Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ELAH Holdings, Inc. | rely-8k_20150928.htm |

Deutsche bank Leveraged Finance conference September 29, 2015 Exhibit 99.1

Cautions about forward-looking statements and other notices Cautionary Statement Regarding Forward-Looking Statements. This presentation contains forward-looking statements, which are based on our current expectations, estimates and projections about Real Industry, Inc. and its subsidiaries’ (the “Company”) businesses and prospects, as well as management’s beliefs and certain assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will” and variations of these words are intended to identify forward-looking statements. Such statements speak only as of the date hereof and are subject to change. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason. These statements include, but are not limited to, statements about the Company’s long-term investment decisions, further acquisitions, potential de-leveraging and expansion and business strategies; anticipated growth opportunities; the amount of capital-raising necessary to achieve those strategies; utilization of federal net operating loss tax carryforwards; Real Alloy’s improvements to operating efficiencies and cost of sales; as well as future performance, growth, operating results, financial condition and prospects. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Accordingly, actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference include, but are not limited to the Company’s ability to successfully identify, consummate and integrate acquisitions and/or other businesses; changes in business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; the difficulty of making operating and cost improvements; the Company and its subsidiaries' ability to successfully defend against current and new litigation and indemnification matters, as well as demands by investment banks for defense, indemnity, and contribution claims; the Company’s ability to access and realize value from its federal net operating loss tax carryforwards; the Company’s ability to identify and recruit management; the Company’s ability to maintain the listing requirements of the NASDAQ; and other risks detailed from time to time in the Company’s SEC filings, including but not limited to the most recently filed Annual Report on Form 10-K and subsequent reports filed on Forms 10-Q and 8-K. Use of Non-GAAP Measures. This presentation includes references to the non-GAAP financial measures of earnings before interest, taxes, depreciation and amortization (“EBITDA”) and, with certain additional adjustments (“Adjusted EBITDA”). Management believes that the non-GAAP measures of EBITDA and Adjusted EBITDA enhance the understanding of the financial performance of the operations of Real Alloy (and prior to its acquisition, the former global recycling and specification alloys business of Aleris Corporation) by investors and lenders. As a complement to financial measures recognized under GAAP, management believes that EBITDA and Adjusted EBITDA assist investors who follow the practice of some investment analysts who adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability. Because EBITDA and Adjusted EBITDA are not measures recognized under GAAP, they are not intended to be presented herein as a substitute for earnings (loss) from continuing operations, net earnings (loss), net income attributable to Aleris or Real Alloy, or segment income, as indicators of operating performance. EBITDA and Adjusted EBITDA are primarily performance measurements used by our senior management and Board of Directors to evaluate certain operating results. Reconciliation to the GAAP equivalent of the non-GAAP measures of EBITDA and Adjusted EBITDA for Real Alloy are provided herein, in our Forms 10-Q filed with the SEC on May 12, 2015 and August 17, 2015, on our Form 8-K filed with the SEC on June 29, 2015, and in Note 4 on page S-35 of the Prospectus Supplement No. 1 dated January 29, 2015 for the rights offering as filed with the SEC.

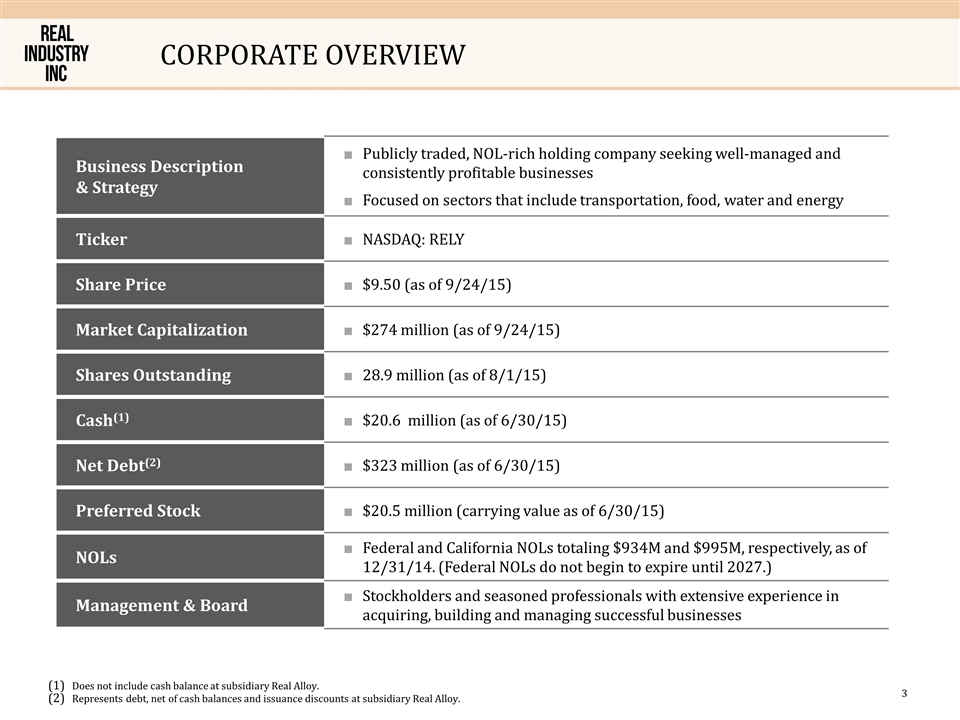

Corporate overview Business Description & Strategy Publicly traded, NOL-rich holding company seeking well-managed and consistently profitable businesses Focused on sectors that include transportation, food, water and energy Ticker NASDAQ: RELY Share Price $9.50 (as of 9/24/15) Market Capitalization $274 million (as of 9/24/15) Shares Outstanding 28.9 million (as of 8/1/15) Cash(1) $20.6 million (as of 6/30/15) Net Debt(2) $323 million (as of 6/30/15) Preferred Stock $20.5 million (carrying value as of 6/30/15) NOLs Federal and California NOLs totaling $934M and $995M, respectively, as of 12/31/14. (Federal NOLs do not begin to expire until 2027.) Management & Board Stockholders and seasoned professionals with extensive experience in acquiring, building and managing successful businesses Does not include cash balance at subsidiary Real Alloy. Represents debt, net of cash balances and issuance discounts at subsidiary Real Alloy.

