Attached files

| file | filename |

|---|---|

| EX-10.2 - EX-10.2 - Multi Packaging Solutions International Ltd | d945269dex102.htm |

| EX-10.8 - EX-10.8 - Multi Packaging Solutions International Ltd | d945269dex108.htm |

| EX-23.3 - EX-23.3 - Multi Packaging Solutions International Ltd | d945269dex233.htm |

| EX-10.5 - EX-10.5 - Multi Packaging Solutions International Ltd | d945269dex105.htm |

| EX-23.4 - EX-23.4 - Multi Packaging Solutions International Ltd | d945269dex234.htm |

| EX-23.9 - EX-23.9 - Multi Packaging Solutions International Ltd | d945269dex239.htm |

| EX-5.1 - EX-5.1 - Multi Packaging Solutions International Ltd | d945269dex51.htm |

| EX-23.2 - EX-23.2 - Multi Packaging Solutions International Ltd | d945269dex232.htm |

| EX-10.4 - EX-10.4 - Multi Packaging Solutions International Ltd | d945269dex104.htm |

| EX-10.3 - EX-10.3 - Multi Packaging Solutions International Ltd | d945269dex103.htm |

| EX-23.8 - EX-23.8 - Multi Packaging Solutions International Ltd | d945269dex238.htm |

| EX-23.5 - EX-23.5 - Multi Packaging Solutions International Ltd | d945269dex235.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 30, 2015

Registration No. 333-205278

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Multi Packaging Solutions International Limited

(Exact name of registrant as specified in its charter)

| Bermuda | 2759 | 98-1249740 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Clarendon House, 2 Church Street

Hamilton HM 11, Bermuda

(441) 295-5950

(Address, including zip code, and telephone number, including area code, of the registrant’s principal executive offices)

William H. Hogan

Executive Vice President and Chief Financial Officer

Multi Packaging Solutions International Limited

150 E 52nd St, 28th Floor

New York, New York 10022

(646) 885-0005

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Patrick H. Shannon Jason M. Licht Latham & Watkins LLP 555 Eleventh Street, NW Washington, D.C. 20004 (202) 637-2200 |

Marko Zatylny Ropes & Gray LLP 800 Boylston Street Boston, MA 02199-3600 (617) 951-7000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated September 30, 2015

PROSPECTUS

Shares

Multi Packaging Solutions International Limited

Common Shares

This is Multi Packaging Solutions International Limited’s initial public offering. We are selling common shares in this offering. The selling shareholders named in this prospectus, including investment funds controlled by The Carlyle Group (“Carlyle”) and Madison Dearborn Partners, LLC (“Madison Dearborn” and, together with Carlyle, the “Sponsors”), are selling common shares in this offering.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for our common shares. We have applied for listing of our common shares on the New York Stock Exchange (the “NYSE”) under the symbol “MPSX”.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in the common shares involves risks that are described in the “Risk Factors” section beginning on page 25 of this prospectus.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds to selling shareholders |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See the section entitled “Underwriting” for additional information regarding underwriting compensation. |

The underwriters may also purchase up to an additional common shares from the selling shareholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus. We will not receive any of the proceeds from the sale of common shares by the selling shareholders in this offering, including from any exercise by the underwriters of their option to purchase additional common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The common shares will be ready for delivery on or about , 2015.

| BofA Merrill Lynch | Barclays |

Citigroup

| Credit Suisse | Goldman, Sachs & Co. | UBS Investment Bank |

| Baird | BMO Capital Markets |

The date of this prospectus is , 2015.

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 25 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 55 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

57 | |||

| 83 | ||||

| 86 | ||||

| 102 | ||||

| 107 | ||||

| 115 | ||||

| 117 | ||||

| 120 | ||||

| 127 | ||||

| 129 | ||||

| 135 | ||||

| 139 | ||||

| 147 | ||||

| 147 | ||||

| 147 | ||||

| 148 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any related free-writing prospectus we prepare or authorize. We and the selling shareholders have not authorized anyone to give you any other information, and we and the selling shareholders take no responsibility for any other information that others may give you. We and the selling shareholders are offering to sell, and seeking offers to buy, the common shares only in jurisdictions where offers and sales are permitted.

Common shares may be offered or sold in Bermuda only in compliance with the provisions of the Investment Business Act of 1998, which regulates the sale of securities in Bermuda. Further, the Bermuda Monetary Authority (the “BMA”) must approve all issues and transfers of shares of a Bermuda exempted company under the Exchange Control Act, 1972 and regulations made thereunder. The BMA has given general permission which will permit the issue of the common shares by Multi Packaging Solutions International Limited and the transfer of such common shares among non-residents for Bermuda exchange control purposes so long as voting securities of Multi Packaging Solutions International Limited are admitted for trading on the NYSE or any other appointed stock exchange. In giving such permission, the BMA accepts no responsibility for the financial soundness of any proposal or for the correctness of any statements made or opinions expressed herein.

i

Table of Contents

BASIS OF PRESENTATION AND OTHER INFORMATION

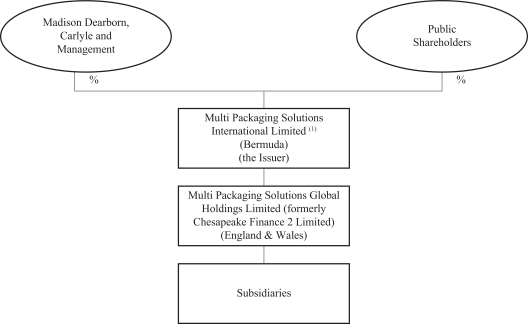

Multi Packaging Solutions International Limited

Unless the context otherwise requires, all references to “MPS Limited,” the “Company,” “we,” “us” and “our” refer to Multi Packaging Solutions International Limited, a Bermuda exempted company incorporated under the laws of Bermuda on June 19, 2015, together with the entities that will become its consolidated subsidiaries prior to completion of this offering contemplated hereby. The entities that will become the consolidated subsidiaries of MPS Limited consist of Multi Packaging Solutions Global Holdings Limited, which we refer to as “MPS Holdings,” and its subsidiaries. Prior to the completion of this offering, MPS Limited will become the direct parent company of MPS Holdings through a series of internal reorganizational transactions. These reorganizational transactions will include the exchanging of shares of MPS Holdings held by investment funds controlled by Madison Dearborn and Carlyle for new shares in MPS Limited. Upon pricing of the offering contemplated hereby, the investment fund controlled by Carlyle that currently directly holds the shares of MPS Holdings (and will hold the common shares of MPS Limited once MPS Limited becomes the direct parent company of MPS Holdings) will be liquidated and the ultimate holder of those shares (after a series of additional upstream liquidations) will be CEP III Chase S.à r.l., Chase Manco, L.P. and certain employees of the Company. We collectively refer to these reorganizational transactions as the “Reorg Transactions.” In connection with the Reorg Transactions, we (through one of our subsidiaries) plan to acquire the noncontrolling interests in one of our German subsidiaries from related parties and we will be required to pay approximately $1.2 million related to German real estate transfer taxes.

