Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MICROSOFT CORP | d29775d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

Microsoft Reporting Segments

Frank Brod

Chris Suh

September 29, 2015

|

|

During this call, we may make forward-looking statements, which are predictions, projections, or other statements about future events. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could materially differ because of factors discussed in today’s conference call, and in the risk factors section of our Form 10-K, Forms 10-Q, and other reports and filings with the Securities and Exchange Commission. We do not undertake any duty to update any forward-looking statement.

|

|

Agenda

New segments overview

Segment mapping

Supplemental financial information

What to expect in October

Q&A

|

|

New Segment Overview

The new segments will report our financial performance against our three bold ambitions

Reinvent productivity & business processes

Build the intelligent cloud

Create more personal computing

Microsoft will report revenue and operating income for each segment

|

|

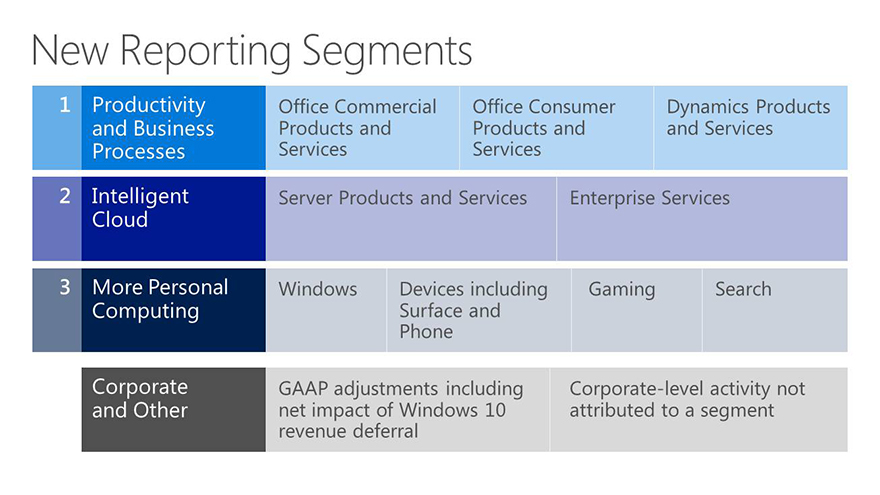

New Reporting Segments

1 Productivity and Business Processes

Office Commercial Products and Services

Office Consumer Products and Services

Dynamics Products and Services

2 Intelligent Cloud

Server Products and Services

Enterprise Services

3 More Personal Computing

Windows

