Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pursuant to Section 13 or 15(d) of the

Securities Act of 1934

(Date of Report)

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

|

Maryland |

|

333-150548 |

|

75-3265854 |

|

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) |

|

(COMMISSION FILE NO.) |

|

(IRS EMPLOYEE IDENTIFICATION NO.) |

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(ISSUER TELEPHONE NUMBER)

This Form 8-K/A amends the original filing dated July 7, 2015 and the amended filing dated August 14, 2015. This amendment amends Exhibit 10.1 (Portfolio of Properties). This amendment further amends the number of shares of common stock issued and outstanding to correspond with the date of this amendment.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREMENT.

On February 4, 2015, the Board of Directors for American Housing Income Trust, Inc., a Maryland corporation, f/k/a Affinity Mediaworks Corp., a Nevada corporation (the "Company"), ratified and approved, amongst other things, the private sale of 20,000 shares of the Series A Preferred Stock (the "Series A Preferred"), each of which has the voting right of 25,000 votes per share on all matters submitted to a vote of the shareholders, and 58,809,678 shares of common stock, representing 50.79% of the total outstanding of 116,068,770 common stock outstanding of the Company.

The Share Purchase Agreements were entered into between the selling shareholders, below, American Realty Partners, LLC, an Arizona limited liability company ("American Realty"), as buyer, and the Company. These agreements are collectively referred to herein as the "SPAs". The SPAs closed escrow on February 13, 2015 with the receipt of medallion signed transfers of the restricted certificates resulting in a change of control. The selling shareholders were as follows:

|

Aquamarine Holdings, LLC

|

9,000,000 Common Shares;

|

|

Dunlap Consulting, LLC

|

9,000,000 Common Shares;

|

|

Nutmeg State Realty, LLC

|

9,000,000 Common Shares;

|

|

Carson Holdings, LLC

|

6,700,000 Common Shares;

|

|

Calypso Ventures, LLC

|

6,250,000 Common Shares;

|

|

Bengal Holdings, Inc.

|

6,250,000 Common Shares;

|

|

Gabon Investments, Inc

|

6,250,000 Common Shares;

|

|

Friction & Heat, LLC

|

6,250,000 Common Shares;

|

|

Cortland Comm., LLC

|

109,678 Common Shares.

|

On March 27, 2015, through Schedule 14C, the Company noticed a reverse split of its common stock on a 1:1,000 basis, and its conversion from a Nevada corporation to a Maryland corporation pursuant to the conversion statutes under the Nevada Revised Statutes and Maryland General Corporation Law. In order to account for dissenter's rights and abbreviated notice to non-beneficial owners of the Company's common stock, these actions did not become effective until May 6, 2015.

Pursuant to the Amended Resolution of the Board of Directors dated May 14, 2015, which supplemented, amended and revised the Resolution of the Board of Directors dated May 8, 2015, the Board of Directors authorized Eric Stoffer's execution of the following materially definitive agreements: (a) the Stock Exchange and Restructuring Agreement (the "Stock Exchange Agreement") between American Realty Partners, LLC, an Arizona limited liability company and related party ("American Realty"), and the Company dated May 15, 2015, and (b) the Parent-Subsidiary and Operations Agreement (the "Subsidiary Agreement") between Performance Realty Management, LLC, an Arizona limited liability company and related party ("Performance Realty"), American Realty and the Company, which has as an effective date of the "Closing," as defined under the Stock Exchange Agreement.

The Stock Exchange Agreement was executed on May 15, 2015, but the closing had been conditioned upon satisfaction of the conditions precedent in Article V thereunder. More specifically, the closing was conditioned upon approval by the Financial Industry Regulatory Authority ("FINRA") of the actions in its Schedule 14C; more specifically, FINRA's approval of the reverse stock split. The closing of the Stock Exchange Agreement occurred on July 6, 2015 with the issuance of 5,000,000 shares of common stock to the former members of American Realty Partners. The closing of the Stock Exchange Agreement resulted in American Realty being a wholly-owned subsidiary of the Company. The Subsidiary Agreement close concomitant with the closing of the Stock Exchange Agreement.

Under the terms of the Subsidiary Agreement, the Company agreed to be bound by the Operating Agreement for American Realty dated November 1, 2013 (the "American Realty Operating Agreement"). The Company further agreed that Performance Realty would continue to operate as the Manager for American Realty pursuant to the terms of the American Realty Operating Agreement, subject to the following amendment to Section 3.10 of the American Realty Operating Agreement:

The Member acknowledges and agrees that, as the sole member of the Company, it and its shareholders directly benefit from the management services provided by Manager under this Article III. The Member further recognizes that any capital expenditures made for the benefit of the Company derive directly from the Member, as opposed to the Company itself. Therefore, in consideration for the services to be rendered to or on behalf of the Company by the Manager, the Member shall issue 1,000,000 shares of common stock in the Member, i.e. American Housing Income Trust, Inc., by May 22, 2015, and on the annual anniversary of this issuance, shares of common stock valued at one-percent (1%) of the net assets of the Company being managed by Manager under this Operating Agreement, unless otherwise agreed upon by Member and Manager, or unless doing so impairs or restricts the Member's intent of operating as a real estate investment trust. In the event such structure impairs or restricts the Member's intent of operating as a real estate investment trust, the Member and Manager agree to work in good faith to restructure compensation for Manager in performing under this Article 3. The fee paid to Manager hereunder is intended to constitute a guaranteed payment within the meaning of IRS Code Section 707(c), and will be treated as an expense of the Company and deducted in determining Profits and Losses."

In the Subsidiary Agreement, the Company recognized the value of Performance Realty in continuing to serve as Manager of American Realty until such time the Company determines that the management impairs or restricts the Company's long-term objective of operating as a real estate investment trust under Maryland law. The parties under the Subsidiary Agreement recognize that until the Company is financially and operationally prepared and positioned to operate as a real estate investment trust, Performance Realty must manage American Realty in order to maintain continuity during this transition in operations. Performance Realty has agreed to take direction from the Company's Board of Directors regarding those matters set forth in Article 3 of the American Realty Operating Agreement. Notwithstanding, the day-to-day administrative and ministerial tasks in operating American Realty are to be performed in the discretion of Performance Realty and its employees and agents, based on their collective education, experience and training. Performance Realty shall provide reporting and general updates to the Company's Board of Directors in a commercially reasonable manner.

On May 26, 2015, the Board of Directors unanimously approved Direct Transfer, LLC to issue additional shares as required to facilitate requests to perform the round-up of the fractional shares on a beneficial holder level following FINRA's approval of the reverse stock split without further notification to or approvals. FINRA approved the completion of the reverse stock split effective June 10, 2015. FINRA assigned the Company the temporary trading symbol of AFFWD for trading on the Over-The-Counter market (recently down-listed from the QB to Pink Sheets). The trading symbol will automatically be changed to AHIT effective July 8, 2015. As a result of the reverse stock split and round-up, and the conversion of the Series A Preferred (but before the issuances under the Stock Exchange Agreement, Subsidiary Agreement and Advisory Agreements discussed herein), the Company's issued and outstanding shares of common stock, as of June 28, 2015, equaled 116,353. On June 29, 2015, the Company issued 21 shares to Pershing, LLC as part of the beneficial round-up previously approved by resolution. Therefore, as of June 29, 2015, the total issued and outstanding shares of common stock equaled 116,374.