As MPS Limited will have no other interest in any operations other than those of MPS Holdings, the historical financial information presented in this prospectus is that of MPS Holdings. With respect to the historical and pro forma financial information and other data presented in this prospectus, including under the headings “Prospectus Summary—Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information,” “Capitalization,” “Selected Historical Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto and our unaudited pro forma combined financial statements appearing elsewhere in this prospectus, all references to the “Company,” “we,” “us” and “our” refer to MPS Holdings, unless the context requires otherwise.

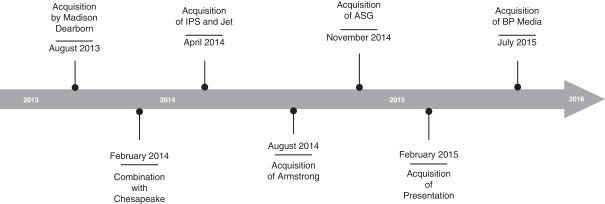

Multi Packaging Solutions Global Holdings Limited

On August 15, 2013, Multi Packaging Solutions, Inc. and its primary shareholder, IPC/Packaging LLC, entered into an Agreement and Plan of Merger to be purchased by Mustang Parent Corp. (“Mustang”), an entity controlled by funds advised by Madison Dearborn. The acquisition of Multi Packaging Solutions, Inc. by Madison Dearborn is referred to as the “Madison Dearborn Transaction.” On November 18, 2013, an investment fund controlled by Madison Dearborn and an investment fund controlled by Carlyle entered into a Combination Agreement, whereby Madison Dearborn contributed 100% of the outstanding equity of Mustang to Chesapeake Finance 2 Limited (“Chesapeake”), in exchange for a 50% equity interest in Chesapeake. The other 50% equity interest in Chesapeake is held by funds advised by Carlyle. The combination transaction between Chesapeake and Mustang was consummated on February 14, 2014 and was accounted for as a reverse acquisition with Chesapeake as the legal acquiror and new parent entity, and Mustang as the legal subsidiary but the accounting acquiror. Subsequently, Chesapeake changed its name to Multi Packaging Solutions Global Holdings Limited.

The financial information prior to the February 14, 2014 completion of the combination reflects that of Mustang and its predecessor.

ii

Table of Contents

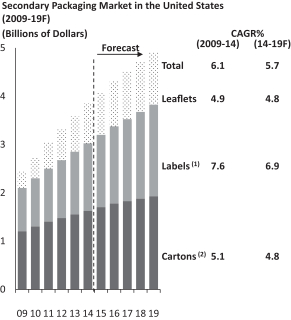

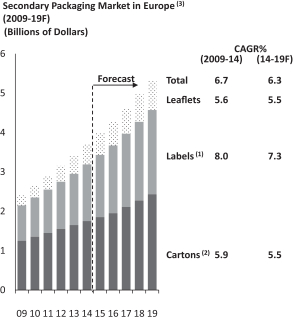

MARKET AND INDUSTRY DATA

The market data and other statistical information used throughout this prospectus are based on independent industry publications, reports by market research firms or other published independent sources. Some market data and statistical information are also based on our good faith estimates, which are derived from management’s knowledge of our industry and such independent sources referred to above. Certain market, ranking and industry data included in this prospectus, including the size of certain markets, the market opportunity across our primary addressable markets, and our size or position and the positions of our competitors within these markets, including our services relative to our competitors, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. Unless otherwise noted, all of our market share, market opportunity and market position information presented in this prospectus is an approximation based on management’s knowledge. Our market share and market position in each of our businesses and product groups, unless otherwise noted, is based on our sales relative to the estimated sales in the markets we serve. References herein to our being a leader in a market or product category refer to our belief that we have a leading market share position in each specified market, unless the context otherwise requires. In addition, the discussion herein regarding our various markets is based on how we define the markets for our products, which products may be either part of larger overall markets or markets that include other types of products and services.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

TRADEMARKS

We own or otherwise have rights to the trademarks, service marks, copyrights and trade names, including those mentioned in this prospectus, used in conjunction with the marketing and sale of our products and services. This prospectus includes trademarks, which are protected under applicable intellectual property laws and are our property and the property of our subsidiaries. This prospectus also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks, service marks, trade names and copyrights referred to in this prospectus may appear without the ®,™ or © symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights.

iii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Selected Historical Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision. Unless the context otherwise requires or otherwise provided herein, references herein to the “Company,” “we,” “us,” “our” and “our company” refer to MPS Limited, together with the entities that will become its consolidated subsidiaries prior to the completion of this offering. See “Basis of Presentation and Other Information.” References herein to “fiscal year” refer to our fiscal years, which end on June 30. See “—Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information.” References herein to the financial measures “EBITDA” and “Adjusted EBITDA” refer to financial measures that do not comply with generally accepted accounting principles in the United States (“U.S. GAAP”). For information about how we calculate EBITDA and Adjusted EBITDA, see footnote 4 to the table under the heading “—Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information.” References to “pro forma” reflect numbers giving effect to all acquisitions that have been completed through June 30, 2015 as if the relevant acquisitions occurred as of the beginning of the period referenced. References to “acquisition adjusted pro forma net sales” and “acquisition adjusted pro forma Adjusted EBITDA” give effect to net sales and EBITDA, respectively, for BP Media Limited, which was acquired on July 1, 2015. See footnotes 2 and 5 to the table under the heading “—Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information” for further detail on these metrics.

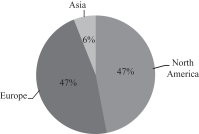

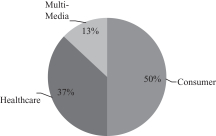

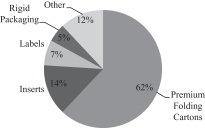

Company Overview

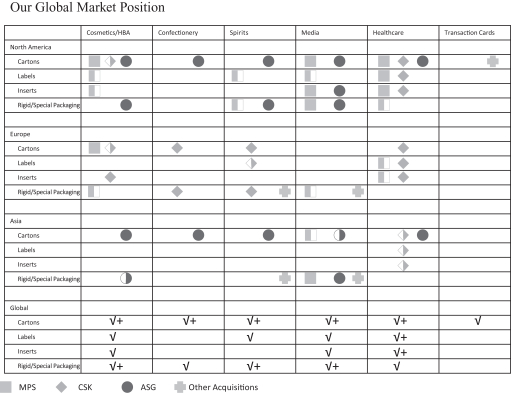

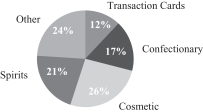

We are a leading, global provider of value-added specialty packaging solutions, based on sales, focused on high complexity products for the consumer, healthcare and multi-media markets. We provide our customers with an extensive array of print-based specialty packaging solutions, including premium folding cartons, inserts, labels and rigid packaging across a variety of substrates and finishes, which are complemented by value-added services, including creative design, new product development and customized supply chain solutions. For the fiscal year ended June 30, 2015, approximately 47%, 47% and 6% of our acquisition adjusted pro forma net sales came from our North American, European and Asian segments, respectively. We believe that our core addressable consumer and healthcare end markets, which account for approximately 87% of our acquisition adjusted pro forma net sales, encompass attractive, resilient and growing packaging categories, and we believe we are a leader in these end markets across North America and Europe based on sales. Additionally, we believe we have a market-leading position in the multi-media specialty packaging sector based on sales, which accounts for 13% of our acquisition adjusted pro forma global net sales. For the fiscal year ended June 30, 2015, acquisition adjusted pro forma net sales and acquisition adjusted pro forma Adjusted EBITDA were $1,830.4 million and $246.1 million, respectively.

