Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VALLEY NATIONAL BANCORP | vly8-k2015916analystpresen.htm |

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Investor Presentation EXHIBIT 99.1

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. 2 Forward Looking Statements The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products, acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward- looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: weakness or an unexpected decline in the U.S. economy, in particular in New Jersey, the New York Metropolitan area (including Long Island) and Florida; unexpected changes in market interest rates for interest earning assets and/or interest bearing liabilities; less than expected cost savings from long-term borrowings that mature from 2015 to 2018; claims and litigation pertaining to fiduciary responsibility, contractual issues, environmental laws and other matters; cyber attacks, computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage our systems; government intervention in the U.S. financial system and the effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve; our inability to pay dividends at current levels, or at all, because of inadequate future earnings, regulatory restrictions or limitations, and changes in the composition of qualifying regulatory capital and minimum capital requirements (including those resulting from the U.S. implementation of Basel III requirements); higher than expected loan losses within one or more segments of our loan portfolio; declines in value in our investment portfolio, including additional other-than-temporary impairment charges on our investment securities; unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments or other factors; unanticipated credit deterioration in our loan portfolio; lower than expected cash flows from purchased credit-impaired loans; unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather or other external events; higher than expected tax rates, including increases resulting from changes in tax laws, regulations and case law; an unexpected decline in real estate values within our market areas; higher than expected FDIC insurance assessments; the failure of other financial institutions with whom we have trading, clearing, counterparty and other financial relationships; lack of liquidity to fund our various cash obligations; unanticipated reduction in our deposit base; potential acquisitions that may disrupt our business; future goodwill impairment due to changes in our business, changes in market conditions, or other factors; legislative and regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations) subject us to additional regulatory oversight which may result in higher compliance costs and/or require us to change our business model; changes in accounting policies or accounting standards; our inability to promptly adapt to technological changes; our internal controls and procedures may not be adequate to prevent losses; failure to obtain shareholder or regulatory approval for the merger of CNLBancshares with Valley or to satisfy other conditions to the merger on the proposed terms and within the proposed timeframe; the inability to realize expected revenue synergies from the proposed CNLBancshares merger or the recent 1st United merger in the amounts or in the timeframe anticipated; costs or difficulties relating to CNLBancshares integration matters might be greater than expected; inability to retain customers and employees, including those of CNLBancshares and 1st United; and other unexpected material adverse changes in our operations or earnings. A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2014. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. 3 Additional Information and Where to Find it This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Valley filed a Registration Statement on Form S-4 that includes a proxy statement of CNL and a prospectus of Valley with the Securities and Exchange Commission. Valley may file other documents with the SEC regarding the proposed transaction. A definitive proxy statement/prospectus will be mailed to the shareholders of CNL. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available), including the proxy statement/prospectus and other documents containing information about Valley and CNL at the Commission’s website at www.sec.gov. These documents may be accessed and downloaded for free at Valley’s website at http://www.valleynationalbank.com/filings.html or by directing a request to Dianne M. Grenz, Executive Vice President, Valley National Bancorp, at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973) 305-3380 or at www.cnlbank.com or by directing a request to Chirag Bhavsar, Executive Vice President and Chief Financial Officer, CNLBancshares, Inc. at 450 South Orange Avenue, Suite 400, Orlando, Florida 32801-3336 (mailing address: P.O. Box 4968, Orlando, Florida 32802- 4968), telephone (407) 244-3100. Participants in the Solicitation This communication is not a solicitation of a proxy from any security holder of CNL. However, Valley, CNL, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from CNL’s shareholders in respect of the merger. Information regarding the directors and executive officers of Valley may be found in its definitive proxy statement relating to its 2015 Annual Meeting of Shareholders, which was filed with the Commission on March 12, 2015 and can be obtained free of charge from Valley’s website. Information regarding the directors and executive officers of CNL may be found in the Registration Statement on Form S-4 when it becomes available, which can be obtained free of charge from CNL. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp • Traded on the New York Stock Exchange (NYSE: VLY) • Regional Bank Holding Company • Headquartered in Wayne, New Jersey • Founded in 1927 • 2,899 Total Employees(1) Balance Sheet Items June 30, 2015(2) June 30, 2014 Assets $19.3 billion $16.3 billion Interest Earning Assets(3) $17.1 billion $14.6 billion Loans $14.5 billion $11.8 billion Deposits $14.3 billion $11.4 billion Market Capitalization $2.4 billion $2.1 billion Corporate Profile 4 Branches 224 ATMs 258 Overview of Valley National Bancorp (1)Total employees reflects the full-time equivalent for the quarter ended June 30, 2015; (2)Increase from June 30, 2014 is partially due to Valley’s acquisition of 1st United Bancorp, Inc. on November 1, 2014. (3)Average interest earning assets for the quarter ended June30, 2015 and 2014.

