Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEY ENERGY SERVICES INC | d85728d8k.htm |

Johnson Rice Energy Conference September 30, 2015 Dick Alario Chief Executive Officer Exhibit 99.1 |

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements as to matters that are not of historic fact are forward-looking statements. The forward-looking statements include a description of our intention to consider alternatives to cure the NYSE continued listing requirement deficiency. These forward-looking statements are based on Key's current expectations, estimates and projections about Key, its industry, its management's beliefs and certain assumptions made by management, and include statements regarding estimated capital expenditures, future operational and activity expectations, international growth, and anticipated financial performance for 2015. No assurance can be given that such expectations, estimates or projections will prove to have been correct. Whenever possible, these "forward-looking statements" are identified by words such as "expects," "believes," "anticipates" and similar phrases. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict, including, but not limited to: risks that Key will be unable to achieve its financial, capital expenditure and operational projections, including quarterly and annual projections of revenue and/or operating income and risks that Key's expectations regarding future activity levels, customer demand, and pricing stability may not materialize (whether for Key as a whole or for geographic regions and/or business segments individually); risks that fundamentals in the U.S. oil and gas markets may not yield anticipated future growth in Key's businesses, or could further deteriorate or worsen from the recent market declines, and/or that Key could experience further unexpected declines in activity and demand for its rig service, fluid management service, coiled tubing service, and fishing and rental service businesses; risks relating to Key's ability to implement technological developments and enhancements; risks relating to compliance with environmental, health and safety laws and regulations, as well as actions by governmental and regulatory authorities; risks relating to compliance with the FCPA and anti-corruption laws, including risks related to costs in connection with FCPA investigations; risks regarding the timing or conclusion of the FCPA investigations, including the risk of fines or penalties imposed by government agencies for violations of the FCPA; risks affecting Key's international operations, including risks affecting Key’s ability to execute its plans to withdraw from its international markets outside North America; risks that Key may be unable to achieve the benefits expected from acquisition and disposition transactions, and risks associated with integration of the acquired operations into Key's operations; risks, in responding to changing or declining market conditions, that Key may not be able to reduce, and could even experience increases in, the costs of labor, fuel, equipment and supplies employed and used in Key's businesses; risks relating to changes in the demand for or the price of oil and natural gas; risks that Key may not be able to execute its capital expenditure program and/or that any such capital expenditure investments, if made, will not generate adequate returns; risks relating to Key’s ability to satisfy listing requirements for its equity securities; risks that Key may not have sufficient liquidity; risks relating to Key’s ability to comply with covenants under its current credit facilities; and other risks affecting Key's ability to maintain or improve operations, including its ability to maintain prices for services under market pricing pressures, weather risks, and the impact of potential increases in general and administrative expenses. Because such statements involve risks and uncertainties, many of which are outside of Key's control, Key's actual results and performance may differ materially from the results expressed or implied by such forward-looking statements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Other important risk factors that may affect Key's business, results of operations and financial position are discussed in its most recently filed Annual Report on Form 10-K, recent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K and in other Securities and Exchange Commission filings. Unless otherwise required by law, Key also disclaims any obligation to update its view of any such risks or uncertainties or to announce publicly the result of any revisions to the forward-looking statements made here. However, readers should review carefully reports and documents that Key files periodically with the Securities and Exchange Commission. |

+ Company-wide reorganization and reallocation of resources to optimize revenue pull-through opportunities, push decision making authority closer to the

field and rationalize support cost structure

+ Functional Support headcount now down 50% since the beginning of 2015 for an aggregate annual run-rate cost savings of approximately $21 million + Since the beginning of Q3 2015, Functional Support headcount has been reduced by 25% with an annual run-rate benefit of approximately $9 million + July rig hours were up 0.2% over June and August rig hours were down 4.1% as compared to July, roughly in-line with our expectations + Recent pricing pressure in U.S. Rigs has been slightly more elevated than anticipated + July truck hours were down 4.0% over June and August truck hours were down 2.9% as compared to July + Completion activity in Coiled Tubing and Fishing & Rental Services lower than

anticipated |

Key’s core production enhancement business

is primarily focused on extending the life and ultimate recovery of a well

through-out the majority of a well’s life; the recurring demand

for Key’s services yields a less volatile business model as

compared to drilling & completion services

Life-Cycle of an Oil Well

Source: Key Energy Services, Inc. |

Even in

a moderated oil price environment expected growth in the

population of horizontal wellbores and the continued aging of the

existing horizontal wellbore inventory provides for meaningful growth

opportunities in Key’s core business HZ Oil Wells in Production

(000’s) HZ Oil Wells >4 Years Old (000’s)

Source: Spears & Associates and PacWest Consulting Partners analysis; analysis contemplates the following oil prices: 2015 - $43 / bbl; 2016 - $59 bbl; 2017 - $65 - $75 / bbl. Note: Data is for U.S. Land only. 18 26 32 45 58 73 90 0 25 50 75 100 2011 2012 2013 2014 2015 2016 2017 42 55 71 88 103 116 131 0 25 50 75 100 125 150 175 2011 2012 2013 2014 2015 2016 2017 Key’s Target Activity Base is Expected to Double Over the Next 3 Years |