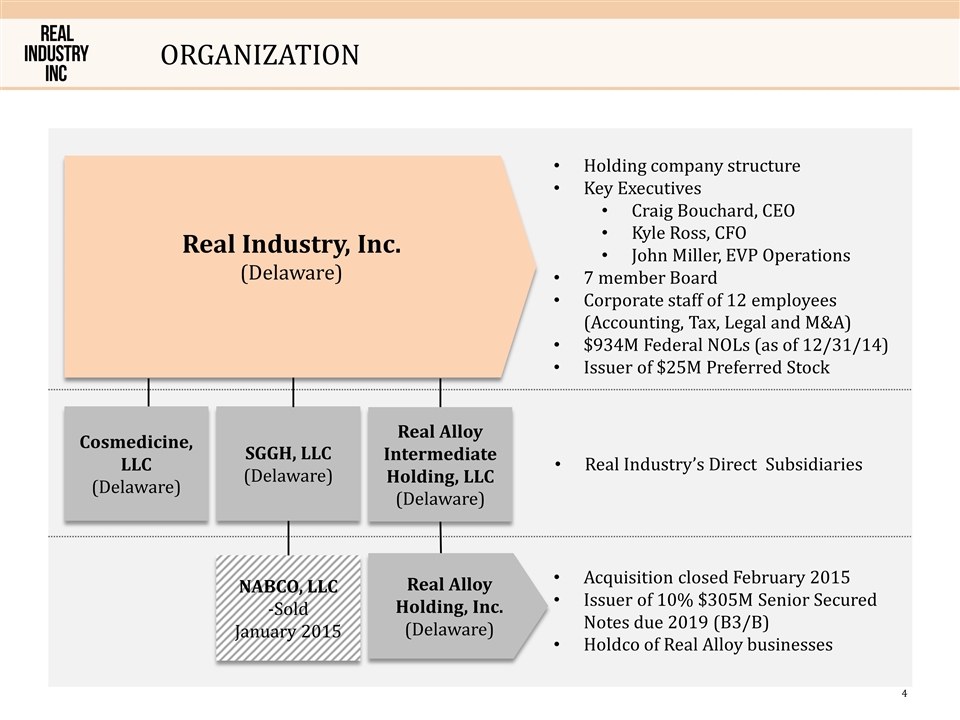

organization Real Alloy Intermediate Holding, LLC (Delaware) Real Alloy Holding, Inc. (Delaware) Real Industry, Inc. (Delaware) SGGH, LLC (Delaware) NABCO, LLC -Sold January 2015 Cosmedicine, LLC (Delaware) Holding company structure Key Executives Craig Bouchard, CEO Kyle Ross, CFO John Miller, EVP Operations 7 member Board Corporate staff of 12 employees (Accounting, Tax, Legal and M&A) $934M Federal NOLs (as of 12/31/14) Issuer of $25M Preferred Stock Real Industry’s Direct Subsidiaries Acquisition closed February 2015 Issuer of 10% $305M Senior Secured Notes due 2019 (B3/B) Holdco of Real Alloy businesses

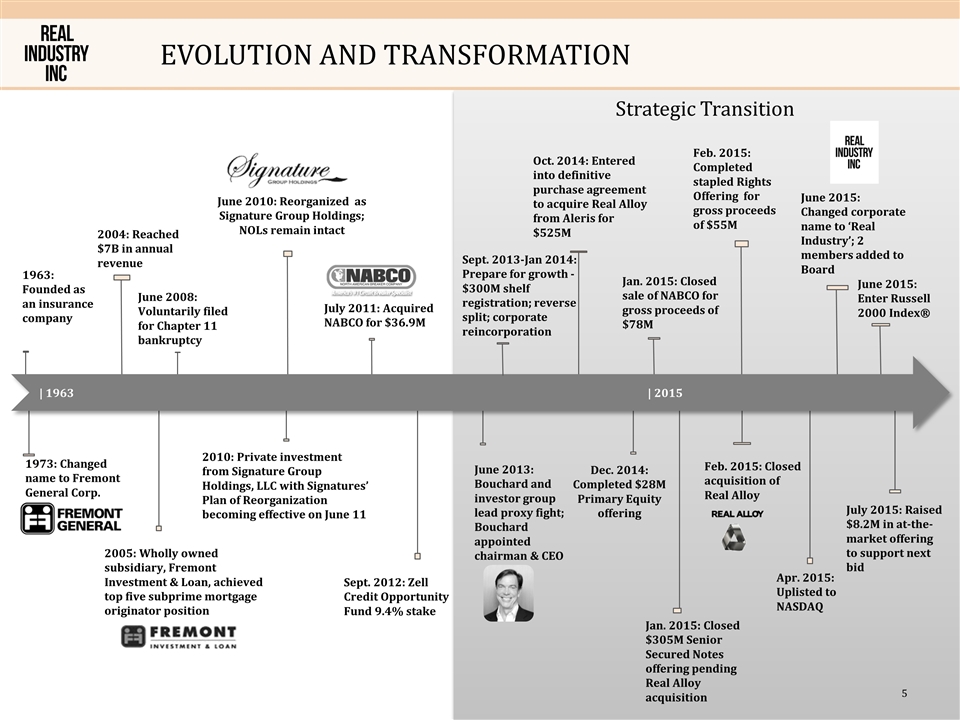

Evolution and transformation 2004: Reached $7B in annual revenue 1973: Changed name to Fremont General Corp. Strategic Transition 1963: Founded as an insurance company 2005: Wholly owned subsidiary, Fremont Investment & Loan, achieved top five subprime mortgage originator position June 2008: Voluntarily filed for Chapter 11 bankruptcy June 2010: Reorganized as Signature Group Holdings; NOLs remain intact 2010: Private investment from Signature Group Holdings, LLC with Signatures’ Plan of Reorganization becoming effective on June 11 July 2011: Acquired NABCO for $36.9M Sept. 2012: Zell Credit Opportunity Fund 9.4% stake June 2013: Bouchard and investor group lead proxy fight; Bouchard appointed chairman & CEO Oct. 2014: Entered into definitive purchase agreement to acquire Real Alloy from Aleris for $525M Dec. 2014: Completed $28M Primary Equity offering Jan. 2015: Closed sale of NABCO for gross proceeds of $78M Jan. 2015: Closed $305M Senior Secured Notes offering pending Real Alloy acquisition 2010 Feb. 2015: Completed stapled Rights Offering for gross proceeds of $55M Feb. 2015: Closed acquisition of Real Alloy June 2015: Changed corporate name to ‘Real Industry’; 2 members added to Board July 2015: Raised $8.2M in at-the-market offering to support next bid June 2015: Enter Russell 2000 Index® Apr. 2015: Uplisted to NASDAQ | 1963 | 2015 Sept. 2013-Jan 2014: Prepare for growth - $300M shelf registration; reverse split; corporate reincorporation

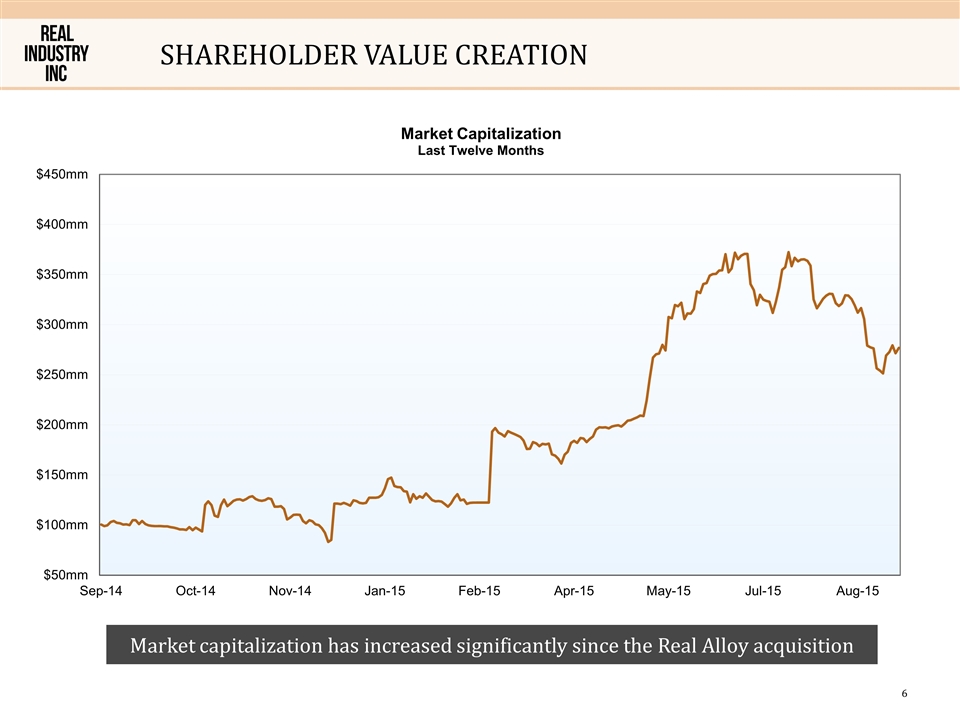

shareholder value creation Market capitalization has increased significantly since the Real Alloy acquisition

