of conversion, and whether such rate shall be a designated amount or an amount determined in accordance with a designated formula or by reference to extrinsic data or events, the date or dates upon or after which they shall be convertible or exchangeable, the duration for which they shall be convertible or exchangeable, the event or events upon or after which they shall be convertible or exchangeable, and whether they shall be convertible or exchangeable at the option of the Corporation, the stockholder or another person, and the method (if any) of adjusting the rate of conversion or exchange in the event of a stock split, stock dividend, combination of shares or similar event;

(e) Whether or not the shares of that series shall be redeemable and, if so, the terms and conditions of such redemption, including the date or dates upon or after which the shares of that series shall be. redeemable, whether they shall be redeemable at the option of the Corporation» the stockholder or another person, the amount per share payable in the event of redemption (which amount may vary under different conditions and at different redemption dates)» whether such amount shall be a designated amount or an amount determined in accordance with a designated formula or by reference to extrinsic data or events, and whether such amount shall be paid in cash, indebtedness, securities or other property or rights, including securities of any other corporation or entity;

(f) Whether that series shall have a retirement or sinking fund for the purchase or redemption of shares of that series, and if so, the terms and amount payable into such fend;

(g) The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative rights of priority, if any, of payment of shares of that series over shares of any other series or over the Common Stock;

(h) Whether the issuance of any additional shares of such series, or of any shares of any other series, shall be subject to restrictions as to issuance, or as to the powers, preferences or rights of any such other series; and

(i) Any other preferences, powers, privileges, and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, of the shares of that series, as the Board of Directors may deem advisable and as shall not be inconsistent with these Amended and Restated Articles of Incorporation, the Kansas General Corporation Code or any other applicable law.

COMMON STOCK

5. Except as provided in Section 5 of Article VI of these Amended and Restated Articles of Incorporation, the holders of Common Stock shall be entitled to one vote per share on all matters to be voted on by the stockholders of the Corporation.

6. To the extent permitted under the Kansas General Corporation Code and -subject to the provisions of the Preferred Stock, the holders of Common Stock shall be entitled to participate ratably on a per share basis in the payment of dividends, whether in cash, property or securities of the Corporation, when and as declared thereon by the Board of Directors.

2

7. Subject to the provisions of the Preferred Stock, the holders of Common Stock shall be entitled to participate ratably on a per share basis in all distributions to the holders of Common Stock in any liquidation dissolution or winding up of the Corporation.

ARTICLE VI

ACTION BY STOCKHOLDERS

1. Any action required or permitted to be taken by the stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders of the Corporation and may not be effected, by any consent in writing by such stockholders/Meetings of stockholders may be held within or without the State of Kansas, as the bylaws of the Corporation may provide.

2. The books of the Corporation may be kept outside the State of Kansas at such place or places as may be designated from time to time by the Board of Directors or in the bylaws of the Corporation, Stockholders shall have the right to inspect the books and records of the Corporation to the extent and in the manner provided by Kansas law, and, as permitted thereunder, such right is subject to reasonable restrictions as may be determined by the Board of Directors or the officers of the Corporation from time to time with respect to any request for such inspection.

3. Except as otherwise required by law and subject to the right of holders of Preferred Stock then outstanding, special meetings of stockholders may be called by the President of the Corporation or by or at the direction of a majority of the Board of Directors, and shall be called by the Chairman of the Board, the President or the Secretary upon the written request of the holders of not less than twenty percent (20 %) of all of the outstanding shares of capital stock of the Corporation entitled to vote at such special meeting. The business transacted at a special meeting of stockholders shall be limited to that stated in the notice of such meeting or in a duly executed waiver thereof.

4. Except as otherwise provided by these Amended and Restated Articles of Incorporation or as otherwise required by any applicable law, and subject to the rights of the holders of any Preferred Stock then outstanding, all of the shares of the capital stock of the Corporation entitled to vote on a matter shall vote on such matter together as a single class.

5. Except as otherwise required by applicable law or regulation and subject to the provisions of the Preferred Stock, stockholders shall not have cumulative voting rights with respect to the election of directors.

6. Except as may otherwise be required by applicable law or regulation, or be expressly authorized by the entire Board of Directors, a stockholder may make a nomination or nominations for Director of the Corporation at an annual meeting of stockholders or may bring up any other matter for consideration and action by the stockholders at an annual meeting of stockholders, only if the provisions of subsections A, Bf C and D hereto shall have been satisfied. If such provisions shall not have been satisfied, any nomination sought to be made or other business sought to be presented by such stockholder for consideration and action by the stockholders at such a meeting shall be deemed not properly brought before the meeting, shall be ruled by the Chairman of the meeting to be but of Order, and shall not be presented or acted upon at the meeting.

A. Such stockholder must be a stockholder of record on the record date for such annual meeting, must continue to be a stockholder of record at the time of such meeting, and must be entitled to vote on such matter so presented.

B. Such stockholder must deliver or cause to be delivered a written notice to the Secretary of the Corporation. Such notice must be received by the Secretary no less than one hundred twenty (120) days prior to the day corresponding to the date on which the Corporation released its proxy statement in connection with the previous year’s annual meeting; provided, however, that if the date of the annual meeting has been changed by more than thirty (30) days from the date of the previous year’s annual meeting, such notice must be received by the Secretary a reasonable time prior to the time at which notice of such meeting is delivered to the stockholders. The notice shall specify (a) the name and address of the

3

stockholder as they appear oil the books of the Corporation, (b) the class and number of shares of the Corporation which are beneficially owned by the stockholder; (c) any material interest of the stockholder in the proposed business described in the notice; (d) if such business is a nomination for director» each nomination sought to be made, together with the reasons for each nomination, a description of the qualifications and business or professional experience of each proposed nominee and a statement signed by each nominee indicating his or her willingness to serve if elected, and disclosing the information about such stockholder that would be required by the Securities Exchange Act of 1934, as amended (the “1934 Act”), and the rules and regulations promulgated thereunder, to be disclosed in the proxy materials for the meeting involved if such stockholder were a nominee of the Corporation for election as one of its directors; (e) if such business is other than a nomination for director, the nature of the business, the reasons why it is sought to be raised and submitted for a vote of the stockholders and if and why it is deemed by such stockholder to be beneficial to the Corporation, and (f) if so requested by the Corporation, all other information that would be required to be filed with the Securities and Exchange Commission if, with respect to the business proposed to be brought before the meeting, the person proposing such business was a participant in a solicitation subject to Section 14 of the 1934 Act.

C. Notwithstanding satisfaction of the provisions of subsection A and subsection B, the proposed business described in the notice may be deemed not to be properly brought before the meeting if, pursuant to state law or any rule or regulation of the Securities and Exchange Commission, it was offered as a stockholder proposal and was omitted, or had it been so offered, it could have been omitted, from the notice of, and proxy material for, the meeting (or any supplement thereto) authorized by the Board of Directors.

D. In the event such notice is timely given pursuant to subsection B and the business described therein is not disqualified pursuant to subsection C, such business may be presented by, and only by, the stockholder who shall have given the notice required by subsection A or a representative of such stockholder.

ARTICLE VII

NUMBER, CLASSIFICATION AND ELECTION OF DIRECTORS; VACANCIES

1. The number of Directors constituting the entire Board of Directors shall be neither less than three (3) nor more than nine (9). Subject to the rights of the holders of any Preferred Stock then outstanding, the specific number of Directors within such minimum and maximum shall be authorized from time to time by, and only by, resolution duly adopted by a majority of the total number of Directors then constituting the entire Board of Directors.

