Attached files

| file | filename |

|---|---|

| EX-31.3 - EXHIBIT 31.3 - Towers Watson & Co. | tw-ex313_10ka.htm |

| EX-32.2 - EXHIBIT 32.2 - Towers Watson & Co. | tw-ex322_10ka.htm |

| EX-31.4 - EXHIBIT 31.4 - Towers Watson & Co. | tw-ex314_10ka.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2015

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File Number: 001-34594

TOWERS WATSON & CO.

(Exact name of registrant as specified in its charter)

Delaware | 27-0676603 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

901 N. Glebe Road, Arlington, VA 22203

(Address of principal executive offices) (Zip Code)

(703) 258-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Class A Common Stock, $0.01 par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

1

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant was approximately $7,310,423,100 based on the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, December 31, 2014.

As of September 25, 2015, there were 69,440,096 outstanding shares of Class A common stock at a par value of $0.01.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Form S-4 Registration Statement filed by Willis Group Holdings Public Limited Company on August 27, 2015 are incorporated by reference into Part III of this Annual Report.

EXPLANATORY NOTE

Towers Watson & Co. is filing this Amendment No. 1 on Form 10-K/A (“Amendment”) to amend its Annual Report on Form 10-K for the year ended June 30, 2015, filed with the Securities and Exchange Commission (“SEC”) on August 14, 2015 (“Original 10-K”). We are filing this Amendment to the Original 10-K to include the information required by Items 10 through 14 of Part III of Form 10-K. Except for the addition of the Part III information, no other changes have been made to the Original 10-K. This Amendment does not reflect events occurring after the filing of the Original 10-K or modify or update those disclosures affected by subsequent events.

2

INDEX

Page | ||

PART IV. | ||

Certifications | ||

3

Part III

Item 10. Directors, Executive Officers and Corporate Governance

Information with respect to the executive officers of the Company is provided in Part I, Item 1 under the heading “Executive Officers of the Company”. Information as to the individuals serving on the board of directors of the Company is incorporated by reference to the Form S-4 Registration Statement filed by Willis Group Holdings Public Limited Company on August 27, 2015.

Audit Committee

The Audit Committee’s principal responsibilities, as set forth in its charter, are to assist the Board in overseeing the Company’s financial reporting process that is established and implemented by management. The Audit Committee oversees the work of the independent registered public accounting firm and also reviews information provided by the Company’s Director of Internal Audit, independent registered public accounting firm, and management concerning internal accounting procedures and controls.

The Audit Committee is currently composed of four independent Directors, Victor F. Ganzi (Chair), Leslie S. Heisz, Gilbert T. Ray and Paul Thomas, all of whom meet the current independence requirements of NASDAQ’s listing standards. The Board of Directors has determined that Mr. Ganzi is both independent and an audit committee financial expert, as defined by SEC guidelines and NASDAQ listing standards.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers and directors, among others, to file with the SEC initial reports of ownership and reports of changes in ownership of the Company’s securities. In addition to requiring prompt disclosure of open-market purchases or sales of Company shares, Section 16(a) applies to a number of other technical situations. The Company maintains and periodically updates a number of procedures to assist in identifying reportable transactions, and assists the Company’s executive officers and directors in preparing initial reports of ownership and reports of changes in ownership and filing those reports with the SEC on their behalf.

Based solely on a review of the copies of such forms furnished to the Company and written representations from the Company’s Section 16 officers and directors, the Company believes that all of such officers and directors filed required reports on a timely basis under Section 16(a) during fiscal year 2015.

Item 11. Executive Compensation

Compensation Discussion and Analysis

Beginning on page 6 of this Form 10-K/A, we present specific information about the compensation for the fiscal year beginning July 1, 2014 through June 30, 2015 (fiscal year 2015) to the following individuals, whom we refer to as our named executives:

• | John J. Haley, Chairman of the Board, President and Chief Executive Officer |

• | Roger F. Millay, Vice President and Chief Financial Officer |

• | James K. Foreman, Managing Director, Exchange Solutions |

• | Gene H. Wickes, Managing Director, Benefits |

• | Carl A. Hess, Managing Director, The Americas |

This Compensation Discussion and Analysis provides you with an overview and analysis of (i) the compensation programs for our named executives; (ii) the decisions made with respect to the compensation of our named executives by the Compensation Committee (the “Committee”) of the Board of Directors under those programs, including material factors considered by the Committee; and (iii) the processes utilized by the Committee in making those decisions.

Executive Summary

2015 Business Highlights

Fiscal year 2015 was a year for growth and progress toward our newly introduced “Towers Watson: 2020” strategy to deliver sustainable, profitable growth. We expanded our capabilities and expertise with the acquisitions of Saville Consulting Group

4

Limited (“Saville”) and Acclaris Holdings, Inc. (“Acclaris”). We also saw strong growth in our OneExchange membership and made significant progress toward achieving our Continuous Improvement target of $100 million run-rate savings and successfully implementing Workplace 2020 across a number of offices. Workplace 2020 is an effort to better utilize our space, keep pace with the evolving needs of our associates and clients, and complement the way our associates work today and will work in the future, by focusing on reducing office-related expenses while sustaining our brand, associate engagement and collaboration.

About Our Growth Strategy

Our three-part Growth Strategy is focused on profitable growth. First, organic growth relates to opportunities to expand our client base and capitalize on our existing businesses. Second, inorganic growth includes strategic moves that allow us to enter existing adjacent spaces, whether by adding scale to an existing business, helping us take our core services into new markets or establishing a new business. Third, innovation incorporates a disciplined approach to help us develop and deliver best-in-class client product and service offerings, beginning with ideas and business model designs, and progressing through acceptance testing and launch.

Key financial results are highlighted below:

In fiscal year 2014, we entered into an agreement to sell our Brokerage business to Jardine Lloyd Thompson Group plc. The financial results above reflect the reclassification of the operating results of our Brokerage business as discontinued operations in our consolidated statements of operations for fiscal years 2014 and 2013.

We use Adjusted Diluted EPS and Adjusted EBITDA (which are both non-U.S. GAAP measures) to eliminate the effect of acquisition-related expenses from the financial results of our operations. A full discussion of our use of non-U.S. GAAP measures to provide a baseline for evaluating and comparing our operating results, and a reconciliation of Adjusted Diluted EPS to diluted EPS and of Adjusted EBITDA to net income before non-controlling interests, can be found at pages 51-53 of the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2015.

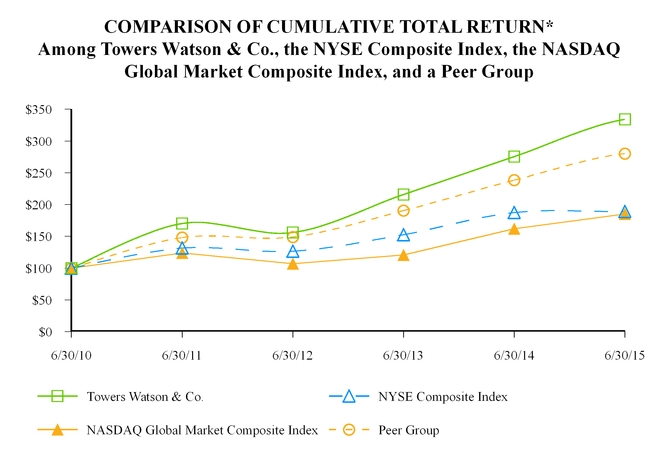

Our strong performance track record and our discipline in managing costs is validated by the course of our Total Shareholder Return (TSR)-a meaningful measure of performance to our stockholders. The table below shows Towers Watson’s comparative total return to stockholders from June 30, 2010, the first fiscal year end following the effective date of the merger of Watson Wyatt Worldwide, Inc. and Towers, Perrin, Forster & Crosby, Inc. (the “Towers Perrin | Watson Wyatt Merger”), through June 30, 2015.

5

*$100 invested on 6/30/10 in stock or 6/30/10 in index, including reinvestment of dividends. Fiscal year ending June 30.

