Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - GL Brands, Inc. | frlf_10k-ex3202.htm |

| EX-31.1 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - GL Brands, Inc. | frlf_10k-ex3101.htm |

| EX-32.1 - CERTIFICATION - GL Brands, Inc. | frlf_10k-ex3201.htm |

| EX-31.2 - CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER - GL Brands, Inc. | frlf_10k-ex3102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 10-K

_______________________________________________

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______.

Commission File Number: 333-190067

______________________________________________

FREEDOM LEAF, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________

| Nevada | 46-2093679 | |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

|

3571 E. Sunset Road, Suite 420 Las Vegas, NV |

89120 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (702) 499-6022

____________________________________________

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 Par Value

(Title of class)

____________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

On December 31, 2014, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $28,279,357, based upon the closing price on that date of the common stock of the registrant on the OTC Bulletin Board system of $1.16. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its Common Stock are deemed affiliates of the registrant.

As of September 16, 2015, the registrant had 174,181,200 shares of its common stock, $0.001 par value, outstanding.

TABLE OF CONTENTS

| Page | |||||

| PART I. | |||||

| Item 1. | Business | 3 | |||

| Item 1A. | Risk Factors | 11 | |||

| Item 1B. | Unresolved Staff Comments | 11 | |||

| Item 2. | Properties | 11 | |||

| Item 3. | Legal Proceedings | 11 | |||

| Item 4. | Mine Safety Disclosures | 11 | |||

| PART II. | |||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 12 | |||

| Item 6. | Selected Financial Data | 13 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 13 | |||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 16 | |||

| Item 8. | Financial Statements and Supplementary Data | 17 | |||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 18 | |||

| Item 9A. | Controls and Procedures | 18 | |||

| Item 9B. | Other Information | 20 | |||

| PART III. | |||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 20 | |||

| Item 11. | Executive Compensation | 23 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 24 | |||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 24 | |||

| Item 14. | Principal Accounting Fees and Services | 25 | |||

| PART IV. | |||||

| Item 15. | Exhibits, Financial Statement Schedules | 26 | |||

| Signatures | 27 | ||||

| Exhibits | |||||

1

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipate,” “expects,” “intends,” “plans,” “believes,” “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our financial statements for Freedom Leaf, Inc. Such discussion represents only the best present assessment from our Management.

2

PART I

Item 1. Business.

General Overview

Freedom Leaf, Inc. (the “Company”) was incorporated in the State of Nevada on February 21, 2013, under the name of Arkadia International, Inc. The Company was originally engaged in the business of the acquisition of in demand equipment, cars, and goods with the intent to resell these in the U.S. territories or export to overseas countries.

On October 3, 2014, the Company experienced a change in control. Richard C. Cowan acquired a majority of the issued and outstanding common stock of the Company in accordance with stock purchase agreements by and between Mr. Cowan and Vladimir and Galina Shekhtman (“Sellers”). On the closing date, October 3, 2014, pursuant to the terms of the Stock Purchase Agreement, Cowan purchased from the Sellers 6,950,100 shares of the Company’s outstanding restricted common stock for $100,000, representing 93% of the total issued and outstanding at that time.

On November 6, 2014, the Company merged with Freedom Leaf, Inc., a private Nevada corporation. The Company changed its name from Arkadia International, Inc., to Freedom Leaf, Inc. As a result of the merger, the private company was dissolved. See Note 2 for related discussion.

For financial reporting purposes, the Share Exchange represents a "reverse merger" rather than a business combination and Private Company is deemed to be the accounting acquirer in the transaction. The Share Exchange is being accounted for as a reverse-merger and recapitalization. Private Company is the acquirer for financial reporting purposes and the Public Company (Freedom Leaf, Inc., f/k/a Arkadia International, Inc.) is the acquired company. Consequently, the assets and liabilities and the operations that will be reflected in the historical financial statements prior to the Share Exchange will be those of the Private Company and will be recorded at the historical cost basis of the Private Company, and the financial statements after completion of the Share Exchange will include the assets and liabilities of the Public Company and the Private Company, and the historical operations of Private Company and operations of both companies from the closing date of the Share Exchange.

We are currently devoting substantially all of our efforts in migrating to the news, arts and entertainment niche, with both in print and online publications. Principal business activities are still in the development stage and have not yet commenced. The Company will generate revenue through paid advertising in publications, both print and online, in the cannabis/hemp marketplace. The Company will also earn revenue from 1) providing consulting services to companies who are in our industry, 2) contracting with companies to brand, market, and sell their products and/or services, 3) provide seminars in this space, and 4) sell branded products for the Company and others the Company represents.

The Company reports its business under the following SIC Codes:

| SIC Code | Description | |

| 2741 | Miscellaneous Publishing | |

| 5960 | Retail – Nonstore Retailers | |

|

5961 |

Retail – Catalog & Mail-Order Houses | |

| 7310 | Services - Advertising | |

| 7380 | Services – Miscellaneous Business Services | |

| 8742 | Services – Management Consulting Services |

Our corporate headquarters are located at 3571 E. Sunset Road, Suite 420, Las Vegas, Nevada 89120. The Company’s primary web site is www.freedomleaf.com and www.cannabizu.com. These web sites is not incorporated in this Form 10-K.

Overview

Freedom Leaf has now published and circulated hundreds of thousands of copies of our nine editions in 32 states with the assistance of over 160 activist marketers. Freedom Leaf magazine, “The Good News in Marijuana Reform™,” reports on arts, fashion, and lifestyle, all of the elements of the burgeoning cannabis movements. Freedom Leaf magazine provides activists, consumers, patients and entrepreneurs with a means to stay informed on the emerging industry's most cutting edge marijuana-related information, innovations and legislation. It is distributed nationally through chapters of the National Organization for the Reform of Marijuana Laws (NORML.org), Students for a Sensible Drug Policy (SSDP.org), and WomenGrow.com, as well as through participating medical and recreational dispensaries, smoke and vape shops, doctors and attorneys’ offices, and others in the marijuana industry. It is also available online at www.FreedomLeaf.com/ezine.

Freedom Leaf is also expanding its online presence. Freedom Leaf has an entire platform of content suited for every aspect of advertising and marketing to consumers from all businesses in the cannabis industry. These sites incorporate many aspects of the marijuana industry and movement.

3

The Industry

The following is a report on the industry, “Legal Marijuana Is The Fastest-Growing Industry In The U.S.: Report,” as published in HuffPost Business (The Huffington Post) on January 26, 2015 and updated on January 28, 2015.

