Attached files

| file | filename |

|---|---|

| 8-K - REMARK HOLDINGS, INC. | form8k09196003_09242015.htm |

| EX-4.1 - REMARK HOLDINGS, INC. | ex41to8k09196003_09242015.htm |

| EX-10.4 - REMARK HOLDINGS, INC. | ex104to8k09196003_09242015.htm |

| EX-10.1 - REMARK HOLDINGS, INC. | ex101to8k09196003_09242015.htm |

| EX-10.3 - REMARK HOLDINGS, INC. | ex103to8k09196003_09242015.htm |

| EX-10.2 - REMARK HOLDINGS, INC. | ex102to8k09196003_09242015.htm |

| EX-99.1 - REMARK HOLDINGS, INC. | ex991to8k09196003_09242015.htm |

| EX-10.5 - REMARK HOLDINGS, INC. | ex105to8k09196003_09242015.htm |

Exhibit 4.2

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL SELECTED BY THE HOLDER, REASONABLY SATISFACTORY TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

REMARK MEDIA, INC.

WARRANT TO PURCHASE COMMON STOCK

September 24, 2015 (the "Issuance Date")

FOR VALUE RECEIVED, REMARK MEDIA, INC., a Delaware corporation (the “Company”), hereby certifies that, subject to the terms and conditions hereof ____________ (the “Holder”), its designees or permitted assigns, is entitled to purchase from the Company [SHARES] ([SHARE NUMBER]) fully paid and nonassessable shares (as adjusted pursuant to the terms hereof, the “Warrant Shares”) of the Company’s common stock, $0.001 par value per share (the “Common Stock”), at a price per Warrant Share of $9.00 (the “Warrant Price”), payable in accordance with Section 1(c) hereof.

This Warrant is issued by the Company in connection with that certain Subscription Agreement, dated as of September 24, 2015 (the “Subscription Date”) (together with the schedules and exhibits thereto, the “Purchase Agreement”), by and among the Company and the subscribers listed on the signature page thereto (the “Subscribers”), pursuant to which the Company has agreed to issue to the Subscribers warrants in order to induce the Subscribers to enter into that certain Financing Agreement, dated as of the Subscription Date, by and among the Company and certain of its subsidiaries, as borrowers, certain subsidiaries of the Company, as guarantors, the lenders from time to time party thereto, and MGG Investment Group LP (“MGG”), as administrative agent for the lenders thereunder, and as collateral agent for the lenders thereunder (as amended, amended and restated, supplemented or otherwise modified from time to time, the “Financing Agreement”). Except as otherwise specified herein, capitalized terms in this Warrant shall have the meanings set forth in the Subscription Agreement.

This Warrant is issued subject to the following terms and conditions:

1. Term and Exercise of Warrants; Issuance of Warrant Shares.

(a) The Holder may exercise this Warrant at any time or from time to time, for all or any part of the Warrant Shares (but not for a fraction of a share) that may be purchased hereunder, as that number may be adjusted pursuant to Section 3 below, prior to 5:00 p.m. Eastern Time on September 24, 2020 (the “Expiration Date”). The Company agrees that the Warrant Shares purchased under this Warrant shall be and are deemed to be issued to the Holder as the record owner of such Warrant Shares as of the close of business on the date on which this Warrant shall have been surrendered, properly endorsed, the completed and executed Form of Subscription in the form attached hereto delivered, and payment made for such Warrant Shares made in accordance with Section 1(c) below, or the date on which the Company Option Notice is delivered in accordance with Section 1(d) below (each, a “Date of Exercise”). The Company shall as soon as practicable after the rights represented by this Warrant have been so exercised, but in any event not later than three (3) Trading Days following the Date of Exercise (except as provided in Section 1(d) below) (X) provided that the Company’s transfer agent is participating in The Depository Trust Company (“DTC”) Fast Automated Securities Transfer Program and the Warrant Shares are subject to an effective resale registration statement in favor of the Holder or at a time when Rule 144 would be available for immediate resale of the Warrant Shares by the Holder, credit such aggregate number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the Holder’s or its designee’s balance account with DTC through its Deposit / Withdrawal At Custodian system, or (Y) if the Company’s transfer agent is not participating in the DTC Fast Automated Securities Transfer Program or if the Warrant Shares are not subject to an effective resale registration statement in favor of the Holder or at a time when Rule 144 would not be exercisable for immediate resale of the Warrant Shares by the Holder, issue and dispatch by overnight courier to the address as specified in the Form of Subscription, at the Company’s expense, certificates for the Warrant Shares so purchased, in each case, together with any other securities or property to which the Holder is entitled upon such exercise. In case the Company delivers a stock certificate to the Holder upon exercise of this Warrant pursuant to the immediately preceding sentence, each stock certificate so delivered shall be registered in the name of the Holder and issued with legends in substantially the form placed on the front of this Warrant. The Company shall be responsible for all fees and expenses of its transfer agent and all fees and expenses with respect to the issuance of Warrant Shares via DTC, if any. In case of a purchase of less than all the Warrant Shares that may be purchased under this Warrant, the Company shall cancel this Warrant and execute and deliver to the Holder within a reasonable time a new Warrant or Warrants of like tenor for the balance of the Warrant Shares purchasable under this Warrant.

