Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - NovoCure Ltd | d940664dex51.htm |

| EX-23.2 - EX-23.2 - NovoCure Ltd | d940664dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on October 1, 2015

Registration No. 333-206681

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NovoCure Limited

(Exact name of registrant as specified in its charter)

| Jersey (Channel Islands) | 3841 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

NovoCure Limited

Le Masurier House

La Rue Le Masurier

St. Helier, Jersey JE2 4YE

+44 (0)15 3475 6700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Wilhelmus Groenhuysen

Chief Financial Officer

NovoCure Limited

c/o Novocure Inc.

20 Valley Stream Pkwy

Suite 300

Malvern, PA 19355

(212) 767-7530

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||||

| Julie M. Allen, Esq. Reid Arstark, Esq. Proskauer Rose LLP Eleven Times Square New York, NY 10036 |

Todd Longsworth, Esq. NovoCure Limited c/o Novocure Inc. 20 Valley Stream Pkwy Suite 300 Malvern, PA 19355 |

Richard D. Truesdell, Jr., Esq. Byron Rooney, Esq. Davis Polk & Wardwell LLP 450 Lexington Ave New York, NY 10017 | ||

| (212) 969-3000 | (212) 767-7530 | (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered | Amount to be |

Proposed maximum |

Proposed maximum aggregate offering price(2) |

Amount of registration fee(2)(3) | ||||

| Ordinary shares, no par value |

8,625,000 |

$24.00 |

$207,000,000 | $24,053.40 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes ordinary shares that may be purchased by the underwriters pursuant to an over-allotment option. |

| (2) | Calculated pursuant to Rule 457(a) under the Securities Act. |

| (3) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated October 1, 2015

Preliminary prospectus

7,500,000 shares

Ordinary shares

We are offering 7,500,000 ordinary shares to be sold in this offering. This is our initial public offering of ordinary shares.

Prior to this offering, there has been no public market for our ordinary shares. The estimated initial public offering price is between $23.00 and $24.00 per share. Our ordinary shares are approved for listing on the NASDAQ Global Select Market under the symbol “NVCR.”

We are an emerging growth company under the federal securities laws and will be subject to reduced public company reporting requirements.

Investing in our ordinary shares involves a high degree of risk. These risks are described under the caption “Risk factors” that begins on page 11 of this prospectus.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| (1) | We have also agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting” for a description of all compensation payable to the underwriters. |

We have granted the underwriters an option for a period of 30 days to purchase up to 1,125,000 additional shares on the same terms and conditions set forth above to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities that may be offered under this prospectus, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to investors on , 2015.

| J.P. Morgan | Deutsche Bank Securities | Evercore | ||

| Wells Fargo Securities | ||||

| JMP Securities |

Wedbush PacGrow | |

Prospectus dated , 2015

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 56 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

58 | |||

| 73 | ||||

| 110 | ||||

| 118 | ||||

| 150 | ||||

| 152 | ||||

| 156 | ||||

| 168 | ||||

| 171 | ||||

| 178 | ||||

| 191 | ||||

| 191 | ||||

| 191 | ||||

| F-1 | ||||

i

Table of Contents

About this prospectus

Neither we nor the underwriters have authorized anyone to provide you with any information other than information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is an offer to sell only the ordinary shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information appearing in this prospectus is accurate only as of the date hereof. Our business, prospects, financial condition and results of operations may have changed since that date. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to this offering and the distribution of this prospectus outside the United States.

The terms “NovoCure,” “the Company,” “we,” “us,” “our” and “our company,” as used in this prospectus, refer to NovoCure Limited, a public limited company incorporated under the laws of Jersey, Channel Islands, and its wholly owned subsidiaries.

All ordinary share amounts in this prospectus reflect a 5.913-for-1 stock split effected on September 16, 2015.

This prospectus includes trademarks of NovoCure and other persons. All trademarks or trade names referred to in this prospectus are the property of their respective owners.

References in this prospectus to “regulatory approvals” should be understood to include U.S. Food and Drug Administration, or FDA, approvals, as well as CE Certificates of Conformity issued by notified bodies in the European Union and approvals by the applicable regulatory authorities in Japan and other relevant jurisdictions. References in this prospectus to “regulatory authorities” should be understood to include the FDA, such notified bodies in the European Union and regulatory authorities in Japan and other relevant jurisdictions.

A copy of this document has been delivered to the registrar of companies in Jersey in accordance with Article 5 of the Companies (General Provisions) (Jersey) Order 2002, and it has given, and has not withdrawn, its consent to circulation thereof. The Jersey Financial Services Commission has given, and has not withdrawn, its consent under Article 2 of the Control of Borrowing (Jersey) Order 1958 to the issue of the ordinary shares. It must be distinctly understood that, in giving these consents, neither the registrar of companies in Jersey nor the Jersey Financial Services Commission takes any responsibility for the financial soundness of our company or for the correctness of any statements made, or opinions expressed, with regard to it.

Nothing in this document or anything communicated to holders or potential holders of ordinary shares is intended to constitute or should be construed as advice on the merits of the purchase of or subscription for ordinary shares or the exercise of any rights attached thereto for the purposes of the Financial Services (Jersey) Law, 1998, as amended. If you are in any doubt about the contents of this prospectus, you should consult your stockbroker, bank manager, solicitor, accountant or other financial advisor.

The directors of our company have taken all reasonable care to ensure that the facts stated in this prospectus are true and accurate in all material respects, and that there are no other facts the omission of which would make misleading any statement in this prospectus, whether of facts or of opinion. All the directors accept responsibility accordingly. It should be remembered that the price of securities and the income from them can go down as well as up.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all the information that you should consider before investing in our ordinary shares. See “Our business” for more information, including a “Glossary of terms” and “Summary of completed and existing clinical trials and registry data” beginning on page 105. You should carefully read the entire prospectus, including our financial statements and related notes included in this prospectus and the information set forth under the headings “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations,” before making an investment decision. In this prospectus, unless the context otherwise requires, the terms “NovoCure,” “we,” “us,” “our” and “our company” refer to NovoCure Limited, a public limited company incorporated under the laws of Jersey, Channel Islands, and its wholly owned subsidiaries.

Our company

We are a commercial-stage oncology company developing a novel, proprietary therapy called Tumor Treating Fields, or TTFields, for the treatment of solid tumor cancers. TTFields is a low-toxicity anti-mitotic treatment that uses low-intensity, intermediate frequency, alternating electric fields to exert physical forces on key molecules inside cancer cells, disrupting the basic machinery necessary for normal cell division, leading to cancer cell death. Physicians have typically treated patients with solid tumors using one or a combination of three principal treatment modalities—surgery, radiation and pharmacological therapies. Despite meaningful advancements in each of these modalities, a significant unmet need to improve survival and quality of life remains. We believe we will establish TTFields as a new treatment modality for a variety of solid tumors that increases survival without significantly increasing side effects when used in combination with other cancer treatment modalities.

We received FDA approval for Optune, our first TTFields delivery system, in 2011 for use as a monotherapy treatment for adult patients with glioblastoma brain cancer, or GBM, following confirmed recurrence after chemotherapy. We have built a commercial organization and launched Optune in the United States, Germany, Switzerland and Japan, which we refer to as our currently active markets. In November 2014, our Phase 3 pivotal trial of Optune in combination with chemotherapy for patients with newly diagnosed GBM met its endpoints and was halted after a protocol pre-specified interim analysis showed significant improvements in both progression free and overall survival. In April 2015, we filed a premarket approval, or PMA, supplement application with the FDA for the treatment of newly diagnosed GBM based on our Phase 3 data and our application was granted priority review status. Upon FDA approval of Optune for newly diagnosed GBM, we believe TTFields will transform the standard of care for patients with newly diagnosed and recurrent GBM.