Based on management estimates, we believe the market opportunity across our primary addressable markets is currently in excess of $17 billion of annual sales. We believe we are market leaders in a fragmented industry as we are one of the few large scale participants serving our addressable markets on a global basis. Competition in our addressable markets is based on stringent quality specifications, significant customer service standards and meaningful investment requirements. Our competitive position in our addressable markets is bolstered by our ability to provide comprehensive product solutions, which often include combination or bundled products, across our global platform driving new customer wins and strengthening our existing customer relationships through product and geographic cross-selling opportunities. Furthermore, the highly fragmented nature of our industry presents numerous acquisition opportunities as we continue to lead consolidation within our core businesses.

1

Table of Contents

We have long-term relationships with our blue chip customer base, who are leaders in our target end markets and include AstraZeneca, Coty, Diageo, Estée Lauder, GlaxoSmithKline, L’Oréal, Mondelēz International, Nestlé, Pernod Ricard, Pfizer and Sony. Our relationships with our top 20 customers average 34 years, with many of our customers operating under multi-year contracts. No one customer accounts for more than 5% of our acquisition adjusted pro forma net sales for the fiscal year ended June 30, 2015. Servicing our customers requires us to meet stringent quality specifications, a high level of customer service and meaningful investment requirements. Our healthcare customers, for example, require exacting standards of manufacturing in order to meet their regulatory requirements, and we are at the front end of our consumer customers’ branding and marketing strategy, enhancing the visual impact at the shelf while also ensuring product integrity and regulatory compliance.

We believe we are one of the few companies in our addressable markets which offers a full range of products across multiple geographies. This unique capability presents a compelling value proposition to our customers as they continue to rationalize their supply chain and seek to partner with global suppliers. Our global manufacturing footprint consists of 59 manufacturing sites and nine sales offices across North America, Europe and Asia. Our strategically located facilities have enabled us to grow our business by leveraging our customer relationships across multiple geographies and products, and drive incremental growth through our ability to integrate and improve our customers’ supply chains. Additionally, our global manufacturing footprint is supported by our sales and design teams, which consist of a dedicated research and development group, more than 115 structural and graphic designers and over 230 sales personnel.

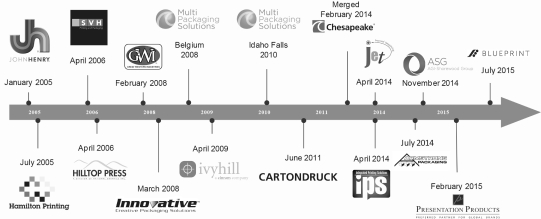

Since 2005, we have evolved from our initial U.S. platform of five facilities into a global specialty packaging leader, based on sales, through completing a total of 15 transactions. Our acquisitions expanded our core end markets and added complementary products and locations. In 2014, we entered into a transformational merger with Chesapeake Finance 2 Limited (“Chesapeake”), acquired the North American and Asian print businesses of AGI-Shorewood Group (“ASG”) and completed five additional acquisitions, which further expanded our global footprint and significantly diversified our product and end market profile. We are in the early stages of leveraging the benefits of these combinations. For example, we believe there is untapped cross-sell potential through opportunities from the MPS and Chesapeake combination in terms of increasing sales to existing customers in new product areas and geographies. Additionally, we estimate that as of June 30, 2015 we have realized a total of approximately $28 million of synergies from the Chesapeake and ASG transactions, which is expected to result in an annualized run-rate as of the same date of approximately $36 million. We believe that these targeted savings and synergy programs will eventually achieve an annualized run-rate of approximately $40 million, although we cannot make any assurances that such an annualized run-rate will be achieved.

The charts below illustrate our diversification by geographic region, end market and product offering as a percentage of acquisition adjusted pro forma net sales for the fiscal year ended June 30, 2015.

| By Geography |

By End Market |

By Product Offering | ||

|

|

|

|

2

Table of Contents

Our Products

We provide our customers a comprehensive suite of value-added specialty packaging solutions, including premium folding cartons, inserts, labels and rigid packaging, which utilize a wide variety of substrates (e.g., paper and paperboard, pressure sensitive labels, plastic, foil) and finishes (e.g., UV coatings, film lamination, stamping, embossing). We also employ an array of value-add decorative technologies to create iridescent, holographic, textured and dimensional effects to provide differentiated specialty packaging products to our customers.

The table below outlines our key product offerings and their competitive advantages.

| Premium Folding |

Inserts |

Labels |

Rigid Packaging |

Other Consumer | ||||||

| Fiscal Year 2015 Acquisition Adjusted Pro Forma Net Sales |

$1,138 million 62% of total |

$260 million 14% of total |

$126 million 7% of total |

$97 million 5% of total |

$209 million 12% of total | |||||

| Products | • Paperboard cartons |

• Healthcare inserts, outserts • Booklets • Folders • Slipsheets |

• Pressure sensitive • Extended content • Cut & stack |

• Rigid boxes • Tubes |

• Transaction cards • Grower tags • Brochures • Product literature | |||||

| Key Competitive Advantages |

• Breadth of product offering • Geographic proximity to customers • Advanced and innovative technology |

• Design and manufacturing capability • Breadth of folding technologies • Global presence |

• Wide variety of product and service capabilities • Product quality and consistency • Ability to handle the increasing complexity |

• Creative product solutions • Geographic proximity to customers • Significant manufacturing capabilities in our key geographies • Dedicated sourcing team focused on supplementing the key offerings to our customers |

• Unique end-to-end ability to service open and closed loop transaction cards • Provide multiple value-added print solutions | |||||

| Product Examples |

|

|

|

|

| |||||

3

Table of Contents

Premium Folding Cartons

Premium folding cartons are widely used, versatile forms of secondary packaging, which play an important role in our customers’ branding and marketing strategy by influencing purchase decisions at the point-of-sale by conveying an exceptional appearance, shelf presence and impact through the use of specialty graphics, a variety of printed finishes and other creative designs. Our folding carton offering competes at the premium end of the market, utilizes high quality inputs such as solid bleached sulfate, and is manufactured with various features and finishes, including lamination, embossing, foil stamping and windowing.

Additionally, our premium folding cartons offering must adhere to stringent regulatory requirements by playing a key role in our customers’ product safety as well as ensuring product authenticity, accurate product information and product compliance to the end customer. Our folding carton customers oftentimes purchase associated labels and inserts. Leveraging cross-selling opportunities is a key strategic initiative of recently completed acquisitions.

Inserts

We provide inserts for all the end markets we serve, with the majority of our sales in this category being to the healthcare end market. Inserts are of particular importance in the healthcare end market given stringent regulations to ensure the accuracy of product information. Numerous regulatory bodies require an increasing level of product information to be made available to the consumer. Providing this increasing amount of information requires larger and, in many instances, more complex inserts. Regulations evolve and consequently, product disclosure requirements change, oftentimes on short notice, which requires the need for a flexible manufacturing footprint and process capabilities, as well as quick reaction and turn-around of insert production. Our ability to be integrated with our customers’ information management systems allow us to monitor customer demand and limit their exposure to inventory obsolescence when product disclosure changes.