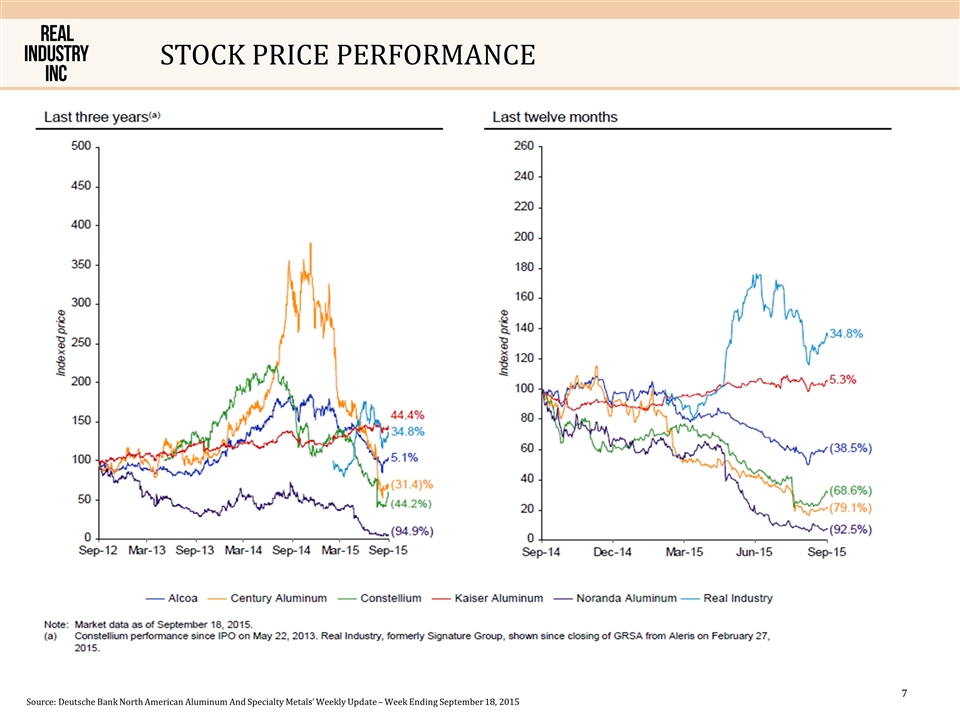

Stock Price Performance Source: Deutsche Bank North American Aluminum And Specialty Metals’ Weekly Update – Week Ending September 18, 2015

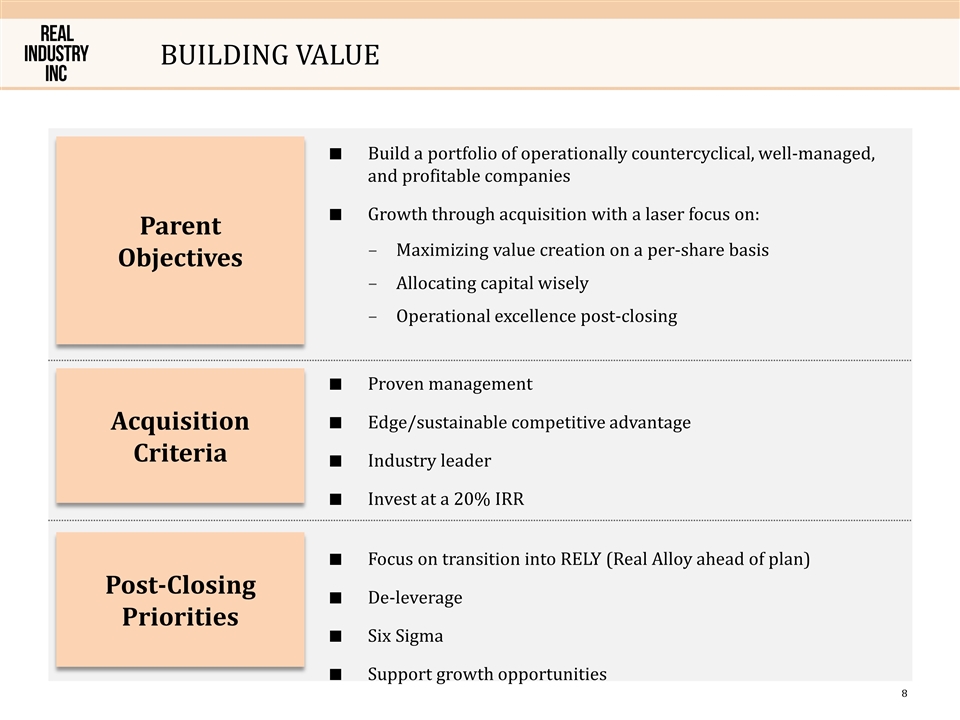

Building value Build a portfolio of operationally countercyclical, well-managed, and profitable companies Growth through acquisition with a laser focus on: Maximizing value creation on a per-share basis Allocating capital wisely Operational excellence post-closing Parent Objectives Acquisition Criteria Post-Closing Priorities Proven management Edge/sustainable competitive advantage Industry leader Invest at a 20% IRR Focus on transition into RELY (Real Alloy ahead of plan) De-leverage Six Sigma Support growth opportunities

What is next? Building the Platform: Target opportunities that generate $30-$100 million pretax income Will pursue, and was recently outbid on, businesses exceeding this range Increase operating margins and free cash flow conversion Blend countercyclical cash flows Utilize the NOL Optimize capital structure

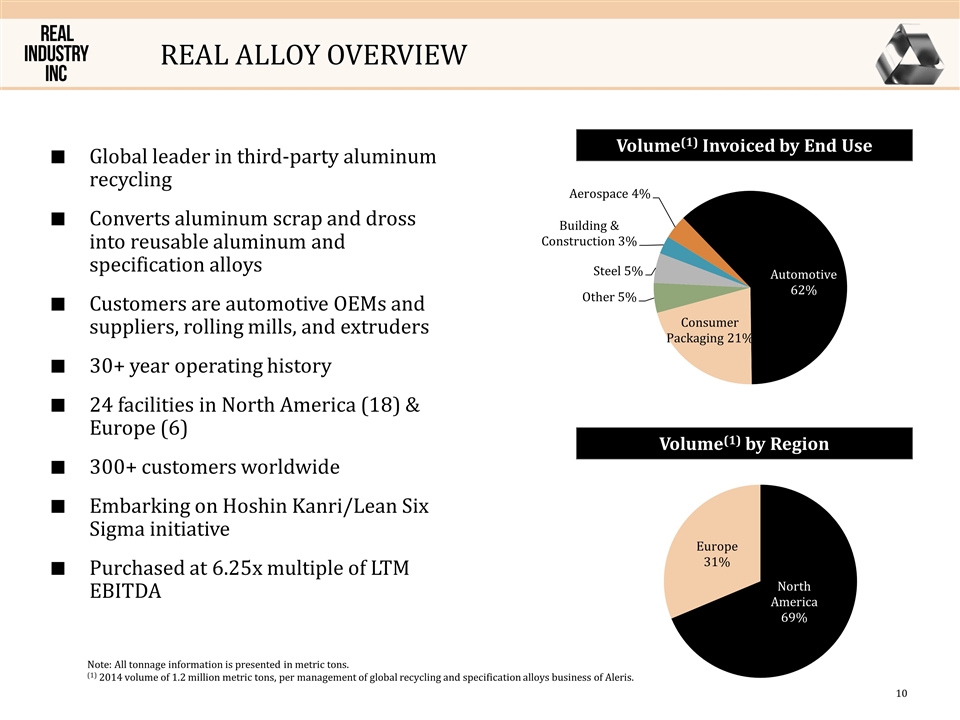

Real alloy OVERVIEW Global leader in third-party aluminum recycling Converts aluminum scrap and dross into reusable aluminum and specification alloys Customers are automotive OEMs and suppliers, rolling mills, and extruders 30+ year operating history 24 facilities in North America (18) & Europe (6) 300+ customers worldwide Embarking on Hoshin Kanri/Lean Six Sigma initiative Purchased at 6.25x multiple of LTM EBITDA Volume(1) Invoiced by End Use Volume(1) by Region Note: All tonnage information is presented in metric tons. (1) 2014 volume of 1.2 million metric tons, per management of global recycling and specification alloys business of Aleris.