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp • Focus on credit quality • Measured growth strategies • Never had a losing quarter • Heavily populated footprint • Strong customer service • Experienced senior and executive management • Experienced commercial lender • Large percentage of retail ownership – Long-term investment approach – Focus on cash dividends • Large insider ownership, family members, retired employees and retired directors • Approximately 255 institutional holders or 53% of all shares held* Our Approach 5 *SNL Financial as of 8/7/2015

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. • Maintain a commercial banking franchise with a diversified balance sheet • Focus on expanding current geographic footprint • 3 of the best markets on east coast • Initial entrée into Florida proved successful Strategic Vision 6 Valley in 2017 NJ NY FL Management’s Vision Asset Size: ~$25 Billion Footprint: NJ/NY/FL Organic / Acquisitions

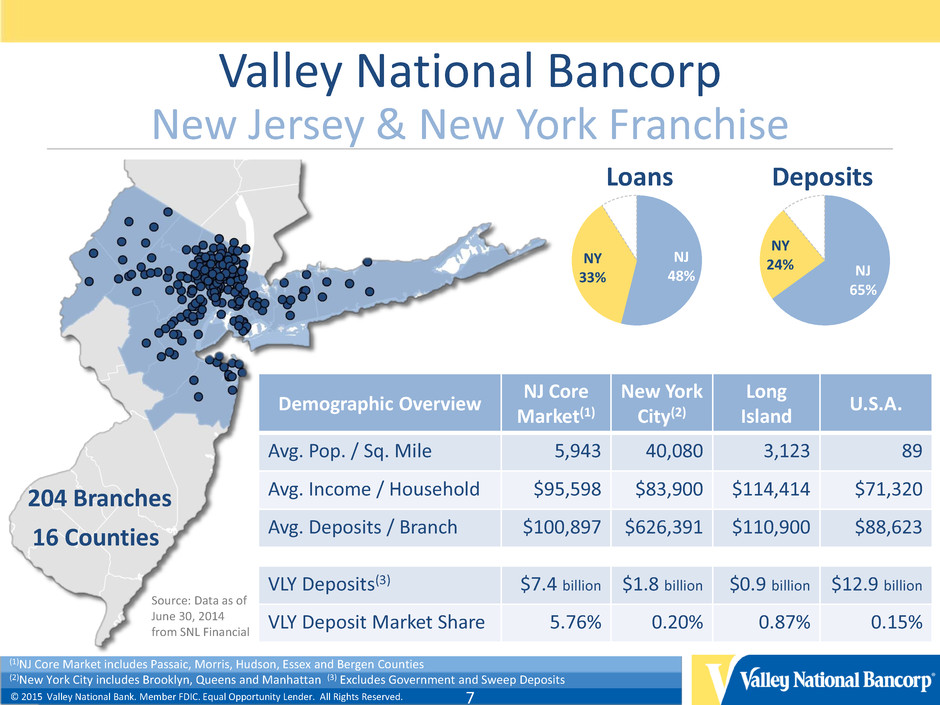

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp 204 Branches New Jersey & New York Franchise NJ 48% NY 33% Loans NJ 65% NY 24% Deposits 7 16 Counties Demographic Overview NJ Core Market(1) New York City(2) Long Island U.S.A. Avg. Pop. / Sq. Mile 5,943 40,080 3,123 89 Avg. Income / Household $95,598 $83,900 $114,414 $71,320 Avg. Deposits / Branch $100,897 $626,391 $110,900 $88,623 VLY Deposits(3) $7.4 billion $1.8 billion $0.9 billion $12.9 billion VLY Deposit Market Share 5.76% 0.20% 0.87% 0.15% (1)NJ Core Market includes Passaic, Morris, Hudson, Essex and Bergen Counties (2)New York City includes Brooklyn, Queens and Manhattan (3) Excludes Government and Sweep Deposits Source: Data as of June 30, 2014 from SNL Financial