Labels

Labels are one of the most visible and recognizable packaging components and are used in a wide variety of applications serving as the primary means of identifying products to consumers, while creating shelf appeal and brand recognition for products. Labels also function as a conduit for fulfilling regulatory requirements, communicating product-related information to consumers and contributing to product integrity and security. We supply a broad range of pressure sensitive labels, including single-panel, multi-panel, multi-ply and extended content labels, as well as cut and stack labels through the application of multiple print technologies, including digital, flexographic and offset printing.

The majority of our sales in this category are pressure sensitive labels sold primarily into the healthcare market which, like our inserts, are subject to stringent regulations to ensure the accuracy of product information. Additionally, we supply both pressure sensitive and cut and stack labels to the consumer products markets where decorative labels are utilized to differentiate products at the retail point-of-sale.

Rigid Packaging

Our rigid packaging offering is composed of rigid boxes, which are commonly used to present ultra-premium products and vary from rigid top load boxes for the high-end spirits market to specialized boxes for perfumes and other luxury products. We recently completed two strategic acquisitions which added to our internal manufacturing capability for customized/high-end rigid boxes. We believe our rigid packaging offering presents a meaningful growth opportunity in the future.

4

Table of Contents

Other Consumer Products Packaging

We offer a number of additional print-based specialty packaging products, including transaction cards, point-of-purchase displays, brochures, product literature, marketing materials and grower tags and plant stakes for the horticultural market. Our transaction cards and card services offerings are of a particular focus. We provide our customers a comprehensive end-to-end solution for credit, debit, general prepaid reloadable, gift, loyalty, hospitality, insurance and other card-based programs. Our integrated supply chain for cards, carriers, multi-packs and point-of-purchase displays greatly simplifies the development and execution of card programs and drives competitive differentiation.

Value-Added Services

We complement our broad product offering with several value-added services, such as creative design and new product development for which we have a team of more than 115 structural designers and graphic designers across a number of key locations. We also provide our customers with customized supply chain solutions, including vendor managed inventory (“VMI”) programs. VMI solutions help customers manage production based on actual demand to reduce lead times, minimize inventory, eliminate waste and enhance supply chain security. Our ability to provide on-demand services for our customers via digital print technology has allowed us to reduce our lead times. Shorter lead times provide a distinct advantage in consumer and healthcare-facing industries where companies must move quickly to introduce new products and ramp-up supply in response to market trends and consumer demand. Shorter lead times also limit our customers’ exposure to inventory obsolescence. Our value-added services build entrenched partnerships with customers and allow us to become a more critical part of the supply chain by helping to improve workflow efficiencies and reduce our customers’ total cost of ownership for packaging materials.

5

Table of Contents

Our End Markets

The following table illustrates our sales, key drivers, end use, customers and competitors for each of our end markets. Additionally, the table reflects our estimates of our addressable market size and growth.

| Consumer |

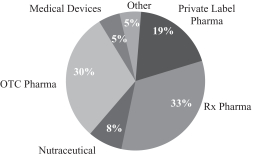

Healthcare |

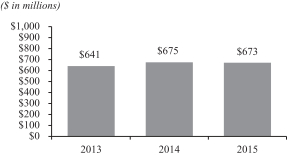

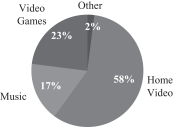

Multi-Media | ||||

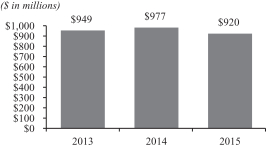

| Fiscal Year 2015 Acquisition Adjusted Pro Forma Net Sales |

$920 million 50% of total |

$673 million 37% of total |

$237 million 13% of total | |||

| Key Drivers | • Brand differentiation • Enhanced design attributes • Product innovation • Rapid refresh cycles |

• Population demographics • Proliferation of pharmaceutical products • Regulatory requirements |

• Commemorative, special editions • Games and gaming platforms | |||

| 2015 Addressable Market(1) |

• $8+ billion |

• $8+ billion |

• $0.3 billion | |||

| Market Growth 2015E – 2020E CAGR(1) |

• 2.0% |

• 6.0% |

• (7.0)% | |||

| End Use | • Personal care • Spirits • Cosmetics • Confectionary |

• Over-the-counter (branded and private label) and ethical pharmaceuticals • Medical devices • Nutritional and dietary supplements, vitamins and minerals |

• Home video • Recorded music • Video games • Software | |||

| Representative Customers |

• Coty • Diageo • Estée Lauder • Henkel • L’Oréal • Mondelēz International • Nestlé • Pernod Ricard |

• AstraZeneca • GlaxoSmithKline • Merck • Pfizer |

• Electronic Arts • Paramount Pictures • Sony • Universal Pictures Home Entertainment • Universal Music • Warner Home Video | |||

| Select Competitors | • Arkay Packaging • Autajon • CCL Industries • Edelmann Group • Multi-Color Corporation |

• CCL Industries • Essentra • Jones Packaging • Nosco |

• ASG Europe • Bert-Co Industries • Wynalda Packaging | |||

| (1) | Based on management estimates of annual sales. |

6

Table of Contents

Consumer (50% of Fiscal Year 2015 Acquisition Adjusted Pro Forma Net Sales)

We focus on the premium end of the personal care, spirits, cosmetics and confectionary markets where high-impact graphics and innovative designs and finishes help brands drive “top-of-mind” positioning at the point-of-purchase. Our multinational customers not only require innovative product solutions, which our leading global design division has positioned us well to deliver, but they have also increasingly centralized their procurement functions seeking fewer, more strategic partners capable of meeting their packaging needs across a range of products, services and geographies. We are well-positioned to benefit from this trend in vendor rationalization by leveraging our ability to deliver a broad range of solutions on a local basis while simultaneously providing global coverage to our multinational customers.

Healthcare (37% of Fiscal Year 2015 Acquisition Adjusted Pro Forma Net Sales)

Our healthcare packaging offering is used in a wide variety of applications including over-the-counter (“OTC”) and prescription pharmaceuticals, medical devices, nutritional and dietary supplements, vitamins and minerals. The healthcare packaging market is characterized by significant technical requirements, recession-resilient demand characteristics and numerous growth opportunities. Healthcare packaging has stringent quality specifications, prerequisite manufacturing standards, including audits and certifications of facilities, and compliance with ever-increasing regulatory requirements. Product innovation also plays a key role in the industry as pharmaceutical manufacturers increasingly incorporate authentication features into packaging to assist in the prevention of counterfeiting. We have developed strong relationships with leading healthcare companies as a result of our high-quality products, expertise in print technologies, excellent customer service and customized supply solutions, which we believe positions us well as the healthcare sector continues to consolidate its packaging spend to those suppliers who can provide consistent high-quality service on a multi-country basis.

Multi-Media (13% of Fiscal Year 2015 Acquisition Adjusted Pro Forma Net Sales)

Our multi-media end market sales are focused on high quality specialty packaging, which often requires quick response, including commemorative and special editions for home videos, recorded music, video games and software. The production of packaging for multi-media customers requires dedicated equipment, order volumes, enterprise resource planning (“ERP”) systems and customer relationships, all of which are significant competitive advantages over any new market entrants.