(b) The Company’s obligations to issue and deliver Warrant Shares in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by the Holder to enforce the same. Nothing herein shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver Warrant Shares upon exercise of this Warrant as required pursuant to the terms hereof.

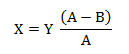

(c) The Holder shall pay the Warrant Price by instructing the Company to issue Warrant Shares then issuable upon exercise of all or any part of this Warrant on a net basis only, such that, without payment of any cash consideration or other immediately available funds, the Holder shall surrender this Warrant in exchange for the number of Warrant Shares as is computed using the following formula:

|

|

Where

|

|

|

X = the number of Warrant Shares to be issued to the Holder;

|

|

|

Y = the total number of Warrant Shares for which the Holder has elected to exercise this Warrant pursuant to Section 1(a);

|

|

|

A = the Fair Market Value (as defined below) of one Warrant Share as of the applicable Date of Exercise; and

|

|

|

B = the Warrant Price.

|

For purposes of this Warrant, “Fair Market Value” means (a) the closing price of the Common Stock on the applicable date reported on The Nasdaq Stock Market LLC or such other principal national securities exchange in the United States on which it is then listed, or, if such date is not a Trading Day, the last prior day on which the Common Stock was so traded; (b) if the Common Stock is not so listed, the mean between the highest bid and lowest asked prices per share of the Common Stock reported on the OTC Bulletin Board, the Pink OTC Markets or similar quotation system or association on the applicable date; or (c) if such bid and asked prices are not available, such value determined by the Company’s Board of Directors (the “Board”) in good faith.

(d) If at any time following the date hereof the closing price of the Common Stock is greater than or equal to $14.00 (to be adjusted in the event of any split, subdivision or combination of the Common Stock, or any similar corporate event, occurring after the Subscription Date in order to prevent dilution or enlargement of the Holder’s rights), the Company shall have the right to exercise of all or any portion of this Warrant in accordance with Section 1(a) hereof in its sole discretion (the “Company Option”). The Company Option shall be deemed exercised upon delivery to the Holder of a written notice specifying the number of Warrant Shares with respect to which this Warrant is being exercised and confirming that such Warrant Shares shall be listed on an Eligible Market and be eligible for immediate resale by the Holder pursuant to an effective registration statement or pursuant to Rule 144 without any restriction or limitation and without the Company’s requirement to be in compliance with Rule 144(c)(1) (the “Company Option Notice”). The exercise of a Company Option shall be irrevocable and shall be deemed effective at the close of business on the date on which the Company Option Notice is delivered. The Holder agrees to deliver the original signed copy of this Warrant to the Company promptly after delivery of the Company Option Notice, after which the Company shall (X) provided that the Company’s transfer agent is participating in the DTC Fast Automated Securities Transfer Program and the Warrant Shares are subject to an effective resale registration statement in favor of the Holder or at a time when Rule 144 would be available for immediate resale of the Warrant Shares by the Holder, credit such aggregate number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the Holder’s or its designee’s balance account with DTC through its Deposit / Withdrawal At Custodian system, or (Y) if the Company’s transfer agent is not participating in the DTC Fast Automated Securities Transfer Program or if the Warrant Shares are not subject to an effective resale registration statement in favor of the Holder or at a time when Rule 144 would not be exercisable for immediate resale of the Warrant Shares by the Holder, issue and dispatch by overnight courier to the address as specified in the Form of Subscription, at the Company’s expense, certificates for the Warrant Shares so purchased, in each case, together with any other securities or property to which the Holder is entitled upon such exercise, at the Company’s expense as soon as practicable, but in any event not later than three (3) Trading Days after the exercise of the Company Option. The Company shall be responsible for all fees and expenses of its transfer agent and all fees and expenses with respect to the issuance of Warrant Shares via DTC, if any. If the Company elects to exercise a Company Option pursuant to this Section 1(d), then it must simultaneously take the same action with the same proportion with respect to the other Warrants.

2. Shares to be Fully Paid; Reservation of Shares. The Company covenants and agrees that all Warrant Shares, will, upon issuance and payment of the Warrant Price in accordance with Section 1(c), be duly authorized, validly issued, fully paid and nonassessable, and free of all preemptive rights, liens and encumbrances. The Company shall at all times reserve and keep available out of its authorized and unissued Common Stock, solely for the purpose of providing for the exercise of the rights to purchase all Warrant Shares granted pursuant to this Warrant, 130% of such number of shares of Common Stock as shall, from time to time, be sufficient therefor.

3. Adjustment of Warrant Price and Number of Shares. The Warrant Price and the total number of Warrant Shares shall be subject to adjustment from time to time upon the occurrence of certain events described in this Section 3.