On June 23, 2015, pursuant to Article VII of the Articles of Incorporation for the Company, American Realty approved the Board of Director's recommendation to amend the Articles of Incorporation to ratify the authorized shares of common stock at 100,000,000, par value of $0.01, and shares of preferred stock at 10,000,000, par value of $0.001. In response, on June 24, 2015, the Board of Directors, pursuant to Article III, Section 10 and Article VII, Section 1 of the Bylaws, resolved to amend the Articles of Incorporation as directed by American Realty. The Board of Directors independently resolved to amend the Articles of Incorporation as directed by American Realty, and to amend the fiscal year end to December 31st.

In addition to this amendment, the Board of Directors accepted the resignations of Eric Stoffers as Chairman of the Board, Chief Executive Officer and President, and Bill Deegan as Chief Financial Officer, Treasurer and Secretary, and in turn, appointed Sean Zarinegar to fill the vacancies of Chairman of the Board, Chief Executive Officer, Chief Financial Officer, President and Treasurer. Monica Andreas was appointed Secretary to fill the vacancy. The Board of Directors had concluded that making such adjustments at the director and officer levels were in the best interests of the Company. Jeff Howard was appointed a director to fill the vacancy caused by Eric Stoffers' resignation.

On June 25, 2015, the Company and American Realty entered into restructured financing agreements with Firstkey Lending, LLC ("Firstkey"). Firstkey approved the restructuring of American Realty, as set forth in the Stock Exchange Agreement and Subsidiary Agreement. Sean Zarinegar and Performance Realty ratified their respective duties and obligations to Firstkey. The Firstkey debt service directly benefits the Company.

On June 29, 2015, Performance Realty, American Realty and the Company entered into the First Amended Parent-Subsidiary and Operations Agreement (the "First Amended Subsidiary Agreement"). The First Amended Subsidiary Agreement set forth Performance Realty's agreement to retain an option for the issuance of the 1,000,000 shares upon written notice being exercised by Performance Realty. These shares shall be deposited into the Company's treasury for future issuance.

On July 6, 2015, the Company proceeded to issue shares of common stock to Sean Zarinegar (1,000,000 shares) and Ken Hedrick (25,000 shares) under their respective agreements. There was an additional 21 shares issued to Pershing, LLC and 1 share to Interactive Brokers, LLC, as part of the beneficial round-up, and an additional 109 beneficial round up shares issued upon the effectiveness of the Stock Exchange Agreement. As of this filing, the Company has 7,481,244 shares of common stock issued and outstanding among 596 shareholders.

ITEM 2.01 COMPLETION OF DISPOSITION OR ACQUISITION OF ASSETS.

As described above under Item 1.01, the Company acquired all of the issued and outstanding units in American Realty. American Realty is the owner and operator of 43 residential properties in Arizona, Texas and Nevada. See Exhibit 10.1. 214 former members of American Realty were issued a total of 5,000,000 shares of restricted common stock in the Company pursuant to the Stock Exchange Agreement (subject to a subsequent small round-up of 109 shares). The intent of this restructuring was to effectuate a tax-free reorganization pursuant to IRC 368. Shortly thereafter, on July 6, Sean Zarinegar and Ken Hedrick were issued 1,000,000 and 25,000 shares of common stock, respectively, under their respective advisor agreements. The stock issuance referenced in the agreements between the Company and Stoffers and Deegan was not closed as a result of them resigning their respective positions prior to the closing of the Stock Exchange Agreement. Concomitant with the above-referenced actions, the Company was issued 100 units in American Realty to finalize the stock exchange and restructuring. It is these acts, amongst other disclosures herein, that the Company relies on in coming to the reasoned opinion that it is now an operational entity, as addressed in Item 5.06 herein.

Pursuant to Item 2.01(f) of Form 8-K, the Company provides below the information that would be required if it was filing a general form for registration of securities on Form 10 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), such as a discussion related to the business as a going concern, risk factors, financial information, security ownership of certain beneficial owners, and directors and executive officers. However, for the sake of avoiding redundancy and clarity to the reader, Items typically discussed in Sections 3, 5 and 9 of a Form 10 under the Act are not set forth in this section but are rather set forth in Section 3, 5 and 9 of this Form 8-K.

Item 1. BUSINESS

All statements contained in this Form 8-K, other than statements of historical facts, which address future activities, events or developments, are forward-looking statements, including, but not limited to, statements containing the words "believe," "anticipate," "expect" and words of similar import. These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. However, whether actual results will conform to the expectations and predictions of management is subject to a number of risks and uncertainties that may cause actual results to differ materially.

Consequently, all of the forward-looking statements made in this Form 8-K are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations.

As used in this Form 8-K, unless the context requires otherwise, "we" or "us" or "us" means American Housing Income Trust, Inc. All dollar amounts in this annual report refer to US dollars unless otherwise indicated.

Company Information

Organization

The Company was originally incorporated as Green Bikes Rental Corporation on December 17, 2007, under the laws of the State of Nevada, as a development stage company. The Company issued 5,000,000 shares of common stock at the time of incorporation as "founder's shares" to Yulia Nesterchuk. On April 30, 2008, the Company filed its Form S-1 Registration Statement under the Securities Act of 1933 registering 2,000,000 shares of our common stock at an offering price of $0.10. On May 30, 2008, the Company completed its public offering and raised $50,830 by selling 508,300 shares of registered common stock. On October 17, 2008, our shares of common stock began trading on FINRA's Over-The-Counter Bulletin Board under the symbol "GBKR." There was minimal trading activity in 2009 and early-2010.

On January 30, 2009, the Company amended its Articles of Incorporation to change the name of Green Bikes Rental Corporation to Affinity Mediaworks Corp. and increase the authorized shares of common stock in the Company to 200,000,000 and effectuated a 20:1 forward-split of the Company's issued and outstanding shares of common stock. We received a new symbol - "AFFW", for the quotation of our common stock on the OTC Bulletin Board on January 30, 2009. At the time, the intent of the Company was to become involved in the development, finance, sales, acquisition, distribution and marketing of high quality intellectual property devoted for the entertainment and leisure markets, through films under budgets from $4 to $8 million. We believed that our product line would represent a timely opportunity with the potential for fast acceptance in the international marketplace.