2. At the first annual meeting of stockholders following the adoption of these Amended, and Restated Articles of Incorporation by the stockholders of the Corporation, the Board of Directors shall be divided into three (3) classes, designated Class I, Class II and Class III. Each class shall consist, as nearly as possible, of one-third of the total number of Directors then constituting the entire Board of Directors, At such first annual meeting, Directors will be elected to serve staggered terms of either one, two or three years. The length of each Director’s term shall depend upon the initial classification of the Director. Directors elected to Class I shall serve a one year term. Directors elected to Class II shall serve a two year term, Directors elected to Class III shall serve a three year term.

At each annual meeting of stockholders thereafter, Directors elected to succeed the Directors whose terms expire at such meeting shall be elected for a full three year term. Initially, the number of Directors shall be seven. If the number of Directors is changed, any increase or decrease shall be apportioned among the classes so as to maintain or attain, to the extent possible, the equality of the number of Directors in each class. In no case shall a decrease in the number of Directors shorten the term of any incumbent Director. A Director shall hold office until the annual meeting of stockholders for the year in which such Director’s term expires and until a successor shall be duly elected and qualified, or until such Director’s earlier death, resignation or removal. Directors may be elected to an unlimited number of successive terms.

3. Subject to the rights of the holders of any Preferred Stock then outstanding, any vacancies existing on the Board of Directors for any reason, including by reason of any increase in the number of Directors, shall be

4

filled only by the Board of Directors, acting by the affirmative vote of a majority of the Directors then in office. The term of a Director elected to fill a vacancy shall expire upon the expiration of the term of office of the class of Directors in which such vacancy occurred

4. The Board of Directors may authorize the appointment of a Chairman of the Board of Directors, who may, but need not be, the President of the Corporation.

ARTICLE VIII

REMOVAL OF DIRECTORS

Subject to the rights of the holders of any Preferred Stock then outstanding, (i) any Director, or the entire Board of Directors, may be removed from office at any time by the affirmative vote of the holders of record of outstanding shares representing at least sixty-six and two-thirds percent (66 2/3%) of the voting power of all the shares of capital stock of the Corporation then entitled to vote generally in the election of Directors, voting together as a single class, and (ii) to the extent permitted by law, any Director may be removed from office at any time, but only for Cause, by the affirmative vote of a majority of the entire Board of Directors. As used in these Amended and Restated Articles of Incorporation, the term “Cause” means (i) conviction of the Director of a felony, (ii) declaration by order of a court that the Director is of unsound mind, or (iii) gross abuse of trust that is proven by clear and convincing evidence to have been committed in bad faith.

ARTICLE IX

INDEMNIFICATION OF OFFICERS AND DIRECTORS

The Corporation shall indemnify each officer and Director of the Corporation to the fullest extent permitted by applicable law. The modification or repeal of this ARTICLE IX shall not adversely affect the right to indemnification of an officer or Director hereunder with respect to any act or omission occurring prior to such modification or repeal.

ARTICLE X

LIMITATION ON PERSONAL LIABILITY OF DIRECTORS

No Director of the Corporation shall be liable to the Corporation or its stockholders for monetary damages for a breach of fiduciary duty as a Director, except to the extent such exemption from liability or limitation thereof is not permitted under the Kansas General Corporation Code as presently in effect or as the same may hereafter be amended Any repeal or modification of this ARTICLE X shall not adversely affect any right or protection of a Director of the Corporation existing at the time of such repeal modification.

ARTICLE XI

CONTROL SHARE ACQUISITIONS

The Corporation expressly elects to be governed by Sections 17-1286 et seq. of the Kansas General Corporation Code to the same extent as if such provisions, as amended from time to time, were restated in their entirety herein.

ARTICLE XII

BUSINESS COMBINATIONS WITH INTERESTED STOCKHOLDERS

The Corporation expressly elects to be governed by Sections 17-12,100 et seq. of the Kansas General Corporation Code to the same extent as if such provisions, as amended from time to time, were restated in their entirety herein.

ARTICLE XIII

AMENDMENT OF BYLAWS

The Board of Directors is hereby authorized to make, amend, alter or repeal the bylaws of the Corporation, subject to the power of the stockholders as described below to make, amend, alter or repeal the “bylaws of the

5

Corporation, Notwithstanding the foregoing or any other provisions of these Amended and Restated Articles of Incorporation or of the bylaws of the Corporation, the affirmative vote of at least sixty-six and two-thirds percent (66 2/3% of the voting power of all the shares of the them outstanding voting stock of the Corporation, voting together as a single class, shall be required to amend, alter or repeal, or adopt any provisions inconsistent with, ARTICLES II, III, VIII or IX of the bylaws of the Corporation.

ARTICLE XIV

AMENDMENT OF ARTICLES

The Corporation reserves the right to amend, alter, change or repeal any provision contained in these Amended and Restated Articles of Incorporation in the manner now or hereafter prescribed herein and by the laws of the State of Kansas, and all rights conferred upon stockholders herein are granted subject to this reservation.

Notwithstanding the above provision or any other provisions of these Amended and Restated Articles of Incorporation or the bylaws of the Corporation, the affirmative vote of the holders of at least sixty-six and two-thirds percent (66 2/3%) of the voting power of all of the shares of the then outstanding voting stock of the Corporation, voting together as a single class, shall be required to amend or repeal,, or adopt any provisions inconsistent with, .ARTICLES VI, VII, VIII, IX, XI, XII, XIII or this ARTICLE XIV of these Amended and Restated Articles of Incorporation.

These Amended and Restated Articles of Incorporation were proposed by the Board of Directors of the Corporation and adopted by the Corporation’s stockholders in accordance with the provisions of K.S.A. 17-6605 and K.S.A. 17-6602.

Dated: May 12, 2006.

| EQUITY BANCSHARES, INC. | ||

| By: | /s/ Bruce A. Benyshek | |

| Name: | Bruce A. Benyshek | |

| Title: | Assistant Secretary | |

| ATTEST: | ||

| By: | /s/ Randee Koger | |

| Name: | Randee Koger | |

| Title: | Director | |

6

CERTIFICATE OF AMENDMENT

TO THE ARTICLES OF INCORPORATION

OF

EQUITY BANCSHARES, INC.

| 1. | The name of the corporation is: Equity Bancshares, Inc. |

| 2. | The articles of incorporation are amended as follows: |

ARTICLE VII

1. The number of Directors constituting the entire Board of Directors shall be neither less than three (3) nor more than fifteen (15). Subject to the rights of the holders of any Preferred Stock then outstanding, the specific number of Directors within such minimum and maximum shall be authorized from time to time by, and only by, resolution duly adopted by a majority of the total number of Directors then constituting the entire Board of Directors.

| 3. | The amendment was duly adopted in accordance with the provisions of K.S.A. 17-6602. |

I declare under penalty of penury under the laws of the state of Kansas that the foregoing is true and correct.

Executed on the 1st day of November, 2007.

| /s/ Drayton Alldritt | ||

| Name: |

Drayton Alldritt | |

| Title: |

President | |

| Attest: | ||

| /s/ Julie Huber | ||

| Name: |

Julie Huber | |

| Title: |

Secretary | |

CERTIFICATE OF AMENDMENT

TO

ARTICLES OF INCORPORATION

OF

EQUITY BANCSHARES, INC.

*****

EQUITY BANCSHARES, INC., a corporation organized and existing under the laws of the State of Kansas (the “Corporation”).

DOES HEREBY CERTIFY:

FIRST: That at a meeting of the Board of Directors of the Corporation resolutions were duly adopted setting forth a proposed amendment of the Articles of Incorporation (the “Articles”) of the Corporation, declaring said amendment TO be advisable and calling a meeting of the stockholders of the Corporation for consideration thereof. The resolution setting forth the proposed amendment is as follows:

RESOLVED, that the Board of Directors hereby approves, and deems it advisable for the stockholders of the Corporation to approve, the following amendments to the Corporation’s Articles:

Section 1 of Article V is hereby deleted in its entirety and replaced with the following:

1. The total number of shares of all classes of stock the Corporation shall have authority to issue is (ii) 50,000,000 (50 million) shares of Common Stock, par value $0.01 per share (the “Common Stock”), 45,000,000 (45 million) of which shall be designated, as “Class A Voting Common Stock” and 5,000,000 (5 million) of which shall be designated as “Class B Non-Voting Common Stock,” and (ii) 10,000,000 (10 million) shares of Preferred Stock (“Preferred Stock”).