We have researched the biological effects of TTFields extensively. Because TTFields are delivered regionally, act only on mitotic cells and are tuned to target cancer cells of a specific size, there is minimal damage to healthy cells. We believe our pre-clinical and clinical research demonstrates that TTFields’ mechanism of action affects fundamental aspects of cell division and can have broad applicability across a variety of solid tumors. In addition to our clinical and commercial progress in GBM, we are currently planning or conducting clinical trials evaluating the use of TTFields in brain metastases, advanced non-small cell lung cancer, or NSCLC, pancreatic cancer, ovarian cancer and mesothelioma.

We own all commercialization rights to TTFields in oncology,

and have a patent and intellectual property portfolio that, as of June 30, 2015, consists of a total of 52 issued patents, including 36 issued in the United States,

as well as over 30 additional patent applications on file. We believe we will

maintain exclusive rights to market TTFields for all solid tumor indications in our key markets through the life of our patents.

1

Table of Contents

To date, substantially all of our revenues have been derived from patients using Optune in our currently active markets. Our net revenues for the year ended December 31, 2014 were $15.5 million and $11.8 million for the six months ended June 30, 2015. However, we have incurred significant costs in connection with our pre-clinical and clinical trial programs, commercial launch efforts and general and administrative costs. We had net losses of $77.4 million for the year ended December 31, 2013, $80.7 million for the year ended December 31, 2014 and $52.6 million for the six months ended June 30, 2015, and we have an accumulated deficit of $329.1 million as of June 30, 2015. We expect to continue to incur significant expenses and operating losses for at least the next several years.

GBM—our first approved and commercialized indication

GBM is the most common and aggressive form of primary brain cancer. We estimate approximately 27,500 patients are diagnosed with GBM annually in the United States, the top five European Union markets and Japan. GBM has few effective treatment options at present and provides our first opportunity to transform the standard of care for a solid tumor cancer to include TTFields.

We launched Optune in the United States for the treatment of recurrent GBM in 2011 and more recently in our other currently active markets. Since the majority of recurrent GBM patients are treated at large cancer centers, we built a commercial organization to focus primarily on these centers. As of the date of this prospectus, we have trained physicians in over 270 clinical centers. These trained physicians have treated over 1,600 GBM patients using Optune.

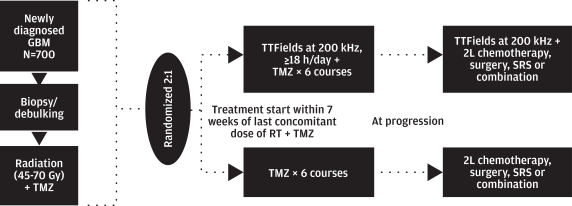

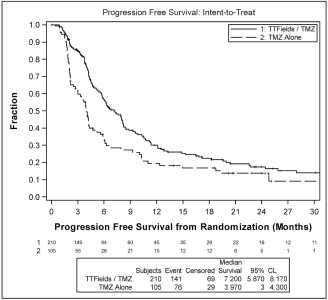

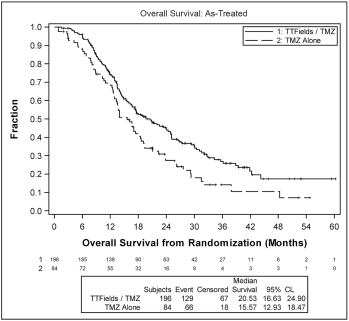

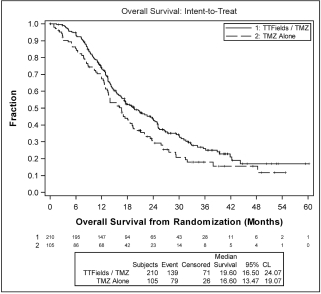

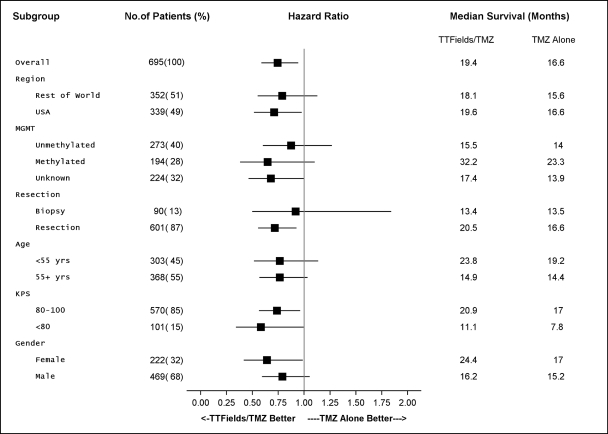

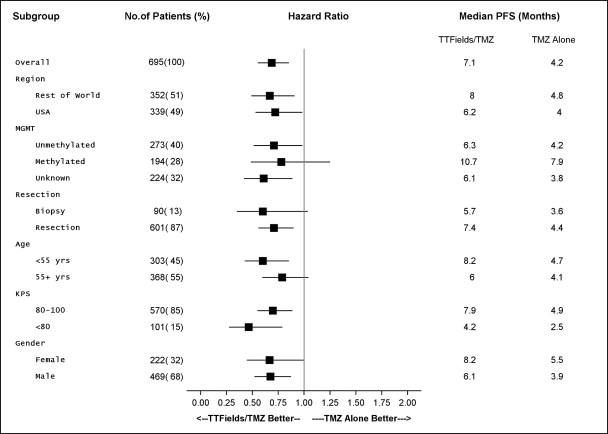

We initiated our EF-14 Phase 3 pivotal trial in 2009 to establish TTFields for the treatment of newly diagnosed GBM. The EF-14 trial randomized 700 patients to receive either temozolomide, the established standard of care chemotherapy for newly diagnosed GBM, or TTFields in combination with temozolomide. In November 2014, a protocol pre-specified interim analysis of the first 315 patients demonstrated the trial met its powered endpoints of significant extension of both progression free survival, or PFS, and overall survival, or OS, in patients treated with TTFields in combination with temozolomide versus temozolomide alone. The interim analysis results demonstrated that:

| • | the two-year survival rate among patients treated with TTFields in combination with temozolomide, in the as-treated population, was 48% compared to 32% among patients treated with temozolomide alone (p=0.0058); |

| • | patients treated with TTFields, in combination with temozolomide, in the intent-to-treat population, demonstrated a statistically significant increase in PFS compared to temozolomide alone (median PFS of 7.2 months compared to 4.0 months, hazard ratio=0.62, p=0.001); and |

| • | patients treated with TTFields, in combination with temozolomide, in the as-treated population, demonstrated a statistically significant increase in OS compared to temozolomide alone (median OS of 20.5 months compared to 15.6 months, hazard ratio=0.66, p=0.004). |

The trial’s independent data monitoring committee recommended that patients receiving temozolomide alone be allowed to cross over immediately to receive TTFields. Following FDA approval of this recommendation in December 2014, we allowed patients receiving temozolomide alone to cross over. We submitted a PMA supplement application to the FDA in April 2015 to expand our label for Optune to include the treatment of newly diagnosed GBM. In May 2015, we received priority review status from the FDA. We believe that following FDA approval of Optune for newly diagnosed GBM, Optune in combination with temozolomide will transform the standard of care for the treatment of patients with newly diagnosed GBM.

