Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - Greenpro Capital Corp. | s101931_2-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 30, 2015

Commission File Number 333-193565

| Greenpro Capital Corp. |

(Exact name of registrant issuer as specified in its charter)

| Nevada | 98-1146821 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Suite 2201, 22/F., Malaysia Building,

| 50 Gloucester Road, Wanchai, Hong Kong |

(Address of principal executive offices, including zip code)

Registrant’s

phone number, including area code

(852) 3111 -7718

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01 | Entry Into A Material Definitive Agreement |

The information provided in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

Acquisition of A&G International Limited

On September 30, 2015, Greenpro Capital Corp. (“GRNQ”) completed its acquisition of A&G International Limited for the aggregate purchase price was $957,840.

On July 31, 2015, 2015, Greenpro Capital Corp. (“GRNQ”), and Ms Yap Pei Ling, a 100% shareholder of A&G International Limited, a Belize corporation(“A&G”), entered into a Sale and Purchase Agreement (the “A&G Purchase Agreement”), pursuant to which GRNQ acquired 100% of the issued and outstanding shares of A&G. As consideration thereof, GRNQ agreed to issue to the shareholder of A&G 1,842,000 restricted shares of GRNQ’s common stock at $0.52 per share, representing an aggregate purchase price of $957,840 based on the average closing price of the ten trading days preceding July 31, 2015. The purchase price was determined by the existing business value generated from A&G.

Ms Yap Pei Ling, the director and sole shareholder of A&G, is the spouse of Lee Chong Kuang, our Chief Executive Officer, President and director.

A&G provides corporate and business advisory services through its wholly-owned subsidiaries as set forth below:

| Name | Business |

Asia UBS Global Limited (Hong Kong) |

Provide business advisory services with main focus on Hong Kong company formation advisory and company secretarial service, such as tax planning, bookkeeping and financial review. It focuses on Hong Kong clients. |

Asia UBS Global Limited (Belize) |

Provide business advisory services with main focus on offshore company formation advisory and company secretarial service, such as tax planning, bookkeeping and financial review. It focuses on South East Asia and China clients. |

A chart of A&G’s corporate structure is set forth below.

The foregoing description of the A&G Purchase Agreement is a summary only and is qualified in its entirety by the copy of the Agreement filed in its Form 8-K filed on August 5, 2015.

Acquisition of Falcon Secretaries Limited, Ace Corporation Services Limited, Shenzhen Falcon Financial Consulting Limited

On September 30, 2015, Greenpro Capital Corp. (“GRNQ”) completed its acquisition of Falcon Secretaries Limited, Ace Corporation Services Limited, Shenzhen Falcon Financial Consulting Limited for the aggregate purchase price was $1,081,704.

On July 31, 2015, Greenpro Capital Corp. (“GRNQ”), and Ms Chen Yan Hong, a 100% shareholder of Falcon Secretaries Limited, 100% shareholder of Ace Corporation Services Limited and 100% shareholder of Shenzhen Falcon Financial Consulting Limited (these companies collectively known as “F&A”), entered into a Sale and Purchase Agreement (the “Falcon Purchase Agreement”), pursuant to which GRNQ acquired 100% of the issued and outstanding shares of F&A. As consideration thereof, GRNQ agreed to issue to the shareholder of F&A 2,080,200 restricted shares of GRNQ’s common stock at $0.52 per share, representing an aggregate purchase price of $1,081,704 based on the average closing price of the ten trading days preceding July 31, 2015. The purchase price was determined by the existing business value generated from F&A.

Ms Chen Yan Hong, the director and 100% shareholder of F&A, is also the director and legal representative of Greenpro Management Consultancy (Shenzhen) Limited, one of the subsidiaries of GRNQ.

F&A provides corporate and business advisory services through its wholly-owned subsidiaries as set forth below:

| Name | Business |

Falcon Secretaries Limited (Hong Kong)

|

Provide Hong Kong Company Formation Advisory Services & Company Secretarial Services. Client Base in Hong Kong & China |

Ace Corporate Services Limited (Hong Kong)

|

Provide Offshore Company Formation Advisory Services & Company Secretarial Services. Client Base in Hong Kong & China |

Shenzhen Falcon Finance Consulting Limited (China) |

Provide Hong Kong Company Formation Advisory Services & Company Secretarial Services and Financial Services. Client Base in China |

The foregoing description of the Falcon Purchase Agreement is a summary only and is qualified in its entirety by the copy of the Agreement filed in its Form 8-K filed on August 5, 2015

Acquisition of Yabez (Hong Kong) Company Limited

On September 30, 2015, Greenpro Capital Corp. (“GRNQ”) completed its acquisition of Yabez (Hong Kong) Company Limited for the aggregate purchase price was $252,808.

On July 31, 2015, Greenpro Capital Corp. (“GRNQ”), and Mr. Cheng Chi Ho and Ms Wong Kit Yi, representing the 51% & 49% shareholders of Yabez (Hong Kong) Company Limited respectively, a Hong Kong corporation(“Yabez”), entered into a Sale and Purchase Agreement (the “Yabez Purchase Agreement”), pursuant to which GRNQ acquired 60% of the issued and outstanding shares of Yabez . As consideration thereof, GRNQ agreed to issue to the shareholders of Yabez 486,171 restricted shares of GRNQ’s common stock at $0.52 per share, representing an aggregate purchase price of $252,808 based on the average closing price of the ten trading days preceding July 31, 2015. The purchase price was determined by the existing business value generated from Yabez.

| Name | Business |

| YABEZ

(HONG KONG) COMPANY LIMITED (Hong Kong) |

Provide Hong Kong company formation advisory services, corporate secretarial services and IT related services. Client Base in Hong Kong |

The foregoing description of the Yabez Purchase Agreement is a summary only and is qualified in its entirety by the copy of the Agreement filed in its Form 8-K filed on August 5, 2015

Acquisition of Greenpro Venture Capital Limited.