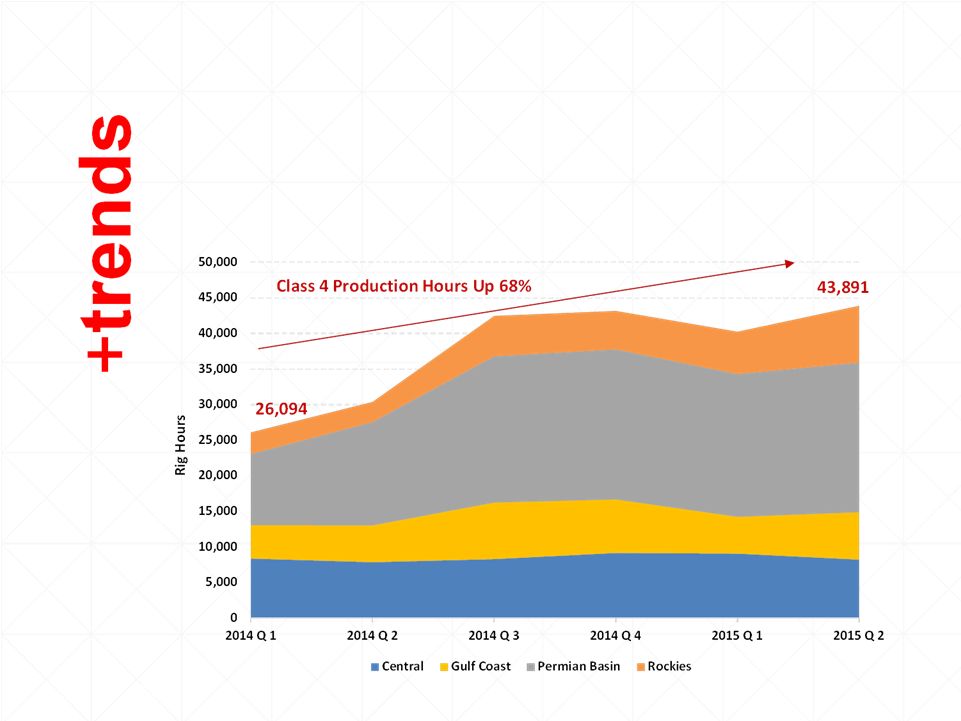

Counter-cyclical trends have emerged

as operators look to “protect the base” of existing production; Key holds a

market-leading position with assets most capable to respond to the

demand for return-accretive activities in the horizontal

wellbore Class 4 Rigs by Market –

Production Hours Source: Key Energy Services, Inc. |

Note: All figures in USD millions.