Devices including Surface and Phone

Gaming

Search

Corporate and Other

GAAP adjustments including net impact of Windows 10 revenue deferral

Corporate-level activity not attributed to a segment

|

|

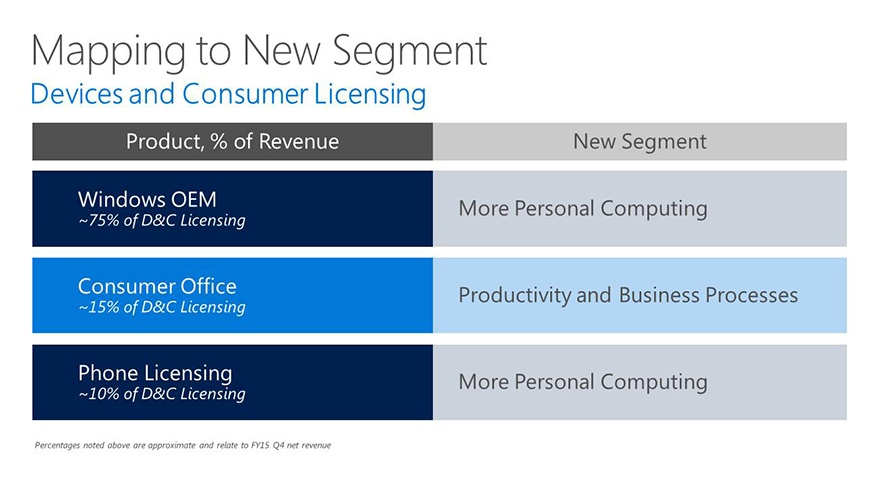

Mapping to New Segment

Devices and Consumer Licensing

Product, % of Revenue

Windows OEM

~75% of D&C Licensing

Consumer Office

~15% of D&C Licensing

Phone Licensing

~10% of D&C Licensing

New Segment

More Personal Computing

Productivity and Business Processes

More Personal Computing

Percentages noted above are approximate and relate to FY15 Q4 net revenue

|

|

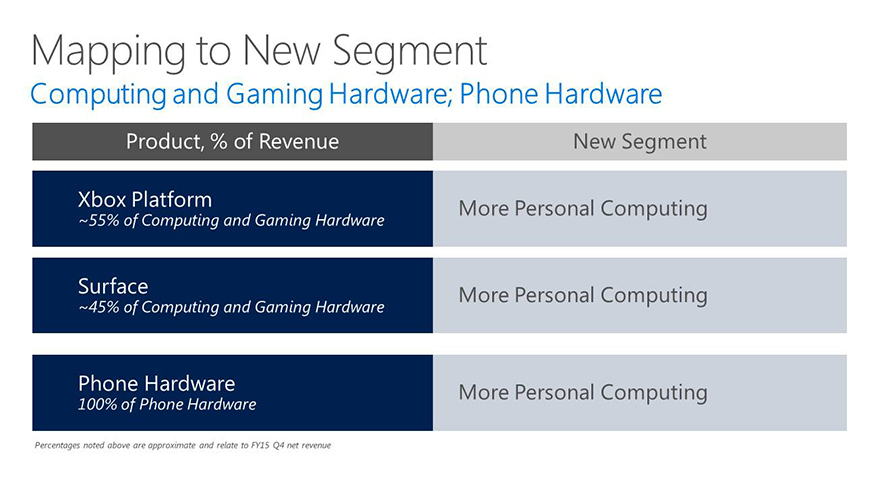

Mapping to New Segment

Computing and Gaming Hardware; Phone Hardware

Product, % of Revenue

Xbox Platform

~55% of Computing and Gaming Hardware

Surface

~45% of Computing and Gaming Hardware

Phone Hardware

100% of Phone Hardware

New Segment

More Personal Computing

More Personal Computing

More Personal Computing

Percentages noted above are approximate and relate to FY15 Q4 net revenue

|

|

Mapping to New Segment

Devices and Consumer Other

Product, % of Revenue

Search

~40% of D&C Other

Xbox Live Transactions, 1st Party Games

~40% of D&C Other

Office 365 Consumer

~10% of D&C Other

Display

~10% of D&C Other

New Segment

More Personal Computing

More Personal Computing

Productivity and Business Processes

More Personal Computing