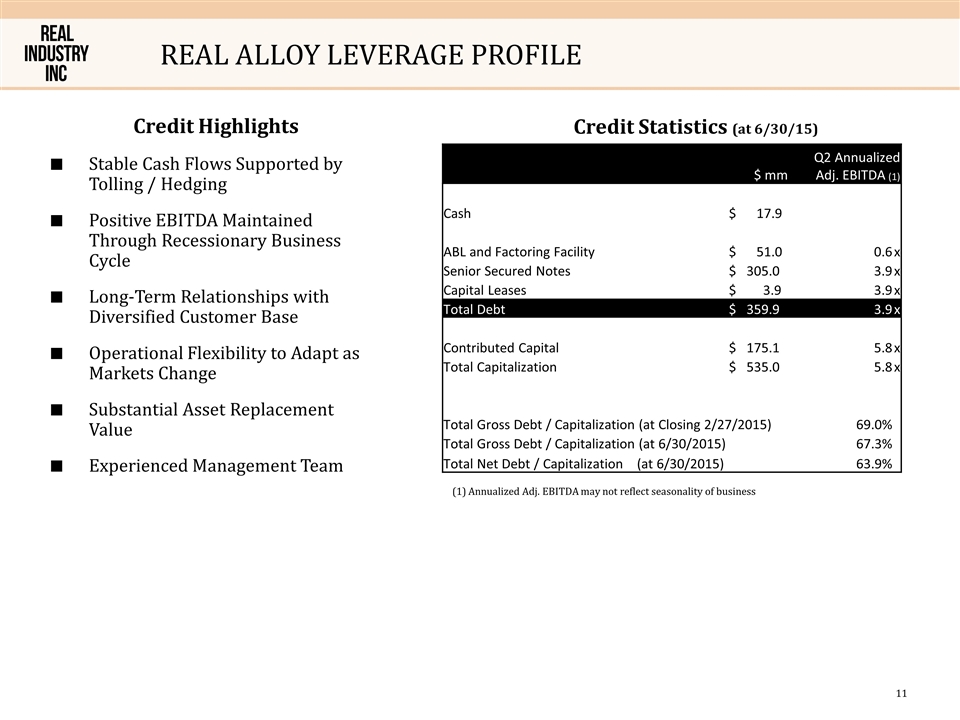

Real Alloy leverage profile Credit Highlights Stable Cash Flows Supported by Tolling / Hedging Positive EBITDA Maintained Through Recessionary Business Cycle Long-Term Relationships with Diversified Customer Base Operational Flexibility to Adapt as Markets Change Substantial Asset Replacement Value Experienced Management Team Credit Statistics (at 6/30/15) (1) Annualized Adj. EBITDA may not reflect seasonality of business $ mm Q2 Annualized Adj. EBITDA (1) Cash $ 17.9 ABL and Factoring Facility $ 51.0 0.6 x Senior Secured Notes $ 305.0 3.9 x Capital Leases $ 3.9 3.9 x Total Debt $ 359.9 3.9 x Contributed Capital $ 175.1 5.8 x Total Capitalization $ 535.0 5.8 x Total Gross Debt / Capitalization (at Closing 2/27/2015) 69.0% Total Gross Debt / Capitalization (at 6/30/2015) 67.3% Total Net Debt / Capitalization (at 6/30/2015) 63.9%

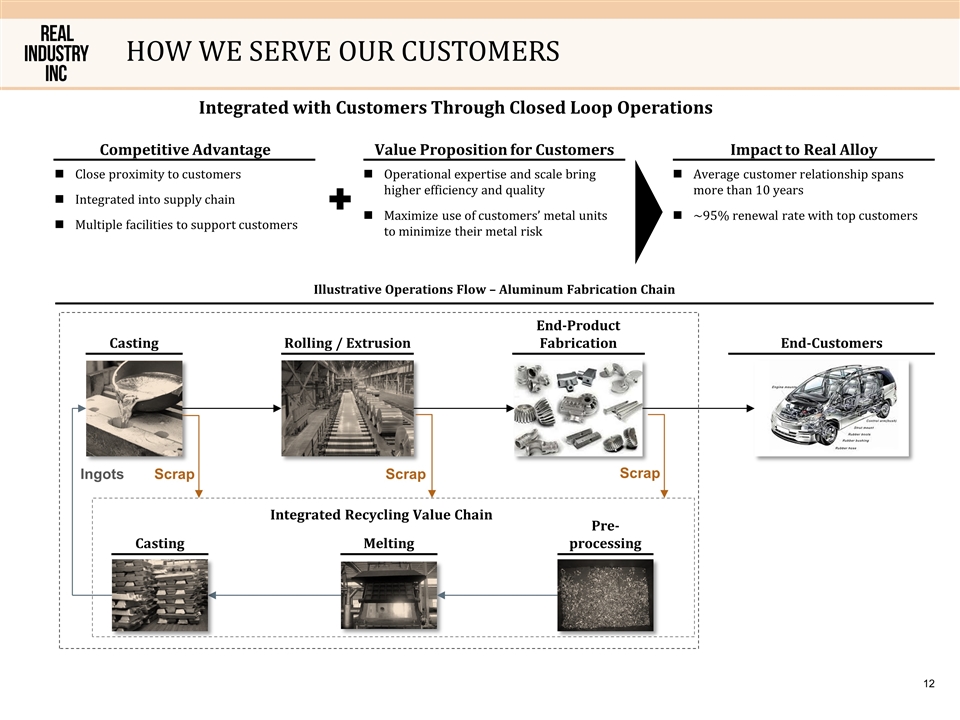

How we serve our Customers Integrated with Customers Through Closed Loop Operations Competitive Advantage Value Proposition for Customers Impact to Real Alloy Close proximity to customers Integrated into supply chain Multiple facilities to support customers Operational expertise and scale bring higher efficiency and quality Maximize use of customers’ metal units to minimize their metal risk Average customer relationship spans more than 10 years ~95% renewal rate with top customers Illustrative Operations Flow – Aluminum Fabrication Chain Pre-processing Melting Casting Ingots Scrap Rolling / Extrusion Scrap End-Product Fabrication Scrap Integrated Recycling Value Chain Casting End-Customers