(a) Merger, Sale of Assets, Etc. If at any time while this Warrant, or any portion hereof, is outstanding and unexpired there shall be directly or indirectly, including through Subsidiaries, Affiliates or otherwise, in one or more related transactions (i) a reorganization, recapitalization or reclassification of the Common Stock, (ii) consolidation or merger of the Company with or into (whether or not the Company is the surviving corporation) another Person or Persons, if the holders of the Voting Stock of the Company immediately prior to such consolidation or merger shall hold or have the right to direct the voting of less than 50% of the Voting Stock of such other surviving Person immediately following such transaction, (iii) a sale, transfer or other disposition of the Company’s properties and assets as, or substantially as, an entirety to any other Person, (iv) a Person makes a purchase, tender or exchange offer that is accepted by the holders of more than the 50% of the outstanding shares of Voting Stock of the Company or (v) consummation of a stock purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) by the Company with another Person whereby such other Person acquires more than the 50% of the outstanding shares of Voting Stock of the Company (each, a “Fundamental Transaction”), then, as a part of such Fundamental Transaction, lawful provision shall be made so that the Successor Entity shall assume in writing all of the obligations of the Company under this Warrant and the other Transaction Documents in accordance with the provisions of this Section 3(a) pursuant to written agreements in form and substance reasonably satisfactory to the Required Holders prior to such Fundamental Transaction, including agreements to deliver to the Holder in exchange for this Warrant a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this Warrant, including, without limitation, an adjusted exercise price equal to the value for the shares of Common Stock reflected by the terms of such Fundamental Transaction, and exercisable for a corresponding number of shares of capital stock equivalent to the shares of Common Stock acquirable and receivable upon exercise of this Warrant (without regard to any limitations on the exercise of this Warrant) prior to such Fundamental Transaction, and reasonably satisfactory to the Required Holders. Upon the occurrence of any Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Warrant referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Warrant with the same effect as if such Successor Entity had been named as the Company herein. As a part of such Fundamental Transaction, lawful provision shall also be made so that the Holder of this Warrant shall thereafter be entitled to receive upon exercise of this Warrant, during the period specified herein and upon payment of the Warrant Price pursuant to Section 1(c), the number of shares of stock or other securities or property of the successor corporation resulting from such Fundamental Transaction that a holder of the Warrant Shares deliverable upon exercise of this Warrant would have been entitled to receive in such Fundamental Transaction if this Warrant had been exercised immediately before such Fundamental Transaction, all subject to further adjustment as provided in this Section 3. If the per share consideration payable to the Holder for securities in connection with any such Fundamental Transaction is in a form other than cash or marketable securities, then the value of such consideration shall be determined in good faith by the Board. In all events, appropriate adjustment (as determined in good faith by the Board) shall be made in the application of the provisions of this Warrant with respect to the rights and interests of the Holder after such Fundamental Transaction, to the end that the provisions of this Warrant shall be applicable after that Fundamental Transaction, as near as reasonably may be, in relation to any shares or other property deliverable after that Fundamental Transaction upon exercise of this Warrant. As used herein, (i) “Voting Stock” of a Person means capital stock of such Person of the class or classes pursuant to which the holders thereof have the general voting power to elect, or the general power to appoint, at least a majority of the board of directors, managers or trustees of such Person (irrespective of whether or not at the time capital stock of any other class or classes shall have or might have voting power by reason of the happening of any contingency), (ii) “Successor Entity” means the Person (or, if so elected by the Required Holders, the Parent Entity) formed by, resulting from or surviving any Fundamental Transaction or the Person (or, if so elected by the Required Holders, the Parent Entity) with which such Fundamental Transaction shall have been entered into and (iii) “Parent Entity” of a Person means an entity that, directly or indirectly, controls the applicable Person and whose common stock or equivalent equity security is quoted or listed on an Eligible Market, or, if there is more than one such Person or Parent Entity, the Person or Parent Entity with the largest public market capitalization as of the date of consummation of the Fundamental Transaction.

(b) Reclassification, Etc. If the Company, at any time while this Warrant or any portion hereof remains outstanding and unexpired, by reclassification, reorganization, recapitalization of securities or otherwise, shall change any of the securities as to which purchase rights under this Warrant exist into the same or a different number of securities of any other class or classes, this Warrant shall thereafter represent the right to acquire such number and kind of securities as would have been issuable as the result of such change with respect to the securities that were subject to the purchase rights under this Warrant immediately prior to such reclassification, reorganization or recapitalization or other change and the Warrant Price shall be appropriately adjusted, all subject to further adjustment as provided in this Section 3.

(c) Split, Subdivision or Combination of Securities. If the Company, at any time while this Warrant or any portion hereof remains outstanding and unexpired, shall split, subdivide or combine the securities as to which purchase rights under this Warrant exist, into a different number of securities of the same class, (i) the number of securities as to which purchase rights under this Warrant exist shall be proportionately increased and the Warrant Price for such securities shall be proportionately decreased in the case of a split or subdivision or (ii) the number of securities as to which purchase rights under this Warrant exist shall be proportionately decreased and the Warrant Price for such securities shall be proportionately increased in the case of a reverse split or combination.