Legal marijuana is the fastest-growing industry in the United States and if the trend toward legalization spreads to all 50 states, marijuana could become larger than the organic food industry, according to The Huffington Post.

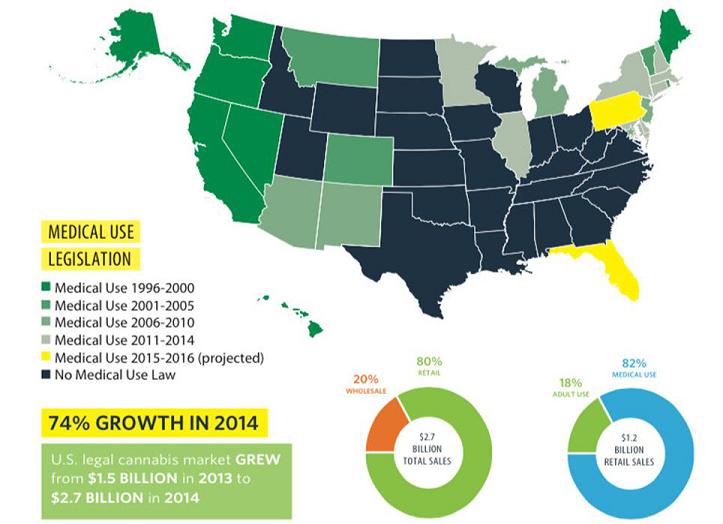

Researchers from The ArcView Group, a cannabis industry investment and research firm based in Oakland, California, found that the U.S. market for legal cannabis grew 74 percent in 2014 to $2.7 billion, up from $1.5 billion in 2013.

The group surveyed hundreds of medical and recreational marijuana retailers in states where sales are legal, as well as ancillary business operators and independent cultivators of the plant, over the course of seven months during 2013 and 2014. ArcView also compiled data from state agencies, nonprofit organizations and private companies in the marijuana industry for a more complete look at the marketplace.

“In the last year, the rise of the cannabis industry went from an interesting cocktail conversation to being taken seriously as the fastest growing industry in America,” Troy Dayton, CEO of The ArcView Group and publisher of the third edition of the State of Legal Marijuana Markets, said in the executive summary of the report. “At this point, it’s hard to imagine that any serious businessperson who is paying attention hasn’t spent some time thinking about the possibilities in this market.”

Graph

courtesy of ArcView Market Research.

Graph

courtesy of ArcView Market Research.

The report also projects a strong year for legal marijuana in 2015 and projects 32 percent growth in the market. Dayton said that places "cannabis in the top spot" when compared with other fast-growing industries.

Over the next five years, the marijuana industry is expected to continue to grow, with ArcView predicting that 14 more states will legalize recreational marijuana and two more states will legalize medical marijuana. At least 10 states are already considering legalizing recreational marijuana in just the next two years through ballot measures or state legislatures.

To date, four states -- Colorado, Washington, Alaska and Oregon -- have legalized retail marijuana. Washington, D.C., voters also legalized recreational marijuana use, but sales currently remain banned. Twenty-three states have legalized medical cannabis. Still, marijuana remains illegal at the federal level.

The report projects that, by 2019, all of the state-legal marijuana markets combined will make for a potential overall market worth almost $11 billion annually.

4

Graph courtesy of ArcView Market Research.

The report also breaks out some interesting marijuana trends from around the nation. California still has the largest legal cannabis market in the U.S., at $1.3 billion. Arizona was found to have the fastest-growing major marijuana market in 2014, expanding to $155 million, up more than $120 million from the previous year. Medical marijuana is already legal in Arizona and California and recreational legalization measures are likely to appear on the 2016 ballots in both states.

More than 1.5 million shoppers purchased legal marijuana from a dispensary, either medical or recreational, in 2014. Five states now boast marijuana markets that are larger than $100 million, and in Colorado and Washington -- the first states to open retail marijuana shops in the U.S. -- consumers bought $370 million in marijuana products last year.

Oregon and Alaska are expected to add a combined $275 million in retail marijuana sales in their first year of operation, the report projects. And while D.C. has also legalized recreational marijuana use, ArcView couldn't project a market size in the District because of an ongoing attempt by congressional Republicans to block the new law.

5

Graph courtesy of ArcView Market Research.

The huge growth potential of the industry appears to be limited only by the possibility of states rejecting the loosening of their drug laws. The report projects a marijuana industry that could be more valuable than the entire organic food industry -- that is, if the legalization trend continues to the point that all 50 states legalize recreational marijuana. The total market value of all states legalizing marijuana would top $36.8 billion -- more than $3 billion larger than the organic food industry.

"These are exciting times," Dayton said in the executive summary, "and new millionaires and possibly billionaires are about to be made, while simultaneously society will become safer and freer."

Industry Statistics

According to ArcView the current value of legal marijuana market is $3 billion+ (as of August 2015) with 14,000+ legal dispensaries. It grew 74% in 2014 and expected to grow another 32% in 2015. If you include revenue generated by ancillary companies (manufacturers who create plant-harvesting machinery, lawyers who represent growers, CPAs and accountants who advise startups), the numbers soar to somewhere in the $9.6-$11 billion range — nearly double the 2013 total of $5.7 billion. It is expected that the annual revenues from these ancillary companies will grow alongside cannabis sales.

23 States have legalized medical marijuana with 11 more pending legislation in 2015.

According to the England Journal of Medicine, 76% of clinicians polled worldwide believe that the medicinal benefits outweigh the risks and potential harms. Within the next 5 years, the legal cannabis industry is expected to out earn the US film industry, the organic foods industry and more than triple the revenues of the NFL. (Source: http://www.nejm.org/doi/full/10.1056/NEJMclde1305159)

53% of Americans support marijuana legalization according to Pew Research. (Source: http://www.pewresearch.org/fact-tank/2015/04/14/6-facts-about-marijuana/)

| 6 |

Customers

Our customers are companies in the Cannabis/Hemp Industry. Two main services that we provide our clients: 1) Advertising in our magazine, website and email blasts; and, 2) branding and marketing services in order to aid companies in our space to develop their brand as well as market and sell their products.

Our customers are also consumers in the Cannabis Marketplace seeking to purchase our products, magazine subscriptions, seminars, expos, education classes and the productions or services of our commercial clients

Licensing: We are providing licenses to individuals who wish to market and sell the Freedom Leaf magazine and website advertising, products, services, seminars as well as other products and services that we develop for those companies that we provide our branding and marketing services. The licenses are available for individuals in States, Cities and Countries.