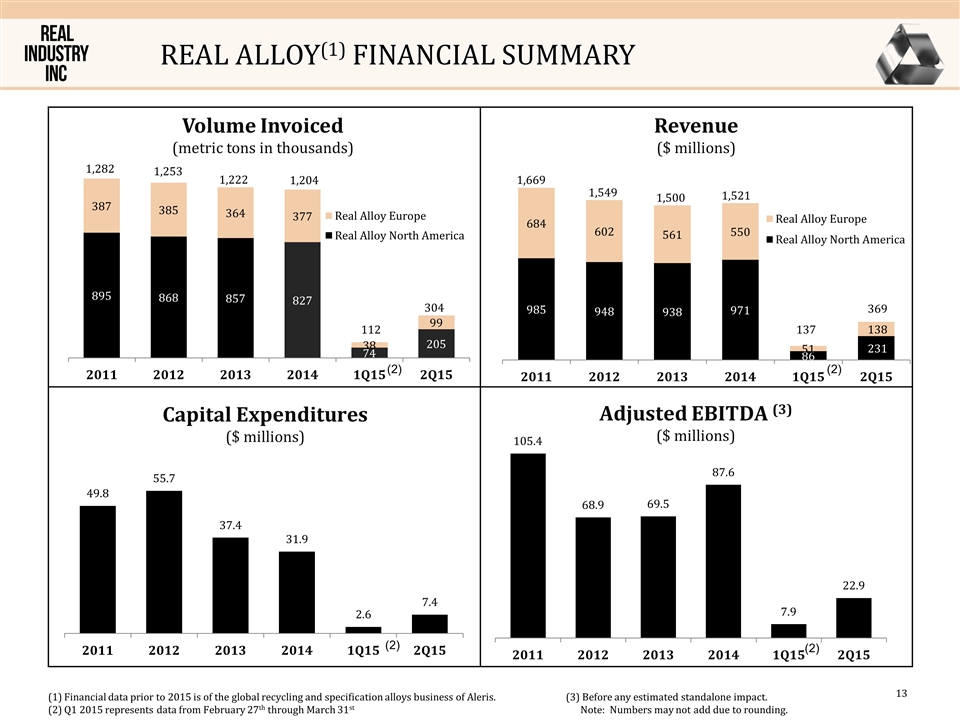

Real alloy(1) FINANCIAL SUMMARY Revenue ($ millions) Volume Invoiced (metric tons in thousands) (1) Financial data prior to 2015 is of the global recycling and specification alloys business of Aleris. (3) Before any estimated standalone impact. (2) Q1 2015 represents data from February 27th through March 31st Note: Numbers may not add due to rounding. 137 369

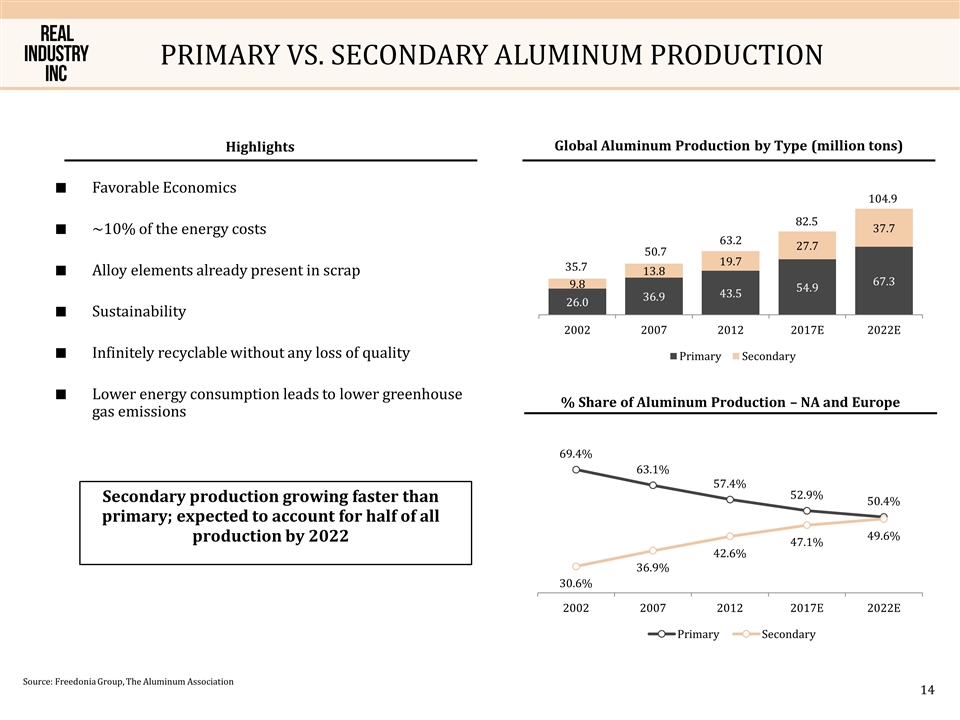

Primary vs. Secondary aluminum Production Favorable Economics ~10% of the energy costs Alloy elements already present in scrap Sustainability Infinitely recyclable without any loss of quality Lower energy consumption leads to lower greenhouse gas emissions % Share of Aluminum Production – NA and Europe Global Aluminum Production by Type (million tons) Secondary production growing faster than primary; expected to account for half of all production by 2022 Source: Freedonia Group, The Aluminum Association Highlights

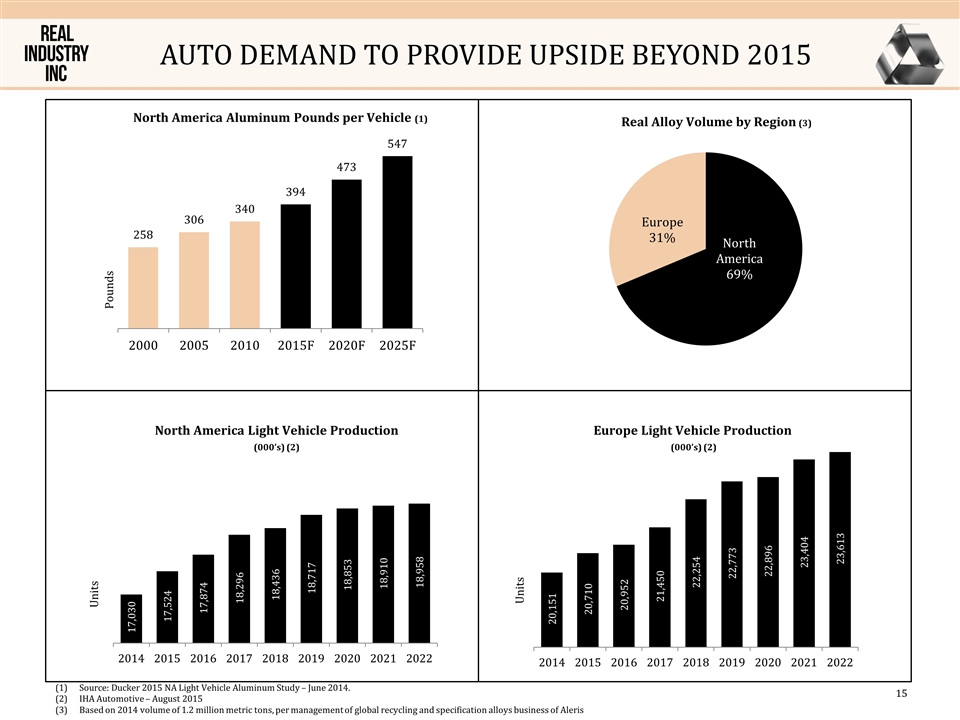

Auto demand to provide upside beyond 2015 Source: Ducker 2015 NA Light Vehicle Aluminum Study – June 2014. IHA Automotive – August 2015 Based on 2014 volume of 1.2 million metric tons, per management of global recycling and specification alloys business of Aleris Units Units