We were also finalizing plans to vertically integrate in all aspects of the industry, including pre and post production services. These ancillary services were priced at a level where we believed we could become a key provider of solutions to the independent and small film sector. The services that we planned on offering would help provide a monthly revenue stream that would create an independent profit center within our organization and provide supplemental cash flow to us while our major film projects are being shot and carried to market. As of May 17, 2010, we had approximately 51 shareholders of record and 50,166,000 outstanding shares of common stock.

On July 23, 2012, Cortland Communications, LLC, a Utah limited liability company ("Cortland"), whose principal was Mark T. Gleason, entered into a share purchase agreement with the Company. Under the terms of the agreement, Cortland purchased a control block consisting of approximately seventy-nine and forty-six one hundredths percent (79.46%) of the outstanding common shares of the Company in consideration for $75,000. Scott Cramer resigned as the sole director of the Company, and Mr. Gleason was appointed Chief Executive Officer, Chief Financial Officer, Treasurer, Secretary, and sole Director. As of July 31, 2012, the Company had 50,355,969 shares of common stock issued and outstanding.

On August 2, 2012, 24,000,000 shares of our common stock were issued in consideration of a release of a note payable to three shareholders. These shares were issued to Robert Thast (7,000,000), Phillip Brooks (7,000,000) and Yuriy Nesterchuck (10,000,000). On August 20, 2012, the Company filed a Certificate of Amendment with the State of Nevada reclassifying its capital stock as 190,000,000 shares of common stock and 10,000,000 shares of blank check preferred stock.

On August 23, 2012, in consideration of the release of a note payable, the Company issued 3,380,000 shares of its common stock. On September 18, 2012, the Company recorded minutes on a proposed 777:1 reverse stock split retroactively adjusted to inception of the Company, pending approval from FINRA. On July 2, 2013, the Company recorded minutes announcing the termination of the proposed reverse stock split. On July 12, 2013, in exchange for notes payable and accrued interest of $16,098, the Company issued 73,549 shares of common stock to Cortland Communications, LLC. The Company recorded a loss on debt conversion of $1,693,902 related to this transaction.

On January 24, 2014, the Company recorded minutes on a proposed a 775:1 reverse stock split. See Form 10-K dated March 7, 2014. As of March 7, 2014, the common stock issued and outstanding had been adjusted retroactively back to inception to reflect this split. The reverse stock split had been approved by FINRA with the effective date of February 21, 2014. As of January 31, 2014, the common stock issued and outstanding had been adjusted retroactively back to inception to reflect the proposed 775:1 reverse stock split.

On April 1, 2014, 69,531,000 shares of common stock were issued for consulting services. The shares of common stock had been valued at $695 based on par value for the issuance for these shares on the date of the grant. The shares were issued to:

|

Fortitude Group, Inc.

|

9,250,000 Common Shares;

|

|

Calypso Ventures, LLC

|

6,250,000 Common Shares;

|

|

Friction and Heat, LLC

|

6,250,000 Common Shares;

|

|

Procap Funding, Inc.

|

6,250,000 Common Shares;

|

|

Rochester Equities of NY, Inc.

|

6,700,000 Common Shares;

|

|

Data Capital Corp.

|

6,700,000 Common Shares;

|

|

Bengal Holdings, Inc.

|

6,250,000 Common Shares;

|

|

Gabon Investments, Inc.

|

6,250,000 Common Shares;

|

|

Carson Holdings, LLC

|

6,700,000 Common Shares;

|

|

Libra6 Management Corp.

|

6,481,000 Common Shares; and

|

|

Gemini Group Global Corp.

|

2,000,000 Common Shares.

|

For the six-month period between January 31, 2014 and July 31, 2014, the Company had issued 198 shares of common stock due to beneficial roundup and recalculation of the previous reverse split. As of April 30, 2014, the Company had 190,000,000 shares of common stock authorized at $0.00001 par value per share and 69,705,022 shares of common stock issued and outstanding.

On July 8, 2014 the Company filed a Certificate of Amendment with the State of Nevada to increase the number of authorized capital stock to 510,000,000. The number of authorized shares common stock increased to 500,000,000 with a par value of $0.00001 and the number of authorized blank check preferred remained the same at 10,000,000 with a par value of $0.00001. On July 11, 2014, the Company authorized from its 10,000,000 shares of preferred stock, the designation of 20,000 shares of preferred stock classified as the "Series A Preferred Stock," which carried super voting rights equal to 25,000 votes per share.

On July 25, 2014, the Company recorded a stock payable of 9,000,000 shares of common stock, in exchange for received payment of $1,800. As of July 31, 2014, the Company had 500,000,000 shares of common stock authorized and 69,705,083 shares of common stock issued and outstanding. On August 19, 2014, 9,000,000 shares of common stock were issued at $0.002/ per share, in exchange for a stock payable of $1,800 recorded on July 25, 2014, and 18,000,000 shares of common stock were issued at $0.002/ per share, in exchange for a stock payable of $3,600 recorded on August 14, 2014.

A change of control of the Company occurred on October 28, 2014 when Cortland Communications, LLC acquired 20,000 shares of the Series A Preferred Stock in consideration for the retirement of debt owed the entity. See Form 8-K dated October 29, 2014. The Company recorded on its Form 10-Q dated December 15, 2014, $19,452 in debt converted held in interest and notes and $66,548 as a loss on the conversion of related party debt. As a result, Cortland Communications, LLC held, at the time, voting rights equivalent to 500,000,000 shares of the Company's common stock. According to the Form 10-Q, as of the filing, the Company had 94,568,770 shares of common stock issued and outstanding.

On February 4, 2015, the Board of Directors for the Company ratified and approved, amongst other things, the private sale of 20,000 shares of the Series A Preferred Stock and 58,809,678 shares of Common Stock representing 50.79% of the total outstanding of 116,068,770 Common Stock outstanding of the Company.

The Share Purchase Agreements were entered into between the selling shareholders, below, American Realty , as buyer, and the Company. These agreements are collectively referred to herein as the "SPAs". The SPAs closed escrow on February 13, 2015 with the receipt of medallion signed transfers of the restricted certificates. The selling shareholders were as follows:

|

Aquamarine Holdings, LLC

|

9,000,000 Common Shares;

|

|

Dunlap Consulting, LLC

|

9,000,000 Common Shares;

|

|

Nutmeg State Realty, LLC

|

9,000,000 Common Shares;

|

|

Carson Holdings, LLC

|

6,700,000 Common Shares;

|

|

Calypso Ventures, LLC

|

6,250,000 Common Shares;

|

|

Bengal Holdings, Inc.

|

6,250,000 Common Shares;

|

|

Gabon Investments, Inc

|

6,250,000 Common Shares;

|

|

Friction & Heat, LLC

|

6,250,000 Common Shares;

|

|

Cortland Comm., LLC

|

109,678 Common Shares.

|

These common shares, in the aggregate, account for 58,809,678, or 50.79% of the common shares outstanding of the Company. In addition, American Realty acquired 20,000 of the Series A Preferred Stock from Cortland Communications, LLC (the "Series A Preferred"). As a result, a change of control of the Company took place on February 13, 2015 (the date of the closing of escrow).