Percentages noted above are approximate and relate to FY15 Q4 net revenue

|

|

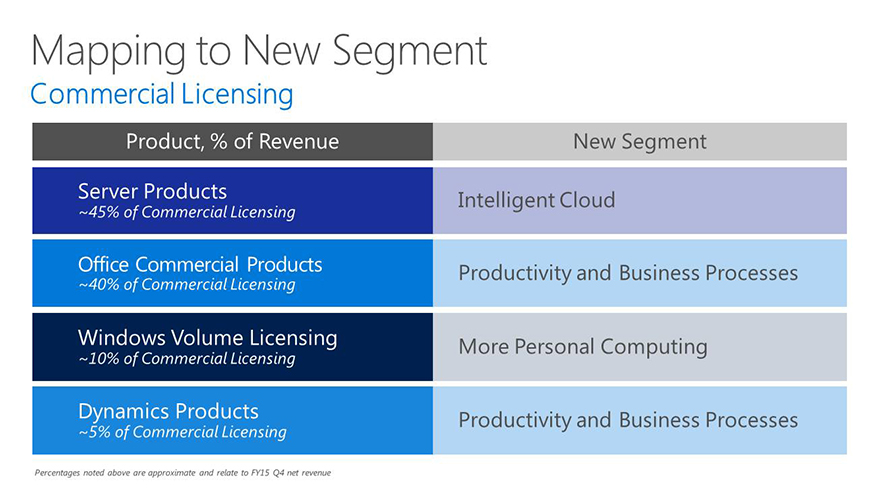

Mapping to New Segment

Commercial Licensing

Product, % of Revenue

Server Products

~45% of Commercial Licensing

Office Commercial Products

~40% of Commercial Licensing

Windows Volume Licensing

~10% of Commercial Licensing

Dynamics Products

~5% of Commercial Licensing

New Segment

Intelligent Cloud

Productivity and Business Processes

More Personal Computing

Productivity and Business Processes

Percentages noted above are approximate and relate to FY15 Q4 net revenue

|

|

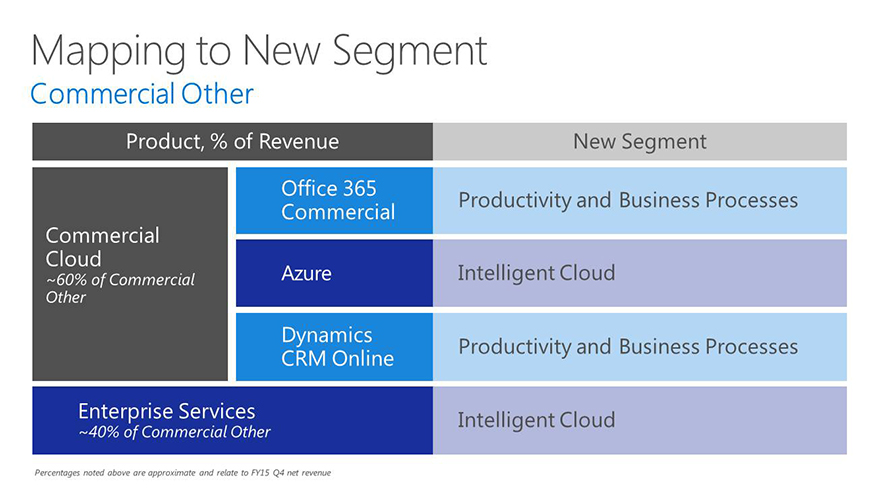

Mapping to New Segment

Commercial Other

Product, % of Revenue

Commercial Cloud

~60% of Commercial Other

Office 365

Commercial

Azure

Dynamics

CRM Online

Enterprise Services

~40% of Commercial Other

New Segment

Productivity and Business Processes

Intelligent Cloud

Productivity and Business Processes

Intelligent Cloud

Percentages noted above are approximate and relate to FY15 Q4 net revenue

|

|

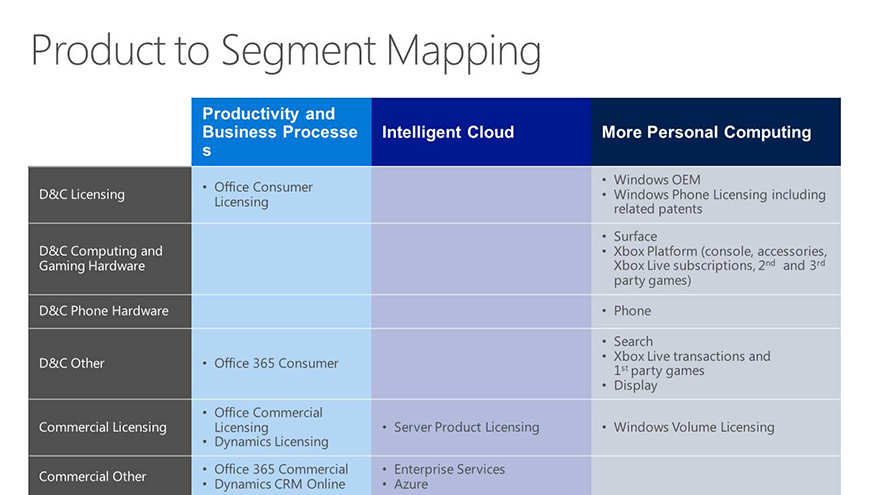

Product to Segment Mapping

Productivity and Business Processes Intelligent Cloud More Personal Computing

D&C Licensing Office Consumer Licensing Windows OEM

Windows Phone Licensing including related patents

D&C Computing and Gaming Hardware Surface

Xbox Platform (console, accessories, Xbox Live subscriptions, 2nd and 3rd party games)