6/30/2010 | 6/30/2011 | 6/30/2012 | 6/30/2013 | 6/30/2014 | 6/30/2015 | ||||||||||||

Towers Watson & Co. | 100.00 | 170.07 | 156.06 | 215.69 | 275.38 | 334.04 | |||||||||||

NYSE Composite | 100.00 | 131.51 | 126.62 | 152.63 | 187.35 | 188.84 | |||||||||||

NASDAQ Global Market Composite | 100.00 | 123.66 | 106.93 | 120.76 | 161.82 | 184.98 | |||||||||||

Peer Group | 100.00 | 148.01 | 148.99 | 190.44 | 238.35 | 280.31 | |||||||||||

The graph above depicts total cumulative stockholder return on $100.00 invested on June 30, 2010, in (i) Towers Watson & Co. common stock, (ii) the New York Stock Exchange Composite Index, (iii) the NASDAQ Global Market Composite Index; and (iv) a peer group index comprised of the common stock of Aon plc and Marsh & McLennan Companies, Inc. and certain publicly traded companies within the management consulting services standard industrial classification code having a reported market capitalization exceeding $150 million. The graph assumes reinvestment of dividends.

Companies included in the peer group index include: Accenture plc; Aon plc; CEB Inc.; FTI Consulting, Inc.; Huron Consulting Group Inc.; Marsh & McLennan Companies, Inc.; Maximus, Inc.; and Navigant Consulting, Inc. These peer companies are used for financial comparison purposes and differ from the peers we use for evaluating compensation levels as described under “Use of Peer Company Data” on page 17 of this CD&A.

2015 CEO Pay at a Glance

We remain focused on the continuous improvement of our executive compensation program to ensure alignment with our compensation philosophy, Growth Strategy and shareholder interests, as well as market best practices. The significant majority of our CEO pay is variable and linked to drivers of financial performance and our Growth Strategy. Mr. Haley’s total direct compensation (i.e., base salary, fiscal year-end bonus, and target value of Performance-vested restricted stock units (“PVRSUs”) for fiscal year 2015 was approximately $5.5 million, an increase of approximately 12.5% over last year. This increase is attributable primarily to an increase in Mr. Haley’s fiscal year-end bonus from the previous fiscal year. The chart below shows the elements of CEO compensation awarded for the last three fiscal years and how the performance-based variable amount has changed as a percentage of total direct compensation.

6

Our PVRSUs: The Primary Link to Performance and Pay

We only use one form of long-term incentive compensation in our executive compensation program at Towers Watson -PVRSUs or performance-vested restricted stock units. This means that all long-term incentive compensation is driven by Company financial and stock-price performance.

Executives become vested in a number of PVRSUs at the end of a three-year performance period, based on the achievement of specified performance goals. Any PVRSUs that become vested are payable in shares of Class A Common Stock of the Company. Dividend equivalents will accrue on the PVRSUs, but are only paid to the same extent and at the same time as the underlying shares vest.

The first time PVRSUs were granted was in July 2010 - shortly after Towers Watson was formed as a Company. In fiscal year 2015, our PVRSU grants were paid out at 144% of target for the July 1, 2012 to June 30, 2015 performance cycle. (See page 22 for information about the number of shares acquired by our named executives and the value realized on vesting.)

“Say on Pay” Vote

At our 2014 annual meeting, over 97% of the stockholders who voted on the “say-on-pay” proposal approved the compensation of our named executives. Although this vote was non-binding, the Committee has considered, and will continue to consider shareholder input and the results of this vote when making compensation decisions for our executive officers, although that consideration did not directly affect the Company’s executive compensation decisions or policies in fiscal year 2015. The Company regularly engages with shareholders on a range of topics, including compensation. The Committee will continue to consider stockholder feedback and relevant competitive factors in determining compensation for our named executives.

Summary of Our Executive Compensation Practices

What We Do | What We Don’t Do | |||

l | Heavy emphasis on variable compensation | l | Have not entered into employment agreements with U.S. executive officers | |

l | Performance-based long-term incentives | |||

l | Stock ownership guidelines | l | No change-in-control severance agreements | |

l | Clawback and anti-hedging and anti-pledging policies | l | No tax gross-ups | |

l | Double-trigger equity vesting upon a change in control | l | No significant perquisites | |

7

Our Executive Compensation Programs in Detail

Our Pay Philosophy

The Company’s executive compensation philosophy is summarized below:

Objectives | l | Attract, motivate and retain the senior talent needed to ensure our success through the use of competitive compensation structures with strong links to Company and individual performance |

l | Align executive compensation with our overall business strategies and values | |

l | Focus executives on creating long-term stockholder value | |

Pay Positioning | l | Total cash (base salary and fiscal year-end bonus) is at the market median of our peer group |

l | Total direct compensation (base salary, fiscal year-end bonus and target value of PVRSUs) is between the 25th and 50th percentile of our peer group | |

l | Take into account the impact of pension value in positioning total direct compensation | |

Pay Mix | l | Use a mix of fixed and variable pay to balance our objectives, competitive practice and specific roles in the organization |

l | Align the financial interests of our executives with those of our stockholders via long-term incentive awards and stock ownership guidelines | |

Our philosophy is supported by the following elements in our executive compensation program:

Element | Form | Purpose |

Base Salary | Cash (Fixed) | Provides a competitive level of pay that reflects the executive’s experience, role and responsibilities |

Fiscal Year-End Bonus | Cash (Performance-Based Variable) | Rewards achievement of individual, business segment/function and/or overall Company results for the most recently completed fiscal year |

Long-Term Incentive Compensation: PVRSUs | Equity (Performance-Based Variable) | Drives financial performance that links to long-term value creation and business strategies |

8

The charts below show that most of our named executives’ total direct compensation is variable (82% for our CEO and an average of 70% for our other named executives) based upon fiscal year 2015 compensation.

Base Salary

The Committee reviews and approves base salary levels and potential changes at the beginning of each fiscal year, which changes (if any) become effective on October 1 of that year. Base salary decisions generally reflect the Committee’s consideration of median compensation data of our peer group for comparable positions, published survey data, and subjective factors including the individual’s experience and past performance.

Mr. Haley makes salary recommendations to the Committee for the named executives other than himself. For fiscal year 2015, Mr. Haley recommended salary increases for the other named executives that ranged from 2.7 percent to 3.3 percent, effective October 1, 2014, which range was consistent with our average salary increase budget on a global basis. Mr. Haley discussed each recommendation with the Committee and, thereafter, the Committee approved the recommended salaries.

From October 1, 2011 through September 30, 2014, Mr. Haley’s annual base salary was $981,000. Effective October 1, 2014, Mr. Haley’s annual base salary was adjusted to $1,010,000, a 3.0 percent increase from his previous year’s base salary. In determining Mr. Haley’s base salary increase, the principal factors that the Compensation Committee considered were the Company’s overall financial results and salary levels of CEOs in the Company’s peer group.

Fiscal Year-End Bonuses

The Company’s named executives participate in an annual fiscal year-end bonus program, which is administered under the stockholder-approved Towers Watson & Co. Incentive Compensation Plan. Pursuant to this program, for fiscal year 2015, the Committee established each named executive’s bonus target as a percentage of base salary. These percentages remained unchanged for fiscal year 2015. These levels were designed to result in target total cash compensation (base salary and target fiscal year-end bonus) at the market median, while also taking into account internal pay equity considerations across the Company’s operations.

9

Name | Target Bonus as a Percentage of Base Salary | Target Bonus | Actual Bonus | Actual Bonus as a Percentage of Target Bonus |

Mr. Haley | 125% | $1,262,500 | $2,020,000 | 160% |

Mr. Millay | 80% | $496,000 | $670,000 | 135% |

Mr. Foreman | 80% | $508,000 | $550,000 | 108% |

Mr. Wickes | 80% | $508,000 | $760,000 | 150% |

Mr. Hess | 80% | $452,000 | $660,000 | 146% |

Fiscal year-end bonuses are awarded as a percentage of target and are discretionarily determined, guided by a framework designed to consider both quantitative and qualitative outcomes against goals. Goals are developed at the beginning of the fiscal year for each named executive based upon the business conditions and areas of opportunity that exist.

The following sections discuss the criteria the Committee applied in determining bonuses for the CEO and other named executives for fiscal year 2015.

CEO Bonus: Performance Results

The principal factors taken into account by the Committee in determining Mr. Haley’s fiscal year 2015 bonus were his performance against the below-described financial quantitative and strategic qualitative goals, with no specific weighting assigned to any specific metric or goal.