On March 2, 2015, American Realty voted its shares of common stock and preferred stock in adopting a Plan of Conversion pursuant to Sections 92A.005 et seq. of the Nevada Revised Statutes, and Section 3-904(c)(1) of the Code of Maryland (the "Plan of Conversion"). The Plan of Conversion was recommended by the Board of Directors of the Company. The action consented to was to convert the Company from a Nevada corporation to a Maryland corporation, pursuant to conversion statutes under the Nevada Revised Statutes (the "NRS") and the Maryland General Corporation Law (the "MGCL") (the "Maryland Conversion").

As of the close of business on March 2, 2015, we had 116,068,770 shares of Common Stock outstanding of the Company (subject to the Reverse Stock Split) and 20,000 shares of Preferred Stock. Each share of outstanding Common Stock is entitled to one vote and each share of Preferred Stock is entitled to 25,000 votes. These common shares, in the aggregate, account for 58,809,678, or 50.79% of the common shares outstanding of the Company. In addition, American Realty acquired 20,000 of the Series A Preferred Stock from Cortland Communications, LLC (the "Series A Preferred"). As a result, a change of control of the Company took place.

On March 27, 2015, through Schedule 14C, the Company noticed a reverse split of its common stock on a 1:1,000 basis, and its conversion from a Nevada corporation to a Maryland corporation pursuant to the conversion statutes under the Nevada Revised Statutes and Maryland General Corporation Law. In order to account for dissenter's rights and abbreviated notice to non-beneficial owners of the Company's common stock, these actions did not become effective until May 6, 2015.

Pursuant to the Amended Resolution of the Board of Directors dated May 14, 2015, which supplemented, amended and revised the Resolution of the Board of Directors dated May 8, 2015, the Board of Directors authorized Eric Stoffer's execution of the following materially definitive agreements: (a) the Stock Exchange and Restructuring Agreement (the "Stock Exchange Agreement") between American Realty Partners, LLC, an Arizona limited liability company and related party ("American Realty"), and the Company dated May 15, 2015, and (b) the Parent-Subsidiary and Operations Agreement (the "Subsidiary Agreement") between Performance Realty Management, LLC, an Arizona limited liability company and related party ("Performance Realty"), American Realty and the Company, which has as an effective date of the "Closing," as defined under the Stock Exchange Agreement.

The Stock Exchange Agreement was executed on May 15, 2015, but the closing had been conditioned upon satisfaction of the conditions precedent in Article V thereunder. More specifically, the closing was conditioned upon approval by the Financial Industry Regulatory Authority ("FINRA") of the actions in its Schedule 14C; more specifically, FINRA's approval of the reverse stock split. The closing of the Stock Exchange Agreement occurred on July 6, 2015 with the issuance of the shares to the former members of American Realty Partners. The closing of the Stock Exchange Agreement resulted in American Realty being a wholly-owned subsidiary of the Company. The Subsidiary Agreement, as amended, closed concomitant with the closing of the Stock Exchange Agreement.

Under the terms of the Subsidiary Agreement, the Company agreed to be bound by the Operating Agreement for American Realty dated November 1, 2013 (the "American Realty Operating Agreement"). The Company further agreed that Performance Realty would continue to operate as the Manager for American Realty pursuant to the terms of the American Realty Operating Agreement, subject to the following amendment to Section 3.10 of the American Realty Operating Agreement:

The Member acknowledges and agrees that, as the sole member of the Company, it and its shareholders directly benefit from the management services provided by Manager under this Article III. The Member further recognizes that any capital expenditures made for the benefit of the Company derive directly from the Member, as opposed to the Company itself. Therefore, in consideration for the services to be rendered to or on behalf of the Company by the Manager, the Member shall issue 1,000,000 shares of common stock in the Member, i.e. American Housing Income Trust, Inc., by May 22, 2015, and on the annual anniversary of this issuance, shares of common stock valued at one-percent (1%) of the net assets of the Company being managed by Manager under this Operating Agreement, unless otherwise agreed upon by Member and Manager, or unless doing so impairs or restricts the Member's intent of operating as a real estate investment trust. In the event such structure impairs or restricts the Member's intent of operating as a real estate investment trust, the Member and Manager agree to work in good faith to restructure compensation for Manager in performing under this Article 3. The fee paid to Manager hereunder is intended to constitute a guaranteed payment within the meaning of IRS Code Section 707(c), and will be treated as an expense of the Company and deducted in determining Profits and Losses."

In the Subsidiary Agreement, the Company recognized the value of Performance Realty in continuing to serve as Manager of American Realty until such time the Company determines that the management impairs or restricts the Company's long-term objective of operating as a real estate investment trust under Maryland law. The parties under the Subsidiary Agreement recognize that until the Company is financially and operationally prepared and positioned to operate as a real estate investment trust, Performance Realty must manage American Realty in order to maintain continuity during this transition in operations. Performance Realty has agreed to take direction from the Company's Board of Directors regarding those matters set forth in Article 3 of the American Realty Operating Agreement. Notwithstanding, the day-to-day administrative and ministerial tasks in operating American Realty are to be performed in the discretion of Performance Realty and its employees and agents, based on their collective education, experience and training. Performance Realty shall provide reporting and general updates to the Company's Board of Directors in a commercially reasonable manner.

On May 26, 2015, the Board of Directors unanimously approved Direct Transfer, LLC to issue additional shares as required to facilitate requests to perform the round-up of the fractional shares on a beneficial holder level following FINRA's approval of the reverse stock split without further notification to or approvals. FINRA approved the completion of the reverse stock split effective June 10, 2015. FINRA assigned the Company the temporary trading symbol of AFFWD for trading on the Over-The-Counter market (recently down-listed from the QB to Pink Sheets). The trading symbol will automatically be changed to AHIT effective July 8, 2015. As a result of the reverse stock split and round-up, and the conversion of the Series A Preferred (but before the issuances under the Stock Exchange Agreement, Subsidiary Agreement and Advisory Agreements discussed herein), the Company's issued and outstanding shares of common stock, as of June 28, 2015, equaled 116,353. On June 29, 2015, the Company issued 21 shares to Pershing, LLC as part of the beneficial round-up previously approved by resolution. Therefore, as of June 29, 2015, the total issued and outstanding shares of common stock equaled 116,374.

On June 23, 2015, pursuant to Article VII of the Articles of Incorporation for the Company, American Realty approved the Board of Director's recommendation to amend the Articles of Incorporation to ratify the authorized shares of common stock at 100,000,000, par value of $0.01, and shares of preferred stock at 10,000,000, par value of $.001. In response, on June 24, 2015, the Board of Directors, pursuant to Article III, Section 10 and Article VII, Section 1 of the Bylaws, resolved to amend the Articles of Incorporation as directed by American Realty. The Board of Directors independently resolved to amend the Articles of Incorporation as directed by American Realty, and to amend the fiscal year end to December 31st.