D&C Phone Hardware Phone

D&C Other Office 365 Consumer Search

Xbox Live transactions and 1st party games

Display

Commercial Licensing Office Commercial Licensing

Dynamics Licensing Server Product Licensing Windows Volume Licensing

Commercial Other Office 365 Commercial

Dynamics CRM Online Enterprise Services

Azure

|

|

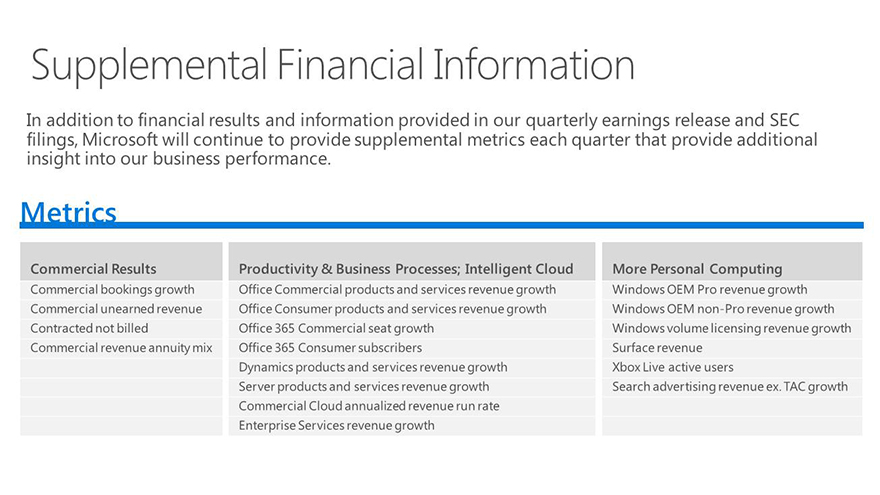

Supplemental Financial Information

In addition to financial results and information provided in our quarterly earnings release and SEC filings, Microsoft will continue to provide supplemental metrics each quarter that provide additional insight into our business performance.

Metrics

Commercial Results

Commercial bookings growth

Commercial unearned revenue

Contracted not billed

Commercial revenue annuity mix

Productivity & Business Processes; Intelligent Cloud

Office Commercial products and services revenue growth

Office Consumer products and services revenue growth

Office 365 Commercial seat growth

Office 365 Consumer subscribers

Dynamics products and services revenue growth

Server products and services revenue growth

Commercial Cloud annualized revenue run rate

Enterprise Services revenue growth

More Personal Computing

Windows OEM Pro revenue growth

Windows OEM non-Pro revenue growth

Windows volume licensing revenue growth

Surface revenue

Xbox Live active users

Search advertising revenue ex. TAC growth

|

|

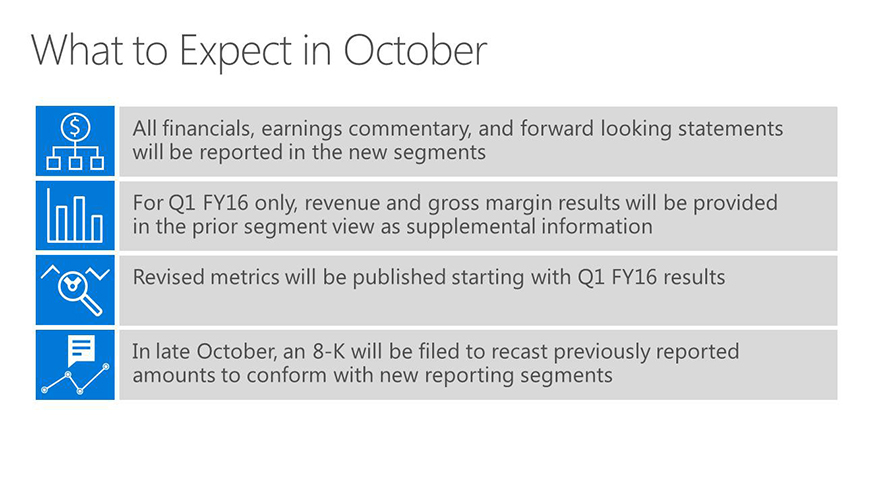

What to Expect in October

All financials, earnings commentary, and forward looking statements will be reported in the new segments