Section 5 of Article V is hereby deleted in its entirety and replaced with the following:

5. Except as provided in Section 5 of Article VI of these Amended and Restated Articles of Incorporation, the holders of Class A Voting Common Stock shall be entitled to one vote per share on all matters to be voted on by the stockholders of the Corporation. Holders of shares of Class B Non-Voting Common Stock shall have no right to vote on matters which are voted upon by the stockholders of this Corporation.

SECOND: That the stockholders of the Company approved the aforesaid amendment at a special meeting of the Corporation’s stockholders held on September 2, 2010.

THIRD: That the aforesaid amendment was duly adopted in accordance with the applicable provisions of Section 17-6602 of the Kansas General Corporation Code.

IN WITNESS WHEREOF, EQUITY BANCSHARES, INC., has caused this certificate to be signed by its authorized officer this 2nd day of September, 2010.

| EQUITY BANCSHARES, INC. | ||

| By: | /s/ Drayton Alldritt | |

| Name: | Drayton Alldritt | |

| Title: | President | |

CERTIFICATE OF DESIGNATION

OF

SENIOR NON-CUMULATIVE PERPETUAL PREFERRED STOCK, SERIES C

OF

EQUITY BANCSHARES, INC.

Equity Bancshares, Inc., a corporation organized and existing under the laws of the Stale of Kansas (the “Issuer”), in accordance with the provisions of Section 17-6401 of the Kansas Statutes Annotated thereof, does hereby certify;

The board of directors of the Issuer (the “Board of Directors”) or an applicable committee of the Board of Directors, in accordance with the amended and restated articles of incorporation and amended and restated bylaws of the Issuer, and applicable law, adopted the following resolution on July 28, 2011 creating a series of 16,372 shares of Preferred Stock of the Issuer designated as “Senior Non-Cumulative Perpetual Preferred Stock, Series C”.

RESOLVED, that pursuant to the provisions of; the amended and restated articles of incorporation and amended and restated bylaws of the Issuer and applicable law, a series of Preferred Stock, par value $.01 per share, of the Issuer be and hereby is created, and that the designation and number of shares of such series, and the voting and other powers, preferences and relative, participating, optional or other rights, and the qualifications, limitations and restrictions thereof, of the shares of such series, are as follows:

Part 1. Designation and Number of Shares. There is hereby created out of the authorized and unissued shares of preferred stock of the Issuer a series of preferred stock designated as the “Senior Non-Cumulative Perpetual Preferred Stock, Series C” (the “Designated Preferred Stock”). The authorized number of shares of Designated Preferred Stock shall be 16,372.

Part 2. Standard Provisions. The Standard Provisions contained in Schedule A attached hereto are incorporated herein by reference in their entirety and shall be deemed to be a part of this Certificate of Designation to the same extent as if such provisions had been set forth in full herein.

Part 3. Definitions. The following terms ate used in this Certificate of Designation (including the Standard Provisions in Schedule A hereto) as defined below:

(a) “Common Stock” means the common stock, par value $.01 per Share, of the Issuer.

(b) “Definitive Agreement” means that certain Securities Purchase Agreement by and between Issuer and Treasury, dated as of the Signing Date.

(c) “Junior Stock” means the Common Stock, and any other class or series of stock of the Issuer the terms of which expressly provide that it ranks junior to Designated Preferred Stock as to dividend and redemption rights and/or as to rights on liquidation, dissolution or winding up of the Issuer.

(d) “Liquidation Amount” means $1,000 per share of Designated Preferred Stock.

(e) “Minimum Amount” means (i) the amount equal to twenty-five percent (25%) of the aggregate Liquidation Amount of Designated Preferred Stock issued on the Original Issue Date or (ii) all of the outstanding Designated Preferred Stock, if the aggregate liquidation preference of the outstanding Designated Preferred Stock is less than the amount set forth in the preceding clause (i).

(f) “Parity Stock” means any class or series of stock of the issuer (other than Designated Preferred Stock) the terms of which do not expressly provide that such class or series will rank senior or junior to Designated Preferred Stock as to dividend rights and/or as to rights on liquidation, dissolution or winding up of the Issuer (in each case without regard to whether dividends accrue cumulatively or non-cumulatively). Without limiting the foregoing, Parity Stock shall include the Issuer’s Fixed Rate Cumulative Perpetual Preferred Stock, Series A and Fixed Rate Cumulative Perpetual Preferred Stock, Series B.

(g) “Signing Date” means August 11, 2011.

(h) “Treasury” means the United States Department of the Treasury and any successor in interest thereto.

Pan 4. Certain Voting Matters. Holders of shores of Designated Preferred Stock will be entitled to one vole for each such share on any matter on which holders of Designated preferred Stock are entitled to vote, including any action by written consent.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, Equity Bancshares, Inc. has caused this Certificate of Designation to be signed by Brad Elliott, its Chief Executive Officer, this 9th day of August, 2011.

| Equity Bancshares, Inc. | ||

| By: | /s/ Brad Elliott | |

| Name: | Brad-Elliott | |

| Title: | Chief Executive Officer | |

Schedule A

STANDARD PROVISIONS

Section 1. General Matters. Each share of Designated Preferred Stock shall be identical in all respects to every other share of Designated Preferred Stock. The Designated Preferred Stock shall be perpetual, subject to the provisions of Section 5 of these Standard Provisions that form a part of the Certificate of Designation. The Designated Preferred Stock shall rank equally with Parity Stock and shall rank senior to Junior Stock with respect to the payment of dividends and the distribution of assets in the event of any dissolution, liquidation or winding up of the Issuer, as set forth below.

Section 2. Standard Definitions. As used herein with respect to Designated Preferred Stock:

(a) “Acquiror,” in any Holding Company Transaction, means the surviving or resulting entity or its ultimate parent in the case of a merger or consolidation or the transferee in the case of a sale, lease or other transfer in one transaction or a series of related transactions of all or substantially all of the consolidated assets of the Issuer and its subsidiaries, taken as a whole.

(b) “Affiliate” means, with respect to any person, any person directly or indirectly controlling, controlled by or under common control with, such other person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”) when used with respect to any person, means the possession, directly or indirectly through one or more intermediaries, of the power to cause the direction of management and/or policies of such person, whether through the ownership of voting securities by contract or otherwise.

(c) “Applicable Dividend Rate” has the meaning set forth in Section 3(a).

(d) “Appropriate Federal Banking Agency” means the “appropriate Federal banking agency” with respect to the Issuer as defined in Section 3(q) of the Federal Deposit Insurance Act (12 U.S.C. Section 1813(q)), or any successor provision.

(e) “Bank Holding Company” means a company registered as such with the Board of Governors of the Federal Reserve System pursuant to 12 U.S.C. §1842 and the regulations of the Board of Governors of the Federal Reserve System thereunder.

(f) “Baseline” means the “Initial Small Business Lending Baseline” set forth on the Initial Supplemental Report (as defined in the Definitive Agreement), subject to adjustment pursuant to Section 3(a).

(g) “Business Combination” means a merger, consolidation, statutory share exchange or similar transaction that requires the approval of the Issuer’s stockholders.

(h) “Business Day” means any day except, Saturday, Sunday and any day on which banking institutions in the State of New York or the District of Columbia generally are authorized or required by law or other governmental actions to close.