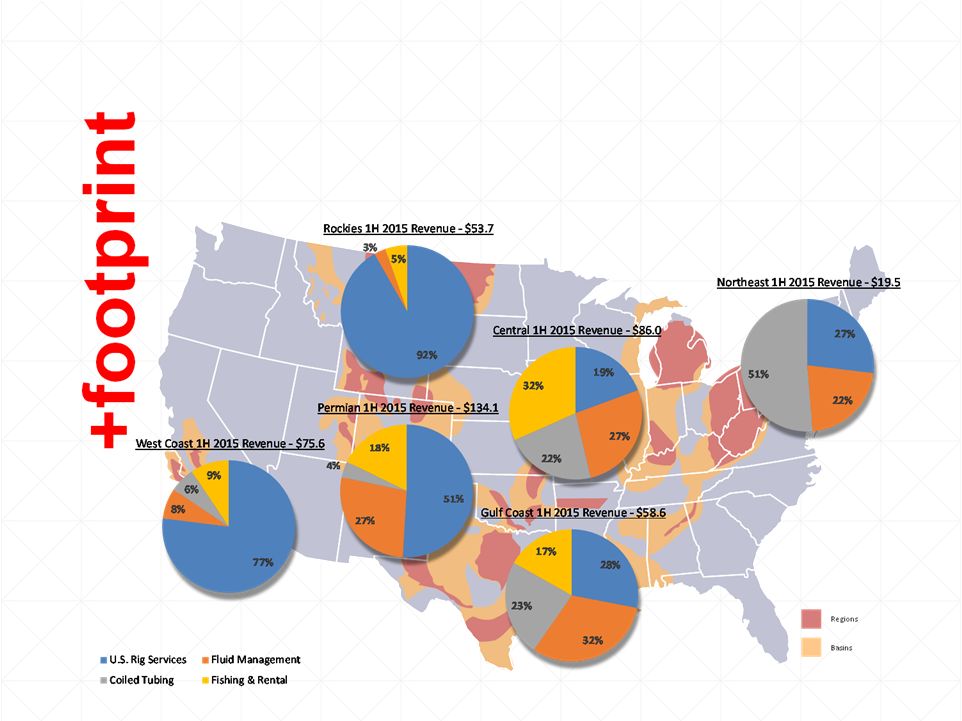

A sharpened focus on the Lower 48

combined with a newly-optimized organizational structure to take

advantage of our regional footprint should yield top-line and cost synergies

as we execute our strategy around production enhancement

|

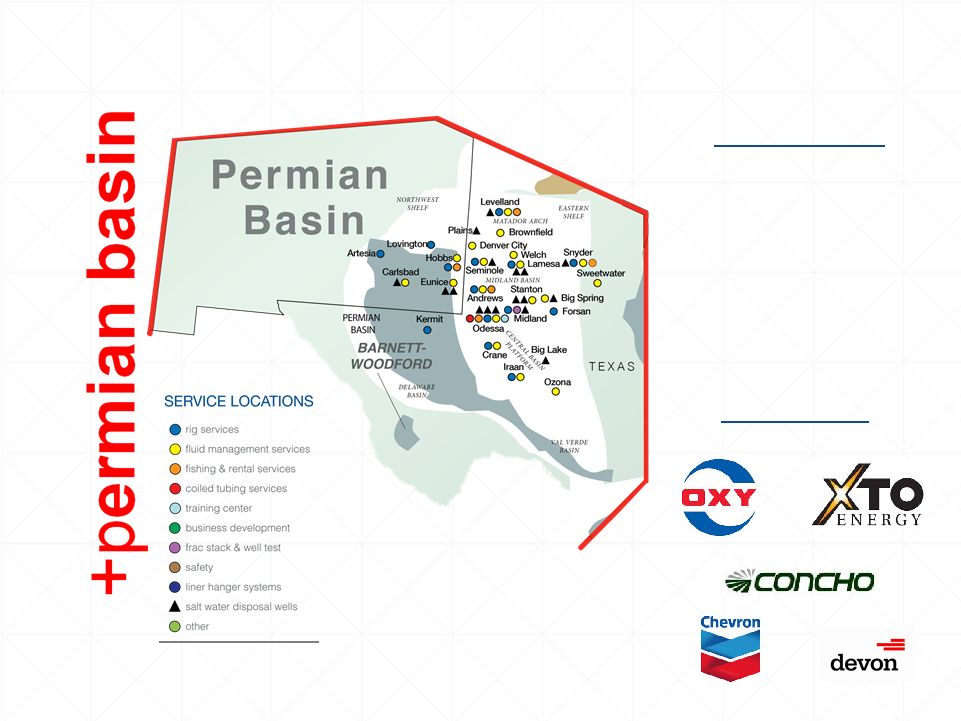

Source: Key Energy Services, Inc.

(1) Asset figures represent average marketed assets during Q2

2015. (2) Represents top customers as measured by revenue for Q2

2015. Permian Asset Base

(1) + Well Service Rigs – 205 + Coiled Tubing Units – 6 + Fluid Trucks – 352 + Salt Water Disposal Wells – 19 + Frac Tanks – 827 Top 5 Customers (2) |

Source: Key Energy Services, Inc.

Note: Service location guide found on ‘Permian Basin’

slide. (1) Asset figures represent average marketed assets during

Q2 2015. (2) Represents top customers as measured by revenue for

Q2 2015. West Coast Asset Base

(1) + Well Service Rigs – 103 + Coiled Tubing Units – 9 + Fluid Trucks – 57 + Frac Tanks – 31 Top 5 Customers (2) |

Source: Key Energy Services, Inc.

Note: Service location guide found on ‘Permian Basin’

slide. (1) Asset figures represent average marketed assets during

Q2 2015. (2) Represents top customers as measured by revenue for

Q2 2015. Rockies Asset Base

(1) + Well Service Rigs – 92 + Coiled Tubing Units – N/M + Fluid Trucks – 16 + Salt Water Disposal Wells – 8 + Frac Tanks – 113 Top 5 Customers (2) |

(1) Reflects a borrowing base of $92.6 million and $48.2 million in letters of

credit outstanding. Balance Sheet & Liquidity

As of ($ in millions) June 30, 2015 Cash & cash equivalents $ 225.5 Total Debt, including current portion $675.0 million 6.750% Senior Notes due 2021 $ 675.0 $315.0 million L + 9.250% Term Loan Facility due 2020 315.0 $100.0 million Asset-based Revolving Credit Facility 0.0 Debt issuance costs and unamortized discount on debt, net (25.8) Total Debt $ 964.2 Total Shareholder's Equity $ 936.9 Total Capitalization $ 1,901.1 Total Liquidity Cash $ 225.5 Availability under Asset-based Revolving Credit Facility (1) 44.4 Total Liquidity $ 269.9 Covenants Asset coverage ratio (1.5 to 1.0) 2.2x |

+ Optimized organizational structure to take advantage of inherent operating leverage + Significant cost cuts to stem cash burn + Evidence of counter-cyclical demand growth in core business + Strong market share in growing market segment + Well-positioned geographically to take advantage of market return |

+ We are the leader in onshore, rig-based well services + We have a strong reputation as a production- enhancement service provider + We are well-positioned to benefit from long-term secular trends + We have developed a differentiated asset base + We believe that our assets, differentiated technology and market position provide the leverage to deliver value to shareholders |

|