For Q1 FY16 only, revenue and gross margin results will be provided in the prior segment view as supplemental information

Revised metrics will be published starting with Q1 FY16 results

In late October, an 8-K will be filed to recast previously reported amounts to conform with new reporting segments

|

|

Appendix

|

|

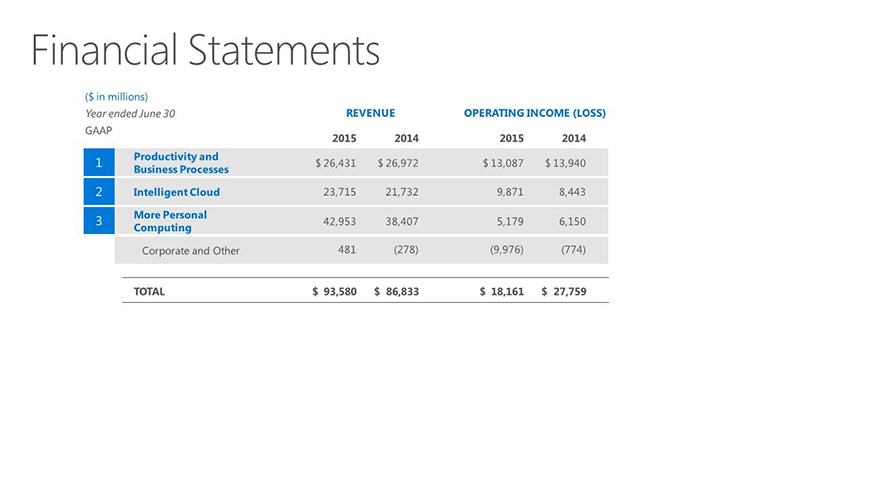

Financial Statements

($ in millions)

Year ended June 30

GAAP 2015 2014

1Productivity and Business Processes $ 26,431 $ 26,972

2 Intelligent Cloud 23,715 21,732

3 More Personal Computing 42,953 38,407

Corporate and Other 481 (278)

REVENUE

$ 93,580 $ 86,833

OPERATING INCOME (LOSS) 2015 2014

$ 13,087 $ 13,940

9,871 8,443

5,179 6,150

(9,976) (774)

$ 18,161 $ 27,759

TOTAL

|

|

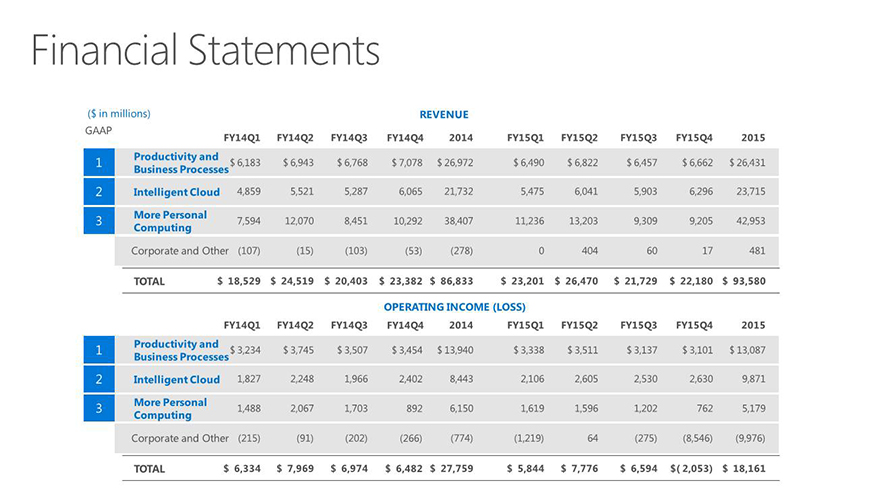

Financial Statements

($ in millions) REVENUE

FY14Q1 FY14Q2 FY14Q3 FY14Q4 2014 FY15Q1 FY15Q2 FY15Q3 FY15Q4 2015

1 Productivity and Business Processes $6,183 $ 6,943 $ 6,768 $ 7,078 $ 26,972 $ 6,490 $ 6,822 $ 6,457 $ 6,662 $ 26,431

2 Intelligent Cloud 4,859 5,521 5,287 6,065 21,732 5,475 6,041 5,903 6,296 23,715

3 More Personal Computing 7,594 12,070 8,451 10,292 38,407 11,236 13,203 9,309 9,205 42,953

Corporate and Other (107) (15) (103) (53) (278) 0 404 60 17 481

TOTAL $ 18,529 $ 24,519 $ 20,403 $ 23,382 $ 86,833 $ 23,201 $ 26,470 $ 21,729 $ 22,180 $ 93,580

OPERATING INCOME (LOSS)