We are negotiating with companies overseas for the Freedom Leaf licenses to market and sell the Freedom Leaf magazine, website advertising, products, services, seminars and other products and services that we develop for those companies that we provide branding and marketing services.

Marketing Focus and Strategy

Our marketing is centered around the Freedom Leaf magazine and website. It is a two-fold strategy. First, the magazine draws businesses that are in the Cannabis/Hemp Industry to speak to us either because they are interested in advertising in the magazine and/or for Freedom Leaf to publicize their business either through us writing an article about their company or for them to write an article about an aspect in the industry that relates to their business (content marketing). Second, Freedom Leaf will undertake cross promotion with operators of different expos, seminars and other public events that extend our reach to companies industry. Last of all, we also use the non-profit alliances that we have established to gain a prominent position in our Industry.

Our Products

| · | Ads in magazine, on Freedom Leaf owned web sites, and in our email blasts. |

| · | Events, education classes, expos and seminars. |

| · | Marketing contracts with Industry businesses |

| · | Branding contracts with Industry businesses |

| · | Freedom Leaf Branded Products |

| · | Magazine Subscriptions |

| · | Branded Products and/or services Companies that we represent. |

Sales Targets

Non-Profits within the Cannabis/Hemp Industry

Freedom Leaf currently has a branding and marketing contract with NORML (National Organization for the Reform of Marijuana Laws). Freedom Leaf is responsible for all of their business activities, such as selling branded merchandise, donation fundraising, licensing their brand, membership campaigns, etc.

There are a few other non-profit organizations within the Cannabis/Hemp Industry that we will approach to develop a contract to do the same.

Companies within the Cannabis/Hemp Industry for Advertising

Some examples are: Dispensaries in the 23 states that are legal for medical marijuana sales; Locations that sell recreational marijuana in 3 states that are legal for those sales, companies that make edible food infused with marijuana and/or CBDs, vape manufacturers and wholesalers, websites that sell auxiliary products. Other that sell products and or services that wish to reach our market, such as clothing, concerts, cell phones, headsets, soda, energy drinks, health products, etc.

7

Target Market

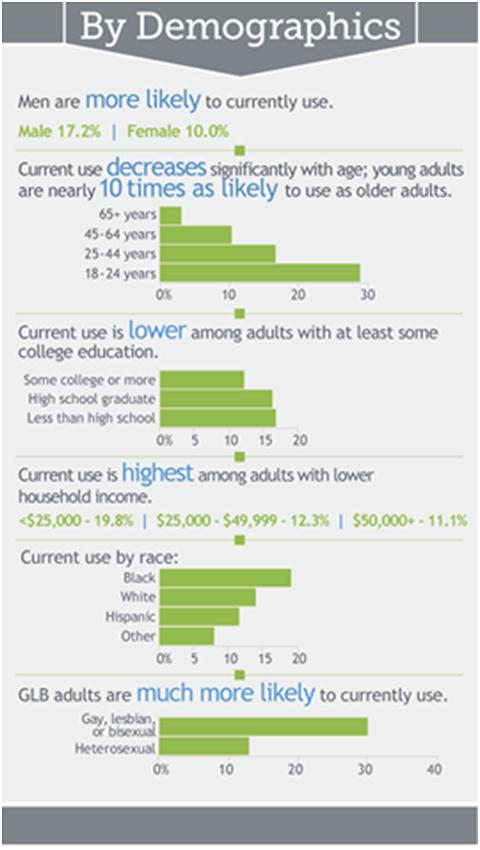

This Survey completed by the State of Colorado for the year 2014 is the best info on the demographics of the target market of Freedom Leaf.

8

Competitive Edge

Freedom Leaf has received wide acceptance in the Cannabis/Hemp marketplace due to its support of non-profits in the space and for the excellent editorial and other content in our magazine.

At least 50% of our distribution is through non-profit activists (to themselves and those they come in contact with) and as everyone knows activists are the most loyal consumers any company can have.

Freedom Leaf has signed a very important branding and marketing agreement with NORML, who is the oldest non-profit in our space promoting the legalization of marijuana and hemp laws, and the most respected non-profit in the Industry.

Its size is perfect for people to carry around easily.

Competitors

We compete with companies of all sizes in a variety of geographies that offer solutions that compete with elements of our business plan, such in print and online printing, advertising, etc. More specifically, however, the medical and recreational marijuana companies is a new, developing and nascent market, resulting in a highly fragmented and fractured marketplace. The federal state and municipal governments have varying degrees of legality that will effect business. Some of the companies we compete with are much larger than us, and such companies have significantly greater resources than us.

Significantly all of our current and potential competitors have longer operating histories, larger customer or user bases, greater brand recognition and significantly greater financial, marketing and other resources than we do. Our competitors may be able to secure experienced employees, accommodate customers more efficiently and adopt more aggressive pricing policies than we can. Many of these current and potential competitors can devote substantially more resources to advertising, marketing and attracting experienced talent than we can. In addition, larger, more well-established and financed entities may acquire, invest in or form joint ventures with our competitors

Our competitors may include:

Culture Magazine

www.ireadculture.com

Southern & Northern CA, Denver CO, Seattle WA, San Diego CA, Portland OR,

Started in Southern CA in 2009

High Times Magazine

www.hightimes.com

Started in 1974, monthly publication, oldest in industry but subscription base has reduced substantially, still the major national magazine.

Dope Magazine

www.dopemagazine.com

Approximately 10 months old in eastern Washington, 4 to 6 months in balance of locations (southern CA, northern CA, eastern WA, Portland, OR, Denver, CO)

Elevate Magazine

www.elavatnv.com

Local Las Vegas magazine (we have a strategic relationship with them)

Intellectual Property

Website

We assert common law copyright in the contents of our web sites, www.freedomleaf.com and www.cannabizu.com, and common law trademark rights in our business name and related product labels, including "Hemp Inspired," “Cannabizu,” and “Cannabiz.” We have not registered for the protection of all of our copyrights, trademarks, patents or designs, although we may do so in the future as we deem necessary to protect our business.

| 9 |

We plan to develop these other domains, which are owned by Freedom Leaf:

www.MarijuanaNews.com

www.LadyCannabis.com

www.CannabisSeminars.com

www.CannabisDebate.com

www.CannaSpa.com

www.Vegasterdam.com

Trademarks

We have registered or filed for registration in the United States for the following copyrights and trademarks: “Freedom Leaf,” “Hemp Inspired,” “Cannabiz U,” and “Cannabiz.” Internationally, we have filed for “Freedom Leaf” in Jamaica and Uruguay.