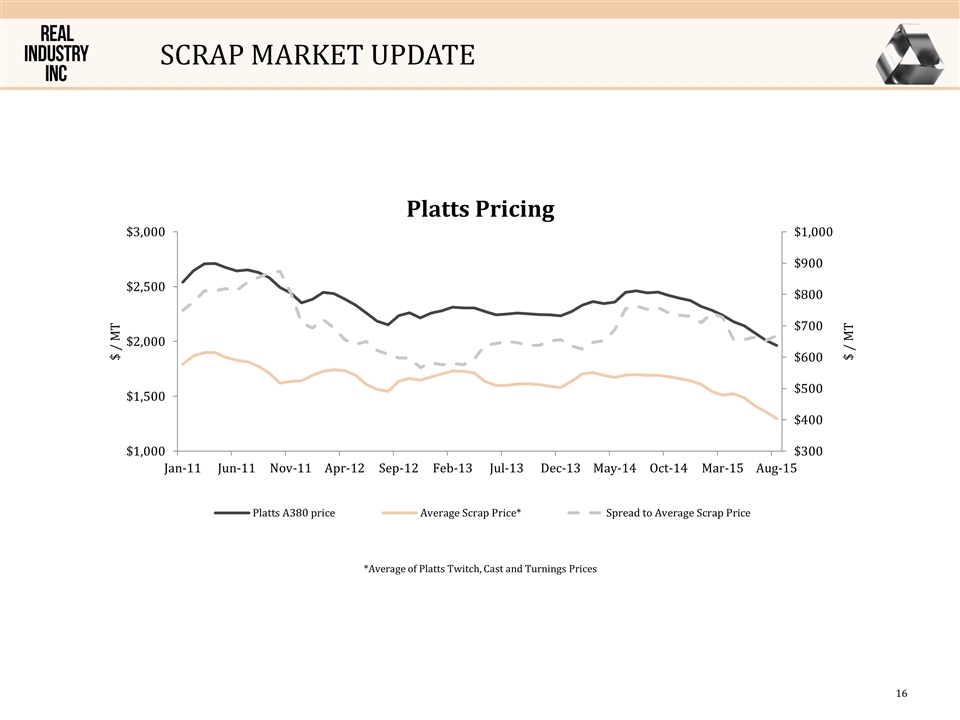

Scrap market update *Average of Platts Twitch, Cast and Turnings Prices

Risk Management General Corporate philosophy of taking as much risk off table as possible Approximately 2/3 of annual Real Alloy volume is protected from metal price fluctuations Multiple counterparties are in place and additional relationships are being negotiated Metal No hedging is needed for Tolling Business Approximately 70% of European Buy/Sell contracts are hedged North American metal risk managed physically Natural Gas Prices locked with physical contracts for a substantial portion of remaining 2015 and 2016 forecasted volumes in Europe Prices locked with financial hedges for a substantial portion of remaining 2015 forecasted volumes in North America (2016 layering has been initiated) Evaluating risk management alternatives through 2017

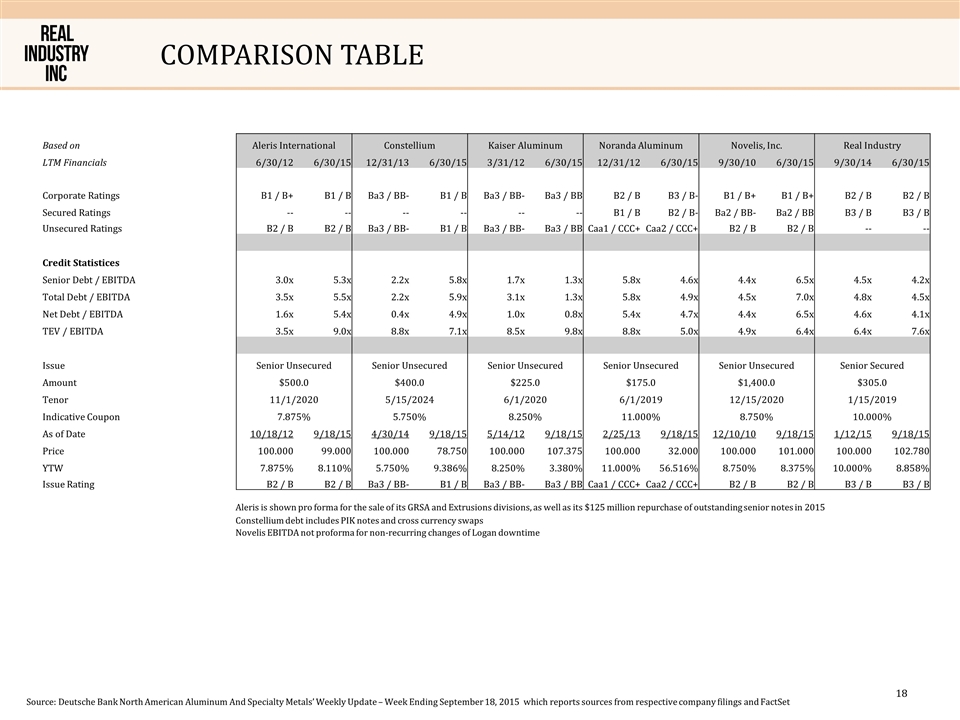

Comparison Table Based on Aleris International Constellium Kaiser Aluminum Noranda Aluminum Novelis, Inc. Real Industry LTM Financials 6/30/12 6/30/15 12/31/13 6/30/15 3/31/12 6/30/15 12/31/12 6/30/15 9/30/10 6/30/15 9/30/14 6/30/15 Corporate Ratings B1 / B+ B1 / B Ba3 / BB- B1 / B Ba3 / BB- Ba3 / BB B2 / B B3 / B- B1 / B+ B1 / B+ B2 / B B2 / B Secured Ratings -- -- -- -- -- -- B1 / B B2 / B- Ba2 / BB- Ba2 / BB B3 / B B3 / B Unsecured Ratings B2 / B B2 / B Ba3 / BB- B1 / B Ba3 / BB- Ba3 / BB Caa1 / CCC+ Caa2 / CCC+ B2 / B B2 / B -- -- Credit Statistices Senior Debt / EBITDA 3.0x 5.3x 2.2x 5.8x 1.7x 1.3x 5.8x 4.6x 4.4x 6.5x 4.5x 4.2x Total Debt / EBITDA 3.5x 5.5x 2.2x 5.9x 3.1x 1.3x 5.8x 4.9x 4.5x 7.0x 4.8x 4.5x Net Debt / EBITDA 1.6x 5.4x 0.4x 4.9x 1.0x 0.8x 5.4x 4.7x 4.4x 6.5x 4.6x 4.1x TEV / EBITDA 3.5x 9.0x 8.8x 7.1x 8.5x 9.8x 8.8x 5.0x 4.9x 6.4x 6.4x 7.6x Issue Senior Unsecured Senior Unsecured Senior Unsecured Senior Unsecured Senior Unsecured Senior Secured Amount $500.0 $400.0 $225.0 $175.0 $1,400.0 $305.0 Tenor 11/1/2020 5/15/2024 6/1/2020 6/1/2019 12/15/2020 1/15/2019 Indicative Coupon 7.875% 5.750% 8.250% 11.000% 8.750% 10.000% As of Date 10/18/12 9/18/15 4/30/14 9/18/15 5/14/12 9/18/15 2/25/13 9/18/15 12/10/10 9/18/15 1/12/15 9/18/15 Price 100.000 99.000 100.000 78.750 100.000 107.375 100.000 32.000 100.000 101.000 100.000 102.780 YTW 7.875% 8.110% 5.750% 9.386% 8.250% 3.380% 11.000% 56.516% 8.750% 8.375% 10.000% 8.858% Issue Rating B2 / B B2 / B Ba3 / BB- B1 / B Ba3 / BB- Ba3 / BB Caa1 / CCC+ Caa2 / CCC+ B2 / B B2 / B B3 / B B3 / B Source: Deutsche Bank North American Aluminum And Specialty Metals’ Weekly Update – Week Ending September 18, 2015 which reports sources from respective company filings and FactSet Aleris is shown pro forma for the sale of its GRSA and Extrusions divisions, as well as its $125 million repurchase of outstanding senior notes in 2015 Constellium debt includes PIK notes and cross currency swaps Novelis EBITDA not proforma for non-recurring changes of Logan downtime