Financial results play a significant role in the determination of the CEO’s bonus. The Company exceeded both its earnings per share (“EPS”) goal and its revenue goal. The financial goals that the Committee considered were:

Financial Goals | Result |

Adjusted Diluted EPS of $5.76 | $6.46 |

Adjusted Revenue of $3.653 Billion | $3.760 Billion |

The Financial Goals and Performance Results are calculated using the currency rates applied to the goals approved by the compensation committee which differ from the rates used in our financial statements. We use Adjusted Diluted EPS and Adjusted Revenue calculated at the compensation committee approved currency rates to eliminate the effect of acquisition-related expenses, currency rate changes, and other non-operating income and expense from our results of operations. A reconciliation to the information reported in the financial statements is as follows:

Adjusted Revenue | Adjusted Diluted EPS | |||||||||||||

Revenue | $ | 3,644,953 | Diluted EPS | $ | 5.50 | |||||||||

Currency translation and other non-operating income | 114,839 | Acquisition related adjustments (1) | 0.69 | |||||||||||

Adjusted Revenue | $ | 3,759,792 | Currency translation and other non-operating income and expense | 0.27 | ||||||||||

(Thousands of U.S. Dollars) | ||||||||||||||

Adjusted Diluted EPS | $ | 6.46 | ||||||||||||

(1) The adjustments to diluted earnings per share of certain acquisition-related items are net of tax. In calculating the net of tax amounts, all adjustments were tax effected at the applicable effective tax rate for the year ended June 30, 2015, which was 34.2%.

10

The Committee also evaluated Mr. Haley’s performance against a number of qualitative goals, including:

Qualitative Goals | Key Goals | Performance Highlights | ||

Growth Strategy | l | Generate short-term and long-term growth using a balanced strategy of organic growth, innovation, and inorganic growth | l | Introduced a refreshed Growth Strategy called “Towers Watson 2020” to focus associates globally on growth opportunities and sustaining a profitable business mix. |

l | Continued support for innovation through our Innovation Office and operation of the New Venture Investment Committee. | |||

l | Completed Acclaris and Saville acquisitions. | |||

l | Led the strategic decision to pursue the Company’s pending merger with Willis Group Holdings Public Limited Company (the “Willis Merger”). | |||

Risk management | l | Monitor and ensure effective risk management | l | Continued ongoing risk management framework with the Risk Committee of the Board, making adjustments as required due to business or environmental changes. |

l | Prepared for retirement of top Risk Officer at the end of the fiscal year and named a successor without delay. | |||

Succession planning | l | Ensure Towers Watson has a robust bench of potential leaders to take on executive roles | l | Actively monitored succession plans for self and key leaders, and ensured appropriate development efforts were undertaken. |

Inclusion and Diversity (I&D) | l | Advance leader and associate engagement on I&D as an important business imperative | l | Maintained personal commitment and visibility around I&D, including participation in the United Nations’ World Autism Awareness Day. |

l | Held senior leaders accountable for incorporating I&D principles into talent management decisions across Towers Watson. | |||

Given the strong overall financial results in a challenging market for professional services, as well as progress made on the many longer term, strategic efforts as noted above, and the growth demonstrated as compared to our competitors, the Committee recommended a bonus for Mr. Haley of 160% of target. This amount was subsequently confirmed by the Board of Directors.

Other Named Executives’ Bonuses: Performance Results

Towers Watson uses a scorecard approach within the bonus program framework to assess performance on an annual basis. All Towers Watson associates, including our named executives other than the CEO, use the scorecard in setting goals at the beginning of each fiscal year across four key performance areas. The four focus areas are based upon pre-established objectives that reflect both Company-wide (“Enterprise”) accountabilities and segment- or region-specific results (“Line of Sight”).

A named executive’s actual bonus recommendation is then determined by Mr. Haley based on an evaluation of Company, region/segment (if applicable) and individual performance versus the weighted objectives. While this process reflects a methodical approach to evaluating the job performance of our named executives, achievement of these goals is evaluated subjectively, and the amount of fiscal year-end bonuses awarded as a percentage of target is discretionarily determined.

11

In determining bonus payments for fiscal year 2015 for the named executives, the Committee asked for recommendations from Mr. Haley. In making his recommendations for the named executives, Mr. Haley reviewed the performance of each of the named executives against his individual, business segment/region/function and overall Company goals for the fiscal year. Mr. Haley discussed each recommendation with the Committee, which has final authority to determine the actual bonus amounts.

In addition to the overall financial performance of the Company during the fiscal year, the bonus recommendations provided to the Committee by Mr. Haley took into account the qualitative assessment described below of each named executive’s performance during the fiscal year:

Named Executive | Weighting | Performance Highlights | |

Mr. Millay (Chief Financial Officer) | 100% Enterprise | l | Led a highly effective Finance team that was able to monitor business results and identify areas of opportunity early. |

l | Co-led, with the Chief Administrative Officer, implementation planning and ongoing Continuous Improvement efforts resulting in significant progress toward achieving our Continuous Improvement target of $100 million run-rate savings. | ||

l | Oversaw strong shareholder engagement through Investor Relations function and personal discussions. | ||

l | Active participant in confidential discussions and due diligence with Willis Group Holdings Public Limited Company (“Willis”) relating to pending Willis Merger. | ||

Given the strong financial results for the fiscal year, as well as progress made on several strategic efforts as noted above, Mr. Haley recommended, and the Committee approved, a bonus for Mr. Millay of 135% of target. | |||

Mr. Foreman (Segment Leader, Exchange Solutions) | 40% Line of Sight 60% Enterprise | l | The Exchange Solutions Segment achieved 36% revenue growth for the year, primarily as a result of increased membership in the Retiree and Access Exchanges and growing membership in the Actives and Health and Welfare practices. |

l | Re-organized the Exchange Solutions Segment to respond to market developments and improve operations. | ||

l | Active participant in the marketplace and in shareholder engagement efforts. | ||

Given the strong financial results for the fiscal year, as well as progress made in the critical Exchange Solutions Segment as noted above, Mr. Haley recommended, and the Committee approved, a bonus for Mr. Foreman of 108% of target. | |||

Mr. Wickes (Segment Leader, Benefits) | l | The Benefits Segment achieved 6% revenue growth and net operating income margin of 36%. | |

l | Continued development of Global Heath & Group Benefits network, an anticipated future source of growth. | ||

l | Launched new products including master trust vehicles in the EMEA region. | ||

l | Active participant in confidential discussions and due diligence with Willis relating to pending Willis Merger. | ||

Given the strong financial results for the fiscal year, as well as the leadership contributions made on several strategic efforts as noted above, Mr. Haley recommended, and the Committee approved, a bonus for Mr. Wickes of 150% of target. | |||

Mr. Hess (Region Leader, Americas) | l | Implemented Client Development Group redeployment and leverage plans; re-focused sales activity to target the most promising large-scale opportunities and actively engaged with current and potential clients. | |

l | Drove restructuring of research functions to better align with business requirements. | ||

l | Sponsor of Out@TW associate resource community and highly visible promoter of The Americas Inclusion & Diversity efforts, serving as a role model for the Company. | ||

Given the strong financial results for the fiscal year, and noting the overall Line of Sight performance, Mr. Haley recommended, and the Committee approved, a bonus for Mr. Hess of 146% of target. | |||

12

Long-Term Incentive Compensation: PVRSUs

The Company’s named executives participate in the stockholder-approved 2009 Long-Term Incentive Plan. Towers Watson uses only one form of long-term compensation in our executive compensation program-PVRSUs or performance vested restricted stock units. This means that long-term incentive compensation is 100% linked to Company financial performance and stock price. Executives become vested in a number of PVRSUs at the end of a three-year performance period, based on the achievement of specified performance goals.

For the 2015-2017 performance period, the Committee established each named executive’s award opportunity as a percentage of base salary. Individual target grant amounts, based on the grant date fair value, were set at 245% of base salary for the Chairman and Chief Executive Officer and 125% of base salary for the other named executives and are unchanged from fiscal year 2014. These levels were designed to result in target total direct compensation (base salary, target fiscal year-end bonuses, and target value of PVRSUs) between the 25th and 50th percentile of our peer group.