(d) Adjustments for Dividends in Stock or Other Securities or Property. If, while this Warrant or any portion hereof remains outstanding and unexpired, the holders of the securities as to which purchase rights under this Warrant exist at the time shall have received, or, on or after the record date fixed for the determination of eligible holders, shall have become entitled to receive, without payment therefor, other or additional stock or other securities or property (other than cash) of the Company by way of dividend, then and in each case, this Warrant shall represent the right to acquire, in addition to the number of shares of the security receivable upon exercise of this Warrant, and without payment of any additional consideration therefor, the amount of such other or additional stock or other securities or property (other than cash) of the Company that such holder would hold on the date of such exercise had it been the holder of record of the security receivable upon exercise of this Warrant on the date hereof and had thereafter, during the period from the date hereof to and including the date of such exercise, retained such shares and/or all other additional stock available by it as aforesaid during such period, giving effect to all adjustments called for during such period by the provisions of this Section 3.

(e) Adjustment Upon Issuance of Shares of Common Stock. If and whenever on or after the Subscription Date, the Company issues or sells, or in accordance with this Section 3(e) is deemed to have issued or sold, any shares of Common Stock (including the issuance or sale of shares of Common Stock owned or held by or for the account of the Company, but excluding shares of Common Stock deemed to have been issued or sold by the Company in connection with any Excluded Securities) for a consideration per share (the “New Issuance Price”) less than the Applicable Price (the foregoing a “Dilutive Issuance”), then immediately after such Dilutive Issuance, the Warrant Price then in effect shall be reduced (but in no event increased) to an amount equal to the product of (A) the Warrant Price in effect immediately prior to such Dilutive Issuance and (B) the quotient determined by dividing (1) the sum of (I) the product derived by multiplying the Warrant Price in effect immediately prior to such Dilutive Issuance and the number of shares of Common Stock Deemed Outstanding immediately prior to such Dilutive Issuance plus (II) the consideration, if any, received by the Company upon such Dilutive Issuance, by (2) the product derived by multiplying (I) the Warrant Price in effect immediately prior to such Dilutive Issuance by (II) the number of shares of Common Stock Deemed Outstanding immediately after such Dilutive Issuance. Upon each such adjustment of the Warrant Price hereunder, the number of Warrant Shares shall be adjusted to the number of shares of Common Stock determined by multiplying the Warrant Price in effect immediately prior to such adjustment by the number of Warrant Shares acquirable upon exercise of this Warrant immediately prior to such adjustment and dividing the product thereof by the Warrant Price resulting from such adjustment. For purposes of determining the adjusted Warrant Price under this Section 3(e), the following shall be applicable:

(i) Issuance of Options. If the Company in any manner grants or sells any Options and the lowest price per share for which one share of Common Stock is issuable upon the exercise of any such Option or upon conversion, exercise or exchange of any Convertible Securities issuable upon exercise of any such Option is less than the Applicable Price, then such share of Common Stock shall be deemed to be outstanding and to have been issued and sold by the Company at the time of the granting or sale of such Option for such price per share. For purposes of this Section 3(e)(i), the “lowest price per share for which one share of Common Stock is issuable upon the exercise of any such Options or upon conversion, exercise or exchange of any Convertible Securities issuable upon exercise of any such Option” shall be equal to the sum of the lowest amounts of consideration (if any) received or receivable by the Company with respect to any one share of Common Stock upon the granting or sale of the Option, upon exercise of the Option and upon conversion, exercise or exchange of any Convertible Security issuable upon exercise of such Option less any consideration paid or payable by the Company with respect to such one share of Common Stock upon the granting or sale of such Option, upon exercise of such Option and upon conversion exercise or exchange of any Convertible Security issuable upon exercise of such Option. No further adjustment of number of the Warrant Price or Warrant Shares shall be made upon the actual issuance of such shares of Common Stock or of such Convertible Securities upon the exercise of such Options or upon the actual issuance of such shares of Common Stock upon conversion, exercise or exchange of such Convertible Securities.

(ii) Issuance of Convertible Securities. If the Company in any manner issues or sells any Convertible Securities and the lowest price per share for which one share of Common Stock is issuable upon the conversion, exercise or exchange thereof is less than the Applicable Price, then such share of Common Stock shall be deemed to be outstanding and to have been issued and sold by the Company at the time of the issuance or sale of such Convertible Securities for such price per share. For the purposes of this Section 3(e)(ii), the “lowest price per share for which one share of Common Stock is issuable upon the conversion, exercise or exchange thereof” shall be equal to the sum of the lowest amounts of consideration (if any) received or receivable by the Company with respect to any one share of Common Stock upon the issuance or sale of the Convertible Security and upon conversion, exercise or exchange of such Convertible Security less any consideration paid or payable by the Company with respect to such one share of Common Stock upon the issuance or sale of such Convertible Security and upon conversion, exercise or exchange of such Convertible Security. No further adjustment of the Warrant Price or number of Warrant Shares shall be made upon the actual issuance of such shares of Common Stock upon conversion, exercise or exchange of such Convertible Securities, and if any such issue or sale of such Convertible Securities is made upon exercise of any Options for which adjustment of this Warrant has been or is to be made pursuant to other provisions of this Section 3(e), no further adjustment of the Warrant Price or number of Warrant Shares shall be made by reason of such issue or sale.

