UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

September 28, 2015

GREAT SOUTHERN BANCORP, INC.

(Exact name of Registrant as specified in its Charter)

|

Maryland

|

|

0-18082

|

|

43-1524856

|

|

(State or other jurisdiction of

incorporation) |

|

(Commission File No.)

|

|

(IRS Employer Identification

Number) |

|

1451 East Battlefield, Springfield, Missouri

|

65804

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (417) 887-4400

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure

Set forth below is presentation material of Great Southern Bancorp, Inc., the holding company for Great Southern Bank, to be presented at an investor conference.

Forward-Looking Statements 2 When used in documents filed or furnished by Great Southern Bancorp, Inc. (the “Company”) with the Securities and Exchange Commission (the "SEC"), in this presentation , press releases or other public or stockholder communications, and in oral statements made with the approval of an authorized executive officer, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "intends" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties, including, among other things, (i) non-interest expense reductions from Great Southern’s banking center consolidations might be less than anticipated and the costs of the consolidation and impairment of the value of the affected premises might be greater than expected; (ii) expected revenues, cost savings, earnings accretion, synergies and other benefits from the banking center consolidations and the Company’s merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (iii) changes in economic conditions, either nationally or in the Company’s market areas; (iv) fluctuations in interest rates; (v) the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses; (vi) the possibility of other-than-temporary impairments of securities held in the Company’s securities portfolio; (vii) the Company’s ability to access cost-effective funding; (viii) fluctuations in real estate values and both residential and commercial real estate market conditions; (ix) demand for loans and deposits in the Company’s market areas; (x) legislative or regulatory changes that adversely affect the Company’s business, including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations, and the overdraft protection regulations and customers’ responses thereto; (xi) monetary and fiscal policies of the Federal Reserve Board and the U.S. Government and other governmental initiatives affecting the financial services industry; (xii) results of examinations of the Company and Great Southern by their regulators, including the possibility that the regulators may, among other things, require the Company to increase its allowance for loan losses or to write-down assets; (xiii) the uncertainties arising from the Company’s participation in the Small Business Lending Fund program, including uncertainties concerning the potential future redemption by us of the U.S. Treasury’s preferred stock investment under the program, including the timing of, regulatory approvals for, and conditions placed upon, any such redemption; (xiv) costs and effects of litigation, including settlements and judgments; and (xv) competition. The factors listed above and other risks described from time to time in documents filed or furnished by the Company with the SEC could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements.The Company does not undertake-and specifically declines any obligation- to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

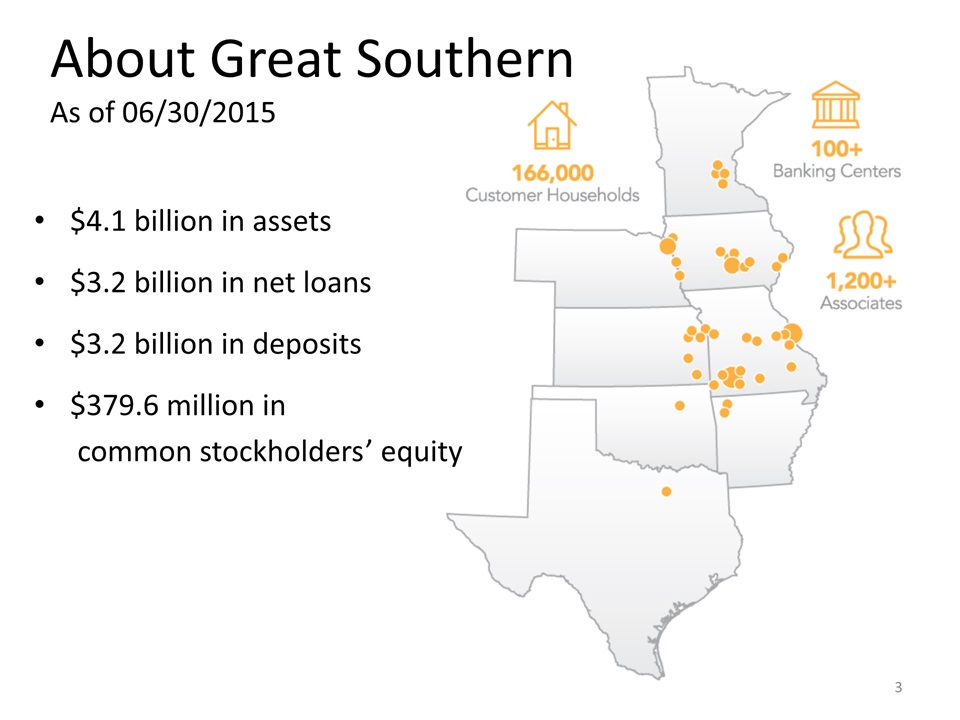

$4.1 billion in assets $3.2 billion in net loans$3.2 billion in deposits $379.6 million in common stockholders’ equity About Great SouthernAs of 06/30/2015 3