2

Table of Contents

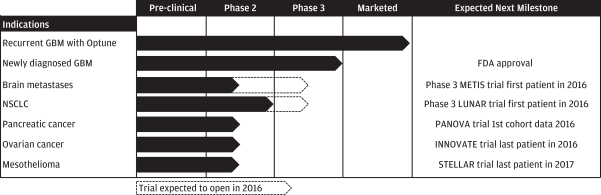

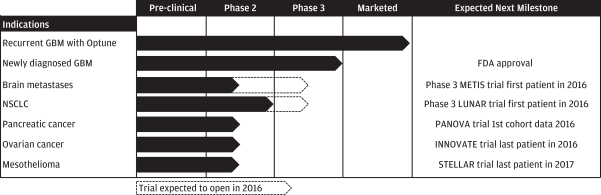

Our clinical pipeline

We have performed extensive pre-clinical research on TTFields and their effects in multiple solid tumor cancers. We have gained a deep understanding of the underlying mechanism of action and the multiple pathways through which TTFields exert their effects within the dividing cancer cells. Our research shows that TTFields have an anti-mitotic effect in over 15 different solid tumor types in culture and in multiple in vivo tumor models. In vitro and in vivo studies combining TTFields with radiation or chemotherapy, in multiple tumor types, have demonstrated at least additive efficacy, or stronger efficacy than the effect of either treatment alone, and in some cases synergistic efficacy, or stronger efficacy than the sum of the effects of both treatments. An increase in cancer cell sensitivity to chemotherapy when used in combination with TTFields in the range of one to two orders of magnitude suggests additivity, while an increase in the range of three to four orders of magnitude suggests synergism. Certain in vitro experiments using TTFields have suggested both additivity and synergism when used in combination with chemotherapy, as the presence of TTFields was shown to increase cancer cell sensitivity to chemotherapy from approximately 275 times to over 1,250 times depending on the mechanism of action of the particular chemotherapy. The upper end of this range was observed in testing with taxane-based chemotherapies.

We believe our success in delaying disease progression and extending survival in GBM patients, our pre-clinical data and our early clinical data in additional indications validate the potential of TTFields to become a new therapeutic modality for a variety of solid tumors. We have developed a pipeline strategy to advance TTFields through Phase 2 pilot and Phase 3 pivotal clinical trials across multiple solid tumor types, and anticipate expanding our clinical pipeline over time to study the safety and efficacy of TTFields for additional solid tumor indications.

Our competitive advantages

We believe our key competitive advantages are:

| • | Significant market potential addressable via a broadly applicable mechanism of action. Based on our pre-clinical research and clinical experience to date, we believe the anti-mitotic mechanism of action of TTFields is broadly applicable to a variety of solid tumors with an annual incidence of approximately 1.1 million people in the United States alone. Currently, we have ongoing and completed clinical trials for indications with an incidence of approximately 350,000 people annually in the United States. We believe that the global incident population of target solid tumors provides us with significant additional commercial opportunities. |

3

Table of Contents

| • | Immediate commercial opportunity for Optune in GBM. We are currently marketing Optune for the treatment of recurrent GBM in the United States and our other currently active markets. We have applied for FDA approval for the treatment of newly diagnosed GBM based on the results of our successful EF-14 Phase 3 clinical trial. Upon approval, we will begin marketing Optune as a treatment for newly diagnosed GBM, and we expect that Optune will transform the standard of care for the treatment of patients with newly diagnosed GBM. |

| • | Pipeline of Phase 2 trials in five additional indications. In addition to our GBM clinical programs, we have invested in a variety of clinical programs in other solid tumors. We have completed a Phase 2 trial in NSCLC, and are currently enrolling patients in Phase 2 trials for brain metastases, pancreatic cancer, ovarian cancer and mesothelioma. We expect to continue investing in our pipeline over time to broaden our commercial opportunity. |

| • | Established commercial organization and supply chain. We have established our commercial organization and believe we have the experience, expertise and infrastructure to scale our sales and marketing efforts in our key markets. In addition to our commercial organization, we have established a scalable supply chain. |

| • | Significant barriers to entry. We own all commercialization rights to TTFields in oncology and have a patent and intellectual property portfolio that, as of June 30, 2015, consists of a total of 52 issued patents, including 36 issued in the United States, as well as over 30 additional patent applications on file. We have patent protection through 2031 in the United States and through 2026 in other key markets. We believe we will maintain exclusive rights to market TTFields for all solid tumor indications in our key markets for the life of our patents. In addition, even after the expiration of our U.S. patents, potential market entrants applying low-intensity, alternating electric fields to solid tumors in the United States will have to undertake their own clinical trials and PMA submissions to the FDA to demonstrate equivalence to TTFields to market a competing product. |

Our strategies for growth

Our objective is to establish TTFields as a new modality for the treatment of a variety of solid tumors. Our key strategies include the following:

| • | Drive adoption of Optune in GBM. We plan to use the data from our pivotal EF-14 Phase 3 clinical trial and our commercial organization to transform the standard of care for patients with newly diagnosed and recurrent GBM and to drive adoption of Optune by physicians and patients. |

| • | Expand our commercial organization. We plan to expand our direct sales force to call on physicians who treat newly diagnosed GBM patients. We expect to further expand our commercial organization following regulatory approvals for additional indications. |

| • | Advance clinical development of TTFields. We plan to advance our clinical pipeline and evaluate other solid tumor indications that we believe can be targeted with TTFields. |

| • | Evaluate the use of TTFields in combination with other solid tumor therapies. We are supporting independent research into the optimal combinations of TTFields with radiation or pharmacological therapies to expand the population of patients who may benefit from TTFields. For example, we believe that TTFields may be combined with radiation or chemotherapy to allow for dose reductions, leading to reduced toxicity while achieving the same or better treatment outcomes. |

4

Table of Contents

| • | Continue to improve our TTFields delivery systems. We plan to continue to develop and enhance our TTFields delivery systems to improve performance and to provide the optimal patient experience across a variety of approved and potential clinical indications. We intend to seek FDA approval for the second generation of Optune, which is less than half the weight and size of the current version. |

Risk factors

Our business is subject to numerous risks as discussed more fully in the section entitled “Risk factors” immediately following this prospectus summary. Principal risks of our business include:

| • | Our business and prospects depend heavily on Optune, which is currently FDA-approved only for recurrent GBM. If we are unable to increase sales of Optune, obtain regulatory approvals for and commercialize Optune or our other delivery system candidates for the treatment of additional indications or significantly delayed or limited in doing so, our business and prospects will be materially harmed. |

| • | To date, we have incurred substantial operating losses. |

| • | If we do not achieve our projected research and development and commercialization goals, including FDA approval of Optune for newly diagnosed GBM, in the timeframes we announce or expect, our business would be harmed and we may need to raise additional capital to fund our operations. |

| • | We may not be successful in achieving market acceptance of TTFields by healthcare professionals, patients and/or third-party payers in the timeframes we anticipate, or at all, which could have a material adverse effect on our business, prospects, financial condition and results of operations. |

| • | Failure to secure and maintain adequate coverage and reimbursement from third-party payers could adversely affect acceptance of our delivery systems and reduce our revenues. |

| • | We depend on single-source suppliers for some of our components. The loss of these suppliers could prevent or delay shipments of Optune, delay our clinical trials or otherwise adversely affect our business. |

| • | If we encounter difficulties enrolling patients in our clinical trials, our clinical trials could be delayed or otherwise adversely affected. |

| • | We are subject to extensive federal, state and foreign laws and regulations in the conduct of our business. |

| • | If we are unable to protect our proprietary technology, trade secrets or know-how, we may not be able to operate our business profitably. Similarly, if we fail to sustain, further build and enforce our intellectual property rights, competitors may be able to develop competing therapies. |