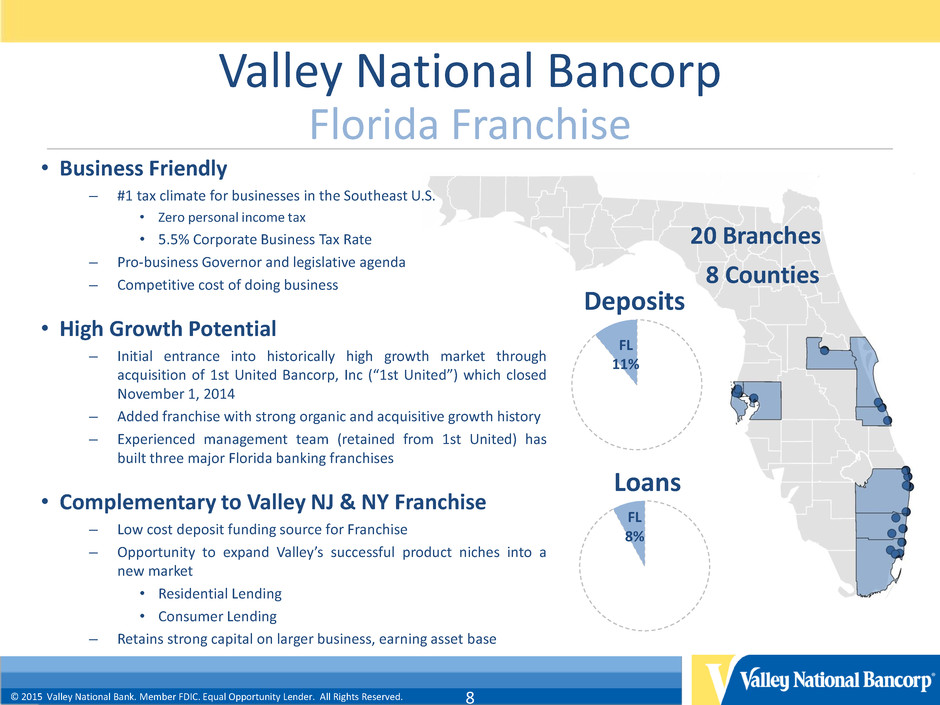

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. • Business Friendly – #1 tax climate for businesses in the Southeast U.S. • Zero personal income tax • 5.5% Corporate Business Tax Rate – Pro-business Governor and legislative agenda – Competitive cost of doing business • High Growth Potential – Initial entrance into historically high growth market through acquisition of 1st United Bancorp, Inc (“1st United”) which closed November 1, 2014 – Added franchise with strong organic and acquisitive growth history – Experienced management team (retained from 1st United) has built three major Florida banking franchises • Complementary to Valley NJ & NY Franchise – Low cost deposit funding source for Franchise – Opportunity to expand Valley’s successful product niches into a new market • Residential Lending • Consumer Lending – Retains strong capital on larger business, earning asset base Valley National Bancorp Florida Franchise FL 8% Loans FL 11% Deposits 8 20 Branches 8 Counties

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp • Rudy Schupp (former CEO of 1st United) is President of Florida Division • Florida lending and credit teams successfully retained • Long-term incentive program to maintain Relationship Managers • Significant opportunity in the commercial and consumer pipelines throughout the southeast and central Florida footprint • Introduction of Valley consumer products to Florida – $499 Residential Mortgage Refinance Program – Consumer Auto expansion through its approximately 65 dealership network • Sustained emphasis on lender recruiting via Team and Bank expansion • Growing attractive Florida deposit base Florida Franchise 9 Growth Potential by Region Florida Division Highlights • Approximately $44.0 million or 7 percent of total commercial real estate loans were originated in Florida • CNLBank acquisition will strengthen Florida footprint and expand the branch network into desirable new markets Platform for Future Growth 4%-6% 7%-8% 10%-12% 0% 2% 4% 6% 8% 10% 12% 14% Optimum Rate Base Rate NY/NJ Region VLY Consolidated Florida Region

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Strong Addition to Franchise Financial Highlights 3/31/2015 Assets $1.4 Billion Loans $833 Million Deposits $1.1 Billion Tangible Common Equity $123 Million YTD ROAA 0.69% YTD NIM 3.33% TCE / TA* 9.01% NPAs / Total Assets 2.66% YTD Loan Growth (Annualized) 12.1% Tangible Book Value per Common Share (period end) $4.71 • Founded in 1999 • Headquartered in Orlando, FL • Currently the 16th largest community bank headquartered in Florida by total deposits • 16 branches focused in five of the six largest MSAs in the state (Orlando, Miami-Fort Lauderdale-West Palm Beach, Cape Coral- Fort Myers, Naples, Jacksonville and Bradenton) • Enviable core deposit franchise with 39% non-interest bearing deposits • Experienced management team/ market leaders with solid reputation 10 *Refer to Non-GAAP disclosure on slide 26.

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Current Markets New Markets Valley Branches CNL Branches Strategically Attractive Market Complements Existing Franchise Pro-Forma as of 3/31/2015 Southeast Loans $1,128 MM Deposits $1,417 MM Branches 19 Central - Orlando Loans $513 MM Deposits $510 MM Branches 5 Northeast Loans $155 MM Deposits $187 MM Branches 3 Southwest Loans $121 MM Deposits $266 MM Branches 5 Central - Tampa Loans $136 MM Deposits $119 MM Branches 4 Total Florida Loans $2.1 Billion Deposits $2.5 Billion Branches 36 11