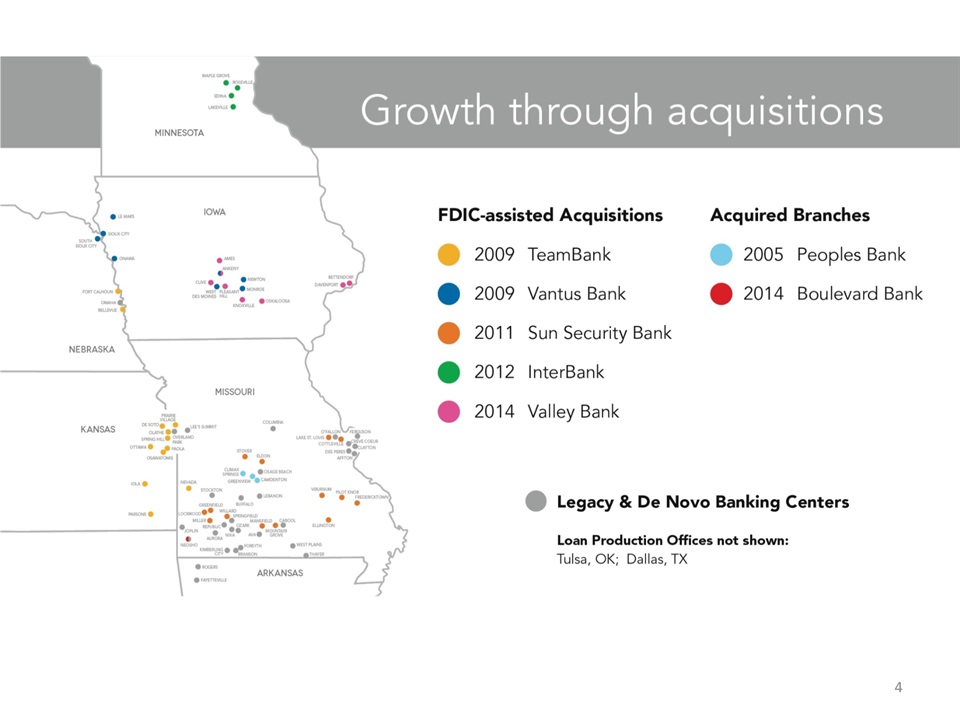

4

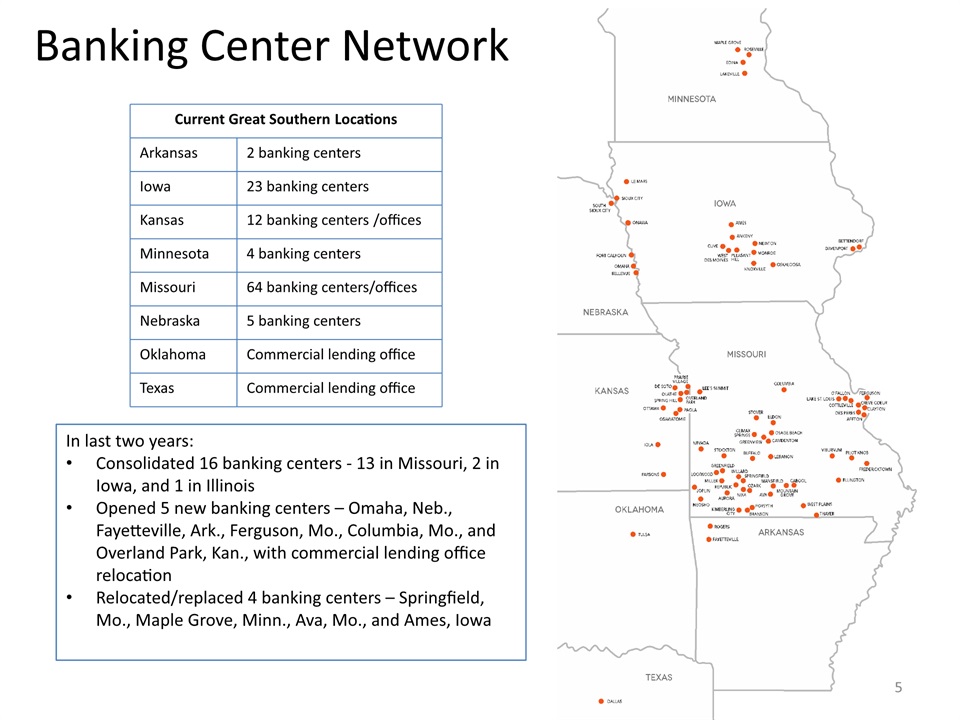

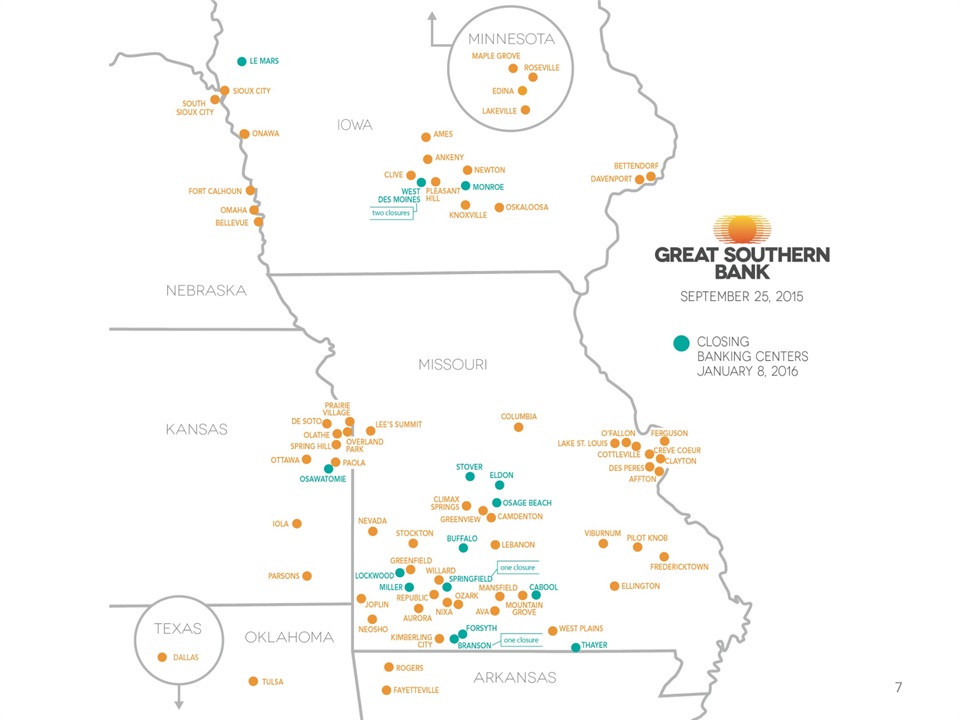

Current Great Southern Locations Arkansas 2 banking centers Iowa 23 banking centers Kansas 12 banking centers /offices Minnesota 4 banking centers Missouri 64 banking centers/offices Nebraska 5 banking centers Oklahoma Commercial lending office Texas Commercial lending office In last two years: Consolidated 16 banking centers - 13 in Missouri, 2 in Iowa, and 1 in IllinoisOpened 5 new banking centers – Omaha, Neb., Fayetteville, Ark., Ferguson, Mo., Columbia, Mo., and Overland Park, Kan., with commercial lending office relocationRelocated/replaced 4 banking centers – Springfield, Mo., Maple Grove, Minn., Ava, Mo., and Ames, Iowa Banking Center Network 5