Implications of being an emerging growth company

We qualify as an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As an emerging growth company, we may take advantage of reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s discussion and analysis of financial condition and results of operations” disclosure; |

| • | reduced disclosure about our executive compensation arrangements; |

5

Table of Contents

| • | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or SEC. We may choose to take advantage of some but not all of these exemptions. We have taken advantage of these reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock. We have irrevocably elected to “opt out” of the exemption for the delayed adoption of certain accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate information

We were incorporated under the laws of Jersey, Channel Islands, in 2000. Our registered office address is located at Le Masurier House, La Rue Le Masurier, St. Helier, Jersey JE2 4YE, and our telephone number is +44 (0)15 3475 6700. Our agent for service of process in the United States is NovoCure Limited, c/o Novocure Inc., located at 20 Valley Stream Pkwy, Suite 300, Malvern, PA 19355 and our telephone number is 212-767-7530. Our register of members is kept at our registered office address at Le Masurier House, La Rue Le Masurier, St. Helier, Jersey JE2 4YE. Our website address is www.novocure.com. We do not incorporate the information on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus, nor should you rely on any such information in making your decision whether to purchase our ordinary shares.

6

Table of Contents

The offering

| Ordinary shares offered by us |

7,500,000 ordinary shares. |

| Ordinary shares outstanding immediately after this offering |

82,676,810 ordinary shares (or 83,801,810 ordinary shares if the underwriters exercise their over-allotment option in full). |

| NASDAQ symbol |

NVCR. |

| Over-allotment option |

We have granted to the underwriters an option, exercisable within 30 days from the date of this prospectus, to purchase up to 1,125,000 additional ordinary shares to cover over-allotments, if any. |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $161.0 million from this offering after deducting the underwriting discounts, commissions and estimated offering expenses payable by us and assuming an initial public offering price of $23.50 per share, the mid-point of the range of the initial public offering price shown on the front cover of this prospectus. We plan to use the net proceeds we receive from this offering for working capital and general corporate purposes, including clinical trials and research and development and continued commercialization of Optune and our future delivery systems. In addition, we are required to make a $1.0 million payment to the Technion Research and Development Foundation and the Technion—Israel Institute of Technology, which we refer to collectively as the Technion, with the net proceeds of this offering. See “Use of proceeds” and “Our business—Intellectual property.” |

| Dividend policy |

We do not intend to pay dividends on our ordinary shares. We plan to retain our available cash and any future earnings for use in the operation of our business and to fund future growth. |

Unless we specifically state otherwise, the information in this prospectus assumes:

| • | the conversion of all our outstanding preferred shares in connection with the consummation of this offering after giving effect to a 5.913-for-1 stock split effected on September 16, 2015; |

| • | that we will amend and restate our current memorandum and articles of association, and that such amendment and restatement will be effective upon consummation of this offering; and |

| • | an initial public offering price of $23.50 per share, the mid-point of the price range set forth in the cover of this prospectus. |

7

Table of Contents

Unless we specifically state otherwise, the information in this prospectus does not take into account:

| • | up to an additional 1,125,000 ordinary shares issuable pursuant to the underwriters’ over-allotment option; |

| • | 10,054,321 ordinary shares issuable upon the exercise of outstanding options as of June 30, 2015, at a weighted average exercise price of $5.39 per share (including the option to acquire 1,005,210 ordinary shares held by the Technion Research and Development Foundation); |

| • | 921,488 ordinary shares issuable upon the exercise of options granted conditioned upon the consummation of this offering at an exercise price equal to the price per share to the public in this offering; |

| • | 4,635,317 ordinary shares issuable upon the exercise of outstanding warrants as of June 30, 2015, at a weighted average exercise price of $6.75 per share; or |

| • | 11,978,512 ordinary shares reserved for future issuance under our 2015 Omnibus Incentive Plan. |

8

Table of Contents

Summary consolidated financial and operating data

We present below our summary consolidated financial and operating data for the periods and as of the dates indicated. The following summary consolidated statement of operations data for the years ended December 31, 2013 and 2014 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statement of operations data for the six months ended June 30, 2014 and 2015, and the summary consolidated balance sheet data as of June 30, 2015, have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on a basis consistent with our audited consolidated financial statements. In the opinion of management, the unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. Results for interim periods are not necessarily indicative of results that may be expected for a full fiscal year. Historical results are not necessarily indicative of the results expected in the future.

The summary consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s discussion and analysis of financial condition and results of operations” included elsewhere in this prospectus.

| Year ended December 31, |

Six months ended June 30, | |||||||||||||||

| (in thousands except share and per share data) | 2013 | 2014 | 2014 | 2015 | ||||||||||||

| Consolidated statement of operations data |

||||||||||||||||

| Net revenues |

$ | 10,359 | $ | 15,490 | $ | 7,315 | $ | 11,751 | ||||||||

| Cost of revenues |

7,013 | 10,036 | 4,820 | 8,647 | ||||||||||||

|

|

|

|||||||||||||||

| Gross profit |

3,346 | 5,454 | 2,495 | 3,104 | ||||||||||||

|

|

|

|||||||||||||||

| Operating costs and expenses: |

||||||||||||||||

| Research, development and clinical trials |

34,797 | 40,381 | 19,915 | 22,692 | ||||||||||||

| Sales and marketing |

16,406 | 21,177 | 11,055 | 15,221 | ||||||||||||

| General and administrative |

16,602 | 24,052 | 10,767 | 14,343 | ||||||||||||

|

|

|

|||||||||||||||

| Total operating costs and expenses |

67,805 | 85,610 | 41,737 | 52,256 | ||||||||||||

|

|

|

|||||||||||||||

| Operating loss |

(64,459 | ) | (80,156 | ) | (39,242 | ) | (49,152 | ) | ||||||||

| Financial expenses, net |

12,558 | 144 | 38 | 1,467 | ||||||||||||

|

|

|

|||||||||||||||

| Loss before income taxes |

(77,017 | ) | (80,300 | ) | (39,280 | ) | (50,619 | ) | ||||||||

| Income taxes |

353 | 382 | 166 | 2,011 | ||||||||||||

|

|

|

|||||||||||||||

| Net loss |

$ | (77,370 | ) | $ | (80,682 | ) | $ | (39,446 | ) | $ | (52,630 | ) | ||||

|

|

|

|||||||||||||||

| Basic and diluted net loss per ordinary share |

$ | (6.73 | ) | $ | (6.46 | ) | $ | (3.21 | ) | $ | (4.12 | ) | ||||

| Weighted average number of ordinary shares used in computing basic and diluted net loss per share |