(i) “Bylaws” means the bylaws of the Issuer, as they may be amended from time to time.

(j) “Call Report” has the meaning set forth in the Definitive Agreement.

(k) “Certificate of Designation” means the Certificate of Designation or comparable instrument relating to the Designated Preferred Stock, of which these Standard Provisions form a part, as it may be amended from time to time.

A-1

(l) “Charge-Offs” means the net amount of loans charged off by the Issuer or, if the Issuer is a Bank Holding Company or a Savings and Loan Holding Company, by the IDI Subsidiary(ies) during quarters that begin on or after the Signing Date, determined as follows:

(i) if the Issuer or the applicable IDI Subsidiary is a bank, by subtracting (A) the aggregate dollar amount of recoveries reflected on line RIAD4605 of its Call Reports for such quarters from (B) the aggregate dollar amount of charge-offs reflected on line RIAD4635 of its Call Reports for such quarters (without duplication as a result of such dollar amounts being reported on a year-to-date basis); or

(ii) if the Issuer or the applicable IDI Subsidiary is a thrift, by, subtracting (A) the sum of the aggregate dollar amount of recoveries reflected on line VA140 of its Call Reports for such quarters and the aggregate dollar amount of adjustments reflected on line VA150 of its Call Reports for such quarters from (B) the aggregate dollar amount of charge-offs reflected on line VA160 of its Call Reports for such quarters.

(m) “Charter” means the Issuer’s certificate or articles of incorporation, articles of association, or similar organizational document.

(n) “CPP Lending Incentive Fee” has the meaning set forth in Section 3(e).

(o) “Current Period” has the meaning set forth in Section 3(a)(i)(2).

(p) “Dividend Payment Date” means January 1, April 1, July 1, and October 1 of each year.

(q) “Dividend Period” means the period from and including any Dividend Payment Date to, but excluding, the next Dividend Payment Date; provided, however the initial Dividend Period shall be the period from and including the Original Issue Date to, but excluding, the next Dividend Payment Date (the “Initial Dividend Period”).

(r) “Dividend Record Date” has the meaning set forth in Section 3(b).

(s) “Dividend Reference Period” has the meaning set forth in Section 3(a)(i)(2)).

(t) “GAAP” means generally accepted accounting principles in the United States.

(u) “Holding Company Preferred Stock” the meaning Set forth in Section 7(c)(v).

(v) “Holding Company Transaction” means the occurrence of (a) any transaction (including, without limitation, any acquisition, merger or consolidation) the result of which is that a “person” or “group” within the meaning of Section 13(d) of the Securities Exchange Act of 1934, as amended, (i) becomes the direct or indirect ultimate “beneficial owner” as defined in Rule 13d-3 under that Act, of common equity of the Issuer representing more than 50% of the voting power of the outstanding Common Stock or (ii) is otherwise required to consolidate the Issuer for purposes of generally accepted accounting principles in the United States, or (b) any consolidation or merger of the Issuer or similar transaction or any sale, lease or other transfer in one transaction or a series of related transactions of all or substantially all of the consolidated assets of the Issuer and its subsidiaries, taken as a whole, to any Person other than one of the Issuer’s subsidiaries; provided that, in the case of either clause (a) or (b), the Issuer or the Acquiror is or becomes a Bank Holding Company or Savings and Loan Holding Company.

(w) “IDI Subsidiary” means any Issuer Subsidiary that is an insured depository institution.

(x) “Increase in QSBL” means:

(i) with respect to the first (1st) Dividend Period, the difference obtained by subtracting (A) the Baseline from (B) QSBL set forth in the Initial Supplemental Report (as defined in the Definitive Agreement); and

(ii) with respect to each subsequent Dividend Period, the difference obtained by subtracting (A) the Baseline from (B) QSBL for the Dividend Reference Period for the Current Period.

A-2

(y) “Initial Dividend Period” has the meaning set forth in the definition of “Dividend Period”.

(z) “Issuer Subsidiary” means any subsidiary of the Issuer.

(aa) “Liquidation Preference” has the meaning set forth in Section 4(a).

(bb) “Non-Qualifying Portion Percentage” means, with respect to any particular Dividend Period, the percentage obtained by subtracting the Qualifying Portion Percentage from one (1).

(cc) “Original Issue Date” means the date on which shares of Designated Preferred Stock are first issued.

(dd) “Percentage Change in QSBL” has the meaning set forth in Section 3(a)(ii).

(ee) “Person” means a legal person, including any Individual, corporation, estate, partnership, joint venture, association, joint-stock company, limited liability company or trust.

(ff) “Preferred Director” has the meaning set forth in Section 7(c).

(gg) “Preferred Stock” means any and all series of preferred stock of the Issuer, including the Designated Preferred Stock.

(hh) “Previously Acquired Preferred Shares” has the meaning set forth in the Definitive Agreement.

(ii) “Private Capital” means, if the Issuer is Matching Private Investment Supported (as defined in the Definitive Agreement), the equity capital received by the Issuer or the applicable Affiliate of the Issuer from one or more non-governmental investors in accordance with Section 1.3(m) of the Definitive Agreement.

(jj) “Publicly-traded” means a company that (i) has a class of securities that is traded on a national securities exchange and (ii) is required to file periodic reports with either the Securities and Exchange Commission or its primary federal bank regulator.

(kk) “Qualified Small Business Lending” or “QSBL” means, with respect to any particular Dividend Period, the “Quarter-End Adjusted Qualified Small Business Lending” for such Dividend Period set forth in the applicable Supplemental Report.

(ll) “Qualifying Portion Percentage” means; with respect to any particular Dividend Period, the percentage obtained by dividing (i) the Increase in QSBL for such Dividend Period by (ii) the aggregate Liquidation Amount of then-outstanding Designated Preferred Stock.

(mm) “Savings and Loan Holding Company” means a company registered as such with the Office of Thrift Supervision pursuant to 12 U.S.C. §1467a(b) and the regulations of the Office of Thrift Supervision promulgated thereunder.

(nn) “Share Dilution Amount” means the increase in the number of diluted shares outstanding, (determined in accordance with GAAP applied on a consistent basis, and as measured from the date of the Issuer’s most recent consolidated financial statements prior to the Signing Date) resulting from the grant, vesting or exercise of equity-based compensation to employees and equitably adjusted for any stock split, stock dividend, reverse stock split, reclassification or similar transaction.

A-3

(oo) “Signing Date Tier 1 Capital Amount” means $50,326,944.

(pp) “Standard Provisions” mean these Standard Provisions that form a part of the Certificate of Designation relating to the Designated Preferred Stock.

(qq) “Supplemental Report” means a Supplemental Report delivered by the Issuer to Treasury pursuant to the Definitive Agreement.

(rr) “Tier 1 Dividend Threshold” means, as of any particular date, the result of the following formula:

( (A + B – C) * 0.9) – 1)

where:

| A = | Signing Date Tier I Capital Amount; | |

| B = | the aggregate Liquidation Amount of the Designated Preferred Stock issued to Treasury; | |

| C = | the aggregate amount of Charge-Offs since the Signing Date; and | |

| D = | (i) beginning on the first day of the eleventh (11th) Dividend Period, the amount equal to ten percent (10%) of the aggregate Liquidation Amount of the Designated Preferred Stock issued to Treasury as of the Effective Date (without regard to any redemptions of Designated Preferred Stock that may have occurred thereafter) for every one percent (1%) of positive Percentage Change in Qualified Small Business Lending between the ninth (9th) Dividend Period and the Baseline; and

(ii) zero (0) at all other times. | |

(ss) “Voting Parity Stock” means, with regard to any matter as to which the holders of Designated Preferred Stock are entitled to vote as specified in Section 7(d) of these Standard Provisions that form a part of the Certificate of Designation, any and all series of Parity Stock upon which like voting rights have been conferred and are exercisable with respect to such matter.