Great Southern Bank Branch ClosingsAnnounced September 24, 2015 Consolidating 16 branches – 11 in Missouri, four in Iowa and one in KansasClosures were determined as a result of the Bank’s ongoing evaluation of the banking center network Expected closing date of branches – January 8, 201616 branches represent approximately $172 million in deposits Great Southern ATMs will remain operational at each of the affected banking center sites 6

7

Banking Center Closures Financial Considerations Beginning in 2016, expect annual positive pre-tax income statement impact of approximately $3.2 million to $3.5 million primarily due to reduction in non-interest expenses. During the third and fourth quarters of 2015, anticipate recording one-time expenses totaling approximately $500,000 to $900,000 in connection with severance costs, shortened useful lives of certain leases and furniture and equipment and other costs related to the consolidations. Affected premises will be marketed for sale. The carrying value of affected premises (totaling approx. $7.5 million) is under evaluation to determine if any impairment is necessary at this time. 8

GSBC Earnings 9 In thousands

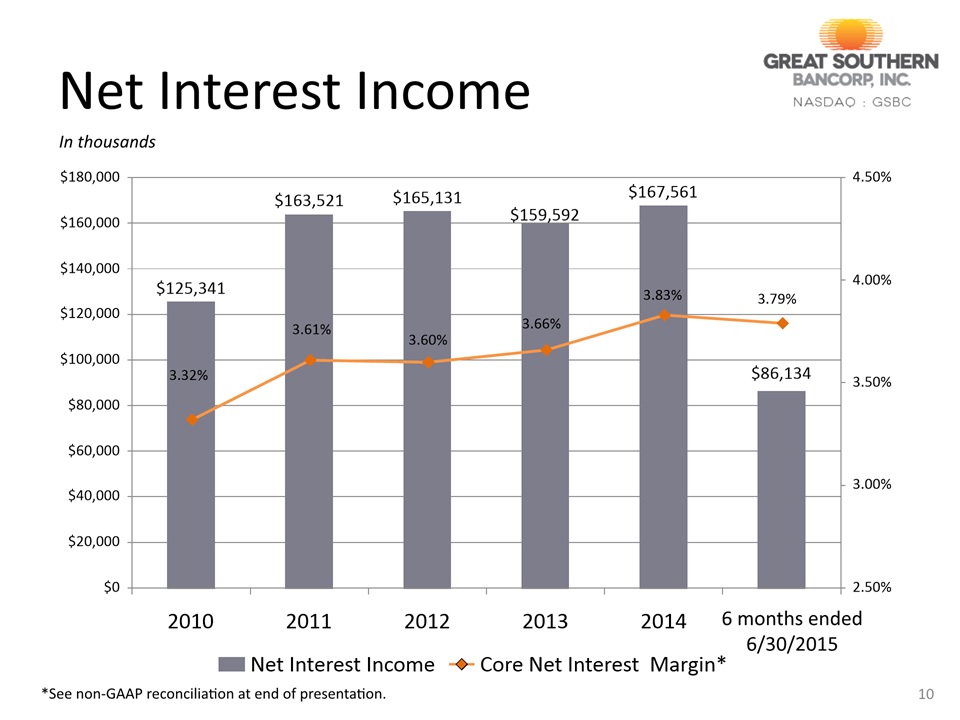

In thousands 6 months ended 6/30/2015 Net Interest Income *See non-GAAP reconciliation at end of presentation. 10