11,498,392 | 12,490,017 | 12,269,507 | 12,783,881 | ||||||||||||

|

|

|

|||||||||||||||

| Basic and diluted pro forma net loss per ordinary share(1) |

$ | (1.13 | ) | $ | (0.73 | ) | ||||||||||

| Weighted average number of ordinary shares used in computing basic and diluted pro forma net loss per ordinary share(1) |

71,166,032 | 72,137,939 | ||||||||||||||

|

|

||||||||||||||||

9

Table of Contents

| June 30, 2015

(in thousands) |

Actual |

Pro forma

as adjusted(1)(2) |

||||||

| Consolidated balance sheet data: |

||||||||

| Cash and cash equivalents |

$ | 106,508 | $ | 266,755 | ||||

| Short-term investments |

56,996 | 56,996 | ||||||

| Total assets |

192,770 | 352,223 | ||||||

| Working capital |

158,677 | 320,378 | ||||||

| Total liabilities |

48,463 | 47,009 | ||||||

| Total shareholders’ equity |

$ | 144,307 | $ | 305,214 | ||||

|

|

||||||||

| (1) | Pro forma for the conversion of all our outstanding preferred shares into ordinary shares in connection with the consummation of this offering (see Note 13a to the consolidated financial statements) after giving effect to a 5.913-for-1 stock split effected on September 16, 2015. Does not include any ordinary shares to be sold by us in this offering. |

| (2) | Pro forma as adjusted balances reflect the sale by us of 7,500,000 ordinary shares in this offering and our receipt of the estimated net proceeds from that sale, based on an assumed public offering price of $23.50 per share, which is the midpoint of the range set forth on the cover page of this prospectus, and after deducting underwriting discounts, commissions, estimated offering expenses payable by us and a $1.0 million payment to the Technion. A $1.00 increase (decrease) in the assumed initial public offering price of $23.50 per share would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, total assets, working capital and total stockholders’ equity by approximately $7.0 million, assuming that the number of ordinary shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts, commissions and estimated offering expenses payable by us. |

The following table includes certain commercial patient operating statistics for and as of the end of the periods presented.

| Operating statistics | Year

ended December 31, |

Six months ended June 30, |

||||||||||||||

| 2013 | 2014 | 2014 | 2015 | |||||||||||||

| Prescriptions received in period(1) |

510 | 707 | 298 | 865 | ||||||||||||

| Active patients at period end(2) |

184 | 225 | 172 | 425 | ||||||||||||

|

|

||||||||||||||||

| (1) | A “prescription received” is a commercial order for Optune that is received from a physician certified to treat patients with TTFields therapy for a patient not previously on TTFields therapy. Orders to renew or extend treatment are not included in this total. In the future, we may have regulatory approvals and commercial programs for multiple clinical indications, at which time we will recognize a commercial order as a prescription for the same patient for each clinical indication treated. For example, in the future, a patient may have a prescription for the treatment of lung cancer and a prescription for the treatment of brain metastases from the lung cancer. |

| (2) | An “active patient” is a patient who is on TTFields therapy under a commercial prescription order as of the measurement date, including patients who may be on a temporary break from treatment and who plan to resume treatment in less than 60 days. |

10

Table of Contents

An investment in our ordinary shares involves a high degree of risk. You should carefully consider all of the information in this prospectus, including the risks and uncertainties described below, before you decide to buy our ordinary shares. Any of the following risks could have a material adverse effect on our business, prospects, financial condition and results of operations. In any such case, the trading price of our ordinary shares could decline, and you could lose all or part of your investment. In assessing these risks, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes.

Risks relating to our business, TTFields and our delivery systems

Our business and prospects depend heavily on Optune, which is currently FDA-approved only for recurrent GBM. If we are unable to increase sales of Optune, obtain regulatory approvals for and commercialize Optune or our other delivery system candidates for the treatment of additional indications or are significantly delayed or limited in doing so, our business and prospects will be materially harmed.

Although we have received the FDA and Japanese Ministry of Health, Labour and Welfare regulatory approvals for Optune for treatment of adult patients with recurrent GBM and have affixed a CE mark to our TTFields delivery systems for certain indications in the European Union, such approvals and the CE mark affixed to our delivery systems do not guarantee future revenues for these indications, and until we receive FDA approval for the use of Optune for newly diagnosed GBM and TTFields delivery systems for other indications, almost all of our revenues in the United States will derive from sales of Optune for recurrent GBM. The commercial success of Optune and any other delivery systems and our ability to generate and maintain revenues from the use of these delivery systems will depend on a number of factors, including:

| • | our ability to develop, obtain regulatory approval for and commercialize Optune and our other TTFields delivery system candidates for additional indications, including newly diagnosed GBM; |

| • | our ability to successfully commercialize Optune and our other delivery system candidates for approved indications in our key markets; |

| • | the acceptance of TTFields by patients and the healthcare community, including physicians and third-party payers (both private and public), as therapeutically effective and safe relative to the cost and safety of alternative therapies; |

| • | the ability to obtain and maintain sufficient coverage or reimbursement by private and public third-party payers; |

| • | the ability of our third-party manufacturers to manufacture Optune and other delivery systems in sufficient quantities with acceptable quality; |

| • | our ability to provide marketing and distribution support for Optune and our other delivery system candidates; |

| • | results of future clinical studies relating to TTFields or our competitors’ products; |

| • | the label and promotional claims allowed by the FDA and by the applicable rules on the promotion of medical devices in other foreign jurisdictions, such as in the EU member states; |

| • | the maintenance of our existing regulatory approvals in the United States, the European Union, Switzerland and Japan; and |

| • | the consequences of any reportable adverse events occurring in the United States, the European Union or other foreign jurisdictions. |

11

Table of Contents

In addition, sales of Optune are limited to approved indications, which vary by geography, and the FDA label for Optune is limited in certain respects (for example, it is not approved for use in the brain stem, and is limited for use by adults ages 22 and older). Optune is also less efficacious in the cerebellum, which may reduce the number of GBM patients to whom it may be prescribed.

Our ability to generate future revenues will depend on achieving regulatory approval of, and eventual commercialization of, our most advanced delivery system candidates. However, obtaining regulatory approval of our delivery systems is not guaranteed. For example, although we expect to receive FDA approval of Optune for newly diagnosed GBM, we cannot assure you that we will receive such approval in a timely manner, or at all. Our near-term prospects are substantially dependent on our ability to obtain regulatory approvals on the timetable we have anticipated, and thereafter to further successfully commercialize our delivery systems. If we are not able to receive such approvals or to further commercialize our delivery systems, or are significantly delayed or limited in doing so, our business and prospects will be materially harmed and we may need to delay our initiatives or even significantly curtail operations.

To date, we have incurred substantial operating losses.