(iii) Change in Option Price or Rate of Conversion. If the purchase price provided for in any Options, the additional consideration, if any, payable upon the issue, conversion, exercise or exchange of any Convertible Securities, or the rate at which any Convertible Securities are convertible into or exercisable or exchangeable for shares of Common Stock increases or decreases at any time, the Warrant Price and the number of Warrant Shares in effect at the time of such increase or decrease shall be adjusted to the Warrant Price and the number of Warrant Shares, which would have been in effect at such time had such Options or Convertible Securities provided for such increased or decreased purchase price, additional consideration or increased or decreased conversion rate, as the case may be, at the time initially granted, issued or sold. For purposes of this Section 3(e)(iii), if the terms of any Option or Convertible Security that was outstanding as of the Subscription Date are increased or decreased in the manner described in the immediately preceding sentence, then such Option or Convertible Security and the shares of Common Stock deemed issuable upon exercise, conversion or exchange thereof shall be deemed to have been issued as of the date of such increase or decrease. No adjustment pursuant to this Section 3(e) shall be made if such adjustment would result in an increase of the Warrant Price then in effect or a decrease in the number of Warrant Shares.

(iv) Calculation of Consideration Received. In case any Option is issued in connection with the issue or sale of other securities of the Company, together comprising one integrated transaction, (x) the Options will be deemed to have been issued for the fair value of such portion of the aggregate consideration received by the Company as is attributable to such Option (the “Option Value”) and (y) the other securities issued or sold in such integrated transaction shall be deemed to have been issued or sold for the difference of (I) the aggregate consideration received by the Company less any consideration paid or payable by the Company pursuant to the terms of such other securities of the Company, less (II) the Option Value of such Options. If any shares of Common Stock, Options or Convertible Securities are issued or sold or deemed to have been issued or sold for cash, the consideration other than cash received therefor will be deemed to be the net amount received by the Company therefor. If any shares of Common Stock, Options or Convertible Securities are issued or sold for a consideration other than cash, the amount of such consideration received by the Company will be the fair value of such consideration, except where such consideration consists of publicly traded securities, in which case the amount of consideration received by the Company will be the Fair Market Value of such publicly traded securities on the date of receipt of such publicly traded securities. If any shares of Common Stock, Options or Convertible Securities are issued to the owners of the non-surviving entity in connection with any merger in which the Company is the surviving entity, the amount of consideration therefor will be deemed to be the fair value of such portion of the net assets and business of the non-surviving entity as is attributable to such shares of Common Stock, Options or Convertible Securities, as the case may be. The fair value of any consideration other than cash or publicly traded securities will be determined jointly by the Company and the Required Holders. If such parties are unable to reach agreement within ten (10) days after the occurrence of an event requiring valuation (the “Valuation Event”), the fair value of such consideration will be determined within five (5) Business Days after the tenth (10th) day following the Valuation Event by an independent, reputable appraiser jointly selected by the Company and the Required Holders. The determination of such appraiser shall be final and binding upon all parties absent manifest error and the fees and expenses of such appraiser shall be borne by the Company.

(v) Treatment of Expired or Terminated Options or Convertible Securities. Upon the expiration or termination of any unexercised Option (or portion thereof) or any unconverted or unexchanged Convertible Security (or portion thereof) for which any adjustment was made pursuant to this Section 3, the Warrant Price with respect to the unexercised portion of this Warrant that remain outstanding at the time of the expiration or termination of such unexercised Option (or portion thereof) or any unconverted or unexchanged Convertible Securities (or portion thereof) then in effect shall be adjusted to such Warrant Price that would have been in effect at the time of such expiration or termination had such unexercised Option (or portion thereof) or unconverted or unexchanged Convertible Security (or portion thereof), to the extent outstanding immediately prior to such expiration or termination, never been issued. For the avoidance of doubt, any portion of this Warrant that has been exercised after Options or Convertible Securities have been issued or sold, or are deemed issued or sold pursuant to this Section 3(e), but prior to such the time of the expiration or termination of such unexercised Option (or portion thereof) or any unconverted or unexchanged Convertible Securities (or portion thereof), the Warrant Price with respect to the portion of this Warrant that has so been exercised shall not be re-adjusted pursuant to this Section 3(e)(v).

(vi) Record Date. If the Company takes a record of the holders of shares of Common Stock for the purpose of entitling them (A) to receive a dividend or other distribution payable in shares of Common Stock, Options or in Convertible Securities or (B) to subscribe for or purchase shares of Common Stock, Options or Convertible Securities, then such record date will be deemed to be the date of the issue or sale of the shares of Common Stock deemed to have been issued or sold upon the declaration of such dividend or the making of such other distribution or the date of the granting of such right of subscription or purchase, as the case may be.