Awards Granted for the 2015 - 2017 Performance Period

The Committee specified two distinct performance metrics for PVRSUs granted to the Company’s named executives for the 2015-2017 performance period: organic revenue growth (based on fiscal year 2017 revenue versus fiscal year 2014 revenue) as the primary metric and average three-year adjusted earnings per share (“Adjusted EPS”) as a modifier. These metrics were selected to focus our named executives on driving profitable organic revenue growth, while also maintaining stable profit margins at a relatively high level.

The actual number of PVRSUs that will vest and become payable is first determined by applying a performance factor based on organic revenue achievement to the target number of PVRSUs. The number of PVRSUs earned based on organic revenue achievement is then further adjusted by the Adjusted EPS performance factor. The Adjusted EPS results used as a modifier were decreased in fiscal year 2015 from the goals established for PVRSUs granted in the prior fiscal year to a targeted three-year average of $5.97. This reduction occurred in order to account for the impact on our operating results from the sale of our Brokerage line of business in fiscal year 2014. Named executives may therefore earn between zero (if the minimum threshold for either metric is not achieved) and 204% of their target number of PVRSUs for the 2015-2017 performance period.

Organic Revenue Growth | Adjusted EPS | Total Award Opportunity (as a Percentage of Target) | ||

Potential Achievement | Performance Factor | Potential Achievement | Performance Factor | |

<106.5% | 0% | <$5.65 | 0% | 0% |

111.5% | 100% | $5.97 | 100% | 100% |

117.5% | 170% | $6.14 | 120% | 204% |

See pages 20 to 21 related to the table on Grants of Plan-Based Awards in Fiscal Year 2015 for more information on the target performance goals and the formula to be used to determine the amount payable based on results for the 2015-2017 performance period.

The Committee has the authority to exercise negative discretion in determining the number of PVRSUs that become vested and payable at the end of the performance period to each named executive.

Named executives generally will forfeit unvested PVRSUs upon a termination of employment prior to the end of the performance period. However, in all jurisdictions in which a benefit can lawfully be conditioned on age and/or years of service, the awards will continue to vest following a “qualifying retirement”, subject to (i) achievement of the performance conditions with respect to the PVRSUs; (ii) compliance with certain non-competition obligations; and (iii) completion of the first fiscal year (July 1 to June 30) of service during the performance period at or before the date of retirement.

In connection with the pending Willis Merger, it is anticipated that each outstanding PVRSU will be converted into a service-vesting award corresponding to a number of Willis ordinary shares (rounded down to the nearest whole share) equal to the product of (a) the applicable number of shares of Company common stock subject to such PVRSU and (b) 2.6490 (the “Exchange Ratio”). The applicable number of shares of Company common stock subject to be so converted will be determined by applying the target level of performance or, if greater, the actual performance through the most recent date prior to the effective time for which performance goal achievement can reasonably be determined. Following the Willis Merger, the converted PVRSUs will no longer be subject to performance-based vesting criteria. Otherwise, PVRSUs so assumed and converted will continue to have, and will be subject to, the same time-based vesting and other terms and conditions as applied

13

to the applicable PVRSU award immediately prior to the effective time of the Willis Merger, except that the PVRSUs will vest if the executive’s employment is terminated without cause within 12 months following the effective time of the Willis Merger.

Other Pay Programs and Policies

Clawback and Hedging Policies

The Company has adopted a formal “clawback” policy applicable to annual and long-term performance-based incentive awards made to its executive officers. Under this policy, the Company will, to the extent permitted by governing law, seek to recoup performance-based compensation paid to its executive officers to the extent that such compensation was based on financial results that the Company is required to restate as a result of non-compliance with applicable accounting standards as generally applied. The Company also may seek to recoup such compensation, to the extent permitted by governing law and determined appropriate by the Committee, in the event that the Company is required to restate its financial results as a result of misconduct on the part of any participant in such compensation arrangement or in the event that incorrect financial information was used in the determination of such compensation (regardless of whether such incorrect information results in a restatement of the Company’s financial results).

In addition, under our insider trading policy, an officer, member of the Board of Directors or designated insider may not engage in short selling Company common stock at any time. Such individuals are prohibited from hedging and from using instruments or arrangements for margin borrowing or stock lending, pledging or placing any “stop loss” orders or any other “limit order” in relation to securities of the Company.

Stock Ownership Guidelines

Our stock ownership guidelines are intended to align associates’ financial interest with the interests of other stockholders and the Company.

The stock ownership guidelines are expressed as a multiple of base salary. Mr. Haley’s ownership requirement is five times his base salary. The ownership requirement for the other named executives is two times their respective base salaries. The aforementioned guidelines are prorated over the first six years of employment with Towers Watson as measured beginning July 1, 2010. Each of our named executives had satisfied his guideline as of June 30, 2015, and owned substantially more stock than required by the guidelines.

Retirement and Savings Plans

Each of the named executives participates in qualified and supplemental non-qualified defined benefit plans sponsored by the Company that are available to associates in the United States. The Company’s sponsorship of such plans is consistent with its belief that defined benefit plans continue to represent a crucial and viable means to provide for the future retirement security of our associates and to encourage sustained service with the Company. When the Committee assesses the competitiveness of executive compensation, it takes into account the impact of changes in pension value to positioning of total compensation. More details regarding the defined benefit plans are included in the discussion following the Pension Benefits table on page 24. Each of our named executives is also eligible to participate in a 401(k) plan that is available to associates in the United States.

The Towers Watson defined benefit plans provide benefits using a stable value formula for service rendered on or after January 1, 2012. Under this formula, the qualified and supplemental non-qualified plans will provide each eligible participant with a lump sum benefit payable at age 65 equal to 15 percent of each covered year’s pay up to the Social Security wage base, and 20 percent of each covered year’s pay in excess of the wage base, with pay for these purposes consisting of salary, bonuses and, for non-executives, any overtime wages. The lump sum will be reduced for benefit commencement prior to age 62. Participants in the qualified pension plan may, in most instances, choose to receive the value of their lump sum benefit as an annuity at the time of retirement.

On August 16, 2013, the Committee recommended, and the Board (with Mr. Haley recusing himself) approved, freezing the portion of the lump sum benefit payable to Mr. Haley upon his retirement under the non-qualified defined benefit plan attributable to his accrued benefit under the legacy Watson Wyatt formula at $17,597,266, its value as of June 30, 2013. The Committee recommended this change as a retention tool, because, otherwise, Mr. Haley could have been incentivized to retire if he believed interest rates would increase (which would cause the lump sum value of his benefit to decline). This benefit is subject to applicable tax withholding. Mr. Haley will also continue to be entitled to any benefits earned under the non-qualified defined benefit plan stable value formula attributable to his service after January 1, 2012. Additional information on the legacy Watson Wyatt benefit under the non-qualified defined benefit plan is included in the discussion following the Pension Benefits Table on page 24.

14

Non-Qualified Deferred Savings Plan for U.S. Employees

On November 14, 2013, the Compensation Committee approved the Towers Watson Non-Qualified Deferred Savings Plan for U.S. Employees (the “Towers Watson Deferred Savings Plan”). The Towers Watson Deferred Savings Plan is an unfunded deferred compensation plan for select management and other highly-compensated associates, including the Company’s executive officers. The purpose of the Towers Watson Deferred Savings Plan is to provide a select group of associates who contribute significantly to the future success of the Company with a means to defer receipt of a portion of their compensation, and potentially to receive a discretionary matching contribution from the Company. All associate deferrals, and all Company matches, are credited in the form of Company stock units and will be paid in shares of Company stock under the Towers Watson & Co. 2009 Long Term Incentive Plan. As a result, the value of the notional account is aligned with the value of the Company’s stock. Payments will be made on the first business day of the month following the date that is six months after the participant’s separation from service. This transitioned from the prior arrangement whereby all eligible associates received an annual cash distribution for the “missed” Company match related to compensation above IRS limits. Effective January 1, 2014 under the new Towers Watson Deferred Savings Plan, eligible associates are required to make their own compensation deferrals in order to receive credit for the match.

Employee Welfare Benefit Plans

Our named executives are eligible to participate in the medical, life insurance and other welfare benefits available to all other associates. There are no special medical plans or other welfare plans for our named executives, except that the named executives are covered by an officers’ and directors’ liability policy that the Company provides only to certain of its senior executives and its non-employee directors.