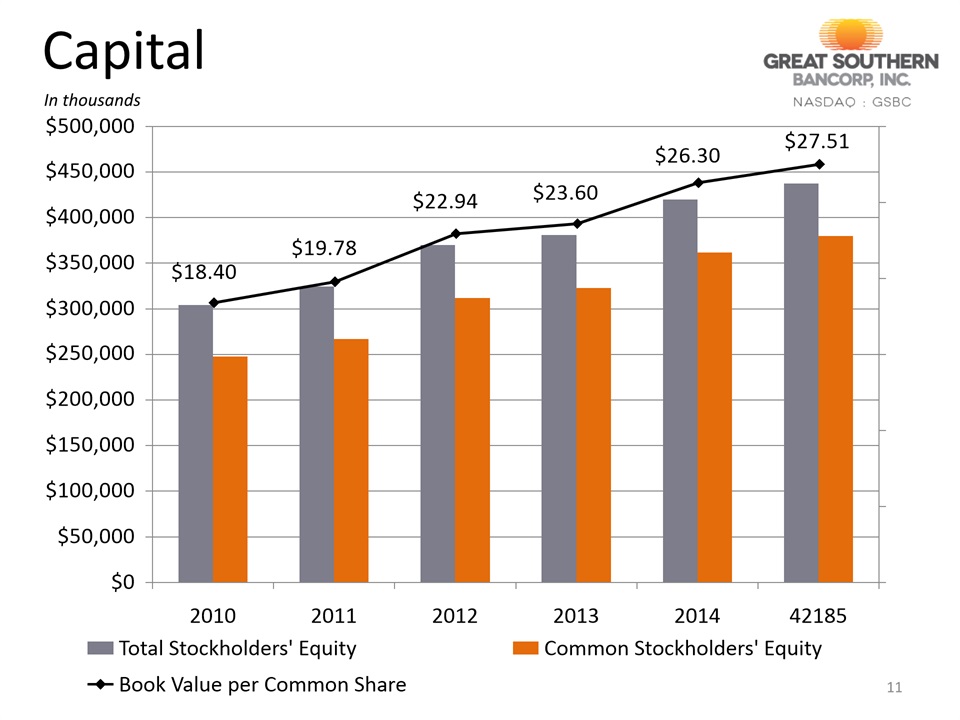

In thousands Capital 11

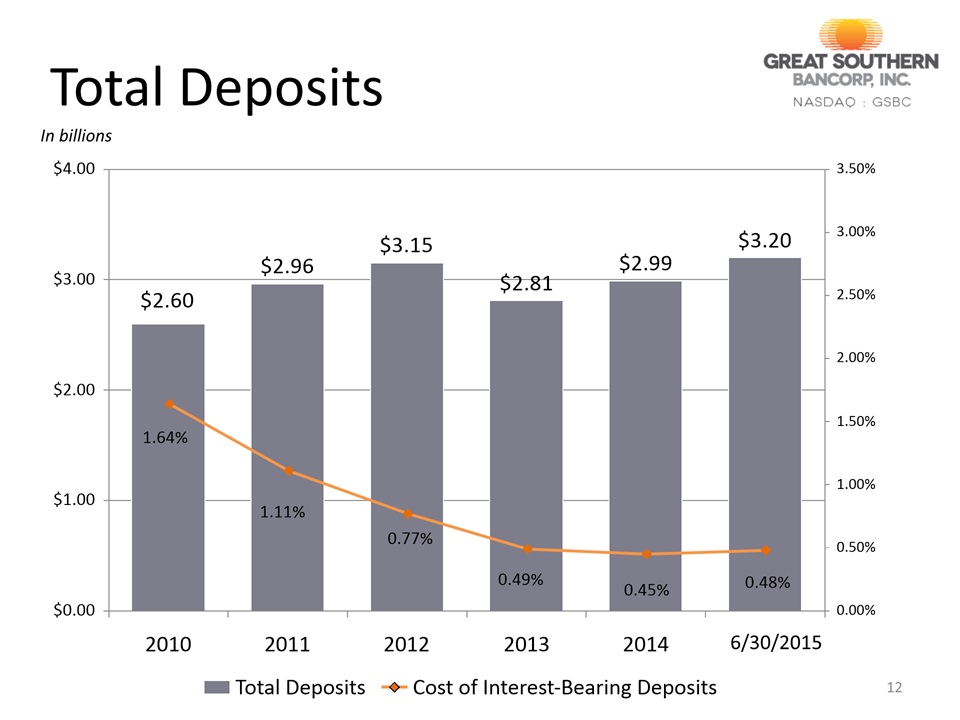

In billions Total Deposits 12 6/30/2015

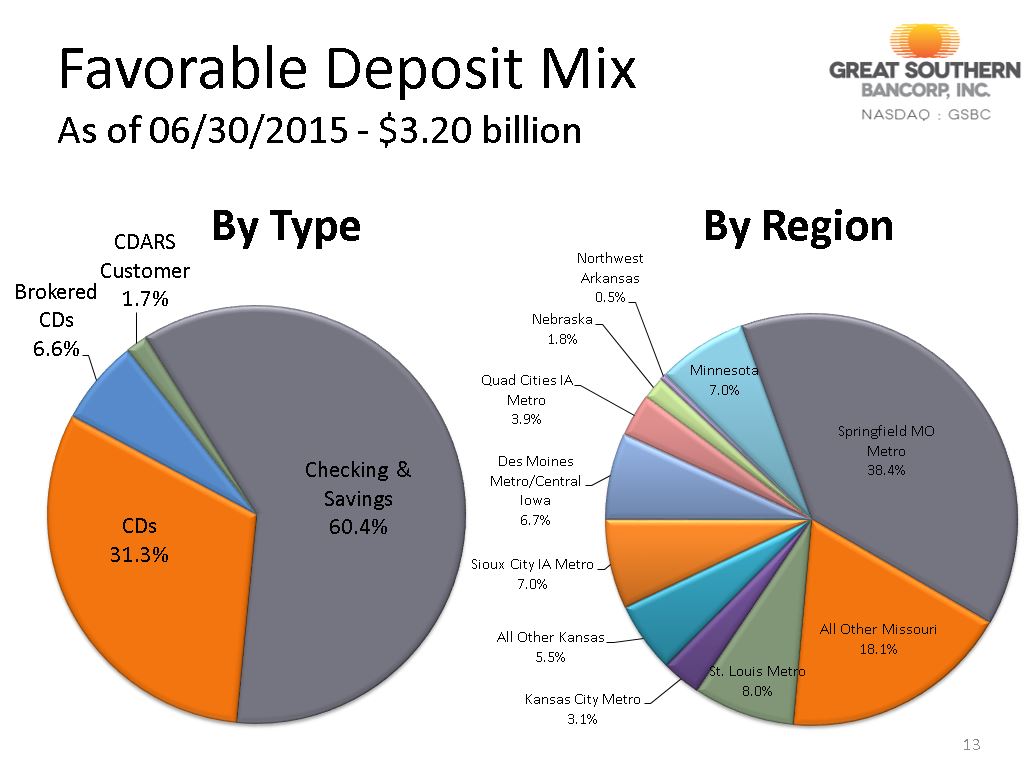

Favorable Deposit Mix As of 06/30/2015 - $3.20 billion By Type By Region 13

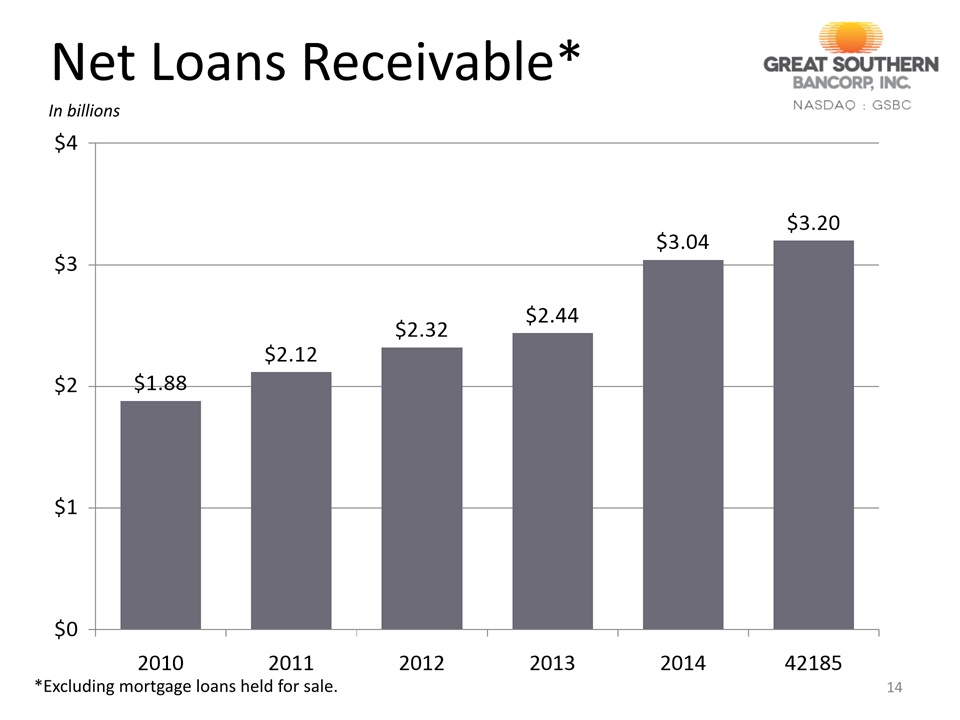

In billions *Excluding mortgage loans held for sale. Net Loans Receivable* 14

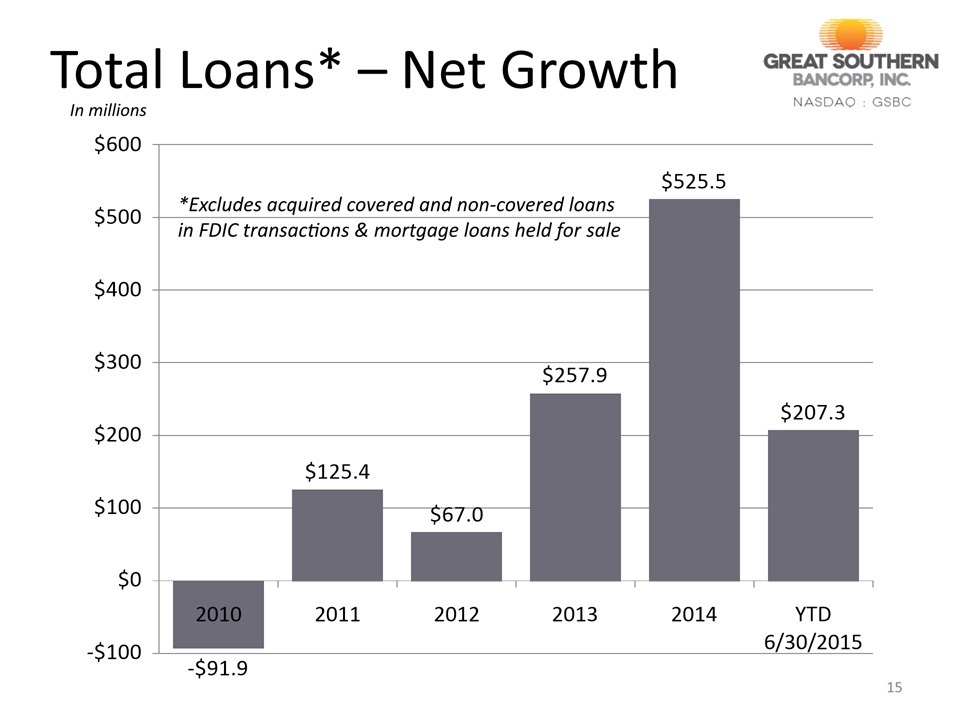