(vi) Definitions. As used herein:

(1) “Applicable Price” means (I) in the case of an Insider Issuance, the greater of (A) the lesser of (x) $6.75 (to be adjusted in the event of any split, subdivision or combination of the Common Stock, or any similar corporate event, occurring after the Subscription Date in order to prevent dilution or enlargement of the Holder’s rights) and (y) the Warrant Price in effect immediately prior to such Dilutive Issuance, or (B) the Market Price immediately prior to such Dilutive Issuance and (II) in all other cases, the lesser of (A) $6.75 (to be adjusted in the event of any split, subdivision or combination of the Common Stock, or any similar corporate event, occurring after the Subscription Date in order to prevent dilution or enlargement of the Holder’s rights) and (B) the Warrant Price in effect immediately prior to such Dilutive Issuance.

(2) “Approved Stock Plan” means any employee benefit plan, agreement or arrangement which has been approved by the Board of Directors of the Company, pursuant to which the Company’s securities may be issued to any employee, officer, director, consultant or advisor for services provided to the Company and/or its wholly-owned Subsidiaries.

(3) “Common Stock Deemed Outstanding” means, at any given time, the number of shares of Common Stock actually outstanding at such time, plus the number of shares of Common Stock deemed to be outstanding pursuant to Sections 3(e)(i) and 3(e)(ii) hereof regardless of whether the Options or Convertible Securities are actually exercisable at such time, but excluding any shares of Common Stock owned or held by or for the account of the Company or issuable upon exercise of the Warrants issued pursuant to the Subscription Agreement,

(4) “Convertible Securities” means any stock or securities (other than Options) directly or indirectly convertible into or exercisable or exchangeable for shares of Common Stock,

(5) “Excluded Securities” means any Common Stock issued or issuable or deemed issued or issuable: (i) in connection with any Approved Stock Plan, (ii) upon exercise of the Warrants; provided, that the terms of such Warrants are not amended, modified or changed on or after the Subscription Date, (iii) upon conversion, exercise or exchange of any Options or Convertible Securities which are outstanding on the day immediately preceding the Subscription Date; provided, that the terms of such Options or Convertible Securities are not amended, modified or changed on or after the Subscription Date and (iv) in connection with the Unit Purchase Agreement and the Transaction Documents as defined therein.

(6) “Insider Issuance” means the issuance or sale, or deemed issuance or sale pursuant to this Section 3(e), to an officer, director or Affiliate of the Company or to a “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act) of 10% or more of the Company’s outstanding Common Stock.

(7) “Market Price” means the arithmetic average of the volume weighted average price (“VWAP”) of the Common Stock for the ten (10) consecutive Trading Days immediately preceding the applicable Dilutive Issuance.

(8) “Options” means any rights, warrants or options to subscribe for or purchase shares of Common Stock or Convertible Securities.

(9) Other Events. If any event occurs of the type contemplated by the provisions of this Section 3 but not expressly provided for by such provisions (including, without limitation, the granting of stock appreciation rights, phantom stock rights or other rights with equity features), then the Board will make an appropriate adjustment in the Warrant Price and the number of Warrant Shares, reasonably acceptable to the Required Holders, so as to protect the rights of the Holder; provided that no such adjustment pursuant to this Section 3(f) will increase the Warrant Price or decrease the number of Warrant Shares as otherwise determined pursuant to this Section 3.

4. Holder Put Option. On the Expiration Date, the Holder shall have the right to sell all or any portion of this Warrant that then remains outstanding to the Company (the “Put Option”) by delivering a written notice (a "Put Option Notice") thereof to the Company, for an amount in cash equal to (x) the number of Warrant Shares subject to the Put Option, which number of Warrant Shares shall not exceed the number of Warrant Shares issuable upon exercise of this Warrant on the Expiration Date (without regard to any limitations on exercised), divided by (y) the total number of Warrant Shares issuable upon exercise of the Warrants (without regard to any limitation on exercises and whether any Warrant has been exercised) issued to the Subscribers on the Closing Date pursuant to the Subscription Agreement (as adjusted for any adjustments to the number of Warrant Shares issuable upon exercise of the Warrants on or prior to the Expiration Date), multiplied by (z) $3,000,000, which amount shall be payable within three (3) Business Days after the Expiration Date in cash by wire transfer of immediately available funds to one or more accounts specified by the Holder in the Holder's Put Option Notice. The exercise of the Put Option shall be irrevocable and shall be deemed effective upon the Holder’s delivery of the Put Option Notice to the Company. The Holder shall as soon as reasonably practicable following the Holder's exercise of the Put option pursuant to this Section 4 surrender this Warrant to the Company.