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Financially Attractive Transaction Consideration & Structure Structure •100% common stock consideration; 0.75 / 1 exchange ratio* Transaction Value •~$207 million** Taxable / Non Taxable •Anticipate a non-taxable merger transaction Pricing Multiples (Based on VLY 5/22/15 Close of $9.75) Price / Tangible Book •1.55x (does not include option consideration) Price / Fully Diluted Tangible Book •1.68x** Price / 2015 Estimated EPS •18.7x excluding projected cost saves • 9.2x including projected cost saves Core Deposit Premium •8.05% Financial Impact & Assumptions Earnings •Estimated to be EPS accretive in 2016 (excludes substantial identified synergies) Tangible Book Value Earn-back •Approximately 4.5 years (initial dilution of 1.64% inclusive of purchase accounting marks) Capital •Immediately accretive to CETI, Tier I RBC ratios Loan Mark •~3.2% of Loans Cost Saves •~41% of 2014 of non-interest expense Transaction One-Time Charges •~$13.6 million after tax Closing & Other Due Diligence •~80% of commercial loan portfolio reviewed by Valley’s experienced staff Approvals •Subject to customary regulatory and CNL shareholder approval for merger Management Transitions •VLY inherits strong seasoned Florida bank management team Expected Closing •4Q 2015 Key Terms *Exchange ratio subject to an adjustment as outlined in the merger agreement **Includes option consideration of $16.2 million 12

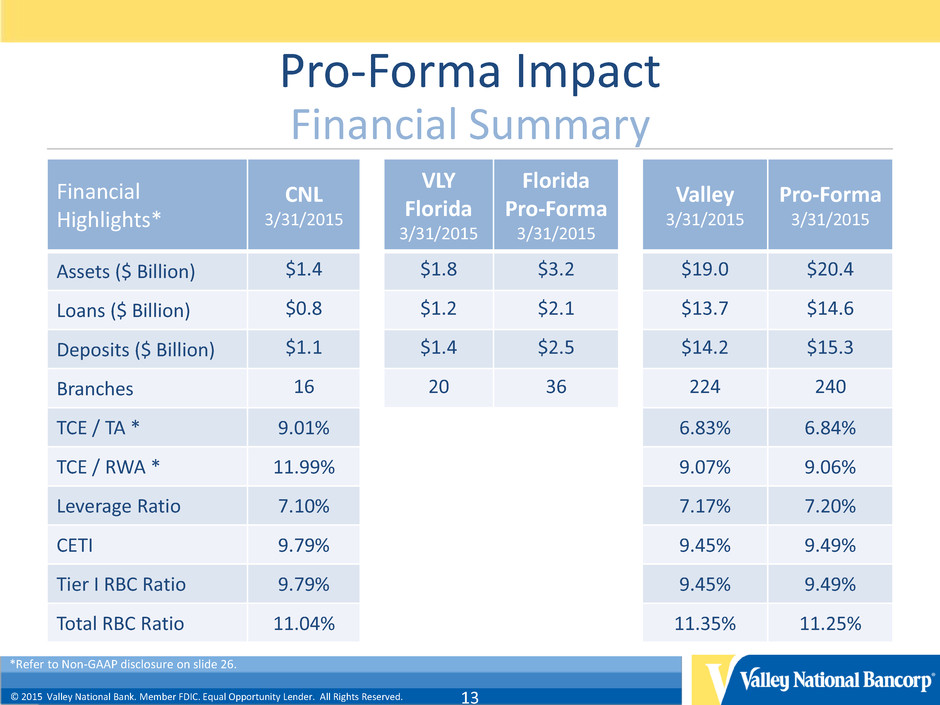

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Financial Highlights* CNL 3/31/2015 VLY Florida 3/31/2015 Florida Pro-Forma 3/31/2015 Valley 3/31/2015 Pro-Forma 3/31/2015 Assets ($ Billion) $1.4 $1.8 $3.2 $19.0 $20.4 Loans ($ Billion) $0.8 $1.2 $2.1 $13.7 $14.6 Deposits ($ Billion) $1.1 $1.4 $2.5 $14.2 $15.3 Branches 16 20 36 224 240 TCE / TA * 9.01% 6.83% 6.84% TCE / RWA * 11.99% 9.07% 9.06% Leverage Ratio 7.10% 7.17% 7.20% CETI 9.79% 9.45% 9.49% Tier I RBC Ratio 9.79% 9.45% 9.49% Total RBC Ratio 11.04% 11.35% 11.25% Pro-Forma Impact Financial Summary 13 *Refer to Non-GAAP disclosure on slide 26.