Total Loans* – Net Growth *Excludes acquired covered and non-covered loans in FDIC transactions & mortgage loans held for sale In millions 15

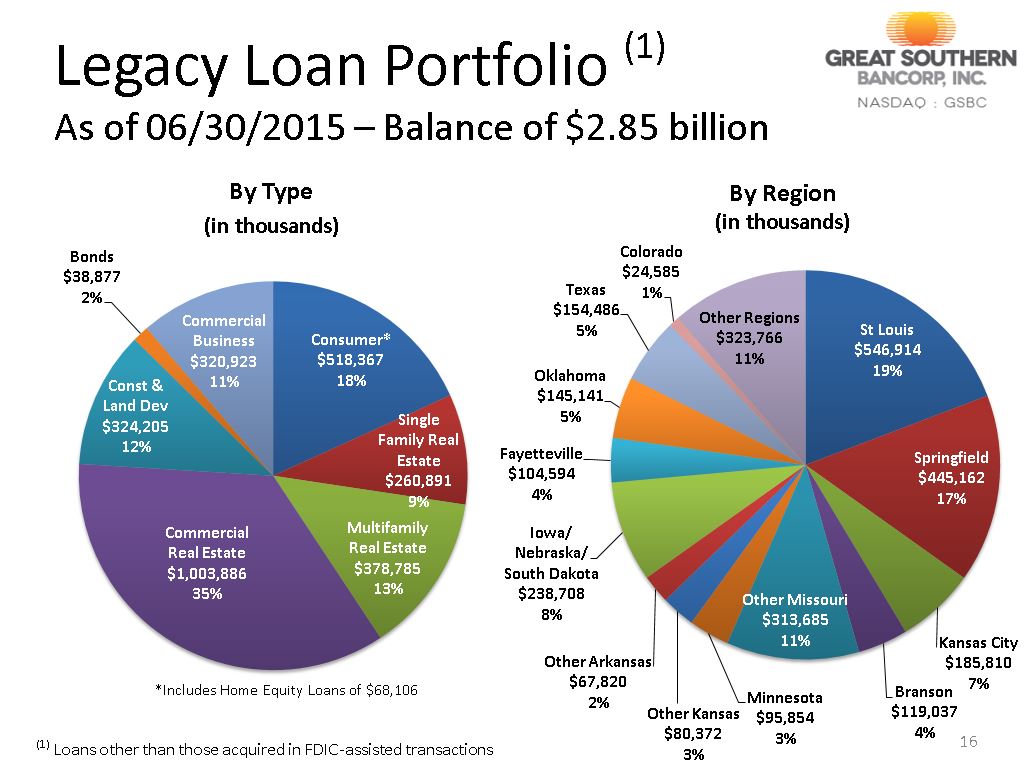

Legacy Loan Portfolio (1)As of 06/30/2015 – Balance of $2.85 billion By Type(in thousands) *Includes Home Equity Loans of $68,106 By Region(in thousands) 16 (1) Loans other than those acquired in FDIC-assisted transactions