Our Competitive Strengths

Industry leader focused on attractive end markets

We believe that we are a leading supplier, based on sales, in our core addressable consumer and healthcare end markets, which account for approximately 87% of our acquisition adjusted pro forma global net sales. The global markets for consumer and healthcare packaging have proven to be recession resistant over time, experiencing steady growth in excess of gross domestic product (“GDP”), which is expected to continue. For example, based on management estimates, we estimate that the annual sales for the healthcare packaging market grew at a compound annual growth rate (“CAGR”) of 6.4% from 2010 to 2015. Over the same period, based on management estimates, we believe annual sales for the remainder of our addressable market in the consumer end market grew at a CAGR of approximately 2.9%. According to the International Monetary Fund, GDP growth in the United States and European Union during the same period will average 2.3% and 0.9% per year, respectively.

Scale benefits in a fragmented industry

As one of the leading global providers, based on sales, of value-added specialty packaging solutions in a highly fragmented industry, our scale provides us with competitive advantages including: innovative design and new product development, purchasing leverage, value-added supply chain solutions (e.g., VMI) and redundant

7

Table of Contents

manufacturing capacity from our global footprint. Further, our scale has resulted in a global manufacturing platform that enables us to reliably serve our multinational customers intent on consolidating their supplier bases across multiple geographies. Our scale provides us with a significant competitive advantage, as most other market participants lack the financial resources to replicate our enterprise capabilities. Additionally, our scale provides us with the financial flexibility to selectively pursue and integrate bolt-on acquisition opportunities in this highly fragmented industry.

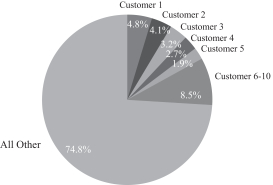

Long-term relationships with a diverse, blue chip customer base

We have long-term customer relationships driven by our local and global presence, breadth of products, value-added service offering and innovative packaging solutions. Our customers include AstraZeneca, Coty, Diageo, Estée Lauder, GlaxoSmithKline, L’Oréal, Mondelēz International, Nestlé, Pernod Ricard, Pfizer and Sony. Our relationships with our top 20 customers average 34 years, with no one customer accounting for more than 5% of our acquisition adjusted pro forma net sales for the twelve-month period ended June 30, 2015 and our top ten customers accounting for less than 26% of acquisition adjusted pro forma net sales for the same time period.

Strategically located global manufacturing footprint and high quality asset base

Our global packaging footprint provides us with the ability to serve our customers across North America, Europe and Asia. We believe this is a key competitive differentiator in a fragmented industry that has predominantly regional and locally focused peers, and positions us to continue to grow in our core end markets. Our global sales, design and manufacturing capabilities enable us to simplify and economize our global customers’ supply chains through executing global supply contracts with key multinational customers. We believe our global production management capabilities and technologically advanced asset base positions us as a “provider-of-choice” for customers looking for product quality in emerging markets. We continually invest in our asset base to ensure we have state-of-the-art technology and high-performing equipment and implement operating best practices across our sites.

Product innovation capabilities and complementary service offering

We believe our new product development capabilities result in products with unique performance characteristics that add value for our customers, drive customer loyalty and support our overall profitability. Furthermore, as design and regulations continue to evolve, we believe it is imperative to constantly innovate in order to comprehensively address customer needs.

Our innovative product offering is complemented with several value-added services and technologies that our larger customers demand, including creative design, new product development and bespoke supply chain solutions such as VMI. Our creative team includes more than 115 structural designers and graphic designers across a number of key locations. We believe our sales and design capabilities, in tandem with our global footprint, facilitate a superior speed-to-market versus our competitors, which enables us to provide customers with faster product turnaround that leads to reduced inventory and product obsolescence when introducing new and redesigned products. Our value-added services, such as on-demand printing and customer-dedicated presses and facilities, allow us to build entrenched partnerships with customers and facilitate us in becoming a more critical part of the supply chain by helping to improve workflow efficiencies and reduce our customers’ total cost of ownership for packaging materials. In this fragmented industry, our size and financial resources enable us to continuously innovate, which we believe is a significant competitive advantage.

Proven acquisition track record

We have a successful track record of acquiring strategically relevant companies, establishing and realizing savings and synergy programs and integrating acquired operations and customers into our global platform.

8

Table of Contents

Through successful execution and integration of acquired businesses, we have expanded our geographic reach and product and service offering, which has enabled us to better serve our large multinational customers, as well as penetrate new regional and local customers in our key end markets. We have expanded the operating margins of companies we have acquired, achieving our synergy targets and leveraging our platform as evidenced by our accreting EBITDA margins subsequent to each acquisition.

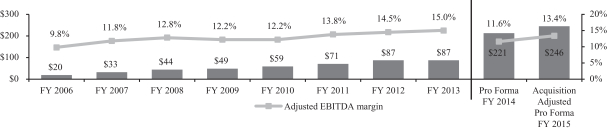

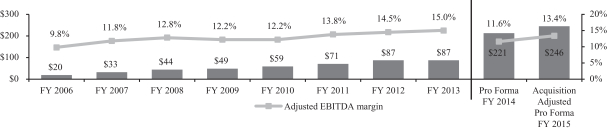

Strong earnings growth, margin improvement and free cash flow generation

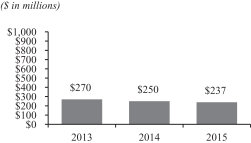

We have a successful track record of creating shareholder value since our inception. We have consistently delivered growth through a focus on attractive products and end markets, operational excellence and executing value accretive acquisitions. Adjusted EBITDA has grown at a CAGR of 36.1% from fiscal year 2006 to fiscal year 2013. Over the same period we have increased Adjusted EBITDA margins from 9.8% to 15.0%. The chart below illustrates our growth in Adjusted EBITDA and related margin. The pro forma results below reflect the acquisitions we made through June 30, 2015 as if they occurred on July 1, 2013. The pro forma Adjusted EBITDA margin is lower than historical periods primarily due to the lower historical Adjusted EBITDA margin for the acquired ASG businesses and is reflective of the potential accretion opportunity available to us.

Adjusted EBITDA ($ in millions)

| Note: | Our fiscal year ends June 30th. See footnote 4 set forth in “—Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information” for a reconciliation of Adjusted EBITDA to net income. |

We have also consistently demonstrated our ability to generate strong cash flows driven by efficient investment of capital, good working capital control and operational discipline throughout the Company. Our capital investment requirements have generally been in the range of 3.5 to 3.9% of net sales, achieving strong free cash flow conversion relative to our Adjusted EBITDA margin. Our free cash flow conversion (defined as Adjusted EBITDA less capital expenditures) has averaged over 70% over the last seven years.