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. • Increased Lending Limit • Residential Lending • Auto Lending Lending Enhancements • Asset Management & Trust Services • Insurance Services • Customer Derivative Products Non-Interest Income • 24/7 Customer Service • Mobile Banking Application • Mobile Deposit Delivery Channels Enhancements Products & Services Likely Synergies / Enhancements 14

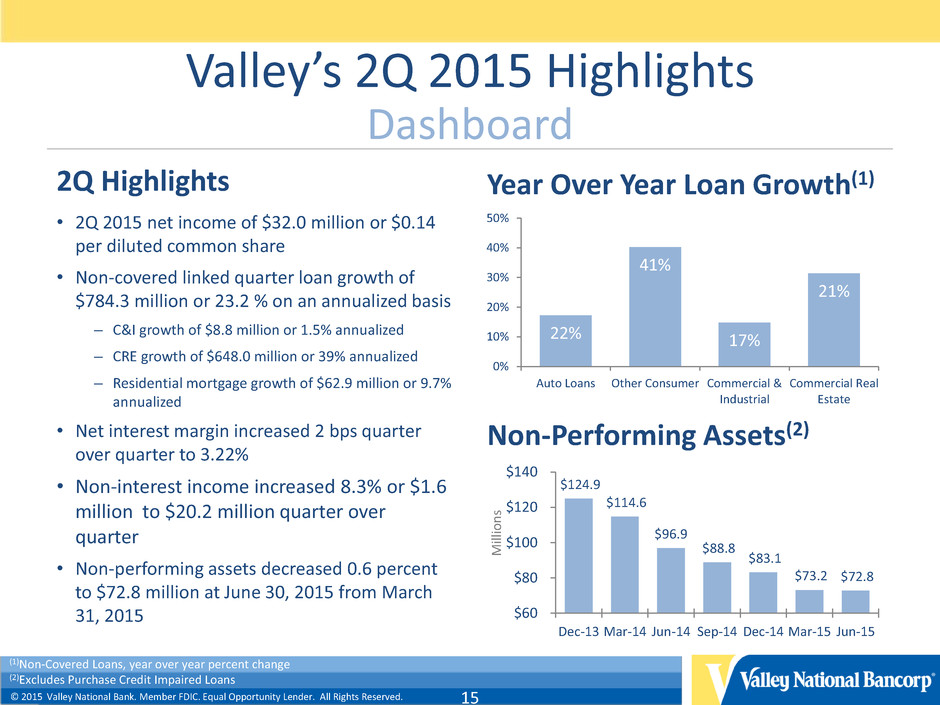

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. $124.9 $114.6 $96.9 $88.8 $83.1 $73.2 $72.8 $60 $80 $100 $120 $140 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 M ill io n s Valley’s 2Q 2015 Highlights 2Q Highlights Year Over Year Loan Growth(1) • 2Q 2015 net income of $32.0 million or $0.14 per diluted common share • Non-covered linked quarter loan growth of $784.3 million or 23.2 % on an annualized basis – C&I growth of $8.8 million or 1.5% annualized – CRE growth of $648.0 million or 39% annualized – Residential mortgage growth of $62.9 million or 9.7% annualized • Net interest margin increased 2 bps quarter over quarter to 3.22% • Non-interest income increased 8.3% or $1.6 million to $20.2 million quarter over quarter • Non-performing assets decreased 0.6 percent to $72.8 million at June 30, 2015 from March 31, 2015 Dashboard 22% 41% 17% 21% 0% 10% 20% 30% 40% 50% Auto Loans Other Consumer Commercial & Industrial Commercial Real Estate Non-Performing Assets(2) 15 (1)Non-Covered Loans, year over year percent change (2)Excludes Purchase Credit Impaired Loans

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Overview of Credit Trends 2003 – 2015 Average Net Charge-offs 0.07% 0.46% 0.24% 0.06% 0.07% 0.42% 0.20% 0.34% 0.61% 1.68% 0.41% 0.48% 1.28% 0.57% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% CRE C&I C&D Residential Home Equity Consumer Total VLY Peers Source: SNL Financial data as of 8/7/2015 Peer group includes banks between $10 billion and $50 billion in assets 16