Severance and Other Benefits

The Company has not entered into employment agreements or change-in-control severance agreements with its named executives and does not provide any form of tax gross-ups or significant perquisites. Named executives are eligible for the same severance pay plan as all U.S.-based associates. The plan provides for severance pay in an amount equal to three weeks’ base pay for each completed year of the named executive’s service, plus twelve weeks, up to a maximum of 44 weeks’ pay, payable in a lump sum upon termination.

Tax and Accounting Treatments of Elements of Compensation

Section 162(m) of the Internal Revenue Code (the “Code”) disallows a tax deduction for the Company for compensation paid to certain executives exceeding $1 million in any taxable year, excluding compensation that is considered to be “performance based.” Annual fiscal year-end bonuses paid to senior executives and PVRSUs may qualify as “performance-based compensation” that is not counted toward the $1 million limitation on deductibility of compensation. However, the rules and regulations promulgated under Section 162(m) of the Code are complicated and subject to change from time to time, sometimes with retroactive effect. In addition, a number of requirements must be met in order for particular compensation to so qualify. As such, there can be no assurance that any compensation will be deductible under all circumstances.

At the beginning of fiscal year 2015, in accordance with the terms of the stockholder-approved Towers Watson & Co. Incentive Compensation Plan, the Committee established the maximum annual bonus award as 2.5 percent of net income for the fiscal year in the case of the CEO and 1.5 percent of net income for each other named executive. For fiscal year 2015, the Committee certified the amount of net income as defined under the plan for the performance period and each participant’s maximum award under the plan, and determined each participant’s actual award as described above, exercising discretion so that the bonuses actually paid were well below the maximum incentive awards permissible under the performance goals.

As a result, it is expected that the 2015 fiscal year-end bonuses paid to the named executives under the Incentive Compensation Plan will not be counted toward the $1 million limitation on deductibility of compensation. Likewise, because they were granted under a stockholder-approved plan and other requirements were satisfied, it is expected that the PVRSUs awarded to the named executives will not be subject to the $1 million limitation on deductibility of compensation.

Compensation Decision Process and Methodology

Role of the Committee

The Committee is responsible for evaluating the compensation levels for each of the named executives and for administering the Company’s executive compensation program. The Committee reviews and approves all components of executive compensation for the named executives. Each year, the Committee reviews and approves the corporate goals and key objectives related to the compensation of the CEO and reviews the key objectives of the named executives and evaluates their performance in light of those goals and objectives. In addition, the Committee reviews a pay-for-performance assessment of the

15

CEO that includes a review of the Company’s financial performance versus the peer group (as described below) over a one- and three-year period. The following metrics are reviewed for the Company and the peer group:

• | Revenue growth |

• | Earnings before interest, taxes, depreciation and amortization (“EBITDA”) (growth and margin) |

• | Net Income growth |

• | EPS growth |

• | Total Shareholder Return (stock price plus dividends) |

In reviewing the Company’s pay programs, the Committee considers whether the programs encourage unnecessary or excessive risk taking that might have an adverse impact on the Company and has determined that the Company’s compensation programs do not create risks that are reasonably likely to result in a material adverse impact to the Company.

Role of Internal and External Compensation Consultants

The Committee has engaged Compensation Advisory Partners, LLC (“CAP”) as its compensation consultant to support its responsibilities. CAP’s work is performed directly under the guidance of the Committee, in cooperation with management, to assist the Committee with executing its executive compensation-related responsibilities. In such role, CAP serves as an objective third-party advisor in assessing the reasonableness of compensation levels and the appropriateness of the design of the Company’s evolving executive compensation program structure. The Committee has the sole authority to retain and terminate the services of CAP.

In fiscal year 2015, CAP supported the Committee by:

• | Conducting a competitive review and analysis of the Company’s current executive compensation program in comparison to competitive market survey data and executive pay and performance at a specified peer group of companies, for reference in determining the appropriate levels for future long-term incentive awards and in making fiscal year 2015 compensation decisions; |

• | Performing a comprehensive risk assessment of the Company’s executive compensation plans, practices and policies for the purpose of confirming/evaluating whether the Company’s executive compensation program is sufficiently balanced and does not create incentives for excessive risk taking; |

• | Recommending and evaluating companies to be included in the Committee’s peer group; |

• | Reviewing competitive long-term incentive practices and goals set for the fiscal year 2015 PVRSU awards; |

• | Providing information on executive compensation trends, as requested; and |

• | Participating in many of the Committee’s meetings and conference calls (there were six such meetings or calls during fiscal year 2015) and, when requested by the Committee chair, in the Committee’s executive sessions. |

Also, for the fiscal year ended June 30, 2015, the Company’s Human Resources department used internal Company executive compensation consultants to provide various services. These services included assisting in recommending financial and other targets to be achieved under the Company’s compensation and incentive programs and in preparing analyses of financial data, peer group comparisons and other briefing materials for management’s review, which information was ultimately shared with the Committee.

The Committee has assessed the independence of CAP, considering the following six factors and other factors that it deemed relevant: (1) the absence of other services provided to the Company by CAP; (2) the amount of fees paid by the Company to CAP as a percentage of CAP’s total revenue; (3) the policies or procedures maintained by CAP that are designed to prevent conflicts of interest; (4) the absence of any business or personal relationships between the individual employees of CAP involved in the engagement and a member of the Committee; (5) the absence of any Company stock owned by CAP’s employees involved in the engagement; and (6) the absence of any business or personal relationships between our executive officers and CAP or the employees of CAP involved in the engagement.

The Role of the CEO and Management

The CEO does not participate in the Committee’s determination of his own compensation. However, he makes

16

recommendations to the Committee for each of the other named executives. The CEO bases these recommendations on his assessment of each executive’s performance, as well as business segment/region/function and overall Company goals for the fiscal year as described above. The Committee reviews the CEO’s recommendations, makes adjustments as it determines appropriate, and approves compensation at its sole discretion.

Use of Peer Company Data

In making its determinations for fiscal year 2015, the Committee relied on publicly available information for a select group of peer companies, commissioned compensation survey data and its own knowledge of the market for key executives. The peer group was selected by the Committee based on the recommendations of CAP and input from management on the comparability of the business operations of potential peer group companies. Information about the peer group companies was used to inform decisions regarding the assessment of competitive pay levels and mix, annual performance/merit driven compensation and future program design.

The peer group companies include those few public companies with human resources consulting lines of business. Because many of the Company’s direct competitors are privately owned (e.g., the Hay Group) or are subsidiaries of larger public companies (e.g., Mercer Human Resource Consulting, Aon Hewitt and Buck Consultants), the number of direct competitors for which public information is available for peer group comparison is limited. Therefore, additional peer group companies in other industries were selected using the following criteria:

• | Reasonably comparable size (based on revenue and market capitalization); |

• | Positive EBITDA; |

• | High human capital/low financial capital business model; and |

• | Global reach. |

For conducting a competitive assessment of the compensation levels of each of its named executives for fiscal year 2015, the Committee approved the following peer group of sixteen companies, which remains unchanged from that used for the Committee’s fiscal year 2014 assessment:

l | AllianceBernstein Holdings L.P. | l | FTI Consulting, Inc. |

l | Aon plc* | l | Gartner, Inc. |

l | Arthur J. Gallagher & Co. | l | Marsh & McLennan Companies, Inc.* |

l | Booz Allen Hamilton Holding Corporation | l | Moody’s Corporation |

l | CACI International Inc. | l | Paychex, Inc. |

l | Cognizant Technologies Solutions | l | Robert Half International Inc. |

l | Dun & Bradstreet, Inc. | l | Unisys |

l | Equifax Inc. | l | Willis Group Holdings plc |

*The full peer group is used while examining pay levels, while these direct competitors (Aon plc and Marsh & McLennan Companies, Inc.) receive greater focus for pay practice information (i.e., the specific mix of compensation including base, bonus, long term incentives, etc.) relating to the CEOs of their relevant subsidiaries, Aon Hewitt and Mercer Human Resource Consulting, respectively.

Towers Watson continues to approximate the median in terms of revenues and is near the 75th percentile in terms of market capitalization among this peer group. The competitive assessment performed by CAP at the beginning of the fiscal year, using publicly-disclosed compensation data from the Company’s peer group, as well as published survey data then available, indicated that overall, the Towers Watson executives’ target total direct compensation (target total cash plus target long-term incentive opportunity) was positioned near the 25th percentile for most of the executives, including the CEO.