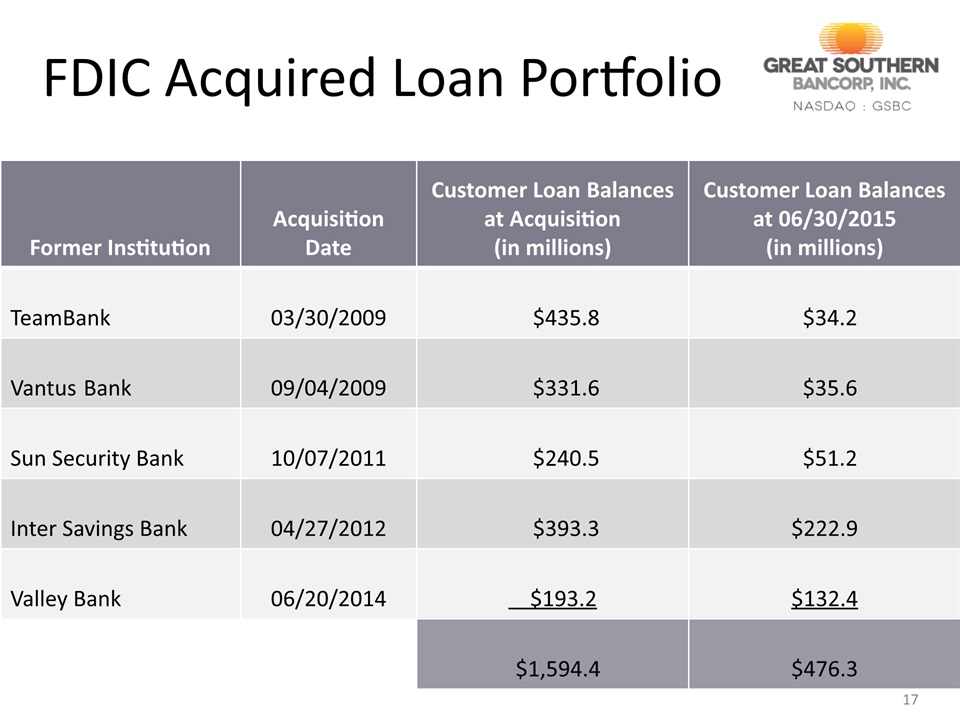

Former Institution Acquisition Date Customer Loan Balances at Acquisition (in millions) Customer Loan Balances at 06/30/2015(in millions) TeamBank 03/30/2009 $435.8 $34.2 Vantus Bank 09/04/2009 $331.6 $35.6 Sun Security Bank 10/07/2011 $240.5 $51.2 Inter Savings Bank 04/27/2012 $393.3 $222.9 Valley Bank 06/20/2014 $193.2 $132.4 $1,594.4 $476.3 FDIC Acquired Loan Portfolio 17

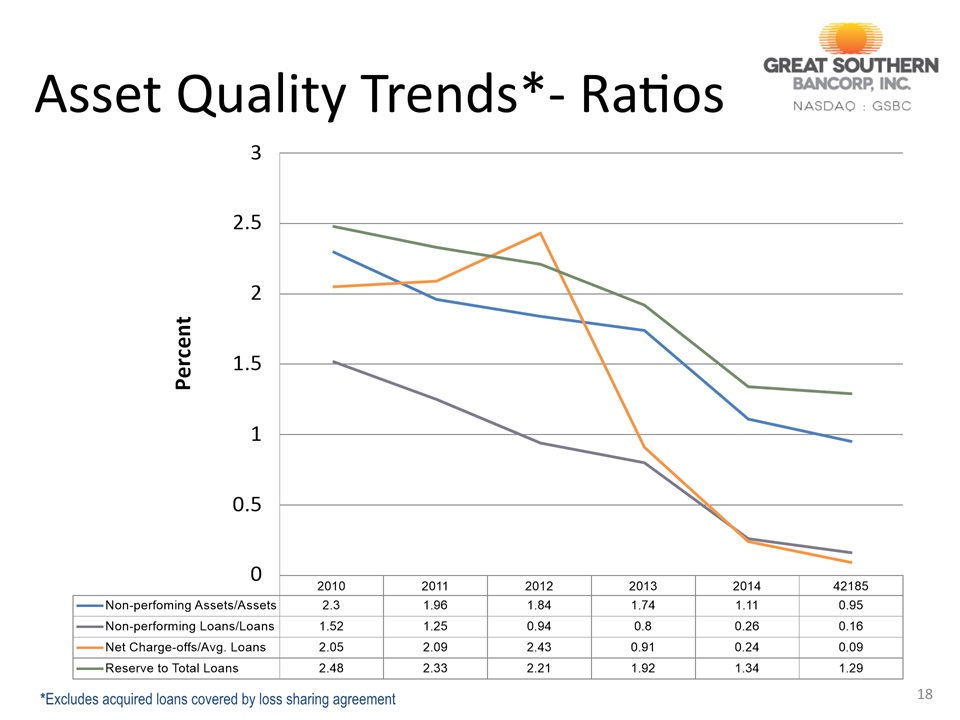

Asset Quality Trends*- Ratios *Excludes acquired loans covered by loss sharing agreement 18