appendix

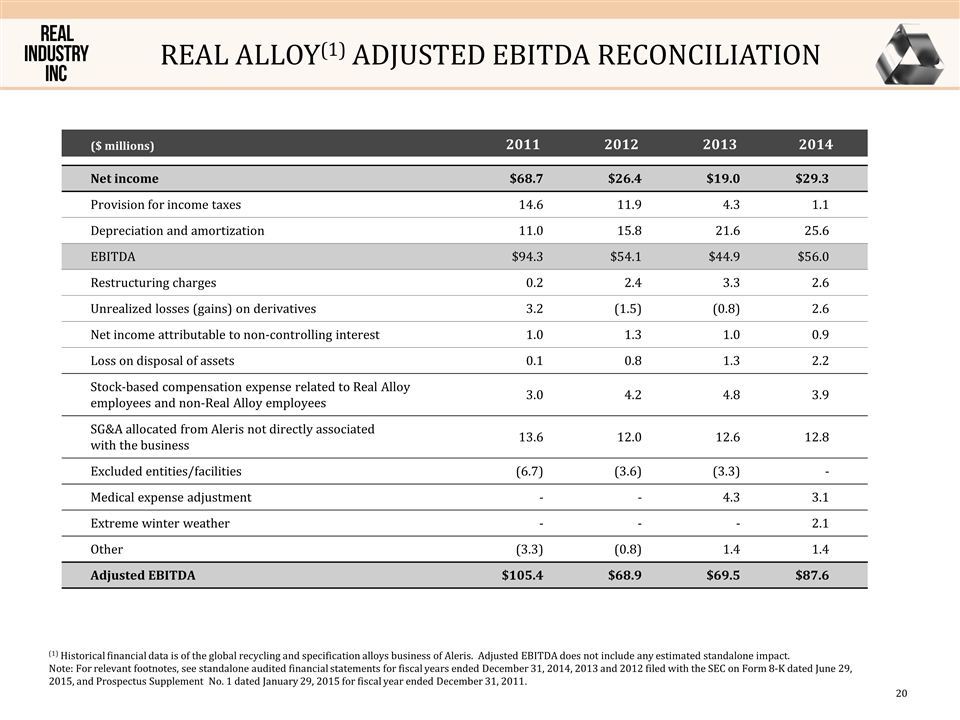

Real alloy(1) ADJUSTED EBITDA RECONCILIATION ($ millions) 2011 2012 2013 2014 Net income $68.7 $26.4 $19.0 $29.3 Provision for income taxes 14.6 11.9 4.3 1.1 Depreciation and amortization 11.0 15.8 21.6 25.6 EBITDA $94.3 $54.1 $44.9 $56.0 Restructuring charges 0.2 2.4 3.3 2.6 Unrealized losses (gains) on derivatives 3.2 (1.5) (0.8) 2.6 Net income attributable to non-controlling interest 1.0 1.3 1.0 0.9 Loss on disposal of assets 0.1 0.8 1.3 2.2 Stock-based compensation expense related to Real Alloy employees and non-Real Alloy employees 3.0 4.2 4.8 3.9 SG&A allocated from Aleris not directly associated with the business 13.6 12.0 12.6 12.8 Excluded entities/facilities (6.7) (3.6) (3.3) - Medical expense adjustment - - 4.3 3.1 Extreme winter weather - - - 2.1 Other (3.3) (0.8) 1.4 1.4 Adjusted EBITDA $105.4 $68.9 $69.5 $87.6 (1) Historical financial data is of the global recycling and specification alloys business of Aleris. Adjusted EBITDA does not include any estimated standalone impact. Note: For relevant footnotes, see standalone audited financial statements for fiscal years ended December 31, 2014, 2013 and 2012 filed with the SEC on Form 8-K dated June 29, 2015, and Prospectus Supplement No. 1 dated January 29, 2015 for fiscal year ended December 31, 2011.

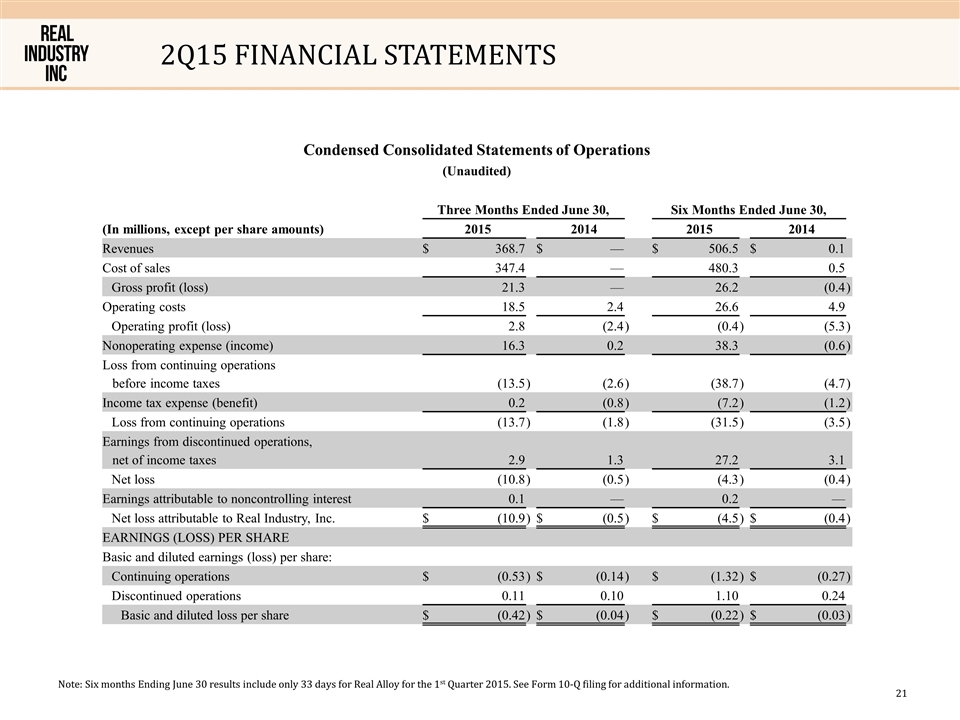

2q15 financial statements Note: Six months Ending June 30 results include only 33 days for Real Alloy for the 1st Quarter 2015. See Form 10-Q filing for additional information. Condensed Consolidated Statements of Operations (Unaudited) Three Months Ended June 30, Six Months Ended June 30, (In millions, except per share amounts) 2015 2014 2015 2014 Revenues $ 368.7 $ — $ 506.5 $ 0.1 Cost of sales 347.4 — 480.3 0.5 Gross profit (loss) 21.3 — 26.2 (0.4 ) Operating costs 18.5 2.4 26.6 4.9 Operating profit (loss) 2.8 (2.4 ) (0.4 ) (5.3 ) Nonoperating expense (income) 16.3 0.2 38.3 (0.6 ) Loss from continuing operations before income taxes (13.5 ) (2.6 ) (38.7 ) (4.7 ) Income tax expense (benefit) 0.2 (0.8 ) (7.2 ) (1.2 ) Loss from continuing operations (13.7 ) (1.8 ) (31.5 ) (3.5 ) Earnings from discontinued operations, net of income taxes 2.9 1.3 27.2 3.1 Net loss (10.8 ) (0.5 ) (4.3 ) (0.4 ) Earnings attributable to noncontrolling interest 0.1 — 0.2 — Net loss attributable to Real Industry, Inc. $ (10.9 ) $ (0.5 ) $ (4.5 ) $ (0.4 ) EARNINGS (LOSS) PER SHARE Basic and diluted earnings (loss) per share: Continuing operations $ (0.53 ) $ (0.14 ) $ (1.32 ) $ (0.27 ) Discontinued operations 0.11 0.10 1.10 0.24 Basic and diluted loss per share $ (0.42 ) $ (0.04 ) $ (0.22 ) $ (0.03 )