17

COMPENSATION COMMITTEE REPORT

Our Committee is composed of four independent Directors, each of whom meets the independence requirements of the NASDAQ listing standards and the rules and regulations of the SEC. The Compensation Committee operates under a written charter adopted by the Board. Our charter can be viewed on the Company’s website (www.towerswatson.com) in the Investor Relations section.

We have reviewed and discussed the Compensation Discussion and Analysis (CD&A) with the CEO and CFO. Based upon our review and such discussion, we recommended to the Board that the CD&A be included in the Form 10-K/A.

THE COMPENSATION COMMITTEE:

Gilbert T. Ray (Chair)

Linda D. Rabbitt

Brendan R. O’Neill

Wilhelm Zeller

Compensation of Executive Officers

General Overview

The tables and narratives set forth below provide specified information concerning the compensation of our named executives. The Summary Compensation Table below reports compensation paid or accrued by Towers Watson with respect to services rendered to Towers Watson for the fiscal year ended June 30, 2015 and the two prior fiscal years.

Summary Compensation Table

Name and Principal Position | Fiscal Year | Salary (1) | Bonus (2) | Stock Awards (3) | Change in Pension Value and Non-Equity Nonqualified Deferred Compensation Earnings (4) | All other Compensation(5) | Total | |||||||||||||||||||

John J. Haley | 2015 | $ | 1,002,750 | $ | 2,020,000 | $ | 2,474,495 | $ | 665,075 | $ | 109,825 | $ | 6,272,145 | |||||||||||||

Chairman of the Board, President and Chief Executive Officer | 2014 | $ | 981,000 | $ | 1,500,000 | $ | 2,403,401 | $ | 1,811,884 | $ | 114,954 | $ | 6,811,239 | |||||||||||||

2013 | $ | 981,000 | $ | 1,656,000 | $ | 2,403,434 | $ | 680,005 | $ | 112,692 | $ | 5,833,131 | ||||||||||||||

Roger F. Millay | 2015 | $ | 615,000 | $ | 670,000 | $ | 774,955 | $ | 262,655 | $ | 58,324 | $ | 2,380,934 | |||||||||||||

Vice President and Chief Financial Officer | 2014 | $ | 600,000 | $ | 525,000 | $ | 749,984 | $ | 259,957 | $ | 61,443 | $ | 2,196,384 | |||||||||||||

2013 | $ | 600,000 | $ | 575,000 | $ | 749,957 | $ | 188,360 | $ | 53,649 | $ | 2,166,966 | ||||||||||||||

James K. Foreman | 2015 | $ | 630,000 | $ | 550,000 | $ | 793,659 | $ | 474,857 | $ | 50,923 | $ | 2,499,439 | |||||||||||||

Managing Director, Exchange Solutions | 2014 | $ | 615,000 | $ | 550,000 | $ | 768,728 | $ | 416,541 | $ | 53,605 | $ | 2,403,874 | |||||||||||||

2013 | $ | 615,000 | $ | 650,000 | $ | 768,736 | $ | 229,185 | $ | 50,818 | $ | 2,313,739 | ||||||||||||||

Gene H. Wickes | 2015 | $ | 630,000 | $ | 760,000 | $ | 793,659 | $ | 311,711 | $ | 60,212 | $ | 2,555,582 | |||||||||||||

Managing Director, Benefits | 2014 | $ | 608,750 | $ | 550,000 | $ | 768,728 | $ | 439,470 | $ | 64,017 | $ | 2,430,965 | |||||||||||||

2013 | $ | 590,000 | $ | 635,000 | $ | 737,456 | $ | 859,928 | $ | 60,226 | $ | 2,882,610 | ||||||||||||||

Carl A. Hess | 2015 | $ | 561,250 | $ | 660,000 | $ | 706,241 | $ | 303,809 | $ | 47,823 | $ | 2,279,123 | |||||||||||||

Managing Director, The Americas | ||||||||||||||||||||||||||

(1) | Salary adjustments become effective on October 1 of each fiscal year. Effective October 1, 2014, Mr. Haley’s base salary increased from $981,000 to $1,010,000, Mr. Millay’s base salary increased from $600,000 to $620,000, Mr. Foreman’s base salary increased from $615,000 to $635,000, Mr. Wickes’ base salary increased from $615,000 to $635,000 and Mr. |

18

Hess’ base salary increased from $550,000 to $565,000. Thus, the salary amounts shown in the Summary Compensation Table for fiscal year 2015 reflect three months of salary at the rate in effect prior to October 1, 2014 and nine months of salary at the new rate effective October 1, 2014.

(2) | Reflects the value of fiscal year-end bonuses earned during the applicable fiscal year and which were paid in the following fiscal year (e.g., bonuses earned in fiscal year 2015 were paid in September 2015 and are reported in the row for fiscal year 2015). The fiscal year-end bonus program is a discretionary bonus program, which is designed to reward achievement of individual, business segment/function and/or overall results for the Company during the fiscal year. For fiscal year 2015, Mr. Haley’s target bonus was 125 percent of his base salary, and the target bonus for Messrs. Millay, Foreman, Wickes and Hess was 80 percent of base salary, in each case at the rate in effect at the end of the fiscal year. The amount of the bonus awarded as a percentage of target was discretionarily determined at fiscal year-end by the Committee based on the achievement of individual, business segment/function and/or overall results for the Company during the fiscal year, as described above in the Compensation Discussion and Analysis. |

(3) | For fiscal year 2015, amounts shown represent the aggregate target grant date fair value under applicable accounting standards of PVRSU awards under the Company’s 2009 Long Term Incentive Plan, as discussed in Note 16 to the Company’s Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2015. The aggregate grant date fair value of the 2015 PVRSU awards, assuming the maximum level of achievement of the performance metrics over the three-year performance period beginning July 1, 2014 and ending June 30, 2017, is $5,048,009 for Mr. Haley, $1,580,916 for Mr. Millay, $1,619,124 for Mr. Foreman, $1,619,124 for Mr. Wickes and $1,440,788 for Mr. Hess. |

(4) | This column reflects any aggregate increase in actuarial present values of accumulated benefits during the relevant fiscal year for the named executives under the Towers Watson Pension Plan and the Towers Watson SERP. Any increase in actuarial present value was determined using assumptions that are the same as those used in Towers Watson’s financial statements for the fiscal year ended June 30, 2015, except that retirement is assumed to occur at the earliest unreduced retirement age for the named executives, and no pre-retirement terminations or deaths are assumed to occur. |

The earliest unreduced retirement age for Messrs. Millay and Hess is age 62. The earliest unreduced retirement age assumed for Mr. Foreman is age 60 because the majority of his accrued benefits is unreduced at age 60. The earliest unreduced retirement age for Mr. Haley and Mr. Wickes are their current ages because they were over age 62 at the end of the fiscal year.

The increases in the actuarial present values for Messrs. Haley, Millay, Foreman, Wickes and Hess for fiscal year 2015 of $665,075, $262,655, $474,857, $311,711 and $303,809, respectively, can be attributed to several factors. First, the assumed discount rate used to determine the value of benefits changed from 4.75 percent to 5.00 percent for benefits from the Towers Watson SERP. The discount rate change had the effect of decreasing the present values. The assumed interest rate for estimating the lump sum value of the Towers Watson SERP benefits payable at retirement was changed from 1.75 percent, 2.25 percent, 2.75 percent and 3.00 percent for retirements in fiscal year 2015, 2016, 2017 and 2018 and thereafter, respectively, to 1.50 percent, 2.00 percent, 2.50 percent and 3.00 percent for retirements in fiscal year 2016, 2017, 2018 and 2019 and thereafter, respectively. The mortality assumption for the Towers Watson Pension Plan was changed from the prescribed annuitant table under Internal Revenue Code Section 430(h)(3)(A) for the 2014 plan year to the RP-2014 white collar annuitant table with improvements from 2006-2015 based on Scale BB-2D and future improvements grading down linearly to 0% over ten years. The assumption changes increased the actuarial present value amounts by $131,870 for Mr. Haley, $113,467 for Mr. Foreman, $186,853 for Mr. Wickes and $8,962 for Mr. Hess, and decreased the actuarial present value amounts by $2,972 for Mr. Millay. Second, each of the named executives accrued an additional year of service, which increased the present values by $585,995 for Mr. Haley, $205,743 for Mr. Millay, $176,060 for Mr. Foreman, $266,923 for Mr. Wickes and $161,264 for Mr. Hess. Third, the passage of time means that Messrs. Millay, Foreman and Hess are all one year closer to their assumed retirement dates and therefore payment of benefits, resulting in increases to the actuarial present value. For Messrs. Haley and Wickes, the passage of time results in a decrease to the actuarial present value because their benefits were assumed to have commenced and they have foregone receipt of benefits because of their continued employment.