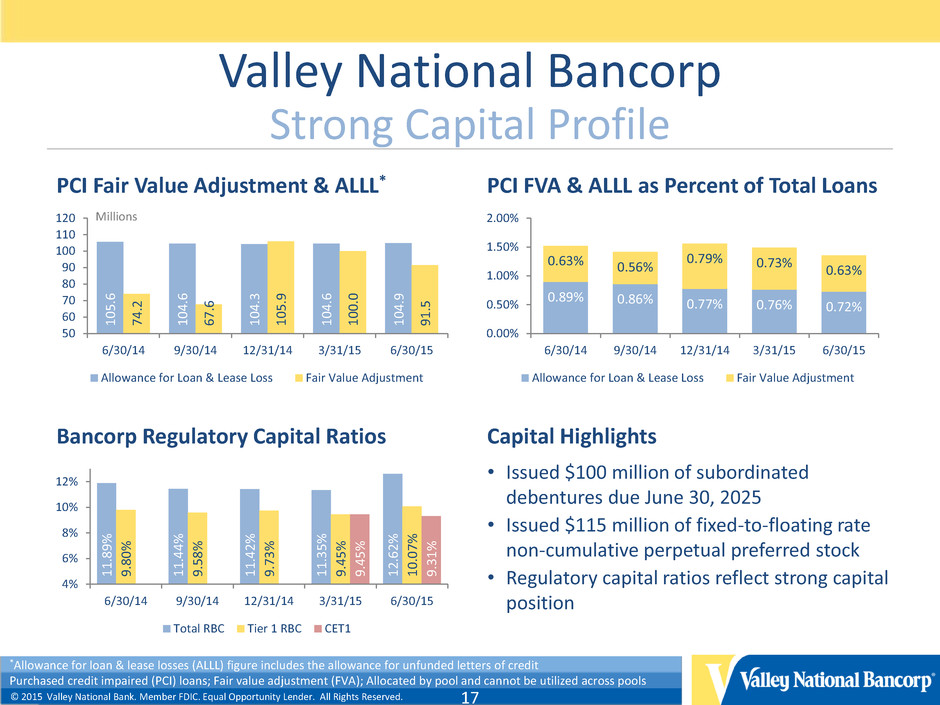

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp PCI Fair Value Adjustment & ALLL* PCI FVA & ALLL as Percent of Total Loans 1 0 5 .6 1 0 4. 6 1 0 4 .3 1 0 4 .6 1 0 4 .9 7 4 .2 6 7 .6 1 0 5 .9 1 0 0 .0 9 1 .5 50 60 70 80 90 100 110 120 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Allowance for Loan & Lease Loss Fair Value Adjustment Millions Bancorp Regulatory Capital Ratios Capital Highlights Strong Capital Profile 0.89% 0.86% 0.77% 0.76% 0.72% 0.63% 0.56% 0.79% 0.73% 0.63% 0.00% 0.50% 1.00% 1.50% 2.00% 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Allowance for Loan & Lease Loss Fair Value Adjustment 1 1 .8 9 % 1 1 .4 4 % 1 1 .4 2 % 1 1 .3 5 % 1 2 .6 2 % 9 .8 0 % 9 .5 8 % 9 .7 3 % 9 .4 5 % 1 0 .0 7 % 9 .4 5 % 9 .3 1 % 4% 6% 8% 10% 12% 6/30/14 9/30/14 12/31/14 3/31/15 6/30/15 Total RBC Tier 1 RBC CET1 • Issued $100 million of subordinated debentures due June 30, 2025 • Issued $115 million of fixed-to-floating rate non-cumulative perpetual preferred stock • Regulatory capital ratios reflect strong capital position 17 *Allowance for loan & lease losses (ALLL) figure includes the allowance for unfunded letters of credit Purchased credit impaired (PCI) loans; Fair value adjustment (FVA); Allocated by pool and cannot be utilized across pools

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp Appendix

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Valley National Bancorp Asset & Loan Composition Non-Covered Loans 74% Securities 13% Covered Loans <1% (2) Cash 3% Intangible Assets 3% Other Assets (1) 6% Commercial Real Estate 47% Residential Mortgages 18% Commercial Loans 17% Auto Loans 8% Other Consumer 6% Construction Loans 4% Total Assets $19.3 Billion Non-Covered Loans (Gross) $14.3 Billion (1) Other Assets includes bank owned branch locations carried at a cost estimated by management to be less than the current market value. (2) Loans subject to loss sharing agreements with the FDIC. 19

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Total Commercial Real Estate - $6.8 Billion (Includes both Covered and Non-Covered Loans) 15% 13% 12% 12% 12% 4% 4% 4% 2% 1% 19% -Average LTV based on current balances and most recent appraised value. -LTV calculation excludes Covered Loans. -The total CRE loan balance is based on Valley’s internal loan hierarchy structure . Does not reflect loan classifications reported in Valley’s SEC and bank regulatory reports. -Chart does not include $497 Million in Construction loans. *The average LTV’s does not include 1st United CRE portfolio collateral values. Commercial Real Estate Diversified Portfolio 20 Primary Property Type $ Amount (Millions) % of Total Avg. 2011 2Q Avg. LTV* LTV* Retail 1,284 19% 53% 49% Apartments 1,028 15% 61% N/A Mixed Use 920 13% 54% 45% Industrial 846 12% 11% N/A Coop Mortgages 834 12% 53% 52% Office 783 12% 50% 53% Healthcare 299 4% 58% 62% Specialty 296 4% 47% 50% Other 268 4% 40% 48% Residential 155 2% 50% 49% Land Loans 86 1% 57% 67% Total $6,798 48%