Free Cash Flow Conversion

| Note: | Free cash flow is defined as Adjusted EBITDA less capital expenditures. Free cash flow conversion is defined as free cash flow divided by Adjusted EBITDA. See footnote 4 set forth in “—Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information” for a reconciliation of Adjusted EBITDA to net income. Pro forma FY 2015 is calculated using acquisition adjusted pro forma Adjusted EBITDA. |

9

Table of Contents

Experienced management team with strong track record of execution

Our seasoned and capable senior management team consisting of 30 individuals averages more than 20 years of direct industry experience and brings an impressive track record of both operating businesses and sourcing and integrating acquisitions. We are led by our Chief Executive Officer, Marc Shore, the former Chairman and CEO of Shorewood Packaging Corporation (“Shorewood”), which completed an initial public offering in October 1986 and was eventually sold to International Paper in February 2000, resulting in a total return of 22% on a compounded annual basis over that period. At MPS, Mr. Shore and the management team are responsible for taking us from $209 million of net sales in our first full year of operation in 2006 to $1.8 billion in pro forma net sales for the twelve months ended June 30, 2015. Mr. Shore is joined by Dennis Kaltman, our President, and William Hogan, our Executive Vice President and Chief Financial Officer, both of whom helped build Shorewood alongside Mr. Shore and have worked with him for over 17 years. Mr. Kaltman and Mr. Hogan joined MPS in July 2005 and February 2006, respectively, and have more than 50 years of combined experience in the print-based specialty packaging industry. This management team is supported by a large number of seasoned employees, many who have joined from acquired businesses and have extensive operational experience and strong customer relationships.

Our Strategies

We seek to continue to take advantage of our competitive strengths by pursuing the following business strategies:

Position for organic growth in core markets

We seek to further develop our product capabilities and geographic reach in order to: enhance our existing customer relationships; take advantage of positive growth dynamics within our core consumer and healthcare markets; and focus on market segments where we have sustainable, competitive advantages. Additionally, our footprint in Asia and Eastern Europe gives us access to higher growth emerging markets.

| • | Consumer: As traditional forms of advertising media have continued to fragment, it is becoming increasingly important to have high quality packaging in order to capture consumers’ attention at point-of-sale in order to help brands differentiate their products in a cost effective way and gain “top-of-mind” positioning. Security and safety concerns are resulting in the growth of tamper-proof packaging. Additionally, increasing focus on environmental issues and recyclability of materials represents an opportunity for us to further strengthen our market position. Finally, continued compression in the product life cycle of consumer goods and a rapid refresh cycle have led to a growing need for new and differentiated packaging products. Our strength in new product development positions us to benefit from this trend. |

| • | Healthcare: An aging population demographic, increasing consumer awareness regarding health and wellness, generic pharmaceutical SKU proliferation and evolving regulatory standards are expected to be key drivers of continued growth. The growing global population has increased the market for pharmaceuticals, an effect that is amplified by demographic shifts as the universe for pharmaceuticals targeting chronic diseases has expanded. We believe that we have a market leading position in the healthcare end market based on sales, which coupled with our multinational presence, give us global scale and a significant opportunity to follow customers looking to consolidate their supply chains. |

Leverage our scale and differentiated approach to market to increase market share

We believe our ability to serve our customers through our global presence, breadth of products, value-added service offering and innovative packaging solutions is a competitive advantage, as our global customers increasingly require their packaging providers to supply multiple products across multiple regions. Our ability to be a “one-stop shop” on a global basis for our customers simplifies and optimizes their supply chains and

10

Table of Contents

represents a significant opportunity to take market share from smaller, local and regionally focused specialty packaging providers. Our extensive range of complementary high value-added products and solutions supports our value proposition to our customers and creates a “stickiness” to our customer relationships.

Continue to leverage cross-sell potential opportunities

We believe we can continue to increase our share of specialty packaging sales to our existing customers through meaningful geographic and product cross-selling opportunities related to our merger with Chesapeake and purchase of ASG. Our ability to provide multiple products across numerous locations enables us to maximize cross-selling opportunities to our existing customers. For example, Chesapeake brought European spirits and confectionary capability which we can leverage into the United States, while we brought a broader personal care and healthcare customer base seeking suppliers with capabilities in Europe. This “one-stop shop” nature of our business yields economic benefits to our customers that are difficult for our competitors to achieve. We are only beginning to realize new sales opportunities as a consequence of bringing MPS, Chesapeake and ASG together.

Continue pursuit of operational excellence

Continuous operational improvement is core to our strategy. We consistently benchmark our sites against each other in terms of profitability metrics and key performance indicators across our equipment to optimize our processes. We continue to develop and implement operating best practices and remediate underperforming sites through utilization improvement, expense management and facility rationalizations. Over the last five years we have invested over $330 million in our manufacturing network to provide and improve scale and geographic coverage, operational flexibility, security of redundant capacity and ensure site accreditation. Our key cost savings initiatives include improving our productivity and asset utilization, optimizing our industrial footprint and investing capital efficiently. Through these key savings initiatives as well as our global lean manufacturing efforts, we believe we will continue to drive operational excellence in order to further improve our operating margins.

Continue disciplined acquisition strategy

We have established a track record of successfully sourcing, executing and integrating strategic, value accretive acquisitions in the fragmented specialty packaging industry. We maintain and monitor a list of potential acquisition targets and we believe we will continue to be able to achieve and execute acquisitions at attractive post-synergy valuations. Since 2005, we have completed 15 acquisitions at what we believe were attractive pre-synergy and post-synergy multiples. As a result of our management’s tenure in the industry, most of our acquisitions have been identified and initiated by our management team outside of formal sale processes.

Drive margin expansion and synergy benefits from recent acquisitions

We are focused on continuing to drive synergies from recent acquisitions to reduce costs and increase our Adjusted EBITDA margins. We are in the process of executing synergies related to the Chesapeake merger and ASG acquisition, both of which were completed in calendar year 2014. Specifically, we estimate that as of June 30, 2015 we have realized a total of approximately $28 million of synergies from the Chesapeake and ASG transactions, which is expected to result in an annualized run-rate as of the same date of approximately $36 million. We believe that these targeted savings and synergy programs will eventually achieve an annualized run-rate of approximately $40 million, although we cannot make any assurances that such an annualized run-rate will be achieved. These savings come from procurement, leveraging our existing selling, general and administrative functions, optimizing workflow within and across sites and driving strong operational performance through close monitoring and management.

11

Table of Contents

Maximize free cash flow generation

Free cash flow generation continues to be a focus of our business, and our consistent free cash flow generation is a result of: (i) a stable gross margin profile that reflects the value of the products and services we provide; (ii) management’s focus on operational efficiency; (iii) disciplined capital expenditures focused on attractive, high return on investment projects and the ability to repurpose machinery; and (iv) the optimization of operations and realization of synergies from acquisitions, including leveraging our fixed-cost base. We believe our execution of operational improvements and acquisition integration, supplemented with modest capital expenditure requirements, will continue to drive our free cash flow in the future.