Reports to Security Holders

We intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company's operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

We believe that we are and will continue to be in compliance in all material respects with applicable statutes and the regulations passed in the United States. There are no current orders or directions relating to our company with respect to the foregoing laws and regulations.

Continued development of the marijuana industry is dependent upon continued legislative authorization of marijuana at the state level. Any number of factors could slow or halt progress in this area. Further, progress, while encouraging, is not assured. While there may be ample public support for legislative action, numerous factors impact the legislative process. Any one of these factors could slow or halt use of marijuana, which would negatively impact our proposed business.

Marijuana is a Schedule-I controlled substance and is illegal under federal law. Even in those states in which the use of marijuana has been legalized, its use remains a violation of federal laws. There are currently 23 states and the District of Columbia allowing its citizens to use Medical Marijuana. Additionally, Alaska, Colorado, Oregon, Washington State, as well as Washington D.C., have voted to legalize cannabis for adult recreational use. The state laws are in conflict with the federal Controlled Substances Act, which makes marijuana use and possession illegal on a national level. The Obama administration has effectively stated that it is not an efficient use of resources to direct law federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. However, there is no guarantee that the administration will not change its stated policy regarding the low-priority enforcement of federal laws. Additionally, any new administration that follows could change this policy and decide to enforce the federal laws strongly. Active enforcement of the current federal regulatory position on cannabis may thus indirectly and adversely affect our revenues and profits. Any such change in the federal government’s enforcement of current federal laws could cause significant financial damage to us. While we do not intend to harvest, distribute or sell cannabis, we may be irreparably harmed by a change in enforcement by the Federal or state governments.

Environmental Regulations

We do not believe that we are or will become subject to any environmental laws or regulations of the United States. While our products and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our products or potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

| 10 |

Employees

As of June 30, 2015, we had a total of seven full time employees. Our employees are not parties to any collective bargaining agreement. We believe our relationships with our employees are good.

Property

We lease approximately 2,800 square feet of office space in Las Vegas, Nevada, pursuant to a lease that will expire on September 30, 2019. This facility serves as our corporate headquarters. After September 30, 2017, the Company has the option to opt out of the lease.

Available Information

All reports of the Company filed with the SEC are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

Item 1A. Risk Factors.

As a smaller reporting company, we are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We lease approximately 2,800 square feet of office space in Las Vegas, Nevada, pursuant to a lease that will expire on September 30, 2019. This facility serves as our corporate headquarters. After September 30, 2017, the Company has the option to opt out of the lease.

Item 3. Legal Proceedings.

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. As of October 1, 2015, there were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the results of our operations.

Item 4. Mine Safety Disclosures.

Not applicable.

11

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Common Equity

Market Information

The Company’s common stock is traded on the OTC Pink under the symbol “FRLF.PK.” The symbol change from the predecessor company was effective February 24, 2015. As of June 30, 2015, the Company’s common stock was held by 45 shareholders of record, which does not include shareholders whose shares are held in street or nominee name.

The Company’s shares commenced trading on or about February 10, 2014 (for Arkadia International, Inc.). The following chart is indicative of the fluctuations in the stock prices:

| For the Years Ended June 30, | ||||||||||||||||

| 2015 | 2014 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 1.05 | $ | 0.25 | N/A | N/A | ||||||||||

| Second Quarter | $ | 10.00 | $ | 1.05 | N/A | N/A | ||||||||||

| Third Quarter | $ | 5.625 | $ | 0.05 | $ | 0.25 | $ | 0.25 | ||||||||

| Fourth Quarter | $ | 1.00 | $ | 0.05 | $ | 0.25 | $ | 0.25 | ||||||||

Source: OTC Markets

The Company’s transfer agent is Globex Transfer, LLC at 780 Deltona Blvd., Suite 202, Deltona, FL 32725.

Dividend Distributions

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Securities authorized for issuance under equity compensation plans

The Company does not have a stock option plan.

Penny Stock

Our common stock is considered "penny stock" under the rules the Securities and Exchange Commission (the "SEC") under the Securities Exchange Act of 1934. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market System, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that:

| • | contains a description of the nature and level of risks in the market for penny stocks in both public offerings and secondary trading; |

| • | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| • | contains a toll-free telephone number for inquiries on disciplinary actions; |

| • | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| • | contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation. |

| 12 |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

| • | bid and offer quotations for the penny stock; |

| • | the compensation of the broker-dealer and its salesperson in the transaction; |

| • | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the marker for such stock; and |

| • | monthly account statements showing the market value of each penny stock held in the customer's account. |

In addition, the penny stock rules that require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgement of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

Related Stockholder Matters

None.

Purchase of Equity Securities

None.

Item 6. Selected Financial Data.

As the Company is a “smaller reporting company,” this item is inapplicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipate,” “expects,” “intends,” “plans,” “believes,” “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our financial statements and summary of selected financial data for Freedom Leaf, Inc. Such discussion represents only the best present assessment from our Management.

DESCRIPTION OF COMPANY

The Company was a startup company that was incorporated in Nevada under the name Arkadia International, Inc. on February 21, 2013.

On October 3, 2014, the Company experienced a change in control. Richard C. Cowan acquired a majority of the issued and outstanding common stock of the Company in accordance with stock purchase agreements by and between Mr. Cowan and Vladimir and Galina Shekhtman (“Sellers”). On the closing date, October 3, 2014, pursuant to the terms of the Stock Purchase Agreement, Cowan purchased from the Sellers 6,950,100 shares of the Company’s outstanding restricted common stock for $100,000, representing 93%.