(5) | For the fiscal year ended June 30, 2015, all other compensation consists of (a) Company matching contributions made to a Towers Watson qualified savings plan in the amount of $10,600 for each of Messrs. Haley, Millay and Wickes, $10,888 for Mr. Foreman and $11,251 for Mr. Hess; (b) Company matching contributions made in the form of fully vested restricted stock units to a defined contribution supplemental executive retirement plan in the amount of $89,462 for Mr. Haley, $34,967 for Mr. Millay, $36,567 for Mr. Foreman, $36,567 for Mr. Wickes, and $26,867 for Mr. Hess; (c) premiums paid for group term life insurance in the amount of $51 for Mr. Haley and $1,026 for each of Messrs. Millay, Foreman and Wickes and $888 for Mr. Hess; and (d) other miscellaneous compensation, including payment for the cash out or sale back |

19

to the Company of excess unused paid time off (all U.S.-based associates are subject to the same paid time off limits) in the amount of $9,712 for Mr. Haley, $11,731 for Mr. Millay, $2,442 for Mr. Foreman, $12,019 for Mr. Wickes and $8,817 for Mr. Hess.

Towers Watson provides no perquisites or other personal benefits having an aggregate incremental cost for any named executive in excess of $10,000, and as a result, the value of any such perquisites or other personal benefits is not included in this column.

Grants of Plan-Based Awards in Fiscal Year 2015

The table below shows the PVRSUs that were granted to each of the named executives during fiscal year 2015 under the Company’s 2009 Long Term Incentive Plan.

Estimated Future Payouts Under Equity Incentive Plan Awards | |||||||||||||||

Name | Grant Date | Threshold Number of Shares | Target Number of Shares | Maximum Number of Shares | Grant Date Fair Value of Stock Awards | ||||||||||

John J. Haley | 9/25/2014 | 2,474 | 24,740 | 50,470 | $ | 2,474,495 | |||||||||

Roger F. Millay | 9/25/2014 | 775 | 7,748 | 15,806 | $ | 774,955 | |||||||||

James K. Foreman | 9/25/2014 | 794 | 7,935 | 16,188 | $ | 793,659 | |||||||||

Gene H. Wickes | 9/25/2014 | 794 | 7,935 | 16,188 | $ | 793,659 | |||||||||

Carl A. Hess | 9/25/2014 | 707 | 7,061 | 14,405 | $ | 706,241 | |||||||||

Amounts shown under the “Estimated Future Payouts Under Equity Incentive Plan Awards” columns represent threshold, target and maximum number of PVRSU Awards that may be earned (that is, become vested) under the Company’s 2009 Long Term Incentive Plan following the end of the three-year performance period beginning July 1, d 2014 and ending June 30, 2017. Amounts actually earned are payable in shares of Company stock. Dividend equivalents are accrued during the performance period for outstanding awards but are only paid out when and to the extent such awards are earned. See a discussion of the PVRSU Awards in the Compensation Discussion and Analysis beginning on page 7 of this disclosure.

For the fiscal year 2015 PVRSU Awards, the Committee established organic revenue growth during the performance period (based on fiscal year 2017 revenue versus fiscal year 2014 revenue on a constant currency basis) and three-year average adjusted EPS as the performance metrics for the PVRSU Awards. For the fiscal 2015 through 2017 performance period, the number of PVRSUs that may become vested and payable pursuant to the Award shall be determined as the product of multiplying items (a), (b) and (c) below, where:

(a) | is the target number of PVRSUs subject to the Award; |

(b) | is the contingent percentage (as set forth in Table A) that corresponds to the percentage growth in Company organic revenue achieved over the performance period; and |

(c) | is the three-year average adjusted EPS multiplier (as set forth in Table B) that corresponds to the average adjusted EPS over the three-year performance period ending June 30, 2017. |

Table A | ||

Fiscal Year 2017 Company Organic Revenue as a Percentage of Fiscal Year 2014 Company Organic Revenue | Contingent Percentage of Award Earned | |

≥ 117.5% | 170% | |

≥ 115.5% | 140% | |

≥ 113.5% | 120% | |

≥ 111.5% | 100% | |

≥ 109.5% | 90% | |

≥ 108.5% | 75% | |

≥ 107.5% | 50% | |

≥ 106.5% | 25% | |

< 106.5% | 0% | |

20

Table B | ||

Three-Year Average Adjusted EPS for the Three-Year Performance Period Ending June 30, 2017 | Contingent Percentage of Award Earned | |

< $5.65 | 0% | |

≥ $5.65 | 40% | |

≥ $5.81 | 80% | |

≥ $5.97 | 100% | |

≥ $6.14 | 120% | |

For example, at the end of the three-year performance period, if organic revenue growth is 113.8% and the three-year average adjusted EPS for the three-year performance period ending June 30, 2017 is $6.10, Mr. Haley would vest in 29,688 PVRSUs (24,740 x 120% x 100%), in addition to the dividend equivalents credited to his PVRSU Award during the performance period that would vest on the same basis.

Outstanding Equity Awards at 2015 Fiscal Year-End

The following table sets forth information concerning the outstanding stock awards held at June 30, 2015 by each of the named executives.

Option Awards | Stock Awards | |||||||||||

Name | Number of Securities Underlying Unexercised Options Exercisable(1) | Option Exercise Price(2) | Option Expiration Date | Equity Incentive Plan Awards: Number of Unearned Shares(3) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares(4) | |||||||

John J. Haley | 0 | N/A | N/A | |||||||||

32,972(5) | $ | 4,147,878 | ||||||||||

50,728(6) | $ | 6,381,582 | ||||||||||

Roger F. Millay | 12,073 | 45.88 | 3/4/17 | |||||||||

10,289(5) | $ | 1,294,356 | ||||||||||

15,887(6) | $ | 1,998,585 | ||||||||||

James K. Foreman | 0 | N/A | N/A | |||||||||

10,546(5) | $ | 1,326,687 | ||||||||||

16,271(6) | $ | 2,046,892 | ||||||||||

Gene H. Wickes | 0 | N/A | N/A | |||||||||

10,546(5) | 1,326,687 | |||||||||||

16,271(6) | 2,046,892 | |||||||||||

Carl A. Hess | 0 | N/A | N/A | |||||||||

3,925(5) | 493,765 | |||||||||||

14,4796) | 1,821,458 | |||||||||||

(1) | All options reported are fully vested and represent the right to purchase Towers Watson Class A Common Stock at the stated exercise price. |

(2) | All option exercise prices were set at the closing price on the date of grant of Watson Wyatt common stock (for those options issued prior to the Towers Perrin | Watson Wyatt Merger) or Towers Watson Class A Common Stock (for those options issued subsequent to the Towers Perrin | Watson Wyatt Merger). |

(3) | Represents the number of PVRSUs granted under the Company’s 2009 Long Term Incentive Plan and credited with dividend equivalents, assuming projected earn-out of 144 percent following completion of the three-year performance period ending June 30, 2016 and assuming projected earn-out of 204 percent following completion of the three-year |

21

performance period ending June 30, 2017, such projections based on actual performance through June 30, 2015. Awards vest at between zero and 204 percent of the target number of PVRSUs based on the extent to which specified performance metrics are achieved over the applicable three-year performance period, subject to the named executive’s continued employment with the Company through the end of the performance period. See the discussion following the table on Grants of Plan-Based Awards in Fiscal Year 2015 on page 20 for more information on the formula to be used to determine the amount payable based on results for the fiscal year 2015 through 2017 performance period.

The Committee has the authority to exercise negative discretion in determining the number of PVRSUs that become vested and payable pursuant to the PVRSU Awards.