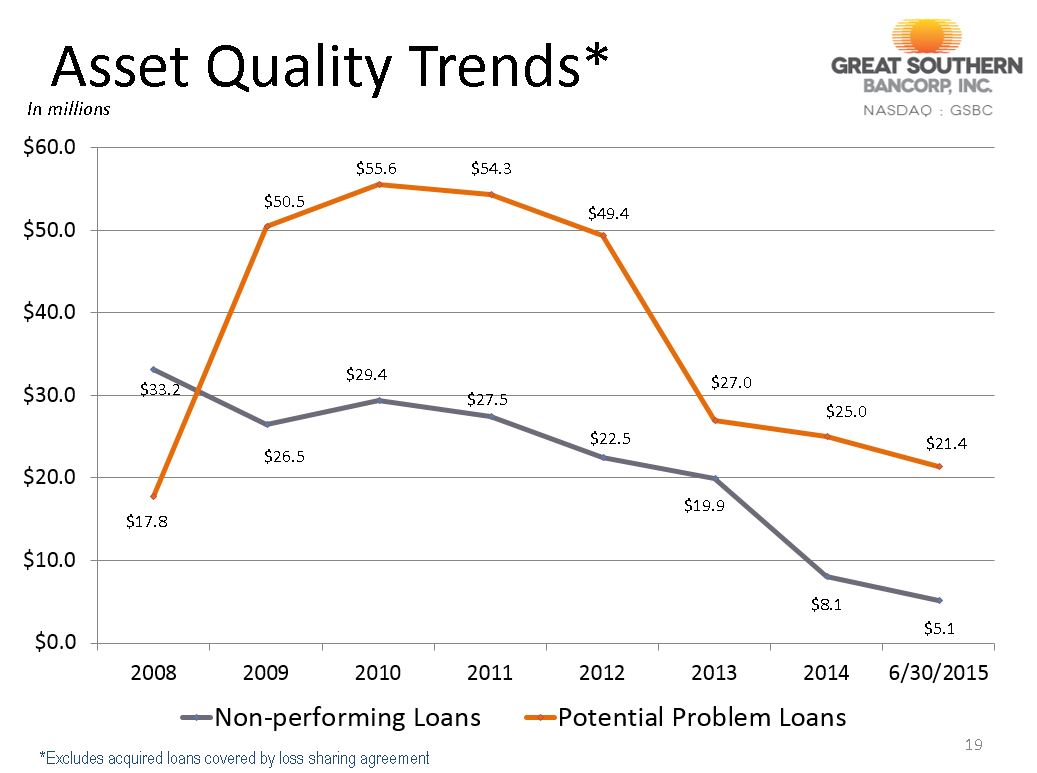

Asset Quality Trends* In millions 19 *Excludes acquired loans covered by loss sharing agreement

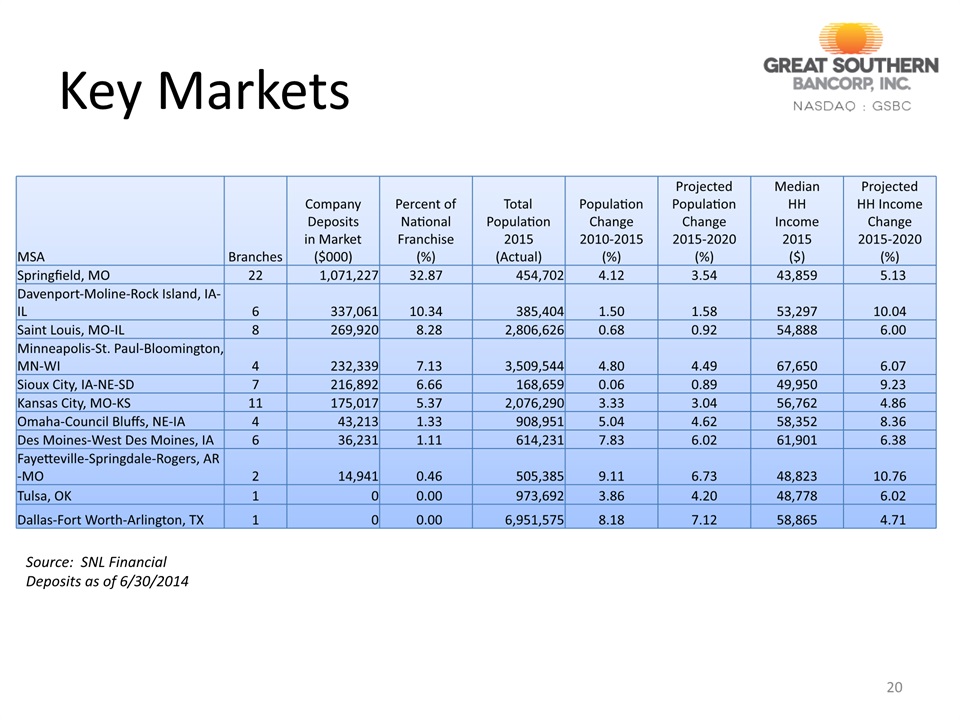

Key Markets Source: SNL FinancialDeposits as of 6/30/2014 20 MSA Branches CompanyDepositsin Market($000) Percent ofNationalFranchise(%) TotalPopulation2015(Actual) PopulationChange2010-2015(%) ProjectedPopulationChange2015-2020(%) MedianHHIncome2015($) ProjectedHH IncomeChange2015-2020(%) Springfield, MO 22 1,071,227 32.87 454,702 4.12 3.54 43,859 5.13 Davenport-Moline-Rock Island, IA-IL 6 337,061 10.34 385,404 1.50 1.58 53,297 10.04 Saint Louis, MO-IL 8 269,920 8.28 2,806,626 0.68 0.92 54,888 6.00 Minneapolis-St. Paul-Bloomington, MN-WI 4 232,339 7.13 3,509,544 4.80 4.49 67,650 6.07 Sioux City, IA-NE-SD 7 216,892 6.66 168,659 0.06 0.89 49,950 9.23 Kansas City, MO-KS 11 175,017 5.37 2,076,290 3.33 3.04 56,762 4.86 Omaha-Council Bluffs, NE-IA 4 43,213 1.33 908,951 5.04 4.62 58,352 8.36 Des Moines-West Des Moines, IA 6 36,231 1.11 614,231 7.83 6.02 61,901 6.38 Fayetteville-Springdale-Rogers, AR-MO 2 14,941 0.46 505,385 9.11 6.73 48,823 10.76 Tulsa, OK 1 0 0.00 973,692 3.86 4.20 48,778 6.02 Dallas-Fort Worth-Arlington, TX 1 0 0.00 6,951,575 8.18 7.12 58,865 4.71