In addition to this amendment, the Board of Directors accepted the resignations of Eric Stoffers as Chairman of the Board, Chief Executive Officer and President, and Bill Deegan as Chief Financial Officer, Treasurer and Secretary, and in turn, appointed Sean Zarinegar to fill the vacancies of Chairman of the Board, Chief Executive Officer, Chief Financial Officer, President and Treasurer. Monica Andreas was appointed Secretary to fill the vacancy. The Board of Directors had concluded that making such adjustments at the director and officer levels were in the best interests of the Company. Jeff Howard was appointed a director to fill the vacancy caused by Eric Stoffers' resignation.

On June 25, 2015, the Company and American Realty entered into restructured financing agreements with Firstkey Lending, LLC ("Firstkey"). Firstkey approved the restructuring of American Realty, as set forth in the Stock Exchange Agreement and Subsidiary Agreement. Sean Zarinegar and Performance Realty ratified their respective duties and obligations to Firstkey. The Firstkey debt service directly benefits the Company.

On July 6, 2015, the Company proceeded to issue shares of common stock to Sean Zarinegar (1,000,000 shares) and Ken Hedrick (25,000 shares) under their respective agreements. There was an additional 21 shares issued to Pershing, LLC and 1 share to Interactive Brokers, LLC, as part of the beneficial round-up, and an additional 109 beneficial round up shares issued upon the effectiveness of the Stock Exchange Agreement. Therefore, as of this filing, the Company has 7,481,244 shares of common stock issued and outstanding among 596 shareholders.

Although management believes that the assumptions underlying the forward looking statements included in this filing are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment.

To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this filing will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

Factors that might cause or contribute to such differences include, but are not limited to, those discussed in "Risk Factors" contained in this report. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate. Except as required by law, we expressly disclaim any obligation to update publicly any forward-looking statements for any reason after the date of this report, to conform these statements to actual results, or to changes in our expectations. You should, however, review the factors and risks we describe in the reports we will file from time to time with the United States Securities and Exchange Commission (the "SEC") after the date of this report.

The Company is currently working with its auditors, financial advisors, and corporate, tax and securities counsel to take the necessary steps to restructure the entity into a real estate investment trust (a "REIT"). The intent following the restructuring into a REIT is to embark on an aggressive capital raising strategy in mid-2015 in order to expand upon the recent successes of our wholly-owned subsidiary - American Realty.

Operation of Business - Acquire, Renovate, Lease, and Manage Single-Family Residential Properties

WHY AHIT?

Through its wholly-owned subsidiary, American Realty, the Company currently holds title to 34 residential properties, subject to the first secured debt serviced by Firstkey. The Company will continue to acquire, renovate, lease, and manage primarily single-family residential properties, and engage in such other activities as are reasonably incidental to the foregoing. More specifically, the Company intends on engaging in the business of purchasing real estate for the purpose of making cosmetic changes, repairs, and other enhancements in order to increase the value of the properties, and then rent such property to tenants. The Company intends on renting each property for a period of 12 months from acquisition and then resell the property. However, the occurrence of unforeseen events (e.g., a robust rental market or a weak resale market) may cause the Company to adjust its rental and resale strategies. The Company does not intend to acquire commercial properties.

Acquisition of Properties

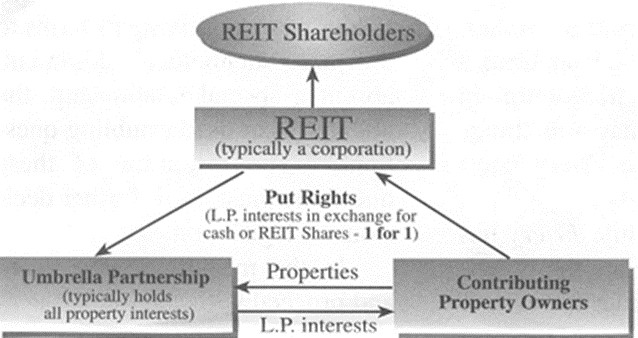

The Company intends on acquiring residential properties primarily through foreclosure sales, bank owned real estate, purchase transactions constituting a short sale (a transaction where the purchase price is less than the secured indebtedness on the property), distressed sale transactions, and, in some circumstances, wholesale transactions. The number of residential properties that may be available from all of the foregoing sources will vary from time to time, depending on numerous factors including, without limitation, trends in delinquent mortgages and foreclosure sales in a given area, extent to which banks may or may not aggressively seek to sell owned real estate (typically acquired through foreclosure on a delinquent mortgage), number of persons seeking to purchase distressed properties, trends impacting values of residential properties, and other factors beyond the control of the Company. Another intended strategy of the Company is to partner with other single family residential owners in creating related umbrella partnerships through entities commonly referred to as an "UPREIT" similar to the following schematic:

Target Markets

The Company's goal is to purchase real property primarily in the western United States (including without limitation Phoenix, Las Vegas, Tucson, and California) at or below the target purchase price of $200,000 (which amount is intended to include completion costs of any repairs and/or other enhancements). Although the Company will strive to meet this goal, it may, however, on occasion, purchase real property with a total purchase price in excess of $200,000. If the Board of Directors decides that any markets outside of the aforementioned markets present an opportunity to purchase real property in accordance with the Company's business and purpose, the Board of Directors, in its sole and absolute discretion, may pursue the purchase of real estate in such markets. The Board of Directors will have complete discretion in the types of residential properties purchased by AHIT. Consequently, shareholders will be dependent upon the ability of the Board of Directors to select residential properties that have the most potential to generate potential profits and can be readily marketed and sold.

Selection Criteria and Methodology for Properties

The Company intends to use a specific methodology when analyzing each property. This methodology is described in the paragraphs that follow. However, these steps are subject to change and refinement by the Board of Directors as warranted by market conditions and other considerations, all in the Board of Directors' sole discretion. The Board of Directors will create a list of potential residential properties is created. Often this list is based on actual homes being auctioned. The homes are then compared under the following factors:

A. Potential fair market value and sales price, keeping in mind that:

i. Each market has a target sales price; and

ii. The potential sales price is determined by looking at a comparative market analysis detailing:

a. Homes for sale in the subject area; and

b. Homes sold in the subject area.

B. Potential acquisition price, keeping in mind that:

i. Each property is physically inspected and necessary repairs are estimated; and

ii. The acquisition price is based on the potential sales price plus expected costs associated with the property.

Qualified properties, as determined by the Board of Directors in its sole and absolute discretion, will then be evaluated and assessed based on the following:

A. Determining if the house has had any reports of meth use. If the home has such a history, it is automatically rejected.