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Total Retail Property Types - $1.3 Billion 32% 25% 19% 8% 8% 4% 3% 1% -Average LTV based on current balances and most recent appraised value -The chart above excludes construction loans. -LTV calculation excludes Covered Loans. *The average LTV’s does not include 1st United CRE portfolio collateral values Retail Composition Commercial Real Estate 21 Retail Property Type % of Avg. 2011 2Q Avg LTV* Total LTV* Single Tenant 32% 54% 50% Multi-Tenanted - Anchor 25% 53% 49% Multi-Tenanted – No Anchor 19% 55% 53% Auto Dealership 8% 50% 50% Other 8% N/A N/A Food Establishments 4% 54% 54% Entertainment Facilities 3% 51% 45% Auto Servicing 1% 46% 51%

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. 29% 26% 13% 13% 8% 5% 4% 2% Composition Construction Loan Total Construction Loans - $510 Million -Construction loan balance is based on Valley’s internal loan hierarchy structure and does not reflect loan classifications reported in Valley’s SEC and bank regulatory reports. *The average LTV’s are exclusive of collateral values for loans acquired from 1st United. 22 Primary Property Type $ Amount (Millions) % of Total 2011* % of Total Residential 147 29% 38% Apartments 132 26% 11% Mixed Use 64 13% 10% Land Loans 66 13% 13% Retail 41 8% 13% Healthcare 26 5% 2% Other 23 4% 11% Specialty 11 2% 2% Total $510 100%

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Commercial Real Estate 54% Commercial & Industrial 15% Residential Mortgage 12% Other Consumer 6% Construction 13% CNL Pro-Forma Acquisition Complementary Loan Composition Commercial Real Estate 45% Commercial & Industrial 17% Residential Mortgage 19% Other Consumer 14% Construction 4% Covered Loans 1% Valley Commercial Real Estate 45% Commercial & Industrial 17% Residential Mortgage 19% Other Consumer 14% Construction 4% Covered Loans 1% Pro-Forma Loan Portfolio (millions) Amount % Commercial Real Estate $6,097 45% Commercial & Industrial 2,362 17% Residential Mortgage 2,586 19% Other Consumer 1,967 14% Construction and Development 539 4% Covered Loans 184 1% Total Loans $13,734 100% Loan Portfolio (millions) Amount % Commercial Real Estate $450 54% Commercial & Industrial 129 15% Residential Mortgage 102 12% Other Consumer 47 6% Construction and Development 105 13% Covered Loans - 0% Total Loans $833 100% Loan Portfolio (millions) Amount % Commercial Real Estate $6,547 45% Commercial & Industrial 2,491 17% Residential Mortgage 2,688 18% Other Consumer 2,015 14% Construction and Development 643 4% Covered Loans 184 1% Total Loans $14,567 100% 23