We were founded in 2000, operated as a development stage company through December 31, 2011 and have incurred substantial operating losses to date. In assessing our prospects, you must consider the risks and difficulties frequently encountered by companies in new and rapidly evolving markets, particularly companies engaged in the development and sales of oncology products. These risks include our ability to:

| • | continue to develop and enhance Optune and our delivery system candidates; |

| • | obtain regulatory clearance to commercialize new delivery systems and enhance or modify our existing delivery systems; |

| • | increase our sales, marketing and distribution organization to commercialize our delivery systems; |

| • | perform clinical research and trials on TTFields; |

| • | establish and increase awareness and acceptance of our delivery systems; |

| • | implement and successfully execute our business and marketing strategy; |

| • | respond effectively to competitive pressures and developments; |

| • | maintain, protect and expand our intellectual property portfolio; |

| • | expand our presence and commence operations in our key markets; |

| • | attract, retain and motivate qualified personnel; and |

| • | grow our organization to support our operations as a public company and our clinical pipeline and planned commercialization efforts. |

We anticipate incurring significant costs associated with commercializing our delivery systems for approved indications. Our expenses could increase beyond expectations if we are required by the FDA, or other regulatory agencies, domestic or foreign, to change manufacturing processes for our delivery systems, or to perform clinical, nonclinical or other types of studies in addition to those that we currently anticipate. Our revenues are dependent, in part, upon the size of the markets in the jurisdictions in which we receive regulatory approval, the accepted price for our delivery systems and the ability to obtain reimbursement at such price. If the number of our addressable patients is not as significant as we estimate, the indications approved by regulatory

12

Table of Contents

authorities is narrower than we expect or the population for treatment is narrowed by competition, physician choice or treatment guidelines, we may not generate significant revenues. If we are not able to generate significant revenues, we may never become profitable.

We can also be negatively affected by general economic conditions. We may not have insight into trends that could emerge and negatively affect our business. As a result of these or other risks, our business strategy might not be successful.

If we do not achieve our projected research and development and commercialization goals, including FDA approval of Optune for newly diagnosed GBM, in the timeframes we announce or expect, our business would be harmed and we may need to raise additional capital to fund our operations.

For planning purposes, we estimate the timing of the accomplishment of various scientific, clinical, regulatory and other goals, which we sometimes refer to as milestones. These milestones may include the commencement or completion of scientific studies and clinical trials, the submission of regulatory filings in the United States and other foreign jurisdictions and the receipt of regulatory approvals in such jurisdictions. From time to time, we may publicly announce the expected timing of some of these milestones. All of these milestones are based on a variety of assumptions. The actual timing of the achievement of these milestones can vary dramatically from our estimates, in many cases for reasons beyond our control, depending on numerous factors, including:

| • | the rate of progress, costs and results of our research and development activities and clinical trials; |

| • | our ability to identify and enroll patients who meet clinical trial eligibility criteria; |

| • | the extent of scheduling conflicts with participating clinicians and clinical institutions; |

| • | the occurrence of unanticipated adverse events during clinical trials; |

| • | the receipt of approvals by our competitors and by us of our delivery systems and our competitors’ products; |

| • | our ability to achieve coverage and reimbursement milestones with private and governmental third-party payers; |

| • | our ability to access sufficient, reliable and cost-effective supplies of components used in the manufacture of our delivery systems and delivery system candidates, including the transducer arrays and other materials; |

| • | our ability to develop a sales and marketing organization and/or enter into sales and marketing collaborations for Optune and, if approved, our delivery system candidates; and |

| • | other actions by regulators. |

For example, our key milestones include our expected FDA approval of Optune for newly diagnosed GBM and FDA approval of our second-generation Optune delivery system for GBM, as well as other clinical development milestones for other indications described in this prospectus. We can provide no assurance that we will achieve these milestones on our expected timetable, or at all.

If we do not achieve these milestones in the timeframes we expect, and/or if we are unable to obtain sufficient additional funds through financings, including sales of securities such as those in this offering, the proceeds from long-term loans, strategic collaborations or the license or sale of certain of our assets on a timely basis when necessary, we may be required to reduce expenses by delaying, reducing or curtailing the development of our delivery systems and we may need to raise additional capital to fund our operations, which we may not be able to obtain on favorable terms, if at all. If we fail to commence or complete, or experience delays in or are forced to curtail, our proposed clinical programs or otherwise fail to adhere to our projected development goals

13

Table of Contents

in the timeframes we announce or expect (or within the timeframes expected by analysts or investors), or we fail to raise any required additional capital, any of such events could have a material adverse effect on our business, prospects, financial condition and results of operations and cause our stock price to decline.

We may not be successful in our efforts to create a pipeline of delivery system candidates for future indications for TTFields and successfully commercialize them, or we may expend our resources on indications that do not yield a successful approval and fail to capitalize on other indications that may be more profitable or for which there is a greater likelihood of success.

We are pursuing clinical development of TTFields to treat a variety of solid tumors. For these future indications, we are at an early stage of development and we do not have approvals. Further, we do not intend to pursue indications involving solid tumors of the throat or extremities, and TTFields would not be efficacious for non-solid tumor cancers like lymphoma or other blood cancers.

Even if we are successful in continuing to build our pipeline, obtaining regulatory approvals and commercializing our delivery system candidates for additional indications are prone to risks of failure, including the significant risk that the development of our delivery system candidates for any potential indications will fail to demonstrate adequate efficacy or an acceptable safety profile, gain regulatory approval and become commercially viable. We cannot provide you any assurance that we will be able to advance any of these additional indications through the development and commercialization process. Our research programs may initially show promise in addressing additional indications, yet fail to yield approvals or commercialization for many reasons, including the following:

| • | we may not be able to assemble sufficient resources to pursue clinical trials for additional indications; |

| • | our delivery system candidates may not succeed in pre-clinical or clinical testing; |

| • | our delivery systems may on further study be shown to have harmful side effects for other indications or other characteristics that indicate they are unlikely to be effective or otherwise do not meet applicable regulatory criteria for such indications; |

| • | competitors may develop alternative treatments that render our delivery systems obsolete or less attractive; |

| • | the market for TTFields may change so that the continued development of our pipeline as currently contemplated is no longer appropriate; |

| • | our delivery systems may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and |

| • | our delivery systems may not be accepted as safe, effective, convenient or otherwise desirable by patients, the medical community or third-party payers. |

If any of these events occur, we may be forced to delay or abandon our development efforts for our anticipated pipeline, which would have a material adverse effect on our business and prospects and could potentially cause us to cease operations. Moreover, any such events in respect of any particular indication and/or delivery system candidate may have a negative effect on the approval process for other indications and/or result in losing approval of approved delivery systems for other indications, which may exacerbate the harm to our business and prospects.

We have limited experience in commercializing Optune and, to the extent we do not successfully develop this ability or contract with a third party to assist us, we may not be able to successfully commercialize our delivery systems that may be approved for commercial sale.

We currently have a small sales and marketing organization, and we may not be able to successfully develop adequate sales and marketing capabilities to achieve our growth objectives. The growth of our sales and

14

Table of Contents

marketing organization will require us to commit significant additional management and other resources. We will have to compete with other pharmaceutical and life sciences companies to recruit, hire, train and retain the sales and marketing personnel that we anticipate we will need. If we are unable to establish adequate sales and marketing capabilities, we will need to enter into sales and distribution agreements to market some or all of our delivery systems that may be approved for commercial sale. In addition, because Optune and future delivery systems require physician training and education, our sales and marketing organization must grow substantially as we expand our approved indications and markets. As a consequence, our expenses associated with building up and maintaining our sales force and marketing capabilities may be disproportionate to the revenues we may be able to generate on sales of Optune and other delivery systems.

If we are unable to establish adequate sales and marketing capabilities or successful distribution relationships, we may fail to realize the full sales potential of some or all of our delivery system candidates, and we may not be able to achieve the necessary growth in a cost-effective manner or realize a positive return on our investment. If we establish distribution agreements with other companies, we generally would not have control over the resources or degree of effort that any of these third parties may devote to our delivery systems, and if they fail to devote sufficient time and resources to the marketing of such delivery systems, or if their performance is substandard, it will adversely affect our revenues.