On November 4, 2014, the Company's Board of Directors declared a twelve for one forward stock split of all outstanding shares of the Company’s common stock. As the stock split was approved by FINRA, the common share and per common share data in these financial statements and related notes hereto have been retroactively adjusted to account for the effect of the stock split. The total number of authorized common shares and the par value thereof was not changed by the split.

| 13 |

On November 6, 2014, we entered into a share exchange agreement (the “Exchange Agreement”) with Freedom Leaf, Inc., a Nevada corporation (“Private Company”), and the Company’s sole officer and director Clifford J. Perry (“Perry”), being the owners of record of all of the issued share capital of Freedom Leaf, Inc. (the “FL Stock”). Pursuant to the Exchange Agreement, the Shareholders received an aggregate of 83,401,200 shares (48.1%) our common stock (consisting of a new issuance of shares and Mr. Perry’s transfer of all of his shares) and we received the FL Stock. As a result of the exchange of the FL Stock for the Acquisition Stock (the “Share Exchange”), Freedom Leaf, Inc. became our Company whereas the operations of Arkadia International, Inc. ceased, and there was a change of control of the Company.

Prior to the Share Exchange, we were a startup company that originally intended to engage in the business of the acquisition of in demand equipment, cars, and goods with the intent to resell these in the in the U.S. territories or export to overseas countries.

We have had limited operations and have been issued a “going concern” opinion by our auditor, based upon our reliance on the sale of our common stock as the sole source of funds for our future operations.

We are currently devoting substantially all of our efforts in migrating to the news, arts and entertainment niche, with both in print and online publications. Principal business activities are still in the development stage and have not yet commenced. The Company will generate revenue through paid advertising in publications, both print and online, in the cannabis/hemp marketplace. The Company will also earn revenue from providing consulting services to companies who are in our industry, contracting with companies to brand, market, and sell their products and/or services, provide seminars in this space, and sell branded products for the Company and others the Company represents.

The following Management Discussion and Analysis should be read in conjunction with the financial statements and accompanying notes included in this Form 10-K.

COMPARISON OF THE YEAR ENDED JUNE 30, 2015 TO THE YEAR ENDED JUNE 30, 2014

Results of Operations

Revenue. For the year ended June 30, 2015, our revenue was $48,674, compared to $0 for the same period in 2014. This increase in revenue was attributable to increased sales related to the beginning of operations in 2015.

Operating Expenses:

Direct costs of Revenue. For the year ended June 30, 2015, direct costs of revenue were $213,604 compared to $0 for the same period in 2014. As a percent of revenue, direct costs of revenue were 26.8% and 0%, respectively, for 2015 and 2014. The direct costs of revenue increased in proportion to the increase of revenue.

General and Administrative Expenses. For the year ended June 30, 2015, general and administrative expenses were $768,938 compared to $0 for the same period in 2014. The increase was due to the increase in operations.

Net Loss. We generated net losses of $999,118 for the year ended June 30, 2015, compared to $0 for the same period in 2014.

Liquidity and Capital Resources

General. At June 30, 2015, we had cash and cash equivalents of $901. We have historically met our cash needs through a combination of cash flows from operating activities and proceeds from private placements of our securities and loans. Our cash requirements are generally for selling, general and administrative activities. We believe that our cash balance is not sufficient to finance our cash requirements for expected operational activities, capital improvements, and partial repayment of debt through the next 12 months.

Our operating activities used cash of $944,352 for the year ended June 30, 2015, and we used cash in operations of $0 during the same period in 2014. The principal elements of cash flow from operations for the year ended June 30, 2015, included a net loss of $999,118.

Cash provided by investing activities during the year ended June 30, 2015, was $4,301 compared to $0 during the same period in 2014.

Cash generated in our financing activities was $940,952 for the year ended June 30, 2015, compared to cash generated of $0 during the comparable period in 2015.

| 14 |

As of June 30, 2015, current liabilities exceeded current assets by 9.17 times. Current assets increased from $0 at June 30, 2014 to $5,381 at June 30, 2015, whereas current liabilities increased from $0 at June 30, 2014, to $49,361 at June 30, 2015.

| For the years ended | ||||||||

| June 30, | ||||||||

| 2015 | 2014 | |||||||

| Cash used in operating activities | $ | (944,352 | ) | $ | – | |||

| Cash provided by investing activities | 4,301 | – | ||||||

| Cash provided by financing activities | 940,952 | – | ||||||

| Net changes to cash | $ | 901 | $ | – | ||||

Going Concern

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company had sales of $48,674 and net losses of $999,118 for the year ended June 30, 2015, compared to sales of $0 and net losses of $0 for the year ended June 30, 2014. The Company had a working capital deficit, stockholders’ deficit, and accumulated deficit of $44,780, $230,807 and $999,118, respectively, at June 30, 2015. These factors raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period of time. The Company is highly dependent on its ability to continue to obtain investment capital from future funding opportunities to fund the current and planned operating levels. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. The Company’s continuation as a going concern is dependent upon its ability to bring in income generating activities and its ability to continue receiving investment capital from future funding opportunities. No assurance can be given that the Company will be successful in these efforts.

Critical Accounting Policies

Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates in the accompanying financial statements include the amortization period for intangible assets, valuation and impairment valuation of intangible assets, depreciable lives of the web site and property and equipment, valuation of warrant and beneficial conversion feature debt discounts, valuation of share-based payments and the valuation allowance on deferred tax assets.

Changes in Accounting Principles. No significant changes in accounting principles were adopted during fiscal 2015 and 2014.

Derivatives. The Company evaluates its convertible debt, options, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for. The result of this accounting treatment is that under certain circumstances the fair value of the derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the statement of operations as other income or expense. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity. Equity instruments that are initially classified as equity that become subject to reclassification under this accounting standard are reclassified to liability at the fair value of the instrument on the reclassification date.

Impairment of Long-Lived Assets. The Company accounts for long-lived assets in accordance with the provisions of Statement of Financial Accounting Standards ASC 360-10, “Accounting for the Impairment or Disposal of Long-Lived Assets”. This statement requires that long-lived assets and certain identifiable intangibles be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

| 15 |

Fair Value of Financial Instruments and Fair Value Measurements. The Company measures their financial assets and liabilities in accordance with generally accepted accounting principles. For certain of our financial instruments, including cash, accounts payable, accrued expenses escrow liability and short-term loans the carrying amounts approximate fair value due to their short maturities.

We have adopted accounting guidance for financial and non-financial assets and liabilities. The adoption did not have a material impact on our results of operations, financial position or liquidity. This standard defines fair value, provides guidance for measuring fair value and requires certain disclosures. This standard does not require any new fair value measurements, but rather applies to all other accounting pronouncements that require or permit fair value measurements. This guidance does not apply to measurements related to share-based payments. This guidance discusses valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). The guidance utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Inputs other than quoted prices that are observable, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active.

Level 3: Unobservable inputs in which little or no market data exists, therefore developed using estimates and assumptions developed by us, which reflect those that a market participant would use.