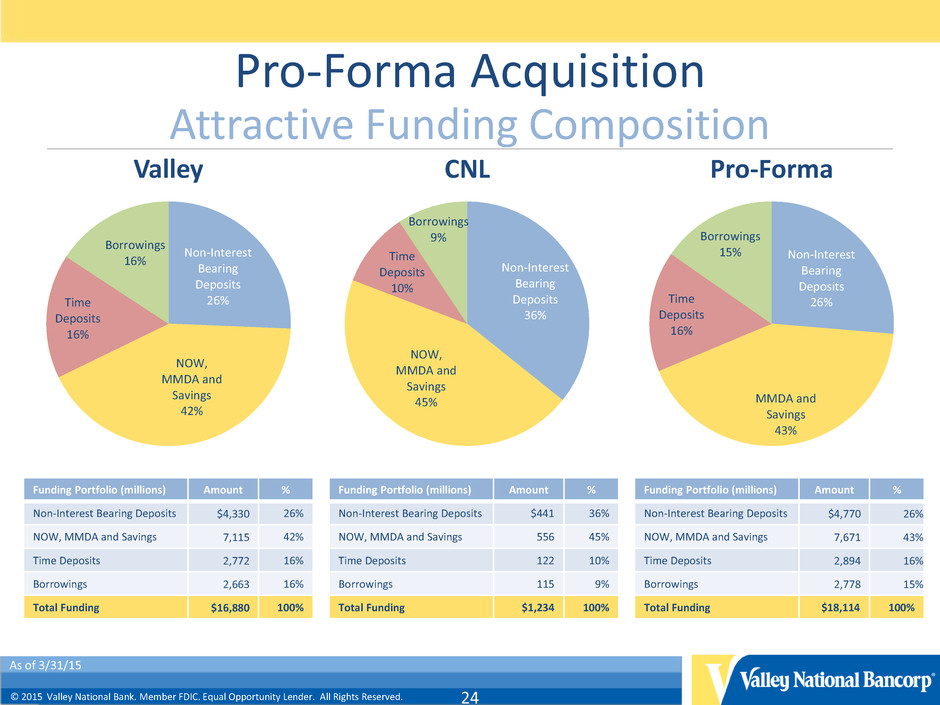

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Pro-Forma Acquisition Attractive Funding Composition Non-Interest Bearing Deposits 26% NOW, MMDA and Savings 42% Time Deposits 16% Borrowings 16% Valley Non-Interest Bearing Deposits 36% NOW, MMDA and Savings 45% Time Deposits 10% Borrowings 9% CNL Non-Interest Bearing Deposits 26% MMDA and Savings 43% Time Deposits 16% Borrowings 15% Pro-Forma Funding Portfolio (millions) Amount % Non-Interest Bearing Deposits $4,330 26% NOW, MMDA and Savings 7,115 42% Time Deposits 2,772 16% Borrowings 2,663 16% Total Funding $16,880 100% Funding Portfolio (millions) Amount % Non-Interest Bearing Deposits $441 36% NOW, MMDA and Savings 556 45% Time Deposits 122 10% Borrowings 115 9% Total Funding $1,234 100% Funding Portfolio (millions) Amount % Non-Interest Bearing Deposits $4,770 26% NOW, MMDA and Savings 7,671 43% Time Deposits 2,894 16% Borrowings 2,778 15% Total Funding $18,114 100% As of 3/31/15 24

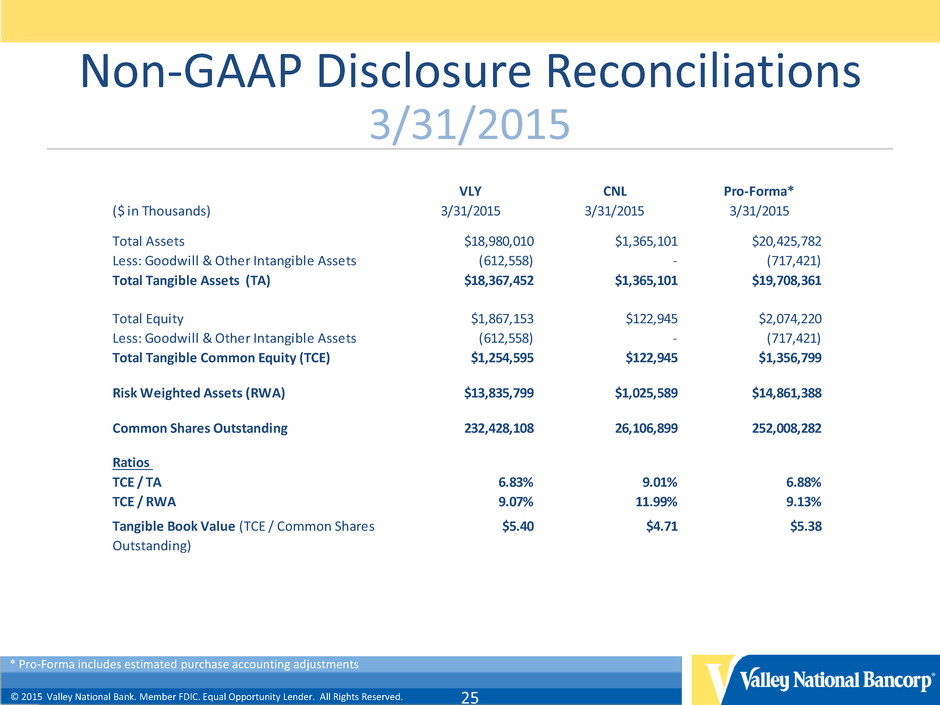

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. Non-GAAP Disclosure Reconciliations 25 3/31/2015 ($ in Thousands) VLY 3/31/2015 CNL 3/31/2015 Pro-Forma* 3/31/2015 Total Assets $18,980,010 $1,365,101 $20,425,782 Less: Goodwill & Other Intangible Assets (612,558) - (717,421) Total Tangible Assets (TA) $18,367,452 $1,365,101 $19,708,361 Total Equity $1,867,153 $122,945 $2,074,220 Less: Goodwill & Other Intangible Assets (612,558) - (717,421) Total Tangible Common Equity (TCE) $1,254,595 $122,945 $1,356,799 Risk Weighted Assets (RWA) $13,835,799 $1,025,589 $14,861,388 Common Shares Outstanding 232,428,108 26,106,899 252,008,282 Ratios TCE / TA 6.83% 9.01% 6.88% TCE / RWA 9.07% 11.99% 9.13% $5.40 $4.71 $5.38Tangible Book Value (TCE / Common Shares Outstanding) * Pro-Forma includes estimated purchase accounting adjustments

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. For More Information Log onto our web site: www.valleynationalbank.com E-mail requests to: tscortes@valleynationalbank.com Call Shareholder Relations at: (973) 305-3380 Write to: Valley National Bank 1455 Valley Road Wayne, New Jersey 07470 Attn: Tina Cortes, Shareholder Relations Specialist Log onto our website above or www.sec.gov to obtain free copies of documents filed by Valley with the SEC 26

© 2015 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights Reserved. 27