On September 30, 2015, Greenpro Capital Corp. (“GRNQ”), and Mr. Lee Chong Kuang and Mr. Loke Che Chan Gilbert, each representing 50% shareholder of Greenpro Venture Capital Limited, an Anguilla corporation, (“GPVC”) entered into a Sale and Purchase Agreement (the “GPVC Purchase Agreement”), pursuant to which GRNQ acquired 100% of the issued and outstanding shares of GPVC (the “Acquisition”). As consideration thereof, GRNQ agreed to issue to the shareholders of GPVC 13,260,000 restricted shares of GRNQ’s common stock (valued at $7,956,000 based on the signed Memorandum of Understanding on July 25, 2015 of $0.6 per share) and pay US$6,000 in cash, representing an aggregate purchase price of US$7,962,000. The purchase price was determined based on the existing business value of GPVC, covering all the customers, fixed assets, investment, cash and cash equivalents, liabilities of GPVC.

Mr. Lee Chong Kuang, our Chief Executive Officer, President and director, is also the Chief Executive Officer, President and director of GPVC. Mr. Lee holds 43.02% of our issued and outstanding shares and 50% of the issued and outstanding shares of GPVC. Mr. Loke Che Chan Gilbert, our Chief Financial Officer, Secretary, Treasurer and director, is also the Chief Financial Officer and director of GPVC. Mr. Loke holds 43.02% of our issued and outstanding shares and 50% of the issued and outstanding shares of GPVC. Upon the consummation of the Acquisition, Messrs. Lee and Loke received US$6,000 in cash and US$7,956,000 in shares, which equivalent to 13,260,000 shares of our restricted common stock. Mr. Lee Chong Kuang is the sole director of Greenpro Venture Cap (CGN) Limited. Mr. Loke Che Chan Gilbert is the CFO, Treasurer, Secretary & Director of CGN Nanotech Inc and Mr. Lee is the shareholder of CGN Nanotech Inc. Greenpro Resources limited (BVI), which is a subsidiary of GRNQ, is the director of the Forward Win International Limited.

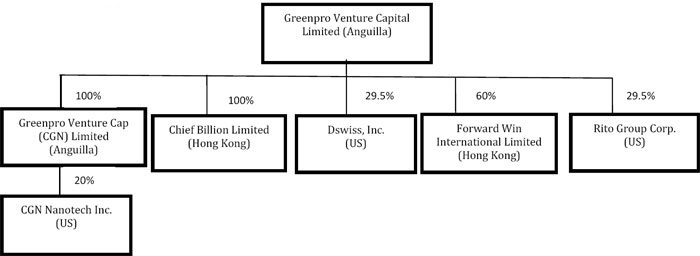

GPVC is an investment holding company and generates income through its real estates of owned subsidiaries as set forth below:

| Name | Shareholding | Business |

|

Rito Group Corp. (Nevada, USA)

|

29.5% | Providing an online platform for merchants and customers to facilitate transactions |

|

Forward Win International Limited (Hong Kong)

|

60% | Holding Hong Kong real estate for investment purpose |

|

DSwiss, Inc. (Nevada, USA) |

29.5% | Retailing in slimming and beauty products |

|

Chief Billion Limited (Hong Kong) |

100% | Holding Hong Kong real estate for investment purpose |

|

Greenpro Venture Cap (CGN) Limited (Anguilla)

|

100% | Holding company which holds 20% shareholding of CGN Nanotech Inc. |

|

CGN Nanotech Inc. (Nevada, USA)

|

20% (indirect) |

Trading and distributing of Nano-ceramic lighting products. |

The Acquisition is completed on September 30, 2015. We believe and hope that the acquired entities will broaden the range of services we offer as well as our revenue sources.

A chart of GPVC’s corporate structure is set forth below.

The foregoing description of the Agreement is a summary only and is qualified in its entirety by the copy of the Agreement filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 | Financial Statements And Exhibits |

| (a) | Financial Statements of Business Acquired. |

The financial statements required by Item 9.01(a) of Form 8-K will be filed by amendment within 71 calendar days after the date this report on Form 8-K must be filed.

| (b) | Pro Forma Financial Information. |

The pro forma financial information required by Item 9.01(b) of Form 8-K will be filed by amendment within 71 calendar days after the date this report on Form 8-K must be filed.

| (d) | Exhibits. |

|

Exhibit No. |

Description | |

| 2.1 | Sale and Purchase Agreement, dated as of September 30, 2015, between Greenpro Capital Corp. and Greenpro Venture Capital Limited. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GREENPRO CAPITAL CORP. (Name of Registrant) | ||

| Date: September 30, 2015 | ||

| By: | /s/ Lee Chong Kuang | |

| Title: | Chief Executive

Officer, President, Director (Principal Executive Officer) | |

| Date: September 30, 2015 | ||

| By: | /s/ Loke Che Chan, Gilbert | |

| Title: | Chief Financial

Officer, Secretary, Treasurer, Director (Principal Financial Officer, Principal Accounting Officer) | |