Revenue Recognition. The Company recognizes revenue for our services in accordance with ASC 605-10, "Revenue Recognition in Financial Statements." Under these guidelines, revenue is recognized on transactions when all of the following exist: persuasive evidence of an arrangement did exist, delivery of service has occurred, the sales price to the buyer is fixed or determinable and collectability is reasonably assured. The Company has five primary revenue streams as follows:

| • | Consulting services. | |

| • | Advertising services. | |

| • | Branding, marketing and selling products for companies. | |

| • | Educational seminars. | |

| • | Selling branded products. |

Stock-Based Compensation. The Company accounts for stock-based instruments issued to employees in accordance with ASC Topic 718. ASC Topic 718 requires companies to recognize in the statement of operations the grant-date fair value of stock options and other equity based compensation issued to employees. The Company accounts for non-employee share-based awards in accordance with ASC Topic 505-50. The value of the portion of an award that is ultimately expected to vest is recognized as an expense over the requisite service periods using the straight-line attribution method. The Company estimates the fair value of each stock option at the grant date by using the Black-Scholes option-pricing model. The Company estimates the fair value of each stock option at the grant date by using the Black-Scholes option-pricing model.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

As the Company is a “smaller reporting company,” this item is inapplicable.

16

Item 8. Financial Statements and Supplementary Data.

Freedom Leaf, Inc.

Table of Contents

| Page | ||||

| Report of Independent Registered Public Accounting Firm | F-1 | |||

| Balance Sheets | F-2 | |||

| Statements of Operations | F-3 | |||

| Statements of Changes in Shareholders’ Equity | F-4 | |||

| Statements of Cash Flows | F-5 | |||

| Notes to Financial Statements | F-6 | |||

| 17 |

|

Green & Company, CPAs |

| A PCAOB Registered Accounting Firm |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of:

Freedom Leaf, Inc.

We have audited the accompanying balance sheets of Freedom Leaf, Inc. and subsidiaries as of June 30, 2015 and the related statements of operations, changes in shareholders’ equity, and cash flows for the year then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Freedom Leaf, Inc. as of June 30, 2015 and the results of its operations and its cash flows for the year in the period ended June 30, 2015 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company reported a net loss of $252,521 in 2015, and used cash for operating activities of $197,755. At June 30, 2015, the Company had a working capital deficit, shareholders’ deficit and accumulated deficit of $44,780, $230,807 and $252,521, respectively. These matters raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans as to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Green & Company CPAs, Inc.

Green & Company CPAs, Inc.

Temple Terrace, Florida

October 5, 2015

|

10320 N 56th Street, Suite 330 |

Temple Terrace, FL 33617 |

813.606.4388 |

| F-1 |

FREEDOM LEAF, INC.

(f/k/a Arkadia International, Inc.)

Balance Sheets

| June 30, | June 30, | |||||||

| 2015 | 2014 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | 901 | $ | – | ||||

| Accounts receivable | 2,480 | – | ||||||

| Other receivable | 2,000 | – | ||||||

| Total current assets | 5,381 | – | ||||||

| Intangible assets, net | 4,744 | – | ||||||

| Other assets | 3,584 | – | ||||||

| Total assets | $ | 13,709 | $ | – | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 4,711 | $ | – | ||||

| Accounts payable to related parties | 27,466 | – | ||||||

| Accrued expenses | 17,984 | – | ||||||

| Total current liabilities | 50,161 | – | ||||||

| Long-term liabilities | ||||||||

| Payable to related party | 194,355 | – | ||||||

| Total long-term liabilities | 194,355 | – | ||||||

| Total liabilities | 244,516 | – | ||||||

| Commitments and contingencies | ||||||||

| Stockholders' deficit | ||||||||

| Common stock, $0.001 par value, 500,000,000 and 75,000,000 shares authorized, respectively, 174,181,200 and 0 shares issued, issuable, and outstanding at June 30, 2015 and 2014, respectively | 174,181 | – | ||||||

| Additional paid-in capital | 594,130 | – | ||||||

| Accumulated deficit | (999,118 | ) | – | |||||

| Total stockholders' deficit | (230,807 | ) | – | |||||

| Total liabilities and stockholders' deficit | $ | 13,709 | $ | – | ||||

See accompanying notes to financial statements.

| F-2 |

FREEDOM LEAF, INC.

(f/k/a Arkadia International, Inc.)

Statements of Operations

For the Years Ended June 30,

| 2015 | 2014 | |||||||

| Revenue, net | $ | 48,674 | $ | – | ||||

| Operating expenses | ||||||||

| Direct costs of revenue | 213,604 | – | ||||||

| General and administrative | 768,938 | – | ||||||

| Marketing expense | 65,250 | – | ||||||

| Net loss | $ | (999,118 | ) | $ | – | |||

| Net loss per share - basic and diluted | $ | (0.01 | ) | $ | – | |||

| Weighted average number of shares outstanding - basic and diluted | 173,896,981 | – | ||||||

See accompanying notes to financial statements.

| F-3 |

FREEDOM LEAF, INC.

Statement of Shareholders' Deficit

June 30, 2015

| Common Stock | Additional | |||||||||||||||||||||||||||

| Issuable | Common Stock | Paid In | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance at June 30, 2014 | – | $ | – | – | $ | – | $ | – | $ | – | $ | – | ||||||||||||||||

| Reverse merger | 83,401,200 | 83,401 | 90,000,000 | 90,000 | (164,187 | ) | – | 9,214 | ||||||||||||||||||||

| Issuance of common stock for services | 780,000 | 780 | – | – | 11,720 | – | 12,500 | |||||||||||||||||||||

| Issuable stock issued | (84,181,200 | ) | (84,181 | ) | 84,181,200 | 84,181 | – | – | – | |||||||||||||||||||

| Contributed capital | – | – | – | – | 746,597 | – | 746,597 | |||||||||||||||||||||

| Net loss for the period ended June 30, 2015 | – | – | – | – | – | (999,118 | ) | (999,118 | ) | |||||||||||||||||||

| Balance at June 30, 2015 | – | $ | – | 174,181,200 | $ | 174,181 | $ | 594,130 | $ | (999,118 | ) | $ | (230,807 | ) | ||||||||||||||

See accompanying notes to financial statements.

| F-4 |

FREEDOM LEAF, INC.

(f/k/a Arkadia International, Inc.)