5. Limitation on Number of Shares Issuable. Notwithstanding anything herein to the contrary, the Company shall not issue to the Holder any Warrant Shares to the extent that the issuance of such Warrant Shares would cause the Company to exceed the aggregate number of shares of Common Stock that the Company is permitted to issue without breaching the Company’s obligations under Nasdaq Listing Rule 5635 (the “Exchange Cap”), except that such limitation shall not apply in the event that the Company obtains the approval of its stockholders as required under Nasdaq Listing Rule 5635 for issuances in excess of the Exchange Cap. For avoidance of doubt, the limitations contained in this Section 5 shall apply to any successor Holder of this Warrant.

6. No Voting or Dividend Rights. Nothing contained in this Warrant shall be construed as conferring upon the Holder the right to vote or to consent to receive notice as a stockholder of the Company on any other matters or any rights whatsoever as a stockholder of the Company. No dividends or interest shall be payable or accrued in respect of this Warrant or the interest represented hereby or the Warrant Shares purchasable hereunder until, and only to the extent that, this Warrant shall have been exercised.

7. Registration Rights Agreement. All Warrant Shares issuable upon exercise of this Warrant are and shall become subject to, and have the benefit of, the Registration Rights Agreement, subject to compliance with the terms thereof, including but not limited to Section 3.1(b) thereof.

8. Transferability. The Holder may not assign or transfer any of its rights or obligations under this Warrant except in accordance with all applicable securities laws, including but not limited to the Securities Act. To the extent permitted hereunder, this Warrant shall be deemed transferred upon surrender of this Warrant at the principal office of the Company, together with a written Form of Assignment and Assumption in the form attached hereto duly executed by the Holder or its agent or attorney and funds sufficient to pay any applicable transfer taxes. The Company agrees that it shall execute, or cause to be executed, such documents, instruments and agreements as the Holder shall reasonably deem necessary to effect the foregoing. In addition, at the request of the Holder and any Assignee (as defined below), the Company shall issue one or more new Warrants, as applicable, to any such Assignee and, if the Holder has retained any of its rights and obligations under this Warrant following such assignment, to the Holder, which new Warrants shall reflect the rights held by such Assignee and the Holder after giving effect to such assignment. Upon the execution and delivery of appropriate assignment documentation and any other documentation reasonably requested by the Company in connection with such assignment, and the payment by the Assignee of the purchase price agreed to by the Holder and such Assignee, such Assignee shall be a holder of this Warrant shall have all of the rights and obligations of the Holder hereunder to the extent that such rights and obligations have been assigned by the Holder pursuant to the assignment documentation between the Holder and such Assignee, and the Holder shall be released from any obligations it may have hereunder to a corresponding extent. Notwithstanding anything herein to the contrary, without the prior written consent of the Company, this Warrant shall only be transferred in connection with a transfer or assignment of the Term Loans (as defined in the Financing Agreement) or if at least a number of shares of Common Stock equal to twenty-five percent (25%) of the number of shares of Common Stock for which this Warrant was exercisable on the Issuance Date (or such lesser number of shares of Common Stock that then remains outstanding under this Warrant) are issuable upon exercise of the portion of the Warrant that is being transferred (where the number of shares issuable upon exercise of Warrants held by transferees that are Affiliates of each other shall be aggregated for such purpose).

9. Warrant Register. The Company shall keep and properly maintain at its principal executive offices books for the registration of this Warrant and any transfers thereof. Absent manifest error, the Company may deem and treat the holder in whose name this Warrant is registered on such register as the Holder and absolute owner hereof for all purposes, and the Company shall not be affected by any notice to the contrary, except any assignment, division, combination or other transfer of the Warrant effected in accordance with the provisions of this Warrant.

10. Notices. All notices and other communications hereunder (except payment) shall be in writing and shall be deemed given (a) when delivered personally, (b) one business day after being delivered to a nationally recognized overnight courier or (c) on the business day received (or the next business day if received after 5:00 p.m. local time or on a weekend or day on which banks are closed) when sent via facsimile (with a confirmatory copy sent by overnight courier) or electronic mail, to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

|

To the Holder:

|

|

|

With a copy (for informational purposes only) to:

|

|

|

To the Company:

|

Remark Media, Inc.

3930 Howard Hughes Parkway, Suite 400

Las Vegas, Nevada 89169

Attn: Chief Financial Officer

Email: dosrow@remarkmedia.com

|

|

With a copy (for informational purposes only) to:

|

|

|

Olshan Frome Wolosky LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

Attn: Robert H. Friedman, Esq.

Fax: (212) 451-2222

Email: rfriedman@olshanlaw.com

|

11. Governing Law. This Warrant shall be governed by and construed and enforced in accordance with, and all questions concerning the construction, validity, interpretation and performance of this Warrant shall be governed by, the internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York. The Company hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in The City of New York, Borough of Manhattan, for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. The Company hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to the Company at the address set forth in Section 6.3 of the Subscription Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Nothing contained herein shall be deemed or operate to preclude the Holder from bringing suit or taking other legal action against the Company in any other jurisdiction to collect on the Company’s obligations to the Holder, to realize on any collateral or any other security for such obligations, or to enforce a judgment or other court ruling in favor of the Holder. THE COMPANY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS WARRANT OR ANY TRANSACTION CONTEMPLATED HEREBY.