(4) | Reflects the value as calculated based on the closing price of the Company’s stock on June 30, 2015 of $125.80 per share. |

(5) | Represents an award of PVRSUs granted for the three-year performance period beginning July 1, 2013 and ending June 30, 2016. |

(6) | Represents an award of PVRSUs granted for the three-year performance period beginning July 1, 2014 and ending June 30, 2017. |

Options Exercised and Stock Vested During the Fiscal Year Ended June 30, 2015

The following table sets forth information concerning option awards that were exercised and stock awards that vested during fiscal year 2015 for each of the named executives.

Option Awards | Stock Awards | |||||||||||||||

Name | Number of Shares Acquired on Exercise | Value Realized on Exercise | Number of Shares Acquired on Vesting | Value Realized on Vesting | ||||||||||||

John J. Haley | 106,933 | $ | 9,663,905 | |||||||||||||

64,617 | (1) | $ | 8,128,819 | (2) | ||||||||||||

Roger F. Millay | 13,042 | $ | 910,324 | |||||||||||||

20,163 | (1) | $ | 2,536,505 | (2) | ||||||||||||

James K. Foreman | — | $ | — | |||||||||||||

20,668 | (1) | $ | 2,600,034 | (2) | ||||||||||||

Gene H. Wickes | 21,005 | $ | 1,859,968 | |||||||||||||

19,827 | (1) | $ | 2,494,237 | (2) | ||||||||||||

Carl A. Hess | — | $ | — | |||||||||||||

— | $ | — | ||||||||||||||

(1) | Represents the number of PVRSUs that vested for the three-year performance period beginning July 1, 2012 and ending June 30, 2015, including the vesting of accrued dividend equivalents. |

For the fiscal year 2013 PVRSU Awards, the Committee established organic revenue growth during the performance period (based on fiscal year 2015 revenue versus fiscal year 2012 revenue on a constant currency basis) and three-year average adjusted EPS as the performance metrics for the PVRSU Awards. For the fiscal 2013 through 2015 performance period, the number of PVRSUs that became vested and payable was determined as the product of multiplying items (a), (b) and (c) below, where:

(a) | was the target number of PVRSUs subject to the award; |

(b) | was the contingent percentage (as set forth in Table A) that corresponds to the percentage growth in Company organic revenue achieved over the performance period; and |

(c) | was the three-year average adjusted EPS multiplier (as set forth in Table B) that corresponds to the average adjusted EPS over the three-year performance period ending June 30, 2015. |

22

Table A | ||

Fiscal Year 2017 Company Organic Revenue as a Percentage of Fiscal Year 2014 Company Organic Revenue | Contingent Percentage of Award Earned | |

≥ 117.5% | 170% | |

≥ 115.5% | 140% | |

≥ 113.5% | 120% | |

≥ 111.5% | 100% | |

≥ 109.5% | 90% | |

≥ 108.5% | 75% | |

≥ 107.5% | 50% | |

≥ 106.5% | 25% | |

< 106.5% | 0% | |

Table B | ||

Three-Year Average Adjusted EPS for the Three-Year Performance Period Ending June 30, 2017 | Contingent Percentage of Award Earned | |

< $5.65 | 0% | |

≥ $5.65 | 40% | |

≥ $5.81 | 80% | |

≥ $5.97 | 100% | |

≥ $6.14 | 120% | |

Following the completion of the fiscal year 2013 through 2015 performance period, the Committee certified that revenue growth exceeded 113.5 percent, and that three-year average adjusted EPS for the three-year period ending June 30, 2015 exceeded $5.90. As a result, the Committee determined that PVRSU awards for the fiscal year 2013 through 2015 performance period had vested, and should be paid out, at 144 percent (120 percent multiplied by 120 percent).

The Committee did not exercise negative discretion in determining the number of PVRSUs that became vested and payable pursuant to the PVRSU Awards.

(2) | Reflects the value as calculated based on the closing price of Towers Watson Class A common stock on June 30, 2015 of $125.80 per share. The shares were actually distributed on September 15, 2015 following certification by the Committee. The actual value of stock awarded on the distribution date, based on the Company’s closing share price on the prior business day of $119.30, was $7,708,793 for Mr. Haley, $2,405,449 for Mr. Millay, $2,465,758 for Mr. Foreman and $2,365,324 for Mr. Wickes. |

Pension Benefits at 2015 Fiscal Year-End

With respect to each of the named executives, the table below provides information as of June 30, 2015 regarding the number of years of credited service and the present value of accumulated benefits payable at the earliest unreduced retirement age with respect to the Towers Watson Pension Plan and the Towers Watson SERP.

Messrs. Haley, Millay, Foreman, Wickes and Hess received distributions of $16,544, $5,431, $6,919, $6,760 and $2,794, respectively, from the Towers Watson SERP during the fiscal year ended June 30, 2015 to pay the associate portion of the Social Security tax attributable to benefits earned under the plan, as well as to cover the income tax thereon. Mr. Wickes received distributions of $31,827 from the Towers Watson Pension Plan during fiscal year 2015 for a prior period of service with Towers Perrin.

23

Pension Benefits | ||||||||||||

Name | Plan | Number of Years Credited Service | Present Value of Accumulated Benefit(1) | Payments During the Twelve Months Ended June 30, 2015 | ||||||||

John J. Haley | Towers Watson Pension Plan | 38.17 | $ | 2,281,838 | $ | — | ||||||

Towers Watson SERP | 38.17 | 19,000,574 | 16,554 | |||||||||

Total | $ | 21,282,412 | $ | 16,554 | ||||||||

Roger F. Millay | Towers Watson Pension Plan | 6.83 | $ | 322,303 | $ | — | ||||||

Towers Watson SERP | 6.83 | 1,205,611 | 5,431 | |||||||||

Total | $ | 1,527,914 | $ | 5,431 | ||||||||

James K. Foreman | Towers Watson Pension Plan | 29.00 | $ | 917,809 | $ | — | ||||||

Towers Watson SERP | 29.00 | 2,935,557 | 6,919 | |||||||||

Total | $ | 3,853,366 | $ | 6,919 | ||||||||

Gene H. Wickes | Towers Watson Pension Plan | 36.50 (2) | $ | 1,610,703 | $ | 31,827 | ||||||

Towers Watson SERP | 36.50 (2) | 4,959,080 | 6,760 | |||||||||

Total | $ | 6,569,783 | $ | 38,587 | ||||||||

Carl A. Hess | Towers Watson Pension Plan | 25.92 | $ | 1,051,480 | $ | — | ||||||

Towers Watson SERP | 25.92 | 2,079,507 | 2,794 | |||||||||

Total | $ | 3,130,987 | $ | 2,794 | ||||||||

(1) | The assumptions and methodology used in calculating the estimated present value shown in this column are the same as those used and disclosed in Note 11, “Retirement Benefits,” to our audited financial statements for the fiscal year ended June 30, 2015, beginning on page 84 of the Company’s Annual Report on Form 10-K, except the named executives are assumed to retire at their earliest unreduced retirement age and no pre-retirement terminations or deaths are assumed to occur. Also, no additional compensation or service is assumed beyond the June 30, 2015 calculation date. The specific relevant assumptions include a discount rate of 5.00 percent for the Towers Watson Pension Plan and 5.00 percent for the Towers Watson SERP, and post-retirement lump sum interest rates for the legacy Watson Wyatt and legacy Towers Perrin final average pay formulas in the Towers Watson SERP of 1.50 percent for retirements occurring during fiscal year 2016, 2.00 percent for retirements occurring during fiscal year 2017, 2.50 percent for retirements occurring during fiscal year 2018 and 3.00 percent for retirements occurring after fiscal year 2018. The mortality assumption for the Towers Watson Pension Plan is the RP-2014 white collar annuitant table with improvements from 2006 to 2015 based on Scale BB-2D with future improvements grading down linearly to 0% over 10 years. In addition, for the legacy Watson Wyatt and legacy Towers Perrin final average pay formulas in the Towers Watson SERP benefits, which require the conversion of life annuity benefits into a lump sum or annual installments, post-retirement mortality was based on the 1983 Group Annuity Mortality table (blended 50/50 for males and females) for Messrs. Haley, Millay, Wickes and Hess, while the UP-94 Static Mortality table (blended 90/10 for males and females) was used for Mr. Foreman. |