Statements of Cash Flows

For the Years Ended June 30,

| 2015 | 2014 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (999,118 | ) | $ | – | |||

| Adjustments to reconcile net loss to net cash used in operations: | ||||||||

| Issuance of common stock for services | 12,500 | – | ||||||

| Amortization of intellectual properties | 169 | – | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (2,480 | ) | – | |||||

| Other receivable | (2,000 | ) | – | |||||

| Other assets | (3,584 | ) | – | |||||

| Accounts payable | 4,711 | – | ||||||

| Accounts payable to related parties | 27,466 | – | ||||||

| Accrued expenses | 17,984 | – | ||||||

| Net cash used in operating activities | (944,352 | ) | – | |||||

| Cash flows provided by investing activities | ||||||||

| Cash acquired from acquisition | 9,214 | – | ||||||

| Intangible asset acquired | (4,913 | ) | – | |||||

| Net cash provided by investing activities | 4,301 | – | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from capital contributed | 746,597 | – | ||||||

| Proceeds from related party | 194,355 | – | ||||||

| Net cash provided by financing activities | 940,952 | – | ||||||

| Net decrease in cash | 901 | – | ||||||

| Cash at beginning of period | – | – | ||||||

| Cash at end of period | $ | 901 | $ | – | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | – | $ | – | ||||

| Cash paid for taxes | $ | – | $ | – | ||||

See accompanying notes to financial statements.

| F-5 |

Freedom Leaf, Inc.

(f/k/a Arkadia International, Inc.)

Notes to Financial Statements

June 30, 2015

NOTE 1 – NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Freedom Leaf, Inc. (the “Company,” “we,” “us,” “our,” or “Freedom Leaf”) was incorporated in the State of Nevada on February 21, 2013, under the name of Arkadia International, Inc. The Company was originally engaged in the business of the acquisition of in demand equipment, cars, and goods with the intent to resale these in the U.S. territory or export to overseas countries.

On October 3, 2014, the Company experienced a change in control. Richard C. Cowan acquired a majority of the issued and outstanding common stock of the Company in accordance with stock purchase agreements by and between Mr. Cowan and Vladimir and Galina Shekhtman (“Sellers”). On the closing date, October 3, 2014, pursuant to the terms of the Stock Purchase Agreement, Cowan purchased from the Sellers 6,950,100 shares of the Company’s outstanding restricted common stock for $100,000, representing 93%.

On November 6, 2014, the Company merged with Freedom Leaf, Inc., a private Nevada corporation. The Company changed its name from Arkadia International, Inc., to Freedom Leaf, Inc. As a result of the merger, the private company was dissolved. See Note 2 for related discussion.

For financial reporting purposes, the Share Exchange represents a "reverse merger" rather than a business combination and Private Company is deemed to be the accounting acquirer in the transaction. The Share Exchange is being accounted for as a reverse-merger and recapitalization. Private Company is the acquirer for financial reporting purposes and the Public Company (Freedom Leaf, Inc., f/k/a Arkadia International, Inc.) is the acquired company. Consequently, the assets and liabilities and the operations that will be reflected in the historical financial statements prior to the Share Exchange will be those of the Private Company and will be recorded at the historical cost basis of the Private Company, and the financial statements after completion of the Share Exchange will include the assets and liabilities of the Public Company and the Private Company, and the historical operations of Private Company and operations of both companies from the closing date of the Share Exchange.

Nature of Operations

We are currently devoting substantially all of our efforts in migrating to the news, arts and entertainment niche, with both in print and online publications. Principal business activities are still in the development stage and have not yet commenced. The Company will generate revenue through paid advertising in publications, both print and online, in the cannabis/hemp marketplace. The Company will also earn revenue from consulting companies who are in our industry, contracting with companies to brand, market, and sell their products and/or services, provide seminars in this space, and sell branded products for the Company and others the Company represents.

Basis of Presentation

The Company prepares its financial statements in conformity with generally accepted accounting principles in the United States of America.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates in the accompanying financial statements include the amortization period for intangible assets, valuation and impairment valuation of intangible assets, allowance for accounts receivable, depreciable lives of the web site, valuation of warrants and beneficial conversion feature debt discounts, valuation of derivatives, and valuation of share-based payments.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents.

Property, Equipment and Depreciation

Property and equipment is recorded at cost. Depreciation is computed using the straight-line method based on the estimated useful lives of the related assets of three years for computer equipment, five years for office furniture and fixtures, and the lesser of the lease term or the useful life of the leased equipment. Leasehold improvements, if any, would be amortized over the lesser of the lease term or the useful life of the improvements. Expenditures for maintenance and repairs along with fixed assets below our capitalization threshold are expensed as incurred.

| F-6 |

Freedom Leaf, Inc.

(f/k/a Arkadia International, Inc.)

Notes to Financial Statements

June 30, 2015

Accounting for Derivatives

The Company evaluates its convertible debt, options, warrants or other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for. The result of this accounting treatment is that under certain circumstances the fair value of the derivative is marked-to-market each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the statement of operations as other income or expense. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity. Equity instruments that are initially classified as equity that become subject to reclassification under this accounting standard are reclassified to liability at the fair value of the instrument on the reclassification date.

Impairment of Long-Lived Assets

The Company accounts for long-lived assets in accordance with the provisions of Statement of Financial Accounting Standards ASC 360-10, “Accounting for the Impairment or Disposal of Long-Lived Assets”. This statement requires that long-lived assets and certain identifiable intangibles be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future undiscounted net cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell.

Fair Value of Financial Instruments

The Company measures its financial assets and liabilities in accordance with generally accepted accounting principles. For certain of our financial instruments, including cash, accounts payable, accrued expenses, deposits received from customers for layaway sales and short term loans the carrying amounts approximate fair value due to their short maturities.

We follow accounting guidance for financial and non-financial assets and liabilities. This standard defines fair value, provides guidance for measuring fair value and requires certain disclosures. This standard does not require any new fair value measurements, but rather applies to all other accounting pronouncements that require or permit fair value measurements. This guidance does not apply to measurements related to share-based payments. This guidance discusses valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). The guidance utilizes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The following is a brief description of those three levels:

Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Inputs other than quoted prices that are observable, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are not active.

Level 3: Unobservable inputs in which little or no market data exists, therefore developed using estimates and assumptions developed by us, which reflect those that a market participant would use.

| F-7 |

Freedom Leaf, Inc.

(f/k/a Arkadia International, Inc.)