We may not be successful in achieving market acceptance of TTFields by healthcare professionals, patients and/or third-party payers in the timeframes we anticipate, or at all, which could have a material adverse effect on our business, prospects, financial condition and results of operations.

Our business model is predicated on achieving market acceptance of TTFields as a monotherapy or in combination with well established cancer treatment modalities like surgery, radiation and chemotherapy. We may not achieve market acceptance of Optune and other TTFields delivery systems we develop in the amount of time that we have anticipated, or at all, for a number of different reasons. As a general matter, we may not achieve market acceptance of TTFields because of the following factors, among others:

| • | it may be difficult to gain broad acceptance of TTFields because it is a new technology and involves a novel delivery system, and as such physicians may be reluctant to prescribe TTFields delivery systems without prior experience or additional data or training; |

| • | it may be difficult to gain broad acceptance at community hospitals where the number of patients seeking cancer treatment may be more limited than at larger medical centers, and such community hospitals may not be willing to invest in the resources necessary for their physicians to become trained to use TTFields, which could lead to reluctance to prescribe our TTFields delivery systems; |

| • | patients may be reluctant to elect to use our TTFields delivery systems, including Optune, for various reasons, including a perception that the treatment is untested; |

| • | the delivery systems may have some side effects (for example, dermatitis where the transducer arrays are placed) and the delivery system cannot be worn in all circumstances (for example, it cannot get wet and is difficult to wear in high temperatures); and |

| • | the price of the TTFields delivery systems includes a monthly fee for use of the delivery system (including the transducer arrays), so as the duration of the treatment course increases, the price will increase correspondingly, and, when used in combination with other treatments, the overall cost of treatment will be greater than using a single type of treatment. |

15

Table of Contents

In particular, Optune may not achieve market acceptance because of the following additional factors (which may apply to our future delivery systems, to varying degrees):

| • | achieving patient acceptance is difficult because GBM is a devastating disease with a poor prognosis, and not all patients with short lifespans are willing to comply with Optune therapy requirements, such as extended use of Optune, carrying around a battery pack and shaving their heads (which may be of particular concern to women), and other patients may forego Optune treatment for cosmetic or mobility reasons; |

| • | achieving patient compliance is difficult because the recommended average daily use of Optune is at least 18 hours a day, requiring patients to wear the delivery system nearly continuously, which to some extent restricts physical mobility because the battery must be frequently recharged, and the patient or a caregiver must ensure that it remains continuously operable; |

| • | certain patients are not advised to use Optune, including: patients who have an active electronic medical device, which include deep brain stimulators, spinal cord stimulators, vagus nerve stimulators, pacemakers, defibrillators and programmable shunts, because the use of Optune with these devices has not been tested and may lead to malfunctioning of these devices; patients who have a skull defect, a shunt or bullet fragments because the use of Optune with these conditions has not been tested and may lead to tissue damage or render Optune ineffective; and patients who are sensitive to conductive hydrogels because skin contact with the gel used in Optune for patients that are sensitive to conductive hydrogels may commonly cause increased redness and itching, and in rare instances may lead to severe allergic reactions, such as shock or respiratory failure; |

| • | the need to wear Optune nearly continuously in order to achieve efficacy of TTFields may also impact the pool of patients to whom physicians may be willing to prescribe treatment, as physicians may be reluctant to treat patients who are physically frail or lack caregiver support with Optune, and efficacy may also be limited in instances where patients take a break from the delivery system when experiencing skin rashes, while bathing or swimming because Optune cannot get wet, or while traveling because Optune batteries cannot be taken on airplanes, and although we ship batteries to patients, there is inevitably a disruption in continuous use; and |

| • | side effects reported by GBM patients treated with a combination of TTFields and temozolomide, including dermatitis where the transducer arrays are placed, headaches, weakness, falls, fatigue, muscle twitching and skin ulcers (and there may be additional side effects not yet observed). |

In addition, even if we are successful in achieving market acceptance of Optune for GBM, we may be unsuccessful in achieving market acceptance of TTFields as a treatment for other solid tumor cancers, such as brain metastases, NSCLC, pancreatic cancer, ovarian cancer, mesothelioma and other solid tumor cancers, because certain radiation or chemotherapies may remain the preferred standard of care for these indications.

There may be other factors that are presently unknown to us that also may negatively impact our ability to achieve market acceptance of TTFields delivery systems. If we do not achieve market acceptance of our delivery systems in the timeframes we anticipate, or are unable to achieve market acceptance at all, our business, prospects, financial condition and results of operations could be materially adversely affected, and our stock price could decline.

Failure to secure and maintain adequate coverage and reimbursement from third-party payers could adversely affect acceptance of our delivery systems and reduce our revenues.

We expect that the vast majority of our revenues will come from third-party payers either directly to us in markets where we provide our delivery systems to patients or indirectly via payments made to hospitals or other entities providing our delivery systems to patients. Private payers in the United States cover a majority of

16

Table of Contents

the population, with the remainder covered by governmental payers or uninsured. In 2014, United Healthcare and Aetna represented 15% and 12%, respectively, of our net revenues. We anticipate that the majority of the third-party payers outside the United States will be government agencies, government sponsored entities or other payers operating under significant regulatory requirements from national or regional governments.

Medical treatments may not be reimbursed by third-party payers based on a number of factors, such as a determination that it is experimental, not medically necessary or not appropriate for a particular patient. Currently, we are aware that seven private payers in the United States have issued policies that deny coverage for Optune on one or more of these bases. Additionally, private commercial and government payers may be permitted to consider the cost of a treatment in approving coverage or in setting payment for the treatment.

Private and government payers in the United States and around the world are increasingly challenging the prices charged for medical products and services. Additionally, the containment of healthcare costs has become a priority of U.S. federal and state governments and governments around the world. Adoption of additional price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit our revenues and operating results. If third-party payers do not consider our delivery system or the combination of our delivery system with additional treatments to be cost-justified under a required cost-testing model, they may not cover our delivery systems for their populations or, if they do, the level of payment may not be sufficient to allow us to sell our delivery systems on a profitable basis.

Reimbursement for the treatment of patients with medical devices in the EU member states, Switzerland and Japan is governed by complex mechanisms established on a national level in each country. In the European Union, these mechanisms vary widely among the EU member states and evolve constantly, reflecting the efforts of these countries to reduce public spending on healthcare. As a result, obtaining reimbursement for the treatment of patients with medical devices has become more challenging. Outside the United States, the European Union and Japan, reimbursement systems vary significantly by country. We cannot, therefore, guarantee that the treatment of patients with Optune or any of our future delivery systems would be reimbursed in any of the EU member states, Switzerland, Japan or any other country.