B. Performing a lien search to determine what, if any, liens are associated with the property.

If after evaluating a property under the foregoing, the Board of Directors determines that a property is qualified to be acquired, the property is then subjected to a physical inspection by a third party vendor making, at a minimum, an external inspection of the property. Among the matters which will be considered in conducting the physical inspection are:

A. Is the property occupied? If the property is occupied, an agreement between AHIT and the current tenant must be reached as to vacating the property and other pertinent considerations in order to continue further with such property.

B. What is the condition of the property?

C. Are there any major structural concerns with the property? Major structural concerns are automatic cause for rejection of a property.

D. Does the property have curb appeal? If a property does not have curb appeal, what would it take to make the property have curb appeal?

E. Is the floor plan desirable and functional?

F. The extent of any water damage, costs associated with cosmetic enhancements which may be necessary, and other similar factors.

Once the property is acquired, then a detailed plan of action will be put into place regarding the improvement and sale of the property. These project management plans include timelines, order of events and inspections of repairs. All federal and local building codes will be followed. In addition, building permits will be obtained whenever required.

Selection Criteria and Methodology for Tenants

Each potential tenant will be evaluated on a case-by-case basis by the Board of Directors. Regardless, at a minimum, all tenants will be subject to credit and criminal background checks. Tenants will be chosen based on their ability to pay rent and a clear background check.

Management of Properties

At this time, it is anticipated that all rental properties will be managed by CORE Performance Realty, LLC and Performance Realty Management.

FHA Rules and Considerations

Since most residential properties the Company anticipates re-selling in the retail arena involve Federal Housing Administration ("FHA") loans, the Company intends to make all repairs in accordance with FHA standards. FHA has shifted from its historical emphasis on the repair of minor property deficiencies and now only requires repairs for those conditions that rise above the level of cosmetic defects or normal wear and tear, and do not affect the safety of the occupants or the security or soundness of the property.

Accordingly, the Company will focus on repairs that include, but are not limited to, paint, carpet, flooring, windows, roof, decking, furnace, hot water heater, electric, plumbing, etc. The Company believes that focusing on the foregoing repairs, as necessary, will enhance the likelihood that the renovated property can be resold using an FHA loan which, in the current environment of restricted access to credit, works well for first time buyers because it allows individuals to finance up to 97% of the home loan and helps to keep down payments and closing costs at a minimum.

Liquidity and Capital Resources

The Company intends on seeking additional financing, which might result in the dilution of your common stock. In addition, although not anticipated at this time, the Company may leverage all or a portion of its assets to obtain debt financing. Such debt financing could be obtained in connection with a single property or for the Company as a whole.

Competition

The Company faces competition from many entities engaged in real estate investment activities, including individuals, other real estate investment companies including newly formed REITs, and real estate limited partnerships. Our competitors may enjoy significant competitive advantages that result from, among other things, having substantially more available capital, a lower cost of capital and enhanced operating efficiencies. Further, the market for the rental of properties is highly competitive. We also face competition from new home builders, investors and speculators, as well as homeowners renting their properties.

Employees

As of June 30, 2015, the Company employed a total of four people. The Company considers its relationship with its employees to be stable, and anticipates growing its workforce.

Facilities and Logistics

The Company's offices are located at 34225 North 27th Drive, Building 5, Suite 238 in Phoenix, Arizona 85085. The Company is in the process of applying as a foreign business entity in the State of Arizona.

Item 1A. RISK FACTORS

An investment in our common stock is highly speculative in nature, involves a high degree of risk, and is suitable only for persons who can afford to risk the loss of the entire amount invested. Before purchasing any of these securities, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the eventual trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to our Business

Although we consider ourselves an operating company following the acquisitions identified herein, we have no operating history, so it will be difficult for potential investors to judge our prospects for success.

We have a limited operating history based solely on the financial history of American Realty through the reverse merger disclosed herein from which to evaluate our business and prospects. We have earned little to no revenue since inception. There can be no assurance that our future proposed operations will be implemented successfully or that we will ever have profits. If we are unable to sustain our operations, investors may lose their entire investment.

The Company plans to increase significantly its expenditures on sales and marketing, technology and infrastructure, expand administrative resources to support the enlarged organization, maintain brand identity, broaden its customer support capabilities, and pursue strategic alliances. To the extent that revenues do not grow at anticipated rates or that increases in such operating expenses precede or are not subsequently followed by commensurate increases in revenues, the Company's business, results of operations and financial condition will be materially and adversely affected. There can be no assurance that the Company will achieve or sustain the substantial revenue growth needed in order to reach profitability.

We may experience potential fluctuations in results.

The Company's operating results may fluctuate significantly in the future as a result of a variety of factors, some of which are outside of the Company's control. These factors include: general economic conditions, specific economic conditions in the transportation industry, demand for transportation products/services, usage and growth of transportation products/services, seasonal sales trends, budget cycles of individual customers, the mix of products or services sold by the Company or the Company's competitors, lengthy sales cycles for Company's products or services, changes in costs of expenses or capital expenditures relating to the Company's expansion of operations, the introduction of new products or services by the Company or its competitors, change in the sales mix, distribution channels or pricing for the Company's products or services. In the future, strategic partners may require payments or other consideration in exchange for providing access to the Company's products or services. As a strategic response to a changing competitive environment, the Company may elect from time to time to make certain pricing, service or marketing decisions or acquisitions that could have a material adverse effect on its results.

The company's auditor has substantial doubts as to the Company's ability to continue as a going concern.

Our auditor's report on our 2014 and 2013 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. The Company has suffered recurring losses and generated negative cash flows from operations. These raise substantial doubt about our ability to continue as a going concern. The accompanying audited financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this uncertainty.

Because the Company has been issued an opinion by its auditors that substantial doubt exists as to whether the company can continue as a going concern, it may be more difficult for the company to attract investors. Our future is dependent upon our ability to obtain financing to continue operations and attain profitable operations. We will seek additional funds through private placements of our common stock. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence.

If we complete a financing through the sale of additional shares of our common stock in the future, then shareholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that, if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

As of the date of this filing, we have earned revenue. However, we cannot guarantee we will be successful in continuing to generate revenue or be successful in raising funds through the sale of shares to pay for the Company's business plan and expenditures. Failure to generate revenue or to raise funds could cause us to go out of business, which would result in the complete loss of your investment.

Because we do not have an audit committee, shareholders will have to rely on the directors, who are not independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. The board of directors as a whole performs these functions. The members of the Board of Directors are not independent. Thus, there is a potential conflict in that the board members are also engaged in management and participates in decisions concerning management compensation and audit issues that may affect management performance.

We have not developed independent corporate governance.

We do not presently have audit, compensation, or nominating committees. This lack of independent controls over our corporate affairs may result in conflicts of interest between our officers, directors and our stockholders. We presently have no policy to resolve such conflicts. As a result, our directors have the ability to, among other things, determine their own level of compensation. Until we comply with such corporate governance measures to form audit and other board committees in a manner consistent with rules of a national securities exchange, there is no assurance that we will not be subject to any conflicts of interest. As a result, potential investors may be reluctant to provide us with funds necessary to expand our operations.