Section 3. Dividends.

(a) Rate.

(i) The “Applicable Dividend Rate” shall be determined as follows:

| (1) | With respect to the Initial Dividend Period, the Applicable Dividend Rate shall be five percent (5%). |

| (2) | With respect to each of the second (2nd) through the tenth (10th) Dividend Periods, inclusive (in each case, the “Current Period” the Applicable Dividend Rate shall be; |

(A) (x) the applicable rate set forth in column “A” of the table in Section 3(a)(iii), based on the Percentage Change in QSBL between the Dividend Period that was two Dividend Periods prior to the Current Period (the “Dividend Reference Periods and the Baseline, multiplied by (y) the Qualifying Portion Percentage; plus

(B) (x) five percent (5%) multiplied by (y) the Non-Qualifying Portion Percentage.

A-4

In each such case, the Applicable Dividend Rate shall be determined at the time the Issuer delivers a complete and accurate Supplemental Report to Treasury with respect to the Dividend Reference Period.

| (3) | With respect to the eleventh (11th) through the eighteenth (18th) Dividend Periods, inclusive, and that portion of the nineteenth (19th) Dividend Period prior to, but not including, the four and one half (4 1⁄2) year anniversary of the Original Issue Date, the Applicable Dividend Rate shall be: |

(A) (x) the applicable rate set forth in column “B” of the table in Section 3(a)(iii), based on the Percentage Change in QSBL between the ninth (9th) Dividend Period and the Baseline, multiplied by (y) the Qualifying Portion Percentage, calculated as of the last day of the ninth (9th) Dividend Period; plus

(B) (x) five percent (5%) multiplied by (y) the Non-Qualifying Portion Percentage, calculated as of the last day of the ninth (9th) Dividend Period.

In such case, the Applicable Dividend Rate shall be determined at the time the Issuer delivers a complete and accurate Supplemental Report to Treasury with respect to the ninth (9th) Dividend Period.

| (4) | With respect to (A) that portion of the nineteenth (19th) Dividend Period beginning on the four and one half (4 1⁄2) year anniversary of the Original Issue Date and (B) all Dividend Periods thereafter, the Applicable Dividend Rate shall be nine percent (9%). |

| (5) | Notwithstanding anything herein to the contrary, if the Issuer fails to submit a Supplemental Report that is due during any of the second (2nd) through tenth (10th) Dividend Periods on or before the sixtieth (60th) day of such Dividend Period, the Issuer’s QSBL for the Dividend Period that would have been covered by such Supplemental Report shall be zero (0) for purposes hereof. |

| (6) | Notwithstanding anything herein to the contrary, but subject to Section 3(a)(i)(5) above, if the Issuer fails to submit the Supplemental Report that is due during the tenth (10th) Dividend Period, the Issuer’s QSBL for the shall be zero (0) for purposes of calculating the Applicable Dividend Rate pursuant to Section 3(a)(1)(B) and (4). The Applicable Dividend Rate shall be re-determined effective as of the first day of the calendar quarter following the date such failure is remedied, provided it is remedied prior to the four and one half (4 1⁄2) anniversary of the Original Issue Date. |

| (7) | Notwithstanding anything herein to the contrary, if the Issuer fails to submit any of the certificates required by Sections 3.1(d)(ii) or 3.1(d)(iii) of the Definitive Agreement when and as required thereby, the Issuer’s QSBL for the shall be zero (0) for purposes of calculating the Applicable Dividend Rate pursuant to Section 3(a)(i)(2) or (3) above until such failure is remedied. |

A-5

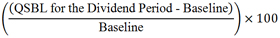

(ii) The “Percentage Change in Qualified Lending” between any given Dividend Period and the Baseline shall be the result of the following formula, expressed as a percentage:

(iii) The following table shall be used for determining the Applicable Dividend Rate;

| The Applicable Dividend Rate shall be: | ||||||||

| If the Percentage Change in Qualified Lending is: |

Column “A” (each of the 2nd - 10th Dividend Periods) |

Column “B” (11th-18th, and the first part of the 19th, Dividend Periods) |

||||||

| 0% or less |

5 | % | 7 | % | ||||

| More than 0%, but less than 2.5% |

5 | % | 5 | % | ||||

| 2.5% or more, but less than 5% |

4 | % | 4 | % | ||||

| 5% or more, but less than 7.5% |

3 | % | 3 | % | ||||

| 7.5% or more, but less than 10% |

2 | % | 2 | % | ||||

| 10% or more |

1 | % | 1 | % | ||||

(iv) If the Issuer consummates a Business Combination, a purchase of loans or a purchase of participations in loans and the Designated Preferred Stock remains outstanding thereafter, then the Baseline shall thereafter be the “Quarter-End Adjusted Small Business Lending Baseline” set forth on the Quarterly Supplemental Report (as defined in the Definitive Agreement).

(b) Payment. Holders of Designated Preferred Stock shall be entitled to receive, on each share of Designated Preferred Stock if, as and when declared by the Board of Directors or any duly authorized committee of the Board of Directors, but only out of assets legally available therefor, non-cumulative cash dividends with, respect to:

(i) each Dividend Period (other than the Initial Dividend Period) at a rate equal to one-fourth ( 1⁄4) of the Applicable Dividend Rate with respect to each Dividend Period on the Liquidation Amount per share of Designated Preferred Stock, and no more, payable quarterly in arrears on each Dividend Payment Date; and

(ii) the Initial Dividend Period, on the first such Dividend Payment Date to occur at least twenty (20) calendar days after the Original Issue Date, an amount equal to (A) the Applicable Dividend Rate with respect to the Initial Dividend Period multiplied by (B) the number of days from the Original Issue Date to the last day of the Initial Dividend Period (inclusive) divided by 360.

In the event that any Dividend Payment Date would otherwise fall on a day that is not a Business Day, the dividend payment due on that date will be postponed to the next day that is a Business Day and no additional dividends will accrue as a result of that postponement. For avoidance of doubt, “payable quarterly in arrears” means that, with respect to any particular Dividend Period, dividends begin accruing on the first day of such Dividend Period and are payable on the first day of the next Dividend Period.

The amount of dividends payable on Designated Preferred Stock on any date prior to the end of a Dividend Period, and for the initial Dividend Period, shall be computed on the basis of a 360-day year consisting of four 90-day quarters, and actual days elapsed over a 90-day quarter.

Dividends that are payable on Designated Preferred Stock on any Dividend Payment Date will be payable to holders of record of Designated Preferred Stock as they appear on the stock register of the Issuer on the applicable record date, which shall be the 15th calendar day immediately preceding such Dividend Payment Date or such other record date fixed by the Board of Directors or any duly authorized committee of the Board of Directors

A-6

that is not more than 60 nor less than 10 days prior to such Dividend Payment Date (each, a “Dividend Record Date”). Any such day that is a Dividend Record Date shall be’ a Dividend Record Date whether or not such day is a Business Day.

Holders of Designated Preferred Stock shall not be entitled to any dividends, whether payable in cash, securities or other property, other than dividends (if any) declared and payable on Designated Preferred Stock as specified in this Section 3 (subject to the other provisions of the Certificate of Designation).

(c) Non-Cumulative. Dividends on shares of Designated Preferred Stock shall be non-cumulative. If the Board of Directors or any duly authorized committee of the Board of Directors does not declare a dividend on the Designated Preferred Stock in respect of any Dividend Period:

(i) the holders of Designated Preferred Stock shall have no right to receive any dividend for such Dividend Period, and the Issuer shall have no obligation to pay a dividend for such Dividend Period, whether or not dividends are declared for any subsequent Dividend Period with respect to the Designated Preferred Stock; and

(ii) the issuer shall, within five (5) calendar days, deliver to the holders of the Designated Preferred Stock a written notice executed by the Chief Executive Officer and the Chief Financial Officer of the Issuer stating the Board of Directors’ rationale for not declaring dividends.