Risks Related to Our Business

Investing in our common shares involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common shares. There are several risks related to our business and our ability to leverage our strengths that are described under “Risk Factors” elsewhere in this prospectus. Among these important risks are the following:

| • | our ability to compete against competitors with greater resources or lower operating costs; |

| • | adverse developments in economic conditions, including downturns in the geographies and target markets that we serve; |

| • | difficulties in restructuring operations, closing facilities or disposing of assets; |

| • | our ability to successfully integrate our acquisitions and identify and integrate future acquisitions; |

| • | our ability to realize the growth opportunities and cost savings and synergies we anticipate from the initiatives that we undertake; |

| • | changes in technology trends and our ability to develop and market new products to respond to changing customer preferences and regulatory environment; |

| • | the impact of electronic media and similar technological changes, including the substitution of physical products for digital content; |

| • | seasonal fluctuations; |

| • | the impact of significant regulations and compliance expenditures as a result of environmental, health and safety laws; |

| • | risks associated with our non-U.S. operations; |

| • | exposure to foreign currency exchange rate volatility; |

| • | the loss of, or reduced purchases by, one or more of our large customers; |

| • | failure to attract and retain key personnel; |

| • | increased information technology security threats and targeted cybercrime; |

| • | changes in the cost and availability of raw materials; |

| • | operational problems at our facilities; |

| • | the impact of any labor disputes or increased labor costs; |

| • | the failure of quality control measures and systems resulting in faulty or contaminated products; |

| • | the occurrence or threat of extraordinary events, including natural disasters and domestic and international terrorist attacks; |

| • | increased energy or transportation costs; |

12

Table of Contents

| • | our ability to develop product innovations and improve production technology and expertise; |

| • | the impact of litigation, uninsured judgments or increased insurance premiums; |

| • | an impairment of our goodwill or intangible assets; |

| • | our ability to comply with all applicable export control laws and regulations of the United States and other countries and restrictions imposed by the Foreign Corrupt Practices Act; |

| • | the impact of regulations to address climate change; |

| • | risks associated with the funding of our pension plans, including actions by governmental authorities; |

| • | the impact of regulations related to conflict minerals; |

| • | our ability to acquire and protect our intellectual property rights and avoid claims of intellectual property infringement; |

| • | risks related to our substantial indebtedness; |

| • | failure of internal controls over financial reporting; and |

| • | the ability of Carlyle and Madison Dearborn to control us. |

Our Anticipated Corporate Structure After the Offering

| (1) | Prior to the completion of this offering, the Issuer will become the direct parent company of MPS Holdings as a result of the investment vehicles controlled by Madison Dearborn and Carlyle exchanging their shares in MPS Holdings for new shares in the Issuer. |

13

Table of Contents

Our Principal Shareholders

On August 15, 2013, Multi Packaging Solutions, Inc. and its primary shareholder, IPC/Packaging LLC, entered into an Agreement and Plan of Merger to be purchased by Mustang, an entity controlled by funds advised by Madison Dearborn. On November 18, 2013, an investment fund controlled by Madison Dearborn and an investment fund controlled by Carlyle entered into a Combination Agreement and the combination was consummated on February 14, 2014. Pursuant to the Combination Agreement, Madison Dearborn contributed 100% of the outstanding equity of Mustang to Chesapeake, in exchange for a 50% equity interest in Chesapeake. The other 50% equity interest in Chesapeake is held by funds advised by Carlyle. The transaction between Chesapeake and Mustang was accounted for as a reverse acquisition with Chesapeake as the legal acquiror and new parent entity, and Mustang as the legal subsidiary but the accounting acquiror. Subsequently, Chesapeake changed its name to Multi Packaging Solutions Global Holdings Limited. On June 19, 2015, Multi Packaging Solutions International Limited, the registrant, was formed in Bermuda. Affiliates of Madison Dearborn and Carlyle collectively currently beneficially own all of our common shares, as well as the ordinary shares of Multi Packaging Solutions Global Holdings Limited. See “Basis of Presentation and Other Information—Multi Packaging Solutions International Limited.” Following consummation of this offering affiliates of Madison Dearborn and Carlyle will continue to be controlling shareholders and will have the right to designate a number of directors to our board pursuant to a shareholders’ agreement. See “Certain Relationships and Related Party Transactions—Shareholders’ Agreement.”

Carlyle

Founded in 1987, Carlyle is a global alternative asset manager and one of the world’s largest global private equity firms with approximately $193 billion of assets under management across 130 funds and 156 fund of funds vehicles as of June 30, 2015. Carlyle invests across four segments – Corporate Private Equity, Real Assets, Global Market Strategies and Investment Solutions – in Africa, Asia, Australia, Europe, the Middle East, North America and South America. Carlyle has expertise in various industries, including aerospace, defense & government services, consumer & retail, energy, financial services, healthcare, industrial, real estate, technology & business services, telecommunications & media and transportation. Carlyle employs more than 1,650 employees, including more than 700 investment professionals, in 40 offices across six continents.

Madison Dearborn

Madison Dearborn, based in Chicago, is an experienced private equity investment firm that has raised over $18 billion of capital. Since its formation in 1992, Madison Dearborn’s investment funds have invested in approximately 130 companies across a broad spectrum of industries, including basic industries; business and government services; consumer; financial and transaction services; healthcare; and telecom, media and technology services. Madison Dearborn’s objective is to invest in companies with strong competitive characteristics that it believes have the potential for significant long-term equity appreciation. To achieve this objective, Madison Dearborn seeks to partner with outstanding management teams that have a solid understanding of their businesses as well as track records of building shareholder value.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in gross revenue during our last fiscal year before our first public filing, we qualified as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being permitted to present only two years of audited financial statements and only two years of related results of operations in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section in this prospectus; |

14

Table of Contents

| • | being permitted to adopt any new or revised accounting standards using the same timeframe as private companies (if such standard applies to private companies); |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”), which such fifth anniversary will occur in 2021. However, if specified events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of some of the reduced disclosure obligations listed above in this prospectus, and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

Company Information

Multi Packaging Solutions International Limited was incorporated pursuant to the laws of Bermuda on June 19, 2015. Our principal executive offices are located at 150 E 52nd St., 28th Floor, New York, New York, 10022, and our telephone number is (646) 885-0005. Our website address is www.multipkg.com. Information on, or accessible through, our website is not part of this prospectus, nor is such content incorporated by reference herein. You should rely only on the information contained in this prospectus when making a decision as to whether to invest in our common shares.

We maintain a registered office in Bermuda at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The telephone number of our registered office is (441) 295-5950.

15

Table of Contents

The Offering

| Common shares offered by us |

shares. |

| Common shares offered by the selling shareholders |

shares. |

| Total common shares offered |

shares. |

| Selling shareholders |

The selling shareholders identified in “Principal and Selling Shareholders.” |

| Common shares outstanding after this offering |

shares. |

| Option to purchase additional common shares |

The selling shareholders have granted the underwriters a 30-day option from the date of this prospectus to purchase up to an additional common shares at the initial public offering price, less underwriting discounts and commissions. |

| Use of proceeds |

We estimate the net proceeds to us from this offering will be approximately $ million, based on an assumed public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, after deducting assumed underwriting discounts and commissions and other estimated offering expenses payable by us. We intend to use the net proceeds from this offering to repay certain indebtedness and to pay related premiums, accrued and unpaid interest and to pay expenses related to this offering. See “Use of Proceeds” for additional information. To the extent that the public offering price is lower than $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and our cash proceeds are lower than we have estimated, or our offering expenses are greater than we have estimated, the amount of the indebtedness that we will repay will be reduced. To the extent that the public offering price is higher than $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and our cash proceeds are higher than we have estimated, or our offering expenses are less than we have estimated, the amount of the indebtedness that we will repay will be increased. We will not receive any net proceeds from the sale of common shares by the selling shareholders, including from any exercise by the underwriters of their option to purchase additional common shares. For more information about the selling shareholders, see “Principal and Selling Shareholders.” See “Use of Proceeds” for additional information. |

| Dividend policy |

We do not currently pay and do not currently anticipate paying dividends on our common shares following this offering. Any declaration and payment of future dividends to holders of our |