The requirements of being a public company may strain our resources and distract our management, which could make it difficult to manage our business, particularly after we are no longer an "emerging growth company."

We are required to comply with various regulatory and reporting requirements, including those required by the SEC. Complying with these reporting and other regulatory requirements are time-consuming and expensive and could have a negative effect on our business, results of operations and financial condition.

As a public company, we are subject to the reporting requirements of the Exchange Act, and requirements of the Sarbanes-Oxley Act of 2002 ("SOX"). The cost of complying with these requirements may place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. SOX require that we maintain effective disclosure controls and procedures and internal controls over financial reporting. To maintain and improve the effectiveness of our disclosure controls and procedures, we must commit significant resources, may be required to hire additional staff and need to continue to provide effective management oversight. We will be implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. Sustaining our growth also will require us to commit additional management, operational and financial resources to identify new professionals to join the Company and to maintain appropriate operational and financial systems to adequately support expansion. These activities may divert management's attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We cannot predict or estimate the amount of additional costs we may incur as a result of becoming a public company or the timing of such costs.

We will be obligated to develop and maintain proper and effective internal controls over financial reporting.

We may not complete our analysis of our internal controls over financial reporting in a timely manner, or these internal controls may have one or more material weaknesses, which may adversely affect investor confidence in our company and, as a result, the value of our common stock.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that will need to be evaluated frequently. Section 404 of the Sarbanes-Oxley Act requires public companies to conduct an annual review and evaluation of their internal controls and attestations of the effectiveness of internal controls by independent auditors. We will be required to perform the annual review and evaluation of our internal controls no later than for the fiscal year ending January 31st on any given year. However, we initially expect to qualify as a smaller reporting company and as an emerging growth company, and thus, we would be exempt from the auditors' attestation requirement until such time as we no longer qualify as a smaller reporting company and an emerging growth company. We would no longer qualify as a smaller reporting company if the market value of our public float exceeded $75 million as of the last day of our second fiscal quarter in any fiscal year following this offering. We would no longer qualify as an emerging growth company at such time as described in the risk factor immediately below.

We are in the early stages of the costly and challenging process of compiling the system and processing documentation necessary to evaluate our internal controls needed to comply with Section 404. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to assert that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our common stock to decline.

We have not achieved profitable operations and continue to operate at a loss.

From incorporation to date, we have not achieved profitable operations and continue to operate at a loss. Our present business strategy is to improve cash flow by adding to our existing product line and expanding our sales and marketing efforts, including the addition of in-house sales personnel. There can be no assurance that we will ever be able to achieve profitable operations or that we will not require additional financing to fulfill our business plan.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the Exchange Act, we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. Our management team lacks significant public company experience, which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with Federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately responds to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Our profitability depends upon achieving success in our future operations through implementing our business plan, increasing sales, and expanding our customer and distribution bases, for which there can be no assurance given.

Profitability depends upon many factors, including the success of the Company's marketing program, the Company's ability to identify and obtain the rights to additional products to add to its existing product line, expansion of its distribution and customer base, maintenance or reduction of expense levels and the success of the Company's business activities. The Company anticipates that it will continue to incur operating losses in the future. The Company's ability to achieve profitable operations will also depend on its ability to develop and maintain an adequate marketing and distribution system.

There can be no assurance that the Company will be able to develop and maintain adequate marketing and distribution resources. If adequate funds are not available, the Company may be required to materially curtail or cease its operations.

We are highly dependent on our directors and executive officers.

We depend heavily on our directors and executive officers, and more specifically, Sean Zarinegar (who has also personally guaranteed the debt of our wholly-owned subsidiary, American Realty, serviced by Firstkey). We have written board or executive agreements with Sean Zarinegar with these directors and officers. The loss of services of any of these personnel could impede the achievement of the Company's objectives. There can be no assurance that the Company will be able to attract and retain qualified executive or technical personnel on acceptable terms.

Our insurance policies may be inadequate and potentially expose us to unrecoverable risks.

Any significant insurance claims would have a material adverse effect on our business, financial condition and results of operations. Insurance availability, coverage terms and pricing continue to vary with market conditions. We endeavor to obtain appropriate insurance coverage for insurable risks that we identify; however, we may fail to correctly anticipate or quantify insurable risks. Additionally, we may not be able to obtain appropriate insurance coverage, and insurers may not respond as we intend to cover insurable events that may occur. We have observed rapidly changing conditions in the insurance markets relating to nearly all areas of traditional corporate insurance. Such conditions have resulted in higher premium costs, higher policy deductibles, and lower coverage limits. For some risks, we may not have or maintain insurance coverage because of cost or availability.

We have no dividend history and have no intention to pay dividends in the foreseeable future.

We have never paid dividends on or in connection with any class of our common stock and do not intend to pay any dividends to common stockholders for the foreseeable future. Ownership of our common stock will not provide dividend income to the holder, and holders should not rely on investment in our common stock for dividend income. Any increase in the value of investment in our common stock could come only from a rise in the market price of our common stock, which is uncertain and unpredictable, and there can be no guarantee that our stock price will rise to provide any such increase.

We face competition from established as well as other emerging companies, which could divert customers to our competitors and significantly reduce our revenue and profitability.

We expect existing competitors and new entrants to the market to constantly revise and improve their business models in response to challenges from competing businesses, including ours. If these or other participants introduce changes or developments that we cannot meet in a timely or cost-effective manner, our revenue and profitability could be reduced.

In addition, consolidation among our competitors may give them increased negotiating leverage and greater marketing resources, thereby providing corresponding competitive advantages over us. Consolidation among other companies may increase competition from a small number of very prominent companies in the market place. If we are unable to compete effectively, competitors could divert our customers away from our products.

Regulations, including those contained in and issued under the Sarbanes-Oxley Act of 2002 ("SOX") and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ("Dodd-Frank"), increase the cost of doing business and may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our common stock.

We are a publicly reporting company. The current regulatory climate for publicly reporting companies, even small and emerging growth companies such as ours, may make it difficult or prohibitively expensive to attract and retain qualified officers, directors and members of board committees required to provide for our effective management in compliance with the rules and regulations which govern publicly-held companies, including, but not limited to, certifications from executive officers and requirements for financial experts on boards of directors.

The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles. For example, the enactment of the Sarbanes-Oxley Act of 2002 has resulted in the issuance of a series of new rules and regulations and the strengthening of existing rules and regulations by the SEC. Further, recent and proposed regulations under Dodd-Frank heighten the requirements for board or committee membership, particularly with respect to an individual's independence from the corporation and level of experience in finance and accounting matters. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business could be adversely affected.

If we are unable to obtain adequate insurance, our financial condition could be adversely affected in the event of uninsured or inadequately insured loss or damage. Our ability to effectively recruit and retain qualified officers and directors could also be adversely affected if we experience difficulty in obtaining adequate directors' and officers' liability insurance.