(d) Priority of Dividends; Restrictions on Dividends.

(i) Subject to Sections 3(d)(ii), (iii) and (v) and any restrictions imposed by the Appropriate Federal Banking Agency or, if applicable, the Issuer’s state bank supervisor (as defined in Section 3(r) of the Federal Deposit Insurance Act (12 U.S.C. § 1813(q)), so long as any share of Designated Preferred Stock remains outstanding, the Issuer may declare and pay dividends on the Common Stock, any other shares of Junior Stock, or Parity Stock, in each case only if (A) after giving effect to such dividend the Issuer’s Tier 1 capital would be at least equal to the Tier 1 Dividend Threshold, and (B) full dividends on all outstanding shares of Designated Preferred Stock for the most recently completed Dividend Period have been or are contemporaneously declared and paid.

(ii) If a dividend is not declared and paid in full on the Designated Preferred Stock in respect of any Dividend Period, then from the last day of such Dividend Period until the last day of the third (3rd) Dividend Period immediately following it, no dividend or distribution shall be declared or paid on the Common Stock or any other shares of Junior Stock (other than dividends payable solely in shares of Common Stock) or Parity Stock; provided, however, that in any such Dividend Period in which a dividend is declared and paid on the Designated Preferred Stock, dividends may be paid on Parity Stock to the extent necessary to avoid any material breach of a covenant by which the Issuer is bound.

(iii) When dividends have not been declared and paid in full for an aggregate of four (4) Dividend Periods or more, and during such time the Issuer was not subject to a regulatory determination that prohibits the declaration and payment of dividends, the Issuer shall, within five (5) calendar days of each missed payment, deliver to the holders of the Designated Preferred Stock a certificate executed by at least a majority of the Board of Directors stating that the Board of Directors used its best efforts to declare and pay such dividends in a manner consistent with (A) safe and sound banking practices and (B) the directors’ fiduciary obligations.

(iv) Subject to the foregoing and Section 3(e) below and not otherwise, such dividends (payable in cash, securities or other property) as may be determined by the Board of Directors or any duly authorized committee of the Board of Directors may be declared and paid on any securities, including Common Stock and other Junior Stock, from time to time out of any funds legally available for such payment, and holders of Designated Preferred Stock shall not be entitled to participate in any such dividends.

(v) If the Issuer is not Publicly-Traded, then after the tenth (10th) anniversary of the Signing Date, so long as any share of Designated Preferred Stock remains outstanding, no dividend or distribution shall be declared or paid on the Common Stock or any other shares of Junior Stock (other than dividends payable solely in shares of Common Stock) or Parity Stock.

A-7

(e) Special Lending Incentive Fee Related to CPP. If Treasury held Previously Acquired Preferred Shares immediately prior to the Original Issue Date and the Issuer did not apply to Treasury to redeem such Previously Acquired Preferred Shares prior to December 16, 2010, and if the Issuer’s Supplemental Report with respect to the ninth (9th) Dividend Period reflects an amount of Qualified Small Business Lending that is less than or equal to the Baseline (or if the Issuer fails to timely file a Supplemental Report with respect to the ninth (9th) Dividend Period), then beginning on April 1, 2014 and on all Dividend Payment Dates thereafter ending on April 1, 2016, the Issuer shall pay to the Holders of Designated Preferred Stock, on each share of Designated Preferred Stock, but only out of assets legally available therefor, a fee equal to 0.5% of the Liquidation Amount per share of Designated Preferred Stock (“CPP Lending Incentive Fee”). All references in Section 3(d) to “dividends” on the Designated Preferred Stock shall be deemed to include the CPP Lending Incentive Fee.

Section 4. Liquidation Rights.

(a) Voluntary or Involuntary Liquidation, In the event of any liquidation, dissolution or winding up of the affairs of the Issuer, whether voluntary or involuntary, holders of Designated Preferred Stock shall be entitled to receive for each share of Designated Preferred Stock, out of the assets of the Issuer or proceeds thereof (whether capital or surplus) available for distribution to stockholders of the Issuer, subject to the rights of any creditors of the Issuer, before any distribution of such assets or proceeds is made to or set aside for the holders of Common Stock and any other stock of the Issuer ranking junior to Designated Preferred Stock as to such distribution, payment in full in an amount equal to the sum of (i) the Liquidation Amount per share and (ii) the amount of any accrued and unpaid dividends on each such share (such amounts collectively, the “Liquidation Preference”).

(b) Partial Payment. If in any distribution described in Section 4(a) above the assets of the Issuer or proceeds thereof are not sufficient to pay in full the amounts payable with respect to all outstanding shares of Designated Preferred Stock and the corresponding amounts payable with respect of any other stock of the Issuer ranking equally with Designated Preferred Stock as to such distribution, holders of Designated Preferred Stock and the holders of such other stock shall share ratably in any such distribution in proportion to the full respective distributions to which they are entitled.

(c) Residual Distributions. If the Liquidation Preference has been paid in full to all holders of Designated Preferred Stock and the corresponding amounts payable with respect of any other stock of the Issuer ranking equally with Designated Preferred Stock as to such distribution has been paid in full, the holders of other stock of the Issuer shall be entitled to receive all remaining assets of the Issuer (or proceeds thereof), according to their respective rights and preferences.

(d) Merger, Consolidation and Sale of Assets Is Not Liquidation. For purposes of this Section 4, the merger or consolidation of the Issuer with any other corporation or other entity, including a merger or consolidation in which the holders of Designated Preferred Stock receive cash, securities or other property for their shares, or the sale, lease or exchange (for cash, securities or other property) of all or substantially all of the assets of the Issuer, shall not constitute a liquidation, dissolution or winding up of the Issuer.

Section 5. Redemption.

(a) Optional Redemption.

(i) Subject to the other provisions of this Section 5:

| (1) | The Issuer, at its option, subject to the approval of the Appropriate Federal Banking Agency, may redeem, in whole or in part, at any time and from time to time, out of funds legally available therefor, the shares of Designated Preferred Stock at the time outstanding; and |

| (2) | If, after the Signing Date, there is a change in law that modifies the terms of Treasury’s Investment in the Designated Preferred Stock or the terms of Treasury’s Small Business Lending Fund program in a materially adverse respect for the Issuer, the Issuer may, after consultation with the Appropriate Federal Banking Agency, redeem all of the shares of Designated Preferred Stock at the time outstanding. |

A-8

(ii) The per-share redemption price for shares of Designated Preferred Stock shall be equal to the sum of:

| (1) | the Liquidation Amount per share. |

| (2) | the per-share amount of any unpaid dividends for the then current Dividend Period at the Applicable Dividend Rate to, but excluding, the date fixed for redemption (regardless of whether any dividends are actually declared for that Dividend Period; and |

| (3) | the pro rata amount of CPP Lending Incentive Fees for the current Dividend Period. |

The redemption price for any shares of Designated Preferred Stock shall be payable on the redemption date to the holder of such shares against surrender of the certificate(s) evidencing such shares to the Issuer or its agent. Any declared but unpaid dividends for the then current Dividend Period payable on a redemption date that occurs subsequent to the Dividend Record Date for a Dividend Period shall not be paid to the holder entitled to receive the redemption price on the redemption date, but rather shall be paid to the holder of record of the redeemed shares on such Dividend Record Date relating to the Dividend Payment Date as provided in Section 3 above.

(b) No Sinking Fund. The Designated Preferred Stock will not be subject to any mandatory redemption, sinking fund or other similar provisions, Holders of Designated Preferred Stock will have no right to require redemption or repurchase of any shares of Designated Preferred Stock.