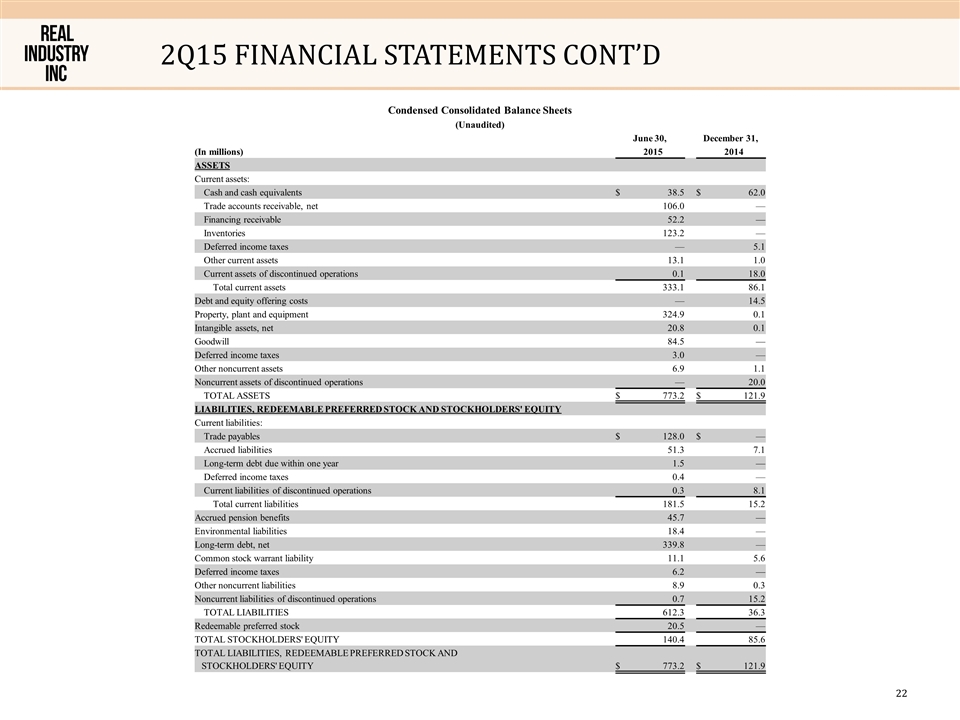

2q15 financial statements cont’d Condensed Consolidated Balance Sheets (Unaudited) June 30, December 31, (In millions) 2015 2014 ASSETS Current assets: Cash and cash equivalents $ 38.5 $ 62.0 Trade accounts receivable, net 106.0 — Financing receivable 52.2 — Inventories 123.2 — Deferred income taxes — 5.1 Other current assets 13.1 1.0 Current assets of discontinued operations 0.1 18.0 Total current assets 333.1 86.1 Debt and equity offering costs — 14.5 Property, plant and equipment 324.9 0.1 Intangible assets, net 20.8 0.1 Goodwill 84.5 — Deferred income taxes 3.0 — Other noncurrent assets 6.9 1.1 Noncurrent assets of discontinued operations — 20.0 TOTAL ASSETS $ 773.2 $ 121.9 LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY Current liabilities: Trade payables $ 128.0 $ — Accrued liabilities 51.3 7.1 Long-term debt due within one year 1.5 — Deferred income taxes 0.4 — Current liabilities of discontinued operations 0.3 8.1 Total current liabilities 181.5 15.2 Accrued pension benefits 45.7 — Environmental liabilities 18.4 — Long-term debt, net 339.8 — Common stock warrant liability 11.1 5.6 Deferred income taxes 6.2 — Other noncurrent liabilities 8.9 0.3 Noncurrent liabilities of discontinued operations 0.7 15.2 TOTAL LIABILITIES 612.3 36.3 Redeemable preferred stock 20.5 — TOTAL STOCKHOLDERS' EQUITY 140.4 85.6 TOTAL LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY $ 773.2 $ 121.9

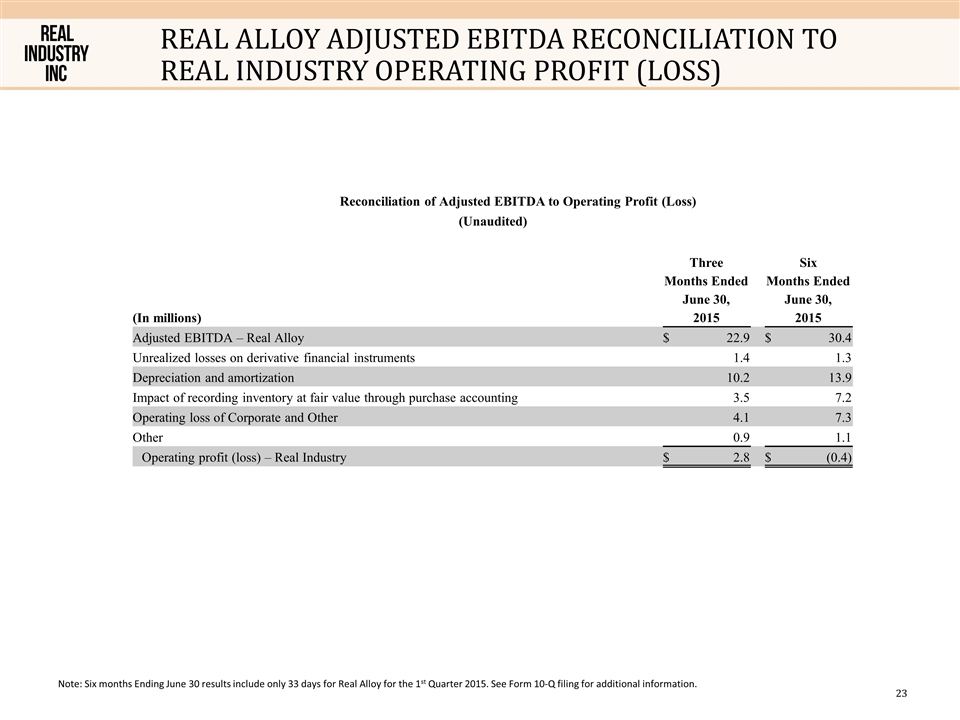

Real alloy adjusted ebitda reconciliation to real industry OPERATING PROFIT (LOSS) Note: Six months Ending June 30 results include only 33 days for Real Alloy for the 1st Quarter 2015. See Form 10-Q filing for additional information. Reconciliation of Adjusted EBITDA to Operating Profit (Loss) (Unaudited) (In millions) Three Months Ended June 30, 2015 Six Months Ended June 30, 2015 Adjusted EBITDA – Real Alloy $ 22.9 $ 30.4 Unrealized losses on derivative financial instruments 1.4 1.3 Depreciation and amortization 10.2 13.9 Impact of recording inventory at fair value through purchase accounting 3.5 7.2 Operating loss of Corporate and Other 4.1 7.3 Other 0.9 1.1 Operating profit (loss) – Real Industry $ 2.8 $ (0.4)