We do not have officer and director liability insurance or general liability insurance for our business. We may be unable to maintain sufficient insurance to cover liability claims made against us or against our officers and directors. If we are unable to adequately insure our business or our officers and directors, our business will be adversely affected and we may not be able to retain or recruit qualified officers and directors to manage the Company.

Limitations on director and officer liability and our indemnification of our officers and directors may discourage stockholders from bringing suit against a director.

Our Certificate of Incorporation and By-Laws provide, with certain exceptions as permitted by Maryland law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director. In addition, our Certificate of Incorporation and By-Laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by governing state law.

Our failure to manage growth effectively could harm our ability to attract and retain key personnel and adversely impact our operating results.

Our culture is important to us, and we anticipate that it will be a major contributor to our success. As we grow, however, we may have difficulty maintaining our culture or adapting it sufficiently to meet the needs of our operations. Failure to maintain our culture could negatively impact our operations and business results. Additionally, expansion increases the complexity of our business and places a significant strain on our management, operations, technical performance, financial resources and internal control over financial reporting functions.

There can be no assurance that we will be able to manage our expansion effectively. Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations, especially as we employ personnel in multiple geographic locations. We may not be able to hire, train, retain, motivate and manage required personnel, which may limit our growth, damage our reputation and negatively affect our financial performance and harm our business.

We cannot assure that our marketing and sales efforts will be successful.

Management believes that its marketing and development programs will sustain the business. Additionally, we intend to invest substantial financial resources in the marketing and sales of our business concept. We cannot assure you that our marketing and sales efforts will be successful and that we will be able to capture sufficient market share to realize our financial projections.

The Company's operating results may fluctuate significantly from period to period as a result of a variety of factors, including purchasing patterns of customers, competitive pricing, debt service and principal reduction payments, and general economic conditions. There is no assurance that the Company will be successful in marketing any of its products, or that the revenues from the sale of such products will be significant. Consequently, the Company's revenues may vary by quarter, and the Company's operating results may experience fluctuations.

We cannot assure that acceptance of products and services will be successful.

There is no assurance that customers will accept our product offer.

Risks of borrowing might adversely impact us.

If the Company incurs indebtedness, a portion of its cash flow will have to be dedicated to the payment of principal and interest on such indebtedness. Typical loan agreements also might contain restrictive covenants, which may impair the Company's operating flexibility. Such loan agreements would also provide for default under certain circumstances, such as failure to meet certain financial covenants. A default under a loan agreement could result in the loan becoming immediately due and payable and, if unpaid, a judgment in favor of such lender which would be senior to the rights of members of the Company. A judgment creditor would have the right to foreclose on any of the Company's assets resulting in a material adverse effect on the Company's business, operating results or financial condition.

Changes in or missteps in the execution of our business plan may adversely impact operations.

The Company's business plans may change significantly. Many of the Company's potential business endeavors are capital intensive and may be subject to statutory or regulatory requirements. Management believes that the Company's chosen activities and strategies are achievable in light of current economic and legal conditions with the skills, background, and knowledge of the Company's principals and advisors. Management reserves the right to make significant modifications to the Company's stated strategies depending on future events.

There can be no assurances that secrecy obligations will be honored.

In certain cases, the Company may rely on trade secrets to protect intellectual property, proprietary technology and processes, which the Company has acquired, developed or may develop in the future. There can be no assurances that secrecy obligations will be honored or that others will not independently develop similar or superior products or technology.

Substantial funds are required in the future to implement our plans.

We may require substantial additional funds in the future to finance our product development and commercialization plans. Our product development schedule could be delayed if we are unable to fund our research and development activities.

Changes in laws or regulations may adversely impact our business.

National, regional and local governments may enact laws that we may be subject to that may adversely impact our operations. In particular, we will be required to comply with certain SEC, state and other legal requirements. Compliance with, and monitoring of, applicable laws and regulations may be difficult, time consuming and costly. Those laws and regulations and their interpretation and application may also change from time to time and those changes could have a material adverse effect on our business, investments and results of operations. In addition, a failure to comply with applicable laws or regulations, as interpreted and applied could have a material adverse effect on our business and results of operations.

A downturn in general economic conditions could cause adverse consequences for the Company operations.

The financial success of the Company may be sensitive to adverse changes in general economic conditions in the United States, and any States in which we do business, such as recession, inflation, unemployment, and interest rates. Such changing conditions could reduce demand in the marketplace for the Company's services and products. Management believes that the impending growth of the market, mainstream market acceptance and the targeted product line of the Company will insulate the Company from excessive reduced demand. Nevertheless, the Company has no control over these changes.

We have not obtained an opinion of counsel as to the tax treatment of certain material federal tax issues potentially affecting the Company, the management, and/or the shareholders.

Moreover, any such opinion, if we obtained one, would not be binding upon the IRS, and the IRS could challenge our position on such issues. Also, rulings on such a challenge by the IRS, if made, could have a negative effect on the tax results of ownership of the Company's securities.

Tax laws are subject to change and these changes could adversely impact our business.

Tax laws are continually being introduced, changed, or amended, and there is no assurance that the tax treatment presently potentially available with respect to the Company's proposed activities will not be modified in the future by legislative, judicial, or administrative action. Congress could enact proposals or laws having an adverse tax impact on our activities and these proposals could be adopted by at any time, and such proposals could have a severe economic impact on us.

Risks Related to Ownership of Our Common Stock

We are subject to the reporting requirements of federal securities laws, which can be expensive.

We are a public reporting company and, accordingly, are subject to the information and reporting requirements of the Exchange Act and other federal securities laws. The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC and furnishing audited reports to stockholders will cause our expenses to be higher than they would be if we remained a privately held company.

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls may be time consuming, difficult and costly.

The Company's Chairman of the Board and two current directors do not have recent experience in management of a publicly reporting company. It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by Sarbanes-Oxley. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with Sarbanes-Oxley's internal controls requirements, we may not be able to obtain the independent accountant certifications that Sarbanes-Oxley Act requires publicly traded companies to obtain.

There is no public market for our securities and an active trading market may not develop.

We cannot predict the extent to which investor interest will lead to the development of an active trading market on the OTC Bulletin Board or otherwise or how liquid that market might become. An active public market for our common stock may not develop or be sustained after the offering. If an active public market does not develop or is not sustained, it may be difficult for our current shareholders to sell their shares of common stock at a price that is attractive to them, or at all. Once our shares begin trading, the market price for our common stock is likely to be volatile, in part because our shares have not been traded publicly.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about our business or us. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of our company, the trading price for our common stock would be negatively impacted. If we obtain securities or industry analyst coverage and if one or more of the analysts who cover us downgrades our common stock or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts cease coverage or fail to publish reports on us regularly, demand for our common stock could decrease, which could cause our stock price and trading volume to decline.

Our common stock is subject to risks arising from restrictions on reliance on Rule 144 by shell companies or former shell companies.