(c) Notice of Redemption. Notice of every redemption of shares of Designated Preferred Stock shall be given by first class mail, postage prepaid, addressed to the holders of record of the shares to be redeemed at their respective last addresses appearing on the books of the Issuer. Such mailing shall be at least 30 days and not more than 60 days before the date fixed for redemption. Any notice mailed as provided in this Subsection shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of Designated Preferred Stock designated for redemption shall not affect the validity of the proceedings for the redemption of any other shares of Designated Preferred Stock. Notwithstanding the foregoing, if shares of Designated Preferred Stock are issued in book-entry form through The Depository Trust Company or any other similar facility, notice of redemption may be given to the holders of Designated Preferred Stock at such time and in any manner permitted by such facility. Each notice of redemption given to a holder shall state: (1) the redemption date; (2) the number of shares of Designated Preferred Stock to be redeemed and, if less than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder; (3) the redemption price; and (4) the place or places where certificates for such shares are to be surrendered for payment of the redemption price.

(d) Partial Redemption. In case of any redemption of part of the shares of Designated Preferred Stock at the time outstanding, the shares to be redeemed shall be selected either pro rata or in such other manner as the Board of Directors or a duly authorized committee thereof may determine to be fair and equitable, but in any event the shares to be redeemed shall not be less than the Minimum Amount. Subject to the provisions hereof,

A-9

the Board of Directors or a duly authorized committee thereof shall have full power and authority to proscribe the terms and conditions upon which shares of Designated Preferred Stock shall be redeemed from time to time, subject to the approval of the Appropriate Federal Banking Agency. If fewer than all the shares represented by any certificate are redeemed, a new certificate shall be issued representing the unredeemed shares without charge to the holder thereof.

(e) Effectiveness of Redemption. If notice of redemption has been duly given and if on or before the redemption date specified in the notice all funds necessary for the redemption have been deposited by the Issuer, in trust for the program benefit of the holders of the shares called for redemption, with a bank or trust company doing business in the Borough of Manhattan, The City of New York, and having a capital and surplus of at least $500 million and selected by the Board of Directors, so as to be and continue to be available solely therefor, then, notwithstanding that any certificate for any share so called for redemption has not been surrendered for cancellation, on and after the redemption date dividends shall cease to accrue on all shares so called for redemption, all shares so called for redemption shall no longer be deemed outstanding find all rights with respect to such shares shall forthwith on such redemption date cease and terminate, except only the right of the holders thereof to receive the amount payable on such redemption from such bank or trust company, without interest. Any funds unclaimed at the end of three years from the redemption date shall, to the extent permitted by law, be released to the Issuer, after which time the holders of the shares so called for redemption shall look only to the Issuer for payment of the redemption price, of such shares.

(f) Status of Redeemed Shares. Shares of Designated Preferred Stock that are redeemed, repurchased or otherwise acquired by the Issuer shall revert to authorized but unissued shares of Preferred Stock (provided that any such cancelled shares of Designated Preferred Stock may be reissued only as shares of any series of Preferred Stock other than Designated Preferred Stock).

Section 6. Conversion. Holders of Designated Preferred Stock shares shall have no right to exchange or convert such shares into any other securities.

Section 7. Voting Rights.

(a) General The holders of Designated Preferred Stock shall not have any voting rights except as set forth below or as otherwise from time to time required by law.

(b) Board Observation Rights. Whenever, m any time or times, dividends on the shares of Designated Preferred Stock have not been declared and paid in full within five (5) Business Days after each Dividend Payment Date for an aggregate of five (5) Dividend Periods or more, whether or not consecutive, the Issuer shall invite a representative selected by the holders of a majority of the outstanding shares of Designated Preferred Stock, voting as a single class, to attend all meetings of its Board of Directors in a nonvoting observer capacity and, in this respect, shall give such representative copies of all notices, minutes, consents, and other materials that it provides to its directors in connection with such meetings; provided, that the holders of the Designated Preferred Stock shall not be obligated to select such a representative, nor shall such representative, if selected, be obligated to attend any meeting to which he/she is invited. The rights of the holders of the Designated Preferred Stock set forth in this Section 7(b) shall terminate when full dividends have been timely paid on the Designated Preferred Stock for at least four consecutive Dividend Periods, subject to revesting in the event of each and every subsequent default of the character above mentioned.

(c) Preferred Stock Directors. Whenever, at any time or times, (i) dividends on the shares of Designated Preferred Stock have not been declared and paid in full within five (5) Business Days after each Dividend Payment Date for an aggregate of six (6) Dividend Periods or more, whether or not consecutive, and (ii) the aggregate liquidation preference of the then-outstanding shares of Designated Preferred Stock is greater than or equal to $25,000,000, the authorized number of directors of the Issuer shall automatically be increased by two and the holders of the Designated Preferred Stock, voting as a single class, shall have the right, but not the obligation, to elect two directors (hereinafter the “Preferred Directors” and each a “Preferred Director”) to fill such newly created directorships at the Issuer’s next annual meeting of stockholders (or, if the next annual meeting is not yet scheduled or is scheduled to occur more than thirty days later, the President of the Company shall promptly call a special meeting for that purpose) and at each subsequent annual meeting of stockholders until full dividends have been

A-10

timely paid on the Designated Preferred Stock for at least four consecutive Dividend Periods, at which time such right shall terminate with respect to the Designated Preferred Stock, except as herein or by law expressly provided, subject to revesting in the event of each and every subsequent default of the character above mentioned; provided that it shall be a qualification for election for any Preferred Director that the election of such Preferred Director shall not cause the Issuer to violate any corporate governance requirements of any securities exchange or other trading facility on which securities of the issuer may then be listed or traded that listed or traded companies must have a majority of independent directors. Upon any termination of the right of the holders of shares of Designated Preferred Stock to vote for directors as provided above, the Preferred Directors shall cease to be qualified as directors, the term of office of all Preferred Directors then in office shall terminate immediately and the authorized number of directors shall be reduced by the number of Preferred Directors elected pursuant hereto. Any Preferred Director may be removed at any time, with or without cause, and any vacancy created thereby may be filled, only by the affirmative vote of the holders a majority of the shares of Designated Preferred Stock at the time outstanding voting separately as a class. If the office of any Preferred Director becomes vacant for any reason other than removal from office as aforesaid, the holders of a majority of the outstanding shares of Designated Preferred Stock, voting as a single class, may choose a successor who shall hold office for the unexpired term in respect of which such vacancy occurred.

(d) Class Voting Rights as to Particular Matters. So long as any shares of Designated Preferred Stock are outstanding, in addition to any other vote or consent of stockholders required by law or by the Charter, the written consent of (x) Treasury if Treasury holds any shares of Designated Preferred Stock, or (y) the holders of a majority of the outstanding shares of Designated Preferred Stock, voting as a single class, if Treasury does not hold any shares of Designated Preferred Stock, shall be necessary for effecting or validating:

(i) Authorization of Senior Stock. Any amendment or alteration of the Certificate of Designation for the Designated Preferred Stock or the Charter to authorize or create or increase the authorized amount of, or any issuance of, any shares of, or any securities convertible into or exchangeable or exercisable for shares of, any class or series of capital stock of the Issuer ranking senior to Designated Preferred Stock with respect to either or both the payment of dividends and/or the distribution of assets on any liquidation, dissolution or winding up of the Issuer;

(ii) Amendment of Designated Preferred Stock. Any amendment, alteration or repeal of any provision of the Certificate of Designation for the Designated Preferred Stock or the Charter (including, unless no vote on such merger or consolidation is required by Section 7(e)(iii) below, any amendment, alteration or repeal by means of a merger, consolidation or otherwise) so as to adversely affect the rights, preferences, privileges or voting powers of the Designated Preferred Stock;