FY14Q1 FY14Q2 FY14Q3 FY14Q4 2014 FY15Q1 FY15Q2 FY15Q3 FY15Q4 2015

1 Productivity and Business Processes $3,234 $ 3,745 $ 3,507 $ 3,454 $ 13,940 $ 3,338 $ 3,511 $ 3,137 $ 3,101 $ 13,087

2 Intelligent Cloud 1,827 2,248 1,966 2,402 8,443 2,106 2,605 2,530 2,630 9,871

3 More Personal Computing 1,488 2,067 1,703 892 6,150 1,619 1,596 1,202 762 5,179

Corporate and Other (215) (91) (202) (266) (774) (1,219) 64 (275) (8,546) (9,976)

TOTAL

$ 6,334 $ 7,969 $ 6,974 $ 6,482 $ 27,759 $ 5,844 $ 7,776 $ 6,594 $(2,053) $ 18,161

|

|

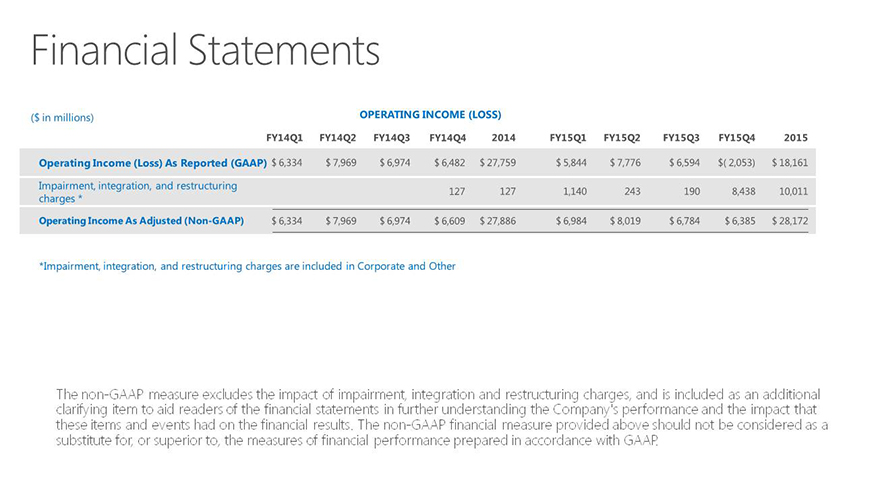

Financial Statements

($ in millions) OPERATING INCOME (LOSS)

FY14Q1 FY14Q2 FY14Q3 FY14Q4 2014 FY15Q1 FY15Q2 FY15Q3 FY15Q4 2015

Operating Income (Loss) As Reported (GAAP) $ 6,334 $ 7,969 $ 6,974 $ 6,482 $ 27,759 $ 5,844 $ 7,776 $ 6,594 $(2,053) $ 18,161

Impairment, integration, and restructuring charges * 127 127 1,140 243 190 8,438 10,011

Operating Income As Adjusted (Non-GAAP) $ 6,334 $ 7,969 $ 6,974 $ 6,609 $ 27,886 $ 6,984 $ 8,019 $ 6,784 $ 6,385 $ 28,172

* Impairment, integration, and restructuring charges are included in Corporate and Other

The non-GAAP measure excludes the impact of impairment, integration and restructuring charges, and is included as an additional clarifying item to aid readers of the financial statements in further understanding the Company’s performance and the impact that these items and events had on the financial results. The non-GAAP financial measure provided above should not be considered as a substitute for, or superior to, the measures of financial performance prepared in accordance with GAAP.