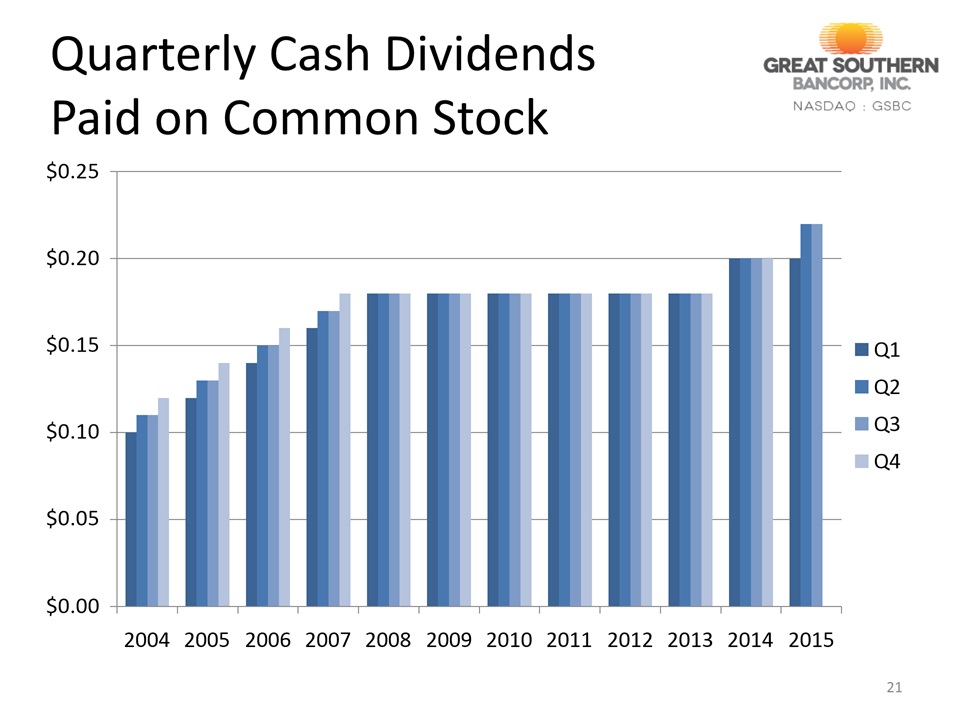

Quarterly Cash Dividends Paid on Common Stock 21

Why Great Southern? Positioned for long-term growthWell capitalized, diversified loan portfolio and strong core deposit baseStrong core operating earnings powerExpanding retail banking franchiseExperienced management team High percentage of insider ownership 22

Thank You For more information: Visit our Web site: www.GreatSouthernBank.comSign up for e-mail notification to get the latest Great Southern newsCall us with questions: 417.895.5242 23

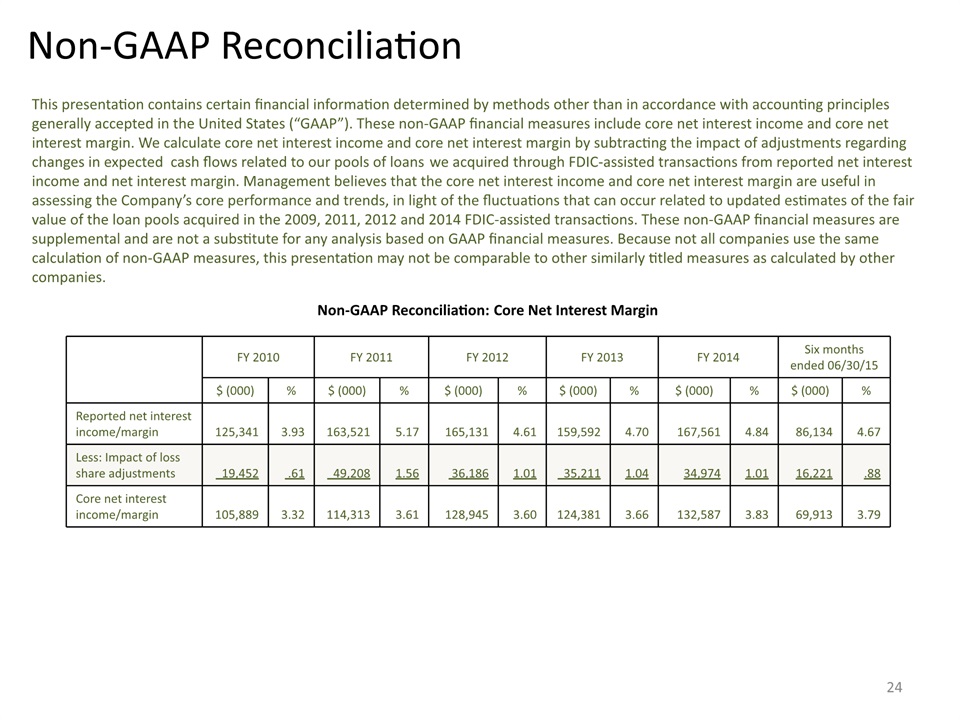

Non-GAAP Reconciliation Non-GAAP Reconciliation: Core Net Interest Margin This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include core net interest income and core net interest margin. We calculate core net interest income and core net interest margin by subtracting the impact of adjustments regarding changes in expected cash flows related to our pools of loans we acquired through FDIC-assisted transactions from reported net interest income and net interest margin. Management believes that the core net interest income and core net interest margin are useful in assessing the Company’s core performance and trends, in light of the fluctuations that can occur related to updated estimates of the fair value of the loan pools acquired in the 2009, 2011, 2012 and 2014 FDIC-assisted transactions. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Because not all companies use the same calculation of non-GAAP measures, this presentation may not be comparable to other similarly titled measures as calculated by other companies. 24 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 Six months ended 06/30/15 $ (000) % $ (000) % $ (000) % $ (000) % $ (000) % $ (000) % Reported net interest income/margin 125,341 3.93 163,521 5.17 165,131 4.61 159,592 4.70 167,561 4.84 86,134 4.67 Less: Impact of loss share adjustments 19,452 .61 49,208 1.56 36,186 1.01 35,211 1.04 34,974 1.01 16,221 .88 Core net interest income/margin 105,889 3.32 114,313 3.61 128,945 3.60 124,381 3.66 132,587 3.83 69,913 3.79

25

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| GREAT SOUTHERN BANCORP, INC. | |||

|

Date September 28, 2015

|

By:

|

/s/ Joseph W. Turner | |

| Joseph W. Turner | |||

| President and Chief Executive Officer | |||