(iii) Share Exchanges, Reclassifications, Mergers and Consolidations. Subject to Section 7(d)(v) below, any consummation of a binding share exchange or reclassification involving the Designated Preferred Stock, or of a merger or consolidation of the Issuer with another corporation or other entity, unless in each case (x) the shares of Designated Preferred Stock remain outstanding or, in the case of any such merger or consolidation with respect to which the Issuer is not the surviving or resulting entity, are converted into or exchanged for preference securities of the surviving or resulting entity or its ultimate parent, and (y) such shares remaining outstanding or such preference securities, as the case may be, have such rights, preferences, privileges and voting powers, and limitations and restrictions thereof that are the same as the rights, preferences, privileges and voting powers, and limitations and restrictions thereof, of Designated Preferred Stock immediately prior to such consummation, taken as a whole; provided, that in all cases, the obligations of the Issuer are assumed (by operation of law or by express written assumption) by the resulting entity or its ultimate parent;

(iv) Certain Asset Sales. Any sale of all, substantially all, or any material portion of, the assets of the Company, if the Designated Preferred Stock will not be redeemed in full contemporaneously with the consummation of such sale; and

(v) Holding Company Transactions. Any consummation of a Holding Company Transaction, unless as a result of the Holding Company Transaction each share of Designated Preferred Stock shall be converted into or exchanged for one share with an equal liquidation preference of preference

A-11

securities of the Issuer or the Acquiror (the “Holding Company Preferred Stock”). Any such Holding Company Preferred Stock shall entitle holders thereof to dividends from the date of issuance of such Holding Company Preferred Stock on terms that are equivalent to the terms set forth herein, and shall have such other rights, preferences, privileges and voting powers, and limitations and restrictions thereof that are the same as the rights, preferences, privileges and voting powers, and limitations and restrictions thereof, of Designated Preferred Stock immediately prior to such conversion or exchange, taken as a whole;

provided, however, that for all purposes of this Section 7(d), any increase in the amount of the authorized Preferred Stock, including any increase in the authorized amount of Designated Preferred Stock necessary to satisfy preemptive or similar rights granted by the Issuer to other persons prior to the Signing Date, at the creation and issuance, or an increase in the authorized or issued amount, whether pursuant to preemptive or similar rights or otherwise, of any other series of Preferred Stock, or any securities convertible into or exchangeable or exercisable for any other series of Preferred Stock, ranking equally with and/or junior to Designated Preferred Stock with respect to the payment of dividends (whether such dividends are cumulative or non-cumulative) and the distribution of assets upon liquidation, dissolution or winding up of the Issuer will not be deemed to adversely affect the rights, preferences, privileges or voting powers, and shall not require the affirmative vote or consent of, the holders of outstanding shares of the Designated Preferred Stock.

(e) Changes after Provision for Redemption. No vote or consent of the holders of Designated Preferred Stock shall be required pursuant to Section 7(d) above if, at or prior to the time when any such vote or consent would otherwise be required pursuant to such Section, all outstanding shares of the Designated Preferred Stock shall have been redeemed, or shall have been called for redemption upon proper notice and sufficient funds shall have been deposited in trust for such redemption, in each case pursuant to Section 5 above.

(f) Procedures for Voting and Consents. The rules and procedures for calling and conducting any meeting of the holders of Designated Preferred Stock (including, without limitation, the fixing of a record date in connection therewith), the solicitation and use of proxies at such a meeting, the obtaining of written consents and any other aspect or matter with regard to such a meeting or such consents shall be governed by any rules of the Board of Directors or any duly authorized committee of the Board of Directors, in its discretion, may adopt from time to time, which rules and procedures shall conform to the requirements of the Charter, the Bylaws, and applicable law and the rules of any national securities exchange or other trading facility on which Designated Preferred Stock is listed or traded at the time.

Section 8. Restriction on Redemptions and Repurchases.

(a) Subject to Sections 8(b) and (c), so long as any share of Designated Preferred Stock remains outstanding, the Issuer may repurchase or redeem any shares of Capital Stock (as defined below), in each case only if (i) after giving effect to such dividend, repurchase or redemption, the Issuer’s Tier 1 capital would be at least equal to the Tier 1 Dividend Threshold and (ii) dividends on all outstanding shares of Designated Preferred Stock for the most recently completed Dividend Period have been or are contemporaneously declared and paid (or have been declared and a sum sufficient for the payment thereof has been set aside for the benefit of the holders of shares of Designated Preferred Stock on the applicable record date).

(b) If a dividend is not declared and paid on the Designated Preferred Stock in respect of any Dividend Period, then from the last day of such Dividend Period until the last day of the third (3rd) Dividend Period immediately following it, neither the Issuer nor any Issuer Subsidiary shall, redeem, purchase or acquire any shares of Common Stock, Junior Stock, Parity Stock or other capital stock or other equity securities of any kind of the Issuer or any Issuer Subsidiary, or any trust preferred securities issued by the Issuer or any Affiliate of the Issuer (“Capital Stock”), (other than (i) redemptions, purchases, repurchases or other acquisitions of the Designated Preferred Stock and (ii) repurchases of Junior Stock or Common Stock in connection with the administration of any employee benefit plan in the ordinary course of business (including purchases to offset any Share Dilution Amount pursuant to a publicly announced repurchase plan) and consistent with past practice; provided that any purchases to offset the Share Dilution Amount shall in no event exceed the Share Dilution Amount, (iii) the acquisition by the Issuer or any of the Issuer Subsidiaries of record ownership in Junior Stock or Parity Stock for the beneficial ownership of any other persons (other than the Issuer or any other Issuer Subsidiary), including as trustees or custodians, (iv) the exchange or conversion of Junior Stock for or into other Junior Stock or of Parity Stock or trust

A-12

preferred securities for or into other Parity Stock (with the same or lesser aggregate liquidation amount) or Junior Stock. In each case set forth in this clause (iv), solely to the extent required pursuant to binding contractual agreements entered into prior to the Signing Date or any subsequent agreement for the accelerated exercise, settlement or exchange thereof for Common Stock, (v) redemptions of securities held by the Issuer or any wholly-owned issuer Subsidiary or (vi) redemptions, purchases or other acquisitions of capital stock or other equity securities of any kind of any Issuer Subsidiary required pursuant to binding contractual agreements entered into prior to (x) if Treasury held Previously Acquired Preferred Shares immediately prior to the Original Issue Date, the original issue date of such Previously Acquired Preferred Shares, or (y) otherwise, the Signing Date).

(c) If the Issuer is not Publicly-Traded, then after the tenth (10th) anniversary of the Signing Date, so long as any share of Designated Preferred Stock remains outstanding, no Common Stock, Junior Stock or Parity Stock shall be, directly or indirectly, purchased, redeemed or otherwise acquired for consideration by the Issuer or any of its subsidiaries.

Section 9. No Preemptive Rights. No share of Designated Preferred Stock shall have any rights of preemption whatsoever as to any securities of the Issuer, or any warrants, rights or options issued or granted with respect thereto, regardless of how such securities, or such warrants, rights or options, may be designated, issued or granted.

Section 10. References to Line Items of Supplemental Reports. If Treasury modifies the form of Supplemental Report, pursuant to its rights under the Definitive Agreement, and any such modification includes a change to the caption or number of any line item on the Supplemental Report, then any reference herein to such line item shall thereafter be a reference to such re-captioned or re-numbered line item.

Section 11. Record Holders. To the fullest extent permitted by applicable law, the Issuer and the transfer agent for Designated Preferred Stock may deem and treat the record holder of any share of Designated Preferred Stock as the true and lawful owner thereof for all purposes, and neither the Issuer nor such transfer agent shall be affected by any notice to the contrary.