12. Lost or Stolen Warrant. Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction, or mutilation of this Warrant and, in the case of any such loss, theft or destruction, upon receipt of an indemnity reasonably satisfactory to the Company, or in the case of any such mutilation, upon surrender and cancellation of this Warrant, the Company, at its expense, will make and deliver a new Warrant, of like tenor, in lieu of the lost, stolen, destroyed or mutilated Warrant.

13. Fractional Shares. No fractional shares shall be issued upon exercise of this Warrant. The Company shall, in lieu of issuing any fractional share, pay the Holder entitled to such fraction a sum in cash equal to such fraction (calculated to the nearest 1/100th of a share) multiplied by the then effective Warrant Price on the date the Form of Subscription is received by the Company.

14. No Third-Party Beneficiaries. This Warrant is for the sole benefit of the Company and the Holder and their respective successors and, in the case of the Holder, permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other party any legal or equitable right, benefit or remedy of any nature whatsoever, under or by reason of this Warrant.

15. Entire Agreement; Amendments and Waivers. This Warrant, together with the Purchase Agreement and the Registration Rights Agreement, constitute the sole and entire agreement of the parties to this Warrant with respect to the subject matter contained herein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Warrant, the Purchase Agreement and the Registration Rights Agreement, the statements in the body of this Warrant shall control. Except as otherwise provided herein, this Warrant may only be amended, modified or supplemented by an agreement in writing signed by the Company and the Holder. No waiver by the Company or the Holder of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No waiver by any party shall operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any rights, remedy, power or privilege arising from this Warrant shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

16. Successors and Assigns. This Warrant and the rights evidenced hereby shall inure to the benefit of and be binding upon the successors of the Company and the successors and assigns of the Holder, including subsequent holders hereof (collectively, “Assignees”). The provisions of this Warrant are intended to be for the benefit of all Holders from time to time of this Warrant, and shall be enforceable by any such Holder.

17. Severability. In case any one or more of the provisions of this Warrant shall be invalid or unenforceable in any respect, the validity and enforceability of the remaining terms and provisions of this Warrant shall not in any way be affected or impaired thereby and the parties will attempt in good faith to agree upon a valid and enforceable provision which shall be a commercially reasonable substitute therefor, and upon so agreeing, shall incorporate such substitute provision in this Warrant.

18. Counterparts. This Warrant may be executed in two or more counterparts, each of which shall be deemed to be an original copy of this Warrant and all of which, when taken together, shall be deemed to constitute one and the same agreement, and photostatic, .pdf or facsimile copies of fully-executed counterparts of this Warrant shall be given the same effect as originals.

19. No Strict Construction. This Warrant shall be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument or causing any instrument to be drafted.

[Signature Page Follows]

IN WITNESS WHEREOF, the Company has caused this Warrant to be duly executed by its officer, thereunto duly authorized, as of the date first indicated above.

|

REMARK MEDIA, INC.

|

|||||

|

By:

|

|||||

|

Name:

|

Douglas Osrow

|

||||

|

Title:

|

Chief Financial Officer

|

||||

|

ACCEPTED AND AGREED:

|

|||||

|

[HOLDER]

|

|||||

|

By:

|

|||||

|

Name:

|

|||||

|

Title:

|

|||||

FORM OF SUBSCRIPTION

The undersigned, the Holder of the attached Warrant, hereby elects to exercise the purchase right represented by such Warrant for, and to purchase thereunder, ____________ Warrant Shares and such Holder directs the Company to accept payment of the Warrant Price by net exercise of the Warrant, as set forth in Section 1(c) of such Warrant.

The undersigned requests that Warrant Shares be issued and delivered to:

If the Warrant Shares are being issued in the form of a stock certificate:

|

Name:

|

|||

|

whose address is:

|

|

|

If the Warrant Shares are being issued electronically:

|

|

|

DWAC Instructions:

|

|

|

DATED:

|

|||

|

HOLDER

|

|||

|

(Signature must conform in all respects to name of the Holder as specified on the face of the Warrant)

|

|||

|

Name:

|

|

Title:

|

FORM OF ASSIGNMENT AND ASSUMPTION

FOR VALUE RECEIVED, the right to purchase _______________ Warrant Shares under the attached Warrant and all rights evidenced thereby are hereby assigned to:

|

(the “Assignee”)

|

|

whose address is:

|

|

The Assignee, by executing this Assignment and Assumption, hereby agrees to comply with all of the provisions of the Warrant, with the same force and effect as if the Assignee were originally the Holder thereunder.

|

DATED:

|

|||

|

HOLDER

|

|||

|

(Signature must conform in all respects to name of the Holder as specified on the face of the Warrant)

|

|||

|

Name:

|

|

Title:

|

|

ASSIGNEE

|

||

|

Name:

|

||

|

Title:

|