We provide financial assistance to patients to defray their out-of-pocket costs for Optune, and therefore, absorb any unreimbursed costs of patients who begin treatment and are unable to pay for the costs of their treatment not covered by insurance. Our costs associated with this program could increase if payers increase the cost-sharing burden of patients. We bill $21,000 for each month that a patient uses Optune in the United States. Total cash payments of $12.4 million received during the six months ended June 30, 2015 were recorded as revenues for Optune therapy provided to patients in the current period and prior periods. These cash payments represent an average of approximately $14,700 for a month of use. The difference between billed and paid amounts consists of disputed underpayments, patient financial assistance and discounts. Additionally, during the period ended June 30, 2015, for each month of use, we paid approximately $600 in indirect taxes, primarily the federal medical device excise tax. This metric does not include our experience with patients covered by the Medicare fee-for-service program, as we have not received material payments from that program and the invoices remain open as we appeal the coverage denials. Our average payment amount per month of use in the United States may decrease based on a number of factors, including, but not limited to, agreeing to greater discounts with payers and payers increasing the cost-sharing requirement for patients.

Our failure to secure or maintain adequate coverage or reimbursement for Optune or any of our future delivery systems by third-party payers in the United States or in the other jurisdictions in which we market Optune or any of our future delivery systems, could have a material adverse effect on our business, financial condition and results of operations and cause our stock price to decline.

17

Table of Contents

We may not be successful securing and maintaining reimbursement codes necessary to facilitate accurate and timely billing for Optune, future delivery systems and physician services attendant to TTFields therapy.

Third-party payers, healthcare systems, government agencies or other groups often issue reimbursement codes to facilitate billing for products and physician services used in the delivery of medicine. Within the United States, the billing codes most directly related to Optune and future delivery systems are contained in the Healthcare Common Procedure Coding System, or HCPCS code set. The HCPCS code set contains Level I codes that describe physician services, also known as Common Procedural Terminology codes, or CPT codes, and Level II codes that primarily describe products. The Centers for Medicare and Medicaid Services, or CMS, is responsible for issuing the HCPCS Level II codes. The American Medical Association issues HCPCS Level I codes.

We have secured unique HCPCS Level II codes that describe Optune and we are able to use these codes in the United States to bill third-party payers. Loss of these codes or any alteration in the payment attached to these codes would materially impact our operating results.

No CPT codes exist to describe physician services related to the delivery of TTFields therapy. We may not be able to secure CPT codes for physician services related to Optune based on the relatively low incidence of GBM. Our future revenues and results may be affected by the absence of CPT codes, as physicians may be less likely to adopt the therapy when not adequately reimbursed for the time, effort, skill, practice expense and malpractice costs required to provide the therapy to patients.

We have not secured codes to describe our delivery systems or to document physician services related to the delivery of TTFields therapy in markets outside the United States. Absence of these codes may affect the future growth of our business.

There is no assurance that Medicare or the Medicare Administrative Contractors will provide coverage or adequate payment rates for Optune or our future delivery systems.

Approximately 25% of our patients are beneficiaries under the Medicare fee-for-service program as of June 30, 2015. Failure to secure coverage and adequate payment from Medicare would reduce our revenues and may also affect the coverage and payment decisions of other third-party payers in the United States.

Medicare has the authority to issue national coverage determinations or to defer coverage decisions to its regional Medicare Administrative Contractors, or MACs. Medicare has not issued a national coverage determination for Optune. The four MACs that administer the durable medical equipment benefit for Medicare, or DME MACs, have each issued local coverage determination policies stating that Optune is not reasonable and necessary for the treatment of recurrent GBM. The continuing absence of a positive coverage determination from Medicare or the DME MACs would materially affect our future revenues.

Additionally, Medicare has the authority to publish the price of durable medical equipment products. Medicare may publish prices for Optune or future delivery systems that do not reflect then current prices for Optune or future delivery systems. Medicare price schedules are frequently referenced by private payers in the United States and around the world. Medicare would materially reduce our revenues and operating results by publishing a price for Optune or future delivery systems that is not based on the actual price of Optune or future delivery systems within the private payer market.

We are unable to bill our existing Medicare fee-for-service patients for amounts not paid by Medicare. Therefore, we will absorb the costs of treatment for amounts not paid by Medicare.

We depend on single-source suppliers for some of our components. The loss of these suppliers could prevent or delay shipments of Optune, delay our clinical trials or otherwise adversely affect our business.

We source some of the key components of Optune from only a single vendor. If any one of these single-source suppliers were to fail to continue to provide components to us on a timely basis, or at all, our business and

18

Table of Contents

reputation could be harmed. For example, we currently have a single source for the ceramic discs used in the transducer arrays for Optune, which we source from Exelis Inc., or Exelis (formerly ITT Corporation). We currently do not have alternate suppliers for these ceramic discs, and our existing supplier would be difficult for us to replace because the ceramic discs are manufactured with specialized electrical properties designed specifically for Optune, and as such there are few vendors available to produce these components, and those that can supply them may not be able to do so on terms that are commercially favorable to us. We are in the process of identifying a second source for the ceramic discs, but we can provide no assurance that we will secure an alternate supplier on favorable terms or in time to support our commercialization efforts, or at all. Our current agreement with Exelis continues through July 21, 2017, following which time the agreement will automatically renew for up to three successive two-year periods unless either we provide timely written notice of non-renewal (for any reason) or Exelis provides timely written notice of non-renewal (if we fail to satisfy certain minimum purchase requirements). We currently expect that this agreement will be renewed. In addition to certain other customary termination rights, Exelis can terminate this agreement with 90 days’ written notice if we breach any of our material obligations under the agreement.

Agreements with our other suppliers range from terms of four years to ten years and are terminable by either party, generally between 180 days’ and 12 months’ written notice. Establishing additional or replacement suppliers for any components of our delivery systems, and obtaining any additional regulatory approvals required to add or replace suppliers, will take a substantial amount of time and could result in increased costs and impair our ability to produce Optune, which would have a material adverse effect on our business, prospects, financial condition and results of operations. We may have difficulty obtaining similar components from other suppliers that are acceptable to the FDA or foreign regulatory authorities, or to comply with the Essential Requirements laid down in Annex I to the Directive 93/42/EEC concerning medical devices, commonly known as the Medical Devices Directive, which are the minimum requirements governing design and manufacturing in the European Union. The risks associated with the failure of our suppliers to comply with strictly enforced regulatory requirements as described below are exacerbated by our dependence on single-source suppliers. Furthermore, since some of these suppliers are located outside of the United States, we are subject to foreign export laws and United States import and customs regulations, which complicate and could delay shipments of components to us.

We are currently seeking second-source suppliers, which we expect to have under contract over the next few years, but we can provide no assurance we will achieve this on this timeframe or at all. Various steps must be taken before signing up these suppliers, including qualifying these suppliers in accordance with regulatory requirements.

If we experience any delay or deficiency in the quality of components supplied to us by third-party suppliers, or if we have to switch to replacement suppliers, we may face additional regulatory delays and the manufacture and delivery of Optune would be interrupted for an extended period of time, which could materially adversely affect our business, prospects, financial condition and results of operations. In addition, we may be required to obtain prior regulatory approval if we use different suppliers or components. Such changes could affect our FDA regulatory approvals and the compliance of our delivery systems with the Essential Requirements laid down in Annex I to the Medical Devices Directive and the validity of our current CE Certificates of Conformity. If we are required to obtain prior regulatory approval from the FDA or foreign regulatory authorities or to conduct a new conformity assessment procedure and obtain new CE Certificates of Conformity in the EU to use different suppliers or components for our delivery systems, regulatory approval or the CE Certificates of Conformity for our delivery systems may not be received on a timely basis, or at all, which would have a material adverse effect on our business, prospects, financial condition and results of operations.

19

Table of Contents