Notes to Financial Statements

June 30, 2015

We currently measure and report at fair value our intangible assets (due to our impairment analysis) and derivative liabilities. The fair value of intangible assets has been determined using the present value of estimated future cash flows method. The fair value of derivative liabilities is measured using the Black-Scholes option pricing method. The following table summarizes our non-financial assets and liabilities measured at fair value on a recurring basis as of June 30, 2015:

| Balance at | Quoted Prices in Active Markets | Significant Other | Significant | |||||||||||||

| June 30, | for Identical | Observable | Unobservable | |||||||||||||

| 2015 | Assets | Inputs | Inputs | |||||||||||||

| (Level 1) | (Level 2) | (Level 3) | ||||||||||||||

| Assets: | ||||||||||||||||

| Trademarks | $ | 4,744 | $ | – | $ | – | $ | 4,744 | ||||||||

| Total Financial Assets | $ | 4,744 | $ | – | $ | – | $ | 4,744 | ||||||||

Following is a summary of activity through June 30, 2015 of the fair value of intangible assets valued using Level 3 inputs:

| Asset | Accumulated Amortization | Net | ||||||||||

| Intangibles - June 30, 2014 | $ | – | $ | – | $ | – | ||||||

| Additions | 4,913 | – | 4,913 | |||||||||

| Amortization | – | (169 | ) | (169 | ) | |||||||

| Intangibles - June 30, 2015 | $ | 4,913 | $ | (169 | ) | $ | 4,744 | |||||

Development Stage Company

Since inception, the Company became a “development stage company” as defined in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 915 “Development Stage Entities.” On June 10, 2014 the FASB issued authoritative guidance which eliminates the concept of a development stage entity. The incremental reporting requirements for presenting the development stage operations and cash flows since inception will no longer apply to development stage entities. The amendments of Topic 915 are to be applied retrospectively and are effective for fiscal years beginning after December 15, 2014. The Company has elected early adoption of this guidance effective with the filing of its previous quarterly report.

On November 6, 2015, the Company merged with Freedom Leaf, Inc., a private Nevada corporation. The Company changed its name from Arkadia International, Inc., to Freedom Leaf, Inc. As a result of the merger, the private company was dissolved. See Note 3 for related discussion.

Revenue Recognition

The Company recognizes revenue for our services in accordance with ASC 605-10, "Revenue Recognition in Financial Statements." Under these guidelines, revenue is recognized on transactions when all of the following exist: persuasive evidence of an arrangement did exist, delivery of service has occurred, the sales price to the buyer is fixed or determinable and collectability is reasonably assured. The Company has five primary revenue streams as follows:

| · | Consulting services. | |

| · | Advertising services. | |

| · | Branding, marketing and selling products for companies. | |

| · | Educational seminars. | |

| · | Selling branded products. |

| F-8 |

Freedom Leaf, Inc.

(f/k/a Arkadia International, Inc.)

Notes to Financial Statements

June 30, 2015

Stock-Based Compensation

The Company accounts for stock-based instruments issued to employees in accordance with ASC Topic 718. ASC Topic 718 requires companies to recognize in the statement of operations the grant-date fair value of stock options and other equity based compensation issued to employees. The value of the portion of an award that is ultimately expected to vest is recognized as an expense over the requisite service periods using the straight-line attribution method. The Company accounts for non-employee share-based awards in accordance with the measurement and recognition provisions ASC Topic 505-50. The Company estimates the fair value of stock options at the grant date by using the Black-Scholes option-pricing model.

Advertising

Advertising is expensed as incurred and is included in selling, general and administrative expenses on the accompanying statement of operations. For the years ended June 30, 2015 and 2014 advertising expense was $65,250 and $0, respectively.

Income Taxes

Beginning September 1, 2009, the Company adopted the provisions of ASC 740-10, “Accounting for Uncertain Income Tax Positions.” When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. In accordance with the guidance of ASC 740-10, the benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above should be reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. The Company believes its tax positions are all highly certain of being upheld upon examination. As such, the Company has not recorded a liability for unrecognized tax benefits. As of June 30, 2015, tax year 2014 remain open for IRS audit. The Company has received no notice of audit from the IRS for any of the open tax years.

Effective September 1, 2009, the Company adopted ASC 740-10, “Definition of Settlement in FASB Interpretation No. 48,” (“ASC 740-10”), which was issued on May 2, 2007. ASC 740-10 amends FIN 48 to provide guidance on how an entity should determine whether a tax position is effectively settled for the purpose of recognizing previously unrecognized tax benefits. The term “effectively settled” replaces the term “ultimately settled” when used to describe recognition, and the terms “settlement” or “settled” replace the terms “ultimate settlement” or “ultimately settled” when used to describe measurement of a tax position under ASC 740-10. ASC 740-10 clarifies that a tax position can be effectively settled upon the completion of an examination by a taxing authority without being legally extinguished. For tax positions considered effectively settled, an entity would recognize the full amount of tax benefit, even if the tax position is not considered more likely than not to be sustained based solely on the basis of its technical merits and the statute of limitations remains open. The adoption of ASC 740-10 did not have an impact on the accompanying financial statements.

Net Earnings (Loss) Per Share

In accordance with ASC 260-10, “Earnings Per Share,” basic net earnings (loss) per common share is computed by dividing the net earnings (loss) for the period by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share are computed using the weighted average number of common and dilutive common stock equivalent shares outstanding during the period.

Segment Information

In accordance with the provisions of ASC 280-10, “Disclosures about Segments of an Enterprise and Related Information”, the Company is required to report financial and descriptive information about its reportable operating segments. The Company does not have any operating segments as of June 30, 2015 and 2014.

Effect of Recent Accounting Pronouncements

The Company reviews new accounting standards and updates as issued. No new standards or updates had any material effect on these unaudited financial statements. The accounting pronouncements and updates issued subsequent to the date of these audited financial statements that were considered significant by management were evaluated for the potential effect on these audited financial statements. Management does not believe any of the subsequent pronouncements will have a material effect on these audited financial statements as presented and does not anticipate the need for any future restatement of these audited financial statements because of the retro-active application of any accounting pronouncements issued subsequent to June 30, 2015 through the date these audited financial statements were issued.

| F-9 |

Freedom Leaf, Inc.

(f/k/a Arkadia International, Inc.)

Notes to Financial Statements

June 30, 2015

NOTE 2 – ENTRY INTO A DEFINITIVE AGREEMENT