16

Table of Contents

| common shares may be limited by restrictive covenants in our debt agreements, and will be at the sole discretion of the Board of Directors of MPS Limited (our “Board of Directors”) and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that our Board of Directors deems relevant. In addition, Bermuda law imposes requirements that may restrict our ability to pay dividends to holders of our common shares. Under the Companies Act, 1981, we may declare and pay a dividend only if we have reasonable grounds to believe that we are, or would be after the payment, able to pay our liabilities as they become due and if the realizable value of our assets would thereby not be less than our liabilities. See “Dividend Policy,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and “Description of Share Capital.” |

| Reserved Share Program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to 5% of the common shares offered by this prospectus for sale to some of our directors, officers, employees, business associates and related persons through a Reserved Share Program. If these persons purchase reserved common shares it will reduce the number of common shares available for sale to the general public. Any reserved common shares that are not so purchased will be offered by the underwriters to the general public on the same terms as the other common shares offered by this prospectus. |

| Proposed stock exchange symbol |

“MPSX”. |

| Risk factors |

See “Risk Factors” beginning on page 25 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common shares. |

The number of common shares to be outstanding after completion of this offering is based on common shares outstanding as of , 2015, which includes common shares to be sold by the selling shareholders, and excludes common shares reserved for issuance under our 2015 Incentive Plan (the “2015 Plan”), which we plan to adopt in connection with this offering.

Unless we specifically state otherwise, all information in this prospectus assumes:

| • | no exercise of the option to purchase additional common shares by the underwriters; |

| • | an initial offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus; |

| • | the completion of a -for- split of our common shares (the “common share split”), which will occur prior to the closing of this offering; and |

| • | the adoption of our amended and restated bye-laws immediately prior to the closing of this offering. |

17

Table of Contents

Summary Historical Audited Consolidated and Unaudited Pro Forma Combined Financial Information

The following table sets forth our summary historical audited consolidated and unaudited pro forma combined financial information for the periods and dates indicated.

The balance sheet data as of June 30, 2014 and 2015 and the statements of operations and cash flow data for the fiscal year ended June 30, 2013, the period from July 1, 2013 to August 14, 2013, the period from August 15, 2013 to June 30, 2014 and the fiscal year ended June 30, 2015 have been derived from the audited consolidated financial statements of MPS Holdings appearing elsewhere in this prospectus. The balance sheet data as of June 30, 2013 has been derived from the audited consolidated financial statements of MPS Holdings not included in this prospectus.

The statements of operations and cash flow data are presented for the Predecessor period, which relates to the period preceding the Madison Dearborn Transaction, and the Successor period, which relates the period succeeding the Madison Dearborn Transaction.

We have derived the summary unaudited pro forma combined financial data for the year ended June 30, 2015 from our unaudited pro forma combined financial statements appearing elsewhere in this prospectus.

The unaudited pro forma combined financial data for the year ended June 30, 2015 give effect to the following transactions as if they had occurred on July 1, 2014:

| • | the acquisition of Armstrong Packaging Limited on July 8, 2014; |

| • | the acquisitions of the Non-European Folding Carton and Lithographic Printing Business of AGI Global Holdings Coöperatief U.A. and the U.S. Folding Carton and Lithographic Printing Business of Atlas AGI Holdings LLC on November 21, 2014; and |

| • | the acquisition of Presentation Products Group on February 28, 2015. |

We refer to the foregoing collectively as the “Transactions.” See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Transactions.”

The unaudited pro forma combined financial data for the year ended June 30, 2015 do not give effect to the acquisition of BP Media Limited on July 1, 2015, the impact of which is not material to the Company’s financial results.

The summary unaudited pro forma combined financial data is for informational purposes only and does not purport to represent what our results of operations would have been if the Transactions had occurred as of those dates or what those results will be for future periods. We cannot assure you that the assumptions used by our management, which they believe are reasonable, for preparation of the summary unaudited pro forma combined financial data will prove to be correct.

Historical results are not indicative of the results to be expected in the future. You should read the following data together with the more detailed information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes thereto and our unaudited pro forma combined financial statements appearing elsewhere in this prospectus.

18

Table of Contents

Statement of Operations

| Fiscal year ended June 30, 2014 |

||||||||||||||||||||||||||

| Predecessor | Successor | Pro forma | ||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Fiscal year ended June 30, 2013 |

Period from July 1, 2013 to August 14, 2013 |

Period from August 15, 2013 to June 30, 2014 |

Fiscal year ended June 30, 2015 |

Twelve months ended June 30, 2014(1) |

Twelve months ended June 30, 2015 |

||||||||||||||||||||

| Net sales |

$ | 579,401 | $ | 74,081 | $ | 814,213 | $ | 1,617,640 | $ | 1,902,429 | $ | 1,807,513 | (2) | |||||||||||||

| Cost of goods sold |

456,958 | 58,054 | 668,441 | 1,285,673 |

|

1,517,731 |

|

1,447,787 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Gross margin |

122,443 | 16,027 | 145,772 | 331,967 |

|

384,698 |

|

359,726 | ||||||||||||||||||

| Selling, general and administrative expenses: |

||||||||||||||||||||||||||

| Selling, general and administrative expenses |

76,260 | 9,729 | 135,212 | 247,360 | 366,055 | 271,373 | ||||||||||||||||||||

| Management fees and expenses |

2,315 | 264 | — | — | 4,882 | 236 | ||||||||||||||||||||

| Transaction and other related expenses |

3,080 | 28,370 | 38,844 | 13,630 |

|

85,224 |

|

2,203 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| 81,655 | 38,363 | 174,056 | 260,990 |

|

456,161 |

|

273,812 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Operating income (loss) |

40,788 | (22,336 | ) | (28,284 | ) | 70,977 |

|

(71,463 |

) |

85,914 | ||||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||||

| Other income, net |

1,426 | 1,063 | 370 | 10,625 | 4,643 | 14,612 | ||||||||||||||||||||

| Debt extinguishment charges |

(4,140 | ) | (14,042 | ) | — | (1,019 | ) | (14,042 | ) | (1,019) | ||||||||||||||||

| Interest expense |

(24,546 | ) | (3,991 | ) | (43,215 | ) | (75,437 | ) |

|

(84,983 |

) |

(77,936) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Total other expense, net |

(27,260 | ) | (16,970 | ) | (42,845 | ) | (65,831 | ) |

|

(94,382 |

) |

(64,343) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) before income taxes |

13,528 | (39,306 | ) | (71,129 | ) | 5,146 |

|

(165,845 |

) |

21,571 | ||||||||||||||||

| Income taxes (benefit) expense |

4,195 | (15,621 | ) | (19,481 | ) | (1,880) |

|

(45,425 |

) |

7,399 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Net income (loss) |

9,333 | (23,685 | ) | (51,648 | ) | 7,026 |

|

(120,420 |

) |

14,172 | ||||||||||||||||

| Less net income attributable to noncontrolling interest |

— | — | 216 | 527 |

|

(853 |

) |

527 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Net income (loss) attributable to the Company |

$ | 9,333 | $ | (23,685 | ) | $ | (51,864 | ) | $ | 6,499 |

$ |

(119,567 |

) |

13,645 | ||||||||||||

| Preferred stock dividends |

(9,275 | ) | (25 | ) | — | — |

|

— |

|

— | ||||||||||||||||